Abstract

Demand information and consumer valuation uncertainty of new products have significant impacts on both consumers’ purchasing behavior and retail operations. To address the information transparency for new products launching, this study examines the profitability of omni-channel pre-ordering (i.e., compared to traditional online pre-ordering), a new advance selling strategy for retailers whereby consumers can solve product value uncertainty first and then decide whether to purchase in advance. Our analysis finds that advance selling is not always an appropriate choice for the retailer, but is contingent on related costs (e.g., losses from the costs of returns for retailers and consumers and the hassle cost of solving uncertain value for consumers). Specifically, only when the retailer’s return cost is relatively low and the hassle cost of solving uncertain value is relatively high should the retailer adopt the traditional online pre-ordering strategy. However, when the hassle cost of solving uncertain value is relatively low, the omni-channel pre-ordering strategy is more profitable for the retailer. By contrast, advance selling should not be offered when the retailer’s return cost and the hassle cost of solving uncertain value are both high. Next, we derive the optimal advance selling price and ordering quantity for the regular season for different strategies. Our results reveal that the optimal price varies along with the costs involved in the consumer’s purchasing choice. Finally, we find that the retailer is more likely to order a smaller quantity when the traditional online pre-ordering option is used.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The launch of a new product brings two main challenges to the firm’s operations: firm’s uncertainty about product demand information and consumer’s uncertainty about product value. To reduce the uncertainty about product demand, many industries, such as the book and consumer electronics sectors, have begun to allow consumers to pre-order new products (Zhao and Stecke 2010). Advance selling can benefit a retailer for several reasons. For instance, advance selling allows the retailer to mitigate the mismatch between supply and demand by acquiring demand information. The demand uncertainty from the advance selling period can be eliminated completely because the advance orders are precommitted, and the retailer can update the demand forecast information in the regular selling period, leading to lower inventory risk (Tang et al. 2004; Prasad et al. 2011; Ma et al. 2019). The potential benefits of advance selling have been attracting increasing interest from both academics and practitioners (Xie and Shugan 2001; Li and Zhang 2013; Wei and Zhang 2018a).

Although advance selling is beneficial to improve the information transparency for the retailer, consumers may hesitate to purchase in advance because new product information is often private to the retailer and unclear to consumers (Wang et al. 2019). Consumers cannot examine all the features of new products or know their precise value when they place pre-orders using traditional online channels (Shi et al. 2018). Consumer valuation uncertainty of new products inevitably leads to the product return, which generates a significant impact on consumers’ purchasing behavior. This is exactly what Bell et al. (2017) commented, consumers’ inability to touch and feel new products before buying can (1) deter purchase and (2) increase return costs due to dissatisfaction with the product. Therefore, it is necessary to consider the consumer return into the study of advance selling. To address this problem, some retailers have adopted an omni-channel pre-ordering strategy to share a new product’s information with consumers. Specifically, in addition to offering the traditional online pre-ordering options, these retailers are transforming their offline stores into physical showrooms and displaying new to-be-released products to solve consumers’ valuation uncertainty by allowing consumers to examine the new products thoroughly (Gao and Su 2019). Consumers can then place a pre-order either online or offline. This new strategy was used in the two examples below:

-

At an exclusive launch event held on March 27 at the iconic Grand Palais, Huawei Consumer Business Group unveiled the much-anticipated HUAWEI P20 and HUAWEI P20 Pro. They have already existed in the domestic offline experience stores; consumers can examine new products thoroughly. After experience, consumers who want to buy can pre-order either from the online channel or offline channel. “Even though a product is selling online, people are very keen to see and feel a product at an offline store. The experience store is a part of our offline strategy,” said by a manager from Huawei India Consumer Business Group.Footnote 1

-

Toronto Fashion Week and THE COLLECTIONS\(^{\mathrm{TM}}\) are pleased to announce the RE\(\setminus \)SET\(^{\mathrm{TM}}\) 003 Designer Showroom, located on the second floor of Yorkville Village. Open to the public daily, consumers will have the opportunity to pre-order their desired products. In addition to pre-order, consumers can purchase pieces directly off the runway, eliminating the usual wait time of four to six months.Footnote 2

Many consumers enjoy the convenience of pre-ordering directly without realizing product valuations. However, conducting inspections in offline physical showrooms allows consumers to examine the new product thoroughly in order to resolve product value uncertainty. This option is beneficial to improve the information transparency for consumers, and is especially valuable for new to-be-released products. Since these products are new to the market, it may be hard for consumers to value the products precisely before they have started to be adopted or evaluated. Therefore, some consumers may prefer to first examine the product in offline physical showrooms to ensure that it fits their needs and preferences before deciding whether to purchase in advance. Moreover, the retailer’s configuration policy also affects consumers’ choices. On the one hand, consumers dealing with retailers that play only one role—a traditional online channel offering direct pre-orders—must wait until the regular season before they can determine whether they like the product. As a result, the return of unsatisfied products will incur costs. Thus, when deciding whether to purchase in advance, consumers evaluate the trade-off between possession and the possible loss due to uncertain product valuations. On the other hand, when the retailer plays a dual role (i.e., resolving product valuation uncertainty by permitting consumers to examine the product in offline physical showrooms and offering a channel via which to pre-order the product). Consumers will incur a hassle cost due to the need to travel to the store and assess the product. Under these circumstances, consumers will have three choices: (i) pre-order the product directly; (ii) inspect the product at a physical showroom and then decide whether to purchase in advance; or (iii) buy the product in the regular season. Consumers make optimal choices according to the trade-off between the potential return costs and hassle costs of solving uncertain valuations.

In view of the above discussion, we consider a retailer that sells a new type of product to consumers over two periods—the advance selling period and the regular selling season. There are two types of consumers: informed and uninformed consumers according to whether to know the information of advance selling. Informed consumers have the opportunity to buy new products during the advance selling period. Uninformed consumers can make purchases only in the second period, during which valuations become known to themselves but are not revealed to the retailer no matter which purchase channel they chose to use. This paper incorporates the aspects of consumer behavior into the retailer’s strategy and provides answers to the following three questions. First, should retailers adopt an advance selling strategy, and, if they should, is it worthwhile to configure physical showrooms in which consumers could examine to-be-released products (i.e., omni-channel pre-ordering)? Second, what are the optimal pricing and ordering decisions for the different strategies? Third, how is the optimal pricing strategy influenced by the retailer’s and consumer’s costs?

Our contribution to the literature and practice is threefold. First, product valuation uncertainty has significant impacts on consumers’ purchasing behavior. Our study considers two policies: the physical showroom and full-return in the advance selling environment. For retailers, simultaneously adopting advance selling strategy to acquire demand information and offering a physical showroom to reveal new product information are two important steps for eliminating the information asymmetry between retailers and consumers, which are rarely investigated. Using game theory and utility theory approaches, we solve a newsvendor problem involving a omni-channel retailer and consumers. Second, our study investigates the conditions under which retailers decide whether to configure a physical showroom during the advance selling period in light of the potential for losses. Through analysis, we finds that advance selling is not always an appropriate choice for the retailer, but is contingent on related costs (e.g., losses from the costs of returns for retailers and consumers and the hassle cost of solving uncertain value for consumers). Third, we derive the optimal advance selling price and ordering quantity for the regular season under different strategies. These findings provide important insights into the optimal decisions of the advance selling strategy for omni-channel retailers.

The rest of the paper is organized as follows. The next section reviews the literature. Section 3 introduces the study’s problem settings. Section 4 presents the study’s model and optimal solutions for three strategies: no advance selling, traditional online pre-ordering, and omni-channel pre-ordering options. Section 5 provides guidance for the retailer in choosing the right advance selling strategy and conducts a numerical study on advance selling strategies’ sensitivity to retailer and consumer characteristics. Finally, Sect. 6 concludes the paper and suggests avenues for future research. All proofs are provided in the “Appendix”.

2 Literature review

Our study investigates the effects of advance selling strategy and showroom on improving the information transparency of new products. The related literature could be divided into the following three aspects: advance selling, consumers returns, and physical showrooms.

