Abstract

In this paper, we analyze the relationship between technological greening, eco-efficiency and no-regret strategies. By using a simple theoretical model we evaluate the effects of technological greening on creation value, pollution level, and eco-efficiency. We show three contrasting effects of technological greening. First, technological greening may increase the pollution of a firm, and also of the whole industry. Second, the indicator of eco-efficiency can be misleading because it may improve in situations where pollution increases and/or profit decreases after technological greening. Third, technological greening that induces an improvement of the eco-efficiency indicator does not necessarily lead to a no-regret strategy. As a result, the indicator should not be used for decision-making. These are the many traps of technology greening promotion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In order to provide a comprehensive evaluation of both the environmental and the economic performance of firms, the World Business Council for Sustainable Development (WBCSD) elaborated in 1991 the concept of eco-efficiency, to be understood as the ratio of product value over environmental pressure (Schmidheiny 1992). Broadly defined, eco-efficiency is also a management philosophy that encourages business to look for environmental improvements that yield joint economic benefits. As an example, Schmidheiny (1992) defines eco-efficient companies as “those which create ever more useful products and services while continuously reducing their consumption of resources and their pollution”. De Simone and Popoff (1997) extend the scope of this definition with four criteria: the definition of targets to reach, the dynamic assessment of environmental performance, the broad integration of environmental impacts, and the awareness of the firm’s impact on the Earth’s carrying capacity. Basically, the underlying idea behind all these definitions is that it is a good thing to produce more desirable output with less undesirable output.

In fact, very few papers in the literature address the issue of eco-efficiency from a theoretical perspective (Huppes and Ishikawa 2005a, b; Guenster et al. 2010). Hence, after having empirically explored the link between environmental performance and economic performance, Telle (2006) calls for theoretical research to understand the links between the two. Our contribution is to provide a formal and theoretical analysis to understand the relationship between technological greening, eco-efficiency, and no-regret strategies. Let us briefly define these three terms. Technological greening simply consists in the adoption of a less polluting technology. Thus, technological greening is good for the environment because it reduces the pollution level, but it can be costly to the firm since an advanced green technology is more expensive than an old dirty one. However, some authors believe that adopting a clean technology may yield competitive advantages, which leads on to the concept of no-regret strategy. A no-regret strategy is a strategy (here, investing or not in a green technology) such that the decrease in pollution is accompanied by an increase in profit. Eco-efficiency defined as “creating more value with less impact” (WBCSD 2000) can be seen as the nexus of the two previous concepts. In our paper, eco-efficiency is defined as the ratio of profit over polluting emissions because, like, e.g., Derwal et al. (2005) or Jollands et al. (2004), we understand “creating more value” as the added value of a firm. Therefore, improving the value of the indicator by technological greening means that more value is created with less pollution. As eco-efficiency is considered by the WBCSD to be a tool for decision-making, we decide to question this idea. Does the eco-efficiency indicator really capture all the effects of technological greening? Can it help identifying no-regret decisions? In fact, we will see that the eco-efficiency indicator cannot be trusted for decision-making.

Two strands of literature are of special relevance to our study. The first one deals with the relationship between environmental performance and economic performance. There exist two slightly different standpoints. Some authors argue that greater environmental performance systematically increases the firm’s economic performance. Porter and Van Der Linde (1995), for example, consider that environmental performance is a key opportunity to foster a firm’s competitive position, as it allows for increases in profitability or market share. Improving environmental performance may also lead to benefits from a managerial point of view. Hart (1995) or Russo and Fouts (1997) argue that an environmentally friendly technology may be a competitive advantage used as a resource-based strategy of the firm. A theoretical rationale for such no-regret options is provided by Bréchet and Jouvet (2009). The idea that greater environmental performance may foster economic performance has also been stressed by many empirical studies. Some papers show that better environmental performance increases the firm’s value. For example, Dowell et al. (2000) show that environmental performance (through compliance with environmental standards) is profitable to the firm. King and Lenox (2002) assess the positive relationship between environmental and economic performance through waste prevention, while Sinkin et al. (2008) study the impacts of ISO 14000 on a firm’s value. Rennings et al. (2006) show the positive effect of environmental innovation on economic performance. All these results illustrate the idea that technological greening makes the firm better off, which coincides with an improvement in eco-efficiency.

On the other hand, some authors consider that an improvement in environmental performance does not systematically lead to an increase in economic performance, e.g., Lankoski (2006). Palmer et al. (1995) show that stringent environmental regulation reduces a firm’s profit because of the cost of environmental compliance. Boons and Wagner (2009) question the current assessment which states that innovation has an effect only on economic and ecological performance. The authors discuss the existence of a broader range of actions for innovation that explains this unclear relationship between innovation, environmental and economic performance. Bréchet and Michel (2007) formally show that the ranking of firms in terms of environmental performance depends not only on technological choice, but also on market equilibrium. In other words, the ranking cannot be reduced to the mere technological greening issue. Finally, to test the Porter hypothesis, Brännlund and Lundgren (2010) use a factor-demand modeling approach and specify a profit function that has a technology component dependent upon firm-specific effective tax on carbon dioxide. They are able to separate out the effect of regulatory pressure on technological progress. Their results show some evidence of a “reversed” Porter effect in most industrial sectors, specifically in energy intensive industries.

