Abstract

Robust optimization (RO) is a distribution-free worst-case solution methodology designed for uncertain maximization problems via a max-min approach considering a bounded uncertainty set. It yields a feasible solution over this set with a guaranteed worst-case value. As opposed to a previous conception that RO is conservative based on optimal value analysis, we argue that in practice the uncertain parameters rarely take simultaneously the values of the worst-case scenario, and thus introduce a new performance measure based on simulated average values. To this end, we apply the adjustable RO (AARC) to a single new product multi-period production planning problem under an uncertain and bounded demand so as to maximize the total profit. The demand for the product is assumed to follow a typical life-cycle pattern, whose length is typically hard to anticipate. We suggest a novel approach to predict the production plan’s profitable cycle length, already at the outset of the planning horizon. The AARC is an offline method that is employed online and adjusted to past realizations of the demand by a linear decision rule (LDR). We compare it to an alternative offline method, aiming at maximum expected profit, applying the same LDR. Although the AARC maximizes the profit against a worst-case demand scenario, our empirical results show that the average performance of both methods is very similar. Further, AARC consistently guarantees a worst profit over the entire uncertainty set, and its model’s size is considerably smaller and thus exhibit superior performance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

RO is a large-scale distribution-free worst-case solution methodology designed for uncertain maximization problems via a max-min approach. The resulting solution is feasible for all uncertain realization within a user predefined uncertainty set, and its value is a guaranteed lower bound on the objective function value over this set. The fact that a RO solution corresponds to a worst possible realization of the uncertain parameters leads one to claim it is conservative, in particular when compared with the nominal (NOM) solution in which the uncertain parameters are replaced by their nominal values. The gap between the NOM and RO values was referred to as the price of robustness (POR) in Bertsimas and Sim (2004). However, comparing the two methods based on POR is meaningless, since in reality neither the worst-case, nor the nominal case of the parameters will necessarily occur. Our empirical study show that for the production planning problem studied here, the average POR (APOR) indicates that the RO solution is actually less conservative than expected.

This paper calls into question the way RO is to be compared with other methods dealing with uncertainty by examining empirically whether its performance is actually conservative as claimed, and by suggesting a new appropriate comparison measure with regard to other methods such as Monte Carlo simulation based approach (MC) and stochastic programming (SPR).

The fundamental difficulties in comparing RO to the aforementioned methods are threefold. First, the granularity level of the data supplied by the user differs greatly amongst various methods. For instance, SPR require the user to supply the probability distributions of the uncertain parameters, whereas RO calls for a much cruder description of the uncertain data in the form of an “uncertainty set”, i.e, a bounded set in which the uncertain parameters potentially reside. Second, RO guarantees a solution that is immunized against infeasibility whereas other methods do not necessarily ensure that. In the case of a non-feasible solution, a comparison based on the optimal objective function values is meaningless, unless the user can estimate accurately the cost of regaining feasibility. Third, RO is performed offline in the sense that the optimization is carried out at the outset of the planning horizon, and thus is not compatible with online methods where the optimization is reactivated in each stage of the planning horizon. The offline nature of RO allows the decision maker to analyze different aspects already at the planning stage, i.e., at the outset of the planning horizon, whereas an online method does not support it.

An additional important criterion is the tractability of the various methods. For comparison, SPR can be solved only in special cases, in particular, when the uncertain parameters take a finite number of values. However, its computational complexity grows severely with the number of periods.

Specifically, we assess empirically the performance of the RO methodology as applied to a prevalent single-product multi-period production planning problem in which the inventories are managed periodically over a finite horizon in order to maximize the total profit. The demand for the product is uncertain and is only known to fall within a user-defined interval uncertainty set which is assumed to follow a typical life-cycle pattern. We employ a suitable comparison based on a simulation study as indicated previously. Further, to avoid comparing RO with not necessarily feasible methods, our model has all the uncertainty in the objective function.

