Abstract

In this paper we analyze per capita incomes of the G7 countries using the common cycles test developed by Vahid and Engle (Journal of Applied Econometrics, 8:341–360, 1993) and extended by Hecq et al. (Oxford Bulletin of Economics and Statistics, 62:511–532, 2000; Econometric Reviews, 21:273–307, 2002) and the common trend test developed by Johansen (Journal of Economic Dynamics and Control, 12:231–254, 1988). Our main contribution is that we impose the common cycle and common trend restrictions in decomposing the innovations into permanent and transitory components. Our main finding is permanent shocks explain the bulk of the variations in incomes for the G7 countries over short time horizons, and is in sharp contrast to the bulk of the recent literature. We attribute this to the greater forecasting accuracy achieved, which we later confirm through performing a post sample forecasting exercise, from the variance decomposition analysis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Identifying the forces that induce fluctuations in macroeconomic aggregates has become an important topic in macroeconomics because its motivation is to investigate the relative importance of supply (permanent) and demand (transitory) shocks in the generation and propagation of business cycles. Keating and Nye (1999) employ post-war and pre-war period data to examine the impact of demand and supply side shocks on output for the G7 countries. Their main finding is demand shocks explain most of the short-run output variance for Italy (77%), the United Kingdom (UK) (97%), Germany (67%) and France (74%), and large proportions in the case of the United States of America (USA) and Canada (47% and 46%, respectively). However, in the case of Japan, they found most of the variations in output for short time horizons were due to supply shocks.

Centoni and Cubadda (2003) examine the relative importance of permanent and transitory shocks on the US business cycles by modelling per capita gross domestic product (GDP), per capita investment and per capita consumption in a multivariate framework over the period January 1974 through April 2001. They find that demand shocks explain the bulk of the variations in GDP (82%) and investment (86%), but supply shocks explain the bulk of the variations (57%) in consumption. Hartley and Walsh (2003) find that demand shocks explain the bulk of the variations in output for Germany, France, The Netherlands, and the USA—around 70–80%. Further, they find an even greater role for demand shocks in explaining variations in output for Italy and the UK—over 90%. In another study, for Italy from 1974–1994, Gavosto and Pellegrini (1999) find supply shocks are important in explaining output variability at all frequencies over the 20 years. For instance, after one quarter, supply shocks explain over 70% of the variation in output and, even after 20 years, the incidence of supply shocks still explains around 75% of the variation in output.

The above-mentioned studies differ in their approach to modelling the relative importance of permanent and transitory shocks in explaining variations in macroeconomic aggregates. For instance, many of the studies already mentioned use vector autoregressive (VAR) models, imposing long run restrictions in many cases. In a departure from the extant literature, Hartley and Walsh (2003) and Hartley and Walsh (1992) use a method of moments procedure to estimate the parameters of a structural model of output variation.

In this paper, our main innovation is our extension of the work on the role of permanent and transitory shocks in explaining variations in income by considering the per capita income levels of the G7 countries with an application of the common trend and common cycle methodologies. The joint use of common trend and common cycle restrictions is important for two reasons. First, a correct imposition of the common cycle restrictions provides more accurate estimates from a dynamic model (in our case, the VAR model), leading to a more accurate measurement of the relative importance of permanent and transitory shocks.Footnote 1 The second reason relates to the issue of different time horizons when measuring the relative importance of shocks. While the relative importance of permanent and transitory shocks should not differ greatly for long time horizons, they do differ in short time horizons because the short-run dynamics are imposed only by one of them (Issler and Vahid 2001).Footnote 2 In light of this, the aim of this paper is threefold:

-

1.

To examine whether per capita GDP for the G7 countries shares long-term (common trends) and short-term (common cycles) features,

-

2.

To examine the importance of permanent and transitory shocks on per capita GDP for the G7 countries, and

-

3.

To examine whether the transitory components or the permanent components are important in explaining the cyclical behaviour in per capita GDP for the G7 countries.

The aims of this paper are achieved in four steps. First, to examine evidence for common trends in per capita GDP for the G7 countries, we apply the Johansen’s (1988) maximum likelihood approach to cointegration. Second, to examine evidence for common cycles in per capita GDP for the G7 countries, we use two tests to examine short run co-movements. More specifically, we use the weak form (WF) reduced rank test proposed by Hecq et al. (2000, 2002) and the polynomial serial correlation common feature (PSSCF) test recommended by Cubadda and Hecq (2001).Footnote 3 Third, to examine the issue of the relative importance of permanent and transitory shocks, we undertake a multivariate variance decomposition analysis of innovations in per capita income. To achieve this, we impose the common trend and common cycle restrictions proposed by Vahid and Engle (1993) and Issler and Vahid (2001). The Gauss code, which implements this variance decomposition analysis, is available from the author upon request. Fourth, a linear regression model estimated using ordinary least squares (OLS) is used to examine the relationship between transitory and permanent components of per capita GDP for the G7 countries.

