Abstract

This study investigates two popular omnichannel strategies for managing consumer returns. The reactive strategy is online–offline return partnership, which offers eco-friendly and cost-effective reverse logistics. The proactive strategy involves conveying fit information through showrooms, in order to reduce returns. We apply a game-theoretic model to explore online retailers’ optimal choice among four strategies, namely, the benchmark strategy of pure online channel, the reactive strategy of return partnership, the proactive strategy of fit information, and the hybrid strategy of joint implementation. Our main findings are as follows. First, online retailers should not implement any omnichannel strategy on extremely low-end products. Second, offering fit information is essential for online retailers who sell sufficiently high-end products. Third, the single reactive strategy is optimal in terms of standardized products with moderate valuation. Finally, implementing both omnichannel strategies simultaneously may hurt online retailers, especially those owning an efficient logistics system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last decade, online retailing has seen increasing popularity, due to advances in information technology. However, a crucial drawback of online retailing is the inability of online shoppers to physically and accurately inspect the nondigital attributes of a product before purchase (Bell et al., 2018). Thus, consumers who purchase online face great product fit uncertainty, which may result in extensive product returns. According to a recent survey published by the National Retail Federation, $761 billion of merchandise was returned to retailers in 2021, and the average return rate of online purchases rose to 20.8%.

When consumer returns do occur, retailers need to collect the misfit products from customers, ship them to the warehouse, conduct thorough examinations for grading and sorting, and finally restock, refurbish, liquidate, or dispose of the returns (Ofek et al., 2011). These reverse logistics activities not only impose substantial losses on online retailers but also generate substantial carbon emissions and resource consumption (De Giovanni & Zaccour, 2022). It is reported that a courier collecting and shipping a single retuned item emit 181 g–203 g of carbon dioxide (Khusainova, 2019). Meanwhile, Optoro, a returns solution provider, estimates that returned goods of US retailers annually generate 5.8 billion pounds of landfill, and handling these returns produces 16 million metric tons of carbon emissions each year (Schoolov, 2022). As environmental sustainability has become a global concern, governments have issued strict regulations to cut down carbon emissions (Li et al., 2019a, 2020; Sun & Li, 2022). Thus, it is urgent for online retailers to address the environmental problems associated with product returns.

Digital technologies, such as mobile computing, social media, smart devices, and augmented reality, have made it possible for retailers to integrate online and offline channels. As the boundaries between physical and online retailing vanish, the retail industry is shifting toward seamless “omnichannel retailing.” Technology-enabled omnichannel retailing provides online retailers with various strategies for addressing the environmental challenges associated with online returns. One common strategy is cooperating with third-party solution providers who accept returns at offline locations (henceforth, return partnership). These partners employ advanced digital tools to ensure an environmentally friendly and cost-effective return process. Online retailers such as Revolve, Everlane, and Rothy’s have collaborated with online return portals Happy Returns and Narvar, so as to handle returns in a decarbonized way. Online shoppers can quickly initiate returns in these portals, drop off the returning items label-free and box-free to a nearby location, and then simply show a QR express code. Subsequently, returns are aggregated in reusable totes through freight consolidation and shipped to return hubs for sorting and processing with advanced reverse logistics software. Such return partnerships can mitigate return costs for online retailers, as it is typically much cheaper to ship back and handle returns in bulk, compared to direct returns from individual customers (AlixPartners, 2017). Furthermore, as paperless and boxless returns, reusable packaging, and bulk shipping are all eco-friendly and improve environmental sustainability. Happy Returns demonstrates that, by replacing cardboard packaging with reusable containers, it reduces greenhouse gas emissions by 120 k lbs for each million returns (Happy Returns, 2022).

The other popular omnichannel strategy involves providing fit information via showrooms. Typically, these small-footprint locations do not stock inventories, so they do not require demand forecasting or replenishment. Instead, they are always equipped with digital components, purely for experiential purposes (Bell et al., 2018). Beyond seeing, touching, and trying out the samples in the showrooms, customers can also scan product reviews, video content, and social posts through electronic screens or shelf labels. In addition, in-store smart devices, such as intelligent fitting rooms and smart mirrors, enable customers to see how products would fit under various circumstances. By combining online content in the digital world with touch-and-feel information in the physical world, the technologies in showrooms can help consumers fully resolve product fit uncertainty (Gao et al., 2021). If a customer likes a given product after experiencing it in a showroom, they need to place an order on the corresponding website through a smartphone or iPad. The fit information in showrooms can prevent returns from occurring in the first place. Recognizing the potential of this strategy, various retailers, such as Warby Parker, Bonobos, Blue Nile, Tesla, Amazon, and JD.com, have set up showrooms to better communicate fit information.

By integrating online and offline channels with advanced technologies, the two omnichannel strategies have the potential to alleviate the issues associated with online returns. However, existing studies have found opposite results in terms of the impact of introducing a new channel. Some research indicates that a new channel may cannibalize the existing channels and thus hurt firms (Gao et al., 2021; Nageswaran et al., 2020; Ofek et al., 2011), while other work shows that there may exist complementary and synergistic effects between existing and new channels, thereby benefiting firms (Kumar et al., 2019; Li et al., 2019c; Luo et al., 2020). As such, it is debatable whether online retailers should adopt the above omnichannel strategies to introduce the experience or return channels for managing returns. In reality, some online retailers first moved forward to omnichannel retailing but subsequently abandoned it. For example, Microsoft opened its first store in 2009, in order to compete with Apple’s successful retail stores, but recently announced that 83 Microsoft stores will close permanently (Shoulberg, 2020). In contrast to smartphone firms (e.g., Samsung, Huawei, and Xiaomi) who have expanded their flagship stores worldwide, the Chinese brand OnePlus announced a plan to shut down its experience stores across the country in 2015 (Figuccia, 2016). Moreover, the same online retailer may employ omnichannel strategies selectively for different product categories. For instance, not all items purchased on Amazon’s website can be returned at its partners’ locations. Some items or locations are not eligible for in-store return (Amazon, 2022).

In addition, the two omnichannel strategies differ in their effectiveness in managing consumer returns. The return partnership can be regarded as a reactive strategy, given that it improves the efficiency and sustainability of reverse logistics after returns occur, while fit information is part of a proactive strategy that prevents returns from occurring in the first place, by resolving product fit uncertainty. Intuitively, the proactive strategy may seem more effective than the reactive strategy. However, as the above examples illustrate, some online retailers (e.g., Revolve, Everlane, and Rothy’s) offer offline return options through partnerships, while some (e.g., Blue Nile, Tesla, and JD.com) employ showrooms. More interestingly, certain retailers apply both omnichannel strategies simultaneously. For example, Warby Parker and Bonobos have introduced retail locations not only to facilitate offline inspection but also to accept returns. Given the distinct practices observed in reality, some important questions naturally arise:

-

(1)

When should online retailers implement these omnichannel strategies to manage online returns?

-

(2)

Which omnichannel strategy is more profitable for online retailers—under what conditions and for what kinds of products?

-

(3)

Is the joint implementation of both omnichannel strategies always more beneficial than a single omnichannel strategy?

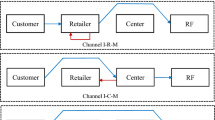

To answer these questions, we develop a game-theoretic model in which an online retailer sells a product to customers who face product fit uncertainty. Once the product is delivered, consumers can decide whether they like it only by actually inspecting it. When the online purchase results in a misfit product, the online retailer offers a full refund. Purchasing or returning the product through the online channel incurs an online hassle cost to customers. Traveling to the offline location to inspect or return the product incurs an offline visit cost. Ex ante, customers are heterogeneous as regards preferences of channels. For online retailers, receiving and processing returns through different channels incurs different costs and losses. In particular, the offline channel results in lower handling costs and losses, due to economies of scale. Based on the analysis of customers’ purchase and return behaviors, we investigate the online retailer’s optimal choice among four strategies, namely, the benchmark strategy of pure online channel, the reactive strategy of return partnership, the proactive strategy of fit information, and the hybrid strategy of joint implementation. Moreover, we extend our main model to examine a partial refund policy and to explore the robustness of our main results.

