Abstract

Investments in climate-change adaptation will have to be made while the extent of climate change is uncertain. However, some important sources of uncertainty will fall over time as more climate data become available. This paper investigates the effect on optimal investment decision-making of learning that reduces uncertainty. It develops a simple real options method to value options that are found in many climate-change adaptation contexts. This method modifies a binomial tree model frequently applied to climate-change adaptation problems, incorporating gradual learning using a Bayesian updating process driven by new observations of extreme events. It is used to investigate the timing, scale, or upgradable design of an adaptation project. Recognition that we might have more or different information in the future makes flexibility valuable. The amount of value added by flexibility and the ways in which flexibility should be exploited depend on how fast we learn about climate change. When learning will occur quickly, the value of the option to delay investment is high. When learning will occur slowly, the value of the option to build a small low-risk project instead of a large high-risk one is high. For intermediate cases, the option to build a small project that can be expanded in the future is high. The approach in this paper can support efficient decision-making on adaptation projects by anticipating that we gradually learn about climate change by the recurrence of extreme events.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The investment expenditure needed to adapt to climate change will be enormous. For example, the UN Environment Programme estimates that annual spending to help developing countries adapt will be up to USD300 billion by 2030 and USD500 billion by 2050 (UNEP 2016). Spending in developed countries will be even greater (UNFCCC 2007). Investment of this scale—combined with substantial uncertainty about the speed, scale, and incidence of climate change—creates enormous potential for inefficient decisions involving the timing, scale, and location of investment. This paper investigates the effect of uncertainty on optimal investment decision-making and shows how the ability to learn more about climate change over time makes decision-making flexibility valuable.

Auffhammer (2018) and Hsiang and Kopp (2018) interpret “climate” as the set of factors determining the underlying distribution of specific weather events and “climate change” as a slow shift in this distribution. There is currently a great deal of uncertainty about the underlying distribution’s characteristics and how they will change in the future. Some of this uncertainty will fall over time as we obtain more weather observations. Models that investigate the value of investment flexibility typically assume that the magnitude of uncertainty is constant over time. In contrast, this paper uses a simple theoretical model to show how the prospect of uncertainty falling in the future alters socially optimal investment in climate-change adaptation projects.

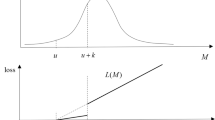

Uncertainty reduction is incorporated in the model by supposing there are multiple regimes which differ according to the distribution of extreme weather events.Footnote 1 Decision-makers are uncertain about which regime applies, but this uncertainty will fall gradually over time as the observed frequency of extreme weather events allows decision-makers to update their beliefs.Footnote 2 If storms occur frequently, for example, then decision-makers will increase the probability they attach to high-frequency regimes and decrease the probability they attach to low-frequency regimes. The perceived probability of each regime therefore fluctuates over time in response to observed weather patterns, which introduces volatility into the investment payoff: when an extreme weather event occurs the probability attached to the high-frequency regime increases, which in turn increases the expected investment payoff; during periods without extreme weather events, the shift in beliefs leads to a lower expected investment payoff. This contrasts with the standard approach to modelling investment flexibility, which assumes the probability of an extreme weather event is constant over time.

We investigate the effect of gradual, ongoing learning on decision-making about socially optimal investment. If planners’ uncertainty about the future did not evolve over time, it would be possible to make optimal adaptation decisions up front, even if the investments themselves were delayed. However, more information about the extent and impact of many aspects of climate change will become available over time (including the resulting changes in demand by users). We show that delaying investment decisions can lead to higher quality decision-making when waiting allows us to learn more about the true climate. Planners need to weigh the benefits of delaying decisions until better information is available against the cost of being unprepared for climate-change events. Real options analysis finds the optimal tradeoff. Planners choosing between different ways of adapting based on current information also need to consider policies that involve waiting and making decisions when new (by definition unpredictable) information becomes available. Resource constraints will mean some investments have to be delayed, but in many cases it will be optimal to delay decisions even if the resources needed for immediate investment are available.

The value of investment flexibility depends on the speed with which we learn about climate change. If the climate scenarios have quite different characteristics, then even a relatively short history will give a clear picture of which scenario is likely to hold. However, if the characteristics are similar then a much longer time series of weather outcomes will be needed to achieve the same level of precision. We find that it is optimal to set a relatively tough investment threshold when we learn relatively quickly which climate scenario holds. In some cases, the expected benefits of an adaptation project need to be twice as large as the investment costs in order for immediate investment to be optimal. In contrast, if we will learn very slowly, the disruption costs incurred while we wait for uncertainty to be significantly reduced will be so high that it is optimal to set a relatively easy investment threshold. We find that if the cost of waiting is high, then an option to build a smaller, safer project rather than waiting to build a large project can have considerable value. Building an expansion option into the small project at the time of construction can be valuable as long as learning is neither too fast nor too slow. An expansion option has little value if learning occurs quickly because in that case it is optimal to wait and build the large project. It has little value if learning occurs slowly because in that case the expansion option will not be exercised until so far in the future that it has little value.

We begin by placing our contribution in the context of the existing literature on decision-support methods for problems involving climate-change adaptation. In Section 3, we present our underlying climate model and the associated learning process. We introduce a generic adaptation project in Section 4 and describe in broad terms how to determine socially optimal ways to undertake this project. Section 5 investigates a particular adaptation project, starting with a simple now-or-never investment problem and introducing various forms of flexibility. We continue to analyze this project in Section 6, where we carry out sensitivity analysis on the speed of learning. Section 7 concludes the paper with some suggestions of ways in which the model can be made more realistic and a discussion of its merits as a practical decision-support tool.

