Abstract

Do firms respond to changes in economic growth by altering their corporate social responsibility programs? If they do respond, are their responses simply neglect of areas associated with corporate social performance (CSP) or do they also cut back on positive programs such as profit sharing, public/private housing programs, or charitable contributions? In this paper, we argue that because CSP-related actions and programs tend to be discretionary, they are likely to receive less attention during tough economic times, a result of cost-cutting efforts. However, the various CSP performance areas vary in terms of their resource requirements and their influence on financial performance (short- and long-term), which suggests that firms may respond differently depending on area. Consequently, in addition to examining CSP concerns separately from positive actions and programs (CSP strengths), we also examine the influence of economic growth across the five areas of diversity, employee relations, the environment, product quality/safety, and the community. Based on data from 837 firms over 15 years, our results suggest that firms neglect some areas associated with CSP during economic downturns, resulting in increased concerns about community and employee relations, product safety/quality, and the environment. However, this relationship does not apply to positive actions and programs. Instead, firms tend to increase their positive CSP programs in areas such as diversity, employee relations, and the environment during periods of slow economic growth and reduce them when the economy picks up. We offer potential explanations for our findings and discuss their importance to research on CSP.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

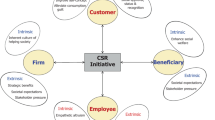

Corporate social responsibility has become a part of the fabric of Western society (Bondy et al. 2012). Society expects organizations to perform responsibly in the social, environmental, and economic arenas (Elkington 1997; Garriga and Melé 2004; Norman and MacDonald 2004), and organizations have responded through a variety of plans, programs, communications, and other activities with the intended purpose of either purposefully aligning the interests of society with the interests of the firm, or at least providing this impression (Du and Vieira 2012; Hsu 2012; McShane and Cunningham 2012; Uecker-Mercado and Walker 2012). In some of the most controversial industry sectors, this may involve simply minimizing harm (Lindorff et al. 2012).

Although there is disagreement regarding the precise definition of what constitutes corporate social responsibility, its normative foundation is strong, based on moral concepts such as responsibility, harm, intention, and consequences (Eabrasu 2012). It is possible to argue that there is a contradiction between the pursuit of social goals and the pursuit of profit. Sabadoz (2011) refers to this logical conflict as a “necessary contradiction”. However, many scholars have argued that there is no contradiction, and that both objectives may be simultaneously pursued, because of the economically advantageous benefits that socially responsible firms enjoy (i.e., Barringer and Harrison 2000; Du et al. 2011; Russo and Fouts, 1997; Porter and Kramer 2011; Shane and Spicer 1983).

Because resources expended in socially responsible ways potentially have less direct or less obvious financial benefits (e.g., spending on “social causes”), the relationship between social responsibility and profits has attracted significant research attention (i.e., Barnett and Salomon 2006; Berman et al. 1999; Choi and Wang 2009; Hillman and Keim 2001; Margolis and Walsh 2003; Orlitzky et al. 2003; Surroca et al. 2010). Some studies have supported a positive relationship between corporate social performance (CSP) and firm performance, while others have not; however, a meta-analysis documented a small positive relationship overall (Orlitzky et al. 2003). The converse question, that profitability may lead to improved social performance, has also been studied and confirmed (e,g., Surroca et al. 2010; Waddock and Graves 1997).

While many researchers have studied the relationship between CSP and firm profitability, none, to our knowledge, has studied the link between economic growth and CSP. Based on a review of the corporate social responsibility literature, Campbell (2007, p. 952) proposes: “Corporations will be less likely to act in socially responsible ways when they are experiencing relatively weak financial performance and when they are operating in a relatively unhealthy economic environment where the possibility for near-term profitability is limited”. As noted, the first part of this proposition has been confirmed in the empirical research literature. The second part, dealing with relative economic conditions, has not.

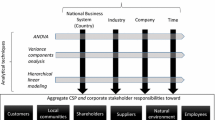

In this study, we provide evidence regarding the influence of economic growth on CSP. In addition to measuring CSP as an aggregate of all of the various components of corporate social responsibility, we also examine each component separately based on the assumption that economic growth may have a different effect on, for example, environmental performance as compared to employee performance. We also examine a firm’s CSP strengths and weaknesses independently because strengths are more closely associated with positive actions that may be resource intensive (i.e., charitable contributions, employee benefits), whereas concerns are more likely to be associated with neglect of particular areas (i.e., environmental infractions, tax violations) or cutting back on expenditures (i.e., layoffs). Consequently, economic growth could influence these two aspects of CSP differently.

Our findings offer strong evidence that economic conditions influence CSP and, as expected, they influence some areas of CSP differently than other areas. The differences are important to the literature because they help us understand how firms and their managers value various factors associated with CSP. In supplemental analyses, we also find that positive CSP actions and programs (strengths) influence firm profitability differently than neglect of particular areas associated with CSP (concerns). Our evidence provides a strong argument that economic growth should be measured and included in future studies of CSP.

The rest of the paper is organized as follows: First, we examine firm motivations for pursuing socially responsible behavior, as well as countervailing influences. We then discuss how changes in economic growth might be expected to influence CSP, as a whole and by type of CSP. Following a description of our methods and presentation of results, we discuss the implications of our findings for research and practice.

The Stability of Investments in Social Responsibility

Although we did not find extant studies related directly to the relationship between economic growth and CSP, evidence from existing research suggests such a relationship. Some of this evidence regards the conjecture that higher slack resources (i.e., more liquidity), which are often associated with profitability, allow for higher levels of activities associated with social responsibility. This idea is supported by Harrison and Coombs (2012) in the context of community investments and is also broadly supported in the Orlitzky et al. (2003) meta-analysis of the relationship between corporate financial performance and corporate social responsibility. To complete the picture, there is evidence that slack is related to economic cycles (Sadowski 2011). So economic health influences slack, and slack influences CSP. Note also that this logic suggests that it will be important to control for slack in any test of the relationship between economic growth and CSP.

Corporations reacted to economic uncertainty caused by the most recent recession by reducing investments in many areas. As of September 2010, total liquid assets rose as a share of total corporate assets by approximately 2 % since the start of the recession (Sadowski 2011). This ratio increased to as high as 7.4 % at times, which was the highest relative cash percentage for U.S. corporations since the middle of the 1950s (Sadowski 2011). Anecdotal evidence suggested reductions in investments in everything from information technology to research and development as the economy weakened (Virki 2010). Does a slowdown in these types of investments also extend to social and environmental activities? In the language of Harwood et al. (2011), how “resilient” is investment in corporate social responsibility?

Corporate Social Responsibility as a Crucial Investment Area Resistant to Changes in Economic Growth

There are reasons to believe that CSP may not decline significantly during an economic downturn. As mentioned previously, past empirical findings suggest a small positive relationship between CSP and financial performance, which is supported by a rather large conceptual literature. In this section, we will focus on some of the core ideas in this literature to demonstrate that firms may be reluctant to reduce investments in CSP-related areas even during economic downturns.

