Abstract

We examine conditions under which a new or tighter restriction on emissions from a competitive polluting industry creates price effects in adjacent markets. Price effects may arise when a quantity restriction on emissions causes output to fall and, therefore, output price to rise. They may also arise when the required reduction in output causes the price of a polluting input to fall. We model emissions as a fixed proportion of output, limiting the possibilities for input substitutions. The possibility of price effects exists whenever the set of regulated firms is large relative to its input or output markets, a possibility that is expressly ruled out in Montgomery’s (J Econ Theory 5:395–418, 1972) paper. Two potential implications of price effects are explored. One is an efficiency concern: a welfare-maximizing regulator who neglects price effects will require more than the optimal level of abatement. The other is a distributional concern: an emissions restriction might create windfall profits for the polluting industry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a landmark paper, Montgomery (1972) provided the first formal mathematical treatment of the use of permit markets to control pollution. That influential paper contains a number of innovations. Among them is his abatement cost function \(F^i(e^i)\) for an individual firm, which depends only upon its emissions. Montgomery’s function is defined as the difference between the maximum profit experienced by a perfectly competitive firm at the unregulated (profit-maximizing) level of emissions \(\bar{e}^i\) and at any regulated level \(e^i<\bar{e}^i\). In both cases, the firm is assumed to behave optimally given input and output prices and the emissions level under consideration. The fact that the entire operation of a firm can be represented by a function depending only upon a single exogenous policy variable is powerful.

We shall argue that care should be exercised when adopting Montgomery’s formulation in the study of environmental policy. The reason is that it relies upon a carefully stated set of mathematical assumptions that are not always satisfied in practice. Among them (1972, p. 396) is that “The prices of the inputs and outputs of these firms are fixed, because the region is small relative to the entire economy. Therefore any change in the level of output of a firm or industry in the region will have only a negligible impact on the output of the economy as a whole, and prices will be unaffected by output changes in the region.” Under his conditions it must be true that firm and industry profits fall as the required level of abatement increases. Montgomery’s abatement costs, for the firm and the industry, must rise.

There are certainly many situations in which the conditions in Montgomery are satisfied; however, if the regulated industry is large relative to its output or input markets, these conditions need not be true and the use of the Montgomery cost function may no longer be appropriate. Even if the polluting firms are price takers in their input and output markets, Montgomery’s cost function could well be an incorrect tool.Footnote 1 One difficulty is that any policy that causes emissions to fall might also cause aggregate output to fall, which in turn means the market-clearing output price must rise. Another difficulty is that the policy might cause aggregate use of a polluting input to fall, which in turn means the market-clearing input price must fall. In either case, the Montgomery function will not account for changes in prices.

By “price effects” we mean these follow-on changes in output and input prices that might arise as a direct result of an emissions restriction. By design, the Montgomery abatement cost function in its usual form does not account for price effects. The present paper is meant to speak to those branches of the literature in which price effects and their implications are expressly ruled out.Footnote 2 We show that, when price effects are present, ignoring them can lead to unanticipated welfare changes and potentially suboptimal regulatory choices. Our model, while relaxing the fixed-price assumptions from Montgomery, assumes a linear relationship between emissions and output. To focus on price effects, we also rule out the possibility of a new abatement technology.

Before turning to the presentation of our model, we wish to emphasize that there is no Montgomery-style abatement cost function in what follows. Instead we develop our model in a structural way. The building blocks are production functions for the firms and demand and supply functions for the polluting industry’s output and inputs. This approach provides an alternative to the Montgomery approach, in which the information contained in the various elements of the market are concentrated in a single abatement cost function. We do not claim that the Montgomery abatement cost function is incorrect. Far from it, as the assumptions in Montgomery’s model regarding price effects are clear. Rather, we suggest only that it should be used with care, and that one should consider the implications of assuming away price effects in the output and input markets. We also suggest a re-examination of extant results that have been obtained using the Montgomery function. We leave aside the question of whether our analysis could also be carried out through the use of a more complicated abatement cost function that takes account of price effects, but we stress that any such analysis would require specifying many of the building blocks described above.

The model we employ is of a polluting industry that, in the beginning, faces no environmental regulation. In the initial equilibrium, markets do not achieve the socially optimal input and output prices. The price of the polluters’ output will be inefficiently low due to the externality associated with production, and the price of a polluting input will be inefficiently high due to excessive input demand. Introducing a restriction on emissions, either a quantity restriction or an emissions tax, can bring both input and output prices to their optimal levels. This change creates aggregate welfare losses for buyers and sellers in related markets, relative to the status quo. But we emphasize that, once the effects of avoided environmental damages are included, the changes are welfare improving for society as a whole.

The model is used to examine two implications of price effects. The first is an efficiency concern that can arise if a regulator fails to account for price effects. In such cases the regulator will require more than the socially optimal level of abatement. This possibility, we will show, stems from the fact that, in ignoring price effects, this regulator also ignores the loss in surplus suffered by consumers of the polluters’ output as well as the loss in surplus suffered by producers of the polluting input. The true cost of abatement, including this loss in surplus, is higher than anticipated if price effects are ignored, and so the correct optimum involves a lower level of abatement.

The second implication is windfall profits, a situation in which a new or tighter restriction on emissions from a polluting industry causes aggregate profits in that industry to rise. From the perspective of Mongomery’s function, this outcome represents negative abatement costs. The possibility of windfall profits is real. An interesting example may be found in Malina et al. (2012), who studied the likely effect of the European Union’s Directive 2008/101/EC. Adopted in 2008, that measure laid down a requirement that, starting in 2012, all international airlines serving member countries must participate in the EU’s Emission Trading Scheme for carbon allowances. Malina et al. concluded that U.S. carriers collectively might have gained as much as $289 million annually as carriers responded to the new emissions restriction by passing on to customers the opportunity costs embodied in grandfathered allowances.

The price effects that we identify can occur in a perfectly competitive industry, so they do not depend upon market power.Footnote 3 We expressly rule out market power in order to place focus on the potential for price effects even in a perfectly competitive setting. Indeed, our findings highlight the fact that environmental constraints sometimes confer something like market power on even a competitive polluting sector.

In our model, the quantity policy under study is a direct limit on emissions, imposed on each polluting firm, with emissions proportional to output. We rule out allowance trading so as to emphasize that it is price effects, not the issuance of free allowances, that create inefficiencies and generate windfall profits. We show that windfall profits can arise under a quantity constraint, but under quite general conditions they cannot arise under an emissions tax. The key point with a tax is that it requires polluters to pay the “scarcity value” for each unit of emissions.Footnote 4

The issue of price effects and windfall profits is featured prominently in the literature on climate policy.Footnote 5 Authors in this literature consider carefully whether cap-and-trade or tax policies, configured in a variety of ways, might confer windfall profits upon carbon-intensive industries. The equilibrium models they often employ can make it difficult to discern precisely when and why windfall profits occur. For a clear explication of the role of output markets, though, see Burtraw et al. (2002, esp. pp. 56–57) or Goulder and Schein (2013, esp. pp. 6–7). We believe our work is complementary, in that we highlight the fundamental role of price effects, in both input and output markets, even in the absence of allowance trading.