In this paper, we formally make the link between technological greening, eco-efficiency and no-regret strategy, and we highlight the many traps that can be met when promoting green technology. Our purpose is to question whether an improvement of the eco-efficiency indicator due to technological greening necessarily leads to an increase in profits and to a decrease in pollution. We do not address the issue of the adoption of clean technologies and incentives (for a survey on that literature, see, e.g., Requate 1998, or Montalvo 2008). For a comprehensive survey on the complex relationship between regulation and technical change, see also Erbas (2010). Instead, we are interested in the consequences of technological adoption. To this end, we develop a framework to understand the effects of technological greening on a firm’s profit, a firm’s emissions, emissions at the market level, and on the WBCSD indicator of eco-efficiency. By using a simple theoretical model we show that for a high tax level that gives a positive incentive for a less polluting technology, technological greening does not necessarily reduce emissions, either at the firm level or at the market level. We show that setting too high a tax can lead to an increase in total pollution in the economy. This suggests that price regulation must be designed very carefully. Nevertheless, in such a case it may well be that the eco-efficiency indicator improves, thus providing a wrong signal to decision-makers. These results question the reliability of the indicator for decision-making. Indeed, we show that, after technological greening, the eco-efficiency indicator can increase when the firm experiences a profit loss and/or when the emission level increases. Finally, we show that the improvement of the eco-efficiency indicator is a necessary but not a sufficient condition for no-regret strategies.

The paper is organized as follows. In the next section, we propose an overview of the use of the eco-efficiency indicator in business practice. In Sect. 3 the setting is presented. Section 4 analyzes the effects of technological greening on profit and emissions at the firm level. Section 5 discusses the cases of no-regret strategy and Sect. 6 analyzes the effects of technological greening on the eco-efficiency indicator. The last section is the conclusion.

2 Eco-efficiency in practice

Before beginning the theoretical analysis it is of interest to see to what extent the concept of eco-efficiency, and the related indicators, are used in practice.

Private and public sectors make wide use of eco-efficiency as an indicator to support decision-making. As guidance for managers and policy-makers in measuring and assessing a firm’s performance, many institutional reports are based on the WBCSD concept, see e.g., Schmidheiny (1992), WBCSD (2000), Verfaillie and Bidwell (2001). Some institutions further develop managerial specificities linked to the indicator so as to widen its scope, for example in finance, accountancy or production areas. For example, the United Nations Conference on Trade And Development (Sturm et al. 2003) and the widely used Global Reporting Initiative (GRI 2006) provide a method to report environmental performance with respect to financial performance in an accountancy framework. Interestingly, both reports are divided into categories of materials (water use, energy use, global warming contribution, etc.) and assessment areas (economic, labor, environmental, social or human rights indicators).

At the business level, Ditz and Ranganathan (1997) wrote a report for the World Resources Institute that highlights the use of intensity measures for internal comparisons, but without providing any detail on the calculations. In addition to its 1991 seminal report, the WBCSD has also developed a classification of indicators into core and supplemental subdivisions, as presented by Verfaillie and Bidwell (2001). The first category of indicators is implementable, which makes comparisons between sectors or firms feasible. The second category consists in business-specific indicators which are designed to be used for internal purposes or for comparisons between plants in the same industry. This suggests that the generic concept of eco-efficiency cannot be generalized or, to put it in different terms, that eco-efficiency is sector-specific. We shall return to this point. In Canada, the National Round Table on the Environment and the Economy (NRTEE 2001) has created a workbook defining indicators according to the life-cycle approach (from cradle to grave). It classifies the indicators in energy use, waste intensity and water intensity. The eco-efficiency ratios are then calculated as the amount of resource consumed or as undesirable output over production level. See also Callens and Tyteca (1999) for more developed sets of indicators.

Finally, there also exists a literature on eco-efficiency that focuses on the implementation aspects at the company level. For example, BASF (Saling et al. 2002) and Akzo Nobel (Cramer and van Lochem 2001) have both published case studies on the eco-efficiency analysis of their production processes. Both use the eco-efficiency indicator in a broad sense, including life-cycle analysis. They have developed measurements for internal comparison among their own products. The methodology is not the same in the two case studies. BASF assesses eco-efficiency with diamond diagrams, because they want to encompass multi-pollutant products. Such a comparison is difficult because of the multidimensional problem (weightings, pollution preferences: is it better to produce a good that emits a lot of sulfur dioxide and little carbon dioxide, or the contrary?). The other firm, Akzo Nobel, assesses eco-efficiency by comparing six pilot projects corresponding to six business units differentiated by their innovation level. Both studies make use of eco-efficiency for internal comparison.