Methodology: A Common Cycles and Trends Framework

Following Vahid and Engle (1993), we assume that y t is a n-vector of I(1) variables and the stationary Wold representation has the form:

where C(L) is a matrix polynomial in the lag operator, L, with \(C\left( 0 \right) = I_n ,\sum\nolimits_{j = 1}^\infty {\left\| {C_j } \right\|\kern1.5pt<\kern1.5pt\infty } \). The vector εt is a n × 1 vector of stationary one-step-ahead linear forecast errors in y t , given information on the lagged values of y t . Equation 1 can now be written as:

based on the polynomial factorization \(C\left( L \right) = C\left( 1 \right) + \Delta C^* \left( L \right)\), where \(C_i^* = \sum\nolimits_{j >1} { - C_j } \) for all i. By integrating both sides of Eq. 2, Vahid and Engle (1993) obtain the Beveridge–Nelson permanent-transitory decomposition of yt as follows:

It follows if evidences for cointegration and common cycles are found, then it amounts to imposing restrictions on the components of C(1) and C*(L). From Eq. 3 we know that cointegration restrictions relate to the C(1) components while the common cycle restrictions relate to the components of C *(L). This can be shown by assuming that y t is generated by a VAR as follows:

If elements of y t cointegrate, then the matrix \(I - \sum\nolimits_{i = 1}^p {\Gamma _i } \) must have less than full rank, which imposes cross-equation restrictions on the VAR. Imposing such restrictions, Engle and Granger (1987) have shown that Eq. 4 takes the form of a VEC model (VECM), as follows:

where γ and a are full rank matrices of order n × r, r is the rank of cointegrating space, \( - \left( {I - \sum\nolimits_{i = 1}^p {\Gamma _i } } \right) = \gamma \alpha \prime \), and \(\Gamma _j^* = - \sum\nolimits_{i = j + 1}^p {\Gamma _{i,} \,j} = 1, \ldots ,p - 1\). The WF arises when s linear combinations δ of Δy t in deviation from the error-correction terms \(\alpha \beta \prime y_{t - 1} \) are white noises. This amounts to imposing the restriction, \(\delta \prime \Gamma _i = 0,\) where \(i = 1 \ldots p - 1,\) on Eq. 5. The other approach—advocated by Cubadda and Hecq (2001)—is known as the PSSCF, which is present when there exists a polynomial matrix \(\delta _c \left( L \right) = \delta _{0,c} - \delta _{1,c} L\) such that \(\delta _c \left( L \right)\prime \Delta y_t = \delta _{0,c}^\prime \varepsilon _t \) This amounts to imposing two restrictions on Eq. 5: \(\left( {\text{a}} \right)\,\delta _{0,c}^\prime \alpha = 0\) and \(\left( {\text{b}} \right)\,\delta _{0,c}^\prime \Gamma _i = 0\,\) if \(i >1\) and \(\delta _{0,c}^\prime \Gamma _i = \delta _{1,c}^\prime \,\text{if}\,i = 1\).

The test for common cycles follows an asymptotic \(\chi _{\left( v \right)}^2\) distribution under the null of common features. The likelihood ratio test has the form:

where s = 1…n and the \(\hat \lambda _i \) with \(0 \leqslant \hat \lambda _i <\ldots <\hat \lambda _i <\ldots <1\) are the estimated eigenvalues, smallest squared canonical correlations. The variance decomposition of shocks is obtained using the procedure in Vahid and Engle (1993) and Issler and Vahid (2001).

Empirical Results

Data

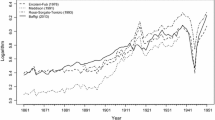

We use annual data on per capita real GDP for the USA, the UK, Canada, France, Germany, Italy, and Japan for the period 1870–2001. This data is extracted from the Groningen Growth and Development Centre and The Conference Board Total Economy Database (available at http://www.ggdc.net; access August 2004). Before conducting the empirical analysis, all data was converted into natural logarithmic form.

