Abstract

Based on panel data covering 114 countries between 1996 and 2011, this study investigates the impact on pollution of trade in environmental goods (EGs). We check the validity of the implicit consequences assumed by the win–win scenario in the current trade-climate negotiations, arguing that market dynamics should guarantee that EGs’ liberalization is ‘automatically’ in the interest of all countries, regardless their market and institutional capacities. We show that trade in EGs alone fail to address environmental problems effectively. In particular, although we found efficiency gains from trade in EGs (in terms of CO2 and SO2 emissions per 1 US$ of GDP), and more recurrently for net exporters than for net importers, our results often failed to highlight environmental effectiveness (in terms of total CO2 and SO2 emissions). A general conclusion that emerges from our empirical results is that trade [in EGs] cannot effectively replace non-market-based solutions, when it comes to non-trade objectives. However, it seems to complement them efficiently. Our multiple-equation GMM estimations reveal specific direct, indirect and total effects on pollution depending on the countries’ net trade status, leading to several policy recommendations for an increased environmental effectiveness of trade in EGs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Negotiations toward an international Environmental Goods Agreement (EGA), officially launched by the World Trade Organisation (WTO) members in Geneva, Switzerland, on July 8, 2014, are supposed to bring opportunities for developing countries to achieve greater environmental performance. This agreement should indeed make trade in ‘environmental goods’ (EGs) tariff-free, the EGs encompassing various goods used for the production of renewable energy, pollution prevention and control, the management and conservation of natural resources, and environmental monitoring (e.g., parts for auxiliary plant for boilers, condensers for steam, vapour power unit; solar power electric generating sets and water heaters; wind turbine blades and hubs; gas, hydraulic turbines; filtering or purifying machinery and apparatus for liquids, gases; bamboo, etc.).Footnote 1 Despite little progress in EGs trade liberalization, the global trade of EGs has significantly risen in recent years, both in developed and developing countries, representing USD 1 trillion annually (around 5% of all trade). EGs market is expected to more than double its 2012-estimated value by 2022, growing from USD 1.1 trillion to some USD 2.5 trillion.Footnote 2 UNEP (2013) states that between 2001 and 2007 the total EGs export value has grown by more than 100%. Yet, the EGs exports are much more concentrated in a couple of leading economies (e.g., China, Germany, Japan, and the US), developing countries typically being net importers.Footnote 3

According to the WTO, all increase in the availability of EGs through trade openness should represent an opportunity for a ‘triple win’ relationship between trade, development and the environment (Yu 2007). First, trade should be facilitated and thus intensified through the reduction or elimination of both tariff and non-tariff barriers. Second, the liberalization of trade in EGs should be beneficial for development, as it would stimulate innovation and further technology transfer by reducing their costs on the local markets. For instance, Schmid (2012) shows that international projects (in particular the Clean Development Mechanism under the Kyoto protocol) are more likely to be accompanied by technology transfers when tariffs are low in the host countries. Additional employment and income in the eco-industrial activities should contribute to the economic development. Third, the increased trade in EGs, making cleaner technologies more widely available, must be good for the environment. Lower compliance costs and ease access to EGs should finally facilitate setting (and reaching) stringent greenhouse gas (GHG) emission targets.

However, if developing countries are expected to see reductions in their environmental compliance costs, the direct commercial profits from EGs’ trade liberalization should primarily benefit the most advanced WTO member countries, enjoying a better access to EGs markets in the developing countries (Hamwey et al. 2003; Vikhlyaev 2004). Indeed, the international trade of EGs is largely dominated by firms from the developed countries, representing about 90% of world supply of EGs (GIER 2009). Because tariffs applied to EGs are higher in the developing countries than in the developed countries, EGs’ trade liberalization could be mainly economically beneficial to the advanced economies. Moreover, given that most of the developing countries are net importers of EGs, liberalization of these products could worsen their trade deficits and reduce tariff revenues. Finally, one could question the environmental effectiveness of EGs’ trade given that negotiations on the list of EGs for accelerated liberalisation proceeded generally in a mercantilist way. According to Musch and De Ville (2019), the negotiations toward an EGA failed in late 2016 because of the ‘liberal environmental’ paradigm that has become central in thinking about the trade-climate nexus. Specifically, by assuming that trade liberalisation ‘as such’ would guarantee technology transfer, this new paradigm has left little space for negotiation to non-trade actors (non-industry experts, NGOs) and developing countries (see Sect. 5 for further discussion). The failure of the establishment of a multilateral EGA thus requires a better understanding of the mechanisms through which trade in EGs would affect the environment, in all the countries and depending on their competitiveness in this sector.Footnote 4

The academic literature includes very few empirical investigations on the potential effects of EGs’ trade on environmental quality, for developed as well as developing countries, and results are still not conclusive. For instance, by focusing on a particular group of EGs (i.e., Renewable Energy Plant sub-group considered to be of high potential to reduce GHG), Wooders (2009) suggests that the elimination of these products’ tariffs would not have sufficiently high potential to reduce worldwide greenhouse gas emissions. On the contrary, by exploring individual and conditional effects on the pollution of trade intensity in EGs, de Alwis (2015) asserts that EGs trade liberalization would be associated with declining SO2 emissions, regardless of income levels. But since de Alwis (2015) investigates only effects for a narrow sample of countries (62 countries) and does not allow for the possible endogeneity problem in the relationship between trade in EGs, income and pollution, his results are at best partial and too optimistic. Through a deeper investigation of the direct and indirect effects for transition economies from Central and Eastern Europe, Zugravu-Soilita (2018) finds diverging results depending on pollution types and EGs category. In particular, trade intensity in EGs appears to have a negative total impact on CO2 emissions in these countries (mainly through an indirect income effect) and a positive effect on water pollution (prevailing, direct scale-composition effectFootnote 5). No significant overall effect is found for SO2 emissions for overall trade in EGs. However, results are diverging when looking on specific EGs categories (e.g., end-of-pipe, integrated solutions, environmentally preferable products). For instance, trade intensity in end-of-pipe abatement technologies appears to reduce only SO2 emissions through a direct technique effect. However, as suggested by the theoretical literature linking EGs trade to the stringency of the environmental policy (see next section), particular attention must be paid to the countries that are not [or poor-performing] producers of EGs or emerging new exporters of such products (Greaker and Rosendahl 2008; Nimubona 2012).

Given the contrasting results of the recent academic research on the expected environmental effects of EGs trade liberalization,Footnote 6 we can cast doubt on the ‘triple win’ scenario mentioned above and legitimately ask the following questions: How does EGs trade ultimately affect the environmental quality? Which are the transmission channels? Are the net importers affected in the same way as the leading exporters of EGs? Could we validate the assumption of ‘automatic’ technology transfer based on free-market mechanisms alone? These questions form the research objective of our empirical study, which aims to estimate the effect of EGs trade on pollution in countries with different trade profiles. As tariffs are currently amply low to have significant economic impacts and their further cuts should mainly affect volumes of trade,Footnote 7 countries would be ultimately interested in understanding the economic and environmental impacts of actual volumes of trade flows in EGs. Hence, instead of questioning the environmental impact of EGs’ trade liberalization (measured by changes in tariffs or trade intensityFootnote 8), this study investigates the impact on (air) pollution of actual EGs trade flows (exports + imports; in levels) in order to better capture evolutions in EGs’ market capacity that would depend on frictions to trade more complex than tariff barriers.Footnote 9

The contribution of this study is threefold:

-

(1)

From the methodological point of view, our empirical approach based on a mediation effect model (simultaneous equations system) should bring additional understanding of the mechanisms linking trade to the environment by asking ‘why’ and ‘how’ a cause-and-effect happens. Indeed, the most of reference studies in the field (e.g., Antweiler et al. 2001; Cole and Elliott 2003; Managi et al. 2009) have particularly made use of moderation effect models (equations with interaction effects) postulating ‘when’ or ‘for which country characteristics’ trade most strongly (or weakly) causes environmental degradations. More precisely, if the moderation effect model explores individual and joint (conditional to income or factor endowments) effects of trade on environment, the mediation model investigates the mechanism through which the causal variable (trade) affects the outcome (pollution), in particular by estimating direct and indirect effects (via income and environmental policy in our study). We thus think mediation analysis should be more powerful and interesting for policy implications than moderation analysis.

