Abstract

This article investigates the dynamic process of convergence among a set of real alternative (art, fine wine, gold, residential real estate) and financial assets in the US context over the period 2003–2019. The objective is to explore the time-varying behavior of their links considering structural breaks coming from exogenous economic and financial shocks that prevent market convergence from being a linear process. Using a procedure that determines endogenously multiple structural breaks and a rolling co-integration framework, we show that price co-movements depend on the global financial and economic environments. Our results confirm the existence of a long-term co-integration relationship among price series but with structural breaks. We find that exogenous shocks lead to a lower degree of convergence of real alternative and conventional assets, and expansion phases promote market convergence between them. Our results contribute to guiding investors in their efforts to diversify their wealth and portfolio.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A growing number of institutional and private investors and academics are interested in real alternative assets, because they are a source of capital appreciation and a vehicle for portfolio diversification (Knight Franck, 2018). According to Chambers et al. (2015), alternative assets are often defined not by what they are but what they are not, that is, something other than stocks and bonds. Financial alternative assets (e.g., private equity, venture capital, REITs) and real alternative assets (commodities, residential real estate, collectibles) are included in this asset class. The results of financialization and globalization since the new millennium has influenced the price dynamics of these assets, allowing investors to include them in their portfolio. Indeed, recent reports highlight the high returns of real alternative assets in recent years in a context of renewed global risk aversion.Footnote 1 Within this framework, the main question is whether the price dynamics of these assets have been coupled with a convergence mechanism that could limit diversification opportunities for investors and collectors (Le Fur, 2021a). It is specifically in this context that our article focuses.

The concept of price convergence is based on the principle of the law of one price (LOOP), which implies a perfect price equality for goods with same characteristics in different markets at the same time. From a theoretical point of view, the prices of goods can be subject to arbitrage, which under certain assumptions leads to equal prices. However, these assumptions are very difficult to assume, so that the LOOP is not often verified empirically (Crucini & Shintani, 2008; Lutz, 2004). Nevertheless, in its weak version, the LOOP allows some degree of price convergence or co-movements (Crucini & Smith, 2016). In this study, real alternative and traditional financial assets, as investment vehicles for investors, offer a kind of substitutability that leads, according to the weak version the LOOP, to a more or less strong price convergence of these assets. This analysis of the degree of convergence, or co-movements, between these different assets could guide future investment decisions of investors to achieve more efficient portfolio diversification. In other words, the scope for diversification benefits can be assessed through an analysis of the price co-movements of alternative and traditional assets. More specifically, finding price co-movements among alternative assets along with traditional financial assets implies that portfolio diversification becomes less effective because price series tend to exhibit the same behavior in the long run. In light of the price dynamics of these assets, investors will be better able to rebalance their portfolios and shift their strategy to take advantage of abnormal return or risk reduction opportunities, by modifying the weight of assets according to their degree of convergence with traditional financial assets. Even if the question of convergence seems to be crucial, few studies have addressed this issue for real alternative assets.

The academic literature is mainly interested in the relationship between one type of real alternative asset (commodities, residential real estate, or collectibles) and a financial asset in a linear framework over a period when shocks are not considered. To our knowledge, only the articles by Chan et al. (2011) and Dimson and Spaenjers (2014) deal with price movements for various real alternative assets and financial assets, but always in a linear analysis framework. However, the shocks that have occurred since the new millennium (global financial crisis [GFC], sovereign debt crisis, Brexit, oil prices, etc.) have probably had an impact on asset price dynamics, and it seems necessary to model them in a nonlinear framework. The purpose of this article is therefore to question the existence of market convergence between the main real alternative assets and conventional markets over a long period, including the possible effects of exogenous shocks. This question thus contributes to shedding light for investors on the conditions under which real alternative assets can participate in portfolio diversification strategies.

To assess the degree of convergence of real alternative and financial assets in a nonlinear context, we focus on four main real alternative assets (art, wine, gold, and residential real estate) and a global stock market index (the MSCI index) for the US zone. The choice of the geographic area and assets is based on purely quantitative criteria. On the one hand the US area concentrates the largest population of UHNWI,Footnote 2 that is, the investors most likely to be interested in these types of real alternative assets. On the other hand, these four real alternative assets are among the most widely used in terms of allocation in investment portfolios (Knight Franck, 2019). The dynamics of price series are analyzed using monthly data over the period between 2003M05 and 2019M12.Footnote 3 In this article, we track the ongoing price links of alternative and financial assets, and we assess the regime-shifting impacts of exogenous economic and financial shocks on these links. First, we explore the instability of the relationships between the variables using a structural-breaking co-integration procedure that determines structural breakpoints endogenously. In a next step, we use a rolling co-integration analysis framework to examine the dynamic process of the co-integrating vectors to have a clearer picture of the gradual convergence of real alternative and financial assets over time. Estimating the parameters of long-term relationships and adjustment speeds in a rolling framework reflects the nonlinearity of the convergence process between assets. This procedure is also very useful to account for multiple structural breaks in the underlying co-movements among these assets. Our results tend to confirm the nonlinearity of the convergence process among assets; that is, the degree of convergence evolves over time and seems to be strongly affected by financial shocks and global risk aversion.

Our contribution to the literature is threefold. First, we include in our analysis a sample of real alternative assets (commodities, residential real estate, and collectibles) that are rarely considered together. Most studies consider only one type of real alternative asset and investigate the relationship with conventional financial assets. Second, the previous literature examines price co-movements of real assets without considering exogenous shocks, even though economic and financial shocks have occurred since the new millennium. In this article, we shed new light on the dynamics of convergence in the presence of these structural ruptures. From a methodological point of view, rolling co-integration seems to be the most appropriate method to ensure that the effects of regime shift are affected within a specific event period and do not spread to the overall period. Third, by precisely analyzing the dynamics of convergence of alternative assets, our results could have implications for investors. This information can contribute to enlightening their diversification decisions in changing financial and economic contexts (periods of risk aversion or risk appetite, economic or financial shocks, growing economic cycles, etc.).

The remainder of the article is organized as follows. Section 2 presents the literature review. Section 3 provides the methodology. Section 4 displays the data. Section 5 presents the results. Section 6 discusses the results. Section 7 concludes.

2 Literature review

The literature that underlies the concepts in our article meets at the crossroads of two areas of research: price convergence and co-movements, and real alternative assets. While it is difficult to find a formal definition of convergence (Clark & Qiao, 2021; Mylonidis & Kollias, 2010), it seems crucial to assess the degree of convergence of asset prices because it has significant implications for the diversification potential of investors and portfolio managers. For example, European stock market integrationFootnote 4 implies reduced gains from intra-European portfolio diversification after risk adjustments (Beine et al., 2010; Eun & Lee, 2010). There are different methods used in the literature. Convergence is generally approached as a global concept rather than as a gradual and discontinuous process.

The approach in this article uses co-integration techniques to calculate the number of common stochastic trends (Corhay et al., 1993; Demian, 2011; Engsted & Lund, 1997; Khan, 2011; Switzer & Tahaoglu, 2015; Yang et al., 2003). Other approaches focus on either the dynamic process of convergence using a recursive and sliding co-integration analysis or the Kalman filter model (Apergis et al., 2014; Chien et al., 2015; Gilmore et al., 2008; Pascual, 2003; Rangvid, 2001; Serletis & King, 1997; Yu et al., 2010). In general, these studies find little or no evidence of increased convergence between financial markets. Another approach is to focus on the volatility spillover using either a variant of the GARCH models (Fratzscher, 2002; Bartram et al., 2007) or regime-switching models with time-varying transition probabilities for different regimes (Baele et al., 2004; Guesmi et al., 2013; Hardouvelis et al., 2006; Morana & Beltratti, 2002). The results differ according to the timing and degree of convergence.