We apply the adjustable version of RO to such a production planning problem. This method assumes the decisions, which can be delayed in time, are adjustable to revealed data from the past. To impose tractability, these decisions are restricted to depend affinely on the past data (LDR), and hence this method is called affinely adjustable robust counterpart (AARC). In effect, the AARC solution is obtained offline at the outset of the planning horizon, whereas the adjustable decisions are made at each period according to the revealed data by plugging it into the affine offline function determined by the AARC solution.

The offline nature of the AARC scheme makes it possible to answer important strategic questions at the planning stage of the production process. One such question is how to estimate the length of the period in which the production is profitable (compared with the best alternative). In Sect. 6, we show a novel approach that determines both the number of periods, in which running the production system is profitable, and a robust production plan utilizing the AARC method.

We test the performance of the AARC for a production system with and without fixed costs. The fixed cost case calls for solving an adjustable robust counterpart problem of an uncertain mixed integer linear problem (MILP). For a polyhedral uncertainty set the corresponding AARC problem is itself a MILP, which is still manageable. We show that although the integer variables are treated as non-adjustable, they are essentially adjustable due to the adjustability of the production quantities and their binding constraints.

In our simulation study we compare the average performance of the AARC to an adjustable offline alternative method employing the same LDR, namely a hybrid Monte Carlo simulation based approach and robust optimization with LDR (MCL-RO). It is essentially a Monte Carlo method which utilizes the robust optimization for feasibility purposes and apply it to part of the constraints. This method’s objective is to maximize the expected profit over an offline generated demand sample. Since we consider here a production planning problem of a new product such a sample is not available. For the purpose of comparison the expected profit was evaluated based on a sample generated out of the uncertainty set using a uniform distribution.

Our simulation results show that the average performance of the AARC is very similar to the MCL-RO. Thus, the return from these methods is basically the same on average, but the risk of employing each varies. AARC consistently guarantees worst-case profit for every realization within the uncertainty set, whereas, in general, such guaranteed worst profit cannot be assessed for the MCL-RO method. Moreover, the computational cost of each method highly depends on the corresponding model size. Size-wise, both models have the same number of decision variables, yet their number of constraints differ greatly in favor of the AARC method, which has \(O\left( T^2 \right) \) constraints, whereas the MCL-RO model has \(O(T^2 + NT)\) where the sample size N typically satisfy \(N>>T\), e.g., creating an event tree with m possible demand values at every time period \(t=1,\ldots ,T\) require \(N=m^T\), and thus results in exponential in T number of constraints. These observations further suggest that the AARC exhibit superior performance compared with the MCL-RO method.

Moreover, our computational study shows that the AARC achieves average profits that are extremely close to the perfect hindsight (PH) profit, i.e., the objective value that would have been obtained if it was possible to know apriori the exact values of the demand quantities for the entire horizon.

In summary, this paper makes the following contributions:

-

It proposes a novel approach for assessing the profitability of a production plan with regard to an alternative investment, which simultaneously yields a profitable horizon length and determines a robust production plan.

-

The AARC method inherently guarantees a worst-case profit, whereas, in general, such guaranteed worst profit cannot be assessed for the MCL-RO method. Thus, the risk employing AARC is lower.

-

The AARC’s computational cost is also lower compared with MCL-RO due to its smallest model size.

-

It includes an experimental evaluation which shows that:

-

The average performance of AARC and MCL-RO is very similar although the AARC maximizes the profit against a worst-case demand scenario, whereas the MCL-RO aim at maximum expected profit. Therefore, the return gained by applying AARC is similar.

-

The average profit of AARC is nearly optimal for the perfect-hindsight (PH) problem as it is 93 % and 99 % of the PH average profit on the worst and best cases, respectively.