Our key findings are summarized as follows. First, omnichannel strategies do not always benefit online retailers. In particular, it may be detrimental to implement omnichannel strategies in the case of extremely low-end products. Given a lower per-unit loss on returns, retailers have an incentive to reduce the retail price, in order to encourage purchases from more customers. At the same time, a comparatively low retail price can help to fully compensate for return losses. Although omnichannel strategies could expand market size and reduce return losses, the advantages are insignificant for low-end products, which cannot offset the decreased revenue due to reductions in retail price. Second, when the online retailer sells high-end products, offering fit information proactively is an essential strategy. This is because displaying high-end products in showrooms is effective in encouraging more customers to purchase. Given the high prices of these high-end products, the increased demand will bring substantial profits. Third, because fit information can prevent returns, it is more effective in reducing return losses when the return rate is relatively high. Therefore, for relatively personalized products, only offering the return partnership will never be optimal. In contrast, when products are relatively standardized and moderately valued, the online retailer should adopt the single reactive strategy, since fit information may lead to a great reduction in retail price. Fourth, online retailers may disadvantage themselves by simultaneously implementing both omnichannel strategies. In particular, when the reduction in per-unit return loss in the reactive strategy is insignificant, adding the reactive strategy to the proactive strategy will be counterproductive. The reason for this lies in the trade-off between the substitution effect and the complementary effect.

The remainder of our paper is organized as follows. Section 2 briefly reviews the relevant literature. Section 3 describes our model. Section 4 derives and analyzes the equilibrium solutions for each of the four strategies. Section 5 compares the above equilibrium outcomes to ascertain the online retailer’s optimal strategy. Section 6 considers several extensions to our basic model. Section 7 presents concluding comments and proposes directions for future research. All proofs are relegated to the Appendix.

2 Literature review

Our work is closely related to two streams of literature: consumer returns and omnichannel retailing. In this section, we present a brief overview of each aspect and explain our contributions.

2.1 Consumer returns

Since product fit uncertainty is a key issue for the booming online retail sector, managing consumer returns has garnered increasing interest among scholars of both operations management and marketing. One stream in this literature pays close attention to how to efficiently manage returns after they have occurred. This reactive stream of literature can be divided into two main categories: micro return policy and macro strategy of return management. There is an extensive body of literature that investigates firms’ return policies along different dimensions, such as refunds (Li et al., 2019b; Liu et al., 2022a; Su, 2009), return-freight-insurances (Lin et al., 2023), and return periods or windows (Ertekin & Agrawal, 2020; Ma et al., 2020). Moreover, Abdulla et al. (2022) comprehensively assess the impact of return policies on consumer behaviors, in terms of five leniency levers. From strategic perspectives, Mishra and Singh (2022) approach questions regarding efficiency via cost-effective reverse logistics network designs; Govindan et al. (2017) propose a supply chain network for the selection and evaluation of third-party reverse logistic providers as well as forward distribution partners from the perspective of sustainability. Our reactive strategy belongs to this category. However, the return partnership in our work is a novel mode in the context of omnichannel retailing. It improves the efficiency of reverse logistics by integrating the online and the offline channel with advanced technologies. Specifically, online retailers establish return portals which allow customers to conveniently make cross-channel returns.

In addition to improving the efficiency of reverse logistics, another stream of research focuses on the provision of fit information as a means for preemptively reducing the number of returns. Extant research examines the role of in-store assistance or services in reducing returns (Ertekin et al., 2019; Ofek et al., 2011; Xiao & Shi, 2014). Moreover, several papers investigate the usefulness of online technologies in the reduction of returns. For example, De et al. (2013) explore the relationship between product-oriented web technologies and product returns. Gallino and Moreno (2018) examine virtual fitting-room technology and find that virtual fit information can decrease fulfillment costs arising from returns. Xu et al. (2023) analyze the benefits of artificial intelligence adoption for a platform supply chain with product returns. Taking a more theoretical perspective, Sun et al. (2022) and Yang et al. (2022) have developed game-theoretical models to investigate the optimal virtual-reality webroom strategy. The methods in the above papers can only partially resolve customers’ fit uncertainty. To completely reveal product fit and quality information, Liu and Xiong (2023) investigate whether a pure e-tailer should open traditional stores. In contrast, we study a more immersive experience environment, i.e., showroom, by combining the digital and physical retail worlds.

Overall, our work makes two contributions to the above streams of literature. First, existing research mainly focuses on implementing similar strategies for return management in the same channel. We theoretically investigate and compare channel integration strategies from both reactive and proactive perspectives in the context of omnichannel retailing. Second, we comprehensively analyze a scenario in which these strategies are jointly employed, so as to assess the interactions between them.

2.2 Omnichannel retailing

With the growing prevalence of advanced technologies, retailers integrate online and offline channels in various ways in order to offer consumers a seamless shopping experience. Among the various omnichannel strategies, two are closely related to our paper: buy-online-and-return-in-store and showroom.

The former strategy allows customers to return misfit products to physical locations. Extant research mainly analyzes whether and when firms should adopt buy-online-and-return-in-store. For example, Nageswaran et al. (2020) compare different return policies, including full refunds, partial refunds, and in-store returns, to identify the conditions under which an in-store return policy is optimal for a multichannel retailer. Subsequently, Yang et al. (2023) examine the impact of buy-online-and-return-in-store on a retailer’s store operations and find that this strategy may hurt the retailer owing to the large proportion of resalable returns; Jin et al. (2020) analyze multichannel retailers’ decisions on the adoption of cross-channel return services in a duopoly setting; Huang and Jin (2020) investigate this problem in the context of two competitive supply chains. Moreover, some existing research compares buy-online-and-return-in-store with other strategies, such as buy-online-and-pick-up-in-store (Liu et al., 2022b). However, the above literature mainly conducts analyses from the view of a multichannel retailer who owns both online and offline channels. For a purely online retailer, who does not have any physical stores, return partnerships constitute a growing omnichannel practice. Under this strategy, pure online retailers partner with third-party service providers or physical firms to offer customers offline return services. Hwang et al. (2021) empirically examine the value of such partnerships to the offline location partner. Additionally, Jin and Huang (2021) study the adoption of these return partnerships in the context of competition between two e-retailers. These papers mainly emphasize the effect of return partnerships on offline locations and customer return behaviors. In contrast, we analyze return partnerships from the environmental view and with a focus on their efficiency in handling online returns. To date, the existing literature on these return partnerships is scarce. We enrich this stream of research by comparing the return partnership and showroom strategies.

The emerging practice of showrooms has spurred considerable attention in the academic literature. Empirical research has verified that various kinds of showrooms can not only boost sales but also reduce online returns (Bell et al., 2018, 2020). In light of the demand-boosting effect of showrooms, Konur (2021) establishes a model to explore two competitive online brands’ decisions on the introduction of showrooms. By contrast, we focus on the fit information and returns-reducing effect of showroom strategy. Gao and Su (2017) establish a monopolistic model to study an omnichannel retailer’s showroom strategy considering inventory decisions; they caution that turning a store into a showroom may be unprofitable due to the decreased inventory level. Gao et al. (2021) analyze the impact of the showroom strategy on the number and size of a retailer’s physical stores. Zhang et al. (2021) comprehensively examine omnichannel retailers’ advance selling and physical showroom strategies. The closest paper to ours is that of Mandal et al. (2021). They compare the showroom strategy with the brick-and-mortar store strategy. Their brick-and-mortar store strategy consists in opening a traditional store both for selling products and for receiving returns. Our work differs from them in that we focus on an online retailer’s price decisions under the showroom strategy and compare this with the return partnership strategy.

In summary, none of the above papers has comprehensively analyzed and compared the two omnichannel strategies so as to address the environmental challenges arising from online returns. Our work differs from these studies in the following ways. First, we clearly recognize the interaction between different channels and elaborate on the underlying mechanisms of channel integration. Specifically, these omnichannel strategies exert two positive and one negative effects on the retailer. The relative strengths of these effects drive the final results. Second, we consider the scenario in which both omnichannel strategies are implemented at the same time, in order to determine potential interactions between the two strategies.

3 Model

We consider an online retailer who sells a product through his online channel. Ex ante, his consumers are uncertain whether the product fits them, due to the lack of physical access to the product’s nondigital attributes prior to purchase. Let \(\theta \in (\mathrm{0,1})\) denote the fit probability, that is, the probability that the product matches a particular consumer’s taste. We thereby assume that the product only conforms to the preferences of a fraction \(\theta \) of customers. Following Mandal et al. (2021), \(\theta \) can also be interpreted as the degree of product standardization. Specifically, the product is highly standardized (personalized) given a large (small) \(\theta \). A consumer gains a positive valuation \(v\) from the product if she likes it and a valuation of zero otherwise. Based on the valuation \(v\), products can be classified into different categories, e.g., high-end, middle-end, or low-end. We also assume that \(\theta \) and \(v\) are common knowledge; thus, they are known to the retailer and all consumers.