The literature on the financial integration of real alternative assets, and more specifically on their co-movement in price indices, is substantial but fragmented and limited to short periods that were deemed homogeneous. There is also a considerable number of research efforts on the relationship between real estate and the stock markets. Although some studies find evidence of market segmentation between real estate and the stock markets (Geltner, 1990; Liu et al., 1990, 2015; Okunev and Wilson, 1997), others indicate that real estate and the stock markets are integrated (Ambrose et al., 1992; Glascock et al., 2000; Gyourko & Keim, 1992; Lin & Lin, 2011; Tsai, 2013). Studies exploring the link between real estate and equity markets have mainly considered real estate securities (such as REITs), which have to be viewed not as real alternative assets but rather as institutional alternative assets. Liu et al. (1990) provided evidence of a relationship between stock returns and real assets returns but reported significant effects of barriers, such as transaction costs and imperfect information. Bouchouicha and Ftiti (2012) identified a common trend for the US market that drives all real estate market components in the long run so that co-integrating relationships justify the existence of a real estate class. More recently, Poshakwale and Mandal (2016) indicate the evidence of co-movements between stocks and real estate with a significant effect of inflation on these co-movements during economic contraction times, whereas risk aversion significantly affects the return co-movements during the economic expansion times.

There are fewer studies analyzing the relationship between financial markets and commodity markets, mainly in gold and oil (Chan et al., 2011; Ftiti et al., 2016). The financial literature on commodities is more recent, particularly rich, and complex. This complexity derives from the great heterogeneity of products and operators in this category (see World Bank Commodity Markets Outlook 2014). Gorton and Rouwenhorst (2006) showed that a diversified investment in commodities is slightly safer than an investment in equities, and commodity price series offer potential greater returns (e.g., Cuddington & Jerrett, 2008; Jacks 2019). However, price movements concerning agricultural, metal, and energy products are only weakly linked to investor decisions. The role of world industrial and climatic shocks and income growth are more crucial in explaining price movements (Baffes & Etienne, 2014; Baffes & Savescu, 2014; Webster et al., 2008). Other authors have emphasized a contagion effect between gold and conventional assets. For example, Mensi et al. (2013) indicate that past shocks and volatility of the S&P 500 strongly influenced the gold market. This link is confirmed by Brooks and Prokopczuk (2013). Additionally, even if gold does not provide cash flows, it is a very liquid asset with lower holding and transaction costs than other real alternative assets.

There is little research on the co-integration of artFootnote 5 and capital markets (Chanel, 1995; Ginsburgh & Jeanfils, 1995; Worthington & Higgs, 2003), but these items show a high level of integration. However, most studies test the integration between different art markets (Bakhouche, 2013; Ballesteros, 2011; Chanel et al., 1994; Erdos and Ormos 2010; Le Fur, 2020) and indicate that art markets are weakly to moderately integrated. The question of price transmission (returns and volatility) in the art market has been discussed since the 1990s (e.g., Chanel, 1995; Ginsburgh & Jeanfils, 1995; Goetzmann, 1995). Worthington and Higgs (2003) used the co-integration method or ECM model to identify short- and long-run co-movements among major art and equity markets over the period between 1976 and 2001. Finally, Worthington and Higgs (2004) indicated a volatility transmission effect between financial markets and different segments of the art market by using MGARCH methodology.

There is a controversial interpretation of the co-integration between the financial markets and the fine wine markets (Le Fur & Outreville, 2019). For example, Bouri (2014) measured the impact of negative shocks on fine wines and showed that there is an asymmetric inverse volatility in this market. On the one hand, there is a high impact of financial markets on wine prices and short-term causality for some fine wines (Faye et al., 2015). On the other hand, there is a possible diversification advantage due to the lack of co-integration between fine wines and normal wine, and the MSCI index world (Introvigne et al., 2017). The different wine indices are not affected in the same way by the volatility of the financial markets. Thus, there is a proximity or regional effect that favors the transmission by contagion of financial market volatility to fine wine indices (Le Fur et al., 2016a). Moreover, Bordeaux wines present the greatest systematic risk among the world's greatest wines (Le Fur et al., 2016b). In the short term, volatility is transmitted to the wine market with a negative effect via the financial and commodity markets and with a positive effect via the art, residential real estate, and credit markets. In the long term, the wine market is affected by all other markets (Ben Ameur & Le Fur, 2020). For an in-depth study of the potential of wine as a financial investment, see Fogarty (2006) and Storchmann (2012). See also Burton and Jacobsen (2001), Sanning et al. (2008), and Masset and Weisskopf (2010) for an estimation of the rate of return of wines during average conditions and in conditional volatility or covariance. Other articles consider links of fine wines with conventional assets using correlations (Kourtis et al., 2012), CAPM models (Baldi et al., 2013; Masset & Weisskopf, 2010) and co-integrating or ECM models (Faye et al., 2015). Recent academic literature indicates that returns of fine wines and their links to conventional asset indices depend on the wine liquidity market (Masset et al., 2016) transaction and holding costs and buyer profiles (Cardebat et al., 2017).

However, these studies remain partial considering only the link between a type of real alternative asset and conventional assets (generally apprehended by the MSCI) or the links among a reduced number of real alternative assets. Moreover, these studies of the co-movements of asset price indices cover a single period considered homogeneous, without considering exogenous shocks that could modify investors' diversification strategies.

3 Methodology

In order to analyze the convergence process of the price series of alternative assets and market variables, we implement the methodology that enables us to take into account possible breaks in the process. These breaks are inherent in the exogenous shocks that regularly hit economies and financial markets and that prevent the relationships between financial variables from fitting into a linear analytical framework. This results in nonlinear co-movements between traditional financial and alternative asset prices.

To explore the time-varying behavior of the links between those alternative asset markets, we first apply the Gregory-Hansen (1996) method to test for co-integration relationships with possible structural breaks among price series in the model. The testing procedure sets up the null hypothesis of no co-integration against the alternative hypothesis of co-integration, allowing for a regime shift in the deterministic component of the series at some unknown date. The authors develop residual-based tests for co-integration with three alternative hypotheses concerning the structural change. As the authors describe, model C considers a level shift in the co-integrating relationship (level shift), modeled as a change in the intercept; model C/T introduces a time trend into the level shift model (Level shift with trend), and model C/S is a regime-shift model that enables the slope vector to change as well (regime shift). Gregory and Hansen (1996) presented three tests designed to identify co-integration with the presence of structural breaks: \(Z_{\alpha }^{*} = inf_{\tau \in T} Z_{\alpha }\) and \(Z_{t}^{*} = inf_{\tau \in T} Z_{t}\) of Phillips (1987) and the \(ADF^{*} = inf_{\tau \in T} ADF\). These three tests are modified versions of the standard Phillips and ADF tests that are designed to analyze co-integration relationships without regime shifts.