The importance of advance selling has grown in recent years. Many studies focus on the optimal pre-order strategy and examine the conditions under which a retailer should adopt an advance selling strategy. Xie and Shugan (2001) show that consumers face product valuation uncertainty during the advance selling period and determine when and how to advance sell in a variety of situations. Zhao and Stecke (2010) study how a retailer could design an advance selling strategy to maximize profits when faced with loss-averse consumers. The retailer can choose from among three strategies: no advance selling, moderate advance selling with a moderate discount for pre-orders, and deep advance selling with a deep discount for pre-orders. Nasiry and Popescu (2012) examine how anticipated regret affects consumer decisions and firm profits and investigate strategies in an advance selling context where consumers have uncertain valuations. Based on the consideration that consumer’s valuation is jointly determined by the product’s inherent quality and private fitness, Xiao et al. (2019) investigate a seller’s equilibrium pricing strategies under two classic advance selling pricing schemes: the dynamic pricing scheme and price commitment scheme. Advance selling can reduce inventory risk: The retailer can utilize advance selling demand information to update the regular selling demand (Tang et al. 2004; Prasad et al. 2011; Zhao et al. 2016). However, Li and Zhang (2013) show that this kind of information may hurt a retailer. Furthermore, some studies find that the retailer can influence consumer behavior in the advance selling setting via information-based control. Chu and Zhang (2011) investigate information and pricing strategies for sellers. They show that the seller’s optimal information strategy depends on the ratio of the expected profit margin to the standard deviation of consumer valuation. Virtually all studies assume that consumers always face uncertain product valuations during the advance selling period and must place their pre-orders online. By contrast, this study considers a new omni-channel pre-ordering strategy. In addition to offering traditional online pre-ordering options, some retailers transform their offline stores into physical showrooms and display new to-be-released products; this solves consumers’ valuation uncertainty, since consumers can evaluate the new products offline before making a purchase. Furthermore, we also consider the cost of solving uncertain valuation in advance, which is largely ignored in similar strategies, such as product previews and trials.

Consumers who are deciding whether to purchase before the product is released will anticipate future product availability and the value realization; they will then choose a purchase timing that maximizes their expected utility (Su and Zhang 2008; Li et al. 2019c). Generally speaking, if pre-ordering consumers dislike the product they receive, they will return it. Most studies examine the optimal return policies in the single-selling strategy model (Ferguson et al. 2006; Su 2009; Chen and Bell 2013; Karakayali et al. 2013; Choi and Guo 2018; Zhang et al. 2018; Li et al. 2019a; Chou et al. 2020; He et al. 2020; Taleizadeh et al. 2020; Yang et al. 2020; Zhou et al. 2020). However, few studies explore the return policy for the advance selling strategy. Li et al. (2014) explore the advance selling strategy for a retailer who sells fashion products by considering potential consumer opportunistic returns. Shi et al. (2018) study the buy-online-and-pick-up-in-store (BOPS) strategy with pre-orders for a retailer. They analyze and compare three kinds of selling strategies: 1) store-only selling, 2) BOPS with pre-orders and product returns, and 3) BOPS with pre-orders and no product returns. Amid the era of service systems, Xie and Gerstner (2007) discuss the benefits of letting customers escape from pre-purchased service contracts by offering refunds for cancellations. Oh and Su (2018) consider a reservation policy in which the firms like restaurants ask for an upfront reservation deposit. The nonrefundable deposit is deducted from the dinner bill when the customer shows up for the reservation; if the customer does not show up, the firm keeps the deposit. Other studies focus on strategies that can counteract consumers’ strategic behavior and make them buy immediately (Liu and Van Ryzin 2008; Su 2009; Swinney 2011; Altug and Aydinliyim 2016). Wei and Zhang (2018a) study the effectiveness of the preorder contingent production strategy, a new advance selling strategy wherein the seller’s production decision is contingent on an advance selling target, in counteracting strategic consumer behavior.

As an alternative method of mitigating strategic waiting behavior, physical showrooms provide a place where consumers can experience the product before purchasing. This is often adopted in omni-channel settings. Balakrishnan et al. (2014) study how the browse-and-switch option affects retail and online-pricing strategies and profits by analyzing a model that incorporates product value uncertainty. Bell et al. (2015) identify and measure the critical impact of informational differences on customer migration and operational costs in an omni-channel setting. Gao and Su (2016) conduct a theoretical study on how retailers can effectively deliver online and offline information to omni-channel consumers who strategically choose whether to gather information and buy products online or offline. They consider three information mechanisms: physical showrooms, virtual showrooms, and availability information. Bell et al. (2017) isolate the information function of channels in the important context of online-first retailers that add showrooms. They verify that showrooms can deliver substantial demand- and supply-side benefits. Fernández et al. (2018) empirically examine the effects of “webrooming” and showrooming on consumers’ purchasing behaviors, showing that showroomers are willing to pay a high price for a hedonic product. Mehra et al. (2018) analyze price matching as a short-term strategy and exclusivity of product assortments as a long-term strategy to counter showrooming. Li et al. (2019b) investigate the impacts of showrooming effect on firm’s decisions under three different service effort strategies. Their results indicate that firm could benefit most from the showrooming effect under the ex-post service effort strategy. Zhang et al. (2020) develop a theoretical model to investigate consumer inter-product showrooming behavior and the information service provision in an omni-channel supply chain. Therefore, the physical showroom can be regarded as a way of product information sharing between retailers and consumers.

Our study differs from the existing literature in the following ways. First, unlike most other strategies for resolving uncertainty in consumer valuations such as product previews, sampling, trials or return guarantees (Bhargava and Chen 2012), our strategy considers the cost of solving valuation uncertainty, and our study investigates how physical showrooms impact the advance selling strategy based on consumers’ choices. Second, various mechanisms have been proposed in the literature to counteract the adverse impact of strategic consumer behavior, including capacity/production control, pricing control, and information-based control (Wei and Zhang 2018a, b). This study discusses product information leakage—whereby consumers choose to purchase in advance after inspecting the new product thoroughly in an offline physical store—as a new issue related to information control. Numerous studies explore the issues on information (e.g., information asymmetry, information acquisition, information sharing) between the manufacture and the retailer (Xue et al. 2017; Li et al. 2020a, b). To the best of our knowledge, this study is the first to explore the benefits of omni-channel pre-ordering, as opposed to traditional online pre-ordering. Table 1 displays the position of this study, thereby indicating our contributions to the literature.

3 The model

We consider a retailer (“he”) selling with pre-order options, implying that he offers the consumer (“she”) two distinct prices: advance selling price X in period 1 (the advance selling period) and full price p (\(>X\)) in period 2 (the regular selling season). Each product is purchased at price c, and unsold items are salvaged at s per unit at the end of the regular selling season. Table 2 summarizes the main notations used in our models.

During the advance selling period, consumers are uncertain about their valuations for the new product (Zhao and Stecke 2010; Prasad et al. 2011; Bhargava and Chen 2012). In order to eliminate the negative effect of valuation uncertainty, the retailer can choose to adopt an omni-channel pre-ordering strategy by configuring physical showrooms in which consumers can examine the forthcoming to-be-released products thoroughly when they see the actual products. As previous studies on advance selling (e.g., Prasad et al. 2011; Shi et al. 2018) suggest, two sequential decisions are required from the retailer. In the first, the retailer commits to a fixed price path, including an advance selling price X and a regular selling price p (Zeng 2013). Second, the retailer decides on the quantity of products to procure (i.e., \(Q+n\)), where n fulfills the pre-determined advance demand, and Q is prepared for the forthcoming regular selling season. This decision is made at the start of the regular season so that the information from the advance demand can be used to update the forecast for the regular demand. Here, we assume that each consumer who buys with a pre-order is guaranteed to receive a unit of the product. The overall goal is to study the different environments the retailer faces in making decisions about whether to adopt an advance selling strategy and the conditions under which the retailer should provide omni-channel pre-ordering options, implying the need to configure physical showrooms to solve consumers’ valuation uncertainty during the advance selling period.

Depending on whether being offered with pre-order options, consumers in the market are devided into two types, referred to as informed and uninformed consumers. The numbers of both types are random and nonnegative, and denoted by \(N_i\) and \(N_u\), respectively; these are jointly distributed as a bivariate normal distribution with means \(\mu _i\) and \(\mu _u\), standard deviations \(\sigma _i\) and \(\sigma _u\), and correlation coefficient \(\rho \in (-1,1)\). We then let random variable V represent consumer valuation that follows a general distribution function \(F(\cdot )\) with a bounded support on [l, h] and has expected value \(\mu _v\) and standard deviation \(\sigma _v\). However, informed consumers dealing with a retailer that has configured a physical showroom can learn their valuations before purchase. This assumption is reasonable for many products, such as electronics, video games, household appliances, and apparel. For instance, consumers seeking to purchase a smartphone in advance focus on product information about pictures and product capability before the product is launched. They may not be sure of whether the purchased products fit them before using (Xiao and Shi 2016). In a physical showroom, however, consumers can “touch and feel” an item and verify its fit and features. Showrooms also often provide facilities where consumers can try the product or see demonstrations. These experiences will often provide consumers with what they need to decide whether they like the product (Balakrishnan et al. 2014).