3.1 Online retailer’s strategies

When the online retailer only operates the online channel, customers cannot resolve their fit uncertainty before making purchases online. They can ascertain their valuations only after receiving the product. Consistent with previous literature (e.g., Gao et al., 2021; Xiao et al., 2022; Zhang & Choi, 2020; McWilliams, 2012), we assume that the online retailer provides a money-back guarantee with full refunds and that consumers prefer returning misfit products rather than keeping them. In other words, if the product is fit, customers will keep it; otherwise, customers prefer to return it. In Sect. 6.1, we examine a partial refund scenario wherein the online retailer may charge a restocking fee or penalty for online returns. The result shows that omnichannel strategies may become more preferable under this situation.

For each unit returned online, the online retailer faces a net loss of \({c}_{o}\), which includes handling costs (e.g., collecting, shipping, or restocking) and net salvage value. Generally, \({c}_{o}\) represents the operational efficiency of the online retailer’s reverse logistics system; an efficient and responsive reverse logistics system ensures a low value for \({c}_{o}\). We assume that the online retailer absorbs the shipping fees for online returns; shipping misfit products back is free for customers. For example, Warby Parker offers a hassle-free return policy; Bonobos uses prepaid return labels which allow customers to ship domestic orders back at no cost. We relax this assumption in Sect. 6.2, where customers are instead assumed to pay for the shipping of online returns. The result shows that our main findings continue to hold qualitatively.

Considering the reactive strategy, each unit returned at a store generates a handling cost \({c}_{s}\) for the online retailer. Following Gao et al. (2021), we assume \({c}_{s}<{c}_{o},\) as return partners are typically large-scale operations which handle product returns using advanced technologies and hence tend to be more cost-effective. For example, the third-party service provider Happy Returns has announced that it helps online retailers save an average of 20% on reverse logistics (Happy Returns, 2021). Regarding the proactive strategy, the online retailer may establish a showroom to provide full fit information. In line with Gao et al. (2021) and Gao and Su (2017), we assume that fit information can help a customer completely resolve her fit uncertainty. Finally, the retailer can also adopt the two omnichannel strategies at the same physical location, just as Warby Parker and Bonobos do.

To underscore the demand-side effect of omnichannel strategies and for the sake of parsimony, we regard the fixed software fee in return partnerships and the setup costs of physical locations in the showroom strategy as sunk costs and put aside considerations of them in our main model, which is in the spirit of previous research (Balakrishnan et al., 2014; Raj et al., 2020). This way, we hope to help online retailers identify the pros and cons if and when implementations become possible.

3.2 Customers’ shopping behaviors

When customers make both purchases and returns through the online channel, we call this shopping behavior buy-online-and-return-online (BORO). Purchasing the product online generates a corresponding online hassle cost \({h}_{o}\) to consumers, which mainly includes wait costs, security risks of online transactions, and any inconveniences of operating on the website or app (Gao & Su, 2017; Gao et al., 2021; Mehra et al., 2018). Following Balakrishnan et al. (2014) and Jing (2018), we assume that \({h}_{o}\) is uniformly distributed in [0, 1], considering the heterogeneity in consumers’ inclinations toward the online channel. In the benchmark strategy, when a customer purchases the product directly through the online channel, she can resolve her fit uncertainty only after receiving the product. Upon physically inspecting the product, she will dislike it with probability 1−\(\theta \). If she dislikes the product, she has to perform an extra online operation and thus incurs an extra cost, \({h}_{o}\), to return the product. This is in the spirit of Pun et al. (2020), who assume that purchasing and returning products in the offline channel incur the same cost. Thus, \({h}_{o}\) also represents the customer’s hassle cost in returning the product through the online channel. In turn, a consumer’s expected utility for BORO is given by

where \(\theta (v-p)\) represents the expected utility if the product is satisfactory and thus kept, \((1-\theta ){h}_{o}\) reflects the expected hassle cost when the product is misfit and then returned online, and the last term is the hassle cost of purchasing online.

In the reactive strategy, a customer can choose to return the misfit item purchased online to the offline store. This shopping behavior is denoted by buy-online-and-return-in-store (BORS). Traveling to the physical location incurs a uniform offline visit cost \({h}_{s}\) for customers (Balakrishnan et al., 2014; Jing, 2018). Thus, a consumer’s expected utility for BORS is given by

In the proactive strategy, a customer can first travel to the showroom to experience the product and then make a purchase online if she likes it. This shopping behavior is called experience-in-showroom-and-buy-online (ESBO). After a customer visits the showroom, she will buy the product with probability \(\theta \). With probability 1 − \(\theta \), she will find the product unsatisfactory and not buy it. Thus, a consumer’s expected utility for ESBO is

Note that the purchase cost and return cost in the online (offline) channel are equal to \({h}_{o}\) (\({h}_{s}\)), as purchasing and returning products in the same channel are exactly opposite processes. Accordingly, the relative value of \({h}_{s}\) versus \({h}_{o}\) not only captures the advantages and disadvantages of each channel in the purchase or return process but also incorporates the heterogeneity in customers’ channel preferences. For example, when \({h}_{o}<{h}_{s}\), consumers will prefer to purchase or return the product through the online channel rather than through the offline channel. In Sect. 6.3, we consider the cost differences between purchasing and returning the product through the same channel. The result shows that cost differences do not affect our main results qualitatively.

Following Hu et al. (2021), we assume that the total demand in the entire market is 1. Additionally, the product valuation \(v\) is not very large, such that the entire market is partially covered. The unit procurement cost is \(c\). Given that customers always place their orders through the online channel, the retail price \(p\) holds across all channels. Finally, we use \(d\), \({d}_{BORO}\), \({d}_{BORS},\) and \({d}_{ESBO}\) to denote the total demand and the demands of BORO, BORS, and ESBO, respectively. A summary of the notations we use is presented in Table 1.

The game sequence is as follows. In Step 1, the retailer makes a choice from the above four strategies (i.e., the benchmark strategy, the reactive strategy, the proactive strategy, and the hybrid strategy). In Step 2, the online retailer chooses the retail price. In Step 3, customers determine whether to buy the product, how to purchase it, and how to return it if it is misfit.

4 Equilibrium solutions

In this section, we derive the equilibrium outcomes for each strategy through backward induction. First, we analyze customers’ channel choices given the retail price. Then, according to customers’ purchase and return behaviors, we pinpoint the retailer’s optimal retail price by maximizing his profit function. Finally, all equilibrium outcomes are obtained on the basis of the optimal retail price. We denote them with superscripts B, R, P, H to indicate the benchmark strategy, the reactively strategy, the proactively strategy, and the hybrid strategy, respectively. Note that we ignore any market condition that leads to the meaningless boundary solution where the total market is fully covered or zero covered.

4.1 Benchmark strategy: pure online channel

In the benchmark strategy, the online retailer operates an online channel, which is the only route for customers to buy and return the product. A customer’s expected utility for BORO is displayed in Eq. (1). As illustrated in Fig. 1a, when \({u}_{BORO}\ge 0\), consumers with \({h}_{o}\le \frac{\theta (v-p)}{2-\theta }\) will buy the product from the online channel. The remaining customers will choose not to buy, due to their large online hassle costs. Among the total demand, a fraction \(\theta \) of purchases will eventually be kept, and the corresponding net profit margin is \(p-c\); on average, \((1-\theta )d\) units will be returned, and the retailer faces a net loss \({c}_{o}\) for each unit returned online. Thus, the online retailer’s expected profit in the benchmark strategy is

Proposition 1 structurally characterizes all equilibrium outcomes for the benchmark strategy.

Proposition 1

In the benchmark strategy, the equilibrium retail price and profit are \({p}^{B*}=\frac{v+c}{2}+\frac{(1-\theta ){c}_{o}}{2\theta }\) and \({\pi }^{B*}=\frac{(\theta (v-c)-(1-\theta ){c}_{o}{)}^{2}}{4(2-\theta )}\), respectively.

Next, we examine the impacts of different parameters on the equilibrium results for the benchmark strategy, as shown in Lemma 1.

Lemma 1

-

(i)

When the product valuation \(v\) increases, the equilibrium retail price and profit both increase.