Unit Root and Cointegration Tests

We begin the empirical analysis by performing the Augmented Dickey–Fuller (ADF) unit root test and find per capita GDP for the USA, the UK, Canada, France, Germany, Italy, and Japan are integrated of order one.Footnote 4 Next, we apply the Johansen (1988) maximum likelihood technique to test for cointegration among per capita GDP for the seven countries. We estimate a model with an unrestricted intercept and a restricted trend. The trace test statistics together with the 5% and 10% level critical values, generated from the Microfit software, are reported in Table 1. We find that there are three cointegration relationships.

Common Feature Test

The results from the common feature test analysis are presented in Table 2. The results are organized as follows. Column 1 contains information on the null hypothesis of common feature vectors. The WF test statistic is presented in column 2 and the PSCCF test statistic is presented in column 3. As noted earlier, the two test statistics have the same null hypotheses because there exists at least s co-feature vectors, which are tested using the p values. We find that there are four co-feature vectors.

Multivariate Trend-Cycle Decomposition Based Variance Decomposition Analysis

The results of the variance decomposition of per capita GDP for the USA, the UK, Canada, Japan, Germany, Italy, and France are presented in Table 3. We present the results on the percentage of the variance of total forecast errors explained by permanent shocks over the horizon 1–20. There are two observations that deserve particular mention. First, in the case of the USA, Japan, and Italy, transitory shocks seem to be more influential than in other countries after a time horizon of 1. For instance, approximately 42% of the variance in the USA, 41% of the variance in Japanese, and 40% of the variance in Italian per capita income is explained by transitory shocks. Even after four horizons, the role of transitory shocks in explaining per capita incomes in Japan and Italy is above 35%. In the remaining countries (the UK, Germany, France, and Canada), the importance of transitory shocks over short horizons is much smaller. For instance, transitory shocks explain only 28% of the variation in Germany’s and Canada’s per capita income, 20% of the variation in France’s per capita income, and 15% of the variation in the UK’s per capita income. Second, for the UK, Germany, France, and Canada per capita incomes are, in large part, explained by permanent innovations, over both short and long horizons.

Post Sample Forecasts of Per Capita GDP

In this section, we attempt to test the proposition that imposing common cycle restrictions improves the accuracy of the results. As shown in Issler and Vahid (2001), one way of testing this claim is through performing the post-sample one-step-ahead forecasts. Our approach involves performing two sample forecasts. One model, which does not take into account short run restrictions available from the common cycles analysis, is known as the unrestricted VEC model (UVECM), while the other model, which takes these restrictions into account, is known as the restricted VECM. Sample estimates were for the period 1870–1970, while post-sample one-step-ahead forecasts were calculated over the period 1971–2002. For the UVECM and the RVECM, we use two lags for the first difference variables and one lag for the error correction term. We estimate the UVECM using OLS and the RVECM using the full information maximum likelihood estimator. The results are reported in Table 4. We measure the forecasting performance using the root mean square error, mean absolute error, and the mean absolute percentage error for each of the seven equations, where per capita income in each of the seven countries is in turn taken as the dependent variable. We find the RVECM performs better than the UVECM across all the three indicators.

What Explains Cyclical Behavior?

The correlation of business cycles dates back to the work of Mitchell (1927), who found evidence of positive correlation of business cycles across countries and, more importantly, showed that this correlation was growing over time. He reasoned that this relationship was due to the growth in international financial linkages; his findings were expanded upon in Morgenstern (1959), Dornbusch and Fischer (1986), Baxter and Stockman (1989), and Gerlach (1988). In Table 5, we present the results on the role of cycles and trends in explaining the cyclical patterns in per capita GDP for each of the seven countries. We estimate two models. The first model (model 1) is based on regressing the cyclical component in per capita GDP for a country on the cyclical components of per capita GDP for all other countries. The second model (model 2) regresses the cyclical component in one country on the cyclical and trend components of per capita GDP for all other countries, including the trend component of the regress and country. The results show that in the case of the USA, cyclical components in Japan, Canada, and Germany positively and significantly contribute to the USA’s cyclical component in per capita GDP, while cyclical components in France and Italy display a negative and statistically significant relationship with the USA’s cyclical component in per capita GDP. Meanwhile, cycles in the UK’s per capita GDP contribute insignificantly to the USA’s cyclical component. When we include the trend components in the model together with the cyclical components (model 2), our results on the impact of other countries’ cyclical components on the USA’s cyclical components do not change. Interestingly, however, we find that the trend component in France’s per capita GDP positively and significantly contributes to the cyclical pattern in the USA’s per capita GDP.