Consumer surplus can be derived under two scenarios based on whether omni-channel pre-ordering options are offered. In one scenario (i.e., online pre-ordering only), consumers who purchase in advance cannot realize their product valuations until they receive the new product in the regular selling period. If they like the product, they keep it and receive surplus \(V-X\); if they dislike it, they return it. Returns are costly to both the retailer and consumers: each returned unit generates net loss \(r>0\) to the retailer and hassle cost \(h_r>0\) to consumers (Gao and Su 2016). We assume that consumers whose realized valuations are low prefer returning the product to keeping it (i.e., \(h_r<X\)). Therefore, consumers’ expected utility from purchasing in advance is given by \(U_A=E_V\max (V-X, -h_r)\). We do not consider the hassle cost of pre-ordering directly because pre-ordering consumers are often not charged for delivery, and they receive the new product soon after it is released.

In the other scenario (i.e., omni-channel pre-ordering options are offered), each consumer has an opportunity to inspect the new product even during the advance selling period. Those who do so incur hassle costs \(h_s\) to resolve their valuation uncertainty (e.g., traveling to the store and experiencing the product). We assume that all informed consumers have the same \(h_r\) and \(h_s\). After informed consumers have visited the physical store before purchasing in advance, they pre-order only when their realized value is greater than the advance selling price. Thus, consumers’ expected utility can be expressed as \(U_S=-h_s+\int _X^h (v-X)f(v)\, dv\). To eliminate trivial cases, the model assumes that \(h_r<X\) and \(h_s<\int _X^h (v-X)f(v)\, dv\). Strictly speaking, the retailer who decides to provide physical showrooms will incur a fixed cost T to construct the infrastructure required for consumers to touch and feel the new product. Our results and insights continue to hold qualitatively true when this fixed cost is excluded; thus, without deviating from the purpose of this research, we keep the cost set at zero (i.e., \(T=0\)).

Consumers who do not buy with a pre-order will wait until the regular selling season and choose to buy and get a surplus of \(v-p\) if their realized valuations are at least equal to the regular selling price and the product is available; otherwise, they receive zero. Uninformed consumers face the same decision faced by informed consumers who do not choose a pre-order option: purchasing or leaving. Let \(\mu _W\) denote the mean of consumer surplus when there is no purchase in advance, and there is a risk of stock-out in the regular selling season, denoted as \(\eta \). Thus, consumers’ expected utility is \(U_W=(1-\eta )\int _p^h (v-p)f(v)\, dv\).

Informed consumers make decisions about whether to place a pre-order during the advance selling period. They are willing to purchase in advance if and only if \(U_A\ge U_W\) when only online pre-ordering is offered. When the advance selling period finishes, they can decide whether to return the product after realizing their valuations. Those with \(V\in (X-h_r, X)\) will not like the product (since \(V<X\)), but they will not return it because the return cost is too high (since \(V-X>-h_r\)). However, when the retailer offers consumers omni-channel pre-ordering options in order to solve their uncertain valuations, each consumer makes a choice between purchasing in advance directly or going to the offline store first. Consumers choose the former if and only if \(U_A\ge U_S\ge U_W\); otherwise, they prefer to examine the new product in the physical store (i.e., \(U_S>U_A\ge U_W\)). Uninformed consumers can purchase only during the regular selling period contingent on new product availability if their realized valuations are at least equal to the regular selling price p.

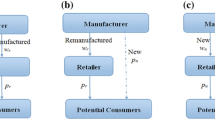

4 Three types of retailer strategy

In this section, the retailer can adopt three strategies: no advance selling, traditional online pre-ordering, and omni-channel pre-ordering. Optimal profits are compared among the strategies in order to determine the conditions under which each strategy is optimal. Taking consumer behavior into consideration, the retailer can set an advance selling price and offer omni-channel pre-ordering options in order to lead consumers to make decisions that are beneficial to him. The following proposition provides guidelines by which the retailer should set the advance selling price X.

Proposition 1

If the retailer offers only the traditional online pre-ordering option during the advance selling period, then informed consumers purchase in advance if and only if \(X+\int _{X-h_r}^h F(v)\, dv\le p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\); otherwise, no consumers buy the new product early. If the retailer offers omni-channel pre-ordering options, informed consumers will have three choices:

(a) pre-order directly if and only if \(\int _{X-h_r}^{X} F(v)\, dv\le h_s\) and \(X+\int _{X-h_r}^h F(v)\, dv\le p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\);

(b) inspect-first-and-then-buy if and only if \(\int _{X-h_r}^{X} F(v)\, dv>h_s\) and \(X+\int _X^h F(v)\, dv\le p-h_s+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\);

(c) no consumers purchase early if and only if \(X+\int _{X-h_r}^h F(v)\, dv>p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\) and \(X+\int _X^h F(v)\, dv>p-h_s+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\).

Proposition 1 incorporates consumer choices into the retailer’s decision making. Section 4.1 provides a profit benchmark for when the retailer sells only in the regular season. Section 4.2 analyzes traditional online pre-ordering, wherein informed consumers have to decide in which period they will purchase. Section 4.3 explores a new type of advance selling, omni-channel pre-ordering, wherein informed consumers have two advance purchase options.

4.1 No advance selling

When the retailer does not adopt an advance selling strategy or if the price during the advance selling period is so large that \(U_W>U_A\) and \(U_W>U_S\), all consumers will not purchase in advance, implying no advance demand. As for the regular demand, some consumers whose realized valuations are equal to or higher than the regular selling price will buy new products. The regular demand is then \(N_2={{\bar{F}}}(p)(N_i+N_u)\), which is a linear combination of \(N_i\) and \(N_u\). Following the previous literature (e.g., Zhao and Stecke 2010; Prasad et al. 2011; Shi et al. 2018), the linear combination of \(N_i\) and \(N_u\) follows a normal distribution. Thus, random variable \(N_2\) has the following mean and standard deviation:

Let \(\Pi _{basic}\) be the optimal expected profit in the basic model without adopting any advance selling strategies, we have

where the first term represents the procurement cost, the second term is the regular selling benefits, and the last one is the salvage value of unsold items.

The retailer will determine the optimal order quantity \(Q_{basic}\) in order to maximize the expected profit \(\Pi _{basic}\). According to Silver et al. (1998) and Shen et al. (2013), the optimal order quantity \(Q_{basic}\) is given as:

and corresponding optimal expected profit

where \(k=\varphi ^{-1}(\frac{p-c}{p-s})\), \(\phi (\cdot )\) and \(\varphi (\cdot )\) represent the cumulative and density distribution functions, respectively, of the standard normal distribution.

4.2 Traditional online pre-ordering

In this subsection, we consider the case in which a retailer offers only online pre-ordering options to consumers. Here, consumers are uncertain about their product valuations during the advance selling period. According to Proposition 1, when the retailer does not offer a physical showroom during this period, all informed consumers buy the new product in advance if and only if \(U_A\ge U_W\). The retailer will charge the highest price at which all informed consumers are induced to purchase in advance (Prasad et al. 2011). At the start of the regular selling season, uninformed consumers arrive and prefer to buy new products if and only if their realized valuations are at least equal to the regular selling price p. Therefore, the advance and regular demands are expressed as \(N_1=N_i\) and \(N_2=N_u{{\bar{F}}}(p)\), respectively, and follow a binomial normal distribution with means \(\mu _1=\mu _i\) and \(\mu _2=\mu _u{{\bar{F}}}(p)\), standard deviations \(\sigma _1=\sigma _i\) and \(\sigma _2=\sigma _u{{\bar{F}}}(p)\), and correlation coefficient \(corr(N_1, N_2)=\rho \).

As stated in Bickel and Doksum (1977), advance demand information (i.e., n: the number of pre-orders) can be used effectively in order to improve the forecast of the regular demand \(N_2\). After the update, the demand \(N_2\) has a new mean and standard deviation which are expressed as follows:

which specify that the mean of the regular demand is corrected by the number of pre-orders and the correlation between informed and uninformed consumers, and the standard deviation of the regular demand is becoming smaller.

Let \(\Pi _A\) denote the total expected profit when the retailer only offer the traditional online pre-ordering during the advance selling period. Thus we have

where \((X-c)N_1{{\bar{F}}}(X-h_r)\) gives the profit from the advance selling period and \(rN_1F(X-h_r)\) is the loss from consumer returns. The last term specifies the expected profit from the regular selling period.

Similar to the previous analysis, the optimal order quantity Q can be expressed as follows:

and the corresponding optimal total profit

By comparing the last term in expression (10) with that in (5), we find that the advance selling strategy can largely reduce the variability of regular demand, that is, \((p-s)\varphi (k){{\bar{F}}}(p)[(\sigma _i^2+\sigma _u^2+2\sigma _i\sigma _u\rho )^{\frac{1}{2}}-\sigma _u\sqrt{1-\rho ^2}]>0\). Such a situation is caused by the factor that the information of pre-determined advance demand can help the retailer update the forecast of the regular demand, thereby also reducing its variability.