2 Existing decision-support methods

The potential value associated with decision-making flexibility is often ignored when cost–benefit analysis is used to evaluate public investment in infrastructure.Footnote 3 This is especially limiting in the case of adaptation projects because of the uncertain project benefits and, due to the long project lifetimes, the potential for investment programs to adapt to future climatic and economic conditions. Two types of decision-support tools have emerged in response to these problems. One type of response can be regarded as “bottom-up” (Helgeson 2018). Members of this family typically start with a small number of candidate policies and then identify conditions in which policies perform unsatisfactorily. Different approaches proceed in various ways. Robust decision-making identifies circumstances in which individual policies perform poorly, and uses this information to identify policies that perform well across a range of conditions (Groves and Lempert 2007). The probability-threshold approach estimates the maximum probability with which these conditions need to hold in order for the policy to be acceptable on average (Lempert 2014). The adaptation-pathways approach and its extensions “build out” the policy when the system moves into the region where performance of the original policy is unsatisfactory (Haasnoot et al. 2012, 2013). Unlike these “bottom-up” approaches, the method in this paper requires estimates of underlying probabilities, but in return it is able to actually quantify the benefits of decision-making flexibility.

The second response to the limitations of standard cost–benefit analysis, real options analysis, can be regarded as a “top-down” approach (Helgeson 2018). This approach incorporates uncertainty by specifying the probabilities of various outcomes and choosing policies that maximize the expected value of a project’s net benefits; it incorporates flexibility using dynamic programming. Typical applications assume the model’s underlying parameters and the stochastic process that determines future outcomes are known with certainty. That is, the only uncertainty involves random events that occur in the future. This paper, on the other hand, allows for uncertainty about the model’s underlying parameters.

Some real options analyses use binomial trees to model climate-change uncertainty (Kontogianni et al. 2014; Ryu et al. 2018).Footnote 4 Others use continuous-time stochastic processes (Gersonius et al. 2013; Narita and Quaas 2014). In contrast to the approach adopted here, these authors all assume their state variable’s volatility is constant over time. This simplifies the analysis, but is inconsistent with a world in which we learn about the state of climate change by observing actual weather patterns. Other authors have modelled the underlying uncertainty using Monte Carlo simulation (Dawson et al. 2018; Kind et al. 2018; Linquiti and Vonortas 2012; Woodward et al. 2011, 2014). This approach offers greater flexibility in modelling uncertainty, but in order to make the analysis of decision-making tractable, the associated decision trees typically have only a few decision nodes. The approach to real options analysis described here allows for gradual learning about climate change without restricting the number of decision nodes.

Despite the prospect that some types of uncertainty about climate change will fall gradually over time, the literature blending adaptation decision-making and learning is currently small. Van der Pol et al. (2014) consider the dike-heightening problem when the rate of water-level increase is initially uncertain. Learning is sudden in their model, with uncertainty about the rate of water-level increase being completely resolved at a single date in the future. In contrast, climate-change uncertainty falls gradually in De Bruin and Ansink (2011), which uses a three-date Bayesian framework to analyze investment-timing decisions involving flood-protection measures. Van der Pol et al. (2017, Section 3.3) outline a framework for modelling gradual learning about climate change that is similar to the one used here, but they do not develop the implications for decision-making.

3 Observation-based learning

We suppose the climate is in either regime 1 (the “good” scenario) or regime 2 (the “bad” scenario). Each period, an extreme weather event occurs with probability π1 if the climate is in regime 1 and π2 if the climate is in regime 2, where π1 < π2. The event could be a storm, drought, heat wave, or some other event with substantial economic costs. We are initially uncertain which regime holds, believing that the climate is in regime 2 with subjective probability α0. We update this probability each period after observing whether or not an event has occurred that period. That is, the “true” regime does not change over time, but the probabilities that we attach to each regime being the “true” one change over time according to Bayes’ law.

Our uncertainty about the climate evolves according to a binomial tree in which node (i, n) corresponds to a point n periods in the future, when i of those periods have passed without an extreme weather event. Let α(i, n) denote the conditional probability that the bad scenario applies—calculated using all information available to us when we are at node (i, n). If an event occurs in the next period, we use Bayes’ law to update the probability that the bad regime applies to α(i, n + 1). If an event does not occur, our updated probability equals α(i + 1,n + 1). We show in the Appendix that

We use this to build a binomial tree for the perceived probability that an extreme weather event occurs next period (called the “storm probability” here). As we show in the Appendix, the subjective storm probability equals

at node (i, n), where π0 = (1 − α0)π1 + α0π2 is the initial storm probability. The assumption that π1 < π2 implies that each period that an event occurs we increase the probability attached to the bad scenario (and the storm probability rises); each period that an event does not occur we decrease the probability attached to the bad scenario (and the storm probability falls).

Figure 1 illustrates this process for a numerical example in which the good and bad scenarios have storm probabilities π1 = 0.05 and π2 = 0.20. The graphs assume that α initially equals 0.5, so the storm probability is initially 0.125.

The top graph shows the binomial tree that describes the evolution of the probability that the bad scenario applies. When an extreme weather event occurs, we move along the up arrow and the bad scenario becomes more likely. When one does not occur, we move along the down arrow and the bad scenario becomes less likely. The middle graph has the same structure, but now the points show the storm probability. Up moves make extreme weather events more likely; down moves make them less likely.

We can interpret the storm probability p(i, n) as a random variable in its own right. In fact, it is the stochastic exogenous state variable that is the source of option value in this model. From the viewpoint of node (i, n), the probability of an event this period is p(i, n) and the probability of one next period is a random variable with expected value p(i, n) and standard deviation (p(i, n) − π1)1/2(π2 − p(i, n))1/2. If we observe events occurring with a relatively high frequency, then p(i, n) will approach π2. In contrast, if we observe them occurring with a relatively low frequency, then p(i, n) will approach π1. In both cases, the standard deviation will tend toward zero. As time passes and we observe the frequency with which events actually occur, the volatility of the estimated storm probability falls.