3 The setting

Our purpose is to develop a simple theoretical setting to understand the many effects of technological greening at the firm and market levels. We consider a static, short-term analysis. Footnote 1 The industry is composed of a continuum of n heterogeneous firms. Each firm is indexed by \(i \in F: \{1,\ldots,n\}\) and uses a production function \(y_{i}=\sqrt{x_{i}},\) where y i is the output and x i is the input. Firms operate under perfect competition. The output price is p and the input price is normalized to 1. Let us denote by e i the pollution level of firm i. Pollution is a joint product of output, e i = y i /b i , where b i is the inverse of the emission/output intensity. We assume that firms acquired their initial technology before the enforcement of a regulation on environment. So the firms are differentiated by their polluting intensity 1/b i . By convention, the most polluting technology is b 1 = 1 and the cleanest one is b n = b max > 1. From now on, the regulator levies a uniform emission tax t on pollution. Firm i’s problem writes as follows:

The problem is solved by substituting y i by e i . The first-order condition gives the firm’s optimal emission level (\(e_{i}^{*}\)), which yields the expressions for output (\(y_{i}^{*}\)) and profit (\(\pi_{i}^{*}\)) at the firm’s optimum:

The impact of the emission tax on firm i’s profit is ▵π i = π * i (t > 0) − π * i (t = 0) = t(t − 2b i p)/4b 2 i . This expression shows that two effects interplay. On the one hand, the higher the tax level, the lower the profit (which is not surprising). But, on the other hand, for a given tax level, the lower b i , the higher the profit decrease due to the tax. This means that a firm with a greener technology (i.e., a higher b i ) will experience a lower profit decrease if the tax is implemented. Does this suggests that, under some tax regulation, a firm always has an incentive to green its technology? And is it the case that technological greening is always good for the environment? In the sequel we will see that it is not always the case.

4 The effects of technological greening at the firm level

In this section, we analyze the effects of technological greening at the firm level. Let us start by being precise about the terminology. We formally define technological greening as a marginal increase in b i . Such an increase represents the adoption of a less polluting (or ‘green’) technology per unit of output. Because we use a primal approach (i.e., with an explicit production function) we are able to explicitly define technological greening. This is in contrast with many papers in the literature that make use of the dual approach (i.e., with an abatement cost function) and assume that technological greening shifts the pollution abatement cost downwards (see e.g., Coria and Hennlock 2012), which is not always the case as shown by Bréchet and Jouvet (2008). Technological greening is not free. It raises a cost given by ab i , with a > 0. Because we consider marginal improvements of the technology, this cost corresponds to a marginal cost of adoption. This adoption cost is larger when the technology is already very clean (b i is high). So the whole analysis will be conducted in marginal terms. We shall provide a comparative static analysis about the effect of improving a technology on profit and emissions.

4.1 The effects on firm’s profit

The effect of technological greening on firm i’s profit is given by the first derivative of Eq. (2) with respect to the technological parameter b i , net of the adoption cost ab i . This allows us to define a function \(\varphi\) of t, parametrized by b i :

The equation \(\varphi_i^{*}(t;b_i)=0\) provides us with an iso-profit frontier on which firm i’s profit is unchanged after technological greening. The existence of real roots for \(\varphi_i^{*}(t;b_i)=0,\) denoted by \(\underline{t}_i\) and \(\bar{t}_i, \) relies on the assumption that a, the scale parameter of the greening cost, is not too large. Formally, we must have \(a<p^{2}/8b_i^{2}, \quad \forall i \in F. \) The iso-profit frontier is described by functions that are defined by the roots of \(\varphi_i^{*}(t;b_i)=0, \) in (b i , t). In this space firm i’s profit increases or decreases after technological greening, depending on (1) its initial technology, (2) whether the emission tax is inside or outside a frontier t(a, b i , p) defined by \(\underline{t}\) and \(\bar{t}.\) This leads us to our first result.

Lemma 1

Firm i’s profit can increase or decrease after technological greening, depending on the tax level and firm i’s initial technology.

Proof

See Appendix 1.

The rationale behind this first result is twofold. Firstly, greening the technology is costly to the firm, and the cleaner the initial technology, the higher the cost increase. When the technology is already very efficient (large b i ) it may be too costly to improve it further in comparison with the savings on the tax bill. This is why the profit can decrease when b i is initially high (this corresponds to the right side of the \(\varphi_i\) frontier). Secondly, the higher the tax on pollution, the stronger the incentive for technological greening. Upgrading the technology is all the more profitable as the tax is high. However, for a very high tax level a firm with a low b i may also experience a profit decrease. In such a situation, the emission reduction due to the technological greening does not compensate for the tax burden. To remain profitable, the firm should make a stronger innovation effort (even greater b i ). Naturally, these two effects interplay and it may well be the case that the frontier \(\varphi_i\) is wide enough to make technological greening profitable for all initial technology levels.

