Abstract

Against the background of omnichannel retailing, this paper tries to explore the incentive conditions/regions of adopting integrated management service (IMS) and the operational strategies/performance for the assembly system with direct omnichannel (AS). Six different game-theoretical decision models, including a centralized, two decentralized and a coordination decision modelssss for the AS, and a centralized and a coordination decision models for the assembly system with direct omnichannel and IMS (ASI), are developed, analyzed and compared, respectively. Based on an electronic product case, the corresponding numerical and sensitivity analyses are conducted. On this basis, the analytical and numerical results are compared and validated to derive managerial insights. It is found that only when the dual incentive ratio indicators are in the quadrant \(\{ \alpha \ge 1\) and \(\beta \ge 1\}\) of bidimensional incentive region matrix would the AS and IMS provider have the incentive to introduce and provide IMS. Introducing and providing IMS can effectively enhance the ability of quick response, boost the collaborative operations, and improve the operational performance of the AS. Furthermore, a revenue sharing contract-based coordination strategy can effectively improve the operational performance of ASI.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the era of rapid development of mobile commerce and payment, the quickly-evolving omnichannel business mode has transformed the retailing landscape in the last decade. Omnichannel mode refers to the seamless integration of online- and offline- channels to improve customer experience and thus meet the customers’ demands, anytime and anywhere [10]. This mode emerged in recent years with the intention to ensure the retailer marketing strategies are geared toward tempting customers to convert on any channel [32].

According to an industry report from Shopify Plus, considering that an estimated 81% of shoppers conduct online research before making big purchases, the ability to channel even a small percentage of these customers straight from their online research to offline stores would generate a massive potential for sales [13, 24]. With the dual advantages of online information acquisition and offline product experience, the omnichannel mode could bring online customers to brick-and-mortar stores or vice versa, which provides a better shopping experience for customers and more business opportunities for retailers and their supply chains. Hence, many traditional brick-and-mortar/e-commerce retailers, manufacturers/assemblers or their parts and components suppliers are working together to transform their supply chains into an omnichannel mode.

Many industry leaders now believe that China leads the world in omnichannel development due to frequent use of mobile devices and widespread acceptance of mobile payment among the general public. For example, SUNING, a large appliances retail chain store enterprise in China committed to the integration of its online e-commerce platform and its own offline stores, actively implements the consumer-oriented omnichannel business mode and the supplier-oriented omnichannel platform. Besides, SUNING has established many self-pickup points in its offline stores while launching rebate activities of self-pickup for online shopping at the same time.

With the development of the omnichannel retailing mode, consumers’ demand for product shopping experience and face-to-face consultation about price discount, product configuration and product applicability cannot be met in the traditional assembly system with direct online-channels. This calls for an omnichannel solution that provides the customer with a consistent, engaging experience across channels. As a typical assembler, DELL purchases PC components and modules from upstream suppliers, assembles PC products, and then sells PC products to end customers through its own online e-commerce platform and offline brick-and-mortar store partners, such as Walmart, CompUSA [21]. “This is not an abandonment of our direct sales model—this is intended to be additive,” said Kent Cook, senior manager of consumer communications at Dell. “This is a response to customer demand. The direct model is great, but some consumers feel more comfortable going into a store to purchase electronics. We want to respond to our customers’ needs.” [8]. Obviously, the direct-sales channel strategy of the assembler represented by Dell necessitates an omnichannel solution that provides the customer with a consistent, engaging experience across channels. “Dell EMC believes in an omni channel strategy and leaves the choice to the customer in terms of whom they wish to do business with.” Said by Anil Sethi, the vice president of channels India at Dell EMC [9].

Due to the different parts quality, process technology, cost control and delivery ability of different suppliers, the assembly system with direct omnichannel (will be abbreviated as AS) often faces the risk of supply interruption and cannot gather all the modules quickly from multiple suppliers, and quickly assemble and sell the products to the market via omnichannel, and thus resulting in non-cooperative operation and slow response of the AS and forming a “neck stuck” phenomenon in the AS. This is harmful to the healthy and sustainable operations of the AS. In order to ensure that the assembler with direct omnichannel can quickly respond to customer’s needs, bring better product experience to customers, and give full play to the advantages of online information acquisition and offline product experience, the AS urgently needs to improve the collaborative operational ability of the supply chain. Against this background, the professional third-party, integrated management service (IMS) providers, came into being. For example, there are many IMS providers (IPs) in the electronics industry, such as Arrow Electronics, Avnet, WPG Holdings, Future Electronics, etc. These IPs can provide various comprehensive IMS solutions for the AS to enhance their ability of quick response, boost their collaborative operations, and improve their operational performance.

In the context of omnichannel retailing, should the AS introduce IMS? When will the AS have the incentive to introduce IMS? When will the IMS provider (IP) have the incentive to provide IMS? How to achieve the coordinative operations for the AS and IP? These are some major issues calling for urgent consideration both in practice and in theoretical research of AS. In the theoretical research field, the available literature rarely touches upon the following critical issues in the operations management of AS: (1) the role and value of IMS in the AS; (2) the incentive conditions of introducing and providing IMS for the AS; (3) the cooperation region between AS and IP in the assembly system with direct omnichannel and IMS (will be abbreviated as ASI); (4) the operational strategies, decisions and performance for the ASI. Obviously, in the era of omnichannel retailing, these important research gaps need to be addressed urgently. However, it is a new challenge to explore the incentives of introducing and providing IMS and cooperation region between AS and IP for the ASI via game-theoretical modelling approach. Specifically, how to characterize the new demand function with IMS effort in the context of omnichannel retailing, how to formulate objective functions and design the decision structures for the game-theoretical models, and how to derive the incentive conditions and cooperation regions through comparing the profit regions, are all new challenges for our research.

From the perspective of game-theoretical modeling and comparative analysis, we try to explore the incentive conditions and cooperation regions under which the AS would have the incentive to introduce IMS and the IP would have the incentive to provide IMS. A novel and useful bidimensional incentive region matrix will be developed to identify the incentive conditions of introducing and providing IMS for the AS and determine the cooperation region between AS and IP in the ASI. This study aims to investigate when the IMS would be introduced and provided in the AS and how coordinative operations can be achieved across the AS, which will help AS and IP make appropriate operational decisions/strategies and improve their operational performance.

The paper consists of 7 sections. Section 2 gives an overall review of the corresponding literature. In Sect. 3, the modeling notations and assumptions of a generic ASI are defined. Then, game-theoretical decision models for a generic ASI are developed and analyzed in Sect. 4. The comparisons and discussions of analytical results are further summarized in this section. Section 5 offers numerical and sensitive analyses of an electronic product case for all developed analytical models. The comparisons and discussions of numerical results are also synthesized in this section. The managerial insights, limitations of the research and scopes for future research are discussed in Sect. 6. The final section is a summary of the research contributions and foresights drawn from this study.

2 Literature review

The omnichannel retailing mode, as a rising new business model, is quickly replacing the dual-channels. Under an omnichannel mode, the boundary between the online channel and offline channel has been removed, creating a dual advantage of online information search and offline product experience. Transition to the omnichannel mode has become an important strategic direction for both brick-and-mortar retailers and ecommerce ones as it helps to maintain a symbiotic, integrated and mutually reinforcing retail supply chain. The omnichannel mode brings both opportunities and challenges to the theoretical research as it reshapes the structure and mechanism of the competition in the retail market. Prior research on the following three streams—the operations management of the assembly system, the omnichannel retailing and that of the omnichannel supply chain—is related to our current study: However, the available literature regarding the incentive conditions, cooperation regions and operational strategies for the ASI is still very scarce, which justifies further research.

2.1 Assembly system perspective

Previous research on the first stream—the operations management of the assembly system, mainly touches upon the issues of competition, cooperation and coordination in the assembly system, such as the multi-echelon supply chains competition with an assembly network structure [4], information sharing and coordination scheme in an assembly system [37], multilateral negotiations in an assembly supply chain via Nash bargaining [22], alliance/coalition formation among multiple complementary suppliers in a decentralized assembly system [23, 35], supplier competition in a decentralized assembly system [15], and sequential contracting for the decentralized assembly systems under asymmetric demand information [17]. Nevertheless, the existing research doesn’t touch upon the operational strategies/performance of the assembly system in the context of omnichannel retailing, nor does it involve the incentive regions of IMS adoption in the AS.

