Abstract

Our article offers insights on the role of operational research (OR) in understanding financial and economic systems' risks and dynamics. It presents the latest methods in OR to address risks and uncertainties in these systems, covering topics such as options pricing, portfolio optimization, banking resilience, and the analysis of financial and economic co-movements. The included studies utilize advanced analytical tools, like stochastic programming, decision analysis, and machine learning, to create robust models for complex systems. These contributions aim to be valuable for academics, practitioners, policymakers, and regulators in the field.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Over the last 20 years, several periods of turmoil (Such as the Internet bubble, financialization of commodities markets, subprime crisis, sovereign debt, and geopolitics crises) have shaped the financial and economic systems. The economic and financial spheres are highly complex, exhibiting multiple dimensions of uncertainty, nonlinear dynamics, and evidence of chaos. The recent and exponential development of advanced operations research methods provides new insights for understanding these behaviors. Specifically, the recent availability of information technology, such as high-frequency, real-time, network, structured, and unstructured data, offers huge challenges for analyzing, understanding, and forecasting the complex dynamics of economic and financial phenomena.

The articles presented in this special issue showcase the latest research and advancements in operational research methods aimed at mitigating the risks and uncertainty in financial and economic systems. Contributors have explored various aspects of risk and uncertainty modeling, including portfolio optimization, financial risk management, and economic forecasting. They employed sophisticated analytical tools, such as stochastic programming, decision analysis, and machine learning, to develop robust models for these complex systems. These contributions are relevant to not only academics but also practitioners, policymakers, and regulators.

2 Presentation of the contributions

In this section, we present the contributions to this special issue on four topics.

2.1 The role of operational research in options pricing and portfolio optimization

Operational research (OR) has significantly contributed to options pricing and portfolio optimization by leveraging advanced methods to enhance decision-making processes and improve risk management. By employing sophisticated mathematical models and quantitative techniques, OR has facilitated the development of innovative options pricing frameworks that account for market volatility and help investors make informed decisions under uncertain conditions. In this context, the following studies contribute to the literature.

In the current low-interest-rate environment, Bertrand (2022) shows that the quality of the approximation of a warrant by the Black–Scholes formula deteriorates, and the sensitivity of this approximation to the volatility estimate increases. Gradojevic and Kukolj (2022) helps improve our understanding of the dynamics of option prices and their underlying risk factors, and enhances the efficacy of existing non-parametric approaches toward option pricing. Schneider and Tavin (2021) develop a multifactor model in which stochastic volatility dynamics incorporate a seasonal component that can be used for option pricing in the risk-neutral measure and for filtering, smoothing, and predicting via the Kalman filter in the physical measure. Djeutcha and Kamdem (2022) propose a new three-factor pricing model for vulnerable bull-spread options using a mixed modified fractional Hull-White-Vasicek stochastic volatility and stochastic interest rate model. Their results can be applied to realistic credit-risk measurements.

In the context of machine learning approaches, Costola et al. (2022) propose an extension of the portfolio optimization approach related to Markowitz’s mean–variance portfolio theory using machine learning techniques. This study demonstrates that the weights of any Efficient Portfolio are a linear combination of the weights of two special pivotal Efficient Portfolios, which are nonlinear transforms of simple weight vectors. Jimenez and Salhi (2022) propose a variance reduction methodology using a machine learning technique. This methodology reduces the dimensionality of the underlying scenarios while keeping the variance closer to the original setting. Furthermore, a more realistic experiment based on real-world datasets is performed to investigate the practical aspects of the proposed methodology.

Rigamonti and Lučivjanská (2022) show that the minimum average partial significantly improves the performance of mean-semivariance optimization, largely closing the gap in out-of-sample performance with strategies based on the covariance matrix. The proposed strategy is very competitive in a setting in which the investor sets a target return and performs mean(semi)variance optimization. Casarin et al. (2022) consider the problem of designing efficient algorithms for optimizing a nondifferentiable function subject to an integral constraint whose solution is not available in a closed form, which is an important problem in OR. This study proposes two algorithms based on stochastic optimization via simulations to find faster solutions to integral functions that are not analytically reducible and to provide accurate approximations of the true solutions in the case of classical portfolio optimization. La Torre et al. (2021) propose two different extensions of the notion of portfolio efficiency with incomplete information and partial uncertainty. They apply the obtained results to portfolio theory and stochastic dominance. Semmler et al. (2022) analyze the consequences of short-term investor portfolio strategies and their consequences on green investments. Their results show that portfolio wealth declines faster with a higher discount rate, hyperbolic discounting, and a shorter decision horizon.