4.2 The effects on firm’s pollution

Let us now turn to the effect of technological greening on pollution. At the firm’s optimum the emission level is given by Eq. (1). As previously, the effect of technological greening on firm’s pollution is given by the first derivative of this expression with respect to b i , which leads to the following function:

The frontier ψ * i (t;b i ) = 0 is such that technological greening has no impact on firm i’s pollution level. It gives us an iso-emission function, \(\tilde{t}_i=b_ip/2. \) Firm i’s pollution increases or decreases with technological greening depending on (1) its initial technology and, (2) whether the tax is above or below a frontier t(b i , p) given by \(\tilde{t}=b_ip/2. \) The following lemma summarizes the effect of technological greening on firm i’s pollution.

Lemma 2

Firm i’s pollution can increase or decrease after technological greening, depending on the tax level and firm i’s initial technology.

Proof

See Appendix 2.

Actually, it may be the case that, after having adopted a cleaner technology, the firm pollutes more. For a given tax level, unambiguously, technological greening reduces firm’s emission output intensity. But it also allows for an increase in the marginal productivity of pollution, which results in an increase in the firm’s production, ceteris paribus. The increase in output level can offset the improvement in pollution intensity, so that the firm’s pollution level can increase. Such a situation is known in the energy economics literature as the rebound effect (see e.g., Greening et al. 2000; Berkhout et al. 2000). Gains in the efficiency of energy consumption can result in an effective reduction in the per unit price of energy services or an increase in market share such that, by the end, energy consumption increases, partially offsetting the impact of the efficiency gain. So the rebound effet can result from an equilibrium effect through prices, or through a productive effect. Because all prices are exogenous in our setting, only the latter effect comes out. Interestingly, this rebound effect appears when the tax on pollution is high enough. For a given b i , the higher the tax, the stronger the reduction of the production cost after technological greening, and thus the stronger the increase in output.

5 Technological greening and no-regret strategy

At this stage of the paper we have formally identified the conditions under which pollution may increase after technological greening at the firm level. Clearly, one may want to avoid such situations. Among all the situations where pollution decreases (good news), it can be that profit decreases (bad news). The purpose of this section is now to identify the cases in which technological greening corresponds to a ‘no-regret’ strategy, that is, technological greening leading to a profit increase and a pollution decrease. In this section, we will see that such no-regret situations happen under different conditions at the firm level and at the aggregate level.

5.1 No regret at the firm level

Could it be possible that a firm has a positive incentive for technological greening and, by the end, that pollution increases? Conversely, could it be the case that technological greening reduces emissions while not providing a positive incentive to the firm? To answer these questions we shall combine the insights from the two previous analyzes. It is well established in the literature that a pollution tax provides positive incentives for technological greening. Following this literature, the higher the tax, the stronger the incentive (see Requate 1995, 1998). Hereafter, following Bréchet and Jouvet (2008) we will see that it is not necessarily the case.

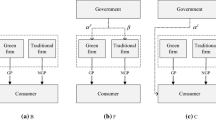

Our analysis is conducted by using the graphical illustration provided in Fig. 1. We restrict ourselves to firms producing a positive output level (y * i (t;b i ) ≥ 0, ∀i). We define the set domain as the space (t;b i ) within the two following frontiers. The first frontier, defined by t = b i p, is such that firms produce a positive output level when they are interior to the frontier (i.e., a smaller b i and/or a smaller t). The second frontier is defined by b max, the best available technology that has the lowest emission-output intensity. In Fig. 1, one can also see the frontier related to the incentive for technological greening \(\varphi_i^{*}(a,b_i,t)=0. \) A firm characterized by some (t; b i ) and located inside the \(\varphi_i\) frontier will experience a profit increase after technological greening. Outside this frontier, the firm will experience a profit loss. The other frontier, ψ * i (t;b i ) = 0, is also displayed. Below that frontier, the firm’s emissions decrease after technological greening; above, they increase. This function is increasing and linear with a slope p/2. The four frontiers gathered in Fig. 1 split the domain into four areas labeled (I), (II), (III) and (IV).

In area (I), polluting emissions decrease with technological greening and profit increases. Here, technological greening corresponds to a no-regret strategy. In area (II), the firm experiences the rebound effect: technological greening yields a higher profit level, but pollution increases too. In this case, the positive incentive to improve the technology harms the environment. In area (III), polluting emissions decrease with technological greening, but profit does the same. In this case, the firm has no incentive for technological greening. At last, in area (IV), emissions increase with technological greening, but profit level decreases also. In other words, the initial technology is already efficient, so greening it even further is not profitable. This situation is not desirable because both the environment and the firm are worse off.