2.2 Omnichannel retailing perspective

Regarding the second stream concerning the operations management of omnichannel retailing, available literatures mainly focus on the impact of various new business/logistic technology on the operational decisions/strategies/performance of omnichannel retailing, such as the impact of buy online and pick up in store (BOPS) on offline store operations and consumers’ channel selections [11], the impact of self-order technologies adoption on operational decisions/performances in an omnichannel restaurant [12], the route capacity sharing for an omnichannel grocery retailer [25],the impact of ship‐to‐store (STS) and quick response on the operational decisions/performances in the fast‐fashion omnichannel retailing [34]. However, the available research neither pays attention to the operational strategies/performance of AS, nor takes into account the incentive regions of IMS adoption for the operations management of AS.

2.3 Omnichannel supply chain perspective

Regarding the third stream, the available literature mainly centers around the issues of operational strategies/decisions/performance of omnichannel (or O2O) supply chain and the impact of disruptions, market power, mutual promotion, low carbon on the operational strategies/decisions/performance of omnichannel (or O2O) supply chain, such as, service competition in an O2O supply chain [38], the impact of disruptions on the O2O supply chain coordination [39], the impact of different power and decision structures on the operational decisions/performance of O2O supply chain [5], initial carbon allowance allocation rules in an O2O supply chain with the cap-and-trade regulation [14], mutual promotional effects, operational strategies and subsidy policies for the O2O supply chain [6], cooperation mechanism for the O2O consignment supply chain with complementary products [7], optimal pricing for an omnichannel supply chain with retail service [16]. Nevertheless, the existing research neither touches upon the operational strategies/performance of assembly supply chain in the omnichannel retailing environment, nor considers the incentive regions of IMS adoption for the assembly supply chain in the context of omnichannel retailing.

In brief, the available literature fails to cover the following critical issues in the operations management of AS: (1) the role and value of IMS in the AS; (2) the incentive conditions of introducing and providing IMS for the AS; (3) the cooperation region between AS and IP in the ASI; (4) the operational strategies, decisions and performance for the ASI.

Considering the critical issues aforementioned, this paper, different from previous research, intends to conduct a novel investigation into the role and economic behaviors of integrated management service (IMS) in the assembly system with direct omnichannel (AS), and explore the incentive conditions, cooperation regions and operational strategies for the ASI. This study will fill up the gap in previous research and add managerial insights for the omnichannel practitioners and their supply chain partners.

3 Modeling notations and assumptions

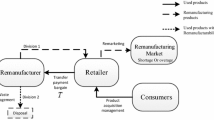

A generic assembly system with direct omnichannel and IMS (ASI), as shown in Fig. 1, is conceptualized for this study. This system includes one IMS provider (IP), n module or component suppliers and an assembler offering an assembled product to the market through an omnichannel mode. In this system, IP provides IMS to the assembler with direct omnichannel and gets relevant service fee as a result. Each supplier produces a module for the assembler to assemble the components into the final product for the retail market. Each supplier negotiates jointly (a centralized strategy), independently (a decentralized strategy) or collaboratively (a coordination strategy) with the assembler regarding the wholesale price that will affect the retail pricing and demands. Through the omnichannel integration, the final product will be sold at a regular retail price in the selling season, and the leftover stock will be sold at a salvage price in the clearance season.

In Fig. 1, notation i is introduced to mark the variables and parameters, \(i \in N\), \(N = \left\{ {1,2, \ldots ,n} \right\}\). For the ith supplier, the unit cost of the ith module is \(c_{i}\) and the wholesale price of the ith module is \(w_{i}\); for the assembler, the unit assembly cost of the final product is \(c\). The final product is sold via omnichannel mode, the operational cost of the online channel is \(c_{e}\) and the operational cost of the offline channel is \(c_{s}\). The retail price of the final product, through either the online channel or offline channel, is \(p\) and the salvage price of the final product in the clearance season is \(\eta p\), where \(\eta\) is the salvage discount price factor,and \(0 < \eta < 1\).

The IP’s IMS effort for the AS is \(s\). Generally, the cost of effort \(c\left( s \right)\) is positive and strictly convex in \(s\), and \(c\left( 0 \right) = 0\) [18, 27, 28]. Thus, the cost of IMS effort is assumed to be a quadric form: \(c\left( s \right) = \frac{1}{2}gs^{2}\), where \(g\) is the cost coefficient of IMS effort. The assembler will pay an IMS fee \(t\) per unit product for IP. Furthermore, this fee will be shared between the assembler and suppliers via contract mechanism.

Following Chen et al. [6] and Chen and Su [7], let \(d_{e} \left( {p,s} \right)\) and \(d_{s} \left( {p,s} \right)\) denote the online demand function and the offline demand function respectively. They can be defined as \(d_{e} \left( p \right) = \lambda v\left( {p,s} \right)x\) and \(d_{s} \left( p \right) = \left( {1 - \lambda } \right)v\left( {p,s} \right)x\). Thus, the total market demand function \(d\left( {p,s} \right) = d_{e} \left( {p,s} \right) + d_{s} \left( {p,s} \right) = v\left( {p,s} \right)x\). In all the demand functions, \(\lambda\) is the market demand share of the online channel and \(\left( {1 - \lambda } \right)\) is the market demand share of the offline channel, \(0 < \lambda < 1\). \(v\left( {p,s} \right)\) is a deterministic function of price \(p\) and IMS effort \(s\), decreasing of price \(p\) and increasing of IMS effort \(s\). \(v\left( {p,s} \right) = ap^{ - b} p^{\theta } s^{\kappa } = ap^{{ - \left( {b - \theta } \right)}} s^{\kappa }\), where \(a\) is the positive constant number, \(b\) is the price-elasticity index of the expected demand, \(\theta \in \left( {0,1} \right)\) is the mutual fusion coefficient between channels, and \(\kappa \in \left( {0,1} \right)\) is the IMS effort-elasticity index of the expected demand, and \(b > n > 1\). Let \(y\left( p \right) = ap^{{ - \left( {b - \theta } \right)}}\), then \(v\left( {p,s} \right) = y\left( p \right)s^{\kappa }\).\(x\) is a random factor defined in the range \(\left[ {A,B} \right]\) with \(B > A > 0\). The CDF (Cumulative distribution function) and PDF (Probability density function) of \(x\) are \(F\left( \cdot \right)\) and \(f\left( \cdot \right)\), and the mean value and standard deviation of \(x\) are \(\mu\) and \(\sigma\). Following Petruzzi and Dada [26], Wang et al. [33], and Wang [30], \(z = \frac{q}{{v\left( {p,s} \right)}}\) is defined as the ‘stock factor’ where \(q\) is the production quantity. In this study, the ‘stock factor’ is used to model the equilibrium and coordination conditions of supply chain.

When the distribution of \(x\) in the demand function satisfies the Increasing Generalized Failure Rate (IGFR) condition, i.e., \(\frac{dg\left( x \right)}{dx} = h\left( x \right) + \frac{xdh\left( x \right)}{dx} > 0\), where \(g\left( x \right) = xh\left( x \right)\), and \(h\left( x \right) = \frac{f\left( x \right)}{{\left[ {1 - F\left( x \right)} \right]}}\) is the classical failure rate [19, 20, 33], the first order conditions of the expected profit function with respect to \(p\) and \(z\) provide a unique solution to the problem of maximizing the expected profit function. The decision variables are the retail price \(p\) and the stock factor \(z\) of the final product, the wholesale price of the ith module \(w_{i}\).

On this basis, the profit functions of the suppliers, assembler, and assembly system under omnichannel (OMO) mode can be formulated as follows:

Furthermore, the profit functions of the suppliers, assembler, and assembly system and IMS provider under omnichannel with IMS (OMI) mode can be formulated as follows:

Table 1 provides a framework of the game-theoretical decision models developed and analyzed in Sect. 4.

Although the ideal centralized decision mode is difficult to realize in an AS in practice, it can be used as an important benchmark for decentralized decision mode in Sect. 4.1.2 and coordination decision mode in Sect. 4.1.3, which is worthy of analysis and discussion. Therefore, Sect. 4.1.1 will develop and analyze a centralized decision model for the AS.

In the real-world scenario, the AS is generally operated under a decentralized decision mode in the absence of contractual coordination. Under the decentralized decision mode, multiple suppliers may make decisions simultaneously or sequentially, i.e., there are two decentralized decision modes for the AS. Since the operational performance under decentralized decision mode is lower than that under the centralized decision mode, it is necessary to analyze and discuss operational decisions and performances under the decentralized decision mode, which can serve as the lower boundary reference for coordination decision mode. Therefore, Sect. 4.1.2 will develop and analyze two decentralized decision models for the AS.

In the case of contractual mechanism introduction, taking the centralized decision mode as the benchmark and taking decentralized decision mode as the lower boundary reference, the AS may achieve coordination decision and realize Pareto improvement of the operational performance for all the stakeholders. Therefore, Sect. 4.1.3 will develop and analyze a coordination decision model for the AS, based on the centralized decision model in Sect. 4.1.1 and decentralized decision models in Sect. 4.1.2.