Many of the early arguments supporting responsible corporate behavior were based on avoidance of negative responses due to a lack of responsibility. For example, Spicer (1978) suggested that socially responsible companies are less likely to be subject to expenses related to adverse legislation, regulatory penalties, or consumer retaliation. Consequently, the stocks of socially responsible companies are less risky and therefore more attractive to investors (Cornell and Shapiro 1987; Shane and Spicer 1983). This reasoning also supports a direct effect between social responsibility and profitability because socially responsible firms, on average, should spend less on the expenses associated with bad citizenship. Investment funds may provide another benefit specifically related to demand for particular shares of stock, which can influence their prices and thus shareholder wealth (Waddock and Graves 1997). Many billions of dollars have been channeled into funds that invest solely in companies that satisfy particular criteria of social responsiveness (Pava and Krausz 1996).

In addition, firms that are considered to be good citizens should be more attractive as business partners or associates, thus leading to competitive advantage. For example, customers may be more likely to shop at a store that is known as a “good corporate citizen” (Brown and Dacin 1997; Sen and Bhattachara 2001). Or highly skilled workers may be attracted to firms that rank high on a list of the best employers (Moskowitz 1972; Turban and Greening 1996). Similarly, responsible corporate behavior can facilitate the formation of long-term contracts, alliances and joint ventures (Barringer and Harrison 2000; Harrison and St. John 1996). In addition, stakeholders are more likely to trust a socially responsible firm compared to firms that exhibit irresponsible behavior, and trust can lead to a reduction in transactions costs (Williamson 1975) by reducing the amount of resources needed for creation and enforcement of contracts containing elaborate safeguards and contingencies.

Some of the more recent arguments in favor of corporate social responsibility are based on the notion of reciprocity, which motivates a firm’s stakeholders to respond favorably to virtuous firm behavior in economically meaningful ways (Becker 1986; Bosse et al. 2009; Fassin 2012; Simon 1966). For example, stakeholders may be motivated to exhibit a high level of performance when engaging with a firm that has exhibited fairness and integrity in its dealings. They should also be more likely to share value-creating information with such a firm (Harrison et al. 2010). A recent study provides some evidence for this position. It demonstrates that employee productivity is related not only to the integrity a firm manifests in its treatment of employees, but also its customers (Cording et al. 2014).

Society scrutinizes businesses based on widely held beliefs about what comprises socially responsible behavior (Brummer 1991). Consequently, tough economic times may represent the ideal time to make targeted investments that help a firm differentiate itself from competitors, especially for firms that have targeted CSP as a central part of their strategies. Discriminating consumers reward firms that support causes in which these consumers believe (Vogel 2006), which may allow firms to retain, or grow, market share in periods of recession. Executives may also recognize that CSP considerations are vital to the future of the business and should be cut with great caution. Indeed, contrary to the argument they lay out above, Ellis and Bastin (2011, p. 303) find that “the way the media has [sic] reported on CSR [corporate social responsibility] has changed during the life cycle of the recession; moving away from the death of CSR to CSR being a mechanism by which companies can survive and come out ‘the other side’”. Moreover, they speculate “the recession has, across the board, had little real impact on CSR activities.”

Corporate Social Responsibility as a Discretionary Expense Highly Subject to Changes in Economic Growth

As the economy slows, business investment weakens (Forrester 1976). Investments in CSP may be no different in this regard, where such activities may be seen as a discretionary expense that is only reasonable during prosperous times. At the core of the argument against investments in CSP is the idea that attempts to be a good corporate citizen are more costly than the benefits derived from such actions (Aupperle et al. 1985). Adding to this perception is the fact that benefits are often difficult to measure directly. Magnifying this position is the strong tradition, correct or incorrect, that the primary responsibility of managers is to produce high financial returns, and therefore investments that are less certain to provide such returns should be avoided (Friedman 1970; Rappaport 1986; Wallace 2003). Based on this logic, investments that are not measurably related to a firm’s financial performance should be avoided and should certainly be reduced or eliminated during tough times.

Related to these arguments, timing may actually be the critical deterrent to investments in corporate social responsibility. Most often these sorts of investments are discretionary and may take a long time to produce tangible returns. For example, investments focused on the community, product safety, or employee relations may result in benefits over the longer term based on the reciprocal forces discussed in the previous section. However, the expenses are incurred immediately, thus reinforcing the short-term perspective often associated with shareholder wealth maximization (Stout 2012).

The idea that corporate social responsibility is an expensive indulgence is amply evidenced in the popular press. For example, Caulkin (2009, p. 1) writes, “Non-government organisations and a number of other CSR observers see signs of companies reverting to the default position that, in today’s conditions, anything other than business as business is a luxury that they can’t afford (emphasis added)”. Doane (2005, p. 25) also suggests that investments in corporate social responsibility might not “pay off in the 2- to 4-year time horizon that public companies…often seem to require”. Echoing Caulkin, Doane asserts that “investments in things like the environment or social causes become a luxury and are often placed on the sacrificial chopping block when the going gets rough”. Finally, Ellis and Bastin (2011, p. 295) summarize this view: “In times of recession or economic downturn, it is necessary to question whether CSR is seen by business as a desirable optional extra, which can be culled in favor of profit maximization”. In acknowledging that this view exists among some managers, Freeman (1984, p. 40) writes “that the phrase often heard from executives is ‘corporate social responsibility is fine, if you can afford it’”.

Similarly, Halal (1987, p. 124) suggests “…business people, under the pressure of adapting to a challenging new environment in a time of economic crisis, came to view social responsibility as a luxury that was to be afforded after they had earned sufficient profits to indulge in this type of philanthropy”. Halal describes the “pressure of adapting to a challenging new environment” as being the root cause of viewing social responsibility as a luxury. In this description, it is not necessarily an actual firm-level profit decline that results in a new attitude about investments in social responsibility. Rather, it is economic uncertainty that causes the attitude (and presumably behavior that is consistent with this attitude). The same forces that have resulted in firms building up their liquid assets during the present downturn (Sadowski 2011), rather than investing them, are likely also to lead to a situation in which firms are unlikely to make new investments in non-core areas that may not be closely linked to short-run profits.

To summarize, during recessions firms may be more likely to focus on “quick fixes” that can lead to short-term positive financial outcomes rather than on corporate social responsibility activities. One possible finding from our study, then, is that when the economy weakens, CSP declines, or at least no longer grows (Juscius 2010).

Differential Influences of Economic Cycles on CSP Factors

During an economic recession, CSP may decline either (1) because of the elimination of positive programs or activities in which firms previously engaged or (2) because of concerns resulting from efforts to cut back in areas that are socially sensitive, leading to negative stakeholder reactions such as lawsuits, regulatory actions, or contract controversies. These two different types of responses require separate treatment (Mattingly and Berman 2006). The health of the economy, up or down, is likely to have a different impact on positive programs than it does on behavior that leads to social concerns. Consistent with a stakeholder perspective that firms are accountable to multiple constituencies (Freeman 1984), we will examine these phenomena across multiple areas, including the community, the environment, products/services, employees, and diversity. We will discuss CSP strengths and concerns in terms of their resource requirements and their potential influence on financial performance in the short term. We are choosing to discuss short-term financial implications because, consistent with the theory presented in the last section, we believe that economic downturns are likely to put pressure on managers to focus more on the short term.