Our model is of a single competitive industry that emits a single perfectly mixed pollutant. Pollution is emitted at a fixed rate per unit of output, with no alternative technology available. The firms’ cost functions are well behaved and the industry faces a downward-sloping demand function for its homogeneous output. One of the inputs, a fuel for example, is implicated in the industry’s pollution. The market for the polluting input is also competitive, but we consider the possibility that the firms in our polluting industry are the only buyers. The supply curve for the polluting input is upward sloping.

Our basic model, developed in Sect. 2, admits output price effects but not input price effects. In Sect. 3, using this model we show that under a quantity constraint windfall profits occur, at least for some levels of emissions restrictions, but that windfall profits are impossible under an emissions tax. Windfall profits cannot arise if, as under Montomery’s conditions, input and output prices are fixed. Finally, we show formally that if a regulator seeking to maximize social welfare ignores output price effects, the chosen level of abatement will always be too high.

The second version of the model, in Sect. 4, admits input but not output price effects. We describe how the aggregate cost function can be reformulated to endogenize the equilibrium response of an input price to a change in output, which allows us to carry out our welfare analysis in the output domain. Within this framework we derive conditions under which, for a given level of abatement, input price effects create windfall profits. The underlying cause is now a reduction in the price of the polluting input, which lowers production costs. We also show that, so long as the firms’ marginal cost functions become steeper in output as the price of an input rises, here again an emissions tax cannot cause windfall profits. And we show that, as before, a regulator who fails to account for the input price effect will choose too much abatement.

In Sect. 5 we allow for both input and output price effects. In this case windfall profits resulting from a quantity restriction are greater than before. The effect of an emissions tax on industry profits depends on the input, not the output price effect. The error in abatement level if the regulator fails to account for both price effects will be compounded, rising further above the optimum than in either of the previous cases.

2 A Model of a Polluting Industry

A single competitive industry, made up of n identical firms indexed by i, produces a single marketed output in the amount \(Y=ny^i\). The production of \(y^i\) requires the use of m inputs \(\mathbf {x}^i=(x^i_1,\dots ,x^i_m)\), and is governed by the strictly concave production function \(y^i=f^i(\mathbf {x}^i)\). We assume that \(f^i\) has continuous third derivatives and satisfies \(\partial ^2f^i/\partial x_j\partial x_k\ge 0\) for all \(j \ne k\). Inputs are purchased in competitive markets at prices \(\mathbf {w}\). A single perfectly mixed pollutant is emitted at a fixed rate \(e^i=\beta y^i\). Total industry emissions are \(E=\beta Y\). This last assumption is restrictive, but perhaps not too heroic in the short run.Footnote 6 This assumption has frequently been adopted in the literature.Footnote 7

We assume that \(x_1\) is a polluting input, coal for example. In this and the following section we assume that the industry is small relative to its input markets, so that all input prices, including \(w_1\), are fixed. In Sect. 4, we allow \(w_1\) to change as the industry’s demand for \(x_1\) shifts left in response to a reduction in output. Demand for Y is given by the twice differentiable and downward-sloping inverse demand function P(Y).

Given input prices, the minimum cost to firm i of producing \(y^i\) is

with \(C^i(0, \mathbf {w})=0\). The firm’s cost function is twice differentiable. It is increasing and, given the strict concavity of the production function, strictly convex in \(y^i\). In this and the following section, firm i’s marginal cost function is denoted \({C^i}'(y^i)= \partial C^i/\partial y^i\), with input prices suppressed because they are unchanging. Industry costs are the sum C(Y) of the \(C^i(y^i)\) across firms. Industry marginal cost, the inverse supply curve, is \(C^{\prime }(Y)\). It is the short run, so there is no entry or exit.

In the initial situation there is no environmental restriction.Footnote 8 Therefore, each firm takes prices as given and chooses output to maximize \(\pi ^i = Py^i- C^i(y^i,\mathbf {w})\). The initial equilibrium output level is \(Y^0 = ny^{i0}\), at which \(P(Y^0)=C^{\prime }(Y^0)\). The initial price is \(P^0= P(Y^0)\) and initial uncontrolled emissions are at \(E^0=\beta Y^0\), with \(e^{i0}= \beta y^{i0}\). Initial profits are \(\pi ^{i0}\) for each firm and \(\pi ^0= n\pi ^{i0}\) for the industry.

Two policy instruments are considered and compared. The first is a quantity restriction \(r\in [0,1]\) on emissions, under which emissions from each firm must fall to \(e^{i1}=re^{i0}\) and aggregate emissions to \(E^1=rE^0\). Given the relationship between output and emissions, each firm must then reduce its output to \(y^{i1}=ry^{i0}\) and industry output falls to \(Y^1=rY^0\). In order to clear the output market, price must rise to \(P(Y^1)\). Unlike output, our assumption of a concave production function does not require that the purchase of the polluting input fall in proportion to the level of regulation. The assumption of identical firms makes our mathematical derivations more transparent. The use of a direct quantity constraint on emissions (rather than allowance trading) highlights the fact that windfall profits are caused by price effects, even in the absence of free allowances. Industry profits after the quantity regulation is imposed are denoted \(\pi (r)\). The change in industry profits created by the quantity regulation is denoted \(\Delta \pi (r)=\pi (r)-\pi (1)\). Windfall profits arise whenever \(\Delta \pi >0\).

The second policy is a tax t on each unit of emissions.Footnote 9 Given the relationship between output and emissions, this is equivalent to a tax of \(\beta t\) on each unit of output. For any r, the equivalent emissions tax will solve

Industry profits after the tax regulation are denoted \(\pi (t)\). The change in industry profits created by the tax is \(\Delta \pi (t)=\pi (t)-\pi (0)\).

The final element of our model is an environmental damage function, D(E) with \(D(0)=0\), that captures the economic value of harm created by any emissions level. We assume that D(E) is differentiable, increasing, and strictly convex in E, so that marginal damages, \(D^{\prime }(E)\), are increasing in emissions. This function will play a role whenever our regulator is asked to select an optimal regulatory level.

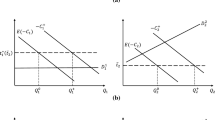

For the base case with input prices fixed, a diagrammatic example is useful in describing how an output price effect can create windfall profits in a competitive industry. (Input price effects make things more complicated, as we shall see.) The situation is illustrated in Fig. 1, where the initial equilibrium is at \((Y^0,P^0)\). Industry profit in the unregulated state is the area below \(P^0\) and above \(C^{\prime }(Y)\) in Fig. 1a.