The key determinants of the speed of learning are the storm probabilities in the two scenarios: π1 and π2. If the two scenarios have quite different storm probabilities, then even a relatively short history will give a clear picture of which scenario is likely to hold. However, if the storm probabilities are similar then a much longer time series of weather outcomes will be needed to achieve the same level of precision. This is illustrated in the bottom graph of Fig. 1 which shows what we can learn about the climate for two different combinations of π1 and π2. The solid curves correspond to the case where π1 = 0.05 and π2 = 0.20, whereas the dashed curves show what happens when π1 = 0.10 and π2 = 0.15. In each case, the downward-sloping curve plots the expected value of α(i, n), as a function of n, if the actual scenario is the good one; the upward-sloping curves plot the same expected value if the actual scenario is the bad one. In both cases, we initially believe the two scenarios are equally likely (α0 = 0.5). When there is a substantial difference between the two scenarios (the solid curves), we will probably have a clearer idea of which scenario holds after 10 periods. In this case, α will fall to 0.31 after 10 periods on average if the climate scenario is actually good and climb to 0.69 if it is actually bad. In contrast, when the differences between the scenarios are smaller (the dashed curves), we will learn little during 10 periods. In this case, α will fall to 0.47 on average after 10 periods if the climate scenario is actually good and climb to 0.53 if it is actually bad.

4 Optimal investment policies

4.1 A stylized adaptation project

In this subsection, we describe a stylized adaptation project. The formulation is designed to be general enough to allow for a wide variety of possible projects, but simple enough to keep the analysis tractable. All expected cash flows are discounted using the constant discount rate r. Our aim is to minimize the present value of all current and future project-related costs. We suppose that each time an extreme weather event occurs, society incurs event-related costs that equal Cu if the project has not been completed before the event occurs and Cp if the project has already been completed (where “u” and “p” denote “unprotected” and “protected,” respectively).Footnote 5 We assume Cp < Cu, so undertaking the project reduces event-related costs. Building the project, which takes one period and is irreversible, has two direct costs. First, construction requires lump-sum capital expenditure of I. Second, the project imposes ongoing costs of F per period. These include the cost of maintaining the project so that it can continue to provide adequate event protection, as well as detrimental effects such as reduced flows of amenities in the vicinity of the project.

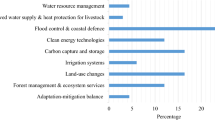

Table 1 describes some examples of adaptation projects that can be modelled using this framework. The projects help society adapt to an increased frequency of events including droughts, heat waves, and storms by reducing the magnitude of event-related costs. In many cases, this reduction occurs because the severity of the weather event needed to impose costs on society will rise once the project is in place. For example, irrigation schemes mean that droughts need to be longer-lasting before farmers suffer drought-related losses. Obviously not all possible adaptation projects will fit into this framework, but Table 1 indicates that the stylized project described in this section has many applications.

We incur immediate expenditure of I when we undertake the project and future event-related costs fall by Cu − Cp each time an event occurs. If we believe events occur with probability π, the expected benefit of the project equals π(Cu − Cp) − F per period. Assuming the benefits of the upgrade last forever, the future benefits have present value (π(Cu − Cp) − F)/r. The project’s benefit–cost ratio is therefore

Conventional cost–benefit analysis implies that we should undertake the project whenever the benefit–cost ratio exceeds 1. However, optimal decision-making requires that we weigh the benefits of investing against all of the costs, including the cost of any real options destroyed by investment. In the next subsection, we show how allowing for decision-making flexibility alters the rule for determining optimal investment.

4.2 Real options analysis with stochastic storm probabilities

Storm-probability trees like the one in Fig. 1 provide the basis for our valuation equations. In most real options models, the probabilities of up and down moves are constant throughout the tree and the values that the state variable takes throughout the tree directly determine the cash flows. In the approach described here, the values of the state variable throughout the tree determine how we move through the tree. Specifically, the storm probability at node (i, n) equals the probability that the next move in the tree will be up. Despite this significant departure from typical models, the process for deriving optimal decision-making has much in common with the standard approach to real options analysis using binomial trees, as described in Guthrie (2009). The most important difference is that the exogenous state variable in the approach presented here is the storm probability rather than some variable that (directly or indirectly) determines a project’s current cash flows. The latter approach is the one usually adopted when real options analysis is used to study climate-change adaptation projects. For example, researchers have used rainfall intensity (Gersonius et al. 2013), weather-dependent productivity variables (Narita and Quaas 2014), and the dollar value of avoided flood-related damages (Ryu et al. 2018) as state variables.

When evaluating a climate-change adaptation project, we begin by identifying every state the project can possibly be in. For example, if we are considering a project that will strengthen coastal defenses in a series of steps, then there will be a separate state for each number of steps completed. We build a separate binomial tree for each project state. For the purposes of the discussion here, let V (i, n;s) denote the present value at node (i, n) of all current and future costs assuming the project is currently in state s and optimal decisions will be made at all future dates.

We start by identifying optimal decisions at the terminal nodes of the binomial tree and then work backwards through time, calculating present values and identifying optimal decisions each step of the way. Each node is analyzed the same way. First, we identify all actions that we can possibly take at the node. Second, for each action, we identify the immediate cash flows and the project state that will occur next period if we take this action at this node. Third, for each action, we calculate the present value if we take this action at this node. Finally, we choose the action that results in the most favorable present value.

For example, suppose that if we are currently in project state s then we can take action a at node (i, n); after one period, the state will be s′ (which might be different from s). Denote the expected cash flow over the upcoming period by C(i, n;a, s). After this period has elapsed, we will be at node (i, n + 1) in state \(s^{\prime }\) if an extreme weather event occurs and at node (i + 1,n + 1) in state \(s^{\prime }\) if one does not occur. The present values of costs, measured from the perspective of date n + 1, will equal \(V(i,n+1;s^{\prime })\) in the first case and \(V(i+1,n+1;s^{\prime })\) in the second case. The present value of costs from the perspective of node (i, n) therefore equalsFootnote 6

As we want to minimize the present value of costs, we choose the action a∗ that minimizes Payoff(i, n;a, s), so that the present value of all current and future costs equals

Carrying out this exercise at all nodes yields an optimal investment policy.