5.2 No regret at the aggregate level

Considering that it may happen that a firm has a positive incentive for technological greening but also that, as a result, its emission level increases, one may ask about the outcome at the market level. If all firms having a positive incentive to green their technology do it, can it happen that aggregate pollution level increases at the industry level? Is it possible that the emission increase of some firms is offset by the emission reduction of some other firms? We already know that pollution increase (after technological greening) happens for firms with a low b i and when the tax level is high. So, one way to answer that question is to search whether there exists a tax level such that technological greening (with a positive incentive) leads to an increase in the aggregate pollution level. The effect of technological greening on the aggregate pollution level is:

Formally, we are looking for a tax level—if it exists—such that technological greening—with positive incentive—leads to an increase in the aggregate pollution level. Let us denote by b 1 and b 2 the technological boundaries within which the firms have a positive incentive for technological greening (see Sect. 4.1). Within these boundaries, for a given tax t, the aggregate effect of technological greening on aggregate emissions is thus given by:

As a consequence, aggregate emissions increase if t > pb 1(t)b 2(t)/(b 1(t) + b 2(t)). To understand how this condition shapes the result it is convenient to consider an numerical example. Let us consider three different tax levels such that b 1(t) = 1: t = 3.5, t = 2.5 and t = 1.0. Figure 2 illustrates the effect of technological greening both on the continuum of firms firm and at the aggregate level.Footnote 2 The horizontal axis represents the continuum of technologies and the vertical axis represents the variation of the emission level after technological greening. Let b 2(t) be the critical technology below which the incentive is positive. The aggregate variation in pollution is provided by the integral under and above these curves between b 1 and b 2. One can see that, for small and medium tax levels, aggregate emissions decrease after technological greening. With t = 3.5, the firms that initially had a very polluting technology (low b i ) experience a rebound effect, while the firms with a larger initial b i pollute less. Aggregate emissions increase after technological greening when the first effect dominates the second one.

This result is summarized in the following proposition.

Proposition 1

Aggregate pollution increases after technological greening if the tax on pollution is high enough.

The literature on the rebound effect (e.g., Greening et al. 2000) or papers on no-regret strategy (Bréchet and Jouvet 2009) do not provide a microeconomic explanation for the aggregate effect on pollution, which is done here. We propose microeconomic foundations why global pollution may increase. Some firms reduce their pollution level, but it can be overcompensated by the pollution increase of other firms. This reveals an important (and neglected) result, that the aggregate effect of a policy does depend on the distribution of the firms when they are heterogenous, because their reaction to the policy is also heterogenous. Two major implications can be drawn from this result. First, it questions the very concept of clean technology. A firm with a larger b i does not necessarily pollute less. Besides the mere technological issue (the choice of b i ), there exists an economical issue, that is, the way the firm makes use of the polluting factor within the production process and in the market. It appears that the relationship between a tight regulation that provides an incentive for innovation and pollution reduction is not straightforward. The incentive may be bad for the environment, and the policy instrument (here, the tax level) must be chosen carefully. Second, it also questions the reliability of the WBCSD eco-efficiency indicator in its ability to detect no-regret strategies. Scrutinizing further this issue is the purpose of our last section.

6 Is the eco-efficiency indicator reliable?

In this section, we question the eco-efficiency indicator proposed by the WBCSD. In other words: is this indicator able to detect the situations where technological greening leads to a no-regret strategy (less pollution, more profit)? The indicator advised by the WBCSD consists in the ratio of created value over environmental impact. We shall interpret it as the ratio between profit level and emission level. This definition is consistent with current business practices (see Sect. 2). So we shall formally define the eco-efficiency indicator at the firm’s optimum as \( I_{i}^{*}= \pi_{i}^{*}/ e_{i}^{*} \). The effect of technological greening on this indicator is given by its first derivative with respect to b i :

The function \(\Uplambda_i^{*}=0\) provides us with a frontier on which technological greening does not impact the indicator. This gives us a function \(\breve{t}_i=(b_ip^2-4ab_i^3)/p\), which is concave to the originFootnote 3 and equals zero for \(b_i=p/(2\sqrt{a}). \) Within the frontier, the indicator increases after technological greening; outside, it decreases. Our last proposition is thus the following.

Proposition 2

The eco-efficiency indicator increases or decreases after technological greening, depending on the tax level and the initial technology.

Proof

See Appendix 3.

To summarize the reliability of the eco-efficiency indicator we have gathered the effects of technological greening on the indicator with those on profit and emissions of firm i in the same figure. This \(\Uplambda_i^{*}=0\) frontier divides areas (II) and (III) into four subdomains that are named (IIa), (IIb), (IIIa), (IIIb). For a given tax level below the frontier \(\Uplambda_i^{*}=0, \) the eco-efficiency indicator increases after technological greening, above it decreases. Table 1 displays the effects of technological greening on the two arguments of the eco-efficiency indicator; it must be used in combination with Fig. 3.

In area (I) and (IV) the eco-efficiency indicator behaves according to the intuition and gives the right signal to the decision-maker. On the one hand, the firm and the environment are getting better in (I), which means that technological greening increases profits and decreases pollution (a no-regret strategy). On the other hand, things are getting worse in (IV) for both the firm and the environment, which is signaled by the eco-efficiency indicator. So both in cases (I) and (IV) the eco-efficiency indicator can be trusted.

Unfortunately, in all other areas the eco-efficiency indicator gives a ‘go’ signal for technological greening, while it worsens the situation both for the firm and for the environment.