In a second step, the Kejriwal and Perron (2010) analysis framework is used to determine and test for multiple structural changes occurring at unknown dates in a co-integration system with nonstationary variables. This step is crucial to determining the true date of breaks. Indeed, the Gregory and Hansen (1996) procedure does not provide a consistent estimate of the breakpoint because it is determined to minimize the described test statistics to increase the power of the tests. In particular, the Kejriwal and Perron (2010) procedure considers three types of test statistics: (1) the sup-Wald test defined as sup \(F_{T} \left( k \right)\) applies when testing \(H_{0} = no break \) against the alternative hypothesis of \(H_{1} = fixed value m = k\) changes; (2) a double-maximum test \(UDmax F_{T} \left( M \right)\) involving an unknown number of breaks between 1 and some upper bound \(M\), based on the maximum individual tests for \(H_{0} = no break\) against the alternative hypothesis \(H_{1} = m breaks \left( {m = 1, \ldots ., M} \right);\)Footnote 6 and (3) a sequential procedure \(SEQ_{T} \left( {k + 1{|}k} \right)\) that tests \(H_{0} = k breaks \) against \(H_{1} = k + 1 breaks\). All these test statistics derive from the global minimization program developed by Bai and Perron (1998, 2003) that used a dynamic programming algorithm in a stationary context. However, because the asymptotic distribution of the test statistics are nonstandard in a context of nonstationary variables, we refer to critical values reported by Kejriwal and Perron (2010) assuming a maximum of five breaks with a trimming value of 0.15.

In a third step, to shed some light on the co-movement process of real alternative and financial assets and the convergence dynamics between them over the period under review, we implement a rolling co-integration analysis. This method seems to be relevant to analyzing whether the degree of convergence of the real alternative and financial assets has strengthened or, on the contrary, has weakened during the period of study marked by the occurrence of economic and financial crises. Intuitively, these shocks should affect the long-term relationship between assets, which will no longer be stable. Our choice to consider time-varying co-integration relationships seems all the more relevant in this context. Technically, the rolling co-integration analysis considers a unique sample size, that is, the number of observations does not change, but with a sample period that varies over time by shifting the sample by one observation at a time. At every stage, an analysis of the statistical tests of the co-integration model is carried out and enables clearly drawing out over the study period the degree of convergence of alternative real assets with stocks.

In a co-integration framework, in which the series are integrated of order 1 \(I(1)\), the model can be written in the form of VECM as follows:

where Y is the vector of a log-transformed price series of real alternative and financial assets: gold, wine, art, residential real estate, and equity. \(\alpha \) is a loading matrix that indicates the rate of adjustment of the endogenous variables toward the equilibrium; and \(\beta \) are the parameters in the co-integrating equation.

The rank of the matrix αβ′ determines the number of co-integrating vectors. Two types of statistics can determine the rank of αβ′: the trace test and the maximum eigenvalue test (Johansen, 1988, 1991). Both tests are based on the maximum likelihood ratio, as follows:

where \(\widehat{{\lambda }_{i}}\) is the estimated value for the ith-ordered eigenvalues from the matrix Π. The trace statistic tests the null hypothesis of \(r\) co-integrating relations against the alternative of \(n\) co-integrating relations, with \(n\) the number of endogenous variables, for \(r=0, 1, \dots , n-1\). The maximum eigenvalue statistic instead tests the null hypothesis showing that there are \(r\) co-integrating relations against the alternative of \(r+1\) co-integrating relations. The asymptotic distributions of the tests are presented in Johansen and Juselius (1990) and MacKinnon et al. (1999), who provide critical values for these two tests.

In our rolling co-integrating framework, the trace test statistics are calculated over a fixed window of 120 observations, that is, a period of 10 years, but this sample period varies over time by shifting it by one observation at a time. In this way, the first study period begins in 2003M05 and ends in 2013M04 (120 obs.). The second study period begins one observation later and also ends one observation later; it corresponds to the period 2003M06–2013M05 (also 120 obs.). The last study window begins in 2010M01 and ends in 2019M12. The rolling methodology and our sample enable us to work on more than 80 estimations of statistical tests of the co-integration model of real alternative asset and stock prices. Each trace test statistic, computed for the 1–120 observations, then for the 2–121 observations, 3–122 observations, and so on, is scaled by its 5% critical value to facilitate its interpretation. If the scaled test statistics is above 1, then the concerning null hypothesis \(r\le i\) for each \(i=0, 1, 2, 3, \dots , 4\) can be rejected at the 5% level for the sample period considered, and there is at least \(r+1\) co-integration relations. We rely on the Schwarz information criteria to determine the optimal lag length of the model that also avoid serial correlation of the error terms. Following Mylonidis and Kollias (2010), we report the trace test statistics on the last day of the subsample period from which they are computed.

This methodology enables us to assess the number of co-integrating relationships among the variables in our model over time and to identify, over our study period, the structure of convergence of real alternative asset and equity prices. In particular, the more co-integrating relationships there are, the closer the links among the variables.

The other steps of the co-integration model are to estimate the VEC model to determine the value of the coefficients in the long-term relationship. In particular, the adjustment parameters \(\alpha \) captures the dynamics of the system and its convergence to the long-term equilibrium after a variable has been perturbed by a shock. In a rolling analysis framework, the adjustment coefficients \(\alpha ,\) which are computed for each subperiod comprising 120 observations, probably provide a more precise picture of the transitional dynamics of real asset and equity prices over the entire period and take more into account the fact that the convergence mechanism is an ongoing process. The time-varying coefficients α of the error-correction term are also interpreted as the speed of adjustment over time of the price series to their long-run equilibrium. The higher the coefficients, the higher the long-run price convergence. Technically, the convergence mechanism therefore operates on the one hand through the number of co-integration relations in the model and on the other hand through the long-term adjustment coefficients of the variables.

Finally, in a last step, we impose restrictions on the coefficients \(\alpha \) to test the rolling weak exogeneity of the variables, which can be interpreted as the dynamics of causality among the variables in the system. Imposing constraints on the coefficients \(\alpha \) to be equal to zero in the long-term relationship is equivalent to testing the null hypothesis of long-term non-causality. If the parameter \(\alpha \) is not significantly different from zero, the concerned variables are weakly exogenous, which means that they are not constrained by the system. In this case, the weakly exogenous variables guide the other variables of the system in terms of unidirectional causality in the long run. On the contrary, when the null hypothesis of weak exogeneity of the variables is rejected, the variables will be forced by the system to return to their long-term equilibrium and will ultimately allow the correction of the system's deviations in a dynamic process.

4 Data

Our empirical model includes a sample of real alternative assets and stock prices for the United States. We examine the time-varying behavior of the links among these types of assets in order to better understand the complex dynamics of the convergence process. Gold data (hereafter GOLD) and the MSCI US Equity Index (hereafter MSCI) are from Datastream. For art market, we use the Artprice USA index (hereafter ART) from the Artprice database. The Artprice company is considered the world leader in art market information. We also use the Fine Wine 1000 (hereafter LIV-EX) for fine wine market. The Liv-ex is the global marketplace for the wine trade. The Fine Wine 1000 tracks 1,000 wines from across the world. Seven price weighted sub-indices are included in this index representing regions from around the world.Footnote 7 Finally, US residential real estate market is highlighting by the apartment RCA CPPI US (hereafter APART) from Real Capital Analytics. Although the RCA Commercial Property Price indices have been developed for traditional commercial property types such as office, industrial, hotels and retail, RCA CPPI also covers residential types, notably apartments. Table 1 reports the major descriptive statistics.

We transform all series using a natural logarithm. The sample period runs from 2003M05 to 2019M12 (200 observations). By focusing on this period, we take into account the deepening of the financial globalization process over the early 2000s, which resulted in real assets becoming investment assets and therefore attractive to investors. The period also includes financial shocks (bankruptcy of Lehman Brothers and the subprime crisis, sovereign debt crisis in the euro zone, Brexit, etc.), which were accompanied by an increase in overall risk aversion from investors.