-

(ii)

When the product fit probability \(\theta \) increases, the equilibrium retail price decreases but the equilibrium profit increases.

-

(iii)

When the per-unit loss on a product returned online \({c}_{o}\) increases, the equilibrium retail price increases but the equilibrium profit decreases.

Lemma 1(i) shows that a higher \(v\) leads to a higher price and more profits for the retailer, since more customers will buy the product. In contrast, Lemma 1(ii) indicates that the optimal retail price decreases with \(\theta ,\) although more customers are willing to purchase at a larger \(\theta \). The reason for this lies in the positive effect of return loss. A small \(\theta \) implies a high rate of product returns. In this case, the online retailer has an incentive to raise his retail price, in order to reduce the market size of BORO for a small volume of total returns. In addition, with a high total return loss, the retailer will charge a high retail price to fully compensate for it. Therefore, when \(\theta \) is low, the retail price will be large. Otherwise, the online retailer may set a low retail price to attract more customers, considering the small return rate. Nevertheless, the retailer’s profit always increases in \(\theta \) as more customers are willing to buy. In a similar vein, as shown in Lemma 1(iii), when the per-unit loss on a product returned online \({c}_{o}\) increases, the optimal retail price increases but the retailer’s profit decreases. In summary, various parameters influence the retail price mainly through two effects, namely, the demand effect and the return loss effect.

4.2 Reactive strategy: return partnership

In the reactive strategy, customers have alternative options for returning a misfit product: (1) ship it back directly through the online channel, incurring an online hassle cost \({h}_{o}\) as before, or (2) travel to the physical store to return it, incurring an offline visit cost \({h}_{s}\). The expected utilities for the two return options are given in Eqs. (1) and (2), respectively. Furthermore, a customer can also choose not to purchase the product, which yields zero utility. Comparing \({u}_{BORO}\), \({u}_{BORS}\), and 0, we obtain the market segmentations displayed in Fig. 1b. Note that no customer will conduct BORS when the offline visit cost is very high (i.e., \({h}_{s}\ge \theta \left(v-{\text{p}}\right)-(1-\theta ){h}_{s}\)). Similar to Hu et al. (2021), we omit this uninteresting situation to focus on markets where both BORO and BORS exist. On the supply side, the online retailer faces a per-unit loss \({c}_{o}\) for an average of \((1-\theta ){d}_{BORO}\) units returned online and a per-unit loss \({c}_{s}\) for an average of \((1-\theta ){d}_{BORS}\) units returned offline. Therefore, the retailer’s expected profit in the reactive strategy is given by

All equilibrium outcomes in the reactive strategy are accounted for in Proposition 2. We discuss their properties below.

Proposition 2

In the reactive strategy, the equilibrium retail price and profit are \({p}^{R*}=\frac{v+c}{2}+\frac{(1-\theta )({c}_{s}-{h}_{s})}{2\theta }\) and \({\pi }^{R*}=\frac{(\theta (v-c)-(1-\theta ){h}_{s}{)}^{2}-2(1-\theta ){c}_{s}(\theta (v-c)-(3-\theta ){h}_{s})-4(1-\theta ){c}_{o}{h}_{s}+(1-\theta {)}^{2}{{c}_{s}}^{2}}{4}\), respectively.

The following lemma shows how different parameters affect the equilibrium solutions for the reactive strategy.

Lemma 2

-

(i)

When the product valuation \(v\) increases or the offline visit cost \({h}_{s}\) decreases, the equilibrium retail price and profit both increase.

-

(ii)

When the product fit probability \(\theta \) increases, the equilibrium retail price decreases if and only if \({c}_{s}>{h}_{s}\), while the equilibrium profit always increases.

-

(iii)

When the per-unit loss on a product returned online \({c}_{o}\) increases, the equilibrium retail price keeps unchanged but the equilibrium profit decreases.

-

(iv)

When the per-unit loss on a product returned offline \({c}_{s}\) increases, the equilibrium retail price increases but the equilibrium profit decreases.

Intuitively, a larger valuation \(v\) or a lower offline visit cost \({h}_{s}\) will motivate more customers to conduct BORS. Consequently, both the retail price and profit increase.

An increase in \(\theta \) not only generates greater demand but also means a lower rate of product returns. Clearly, the profit will increase. However, as for the retail price, the demand-enhancing effect is positive, whereas the return-reducing effect is negative. Therefore, there exists a balance between the two effects. Given a low \({h}_{s}\), the expected hassle cost of returning an item offline, \((1-\theta ){h}_{s}\), will decrease slightly as \(\theta \) increases. Thus, a low \({h}_{s}\) weakens the demand-enhancing effect. When \({c}_{s}\) is large, a decrease in the number of product returns means a substantial reduction in return losses, which intensifies the return-reducing effect. As such, when \({c}_{s}>{h}_{s}\), the return-reducing effect is more significant than the demand-enhancing effect. It drives the retail price to decrease with \(\theta \). Otherwise, the retail price will increase with \(\theta \).

Additionally, the demand for BORO only depends on the relative value of \({h}_{s}\) vs \({h}_{o}\) and is irrelevant to the retail price. Therefore, the retail price is irrelevant to \({c}_{o}\). But, the profit decreases in \({c}_{o}\) because of more return loss. According to the return loss effect illustrated in Lemma 1, the retail price increases with \({c}_{s}\) but the profit decreases with \({c}_{s}\).

4.3 Proactive strategy: fit information

Similarly, the proactive strategy provides customers with two distinct channels for purchases. If a customer chooses to buy the product directly from the online channel, the expected utility is \({u}_{BORO}\), given in Eq. (1). Alternatively, she can first travel to the showroom to resolve fit uncertainty, which generates the corresponding expected utility \({u}_{ESBO}\), given in Eq. (3). By comparing these expected utilities with zero, we can obtain a customer’s optimal shopping behavior. As illustrated in Fig. 1c, the market is divided into three parts. We only analyze the scenario where ESBO exists. Based on customers’ purchasing behaviors, the retailer’s expected profit in the proactive strategy is

The first term is the total expected revenue that the retailer gains from the effective demands. The second term is the expected return loss from BORO. Proposition 3 accounts for all equilibrium outcomes in the proactive strategy.

Proposition 3

In the proactive strategy, the equilibrium retail price and profit are \({p}^{P*}=\frac{v+c}{2}-\frac{{h}_{s}}{2\theta }\) and \({\pi }^{P*}=\frac{{\theta }^{2}(v-c{)}^{2}-2\theta {h}_{s}(v-c+{c}_{o})+{{h}_{s}}^{2}}{4\theta }\), respectively.

Lemma 3 presents the properties of equilibrium outcomes for the proactive strategy.

Lemma 3

-

(i)

When the product valuation \(v\) increases or the offline visit cost \({h}_{s}\) decreases, the equilibrium retail price and profit both increase.

-

(ii)

When the product fit probability \(\theta \) increases, the equilibrium retail price and profit both increase.

-

(iii)

When the per-unit loss on a product returned online \({c}_{o}\) increases, the equilibrium retail price keeps unchanged but the equilibrium profit decreases.

-

(iv)

When the per-unit loss on a product returned offline \({c}_{s}\) increases, the equilibrium retail price increases but the equilibrium profit decreases.

Similar to the reasoning for the preceding lemmas, the equilibrium retail price and profit are increasing in \(v\) but decreasing in \({h}_{s}\), as shown in Lemma 3(i).

Since the purchase choice between BORO and ESBO is irrelevant to the retail price, it is easy to see that the amount of product returns that comes only from BORO will not change with the retail price. Thus, \(\theta \) and \({c}_{o}\) do not influence the retail price through the return loss effect. Moreover, the demand-enhancing effect of \(\theta \) drives the retail price and profit to increase, and the profit decreases in \({c}_{{\text{o}}}\) owing to more return losses, as illustrated in Lemma 3(ii) and (iii).

Similar to the above lemmas, Lemma 3(iv) shows that as \({c}_{{\text{s}}}\) increases, the return loss effect drives the retail price to increase but the profit to decrease.

