Abstract

We investigate the causal effects of trade intensity in environmental goods (EGs) on air and water pollution by treating trade, environmental policy, and income as endogenous. We estimate a system of reduced-form, simultaneous equations on extensive data, from 1995 to 2003, for transition economies that include Central and Eastern Europe and the Commonwealth of Independent States. Our empirical results suggest that, although trade intensity in EGs (pooled list) reduces CO2 emissions mainly through an indirect income effect, it increases water pollution because the income-induced effect does not offset the direct harmful scale-composition effect. No significant effect is found for SO2 emissions with respect to the list of aggregated EGs. In addition to diverging effects across pollutants, we show that results are sensitive to EGs’ classification, e.g., cleaner technologies and products, end-of-pipe products, environmentally preferable products, etc. For instance, a double profit—environmental and economic—is found only for “cleaner technologies and products” in the models explaining emissions of greenhouse gases. Interesting findings are discussed for imports and exports of various classifications of EGs. Overall, we cannot support global and uniform trade liberalisation for EGs from a sustainable development perspective. Either regional or bilateral trade agreements that take into account the states’ priorities could act as building blocks towards a global, sequentially achieved liberalisation of EGs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

At the beginning of the twenty-first century, one cannot validate the thesis that trade openness yields both economic and environmental gains. Nevertheless, the case for this thesis seems particularly strong for environmental goods (EGs), which can play an important role in the diffusion of ecological technologies. In this study, we consider as “environmental” those goods produced for the purpose of environmental protection (i.e., preventing, reducing, and eliminating pollution and any other degradation of the environment) as well as resource management (i.e., preserving and maintaining the stock of natural resources and, hence, safeguarding against depletion).Footnote 1 All increases in the availability of EGs through trade openness would represent an opportunity for a “win–win–win” relationship between trade, the environment, and development (Yu, 2007), that is (1) trade in EGs should be facilitated through either the reduction or the elimination of both tariff and non-tariff barriers, allowing for further technology transfers; (2) environmental technologies would, thus, be more widely available, at lower costs, facilitating compliance with stricter environmental regulations; (3) new employment opportunities and added value in eco-industrial, eventually export-oriented, activities should contribute to economic development. Taking into account this triple-win scenario and, thus, considering that EGs could play an essential role in sustainable development, Paragraph 31(3) of the Doha mandate, agreed to by all Members of the World Trade Organization (WTO) in 2001, calls for a reduction (or, as appropriate, elimination) of tariffs and non-tariff barriers on EGs and environmental services.

If trade gains from the reduction/removal of tariffs and non-tariff barriers on EGs are more or less appraised (e.g., World Bank 2007; Hufbauer and Kim 2010; Jha 2008; Balineau and de Melo 2011; Sauvage 2014; Nguyen and Kalirajan 2016),Footnote 2 no empirical study provides an estimation of potential gains (or losses) in income from increased trade in EGs, and the empirical literature on the impact on pollution of trade intensity in EGs is still scarce (e.g., Wooders 2009; de Alwis 2015). Generally based on simplistic models, the existing studies are likely to highlight overly optimistic conclusions about the impact of trade liberalisation of EGs on pollution. Moreover, they rarely discuss the channels through which trade in EGs may influence the quality of the environment. For instance, de Alwis (2015) argues that opening trade in EGs would be associated with declining SO2 emissions, regardless of income levels in the 62 countries considered, and that this negative effect on SO2 emissions would be stronger in the capital-abundant countries. Building policies on such results may be misleading, because only direct effects are explored and no assumption is made about the possible endogeneity problem in the relationship between trade in EGs, income (and/or environmental regulation), and pollution.Footnote 3 It is important, therefore, to analyse not only direct climate change impacts (i.e., on GHG emissions), but also broader (direct and indirect) environmental impacts (e.g., on the quality of water, in addition to air pollution).

We should recall that economic literature investigating changes in pollution (e.g., Grossman and Krueger 1993; Copeland and Taylor 1994, 2005; Kagohashi et al. 2015; Levinson 2009; Managi 2011) suggests considering total emissions in a country as the sum of emissions from each economic activity/sector, which may be further written as the total output—i.e., the scale effect—multiplied by each sector’s share in this output—i.e., the composition effect—and the sectors’ emission intensity—i.e., the technique effect. All else being constant, the scale effect measures the increase in emissions when scaling up economic activity (represented by GDP). The composition effect, commonly proxied by the capital-to-labour ratio, reflects the rise (reduction) of pollution due to increased resources devoted to more polluting (cleaner) sectors. Indeed, capital-abundant countries, which have a comparative advantage in capital-intensive activities, are empirically found to be more pollution intensive (see Mani and Wheeler 1998; Antweiler et al. 2001; Cole and Elliott 2003, 2005; Managi et al. 2009). The technique effect is generally captured through per capita income, following insights from the Environmental Kuznets Curve (e.g., Antweiler et al. 2001) and/or various proxies for emission intensities, such as measures of pollutant emissions (e.g., Xing and Kolstad 2002), energy use (e.g., Zarsky 1999; Eskeland and Harrison 2003; Cole et al. 2005), pollution abatement costs (e.g., Keller and Levinson, 2002; Henderson and Millimet 2007; Manderson and Kneller 2012), and indices of environmental regulations’ stringency (e.g., Javorcik and Wei 2004; Ben Kheder and Zugravu 2012; Zugravu-Soilita 2017). Finally, a country’s trade openness (both overall and, in particular, trade in EGs) can affect pollution by (1) increasing economic growth through tariff reduction (scale effect); (2) shifting production from pollution-intensive to more ecological goods, or vice versa (composition effect); and (3) promoting the diffusion and the use of technological innovations (technique effect). Thus, trade is a key variable in explaining the changes in pollution and, together with income and environmental regulations, it should be treated as endogenous (see Harbaugh et al. 2002; Copeland and Taylor 2004; Frankel and Rose 2005; Kagohashi et al. 2015; Managi et al. 2009).

In this study, our focus is not on the overall trade openness of a countryFootnote 4 but on the environmental impact of trade in a distinctive category of products—the EGs—that are supposed to have a direct technique effect on emissions because of the scope of their final use (see Sect. 2). Indeed, increased availability of EGs through trade liberalisation should make it much easier and, eventually, less costly for firms to comply with environmental standards. Hence, polluting firms in the developing countries, mainly importers of EGs, should probably increase their pollution-abatement efforts because of the reduced prices resulting from decreased import tariffs (ICTSD 2008). Moreover, this reduction in environmental compliance costs could encourage local governments to establish more ambitious environmental regulations—i.e., an indirect environmental regulation-induced technique effect on pollution.

Literature investigating the environmental policy design in the context of EGs’ trade liberalisation is mainly theoretical and quite rich (e.g., Feess and Muehlheusser 1999, 2002; Copeland 2005; Canton et al. 2008; Greaker and Rosendahl 2008; David et al. 2011; Nimubona 2012; Sauvage 2014). Although stringent environmental regulations should lead to more environmental R&D by domestic firms and increased export market share of the domestic eco-industry (see Costantini and Mazzanti 2012; Feess and Muehlheusser 2002), Greaker (2006) and Greaker and Rosendahl (2008) suggest that this increase in demand for EGs from the domestic polluting industry may benefit foreign eco-firms at the expense of the domestic eco-industry. Thus, governments of small open economies wishing to develop new successful export-oriented eco-firms would not be likely to set especially stringent environmental regulations. Moreover, Nimubona (2012) shows that reduced trade tariffs on EGs might actually reduce the stringency of pollution taxes, which can result in increased pollution levels. The author suggests that, when (reduced) import tariffs on EGs cannot sufficiently extract rents generated by stringent environmental regulation for an imperfectly competitive eco-industry, the “government regulator in an EG-importing country strategically lessens the stringency of environmental regulation to maximise domestic social welfare”.