-

(2)

The existing studies linking trade to the environment, and mainly focusing on the trade-induced composition effects, have used simple approaches in estimating the impact of the so-called trade-induced scale-technique effect. In particular, the common procedure of such an estimation was introducing in the pollution regression the GDP/cap variable (for the scale) and its square (for the technique). Concerned by the highly criticised Environmental Kuznets Curve and its general failure for the GHG, we shall capture the scale and the technique effects through specific measures. Moreover, in addition to endogeneity issues related to trade and income (see Frankel and Rose 2005; Managi et al. 2009), we also treat environmental regulations as endogenous.

-

(3)

In comparison to Zugravu-Soilita (2018), this study uses a larger (1996–2011) and more globally representative sample (114 countries). In addition, we make distinction between ‘EGs’ net importer’ and ‘EGs’ net exporter’ trade status,Footnote 10 as well as between developed and developing countries, when exploring the direct and indirect effects of trade in EGs on CO2 and SO2 emissions. In this study, we are also more critical to endogeneity issues. By looking for the strength of instruments (in addition to their exogeneity), we are able to compute and discuss the magnitudes of the direct and indirect effects of trade in EGs on pollution. All these enhancements give results more relevant for policy recommendations.

This paper is structured as follows. After the introduction of our research objectives, we discuss in Sect. 2 the related literature that helps us clarifying the concepts used in this study and understanding some mechanisms at work. Section 3 introduces the theoretical background of our empirical model, the estimation strategy and data used. Section 4 presents our empirical results, and we discuss some policy implications in Sect. 5. The last section gives conclusions, by identifying directions for further research.

2 Related Literature

After having introduced the few empirical studies exploring the impact of trade in EGs on pollution (de Alwis 2015; Zugravu-Soilita 2018), this section discusses the related literature allowing to define some concepts further used in the study and better understand the undermining theories linking trade in EGs to the environment. In particular, we discuss some recent theoretical studies investigating the link between trade in EGs and the environmental policy design (an important channel through which trade in EGs is expected to reduce pollution), after a brief review of the general findings from the literature linking (total) international trade to the environment.

Numerous studies have explored the environmental impact of international trade, but their results are still not conclusive.Footnote 11 This ambiguity would come from the diverse and opposing macro-level channels and micro-level mechanisms of transmission of the effects of trade on the environmental quality. The macro-level channels, through the scale effect (linking the emission changes to the overall level of economic activity), the composition effect (reflecting changes in pollution due to changes in the composition of the economic activity) and the technique effect (linking the changes in pollution to changes in emission intensities of each industry) have been extensively investigated, both theoretically and empirically. As predicted by the theory, we find that scale effects increase pollution and technique effects are reducing emissions. The sign of the composition effects would vary across countries and the time-period explored. A broad conclusion of the literature exploring the macro-level channels is that international trade has a weak effect, or no effect, on pollution via the (between-industry) composition effect, and the recent emission reductions across the countries in the world would have resulted from a significant negative (income-induced) technique effect (Antweiler et al. 2001; Cole and Elliott 2003; Grether et al. 2009; Levinson 2009; Managi et al. 2009; Brunel and Levinson 2016).

However, following a recent and constructive literature review by Cherniwchan et al. (2017), the standard decomposition at the industry level would miss a reduction in emissions likely to arise from a trade-induced reallocation of output across firms in the same sector but with different emission intensities (from dirty to clean firms). That would underestimate the effects of trade by misclassifying such reductions as technique (usually income-induced) effects. Thus, by reviewing the recent theoretical and empirical research at plant, firm, industry and national levels, Cherniwchan et al. (2017) introduce and discuss new hypotheses that specify within-industry effects of trade on the environmental quality, by linking: (1) market share reallocations and selection effects to changes in industrial emissions (i.e., the firm-reorganization effect or Pollution Reduction by Rationalization Hypothesis); (2) changes in abatement and emission intensities to increased foreign competition brought about by trade liberalization (i.e., the domestic outsourcing effect or Distressed and Dirty Industry Hypothesis); and (3) firm level decisions to shift abroad production of dirty intermediate inputs to trade liberalization with countries having laxer environmental regulations (i.e., the offshoring effect or Pollution Offshoring Hypothesis).Footnote 12 Whereas these hypotheses allow understanding the micro-level mechanisms at work, their empirical check for EGs trade is still a difficult task because of poor or virtually inexistent (cross-country) firm-level data on EGs imports and exports. Nevertheless, empirical data are available for the investigation of the macro-level channels through which EGs trade would affect the environment (scale, composition and technique effects). We should still be careful with their interpretations, which might be mis-specified when the micro-level mechanisms are omitted from the analysis.

The literature investigating the link between trade in EGs and environmental performance is mainly theoretical and has been focusing on the environmental policy design in the context of EGs’ trade liberalization (Feess and Muehlheusser 2002; Copeland 2005; Canton et al. 2008; Greaker and Rosendahl 2008; David et al. 2011; Nimubona 2012; Sauvage 2014). For instance, Feess and Muehlheusser (2002) show that, when the domestic eco-firms are likely to benefit from higher emission tax rates, the home government would set stricter environmental regulations than foreign governments, which would lead to national leadership in pollution control.Footnote 13 Stricter environmental regulations would induce more firms to pay the initial R&D cost to enter the eco-industry, which should lead to an increased export market share of the domestic eco-industry. An empirical illustration of these last effects is proposed by Costantini and Mazzanti (2010). By employing a gravity model of trade, the authors find that environmental and energy taxes in the EU-15 countries between 1996 and 2007 have been associated with higher EGs exports.

Although stringent environmental regulations lead to more environmental R&D by domestic firms in a small open economy, Greaker (2006) suggests that foreign eco-firms would also increase their R&D spending and sales of EGs to this country. Similarly, Greaker and Rosendahl (2008) show that stricter environmental policy is good for the domestic polluting industry, allowing it to get abatement equipment easier and at lower costs. Nonetheless, the authors suggest that this increase in demand for EGs from the domestic polluting industry may benefit foreign eco-firms at the expense of the domestic eco-industry. Hence, an especially stringent environmental policy should not be a suitable industrial policy for small open economies wishing to develop new successful export-oriented sectors. Moreover, while increased emission tax rates should induce new abatement suppliers to enter the market, David et al. (2011) show it might not increase abatement efforts, because the demand for the abatement goods becomes more price inelastic when taxes are severe, thus leading the eco-firms to reduce their output.

An interesting research question emerging from this literature is the interaction between the environmental policy and the EGs’ tariffs in countries that are not exporters or even not producers of such goods. For instance, Nimubona (2012) develops a theoretical framework to investigate the EGs’ trade liberalization effects in a developing country that is a non-competitive producer of abatement technologies and, thus, it is dependent on EGs imports. The author suggests that, when weak tariffs on EGs cannot sufficiently extract rents generated by severe environmental policy for an imperfectly competitive eco-industry, the government might choose to reduce the stringency of pollution taxes to maximize domestic social welfare. This can finally result in increased domestic pollution levels. Hence, following Nimubona (2012), exogenous reductions of EGs tariffs in the developing countries would lead their governments—which are facing a loss of rents extracted from foreign eco-firms—to lower emission taxes.