5 Flexible responses with observation-based learning

In this section, we consider a situation where society incurs costs each time an extreme weather event occurs. We are initially uncertain about the severity of the problem—and therefore uncertain about the required scale of the solution. When making our investment decision, we anticipate that we will learn about the severity of the problem over time.

We use the storm-probability tree in Fig. 1: on average, events occur once every 20 years in the good scenario and once every 5 years in the bad scenario; we initially believe that the scenarios are equally likely, implying a subjective storm probability of 0.125. If no adaptation project is undertaken, then we incur disruption costs of 20 each time an event occurs, so the expected value of the disruption costs is 2.50 each period. All expected future cash flows are discounted at the rate of 5% per annum, so the present value of the cost to society equals 52.50 if we put no measures in place.Footnote 7

Our starting point is an adaptation project of the type described in Section 4.1. By incurring I = 16 of capital expenditure, we can reduce event-related costs to Cp = 3. There are ongoing costs of F = 1, so the expected value of project-related costs equals 1.375 per period, implying a present value of 30, measured immediately before we begin construction.Footnote 8 If we invest in the project immediately, then we can reduce the present value of costs from 52.50 to 46.00.Footnote 9

The rest of this section shows how decision-making flexibility can enhance the performance of this adaptation project when we can wait, observe weather patterns, update our climate beliefs, and reevaluate our adaptation options. We consider three ways to reduce the cost of our exposure to event risk. First, we can delay investing until we have a better idea about the state of the climate. Second, we can make a smaller, earlier investment, which reduces the cost of delaying investment (but increases long-run costs if the climate is worse than expected). Third, we can build flexibility into the small project that allows us to scale up our response if extreme weather events occur more often than is probable in the good scenario.

5.1 Flexible choice of project timing

We start by supposing we have the option to delay investment. This option has no value if we know which scenario applies: if we know the bad scenario holds, then we should invest immediately; if we know the good scenario holds, then we should never invest. The delay option also has no value if there is uncertainty but no opportunity to learn, because if we wait one period the situation will be exactly the same as it is now. For example, if we will always believe the climate is in the bad scenario with probability α, so that the storm probability is always π = (1 − α)π1 + απ2, then Eq. 2 implies the project has benefit–cost ratio

We should undertake the project immediately if and only if the benefit–cost ratio exceeds 1, which is the case when

If this condition is not satisfied, then we should abandon the project forever.

Now consider the case where we will use the opportunity provided by waiting to update our beliefs. In terms of the generic approach in Section 4.2, there are two project states: before and after investment. The storm probability at node (i, n) equals p(i, n), so the expected per-period cost after investment equals p(i, n)Cp + F. The present value of all future costs after investment therefore equals (p(i, n)Cp + F)/r when measured from the viewpoint of node (i, n). Before investment, we can choose between two possible actions: invest and wait. In both cases, the expected event-related cost over the upcoming period equals p(i, n)Cu, because the project will not be in place. If we invest, the present value of costs equals

If we wait, the present value is

where V denotes the present value of costs if we are still waiting to undertake the project. It follows that the present value of costs, measured before investment, satisfies

The optimal policy is to undertake the project immediately if the expression in Eq. 3 is less than the one in Eq. 4, and wait otherwise.Footnote 10

The top graph in Fig. 2 illustrates the optimal policy. The dashed line plots the present value of costs if we never undertake the project, for all values of α0 between 0 (when we are certain the climate is in the good scenario) to 1 (when we are certain it is in the bad scenario). The dotted line plots the present value of costs if we undertake the project immediately and the red curve plots the present value of costs if we adopt the cost-minimizing policy.Footnote 11 To the left of the vertical gray line (that is, if α0 < 0.65), it is optimal to delay investment; for higher values of α0, it is optimal to invest immediately.

In the special case where the two scenarios are equally likely, the present value of costs is 42.90 when we have the option to delay the project. Recall that in this case if no adaptation project is available, this present value equals 52.50; if the project is available but investment cannot be delayed, the present value equals 46.00. A significant part of the project’s value thus comes from the option to delay investment as long as we want. This option is destroyed when we invest, so delaying the project is optimal as long as the present value of the cost savings is less than the required capital expenditure plus the value of the delay option that is destroyed when we invest. This is why it is optimal to wait when 0.37 < α0 < 0.65 in the graph even though in this region the present value of costs is lower if we invest immediately than if we never invest: the cost saving from immediate investment is not large enough to compensate for the destruction of the delay option.

Decision-making based on standard cost–benefit analysis leads to investment whenever the benefit–cost ratio exceeds 1. However, optimal decision-making requires that the benefits of an investment exceed the required capital expenditure plus the value of the delay option. As the denominator in the benefit–cost ratio excludes the option value, optimal decision-making requires that we invest only when the standard benefit–cost ratio exceeds 1 by a margin large enough to cover the cost of the delay option. For the example here, the benefit–cost ratio must exceed 1.87 in order for investment to be optimal.

Figure 3 shows how we can use an investment rule like this. It shows two of the 220 ≈ 1 million possible paths over the next 20 years. The height of each curve has two possible interpretations. Using the left-hand scale, the height is the probability that the climate is in the bad scenario, calculated using Eq. 1. Using the right-hand scale, the height is the benefit–cost ratio if the project is undertaken immediately, calculated using Eq. 2. Each time that an extreme weather event occurs, the probability (or benefit–cost ratio) increases, otherwise it falls gradually over time. The bottom of the shaded region in Fig. 3 corresponds to a benefit–cost ratio of 1; the top of this region corresponds to the optimal threshold when we have the option to delay investment indefinitely.