Suppose a regulatory authority imposes a quantity restriction \(r<1\) on emissions, which means output must fall to \(Y^1 = rY^0\). The output market will clear at output price \(P^1\) as depicted in Fig. 1a. Area C represents a loss in profit due to the decrease in output. Area B represents an increase in profit due to the increase in price. Industry profits are area \(A+B\). So long as area B exceeds area C, the output price effect creates windfall profits. The quantity constraint confers something very like monopoly rents upon the polluting industry. [This point is explained well in Goulder and Schein (2013, Fig. 1).] Consumer surplus is reduced as quantity falls and the price rises. The social cost of abatement, the sum of areas C and D, is the reduction in consumer surplus and industry profit. In our setting with emissions and output locked together by the parameter \(\beta \), no alternative low-emissions technology is available. Of course, in practice the cost of abatement will include such things as scrubbers and other abating inputs.

Now suppose the authority chooses instead to achieve the same reduction using an emissions tax. At the equivalent tax, shown in Fig. 1b, output once again falls to \(Y^1\), the market price rises to \(P^1\), producers receive \(P^1-\beta t\), and consumer surplus falls by the same amount as before. But now profits must decline as well, decreasing to area A. Area E represents tax revenue. This could be used for a number of purposes, including to compensate consumers for their welfare losses. The welfare difference between the quantity restriction and the emissions tax is strictly distributional, although windfall profits are very different. Social cost of abatement in the market for Y is identical to that experienced with the quantity restriction.

Finally, suppose that, as in Montgomery, the set of regulated firms is a negligible fraction of a much larger market for Y. Perhaps a restriction of r is imposed on phosphorus runoff from the farms in a single small watershed, which means they must reduce their output of corn. Because the firms make up a tiny portion of their output market, the price of corn will not change. In Fig. 1c, where \(C^{\prime }(Y)\) now captures aggregate marginal cost for the regulated firms only, we see that their profit falls by an amount represented by area C. This loss in profit is Montogemery’s aggregate abatement cost. With no output price effect, abatement cost must be positive and thus windfall profits cannot occur.

3 Output Price Effects

In this section we assume that input prices are fixed, but the output price is not. The imposition of a quantity restriction on emissions leads inevitably to a proportional reduction in output. The market-clearing output price must rise and, because input prices do not change, the industry marginal cost function does not change either. Under these conditions we derive the changes in profit, consumer surplus, and the social cost of abatement resulting from either policy.

Proposition 1 establishes that, under very general conditions on costs and output demand, with emissions in fixed proportion to output, a quantity policy must create windfall profits for some nonempty interval of r with right endpoint at \(r=1\). The geometric intuition for this result, which is true regardless of the relative slopes of demand and marginal cost, is that for r near 1 a rectangle (area B in Fig. 1a) changes more quickly than the area of a triangle (area C in Fig. 1a). The proposition also establishes that an emissions tax cannot create windfall profits. In order to formalize the comparison to the usual treatment, part (iii) establishes that, in the absence of an output price effect, windfall cannot arise with either policy. Proofs of all formal results appear in the Appendix.

Proposition 1

Consider a competitive polluting industry satisfying the assumptions laid out above. Suppose industry demand P(Y) is downward sloping and industry marginal cost \(C^{\prime }(Y)\) is upward sloping in Y, and that all input prices are fixed.

-

(i)

There is \(\tilde{r}<1\) such that \(\Delta \pi (\tilde{r})=0\). If industry profit is strictly concave in r, \(\tilde{r}\) is unique, and \(\Delta \pi (r)>0\) for \(r \in (\tilde{r},1)\).Footnote 10

-

(ii)

For any \(t>0\), \(\Delta \pi (t)<0\).

-

(iii)

In the absence of output price effects, with the output price fixed at \(P^0\), \(\Delta \pi <0\) for any \(r<1\) and for any \(t>0\).

An environmental regulator who correctly accounts for the output price effect can achieve a given level of emissions with either policy instrument. It would be possible for such a regulator to control the distribution of welfare losses across consumers and producers through the use of a combined tax-quantity policy. Suppose that, at the chosen quantity restriction, windfall profits occur, which means that area \(B>C\) in Fig. 1a. The regulator can always find a value \(\lambda \in (0,1)\) so that \(\lambda B=C\). The required tax, which ensures that \(\Delta (r)=0\), is given by \(t=\lambda (P^1-P^0)/\beta \). The tax revenue could then be returned to consumers, lump-sum fashion, to limit their welfare loss.

In Proposition 1, the regulator’s choice of r or t is given exogenously. We turn next to the question of an optimal policy choice. For any given quantity policy r, the correct measure of the social cost of abatement is:

where the superscript “Out” refers to the output price effect. This function is represented by the sum of areas C and D in Fig. 1a. We emphasize again that although the social cost of abatement has the look and feel of a deadweight loss triangle, in fact \(Y^0\), the output level given by the intersection of demand and marginal cost, is not optimal from society’s perspective. The optimal quantity policy, which is denoted \(r^*\), will minimize the sum of \(L^{\text {Out}} (r)\) and environmental damage \(D(rE^0)\). A completely informed tax-setting regulator will choose an optimal tax, denoted \(t^*\), so as to achieve the same level of emissions. Both the social cost of abatement and damage will be identical. Only the distribution of the remaining surplus is different.

But what will change if, instead, the regulator fails to anticipate the output price effect or, more properly, if the economist providing the analysis does so? The incorrect measure of abatement cost that will be used by this analyst, who incorrectly believes \(P^0\) will be unchanged, includes only the reduction in industry profit:

This function is represented by area C in Fig. 1a; one can see that \(\widehat{L}(r)\) is an underestimate of the true social cost of abatement. Let \(\hat{r}\) denote the quantity policy that minimizes the sum of \(\widehat{L} (r)\) and damages, and let \(\hat{t}\) denote the equivalent tax. Proposition 2 shows that the selected policy will require too much abatement. Windfall profits affect the distribution of welfare, but accounting correctly for output price effects has crucial implications for efficiency, for determining the socially optimal level of environmental quality.Footnote 11

Proposition 2

If a regulator seeking to maximize social welfare ignores output price effects, the chosen level of abatement will be too high for either policy: \(\hat{r} < r^*\) and \(\hat{t} > t^*\).