Influences of the Economy on CSP Strengths

CSP strengths come from positive corporate programs or activities associated with corporate social responsibility. For example, in the community area, strengths are associated with activities such as generous corporate giving programs (domestic and international) and support for community housing and educational programs. Investments in the community can require a lot of resources (although they may be relatively easy to reduce if necessary), and they tend to have an immediate negative impact on the financial condition of the firm. That is, philanthropy directly reduces the amount of financial resources available for the shareholders and other stakeholders, and for other types of investments directly related to firm operations. Any potential financial payoff is uncertain, and is likely to be realized over a period of years rather than immediately. This is the type of investment we expect to see reduced during economic downturns and increased in periods of economic prosperity.

Corporations can also increase their CSP through strengths in other areas. In the human resources area, CSP strengths include factors such as employee profit sharing programs and strong retirement benefits. For product quality and safety, CSP strengths include the development of a noteworthy quality or R&D program, as well as production of new products that benefit the economically disadvantaged. New programs to develop these sorts of product and employee strengths seem fairly resource intensive both financially and in human terms, and would tend to have a noticeable impact on a firm’s bottom line, although it is possible that the payoffs could begin to accrue to the firm a little more quickly than in areas such as corporate philanthropy that are less closely related to the value-creating core of the business.

Environmental strengths are also highly relevant to this discussion and often included in studies of corporate social responsibility (i.e., Berman et al. 1999; Choi and Wang 2009; Hillman and Keim 2001; Kang 2013; Waddock and Graves 1997). Environmental strengths are associated with programs such as pollution prevention, recycling, and use of alternative fuels. These sorts of programs tend to use a lot of financial, human and even capital resources; however, some of the expenses can be recouped through cost savings (Russo and Fouts 1997). Still, even in the best-case scenario that the benefit to cost ratio is positive, it will likely take a while to be realized. Consequently, a period of economic recession may be an unlikely time to begin an activity in this area.

Finally, diversity strengths are another factor often included in studies of corporate responsibility. Support of strong family benefit programs such as daycare can be very resource intensive; however, most of the other factors would seem to have a more moderate impact on the bottom line of the firm. For example, most of the diversity strengths focus on firm treatment of protected groups or females, such as their participation in leadership as CEO or on the board of directors, use of female- or minority-owned contractors, employment of the disabled, or progressive gay/lesbian policies. Because the bulk of the diversity strengths are not as resource intensive as some of the other strengths, they may not have as much of a negative immediate influence on financial performance, and may therefore respond differently to economic cycles than the other strengths.

Overall, because of the amount of resources required to start new programs in the CSP strength areas, and the immediate effect of these resource allocations on financial performance, we expect that firms are unlikely to engage in actions to build these strengths during economic downturns, and are more likely to build programs in these areas in economic good times. Having said this, we acknowledge that highly visible positive programs may be hard to eliminate without serious consequences, especially with a vigilant press. In fact, the counter argument is that firms might actually be interested in engaging in positive programs for the reason of attempting to counteract the influences of a recession. Regardless, there is variance across both the resources needed and the theorized time lags between resource allocations and potential financial payoffs, as well as the uncertainty of those payoffs. Consequently, we need to test both the cumulative CSP strengths and the individual strength areas to gain a complete picture.

Influences of the Economy on CSP Weaknesses

During a recession, CSP could also decline through neglect of areas associated with corporate social responsibility. We define CSP concerns as problems stemming from violations of societal expectations associated with corporate social responsibility. Again, we will examine each of the CSP concern areas in terms of the resources involved and the potential for short-term impact on financial performance.

Three of the CSP concern areas seem to have a lot in common in terms of the types of corporate behaviors associated with them. Community concern areas include problems such as tax disputes, investment controversies, and having a negative impact on the community. Product concerns include marketing or contracting controversies, product safety problems, and antitrust concerns. Employee concerns include difficulties with unions, health and safety concerns, and concerns about pensions or benefits, as well as workforce reductions. These sorts of problems seem to share a common objective in that they all seem to be closely associated with efforts to reduce the resources allocated to these areas in an effort to cut costs and thus increase financial performance in the short term. For example, tax disputes can occur as a result of trying to avoid taxes, union difficulties can emerge as companies try to re-write union contracts during tough times and, of course, workforce reductions are directly associated with cost-cutting efforts. Because of their strong link to cost cutting, we expect that all of them will be more evident during recessions and less evident when economic times are good.

The cost savings associated with environmental concerns seem to be less direct. For example, in the environmental area, concerns include problems with substantial omissions or hazardous waste. On the surface, we are unsure how increasing omissions or waste would be expected to significantly reduce resource allocations and thus increase financial performance. Perhaps the most logical expectation is that firms may simply reduce resources expended for monitoring and control activities in an effort to cut costs during recessions, and increase these resources during economic upturns.

The influence of the economy on diversity concerns is also challenging to predict. Diversity concerns focus primarily on employee discrimination in one form or another, and at various levels of the organization (i.e., rank-and-file, top management). Discrimination, different from affirmative action, would seem not to have much impact on resource allocations, except for the legal costs associated with defending the firm. In today’s society, a firm that discriminates is likely to experience negatives such as legal suits, reduced consumer demand, fewer opportunities for alliances with other firms, and so forth, which can eventually hurt financial performance. However, we do not believe the economy will have a significant impact on the level of discrimination in the firm.

Given that three of the five CSP concern areas are so closely related to cost cutting, we expect to find increased concerns during recessions and fewer concerns during economic upturns. As before, the variance in possible cost savings and their possible influence on short-term financial performance across the five areas serves as motivation to investigate the relationships both cumulatively and separately.

Methods

The KLD Measures

To assess our central question of the relationship between economic growth and CSP, we examine the CSP of some of the largest best-known companies in the United States economy. We use the Kinder, Lydenberg, and Domini (KLD) ratings of firms’ social and environmental performance because they are based on investments and other firm behaviors related to these areas. Also, the KLD measures currently are the most widely used in empirical research on CSP (i.e., Choi and Wang 2009; Harrison and Coombs 2012; Manner 2010). Deckop et al. (2006, p. 334) recognized KLD as “the largest multi-dimensional CSP database available to the public”. Waddock (2003, p. 369) refers to the KLD data as “the de facto [CSP] research standard”. Beginning with Graves and Waddock (1994) and Brown and Perry (1994), researchers have been drawn to the data because they provide a fairly consistent set of ratings on non-financial performance. The data’s use is not restricted to academia, as KLD itself noted that 60 % of the world’s top institutional financial managers use KLD’s data and research to evaluate investments (Chatterji et al. 2009). The fact that KLD data are collected by a third party for a non-academic purpose is a strength with regard to its use in academic research, because it eliminates the potential bias that an academic researcher, because of familiarity with the topic, might unintentionally code variables in a manner consistent with expected results.

