Abstract

There is a growing focus on the economics of adaptation as policy moves from theory to practice. However, the techniques commonly used in economic appraisal have limitations in coping with climate change uncertainty. While decision making under uncertainty has gained prominence, economic appraisal of adaptation still uses approaches such as deterministic cost-benefit analysis. Against this background, this paper provides a critical review and assessment of existing economic decision support tools (cost-benefit analysis and cost-effectiveness analysis) an uncertainty framework (iterative risk management) and alternative tools that more fully incorporate uncertainty (real options analysis, robust decision making and portfolio analysis). The paper summarises each method, provides examples, and assesses their strengths and weaknesses for adaptation. The tools are then compared to identify key differences, and to identify when these approaches might be appropriate for specific applications in adaptation decision making.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is increasing interest in the economics of adaptation. This information is relevant at various geographical levels, to address different objectives, such as decisions on national sectoral policies or programmes, or the appraisal and prioritization of projects at sub-national or local level.

Estimates of the costs and benefits of adaptation for such decisions are emerging (Agrawala et al. 2011) though the empirical data remains scattered. Deriving these estimates involves methodological challenges (UNFCCC, 2009) and estimates differ depending on the methods used, on which there is no current consensus, as well as the level of future climate change, the spatial, sector, and temporal contexts, and objectives. However, a principal challenge is the incorporation and treatment of uncertaintyFootnote 1 (Hallegatte, 2009), particularly for future climate change (longer-term decisions or near-term decisions with long life-times). This can be demonstrated by way of example.

Figure 1 (top) shows the relative change (%) in summer precipitation, presenting the 5th and 95th percentile from an ensemble of regional climate model (RCMs) simulations for Europe. For a large transect from the UK to Romania, the direction of change differs (left and right respectively). While the figure shows averaged seasonal values for a defined time period, there is also variability across seasons and over years, including for daily variability and extremes. It is noted that similar uncertainty remains with the new Representative Concentration Pathways (RCP) (IPCC, 2013). In turn, these uncertainties cascade through and are increased in the analysis of impacts and costs, and thus adaptation responses. Fig 1 (bottom) shows the change in expected annual damage (EAD) for two GCM-RCM outputs from the same ensemble and shows the variation in impacts.

Whilst the focus to date has been on the uncertainty in the projections of future socio-economic scenarios and climate models, there is also uncertainty in impact modelling. The Inter-Sectoral Impact Model Inter-comparison Project reports large differences between impact models and input assumptions (e.g. Rosenzweig et al., 2013). There is also uncertainty from the level of autonomous adaptation and the choice of monetary values and methods used to derive these. Indeed, alternative climate outcomes will not necessarily dominate uncertainty in the overall analysis.

The most common techniques used in economic appraisal of adaptation have limitations in coping with this uncertainty. Whilst a focus on decision making under uncertainty has become widespread in the adaptation literature, there has been less attention in economic assessment, and the default has been towards scenario-based impact assessment and cost-benefit analysis, with little consideration of uncertainty.

Against this background, this paper provides a review of promising economic decision-support tools for adaptation that more fully incorporate uncertainty. The primary context is the application to public sector resource allocation decisions, i.e. to assess changes in social welfare against various relevant criteria—most prominently economic efficiency.

2 Methodology

This paper reviews the principal approaches currently in use for economic decision support, and the use of uncertainty frameworks and alternative tools for addressing uncertainty in economic analysis. These are summarised in Fig. 2.

We review the formal concept underlying each tool and then consider application to the adaptation context, including a summary of data required, methodological strengths and weaknesses, resources and degree of expertise required.

The review is based on the authors’ readings of the academic and grey literature, complemented by application experience for all of these tools (Blyth et al., 2007; Dyszynski and Takama, 2010; Hunt, 2010; Watkiss et al., 2013). On the basis of the review, an assessment is made of relative merits and potential applicability to different adaptation problems.

3 Results

The review starts with two standard forms of appraisal before considering alternatives that allow consideration of uncertainties more explicitly.

3.1 Cost benefit analysis

3.1.1 Outline of Approach

Social cost-benefit analysis (CBA) is frequently used in Government economic appraisal (e.g. HMT, 2007). It aims to value all relevant costs and benefits of a proposed project/programme to society, allowing comparison of costs and benefits in a common metric—money. It therefore takes a social welfare maximisation perspective. CBA compares options using net present values (NPV), calculated as total discounted benefits minus total discounted costs, or benefit:cost ratios. As it identifies whether benefits exceed the costs, it can justify intervention, and allows resources to be allocated efficiently against other priorities, facilitating NPV ranking of options (Mishan, 1988). In addition to a deterministic analysis, CBA may use expected values, (the weighted average of all possible values of a variable, where the weights are the probabilities, HMT, 2007), and expected utility—if the risk preferences of those affected are known—or a measure of uncertainty preference, where these are known and the probabilities of outcomes are unknown. However, in reality such preferences are often not understood and excluded/imposed by the analyst/decision-maker (Pearce and Nash, 1981).