In a number of academic studies on dynamics of asset convergence (Chien et al., 2015; Chien et al., 2015; Kahan, 2011; Switzer & Tahaoglu, 2015; Gilmore et al., 2008 among others), the methodological framework of recursive cointegration was selected. However, although this technique allows for some form of dynamics to be introduced into the model, it only imperfectly accounts for breaks because the estimation process could not differentiate if the varying test statistics are due to a structural break or to an increase in power of tests resulting from adding one observation. The rolling cointegration framework allows on the contrary to assess the convergence process in terms of degree and timing all over the period.

5 Empirical results and discussion

5.1 Unit root tests and co-integration in a nonlinear framework

The first step in our empirical analysis is to estimate the order of integration of the variables and ensure that they are \(I(1)\), that is, stationary in first differences. We first run the DF-GLS test (Elliot et al., 1996) to examine the stationarity of the variables, which is an augmented Dickey-Fuller test with a prior GLS transformation of the time series to obtain detrended data. Elliot et al. (1996) have shown that the DF-GLS test has a greater power than the standard augmented Dickey-Fuller test, even if these tests do not assume structural breaks in the data. We then run the Zivot-Andrews (1992) unit root tests, which allow for one endogenous-determined structural break. Three models are proposed by the authors to test for the unit root: (1) model A allows for a break in the level of the series, (2) model B permits a break in the slope of the trend function, and (3) model C combines one time shift in the level and the slope of the trend function. Table 2 reports the results of the two unit root tests.

The results of the unit root tests show that the series are \(I(1)\) at the 5% significant level. The Zivot-Andrews tests also detect breakpoints that differ across considered asset price series and estimated models.Footnote 8

5.2 Co-integration tests in a context of structural breaks

Once we have ensured that all the price series are \(I(1)\), the next step is to test for long-term relationships among the variables. Given the results in Table 2, which confirm the existence of breaks linked to economic and financial shocks on the variables throughout the period, it seems relevant to apply Gregory-Hansen’s (1996) co-integration tests with structural breaks. The procedure consists of testing the null hypothesis of no co-integration against the alternative hypothesis of co-integration with a regime shift at an unknown date. The regime shift is based on three different assumptions (see the preceding section). The results of the Gregory-Hansen (1996) tests based on the equation with gold prices as a dependent variable are presented in Table 3. The \({ADF}^{*}, {Z}_{\alpha ,}^{*} and {Z}_{t}^{*}\) tests statistics reject the null hypothesis at the 5% level, implying the existence of a long-term co-integrating relationship with a structural break between alternative and traditional financial assets.Footnote 9

As previously described, Gregory and Hansen’s methodology does not enable determining the exact break date because the procedure seeks to minimize the \(ADF, {Z}_{\alpha ,} and {Z}_{t}\) statistics. Following Mylonidis and Kollias (2010), we use the Kejriwal and Perron (2008, 2010) analysis framework to determine multiple structural breaks for our co-integrated variables at an unknown time. Three statistical tests derived from Bai and Perron (1998, 2003) are developed, and these critical values are derived from the work of Kejriwal and Perron (2010) in a context of non-stationary variables. Results are presented in Table 4 assuming a maximum of five breaks and under 15% trimming. The ART price series is assumed to be a dependent variable.

Regardless of the procedures used, all tests are highly significant. In particular, the supF tests reject the null hypothesis of no co-integration against a fixed number of breaks, as well as the double-maximum test \((UDmax)\) of no co-integration against an unknown number of breaks. The sequential procedure estimated the number of breaks at three over the study period. This result is confirmed by the information criterion (BIC) applied to the global optimization procedure.Footnote 10 According to Kejriwal and Perron (2010), if the system is co-integrated with fewer than M breaks, the sequential testing procedure can be used to consistently estimate the number of breaks. We also report the break dates with their 90% lower and upper bounds estimated by the procedure.

5.3 Rolling co-integration analysis

As previously discussed, we employ a rolling co-integration framework to examine the dynamics of price co-movements between alternative and financial assets. This methodology enables evaluating the degree of convergence between them by testing over each subperiod the stability of the co-integrating relations and also the parameters of interest. Estimates of the trace statistic, as well as the adjustment coefficients for the long-term relationships \((\alpha )\) and weak exogeneity tests, are performed for more than 80 subperiods, during which the number of observations remains fixed (120 obs.) but in which the sample period is shifted by one observation each time.

5.3.1 Rolling trace tests

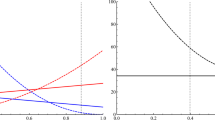

The trace test traditionally specifies the number of co-integrating vectors that link the variables in the sample over the study period. We compile the results of the rolling trace tests in a continuous graph, which enables us to represent the dynamics of the relationships between the alternative and financial assets over all the subperiods. As mentioned, the trace statistics are standardized by their 5% critical value to facilitate their interpretation. A value of the standardized statistic above 1 indicates that the corresponding null hypothesis can be rejected at the 5% level for the considered subperiod. Figure 2 represents the scaled trace statistics for the null hypotheses \(r=0, r\le 1, r\le 2, r\le 3, and r\le 4,\) respectively.

Figure 2 indicates some major facts about co-movements between alternative and traditional assets. Indeed, the variables are linked over the entire period by at least two co-integrating vectors (the line corresponding to \(H0:r\le 1\) is always above 1 indicating that there at least two co-integrating relationships). It can also be noted that the links among the variables intensify over the period from 2013 to mid-2015 and then again between mid-2016 and mid-2018, for which the trace statistics indicate three co-integration relationships (the line \(H0:r\le 2\) is above 1). However, we note a weakening of the links at the end of the period.

5.3.2 Rolling adjustment coefficients

The next step of the co-integration model is to focus on the adjustment coefficients (matrix \(\alpha \) of the VEC model) of the variables to deviations from their long-term equilibrium relationship. As mentioned previously, larger values of \(\alpha \) coefficients imply a faster return to long-term equilibrium of the variables that deviated from the co-integration relation in the previous period. This can also be interpreted in terms of convergence among assets, as explained previously. Applied in a rolling analysis framework, the computation of the loading coefficients will provide detailed information about the transitional dynamics of real asset and equity prices.

Figures 3a–e, show the estimated rolling adjustment coefficients \((\alpha )\) for more than 80 subperiods. Given the results of the previous section, we present in this section the graphs of the coefficients for each variable associated with the first co-integrating vector. The rolling coefficients of the other co-integrating vectors are presented in Appendices Fig. 5a to e.

5.3.3 Rolling weak exogeneity

In a last step, we conduct weak exogeneity tests by imposing constraints on the adjustment coefficients to determine the dynamics of causality among the variables in the system. This enables us to test empirically the long-run causality among our variables of interest. The corresponding null hypothesis is \({H}_{0}: {\alpha }_{i}=0\). If the null hypothesis is rejected, the concerned variables are constrained by the system to adjust to their long-run relationship in a dynamic process. On the contrary, if the loading coefficients are not statistically different from zero, the concerned variables are said to be weakly exogenous and guide the other variables of the system in terms of unidirectional causality in the long run. As for the other co-integration tests, we normalize the LR statistics by its 5% critical value to facilitate the interpretation. A value greater than 1 indicates rejection of the null hypothesis.Footnote 11 Results are presented in Figs. 4a to e.