In the case of the UK, cyclical components of per capita GDP in Canada, Italy, and Germany have a positive and statistical significant effect, while the cyclical component of the USA, Japan, and France have a negative and statistically significant effect. The inclusion of trend components does not change the results on the impact of cyclical components of other countries’ on the UK’s cyclical component; however, we find that trend components in per capita GDP are all statistically insignificant. In the case of Japan, model 1 reveals that while cyclical components of per capita GDP of the USA, Italy and Germany have positive and statistically significant effects, Canada’s and France’s cyclical components have a negative effect on the cyclical component of Japan’s per capita GDP. We also find, that while the inclusion of trend components reduces the statistical significance of the USA’s cyclical component, the trend component in Italy has a statistically significant negative effect on the cyclical component of Japan’s per capita GDP.

Meanwhile, only the cyclical component of Germany has a negative effect on the cyclical component of Canada’s per capita GDP, while all the remaining cyclical components have a positive and statistically significant effect. Moreover, the inclusion of trend components do not change the relationship between the cyclical components. However, we find that the trend component in Germany’s per capita GDP has a negative and statistically significant (at the 1% level) relationship with Canada’s cyclical component.

In the case of Germany’s cyclical component, we find that cycles in the UK, Japan, and France have a statistically significant relationship, with cycles in France having a statistically significant negative relationship. The inclusion of trend components, however, renders the impact of cycles in the UK insignificant. Moreover, we find that the trend component in Canada’s per capita GDP is negatively related, and the trend component in Germany’s per capita GDP is positively related, to Germany’s cyclical component. Meanwhile, the results for Italy suggest that its cyclical component is positively related to cycles in all countries except for the USA, and the trend component in France’s per capita GDP is negatively related, while the trend component in Germany’s per capita income is positively related, with cyclical components in Italy’s per capita GDP. In the case of France, we find that its cyclical component is negatively related to cycles in all countries except Germany. We find that trend components in the G6 countries do not have any statistically significant relationship with the cyclical component of France’s per capita GDP.

In sum, there are two observations worth highlighting. First, generally cyclical patterns in one country tend to contribute positively to other countries cycles. Second, France seems to be an outlier, for cycles in France have a negative relationship with cycles in the USA, the UK, and Japan, and when we model the relationship taking cycles in France as the endogenous variable we find that cycles in the USA and the UK negatively impact on cycles in France, while cycles in the rest of the countries have a statistically insignificant relationship with cycles in France.

Conclusions

In this paper, we examine the issue of common cycles, the co-movement among the stationary components of per capita GDP, and common trends, the co-movement among the non-stationary components of per capita GDP, for the G7 countries using historical data for the period 1870–2001. Our main findings follow. First, we find that there are three common trends and four common features in per capita GDP. Second, we find that over short time horizons, transitory shocks explain approximately 40% of the variations in per capita incomes for the USA, Japan, and Italy. For Germany, France, Canada, and the UK, over both the short and long time horizons, permanent shocks are the most important components in explaining variations in per capita GDP. Third, we attempted to examine the importance of cyclical components and trend components in explaining cyclical behaviour in each of the seven countries per capita GDP. To this end, we regressed a country’s cyclical component on the cyclical components of the remaining six countries, and we regressed a country’s cyclical component on the cyclical component of the six countries and all the seven countries trend component. Our main finding from this exercise was USA, Japanese, Italian, and UK cyclical components are more related to cyclical patterns in other countries per capita incomes, while the trend component generally has an insignificant relationship with the cyclical components.

The key implications of our findings are as follows. First, over short horizons, we find transitory shocks explain approximately 40% of the variations in per capita incomes for the USA, Japan, and Italy, and this shows that the role of demand shocks is not trivial. Demand shocks, such as changes in fiscal policy, tastes, velocity and autonomous investment, are likely to have a say in business cycle fluctuations for these countries. Second, over both short and long time horizons, we find supply shocks explain the bulk of the variations in per capita incomes for the G7 economies, implying the importance of productivity shocks. Our findings, while consistent with those of Ahmed et al. (1993) are in sharp contrast to Keating and Nye (1999), Gavosto and Pellegrini (1999), Centoni and Cubadda (2003) and Hartley and Walsh (2003). This difference in results could be due to our methodological innovation. To this end, Vahid and Issler (2002) use Monte-Carlo simulations to investigate the importance of restrictions implied by common cyclical features for estimates and forecasts based on VAR models and show that the costs of ignoring common cyclical features in VAR modelling can be high, both in terms of forecast accuracy and efficient estimation of variance decomposition coefficients. Vahid and Issler (2002) further find the short-run restrictions are more important than the cointegrating restrictions for forecasting at business cycle horizons. We attempt to show that we indeed obtain better forecasting accuracy through common cycle restrictions by conducting a post sample forecasting exercise. We did find evidence for efficiency gains in that the restricted model outperformed the unrestricted model for all the seven countries.