-

The rest of the paper continues as follows. Section 2 discusses the related work. In Sect. 3 we give our problem formulation, and investigate its corresponding robust formulations, which are presented in Sect. 4. Section 5 describes the simulation study results for the basic model with linear costs, and in Sect. 6 we suggest a novel approach to estimate a profitable horizon length at the outset of the planning horizon. Section 7 shows the RO formulation and simulation study results for the setting where fixed costs are present.

2 Literature review

A central issue in production planning is the determination of a production policy that would maximize the profit by producing the right quantities at the right time, thus satisfying the demand without holding excess inventory or creating unnecessary shortages. Many real-world production planning problems involve a single product over a finite horizon where decisions are made in discrete periods under demand uncertainty.

The classical research in this field began in the early 50’s assuming that the demand distribution is fully known. The minimum expected cost was found for two kinds of settings: (1) linear costs where all the costs are attributed to specific quantities, (2) fixed cost in which setup costs are present. Moreover, two types of models were considered a single period and a multi-period. The rather simple form of the optimal ordering policies was obtained using dynamic programming (DP) and is shown in Arrow et al. (1951), Dvoretzky et al. (1952), Scarf (1960, 1963) and Veinott (1966).

This pioneering research assumes that the demand distribution is known, however in practice the information about the form of the probability distribution that characterizes the behavior of the actual demand is very limited. Subsequent research exploited a worst-case scenario approach assuming that the demand probability distribution is unknown but some of its moments are known (Scarf 1958; Gallego and Moon 1993; Gallego et al. 2001), or that it is bounded within a given closed interval (Kasugai and Kasegai 1960), or is given by a “black box” (Levi et al 2007).

Both DP and SPR call for a full knowledge of the uncertain parameters, namely their probability distribution. Unfortunately, this kind of information is rarely available in practice and may at times be misleading due to errors in forecasting or estimation. Further, in a multi-period setting, as in the problem studied here, both methods are typically intractable (Zipkin 2000; Shapiro et al. 2009).

To overcome the SPR intractability an approximation, namely the known sample average approximation (SAA), was introduced (Shapiro et al. 2009). The SAA is a Monte Carlo simulation based approach with the basic idea of generating a random sample and approximate its expected value function by the corresponding sample average function.

The difficulties associated with DP and SPR led researchers to look for a tractable method designed for distribution-free large-scale problems, such as the RO methodology. RO, as introduced in Ben-Tal and Nemirovski (2002), uses a min–max approach to solve uncertain minimization problems where the uncertain parameters reside within a known deterministic uncertainty set. This approach guarantees that the solution is feasible for any realization of the parameters within the uncertainty set. RO was originally designed to deal with static problems where all decisions should be made at the outset of the horizon, before the uncertain data is revealed, namely the RC method. Nevertheless, in most real-world problems, some decisions can depend on past realizations of the uncertain data. Recognizing the need to address such dynamic environments RO was extended into the AARC method (Ben-Tal et al. 2004). In the AARC the dependence of the adjustable decision variables on observed data is restricted to be linear to achieve tractability.

Both methods were applied to the field of operations management. In particular, there are papers studying a very similar problem to the one we consider here. Bertsimas and Sim (2004) compared its RC and nominal models on the basis of their optimal solutions, and stated the notion of the price of robustness (POR).

Ben-Tal et al. (2005) employed the AARC method to a similar problem. They showed numerically, that the optimal values of the min–max and the AARC can often be identical.

Bertsimas and Thiele (2006) follow the same line of research as in Bertsimas and Sim (2004), and further provide a closed form of the optimal base-stock policy.

See and Sim (2010) use a descriptive statistics of the uncertain parameter, particularly, the knowledge of some of its moments, to construct its uncertainty set. They show that a piece-wise linear decision rule improves upon the static and linear decision rules. In this paper we show empirically that employing the simpler linear decision rule already delivers very good performance in our model.