3.2 Application to Adaptation

In the application of CBA to climate adaptation, benefits are defined as the avoided damage costs of climate change. If benefits outweigh the costs of a given adaptation measure, there are net benefits and the adaptation measure is economically efficient, meeting the principal criterion of CBA.

Applications exist for adaptation. These primarily use scenario-based impact assessment to appraise measures (e.g. AIACC, 2006) with a predict-then-optimise framework, estimating baseline damage costs then applying CBA to appraise responses under alternative climatic and socio-economic futures.

CBA is widely used and has many advantages, though its obvious limitation is that it requires all elements to be expressed in monetary terms: in practice it is difficult to value all costs and benefits, particularly in non-market sectors. This presents a challenge for adaptation, as capacity building and non-technical options are difficult to quantify and value, and thus may be given lower priority or omitted.

It is relatively easy to incorporate risk within CBA using expected values. However, this can provide misleading results when probabilities are not known. This is highlighted in Fig. 1, which presents a typical damage cost input for an adaptation CBA. The optimal CBA response to the mean of the multiple simulations is likely to orientate the response towards minor deviations from the current, even though the direction of change varies across the ensemble. This has the potential for a resource allocation that is insufficient to cope with more extreme outcomes. The extent of uncertainty averseness is also not recorded.

3.3 Cost-Effectiveness Analysis (CEA)

3.3.1 Outline of Approach

Cost-effectiveness analysis is used to compare the costs of alternative ways of producing the same or similar outputs. As such, it is a relative measure, providing comparative information between choices. CEA has been widely used for environmental policy, because it avoids the need to provide monetary valuation of benefits, e.g. in flood protection alternative ways of achieving defined levels of acceptable risk can be compared.

At the project level, CEA can be used to provide a ranking of alternative options using cost per unit benefit (i.e. cost-effectiveness). At the programme or policy level, it can assess the least cost solution to achieve pre-defined targets or objectives - or identify the largest benefits possible with available resources. To do this, abatement cost curves (often referred to informally as marginal abatement cost curves) are used. These apply the most cost-effective options in order, assessing their cumulative contribution, until the defined target is achieved. These curves have been widely used for air pollution and for mitigation policy (CCC, 2008).

The key strength of CEA is its applicability where monetary valuation is difficult or contentious. It has become the main appraisal method for greenhouse gas mitigation. Most applications present individual cost curves, thus omit risk or uncertainty, though sensitivity analysis is possible (e.g. with alternative energy prices or discount rates: CCC, 2008). While it is possible to use stochastic approaches in CEA to assess changes in ranking and target levels, this is rarely undertaken, due to the added complexity and resources involved. In principle, preferences relating to risk or uncertainty can also be incorporated into CEA, though this is exceptional in practice.

3.4 Application to Adaptation

To date the number of adaptation CEA studies is relatively small. Boyd et al. (2006)) assessed future climate change impacts on household water deficits across a range of climate scenarios in South-East England and considered the cost-effectiveness of demand and supply options for managing public water supply. Cost-yield curves were constructed to assess how to eliminate household water deficits at minimum cost.

Such studies highlight that applying CEA to adaptation involves major differences to the mitigation context. Mitigation options are compared directly across sectors with a single globally comparable common metric ($/tCO2). In contrast, adaptation is a response to specific local, regional or national level impacts across a variety of metrics, e.g. adaptation to sea level rise (SLR) involves protecting people, reducing erosion, conserving ecosystems, and a single metric may omit categories and may not identify the most holistic option. Adaptation benefits are also location and technology specific, and time-dependent, thus unit effectiveness changes over time.

CEA also tends to focus on technical options, because these can be easily quantified, omitting (or giving lower priority to) capacity building and non-technical options. It also considers options discretely, in a linear and sequential order, which is at odds with the adaptation literature on portfolios and inter-dependencies in managing uncertainty (IPCC, 2012).

3.5 Frameworks for Uncertainty: Adaptive Management

It is possible to apply the conventional tools above (CBA, CEA and also MCA, multi-criteria analysis) within a framework that considers uncertainty. In the adaptation context, the most advanced example of this is with the use of adaptive management.

3.6 Outline of Approach

Adaptive management is an established approach that uses a monitoring, research, evaluation and learning process (cycle) to improve future management strategies. Its potential application to adaptation has long been recognised (Tompkins and Adger, 2004), though term iterative risk management (IRM) is often now used (IPCC, 2012), as well as ‘adaptation pathways’ (Downing, 2012) and route maps (Haasnoot et al., 2013).