2.2 Strengthening banking resilience and efficiency through operational research

OR has made significant contributions to the banking sector and regulations, proving to be an indispensable tool for enhancing efficiency, risk management, and decision making. By employing advanced quantitative methods and analytical models, OR has revolutionized the way banks manage their resources, optimize their portfolios, and comply with regulatory requirements. In this context, the following studies contribute to the literature.

To confront the unprecedented challenges posed by the COVID-19 pandemic, Saâdaoui and Khalfi (2022) consider a data mining approach to estimate the governance-based efficiency of Islamic banks in developed and emerging countries. The main result shows that governance is the main factor influencing Islamic banks in both regions. Mirzaei et al. (2022) evaluate the stock performance of Islamic banks during the initial phase of the COVID-19 crisis using data envelopment analysis—a linear programming-based methodology for benchmarking a set of decision-making units.

The important issue of liquidity was addressed by Louhichi et al. (2022), who investigate the effect of high liquidity creation on systemic risk, which became one of the most important topics in economic and financial regulatory debates after the 2008 financial crisis. Ben Lahouel et al. (2022) examine the nonlinear effects of liquidity risk on financial stability under different levels of income diversification among European banks. The results show that diversification strategies do not destroy the primary function of commercial banks—liquidity creation. Fukuyama and Tan (2021) use advanced operational methods that incorporated risk indicators to evaluate bank efficiency. They focus on employing the "real" risk indicator, namely non-performing loans, and try to propose the dual role played by the LLRs in the banking production process.

Within the regulatory framework, researchers have been striving to develop innovative solutions to address complex challenges. Seera et al. (2021) identify a feature optimization aggregation method for processing payment transaction records and develop a machine learning model to predict fraudulent activity in the payment card industry. Regarding environmental regulations and tax evasion, Goldberg et al. (2022) develop methods to evaluate and compare explicit solutions under given monitoring costs and income distributions. The results show that dynamic monitoring is superior, even when all firms are constrained at rates below the optimal static rate.

2.3 Demystifying interdependencies: operational research contributions to financial and economic co-movements

Understanding the co-movement and spillover effects among different asset classes is important for asset allocation, portfolio diversification, and cross-market hedging. In the context of operations research, this knowledge enables the optimization of decision-making processes and improves risk management. The value of this information is increasingly relevant for portfolio managers because growing interconnectedness, spillovers, and high contagion effects between financial markets diminish portfolio diversification benefits. In this context, the following studies introduce new insights into existing literature.

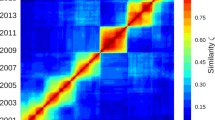

In the context of the link with alternative assets, Faye et al. (2022) investigate the dynamic process of convergence among a set of real alternative and financial assets using a procedure that endogenously determines multiple structural breaks and a rolling co-integration framework.

Huynh et al. (2021) explore the nexus between the Bitcoin and US oil returns by employing various quantitative techniques, both non-parametric (Kendallplots) and parametric (three kinds of copulas and stationary bootstrap for the partial cross-quantilogram), to test the tail-dependence structure. Bouri et al. (2022) examine the impact of microstructure noise on idiosyncratic volatility anomalies in the framework of the cryptocurrency market.

In the context of the link with energy assets, Foglia et al. (2022) examine the spillover and connectedness effects between clean energy and oil firms. The relationships among energy firms tend to be intersectoral. Zaghdoudi et al. (2023) explore the link between oil and coal prices and renewable energy consumption in China using a machine learning approach. The results show that an increase in coal price has a higher ability to predict renewable energy consumption. Baba et al. (2022) examine the direction of causality between the futures and spot prices of the US and European natural gas markets using multiscale linear and nonlinear Granger causality and tests the random-walk hypothesis. Jabeur et al. (2021) propose an innovative approach to accurately forecast gold price movements and interpret forecasts. The results show significant correlations between gold prices and all the predictor variables considered: crude oil, iron, and silver prices; USD/EUR and USD/CNY exchange rates; S&P 500; and the US inflation rate.