We acknowledge from the outset that, like all data sources, the KLD data have weaknesses (Chatterji et al. 2009; Griffin and Mahon 1997; Rowley and Berman 2000). However, it is not our intention in this paper to add to the discussion of the strengths and weaknesses of the database as a proxy for CSP—let alone attempt to resolve these disputes. We are using the KLD measures because (1) they are currently the most widely used proxy for studying social and environmental performance in organizational research, so determining their relationship with economic growth should be of broad interest in the field; and (2) the KLD measures are based on real firm behaviors, which may include positive behaviors associated with CSP strengths or neglectful behaviors associated with CSP concerns. After two acquisitions, the KLD data are now owned by MSCI Inc. and called the ESG (environmental, social and governance) indices, but to avoid confusion we are keeping the traditional name most often found in the research literature.

The KLD ratings are set up by categories—the natural environment, the community, products, diversity, and employee relations—with a score for strengths and concerns for each area. Examples include participation in programs that benefit the economically disadvantaged (community strength), promotion of women and minorities (diversity strength), violations of health and safety standards (employee concern), high emissions of toxic chemicals (environmental concern), and marketing or contracting controversies (product concern). If the rating in one of these areas changes it does so because of an observation by a KLD researcher for the year in which it changes. Each strength or concern counts as 1 point for the area (either positively or negatively). So, in essence, we are asking whether we are likely to see changes (positive or negative) based on firm activities during the year in question in connection to changes in economic growth, which is precisely the purpose of our study.

Because we are using KLD data, we are not in a position of having to determine which of the concerns or strengths is more or less important. Each rating is based on firm behavior, and managers make the decisions that influence the observed behavior. These same managers are influenced by reports about the economy. In a downturn, we might see a firm execute a layoff. This would result in adding a 1 to the concerns category in the employee area. In the same year, the company could participate in a new public/private partnership for the economically disadvantaged. This would result in adding a 1 to community strengths.

KLD researchers use a proprietary research process to collect the data they use to make their ratings (KLD Research and Analytics 2008). However, we assume that much of the information they use for their ratings is also publicly available. To confirm that such is the case, and to get a better sense for how KLD makes its ratings, we examined several instances where KLD had changed a rating for a variable in one of the most commonly used categories for 2008 and 2009. We did searches using publicly available information such as press releases, annual reports, the popular business press, and trade magazines and found evidence supporting the ratings change made by KLD. Table 1 illustrates what we found, with examples based on a concern and strength for each of the five categories of employee relations, product issues, diversity, community, and the environment.

Sample

Because we are examining broad trends, we include as much data as possible while also ensuring comparability from year to year. KLD reports summary measures of total strengths and concerns for each of the five areas we include. However, since KLD began collecting data in 1991 some variables have been added and dropped within their broad categories, which means that KLD’s summary measures are not directly comparable from year to year. To ensure comparability and eliminate the possibility that any changes we observe are due simply to including or excluding particular variables, we settled on a group of variables for each area that was available for each of the years of our study. From 1995 to 2009, fifty variables were consistently included for each company for the five areas, which is an average of 10 ratings per area. In 2010 KLD made highly significant changes to the database, both adding and dropping numerous variables. The changes obviously reflect changes in the demand patterns of their core business customers (not academic researchers). Unfortunately, this means that the 2010 data are not comparable to 2009 or previous data. Our database, then, includes 50 variables in the five groups over the years 1995–2009. The number of firms included for each year varies, which means that we have an unbalanced panel design. Our sample includes 837 firms for most of the tests. We lost a small number of firms for our moderation tests because ROA was not available in the subsequent year for some observations.

Measures

Dependent Variable

Our dependent measures are all based on the KLD ratings. Based on the corporate social responsibility literature, five KLD areas are attractive to researchers who examine social issues. They are community relations, product safety/quality issues (reflecting customer interests), employee relations, diversity issues and environmental protection (Berman et al. 1999; Choi and Wang 2009; Hillman and Keim 2001; Kang 2013; Waddock and Graves 1997). As suggested previously, economic cycles may influence CSP strengths differently from CSP weaknesses. Consequently, our primary tests include models with two different dependent variables. The first is the sum of CSP strengths (Total Strengths), and the second is the sum of CSP concerns (Total Concerns). We standardized the totals for the five areas for increased comparability (i.e., Mattingly and Berman 2006). For consistency, we used the standardized scores for each KLD area throughout our analyses, including the correlation matrix. We ran models separately for each of the five CSP areas, consistent with the idea that firms may respond differently in the various areas. In supplemental analyses, we also ran models to investigate whether economic cycles moderate the relationship between CSP and firm performance. These supplemental tests and corresponding results are described in the “Discussion and Implications” section.

Primary Independent Variable

Our primary independent measure is change in gross domestic product (ΔGDP) Per Capita (Economic Report of the President 2011) over 1 year. GDP is appropriate for our study because it is an indicator of potential changes in the demand for the products and services of the firms in our sample, presumably influencing sales and thus the amount of resources they have available to them to cover their obligations, as well as discretionary investments (Narayan 2008). Also, GDP is highly correlated with other measures of economic health, such as unemployment, and is sometimes referred to as “the central measure of an economy” (Hobijn and Steindel 2009, p. 1). Perhaps most important is the widespread acceptance of Shiskin’s (1974) suggestion that two consecutive quarterly declines in GDP are a rule of thumb for identifying recessions (Gaski 2012). The CSP variables (and controls) lag the GDP variable by 1 year, allowing firms to adjust their CSP decision-making on the basis of what is happening in the economy or, alternatively, to experience the consequences from neglect of certain areas associated with CSP.

Control Variables

Our control variables are based on financial data from Compustat. As explained previously, managers might be expected to respond to an uncertain economy by conserving cash instead of spending it on activities associated with the investment areas we are examining or, indeed, any investments. For example, economic uncertainty could cause a firm to hold on to cash rather than investing it in programs for employees or donating it to community causes. We control for this influence by determining what portion of total assets is held as cash (cash/assets). We further recognize that the economy can influence debt, as firms may find it difficult to pay their obligations in a poor economy. We control for this influence by comparing debt to a firm’s total capitalization (total debt/assets).

In addition, the economy may affect profitability and profitability may in turn influence how much a firm is willing to invest in initiatives with indirect financial consequences. In pre-analysis testing, we found that ROA (net income/assets) varies more closely with the economy relative to other common profitability measures we could have included (ROE and ROS). Therefore, we include ROA to control for firm profitability. Firm size might also be expected to have an influence on how firms respond to economic conditions, due to higher social visibility and the extent to which they have resources to invest in the sorts of initiatives measured by KLD. Our measure of firm size is the log of firm sales. We also include research and development intensity (R&D/sales) and advertising intensity (advertising/sales) because these variables have been found to be important in explaining social performance (Brammer and Millington 2008; Brammer and Pavelin 2006; McWilliams and Siegel 2000).