4.4 Hybrid strategy: joint implementation

In the hybrid strategy, customers will choose from BORO, BORS, and ESBO to achieve the highest utility. The comparisons of Eqs. (1), (2), and (3) yield the market segmentations for this strategy. As shown in Fig. 1d, no customer will conduct BORS if the return rate is high (i.e., \(\theta \le 0.5\)). The reason for this is that, at a high return rate, ESBO is preferable to BORS if \({h}_{o}\) is high, and BORO outperforms BORS if \({h}_{o}\) is low. We omit this uninteresting situation and focus only on the effective area where both BORS and ESBO exist. According to customers’ shopping behaviors, the online retailer’s expected profit in the hybrid strategy is

Following the same solution procedure, we derive a unique equilibrium for the hybrid strategy. The following Proposition and Lemma present the equilibrium outcomes for the hybrid strategy and their properties, respectively.

Proposition 4

In the hybrid strategy, the equilibrium retail price and profit are \({p}^{H*}=\frac{v+c}{2}-\frac{{h}_{s}}{2\theta }\) and \({\pi }^{H*}=\frac{{\theta }^{2}(v-c{)}^{2}-2\theta {h}_{s}(v-c+2(1-\theta ){c}_{o}+2(2\theta -1){c}_{s})+{{h}_{s}}^{2}}{4\theta }\), respectively.

Lemma 4

-

(i)

When the product valuation \(v\) increases or the offline visit cost \({h}_{s}\) decreases, the equilibrium retail price and profit both increase.

-

(ii)

When the product fit probability \(\theta \) increases, the equilibrium retail price and profit both increase.

-

(iii)

When the per-unit loss on a product returned online \({c}_{o}\) increases, the equilibrium retail price keeps unchanged but the equilibrium profit decreases.

-

(iv)

When the per-unit loss on a product returned offline \({c}_{s}\) increases, the equilibrium retail price increases but the equilibrium profit decreases.

It is easy to see from Fig. 1 that the volume of product returns is irrelevant to the retail price in both the hybrid strategy and the proactive strategy. This means that the return loss exerts no influence on the retail price. Since the total demands in both strategies are only determined by the market size of ESBO, the hybrid strategy has the same retail price and total demand as those in the proactive strategy. Thus, Lemma 4 is line with Lemma 3, i.e., the properties of the equilibrium retail price and profit are consistent with those in the proactive strategy.

5 Optimal strategy

Based on the equilibrium outputs of the different strategies, we now examine the first stage of the game in which the online retailer determines his strategy. To better understand the managerial insights of our results, we first explore the relationships across the four strategies in terms of the retail price and demand. The lemmas below provide a comparison of their results.

Lemma 5

The retail prices and total demands under the four strategies have the following orders: \({{p}^{H*}=p}^{P*}<{p}^{R*}<{p}^{B*}\) and \({d}^{H*}={d}^{P*}>{d}^{R*}>{d}^{B*}\).

Lemma 5 reveals that the benchmark strategy yields the highest retail price, followed by the reactive strategy and lastly the proactive and hybrid strategies. The order of the total demands is the exact opposite. Obviously, omnichannel strategies will motivate more customers to buy, due to the lower expected shopping costs. Nonetheless, the retail prices finally decrease. To see the intuition behind this, note that the retail price is positively influenced by the return loss in addition to the demand, as discussed in the above lemmas. In comparison to the benchmark strategy, the omnichannel strategies may help the retailer reduce his return losses through various mechanisms. Specifically, the reactive strategy reduces the per-unit loss on returns, whereas the proactive strategy avoids returns from occurring in the first place. The latter is more aggressive than the former in reducing return losses. Therefore, the return loss in the benchmark strategy is the highest, followed by that of the reactive strategy and finally that of the proactive strategy. Although a higher demand may raise the retail price, the effect of decreased return loss dominates. In addition, the retailer in the hybrid strategy and the proactive strategy has equal retail prices and total demands, since the volume of product returns is irrelevant to the retail price in both strategies. Thus, the results in Lemma 5 are straightforwardly obtained.

From the above discussions, we can easily see that omnichannel strategies exert three effects on the online retailer. First, the return loss obviously declines when the shopping behavior shifts from BORO to BORS or ESBO. This impact is referred to as the “return loss reduction effect.” Second, the result \({{p}^{H*}=p}^{P*}<{p}^{R*}<{p}^{B*}\) implies a price disadvantage for omnichannel strategies. Therefore, given equal base demand, omnichannel strategies yield lower revenues than the benchmark strategy. We call this the “price decrease effect.” Finally, the result \({d}^{H*}={d}^{P*}>{d}^{R*}>{d}^{B*}\) indicates that omnichannel strategies can attract new customers. These increases in demand bring net profits, a positive effect we refer to as the “demand expansion effect.” In comparison to the reactive strategy, the proactive strategy may generate more “BORO” customers when \(\theta \) is large. Nevertheless, the overall return loss in the proactive strategy will still be smaller, due to the large market size of ESBO. Thus, the proactive strategy also has the above three effects, in contrast to the reactive strategy. Taking the benchmark strategy and the proactive strategy as examples, Fig. 2 graphically illustrates the above three effects between them.

Since the hybrid strategy and the proactive strategy have the same retail price and total demand, the above price decrease and demand expansion effects do not obtain between them. As for return loss, Lemma 6 gives the comparison of market segmentations between them.

Lemma 6

\({d}_{ESBO}^{P*}-{d}_{ESBO}^{H*}={d}_{BORO}^{P*}-{d}_{BORO}^{H*}=\frac{(2\theta -1){h}_{s}}{2(1-\theta )}\).

Figure 3 graphically demonstrates Lemma 6. As shown in Fig. 3, adding the reactive strategy into the proactive strategy results in a substitution effect as well as a complementary effect. As \({h}_{o}\) increases, BORO’s expected utility decreases at the highest rate, followed by BORS’s and ESBO’s. Therefore, a proportion of customers (i.e., \({d}_{ESBO}^{P*}-{d}_{ESBO}^{H*}\)) who initially prefer ESBO under the proactive strategy now switch to BORS under the hybrid strategy, resulting in more returns—which we refer to as the “substitution effect.” Meanwhile, a proportion of customers (i.e., \({d}_{BORO}^{P*}-{d}_{BORO}^{H*}\)) who initially choose BORO under the proactive strategy now also shift to BORS under the hybrid strategy, leading to a lower per-unit loss on returns—which we refer to as the “complementary effect.” Moreover, since the differences in expected shopping costs across BORS, BORO, and ESBO are identical, the demand changes for the two effects are equal to \(\frac{(2\theta -1){h}_{s}}{2(1-\theta )}\).

Next, we compare the retailer’s profits in the hybrid strategy and the proactive strategy to conduct a preliminary analysis. Note that the profit comparison assumes a common feasible domain shared by the two strategies, as is explained in the Appendix. Proposition 5 presents the result of our profit comparison between the two strategies.

Proposition 5

\({\pi }^{H*}\le {\pi }^{P*}\) if \({c}_{o}\le 2{c}_{s}\) and \({\pi }^{H*}>{\pi }^{P*}\) if \({c}_{o}>2{c}_{s}\).

Proposition 5 shows that the result depends only on the relative values of \({c}_{o}\) and \({c}_{s}\). When \({c}_{o}\) is much larger than \({c}_{s}\), the hybrid strategy is more beneficial. Otherwise, it is more profitable to employ the single proactive strategy. The underlying logic is as follows. The substitution effect generates a per-unit loss \({c}_{s}\) when shopping behavior shifts from ESBO to BORS, while the complementary effect decreases the per-unit loss by \({c}_{o}-{c}_{s}\). As stated above, the demand changes in both effects are equal. Given these identical demand changes, the substitution effect will exceed the complementary effect when the marginal loss \({c}_{s}\) is larger than the marginal gain \({c}_{o}-{c}_{s}\) (i.e., \({c}_{o}<2{c}_{s}\)). This ultimately leads to a negative net effect. In contrast, when \({c}_{o}\) is very large, it is worthwhile to simultaneously implement both omnichannel strategies, so as to further reduce return losses.

Proposition 5 has the following implications for retailers who have already set up showrooms. If they do not have large logistics systems and thus incur high losses of online returns, it may be more profitable to add the return partnership into the function of showrooms. Otherwise, they should only exploit the fit information in showrooms since the initial loss of online returns is not high. This supports the recent practices of online retailers such as JD.com, Warby Parker, and Bonobos. Warby Parker and Bonobos do not have their own logistics systems, and they allow customers to return online purchases at their physical showrooms. In contrast, JD.com owns an efficient logistics team and does not accept online returns at its experience stores.