While the concepts are established, the inclusion of economic appraisal within an IRM framework is less common, and so less methodologically developed. The overall method includes the following steps (Reeder and Ranger, 2011). First, an understanding of the current climate variability and any existing adaptation deficit are made, followed by the identification of major future risks from climate change. Future risk scenarios are then constructed and the analysis investigates and identifies vulnerability/impact thresholds that could trigger risks when coping capacity is exceeded, as well as effective indicators. The importance of alternative thresholds may in turn be determined by the risk/uncertainty preferences of the decision maker(s). The analysis then moves to adaptation, identifying possible adaptation options or portfolios that could be implemented in response to different threshold levels, and develops pathways of options. Finally, the analysis considers options against economic and other criteria and recommends a feasible, preferred route or pathway, as well as key monitoring variables. A key element of the approach is the link to on-going monitoring and a cycle of review, which allows learning and revision of the strategy over time.

3.7 Application to Adaptation

IRM has been widely recommended for long-term adaptation (Haasnoot et al., 2013) including major change, such as extreme sea level rise. One of the most frequently cited adaptation applications is the Thames Estuary 2100 project (EA, 2011). This developed a tidal flood risk management plan for London, developing a short-, medium- and long-term programme to address sea level rise, leaving major irreversible decisions as far as possible into the future to make best use of available information. Four future SLR scenarios were considered, including an extreme scenario. A series of defence options were appraised using CBA, complemented by Multi-Criteria Analysis to capture indirect/ancillary impacts. The plan recommended maintenance of existing flood defence system initially, followed by a programme of renewal and improvement, with a decision on the ‘end-of-century’ option by 2,050 (including a new downstream Thames Barrier), noting this decision will depend on conditions at that time. The project included a monitoring and evaluation strategy, with established decision points. If monitoring reveals SLR is happening more quickly (or slowly), options can be brought forward (or put back). Similar pathway approaches have also been developed in the Netherlands (see Haasnoot et al. this issue). IRM concepts are also starting to be applied at national level (e.g. Watkiss et al., 2013).

The use of such iterative planning aims to build adaptive capacity, implement early low and no-regret options, and identify areas of long-term concern that warrant early action to ensure flexibility is incorporated, risks of lock-in are minimized and future options are kept open.

The key advantage is that rather than taking an irreversible decision now– which may or may not be needed - decisions are adjusted over time with evidence (Reeder and Ranger, 2011). This helps ensure that appropriate decisions are taken at the right time, ideally with reference to the risk preferences for the given context. The economic appraisal step within IRM is flexible. It can use economic tools (CBA) or tools that allow the analysis of both quantitative and qualitative information (e.g. MCA) within the framework of uncertainty.

The main disadvantage of the approach is the difficulty identifying risk thresholds. As a result, the principle application to date has been for (directionally bounded, gradual) SLR. Other studies show the challenges in applying to other sectors (Watkiss et al., 2013) such as agriculture, due to the combination of many climatic parameters, multiple impact risks (with different thresholds), and complex socio-economic and institutional baselines. These problems are compounded with scale and geographical aggregation. Application can also be challenging due to the dependencies between options within a pathway.

3.8 Real options analysis

3.8.1 Outline of Approach

The concept of real options analysis derives from methods developed in the financial markets. A financial option gives the investor the right, but not the obligation, to acquire a financial asset in the future, allowing them to see how market conditions play out before deciding whether to exercise the option. This transfers risk from the buyer to the seller, making the option a valuable commodity. Options analysis quantifies this value, based on how much the risk transfer is worth (Merton, 1973).

The same insights are useful for investment in physical assets, hence ‘real’ options, in cases where there is risk/uncertainty attached to future values (McDonald and Siegel, 1986). Real options analysis (ROA) quantifies the investment risk with uncertain future outcomes. It is particularly useful when considering the value of flexibility with respect to the timing of capital investment, or adjustment of the size and nature of investment over a number of stages in response to unfolding events. In the adaptation context, this allows for the analysis of flexibility, learning and future information, particularly relevant for uncertainty.

ROA typically gives two types of result that set it apart from conventional economic analysis. The first applies to projects that are cost-efficient under a deterministic analysis: ROA may show that it makes more sense to wait for the outcome of new information, rather than investing immediately, if the benefits of the new information outweigh the costs – i.e. deferred benefits – of delaying implementation. The value of waiting will then be higher if the degree of uncertainty regarding the return of the project is greater; and the duration of the period of waiting before information is gained is shorter. The value of waiting needs to be balanced against the cost of waiting, because while waiting, the project will not be delivering benefits (Dixit and Pindyck, 1994).

The second applies to projects which fail a conventional CBA under deterministic analysis, but under conditions of uncertainty it may make financial sense to start the initial stages, or at least keep the option open for potential future investment. This arises because ROA helps understand how project value evolves during development: there will often be flexibility to adjust the project as it proceeds and it can expand, contract or stop. ROA can incorporate this value of flexibility (which is omitted in standard economic analysis). As with CBA, effective treatment of risk preferences depends on the ability of the analyst to describe these accurately.