Goh and Hall (2013) also assumes a known support, mean and deviation. In this paper, the RO methodology is applied to a project management problem, and compared with a Monte Carlo (MC) simulation method (SAA). As opposed to our work they apply an offline version of the MC method without assuming LDR, which inherently gives the AARC method, which is executed online, an advantage. They explore the effect of the distribution that the samples are taken from both for the MC method and the uncertain parameters, and conclude that the MC method is sensitive, whereas the AARC method is stable.

Bertsimas et al. (2010) examined a very similar problem, associated with a box shaped uncertainty set, and prove a base-stock form for the optimal policy. In the case where the linear decision rule accounts for all the available data so far (full-disturbance), they show that the AARC method is optimal for the min–max problem.

Iancu and Trichakis (2014) studied the set of robust solutions of a linear program, associated with a polyhedral uncertainty set. They defined a subset of the former set, that Pareto dominates the other points within the set, and showed how to obtain such Pareto robust (PRO) solutions. Their experimental results indicate that a PRO solution performs better than a non-PRO one. Therefore, in our simulation results we show the average performance for PRO solutions when possible.

Other RO applications to various fields, such as multi-period portfolio selection, binary classification via linear discriminants, and many more are reviewed in Bertsimas et al. (2011).

All of the above problems, assume a finite and fixed planning horizon length. However, the length of the horizon of a product that follows a life-cycle pattern, which we study here, is typically uncertain as well. In the sub-field of perishable inventory control, that treats both horizon length and demand as random, there are results only for the case where successive orders outdate in the same sequence that they are stocked (Nahmias 1982). Chan et al. (2004) surveyed the topic of coordination of inventory control and pricing strategies with random demand. The research in this field examines both finite and infinite horizon problems, yet it does not discuss the determination of its length. Another field of research studies the forecast horizon; see for example (Bes and Sethi 1988). However, it defines the forecast horizon as the finite number of periods, such that a future forecast does not affect the initial decisions. In this work we suggest a novel approach to predict the profitable horizon length of a product with regard to an alternative investment, already in the planning stage.

3 A multi-period production planning problem: the basic model

We consider a single-product multi-period production planning problem in which the inventories are managed periodically over a finite horizon of T periods. Additionally, we assume that the product is new to the market, and thus no previous data is available for it. At the beginning of each period t, the decision maker has an inventory level that equals the inventory size at the end of the previous period \(I_{t-1}\), and she produces a quantity \(q_t\) at a unit cost \(c_t\). The actual demand \(d_{t}\) is then realized, and the supplied goods are sold at a unit selling price \(m_t\). The unsatisfied demand is supplied in later periods at the same unit selling price \(m_t\), except for the last period T. The decision maker’s status at the beginning of the planning horizon is given by the initial inventory \(I_0\). Holding and shortage costs are incurred for each unit of surplus at a cost \(h_t\), and for each unit of shortage at a cost \(p_t\), respectively. Any surplus left at the end of period T is salvaged at a unit salvage value s. The decision maker objective is to determine the production quantity in each period \(t=1,2,\ldots ,T\) so as to maximize the total profit over the entire planning horizon.

The inventory level \(I_t\) at the end of each period \(t=1,\ldots ,T\) is given by the following balance equation:

Letting \(q:=\left( q_1,\ldots ,q_T \right) \) be the production quantity trajectory, and \(d:=\left( d_1,\ldots ,d_T \right) \) the demand trajectory, using the balance equation recursively we obtain, for each period t:

Denote the surplus and shortage inventory levels by \(I_t^+=I_t^+(q,d)=\max \left\{ 0,I_t\left( q,d\right) \right\} \) and \(I_t^-=I_t^-(q,d)=\max \left\{ 0,-I_t\left( q,d\right) \right\} \), respectively. The objective function is then

where

and

For known demands \(d_1,d_2,\ldots ,d_T\), the optimization problem is

It is assumed that the demand trajectory follows a typical life-cycle pattern. Such a pattern depicts the demand curve for some product from the first time it was introduced into the market until it is discontinued. Schematically, the product life-cycle pattern can be approximated by a bell-shaped curve which is divided into four sequential stages: (a) introduction—where the product demand is low due to reduced customer awareness, (b) growth—where the customers recognize and accept the product, and hence the demand rate starts to increase, but in time the rate drops as more competitors enter the industry and the market becomes more saturated, (c) maturity—where demand rate reaches a plateau, (d) retirement—where most of the market has already purchased the product and abandons the product for its newer substitutes (Rink and Swan 1979).