Notes

The main importance of imposing common cycle restrictions are their reduction in the number of free parameters of a VAR model and this helps achieve more accurate estimates. Vahid and Issler (2002, p. 342) present the case, with 200 data points and a VAR with three variables and eight lags, that there are 75 mean parameters to be estimated. If the three variable system has one known cointegrating vector, the number of free parameters falls from 75 to 69 when estimating a vector error correction (VEC) model. Common cyclical features show more potential in reducing the number of conditional mean parameters. If the three variables in the VEC model share one common cycle, then the number of mean parameters falls from 69 to 27.

Because forecasting uncertainty at long horizons can be large, time series models are generally most useful for forecasting over short horizons. Hence, imposing short-run constraints might be a way of improving the effectiveness of time series models at horizons where they are most useful (Vahid and Issler 2002, p. 342).

Both the WF and PSCCF tests are based on the earlier work of Vahid and Engle (1993).

The unit root test results are available from the author upon request.

References

Ahmed, S., Ickes, B. W., Wang, P., & Yoo, B. S. (1993). International business cycles. American Economic Review, 83, 335–359.

Baxter, M., & Stockman, A. C. (1989). Business cycles and the exchange rate system : some international evidence. Journal of Monetary Economics, 23, 377–400.

Centoni, M., & Cubadda, G. (2003). Measuring the business cycle effects of permanent and transitory shocks in cointegrated time series. Economics Letters, 80, 45–51.

Cubadda, G., & Hecq, A. (2001). On non-contemporaneous short-run co-movements. Economics Letters, 73, 389–397.

Dornbusch, R., & Fischer, S. (1986). The open economy: Implications for monetary and fiscal policy. In R. Gorden (Ed.), The American business cycle: Continuity and change (pp. 495–516). Chicago University Press: Chicago.

Engle, R. F., & Granger, C. W. J. (1987). Cointegration and error correction representation, estimation and testing. Econometrica, 55, 251–276.

Gavosto, A., & Pellegrini, G. (1999). Demand and supply shocks in Italy: an application to industrial output. European Economic Review, 43, 1679–1703.

Gerlach, S. (1988). World business cycles under fixed and flexible exchange rates. Journal of Money, Credit and Banking, 20, 621–32.

Hartley, P. R., & Walsh, C. E. (2003). Macroeconomic fluctuations: demand or supply, permanent or temporary? European Economic Review, 47, 61–94.

Hartley, P. R., & Walsh, C. E. (1992). A generalised methods of moments approach to estimating a structural vector autoregression. Journal of Macroeconomics, 14, 199–232.

Hecq, A., Palm, F. C., & Urbain, J. P. (2000). Permanent-transitory decomposition in VAR models with cointegration and common cycles. Oxford Bulletin of Economics and Statistics, 62, 511–532.

Hecq, A., Palm, F. C., & Urbain, J. P. (2002). Separation, weak exogeneity and P-T decomposition in cointegrated VAR systems with common features. Econometric Reviews, 21, 273–307.

Issler, J. V., & Vahid, F. (2001). Common cycles and the importance of transitory shocks to macroeconomic aggregate. Journal of Monetary Economics, 47, 449–475.

Johansen, S. (1988). Statistical analysis of cointegrating vectors. Journal of Economic Dynamics and Control, 12, 231–254.

Keating, J. W., & Nye, J. V. (1999). The dynamic effects of aggregate demand and supply disturbances in the G7 countries. Journal of Macroeconomics, 21, 263–278.

Mitchell, W. C. (1927). Business cycles: The problem and its setting. National Bureau of Economic Research: New York.

Morgenstern, O. (1959). International financial transactions and business cycles. Princeton University Press: Princeton, NJ, USA.

Vahid, F., & Engle, R. F. (1993). Common trends and common cycles. Journal of Applied Econometrics, 8, 341–360.

Vahid, F., & Issler, J. V. (2002). The importance of common cyclical features in VAR analysis: a Monte-Carlo study. Journal of Econometrics, 109, 341–363.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Narayan, P.K. Common Trends and Common Cycles in Per Capita GDP: The Case of the G7 Countries, 1870–2001. Int Adv Econ Res 14, 280–290 (2008). https://doi.org/10.1007/s11294-008-9162-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-008-9162-y