The approach has been used for low-carbon energy investments, see Martínez Ceseña et al. (2013) for a review, including carbon capture and storage (Eckhause and Herold, 2013) and nuclear (Zhu and Fan, 2011). The approach has also been used for climate policy analysis: Fuss et al. (2009) and Reuter et al. (2012) analyse climate policy uncertainty and market risk for energy investment decisions, identifying opportunities for improving mitigation policy to reduce policy risk. Anda et al. (2009) consider climate policy under uncertain impacts including ‘fat tail’ probability distributions, using ROA to formulate rules for selecting emission targets and the value of future flexibility from interim climate policy and new knowledge.

Such studies show that ROA can be useful under three conditions: first, the investment decision is irreversible; second, the decision-maker has some flexibility when to carry out the investment (single step, or in stages); third, the decision-maker faces uncertain conditions and by waiting they gain new information regarding the success of the investment.

3.9 Application to adaptation

ROA has been advanced as a tool for adaptation (HMT 2009), as it aligns closely with the concepts of iterative decision making. ROA is usually carried out by formulating multi-stage decisions either as a stochastic programming or a dynamic programming problem. The approach assesses probabilities and resolution of uncertainty at each decision-point, taking into account the impact of decisions taken in later stages on the value of decisions taken in earlier stages. The key feature is the ability to account for the value of flexibility in investment decision-making, whether to alter the timing of investment, or to change plans at decision-points during the investment. There are therefore three main applications for adaptation. First, when considering adaptation infrastructure investment, ROA can assess whether there is a value to waiting for (climate) uncertainties to be resolved to avoid negative outcomes. Second, ROA may show that investing in more flexible adaptation solutions is a better solution, even if there are additional costs involved (i.e. projects that can be expanded, contracted or adapted can be favoured compared to a static NPV analysis). Finally, ROA may show higher value for early enabling steps such as feasibility studies and initial investments, which would not appear cost-effective under a deterministic approach, i.e. in keeping options open.

ROA investment rules tend to be most relevant for large capital intensive projects such as flood protection or water storage. It is highly relevant for projects where potential near-term benefits are involved, i.e. when there is an existing adaptation deficit (otherwise there is little penalty in delaying to wait for uncertainty resolution). However, it is also relevant for capacity building, no-regret or soft options when these initial steps keep open possible future investment options.

There are applications of ROA to adaptation. HMT (2009) provides supplementary economic appraisal guidance with a hypothetical ROA for future uncertain sea level rise, comparing a fixed-height sea wall against one that is upgradable, highlighting that ROA selects the latter. However, the use of ROA with climate projections and real project data involves a step change in complexity. Most applications have focused on sea-level rise, which lends itself to ROA due to the high capital investments and the nature of single, directionally bounded, gradual change. Linquiti and Vonortas (2012) report that framing investments in coastal protection as real options leads to better use of resources in Dhaka and Dar-es-Salaam. Kontogianni et al. (2013) use ROA to assess the value of maintaining flexibility (e.g. scaling up or down, deferral, acceleration or abandonment) to engineered structures in Greece. Scandizzo (2011) applies ROA to assess the value of hard infrastructure, restoration of mangroves and coastal zone management options in Mexico, concluding ROA highlights the value of gradual and modular options. Applications to other areas are rarer and often involve more complexity. Jeuland and Whittington (2013) applied ROA to water investment planning on the Blue Nile to identify flexibility in design and operating decisions for a series of large dams. Their results do not identify a single ‘best’ investment plan, but highlight configurations robust to poor outcomes but flexible enough to capture upside benefits of favourable future climates. Other examples include applications to agricultural irrigation in Mexico (World 2009) and Gersonius et al. (2013) on urban drainage infrastructure in England.

Important lessons emerge from these applications. First, the technique can be conceptually consistent with iterative adaptation, but data constraints may be a barrier to use, especially since key inputs are probabilistic climate information and quantitative impact data, noting the scope for the incorporation of risk preferences also remains limited. Furthermore, adaptation ROA needs to identify decision points in complex evolving climate pathways. Finally, the complexity of the approach is likely to require considerable expertise to apply, which will constrain widespread up-take.

3.10 Robust decision making

3.10.1 Outline of approach

Robust Decision Making (RDM) is a decision-support method premised on robustness rather than economic optimality. RDM involves testing strategies across a large number of plausible futures. It is often described as decision making under deep uncertainty, i.e. where little or no probabilistic information is available. In so doing, it helps to identify robust options or strategies, i.e. which perform well over a wide range of scenario futures. A key aim is therefore to help take robust decisions today, despite imperfect and uncertain information about the future.