In addition, recent theoretical studies (Perino 2010; Bréchet and Ly 2013; Dijkstra and Mathew 2016) find that, despite increasing the expected cleanliness of production, EGs’ trade liberalisation may finally increase overall pollution though a ‘backfire effect’ (rebound effect exceeding 100%), that is, total pollution would increase because more production is allowed by the government enjoying the opportunity for cleaner production (i.e., the trade-induced scale effect offsetting the technique effect). Furthermore, if production of particular EGs is pollution intensive, countries enjoying these EGs’ export opportunities from trade liberalisation could also see their pollution increase (i.e., the trade-induced composition effect). We will further qualify the last two adverse effects as direct scale-composition effects from trade in EGs.

Finally, exporters of EGs should benefit from getting new markets as the result of tariff reductions; this would contribute to economic development by creating more employment and income in eco-industrial activities, allowing for an indirect income-induced technique effect of trade in EGs on pollution. Indeed, income can have a technique effect on environmental quality through two channels: first, it can have a direct effect via consumers’ richness and their willingness-to-pay for the environment, thus reducing pollution during consumption; second, it can have an indirect effect via environmental policy, i.e., by requiring more environmental protection and, therefore, stricter environmental standards. We should then mention that EGs’ import tariffs can play at least two roles in countries that are either not producing EGs or are non-competitive producers. First, EGs’ import tariffs can contribute to welfare improvement because they permit the importing country to retain a portion of the revenues of international eco-industrial firms. Second, according to the literature on the determinants of foreign direct investments, tariffs can lead to technology transfer via investments into eco-industrial activities.Footnote 5 Thus, removal of tariff barriers in a net EG importing country can lead to a loss of income and, thus, to a lower demand for environmental quality.

The originality of this study relies on the empirical investigation of the causal, both direct and indirect, effects of trade intensity in EGs on air and water pollution (CO2, SO2, and BOD) by treating trade, environmental policy, and income as endogenous and, thus, adopting the instrumental variable approach in a system of simultaneous equations. The contribution of this study is to highlight some political implications (e.g., in terms of EGs’ trade liberalisation), enabling us to see the good (or bad) of EGs’ trade intensity by investigating its overall environmental effect, each of its direct scale-composition or technique effects, and its indirect environmental regulation- and income-induced effects. Moreover, we estimate these effects for specific categories of EGs, for example, cleaner technologies and products, end-of-pipe products, and environmentally preferable products (see Sect. 2). For instance, one can expect stronger direct technique effects for imports of end-of-pipe products (as the latter represent direct additional capacity in pollution abatement at home), but higher indirect income-induced effects for exports of such goods (enjoying new/increased markets for high value-added activities). Since trade liberalisation of EGs is expected to increase both imports and exports of EGs, with different (even opposite) channels at work, focusing on a specific flow (EGs imports or exports) would prevent us from estimating the overall environmental effect of trade intensity in EGs.Footnote 6

We have chosen to work on a sample of countries from Eastern Europe and the former Soviet Union for several reasons. First, although the Member States of the Organisation for Economic Co-operation and Development (OECD) represent the major share of the EGs’ market, the fastest growth rates during the last decade occurred in the developing and the transition economies (Kennett and Steenblik 2005). Since EGs’ import tariffs are relatively low in the industrialised countries, an alternative approach to obtain highly ‘visible’ effects on pollution of EGs’ trade openness (i.e., stronger statistical inference) would consist of finding a ‘natural experiment’ for trade in the EGs–pollution relationship. For instance, the investigation of transition economies from Central and Eastern Europe (CEE) and the Commonwealth of Independent States (CIS), between 1995 and 2003, should enable a proper identification of the effects of trade liberalisation, because these countries opened their economies quickly and consistently and experienced strong reductions in pollution levels during the same period (e.g., an 18% decrease in CO2 from industrial activities). In addition, increased EGs’ trade intensity because of the collapse of the Soviet Union and, thus, rushed openness to the world economy due to exogenous factors (unrelated to pollution levels) should be less subject to endogeneity bias. Finally, as stressed in Sect. 2, empirical investigation of EGs’ trade has some limits linked to difficulties in defining and classifying the EGs in the international harmonised system (HS). HS categories at the six-digit level do not allow the designation of specific goods that are really deemed climate friendly, and some designated goods present the ‘double-use’ problem (i.e., the existence of products with multiple uses, some of which are not environmental). Moreover, six-digit HS codes experienced some revisions (1996, 2002), and countries around the world adopted the new codes (some countries still use old codes) to different degrees (delays). Our dataset focused on the transition countries enables us to avoid biases related to aggregation and unobserved heterogeneity.Footnote 7

Consequently, and more precisely, this study seeks to investigate the impact on CO2, SO2, and BOD of trade intensity in EGs in the transition economies between 1995 and 2003 using instrumental variables for trade intensity in EGsFootnote 8 in a system of three simultaneous equations that explain pollution, environmental regulation stringency, and per-capita income. We employ a theoretical framework inspired by Grossman (1995) and Antweiler et al. (2001) for the pollution equation (distinguishing between scale, composition, and technique effects), the main theoretical assumptions of some recent studies on environmental policy design (e.g., Damania et al. 2003; Fredriksson et al. 2005; Greaker and Rosendahl 2008), and the endogenous growth literature (see, for example, Mankiw et al. 1992; Frankel and Romer 1999) for income equation.

This paper is structured as follows. Following this introduction of our research objectives and the literature on trade in EGs, Sect. 2 presents definitions of EGs and stylised facts about our country sample. Section 3 specifies the model to be estimated, and Sect. 4 presents the estimation strategy and data. We discuss the basic empirical results, some robustness tests, and extended empirical findings in Sects. 5 and 6. The last section presents our conclusions and the policy implications.

2 Definition of EGs and some stylised facts

The concept of EGs provides intellectual coverage of all products and all technologies favourable to the environment. However, the lack of a universally accepted definition of EGs has slowed down agreement on product coverage in negotiations on EGs. Various suggestions have been made concerning the criteria for identifying EGs. The criterion of final use or prevalent final use can be applied to the selection of equipment used in environmental activities such as pollution control and waste management. In theory, there is broad support for this criterion, which distinguishes ‘traditional environmental’ goods whose main purpose is to address or remedy an environmental problem (e.g., carbon capture and storage technologies). The lists drawn up by OECD and the member economies of Asia-Pacific Economic Co-operation forum (APEC) have been the references so far, despite the fact that other international organisations work on this classification criterion.Footnote 9 If EGs were to be limited to the OECD and APEC’s narrow lists, only the few advanced developing countries would benefit from trade in EGs. Most developing countries do not yet have well-developed markets for such products. Other criteria could also be applied to identify environmentally preferable products (EPPs). Lists of EPPs (e.g., the UNCTADFootnote 10 list) include products that cause less damage to the environment during one of their life-cycle stages because of the manner they are manufactured, collected, used, destroyed or recovered. In particular, developing countries have suggested that negotiations should not be limited to industrial products (which are of interest to developed countries) but should also include agricultural goods (which are of particular interest to developing countries) because developing countries generally have negative trade balances in traditional environmental goods but considerable export opportunities in EPPs, which often include natural resource-based, raw and processed commodities (UNESCWA 2007). However, to identify EPPs, one must generally resort to labelling and certification measures. Because EPPs differentiate among seemingly similar products, or ‘like products’, the WTO has not yet considered these products in the negotiations on EGs’ trade liberalisation. Several WTO members, including developing countries, fear that the liberalisation of EPPs will lead to discrimination against their products based on non-environmental concerns, e.g., social concerns (de Melo and Vijil 2014). Finally, performance criteria were also proposed, e.g., energy efficiency during product use. However, because of the reality of technological progress and innovation, it can be difficult to apply such criteria in a continuous manner.