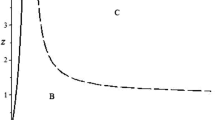

The intuition for this result may be gleaned from Fig. 2. The correct measure of the social cost of abatement is the upper curve labeled \(L^{\text {Out}}(r)+D(rE^0)\). For any emissions restriction r, this expression captures the aggregate welfare losses suffered by consumers and producers of Y, together with environmental damages. The alternative curve, labeled \(\widehat{L}(r)+D(rE^0)\), fails to include the welfare losses suffered by consumers of Y. Therefore, the regulator (or the economic analyst) seeking to minimize the incorrect measure of welfare loss will mistakenly settle on the more stringent policy of \(\hat{r}\). The corresponding figure for a tax-setting regulator is omitted.

A regulator who ignores the output price effect will choose \(\hat{r}\), an abatement level more stringent than the optimal \(r^*\). The upper black curve includes loss of consumer surplus and is the correct measure of social welfare change. The lower gray curve ignores loss of consumer surplus and is incorrect

4 Input Price Effects

We now turn our attention to the case in which a reduction in industry output affects the price of an input, as demand for that input shifts leftward. The change in input price has the effect of transferring surplus from input suppliers to polluters, a possibility that appears to have received less attention than transfers from consumers to polluters. In this section the polluting industry is assumed to be small relative to its output market, so the output price is fixed at \(P^0\). We begin with an analysis of a single firm’s demand for inputs, the vector-valued solution function

where as always we assume that the industry faces competitive input markets. The firms take \(\mathbf {w}\) as given, with prices \((w_2,\dots ,w_m)\) assumed to be fixed because the industry is small relative to those markets as well. The polluting industry is the only buyer of \(x_1\), though, so changes in its demand for \(x_1\) will cause \(w_1\) to change. Write the firm’s demand for \(x_1\) and its cost function as \(x^i_1(y^i,w_1)\) and \(C^i(y^i,w_1)\) respectively, with the fixed input prices suppressed. Industry cost is \(C(Y,w_1)\) and industry demand for \(x_1\), the sum of individual firm demands, is \(x_1(Y,w_1)\). The assumption that cross partial derivatives of the production function are non-negative guarantees that all of the inputs are “normal”. That is, \(\partial x^i_j(y^i,\mathbf {w})/ \partial y^i >0\) for all j (Bertoletti and Rampa 2013). Therefore, in particular, the industry demand for \(x_1\) is increasing in industry output: \(\partial x_1(Y,w_1)/\partial Y>0\). The supply function for \(x_1\) facing the industry, denoted \(s_1(w_1)\), is strictly increasing in \(w_1\). We will sometimes use \(C_Y\) or \(C_{w_1}\) to denote derivatives of industry cost with respect to output or price.

Initially, before an environmental restriction is imposed, the input market is in equilibrium at price \(w_1^0\) and quantity \(x_1(Y^0,w_1^0)\). Suppose first that the regulator imposes a quantity restriction r on emissions, which in turn causes a reduction in firm-level output to \(y^{i1}=r y^{i0}\) and industry output to \(Y^1=rY^0\). Firm and industry demands shift left to \(x^i_1(y^{i1}, w_1)\) and \(x_1(Y^1,w_1)\) respectively. But now the equilibrium input price also falls so as to bring input supply in line with the new quantity demanded. The new input price, which must be unique, will satisfy

For any Y, the endogenous relationship in (4), between the equilibrium input price and industry output, may be expressed as the implicit function \(w_1(Y)\) that solves the equilibrium identity

Given the differentiability of demand, \(w_1(Y)\) is also differentiable. It is straightforward to show that \(w_1^{\prime }(Y)>0\).

The diagrammatic example in Fig. 3 illustrates how profits change in response to an emissions policy. In Fig. 3a, the input domain, we see the inward shift to \(x_1(Y^1,w_1)\) and the new equilibrium input price and quantity, \((x_1^1,w_1^1)\). The monetary value represented by the sum of area B and area \(C^I\) is the loss in producer surplus suffered by the suppliers of \(x_1\). Area B is recovered by producers of Y as a reduction in the cost of \(x_1\). The remainder, \(C^I\), is one part of the social cost of abatement.

Figure 3b depicts the output domain, as in Fig. 1. A quantity restriction causes industry output to fall from \(Y^0\) to \(Y^1\). The curve labeled \(C^{\prime }(w_1^0)\), with Y suppressed, is initial industry marginal cost. The lower curve, labeled \(C^{\prime }(w_1^1)\), is industry marginal cost at the new lower input price. Area C is a decrease in profit, at price \(w_1^0\), due to reduced output. It represents the other part of the social cost of abatement. Area B is an increase in profit due to the lower input price. Windfall profits occur if area B exceeds area C.

Given that the input price effect creates an apparent welfare change in both the input market and the output market, one must be careful to account correctly for the resulting change in profit. Is the correct measure area B in Fig. 3a, the integral behind the demand for \(x_1\) at output \(Y^1\), between prices \(w_1^1\) and \(w_1^0\)? Or is it area B in Fig. 3b, the integral between \(C_Y(Y,w_1^0)\) and \(C_Y(Y,w_1^1)\), from 0 to \(Y^1\)? Or is it some combination of the two? It turns out that the two measures are equal, and that the correct change in profit is captured by either, not by the sum. Proposition 3 establishes formally the equivalence of the two measures.

Proposition 3

Suppose the output price is fixed and consider an industry in which cost functions and input supply satisfy the conditions imposed above. The change in industry profit resulting from a change in \(w_1\) is equal whether it is measured in the input domain or the output domain:

The analysis of an emissions tax is somewhat more complicated, because at an equilibrium the input price and industry output are determined simultaneously. The equilibrium output level is Y that satisfies Eq. (5) and also sets \(P^0-\beta t=C_Y(Y,w_1(Y))\). For any given quantity policy r, using the fact that \(Y^1=rY^0\), the equivalent emissions tax is given by

In Fig. 3c we see the equivalent tax required to achieve the same reduction as was achieved by a quantity constraint in Fig. 3b. The figure shows how the tax is determined by Eq. (7), as the difference between \(P^0\) and marginal cost at the new price \(w_1^{\prime }\), evaluated at \(Y^1\). Area C represents profit lost due to the reduction in output. Area E is tax revenue. The figure suggests that the tax must drive profits (area A) lower, even as marginal cost drops for any output level, as the price producers receive for Y drops below what it would be if there were no input price effect.

Proposition 4 establishes the possibility of windfall profits resulting from a quantity policy, and also that windfall profits cannot arise under a tax. The result for a tax requires an additional restriction on cost functions: that industry marginal cost cannot become steeper as \(w_1\) falls or, equivalently, that \(x_1(Y,w_1(Y))\) is strictly convex in Y. This condition is guaranteed by the inequality in (9).

Proposition 4

Suppose that the output price \(P^0\) is fixed, industry marginal cost \(C_Y(Y,w_1)\) is strictly increasing in Y, the supply curve for \(x_1\) is increasing in \(w_1\), and \(x_1\) is a normal input.