The conceptual framework for RDM and applications of the approach are long-established (Matalas and Fiering, 1977) but the advent of computing power has allowed major advances. The formal application has a series of steps (Lempert et al., 2000: Groves and Lempert, 2007) beginning by structuring the problem, proposing alternative strategies and identifying performance measures. Levels of uncertainty characterizing these strategies and performance measures are determined by assigning uncertainty parameters (i.e. a range of potential values) to key variables. Depending on the application, these can be derived using modelling techniques and/or stakeholder consultation. For example, the potential range of per capita water demand for California in 2,050 expresses uncertainty relating to a key variable in water resource planning (Lempert and Groves, 2010). Each strategy is then assessed over a wide range of future scenarios. Qualitative and quantitative information is incorporated in a computer modelling interface that adopts data sampling algorithms to analyse strategies over large ensembles (thousands or millions of runs) reflecting different plausible future conditions. Strategies can then be “stress tested” to identify potential vulnerabilities or weaknesses. The combinations of parameters for which uncertainty is most important can be statistically derived and a summary of key trade-offs across the most robust strategies can be constructed. At this point there is a role for preferences relating to uncertainties and their associated outcomes to be incorporated in the analysis, since these inform the choice of trade-offs to be given most weight, as well as the weights to inform the trade-offs themselves.

3.11 Application to adaptation

RDM has attributes that align with adaptive management and the technique has been applied to adaptation. Lempert and Groves (2010) applied the method to the Urban Water Management Plan in California, evaluating a range of climate and socio-economic scenarios. Principal performance measures and uncertainties were identified, and alternative management strategies were assessed within a water planning model. Adaptive strategies were assessed against six criteria through a succession of iterative 5-year signposts, with performance measured using projected present value (PV) costs against PV shortage costs. The analysis identified eight response strategies, four static and four adaptive, finding the latter led to fewer vulnerable states. Dessai and Hulme (2007) present an example focused on climate robustness for an English water resource zone, and the implications of climate change on water supply options. Their findings indicated the existing water plan was robust across the scenarios evaluated, primarily because it had already mainstreamed climate change by using an extreme dry scenario. More recent applications include application to water management in the Colorado river (Groves et al., 2013), flood risk management in Ho Chi Minh City in Vietnam (Lempert et al., 2013) and planning coastal resilience for Louisiana (Groves and Sharon, 2013).

These applications suggest that when future uncertainties are poorly characterised or probabilistic information is limited/unavailable, RDM is a useful tool and force the decision-maker to make explicit his/her preferences for the importance of relative uncertainties in the model inputs. However, the lack of quantitative probabilities can make it more subjective, influenced by stakeholders’ perceptions. The formal application also has a high demand for quantitative information, computing power, and expert resources.

3.12 Portfolio analysis

Portfolio Analysis (PA) originated in the financial markets as a way of utilising portfolios of assets to maximise the return on investments, subject to a given level of risk. The principle is that spreading investments over a range of asset types spreads risks at the same time. Since individual assets are likely to have different and unpredictable rates of return over time, an investor may be better advised to maximise the expected rate of return and minimise the total portfolio variance, rather than managing assets individually (Markowitz, 1952). As long as the co-variance of assets is low then the overall portfolio risk is reduced, for a given rate of overall return. Aggregate returns are therefore likely to be higher when low returns on an individual stock are at least partly offset by higher returns from other stocks during the same period.

PA highlights the trade-off between the returns on an investment and the riskiness. It measures risk by estimating the variance of the portfolio return, thus a portfolio with a relatively high (low) variance is judged to have a higher (lower) risk. The information on returns and risks is used to identify a portfolio that most closely matches preferences. The method starts by defining options, and constructing feasible portfolios. Investment returns (benefits) are then defined and measured. This can include physical or economic metrics, e.g. quantity of water conserved or NPV. The risk is then characterised in terms of the variance or standard deviation around the mean, using probabilities of alternative outcomes to estimate the Expected NPV (ENPV).

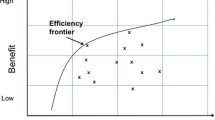

Following this step, the risk-return data for each portfolio is estimated by multiplying the ENPV of each asset in the portfolio by the proportion of each asset. This allows identification of efficient portfolios, i.e. with highest expected return for a given risk or – equivalently - lowest degree of risk for a given mean rate of return (Aerts et al. 2008). The results are plotted in terms of expected return and variance that identifies an efficiency frontier. Portfolios below the efficiency frontier (where lower returns are realised for a given level of risk) are omitted. Finally, the decision-maker chooses a portfolio from the efficiency frontier that best represents their risk-return preferences.

3.13 Applications for adaptation

The principles of diversification and use of portfolios have high relevance for adaptation. PA allows analysis of these in economic terms. It helps in selecting a set of options that, together, are effective over the range of possible projected future climates, rather than a single option best suited to one possible future.