Several negotiated lists have been proposed, ranging from the apparently non-debatable ‘core list’ of 26 products (agreed to by Australia, Colombia, Hong Kong, Norway and Singapore in 2011) to the large so-called “WTO list” of 408 products (a combined list that includes many of the OECD and APEC goods and most of the products from the “Friends of the Environment list”). Currently, there are many difficulties involved in defining EGs, including but not limited to the following: (1) the inadequacy of the Harmonised System’s (HS) descriptors regarding the tariff nomenclature, (2) products’ multiple end-use, and (3) relativism and attribute disclosure that occur when a single good is used and disposed of in different ways (e.g., doubt about the use of bio-fuels to save energy, expressed in Steenblik 2007; Hufbauer et al. 2009).Footnote 11 In addition, Balineau and de Melo (2013) suggest that countries mostly submit goods in which they have a revealed comparative advantage and exclude from their submission list goods with high tariffs (thus revealing mercantilistic behaviour, i.e., countries do not propose highly protected goods).

In this study, we investigate relevant categories of EGs to obtain a proper interpretation of empirical results without restricting the analysis to the shortest list of EGs; we attempt to avoid taking an excessively broad approach that would result from an investigation of aggregate lists of highly heterogeneous EGs. More specifically, we consider explicit types of EGs derived from the extremely comprehensible categorization of EGs proposed by UNCTAD (see “Appendix C” and Hamwey, 2005, for more details). That categorization suggests two broad classes of EGs, which are further decomposed into 10 homogeneous groups: (1) Class A EGs (or traditional EGs; most of these EGs, particularly those included in the OECD and APEC lists, are under discussion in WTO negotiations), which include manufactured goods and chemicals used directly in the provision of environmental services; and (2) Class B EGs (i.e., goods that are less supported in the WTO negotiations, particularly the EPPs), which include industrial and consumer goods not primarily used for environmental purposes but whose production, end-use and/or disposal have positive environmental characteristics relative to similar substitute goods. Here, we can also consider less-polluting and energy-saving technologies, the electrical-production facilities using renewable energy, and recycled materials (the so-called Class B Clean Technologies).

Because the OECD and APEC lists were the most discussed and remain (on a relative basis) the most commonly accepted lists pursuant to the Doha Round negotiations, our core empirical analysis is focused on these EGs. Although we choose to investigate two homogeneous sub-groups of EGs from the OECD + APEC list ([end-of-pipe] pollution-control products and [beginning-of-pipe] pollution-prevention/resource-management products), we also extend our empirical analysis to other sub-categories of EGs from the UNCTAD classificationFootnote 12.

To understand the importance of trade in EGs in the transition economies, we provide some stylised facts about trade in EGs, as defined by OECD and APEC. During the studied period 1995–2003, the transition economies’ trade in EGs was at its beginning stage of development, comprising only 3% of total exports and approximately 6% of total imports in 2005. However, we note substantial differences across countries. With respect to imports, a relatively similar figure (5–6%) characterised the two groups of transition economies: CEE and CIS. For EGs exports, the first country group definitely enjoyed greater advantages: 4.5% in total exports in 2005 compared to the second group, in which EGs counted only for 1.3% in total exports. In 2005, imports of traditional EGs and EPPs were two times higher than the exports of these products. Between 1995 and 2004, the trade intensity ((exports + imports)/GDP) in EGs referenced in the OECD + APEC list increased by 150% in the transition economies (and the same trend existed among CEE and CIS countries). The trade intensity of the EPPs increased by 33% during the same period, with an average annual growth rate of 5% in the case of CEE countries and an average annual growth rate of only 1% in the CIS countries. The most spectacular annual growth rates were registered for trade intensity in Class B Clean Technologies: 11% for CEE and 23% for CIS. In 2005, trade in these products represented 1.75% of the total exports and 3% of the total imports of transition economies.

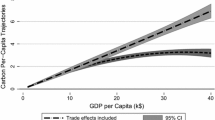

Before conducting a more complex econometric analysis, it would be interesting to examine the primary data and observe correlations. Figure 1 shows an apparent negative relationship between trade intensity in EGs (OECD + APEC list) and [air] pollution in the transition economies.

In Fig. 2, we can also observe a positive correlation between EGs’ trade openness and economic development and between trade openness in EGs and the severity of environmental policy (SEP IndexFootnote 13).

Consistent with the above figures, we would be willing to support trade liberalization of EGs from a sustainable development perspective. However, we should mention that the observed correlations could be caused by endogeneity instead of causality. It has been largely proven, through the environmental Kuznets curve, that income growth has a positive impact on environmental quality. Simultaneously, increasing income and democracy stimulate trade. The endogeneity of trade is a familiar problem in the empirical literature concerning whether openness promotes growth. Harrison (1995) concludes, “[the] existing literature is still unresolved on the issue of causality”. Other causality issues can be identified when analysing environmental regulations, which require firms to use performance technologies and environmental management products, which usually are imported by transition economies from developed countries. Thus, stringent environmental regulation may simultaneously increase the environmental quality and trade intensity in EGs. Consequently, to answer the question about the need to liberalise the transition economies’ trade in EGs so that sustainable development goals can be met, we believe that it is important to develop a system of simultaneous [reduced-form] equations that investigate indirect effects by controlling for endogeneity. As regards the endogeneity, we pay particular attention to trade variables, which are instrumented in our empirical analysis.

3 Theoretical assumptions and econometric specifications

In this section, we examine the direct and indirect determinants of pollution.

3.1 Pollution specification—the direct effects

Following the decomposition proposed by Grossman (1995), the total emissions of a country can be expressed as:

where E is total emissions; i represents countries, t is years and \(j = 1,\,2, \ldots \,n\) are the various economy sectors. Yit is the total GDP (scale of the economy) of country i in year t; it can also be presented by the sum of the n sectors’ added-values, i.e., \(Y_{it} = \sum\nolimits_{j = 1}^{n} {Y_{ijt} }\). \(\gamma_{ij\,t} = Y_{ij\,t} /Y_{it}\) represents the ratio of the sector’s j added-value in the total GDP of country i in year t. We consider parameter eijt to be the ‘effective’ (or ‘net’) emission intensity, i.e., the average quantity of pollution actually emitted in the atmosphere/water for each unit of added-value in the j sectors of country i in year t. According to this equation, total annual emissions of a country can be regarded as the product of the economy’s total added-value (Yit) and the average sectorial pollution intensity, weighted by the ratio of each sector’s added-value in the total GDP (\(\sum\nolimits_{j = 1}^{n} {e_{ijt} } \gamma_{ijt}\)).

Totally differentiating and dividing all Eq. (1)’s terms by E, we can rewrite it as follows:

This decomposition defines the three famous pollution determinants. \(\hat{Y}\) indicates the scale effect, thought to be a growth factor of pollution. All else being equal, any production increase means a quasi-proportional increase in pollution. The composition effect is represented by \(\hat{\gamma }\). Dynamic changes in \(\hat{\gamma }\) represent the impact on pollution of any change in the structure of economic activities. The third term represents the technique effect. The use of clean technologies, more efficient production techniques, and abatement efforts can reduce pollution for the same level of economic growth and industrial structure.

As we have seen in the introduction, numerous works, such as Lucas et al. (1992), Harbaugh et al. (2002), Dean (2002), Copeland and Taylor (2001, 2004), Antweiler et al. (2001) and Frankel and Rose (2005), have shown that scale, composition, and technique effects are endogenous and often determined by the country’s overall trade openness. Trade openness can have a direct impact on environmental quality in the sense that tariff reduction either increases trade intensity, thereby influencing economic growth [first term in Eq. (2)], or simply shifts production from pollution-intensive goods to more ecological goods, or vice versa [second term in Eq. (2)]. In addition, trade openness can have a direct impact on not only the technologies used but also abatement efforts [third term in Eq. (2)]. Thus, trade openness is an economic determinant of pollution to be considered together with all variables representing scale, composition and technique effects.