However, the actual demand d is uncertain and is only known to reside within a user-defined interval uncertainty set which has an upper and lower level demand trajectories \(\bar{d}\) and \(\underline{d}\). The demand then changes around a central (nominal) trajectory \(\hat{d}\) within \(\underline{d}\) and \(\bar{d}\). For example, let \(\hat{d}_t=-0.17+0.25t+1.23t^2-0.18t^3+0.004t^4+0.0002t^5\) be the t-th component of such nominal trajectory, the coefficients of which have been selected to fit a typical life-cycle (see Fig. 1). We define the uncertainty level \(\rho \) to be the relative deviation from the nominal trajectory \(\hat{d}\) as follows: \(d_{t}=\hat{d}_t(1+\rho _t\zeta _t)\) where \(|\zeta _t|\le 1\), \((t=1,\ldots ,T)\). The upper level demand trajectory is then \(\bar{d}_t:=(1+\rho _t)\hat{d}_t\), and the lower level demand trajectory is then \(\bar{d}_t:=(1-\rho _t)\hat{d}_t\). The demand uncertainty set is given by:

Or equivalently

where the vector \(\hat{d}\) is the expected (nominal) demand shown graphically in Fig. 1.

The robust counterpart of problem (5) is of the form \(\max \nolimits _{q\ge 0}\min \nolimits _{d\in U_{box}}\mathcal {F}\left( q,d\right) \). Note that this formulation is generally intractable, since for all t both \(-I_t^-\) and \(-I_t^+\) are concave in d, and thus the inner minimization problem is concave. It is well known that an optimal solution of such problem is a vertex of its feasible set, which is in this case, the uncertainty set \(U_{box}\). Since \(U_{box}\) has \(2^T\) vertices and is exponential in T this problem is generally intractable. Therefore, we consider here a linear program (LP), which is an equivalent deterministic formulation to problem (5), and has a tractable robust counterpart with regard to \(U_{box}\). This problem is very similar to a prevalent model in the literature (Bertsimas and Sim 2004; Bertsimas and Thiele 2006; Bertsimas et al. 2010), and reads as follows:

where y is an auxiliary trajectory, which represents an upper bound on the inventory cost, with t-th component \(y_t\), and the objective function is given by:

Since both the first 2T constraints of problem (8) and its objective function are linear in d, the uncertain parameter, its robust counterpart is tractable with regard to \(U_{box}\). However, the “adversary” (the one that chooses d) is free to choose different values for each of these constraints separably, leading to a conservative RC compared with problem (5). Thus the robust formulation of problem (8) can be considered as a tractable relaxation of the corresponding formulation of (5).

4 Robust formulations

In this section we present the RO methodology formulations for the basic multi-period production planning problem under demand uncertainty \(U_{box}\).

4.1 Affinely adjustable robust counterpart formulation (AARC)

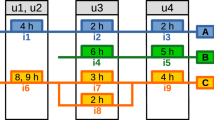

RO was originally designed to deal with static problems where all decision variables need to be decided at the beginning of the horizon, before the uncertain data is revealed. This static version of RO is named robust counterpart (RC). However, in practice, it is not always necessarily to decide on a policy for the entire planning horizon at the beginning of the horizon. Instead, it is possible to make a decision at the beginning of each period, based on realized data from the past. Thus, the decision on the production quantity \(q_t\), can be delayed to the beginning of period t, and adjusted based on the revealed demands form the past \(d_1,d_2,\ldots ,d_{t-1}\). Since the auxiliary variables \(y_t\) \(\forall t=1,\ldots ,T\) also depend on the demand, they are also treated as adjustable variables.