In accord with the results in Proposition 5, we discuss the retailer’s optimal strategy for two cases below. When \(\theta \le 0.5\), only the hybrid strategy is meaningless. When \(\theta >0.5\) and \({c}_{o}\le 2{c}_{s}\), the proactive strategy is superior to the hybrid strategy. Under these situations, we compare the proactive strategy with the benchmark strategy and the reactive strategy, to derive the optimal strategy. On the other hand, for \(\theta >0.5\) and \({c}_{o}>2{c}_{s}\), we compare the hybrid strategy with the other two strategies, as the hybrid strategy outperforms the proactive strategy.

5.1 Comparisons among the three single strategies

We now compare the retailer’s profits among the benchmark strategy, the reactive strategy, and the proactive strategy. Note that the profit comparisons assume the common feasible area of the three strategies. Proposition 6 presents the main result.

Proposition 6

For \(\theta \le 0.5\) or \(\theta >0.5\) and \({c}_{o}\le 2{c}_{s}\), there exist thresholds \({\widehat{v}}_{PB},{\widehat{v}}_{PR},{\widehat{v}}_{RB}\), and \(\widehat{\theta }\), such that the online retailer’s optimal strategy is:

-

(1)

the proactive strategy of fit information, if \(v\ge max({\widehat{v}}_{PB},{\widehat{v}}_{PR})\);

-

(2)

the reactive strategy of return partnership, if \(\theta >\widehat{\theta }\) and \({\widehat{v}}_{RB}<v<{\widehat{v}}_{PR}\);

-

(3)

the benchmark strategy of pure online channel, if \(v\le min({\widehat{v}}_{RB},{\widehat{v}}_{PB})\).

Proposition 6 demonstrates that the online retailer’s optimal choice depends mainly on two factors: product valuation \(v\) and product fit probability \(\theta \). As depicted in Fig. 4, when \(v\) is sufficiently large, the proactive strategy is optimal. When \(v\) is extremely small, the benchmark strategy is optimal. When \(v\) is medium and \(\theta \) is relatively large, the reactive strategy is optimal. The reason for all of this lies in the relative strengths of the three effects depicted above.

The proof of Lemma 5 shows that all demand gaps between strategies become greater as \(v\) increases. Note that a customer will not buy the product when her online hassle cost \({h}_{o}\) exceeds a certain threshold. A larger \(v\) generates a higher threshold of \({h}_{o}\), which is more likely to exceed the offline visit cost \({h}_{s}\). The relatively lower \({h}_{s}\) motivates more customers to conduct ESBO rather than BORO or BORS as \(v\) increases. Therefore, demand gaps between the proactive strategy and the other two strategies will become greater with larger values for \(v\). For a similar reason, as \(v\) increases, the demand gap between the reactive and benchmark strategies becomes much greater. In addition, the above lemmas show that the retail price always increases with \(v\). A greater demand gap, together with a higher retail price, will bring more additional profits. Thus, the demand expansion effect is extremely significant at a large \(v\). Obviously, the return loss reduction effect and the price decrease effect also become intensified as \(v\) increases. When \(v\) is very large, the combined intensity of the demand expansion effect and the return loss reduction effect far exceeds the negative price decrease effect. Eventually, omnichannel strategies lead to a higher profit for the retailer. When \(v\) is extremely small, the total positive effect of omnichannel strategies cannot offset the revenue loss associated with the negative price decrease effect. In a similar vein, the proactive strategy outperforms the reactive strategy when \(v\) exceeds a certain threshold. Therefore, when \(v\) is significantly large, the proactive strategy is optimal. When \(v\) is very small, the benchmark strategy is optimal.

Moreover, Fig. 4 shows that the reactive strategy will never be optimal when \(\theta \) is lower than a certain threshold. This is because, when \(\theta \) is small, the return loss reduction effect plays an important role, since there is a greater number of returns. Obviously, the proactive strategy is more effective than the reactive strategy in reducing return losses, as it prevents returns from occurring in the first place. Under these circumstances, when \(v\) is sufficiently large for adopting an omnichannel strategy, the proactive strategy will be the first choice.

Finally, when \(\theta \) is relatively large and \(v\) is intermediate, the reactive strategy is the best strategy. Given a low return rate, the advantage of the proactive strategy in reducing return loss is insignificant. Meanwhile, at a medium value of \(v\), the reactive strategy will easily outperform the benchmark strategy, but the proactive strategy may not outperform the reactive strategy.

Proposition 6 entails the following managerial insights. First, regarding firms selling low-end products, it is pointless to open a showroom or implement a return partnership. Second, online retailers who sell high-end products could benefit from establishing showrooms. This supports the launches of showrooms for the high-end products of Blue Nile, Tesla, and JD.com. Finally, online retailers should use the software and services of Happy Returns or Narvar to handle returns of standardized and middle-end products. Proposition 6 also offers a possible explanation for the decisions of Microsoft and OnePlus, both of whom ultimately closed their experience stores. This is because the product portfolio of Microsoft has evolved to digital offerings and OnePlus’s entire product line contains only a few kinds of products and thus the fit uncertainty of their products is minor. Instead, we recommend that these firms could implement return partnerships for their standardized and middle-end products.

5.2 Comparisons of the benchmark, reactive, and hybrid strategies

When \(\theta >0.5\) and \({c}_{o}>2{c}_{s}\), the hybrid strategy is more profitable than the proactive strategy. In this case, we compare the hybrid strategy with the benchmark strategy and the reactive strategy, so as to identify the optimal strategy. Proposition 7 presents the comparison results, which are similar to those of Proposition 6.

Proposition 7

For \(\theta >0.5\) and \({c}_{o}>2{c}_{s}\), there exist thresholds \({\widehat{v}}_{HB},{\widehat{v}}_{HR}, {\widehat{v}}_{RB}\) and \({\widehat{\theta }}_{1}\), such that the online retailer’s optimal strategy is:

-

(1)

the hybrid strategy of joint implementation, if \(v\ge max({\widehat{v}}_{HB},{\widehat{v}}_{HR})\);

-

(2)

the reactive strategy of return partnership, if \(\theta >{\widehat{\theta }}_{1}\) and \({\widehat{v}}_{RB}<v<{\widehat{v}}_{HR}\);

-

(3)

the benchmark strategy of pure online channel, if \(v\le min({\widehat{v}}_{RB},{\widehat{v}}_{HB})\).

Figure 5 graphically demonstrates Proposition 7. The profit relationships are similar to those described in Proposition 6. When \({c}_{o}>2{c}_{s}\), adding the reactive strategy into the proactive strategy only enhances the return loss reduction effect, while the demand expansion effect and price decrease effect remain unchanged. Thus, similar to the reasons in Proposition 6, all three effects will become intensified as \(v\) increases. Meanwhile, the total strength of the two positive effects—the demand expansion effect and the return loss reduction effect—will exceed the strength of the negative price decrease effect at large values of \(v\). Therefore, as \(v\) increases, the hybrid strategy gradually surpasses the benchmark strategy and even outperforms the reactive strategy. Moreover, the reactive strategy will never be the best at high return rates, because the fit information under the hybrid strategy is more efficient in reducing return losses. The reactive strategy is optimal only when \(\theta \) is relatively large and \(v\) is intermediate. Compared to the proactive strategy, the hybrid strategy more easily outperforms the other two strategies, due to its greater return loss reduction effect.

6 Extensions

In this section, we study several additional extensions of our main model by relaxing some assumptions. In Sect. 6.1, we investigate a partial refund policy. In Sect. 6.2, we analyze a scenario where customers are responsible for the shipping fees of online returns. In Sect. 6.3, we consider the differences between return costs and purchase costs in both online and offline channels. The solution procedure in this section is the same as that of the main model. For the equilibrium outcomes, we add \(r\), \(f\), or \(d\) into the superscripts to indicate the corresponding extensions. The results of the latter two extensions reveal that the key managerial insights of our main model are not significantly altered.

6.1 Partial refund

Some online retailers charge restocking or penalty fees for products returned online. To capture such cases, we extend our main model to consider a partial refund scenario wherein the online retailer not only sets the retail price but also makes a penalty decision. Let \(r\) denote the penalty, so that the corresponding refund amount is \(p-r\). Thus, a customer’s hassle cost of making an online return and the retailer’s unit loss on online returns are modified to \({h}_{o}+r\) and \({c}_{o}-r\), respectively. Other parameters remain the same. Following solution procedure of the main model, we derive the equilibrium outcomes for this extension, as displayed in Table 2 in the Appendix.