4.3 Omni-channel pre-ordering

For the omni-channel pre-ordering strategy, we suppose that the retailer offers both online and offline pre-ordering options. In other words, a physical showroom is provided in offline stores during the advance selling period. Informed consumers can thus inspect the new product and thereby resolve their product valuation uncertainty. In this subsection, we study the optimal order quantity and corresponding total expected profit when the retailer has configured such a physical showroom. We start by considering the consumer’s purchase options: purchase in advance directly, inspect-first-and-then-buy, and wait until the next period.

4.3.1 Purchase in advance directly

Under this condition, informed consumers purchase in advance directly if and only if \(U_A\ge U_S\) and \(U_A\ge U_W\); uninformed consumers arrive in the second period and are willing to purchase if they obtain a positive surplus. The demand during the advance and regular selling periods is \(N_1=N_i\) and \(N_2=N_u{{\bar{F}}}(p)\), respectively.

Similar to Sect. 4.2, we can obtain the retailer’s optimal order quantity and corresponding total expected profit expressed as follows:

4.3.2 Inspect-first-and-then-buy

In this case, informed consumers choose to examine the new product in the physical showroom to resolve their valuation uncertainty before they purchase in advance if and only if \(U_S\ge U_A\) and \(U _S\ge U_W\). Uninformed consumers prefer to purchase in the regular season if they obtain a positive surplus. The demand is thus \(N_1=N_i\) and \(N_2=N_u{{\bar{F}}}(p)\), respectively.

Similarly, we can write the retailer’s optimal order quantity as follows:

and corresponding total expected profit

where \((X-c)\mu _i\) gives the profit from the advance selling period; the last term specifies the expected profit from the regular selling period. Because all informed consumers who purchase in advance have examined the product in the physical showroom, i.e., realizing their valuation, they always receive the product that they like. As a result, it never leads to the return costs for the reason of the mismatch between the product and consumers’ expected preferences for the retailer.

Two results are obtained by comparing the optimal order quantities between the different strategies. First, advance selling seems to help the retailer better predict demand and thus lower inventory risk. Second, the retailer can order less when the informed consumers choose to pre-order directly via the omni-channel pre-ordering strategy, because the retailer can recycle the products obtained from consumer returns to satisfy the regular demand.

4.3.3 Wait until the next period

The retailer sets a higher advance selling price so that all informed consumers prefer to purchase in the regular selling season. Thus the demand from the advance selling period is then zero (i.e., \(N_1=0\)).

As in the no advance selling strategy, all consumers buy new products only during the regular selling period. Thus, we can obtain the retailer’s order quantity and optimal profit under this strategy:

5 Retailer’s advance selling decision-making

The retailer needs to make a choice at the beginning of the advance selling period between the three alternative advance selling strategies—no advance selling, traditional online pre-ordering, and omni-channel pre-ordering. This choice is influenced by two sources of uncertainty: demand uncertainty and consumer valuation uncertainty. To gain insights into this dilemma, we first analyze the retailer’s advance pricing decisions and corresponding expected profits for each advance selling strategy. We then compare the total profits and discuss the retailer’s advance selling decision-making process. For calculation convenience, we further assume that the consumer’s valuation V is uniformly distributed within the range [l, h].

5.1 Optimal decisions in traditional online pre-ordering

The advance selling and regular selling prices are announced simultaneously to induce all informed consumers to purchase at the beginning of the first period. That is, if the retailer decides to sell in advance, then his problem is as follows:

subject to \(X+\int _{X-h_r}^h F(v)\, dv\le p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\).

Because the total expected profit \(\Pi _A\) is strictly concave in advance selling price X, we can obtain optimal decisions for the retailer which are expressed in following Proposition 2.

Proposition 2

When the retailer sells new products only with online pre-ordering options, he will set an optimal advance selling price \(X^{*}=\min \{X_1^{*}, X_2^{*}\}\), where \(X^{*}=X_1^{*}=\frac{h+h_r+c-r}{2}\) if \(r>c-h-h_r+2\sqrt{(1-\eta )(h-p)^2+2(h-l)h_r}\); otherwise \(X^{*}=X_2^{*}=h+h_r-\sqrt{(1-\eta )(h-p)^2+2(h-l)h_r}\), and the corresponding total expected profits are

respectively.

Proposition 2 shows that the optimal advance selling price can be divided into two cases: 1) high return cost and 2) low return cost. It is intuitive that the retailer decides the optimal price to obtain one of the equations above depending on his return cost. In Lemma 1, we present some analytical properties of the optimal advance selling price \(X^{*}\).

Lemma 1

(i) The retailer’s optimal advance selling price increases with the consumer’s hassle cost for returns if \(0<h_r\le \max \{0, G\}\) or \(h_r>H\), but is convex in the hassle cost if \(\max \{0, G\}\le h_r<H\), where \(G=c+3h-4l-r-2\sqrt{(1-\eta )(h-p)^2+2c(h-l)+2h^2-6hl-2hr+2lr+4l^2}\), \(H=c+3h-4l-r+2\sqrt{(1-\eta )(h-p)^2+2c(h-l)+2h^2-6hl-2hr+2lr+4l^2}\).

(ii) The retailer’s optimal advance selling price is non-increasing with the return cost.

It should be noted that consumers are not likely to return a product when the difference between the realized valuation and purchasing price is small. Lemma 1 (i) shows that the retailer’s optimal advance selling price is first increasing, then decreasing, and finally increasing along with the hassle cost to consumers. Specifically, when the hassle cost of returning is relatively low, a rising advance selling price has less impact on informed consumers’ decisions. Consumers who like the product will keep it; those who dislike it will return it. This will lead to more advance demand. When the hassle cost is moderate, the retailer needs to decrease the advance selling price because a relatively high hassle cost of product return will prevent informed consumers from purchasing in advance. They would rather wait until the regular season to purchase after learning their product valuation. However, when the hassle cost is very high, the retailer will not set a sufficiently low price because of cost requirements; on the other hand, pre-ordering consumers will not choose to return the product even if they dislike it. Therefore, the retailer will increase the advance selling price. Lemma 1 (ii) implies that there exists a threshold on the return cost for the retailer: The retailer should adopt a lower advance selling price to reduce returns only when the return cost is higher than this threshold. To make this property clear, we vary \(h_r\) and r while keeping other parameters fixed (i.e., \(p=100\), \(c=70\), \(s=50\), \(\eta =0.4\), \(\mu _v=90\), and \(\sigma _v=30\)) and graph the optimal advance selling prices as shown in Fig. 1. From Fig. 1, we see that it is lower than the regular selling price. This means that the retailer is willing to use an advance selling discount strategy to attract consumers to place pre-orders.

5.2 Optimal decisions in omni-channel pre-ordering

In the omni-channel pre-ordering strategy, the retailer provides consumers with physical showrooms to solve their valuation uncertainty during the advance selling period. Consumers, therefore, have three purchasing options: (1) purchase in advance directly, (2) inspect-first-and-then-buy (i.e., informed consumers purchase with pre-orders after they inspect the new product in the offline stores), or (3) wait until the next period because of a high advance selling price. In what follows, we present the retailer’s optimal decisions and corresponding total expected profits for each case.

(1) In the first case, the informed consumers choose to pre-order directly considering three conditions: i) facing the stock-out risk if purchasing in the regular season, ii) having a relatively high expected valuation, and iii) facing a relatively high hassle cost of solving uncertain value. Under such circumstances, there is no need to inspect the new product in the physical showroom before deciding whether to purchase. Based on the above description, the retailer’s problem is as follows:

subject to \(\int _{X-h_r}^{X} F(v)\, dv<h_s\) and \(X+\int _{X-h_r}^h F(v)\, dv\le p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\).

Note that \(\Pi _1\) is strictly concave in advance selling price X. We then present the optimal pricing decision for the retailer which are expressed in following Proposition 3.

Proposition 3

When the retailer sells new products in advance with omni-channel pre-ordering options, he will set the optimal advance selling price \(X^{*}=\min \{X_3^{*}, X_4^{*}, X_5^{*}\}\) to induce all informed consumers to pre-order directly, where \(X_3^{*}=\frac{h+h_r+c-r}{2}\), \(X_4^{*}=h+h_r-\sqrt{(1-\eta )(h-p)^2+2(h-l)h_r}\), and \(X_5^{*}=\frac{h_s(h-l)}{h_r}+\frac{h_r}{2}-l\). The corresponding total expected profits are

respectively.