-

(i)

There is \(\tilde{r}<1\) such that \(\Delta \pi (\tilde{r}) =0\). If in addition

$$\begin{aligned} \frac{\partial x_1(Y,w_1)}{\partial w_1} < \frac{C_{YY}+2C_{Yw_1}+x_1(Y,w_1)(\partial ^2 w_1/\partial Y^2)}{(\partial w_1/\partial Y)^2}, \end{aligned}$$(8)then \(\tilde{r}\) is unique and \(\Delta \pi (r)>0\) for \(r\in (\tilde{r},1)\).

-

(ii)

Assume that

$$\begin{aligned} \frac{\partial C_{YY}}{\partial w_1} > 0 . \end{aligned}$$(9)Then \(\Delta \pi (t)<0\) for any \(t>0\).

A quantity-setting regulator who fails to account for the input price effect will, as before, fail to set the socially optimal level of abatement. The correct measure of abatement cost consists of two components. The first, measured in the output domain, is foregone profit for producers of Y, due to reduced output. It is simply \(\widehat{L}(r)\) from Eq. (3), which is area C in Fig. 3b. The second is area \(C^I\) in Fig. 3a. It is the second integral term in

where the “In” superscript refers to the input effect.

If the regulator fails to anticipate the input effect, though, she will select a policy to minimize the sum of damages and \(\widehat{L}(r)\) from Eq. (3), rather than the sum of damages and \(L^{\text {In}}(r)\) from Eq. (10). In Proposition 5 we show that the second integral in (10) must be positive, so that as before the regulator will require more than the socially optimal level of abatement.

Proposition 5

If a regulator seeking to maximize social welfare ignores input price effects, the chosen level of abatement will be too high for either policy.

5 Output and Input Price Effects

We turn now to a discussion of the joint effect of input and output price effects. The section is brief because the two effects combine in unsurprising ways that require no additional mathematical development. Consider Fig. 4, which depicts the situation, and suppose the regulator has chosen a level of abatement at which windfall profits arise under a quantity policy.

Consider first the fate of consumers of Y. The loss of consumer surplus is entirely independent of the input price effect, but depends crucially on the presence of an output price effect. Thus, the welfare outcome for consumers is identical in Sect. 3 and here. The same can be said of consumers when a tax policy is employed, but in this case they can perhaps be made better off if the tax revenue is redirected back to consumers. Whether or not this outcome is realized depends of course on the policy choice and also, in an empirical setting, on the structure of the particular industry in question. In any case, we can be sure that the input price effect makes no difference to consumers of Y.

What about the fate of producers of Y? Suppose the regulator is to choose a quantity policy. The comparison of the size of windfall in the case with only output price effects (Fig. 1) and with only input price effects (Fig. 3) is strictly an empirical matter. We can be sure, though, that windfall profits are greatest if both input and output price effects are present, as in Fig. 4.

If the regulator instead chooses a tax policy, our results are less conclusive. We can say that profits flowing to the polluting industry are now independent of the presence or absence of an output price effect. We cannot say whether the output or the input price effect leads to a greater reduction in profit, but we can be sure that the total tax revenue collected will be greatest when both effects are present.

We have emphasized the fact that a welfare-maximizing regulator who fails to account for price effects in either the input or the output market will choose an abatement level above the social optimum. If both effects are present and the regulator ignores both, this mistake will become even larger as even more social abatement loss is overlooked: area \(C^I\) in Fig. 4a together with areas C and D in Fig. 4b. Whether the monetary value of the loss in social welfare resulting from this mistake is large or small is of course an empirical question. We defer that question to future work, but it is not obvious why one should expect the loss to be small.

Two observations may be made with respect to producers of the polluting input \(x_1\). The first is that this industry suffers the same losses whether the output price rises or not. Producers of \(x_1\) lose profit represented by the sum of areas B and C in Fig. 4a. This loss is suffered whenever producers of Y are required to reduce output, whether because of a tax or because of a quantity restriction, and is entirely separate from the output price. In the case of the tax policy, the amount of tax passed back to input suppliers is likewise independent of the output price. The second is that, in an empirical setting, the welfare effect on input suppliers could be quite large. It is not inconceivable that it might even outweigh the welfare effects in the market for Y. This possibility could suggest that regulating the input market is an appealing policy alternative. We leave this question for future work. In any case, we believe our main insight is useful: analyzing environmental policy without attending carefully to price effects in markets associated with the polluting sector can sometimes lead one astray.

6 Conclusions

Policies aimed at reducing pollution can cause follow-on price effects in markets beyond the regulated industry. Yet when Montgomery’s abatement cost function is employed, the price effects are often ignored. Many of the most important environmental problems are created by large industries. Policies to address those problems are often aimed at entire national sectors. In such cases, or any case in which the regulated sector represents a sizable share of its input or output markets, the Montgomery cost function may not be the appropriate tool.

Of course, any intervention in an interconnected economy can lead to effects that cascade outward through many markets. One must always decide how widely to cast one’s net. Equilibrium models of environmental policy, such as Goulder et al. (2010), are designed to account as fully as possible for these general-equilibrium effects. GE models have powerful advantages. But they also have certain drawbacks, complexity among them, which is why simpler partial-equilibrium models are often employed. Our work provides a caution against using the simplest of models, based upon the Montgomery function, without thinking carefully about what is happening in adjacent markets. There are undoubtedly some situations in which the price effects we study are insignificant, where accounting for them produces unnecessary complications. But in other situations it is likely to be worthwhile to account at least for the effects occurring one step in each direction beyond the emissions domain alone. Choosing the appropriate scope of a particular study should be informed where possible by empirical evidence regarding the importance of price effects.

To highlight one example where ignoring other buyers of the polluting input can be significant, consider a policy to limit emissions of sulfur dioxide from coal-burning power plants. The resulting reduction in demand for coal can be expected to drive its price downward, perhaps leading steal mills to burn more coal and, thereby, to emit more sulfur dioxide. In any given problem one should consider carefully where to draw the line between those market effects that are considered and those that are neglected.

While the model we have presented greatly simplifies the production and pollution relationships, as do many economic models, there are markets that approximately match our setup. Take, for another example, the production of corn. Corn is produced by many relatively small producers in near perfect competition. Application of nitrogen fertilizer, of which corn producers are a major buyer, leads to emissions of nitrous oxide (\(\hbox {N}_{2}\hbox {O}\)), a potent greenhouse gas. If a restriction on \(\hbox {N}_{2}\hbox {O}\) emissions were placed on corn producers, there would likely be a reduction in purchases of nitrogen fertilizer and a corresponding reduction in output of corn (though likely not in proportion to the reduction in fertilizer or emissions). This is an instance where the price effects we have illustrated might emerge in something like a competitive setting, even if emissions are not a fixed proportion of output.