Nevertheless, it is still quite challenging to guarantee effective implementation of the contract. Due to the complicated structure and multiple participants in the AS, the assembler has to deal with the complicated collaborative business relationships with multiple suppliers, resulting in non-cooperative operations and slow-response ability in the AS. Meanwhile, for lack of effective demand information sharing and collaborative planning, forecasting and replenishment mechanism across the AS, suppliers are often unable to guarantee the perfect matching supply of parts and components for the assembly process of the assembler, which may lead to assembly disruption. Therefore, it is necessary to introduce the IMS provider (IP) as it provides a unified logistics and information flow management platform and corresponding comprehensive IMS solutions for the AS, which enhances the demand information sharing between the assembler and multiple suppliers and helps multiple suppliers collaboratively carry out matching collection and distribution of the corresponding parts and components to the assembler in accordance with the assembly requirements of product. The corresponding goal is to enhance the ability of collaborative operation and quick response, strengthen the mutual fusion effect between online- and offline- channels, raise the value added for customers and improve operational performance in the AS. Therefore, Sect. 4.2 will develop and analyze centralized and coordination decision models for the ASI, based on the centralized, decentralized and coordination decision models for the AS in Sect. 4.1.

4 Model setup and discussion

Based on the modeling notations and assumptions discussed in Sect. 3, this section conducts an extensive game-theoretical modeling of the equilibrium and coordination conditions for the ASI. In the models to follow, the superscript or subscript c represents centralized decision and coordination decision under omnichannel mode (i.e., OMO mode); the superscript or subscript d: decentralized decision with suppliers’ simultaneous action under OMO mode; the superscript or subscript d’: decentralized decision with suppliers’ sequential action under OMO mode; the superscript or subscript sc: centralized decision and coordination decision under omnichannel mode with IMS (i.e., OMI mode).

4.1 Game-theoretical decision models under OMO mode

Under OMO mode, the AS does not introduce IMS, i.e., \(t = 0\), \(g = 0\), \(s = 1\) and \(\kappa = 0\). A centralized decision model, two decentralized decision models and a coordination decision model will be developed, analyzed and compared for the AS in this section.

4.1.1 Centralized decision model

Under the centralized decision model, the detailed decision sequences are as follows: the assembly system will first decide the retail price \(p\), and then the stock factor \(z\). The optimal problem for the assembly system under the centralized decision can be formulated as follows:

Solving this optimal problem, we can get the optimal retail price \(p_{c}\), the distribution function of the centralized optimal stock factor \(F\left( {z_{c} } \right)\) and the optimal production quantity \(q_{c}\). Furthermore, the optimal profit of the assembly system can be calculated as \(\varPi_{SC}^{c}\). (See Table 2 for the detailed analytical modeling results and their derivations can be seen in “Appendix”).

4.1.2 Decentralized decision model

4.1.2.1 Stackelberg game model (suppliers’ simultaneous decisions)

Under this scenario, the detailed decision sequences are as follows: all the module suppliers decide their wholesale price \(w_{i}\) simultaneously, and then, the assembler with direct omnichannel decides the retail price \(p\) and stock factor \(z\). The two-stage Stackelberg game model for the decentralized AS can be formulated as:

Solving this two-stage Stackelberg game problem, we get the equilibrium wholesale price \(w_{i}^{d}\), the equilibrium retail price \(p_{d}\), the distribution function of the equilibrium stock factor \(F\left( {z_{d} } \right)\) and the equilibrium production quantity \(q_{d}\). Furthermore, the equilibrium profits of the supplier i, the assembler and the assembly system can be calculated as \(\varPi_{{S_{i} }}^{d}\), \(\varPi_{A}^{d}\) and \(\varPi_{SC}^{d}\) (see Table 2 for detailed analytical modeling results).

4.1.2.2 Stackelberg game model (suppliers’ sequential decisions)

Under this scenario, the detailed decision sequences are as follows: all the module suppliers first make their wholesale price \(w_{i}\) sequentially: module supplier 1 first decides his wholesale price \(w_{1}\), and then, module supplier 2 decides his wholesale price \(w_{2}\) based on supplier 1’s decision…, and finally, module supplier n decides his wholesale price \(w_{n}\) based on decisions of suppliers 1, 2,…, n − 1; and then, the assembler with direct omnichannel decides the retail price \(p\) and stock factor \(z\). The (n + 1)-stage Stackelberg game model for the decentralized AS can be formulated as:

Solving this (n + 1)-stage Stackelberg game problem, we get the equilibrium wholesale price \(w_{i}^{d'}\), the equilibrium retail price \(p_{d'}\), the distribution function of the equilibrium stock factor \(F\left( {z_{d'} } \right)\) and the equilibrium production quantity \(q_{d'}\). Furthermore, the equilibrium profits of the supplier i, the assembler and the assembly system can be calculated as \(\varPi_{{S_{i} }}^{d'}\), \(\varPi_{A}^{d'}\) and \(\varPi_{SC}^{d'}\). (See Table 2 for detailed analytical modeling results).

4.1.3 Coordination decision model

Under this scenario, the detailed decision sequences are as follows: the suppliers simultaneously offer the assembler a revenue sharing contract in which suppliers charge a lower wholesale price \(w_{i}\) from the assembler; if the assembler accepts the contract, he will place an order of quantity \(q\) with the module suppliers, after the final product is assembled by modules or components, he will sell the final product through omnichannel at regular retail price \(p\) and decide the stock factor \(z\) when the selling season starts, and sell the leftover stock through omnichannel at salvage price \(\eta p\) in the clearance season. Finally, the assembler will share a fraction \(1 - \phi\) of his net revenue with the suppliers (supplier i will get a fraction \(\frac{{c_{i} }}{{\mathop \sum \nolimits_{i = 1}^{n} c_{i} }}\left( {1 - \phi } \right)\) of the assembler’s sharing revenue), where \(\phi\) is the revenue keeping fraction of the assembler, and \(0 \le \phi \le 1\). The revenue shared by the assembler with supplier i is as follows:

Thus, the profit functions of the supplier i and assembler under revenue sharing contract are as follows:

The optimal problem for the AS under the revenue sharing contract is as follows:

Solving this two-stage Stackelberg game problem, we get the feasible domain of revenue keeping rate \(\phi^{*}\), the coordinated wholesale price \(w_{i}^{c}\), the optimal retail price \(p_{c}\), the distribution function of the optimal stock factor \(F\left( {z_{c} } \right)\) and the optimal production quantity \(q_{c}\). Furthermore, the coordinated profits of the supplier i, the assembler and the assembly system can be calculated as \({{\varPi }}_{{S_{i} }}^{c}\), \({{\varPi }}_{A}^{c}\) and \({{\varPi }}_{SC}^{c}\). (See Table 2 for detailed analytical modeling results).

The analytical results of Sect. 4.1 are summarized in Table 2. The centralized strategy neglects the roles of the suppliers in making crucial pricing and production quantity decisions and therefore is inferior to the coordination strategy regarding the derived solutions. Thus, the centralized decision results are not shown in Table 2 and will be ruled out in the coming discussions.

4.2 Game-theoretical decision models under OMI mode

Under OMI mode, the AS introduces IMS, i.e., \(t > 0\), \(g > 0\), \(s > 1\) and \(\kappa \in \left( {0,1} \right)\). With the help of integrated management services (IMS) provided by the IP, the demand information sharing between the assembler and multiple suppliers will be enhanced, on which basis, the matching collection and distribution of the corresponding parts and components to the assembler in accordance with the assembly requirements of product will be carried out collaboratively, and thus, the AS can achieve effective coordinative management and improve operational performance. Therefore, the decentralized decision scenario does not exist under OMI mode and will not be considered in this section. On this basis, a centralized decision model and a coordination decision model will be developed, analyzed and compared for the ASI in this section.

4.2.1 Centralized decision model

Under the centralized decision model, the detailed decision sequences are as follows: the IP will first decide the IMS effort \(s\), the assembly system will first decide the retail price \(p\), and then decide the stock factor \(z\). The two-stage Stackelberg game model for the ASI under centralized decision can be formulated as:

Solving this two-stage Stackelberg game problem, we get the equilibrium IMS effort \(s_{c}\), the equilibrium retail price \(p_{c}^{s}\), the distribution function of the centralized equilibrium stock factor \(F\left( {z_{c}^{s} } \right)\) and the equilibrium production quantity \(q_{c}^{s}\). Furthermore, the equilibrium profits of the assembly system and IP can be calculated as \({{\varPi }}_{SC}^{sc}\) and \({{\varPi }}_{IP}^{sc}\) (see Table 2 for detailed analytical modeling results).