It is important to highlight that Bertsimas et al. (2010) proved that the AARC method associated with a box-shaped uncertainty set, as we consider here, provides the optimal solution for the worst-case problem, which does not assume a LDR. Therefore it is the best worst-case method available.

The AARC assumes that the dependence of the adjustable decision variables \(q_t\) and \(y_t\) \(\forall t=1,\ldots ,T\) on the past demand is given by the following linear decision rules (LDR):

The problem solved by the AARC model is then:

where F(q, y, d) is the objective function in problem (8) given by (9), and the t-th component of \(y(\beta ,d)\) and \(q(\alpha ,d)\) are given by (10) and (11), respectively. Notice that this problem (12) is a traditional (nonadjustable) RC problem where the coefficients \({\alpha _t^r }\) and \({\beta _t^r }\) \(\forall t=0,\ldots ,T \quad \forall r=1,\ldots ,t-1\) in the LDRs become the actual decision variables. Also note, that each of the continuum of constraints in (i), (ii) and (iii), is reducible to a single inequality. For example, constraint (iii) for some arbitrary \(t\in \left\{ 1,\ldots ,T \right\} \) reads:

substituting \(d_r\) with its implicit formulation (7) it holds that:

which is equivalent to:

the solution to this optimization problem yields:

Note that constraint (13) is reduced to a single conic quadratic inequality if \(\left\| \zeta \right\| _{\infty }\) in the uncertainty definition (7) is replaced with \(\left\| \zeta \right\| _{2}\).

Constraint (14) can be further formed as a linear inequality system of additional \(2\left( t-1 \right) \) constraints by replacing the \(\left| {\alpha _t^r \hat{d}_r \rho _r }\right| \) terms with additional \(t-1\) nonnegative variables \(w_r\) and requiring \(-w_r \le \alpha _t^r \hat{d}_r \rho _r \le w_r\). Thus, formulating the AARC problem (12) as a LP calls for additional \(2(t-1)\) constraints, and additional \(t-1\) decision variables per each continuum constraint. So finally the AARC model (12) reduces to a LP with \(O(T^2)\) decision variables and \(O(T^2)\) constraints, and thus its number of constraints is quadratic in T.

Solving the AARC offline (before period \(t=1\)), we obtain the optimal coefficients vectors \(\alpha ^*,\beta ^*\). Then, going online, at the beginning of each period t, the optimal production for the period is calculated by the LDR

where \(d_1,d_2,\ldots ,d_{t-1}\) are the revealed values of the demand in the periods preceding period t.

4.2 Pareto affinely adjustable robust counterpart formulation (PAARC)

Iancu and Trichakis (2014) showed that a Pareto robust (PRO) solution performs better in practice than a robust solution, thus in what follows we will assess the performance of the Pareto version of the AARC method (PAARC) when possible. Typically, there are many PRO solutions, each corresponds to a different realization in the relative interior of the uncertainty set. To choose one solution among the set of robustly optimal solutions, that performs well on average we followed the two stage procedure suggested by Ruiter et al. (2014). First, solve the AARC problem (12) and obtain \(F^*_{AARC}\), the guaranteed worst profit. Second, replace the objective function by the profit obtained by the nominal demand \(\hat{d}\), and add a constraint that the worst-case profit is at least as the value of \(F^*_{AARC}\) as follows:

Of course, the worst profit guaranteed by the PAARC method is identical to the corresponding AARC, that is, \(\min _{d\in U_{box}} F\left( q\left( \bar{\alpha },d\right) ,y\left( \bar{\beta },d\right) , d\right) =F_{AARC}^*\). Following the same reasoning as we made in Sect. 4.1 this model’s number of constraints size, as well as the decision variables size, is also quadratic in T.

Note that all the properties of the AARC solution can also be easily verified for the PAARC solution, and hence for coherence purposes we will use AARC onwards.