In conclusion, recent theoretical studies (Perino 2010; David et al. 2011; Nimubona 2012; Bréchet and Ly 2013; Dijkstra and Mathew 2016) find comparable results from quite different models; that is, despite increasing the expected cleanliness of production, EGs’ trade liberalization may finally increase overall pollution. More precisely, the increased availability of cleaner technology due to trade liberalization would cause a ‘backfire effect’Footnote 14 and the improved welfare would come at the expense of the environment. Total pollution should increase because the government enjoying the opportunity for cleaner manufacturing would allow more production. To avoid such negative outcomes, Nimubona (2012) suggests using quantitative abatement standards as an alternative pollution policy instrument accompanying the EGs’ trade liberalization. Furthermore, in a recent theoretical work that includes the upstream production generating negative externalities (dirty inputs in the EGs’ production), Wan et al. (2018) show that trade in EGs is not necessarily beneficial for each country’s environmental quality as well as welfare if there is no upstream pollution control by the environmental policy.

3 Theoretical Framework and Empirical Strategy

3.1 Theoretical Framework

Following the conventional function used in the environmental economics literature to investigate changes in pollution (e.g., Grossman and Krueger 1993; Copeland and Taylor 1994, 2005; Levinson 2009; Managi 2011), we can write total emissions E as the sum of emissions from each of activity/sector, ei, which may be further written as the total output, Y—i.e., the scale effect —, multiplied by each sector’s share in this output, \(\varvec{\gamma}_{\varvec{i}}\)\((\gamma_{i} = y_{i} /Y)\)— i.e., the composition effect—, and the emission per unit of y produced (the sector’s emission intensity), \(\varvec{\tau}_{\varvec{i}}\)—i.e., the technique effect.

In vector notation, we have:

where E and Y are scalars representing the total emissions and economic output (i.e., GDP), respectively; \(\uptau\) and \(\upgamma\) are \(n \times 1\) vectors.

At the same time, as suggested by Antweiler et al. (2001), firms have access to abatement technology (i.e., improved environmental technologies and/or efficient management), which is generally costly. By assuming that pollution is directly proportional to output, and that pollution abatement is a constant return to scale activity, a sector’s emission \(\varvec{e}\) may be written:

where \(\varvec{\theta}_{\varvec{\tau}}\) is the productivity of environmental technologies and \(\varvec{a}\) is the pollution abatement effort. With constant environmental technologies, pollution abatement efforts increase and emissions decline when the price of pollution abatement technologies decreases.

Taking the natural log of Eq. (2) and combining it with Eq. (3) yields:

All else constant (e.g., mix of activities/sectors, environmental techniques and pollution abatement effort), the first term measures the increase in emissions when scaling up economic activity (GDP). Keeping constant output, environmental technologies and abatement efforts by the economic sector, the second term reflects the (between-industry) composition effect; that is, emissions increase if more resources are devoted to polluting sectors. A common proxy for this composition effect is the capital-to-labour ration (K/L). Theoretically, if a country is more capital abundant, it has a comparative advantage in capital-intensive activities, which are also empirically found to be more pollution intensive (see Mani and Wheeler 1998; Antweiler et al. 2001; Cole and Elliott 2003, 2005; Managi et al. 2009).

The last two terms represent the technique (including within-industry reorganization) effects. Following Zugravu-Soilita (2017), we distinguish between ‘autonomous’ and ‘induced’ technique effects. Changes in production methods may affect pollution intensity through two ways:

-

First, ‘induced’ technique effects appear when technological change and abatement efforts occur in response to regulatory mandates. These effects may be captured by a variable measuring the stringency of environmental regulations (ER). Although stringent environmental regulations are not always associated to cleaner technologies, in particular when not efficiently implemented and/or enforced, numerous empirical investigations (e.g., Eskeland and Harrison 2003; Arimura et al. 2007; Cao and Prakash 2012) show that stringent, well-designed environmental policy is—all else equal—associated with an increased investment in environmental R&D accelerating environmental innovation and thus lowering pollution intensities.

-

Second, an ‘autonomous’ technique effect may reduce pollution when investment in environmental technologies occurs more or less automatically from external factors, e.g., technical progress, increased availability of more performing technologies (higher values for \(\varvec{\theta}\)) and eventually less expensive (lower price of abatement technologies should increase abatement effort, i.e., higher values for \(\varvec{a}\)). We shall capture this ‘autonomous’ technique effect in our empirical model by introducing two variables: GNI/cap and Trade_EGs.Footnote 15 As it is commonly assumed that environmental quality is a normal good, per capita income (GNI/cap) is supposed to capture the willingness (and capacity) to pay to reduce pollution, to innovate,etc. Following the strategy of Antweiler et al. (2001), GDP and GNI/cap enter our pollution equation simultaneously in order to distinguish between the scale of the economy (GDP—measuring the intensity of the domestic economic activity) and income (GNI/cap et al. capturing the richness of a country’s inhabitants and economic agents wherever they would be located, and more specifically, their willingness-to-pay for environmental goods). Provided trade in EGs (Trade_EGs) does not affect either the economic structure or the production levels, it is assumed to have a negative (technique) effect on pollution by increasing the availability of less expensive and/or more performing EGs.Footnote 16 Otherwise, a ‘rebound’ or even a ‘backfire’ effect may occur: i.e., despite the marginal abatement cost reduction, one may be encouraged to produce more by maintaining the same total initial level of abatement effort when environmental regulations do not evolve. The sign of Trade_EGs variable should indicate the dominant effect on pollution: the ‘autonomous’ technique (if negative) or scale-composition (if positive).Footnote 17 We should however stress that a negative coefficient could also capture effects from within-industry reorganizations in favour of less polluting firms (i.e., within-industry composition effect) due to increased availability of less costly EGs, without necessarily introducing new/more efficient techniques (see Cherniwchan et al. 2017). As these specific effects may not be captured by our GDP and K/L variables, which are proxies for the macro-channels and do not reflect micro-mechanisms, we qualify any prevailing negative effect in our empirical estimations based on macro-data as ‘a technique-rationalization effect’.

In addition, it is highly stressed that trade openness (Open) is a key variable in explaining the changes in pollution through the scale, composition and technique effects (see Lucas et al. 1992; Dean 2002; Harbaugh et al. 2002; Copeland and Taylor 2004; Frankel and Rose 2005). A country’s overall trade openness can have an impact on pollution by (1) increasing economic growth through tariff reduction; (2) shifting production from pollution-intensive to more ecological goods, or vice versa; and (3) promoting the diffusion and the use of technological innovations.

Following the theoretical and empirical literature on pollution demand and supply, we can derive a reduced-form equation that links pollution emissions to a set of economic factors of which trade in EGs:

We expect positive coefficients for the scale and (between-industry) composition effects, captured by GDP and K/L, respectively, and negative coefficients for ER and GNI/cap variables, capturing the technique effects. The coefficients of our trade variables Open ([total exports + total imports]/GDP) and Trade_EGs (EGs export + EGs import) should reflect the prevailingimpact on emissions of the country’s trade openness and its trade in EGs, respectively: if positive—a scale-composition effect and if negative—a technique-rationalization effect.

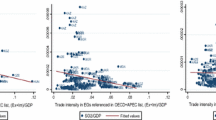

Our model’s identification could raise questions about the measures of trade variables. For instance, why should trade in EGs appear in levels and overall trade as an openness ratio? Why not to use trade intensity (trade/GDP) for both overall trade and trade in EGs? Why using ‘exports plus imports of EGs’ to capture the impact of EGs’ trade on pollution? First, since EGs are defined based on a final use criterion that attributes them a specific role in the environmental quality management, we expect their effects on pollution to differ from trade in other goods. Overall and EGs’ trade intensities appear to exert quite similar roles in explaining CO2 and SO2 (see Figure B.1 for partial correlations in the Electronic Supplementary Material (ESM)). The correlation coefficient is much higher (.48) between overall trade openness and trade intensity in EGs ((X_EGs + M_EGs)/GDP), compared to overall trade openness and EGs trade in levels (-.04). Second, EGs trade in levels should bring additional information to trade openness because (1) these variables do not appear to have similar patterns when looking into our data (see Figure B.2, Appendix B in ESM), and (2) levels should capture ‘evolutions in market capacity’ whereas overall trade intensity as a proxy for openness would control for terms of trade/EGs’ cost reductions. Finally, we suppose reasonable to use ‘exports plus imports of EGs’ to capture the impact of EGs’ trade on pollution, instead of investigating imports and/or exports separately, because an insignificant number of countries in our dataset record only exports in EGs without imports, or vice versa.Footnote 18 Since tariff reductions in EGs should induce changes in both exports and imports, we need to consider overall trade in order to estimate total effect on pollution. However, given the different mechanisms through which EGs’ exports and imports may affect pollution, we estimate all the effects (direct, indirect and total) by distinguishing the country’s net trade status. Consequently, the effects estimated for net importers [net exporters] should highlight impacts specific to EGs imports [exports]. This methodological approach has the advantage to allow for the estimation of the overall impact on pollution of trade in EGs, regardless the country’s competitiveness in this sector as well as by its net trade status.