Obviously, only when the condition \({{\varPi }}_{SC}^{sc} \ge {{\varPi }}_{SC}^{c}\) holds, i.e., only when the incentive ratio indicator \(\alpha \equiv \rho^{b - \theta - 1} s_{c}^{\kappa } \ge 1\), (where \(\rho = \frac{{c + \lambda c_{e} + \left( {1 - \lambda } \right)c_{s} + \mathop \sum \nolimits_{i = 1}^{n} c_{i} }}{{c + \lambda c_{e} + \left( {1 - \lambda } \right)c_{s} + \mathop \sum \nolimits_{i = 1}^{n} c_{i} + t}}\)), would the assembly system have the incentive to introduce integrated management service (IMS). Furthermore, only when the condition \({{\varPi }}_{IP}^{sc} \ge 0\) holds, i.e., only when the incentive ratio indicator \(\beta \equiv 2tg^{ - 1} \rho^{b - \theta } q_{c} s_{c}^{\kappa - 2} \ge 1\), would the IP have the incentive to provide integrated management service (IMS).

4.2.2 Coordination decision model

Under this scenario, the detailed decision sequences are as follows: the IP first decides IMS effort \(s\), and then, the suppliers simultaneously offer the assembler a revenue sharing contract in which suppliers charge a lower wholesale price \(w_{i}\) from the assembler; if the assembler accepts the contract, he will place an order of quantity \(q\) with the module suppliers, after the final product is assembled by modules or components, he will sell the final product through omnichannel at regular retail price \(p\) and decide the stock factor \(z\) when the selling season starts, and sell the leftover stock through omnichannel at salvage price \(\eta p\) in the clearance season. Finally, the assembler will share a fraction \(1 - \delta\) of his net revenue with the suppliers (supplier i will get a fraction \(\frac{{c_{i} }}{{\mathop \sum \nolimits_{i = 1}^{n} c_{i} }}\left( {1 - \delta } \right)\) of the assembler’s sharing revenue), where \(\delta\) is the revenue keeping fraction of the assembler, and \(0 \le \delta \le 1\). The revenue shared by the assembler with supplier i is as follows:

Thus, the profit functions of the supplier i and assembler under revenue sharing contract are as follows:

The two-stage Stackelberg game problem for the AS under the revenue sharing contract is as follows:

Solving this two-stage Stackelberg game problem, we get the feasible domain of revenue keeping rate \(\delta^{*}\), the coordinated wholesale price \(w_{i}^{sc}\), the equilibrium retail price \(p_{c}^{s}\), the distribution function of the centralized equilibrium stock factor \(F\left( {z_{c}^{s} } \right)\) and the equilibrium production quantity \(q_{c}^{s}\). Furthermore, the coordinated profits of the supplier i, the assembler and the assembly system can be calculated as \({{\varPi }}_{{S_{i} }}^{sc}\), \({{\varPi }}_{A}^{sc}\) and \({{\varPi }}_{SC}^{sc}\). (See Table 2 for the detailed analytical modeling results).

The analytical results of Sect. 4.2 are summarized in Table 2. The centralized strategy neglects the roles of the suppliers in making crucial pricing and production quantity decisions and therefore is inferior to the coordination strategy regarding the derived solutions. Thus, the centralized decision results are not shown in Table 2 and will be ruled out in coming discussions.

4.3 Comparisons and discussions of analytical results

Based on the analytical results derived above, the key findings are drawn and summarized as follows:

4.3.1 Findings from OMO mode

-

(1)

When the suppliers make simultaneous (SI) decisions under the OMO mode, (i) the assembler’s equilibrium profit is \(\frac{{\left( {b - \theta } \right)}}{{\left( {b - \theta - 1} \right)}}\) times of any supplier’s profit. That is, \(\frac{{{{\varPi }}_{A}^{d} }}{{{{\varPi }}_{{S_{i} }}^{d} }} = \frac{b - \theta }{b - \theta - 1}\), i = 1, 2, …, n. (ii) the supplier (i + 1)’s profit equals the supplier i’s profit. That is, \(\frac{{{{\varPi }}_{{S_{i + 1} }}^{d} }}{{{{\varPi }}_{{S_{i} }}^{d} }} = 1\), i = 1, 2, …, n. Thus, all suppliers gain the same profit even though their production costs may be different. (iii) the equilibrium profits of the assembly system and its members decrease as the number of the suppliers increases.

-

(2)

When the suppliers make sequential (SE) decisions under the OMO mode, (i) the assembler’s equilibrium profit is \(\left[ {\frac{{\left( {b - \theta } \right)}}{{\left( {b - \theta - 1} \right)}}} \right]^{n - i + 1}\) times of the supplier i’s profit. That is, \(\frac{{{{\varPi }}_{A}^{d'} }}{{{{\varPi }}_{{S_{i} }}^{d'} }} = \left( {\frac{b - \theta }{b - \theta - 1}} \right)^{n - i + 1}\), i = 1, 2, …, n. (ii) the supplier i + 1 gains \(\frac{{\left( {b - \theta } \right)}}{{\left( {b - \theta - 1} \right)}}\) times of the supplier i’s profit. That is, \(\frac{{{{\varPi }}_{{S_{i + 1} }}^{d'} }}{{{{\varPi }}_{{S_{i} }}^{d'} }} = \frac{b - \theta }{b - \theta - 1}\), i = 1, 2, …, n. Thus, the supplier who moves later, gains more profits, i.e., there exists a last-mover advantage when the suppliers make sequential decisions. (iii) the equilibrium profits of the assembly system and its members decrease as the number of the suppliers increases.

-

(3)

Under the OMO mode, only when \(\phi ^{*} \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{\phi } ,\bar{\phi }} \right]\), would the members of assembly system have the economic incentive to coordinate the supply chain and achieve Pareto improvement of operational performance. Hereinto,

$$\underset{\phi } = {\max} \left\{ {\left( {\frac{b - \theta - n}{b - \theta }} \right)^{b - \theta - 1} ,\left( {\frac{b - \theta - 1}{b - \theta }} \right)^{{n\left( {b - \theta - 1} \right)}} } \right\},\;\;\bar{\phi } = \mathop {{\min} }\limits_{i \in N} \left\{ {1 - \frac{{\sum\nolimits_{i = 1}^{n} {c_{i} } }}{{c_{i} }}{\max} \left\{ {\frac{b - \theta - 1}{b - \theta - n}\left( {\frac{b - \theta - n}{b - \theta }} \right)^{b - \theta } ,\left( {\frac{b - \theta - 1}{b - \theta }} \right)^{{n\left( {b - \theta } \right) - i + 1}} } \right\}} \right\}$$ -

(4)

Under the OMO mode, (i) when the decentralized strategy is taken, the retail price under SE decision is lower than that of SI decision, the ordering quantity of SE decision is larger than that of SI decision, and the profits of SE decision are higher than those of SI decision. In brief, the SE strategy can deliver better results than the SI strategy. (ii) the retail price of the coordination strategy is lower than that of SE strategy, the ordering quantity of the coordination strategy is larger than that of SE strategy, and the profits of coordination strategy are higher than those of SE strategy. In brief, the coordination strategy can deliver better results than the decentralized strategies.

4.3.2 Findings from OMI mode

-

(1)

Under OMI mode, as the IMS effort-elasticity index of the expected demand increases, the IMS effort will increase, the ordering quantity of the final product and the profit of the assembly system will first decrease and then increase. Furthermore, as the IMS fee increases, the IMS effort will increase, the ordering quantity of the final product and the profit of the assembly system will increase; As the cost coefficient of IMS effort increases, the IMS effort will decrease, the ordering quantity of the final product and the profit of the assembly system will decrease.

-

(2)

Under OMI mode, a bidimensional incentive region matrix can be formulated to identify the incentive conditions of introducing and providing IMS and determine the cooperation region between AS and IP (see Table 3). This bidimensional incentive region matrix is composed of two key incentive ratio indicators \(\alpha\) and \(\beta\). When \(\alpha\) and \(\beta\) are in different intervals, different situations can be derived and discussed:

Table 3 Bidimensional Incentive Region Matrix -

(i)

In quadrant I, \(\alpha \ge 1\) and \(0 < \beta < 1\), the AS would have the incentive to introduce IMS, while the IP would not have the incentive to provide IMS, i.e., the cooperation between the AS and IP failed.