However, to date there are few applications to the adaptation context. Crowe and Parker (2008) is perhaps the best-known, providing an empirical analysis of selecting genetic material to be used for the restoration/regeneration of a forest under uncertain climate change in Canada. The study combines RCM data with a climate impact model to estimate how different seed sources perform at specific sites under alternative climate futures. It finds that current locations of seed populations are poor predictors of optimal future locations, confirming the need for a broad portfolio of seed sources to maintain the genetic range. Hunt (2009) applied PA to local flood management in the UK. Three alternative adaptation measures were considered for the portfolio: hard defences; flood warning systems; and property-level resilience. The portfolio returns were measured by NPV and a clear, positive, relationship was found between return and variance, highlighting a trade-off between higher NPV of hard defences and higher uncertainty of return, with a number of portfolios found to be sub-optimal.

These case studies demonstrate that for PA to be useful, sufficient data is needed including the average effectiveness (or expected return), the variance, and the co-variance of return for each option over the range of climate scenarios. A minimum level of effectiveness also needs to be defined. PA also requires probabilistic climate information to be imposed, or an accepted assumption, such as the equal weighting of alternative scenarios.

The main strength of the approach is that it provides a structured way of accounting for uncertainty using combinations (portfolios) of options, which individual adaptation options do not allow. It can measure “returns” using various metrics, including physical effectiveness or economic efficiency. The use of the efficiency frontier is an effective way of presenting trade-offs. The disadvantages include that it is resource intensive, requires a high degree of expert knowledge, and relies on the availability of quantitative data. The approach is also static, responding to current uncertainties only, though conceivably, a dynamic element - such as that incorporated in ROA - could be introduced.

4 Discussion

A summary of the economic decision support tools is presented in Table 1. The evaluation of strengths and weaknesses is based on our subjective judgement, drawing on the literature and case studies reviewed above, as well as our own practical application experience. Grading of resources and expertise required are relative; all of these tools are resource/expertise-intensive. However, depending on the size of the investments being considered, such resources can be justified by minimising investment resource mis-allocation.

In comparing the methods, a number of key differences emerge. First, of the approaches considered, two require economic valuation of benefits (CBA and ROA): the other four (CEA, RDM, PA, IRM) have greater flexibility and can consider economic or physical benefits, increasing their applicability. Second, among the uncertainty tools, two are risk-sensitive, requiring estimates of probability (ROA and PA), while two are applicable under situations of uncertainty (RDM and IRM) where probabilistic information is low or missing. Third, while powerful, all uncertainty-focused tools are technically complex. In their formal application, they are data and resource intensive, requiring a high degree of expert knowledge. Finally, the discussion above has focused on climate uncertainty. However, as highlighted earlier, there is additional uncertainty. While this can be included within most approaches, RDM is best structured for addressing multiple sources of uncertainty.

These differences (in design, but also consideration of uncertainty) mean that these tools are suitable for different types of adaptation problems (noting their application to the same problem can also lead to different decisions). The type of problem (and objective) will therefore shape the most appropriate tools to use. None of these tools is universally applicable to all adaptation problems and they each have particular strengths for certain types of decisions and/or applications. Drawing on the review, applicability is summarised in Table 2. A number of observations are highlighted.

A number of the methods require probabilistic inputs, but climate uncertainties are rarely characterised in such terms. Even when probabilistic-like projections exist, e.g. Murphy et al. 2009, these provide a probability distribution for individual emission scenarios, rather than a composite probability distribution for all scenario futures and all models together. This is a critical issue, especially for techniques that require probability/expected value (ROA and PA). This tends to favour RDM and IRM tools when climate change uncertainty is large.

Furthermore, there are differences in the relevant time periods. RDM has broad application for current and future time periods, especially in identification of low- and no-regret options. When investments are nearer term (especially high upfront capital irreversible investments), and where there is an existing adaptation deficit, ROA is a potential useful tool. For long-term investments in conditions of a low current adaptation deficit, IRM may be more applicable.

Finally, with respect to scale: ROA appears to be more orientated towards projects (investments), while RDM and IRM have greater potential for programme/sector analysis. It is not clear how any of these methods might be used to evaluate transformational adaptation, e.g. when the size of change is structural or non-marginal (e.g. major macro-economic or societal change).

Finally, while the tools are presented individually, they are not mutually exclusive. Indeed, a tool focussed on economic efficiency may be complemented by one orientated towards robustness; the decision-maker would then be better able to make an informed judgement across these criteria.

A critical finding is that all of these methods are resource intensive and technically complex, and this is likely to constrain their formal application to large investment decisions or major risks. Given this, a critical question is whether their concepts can be used in ‘light-touch’ approaches that capture principal conceptual aspects, while maintaining a degree of economic rigour. This would allow a wider application in qualitative or semi-quantitative analysis. This could include the broad use of decision tree structures from ROA, the concepts of robustness testing from RDM, the shift towards portfolios of options from PA, and the focus on evaluation and learning from IRM for long-term strategies. There is already some early progress advancing these types of light-touch applications, e.g. Hallegatte et al. (2012), but further work in this area is a priority.

Finally, a further valuable area of future research would be to further advance the empirical applications of these methods. While the number of studies is expanding rapidly, a larger number of applications would allow better understanding and cross-comparison of the relative merits of the methods, their applicability and their contingency on specific contexts.