In the benchmark strategy, the presence of the penalty not only decreases the total demand but also implies a low per-unit loss on online returns. Table 2 shows that the impact of the penalty can be offset by the retail price. In other words, the online retailer can adjust both the retail price and the penalty to balance the total demand: formally, \(p=\frac{v+c}{2}+\frac{(1-\theta )({c}_{o}-2r)}{2\theta }\). Thus, the retailer in this extension attains the same demand and profit as those gained in the main model. For simplicity, let \(r=0\), so that all equilibrium outcomes for the benchmark strategy in this extension are the same as those of the main model.

Regarding omnichannel strategies, the equilibrium prices and total demands remain the same as the corresponding ones in the main model. Note that the retail price is determined by two effects, namely, the demand effect and the return loss effect. Since the penalty has no impact on the expected utilities for BORS or ESBO, the total demand in each omnichannel strategy stays the same. In addition, the penalty only influences the market size of BORO. As stated in Lemmas 1–4, the return loss from BORO does not influence the retail price, as the number of consumers who conduct BORO in each omnichannel strategy is irrelevant to the retail price. So, the effects of the total demand and return loss on the retail price do not change with the penalty. As the retailer’s decision on the retail price is irrelevant to the penalty, the equilibrium price and total demand do not change for any of the omnichannel strategies.

Comparing the retailer’s profits across the four strategies, we have the following proposition.

Proposition 8

In the case of partial refunds, the proactive strategy of fit information is optimal when \(v\ge {\widehat{v}}_{PRr}\); otherwise, the reactive strategy of return partnership is optimal.

Proposition 8 reveals that either the proactive strategy or the reactive strategy is best for the retailer. In addition, as was the case in the main model, the proactive strategy will outperform the reactive strategy if \(v\) is very large. Obviously, no change is exhibited in any of the price decrease effects or demand expansion effects, due to the unaltered retail price and total demand in each strategy. Only the return loss reduction effect changes. Specifically, a higher penalty means a lower return loss for each online return. In comparison to the main model, omnichannel strategies in this extension more significantly reduce return losses. This greater return loss reduction effect makes the proactive strategy and the reactive strategy uniformly superior to the benchmark strategy, as reported in the proof of Proposition 8. Meanwhile, as was the case for the main model, the proactive strategy will outperform the reactive strategy when \(v\) is enough large to generate a high retail price and high total demand. Finally, in the presence of a penalty, more customers will conduct ESBO in the proactive strategy, whereas the market size of ESBO in the hybrid strategy remains unchanged. Hence, the complementary effect between the two strategies exceeds the substitution effect; consequently, the proactive strategy always outperforms the hybrid strategy. Comparing the main model with this extension, we can easily observe that implementing a partial refund policy is more profitable for the online retailer, if it is possible.

6.2 Consumers absorbing the shipping fees for online returns

In our main model, the online retailer absorbs the shipping fees for online returns, which is included in \({c}_{o}\). Here, we consider another scenario where customers pay for the shipping of online returns, as is the case for JD.com and Taobao customers. Let the shipping fee be denoted by \(f\). Then, the hassle cost for returning the product online and the per-unit loss on online returns are modified to \({h}_{o}+f\) and \({c}_{o}-f\), respectively. This modification is similar to that of Sect. 6.1. In contrast to the endogenous penalty \(r\), the shipping fee \(f\) is exogenous in this extension. Substituting them into the corresponding expected utility functions and profit functions, we derive the equilibrium outcomes presented in Table 3 in the Appendix. The profit comparisons in the Appendix show that our key insights continue to qualitatively hold for this extension.

In this extension, the retail price and total demand for each omnichannel strategy remain unchanged. The explanation here is similar to that of Sect. 6.1. On one hand, the shipping fee imposes no impact on the expected utilities for BORS or ESBO; hence, there are no changes to demand. On the other hand, the shipping fee influences the market size of BORO, but the return loss from BORO does not influence the retail price. This means that the shipping fee cannot influence the equilibrium retail price through the effects of the total demand and return loss for any of the omnichannel strategies.

In the case of the benchmark strategy, the retail price decreases, whereas the total demand remains unaltered. Our explanation for this is as follows. First, an increase in the hassle cost for making an online return only decreases customers’ purchase inclinations in the benchmark strategy; it has no impact on the expected utilities for BORS or ESBO. Thus, the demand effect only drives the retailer to decrease his retail price in the benchmark strategy. Second, with a smaller per-unit loss on online returns, a relatively lower retail price can fully compensate for it under the benchmark strategy. Overall, the retail price in the benchmark strategy will fall. In turn, this price adjustment leaves the total demand unchanged in the benchmark strategy. Although the retailer’s total revenue drops, his net profit in the benchmark strategy remains the same, as he does not pay the shipping fees for online returns.

The unaltered prices and demands in omnichannel strategies yield the same price decrease effects and demand expansion effects as those of the main model. Since the retail price in the benchmark strategy decreases, the price decrease effect between the benchmark strategy and each omnichannel strategy will become much weaker. As for the return loss reduction effect, it may become weaker, given that the per-unit loss on online returns declines by \(f\). Moreover, the reactive strategy may even increase return losses when \({c}_{s}\) is extremely large (e.g., \({c}_{s}>{c}_{o}-f\)). Nevertheless, omnichannel strategies will still outperform the benchmark strategy when \(v\) is very large, because the strength of the demand expansion effect always increases with \(v\). It may outweigh the total of the other two effects at extremely large values for \(v\). The profit comparisons among omnichannel strategies follow a similar logic to those in the main model. Thus, regardless of which party pays for the shipping of online returns, our main findings continue to hold qualitatively.

6.3 Differences between return costs and purchase costs

Our main model assumes that the hassle costs of purchasing and returning the product online (offline) are equal to \({h}_{o}\)(\({h}_{s}\)). We now extend the main model to consider the difference between purchase and return costs in each channel. For example, consumers may face more risks or may experience less wait sensitivity for returning an item online than for purchasing it online. Let \({\alpha }_{o}\) and \({\alpha }_{s}\) denote the cost differences in the online and offline channels, respectively. Then a consumer’s expected utilities for BORO and BORS can be rewritten as follows:

Note that the cost differences can be positive or negative. This reflects the fact that the return cost may be higher or lower than the corresponding purchase cost in the same channel. Following the same solution procedure used for the main model, we derive the equilibrium outcomes for this extension, which are given in Table 4 in the Appendix. As demonstrated in the Appendix, the cost differences do not alter our key insights qualitatively.

Note that the values of all parameters are in the common feasible domain for all strategies. First, when \({c}_{o}\le (>)2{c}_{s}\), the proactive strategy is still superior (inferior) to the hybrid strategy. This is because the substitution effect and the complementary effect in Fig. 3 also obtain in this extension. Moreover, both of these effects become more significant when \({\alpha }_{o}\) is far larger than \({\alpha }_{s}\) (i.e., \({\alpha }_{o}>2{\alpha }_{s}\)). Second, in comparison to the main model, the retail prices and the total demands in the benchmark and reactive strategies fall, due to the higher expected hassle costs of BORO and BORS. However, the total demands in other strategies remain the same. The reasons once again resembled those of previous subsections. No matter how the three effects depicted in Fig. 2 change in this extension, the demand expansion effect still increases with \(v\). Meanwhile, the total of the two positive effects cannot always exceed the negative price decrease effect. Therefore, all our results still hold qualitatively.

7 Conclusion

As omnichannel retailing has increasingly become the norm in the retail industry, online retailers more and more frequently resort to channel integration strategies for managing online returns. This paper focuses on two popular omnichannel strategies that involve the management of online returns, namely, the reactive strategy of return partnerships and the proactive strategy of fit information. Our game-theoretic model is designed to examine an online retailer’s optimal choice across four strategies. The comparison results reveal three effects between strategies: the return loss reduction effect, the price decrease effect, and the demand expansion effect. Moreover, we note a substitution effect and a complementary effect that obtain between the hybrid strategy and the proactive strategy. Finally, our results show that a product’s fit probability and valuation jointly determine the relative strengths of the above three effects. They ultimately shape the preference areas for distinct strategies.