Introducing in Eq. (5) interaction terms between our variable of interest Trade_EGs and a dummy (\(\varvec{Net}\_\varvec{ImEGs}\)) taking value 1 if the country is a ‘net importer’ of the specified EGs and 0 otherwise, should allow us to explore the specific effects of trade in EGs in countries that are week performers (compared to the most competing economies) in this sector. In fact, we qualify as ‘net importer’ a country in a specific year when its EGs imports are superior to EGs exports.

Indirect effects of trade in EGs on pollution shall be estimated by endogenizing ER and GNI/cap variables (the possible transmission channels, in particular through technique effects), in a system of simultaneous equations (see Sect. 3.3 for our empirical strategy).

3.2 Data

Our explained variable E represents sequentially total CO2 and SO2 emissions (see Table B.1, Appendix B in ESM, for all variables’ definitions and data sources). We have make the choice to explain total pollution from different sources instead of industrial emissions alone, because environmental degradation is resulting not only from the production, but also—and even mostly—from using resources. Moreover, the EGs is an industry sector devoted to solving, limiting or preventing environmental problems that are not confined to the manufacturing sectors only, but also integrating solutions for renewable energy, transportation and residential sectors. In addition, trade liberalization increases transportation of EGs, which, thus, is also responsible for air pollution. To investigate the possibility of a ‘double win’ (environmental and income) scenario from the increased trade in EGs, we therefore aim to get a broader picture of the possible effects.

Whereas many of our indicators come directly from official data sources (e.g., world development indicators [GDP, GNI, K, L…] and institutional quality from the World Bank, latitude from CEPII and international trade from UN-COMTRADE), we have also computed several indicators for which relevant and comparable data across countries are still not available (or limited to a few countries and/or years). More precisely, we built an indicator of stringency of the environmental regulations (ER), by using a methodology similar to that employed in Zugravu-Soilita et al. (2008), Ben Kheder and Zugravu (2012), and Zugravu-Soilita (2017).Footnote 19 In particular, our ER index is computed as an average Z-score of four indicators: (1) ratification of a selection of Multilateral Environmental Agreements (MEAs) and ProtocolsFootnote 20; (2) energy efficiency (GDP/unit of energy used) corrected for the latitude (in order to control for climate conditions); (3) number of companies certified ISO 14001, weighted by GDP; and (iv) density of international non-governmental organizations (NGOs) (members per million of population). Therefore, this index should simultaneously capture ‘pressure’ and ‘outcome’ aspects, and control for enforcement coming from public authorities and industries, as well as from the population’s ability to organize in lobbies (NGOs, etc.) to enhance national behaviour in a more environmentally friendly direction.

We computed data on international trade in different EGs categories by combining the UN COMTRADE’s world-trade database with the EGs’ classification lists specified at the HS six-digit level by Asia-Pacific Economic Co-operation forum (APEC), OECD and WTO. In particular, we rely on the APEC list of 54 EGs (APEC54), because WTO is currently pursuing negotiations for establishing an EGA based on this list.Footnote 21 This list contains 15 sub-headings for renewable energy, 17 for environmental monitoring, analysis and assessment equipment, 21 for environmental-protection (principally air pollution control, management of solid and hazardous waste, as well as water treatment and waste-water management), and 1 sub-heading for environmentally preferable products (bamboo). However, only 12 of the codes on the APEC list are sufficiently precise to ensure that liberalization will only pertain to EGs; in contrast, 9 codes include products that have broad (non-environmental) applications (e.g., used in the petroleum, nuclear, mining and automobile industries).Footnote 22 Hence, it should be noted that EGs classification is a subject making controversy (Steenblik 2005, 2007; Balineau and de Melo 2013). First, as highlighted by Zhang (2011), HS categories at the six-digit level do not allow the designation of specific goods that are really deemed climate-friendly. Second, the identification difficulty of EGs concerns the ‘double-use’ problem, i.e., the existence of products with multiple uses, some of which are not environmental.Footnote 23 There also might be serious doubts about the use of some products (e.g., bio-fuels) to save energy for example (Steenblik 2007; Hufbauer et al. 2009). Finally, conflicting interests and differing perceptions of the benefits from the liberalization of EGs may also explain—in some measure—the different definition approaches proposed (e.g., prevalent final use, environmental impact during the product’s life-cycle stages, and [energy] performance criterion).

Aware of the limits mentioned above and given that the next stages of the EGA negotiations would focus on removing tariffs on a broader list of EGs, we extend our empirical analysis to alternative lists. First, we explore results for the so-called OECD+APEC list, which has been the reference in the early negotiation stages.Footnote 24Another narrow but more ‘credible’ list of 26 EGs (WTO26) is worth empirical investigation because of its prompt and univocal validation by a set of very active countries in the field of EGs liberalization. However, if the EGs were to be limited to the OECD + APEC and WTO26 narrow lists, only the few advanced developing countries would benefit from trade in EGs. Most of the developing countries do not yet have well-developed markets for the narrow EGs lists and would be more likely to benefit from a larger classification, like the WTO combined list of 408 EGs (WTO408).Footnote 25 Hence, we check our results for the WTO408 list as a hole, as well as for homogenous EGs categories in this list: i.e., WTORE—Renewable Energy (the less subject to ‘multiple use’ problem), WTOET—Environmental Technologies, WTOWMWT—Waste Management and Water Treatment, and WTOAPC—Air Pollution Control.

3.3 Empirical Strategy

Equation (5) gives estimates for the overall effect of trade in EGs on pollution levels. Table C.1 available as ESM provides our first empirical results. Trade in EGs appears to increase CO2 emissions, and this impact would be qualified as a harmful impact driven by a prevailing scale-composition effect. However, these results might be biased because of several econometric problems that may arise in macro-panel-data models: that is, serial correlation, heteroscedasticity, heterogeneity, and endogeneity.

Working with panel data, we first need to test for serial correlation in the idiosyncratic error term that, if present, leads to biased standard errors and less efficient results. The F-statistics from the Wooldridge test for autocorrelation in our models do not allow us to reject the null hypothesis of no first-order autocorrelation.Footnote 26 However, while there should not be a problem of serial correlation, our panel data does suffer from heteroscedasticity and heterogeneity. Different techniques were applied to deal with these issues: e.g., ordinary least squares (OLS) estimations with robust standard errors, generalized least squares (GLS) with country/time random-effects (RE) and fixed-effects (FE) estimations (see Table C.1, Appendix C in ESM). We should however notice that, FE can lead to an improper aggregation of fixed effects and it may be biased in particular with unbalanced panels and when T is small (like in our case, where we have T = 16 and N = 114 in an unbalanced panel).Footnote 27 Moreover, the FE estimator, like OLS, is inconsistent when explanatory variables are endogenous and thus correlated with the error term. Before looking for different estimation results and the selection of the most suitable specification for our model, we thus need to anticipate and address concerns about endogeneity.