6 Discussion

Our results indicate that the first break date, which corresponds to the period when the GFC was triggered following the bankruptcy of Lehman Brothers. As a result of the GFC, some euro zone countries found themselves confronted with a sovereign debt crisis, leading to an increase in global risk aversion at the end of 2011 (second break date), which severely disrupted financial markets. The third break date, at the beginning of 2015, could be in line with the downward momentum recorded in global markets by the prices of raw materials, in particular oil, and that US stock markets were at their highest since the GFC. Price series and estimated break dates are represented in Fig. 1. Following this step, it becomes quite clear that disruptions have disrupted the markets throughout the period, which justifies the use of a nonlinear analysis of the co-integration relationships among the variables.

As indicated in Fig. 2, the first main result derived from the rolling co-integration analysis is that real alternative and financial assets display strong relationships, which can be interpreted in terms of convergence mechanisms. If we look at the first part of the sample in more detail, the variables are strongly related. By contrast, the links seem to weaken from 2015 onward, which could correspond to the turnaround in residential real estate prices heralding the subprime crisis.Footnote 12 The end of the period is also marked by a declining convergence process because the variables are now linked by only two long-term relationships. Indeed, this period was marked by tighter financial conditions linked to the Fed's monetary policy decisions, which led to several consecutive increases in the main policy rate and consequently a sharp drop in US equity markets. The rise in the global risk aversion index (VIX) at the end of 2018 linked to the strong protectionist measures initiated by the US government is probably an explanatory factor for the lesser convergence of alternative and financial assets. This first part of the analysis on the co-integration between alternative and financial assets interestingly reveals a dynamic process of convergence that is nonlinear over the period and subject to global financial conditions, including exogenous shocks. Long-term investors and portfolio managers should therefore be careful in building and holding portfolios that include real alternative assets and financial assets, especially during periods of strong asset price convergence where financial contagion makes portfolio diversification strategies less effective.

Several observations emerge from figures of Rolling adjustment coefficients (from Fig. 3a to e). First, the coefficient estimates display a clear nonlinearity over the sample period. They are sometimes statistically insignificant when the confidence interval includes the value of zero, but they become statistically significant at other subperiods. This is the case, globally, throughout the sample period for ART, except for a short period mid-2019. This is also the case for GOLD and MSCI over two-thirds of the period, from 2015 to 2019. This result suggests that for these variables, the error-correction mechanism did not bring the variables back to their long-term equilibrium in the event of a deviation from the previous period. Second, it is interesting to note that the adjustment coefficients are statistically significant, individually and jointly, for GOLD and MSCI at the beginning of the sample (from 2013 to 2015), implying that both assets adjusted toward their long-term equilibrium in case of shocks. The pattern is clearer for the variables APART and to a lesser extent for LIV-EX, which display a statistically significant coefficient \(\alpha \) over almost the entire sample. For these two variables, the error-correction term is an important component of adjustment to their long-term equilibrium. A final comment can be done about the speed of adjustment of the price series. The value of the coefficients is the highest for GOLD and MSCI, and they are comparable for ART and LIV-EX at a lower level. The values of \(\alpha \) for APART are extremely low. The magnitude of the loading coefficients is another way to analyze the process of convergence among our price series. The higher the coefficients, the faster the return to long-term equilibrium, which can be interpreted in terms of greater convergence among assets (Dolado et al., 2001; Mylonidis & Kollias, 2010) because they are considered in the same way by investors. These results can also be interpreted in terms of financial contagion in the short run for investors and portfolio managers who should consider rebalancing their portfolios to still benefit fully from the effects of diversification. However, this analysis needs to be deepened by an analysis of the weak exogeneity of the variables in order to determine the markets from which possible spillover effects may emerge and those that would be less immunized to external shocks.

Several considerations can be drawn from Figs. 4. A first comment concerns the nonlinear behavior of the variables in terms of (weak) exogeneity. Over the period 2013–2016, the two collectible assets, ART and LIV-EX, fail generally to reject the null hypothesis of weak exogeneity. That implies that they do not adjust to their long-run equilibrium in cases of deviations, that is, they are weakly exogenous during the considered period. This may correspond to the process of financial globalization that has intensified over the period, pushing investors to target assets other than traditional financial assets. However, over the same period, GOLD and MSCI clearly reject the null hypothesis, indicating that these variables tend to adjust in the short run to restore the long-run equilibrium of the system. These findings provide support for a contagion effect from the collectible assets, forcing the other assets—GOLD, APPART and MSCI, to adjust in the long run to short-term deviations. From 2016 onward, the results are reversed, with collectible assets adjusting to the long-term equilibrium, and GOLD and MSCI becoming weakly exogenous. The variable APART appears to be a pulling variable of the system, that is, it responds to short-term deviations to return to long-term equilibrium. Over this last period, investors and portfolio managers should be aware of shocks originating from GOLD and MSCI that would have affected other markets. Indeed, in a period marked by higher global risk aversion, traditional assets are once again preferred by investors, this time affecting other alternative assets.

In such a context, the results support the hypothesis of a nonlinear convergence of real alternative and traditional financial assets, which may depend on global financial conditions, global risk aversion, and possible exogenous shocks that alter the links and contagion effects among assets.

7 Concluding remarks

Our article questions the market convergence of the main real alternative (gold, art, wine, residential real estate) assets and conventional assets (MSCI) as a result of several decades of global capitalization. It is hoped that such a questioning result in a better understanding of investors' strategies, notably in terms of wealth management and portfolio diversification. Studying the time-varying, long-run relationships among the asset price indexes from 2003 to 2019 in the US economy has resulted in three major contributions.

First, in regard to the existing literature, we examine a larger set of main real alternative assets for a broader period. Our results confirm the existence of a long-term co-integration relationship but with structural breaks that previous studies did not test. As expected, the three breaks match with the bankruptcy of Lehman Brothers (2008), the sovereign debt crisis (2011), and the raw material crisis (2015). This first result justifies the use of a rolling co-integration method to explore the nonlinear relationships among assets and discusses the effects of financial shocks on their convergence.

Second, we observe a nonlinear dynamic process of convergence. The number of co-integration relationships changes over time and indicates that shocks in the rolling observation period lead to a lesser convergence of assets. In other words, investment strategies during expansion phases lead to a convergence of real alternative assets and conventional assets, whereas shocks alter the co-movements of price indexes.

Third, the rolling adjustment coefficients identify the asset profile according to their error-correction mechanism (and speed of adjustment) to bring back their long-term equilibrium in the event of a deviation from the previous period. Following a shock, gold and the MSCI adjust to their long-run equilibrium (converge) with a high speed, whereas art and fine wines have a much slower speed, and residential real estate has an extremely low speed of adjustment. Weak exogeneity tests confirm the investor preference for gold and MSCI in cases of a higher risk aversion, far higher than wine and art, and residential real estate appears to be the pulling variable of the system.

This differentiated response of real alternative assets to shocks is probably in line with their specificities (Baumol, 1986). For residential real estate, the existence of a fundamental value based on discounted rent flows and weak financialization provides a strong independence based on macroeconomic and monetary variables (Bouchouicha & Ftiti, 2012; Kydland et al., 2016; see Minetti, 2015 for a discussion). The slow convergence of art and fine wines after an exogeneous shock seems to be explained by the increasing financialization of these markets (Ashenfelter et al., 2018; Bocart & Hafner, 2015), but this market’s liquidity degree remains very moderate (Masset et al., 2021; Penasse & Renneboog, 2018). In comparison, the strong convergence of gold with conventional assets matches with its high degree of financialization and liquidity (Zang et al. 2019). The well-known asymmetry of information in the art and fine wine markets undoubtedly accentuates the slow convergence of price indices following the shocks.