It might be said that, at bottom, windfall profits amount to nothing more than a distributional issue. But our results seem to indicate otherwise. That is, the price effects driving windfall profits also drive efficiency concerns: environmental policy recommendations by economists who neglect price effects might be far from optimal. Many of the standard problems in environmental policy analysis have usually been analyzed using models based upon the Montgomery abatement cost function. It might be useful to revisit some of the standard results to see whether and how they change once price effects are considered. In actual policy-making, where political forces are in play, the socially optimal level of emissions is unlikely to emerge. This fact does not diminish the importance of accounting for price effects.

It is perhaps worth re-emphasizing the fact that, although any abatement policy in our model creates welfare losses in the input and output markets, the initial equilibrium was not efficient from society’s perspective. Rather, the output price was inefficiently low and the input price was inefficiently high. One must account for the welfare losses there when computing the social cost of abatement, but once the effects of environmental damages are included, the changes are welfare improving for society as a whole.

In the longer run the choice of emissions policy, whether quantities or taxes, can have important implications for the development and adoption of new and lower-cost abatement technologies (Milliman and Prince 1989; Requate and Unold 2003). This question, it would appear, might compound the complications we have encountered, as would the potential for entry of new firms.

The distributional impacts of environmental policy, as well as the effect on efficiency, are potentially important. Price effects place a heavy burden on consumers of a product associated with pollution, and also on suppliers to the industry under regulation. Polluters themselves, on the other hand, may reap substantial benefits.

Notes

Many authors, including some authors of the present paper, have failed to appreciate this point. Requate and Unold (2003, p. 131), for example, write: “since the product market is assumed to be competitive, decisions about output need not be modeled explicitly. Those decisions are implicitly accounted for in the abatement cost functions.” This statement is correct at the level of a single firm, but not at the level of an entire regulated industry.

A sample of papers that use an abatement cost function that does not account for input and output prices, and that therefore rule out price effects, includes Adar and Griffin (1976), Krupnick et al. (1983), Hahn (1984), McGartland and Oates (1985), Milliman and Prince (1989), Oates et al. (1989), Atkinson and Tietenberg (1991), Jaffe and Stavins (1995), Jung et al. (1996), Stavins (1996), Huber and Wirl (1998), Moledina et al. (2003), Krysiak and Oberauner (2010), Stocking (2012) and Holland and Yates (2014).

An allowance-trading scheme in which allowances are auctioned rather than allocated for free would also have the effect of requiring polluters to pay the scarcity value. In that sense, of course, a tax and a trading scheme are similar policy instruments.

The effect of introducing an alternative, costly low-abatement technology (perhaps a different \(\beta ^{\prime } <\beta \) that carries a large fixed cost) is an interesting issue that we examine in a companion paper. See Jung et al. (1996) and Requate and Unold (2003). An alternative formulation that we explored is to define emissions as proportional to a polluting input. This alternative does not lead to substantive changes in our results, but it increases complexity significantly.

This assumption is convenient but not essential. Our analysis would not change if the initial situation described an industry in equilibrium while facing a pre-existing environmental constraint, and the change at issue involved tightening it further. The no-regulation baseline matches Montgomery’s treatment.

In our framework, with no uncertainty, this policy is equivalent to an allowance scheme in which allowances are auctioned at the relevant price. The tax requires polluters to pay the scarcity value of their emissions. Our quantity policy effectively allocates that scarcity value to the polluters. We thank an anonymous reviewer for this insight.

In the proof of Proposition 1 we show that this condition is satisfied if \(P''(rY^0)<(C''(rY^0-2P^{\prime }(rY^0))/rY^0\) for all r.

It is important to bear in mind that we ourselves limit price effects to only those experienced in the polluting industry’s output market (in this section) and input market (in the next section). In fact, general-equilibrium effects can ripple out from the proximate input and output markets and affect emissions and social welfare elsewhere in the economy. Also, we do not mean to suggest that environmental restrictions are generally too stringent in practice.

We thank Steve Miller for his help with our approach to this proof.

References

Adar Z, Griffin JM (1976) Uncertainty and the choice of pollution control instruments. J Environ Econ Manag 3:178–188

Aidt TS, Dutta J (2004) Transitional politics: emerging incentive-based instruments in environmental regulation. J Environ Econ Manag 47:458–479

Amir R, Nannerup N (2005) Asymmetric regulation of identical polluters in oligopoly models. Environ Resour Econ 30:35–48

Atkinson S, Tietenberg T (1991) Market failure in incentive-based regulation: the case of emissions trading. J Environ Econ Manag 21:17–31

Bertoletti P, Rampa G (2013) On inferior inputs and marginal returns. J Econ 109:303–313

Bréchet T, Jouvet P-A (2008) Environmental innovation and the cost of pollution abatement revisited. Ecol Econ 65:262–265

Buchanan JM, Tullock G (1975) Polluters’ profits and political response: direct controls versus taxes. Am Econ Rev 65:139–147

Burtraw D, Evans DA (2008) Tradable rights to emit air pollution. Resources for the future discussion paper 08-08

Burtraw D, Palmer K, Bharvirkar R, Paul A (2001) The effect of allowance allocation on the cost of carbon emission trading. Resources for the future discussion paper, pp 01–30

Burtraw D, Palmer K, Bharvirkar R, Paul A (2002) The effect on asset values of the allocation of carbon dioxide emission allowances. Electr J 15:51–62

Bushnell JB, Chong H, Mansur ET (2012) Profiting from regulation: evidence from the European carbon market. Working paper, UC-Davis

Coria J (2009) Taxes, permits, and the diffusion of a new technology. Resour Energy Econ 31:249–271

Fan L, Hobbs BF, Norman CS (2010) Risk aversion and \(\text{ CO }_{2}\) regulatory uncertainty in power generation investment: policy and modeling implications. J Environ Econ Manag 60:193–208

Goulder LH, Hafstead MAC, Dworsky M (2010) Impacts of alternative emissions allowance allocation methods under a federal cap-and-trade program. J Environ Econ Manag 60:161–181

Goulder LH, Schein A (2013) Carbon taxes vs. cap and trade: a critical review. Clim Change Econ 4(3):1–28

Hahn RW (1984) Market power and transferable property rights. Quart J Econ 99:753–765

Holland S, Yates AJ (2014) Optimal trading ratios for pollution permit markets. NBER working paper no. 19780

Huber C, Wirl F (1998) The polluter pays versus the pollutee pays principle under asymmetric information. J Environ Econ Manag 35:69–87

Jaffe AB, Stavins RM (1995) Dynamic incentives of environmental regulatinos: the effects of alternative policy instruments on technology diffusion. J Environ Econ Manag 29:S43–S63