Area (II) is mixed: profit and emissions increase with technological greening. However, this zone is divided into two. In area (IIa), the eco-efficiency indicator gives a positive signal for technological greening, thus giving a wrong information to decision-makers: the firm will be better off, but it will pollute more (rebound effect). The indicator is enhanced because the profit increase is stronger than the emission increase, and this is due to the high marginal benefit of technological greening (high tax on emission/low initial technology level).

In area (IIb), the eco-efficiency indicator gives a ‘no-go’ signal for technological greening because the emission increase is stronger than the profit increase. In that case, the indicator decreases despite an increase of profit.

In area (III), both profit and emissions decrease after technological greening. Again, the effects on eco-efficiency splits the zone into two. In areas (IIIa), the indicator gives a ‘go’ signal. By cleaning its technology the firm will reduce its emission level (no rebound effect in that area), but it will be worse off in terms of profit. The reason here is that the firm is already very clean and the cost of pollution, relative to the cost of adoption, is not high enough. Adopting a cleaner technology would be too expensive in comparison with its productive benefits. Still, the indicator gets higher because the emission reduction is stronger than the profit loss.

In area (IIIb), the indicator gives a ‘no-go’ signal for technological greening because the profit loss is stronger than the emission reduction. The eco-efficiency indicator decreases despite the emission reduction.

By combining all the previous results we are able to state the general following corollary.

Corollary

An improvement in the eco-efficiency indicator is a necessary but not a sufficient condition for a no-regret strategy.

This latter corollary shows that the eco-efficiency indicator, as defined by the World Business Council, is not an adequate indicator for decision-making, either at the firm level or at the market level.

7 Conclusion

In this paper, we provide a framework to understand the effects of technological greening on firm’s profit, firm’s emission, global emissions, and on the indicator of eco-efficiency. It turns out that many unexpected effects may come out, which should suggest the policy-maker to promote green technology carefully. We show why eco-efficiency is at the nexus between technological greening (adopting a less polluting technology) and no-regret strategies (lower pollution level and higher profits). With a theoretical model we highlight that technological greening may raise conflicting effects. First, a high tax level on pollution that provides the firm with a positive incentive for technological greening can lead to an increase in emissions, both at the firm or at the market level. This result shows that an environmental policy aiming at reducing pollution, and tempted to put a very high tax, can end up with an increase in pollution. As already noticed by Telle (2006), understanding this result provides helpful information for regulation design. Second, technological greening can lower the firm’s profit if the initial technology is already very efficient. Third, these conflicting effects are not systematically detected by the eco-efficiency indicator, as defined by the WBCSD. In other words, eco-efficiency cannot be trusted as an indicator for decision-making. More formally, we show that eco-efficiency is a necessary, but not a sufficient condition for identifying no-regret strategies. It may give a ‘go’ signal to the firm for technological greening in cases where the firm will experience a profit decrease and a pollution increase.

In this paper, we just carry out a comparative statics analysis of the effects of a technological improvement in equilibrium with heterogeneous firms. That is to say that we do not address the incentive issue, nor the potential strategic behaviors between the firms and the regulator. This would be an interesting extension of our work with endogenous adoption, following the papers by Requate and Unold (2003) or Bréchet and Meunier (2012), for example.

On purpose, our model was simplified in many aspects to keep it tractable and transparent. Despite these simplifications, it provides a useful framework for understanding the potential impacts and adverse effects of technological greening at the firm and market level. The objective is to help policy-makers set a regulation that improves the environmental quality without endangering firms. Extensions to this framework could be, for example, to compare the impacts of different policy instruments (typically, emission tax versus command-and-control or tradable permits), to endogenize technology adoption or to consider a non-competitive setting. Moreover, an appealing avenue for research would be to better understand why firms subject to the same regulation adopt heterogeneous technologies. Finally, a to-do extension is to carry out a social welfare analysis to determine whether technological greening is good for society, or not.

The very purpose of this paper was not to be nihilist but constructive. How? By scrutinizing the many traps of green technology adoption at the firm and market levels when firms are heterogenous. It shows that firms’ reaction to some environmental regulation and technological greening does depend on their initial situation, and also that global outcome does depend on firms distribution in the market. In other words, firms’ heterogeneity should be taken into account to design an effective policy. Adequate indicators and monitoring tools should be designed in this respect.

Notes

Introducing real dynamics in the model would make it much complex and would not add much to our main conclusions. The analysis is a short-term analysis because we take the firm’s heterogeneity as granted. Explaining why firms are heterogeneous is beyond the scope of the paper.

Parameters value are: p = 5, a = 0.5.

It belongs to the domain.