-

(ii)

In quadrant II, \(0 < \alpha < 1\) and \(0 < \beta < 1\), the AS would not have the incentive to introduce IMS, and the IP would not have the incentive to provide IMS, i.e., the cooperation between the AS and IP failed.

-

(iii)

In quadrant III, \(0 < \alpha < 1\) and \(\beta \ge 1\), the AS would not have the incentive to introduce IMS, while the IP would have the incentive to provide IMS, i.e., the cooperation between the AS and IP failed.

-

(iv)

In quadrant IV, \(\alpha \ge 1\) and \(\beta \ge 1\), the AS would have the incentive to introduce IMS, and the IP would have the incentive to provide IMS, i.e., the cooperation between the AS and IP can be achieved.

Apparently, only when key incentive ratio indicators \(\alpha \ge 1\) and \(\beta \ge 1\), would the AS and IP have the incentive to introduce and provide integrated management service (IMS).

-

(i)

-

(3)

Under OMI mode, only when \(\delta ^{*} \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{\delta } ,\bar{\delta }} \right]\), would the members of assembly system have the economic incentive to coordinate the supply chain and achieve Pareto improvement of operational performance. Hereinto, \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{\delta } = \frac{{\phi^{*} {{\varPi }}_{SC}^{c} }}{{{{\varPi }}_{SC}^{sc} }},\;\;\bar{\delta } = \frac{{{{\varPi }}_{SC}^{sc} - \left( {1 - \phi^{*} } \right){{\varPi }}_{SC}^{c} }}{{{{\varPi }}_{SC}^{sc} }}\).

4.3.3 Findings from OMI mode versus OMO mode

-

(1)

OMI mode versus OMO mode, (i) the optimal stock factor under OMI mode equals that under OMO mode; (ii) the optimal retail price of the final product under OMI mode is \(\rho^{ - 1}\) times of that under OMO mode; (iii)the optimal ordering quantity of the final product under OMI mode is \(\rho \alpha\) times of that under OMO mode; (iv) the optimal profit of the supply chain under OMI mode is \(\alpha\) times of that under OMO mode. That is, \(\frac{{z_{c}^{s} }}{{z_{c} }} = 1\), \(\frac{{p_{c}^{s} }}{{p_{c} }} = \frac{1}{\rho }\), \(\frac{{q_{c}^{s} }}{{q_{c} }} = \rho \alpha\), \(\frac{{{{\varPi }}_{SC}^{sc} }}{{{{\varPi }}_{SC}^{c} }} = \alpha\). Hereinto, \(\rho = \frac{{c + \lambda c_{e} + \left( {1 - \lambda } \right)c_{s} + \mathop \sum \nolimits_{i = 1}^{n} c_{i} }}{{c + \lambda c_{e} + \left( {1 - \lambda } \right)c_{s} + \mathop \sum \nolimits_{i = 1}^{n} c_{i} + t}}\), \(\alpha \equiv \rho^{b - \theta - 1} s_{c}^{\kappa }\).

-

(2)

Under the OMO mode and OMI mode, as the price-elasticity index of the expected demand decreases, the ordering quantity of the final product will increase, and the profit of the assembly system will also increase. Furthermore, as the mutual fusion coefficient between channels increases, the ordering quantity of the final product and the profit of the assembly system will increase. Besides, as the module costs, the assembly cost, the operational cost of the online- or offline- channel decrease, the optimal retail price will decrease, and the optimal ordering quantity and the optimal profits of the assembly system and its members will increase.

-

(3)

Be it under OMO mode or OMI mode, the revenue sharing contract mechanism can effectively coordinate the members of the AS to make the best pricing and quantity decisions that create the best profits for all members. Besides, the supplier who incurs more costs gains more coordinated profits in the coordination decision of assembly system.

The numerical and sensitivity analyses conducted in the next section validate and reveal the key analytical findings of this section with a real example, thus providing a more powerful explanation for the theoretical findings and comparisons drawn in this section.

5 Numerical and sensitivity analyses

An electronic product is selected from the Chinese market for the purpose of numerical and sensitivity analyses [36]. The setting of parameters and their values are listed in Table 4. They will serve as inputs to the analytical models developed in Sect. 4.1, 4.2 and 4.3.

The AS is composed of four key module suppliers and one assembler with direct omnichannel, i.e., \(n = 4\), and \(i = 1,2,3,4\). The unit costs of the modules are represented by \(c_{1}\), \(c_{2}\), \(c_{3}\), and \(c_{4}\) valued at 149, 53, 80 and 60 USD/unit respectively. The unit assembly cost of the final product \(c\) is 50 USD/unit. The operational cost of the online channel \(c_{e}\) is 26 USD/unit and the operational cost of the offline channel \(c_{s}\) is 39 USD/unit. The IMS fee \(t\) is 1 USD/unit. The cost coefficient of IMS effort \(g\) is 1E + 6. The salvage discount price factor \(\eta\) is set at 50%. The market demand share of the online channel \(\lambda\) is set at 0.6. The maximum possible demand \(a\) is set at 5E + 17. The price-elasticity index of expected demand \(b\) is set at 5.0. The mutual fusion coefficient between channels \(\theta\) is set at 0.5. The IMS effort-elasticity index of the expected demand \(\kappa\) is set at 0.5. The revenue keeping rate under OMO mode \(\phi\) is 0.5. The revenue keeping rate under OMI mode \(\delta\) is 0.5. The random factor \(x\) obeys normal distribution, i.e. \(x\sim N\left( {\mu ,\sigma^{2} } \right)\), and μ = 100, σ = 10. A is set at 0.1 and B is set at 1000.

5.1 Numerical analysis

The numerical analysis results of all models are shown in Table 5. The findings are summarized and discussed below:

Simultaneous (SI) versus Sequential (SE) versus Coordination (CO) Decisions under OMO Mode For all model types under OMO mode, it is found that: (1) the stock factor: SI = SE = CO; (2) the retail price: CO < SE < SI; (3) the ordering quantity: CO > SE > SI; and (4) the profits of the AS and its members: CO > SE > SI. Obviously, coordination (CO) decision outperforms the other decisions regarding key indicators of operational performance.

OMI Mode versus OMO Mode Since coordination decision performs best under OMO mode, we will just compare coordination decision under OMI mode with that under OMO mode. Comparing the coordination decision under OMI mode with that under OMO mode in Table 5, it is found that: (1) based on the bidimensional incentive region matrix derived above, the dual incentive ratio indicators \(\alpha = 1.52 \ge 1\) and \(\beta = 4.00 \ge 1\), i.e., the dual incentive ratio indicators are in the quadrant \(\{ \alpha \ge 1\) and \(\beta \ge 1\}\) of bidimensional incentive region matrix, thus, AS and IP would have the incentive to introduce and provide IMS, and the cooperation between AS and IP can be achieved under OMI mode; (2) the stock factor under OMI mode equals that under OMO mode. (3) the retail price under OMI mode is higher than that under OMO mode; (4) the ordering quantity under OMI mode is larger than that under OMO mode; (5) the profits of the AS and its members under OMI mode are higher than those under OMO mode.

Demand growth effect versus cost increasing effect Under OMI mode, the introduction of IMS can enhance the value added for consumers, and lead to a growth in demand. The profit growth effect brought about by this demand growth can be called the demand growth effect. Meanwhile, this demand growth is at the expense of IMS fee/cost payment. This IMS fee/cost payment effect caused by this demand growth can be called the cost increasing effect. On this basis, we can calculate that the demand growth effect is 590,547,817 and the cost increasing effect is 10,899,326. The demand growth effect is stronger than the cost increasing effect. Therefore, it is worth introducing IMS for the AS to improve the operational performance.

Coordination mechanism based on revenue sharing contract Be it under OMO mode or OMI mode, a revenue sharing contract can effectively coordinate the AS and achieve better operational performances for its members.

Summary Across the game-theoretical decision models, we have noticed several phenomena. First, the worst strategy is the SI strategy which causes an extremely low demand for the assembled product due to its exceptionally high retail price. Second, the SE strategy provides much better solutions and higher profits than the SI strategy. Third, the coordinated strategy outperforms the decentralized strategy regarding the profits of AS.

In sum, through the above pairwise model comparisons, the coordination strategy with integrated management service (IMS) is identified as the best operational strategy for the AS. This finding provides profound practical implications for IMS adopting decision and operational strategy selection for the AS, which helps enhance quick response ability and improve operational performance.

5.2 Sensitivity analysis

Since, from the analysis in Sect. 5.1, OMI mode is found to be the most attractive business mode for omnichannel practitioners, the sensitivity analysis will focus on how the changes of seven key parameters of the models under OMI mode impact the profits of the members in the AS. Seven key parameters are: maximum possible demand (a), online channel demand share (λ), price-elasticity index of the expected demand (b), mutual fusion coefficient between channels (θ), IMS effort-elasticity index of the expected demand (κ), cost coefficient of IMS effort (g), and IMS fee (t). The increment scale and range of change of each parameter in the sensitivity analysis are listed in Table 6.