Jung C, Krutilla K, Boyd R (1996) Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. J Environ Econ Manag 30:95–111

Krupnick AJ, Oates WE, Van De Verg E (1983) On marketable air-pollution permis: the case for a system of pollution offsets. J Environ Econ Manag 10:233–247

Krysiak FC, Oberauner IM (2010) Environmental policy à la carte: letting firms choose their regulation. J Environ Econ Manag 60:221–232

Malina R, McConnachie D, Winchester N, Wollersheim C, Paltsev S, Waitz IA (2012) The impact of the European Union emissions trading scheme on US aviation. J Air Transp Manag 19:36–41

Mansur ET (2009) Prices vs. quantities: environmental regulation and imperfect competition. Working paper, Yale University

McGartland AM, Oates WE (1985) Marketable permits for the prevention of environmental deterioration. J Environ Econ Manag 12:207–228

Meunier G (2011) Emission permit trading between imperfectly competitive product markets. Environ Resour Econ 50:347–364

Milliman SR, Prince R (1989) Firm incentives to promote technological change in pollution control. J Environ Econ Manag 17:247–265

Moledina A, Coggins JS, Polasky S, Costello C (2003) Dynamic environmental policy with strategic firms: prices versus quantities. J Environ Econ Manag 45:356–376

Montgomery WD (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5:395–418

Oates WE, Portney PR, McGartland AM (1989) The net benefits of incentive-based regulation: a case study of environmental standard setting. Am Econ Rev 79:1233–1242

Palmer K, Burtraw D, Kahn D (2006) Simple rules for targeting \(\text{ CO }_{2}\) allowance allocations to compensate firms. Clim Policy 6:477–493

Perino G (2010) Technology diffusion with market power in the upstream industry. Environ Resour Econ 46:403–428

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur Econ Rev 47:125–146

Sijm J, Neuhoff K, Chen Y (2006) \(\text{ CO }_{2}\) cost pass-through and windfall profits in the power sector. Clim Policy 6:49–72

Simpson RD (1995) Optimal pollution taxation in a Cournot duopoly. Environ Resour Econ 6:359–369

Smale R, Hartley M, Hepburn C, Ward J, Grubb M (2006) The impact of \(\text{ CO }_{2}\) emissions trading on firm profits and market price. Clim Policy 6:29–46

Stavins RN (1996) Correlated uncertainty and policy instrument choice. J Environ Econ Manag 30:218–232

Stocking A (2012) Unintended consequences of price controls: an application to allowance markets. J Environ Econ Manag 63:120–136

Yates AJ, Doyle MW, Rigby JR, Schnierd KE (2013) Market power, private information, and the optimal scale of pollution permit markets with application to North Carolina’s Neuse River. Resour Energy Econ 35:256–276

Author information

Authors and Affiliations

Corresponding author

Additional information

We wish to thank Derya Eryilmaz, Jose Pacas, Nathan Paine, Jooyoung Yang, and seminar participants at the University of Wyoming, the University of Minnesota, and the 2015 Midwest Economic Association annual meetings for helpful suggestions. We thank especially Jon Strand, Robert Johansson, Steve Miller and Andrew Yates for comments that improved the paper significantly.

Appendix

Appendix

Proof of Proposition 1

(i) We first show that \(\partial \pi (r)/\partial r <0\) when evaluated at \(r=1\). In the initial situation, equilibrium requires that \(P(Y^0) = C^{\prime }(Y^0)\), so that \(E^0 = \beta Y^0\). With regulation at \(r<1\), emissions are \(E^1 = rE^0 = r\beta Y^0\), output drops to \(Y^1 = rY^0\), and aggregate profits become \(\pi (r) = P(rY^0) rY^0 - C(rY^0)\). The change in profits in response to r is

Evaluating (11) at \(r=1\), and using \(P(Y^0)=C^{\prime }(Y^0)\) and \(P^{\prime }(Y)<0\), we can see that \(\partial \pi (1)/\partial r < 0\). It follows that profits must increase as r moves left from 1, and thus that there exists \(r<1\) at which \(\Delta \pi >0\). Because \(C(0)=0\), we must have \(\pi (0)=0\), which in turn means that \(\Delta \pi (0)<0\). By the intermediate-value theorem there is \(\tilde{r}\in (0,1)\) at which \(\Delta \pi (\tilde{r})=0\).

To see that \(\tilde{r}\) is unique, note that the second derivative is

This inequality, which appears in footnote 10, ensures that profits are strictly concave in r. Thus, \(\tilde{r}\) is unique. The strict concavity of \(\pi (r)\) ensures in turn that \(\Delta \pi (r) >0\) for \(r\in (\tilde{r},1)\).

(ii) For any \(t>0\), industry output falls to \(Y^1<Y^0\) and price rises to \(P(Y^1)>P^0\). In equilibrium, \(Y^1\) satisfies:

Thus, industry profit at tax level t is \(\pi (t) = \left[ P(Y^1)-t\beta \right] Y^1-C(Y^1)\) which, combined with (12), yields \(\pi (t) = C^{\prime }(Y^1)Y^1-C(Y^1)\). Also, using the equilibrium condition \(P(Y^0)=C^{\prime }(Y^0)\) we may write

Define \(H(Y)=C^{\prime }(Y)Y-C(Y)\), and from above \(\pi (t) = H(Y^1)\) and \(\pi ^0= H(Y^0)\). Because C(Y) is strictly convex, H(Y) is strictly increasing in Y: \(\partial H(Y)/\partial Y = C''(Y)Y > 0\). Consequently, because \(Y^1<Y^0\), we know that

and therefore \(\Delta \pi (t)<0\) for any \(t>0\).

(iii) Consider first a quantity restriction. We must show that, with \(P^0\) fixed, \(\Delta \pi (r)<0\) for any \(r<1\). Industry profit for a given r is \(\pi (r) = rP^0Y^0-C(rY^0)\), so that

Differentiating with respect to r yields

Because C(Y) is strictly convex, we have \(C^{\prime }(rY^0)\le C^{\prime }(Y^0)\) for \(r\in [0,1]\). Therefore, from the previous argument and the equilibrium condition \(P^0=C^{\prime }(Y^0)\), we know that \(P^0-C^{\prime }(rY^0)\ge P^0-C^{\prime }(Y^0)=0\). Thus, \(\Delta \pi (r)\) is strictly increasing in r for \(r\in [0,1]\). We also have \(\partial \Delta \pi (r)/\partial r=0\) at \(r=1\). Combining these two arguments we have \(\Delta \pi (r)<0\) for \(r\in [0,1)\).