Notes

There are many different definitions of uncertainty. We use the definition from UK Government economic appraisal (HMT, 2007), where uncertainty involves a large number of possible outcomes and it is impossible to attach probabilities, as differentiated from risk, defined as the likelihood, measured by the probability, that a particular event will occur.

References

Aerts, J.C.J.H., Botzen, W., van der Veen, A., Krywkow, J. & Werners, S. (2008) Dealing with uncertainty in flood management through diversification. Ecology and Society, 13, 41

Agrawala S, Bosello F, Carraro C, deCian E, Lanzi E (2011) Adapting to Climate Change: Costs, Benefits, and Modelling Approaches. Int Rev Environ and ResEcon 5:245–284

AIACC (2006) Estimating and Comparing Costs and Benefits of Adaptation Projects: Case Studies in South Africa and Gambia. Report on Assessments of Impacts and Adaptations to Climate Change

Anda J, Golub A, Strukova E (2009) Economics of climate change under uncertainty: Benefits of flexibility. Energy Policy 37(4):1345–1355

Boyd, R Wade, S. and Walton, H (2006) Climate Change Impacts and Adaptation: Cross-Regional Research Project(E). Report to the Department for Environment, Food and Rural Affairs, London, UK

Blyth W, Bradley R, Bunn D, Clarke C, Wilson T, Yang M (2007) Investment risks under uncertain climate change policy. Energy Policy 35(11):5766–5773

CCC (2008) Building a low-carbon economy–the UK’s contribution to tackling climate change. Committee on Climate Change, Published by the Stationary Office, London, UK

Christensen, O.B, et al. (2011) European and Global Climate Change Projections: Outputs, Scenarios and Uncertainty. In. ClimateCost. ISBN 978-91-86125-35-6

Crowe KA, Parker WH (2008) Using portfolio theory to guide reforestation and restoration under climate change scenarios. Clim Chang 89:355–370

Dessai S, Hulme M (2007) Assessing the robustness of adaptation decisions to climate change uncertainties: A case study on water resources management in the East of England. Glob Environ Chang 17:59–72

Downing T (2012) Views of the frontiers in climate change adaptation economics. WIREs ClimChange 3:161–170

Dixit, A.K., Pindyck, R.S., (1994) Investment under Uncertainty. Princeton University Press, Princeton,NJ

Dyszynski, J. and Takama, T. (2010) “Robust decision making for sustainable and scalable drought index based micro-insurance in Ethiopia Reducnig weather related disaster risk with rural agro-insurance: In. Micro-insurance: An innovative tool. Published by the Global Risk Forum, GRF, Davos

EA (2011) TE2100 Strategic Outline Programme. Published by Environment Agency, Bristol, UK

Eckhause, J. and J.Herold (2013) Using real options to determine optimal funding strategies for CO2 capture, transport and storage projects in the EU. Energy Policy

Feyen L, Watkiss P (2011) The impacts and economic costs of river floods in Europe. In. ClimateCost. ISBN 978-91-86125-35-6

Fuss S, Johansson DJA, Szolgayova J, Obersteiner M (2009) Impact of climate policy uncertainty on the adoption of electricity generating technologies. Energy Policy 37(2):733–743

Gersonius B, Ashley R, Pathirana A, Zevenbergen C (2013) Climate change uncertainty: building flexibility into water and flood risk infrastructure. Clim Chang 116(2):411–423

Groves DG, Lempert RJ (2007) A new analytic method for finding policy-relevant scenarios. Glob Environ Chang 17:73–85

Groves, D.G. Fischbach, J.R. Bloom, E., Knopman, D. Keefe, R. (2013) Adapting to a Changing Colorado River. Making Future Water Deliveries More Reliable Through Robust Management Strategies. Published by the RAND Corporation: ISBN/EAN:9780833081797

Groves DG, Sharon C (2013) Planning tool to support planning the future of Coastal Louisiana. Journal of Coastal Research: Special Issue 67 - Louisiana′s 2012 Coastal Master Plan Technical Analysis:147–161.2013

Hallegatte S (2009) Strategies to adapt to an uncertain climate change. Glob Environ Chang 19(2):240–247

Hallegatte, S., Shah, A., Lempert, R., Brown, C. and Gill, S. (2012). Investment Decision Making Under Deep Uncertainty: Application to Climate Change. Policy Research Working Paper 6193. Published by the World Bank Washington DC

Haasnoot M, Kwakkel JH, Walker WE, Maat JT (2013) Dynamic Adaptive Policy Pathways: A Method for Crafting Robust Decisions for a Deeply Uncertain World. Glob Environ Chang 23(2):485–498

HMT (2007) Green Book. Appraisal and Evaluation in Central Government Treasury Guidance. Her Majesty’s Treasury. Published by the Stationary Office, London, UK