We also created industry control variables. However, we discovered serious multicollinearity issues between the industry variables and R&D Intensity that could not be resolved with variable transformations. This is not surprising because the level of R&D spending is strongly influenced by a firm’s industry. However, because we are using a panel design that examines changes in variables longitudinally, we are not particularly concerned about dropping a variable (in this case industry) that has no variation over time within particular firms. After examination, we discovered that it was uncommon for a firm in our sample to change its primary industry during the period of study. On the other hand, R&D has been found to be a very important and potentially even a confounding variable when examining CSP (e.g., McWilliams and Siegel 2000). Also, the observed multicollinearity between R&D and industry suggests that R&D explains much of the variance associated with industry, so we are not losing much explanatory power by dropping industry in favor of keeping R&D. To be cautious, we also excluded the small number of firms (39) that changed their primary industries over the course of our study. Table 2 contains descriptive statistics for our variables for the 837 companies in our sample.

Statistical Tests

Because some of our sample companies are not represented for every year of the study, we have an unbalanced panel design with a company identifier as a stratification variable and year as a period variable. Our complete model is:

We used a two-way random effects model for our statistical tests because we are generalizing to a population not completely represented by our sample. Fixed-effects models focus on the intra-sample variability and assume that any other unmeasured variables will not impact the dependent variable. In contrast, random effects models assume that there are unknowns that can impact the dependent variable, thus acknowledging that the sample was taken from a larger population (Field, 2001; Snijders 2005). The appropriateness of an effects model is also confirmed by very high values for the Lagrange Multiplier (Green 2007), which are reported in the tables containing our results. Sometimes the Hausman statistic is also computed for comparison with the Lagrange Multiplier (Judge et al. 1985) to determine whether a fixed or random effects model is more appropriate. However, in our case, the Hausman statistic could not be computed because the differences between the covariance matrices for the two tests were not positive definite (Green 2007). Instead of forcing the issue by computing a generalized inverse, which results in an inappropriate test statistic, Green (2007) suggests that in these cases the difference between the two estimators is random, which argues in favor of a random effects model.

Results

Table 3 includes the results of our statistical tests for Total Strengths and Total Concerns. The coefficients are highly significant for both CSP variables. The large size of the coefficients for the GDP variable is a function of small average values for this variable relative to the control variables. Consequently, the size of the coefficients for GDP is not directly comparable to the size of the coefficients for the control variables, although their signs and significance levels are meaningful. A negative sign for Total Strengths indicates that firms are more likely to invest in positive CSP programs when economic growth is weak and less likely to do so when the economy is strong. This is a rather surprising finding, and we will examine it further in the discussion section. A negative sign for Total Concerns means that in slow growing economies firms are more likely to neglect areas associated with CSP, resulting in negative outcomes such as pollution, tax violations, legal suits, or other controversies. Neglect of CSP is not particularly surprising when firms are dealing with an adverse economy.

Table 4 provides meaningful detail regarding which CSP factors are driving the results found in Table 3. As expected, firms respond differently to economic growth across the five CSP areas. The Total Strengths variable is primarily a function of actions and programs associated with diversity, the environment, and product safety/quality, although the latter area is less significant than the other two. Since the individual CSP variables are standardized for each area, the size of the individual coefficients compared to the size of the coefficients for other CSP variables in otherwise similar models have some meaning. Consequently, based on the relatively large size of the coefficient for diversity, these initiatives appear to be the most influential factor in the Total Strengths variable. The Total Concerns variable is largely a function of community and employee relations, environmental problems, and product safety/quality issues. Diversity is not significant for CSP concerns—there is no increase or decrease in diversity concerns as a function of changes in GDP.

Among the most interesting control variables, Size was significant in all of the models. As we expected, larger firms tend to have both more strengths and more concerns, perhaps a function of the diversity of their operations on the concerns side and the ability their resources give them to pursue more positive projects (strengths). There is one negative coefficient, in the diversity concerns model, which implies that larger firms have fewer diversity concerns. When Cash/Total Assets is significant, its sign is positive, which is consistent with the idea that high cash levels facilitate CSP. In addition, R&D intensity is also important in many of the models, and is positive in every case. This is as expected—as firms increase in CSP they might also be expected to increase their research budgets.

We ran some supplementary tests to examine both trends and the influence of economic forces on our control variables independently of our CSP models. Consistent with observations about the increase in liquid assets during the most recent recession, we found a positive and significant (p < .01) relationship between change in GDP and current ratios. However, in spite of the fact that we found that higher cash balances tend to be related to high CSP, we also found that cash balances as a percentage of total assets have actually dropped, a possible indication that inventories make up a significant portion of the liquid assets held by firms as a function of economic cycles. As we expected, total debt levels are negatively associated with change in GDP (p < .001). We also found a negative relationship for size (p < .001) and a positive relationship for R&D intensity (p < .01). Advertising intensity was not significantly related to changes in GDP. While ROA had a stronger relationship with economic volatility in pre-tests than other common measures of profitability, it nonetheless was not significant. This is particularly interesting in that it provides evidence to support a lot of current anecdotal evidence that many large firms are doing quite well in terms of profits during the current recession (obviously others are not, which accounts for an insignificant finding).

Discussion and Implications

The empirical models offer strong evidence that economic growth influences CSP. Furthermore, there is significant evidence that firms respond differently to economic growth depending on whether CSP involves positive actions and programs or areas that might be neglected, thus causing concerns. In addition, we found evidence that economic growth influences various areas of CSP differently—community, diversity, employee relations, environmental protection, or product safety/quality. We will discuss each of these findings, beginning with CSP concerns.

We observed a significant increase/decrease in CSP-related concerns when the economy is weak/strong. This is evidence that firms may neglect some aspects of social responsibility as a response to tough economic times (Halal 1987) and restore their vigilance in these areas during good times. In this sense, CSP is responding like other types of corporate resource allocations, which tend to decline with recessions (Forrester 1976). It is worth mentioning again that we do not believe that it is necessarily an actual firm-level profit decline that results in an attitude and decisions that result in CSP concerns. Instead, it is uncertainty about the future that results in a new attitude, and presumably decision-making that is consistent with this attitude. During a recession, this new attitude might be called survival mode (Sadowski 2011; Virki 2010).

To really understand this relationship, it is helpful to look at some of the individual items that make up the concerns tracked by KLD. Tax disputes are among the possible concerns in the community relations area. It is logical that these types of problems will increase in a slow economy as firms look for ways to cut their tax burdens. Violation of health and safety standards, workforce reductions and underfunded pensions are all areas of concern in the employee relations area. All of these seem to be logical areas for cutbacks during a recession. In the environmental area, concerns include violating environmental regulations and production of toxins. For product safety/quality, concerns include product safety infractions and marketing or contracting controversies. Concerns in both of these areas can be explained by an attitude of trying to save money. On the other hand, when times are perceived as good, firms are more likely to try to fix problems in these areas.