5.2.1 Maximum possible demand (a)

The sensitivity analysis results of the maximum possible demand (a) are shown in Fig. 2. There is a positive relationship between profits and a. The profits of suppliers, assembler, AS and IP increase as the maximum possible demand (a) increases.

The AS’ s incentive ratio indicator of adopting IMS (α) increases as the maximum possible demand (a) increases. Especially, when the maximum possible demand (a) is less than about 1.5E + 17, α < 1, i.e., the AS does not have the incentive to adopt IMS; on the contrary, when the maximum possible demand (a) is more than about 1.5E + 17, α > 1, i.e., the AS has the incentive to adopt IMS.

The IP’ s incentive ratio indicator of providing IMS (β) remains unchanged as the maximum possible demand (a) increases. Furthermore, The IP’ s incentive ratio indicator of providing IMS β > 1, i.e., the IP always has the incentive to provide IMS.

The finding may imply that, when the market scale reaches a certain degree, the AS and IP would have the incentive to adopt and provide IMS.

5.2.2 Online channel demand share (λ)

The sensitivity analysis results of the online channel demand share (λ) are shown in Fig. 3. It is clear there is a positive exponential relationship between profits and λ. The profits of suppliers, assembler, AS and IP exponentially increase as the online channel demand share (λ) increases.

The AS’ s incentive ratio indicator of adopting IMS (α) increases as the online channel demand share (λ) increases. Furthermore, the AS’ s incentive ratio indicator of adopting IMS α > 1, i.e., the AS always has the incentive to adopt IMS.

The IP’ s incentive ratio indicator of providing IMS (β) remains unchanged as the online channel demand share (λ) increases. Furthermore, The IP’ s incentive ratio indicator of providing IMS β > 1, i.e., the IP always has the incentive to provide IMS.

The finding may imply that, regardless of how much online channel demand share (λ) is, the AS and IP always have the incentive to adopt and provide IMS.

5.2.3 Price-elasticity index of the expected demand (b)

The sensitivity analysis results of the price-elasticity index of the expected demand (b) are shown in Fig. 4. It is clear there is a reverse exponential relationship between profits and b. The profits of suppliers, assembler, AS and IP exponentially decrease as the price-elasticity index of the expected demand (b) increases.

The AS’ s incentive ratio indicator of adopting IMS (α) decreases as the price-elasticity index of the expected demand (b) increases. Especially, when the price-elasticity index of the expected demand (b) is less than about 5.2, α > 1, i.e., the AS has the incentive to adopt IMS; on the contrary, when the price-elasticity index of the expected demand (b) is more than about 5.2, α < 1, i.e., the AS does not have the incentive to adopt IMS.

The IP’s incentive ratio indicator of providing IMS (β) remains unchanged as the price-elasticity index of the expected demand (b) increases. Furthermore, The IP’ s incentive ratio indicator of providing IMS β > 1, i.e., the IP always has the incentive to provide IMS.

The finding may imply that, when the price-elasticity index of the expected demand is lower than a certain value, the AS and IP would have the incentive to adopt and provide IMS.

5.2.4 Mutual fusion coefficient between channels (θ)

The sensitivity analysis results of the mutual fusion coefficient between channels (θ) are shown in Fig. 5. It is clear there is a positive exponential relationship between profits and θ. The profits of suppliers, assembler, AS and IP exponentially increase as the mutual fusion coefficient between channels (θ) increases.

The AS’ s incentive ratio indicator of adopting IMS (α) increases as the mutual fusion coefficient between channels (θ) increases. Especially, when the mutual fusion coefficient between channels (θ) is less than about 0.3, α < 1, i.e., the AS does not have the incentive to adopt IMS; on the contrary, when the mutual fusion coefficient between channels (θ) is more than about 0.3, α > 1, i.e., the AS has the incentive to adopt IMS.

The IP’ s incentive ratio indicator of providing IMS (β) remains unchanged as the mutual fusion coefficient between channels (θ) increases. Furthermore, The IP’ s incentive ratio indicator of providing IMS β > 1, i.e., the IP always has the incentive to provide IMS.

The finding may imply that, when the mutual fusion coefficient between channels (θ) is higher than a certain value, the AS and IP would have the incentive to adopt and provide IMS.

5.2.5 IMS effort-elasticity index of the expected demand (κ)

The sensitivity analysis results of the IMS effort-elasticity index of the expected demand (κ) are shown in Fig. 6. It is clear there is a positive exponential relationship between profits and κ. The profits of suppliers, assembler, AS and IP exponentially increase as the IMS effort-elasticity index of the expected demand (κ) increases.

The AS’s incentive ratio indicator of adopting IMS (α) increases as the IMS effort-elasticity index of the expected demand (κ) increases. Furthermore, the AS’ s incentive ratio indicator of adopting IMS α > 1, i.e., the AS always has the incentive to adopt IMS.

The IP’s incentive ratio indicator of providing IMS (β) decreases as the IMS effort-elasticity index of the expected demand (κ) increases. Furthermore, The IP’s incentive ratio indicator of providing IMS β > 1, i.e., the IP always has the incentive to provide IMS.

The finding may imply that, regardless of how much IMS effort-elasticity index of the expected demand (κ) is, the AS and IP always have the incentive to adopt and provide IMS.

5.2.6 Cost coefficient of IMS effort (g)

The sensitivity analysis results of the cost coefficient of IMS effort (g) are shown in Fig. 4. It is clear there is a reverse exponential relationship between profits and g. The profits of suppliers, assembler, AS and IP exponentially decrease as the cost coefficient of IMS effort (g) increases.

The AS’ s incentive ratio indicator of adopting IMS (α) decreases as the cost coefficient of IMS effort (g) increases. Furthermore, the AS’ s incentive ratio indicator of adopting IMS α > 1, i.e., the AS always has the incentive to adopt IMS.

The IP’ s incentive ratio indicator of providing IMS (β) remains unchanged as the cost coefficient of IMS effort (g) increases. Furthermore, The IP’ s incentive ratio indicator of providing IMS β > 1, i.e., the IP always has the incentive to provide IMS.

The finding may imply that, regardless of how much cost coefficient of IMS effort (g) is, the AS and IP would have the incentive to adopt and provide IMS (Fig. 7).

5.2.7 IMS fee (t)

The sensitivity analysis results of the IMS fee (t) are shown in Fig. 8. It is clear that there is a positive exponential relationship between profits and t. The profits of suppliers, assembler, AS and IP exponentially increase as the IMS fee (t) increases.

The AS’ s incentive ratio indicator of adopting IMS (α) increases as the IMS fee (t) increases. Furthermore, the AS’ s incentive ratio indicator of adopting IMS α > 1, i.e., the AS always has the incentive to adopt IMS.

The IP’ s incentive ratio indicator of providing IMS (β) remains unchanged as the IMS fee (t) increases. Furthermore, The IP’ s incentive ratio indicator of providing IMS β > 1, i.e., the IP always has the incentive to provide IMS.

The finding may imply that, regardless of how much the IMS fee (t) is, the AS and IP would have the incentive to adopt and provide IMS.

To summarize, the sensitivity analysis of seven key parameters on OMI mode provides valuable implications for both theoretical and practical understanding of the research questions.

6 Managerial insights

Despite its tremendous global growth over the last few years, ecommerce sales still represent only 8.3% of total retail sales in the U.S. [29]. Even though more and more consumers are used to buying things like books, shoes and electronics online, the majority of spending still takes place in brick and mortar outlets. In fact, apart from Amazon, all the top ten retailers in the U.S. are old-school, brick-and-mortar stores (Thau 2017). Most shoppers conduct online research before making big purchases. Being able to channel even a small percentage of these customers straight from their online research to offline stores would represent a massive potential for brick-and-mortar stores. This potential has driven major assemblers with direct retailing channel, either e-commerce or traditional retailing channel, to jump into an omnichannel commerce wagon. This study and its key theoretical findings provide new and useful theoretical and practical insights into the assembler with direct omnichannel.

6.1 Theoretical insights

Based on the foregoing discussions, the following theoretical insights can be derived and summarized as follows:

6.1.1 Operational strategies under the OMO mode

First, when the decentralized strategy is taken, sequential (SE) strategy outperforms simultaneous (SI) strategy regarding the operational performance for the AS. This is a typical ‘late-mover advantage’. Second, the coordination strategy based on the revenue sharing contract (RSC) outperforms SE strategy regarding the operational performance for the AS. Therefore, the RSC based coordination strategy is the best operational strategy to increase operational performance for the AS, and the SE strategy would be the second-best choice for the AS, if the coordination strategy is ruled out due to non-economic reasons.