Now consider an emissions tax. We must show that, with \(P^0\) fixed, \(\Delta \pi (t)<0\) for any \(t>0\). At tax level t, the industry’s total output \(Y^1\) satisfies

Thus, the industry’s profit at t is

The remainder of the proof is similar to the proof of part (ii). \(\square \)

Proof of Proposition 2

The regulator who accounts properly for the output price effect will choose r to minimize the sum of damages and \(L^{\text {Out}}(r)\) from (2). The solution is \(r^*\) satisfying the first-order necessary condition

The regulator who ignores the output price effect minimizes the sum of damages and \(\widehat{L}(r)\) from (3). This solution is \(\hat{r}\) satisfying

Let \(G_1(r)\) and \(G_2(r)\) denote the right-hand sides of (13) and (14):

Because \(P(rY^0)\ge P^0\) for any \(r \in [0,1)\), it follows that \(G_1(r)<G_2(r)\) for any \(r \in [0,1)\). Thus, \(G_2(r^*)>G_1(r^*)=0=G_2({\hat{r}})\). By the strict convexity of \(C(\cdot )\) and \(D(\cdot )\), we also know that \(G_2(r)\) is strictly increasing in r . Thus, the previous inequality also implies that \({\hat{r}}<r^*\), as was to be shown.

The argument for \(t^*<\hat{t}\) is now easily established by reference to Eq. (1). Differentiate t(r) to obtain

Because demand for Y is downward sloping and costs are strictly convex, this expression is strictly negative. Therefore the implicit function t(r) is strictly monotone decreasing and, because \(\hat{r}<r^*\), we have that \(t^*<\hat{t}\). \(\square \)

Proof of Proposition 3

Consider first the right side of Eq. (6). Because \(C(0,w_1)=0\), this may be written

To obtain an expression for the left side of (6), we make use of Shephard’s lemma, \(\partial C(Y,w_1)/\partial w_1 = x_1(Y,w_1)\). Integrating yields

Apply this expression to the definite integral on the left side of (6) to obtain

as was to be shown. \(\square \)

Proof of Proposition 4

(i) The proof is similar to that of Proposition 1(i), but here we assume that the output price is fixed at \(P^0\). The first step is to show that \(\partial \pi (r)/\partial r <0\) when evaluated at \(r=1\). The second is to show that \(\tilde{r}<1\) and \(\Delta \pi >0\) for \(r\in (\tilde{r},1)\).

In the initial situation, equilibrium requires that

Under the regulation, the output must be reduced to \(Y^1=rY^0\). Industry profit becomes

The change in profit with respect to r is

Inserting (17) and evaluating (18) at \(r=1\), we get

By Shephard’s lemma, the first term in (19) is simply \(x_1(Y^0,w_1)\), input demand. It must be strictly positive because \(x_1\) is a normal input and \(Y^0>0\). To see that the second term is strictly positive, first differentiate \(w_1(Y^0)\) with respect to Y:

Now \(\partial w_i/\partial x_1>0\) because the supply curve for \(x_1\) is strictly increasing. Also, \(\partial x_1/\partial Y >0\) because \(x_1\) is a normal input. We conclude that \(\partial w_1(Y^0)/\partial Y>0\) and so, referring back to (19), that

Thus, there exists \(r<1\) with \(\Delta \pi (r)>0\). We know that \(\pi (0)=0\) and thus that \(\Delta \pi (0)<0\). By the intermediate-value theorem there is \(\tilde{r}<1\) at which \(\Delta \pi (\tilde{r})=0\).

To see that this \(\tilde{r}\) is unique, consider Eq. (18). Once again using Shephard’s lemma, we may write it as

Differentiate again to obtain

We wish to show that the right side of (20) is negative. This is true so long as the expression in brackets is strictly positive, which upon rearranging one may see that it is, given that (8) is assumed to be satisfied. Thus, \(\pi (r)\) is strictly concave and we conclude that \(\partial ^2 \pi (r)/\partial r^2 <0\), and so \(\tilde{r}\) is unique. The strict concavity of \(\pi (r)\) ensures that \(\Delta \pi (r)>0\) for \(r\in (\tilde{r},1)\).

(ii) For any given output Y, and a fixed output price \(P^0\), industry profit at tax t is given byFootnote 12

Using (7), the tax that yields output Y may be expressed as

Combining (21) and (22), we obtain

We wish next to sign the derivative of \(\pi (Y)\). Differentiating (23) we find that

We know that \(C_{YY}(\,\cdot \,)>0\) and also that \(w_1^{\prime }(\,\cdot \,)>0\). Thus, (24) is strictly positive if the term in square brackets is strictly positive, which it is if

But Shephard’s lemma allows us to rewrite (25) as

Note that this condition is satisfied whenever \(x_1(Y,w_1(Y))\) is strictly convex in Y, which we know is true from (9). We conclude that

Because marginal cost is strictly increasing in Y, we also know that \(\partial Y(t)/\partial t < 0\) for any \(t\ge 0\). These inequalities may be combined to see that \(\partial \pi /\partial t < 0\) and, therefore, that \(\Delta \pi (t)<0\), as was to be proved. \(\square \)

Proof of Proposition 5

The proof resembles that of Proposition 2. The regulator who ignores the input price effect will again choose \(\hat{r}\) to satisfy Eq. (14). The regulator who accounts properly for the input price effect, though, will choose r to minimize the sum of damages and \(L^{\text {In}}(r)\) from (10). The solution is \(r^*\) that satisfies the first-order necessary condition

The second and third terms make up the derivative of the second integral term in (10) and are obtained using Leibniz’s Rule. Let \(G_3(r)\) denote the right-hand side of (26) and recall \(G_2(r)\) from (16).

If we are able to show that \(G_3(r) - G_2(r) < 0\) for any r then we are through, for the argument is then identical to that found in the proof of Proposition 2. Consider

From Eq. (5) we know that \(s_1(w_1(Y)) \equiv x_1(Y,w_1(Y))\), so the second term is zero. Because \(x_1\) is a normal input we also know that \(\partial x_1(\cdot )/\partial Y>0\). It follows that \(G_3(r)<G_2(r)\) for any \(r \in [0,1)\). Thus, \(G_2(r^*)>G_3(r^*)=0=G_2({\hat{r}})\). By the strict convexity of \(C(\cdot )\) and \(D(\cdot )\), we also know that \(G_2(r)\) is strictly increasing in r . Thus, the previous inequality also implies that \({\hat{r}}<r^*\), as was to be shown.

The argument for \(t^*<\hat{t}\) is identical to that used in the proof of Proposition 2. \(\square \)

Rights and permissions

About this article

Cite this article

Coggins, J.S., Goodkind, A.L., Nguyen, J. et al. Price Effects, Inefficient Environmental Policy, and Windfall Profits. Environ Resource Econ 72, 637–656 (2019). https://doi.org/10.1007/s10640-018-0217-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-018-0217-0