The negative relationship between changes in GDP and CSP strengths is fascinating and somewhat unexpected. We will attempt to provide a plausible explanation here, based on the existing conceptual literature. The starting point is to accept that some of the vast literature on the long-term competitive advantages of corporate social responsibility is legitimate. In the front end, we mentioned some of these advantages, which include reduced risk (Cornell and Shapiro 1987; Shane and Spicer 1983); attractiveness to investors (Waddock and Graves 1997); attraction of high quality employees, customers, and other stakeholders (Vogel 2006; Turban and Greening 1996; Barringer and Harrison 2000); trust leading to a reduction in transactions costs (Williamson 1975); reciprocity by stakeholders leading to higher levels of value creation (Bosse et al. 2009); and higher quality information (Harrison et al. 2010). In each case, the authors relate these factors to higher firm performance, which should provide incentives to corporations to engage in responsible behavior.

The second logical step in our explanation of the influence of growth in GDP on CSP strengths is to understand that firms and their managers make investment decisions based on the attractiveness of a particular investment at a particular time. During a recession investment opportunities in traditional business areas may have less appeal than during a boom because of uncertainty. For example, a recession is a less likely time to expand a business into new markets or to build a new factory than during an economic boom. Uncertain future demand during a recession means that the firm may see a positive investment in CSP as relatively more attractive than during a boom because other investment opportunities appear relatively less attractive. This may be especially true for firms that have a deliberate social responsibility strategy. On the other hand, during periods of strong economic growth, a firm may be more likely to invest resources into areas associated with expansion, which is the other side of the relationship.

From a strategic perspective, because society scrutinizes the social behavior of corporations, positive investments in activities associated with CSP that enhance a corporate reputation might be seen as a type of differentiation strategy (i.e., Fombrun 2001; McWilliams and Siegel 2001; Turban and Greening 1996). If so, then a recession may be perceived as an ideal time to enhance a firm’s reputation for social responsibility, especially if managers believe that other firms are likely to make cuts in these areas. Also, it is possible that positive CSP actions and programs may help a firm come out of a recession in a stronger competitive position (Ellis and Bastin 2011).

With regard to the individual CSP strength areas, the environment, product safety/quality, and diversity are the driving forces. Positive environmental protection programs may include recycling programs, pollution prevention programs, or clean energy programs. Because of social sensitivity to environmental protection, these sorts of programs tend to be broadly reported in annual reports, sustainability reports and the media. This reporting can do a lot to enhance a firm’s social reputation. Furthermore, some “greening” projects lead to cost savings that can cover much or all of the expenses, or even result in savings overall (Russo and Fouts 1997). Positive product factors include initiatives such as an exceptional quality assurance program, leadership in R&D, or providing products or services to the economically advantaged. Again, these are things that a firm can tout, and quality programs and R&D can also have economic payoffs. Not surprisingly, positive community initiatives, mostly associated with charitable giving, do not increase during economic downturns.

The influence of economic growth has a powerful effect on positive diversity programs (strengths), although it does not influence diversity concerns (which means that concerns in this area are immune to changes in economic growth). Diversity has received an increasing amount of attention in society (Kochan et al. 2003), so diversity initiatives are a good way to signal that a firm is seeking to be socially responsible. Also, most of the diversity initiatives tracked by KLD tend to be relatively inexpensive when compared to positive initiatives in other CSP areas. For example, although the diversity area includes family benefits, which can involve significant resources, it also includes progressive gay/lesbian policies, appointing minority members to the board of directors, employment of the disabled and contracting with women and minorities, all of which tend to be relatively inexpensive compared to the other areas. It is possible that the value-to-cost ratio for implementing these sorts of policies may be perceived as highly attractive for firms and their managers providing, perhaps, at least a partial explanation for why firms are prone to engage in diversity initiatives when economic growth is slow.

While not the primary purpose of this study, if economic growth influences CSP, it might also moderate the relationship between CSP and firm performance. Of course, we recognize that we may not even find a significant relationship between CSP and firm performance, given that this relationship has only been confirmed in about half of the empirical work on the topic (Margolis and Walsh 2002). In addition, we are including a control variable, R&D, found to have a confounding influence on this relationship in previous work (McWilliams and Siegel 2000). Nevertheless, a test for moderation effects has the potential to help explain why there is inconsistency in previous findings.

For these tests, the lagged relationships need adjustment. We are testing whether CSP, change in GDP, and the interaction between the two, influence ROA. The GDP and control variables should be for the same year as ROA because we are looking at these variables as concurrent influences on firm performance. To clarify, a particular year’s profits should be related to the same year’s economic growth, liquidity, size, and so forth. However, these variables need to lag the CSP variables to provide time for CSP activities to influence profits. This means that an extra year of financials is needed for each observation. The extra year’s financial information was not available for 17 companies, resulting in a sample with 820 companies. The model results are found in Table 5.

The results are quite interesting, but not particularly supportive of a strong moderation effect. The CSP variable is negative and significant for the Total Strengths model, with or without Change in GDP or the interaction term (CSP strengths × Change in GDP). This is an indication that positive CSP initiatives (CSP Strengths) started in a particular year are likely to have a negative effect on profits in the next year. The logical explanation for this phenomenon is that they cost money, which reduces profits. Also, CSP programs may have longer term positive financial benefits, but most of them probably do not have immediate financial returns (Doane 2005).

Looking at the moderation effects, the only significant interaction effect is in the Total Concerns model. Although it is disappointing to note that the primary variables (CSP Total Concerns and Change in GDP) in this model are not significant, we nonetheless ran two more models to determine what the significant interaction variable means. The observations used in the original moderation test for Total Concerns were split based on the median value for Change in GDP, thus creating a sample for high changes in GDP and another sample for low changes in GDP (we also tried splitting at the mean, but this resulted in a highly uneven distribution of companies). We then ran two models with ROA as the dependent variable, Total Concerns as the primary independent variable, and the same control variables. The first model was for a high growth economy. In this model Total Concerns was negative and significant, which means that in a high growth economy less CSP Concerns are associated with higher profits. This logical effect might be expected in any economy. However, in the second model for the low growth economy CSP concerns was not a significant predictor of ROA.

Overall, this paper identifies some fairly important implications for future research on corporate social responsibility in general and specifically for studies that make use of the KLD measures. First, the change in GDP variable was a fairly consistent predictor of both CSP Strengths and CSP Concerns, and across the five CSP activity areas. Consequently, one implication is that researchers should use this easily accessible variable as a control in future empirical work.

Second, CSP Strengths and CSP Concerns performed in opposite directions overall, as well as in most of the five CSP activity areas. Most of the corporate social responsibility research combines CSP Strengths and CSP Concerns for an overall measure of CSP. In this sort of measure, we might expect strengths and concerns to offset each other, making interpretation of results difficult or even incorrect. Given the popularity of combined measures in the CSP literature, the offsetting influences problem could help explain some of the contradictory findings in previous research.

Third, we found that results also varied depending on which of the five CSP areas was being modeled. Some were significant, while others were not. These results demonstrate that researchers should not combine all types of CSP into a single measure. Future research questions should be more precise in terms of defining which area or areas of CSP are being investigated. In addition, future researchers could explore other factors that might stimulate positive CSP programs and initiatives or lead to reductions in CSP concerns. Finally, one of the weaknesses of our study is an inconsistency in the unit of analysis—macro economic influences versus firm-level decisions that influence CSP. To overcome this weakness, future research could examine firm executive perceptions of economic health as the independent variable rather than changes in GDP.