These results have important implications for investors and portfolio managers. On the one hand, portfolio arbitrage opportunities should be considered by investors and portfolio managers in the short run by using the information content of the long-run relationship, which reflects complex convergence dynamics, to develop more effective portfolio reallocation strategies. In particular, collectibles appear to be a relevant source of portfolio diversification. On the other hand, traditional financial and real estate assets seem to be long-run leading indicators of other real alternative assets, especially at the end of the study period. Hence investors and portfolio managers can use gold and stock prices as a leading signal to adjust their holding positions or to implement hedging strategies in case of a shock on these markets (for example a rise in the FED’s key interest rates).

Future research avenues should build on recent papers on the liquidity of alternative assets to better understand and measure the effect of financial shocks on the convergence of these markets. Furthermore, a better insight into the data-generating process and the analysis of long-memory processes could also enrich the understanding of the mechanisms of price convergence between assets.

Notes

An article in The Wall Street Journal (December 31, 2018) reports that art and wine outperformed stocks and bonds in 2018 (https://www.wsj.com/articles/the-best-investments-of-2018-art-wine-and-cars-11546232460).

UHNWI: Ultra-high-net-worth individuals are those whose net worth exceeds $30 million excluding their primary residence. Almost 31% of UHNWI are located in the United States (Knight Franck 2019).

The availability of price series for residential real estate began in 2003. The beginning of the 2000s also coincides with the acceleration of the process of financialization and globalization from which alternative real assets such as art and wine became investable assets. This was not the case during prior periods.

Financial integration has received considerable attention in the literature (e.g., Hamao et al., 1991; Giovannini & Mayer, 1992; Lemmen & Eijffinger, 1996; Bayoumi, 1997; Story & Walter, 1997; Yuhn, 1997; Korajczyk, 1999; Adam et al., 2002; Hartmann et al., 2003; Baele et al., 2004; Gropp & Kashyap, 2010; Bekaert et al., 2011; Ftiti et al., 2015; Zhu et al., 2018; Hoffmann et al., 2020; Miled et al., 2021).

See Le Fur (2021b) for details of the contagion effect between financial markets and collectibles markets.

According to the authors, the second test seems to be the most useful to determine structural breaks.

Bordeaux 500 (33%—the ten most recently physical vintages for 50 top Bordeaux chateaux); Burgundy 150 (28%—the ten most recently physical vintages for 15 red and white Burgundy); Rest of the World 60 (12%—the ten most recently physical vintages for six wines from Australia, Portugal, Spain and the USA); Bordeaux Legends 40 (10%—40 Bordeaux wines from exceptional older vintages from 1989); Italy 100 (9%—the ten most recently physical vintages for the five Super Tuscan and five other leading Italian wines); Rhone 100 (4%—the ten most recently physical vintages for five Northern and five Southern Rhone wines); Champagne 50 (3%—the most recently physical vintages for 12 champagnes).

Other econometric techniques could have complemented the unit root tests with structural breaks, in particular those concerning long memory process tests. In particular, the Geweke and Porter-Hudak (1983) (GPH) test, the Phillips’ Modified Log Periodogram Regression estimator or the ARFIMA models are particularly suitable in this case. We leave this alternative for future research.

We also run the Gregory-Hansen (1996) co-integration tests with ART, LIV-EX, APART, or MSCI as the dependent variables. The results confirm the long-term co-integration links of the variables. Results are available on request from the authors.

The Matlab codes for the testing procedure can be found on Pierre Perron’s website at http://blogs.bu.edu/perron/codes/.

The long-run causality tests are performed on the basis of the first co-integrating vector.

We report the trace test statistics on the last day of the subsample period from which they are computed.

References

Adam, K., Jappelli, T., Menichini, A., Padula, M., & Pagano, M. (2002). Analyse, compare, and apply alternative indicators and monitoring methodologies to measure the evolution of capital market integration in the European Union. Report to the European Commission, 2002, 1–95.

Ambrose, B. W., Ancel, E., & Griffiths, M. D. (1992). The fractal structure of real estate investment trust returns: The search for evidence of market segmentation and nonlinear dependency. Real Estate Economics, 20(1), 25–54.

Apergis, N., Christou, C., & Miller, S. M. (2014). Country and industry convergence of equity markets: International evidence from club convergence and clustering. The North American Journal of Economics and Finance, 29, 36–58.

Ashenfelter, O., Gergaud, O., Storchmann, K., & Ziemba, W. (2018). Handbook of the economics of wine. Prices, finance, and expert opinion (Vol. 1–2, pp. 1–1048). World Scientific Publishing Co. Pte Ltd.

Baele, L., Ferrando, A., Hördahl, P., Krylova, E., & Monnet, C. (2004). Measuring financial integration in the euro area (No. 14). ECB occasional paper.

Baffes, J., & Etienne, X. L. (2014). Reconciling high food prices with engel and prebisch-singer. In International conference on food price volatility: Causes and consequences, Rabat, Morocco.

Baffes, J., & Savescu, C. (2014). Monetary conditions and metal prices. Applied Economics Letters, 21(7), 447–452.

Bai, J., & Perron, P. (1998). Estimating and testing linear models with multiple structural changes. Econometrica, 66, 47–78.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18, 1–22.

Bakhouche, A. (2013). The examination of the degree of integration among art markets. Journal of Finance and Investment Analysis, 2(1), 101–120.

Baldi, L., Peri, M., & Vandone, D. (2013). Investing in the wine market: A country-level threshold cointegration approach. Quantitative Finance, 13(4), 493–503.

Ballesteros, T. (2011). Efficiency tests in the art market using cointegration and the error correction model. Available at SSRN 1696785.

Bartram, S. M., Taylor, S. J., & Wang, Y. H. (2007). The Euro and European financial market dependence. Journal of Banking & Finance, 31(5), 1461–1481.

Baumol, W. J. (1986). Unnatural value: Or art investment as floating crap game. The American Economic Review, 76(2), 10–14.

Bayoumi, T. A. (1997). Financial integration and real activity. University of Michigan Press.

Beine, M., Cosma, A., & Vermeulen, R. (2010). The dark side of global integration: Increasing tail dependence. Journal of Banking & Finance, 34(1), 184–192.

Bekaert, G., Harvey, C. R., Lundblad, C. T., & Siegel, S. (2011). What segments equity markets? The Review of Financial Studies, 24(12), 3841–3890.

Ben Ameur, H., & Le Fur, E. (2020). Volatility transmission to the fine wine market. Economic Modelling, 85, 307–316.

Bocart, F. Y., & Hafner, C. M. (2015). Volatility of price indices for heterogeneous goods with applications to the fine art market. Journal of Applied Econometrics, 30(2), 291–312.

Bouchouicha, R., & Ftiti, Z. (2012). Real estate markets and the macroeconomy: A dynamic coherence framework. Economic Modelling, 29(5), 1820–1829.

Bouri, E. I. (2014). Beyond the negative relation between return and conditional volatility in the wine market. International Journal of Wine Business Research.

Brooks, C., & Prokopczuk, M. (2013). The dynamics of commodity prices. Quantitative Finance, 13(4), 527–542.

Burton, B. J., & Jacobsen, J. P. (2001). The rate of return on investment in wine. Economic Inquiry, 39(3), 337–350.

Cardebat, J. M., Faye, B., Le Fur, E., & Storchmann, K. (2017). The law of one price? Price dispersion on the auction market for fine wine. Journal of Wine Economics, 12(3), 302.