5 Assessing the average performance of the AARC method

The value \(F_{AARC}^*\) obtained by the optimal solution of problem (12), is only a guaranteed value of the objective function, i.e., no matter what the actual value of the demand trajectory will be realized, as long as it is in the uncertainty set \(U_{box}\), the resulting objective function (profit) will be at least \(F_{AARC}^*\). Now, since in reality, it is not expected that all the demands \(d_1,d_2,\ldots ,d_T\) will take simultaneously the worst possible values, the actual value of the objective function could be, in fact, much better than \(F_{AARC}^*\) as long as the demand trajectory is within the uncertainty set. Therefore, it is more reasonable to assess the performance of the AARC method based on average performance compared with alternative methods.

To this end we simulate l sets of k demand trajectories \(d^1,d^2,\ldots ,d^k\) (each \(d^j\) is a T dimensional vector), where each set corresponds to a different distribution. We then compute, for each studied method, the average profit associated with its optimal solution \(q^{\text {method}}\) regarding a sample set and one of the v cost sets considered as follows:

where \(\mathcal {F}(q,d)\) is the objective function of problem (5), defined in (2). Note that when both \(q^{\text {method}}\) and a demand realization \(d^j\) are known, and satisfy \(q^{\text {method}}\left( d^j \right) \ge 0\) the corresponding inventory level trajectory can be calculated using (1), and thus the appropriate profit can be evaluated by \(\mathcal {F}(q,d)\) instead of F(q, y, d). For example, \(AP^{PAARC}= \frac{1}{k} \sum _{j=1}^{k} \mathcal {F}\left( q\left( \bar{\alpha }^*,d^j\right) ,d^j\right) \) where \(\bar{\alpha }^*\) is the vector of optimal LDR coefficients in problem (15) since \(q\left( \bar{\alpha }^*,d\right) \ge 0 \qquad \forall d\in U_{box}\). Bear in mind, that the AARC method is purposed to prevent the worst-case scenario, and thus is not expected to have superior average profit over the simulations. Nonetheless, our simulation results show that it yields quite good average profit.

5.1 Comparing AARC with alternative methods

A natural benchmark for assessing the average performance of the AARC method is the PH value, computed as follows: for each simulated demand trajectory \(d^j \quad (j=1,\ldots ,k)\) let \(q^j\) be the optimal solution of problem (8) with \(d=d^j\). That is, the objective value that would have been obtained if it was possible to know apriori the exact values of the demand quantities for the entire horizon. Clearly this method, which assumes perfect information, cannot be implemented in a real-world problem, like the one considered here. The average simulated profit of the PH solution is always higher than the corresponding AARC. However, if the difference is small, the average performance of the AARC method can be considered as “good” while at the same time optimal for the worst-case by the result of Bertsimas et al. (2010).

If the difference between the PH average profit and the average performance of the AARC method is big, it does not necessary imply that AARC does not exhibit good average performance. Indeed, even the optimal method (whatever it is) for solving problem (8) under uncertain demand d such that \(d\in U_{box}\) can result in average profit far from the PH average. The merit in adopting the AARC solution should then be assessed by comparing it to an alternative method.

Such an alternative hybrid “semi-robust” approach is the MCL-RO, which maximizes the expected profit over an offline generated demand sample distributed uniformly out of \(U_{box}\), with N trajectories of dimension T, while utilizing RO to ensure feasibility. It assumes a LDR for the decision variables q and y of the form (10) and (11), replacing \(\alpha \) and \(\beta \), with \(\gamma \) and \(\delta \), respectively. Thus the MCL-RO model is given by:

Note that formulating problem (17) as a LP, according to Sect. 4.1, results in a model with \(O(T^2)\) decision variables as the AARC method does, whereas it has greater number of constraints, namely, \(O(T^2+NT)\). Furthermore, if one wants to take into consideration m possible demands at each period then the total number of scenarios to be considered is \(N=m^T\). In this case the number of constraints of the MCL-RO model grows exponentially with T.