Focusing on the expected (technique) effect of trade in EGs, we consider the average ‘net’ emission intensity of polluting sectors of country i in year t [third term in Eq. (2)] to be given by the following additively separable function: \(e = \theta - g(a)\), where θ is the average ‘gross’ emission intensity of polluting activities, depending on the technology used (i.e., when no ‘end-of-pipe’ pollution abatement occurs, but it could result from a ‘beginning-of-pipe’ technique or an ‘integrated solution’), and a is the total demand for products used in the “end-of-pipe” pollution abatement process.Footnote 14 Following our literature review in the introduction, we further make the following assumptions:

-

The term \(e\) is a function of EGs’ trade intensity, particularly of trade in “beginning-of-pipe” or cleaner technologies and products (CTP) affecting the parameter θ (pollution prevention) and of trade in end-of-pipe products (EOP) influencing the parameter a (pollution abatement). Indeed, trade openness is supposed to reduce the local price of EGs, thus inducing increased demand for these goods that is characterised by negative own-price elasticity. Hence, because abatement and cleaner technologies become less expensive and more widely available, one can anticipate a reduction in pollution. Therefore, trade intensity in EGs (CTP and EOP) is assumed to have a direct negative (technique) effect on pollution, provided it does not affect either the economic structure or the production levels.

Otherwise, because it is subject to the same level of environmental regulation, and despite the marginal abatement cost reduction caused by the trade liberalisation of EGs, one can be encouraged to produce more by maintaining the same total initial level of abatement costs, thus increasing total pollution. This ‘rebound effect’ could also suppose a direct positive scale-composition effect on pollution for trade in EGs (Perino 2010; Bréchet and Ly 2013; Dijkstra and Mathew 2016).

-

The technique effect \({\text{e}}\) is also a function of the environmental policy stringency, τ, because regulation acts directly on firms’ production technology used (θ) and pollution-abatement efforts (a). Empirical investigations (e.g., Arimura et al. 2007; Cao and Prakash 2012; Eskeland and Harrison 2003) show that, all else being equal, well-designed and stringent environmental policy is associated with increased environmental R&D, thus boosting environmental innovation and further lowering pollution intensities.

-

Considering total pollutant emissions in a country, consumer behaviour in relation to the environment should also be taken into account, because environmental regulation cannot systematically affect the abatement efforts and technology used in the consumption processes, such as household heating and transport. Households are not usually asked to make capital investments for controlling pollution; rather, they are asked to alter their behaviour. Thus, consumer willingness-to-pay to reduce pollution (usually proxied by per capita income)—i.e., how much is the consumer willing-to-pay for a particular level of an environmental good?—is an important measure, generating a technique effect together with environmental regulation and trade intensity in EGs. Moreover, when formal regulation is either weak or perceived as insufficient, communities that are strongly concerned about environmental quality may informally regulate firms (either indirectly or directly) through bargaining, petitioning, and lobbying and also by organising in NGOs to provide environmental education to the public and/or technical assistance to polluters (e.g., Fredriksson et al. 2005; Dasgupta et al. 2001; Esty and Porter 2001; Javorcik and Wei 2004).

Consequently, the amount of abatement that is undertaken—i.e., g(a)—depends on abatement costs, the efficiency of environmental regulation, and willingness-to-pay for abatement. The same assumption is made about the demand for cleaner production technologies (influencing parameter θ), i.e., the decision to adopt cleaner technologies and products depends on their costs and availability, environmental regulation, and willingness-to-pay for environmental quality.

Following the above-discussed assumptions, we can write the specification explaining a country’s total pollution:

with \(\gamma_{it} = f\left( {K_{it} /L_{it} } \right), \theta_{it} = f\left( {{\text{CTP}}_{it} ,\tau_{it} ,R_{it} } \right), a_{it} = f\left( {{\text{EOP}}_{it} ,\tau_{it} ,R_{it} } \right)\), where Y is the scale of economy (total GDP); \(\gamma = f\left( {K/L} \right)\) is the composition effect supposed to be function of capital (K, stock of capital) to labour (L, active population) relative endowments (Antweiler et al. 2001, solve for the share of polluting production in total output as a function of the capital-to-labour ratio); CTP is trade intensity in “beginning-of-pipe” or cleaner technologies and products; EOP is trade intensity in “end-of-pipe” EGs; τ is the stringency of the environmental regulation; R represents per capita income supposed to capture the willingness-to-pay for environmental goods, as it is commonly assumed that environmental quality is a normal good; and Open is the variable of overall trade openness.

3.2 Indirect effects: environmental regulation- and income-induced technique effects

In addition to the above-specified direct effects, and following the reviewed theoretical literature, trade intensity in EGs can also influence pollution by affecting the level of both environmental regulations’ stringency and economic development (per-capita income). In addition to controlling for endogeneity, estimating a system of simultaneous equations should allow us to identify these indirect channels of the influence of trade intensity in EGs on environmental quality.

First, we derive the environmental regulation specification (τ) from recent studies on environmental policy design. Both theoretical and empirical studies have shown that trade, democracy, corruption, and income have a substantial influence on the stringency of the environmental policy. Damania et al. (2003) have developed a theoretical model that has produced several testable predictions: (1) trade liberalisation increases the stringency of environmental policy; (2) corruption decreases the stringency of environmental policy; and (3) the effect of trade liberalisation (corruption) on environmental policy is conditional on the level of corruption (trade openness). All these predictions are validated empirically using data from a mix of 30 developed and developing countries from 1982 to 1992. Trade may directly influence the stringency of environmental regulations via either “race to the bottom” (negative effect) or “race to the top” (positive effect) phenomena that are said to occur when competition between either nations or states (over investment capital, for example) leads to either the progressive dismantling of or an increase in regulatory standards. Based on predictions generated by a lobby group model and empirical findings, Fredriksson et al. (2005) suggest that environmental lobby groups tend to positively affect the stringency of environmental policy. Moreover, political competition tends to increase the policy stringency, particularly when citizens’ participation in the democratic process is widespread. However, Wilson and Damania (2005) suggest that, while political competition can improve policies, it cannot eliminate corruption at all levels of government. Similarly, Pellegrini and Gerlagh (2006) find that corruption stands out as an important determinant of environmental policies, whereas democracy has a very limited impact. Zugravu-Soilita et al. (2008), using a common agency model of government for environmental policy creation, make the empirical finding that, in addition to corruption, political instability, and current average pollution levels, the stringency of environmental regulation depends on the consumers’ preferences for environmental quality, represented by per capita income.Footnote 15 Indeed, higher revenues induce more preferences for better environmental quality on behalf of the population and, thus, more stringent environmental regulation. Finally, some works highlight the endogeneity of environmental policy design with respect to the supply of EGs. Greaker and Rosendahl (2008) conclude that especially stringent environmental regulation might be well founded, because it increases the competition between technology suppliers, leading to lower domestic abatement costs. Consequently, if liberalisation of EGs takes place, this phenomenon may amplify. Thus, import tariffs’ cut-off induces the government to raise its environmental standards, anticipating firms’ ability to more easily comply with them as EGs become more available. As an empirical validation of these assumptions, Costantini and Mazzanti (2012) find, in a gravity model of trade, that environmental and energy taxes in the EU-15 countries between 1996 and 2007 have been associated with higher exports of EGs. However, Greaker (2006) suggests that foreign eco-firms would compete with local (emerging) eco-firms by also increasing their R&D spending and sales of EGs to the country that is raising the environmental standards. As stated in Greaker and Rosendahl (2008), “an especially stringent environmental policy is not a particularly good industrial policy with respect to developing successful new export sectors based on abatement technology”. In addition, David et al. (2011) show that eco-firms might even reduce their output when the demand for the abatement goods becomes more price inelastic because of overly severe taxes. Finally, economic theory (namely the pollution haven hypothesisFootnote 16) suggests that (1) strict environmental standards weaken a country’s competitive position in pollution-intensive industries, and (2) enforcement causes firms that are active in pollution-intensive industries to relocate their activities to less-regulated countries. Thus, the impact of trade intensity in EGs (EOP and CTP, respectively) on the stringency of the environmental policy would depend on the competitiveness of local firms and the reactiveness of the government in accordance with its industrial policy.