Proposition 3 indicates that the retailer can obtain the same total expected profit when offering omni-channel pre-ordering options as is obtained in Proposition 2. However, although the retailer has more choices of advance selling price in this case, the solution constraints become contractible, leading to less optimal solutions. Thus, configuring the physical showroom to help informed consumers solve their value uncertainty during the advance selling period could backfire for the retailer because of the need to adopt an advance selling price to induce all consumers to purchase in advance that is lower than that set in the traditional online pre-ordering strategy; this leads to lower profits.

Lemma 2

(i) The retailer’s optimal advance selling price is convex in the consumer’s hassle cost for returns, i.e., \(\frac{\partial {X_5^{*}}}{\partial {h_r}}=\frac{1}{2}-\frac{h_s(h-l)}{(h_r)^2}\), \(\frac{\partial ^2{X_5^{*}}}{\partial ({h_r})^2}=\frac{2h_s(h-l)}{(h_r)^3}>0\);

(ii) The retailer’s optimal advance selling price is non-decreasing with the hassle cost of solving value uncertainty, i.e., \(\frac{\partial {X_5^{*}}}{\partial {h_s}}=\frac{h-l}{h_r}>0\).

Lemma 2 has properties similar to those of Lemma 1. First, Lemma 2 (i) shows that the retailer’s optimal advance selling price is also first increasing, then decreasing, and lastly increasing along with the hassle cost of consumer returns even if informed consumers are provided with a physical showroom during the advance selling period. In this case, similar to the scenario where only online pre-ordering is offered, informed consumers will place pre-orders directly. Next, Lemma 2 (ii) indicates that the advance selling price first increases along with the hassle cost of solving value uncertainty and then remains unchanged. Intuitively, at high values of \(h_s\), visiting the store to experience the new product in the physical showroom becomes less attractive for informed consumers than purchasing in advance directly. However, at low values of \(h_s\), the retailer needs to announce a lower price in order to induce consumers to place pre-orders directly; otherwise, informed consumers will choose to experience the product offline before making a purchasing decision.

(2) In this case, the informed consumers choose to visit the physical showroom in order to examine the new product because of the high value uncertainty risk or low hassle cost of eliminating this uncertainty, and then place an order if they are satisfied with the new product. Based on this behavior, the retailer’s problem is as follows:

subject to \(\int _{X-h_r}^{X} F(v)\, dv\ge h_s\) and \(X+\int _X^h F(v)\, dv\le p-h_s+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\).

From the expression of objective function, the retailer’s total expected profit is increasing with advance selling price X. Thus we can obtain the optimal pricing decision for the retailer which are expressed in following Proposition 4.

Proposition 4

When the retailer sells new products in advance with omni-channel pre-ordering options, his optimal advance selling price \(X^{*}=\max \{X_6^{*}, X_7^{*}\}\), where \(X_6^{*}=\frac{h_s(h-l)}{h_r}+\frac{h_r}{2}-l\), \(X_7^{*}=h-\sqrt{(1-\eta )(h-p)^2+2(h-l)h_s}\); then all informed consumers choose offline experience firstly. The corresponding total expected profits are

Proposition 4 shows that return cost r has no effect on the retailer’s expected profit because the informed consumers have all solved their value uncertainty before purchasing in advance. Consumers who are satisfied with the new product will choose to purchase, implying that they can obtain a positive surplus. The following lemma presents the main analytical properties of the optimal advance selling price.

Lemma 3

(i) Optimal advance selling price is first decreasing and then increasing along with hassle cost \(h_s\), i.e., \(\frac{\partial {X_6^{*}}}{\partial {h_s}}=\frac{h-l}{h_r}>0\); \(\frac{\partial {X_7^{*}}}{\partial {h_s}}=-\frac{h-l}{\sqrt{(1-\eta )(h-p)^2+2(h-l)h_s}}<0\).

To make this property clear, we vary \(h_s\) from 0 to 30 while keeping other parameters fixed (i.e., \(p=100\), \(c=70\), \(s=50\), \(\eta =0.4\), \(\mu _v=90\), \(\sigma _v=30\), \(h_r=20\), and \(r=15\)) and graph the optimal advance selling prices in Fig. 2. From Fig. 2, we observe that optimal pre-order price is quasi-convex in the hassle cost \(h_s\). Intuitively, when the hassle cost is in lower range, the retailer needs to set a lower price to induce informed consumers to place pre-orders when the hassle cost of solving value uncertainty gets larger. When the hassle cost \(h_s\) is in higher range, the retailer has to increase advance selling price to offset the procurement cost. Moreover, if the hassle cost is larger than the threshold, the informed consumers will not visit the physical showroom, but choose to pre-order directly or purchase in the regular season.

(3) In the last case, all informed consumers will not buy the new product during the advance selling period due to high price. The retailer’s problem is the same as basic model: no advance selling. Thus

subject to \(X+\int _{X-h_r}^h F(v)\, dv>p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\) and \(X+\int _X^h F(v)\, dv>p-h_s+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\).

Similar to previous analysis, we can obtain the optimal decision for the retailer which are expressed in following Proposition 5.

Proposition 5

When the retailer sells new products in advance with omni-channel pre-ordering options, his optimal advance selling price \(X_8^{*}>\max \{h-\sqrt{(1-\eta )(h-p)^2+2(h-l)h_s}, h+h_r-\sqrt{(1-\eta )(h-p)^2+2(h-l)h_r}\}\), then no consumers purchase early. Thus, the retailer’s optimal total expected profit is

Proposition 5 intuitively shows that a too high advance selling price will prohibit informed consumers purchasing in advance. They would rather wait for a low price in the regular selling season.

Based on above analysis, we can compare the optimal order quantities for the regular season under different advance selling strategies, which are illustrated in the following theorem.

Theorem 1

Comparing the optimal order quantity for the regular season in traditional online pre-ordering with that in omni-channel pre-ordering, we have \(Q^*\le Q_1^*<Q_2^*\).

Theorem 1 firstly implies that the retailer will order a smaller quantity when all informed consumers choose to pre-order directly in the omni-channel pre-ordering option. The reason is that the retailer can sell the products obtained from consumer returns to uninformed consumers during the regular selling season. In addition, Theorem 1 shows that the retailer should order a smaller quantity when using the traditional online pre-ordering option, compared to the omni-channel pre-ordering. The reason is that the retailer needs to announce a lower price to attract more advance purchases in the omni-channel pre-ordering option, leading to less returns even if some pre-purchased consumers are unsatisfied with the new product.

So far, we have obtain all optimal expected profits that the retailer may achieve under scenarios of no advance selling, traditional online pre-ordering strategy, and omni-channel pre-ordering strategy. In what follows, we will investigate under what condition which one of the three strategies mentioned above is the retailer’s best advance selling strategy?

5.3 Decision-making process

The retailer can make advance selling decisions by comparing the optimal expected total profits from among the three cases in the above subsection. Our first goal is to determine whether adopting an advance selling strategy is beneficial to the retailer. Let \(\Delta \Pi _{Ab}^1\) (\(\Delta \Pi _{Ab}^2\)) denote the difference between the optimal profits from traditional online pre-ordering strategy and no advance selling, i.e., \(\Delta \Pi _{Ab}^1=\Pi _{A1}^{*}-\Pi _{basic}\) and \(\Delta \Pi _{Ab}^2=\Pi _{A2}^{*}-\Pi _{basic}\). By comparing Equations (5) and (16), and (5) and (17), we obtain

the first term is a result of the tradeoff between increased advance demand and reduced profit margin. The second term measures the value of advance demand information updating, which can reduce regular inventory risk.

In addition, we let \(\Delta \Pi _{3b}\) (\(\Delta \Pi _{4b}\), \(\Delta \Pi _{5b}\), \(\Delta \Pi _{6b}\), and \(\Delta \Pi _{7b}\)) denote the difference between the optimal profits from traditional online pre-ordering strategy and no advance selling, where \(\Delta \Pi _{3b}=\Pi _{13}^{*}-\Pi _{basic}\), \(\Delta \Pi _{4b}=\Pi _{14}^{*}-\Pi _{basic}\), \(\Delta \Pi _{5b}=\Pi _{15}^{*}-\Pi _{basic}\), \(\Delta \Pi _{6b}=\Pi _{26}^{*}-\Pi _{basic}\), \(\Delta \Pi _{7b}=\Pi _{27}^{*}-\Pi _{basic}\). Because \(\Pi _{13}^{*}\), \(\Pi _{14}^{*}\) have same expressions with \(\Pi _{A1}^{*}\), \(\Pi _{A2}^{*}\), respectively, we omit them, and only present

All potential strategies will be adopted only if they can bring higher profit compared to no advance selling strategy.