HMT (2009) Accounting for the Effects of Climate Change. Supplementary Guidance. Her Majesty’s Treasury. Published by the Stationary Office, London, UK

Hunt, A. (2009) Economic Aspects of Climate Change Impacts and Adaptation in the UK. PhD Thesis. University of Bath

IPCC (2012): Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation. A Special Report of the Intergovernmental Panel on Climate Change [Field, CB et al (eds)] Cambridge University Press, Cambridge, UK and New York, NY USA, 582 pp

IPCC (2013) Summary for Policymakers In: Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Stock, TF et al (eds).]. Cambridge University Press, Cambridge, UK and New York, NY, USA

Jeuland, M and Whittington, D (2013). Water Resources Planning under Climate Change: A “Real Options” Application to Investment Planning in the Blue Nile. Environment-for-Development. Discussion Paper Series, EfD DP 13–05

Kontogianni, A., C.H. Tourkolias, D. Damigos and M. Skourtos (2013). Assessing sea-level-rise costs and adaptation benefits under uncertainty in Greece. Environmental Science & Policy 27:61–78

Lempert RJ, Groves DG (2010) Identifying and evaluating robust adaptive policy responses to climate change for water management agencies in the American west. Technological Forecasting & Social Change 77:960–974

Lempert, R.J. Kalra, N.Peyraud, S. Mao, Z. Sinh-Bach-Tan, S. Cira, D. and Lotsch, A. (2013) Ensuring Robust Flood Risk Management in Ho Chi Minh City. Policy Research Working Paper WPS6465. Published by the World Bank, Washington DC, USA

Linquiti, P. and N. Vonortas (2012). The value of flexibility in adapting to climate change: a real options analysis of investments in coastal defense. Climate Change Economics 03(02):1250008

Markowitz HM (1952) Portfolio selection. J Financ 7:77–91

McDonald R, Siegel D (1986) The value of waiting to invest. Q J Econ 101:707–723

Matalas, N.C. and Fiering, M.B. (1977) Water Resource Systems Planning. In: Climate, climatic change and the water supply. National Academy of Sciences, Washington

Martínez Ceseña EA, Mutale J, Rivas-Dávalos F (2013) Real options theory applied to electricity generation projects: A review. Renew Sust Energ Rev 19:573–581

Merton, R., (1973) The theory of rational option pricing. Journal of Economic Management Science 4,141–183

Mishan, E.1988 Cost-Benefit Analysis: An Informal Introduction (4th edition), London: Unwin-Hyman

Murphy, J.M. et al. (2009), UK Climate Projections Science Report: Climate change projections. Met Office Hadley Centre, Exeter

Pearce, D.W. and C.A. Nash, (1981) The Social Appraisal of Projects: A Text in Cost-Benefit Analysis, Macmillan, London

Reeder, T and Ranger, N (2011) “How do you adapt in an uncertain world? Lessons from the Thames Estuary 2100 project.” World Resources Report, Washington

Rosenzweig, C., et al. (2013) Assessing agricultural risks of climate change in the 21st century in a global gridded crop model intercomparison. PNAS (ISI-MIP Special Feature). doi:10.1073/pnas/1222463110

Reuter, W.H., J. Szolgayová, S. Fuss and M. Obersteiner (2012) Renewable energy investment: Policy and market impacts. Applied Energy 97

Scandizzo P.L. (2011) Climate Change Adaptation and Real Option Evaluation. CEIS Working Paper 232

Tompkins EL; Adger WN (2004) Does Adaptive Management of Natural Resources Enhance Resilience to Climate Change? Ecology and Society, 9

UNFCCC (2009) Potential costs and benefits of adaptation options: A review of existing literature. UNFCCC Technical Paper F CDCeCce/mTPb/e2r0 20090/29

Watkiss, P. et al. (2013) Climate Resilience Strategy: Agriculture. Report to the Global Green Growth Institute/Federal Republic of Ethiopia

World Bank (2009) Evaluating Adaptation via Economic Analysis. Guidance Note 7, Annex 12.

Zhu L, Fan Y (2011) A real options-based CCS investment evaluation model: Case study of China's power generation sector. Appl Energy 88(12):4320–4333

Acknowledgments

The funding for this work was provided by the EC FWP7 funded MEDIATION and IMPACT2C projects.

Author information

Authors and Affiliations

Corresponding author

Additional information

This article is part of a Special Issue on “Uncertainty and Climate Change Adaptation” with Guest Editors Tiago Capela Lourenço, Ana Rovisco, Suraje Dessai, Richard Moss and Arthur Petersen

Rights and permissions

About this article

Cite this article

Watkiss, P., Hunt, A., Blyth, W. et al. The use of new economic decision support tools for adaptation assessment: A review of methods and applications, towards guidance on applicability. Climatic Change 132, 401–416 (2015). https://doi.org/10.1007/s10584-014-1250-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-014-1250-9