Chambers, D. R., Anson, M. J. P., Black, K. H., & Kazemi, H. (2015). Alternative investments: CAIA Level I (3rd ed.). Wiley Finance.

Chan, K. F., Treepongkaruna, S., Brooks, R., & Gray, S. (2011). Asset market linkages: Evidence from financial, commodity and real estate assets. Journal of Banking & Finance, 35(6), 1415–1426.

Chanel, O. (1995). Is art market behaviour predictable? European Economic Review, 39(3–4), 519–527.

Chanel, O., Gérard-Varet, L. A., & Ginsburgh, V. (1994). Prices and returns on paintings: An exercise on how to price the priceless. The Geneva Papers on Risk and Insurance Theory, 19(1), 7–21.

Chien, M. S., Lee, C. C., Hu, T. C., & Hu, H. T. (2015). Dynamic Asian stock market convergence: Evidence from dynamic cointegration analysis among China and ASEAN-5. Economic Modelling, 51, 84–98.

Clark, E., & Qiao, Z. (2021). Stock exchange efficiency and convergence: International evidence. Annals of Operations Research, 1–21.

Corhay, A., Rad, A. T., & Urbain, J. P. (1993). Common stochastic trends in European stock markets. Economics Letters, 42(4), 385–390.

Crucini, M. J., & Shintani, M. (2008). Persistence in law of one price deviations: Evidence from micro-data. Journal of Monetary Economics, 55(3), 629–644.

Crucini, M. J., & Smith, G. (2016). Early Globalization and the law of one price: Evidence from Sweden, 1732–1914. East Asian Economic Review, 20(4), 427–445.

Cuddington, J. T., & Jerrett, D. (2008). Super cycles in real metals prices? IMF Staff Papers, 55(4), 541–565.

Demian, C. V. (2011). Cointegration in central and east European markets in light of EU accession. Journal of International Financial Markets, Institutions and Money, 21(1), 144–155.

Dimson, E., & Spaenjers, C. (2014). Investing in emotional assets. Financial Analysts Journal, 70(2), 20–25.

Dolado, J. J., Gonzalo, J., & Marmol, F. (2001). Cointegration. In B. H. Baltagi (Ed.), A companion to theoretical econometrics (pp. 634–654). Blackwell Publishing.

Elliot, B. E., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests of the unit root hypothesis. Econometrica, 64(8), 13–36.

Engsted, T., & Lund, J. (1997). Common stochastic trends in international stock prices and dividends: An example of testing overidentifying restrictions on multiple cointegration vectors. Applied Financial Economics, 7(6), 659–665.

Erdős, P., & Ormos, M. (2010). Random walk theory and the weak-form efficiency of the US art auction prices. Journal of Banking & Finance, 34(5), 1062–1076.

Eun, C. S., & Lee, J. (2010). Mean–variance convergence around the world. Journal of Banking & Finance, 34(4), 856–870.

Faye, B., Le Fur, E., & Prat, S. (2015). Dynamics of fine wine and asset prices: Evidence from short-and long-run co-movements. Applied Economics, 47(29), 3059–3077.

Fogarty, J. J. (2006). The return to Australian fine wine. European Review of Agricultural Economics, 33(4), 542–561.

Fratzscher, M. (2002). Financial market integration in Europe: on the effects of EMU on stock markets. International Journal of Finance & Economics, 7(3), 165–193.

Ftiti, Z., Guesmi, K., & Abid, I. (2016). Oil price and stock market co-movement: What can we learn from time-scale approaches? International Review of Financial Analysis, 46, 266–280.

Ftiti, Z., Tiwari, A., Belanès, A., & Guesmi, K. (2015). Tests of financial market contagion: Evolutionary cospectral analysis versus wavelet analysis. Computational Economics, 46(4), 575–611.

Le Fur, E. (2021b). Contagion effect between financial markets and collectibles markets. Financial and Economic Systems Transformations & New Challenges, 135–159.

Le Fur, E. (2021a). Collectors’ motives in the context of wealth management. Journal of Asset Management, 1–12.

Geltner, D. (1990). Return risk and cash flow risk with long-term riskless leases in commercial real estate. Real Estate Economics, 18(4), 377–402.

Geweke, J., & Porter-Hudak, S. (1983). The estimation and application of long memory time series models. Journal of Time Series Analysis, 4(4), 221–238.

Gilmore, C. G., Lucey, B. M., & McManus, G. M. (2008). The dynamics of Central European equity market comovements. The Quarterly Review of Economics and Finance, 48(3), 605–622.

Ginsburgh, V., & Jeanfils, P. (1995). Long-term comovements in international markets for paintings. European Economic Review, 39(3–4), 538–548.

Giovannini, A., & Mayer, C. (Eds.). (1992). European financial integration. Cambridge University Press.

Glascock, J. L., Lu, C., & So, R. W. (2000). Further evidence on the integration of REIT, bond, and stock returns. The Journal of Real Estate Finance and Economics, 20(2), 177–194.

Goetzmann, W. N. (1995). The informational efficiency of the art market. Managerial Finance.

Gorton, G., & Rouwenhorst, K. G. (2006). Facts and fantasies about commodity futures. Financial Analysts Journal, 62(2), 47–68.

Gregory, A. W., & Hansen, B. E. (1996). Practitioners corner: Tests for cointegration in models with regime and trend shifts. Oxford Bulletin of Economics and Statistics, 58(3), 555–560.

Gropp, R., & Kashyap, A. K. (2010). A new metric for banking integration in Europe. Europe and the Euro (pp. 219–246). University of Chicago Press.

Guesmi, K., Ftiti, Z., & Abid, I. (2013). Greece's stock market integration with southeast Europe. Journal of Economic Integration, 668–682.

Gyourko, J., & Keim, D. B. (1992). What does the stock market tell us about real estate returns? Real Estate Economics, 20(3), 457–485.

Hamao, Y., Masulis, R. W., & Ng, V. (1991). The effects of the 1987 stock crash on international financial integration.

Hardouvelis, G. A., Malliaropulos, D., & Priestley, R. (2006). EMU and European stock market integration. The Journal of Business, 79(1), 365–392.

Hartmann, P., Maddaloni, A., & Manganelli, S. (2003). The Euro-area financial system: Structure, integration, and policy initiatives. Oxford Review of Economic Policy, 19(1), 180–213.

Hoffmann, P., Kremer, M., & Zaharia, S. (2020). Financial integration in Europe through the lens of composite indicators. Economics Letters, 194, 109344.

Introvigne, S., Bacchiocchi, E., & Vandone, D. (2017). A cointegration analysis of wine stock indexes.

Jacks, D. S. (2019). From boom to bust: A typology of real commodity prices in the long run. Cliometrica, 13(2), 201–220.

Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12, 231–254. https://doi.org/10.1016/0165-1889(88)90041-3

Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica, 59, 1551–1580.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration – with applications to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Kejriwal, M., & Perron, P. (2008). The limit distribution of the estimates in cointegrated regression models with multiple structural changes. Journal of Econometrics, 146, 59–73.

Kejriwal, M., & Perron, P. (2010). Testing for multiple structural changes in cointegrated regression models. Journal of Business & Economic Statistics, 28(4), 503–522.

Khan, T. A. (2011). Cointegration of international stock markets: An investigation of diversification opportunities. Undergraduate Economic Review, 8(1), 7.

Knight Franck (2018). The wealth report, 12th edn. ©Knight Franck LLP.