6.1.2 Incentives of IMS adoption and operational strategies under the OMI mode

First, only when the incentive ratio indicator \(\alpha \ge 1\) would the AS have the incentive to introduce IMS, and only when the incentive ratio indicator \(\beta \ge 1\) would the IMS provider (IP) have the incentive to provide IMS. In other words, only when the dual incentive ratio indicators are in the quadrant \(\{ \alpha \ge 1\) and \(\beta \ge 1\}\) of bidimensional incentive region matrix would AS have the incentive to introduce IMS and IP have the incentive to provide IMS, and thus, the cooperation between AS and IP can be achieved and the operational performance of AS and IP can be improved. Second, with the help of IMS effort, the ability of collaborative operations and quick response for the AS can be effectively improved, the value added for customers can be effectively strengthened, and thus the growth in demand can be effectively reached. Besides, it should be noted that this demand growth is at the expense of IMS fee/cost payment. When the demand growth effect is stronger than the cost increasing effect (in the numerical analysis part, demand growth effect 590,547,817 > cost increasing effect 10,899,326), the operational performance of the AS can be effectively improved. Third, a coordination strategy based on revenue sharing contract (RSC) can effectively improve the operational performance of the ASI. Finally, reducing the module costs, the assembly cost, the operational costs of online- or offline- channel, and the cost of IMS effort can effectively improve the operational performance of the ASI. Furthermore, a higher maximum possible demand, a higher online channel demand share, a lower price-elasticity index of the expected demand, a higher mutual fusion coefficient between channels, a higher IMS effort-elasticity index of the expected demand, and a higher IMS fee, are conducive to the improvement of the operational performance of the ASI. Therefore, reducing operational costs and IMS costs, attracting more demand to the low-cost channel, assembling and selling a lower price elasticity product, enhancing the communication and integration between the ecommerce and physical channels, strengthening mutual fusion effects of omnichannel, introducing, adopting and providing IMS, and setting a relatively higher IMS fee, would be good marketing and operational strategies for assembly system with IMS in omnichannel business scenario.

6.2 Practical insights

From the operational management practical perspective, the practical insights can be derived and summarized as follows:

In management practice, the AS is generally operated under a decentralized decision mode with suppliers’ simultaneous or sequential decision. Based on the modeling and numerical analyses and discussions, the operational performance of the AS under the decentralized decision mode is not Pareto optimal, and still has space for improvement. Due to the different parts quality, process technology, cost control and delivery ability of different suppliers, the AS under decentralized decision often faces the risk of supply interruption, and thus resulting in non-cooperative operation and slow response of the AS and forming a “neck stuck” phenomenon in the AS. This is harmful to the healthy and sustainable operations of the AS.

To address these issues, the assembler with direct omnichannel and multiple suppliers usually try to implement collaborative operations through contractual mechanism. From the theoretical perspective, the AS may achieve coordinative operations and realize Pareto improvement of the operational performance for all the stakeholders. Nevertheless, from the practical perspective, it is still quite challenging to guarantee effective implementation of the contract. Due to the complicated structure and multiple participants in the AS, the assembler has to deal with the complicated collaborative business relationships with multiple suppliers, resulting in non-cooperative operations and slow-response ability in the AS. Meanwhile, owing to the lack of effective demand information sharing and collaborative planning, forecasting and replenishment mechanism across the AS, suppliers are often unable to guarantee the perfect matching supply of parts and components for the assembly process of the assembler, which may lead to assembly disruption.

Against this background, the professional third-party, IMS providers (IPs), came into being. For example, there are many IPs in the electronics industry, such as Arrow Electronics, Avnet, WPG Holdings, Future Electronics, etc. These IMS providers (IPs) can provide various comprehensive IMS solutions for the AS to enhance their ability of quick response, boost their collaborative operations, and improve their operational performance. Specifically, they can provide a unified logistics and information flow management platform for the AS, enhance the demand information sharing between the assembler and multiple suppliers and help multiple suppliers collaboratively carry out matching collection and distribution of the corresponding parts and components to the assembler in accordance with the assembly requirements of product. With the help of IPs, the ability of collaborative operations and quick response can be effectively enhanced, the mutual fusion effect between online- and offline- channels can be effectively strengthened, the value added for customers can be effectively raised, the demand can be effectively increased and the operational performance can be effectively improved in the AS.

Now, research questions aforementioned can be answered. First, it is worth introducing IMS for the AS to enhance their ability of quick response, boost their collaborative operations, and improve their operational performance. Second, a bidimensional incentive region matrix can be applied to identify the incentive regions for AS and IP. Only when the dual incentive ratio indicators are in the quadrant \(\{ \alpha \ge 1\) and \(\beta \ge 1\}\) of bidimensional incentive region matrix would AS have the incentive to introduce IMS and IP have the incentive to provide IMS, and thus, the cooperation between AS and IP can be achieved and the operational performance of AS and IP can be improved. Third, coordination strategy based on revenue sharing contract (RSC) can effectively improve the operational performance of the ASI. Therefore, introducing and providing IMS will not only improve the operational performance for the AS, but also contribute to the development of integrated management service (IMS) industry and cultivation of new economic growth points from the perspective of macro economy.

In order to boost the healthy and sustainable development of IMS industry, effective governance policies and scientific industry standards should be established and improved, and corresponding fiscal and tax policy support should be established and implemented according to the practical situation. Besides, advanced and applicable IMS technologies and corresponding comprehensive solutions can be spread and applied to assembly systems with direct omnichannel. Furthermore, IMS providers with professional technology and strong financing ability can be cultivated, supported and expanded, assembly systems with direct omnichannel can be encouraged to introduce IMS, and the competition order of IMS market and development environment of IMS industry should be regulated and optimized.

In brief, when certain conditions are met, introducing and providing IMS is not only beneficial to improving the operational performance of AS, but also conducive to developing integrated management service (IMS) industry and cultivating new economic growth points. A coordination strategy based on revenue sharing contract (RSC) can effectively improve the operational performance of AS and IP.

7 Conclusion

In the context of the development of the omnichannel retailing mode, introducing and providing integrated management service (IMS) and corresponding comprehensive solutions have important theoretical value and practical significance for the assembly system with direct omnichannel (AS) to optimize their operational performance, further develop IMS industry, and realize new economic growth points. The incentive conditions/regions of adopting IMS and the operational strategies/performance for the AS are important issues calling for urgent solution. To tackle these issues, a centralized, two decentralized and a coordination decision models for the AS are developed and analyzed, and a centralized and a coordination decision models for the ASI are further developed, analyzed and compared. Based on an electronic product case, the corresponding numerical and sensitivity analyses are conducted. On this basis, the analytical and numerical results are compared and validated to derive managerial insights. The research results indicate that: (1) under OMO mode, the coordination strategy based on the revenue sharing contract (RSC) is the best operational strategy to improve operational performance for the AS. (2) under OMI mode, only when the dual incentive ratio indicators are in the quadrant \(\{ \alpha \ge 1\) and \(\beta \ge 1\}\) of bidimensional incentive region matrix would AS and IP have the incentive to introduce and provide IMS. Introducing and providing IMS can effectively improve the operational performance of the AS. Furthermore, the RSC-based coordination strategy can effectively improve the operational performance of the ASI. (3) under OMI mode, reducing operational costs and IMS costs, attracting more demand to the low-cost channel, assembling and selling a lower price elasticity product, enhancing the communication and integration between the ecommerce and physical channels, strengthening mutual fusion effects of omnichannel, introducing, adopting and providing IMS, and setting a relatively higher IMS fee, can effectively improve the operational performance for the ASI.

In terms of theoretical contribution, the existing literatures seldom cover the incentive conditions and cooperation regions regarding the introduction and adoption of the integrated management service (IMS) in the AS and the corresponding operational strategies/decisions/performance for the ASI. We address the literature gaps by cross-fertilizing the areas of mechanism design, operational strategies and management theory. This paper proposes a novel and useful approach toward incentive conditions, cooperation regions and operational strategies for the ASI from the perspective of game-theoretical modeling and comparative analysis. With regard to practical contribution, we shed new light on studies of the incentives of IMS adoption in AS. This paper provides a framework for understanding when the IMS would be introduced and provided in the AS and how to achieve coordinative operations across the AS. The modeling and numerical results can be effectively used to help AS and IP make appropriate operational decisions/strategies and optimize their operational performance.