We can, thus, write the following specification for the stringency of environmental regulations:

with Democ for democracy and Corrup for corruption level—the other variables being specified in Eq. (3).

Next, we specify the income specification (R), following the endogenous growth literature. As highlighted by Rodrik et al. (2004), labour and physical and human capital, while affecting economic development, are, in turn, determined by deeper, more fundamental factors that fall into three broad categories: geography, institutions, and trade (see, e.g., Acemoglu et al. 2001; Frankel and Romer 1999; Sachs 2003). Easterly and Levine (2003) provide a good overview of how each of these three determinants has been treated in the literature with the aim of explaining the vast differences in growth and levels of income amongst countries. Institutional quality is widely considered as one of the most important sources of economic development, whereas geography acts indirectly through the channel of institutions. However, Hibbs and Olsson (2004) demonstrate the importance of initial biogeographic conditions 12,000 years ago—conditions that facilitated the transition from hunting–gathering to agriculture—as a nearly ultimate source of contemporary prosperity. Even if institutional conditions are considered, biogeography and geography remain significant explanatory variables for variations in the level of economic development around the world. Gallup et al. (1999) state that geography plays a fundamental role in economic productivity through four main channels (direct and indirect): human health, agricultural productivity, physical location, and proximity and ownership of natural resources. Regarding the relative importance of the three deep determinants, Rodrik et al. (2004) report that institutions are the most significant contributors to economic development, once the endogeneity of institutions and trade has been properly accounted for (leaving a negligible role for geography, and trade). Sachs (2003), however, finds that geographical factors are the most important deep determinants of income and output, whereas Frankel and Romer (1999) underscore the importance of international trade. Those authors suggest that trade has a quantitatively large and robust significant and positive effect on income. However, when considering transition economies, the impact of trade liberalisation on development may be different depending on adjustment costs. The most serious adjustment costs associated with trade liberalisation and the transition process from centralised to market economies are the social costs that are either reflected in various indicators of poverty or measured by the level of unemployment. Recent experience in CEE/CIS countries also confirms the importance of better public and private governance and a favourable business climate for reducing poverty. Trade liberalisation is often made responsible for both the deterioration in these countries’ trade balances and fiscal problems stemming from the contraction of foreign trade-related taxes in budget revenues.

As regards income as an indirect channel of the effect of trade on pollution, Dean’s (2002) simultaneous-equations system estimation shows that, despite increasing industrial (water) pollution through the effect of pollution havens, international trade also contributes to China’s economic growth and higher income that reinforces public demand for better environmental quality.

Income specification may be written as follows:

where Geo represents geography/settlement characteristics, and Inst is institutional quality, represented here by civil liberties and political rights, namely the Democ variable.

3.3 Trade in EGs–pollution model: a system of three simultaneous equations

We build the following system of three reduced-form, simultaneous equations: the first identifies the direct effect on pollution of trade intensity in EGs, whereas the second two capture the indirect technique effects of trade intensity in EGs, passing through environmental regulation and income, respectively:

We distinguish three endogenous variables, E, τ, and R, in our system along with nine explanatory variables (Y, K, L, Democ, Corrup, Geo, Open, EOP, and CTP) (see also Fig. 3). The system is, thus, overidentified and may be estimated. However, it is often argued that the correlation between trade and income makes it difficult to identify the causality direction between the two. Similarly, double causality may be revealed between trade and environmental regulation, as mentioned in the previous sections. Consequently, trade should also be considered endogenous, and, thus, instrumented by controlling for all the variables in the system affecting it to assess its proper effects. We follow the methodology proposed by Frankel and Rose (2005) to instrument trade by predicting bilateral “natural” flows in a gravity equation, which is one of the most-used tools for this purpose for at least the following reasons: very good empirical explanation of trade flows; a theoretical base that is well understood (i.e., either a monopolistic competition model with transport costs or a Heckscher–Ohlin model with trade costs); and the crucial role given to geography, which has taken its place in international economics.

Conceptual model linking pollution to trade intensity in EGs (e.g., EOP and CTP). The sign of expected effects is specified in parentheses; grey boxes indicate endogenous variables (either estimated as the dependent variables E, τ, R, or instrumentalised using a gravity equation); ε represents error terms of system equations, which are estimated simultaneously using a three-stage least squares technique (instrumental variable estimates, taking into account the covariances across equation disturbances)

In the first system—Eq. (6) (direct effects on pollution—the upper side of Fig. 3)—all else being equal, we expect positive coefficients for the scale (Y) and composition (K/L) effects and negative coefficients for the variables R and τ capturing the technique effect. The coefficients of our (instrumented) trade-intensity variables (Open and, in particular, EOP and CTP) are supposed to represent the prevailing direct impact on emissions, that is, the counterbalance between the expected negative-technique effect and a positive scale-composition effect (in the case of a ‘rebound effect’ or ‘multiple use’ products).

As regards the mediation channels (middle and bottom sides of Fig. 3), the stringency of environmental regulation (τ) is expected to be negatively affected by corruption, and, oppositely, to become stricter in more democratic societies. Democracy is also expected to enhance per capita income (R), which should also be affected by geography (higher latitudes are usually associated with higher development levels) and factor endowments (capital-intensive countries should enjoy higher income, and inversely, labour-intensive countries should have lower per capita income levels). Based on the literature review, we should expect ambiguous effects of our core variable, trade intensity in EGs, on environmental regulations and per capita income. These indirect effects would depend on the local eco-firms’ competitiveness, the local industrial policy and the nature of trade-induced income (e.g., tariff revenues (and thus losses under trade liberalisation) in a net importing country, revenues from high value-added eco-activities, etc.).

4 Empirical strategy

4.1 Data

In our empirical study, we use both country-specific and bilateral data from various sources (see “Appendix B” for the definitions and sources of all variables).Footnote 17 In addition to trade variables, which are instrumented in our study, we use three endogenous variables in our system of simultaneous equations:

-

Pollution (CO2, SO2, and BOD are used to encompass at least two dimensions, air and water pollution, because EGs may have multiple uses and impacts on the overall environmental quality). Data on total CO2 emissions come from IEA and cover 24 CEE/CIS countries from 1995 to 2003, whereas data on SO2 emissions are available for 22 countries from 1995 to 2002 (with some missing points for 2001 and 2002).Footnote 18 The data source of the SO2 variable is an exhaustive data set of worldwide emissions of sulphur dioxide, carefully constructed by Stern (2006) from his own econometric estimates. SO2 (anthropogenic) emissions have characteristics that make them suitable for studying the effects of trade on the environment: a by-product of goods production; strong local effects; regulation across many countries; and available abatement technologies. Note that the focus of the paper is positive analysis, i.e., we are interested in linking pollution to potentially traded production. That is why we use data on emissions instead of on concentration, even though the latter would be more appropriate to address welfare issues. For organic water pollution (BOD in kg per day), we use data from the World Bank that cover 18 countries from 1995 to 2003, with some year/country missing points. Finally, we consider total GHG emissions for comparison, but because these data are available only for 2 years (1995 and 2000) in the time period considered (1995–2003), we analyse this pollutant only in the first part of our empirical work. Data on GHG come from the Climate Analysis Indicators Tool, World Resources Institute.