Both paths in Fig. 3 feature an extreme weather event in year 2 but they differ according to what happens afterwards. There are no further events in the case shown by the bottom curve, so the probability that the climate is in the bad scenario gradually falls toward zero. In contrast, the top curve shows what happens if there are further events in years 6, 9, and 16. Immediately after each event, the probability of being in the bad scenario increases; by year 16, we are almost certain to be in the bad scenario.

Consider the situation immediately after the event in year 2. As the benefit–cost ratio exceeds 1, we would invest immediately after the event if we adopted standard cost–benefit analysis. The risk of investing is exemplified by the bottom curve. No further events occur, so there are no avoided costs that we can use to recover the cost of the capital expenditure. The capital expenditure in year 2 would have been avoided had we adopted the optimal investment threshold and only invested once the benefit–cost ratio exceeded 1.87. However, delaying investment in year 2 exposes us to the risk of incurring unnecessarily high repair costs each time an event occurs, exemplified by the top curve. The shaded region provides a buffer. Delaying investment in this region exposes us to the risk that we incur unnecessary event-related costs if the climate is in the bad scenario, but it also reduces the risk that we incur unnecessary capital expenditure if it is in the good scenario. The optimal investment threshold occurs as soon as these two risks are balanced. The latter risk outweighs the former one in the shaded region, so it is optimal to delay investment. Above the shaded region, the latter risk is dominated by the former one, so immediate investment is optimal.

5.2 Flexible choice of project scale

We now consider the possibility that we can choose the scale as well as the timing of our investment. We retain the option to invest in the project in Section 5.1, but now we have the option to invest in a smaller project instead. Its smaller scale means less capital expenditure is required, but it also means there will be fewer benefits in the form of avoided event-related costs. The small project is optimized for the good scenario, the large project is optimized for the bad scenario. However, because the scale choice is assumed to be irreversible, there is still possibly value in waiting for more information about which is the better approach.

The large project is as described in Section 5.1. The small project requires capital expenditure of \(I^{\prime }\); it results in event-related costs of \(C^{\prime }_{p}\) and ongoing costs of \(F^{\prime }\). This problem can be solved using the generic method in Section 4.2. The only difference from the method used in Section 5.1 is that now we choose between three actions rather than two. In Section 5.1, we could wait or invest in the large project. Now, we can choose to invest in the small project instead. As the payoff from investing in the small project is

the present value of costs, measured before investment, satisfies

The optimal policy is to undertake the small project immediately if the first term inside the brackets is smallest, and undertake the large project immediately if the second term is smallest, otherwise wait.

The middle graph in Fig. 2 summarizes the optimal investment policy for the case where the small project has capital expenditure of \(I^{\prime }=2\), event-related costs of \(C^{\prime }_{p}=15\), and ongoing costs of \(F^{\prime }=0\). It is analogous to the top graph, which summarized optimal investment when only the large project was available. As in that graph, the lines plot the present value of costs. The dashed line plots the present value if we never undertake an adaptation project, the dotted line plots the present value if we build the large project immediately, and the dot-dashed line plots the present value if we build the small project immediately. The red curve plots the present value if we adopt the optimal investment policy and the vertical gray lines split the graph into three regions. If the bad scenario is relatively unlikely (α0 < 0.40), then undertaking the small project immediately is optimal. If it is relatively likely (α0 > 0.68), then we should undertake the large project immediately. Between these two regions, we should wait.

The two straight lines showing the investment payoffs in the middle graph in Fig. 2 cross where α = 0.61. In the region where 0.40 < α < 0.61, we should wait even though we believe the present value of costs will be lower with the small project than the large one. The reason is that they are not lower by a large enough margin to compensate us for the destruction of the option to wait and invest in the large project if we subsequently come to believe the bad scenario holds. Similarly, in the region where 0.61 < α < 0.68, we should wait even though we believe the present value of costs will be lower with the large project than the small one. In this case, the reason is that they are not lower by a large enough margin to compensate us for the destruction of the option to wait and invest in the small project if we subsequently come to believe the good scenario holds. In this part of the middle region, the storm probability is higher, so the expected cost of waiting is higher and it is optimal to set a lower bar when deciding whether or not to invest.

When α0 = 0.5, adding the option to build a smaller project reduces the present value of costs from 42.90 to 41.50. It is optimal to delay investment even though both projects initially have benefit–cost ratios exceeding 1. There is a subtle difference from the decision to wait in Section 5.1. There, we delayed investment in order to reduce the possibility that we built a project that turned out not to be needed. Here, we are delaying investment in order to reduce the possibility that we invest in the wrong project. If the climate is actually in the good state, then we should have invested in the small project; if the climate is actually in the bad state, then we should have built the large project. Waiting allows us to gather more information about the climate and use that information to select an appropriately scaled project.

5.3 Building in the flexibility to expand

In this subsection, we assume that if we incur extra expenditure when building the small project then we can expand the project in the future. In addition to the investment options available in Section 5.2, we also have the option to pay an extra J at the time we build the small project. If we exercise this option, at any future date, we can pay an additional \(I^{\prime \prime }\) and replace the small project with the large one: the event-related costs fall from \(C^{\prime }_{p}\) to Cp and the ongoing costs rise from \(F^{\prime }\) to F. This change in project characteristics is irreversible.Footnote 12 This problem can be solved using the approach in Section 4.2, but we need to consider two separate project states. The first describes the situation if the “expandable” version of the small project is in place. The present value of costs in this case is denoted V (i, n;a), where “a” indicates that the present value is calculated after investment. The second project state describes the situation before any investment has occurred. The present value of costs is denoted V (i, n;b), where “b” indicates that the present value is calculated before investment.

The situation after investment in the expandable version of the project is the same as the investment-timing problem analyzed in Section 5.1, but with different parameter values. The expected value of the costs incurred while we wait equals \(p(i,n) C^{\prime }_{p} + F^{\prime }\) each period. If we spend \(I^{\prime \prime }\), then these costs fall to p(i, n)Cp + F. The present value therefore equals

at node (i, n). The situation before investment is more complex because we choose from four actions at each node. If we invest in the large project, our payoff is given by Eq. 3. If we invest in the small project without the expansion option, our payoff is given by Eq. 6. If we include the expansion option in this investment, our payoff is

The payoff from waiting is

We set V (i, n;b) equal to the minimum of these four possible payoffs.