More importantly, we need to determine whether the retailer can benefit more from offering informed consumers a physical showroom in which to resolve their valuation uncertainty during the advance selling period (i.e., omni-channel pre-ordering), leading to more advance demand. When comparing Propositions 2 and 3, we can observe that informed consumers who purchase in advance directly though they can inspect the new product in the store can bring the same or less profits to the retailer than that in the online pre-ordering scenario. Thus we need only compare the traditional online pre-ordering strategy to the inspect-first-and-then-buy case in the omni-channel pre-ordering strategy. In what follows, we use numerical studies to analyze the effects of the hassle costs and the marginal cost on the retailer’s advance selling strategy and then determine the optimal total expected profit. The basic parameters are as follows: \(p=100\), \(c=70\), \(s=50\), \(\eta =0.4\), \(\rho =0.5\), \(\mu _u=\mu _i=100\), \(\sigma _u=\sigma _i=10\), \(\mu _v=90\), and \(\sigma _v=30\). In Tables 3 and 4, the two values in parentheses denote the optimal profits from adopting the traditionalpre-ordering strategy and omni-channel pre-ordering strategy, respectively.

Assume that r varies from 0 to 10 increments, while all the other parameters are fixed at the given value shown above. In this setting, we aim to examine the effect of hassle cost r on the retailer’s advance selling decisions (see Fig. 3a). The findings are intended to help us identify the advance selling strategies that the retailer should adopt in different conditions.

Finding 1: All other parameters being fixed, \(\Pi _{A1}^{*}\) and \(\Pi _{A2}^{*}\) are decreasing with the return cost r, but \(\Pi _{26}^{*}\) and \(\Pi _{27}^{*}\) remain constant as r increases. In addition, if the variance exceeds a threshold, the traditional online pre-ordering strategy will not be better than the normal selling strategy. As an alternative to advance selling, the omni-channel pre-ordering strategy is superior to no advance selling strategy with regard to profit when the hassle cost of solving uncertain valuation is not sufficiently high.

The numerical study implies that the selling decision for retailers depends on the variance of their return cost and the hassle cost of solving uncertain valuation for consumers. When return cost r is sufficiently low and the hassle cost of solving uncertain valuation is sufficiently high, the retailer is immune to some of the returns made in the regular selling period. Thus, the retailer’s best selling strategy is to not configure a physical showroom. However, when the return cost increases, the retailer should adopt the omni-channel pre-ordering strategy. Because consumers who place pre-orders will solve their uncertain valuation through “inspect-first-and-then-buy” during the advance selling period, preventing product returns, the retailer would benefit more from this advance selling strategy.

Finding 2: All other parameters being fixed, \(\Pi _{A1}^{*}\) and \(\Pi _{A2}^{*}\) remain constant as the hassle cost \(h_s\) increases, but \(\Pi _{26}^{*}\) is increasing with \(h_s\), and \(\Pi _{27}^{*}\) is decreasing with \(h_s\). As shown in the tables, when the hassle cost \(h_s\) is lower than the threshold, the omni-channel pre-ordering strategy outperforms other strategies including the traditional online pre-ordering and no advance selling strategies.

For Finding 2, with the exception of the high hassle cost of solving uncertain value, we find that the omni-channel pre-ordering strategy is optimal for the retailer; this result was not shown in previous research. The reason is that, when hassle cost \(h_s\) is not high, more informed consumers prefer to experience the product in a physical showroom first. However, when \(h_s\) is sufficiently larger than the hassle cost of product return, the inspect-first-and-then-buy strategy becomes less attractive to informed consumers, who would rather pre-order directly or purchase in the regular season.

Finding 3: All other parameters being fixed, \(\Pi _{A1}^{*}\) and \(\Pi _{A2}^{*}\) are increasing with the return cost \(h_r\), but \(\Pi _{26}^{*}\) decreases as \(h_r\) increases, and \(\Pi _{27}^{*}\) remains unchanged.

Looking at Fig. 3c, it is not intuitive that, when hassle cost \(h_r\) is larger, the retailer benefits more by not configuring physical showrooms under the constraint of low return costs r. The reason for this is twofold. One is that a lower advance selling price will offset the negative effect of high return costs for pre-ordering consumers. At the same time, a higher return cost can prevent informed consumers from returning the products in the regular selling period. Second, the retailer is immune to some returns when the return cost is relatively low. Therefore, the retailer should not provide physical showrooms during the advance selling period if the hassle cost of returning is high for consumers. However, when the return cost is relatively high, the traditional online pre-ordering strategy is not the best choice for the retailer. When this result is combined with Finding 1, it is clear that the retailer should choose omni-channel pre-ordering.

Finding 4: All other parameters being fixed, \(\Pi _{A1}^{*}\), \(\Pi _{A2}^{*}\), \(\Pi _{26}^{*}\), and \(\Pi _{27}^{*}\) are decreasing with the marginal cost c.

For the retailer, a low profit margin is always unprofitable due to the high marginal costs. The threshold we identify indicates that a higher marginal cost favors no advance selling strategy.

6 Conclusion

Motivated by current industrial practices, we study the advance selling strategy under two scenarios according to whether omni-channel pre-ordering options are offered during the advance selling period. In the model, informed consumers face uncertain product valuation and do not realize their valuations until the regular selling period. In the traditional online pre-ordering option, consumers decide whether to purchase before new products are released by balancing the potential loss and the stock-out risk. However, in the omni-channel pre-ordering option, consumers have three choices: i) purchase in advance directly, ii) inspect-first-and-then-buy, or iii) purchase in the regular selling season. Consumers make optimal choices depending on the relative prices in both periods, the hassle costs of product return and examination, and the likelihood of realizing a relatively high valuation. Incorporating consumer behavior into the retailer’s strategy, we characterize the optimal pricing and ordering decisions for maximizing the retailer’s total expected profit. The analyses offer three main findings.

1) Going beyond traditional online pre-ordering options, we also incorporate the retailer’s configuration policies into the advance selling process and present a new type of advance selling, that is, omni-channel pre-ordering. By comparison, we find that advance selling is not always an appropriate choice for the retailer. Whether the retailer should implement advance selling, including traditional online pre-ordering or omni-channel pre-ordering, depends on the return cost, the hassle cost of solving uncertain value, and the return cost for consumers. First, regarding the consumer choice of pre-ordering directly in the omni-channel pre-ordering scenario, configuring physical showrooms to help informed consumers solve uncertain valuation during the advance selling period could backfire for the retailer because the retailer needs to adopt a selling price to induce all consumers to purchase in advance that is lower than the price offered in the online pre-ordering scenario, leading to less profits. Second, regarding the inspect-first-and-then buy option, when the hassle cost of solving uncertain value is smaller than the threshold, implementing omni-channel pre-ordering will always be most beneficial. However, when the hassle cost of solving uncertain value is larger than the threshold, the retailer should adopt traditional online pre-ordering only if the retailer’s return cost is relatively low; otherwise, no advance selling strategy is best.

2) Optimal pricing and ordering decisions also depend on the retailer’s return cost, the hassle cost of solving uncertain value, and the consumer’s return cost. Moreover, the optimal advance selling price varies with costs \(h_r\), r, and \(h_s\) differently depending on consumer purchasing behaviors. For example, when consumers choose to pre-order directly in the omni-channel pre-ordering strategy, the optimal advance selling price is first increasing, then decreasing, and lastly increasing along with hassle cost \(h_r\); it is non-increasing with hassle cost r, and it is non-increasing with hassle cost \(h_s\). However, when consumers choose to inspect first and then buy, the optimal advance selling price is quasi-convex in hassle cost \(h_r\), it is not related to hassle cost r, and it is convex in hassle cost \(h_s\). Concerning order quantities, we find that advance demand information can help the retailer update the forecast for regular demand, thereby also reducing its variability. Furthermore, the retailer is more likely to order a smaller quantity when using the traditional online pre-ordering option because the returns that arrived in the regular selling season can be used to sell to uninformed consumers.

3) Our numerical analyses show unintuitively that, when hassle cost \(h_r\) is higher, the retailer benefits more by not configuring a physical showroom. Adopting this kind of advance selling strategy can produce higher profits than those produced by no advance selling strategy if the product returns hurt the retailer less, for two reasons. First, the lower advance selling price will offset the negative effect of the high return cost for pre-ordering consumers; and the higher return cost will prevent them from choosing to return purchased products in the regular selling period. Second, the retailer is immune to some of the returns when the return cost is relatively low. Moreover, the retailer can obtain more profits from the inspect-first-and-then-buy strategy in most cases. Thus, retailers should set up physical showrooms designed to provide consumers with a way to examine new to-be-released products, though this is not easy.