-

Stringency of environmental policy (SEP), our proxy for environmental regulation, is one of the most difficult variables to measure because comparable data do not exist for every country in the world and over time. We use the SEP index constructed by Zugravu-Soilita et al. (2008). This index simultaneously comprises variables both of environmental policy and of industries and the population’s ability to organise in lobbies (nongovernmental organizations, etc.) to pressure government behaviour in a more environmentally friendly direction. The SEP index is computed following the Z-score technique as applied to five indicators: the number of signed multilateral environmental agreements (MEAs), the existence of an air-pollution regulation, the density of international nongovernmental organizations (INGOs), the number of ISO 14001-certified companies, and adhesion to the Responsible Care® Program. Aware of this measure’s potential limits, we perform robustness tests by employing an alternative proxy for the stringency of environmental regulations (SER index) that is computed using—in addition to INGOs, MEAs and ISO 14001—an output indicator (GDP per unit of energy used, climate netted out) that is a real measure of the impact of the former component variables in the aggregated index. This should enable us to distinguish countries that apply effective environmental measures from those that adopt a “theoretical” environmental policy with no efforts to assure compliance.

-

Income/economic development is represented in our study by per capita Gross National Income (GNI/cap), with the data coming from the WDI (World Bank). We follow the strategy of Antweiler et al. (2001), which considers the difference between GDP (measuring the intensity of the economic activity in a given country) and GNI/cap (capturing here the richness of a country’s inhabitants and more specifically, their willingness-to-pay for environmental goods). Thus, to distinguish between the scale of the economy and income, GDP and GNI/cap enter simultaneously our pollution equation.

As explanatory variables in our system of simultaneous equations, we list GDP, relative factor endowments, geographic and institutional factors, instrumented variables for overall trade openness and EGs’ trade intensityFootnote 19. We use the variable Lat (latitude) as a proxy for geographic factors. Latitude gives a place’s location on Earth either north or south of the equator and is one of the most important factors determining a location’s climate. Institutional factors are represented by two variables, Corrup and Democ, which mean corruption level and democracy, respectively. The first variable comes from the database constructed by Kaufmann et al. (2005), namely it is the opposite of the corruption control index.Footnote 20 Kaufmann et al.’s (2005) indicators are highly positively correlated. For that reason, we use a different data source for our democracy variable, which is represented in our study by the Freedom House democracy index. Freedom in the World, which is published by Freedom House, ranks countries according to their political rights and civil liberties, both of which are largely derived from the Universal Declaration of Human Rights.Footnote 21 In our study, we use a variable Democ, which is computed by taking the inverse of the mean of political rights and civil liberties indicators. Thus, higher values of Democ correspond to higher democracy levels.

Finally, trade openness is proxied in our study by trade intensity—namely (Exports + Imports)/GDP—and is instrumented using a gravity equation. Bilateral trade values come from the UN COMTRADE’s world-trade database reporting flows at a high level of product disaggregation. We combine this database with the EGs’ classification listsFootnote 22 specified at the HS 6-digit level and obtain a new dataset for trade in EGs. Thus, we obtain several EGs’ trade variables:

-

Trade_EGs and TradeInt_EGs: trade flows (Trade) and trade intensity (TradeInt) in EGs (pooled lists);

-

TradeA_OA and TradeIntA_OA: trade flows and trade intensity in Class A EGs, OECD + APEC (OA) list. The OA list covers three groups: (A) pollution management (mainly end-of-pipe products), (B) cleaner technologies and products, and (C) resources management. Combining the second two groups in the same-EGs’ category of goods designed to prevent environmental degradation, we obtain the following sub-groups of EGs referenced in OA list:

-

TradeA_EOP and TradeIntA_EOP: trade flows and trade intensity in end-of-pipe products from the OA list, distinguishing between air and water pollution (although these variables have the same name in our regressions, they involve different products while explaining air or water pollution); and

-

TradeA_CTP and TradeIntA_CTP: trade flows and trade intensity in products preventing environmental degradation, here called cleaner technologies and products from the OA list;

-

-

TradeA_OtherEGs and TradeIntA_ OtherEGs: trade flows and trade intensity in Other type Class A EGs not included in the OA list;

-

TradeB_CT and TradeIntB_CT: trade flows and trade intensity in Clean Technologies, Class B EGs; and

-

TradeB_EPP and TradeIntB_EPP: trade flows and trade intensity in Environmentally Preferable Products, Class B EGs.

There are other class B EGs, which are very particular classifications reported in “Appendix C” that are not considered in this study. Here, we focus on the most-discussed categories of EGs.

4.2 Estimation technique

Before estimating our system of simultaneous equations, we test the exogeneity of our explanatory variables. The Durbin–Wu–Hausman test reports endogeneity for GNI/cap, SEP, trade intensity in EGs and GDP. The same test shows that the 1-year lagged GDP is exogenous for this model; we thus use the variable GDPt-1 in our estimations. Because GNI/cap and SEP are endogenous in our theoretical specifications (being estimated through separate equations), we need only to instrument trade flows. For this purpose, we run panel fixed-effects gravity equations to obtain valid instruments for our trade variables.Footnote 23

Our system of three simultaneous equations is estimated using a three-stage least squares (3SLS) procedure.Footnote 24 To do this, we need to check for both the correctness of the specification and the internal consistency of the entire system. Thus, we run the Hausman test for misspecification, which does not reject the null hypothesis of no systematic difference between the 3SLS and the 2SLS estimates, meaning that the 3SLS estimators are both consistent and efficient.Footnote 25 Moreover, the underidentification test (Anderson LM statistic: 19.481, with Chi-sq(3) P val = 0.0002) indicates that the matrix is full column rank—i.e., the model is identified—whereas the Sargan–Hansen test of overidentifying restrictions (Chi-sq(2) P val = 0.5014) does not allow us to reject the null hypothesis of instruments’ validity, i.e., the instruments are uncorrelated with the error term and the excluded instruments are correctly excluded from the estimated equation.

For our panel data, we need to conduct panel 3SLS. One way to do so is to use country dummies in each of our system’s equations to capture the unobserved country-specific effects. However, fixed effects/country-dummies models have some weaknesses. Too many dummy variables can significantly reduce the degrees of freedom needed for powerful statistical tests. In addition, a model with too many dummies may suffer from multicollinearity, which increases the standard errors. Consequently, the panel was resolved in this study by using Stata’s command ‘xtdata’, which transforms the data set of all of the variables as follows: ‘xtdata, fe’ for fixed effects (within) estimation (for each cross-sectional unit, the average over time is subtracted from the data in each time period/time-demeaned data) and ‘xtdata, re’ for random effects, allowing a simultaneous explanation of changes over time and among units. We opt for a random-effects estimation for four reasons. First, descriptive statistics for our core variables (in particular, trade intensity in EGs) clearly indicate that standard deviation between is higher than within. Second, some variables of interest to this study are either mostly time-invariant or fluctuate moderately, such as institutional variables. Third, for each specification, we run a Breusch–Pagan–Lagrange multiplier test. In all of our specifications, random effects are significant. Finally, the random-effects assumption is that individual specific effects are uncorrelated with the independent variables. The fixed-effect assumption is that the individual-specific effect is correlated with the independent variables. If the random-effects assumption holds, the random-effects model is more efficient than the fixed-effects model. In our regressions, the residuals are supposed to be orthogonal to the predetermined variables because the model is estimated through 3SLS, which corrects estimators for endogeneity and cross-equation error correlations. Consequently, random-effects estimations are assumed to perform better.

5 Empirical results

Empirical results from the estimation of our system of simultaneous equations for CO2 emissions (model 1), SO2 (model 2), BOD (model 3), and total GHG emissions (model 4) are reported in Table 1. In these models, we first investigate trade in EGs classified by the OECD and APEC lists.