Knight Franck (2019). The wealth report, 13th edn. ©Knight Franck LLP.

Korajczyk, R. A. (1999). A measure of stock market integration for developed and emerging markets. The World Bank.

Kourtis, A., Markellos, R. N., & Psychoyios, D. (2012). Wine price risk management: International diversification and derivative instruments. International Review of Financial Analysis, 22, 30–37.

Kydland, F. E., Rupert, P., & Šustek, R. (2016). Housing dynamics over the business cycle. International Economic Review, 57(4), 1149–1177.

Le Fur, E. (2020). Dynamics of the global fine art market prices. The Quarterly Review of Economics and Finance, 76, 167–180.

Le Fur, E., Ben Ameur, H., Braune, E., & Faye, B. (2016a). Financial market contagion and fine wines: The evidence of the ADCC GARCH model. International Journal of Entrepreneurship and Small Business, 29(4), 583–601.

Le Fur, E., Ben Ameur, H., & Faye, B. (2016b). Time-varying risk premiums in the framework of wine investment. Journal of Wine Economics, 11(3), 355–378.

Le Fur, E., & Outreville, J. F. (2019). Fine wine returns: A review of the literature. Journal of Asset Management, 20(3), 196–214.

Lemmen, J. J., & Eijffinger, S. C. (1996). The fundamental determinants of financial integration in the European Union. Weltwirtschaftliches Archiv, 132(3), 432–456.

Li, X. L., Chang, T., Miller, S. M., Balcilar, M., & Gupta, R. (2015). The co-movement and causality between the US housing and stock markets in the time and frequency domains. International Review of Economics & Finance, 38, 220–233.

Lin, T. C., & Lin, Z. H. (2011). Are stock and real estate markets integrated? An empirical study of six Asian economies. Pacific-Basin Finance Journal, 19(5), 571–585.

Liu, C. H., Hartzell, D. J., Greig, W., & Grissom, T. V. (1990). The integration of the real estate market and the stock market: Some preliminary evidence. The Journal of Real Estate Finance and Economics, 3(3), 261–282.

Lutz, M. (2004). Pricing in segmented markets, arbitrage barriers and the law of one price: Evidence from the European car market. Review of International Economics, 12, 456–475.

MacKinnon, J. G., Haug, A. A., & Michelis, L. (1999). Numerical distribution functions of likelihood ratio tests for cointegration. Journal of Applied Econometrics, 14, 563–577.

Masset, P., & Weisskopf, J. P. (2010). Raise your glass: Wine investment and the financial crisis. Available at SSRN 1457906.

Masset, P., Weisskopf, J. P., Faye, B., & Le Fur, E. (2016). Red obsession: The ascent of fine wine in China. Emerging Markets Review, 29, 200–225.

Masset, P., Weisskopff, J. P., Cardebat, J. M., Faye, B., & Le Fur, E. (2021). Analyzing the risks of an illiquid and global asset: The case of fine wine. Quarterly Review of Economics and Finance, 82, 1–25.

Mensi, W., Beljid, M., Boubaker, A., & Managi, S. (2013). Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Modelling, 32, 15–22.

Miled, W., Ftiti, Z., & Sahut, J. M. (2021). Spatial contagion between financial markets: new evidence of asymmetric measures. Annals of Operations Research, 1–38.

Minetti, R. (2015). Financial cycles, housing and the macroeconomy. International Finance, 18(2), 249–262.

Morana, C., & Beltratti, A. (2002). The effects of the introduction of the euro on the volatility of European stock markets. Journal of Banking & Finance, 26(10), 2047–2064.

Mylonidis, N., & Kollias, C. (2010). Dynamic European stock market convergence: Evidence from rolling cointegration analysis in the first euro-decade. Journal of Banking & Finance, 34(9), 2056–2064.

Okunev, J., & Wilson, P. J. (1997). Using nonlinear tests to examine integration between real estate and stock markets. Real Estate Economics, 25(3), 487–503.

Pascual, A. G. (2003). Assessing European stock markets (co) integration. Economics Letters, 78(2), 197–203.

Penasse, J., & Renneboog, L. (2018). Speculative trading and bubbles: Origins of art price fluctuations. American Economic Review, 99, 1027–1039.

Phillips, P. C. B. (1987). Time series regression with a unit root. Econometrica, 55, 277–301.

Poshakwale, S. S., & Mandal, A. (2016). Determinants of asymmetric return comovements of gold and other financial assets. International Review of Financial Analysis, 47, 229–242.

Rangvid, J. (2001). Increasing convergence among European stock markets?: A recursive common stochastic trends analysis. Economics Letters, 71(3), 383–389.

Sanning, L. W., Shaffer, S., & Sharratt, J. M. (2008). Bordeaux wine as a financial investment. Journal of Wine Economics, 3(1), 51–71.

Serletis, A., & King, M. (1997). Common stochastic trends and convergence of European Union stock markets. The Manchester School, 65(1), 44–57.

Storchmann, K. (2012). Wine economics. Journal of Wine Economics, 7(1), 1–33.

Story, J., & Walter, I. (1997). Political economy of financial integration in Europe: The battle of the systems. Manchester University Press.

Switzer, L. N., & Tahaoglu, C. (2015). The benefits of international diversification: Market development, corporate governance, market cap, and structural change effects. International Review of Financial Analysis, 42, 76–97.

Tsai, I. C. (2013). Volatility clustering, leverage, size, or contagion effects: The fluctuations of Asian real estate investment trust returns. Journal of Asian Economics, 27, 18–32.

Webster, M., Paltsev, S., & Reilly, J. (2008). Autonomous efficiency improvement or income elasticity of energy demand: Does it matter? Energy Economics, 30(6), 2785–2798.

Worthington, A. C., & Higgs, H. (2003). Art as an investment: Short and long-term comovements in major painting markets. Empirical Economics, 28(4), 649–668.

Worthington, A., & Higgs, H. (2004). Transmission of equity returns and volatility in Asian developed and emerging markets: A multivariate GARCH analysis. International Journal of Finance & Economics, 9(1), 71–80.

Yang, J., Khan, M. M., & Pointer, L. (2003). Increasing integration between the United States and other international stock markets?: A recursive cointegration analysis. Emerging Markets Finance and Trade, 39(6), 39–53.

Yu, I. W., Fung, K. P., & Tam, C. S. (2010). Assessing financial market integration in Asia–equity markets. Journal of Banking & Finance, 34(12), 2874–2885.

Yuhn, K. H. (1997). Financial integration and market efficiency: Some international evidence from cointegration tests. International Economic Journal, 11(2), 103–116.

Zhang, Y., Ding, S., & Scheffel, E. M. (2019). A key determinant of commodity price Co-movement: The role of daily market liquidity. Economic Modelling, 81, 170–180.

Zhu, Y., Yang, F., & Ye, W. (2018). Financial contagion behavior analysis based on complex network approach. Annals of Operations Research, 268(1), 93–111.

Zivot, E., & Andrews, D. (1992). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics, 10, 251–270.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: rolling adjustment coefficients

Appendix: rolling adjustment coefficients

See Fig.

Rights and permissions

About this article

Cite this article

Faye, B., Le Fur, E. & Prat, S. Exogeneous shocks, risk, and market convergence of real alternative and financial assets: evidence from nonlinear dynamics. Ann Oper Res 334, 497–520 (2024). https://doi.org/10.1007/s10479-021-04510-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04510-5

Keywords

- Real alternative assets

- Art

- Fine wine

- Gold

- Residential real estate; Price co-movements; Rolling cointegration