With three key levers, namely, the extent of product standardization, product valuation, and the operational efficiency of reverse logistics systems, our results not only can provide explanations for real practices but also can offer more profound managerial implications for operation managers. First, our results justify the recent practices we observe in various industries, e.g., the launches of showrooms for the high-end products of Blue Nile, Tesla, and Nike. Second, our study highlights the importance of choosing the right product category for the implementation of omnichannel strategies. For JD.com, which has already set up showrooms, we suggest that displaying premium products in its showrooms is more efficient. As regards return partnerships, we recommend that online retailers use the software and services of Happy Returns or Narvar to handle returns of standardized and middle-end products. Third, we also explain why some retailers, such as Microsoft and OnePlus, ultimately chose to shut down their experience stores. Since the product portfolio of Microsoft has evolved to digital offerings and OnePlus’s entire product line contains only a few kinds of products, the fit uncertainty of their products is minor. In this case, the advantage of fit information in reducing return losses is insignificant. Instead, we recommend that such firms consider implementing return partnerships. Finally, our results also support recent practices in relation to the joint implementation. JD.com, Warby Parker, and Bonobos have set up physical stores for customers to inspect and experience products. Warby Parker and Bonobos do not have their own logistics systems, and they allow customers to return online purchases at their physical stores. In contrast, JD.com owns an efficient logistics team and does not accept online returns at its experience stores.

Our paper admits of several limitations. First, we only examine a monopoly retailer’s omnichannel strategies for managing online returns. One could extend the analysis to a multiplayer model which accounts for competition between retailers. Second, we only emphasize the price decision of an online retailer across different strategies. A promising direction for future research is to explore other decisions, such as the leniency of return windows, return shipping services, or inventory. Third, taking the role of the manufacturer into consideration may generate valuable additions to our results. In a multi-echelon supply chain, product returns can be handled in a number of distinctive ways. The manufacturer may not accept product returns from the retailer, in which case returns may be handled and salvaged by the online retailer. Alternatively, products sold through the online retailer may be directly returned to the manufacturer if they are misfit items. Thus, it would be interesting to allow for the reverse process of handling returns.

References

Abdulla, H., Abbey, J. D., & Ketzenberg, M. (2022). How consumers value retailer’s return policy leniency levers: An empirical investigation. Production and Operations Management, 31(4), 1719–1733.

AlixPartners (2017). Retail viewpoint: Many happy returns for retailers. Available at: https://www.alixpartners.com/insights-impact/insights/retail-viewpoint-many-happy-returns-for-retailers/. Retrieved on: 26 May 2022.

Amazon (2022). Amazon physical store return policies. Available at: https://www.amazon.com/gp/help/customer/display.html?nodeId=202075110. Retrieved on: 26 May 2022.

Balakrishnan, A., Sundaresan, S., & Zhang, B. (2014). Browse-and-switch: Retail-online competition under value uncertainty. Production and Operations Management, 23(7), 1129–1145.

Bell, D. R., Gallino, S., & Moreno, A. (2018). Offline showrooms in omnichannel retail: Demand and operational benefits. Management Science, 64(4), 1629–1651.

Bell, D. R., Gallino, S., & Moreno, A. (2020). Customer supercharging in experience-centric channels. Management Science, 66(9), 4096–4107.

De Giovanni, P., & Zaccour, G. (2022). A selective survey of game-theoretic models of closed-loop supply chains. Annals of Operations Research, 314(1), 77–116.

De, P., Hu, Y., & Rahman, M. S. (2013). Product-oriented web technologies and product returns: An exploratory study. Information Systems Research, 24(4), 998–1010.

Ertekin, N., & Agrawal, A. (2020). How does a return period policy change affect multichannel retailer profitability? Manufacturing & Service Operations Management, 23(1), 210–229.

Ertekin, N., Ketzenberg, M. E., & Heim, G. R. (2019). Assessing impacts of store and salesperson dimensions of retail service quality on consumer returns. Production and Operations Management, 29(5), 1232–1255.

Figuccia, P. (2016). OnePlus closes its offline retail stores. Available at: https://www.gizchina.com/2016/09/02/oneplus-closes-its-offline-retail-stores/. Retrieved on: 26 May 2022.

Gallino, S., & Moreno, A. (2018). The value of fit information in online retail: Evidence from a randomized field experiment. Manufacturing & Service Operations Management, 20(4), 767–787.

Gao, F., Agrawal, V. V., & Cui, S. L. (2021). The effect of multichannel and omnichannel retailing on physical stores. Management Science, 68(2), 809–826.

Gao, F., & Su, X. (2017). Online and offline information for omnichannel retailing. Manufacturing & Service Operations Management, 19(1), 84–98.

Govindan, K., Agarwal, V., Darbari, J. D., & Jha, P. C. (2017). An integrated decision making model for the selection of sustainable forward and reverse logistic providers. Annals of Operations Research, 273, 607–650.

Happy Returns (2021). Happy Returns & ShipBob announce integration partnership to help retailers reduce costs, increase exchanges, and raise shopper lifetime value. Available at: https://happyreturns.com/blog/happy-returns-shipbob-partner-to-reduce-returns-costs. Retrieved on: 26 May 2022.

Happy Returns (2022). Sustainable returns & exchanges. Available at: https://happyreturns.com/resource/reduce-your-cardboard-footprint. Retrieved on: 23 May 2022.

Hu, Y., Qu, S., Li, G., & Sethi, S. P. (2021). Power structure and channel integration strategy for online retailers. European Journal of Operational Research, 294(3), 951–964.

Huang, M., & Jin, D. (2020). Impact of buy-online-and-return-in-store service on omnichannel retailing: A supply chain competitive perspective. Electronic Commerce Research and Applications, 41, 100977.

Hwang, E. H., Nageswaran, L., & Cho, S. H. (2021). Value of online–off-line return partnership to off-line Retailers. Manufacturing & Service Operations Management, 24(3), 1630–1649.

Jin, D., Caliskan-Demirag, O., Chen, F., & Huang, M. (2020). Omnichannel retailers’ return policy strategies in the presence of competition. International Journal of Production Economics, 225, 107595.

Jin, D., & Huang, M. (2021). Competing e-tailers’ adoption strategies of buy-online-and-return-in-store service. Electronic Commerce Research and Applications, 47, 101047.

Jing, B. (2018). Showrooming and webrooming: Information externalities between online and offline sellers. Marketing Science, 37(3), 469–483.

Khusainova, G. (2019). There is no such thing as a free return. Available at: https://www.forbes.com/sites/gulnazkhusainova/2019/03/28/there-is-no-such-thing-as-a-free-return/?sh=61ff01407135. Retrieved on 21 May 2022.

Konur, D. (2021). Keep your enemy close? Competitive online brands’ expansion with individual and shared showrooms. Omega, 99, 102206.

Kumar, A., Mehra, A., & Kumar, S. (2019). Why do stores drive online sales? Evidence of underlying mechanisms from a multichannel retailer. Information Systems Research, 30(1), 319–338.

Li, G., Li, L., Choi, T. M., & Sethi, S. P. (2019a). Green supply chain management in Chinese firms: Innovative measures and the moderating role of quick response technology. Journal of Operations Management, 66(7–8), 958–988.

Li, G., Li, L., Sethi, S. P., & Guan, X. (2019b). Return strategy and pricing in a dual-channel supply chain. International Journal of Production Economics, 215, 153–164.

Li, G., Lim, M. K., & Wang, Z. H. (2020). Stakeholders, green manufacturing, and practice performance: Empirical evidence from Chinese fashion businesses. Annals of Operations Research, 290, 961–982.

Li, G., Zhang, X., Chiu, S.-M., Liu, M., & Sethi, S. P. (2019c). Online market entry and channel sharing strategy with direct selling diseconomies in the sharing economy era. International Journal of Production Economics, 218, 135–147.

Lin, J., Choi, T.-M., & Kuo, Y.-H. (2023). Will providing return-freight-insurances do more good than harm to dual-channel e-commerce retailers? European Journal of Operational Research, 307(3), 1225–1239.

Liu, B. S., Zhu, W. W., Shen, Y. H., Chen, Y., Wang, T., Chen, F. W., Liu, M. W., & Zhou, S. H. (2022a). A study about return policies in the presence of consumer social learning. Production and Operations Management, 31(6), 2571–2587.

Liu, J., & Xiong, H. (2023). Information disclosure, consumer returns, and operational costs in omnichannel retailing. Naval Research Logistics, 70(4), 376–391.

Liu, Y., Xiao, Y., & Dai, Y. (2022b). Omnichannel retailing with different order fulfillment and return options. International Journal of Production Research, 61(15), 5053–5074.