Following our literature review, we have theoretical intuitions to consider GNI/cap, ER, Open and Trade_EGs endogenous in our model. Indeed, income can have a technique effect on pollution through two channels: (1) a direct effect through consumers’ behaviour/producers’ investment decisions based on the willingness to pay for the environment; and (2) an indirect effect by enforcing environmental policy. The increased availability of EGs through tariffs that are cut should increase demand for such goods; this should decrease compliance costs and induce the local government to set more ambitious environmental standards. At the same time, the removal of tariff barriers in a net EGs importing country could lead to a loss of income and a lower demand for environmental quality (Nimubona 2012). Similarly, as the demand for EGs essentially is being determined by the stringency of environmental regulations, enforced environmental policy is expected to drive international trade in EGs (Sauvage 2014). Finally, trade flows and environmental regulations normally evolve in response to the emission levels. That is, the higher the pollution emissions and the greater their damage, the more the government (and citizen) would be willing to put pressure on compliance (Fredriksson et al. 2005). That may induce more abatement and changes in the composition of trade flows (Frankel and Rose 2005; Managi et al. 2009; Baghdadi et al. 2013): e.g., increased trade in EGs (Porter hypothesis) and/or increased trade, in particular imports, in pollution-intensive goods (pollution haven hypothesis).Footnote 28

We must emphasize that finding a valid, strong and exogenous instrument for an endogenous variable is a delicate issue in econometrics. As argued by Crown et al. (2011), researchers have a general tendency to identify weak instruments when trying to minimize their correlation with the disturbance term, and that may lead to estimates that have larger bias than OLS, in addition to larger standard errors. The incremental bias of IV versus OLS thus should be inversely proportional to strength of the instrument used.

In this study, we take care of choosing not only valid but also strong instruments. In an a first attempt to find external instruments for overall trade openness (Open) and for trade in EGs (Trade_EGs)—our variable of interest–, we followed the Frankel and Rose’s (2005) approach (also used in Managi et al. 2009; Zugravu-Soilita 2018) that consists of computing a gravity instrument by estimating a bilateral trade equation in a gravity-type model.Footnote 29 Whereas it gives a quite strong and valid instrument for total actual trade flows in levels (the correlation between actual and predicted trade is 0.8), this technique does not seem suitable for instrumenting trade in EGs for the following reasons:

-

First, the predicted bilateral EGs trade in our gravity model based on strictly exogenous factors (external instruments) like geographic characteristics, results in a weak instrument for actual EGs trade flows. The predicted values are at most correlated by 0.5 with actual EGs trade flows (see Figure B.3 in ESM). In addition, the model’s (5) estimation results in Table C.1 (Appendix C in ESM) report an estimated coefficient for predicted trade in EGs three times lower than the estimates found for actual trade flows. Still, the sign and statistical significance are identical. Finally, we found a weak correlation between predicted and actual trade in EGs in the first-stage regression of our IV-GMM model (1) in Table C.2 (Appendix C in ESM). We should mention that our goal is to have a structural interpretation of the coefficients for trade in EGs, and not only to use predictors as instruments.Footnote 30

-

Second, the number of predicted net exporters of EGs is higher than the number of actual net exporters, which is inconsistent with observed data. For instance, as highlighted in Table A.1 (Appendix A in ESM) for EGs in WTO408 list, we have 40% of observations corresponding to ‘predicted’ net exporters, when actual data reports only 30% of observations for this trade status in the WTO408 EGs category. Numerous countries (e.g., Australia, Brazil, China, Greece, Spain, Turkey, USA, etc.) that are net importers in this EGs category become predicted net exporters. Alternatively, some net exporters become predicted net importers (e.g., Algeria, Belarus, Kuweit, Slovakia, etc.).

-

Finally, we should recall the existing controversy regarding the gravity instruments, which may cast doubt on whether trade should exert similar effects on income (and on pollution in our model) when it increases due to deliberate policy (such as trade liberalization, severe environmental regulations, demand for environmental quality) as when it arises from technological factors, geographic and ethnic proximity (Rodriguez and Rodrik 2000; Frankel and Rose 2005). In comparison to Rodriguez and Rodrik (2000), where gravity predicted trade appears to be a satisfactory instrument because their study is concerned with the relationship between income and the volume of trade without questioning implications for trade policy, both policy-induced and geography-induced variations in trade are of high interest for our study. As highlighted by recent empirical studies (Nguyen and Kalirajan 2016; Cantore and Cheng 2018), the production and trade of goods designed to reduce environmental damages are not generally stimulated by market considerations, because the markets fail to price negative externalities. Human, institutional, and infrastructure capacity building appear to be the key determinants of trade in environmental goods. Indeed, what is specific of this market is its technological intensity and its link to environmental policy, which can create the right incentives for producers but also the necessary domestic demand for cleaner technologies.

Our paper’s objective being not limited to sorting out causality but also to the calculation of the magnitudes of direct and indirect marginal effects of trade in EGs on pollution, we need to get unbiased estimates that requires strong instrumental variables. When valid external instruments are difficult to find out, a common technique is to make use of strong internal instruments. Because the dependent variable in Eq. 5 (Et) cannot possibly cause GNI/capt−1, ERt−1, or Trade_EGst−1, replacing GNI/capt, ERt and Trade_EGst with their lagged values in a panel data set should avoid concerns that our explanatory variables are endogenous to pollution (E). By commenting on simultaneity bias and the use of lagged explanatory variables, Reed (2015) cautions that “this is only an effective estimation strategy if the lagged values do not themselves belong in the respective estimating equation, and if they are sufficiently correlated with the simultaneously determined explanatory variable”. As we will show and discuss bellow, our empirical checks reveal sufficiently high correlations between the contemporaneous endogenous variables and their lagged values. Moreover, we have no theoretical intuitions for building a model for pollution emissions with both current and one-period lagged values of our explanatory variables \((Y_{t} = \beta_{1} X_{t} + \beta_{2} X_{t - 1} )\). It should be emphasized, however, that an assumption of only contemporary reverse causality would have been potentially less plausible if we had estimated pollution concentration levels (a series more likely to incorporate dynamic processes) rather than pollutant emissions (flows). As suggested by Bellemare et al. (2017), the lag-identification may be suitable when there is reverse but only contemporaneous causality, and the causal effect of the endogenous variable operates with a one-period lag only. This implies testing that there is no contemporary correlation between the endogenous variable X and the dependent variable Y; that is, we should have a zero coefficient on \(\beta_{1}\) in the regression \(Y_{t} = \beta_{1} X_{t} + \beta_{2} X_{t - 1}\). Finally, we should mention that consistent IV estimation with lagged values of endogenous variables requires that there are no dynamics among unobservables (Roodman 2009; Bellemare et al. 2017). Tables C.1–C.3 and the Box C.1 (Appendix C in ESM) give and discuss results for empirical checks of our instruments’ validity under these different concerns: that is, only contemporaneous reverse causality, strong correlations between endogenous variables and their instruments, no serial correlation among the unobserved sources of endogeneity, robustness of estimation results in alternative specifications and estimation techniques.

OLS, GLS, IV-GMM and System-GMM regressions give significant and quite robust results (in terms of sign, magnitude and statistical significance) concerning the impact of trade in EGs: i.e., all else equal, a 10% increase in Trade_EGs from APEC54 list increases total CO2 emissions by about 3%. However, these regressions only inform us about the overall effects, without any information about the intermediary processes leading from trade in EGs to air pollution. Therefore, we further specify and estimate simultaneous equations using the Multiple-Equation GMM technique that should allow us to identify the direct and indirect effects (i.e., through ER and GNI/cap) on pollution of trade in EGs. Given the likely endogeneity bias for Trade_EGs, GNI/cap and ER variables, we keep one-year lag only for Trade_EGs variable and explicitly endogenize the variables ER and GNI/cap. In addition to their lags, new instruments are identified for ER and GNI/cap variables from the relevant literature in order to build their reduced-form equations. In particular, the stringency of environmental regulations is found to be significantly influenced by corruption (which appears to be a good instrument in our regressions; see Table C.2 in ESM), in addition to the current emission levels, income, openness, and trade in EGs.Footnote 31 With regard to the income reduced-form equation, we retain long-term determinants from the endogenous growth literature; that is, production factors’ (labour, physical capital) endowment, geography, institutions and trade.Footnote 32

The following section discusses—in detail—our empirical results from Multiple-Equation GMM estimations. Using natural logs for variables on both sides of our econometric specifications (except for predicted overall trade openness), we interpret the estimated coefficients directly as elasticities.