From a practical perspective, the evidence found in this paper is relevant in at least two ways. First, it confirms that corporations have a tendency to neglect some areas associated with CSP negatives during recessions, and it is noticed. That is, KLD researchers observed the concerns as they collected the data. As we noted in the methods section, the majority of large institutional financial managers use KLD’s data, and CSP concerns can influence both firm reputation and investment decisions (Waddock and Graves 1997). Consequently, this study suggests that corporate managers should exercise caution and restraint when making decisions that could negatively influence CSP during tough economic times. Second, the rather surprising findings that firms tend to engage in positive CSP-related actions and programs during periods of slow economic growth suggests that they may be using these tools strategically in an effort to enhance their reputations to counteract difficult economic conditions. Although this study utilizes a large sample over several years, this is to our knowledge the first time such an effect has been documented in the empirical research literature. Consequently, we make this observation with reservations, suggesting that further research is necessary on this topic before we can draw this conclusion with confidence.

In conclusion, this study offers evidence that changes in economic growth have a significant influence on firm CSP. Furthermore, the nature of the influence depends on the CSP area under investigation and on whether we are discussing positive CSP actions and programs or neglect of particular CSP areas of concern. We also find that positive CSP initiatives are associated with reduced profits in the next year regardless of economic conditions, but a reduction in CSP concerns is positively related to profits only in high growth economies. We hope these findings stimulate more precise empirical work and theoretical development on the topic of corporate social responsibility and inclusion of changes in economic growth in future empirical models.

References

Aupperle, K. E., Carroll, A. B., & Hatfield, J. D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal, 28, 446–463.

Barnett, M. L., & Salomon, R. M. (2006). Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strategic Management Journal, 27, 1101–1122.

Barringer, B. R., & Harrison, J. S. (2000). Walking a tightrope: Creating value through interorganizational relationships. Journal of Management, 26, 367–403.

Becker, L. (1986). Reciprocity. Chicago: University of Chicago Press.

Berman, S. L., Wicks, A. C., Kotha, S., & Jones, T. M. (1999). Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Academy of Management Journal, 42, 488–506.

Bondy, K., Moon, J., & Matten, D. (2012). An institution of corporate social responsibility (CSR) in multi-national corporations (MNCs): Form and implications. Journal of Business Ethics, 111, 281–299.

Bosse, D. A., Phillips, R. A., & Harrison, J. S. (2009). Stakeholders, reciprocity and firm performance. Strategic Management Journal, 30, 447–456.

Brammer, S., & Millington, A. (2008). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal, 29, 1325–1343.

Brammer, S. J., & Pavelin, S. (2006). Corporate reputation and social performance: The importance of fit. Journal of Management Studies, 43, 435–455.

Brown, T. J., & Dacin, P. A. (1997). The company and the product: Corporate associations and consumer product responses. Journal of Marketing, 61, 68–84.

Brown, B., & Perry, S. (1994). Halo-removed residuals of Fortune’s “responsibility to the community and environment”: A decade of data. Business and Society, 34, 199–215.

Brummer, J. J. (1991). Corporate responsibility and legitimacy: An interdisciplinary analysis. Westport, CT: Greenwood Press.

Campbell, J. L. (2007). Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Academy of Management Review, 32, 946–967.

Caulkin, S. (2009). Social concerns are crunched off the agenda. The Observer. Retrieved July 27, 2012, from http://www.guardian.co.uk/business/2009/apr/05/corporatesocialresponsibility-credit-crunch.

Chatterji, A. K., Levine, D. I., & Toffel, M. W. (2009). How well do social ratings actually measure corporate social performance? Journal of Economics & Management Strategy, 18, 125–169.

Choi, J., & Wang, H. (2009). Stakeholder relations and the persistence of corporate financial performance. Strategic Management Journal, 30, 895–907.

Cording, M., Harrison, J. S., Hoskisson, R. E., & Jonsen, K. (2014). Walking the talk: A multistakeholder exploration of organizational authenticity, employee productivity, and post-merger performance. Academy of Management Perspectives, 28, 38–56.

Cornell, B., & Shapiro, A. C. (1987). Corporate stakeholders and corporate finance. Financial Management, 16, 5–14.

Deckop, J. R., Merriman, K. K., & Gupta, S. (2006). The effects of CEO pay structure on corporate social performance. Journal of Management, 32, 329–342.

Doane, D. (2005). The myth of CSR: The problem with assuming that companies can do well while also doing good is that markets don’t really work that way. Stanford Social Innovation Review, Fall, 22–29.

Du, S., Bhattacharya, C. B., & Sen, S. (2011). Corporate social responsibility and competitive advantage: Overcoming the trust barrier. Management Science, 57, 1528–1545.

Du, S., & Vieira, E. (2012). Striving for legitimacy through corporate social responsibility: Insights from oil companies. Journal of Business Ethics, 111, 301–316.

Eabrasu, M. (2012). A moral pluralist perspective on corporate social responsibility: From good to controversial practices. Journal of Business Ethics, 110, 429–439.

Economic Report of the President. (2011). Washington, DC: United States Government Printing Office.

Elkington, J. (1997). Cannibals with forks: The triple bottom line of 21st century business. Oxford: Capstone Publishing Ltd.

Ellis, L., & Bastin, C. (2011). Corporate social responsibility in times of recession: Changing discourses and implications for policy and practice. Corporate Social Responsibility and Environmental Management, 18, 294–305.

Fassin, Y. (2012). Stakeholder management, reciprocity and stakeholder responsibility. Journal of Business Ethics, 109, 83–96.

Field, A. P. (2001). Meta-analysis of correlation coefficients: A Monte Carlo comparison of fixed and random effects methods. Psychological Methods, 6, 161–180.

Fombrun, C. J. (2001). Corporate reputations as economic assets. In M. A. Hitt, R. E. Freeman, & J. S. Harrison (Eds.), Handbook of strategic management (pp. 289–312). Oxford: Blackwell Publishers Ltd.

Forrester, J. W. (1976). Business structure, economic cycles, and national policy. Futures, 8(3), 195–214.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Marshfield, MA: Pitman Publishing Inc.

Friedman, M. (1970). The social responsibility of business is to increase its profits. New York Times Magazine, September 13, 32–33, 122–124.

Garriga, E., & Melé, D. (2004). Corporate social responsibility theories: Mapping the territory. Journal of Business Ethics, 53(1–2), 51–71.

Gaski, J. F. (2012). On the competing definitions of recession. Society, 49(2), 118–121.

Graves, S. B., & Waddock, S. A. (1994). Institutional owners and corporate social performance. Academy of Management Journal, 37, 1034–1046.

Green, W. H. (2007). LIMDEP version 9.0 econometric modeling guide. Plainview, NY: Econometric Software, Inc.

Griffin, J. J., & Mahon, J. F. (1997). The corporate social performance and corporate performance debate. Business and Society, 36(1), 5–31.