The bottom graph in Fig. 2 summarizes the optimal investment policy for the case where \(I^{\prime \prime }=13\) and J = 3. The three straight lines show the same quantities as in the middle graph: the payoffs from never investing, building the large project immediately, and building the small project immediately (without the expansion option). The solid black curve shows the payoff from investing in the expandable project, given in Eq. 7. Introduction of this curve, and the extra investment flexibility it represents, changes the optimal adaptation policy. There are four regions, separated by the vertical gray lines. First, if α < 0.40 it is optimal to build the small project immediately without the expansion option. In this region, the bad scenario is sufficiently unlikely that the extra investment to include the expansion option is not worthwhile. Second, if 0.40 < α < 0.47, it is optimal to wait. Third, if 0.47 < α < 0.69, it is optimal to build the small project immediately with the expansion option. The probability of the bad scenario holding is still too low to justify building the large project, but the possibility that the bad scenario holds justifies the extra expenditure needed to construct the expansion option. Finally, if α > 0.69, then we should build the large project immediately.

Recall that if α0 = 0.5, then the present value of costs equals 52.50 if no investment is possible, 46.00 if we build the large project immediately, 42.90 if we can delay building the large project, and 41.50 if we can build a small project instead. The option to build flexibility into the small project reduces the present value further to 41.42. This investment flexibility is valuable even though the climate in this model does not change over time. What does change—and what generates the value of decision-making flexibility—is our belief regarding the state of the climate. If we knew the good scenario held, we would build the small project immediately; if we knew the bad scenario held, we would build the large project immediately. In both cases, investment flexibility would have no value. However, our ability to learn from observed weather patterns injects volatility into our subjective investment payoffs, which makes investment flexibility valuable.

6 Option value and the speed of learning about climate change

In this section, we investigate how the speed of learning affects the value of flexibility and how it should be exploited. Table 2 reports our results. Each row of the table corresponds to the combination of the storm probabilities in the good and bad scenarios given in columns (1) and (2).Footnote 13 The only difference between the cases is the variation of actual storm probabilities about the initial value of 0.125. The spread narrows as we move down the table. From Section 3, it follows that the rate at which we learn about the climate falls as we move down the table.

The entries in columns (3)–(7) report the present value of costs for five different situations, assuming that we initially believe the good and bad scenarios are equally likely. Column (3) corresponds to the situation where we never invest and column (4) to immediate investment in the large project in Section 5. Both present values take the same values for all levels of α0, reflecting the fact that the initial storm probability equals π0 = 0.125 in all cases. Columns (5), (6), and (7) show what happens when we can delay investment in the large project (Section 5.1), invest in the small project instead of the large one (Section 5.2), and build an expansion option into the small project (Section 5.3). Working from left to right across each row shows that greater flexibility results in lower present values. Some reductions are negligible, indicating that the additional flexibility has almost no value. For example, the entries in columns (4) and (5) are equal when immediate investment in the large project is optimal; the entries in columns (6) and (7) are equal when it is not optimal to build the expansion option.

Comparing columns (4) and (5) shows the delay option becomes more valuable as the speed of learning increases. The delay option is worthless when learning is very slow, but when learning is rapid the ability to delay investment can lead to a substantial reduction in costs. In contrast, the value of the option to build the small project falls as the speed of learning increases. The value of the ability to add an expansion option to the small project is negligible when learning is very slow or very fast, and modest for intermediate cases.

The final four columns report the smallest benefit–cost ratio needed to justify immediate investment in the large project for all of the situations we consider. When there is no decision-making flexibility (column (8)), we should build the large project whenever the benefit–cost ratio is greater than 1. Adding a delay option increases the threshold for the benefit–cost ratio by an amount that is larger when learning is faster. In some cases, the expected benefits need to be more than twice as large as the investment costs in order for investment to be optimal. Adding the option to build a small project instead of a large one raises this threshold still further, but in this case the amount of the increase is larger when learning is slower. The test for immediate investment in the large project becomes tougher still when we can build the small project with an embedded expansion option.

The intuition for these results is straightforward. Learning about the climate alters the storm probability. The usual story related to volatility and investment timing applies. If the storm probability falls, then the delay allows us to avoid unnecessary expenditure; if the storm probability rises, then we can still invest in the project (the only cost is some unnecessary event-related costs while we wait). Faster learning about climate translates into a more volatile storm probability. Reductions in the storm probability will be larger, but we would not invest in this case anyway. Increases in the storm probability will also be larger, but in this case we are affected: the expected benefits of investing are higher. In summary, faster learning increases the upside risk of waiting without changing the downside risk. The option to delay is thus more valuable, making it optimal to set a tougher investment test.

The relationship between the speed of learning and the option to build a small project instead of the large one is subtly different. Waiting to decide whether or not to build the large project is costly because of the high event-related costs incurred while we wait. The small project provides an alternative adaptation strategy, which reduces short-term event-related costs at the risk of missing out on the opportunity to reduce them further once we have learned more about the actual climate scenario. If the learning process is slow, then the benefits of reducing costs while we learn are relatively high, so the option value associated with the small project will be relatively high. In contrast, if the learning process is fast, then the cost of waiting to make the “correct” decision is relatively low, in which case the option value is relatively low.

7 Concluding remarks

This paper investigated the effect of uncertainty on decision-making involving climate-change adaptation projects. The ability to learn more about some aspects of climate change from observed weather patterns injects volatility into the expected payoff from investing in adaptation projects. We found that this makes decision-making flexibility valuable and that the amount of value added depends on how fast we learn about climate change.