4 Empirical Results

4.1 Environmental ‘Effectiveness’ of Trade in EGs

The empirical models specified based on Eq. (5) lead to estimates of the determinants of total pollutant emissions. Thus, we interpret the different effects on emission levels in terms of environmental ‘effectiveness’. Our detailed results from the Multiple-Equation GMM regressions are available as ESM (Tables D.1–D.9, Appendix D). As predicted by the theory, we find support for the scale, composition and technique effects in the pollution regressions; that is, all else equal, whereas any raise in total economic output (GDP) and capital-to-labour ratio increases CO2 and SO2 emissions, income and stringency of the environmental regulations are found to reduce pollution. We also find a significant negative time trend highlighting worldwide technological advances and successful global action to control emissions. Regarding the ER-channel equation, as expected, pollution and willingness to pay for the environment (proxied by per capita income) are found to increase environmental regulations’ stringency, whereas corruption, when statistically significant (Tables D.5, D.8 and D.9 in ESM), appears to induce laxer regulations. At the same time, higher institutional quality and capital abundance exert a positive effect on per capita income (GNI/cap-channel equation). The impact of predicted trade openness is non-significant in the most of our regressions. However, when estimates are significant, they suggest a direct (negative) technique-effect on pollution and an indirect technique effect through the channel of environmental regulation. Geographically induced trade openness thus would have a beneficial effect on the environmental quality.Footnote 33

4.1.1 Impact on Total Emissions of Trade in EGs from the APEC54 List

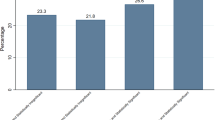

We now focus on the effects of our variable of interest, that is, trade in EGs from the APEC54 reference list—Trade_EGs (Tables D.1–D.3, Appendix D in ESM). For a broader analysis, we consider in this study two types of indirect effects: (1) exclusiveindirect effects, as more restrictive concept including only those influences mediated by the channel variable(s); and (2) incrementalindirect effects, as a wider concept including all compound paths subsequent to our endogenous variables of interest (or channel variables).Footnote 34 For instance, the indirect exclusive effect of trade in EGs on CO2 emissions mediated by GNI is the compound path EGs → GNI → CO2 (it excludes the indirect path operating through ER [i.e., EGs → GNI → ER → CO2]), whereas the indirect incremental effect is the combination of two compound paths: EGs → GNI → CO2 + EGs → GNI → ER → CO2.Footnote 35 We present below direct, computed indirect and total effects of trade in EGs on pollution (CO2 and SO2 emission levels) for the pooled country sample, and by making a distinction between EGs’ net importers and EGs’ net exporters, as well as between OECD and non-OECD member countries.

As shown in Tables 1 and 2 bellow, the prevailing direct effect of trade in EGs (from APEC54 list) on pollution is positive—a scale-composition effect—, but not negative—a technique effect—, as expected. This finding might support the ‘multiple use’ fears with respect to trade in EGs and/or validate the assumption of backfire effects in the pollution-intensive sectors using EGs as suggested by the recent theoretical literature (see Sect. 2). This result is significantly higher for net importers and non-OECD countries.

If trade in EGs appears to have no direct technique effect on pollution,Footnote 36 it is found to reduce total emissions through indirect technique effects, mediated by the stringency of environmental regulations (ER) and per capita income (GNI/cap). Naturally, incremental indirect effects are found to be larger than the exclusive indirect effects, with the former still not high enough to compensate the direct harmful effects. This is particularly true for the net importers of EGs and non-OECD countries, where the total (direct plus indirect) effects on CO2 and SO2 emissions remain positive with exclusive indirect effects, and at best become non-significant when incremental indirect effects are considered. With regard to net exporters and OECD countries, trade in EGs is found to have no statistically significant total effect on CO2 and SO2 emissions.

Because results appear to be quite similar for non-OECD countries and net importers, on the one side, and for OECD members and net exporters, on the other side, one could suppose that EGs’ trade impact on pollution merely depends on the country’s development level, with the OECD countries being necessarily net exporters and the non-OECD countries net importers of EGs. However, we should pay attention to the fact that our data reports cases where OECD members are net importers of EGs (e.g., Australia, Belgium, France, Mexico, USA…) and non-OECD countries are net exporters (e.g., Indonesia, Malaysia, South Africa, Ukraine…).Footnote 37 Moreover, our empirical results highlight specific effects for net importers, which are not found for non-OECD countries. For instance, trade in EGs reduces CO2 emissions through an indirect income-induced technique effect in the EGs’ net importing countries, but appears to have no effect through this channel in the non-OECD countries. The findings specific to country-groups in terms of development level are interesting per se, but could not give us clear suggestions in terms of political implications. In order to allow intuitive interpretations of our empirical results leading to policy recommendations (based on the above reviewed theoretical literature), we have chosen to focus the remaining analysis on countries’ net trade status.

Our empirical results support the theoretical predictions by Greaker (2006) and Greaker and Rosendahl (2008) according to which environmental regulations that are too strict might not be the most suitable industrial policy for the countries with performing/emerging export-oriented eco-industrial firms. In fact, trade in EGs is found to have indirect marginal effects on CO2 emissions, mediated by ER, which are significantly higher for net importers than for net exporters. Moreover, these indirect effects are found to be non-significant in the models explaining SO2 emissions for net exporters. Hence, governments in the EGs’ net exporting countries might be reluctant to increase standards/taxes in order not to increase exposure of the export-oriented eco-sectors to foreign competition. Conversely, the EGs’ net importing countries, which are non- (or weak) performers in this sector, would be more likely to increase the stringency of the environmental regulations in order to further enhance availability of EGs at more competing prices. Finally, the indirect effects of trade in EGs, mediated by per capita income (GNI/cap), are higher for net exporters compared to net importers, with the former’s eco-firms enjoying new/larger markets whereas the latter’s ones—if present—might see their domestic markets narrowing.

As regards the strength of different effects, our results show that a 10% increase in EGs trade flows is associated with an overall increase of 1.8% in CO2emissions, in particular due to a directscale-composition effect of + 2.9% partly offset by (exclusive) indirecttechnique effects of − 1.08%, through improved (by 0.5%) environmental regulations and increased (by 0.6%) per capita income. With a similar direct effect found on SO2 emissions (+ 2.4%) and an indirect technique effect of − 0.7% passing only through the environmental regulations, a 10% increase in EGs trade flows would increase SO2emissions by 1.5%. However, as previously discussed, results diverge by countries’ trade profile. That is, a 10% increase in EGs trade flows in EGs’ net importing countries is associated with an overall increase in CO2 and SO2 emissions by about 2.4%. We found no significant total impact on air pollutant emissions for net exporters.

4.1.2 Impact on Total Emissions of Trade in EGs from Alternative Classification Lists

With the classification of EGs being a continuous process—depending on technological progress and current negotiations—the estimations for different categories of EGs should check the robustness of our previous empirical results and allow a better generalization of our conclusions. Because the protectionist quarrels about the goods to be liberalized quickly have been the main reason of the negotiations’ (temporary) failure, a fine analysis of the different EGs classifications is more than ever necessary and urgent. Thus, we run Multiple-Equation GMM estimations and compute overall, direct and indirect effects for trade in EGs listed by OECD, APEC, and WTO (as alternative classifications for the APEC54 list).

When focusing on the original combined list of OECD and APEC, and the narrow WTO list of 26 EGs (Table 3), we find similar results compared to trade in EGs from the APEC54 reference list. Therefore, whereas trade in EGs from narrow lists (APEC54, OECD+APEC and WTO26) is likely to not harm the environment in the net exporting countries, it is found to increase total CO2 and SO2 emissions in the EGs net importing countries, where the harmful direct scale-composition effects are not offset by the (still weak) indirect technique effects.