References

Berkhout PH et al (2000) Defining the rebound effect. Energy Policy 28:428–432

Boons F, Wagner M (2009) Assessing the relationship between economic and ecological performance: distinguishing system levels and the role of innovation. Ecol Econ 68:1908–1914

Brännlund R, Lundgren T (2010) Environmental policy and profitability: evidence from Swedish industry. Environ Econ Policy Stud 12:59–78

Bréchet Th, Jouvet PA (2008) Environmental innovation and the cost of pollution abatement revisited. Ecol Econ 65(2):262–265

Bréchet Th, Jouvet PA (2009) Why environmental management may yield no-regret pollution abatement options. Ecol Econ 68:1770–1777

Bréchet Th, Meunier G (2012) Are clean technology and environmental quality conflicting policy goals? CORE discussion paper 2012/6, Université catholique de Louvain

Bréchet Th, Michel Ph (2007) Environmental performance and equilibrium. Can J Econ 40(4):1078–1099

Callens I, Tyteca D (1999) Toward indicators of sustainable development for firms: a productive efficiency perspective. Ecol Econ 28(1):41–53

Coria J, Hennlock M (2012) Taxes, permits and costly policy response to technological change. Environ Econ Policy Stud 14:35–60

Cramer J, van Lochem H (2001) The practical use of ‘eco-efficiency’ concept in industry: the case of Akzo Nobel. J Sust Prod Des 1:171–180

Derwalle J et al (2005) The eco-efficiency premium puzzle. Financ Anal J 61(2):51–63

DeSimone LD, Popoff F (1997) Eco-efficiency: the business link to sustainable development. The MIT Press, Cambridge, MA

Ditz D, Ranganathan J (1997) Measuring up: toward a common framework for tracking corporate environmental performance. Technical report, World Resources Institute

Dowell G et al (2000) Do corporate global environmental standards create or destroy market value? Manag Sci 46:1059–1074

Erbas BC (2010) Factors affecting innovation and pollution-reduction performance of environmental regulations. Environ Econ Policy Stud 12:139–163

Greening A et al (2000) Energy efficiency and consumption—the rebound effect—a survey. Energy Policy 28:389–401

GRI (2006) Sustainability reporting guidelines. Technical report, Global Reporting Initiative

Guenster N et al (2010) The economic value of corporate eco-efficiency. European Financial Manag, no. doi:10.1111/j.1468-036X.2009.00532.x

Hart SL (1995) A natural resource-based view of the firm. Acad Manag Rev 20:986–1014

Huppes G, Ishikawa M (2005a) A framework for quantified eco-efficiency analysis. J Indus Ecol 9(4):25–41

Huppes G, Ishikawa M (2005b) Eco-efficiency and its terminology. J Indus Ecol 9(4):43–46

Jollands N et al (2004) Aggregate eco-efficiency indices for New Zealand—a principal components analysis. J Env Manag 73:293–305

King A, Lenox M (2002) Exploring the locus of profitable pollution reduction. Manag Sci 48:289–299

Lankoski L (2006) Environmental and economic performance. The basic links. In: Schaltegger S, Wagner M (eds) Managing the business case for sustainability. Greenleaf, Sheffield

Montalvo C (2008) General wisdom concerning the factors affecting the adoption of cleaner technologies: a survey 1990–2007. J Cleaner Prod 16(1):S7–S13

NRTEE (2001) Eco-efficiency indicators: how to measure eco-efficiency in business. Technical report, National Round Table on the Environment and the Economy, Canada

Palmer K et al (1995) Tightening environmental standards: The benefit-cost or the no-cost paradigm? J Econ Persp 9(4):119–132

Porter ME, Van Der Linde C (1995) Toward a new conception of the environment–competitiveness relationship. J Econ Persp 9(4):97–118

Rennings K, Ziegler A (2006) The influence of different characteristics of the EU environmental management and auditing scheme on technical environmental innovations and economic performance. Ecol Econ 57:45–59

Requate T (1995) Incentives to adopt new technologies under different pollution-control policies. Int Tax Public Fin 2(2):295–317

Requate T (1998) Incentives to innovate under emission taxes and tradeable permits. Eur J Pol Econ 14(1):139–165

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur Econ Rev 47(1):125–146

Russo MV, Fouts PA (1997) A resource-based perspective on corporate environmental performance and profitability. Acad Manag J 40:534–559

Saling P et al (2002) Eco-efficiency analysis by BASF: The method. Int J Life Cycle Assess 4:203–218

Schmidheiny S (1992) Changing Course: A Global Perspective on Development and the Environment. The MIT Press, Cambridge, MA

Sinkin C et al (2008) Eco-efficiency and firm value. J Account Pub Pol 27:167–176

Sturm A et al (2003) Eco-efficiency indicators conceptual framework and guidelines. Technical report, UNCTAD

Telle K (2006) “It pays to be green”—a premature conclusion? Environ Res Econ 35:195–220

Verfaillie HA, Bidwell R (2001) Measuring eco-efficiency: a guide to reporting company performance. Technical report, World Business Council for Sustainable Development

WBCSD (2000) Eco-efficiency: creating more value with less impact. Technical report, World Business Council for Sustainable Development