On the methodological level, Naeem et al. (2021) propose a new approach to investigate the spillover for the short and long terms and while considering the heterogeneous agents/investors as highlighted in behavioral finance.

2.4 Decoding financial dynamics: the role of operational research in addressing news impact, uncertainty, and market sentiment

OR has made significant strides in addressing the challenges posed by news impact, uncertainty, and market sentiment in financial and economic systems. OR allows researchers and practitioners to develop sophisticated models that accurately capture the complex relationships among various financial and economic variables, ultimately improving decision-making processes while facing uncertainty. Within this framework, subsequent studies have provided novel perspectives to enrich the current body of knowledge.

Mili et al. (2023) present a novel empirical technique based on investor sentiment and Bayesian vector autoregressive (BVAR) models to estimate stock returns. Shuwaikh et al. (2022) focus on investment decisions based on two types of investors: corporate and independent venture capital. Yao et al. (2022) explore the double-edged sword effect of investor attention on cryptocurrency market liquidity and construct an abnormal investor attention index. Kim et al. (2021) assess the effects of financial- and news-driven uncertainty shocks in growing Asian economies using bond market data. They show that bond volatility is more closely associated with interest rate uncertainty than with other measures of uncertainty in equity markets and economic policies. Mefteh-Wali et al. (2022) elucidate the CSR–firm risk relationship and the role of uncertainty by applying a broad class of copula functions for modeling the dependence structure of CSR fulfillment and idiosyncratic risk dimensions. Using an unsupervised machine learning algorithm, Xia et al. (2022) explore the mechanism of the information and risk effects on short- and long-term IPO markets from the perspective of semantics and content. This study explores how the information and risk effects of risk disclosure play different roles. Alexander et al. (2022) propose new metrics for discriminating between correctly specified and mis-specified models using a proper multivariate scoring rule. The main practical contribution of this study is the application of these metrics to an extensive investigation of the discrimination ability of the most common multivariate proper scoring rules.

References

Alexander, C., Coulon, M., Han, Y., & Meng, X. (2022). Evaluating the discrimination ability of proper multi-variate scoring rules. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04611-9

Baba, A., Ben Kebaier, S., & Creti, A. (2022). How efficient are natural gas markets in practice? A wavelet-based approach. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04750-z

Ben Lahouel, B., Taleb, L., Ben Zaied, Y., & Managi, S. (2022). Financial stability, liquidity risk and income diversification: Evidence from European banks using the CAMELS–DEA approach. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04805-1

Bertrand, P. (2022). Black-scholes approximation of warrant prices: Slight return in a low interest rate environment. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04622-6

Bouri, E., Kristoufek, L., Ahmad, T., & Shahzad, S. J. H. (2022). Microstructure noise and idiosyncratic volatility anomalies in cryptocurrencies. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04568-9

Casarin, R., Maillet, B. B., & Osuntuyi, A. (2022). Monte carlo within simulated annealing for integral constrained optimizations. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04994-9

Costola, M., Maillet, B., Yuan, Z., & Zhang, X. (2022). Mean–variance efficient large portfolios: A simple machine learning heuristic technique based on the two-fund separation theorem. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04881-3

Djeutcha, E., & Sadefo Kamdem, J. (2022). Pricing for a vulnerable bull spread options using a mixed modified fractional Hull–White–Vasicek model. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04808-y

Faye, B., Le Fur, E., & Prat, S. (2022). Exogeneous shocks, risk, and market convergence of real alternative and financial assets: Evidence from nonlinear dynamics. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04510-5

Foglia, M., Angelini, E., & Huynh, T. L. D. (2022). Tail risk connectedness in clean energy and oil financial market. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04745-w

Fukuyama, H., & Tan, Y. (2021). Investigating into the dual role of loan loss reserves in banking production process. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04365-w

Goldberg, N., Meilijson, I., & Perlman, Y. (2022). Dynamic history-dependent tax and environmental compliance monitoring of risk-averse firms. Annals of Operations Research. https://doi.org/10.1007/s10479-022-05113-4

Gradojevic, N., & Kukolj, D. (2022). Unlocking the black box: Non-parametric option pricing before and during COVID-19. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04578-7

Huynh, T. L. D., Ahmed, R., Nasir, M. A., Shahbaz, M., & Huynh, N. Q. A. (2021). The nexus between black and digital gold: Evidence from US markets. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04192-z