In our regressions, SEP represents the technique effect engendered by the environmental regulation, which is estimated separately from a technique effect induced by consumers’ willingness-to-pay for environmental quality, GNI/cap. The composition effect is estimated in a flexible way by authorising its sign and size to be dependent on the relative capital endowments. Our empirical results confirm the following theoretical assumptions: GDP (models 1–4) and, to a lesser extent, physical capital endowments (model 4) tend to increase pollution, whereas SEP (all models) and per-capita income (except for SO2 emissions) reduce it.

Trade openness, in general, appears to increase both CO2 and SO2 emissions. Trade intensity in end-of-pipe EGs is found to increase CO2, BOD, and total GHG emissions and to decrease SO2 emissions. Abatement processes thus seem to be most efficient in curbing SO2-polluting activities in transition economies because the direct-technique effect of trade in end-of-pipe products dominates over its scale-composition effect for this pollutant. For trade in cleaner technologies and products, we find a direct negative and statistically significant effect both on GHG emissions and on CO2 (models 1 and 4). We find that trade intensity in these types of EGs has no direct impact on SO2 and BOD emissions (models 2 and 3). To conclude in terms of climate change issues, we qualify trade in end-of-pipe EGs as harmful for the environment (however, a beneficial role is found for SO2 reduction). Conversely, trade in cleaner technologies and products appears to contribute to climate-change mitigation. Nonetheless, if indirect effects are not considered, this conclusion is very partial.

The estimation results for environmental policy equation show a positive effect of GNI/cap in our CO2 and BOD models. Corruption is found to reduce the stringency of the environmental policy in the SO2 model. With regard to trade openness (Open), we find no support for either “race to the bottom” or “race to the top” phenomena. As expected, trade intensity in end-of-pipe products increases the stringency of environmental regulation (models 1, 2, and 3). Increased availability of end-of-pipe abatement technologies and products enables governments to set more rigorous environmental standards because compliance becomes effortless. Conversely, we find a negative impact of trade intensity in cleaner technologies and products on the severity of the environmental policy (models 1–3). We can suppose, based on Greaker and Rosendahl’s (2008) findings, that stringent environmental regulation was not the optimal strategy for transition economies, which were mostly net importers of such products during the investigated period. Indeed, the increased demand for EGs from the domestic polluting firms as a response to higher environmental standards would have mostly benefit to foreign eco-firms at the expense of the domestic, emerging eco-industry. This last finding gives some support to the “race to the bottom” hypothesis when considering trade in cleaner technologies and products; Nimubona (2012) also makes a similar finding in a theoretical model for EG-import-dependent countries in the presence of imperfectly competitive foreign eco-industries.

The income equation’s estimates confirm the predictions of the endogenous growth literature. We find that relative capital abundance and distance from the equator increase per-capita income. These results are both robust (i.e., there are similar results for models explaining pollutants of different nature) and highly significant. With respect to the trade intensity in EGs, we find that only trade intensity in cleaner technologies and products has a positive, statistically significant impact on income in our CO2, SO2, and BOD models. Finally, although trade openness has no impact on income in air-pollution models, it appears to reduce GNI/cap in the model explaining BOD emissions. Large trade deficits and related high unemployment rates in CEE/CIS could partially explain this finding. Thus, our results contradict (to an extent) our theoretical assumptions, i.e., that trade increases income (see Frankel and Romer 1999). However, Rigobon and Rodrik (2004) suggest that Frankel and Romer’s (1999) finding is not robust to the inclusion of institutional quality. The authors conclude that “openness (trade/GDP) has a negative impact on income levels after we control for geography and institutions”. Thus, we confirm this finding after having controlled for both geography (distance from the equator) and institutions (civil liberties and political rights).

Concerning the indirect effects on pollution of trade intensity in EGs, we may actually compute (1) exclusive indirect effects, as a more restrictive concept including only those influences mediated by the channel variables (e.g., the exclusive indirect effect of trade in EGs on CO2 mediated by GNI/cap is the compound path EGs → GNI/cap → CO2), and (2) incremental indirect effects, including all compound paths subsequent to our channel variables (e.g., the incremental indirect effect of trade in EGs on CO2 mediated by GNI/cap is the combination of two compound paths: EGs → GNI/cap → CO2 + EGs → GNI/cap → SEP → CO2).Footnote 26 For instance, the ‘restrictive overall (direct + exclusive indirect) effect’ on CO2 emissions of trade intensity in CTP (lnTradeIntA_CTP) is computed as follows:Footnote 27 (− 0.1208) [direct effect] + (− 0.0225) × (− 4.6132) [exclusive indirect effect via SEP] + 0.0858 × (− 0.5593) [exclusive indirect effect via GNI/cap] = − 0.065. To get the ‘wide overall (direct + incremental indirect) effect’, the compound path CTP → GNI/cap → SEP → CO2: 0.0858 × 0.0604 × (− 4.6132) = − 0.024 should also be included, leading to a total impact of − 0.089. Thus, the direct effect of trade in CTP is of − 0.12 (i.e., a 100% increase in CTP trade intensity would reduce CO2 emissions by 12%). However, due to significant indirect effects (mainly, because of a (detrimental) environmental regulation–induced indirect effect), the overall impact on CO2 emissions is weaker (− 0.089).

To summarise the findings explored in Table 1 and draw some conclusions, we compute the wide overall impact (including incremental indirect effects) of trade intensity in EGs on pollution (Table 2), to see if the indirect effects, via SEP and GNI/cap, amplify, reduce, or even offset its direct impact on pollution (prevailing scale-composition or technique effect). We display only the sign of statistically significant total effects, because the magnitudes of the estimated coefficients are not directly comparable across CO2, SO2 and BOD models (estimated on distinct time and country samples).

-

For trade intensity in end-of-pipe products, we find that the direct positive (prevailing scale-composition) effect on CO2, and GHG emissions, in general, is offset by the indirect negative technique effect via SEP, thus generating a negative total impact on these pollutants (see Table 2). In other words, if trade in end-of-pipe EGs appears to reduce the country’s total GHG emissions, it is not because of its direct, final-use technique effect but because of an induced technique effect on overall economic activity through upgraded environmental regulations. The same net impact is found for SO2 emissions, with the difference that the negative indirect effect via SEP amplifies their direct technique effect, which has been found to prevail over the scale-composition effect. As regards the BOD emissions, in addition to its positive, prevailing direct scale-composition effect, trade intensity in end-of-pipe products does not have any indirect technique effect on these types of emissions, thus resulting in a harmful overall impact on water pollution. No impact on income is found for trade intensity in these products. In conclusion, trade intensity in end-of-pipe products was found to increase pollution in the transition economies via a direct, positive, and prevailing scale-composition effect (CO2, BOD, and GHG models). Fortunately, this harmful effect is offset (CO2, SO2, and GHG models) by a positive impact on the stringency of environmental regulations. Although environmental benefits are found for air pollution, our empirical results do not support the double profit (economic and environmental) of trade in end-of-pipe EGs in transition economies.

-

Our empirical results underscore a negative direct impact of trade intensity in cleaner technologies and products on CO2, and GHG emissions in general, strengthened by a negative indirect effect (the harmful impact via SEP being offset by a beneficial effect via income) in the case of CO2 pollution. Regarding SO2 and BOD models, in which no direct impact is found, the indirect effect via income does not compensate for the detrimental effect induced through SEP, thus producing a positive (or harmful) net impact on these pollutants. For this type of EG trade intensity, double profit (environmental and economic) is found only in the model that explains CO2 emissions. Thus, these products’ trade liberalisation could be particularly supported while targeting climate-change mitigation.

We, therefore, identify various transmission channels for these two categories of EGs: direct technique effects for both of them, though on different pollutants, and even a prevailing harmful scale-composition direct effect for end-of-pipe products; and favourable indirect effects passing through environmental regulation in the case of end-of-pipe products and via income in the case of cleaner technologies and products.