With regard to the WTO’s broader list of EGs (WTO408), the results are quite similar to those found for the APEC54 list of EGs when exploring CO2 emissions, especially for net importers. That is, trade in EGs has a substantial direct harmful effect on pollution that is only partly compensated by the indirect, in particular income-induced, technique effects. If for narrow EGs classifications, the income-induced indirect effect appears to be larger for net exporters than for net importers, the results are opposite for the broad WTO408 list. The weaker income-induced indirect effect, coupled with a direct scale-composition effect, leads to a significant positive total effect on CO2 emissions in the EGs net exporting countries. Hence, when trade in narrow lists was found to raise overall CO2 emissions only in the net importing countries, trade in EGs from a broad classification seems to increase pollution in both net importing and net exporting countries.

Another interesting result is found for SO2 emissions, on which trade in EGs from WTO408 list has no significant (at less than 10% level) direct effect for both net importers and net exporters. Moreover, while only ER in the net importing countries channels the indirect technique effect of trade in EGs from the APEC54 list, trade in EGs from the WTO408 list reduced SO2 emissions merely through its indirect effect on GNI/cap. The total effect of trade in EGs (WTO408) on SO2 emissions is non-significant for both net importers and net exporters.

Finally, having in mind the ‘multiple use’ problems and specific comparative advantages of different countries for different EGs categories, we perform additional estimations for distinct, homogenous groups of EGs in the WTO408 list: i.e., WTORE—Renewable Energy, WTOET—Environmental Technologies, WTOWMWT—Waste Management and Water Treatment, and WTOAPC—Air Pollution Control. To save space, Table 4 displays only direct and total effects (including indirect exclusive or incremental indirect effects) for each EGs category.

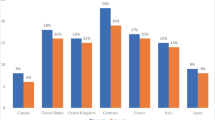

We find that only trade in EGs from the ‘renewable energy’ category performs direct and total negative (i.e., prevailing technique/rationalization) effects on both CO2 and SO2 emissions, in both net importing and net exporting countries. ‘Renewable energy’ EGs are the few range of goods identified by a ‘unique HS code’ and, thus, are more likely to be ‘single-use’ products. In fact, they are very few HS codes at the six-digit level that perfectly match single-use EGs (e.g., HS 841011/2 for hydraulic turbines, HS 850231 for wind-powered electric generating sets). Hence, trade in these EGs, which are designed and used to reduce emissions from one of the most polluting sources (energy sector), reduces CO2 and SO2 emissions by increasing the availability of these products in the net importing countries and by improving the performance of this eco-sector in the net exporting countries. The higher and most significant marginal impacts are naturally found for the latter. A general finding regardless of the country’s trade profile is that a 10% increase in the traded goods from the ‘renewable energy’ category is associated with an overall reduction of CO2 and SO2 emissions of 2.3% and 2.6%, respectively (up to 3.8% for net exporters in SO2 models). Trade in EGs from the ‘environmental technologies’ category is also found to reduce pollution due to a direct technique effect, but only for net importers and SO2 emissions. Trade in these EGs appears to increase CO2 emissions in both net importing and net exporting countries, and has no statistically significant effect on SO2 emissions in the net exporting countries. One explanation to this result is that ‘environmental technologies’ are usually more efficient in abating SO2 emissions (some techniques achieving SO2 removal of more than 90%)Footnote 38 compared to CO2 emissions, the carbon capture (and storage) being an innovative and still the most expensive technology. With regard to the ‘air pollution control’ category, trade in such goods seems to benefit only to net exporters, with a direct and total negative effect on CO2 emissions. Surprisingly, we found a harmful direct and total effect on SO2 emissions for net importers. Finally, we do not find support for liberalizing trade in EGs from the ‘waste management and water treatment’ category because of the harmful (direct and total) effects on CO2 and SO2 emissions found for both net importers and net exporters.

In conclusion, all countries (importers and exporters) seem to be ‘air pollution losers’ (in terms of CO2 and SO2 total emissions) from trade in ‘waste management and water treatment’ EGs category and ‘air pollution winners’ from trade in ‘renewable energy’ EGs category. When net importers would also prefer increased trade in ‘environmental technologies’ in order to reduce SO2 emissions, only the net exporters of ‘air pollution control’ goods would see total CO2 reduction.

Hence, trade in all EGs categories is not necessary beneficial in terms of total emissions reductions for both importers and exporters. To see if these mitigated results would be mainly explained by eventual rebound (even backfire) effects or by the ‘multiple use’ problem often opposed to EGs classifications, we explore in the next subsection the direct, indirect and total effects of trade in EGs on emissions intensity, hereafter called ‘emission efficiency’ (measured by the volume of emissions per unit of GDP).

4.2 Impact on ‘Emission Efficiency’ of Trade in EGs

Table 5 displays the effects on CO2/GDP and SO2/GDP (called ‘emission efficiency’) of trade in the reference APEC54 list of EGs. Whereas trade in EGs from this list was found to exert a harmful direct effect on total emissions, in both net importing and net exporting countries, it now appears to increase ‘emission efficiency’ (e.g., reduce CO2/GDP and SO2/GDP) though a beneficial direct (technique) effect in the countries that are net exporters of EGs. All else equal, a 10% increase in EGs trade flows is associated with 4–5% decrease in air emissions per 1 US$ of GDP in the net exporting countries. This result, coupled with the previous one (i.e., direct positive or non-significant effect on total emission levels) would reveal a ‘backfire’ (≥ 100% rebound) effect in the EGs’ exporting countries. That is, with increased trade in EGs, the most competing countries (EGs net exporters have usually well-established domestic markets for EGs) would encourage further innovations and/or domestic price reductions for mature technologies in the eco-industry, which should allow for efficiency gains in terms of national pollutant emissions. These efficiency improvements would have knocked-on effects that eventually propagate through the entire economy, beyond sectors using EGs, resulting in direct and indirect rebound effects.Footnote 39

Surprisingly enough, we do not found efficiency gains from direct technique effects in the EGs net importing countries. Moreover, EGs trade in these countries is found to increase SO2 emissions per 1 US$ of GDP through a direct scale-composition effect. However, the total effect on emissions is non-significant, due to environmental regulation—induced indirect effects. We found a negative total effect on CO2 emissions per 1 US$ of GDP, statistically significant at 10% level for net importers, due to only indirect environmental regulation- and income-induced technique effects. These results highlight the central role of indirect effects of trade in EGs (through policy and income channels) on ‘emission efficiency’ in the EGs’ net importing countries.

Once again, we might question whether these findings, which differ by trade profile, are directly related to the countries’ development level. In addition to the OECD membership distinction, whose subgroups include countries with highly variable per capita income levels, we also investigate results for high-income countries (GNI/cap > 12,055 US$) and low to middle-income countries (GNI/cap ≤ 12,055 US$). As we can observe in Table 6, direct and total effects are quite similar for developed countries and net exporters, on the one side, and for developing countries and net importers, on the other side. Concerning the direct effects, developed countries (like the EGs net exporters) would have seen improved ‘emission efficiency’ from trade in EGs, which is in conformity with the ‘final use’ definition of EGs. On the contrary, trade in EGs would have increased the emissions per unit of GDP in the less developed countries (like for the EGs net importers) through a direct-scale composition effect, revealing the EGs’ ‘multiple use’ and/or ‘dirty inputs’ related problems in these countries.

With the exception of OECD members for which the results remain similar to those of the net exporters, no indirect effect seems to work for non-OCDE countries, and when distinguishing between per capita income levels. Our results suggest that the magnitude of the indirect effects of trade in EGs on ‘emission efficiency’ would not depend as much on the level of income of the country as on whether it is a net importer or net exporter of EGs. Thus, it seems to us more interesting, from a political point of view, to continue the analysis according to the countries’ trade profile. Trade in EGs appears to have a higher marginal indirect effect on ‘emission efficiency’ trough the environmental regulations’ channel in the EGs net importing countries, as compared to net exporters. The later seem to benefit more from the income-induced technique effect (see Table 5).