Jabeur, S. B., Mefteh-Wali, S., & Viviani, J. L. (2021). Forecasting gold price with the XGBoost algorithm and SHAP interaction values. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04187-w

Jimenez, M., & Salhi, Y. (2022). A semi-supervised learning approach for variance reduction in life insurance. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04845-7

Kim, J., Kumar, A., Mallick, S., & Park, D. (2021). Financial uncertainty and interest rate movements: Is Asian bond market volatility different? Annals of Operations Research. https://doi.org/10.1007/s10479-021-04314-7

La Torre, D., Mendivil, F., & Rocca, M. (2021). Modeling portfolio efficiency using stochastic optimization with incomplete information and partial uncertainty. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04372-x

Louhichi, W., Saghi, N., Srour, Z., & Viviani, J. L. (2022). The effect of liquidity creation on systemic risk: Evidence from European banking sector. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04836-8

Mefteh-Wali, S., Rais, H., & Schier, G. (2022). Is CSR linked to idiosyncratic risk? Evidence from the copula approach. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04980-1

Mili, M., Sahut, J. M., Teulon, F., & Hikkerova, L. (2023). A multidimensional Bayesian model to test the impact of investor sentiment on equity premium. Annals of Operations Research. https://doi.org/10.1007/s10479-023-05165-0

Mirzaei, A., Saad, M., & Emrouznejad, A. (2022). Bank stock performance during the COVID-19 crisis: Does efficiency explain why Islamic banks fared relatively better? Annals of Operations Research. https://doi.org/10.1007/s10479-022-04600-y

Naeem, M. A., Qureshi, F., Farid, S., Tiwari, A. K., & Elheddad, M. (2021). Time-frequency information transmission among financial markets: Evidence from implied volatility. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04266-y

Rigamonti, A., & Lučivjanská, K. (2022). Mean-semivariance portfolio optimization using minimum average partial. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04736-x

Saâdaoui, F., & Khalfi, M. (2022). Revisiting Islamic banking efficiency using multivariate adaptive regression splines. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04545-2

Schneider, L., & Tavin, B. (2021). Seasonal volatility in agricultural markets: Modelling and empirical investigations. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04241-7

Seera, M., Lim, C. P., Kumar, A., Dhamotharan, L., & Tan, K. H. (2021). An intelligent payment card fraud detection system. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04149-2

Semmler, W., Lessmann, K., Tahri, I., & Braga, J. P. (2022). Green transition, investment horizon, and dynamic portfolio decisions. Annals of Operations Research. https://doi.org/10.1007/s10479-022-05018-2

Shuwaikh, F., Brinette, S., Khemiri, S., & Castro, R. G. D. (2022). Venture capital activities under uncertainty: US and UK investors behavior. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04962-3

Xia, H., Weng, J., Boubaker, S., Zhang, Z., & Jasimuddin, S. M. (2022). Cross-influence of information and risk effects on the IPO market: Exploring risk disclosure with a machine learning approach. Annals of Operations Research. https://doi.org/10.1007/s10479-022-05012-8

Yao, S., Sensoy, A., Nguyen, D. K., & Li, T. (2022). Investor attention and cryptocurrency market liquidity: A double-edged sword. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04915-w

Zaghdoudi, T., Tissaoui, K., Hakimi, A., & Ben Amor, L. (2023). Dirty versus renewable energy consumption in China: A comparative analysis between conventional and non-conventional approaches. Annals of Operations Research. https://doi.org/10.1007/s10479-023-05181-0

Acknowledgements

We would like to express our sincere gratitude to the authors who have contributed their expertise and knowledge to this special issue. We believe that their research will advance our understanding of risk and uncertainty modeling in financial and economic systems. We would also like to thank our reviewers who diligently reviewed the submissions and provided constructive feedback to the authors. We express our gratitude to Annals of Operations Research (ANOR) and Springer for the privilege of presenting this special volume. We extend our special thanks to the Editor-in-Chief of ANOR, Prof. Dr. Endre Boros, for his interest and trust since the inception of this project. Finally, we hope that this special issue will inspire further research in the field of OR methods in financial and economic systems.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ben Ameur, H., Clark, E., Ftiti, Z. et al. Operational research insights on risk, resilience & dynamics of financial & economic systems. Ann Oper Res 334, 1–6 (2024). https://doi.org/10.1007/s10479-024-05869-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-024-05869-x