The model’s most restrictive assumption is that the underlying scenario is constant over time. When modeling sea-level rise, for example, it might be more realistic to assume that the “correct” scenario changes stochastically over time as the sea level rises. Waiting provides information about the current scenario, but also gives time for the underlying scenario to change. This could be incorporated in the model using a regime-switching framework in which a transition matrix determines the probability of changing from one regime to another. Decision-makers would use the observed frequency of storms and this transition matrix to update the distribution of the underlying scenario as well as the storm probability.

Another restrictive assumption is that event-related costs are constant over time. In practice, observable economic variables that are not directly climate-related will influence the level of these costs. This assumption could be relaxed using a model with two binomial trees as in Tee et al. (2014). Another extension requiring the use of multiple trees involves a climate model with more than one type of extreme weather event. Bayes’ law can still be used to determine the evolution of the regime probabilities, but we need to specify the numbers of each type of event. For example, if there are two types of event, each node will be described by (i, j, n), where i is the number of periods without an event of the first type and j is the number of periods without an event of the second type.Footnote 14

Despite these limitations, the model presented in this paper can potentially aid adaptation decision-making in practice. A large strand of the cost–benefit analysis literature has advanced without considering decision-making flexibility. For example, it is absent in various recent flood risk applications, such as Zwaneveld et al. (2018) and Haer et al. (2018). Moreover, when project alternatives are considered they are frequently evaluated as now-or-never investments, which is especially limiting for adaptation investments with long planning and implementation times. Other methods that consider flexibility, such as the popular adaptation pathway method (for example Buurman and Babovic (2016); Haasnoot et al. (2013); Ramm et al. (2018)), are not designed to quantify the benefits of flexibility. Real options analysis can quantify these benefits, but its applicability is limited by the technical expertise needed to implement the approach, prompting Watkiss et al. (2015 p. 413) to call for the development of “light-touch” approaches that are easier to implement “while retaining a degree of economic rigour.”

The model developed in this paper offers one such light-touch approach. It uses a binomial tree for the probability of an extreme weather event occurring, which reduces the technical expertise needed to implement the method. Moreover, the approach requires very little information beyond that needed to carry out standard cost–benefit analysis.Footnote 15 It is therefore straightforward to extend the static analysis to incorporate decision-making flexibility, making the approach a suitable decision-support tool for evaluating adaptation projects.

Notes

This structure is general enough to incorporate a wide variety of aspects of climate change including changes in temperature, rainfall, and sea level, and the occurrence of extreme events such as heat waves and storms.

Recent research suggests that meaningful learning about some important aspects of climate change can occur in 20–50 years (Urban et al. 2014; Lee et al. 2017). However, intra-regime variability means that learning about some aspects of climate change, such as local sea-level rise, will be much slower (Kopp et al. 2014).

The closely related methods of cost-effectiveness analysis and multi-criteria analysis also do not deal with flexibility, but unlike cost–benefit analysis they do not require all future benefits of adaptation projects to be monetized.

Erfani et al. (2018) use a multinomial tree in their analysis of water-supply planning.

The magnitude of Cu and Cp will reflect expected disruption costs due to delays, lost production, and general inconvenience caused by the event as well as the direct cost of repairing damaged infrastructure. We summarize the results of the extensive analysis that would normally be carried out to estimate the economic costs of extreme weather events into simple lump-sum expenditures of Cu and Cp. For examples of the sort of analysis that is possible, see Linquiti and Vonortas (2012) and Dawson et al. (2018).

We use the actual probabilities of up and down moves to calculate the expected payoff, so that all risk adjustment occurs via the discount rate.

In terms of the notation in Section 4, π1 = 0.05, π2 = 0.20, r = 0.05, α0 = 0.5, and Cu = 20.

The expected value of event-related costs incurred while the project is being built equals 2.50. The present value of all subsequent costs equals 1.375/0.05 = 27.50.

This comprises capital expenditure of 16 and ongoing costs with a present value of 30.

In practice, planners may not reevaluate a project each year, especially if learning about climate is a slow process. In this case, V (i, n) equals the expression in Eq. 4 in years when the project is not reevaluated.

For each value of α0, we solve the model using a binomial tree with 100 annual time steps. At each terminal node, V (i, n) equals the minimum of the present values if we invest immediately and if we never invest. At all other nodes, V (i, n) equals the expression in Eq. 5.

The specific example in this section is one of many possible examples of sequential investment. However, it features the most important properties of this type of investment. The decision-maker can gradually increase the scale of the project as new information becomes available, but it is costly to decrease the scale in response to new information. Gradual investment reduces the risk of investing in a project that is too large for the true scale of the problem being addressed, but doing so means that we incur high event-related costs in the short term.

In all cases, the project specifications are the same as in Section 5.

Analyzing a model with more than two climate regimes is more straightforward because all the calculations can be done with a single binomial tree. We simply need to specify all of the regime probabilities αk(i, n) at each node of this tree.

The only additional information needed is some measure of the initial uncertainty about climate change. Standard cost–benefit analysis effectively requires us to specify the perceived probability that an event occurs each period. We also need to specify the number of climate scenarios, the probability of events occurring in each scenario, and the probability that each of those scenarios applies.