As regards the trade in EGs from WTO408 categories (Table 7), and like for environmental effectiveness of trade in ‘renewable energy’ goods, we find also efficiency gains for these EGs in terms of CO2 and SO2 emissions per 1 US$ of GDP, for both net importers and net exporters. However, our results suggest existence of rebound effects, in particular regarding CO2 emissions, because the estimated marginal effects on emission intensity are significantly larger than in the regressions of absolute air emissions. The impact on ‘emission efficiency’ of trade in ‘environmental technologies’ and ‘waste management and water treatment’ EGs is also quite similar to the previously found effects on ‘total emissions’. That is, no efficiency gains in terms of CO2 emissions are found from trade in these categories of goods, and only trade in ‘environmental technologies’ seams to reduce SO2 emissions per 1 US$ of GDP. Finally, if trade in EGs from ‘air pollution control’ category was found to reduce total CO2 emissions only in the countries that are net exporters of such products, it appears to increase ‘emission efficiency’ in the net importing countries through indirect technique effects. However, as for EGs from APEC54 list, trade in ‘air pollution control’ goods exert a harmful, direct scale-composition effect on SO2 emissions per 1 US$ of GDP in the net importing countries (the total effect being also non-significant). Although EGs do not appear to have fulfilled their role in terms of ‘final [environmental] use’ in these countries, their availability would have prompted governments to develop more ambitious environmental policies, which would have contributed to reductions in emission intensity.

5 Discussion

By assuming that trade liberalisation and climate protection can go hand in hand, the EGA has been qualified as the key contribution that the international trading system could make to mitigate climate change. However, the negotiations toward an EGA temporarily failed. According to Musch and De Ville (2019), and from a political science perspective, two main reasons could explain this failure and should be seriously taken into consideration. First, the authors point out that the initially discussed ‘environmental protection’ solutions (in the 1970s), followed by ‘managed sustainable growth’ solutions (in the 1980s) have been abandoned from negotiations in order to guarantee a win–win scenario, where the mercantilist dynamic has usually prevailed over the environmental concerns (the so-called ‘liberal environmentalism’ since the 1990s).Footnote 40 Second, the explicit technology transfer from industrialized to developing countries (with sound assistance from North and reforms in the South) has been left to market-based mechanisms, leading to economic solutions that are assumed to fit the existing economic structures to address environmental problems. Musch and De Ville (2019) criticize the current negotiations towards an EGA to be a model focused on the ‘liberal environmental’ paradigm, where trade policy is supposed to be the outcome of conflicting interests between exporters (seeking for new markets, and thus advocating liberalization) and import-competing firms (promoting protectionism to preserve domestic market shares). In such a model, the non-trade actors have no (or very little) place in the trade agenda, which by its nature includes non-trade objectives. This inconsistency casts doubt on the objectives, and therefore the effectiveness, of the negotiated treaty.

In this paper, we have checked the validity of the implicit consequences assumed by the win–win scenario in the current trade-climate negotiations, arguing that market dynamics should guarantee that EGs liberalization is automatically in the interest of all countries, regardless of their market and institutional capacities. If free-market were to resolve all problems, increased trade in EGs would have induced environmental gains in all the countries. EGs’ importers should have seen reduction in CO2 and SO2 emissions because of increased availability of EGs ‘automatically’ absorbed by domestic markets, while EGs’ exporters would have reaped environmental benefits from further innovations and more Performant technologies in their domestic eco-industry.

Empirically, we have shown that market-based solutions alone fail to address environmental problems effectively. In particular, although we found some efficiency gains from trade in EGs (in terms of CO2 and SO2 emissions per 1 US$ of GDP), and more recurrently for net exporters than for net importers, our results often failed to highlight environmental effectiveness (in terms of total CO2 and SO2 emissions’ reduction). Unexpected findings for the direct effect of trade in EGs on absolute pollution levels and on pollution intensity lead to several policy implications, specific to the countries’ net trade position:

-

First, we think the problem of weak effectiveness, when efficiency gains are validated empirically (especially in the case of EGs’ net exporting countries), is a result of rebound, or even backfire, effects. Rebound effects should explain the situations where trade in EGs has a direct negative effect on ‘emission intensity’ but, at the same time, its direct effect on ‘absolute emissions’ is opposite (i.e., positive) or significantly reduced. As regards the positive direct (scale-composition) effect on total pollution levels found for the EGs net exporting countries, we can also refer to the recent findings by Wan et al. (2018), who show that trade liberalization in EGs may lower each country’s welfare when the production of the EGs’ intermediate input generates global pollution (e.g., CO2). The authors suggest that global pollution may increase due to the increased demand for EGs’ dirty intermediate inputs, because “a country’s domestic environmental policy can not effectively control for the negative global externalities generated by upstream production”. In the case of local pollution, trade liberalization in EGs improves each country’s welfare when there is “assistance of an upstream pollution tax” (Wan, Nakada and Takarada 2018). Hence, in order to deal with rebound effects, EGs’ trade liberalization should be combined with rebound mitigation strategies, like economy-wide cap-and-trade systems, energy and carbon taxes, etc.

-

Second, concerning the net importers of EGs (from APEC54 reference list), in addition to potential rebound effects, we suppose that EGs are not necessarily used for reducing environmental damages because of a positive direct scale-composition effect on emissions per 1 US$ of GDP found in our regressions for these countries (highlighting the ‘EGs’ multiple use’ problem). The lack of technical skills, inadequate purchasing power and institutional capacities, could explain the weak domestic demand for these products in the pollution-intensive sectors. Hence, complementary policy and technical assistance should accompany EGs’ trade liberalization in the countries that are weak performers (permanent net importers) in this sector. Since the market would not ‘transfer’ environmental technologies automatically by making EGs cheaper, the future negotiations should improve technology transfer and support competitiveness of net importers’ domestic industries (in particular from the developing countries). Several studies (e.g., Vikhlyaev 2004; Nguyen and Kalirajan 2016; De Melo and Solleder 2018; Tamini and Sorgho 2018) point out that EGs’ liberalisation is not enough, it should be complemented by MEAs, regulatory harmonization between trading partners, investment, government procurement, licensing of intellectual property rights, elimination of non-tariff barriers, etc.

-

Finally, as we have found that income is an important mechanism by which trade in EGs affects pollution, it would be necessary to take into consideration how the selection of a EGs list affects the economy, in addition to the environment. We found trade in EGs from narrow lists (APEC54, OECD + APEC, WTO28) to reduce pollution through the income channel in the net exporting countries to a greater extent than in the net importing countries. However, the results are opposite for trade in EGs from broad lists (e.g., WTO408) where tariffs are still relatively high. We could therefore suggest promoting a list of EGs containing sufficient products in which developing countries have comparative advantage (where economic dynamics related to trade liberalization could generate additional income). Otherwise, attention must be paid to the tariff levels and there contribution to total income. A quick liberalization of EGs with high tariff levels, and for which there is no sufficient local demand with adequate technical skills, could worsen environmental quality through losses in income (in addition to direct scale-composition effects).

6 Concluding Remarks and Prospects

By using instrumental variable regressions (IV-GMM and Arellano-Bond Panel System-GMM) of total CO2 emissions of 114 countries on their trade in EGs between 1996 and 2011, we first estimate the overall effect of trade in EGs on CO2 emissions, which is found to be harmful. All else equal, a 10% increase in EGs trade flows is associated with an overall increase in CO2 emissions by about 2%. However, these findings do not allow an explanation of the forces at work. The Multiple-Equation GMM estimations that simultaneously explain the pollution, the stringency of environmental regulations and the per-capita income, allow further decomposing the overall impact on pollution into direct and indirect effects.