Based on above results, our paper provides instructive guidance for omni-channel retailers when utilizing the advance selling strategy in their marketing practices. This new type of advance selling (i.e., omni-channel pre-ordering) not only helps consumers to solve product value uncertainty before purchases, but also retailers to address the information transparency for new products launching. Our results suggest that the retailer’s configuration policy and advance selling strategy including optimal pricing and ordering decisions depend on the retailer’s return cost, the hassle cost of solving uncertain value, and the consumer’s return cost. In specific, when the consumer’s hassle cost of solving uncertain valuation is relatively low, the retailer can benefit more from implementing the omni-channel pre-ordering strategy. For example, on February 20th, Xiaomi held a 2019 flagship press conference with the theme “Fight for You” and announced a new smartphone called “Battle Angel” Xiaomi 9 in Beijing. After the press conference, Gome opened omni-channel pre-sales in the Gome online stores and more than 2000 stores nationwide as soon as possible to help consumers to examine and gain new smartphones.

Future studies should consider consumer heterogeneity in relation to our analyses. For example, some consumers are risk-averse and will purchase in advance only if their value uncertainty is solved, and some may be more disappointed than others if their realized valuations are lower than expected. In our model, store hassle cost \(h_s\) and return cost \(h_r\) may differ across consumers. Thus, it would be a worthwhile extension of our study to examine how the physical showroom affects the retailer’s decisions in such a heterogeneous market. In addition, we consider advance selling only in terms of the provision of physical showrooms; in fact, virtual showrooms are also available in the online channel. Trying on products virtually provides consumers with imperfect valuation signals. For example, luxury fashion brand Jimmy Choo launched a virtual showroom that allowed consumers to view and pre-order its autumn/winter14 collection alongside buyers and editors before the products were available in stores. Investigating how such a showroom affects advance selling strategies would be worthwhile. Finally, during the advance selling period, new product information provided by firms will influence consumers’ product valuation. Thus it is interesting to explore the firm’s information provision strategy and how much information should consumers search for on official websites and other channels before purchasing.

References

Altug, M. S., & Aydinliyim, T. (2016). Counteracting strategic purchase deferrals: The impact of online retailers’ return policy decisions. Manufacturing & Service Operations Management, 18(3), 376–392.

Balakrishnan, A., Sundaresan, S., & Zhang, B. (2014). Browse-and-switch: Retail-online competition under value uncertainty. Production and Operations Management, 23(7), 1129–1145.

Bell, D., Gallino, S., & Moreno, A. (2015). Showrooms and information provision in omni-channel Retail. Production and Operations Management, 24(3), 360–362.

Bell, D. R., Gallino, S., & Moreno, A. (2017). Offline showrooms in omnichannel retail: Demand and operational benefits. Management Science, 64(4), 1629–1651.

Bhargava, H. K., & Chen, R. R. (2012). The benefit of information asymmetry: When to sell to informed customers? Decision Support Systems, 53(2), 345–356.

Bickel, P. J., & Doksum, K. A. (1977). Mathematical Statistics. San Francisco, CA: Holden-Day.

Chen, J., & Bell, P. C. (2013). The impact of customer returns on supply chain decisions under various channel interactions. Annals of Operations Research, 206(1), 59–74.

Choi, T. M., & Guo, S. (2018). Responsive supply in fashion mass customisation systems with consumer returns. International Journal of Production Research, 56(10), 3409–3422.

Chou, M. C., Sim, C., & Yuan, X. (2020). Policies for inventory models with product returns forecast from past demands and past sales. Annals of Operations Research, 288, 137–180.

Chu, L. Y., & Zhang, H. (2011). Optimal preorder strategy with endogenous information control. Management Science, 57(6), 1055–1077.

Ferguson, M., Guide, V. D. R, Jr., & Souza, G. C. (2006). Supply chain coordination for false failure returns. Manufacturing & Service Operations Management, 8(4), 376–393.

Fernández, N. V., Pérez, M. J. S., & Vázquez-Casielles, R. (2018). Webroomers versus showroomers: Are they the same? Journal of Business Research, 92, 300–320.

Gao, F., & Su, X. (2016). Online and offline information for omnichannel retailing. Manufacturing & Service Operations Management, 19(1), 84–98.

Gao, F., & Su, X. (2019). New Functions of Physical Stores in the Age of Omnichannel Retailing. In Operations in an Omnichannel World (pp. 35–50). Cham: Springer.

He, Y., Xu, Q., & Wu, P. (2020). Omnichannel retail operations with refurbished consumer returns. International Journal of Production Research, 58(1), 271–290.

Karakayali, I., Akçalı, E., Çetinkaya, S., & Üster, H. (2013). Capacitated replenishment and disposal planning for multiple products with resalable returns. Annals of Operations Research, 203(1), 325–350.

Li, C., & Zhang, F. (2013). Advance demand information, price discrimination, and preorder strategies. Manufacturing & Service Operations Management, 15(1), 57–71.

Li, G., Li, L., Sethi, S. P., & Guan, X. (2019a). Return strategy and pricing in a dual-channel supply chain. International Journal of Production Economics, 215, 153–164.

Li, G., Li, L., & Sun, J. (2019b). Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transportation Research Part E: Logistics and Transportation Review, 126, 32–48.

Li, G., Liu, M., Bian, Y., & Sethi, S. P. (2020a). Guarding against disruption risk by contracting under information asymmetry. Decision Sciences,. https://doi.org/10.1111/deci.12437.

Li, G., Zhang, X., Chiu, S., Liu, M., & Sethi, S. P. (2019c). Online market entry and channel sharing strategy with direct selling diseconomies in the sharing economy era. International Journal of Production Economics, 218, 135–147.

Li, G., Zheng, H., Sethi, S. P., & Guan, X. (2020b). Inducing downstream information sharing via manufacturer information acquisition and retailer subsidy. Decision Sciences, 51(3), 691–719.

Li, Y., Xu, L., Choi, T. M., & Govindan, K. (2014). Optimal advance-selling strategy for fashionable products with opportunistic consumers returns. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 44(7), 938–952.

Liu, Q., & Van Ryzin, G. J. (2008). Strategic capacity rationing to induce early purchases. Management Science, 54(6), 1115–1131.

Ma, S., Li, G., Sethi, S. P., & Zhao, X. (2019). Advance selling in the presence of market power and risk-averse consumers. Decision Sciences, 50(1), 142–169.

Mehra, A., Kumar, S., & Raju, J. S. (2018). Competitive strategies for brick-and-mortar stores to counter ”showrooming”. Management Science, 64(7), 3076–3090.

Nasiry, J., & Popescu, I. (2012). Advance selling when consumers regret. Management Science, 58(6), 1160–1177.

Oh, J., & Su, X. (2018). Reservation policies in queues: Advance deposits, spot prices, and capacity allocation. Production and Operations Management, 27(4), 680–695.

Prasad, A., Stecke, K. E., & Zhao, X. (2011). Advance selling by a newsvendor retailer. Production and Operations Management, 20(1), 129–142.

Shen, B., Choi, T. M., Wang, Y., & Lo, C. K. (2013). The coordination of fashion supply chains with a risk-averse supplier under the markdown money policy. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 43(2), 266–276.

Shi, X., Dong, C., & Cheng, T. C. E. (2018). Does the buy-online-and-pick-up-in-store strategy with pre-orders benefit a retailer with the consideration of returns? International Journal of Production Economics, 206, 134–145.

Silver, E. A., Pyke, D. F., & Peterson, R. (1998). Inventory management and production planning and scheduling (Vol. 3, p. 30). Wiley: New York.

Su, X. (2009). Consumer returns policies and supply chain performance. Manufacturing & Service Operations Management, 11(4), 595–612.

Su, X., & Zhang, F. (2008). Strategic customer behavior, commitment, and supply chain performance. Management Science, 54(10), 1759–1773.

Swinney, R. (2011). Selling to strategic consumers when product value is uncertain: The value of matching supply and demand. Management Science, 57(10), 1737–1751.

Taleizadeh, A. A., Haji-Sami, E., & Noori-daryan, M. (2020). A robust optimization model for coordinating pharmaceutical reverse supply chains under return strategies. Annals of Operations Research, 291, 875–896.

Tang, C. S., Rajaram, K., Alptekinoğlu, A., & Ou, J. (2004). The benefits of advance booking discount programs: Model and analysis. Management Science, 50(4), 465–478.

Wang, X., Guan, X., & Yi, Z. (2019). Roles of a preselling strategy under asymmetric information. Marketing Letters, 30(1), 91–105.