Halal, W. E. (1987). Business and government—A new partnership? Long Range Planning, 20, 123–130.

Harrison, J. S., Bosse, D. A., & Phillips, R. A. (2010). Managing for stakeholders, stakeholder utility functions and competitive advantage. Strategic Management Journal, 31, 58–74.

Harrison, J. S., & Coombs, J. E. (2012). The moderating effects from corporate governance characteristics on the relationship between available slack and community-based firm performance. Journal of Business Ethics, 107, 409–422.

Harrison, J. S., & St. John, C. H. (1996). Managing and partnering with external stakeholders. Academy of Management Executive, 10(2), 46–60.

Harwood, I., Humby, S., & Harwood, A. (2011). On the resilience of corporate social responsibility. European Management Journal, 29, 283–290.

Hillman, A. J., & Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strategic Management Journal, 22, 125–139.

Hobijn, B., & Steindel, C. (2009). Do alternative measures of GDP affect its interpretation? Current Issues in Economics and Finance, 15(7), 1–7.

Hsu, K.-T. (2012). The advertising effects of corporate social responsibility on corporate reputation and brand equity: Evidence from the life insurance industry in Taiwan. Journal of Business Ethics, 109, 189–201.

Judge, G. G., Griffiths, W. E., Hill, R. C., Lütkepohl, H., & Lee, T. C. (1985). The theory and practice of econometrics (2nd ed.). New York: Wiley.

Juscius, V. (2010). Globalization and crises in the modern economy, Monograph. Eastern European Development Agency.

Kang, J. (2013). The relationship between corporate diversification and corporate social performance. Strategic Management Journal, 34, 94–109.

KLD Research and Analytics. (2008). Getting started with KLD stats and ratings definitions. Boston: KLD.

Kochan, T., Bezrukova, K., Ely, R., Jackson, S., Joshi, A., Jehn, K., et al. (2003). The effects of diversity on business performance: Report of the diversity research network. Human Resource Management, 42, 3–21.

Lindorff, M., Prior Jonson, E., & McGuire, L. (2012). Strategic corporate social responsibility in controversial industry sectors: The social value of harm minimisation. Journal of Business Ethics, 110, 457–467.

Manner, M. (2010). The impact of CEO characteristics on corporate social performance. Journal of Business Ethics, 93, 53–72.

Margolis, J. D., & Walsh, J. P. (2003). Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly, 48, 268–305.

Mattingly, J. E., & Berman, S. L. (2006). Measurement of corporate social action: Discovering taxonomy in the Kinder Lydenburg Domini ratings data. Business and Society, 45, 20–46.

McShane, L., & Cunningham, P. (2012). To thine own self be true? Employees’ judgments of the authenticity of their organization’s corporate social responsibility program. Journal of Business Ethics, 108, 81–100.

McWilliams, A., & Siegel, D. (2000). Corporate social responsibility and financial performance: Correlation or misspecification? Strategic Management Journal, 21, 603–609.

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of Management Review, 26, 117–127.

Moskowitz, M. (1972). Choosing socially responsible stocks. Business and Society, 1, 71–75.

Narayan, P. K. (2008). Common trends and common cycles in per capita GDP: The case of the G7 countries, 1870-(2001). International Advances in Economic Research, 14, 280–290.

Norman, W., & MacDonald, C. (2004). Getting to the bottom of ‘‘Triple Bottom Line’’. Business Ethics Quarterly, 14(2), 243–262.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization Studies, 24, 403–441.

Pava, M. L., & Krausz, J. (1996). The association between corporate social-responsibility and financial performance: The paradox of social cost. Journal of Business Ethics, 15, 321–357.

Porter, M. E., & Kramer, M. R. (2011). Creating shared value. Harvard Business Review, 89(1/2), 62–77.

Rappaport, A. (1986). Creating shareholder value. New York: The Free Press.

Rowley, T., & Berman, S. (2000). A brand new brand of corporate social performance. Business and Society, 39, 397–416.

Russo, M. V., & Fouts, P. A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40, 534–559.

Sabadoz, C. (2011). Between profit seeking and prosociality: Corporate social responsibility as Derridean supplement. Journal of Business Ethics, 104, 77–91.

Sadowski, R. (2011). A cash buildup and business investment. Federal Reserve Bank of Cleveland. Retrieved December 13, 2012, from http://www.clevelandfed.org/research/trends/(2011)/0111/01regact.cfm.

Sen, S., & Bhattachara, C. B. (2001). Does doing good always lead to doing better? Consumer reactions to corporate social responsibility. Journal of Marketing Research, 38, 225–243.

Shane, P. B., & Spicer, B. H. (1983). Market response to environmental information produced outside the firm. Accounting Review, 58, 521–536.

Shiskin, J. (1974). The changing business cycle. New York Times, December 1: Section 3, 12.

Simon, L. S. (1966). Industrial reciprocity as a business stratagem. Industrial Management Review, 7(2), 27–39.

Snijders, T. A. B. (2005). Fixed and random effects. In B. S. Everitt & D. C. Howell (Eds.), Encyclopedia of statistics in behavioral science (Vol. 2, pp. 664–665). Hoboken, NJ: Wiley.

Spicer, B. H. (1978). Investors, corporate social performance and information disclosure: An empirical study. Accounting Review, 53, 94–111.

Stout, L. (2012). The shareholder value myth: How putting shareholders first harm investors, corporations and the public. San Francisco: Berrett-Koehler Publishers Inc.

Surroca, J., Tribó, J. A., & Waddock, S. (2010). Corporate responsibility and financial performance: The role of intangible resources. Strategic Management Journal, 31, 463–490.

Turban, D. B., & Greening, D. W. (1996). Corporate social performance and organizational attractiveness to prospective employees. Academy of Management Journal, 40, 658–672.

Uecker-Mercado, H., & Walker, M. (2012). The value of social responsibility to facility managers: Revealing the perceptions and motives for adopting ESR. Journal of Business Ethics, 110, 269–284.

Virki, T. (2010). EU slowdown downgrades global IT spending growth. The Globe and Mail. Retrieved December 13, 2012, from http://www.theglobeandmail.com/news/technology/business-technology/eu-slowdown-downgrades-global-it-spending-growth/article2292238.

Vogel, D. (2006). The market for virtue. Washington, DC: Brookings Institution Press.

Waddock, S. (2003). Myths and realities of social investing. Organization and Environment, 16, 369–380.

Waddock, S., & Graves, S. B. (1997). The corporate social performance-financial performance link. Strategic Management Journal, 18, 303–319.

Wallace, J. S. (2003). Value maximization and stakeholder theory: Compatible or not? Journal of Applied Corporate Finance, 15, 120–127.

Williamson, O. E. (1975). Markets and hierarchies: Analysis and antitrust implications. New York: The Free Press.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Harrison, J.S., Berman, S.L. Corporate Social Performance and Economic Cycles. J Bus Ethics 138, 279–294 (2016). https://doi.org/10.1007/s10551-015-2646-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-015-2646-9