References

Auffhammer M (2018) Quantifying economic damages from climate change. J Econ Perspect 32(4):33–52

Buurman J, Babovic V (2016) Adaptation pathways and real options analysis: an approach to deep uncertainty in climate change adaptation policies. Policy and Society 35(2):137–150

Dawson DA, Hunt A, Shaw J, Gehrels WR (2018) The economic value of climate information in adaptation decisions: learning in the sea-level rise and coastal infrastructure context. Ecol Econ 150:1–10

De Bruin K, Ansink E (2011) Investment in flood protection measures under climate change uncertainty. Climate Change Economics 2(4):321–339

Erfani T, Pachos K, Harou JJ (2018) Real-options water supply planning: multistage scenario trees for adaptive and flexible capacity expansion under probabilistic climate change uncertainty. Water Resour Res 54:5069–5087

Gersonius B, Ashley R, Pathirana A, Zevenbergen C (2013) Climate change uncertainty: building flexibility into water and flood risk infrastructure. Clim Chang 116(2):411–423

Groves DG, Lempert RJ (2007) A new analytic method for finding policy-relevant scenarios. Glob Environ Chang 17(1):73–85

Guthrie G (2009) Real options in theory and practice. Oxford University Press, New York

Haasnoot M, Middelkoop H, Offermans A, van Beek E, van Deursen WPA (2012) Exploring pathways for sustainable water management in river deltas in a changing environment. Clim Chang 115(3–4):795– 819

Haasnoot M, Kwakkel JH, Walker WE, ter Maat J (2013) Dynamic adaptive policy pathways: a method for crafting robust decisions for a deeply uncertain world. Glob Environ Chang 23:485–498

Haer T, Botzen WJW, van Roomen V, Connor H, Zavala-Hidalgo J, Eilander DM, Ward PJ (2018) Coastal and river flood risk analyses for guiding economically optimal flood adaptation policies: a country-scale study for Mexico. Philos Trans R Soc A Math Phys Eng Sci 376(2121):20170329

Helgeson C (2018) Structuring decisions under deep uncertainty. Topoi, forthcoming

Hsiang S, Kopp RE (2018) An economist’s guide to climate change science. J Econ Perspect 32(4):3–32

Kind JM, Baayen JH, Botzen WJW (2018) Benefits and limitations of real options analysis for the practice of river flood risk management. Water Resour Res 54 (4):3018–3036

Kontogianni A, Tourkolias C, Damigos D, Skourtos M (2014) Assessing sea level rise costs and adaptation benefits under uncertainty in Greece. Environ Sci Policy 37:61–78

Kopp RE, Horton RM, Little CM, Mitrovica JX, Oppenheimer M, Rasmussen DJ, Strauss BH, Tebaldi C (2014) Probabilistic 21st and 22nd century sea-level projections at a global network of tide-gauge sites. Earth’s Future 2(8):383–406

Lee BS, Haran M, Keller K (2017) Multidecadal scale detection time for potentially increasing Atlantic storm surges in a warming climate. Geophys Res Lett 44(10):617–623

Lempert RJ (2014) Embedding (some) benefit–cost concepts into decision support processes with deep uncertainty. Journal of Benefit–Cost Analysis 5(3):487–514

Linquiti P, Vonortas N (2012) The value of flexibility in adapting to climate change: a real options analysis of investments in coastal defense. Climate Change Economics 3 (2):1–33

Narita D, Quaas MF (2014) Adaptation to climate change and climate variability: do it now or wait and see? Climate Change Economics 5(4):1450013

Ramm TD, Watson CS, White CJ (2018) Describing adaptation tipping points in coastal flood risk management. Comput Environ Urban Syst 69:74–86

Ryu Y, Kim Y-O, Seo SB, Seo IW (2018) Application of real option analysis for planning under climate change uncertainty: a case study for evaluation of flood mitigation plans in Korea. Mitig Adapt Strat Glob Chang 23(6):803–819

Tee J, Scarpa R, Marsh D, Guthrie G (2014) Forest valuation under the New Zealand emissions trading scheme: a real options binomial tree with stochastic carbon and timber prices. Land Econ 90(1):44– 60

UNEP (2016) The adaptation finance gap report 2016. United Nations Environment Programme. Nairobi

UNFCCC (2007) Climate change: impacts, vulnerabilities, and adaptation in developing countries. United Nations Framework Convention on Climate Change. Bonn, Germany

Urban NM, Holden PB, Edwards NR, Sriver RL, Keller K (2014) Historical and future learning about climate sensitivity. Geophys Res Lett 41:2543–2552

van der Pol TD, van Ierland EC, Weikard H (2014) Optimal dike investments under uncertainty and learning about increasing water levels. J Flood Risk Manage 7(4):308–318

van der Pol TD, van Ierland EC, Gabbert S (2017) Economic analysis of adaptive strategies for flood risk management under climate change. Mitig Adapt Strateg Glob Chang 22(2):267–285

Watkiss P, Hunt A, Blyth W, Dyszynski J (2015) The use of new economic decision support tools for adaptation assessment: a review of methods and applications, towards guidance on applicability. Clim Chang 132(3):401–416

Woodward M, Gouldby B, Kapelan Z, Khu ST, Townend I (2011) Real options in flood risk management decision making. J Flood Risk Manage 4(4):339–349

Woodward M, Kapelan Z, Gouldby B (2014) Adaptive flood risk management under climate change uncertainty using real options and optimization. Risk Anal 34 (1):75–92

Zwaneveld P, Verweij G, van Hoesel S (2018) Safe dike heights at minimal costs: an integer programming approach. Eur J Oper Res 270:294–301

Acknowledgments

The author gratefully acknowledges extremely helpful suggestions from three anonymous referees.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Derivations

Appendix: Derivations

If an extreme weather event occurs in the next period then we update the probability that the bad scenario applies to

In contrast, if an event does not occur then our updated probability equals

Equivalently, the odds the good scenario applies decrease to

if an event occurs and increase to

if one does not occur. That is, we multiply the odds of the good scenario applying by π1/π2 each period that an event occurs, and by (1 − π1)/(1 − π2) each period one does not occur. It follows that if we initially believe the bad scenario applies with probability α0 and if i of the next n periods are free of events, we will have revised this probability to the number α(i, n) defined implicitly by

Equivalently,

The probability that an event will occur this period if i of the previous n periods are free of such events therefore equals

where the relationship between α0 and the three storm probabilities explains the final step.

Rights and permissions

About this article

Cite this article

Guthrie, G. Real options analysis of climate-change adaptation: investment flexibility and extreme weather events. Climatic Change 156, 231–253 (2019). https://doi.org/10.1007/s10584-019-02529-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-019-02529-z