Due to the shortage of relevant literature, limited research fund and difficulty in collecting empirical data, this study focuses mainly on the theoretical exploration of the value of IMS for the assembly system in an omnichannel business mode. Even though insightful findings are discovered, there are still many important research issues worthy of further exploration in the future. First, the assembly system may be extended to a three-echelon supply chain composed of multiple complementary module suppliers, an assembler and omnichannel retailer in future research. Second, different market power and related decision structure may be taken into account in the ASI. Third, other types of coordination contracts can also be considered in the ASI. Finally, fairness concern or overconfidence of decision-makers in the assembly system can also be included in future studies.

References

Bertrand, J. (1883). Revue de la Theorie Mathematique de la Richesse Sociate et des Recherches sur ies Principles Mathematiques de ta Theorie des Richesses. Journat des Savants, 67, 499–508.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Management Science, 51(1), 30–44.

Cai, G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing, 86(1), 22–36.

Carr, S. M., & Karmarkar, U. S. (2005). Competition in multiechelon assembly supply chains. Management Science, 51(1), 45–59.

Chen, X., Wang, X., & Jiang, X. (2016). The impact of power structure on the retail service supply chain with an O2O mixed channel. Journal of the Operational Research Society, 67(2), 294–301.

Chen, Z., Fang, L., & Su, S.-I. I. (2019). The Value of Offline Channel Subsidy in Bricks and Clicks: An O2O Supply Chain Coordination Perspective. Electronic Commerce Research. https://doi.org/10.1007/s10660-019-09386-z.

Chen, Z., & Su, S. I. (2020). Consignment supply chain cooperation for complementary products under online to offline business mode. Flexible Services and Manufacturing Journal. https://doi.org/10.1007/s10696-020-09376-6.

Dilworth, D. (2007). Dell to sell computers in Wal-Mart and other retail stores [EB/OL]. https://www.dmnews.com/marketing-channels/multi-omnichannel/news/13067247/dell-to-sell-computers-in-walmart-and-other-retail-stores. Accessed on March 23, 2020.

DT News Network. (2017). Dell EMC Believes in an Omni Channel Strategy. March, 14, 2017. http://digitalterminal.in/news/dell-emc-believes-in-an-omni-channel-strategy/8853.html. Accessed on March 23, 2020.

Duggan, W. (2015). What Does O2O Mean For The Future Of E-Commerce? Yahoo Finance, August 17, 2015.

Gao, F., & Su, X. (2016). Omnichannel retail operations with buy-online-and-pick-up-in-store. Management Science, 63(8), 2478–2492.

Gao, F., & Su, X. (2018). Omnichannel service operations with online and offline self-order technologies. Management Science, 64(8), 1. https://doi.org/10.1287/mnsc.2017.2787.

Investopedia. (2018). Online-to-Offline Commerce. https://www.investopedia.com/terms/o/onlinetooffline-commerce.asp#ixzz5GNPyJCIX. May 24, 2018.

Ji, J., Zhang, Z., & Yang, L. (2017). Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. International Journal of Production Economics, 187, 68–84.

Jiang, L., & Wang, Y. (2010). Supplier competition in decentralized assembly systems with price-sensitive and uncertain demand. Manufacturing and Service Operations Management, 12(1), 93–101.

Jiang, Y., Liu, L., & Lim, A. (2020). Optimal pricing decisions for an omni-channel supply chain with retail service. International Transactions in Operational Research. https://doi.org/10.1111/itor.12784.

Kalkancı, B., & Erhun, F. (2012). Pricing games and impact of private demand information in decentralized assembly systems. Operations Research, 60(5), 1142–1156.

Krishnan, H., Kapuscinski, R., & Butz, D. A. (2010). Quick Response and Retailer Effort. Management Science, 56(6), 962–977. https://doi.org/10.1287/mnsc.1100.1154.

Lariviere, M. A. (2006). A note on probability distributions with increasing generalized failure rates. Operations Research, 54(3), 602–604. https://doi.org/10.1287/opre.1060.0282.

Lariviere, M. A., & Porteus, E. L. (2001). Selling to the newsvendor: An analysis of price-only contracts. Manufacturing and Service Operations Management, 3(4), 293–305.

Lawton, C. (2007). Tweaking the Standard-issue PC. Wall Street Journal. June 14. [EB/OL]. http://www.wsj.com/articles/SB118178612543434724. Accessed on March 23, 2020.

Nagarajan, M., & Bassok, Y. (2008). A bargaining framework in supply chains: the assembly problem. Management Science, 54(8), 1482–1496.

Nagarajan, M., & Sošić, G. (2009). Coalition stability in assembly models. Operations Research, 57(1), 131–145.

Orendorff, A. (2018). O2O Commerce: Conquering Online-to-Offline Retail’s Trillion Dollar Opportunity. May 21, 2018. https://www.shopify.com/enterprise/o2o-online-to-offline-commerce. Accessed on August 20, 2018.

Paul, J., Agatz, N., Spliet, R., & De Koster, R. (2019). Shared capacity routing problem—An omni-channel retail study. European Journal of Operational Research, 273(2), 731–739.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research, 47(2), 183–194. https://doi.org/10.1287/opre.47.2.183.

Rao, R. C. (1990). Compensating heterogeneous salesforces: Some explicit solutions. Marketing Science, 9(4), 319–341.

Taylor, T. A. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007. https://doi.org/10.1287/mnsc.48.8.992.168.

USDOC. (2017). U.S. Department of Commerce Quarterly Retail Ecommerce Sales 4th Quarter 2016, Reported 2/17/17.

Wang, Y. (2006). Joint pricing-production decisions in supply chains of complementary products with uncertain demand. Operations Research, 54(6), 1110–1127.

Wang, Y. (2017). Betting on Brick-And-Mortar: Alibaba’s Billion-Dollar Retail Experiment. Aug 27, 2017, Forbes.

Wallace, T. (2018). The complete omni-channel retail report: What brands need to know about modern consumer shopping habits in 2018, [EB/OL]. https://www.bigcommerce.com/blog/omni-channel-retail/. January 8, 2020

Wang, Y., Jiang, L., & Shen, Z. J. (2004). Channel performance under consignment contract with revenue sharing. Management Science, 50(1), 34–47.

Yang, D., & Zhang, X. (2020). Quick response and omnichannel retail operations with the ship-to-store program. International Transactions in Operational Research. https://doi.org/10.1111/itor.12781.

Yin, S. (2010). Alliance formation among perfectly complementary suppliers in a price-sensitive assembly system. Manufacturing and Service Operations Management, 12(3), 527–544.

Kjmx. (2019). Hardware cost disclosure of Huawei, apple, Samsung and Xiaomi, how much is the profit margin of each manufacturer? [EB/OL]. http://finance.sina.com.cn/stock/relnews/us/2019-06-29/doc-ihytcerm0232231. Accessed on January 12, 2020.

Zhang, F. (2006). Competition, cooperation, and information sharing in a two-echelon assembly system. Manufacturing & Service Operations Management, 8(3), 273–291.

Zhang, J., Chen, H., & Wu, X. (2015). Operation models in O2O supply chain when existing competitive service level. International Journal of u- and e- Service, Science and Technology, 8(9), 279–290.

Zhang, J., Chen, H., Ma, J., & Tang, K. (2015). How to coordinate supply chain under O2O business model when demand deviation happens. Management Science and Engineering, 9(3), 24–28.

Acknowledgements

This work is supported by the National Natural Science Foundation of China (Grant No. 71603125), China Scholarship Council (Grant No. 201706865020), China Postdoctoral Science Foundation (Grant No. 2019M651833), Social Science Foundation of Jiangsu Province in China (Grant No. 19GLC003), the Key project of Social Science Foundation of Jiangsu Province (Grant No. 18EYA002), Young Leading Talent Program of Nanjing Normal University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Proofs for analytical results of game-theoretical decision models

Appendix: Proofs for analytical results of game-theoretical decision models

Based on Sect. 3 modeling notations and assumptions, this section conducts an extensive game-theoretical modeling of the equilibrium and coordination conditions for the assembly system with direct omnichannel and IMS. In the models to follow, note that the superscript or subscript c represents centralized decision and coordination decision under omnichannel mode (i.e., OMO mode); the superscript or subscript d: decentralized decision with suppliers’ simultaneous action under OMO mode; the superscript or subscript d’: decentralized decision with suppliers’ sequential action under OMO mode; the superscript or subscript sc: centralized decision and coordination decision under omnichannel mode with IMS (i.e., OMI mode).

1.1 Appendix 1: Proofs for analytical results of Sect. 4.1 game-theoretical decision models under OMO mode