Wei, M. M., & Zhang, F. (2018a). Advance selling to strategic consumers: Preorder contingent production strategy with advance selling target. Production and Operations Management, 27(7), 1221–1235.

Wei, M. M., & Zhang, F. (2018b). Recent research developments of strategic consumer behavior in operations management. Computers & Operations Research, 93, 166–176.

Xiao, L., Xu, M., Chen, Z., & Guan, X. (2019). Optimal pricing for advance selling with uncertain product quality and consumer fitness. Journal of the Operational Research Society, 70(9), 1457–1474.

Xiao, T., & Shi, J. (2016). Consumer returns reduction and information revelation mechanism for a supply chain. Annals of Operations Research, 240(2), 661–681.

Xie, J., & Gerstner, E. (2007). Service escape: Profiting from customer cancellations. Marketing Science, 26(1), 18–30.

Xie, J., & Shugan, S. M. (2001). Electronic tickets, smart cards, and online prepayments: When and how to advance sell. Marketing Science, 20(3), 219–243.

Xue, W., Zuo, J., & Xu, X. (2017). Analysis of market competition and information asymmetry on selling strategies. Annals of Operations Research, 257, 395–421.

Yang, G., Ji, G., & Tan, K. (2020). Impact of artificial intelligence adoption on online returns policies. Annals of Operations Research,. https://doi.org/10.1007/s10479-020-03602-y.

Zeng, C. (2013). Optimal advance selling strategy under price commitment. Pacific Economic Review, 18(2), 233–258.

Zhang, J., Xu, Q., & He, Y. (2018). Omnichannel retail operations with consumer returns and order cancellation. Transportation Research Part E: Logistics and Transportation Review, 118, 308–324.

Zhang, T., Li, G., Cheng, T. C. E., & Shum, S. (2020). Consumer inter-product showrooming and information service provision in an omni-channel supply chain. Decision Sciences,. https://doi.org/10.1111/deci.12415.

Zhao, X., Pang, Z., & Stecke, K. E. (2016). When does a retailer’s advance selling capability benefit manufacturer, retailer, or both? Production and Operations Management, 25(6), 1073–1087.

Zhao, X., & Stecke, K. E. (2010). Pre-orders for new to-be-released products considering consumer loss aversion. Production and Operations Management, 19(2), 198–215.

Zhou, Y., Xiong, Y., & Jin, M. (2020). Less is more: Consumer education in a closed-loop supply chain with remanufacturing. Omega: The International Journal of Management Science,. https://doi.org/10.1016/j.omega.2020.102259.

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Grant Nos. 72071188, 71872075 and 71671170).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 The effect of the fixed cost of building physical showroom

According to Proposition 1, we know that informed consumers’ choices are not influenced by the fixed cost of building physical showroom T. Thus the retailer’s pricing and ordering decisions are also not affected. If considering the fix cost, the retailer’s optimal expected profits under scenarios of no advance selling, traditional online pre-ordering strategy, and omni-channel pre-ordering strategy change to the following:

Next, let \(\Delta \Pi _{Ab}^1\) (\(\Delta \Pi _{Ab}^2\)) denote the difference between the optimal profits from traditional online pre-ordering strategy and no advance selling, i.e., \(\Delta \Pi _{Ab}^1=\Pi _{A1}^{*}-\Pi _{basic}\) and \(\Delta \Pi _{Ab}^2=\Pi _{A2}^{*}-\Pi _{basic}\). By comparison, we can obtain

Similarly, we let \(\Delta \Pi _{3b}\) (\(\Delta \Pi _{4b}\), \(\Delta \Pi _{5b}\), \(\Delta \Pi _{6b}\), and \(\Delta \Pi _{7b}\)) denote the difference between the optimal profits from traditional online pre-ordering strategy and no advance selling, where \(\Delta \Pi _{3b}=\Pi _{13}^{*}-\Pi _{basic}\), \(\Delta \Pi _{4b}=\Pi _{14}^{*}-\Pi _{basic}\), \(\Delta \Pi _{5b}=\Pi _{15}^{*}-\Pi _{basic}\), \(\Delta \Pi _{6b}=\Pi _{26}^{*}-\Pi _{basic}\), \(\Delta \Pi _{7b}=\Pi _{27}^{*}-\Pi _{basic}\). Because \(\Pi _{13}^{*}\), \(\Pi _{14}^{*}\) have same expressions with \(\Pi _{A1}^{*}\), \(\Pi _{A2}^{*}\), respectively, we omit them, and only present

All potential strategies will be adopted only if they can bring higher profit compared to no advance selling strategy.

Thus, if the fix cost of building physical showroom T is larger than a threshold, the corresponding advance selling strategy will not be adopted by the retailer. Therefore, our results and insights continue to hold qualitatively true when the fixed cost is excluded; thus, without deviating from the purpose of this research, we keep the cost set at zero (i.e., \(T=0\)).

1.2 Proof of Proposition 1

According to expected utility expressions \(U_A\), \(U_S\), and \(U_W\), we have

and

Informed consumers make best purchase to obtain more expected utility. When the retailer doesn’t provide the physical showroom in the advance selling period, they purchase in advance if and only if \(U_A\ge U_W\). Thus we have \(X+\int _{X-h_r}^h F(v)\, dv\le p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\). However, when the retailer offer physical showrooms, informed consumers will have three choices: (i) pre-order directly if and only if \(U_A\ge U_S\) and \(U_A\ge U_W\). Thus we have the constraints \(\int _{X-h_r}^{X} F(v)\, dv\le h_s\) and \(X+\int _{X-h_r}^h F(v)\, dv\le p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\); (ii) inspect-first-and-then-buy if and only if \(U_S>U_A\) and \(U_S\ge U_W\). Thus we have the constraints \(\int _{X-h_r}^{X} F(v)\, dv>h_s\) and \(X+\int _X^h F(v)\, dv\le p-h_s+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\). (iii) nobody purchases early if and only if \(U_A<U_W\) and \(U_S<U_W\). Therefore, we obtain the constraints \(X+\int _{X-h_r}^h F(v)\, dv>p+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\) and \(X+\int _X^h F(v)\, dv>p-h_s+\eta (h-p)+(1-\eta )\int _p^h F(v)\, dv\). \(\square \)

1.3 Proof of Proposition 2

When the retailer determines his advance selling price X, the objective function and the constraint are given by Eq. (14).

First, differentiating the objective function of Eq. (14) with respect to X, we have

and

Second, it’s worth noting that the optimal advance selling price should fulfill \(X^{*}\le h+h_r-\sqrt{(1-\eta )(h-p)^2+2h_r(h-l)}\) from the constraint, because we assume consumer’s valuation V is uniformly distributed within the range [l, h]. Therefore, the retailer’s optimal X can belong to the following two cases:

Case 1: When \(\frac{\partial {\Pi _A}}{\partial {X}}\vert _{X=h+h_r-\sqrt{(1-\eta )(h-p)^2+2h_r(h-l)}}=\frac{c+\sqrt{(1-\eta )(h-p)^2+2h_r(h-l)}-r-h-h_r}{h-l}\mu _i<0\), (i.e., \(r>2\sqrt{(1-\eta )(h-p)^2+2(h-l)h_r}+c-h-h_r\)), the optimal advance selling price is \(X^*=\frac{h+h_r+c-r}{2}\).

Case 2: When \(\frac{\partial {\Pi _A}}{\partial {X}}\vert _{X=h+h_r-\sqrt{(1-\eta )(h-p)^2+2h_r(h-l)}}=\frac{c+\sqrt{(1-\eta )(h-p)^2+2h_r(h-l)}-r-h-h_r}{h-l}\mu _i\ge 0\), (i.e., \(r\le 2\sqrt{(1-\eta )(h-p)^2+2(h-l)h_r}+c-h-h_r\)), the optimal advance selling price is \(X^*=-\sqrt{(1-\eta )(h-p)^2+2h_r(h-l)}+h+h_r\).

Substituting optimal advance selling price into the objective function, we obtain the results in Proposition 2. \(\square \)

1.4 Proof of Lemma 1

Because \(X_1^{*}\) increases with \(h_r\), \(X_2^{*}\) is convex in \(h_r\), let \(X_1^{*}=X_2^{*}\), we have

and

And \(X^{*}=\min \{X_1^{*}, X_2^{*}\}\), so we obtain Lemma 1 (i).

Because \(X_1^{*}\) decreases with r and \(X_2^{*}\) is not related to r, the retailer’s optimal pre-order price is non-increasing with the return cost of himself. \(\square \)

1.5 Proof of Proposition 3

When the retailer determines his advance selling price X, the objective function and the constraint are given by Eq. (17).

First, differentiating the objective function of Eq. (17) with respect to X, we have

and