Acknowledgments

Preliminary versions of this paper were presented at the Environmental Meeting at CORE, at the research seminar of CRECIS, Louvain School of Management, at the Rencontres de l’Environnement organized by CORE–EUREQua–EconomiX–EQUIPEE, at the EAERE-09 (Amsterdam) and at the European Academy of Management 2010 (EURAM at Rome). We are grateful to the editor of the journal, an anonymous referee, Paul Belleflamme, Maria-Eugenia Sanin and Thierry Lafay for their comments and suggestions. The paper was finalized while Th. Bréchet was visiting research fellow at the Grantham Institute for Climate Change at Imperial College London, and visiting professor at the European University at St Petersburg, Russia.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Lemma 1

The effect of technological greening on profit is given by the first derivative of the profit level (2) with respect to the technological parameter b i . Let us define the following:

This \(\varphi_i\) function allows us to define a frontier on which the effect of technological greening on the profit level is zero, \(\varphi_i^{*}(b_i,t)=0. \) There exist cases where real roots of \(\varphi_i^{*}(b_i,t)=0\) do not exist. The very existence of real roots for \(\varphi_i^{*}(b_i,t)=0, \) denoted by \(\underline{t}_i\) and \(\bar{t}_i, \) relies on the following assumption:

Assumption

We suppose a condition on a for which an environmental technological amelioration allow an improvement of the profit level. Otherwise \(\underline{t}_i\) and \(\bar{t}_i\) do not exist which means an environmental technological amelioration decrease the profit level.

Both of the roots belong to the set domain, \(\bar{t}_i<\tilde{t}\) and \(\underline{t}_i<\tilde{t}.\) For b i = 1, we have:

Calculating the first and the second derivatives of the function \(\underline{t}_i=\frac{1}{2}(b_ip-\sqrt{b_i^{2}p^{2}-8ab_i^{4}}),\) we determine that the curve is increasing and convex to the origin.

Calculating the first and the second derivatives of the function \(\bar{t}_i=\frac{1}{2}(b_ip+\sqrt{b_i^{2}p^{2}-8ab_i^{4}}), \) we determine that the curve is decreasing and concave to the origin.

Appendix 2: Proof of Lemma 2

The effect of technological greening on pollution is given by the first derivative of the emissions (1) with respect to the technological parameter b i which is given by:

The function \(\tilde{t}_i\) is linear and increasing in b i .

2.1 Location of the frontier within the set domain

A frontier \(\tilde{t}_i=\frac{b_ip}{2}\) is defined such that the effects of technological greening on pollution level is null: ψ * i (b i ,t) = 0. Under our assumption this function of iso-emissions (\(\tilde{t}_i=\frac{b_ip}{2}\)) belongs to the set domain \(\tilde{t}_1<t_1 \quad \Leftrightarrow \quad p/2<p. \) The function \(\tilde{t}_i=b_ip/2\) is located above the frontier \(\underline{t}_i=\frac{1}{2}(b_ip-\sqrt{b_i^{2}p^{2}-8ab_i^{4}})\) for b 1:

2.2 Crossing point

The function \(\tilde{t}(a, b_i, p)\) crosses the roots \(\bar{t}\) and \(\underline{t}\) at a particular value of b i such that \(b_i=\frac{p}{\sqrt{8a}}:\)

Appendix 3: Proof of Proposition 2

The effect of technological greening on the eco-efficiency indicator is given by the first derivative of I i w.r.t. b − i,

The function \(\breve{t}\) is increasing and concave in b i and equals zero for \(b_i=p/(2\sqrt{a}). \)

3.1 Location of the frontier within the set domain

The frontier \(\breve{t}_i=\frac{b_ip^2-4ab_i^3}{p}\) is such that the effect of technological greening on eco-efficiency indicator level is nill, \(\Uplambda_i^{*}(b_i,t)=0. \) This function \(\breve{t}_i=(b_ip^2-4ab_i^3)/p\) belongs to the set domain

The function \(\breve{t} = (b_ip^2-4ab_i^3)/p\) for b i = 1 gives us \(\breve{t} = (p^2-4a)/p\) and it is located between \(\bar{t}_1\) and \(\tilde{t}_1. \)

Assuming that a < (p 2)/(8b 2 i ) allows us to set a condition on p for b 1. It confirms that \(\bar{t}_1 >\breve{t}_1: a <(p^2)/(8b_i^2) \quad \Leftrightarrow \quad p>\sqrt{8a}. \) Considering this assumption on a we can also confirm that \(\breve{t}_1>\tilde{t}_1: \quad \Leftrightarrow \quad (p^2-4a)/p>p/2 \Leftrightarrow p>\sqrt{8a}.\)

3.2 Crossing point

The function \(\breve{t}(a, b_i, p)\) crosses \(\tilde{t}(a, b_i, p)\) and thus \(\bar{t}(a, b_i, p)\) and \(\underline{t}(a, b_i, p)\) at \(b_i=p/(\sqrt{8a})\) (see Appendix 2) such that

About this article

Cite this article

Bréchet, T., Ly, S. The many traps of green technology promotion. Environ Econ Policy Stud 15, 73–91 (2013). https://doi.org/10.1007/s10018-012-0035-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-012-0035-5