6 Robustness checks and extended empirical analysis

6.1 Tests for environmental regulation variable

First, we perform a robustness test for the SEP variable. We run models (1)–(4) by replacing the SEP variable with a new proxy, the Stringency of Environmental Regulation (SER) index. This proxy differs from the previous one using as components (in addition to the density of INGOs and the number of ISO 14001 certified companies) the number of ratified MEAs, instead of signed MEAs, and energy efficiency, instead of the existence of a regulation on air pollution and adhesion to the Responsible Care® Program. Countries that ratify more MEAs prove their governments’ concern about environmental protection. We believe that it is important to consider MEA ratification in robustness tests because it is often argued that it is the ratification, not the year of signature, which imposes the requirement of compliance with an international environmental treaty. Moreover, because no definition of composite variables really exists, we also believe it important to have an index with consistent but different component variables. Furthermore, because the SEP variable is created using the Z-score method, we have decided to discuss here empirical estimators for the SER index computed using the principal component analysis (PCA) technique, thus highlighting robustness for both component variables and computation technique. Table 7 in “Appendix E” reports comparative estimates for our system of simultaneous equations (CO2, SO2, BOD, and GHG) using the SER index as proxy for the stringency of environmental regulation. The empirical results confirm the robustness of our previous findings, namely, for EGs’ trade intensity estimates. Other core variables, such as environmental regulation and income, retain their sign and significance levels, having very similar coefficients.

6.2 Alternative EGs classifications

In this subsection, we extend our empirical analysis by considering alternative classifications of EGs. We investigate the environmental impact of trade intensity in other Class A EGs that are not included in the OA list (TrInA_OtherEGs), along with the most-often discussed Class B EGs: clean technologies used for power generation and environmentally preferable products (TradeIntB_CT and TradeIntB_EPP, respectively). Many developing countries wish to have these products included in the EGs’ list for WTO negotiations on trade liberalisation.

Table 3 displays results for alternative classifications of EGs. On the whole, our control variables retain their sign and significance compared to our benchmark estimations (models 1–3). With respect to EGs, only trade intensity in environmentally preferable products has a direct negative effect on CO2 emissions, and it has no technique indirect effects. This result is, in some sense, obvious, because the production, consumption, and/or disposal of environmentally preferable products are less polluting (suggesting a negative scale-composition direct effect), and their uses are not pollution-abatement processes (so no technique effect is expected). No significant effect is found for SO2 emissions, which are industrial by-products and, thus, are not directly linked to consumer products. However, trade intensity in environmentally preferable products seems to raise water pollution through an induced reduction in income.

With respect to other Class A EGs that are not included in the OA list, trade intensity in other type A EGs appears to only reduce water pollution through the indirect income channel, which offsets its surprisingly negative impact on the stringency of environmental policy. Similar to environmentally preferable products, although no significant effect is found for SO2 emissions, a harmful impact is found for CO2 emissions.

Finally, trade intensity in Class B clean technologies reduces CO2 and SO2 emissions through indirect channels, primarily through environmental regulation (CO2 and SO2 models), but also through the income effect (CO2 model). The opposite effect is found for BOD emissions that increase with trade intensity in Class B clean technologies via its direct positive scale-composition effect, which is reduced but not offset by the negative indirect-income effect (see Table 4 for overall impacts).

Finally, in this sub-section, we run some additional regressions on the lists of aggregated EGs (see Table 8 in “Appendix E”). The first three models regress pollution on trade intensity in all the EGs referenced in the OA list (EOP and/or CTP), whereas the last three models consider any environmental good that is included in either class A or class B. The six estimation models underline similar findings: when considering pooled/large lists, trade intensity in EGs is found to have an overall negative impact on CO2 emissions as a result of the only significant indirect income effect. Considering BOD emissions, the indirect income effect does not offset the direct positive scale-composition effect, thus inducing a globally harmful effect on water quality. No impact is found for SO2 emissions. This last finding may be explained by the divergent effects found on SO2 emissions for trade intensity in the OA list’s two sub-categories: end-of-pipe products and cleaner technologies and products. Those sub-categories create the interest in separately studying specific and accurate EGs classifications, which enable the identification of homogeneous EGs’ sub-categories that have different transmission channels. For overall trade openness, in all the regressions we find a globally harmful impact on environmental quality. In other words, higher trade intensity generates more pollution in the transition economies, either directly through the scale/composition effects or indirectly through its negative effect on levels of per-capita income. Unlike Antweiler et al. (2001) and Dean (2002), and after having controlled for trade in goods designed to improve environmental quality, i.e., EGs, we do not find any technique effect on pollution for trade openness in the transition countries.

6.3 Environmental impact of EGs imports and exports

Subsequently, we investigate the environmental impact of exports and imports of EGs separately instead of examining trade intensity in EGs. This aspect seems to be very important for CEE/CIS countries, which were net importers of EGs during the analysed period; moreover, the overall impact (economic and environmental) of these products’ liberalisation would mainly depend on the effect of imports of EGs on income, environmental policy, and pollution. Consequently, we rewrite Table 1 models (1)–(3) by replacing trade intensity (TradeInt) variables with imports (Im) and exports (Ex). Table 5 displays the estimation results, which are relatively similar to those found in Table 1 and are quite robust (except for K/L and Open variables, changing statistical significance).

We can draw some interesting conclusions about the EGs. Examining the direct impact on pollution, we find that imports of end-of-pipe products reduce CO2, SO2, and BOD emissions, whereas imports of cleaner technologies and products increase air pollution (CO2 and SO2). These results show a prevailing direct technique effect for imports of end-of-pipe products and a dominating direct scale-composition effect for imports of cleaner technologies and products (the latter usually generating productivity gains, which may lead, through abounding effects, to more production and, thus, more pollution). Examining further indirect effects, for the imports of end-of-pipe products we find a negative impact on SEP, which induces a global positive impact on BOD emissions but does not offset the direct negative effects on CO2 and SO2 emissions. Our empirical results underscore the negative indirect effects on pollution of the import of CTP, passing through both increased income and strengthened environmental standards and, thus, generating these imports’ negative net impact on BOD and CO2 emissions. However, because no indirect technique effect is found on SO2 emissions, the global impact on sulphur dioxide pollution remains positive. In conclusion, focusing on the negative overall effects on pollution, we show that imports of end-of-pipe products contribute to improved environmental quality through a direct technique effect, whereas imports in cleaner technologies and products have indirect effects via environmental regulation and income.

With respect to exports, no effect (direct or indirect) is found for cleaner technologies and products, whereas a global negative impact on our three pollutants is revealed for exports of end-of-pipe products. Concerning this last issue, despite a direct positive scale-composition effect, our results underline a prevailing negative indirect effect, i.e., exports of end-of-pipe products increase the income and severity of environmental regulations, thus inducing an overall beneficial effect on the environment. These findings may be explained by a relatively higher propensity to export end-of-pipe products than cleaner technologies and products in the CEE/CIS countries, highlighting the role of exports in increasing both income and the capacity to comply with regulations.

Finally, we perform additional regressions to identify the environmental impact of imports and exports of EPPs (see Table 9 in “Appendix E”). Our results confirm some practical intuitions. We find an overall negative impact on pollution (CO2 and BOD emissions) for EPPs’ imports mainly because of a negative direct scale-composition effect: these products are recognised as being more environmentally friendly than their substitutes during the consumption and disposal processes; moreover, they have an indirect income effect (CO2). Conversely, our results suggest that exports of EPPs increase BOD emissions (positive net impact), mainly through a harmful effect on the stringency of environmental regulations. As with trade intensity, no significant effect on SO2 emissions is found for imports and exports of EPPs (Table 6).

7 Conclusions

Should transition countries open their markets to EGs? The answer is much more complex than it would seem to be because various aspects—such as EGs’ classifications, countries’ priorities concerning specific pollutants, and the role of tariff revenues in total income—should be considered before concluding.