Since the MCL-RO model’s respective objective is maximizing the expected profit, it is likely to achieve a good average profit. However, in general, since the optimal \(y\left( \delta ,d\right) \) is not necessarily feasible over the entire uncertainty set, this method does not necessarily yield a lower bound on the profit as the AARC method does as explained next.

For any method robust or non-robust the worst possible profit, that can occur when the entire uncertainty set is considered, denoted by \(WP^{\text {method}}\), is evaluated given its solution \(q^{\text {method}}\) and \(y^{\text {method}}\) by:

Note that a robust method already yields this worst-case profit as its optimal objective function value. Such a worst profit can not be assessed by solving the optimization problem \(\min _{d\in U_{box}} \mathcal {F}\left( q,d \right) \), since it is generally intractable, as explained in Sect. 3.

However, in general solving problem (18) with regard to a MCL-RO policy \(q^{MCL-RO}\) does not necessarily yield a valid worst profit due to possibly incorrect values of what is supposed to be the upper bound on the inventory cost \(y\left( \gamma , d \right) \). Such incorrect bound can arouse when an optimal solution to problem (18), that is, a worst-case demand scenario does not belong to the N sized sample used in the MCL-RO model. Consequently, this model’s first 2NT constraint does not necessarily hold, and thus \(y\left( \gamma , d \right) \) is not necessarily an upper bound on the inventory costs. Accordingly, the corresponding objective value, that is, the worst profit, is invalid.

Table 1 presents the average profit of the PAARC, MCL-RO and PH methods along with the corresponding standard deviation. This is done for each combination of \(v=3\) cost sets C1, C2, and C3, and \(l=3\) demand simulation’s sets D1,D2, and D3 each with \(k=100\) trajectories of dimension \(T=12\) (see Appendix), where N the number of generated scenarios for the MCL-RO method is 100. In general, the average profit of all studied methods is the highest for demand set D3, and the lowest for demand set D1.

Table 1 also includes the predicted worst possible profit. Such worst profit associated with the uncertainty set \(U_{box}\) and \(T=12\) can be obtained by solving \(\min _{d \in U_{box}} \mathcal {F}\left( q^{method}(d), d \right) \) via enumeration of its reasonable sized \(2^T\) vertices. Recall that it requires only \(\bar{\alpha }\), or \(\gamma \) for the PAARC or MCL-RO methods, respectively. The Table shows that these worst profits are very similar, yet the models’ size differ in favor of the PAARC method.

The very first row of Table 1 shows the PH method performance. This method achieve the ultimate profit over the simulations as mentioned before. Since we used a starting inventory level of zero in our simulations the PH policy always produces exactly the demand and thus the holding and shortage costs are not relevant to its average profit calculation. Since these are the only parameters that differentiate among the \(v=3\) cost sets, the PH average profit is identical for them all.

The first and last records in each sub-table shows the average simulated performance of the PAARC (15) and the MCL-RO methods (17), respectively. As expected, average-wise, the MCL-RO has a good performance, but it is very similar to the PAARC corresponding performance. A paired t-test with a level of significant of 95 % exploring the difference between these methods’ means, shows that they are significantly different, where 7 out of 9 combinations of cost and demand sets results in favor of the PAARC method. Furthermore, the average difference between the appropriate confidence intervals over all tested sets is very small (0.15) compared with the profit values, and the maximal difference is only 0.743. These measures suggest that, essentially, the average profits of these two methods are similar.

In order to strengthen the experimental results of average performance similarity of the AARC and MCL-RO methods, we consider the AARC problem (12) with regard to the following uncertainty set

where the vector \(\hat{d}\) is the expected (nominal) demand shown graphically in Fig. 1. Note that the AARC problem associated with this uncertainty set (19) is not necessarily the optimal policy for the max-min problem. The corresponding MCL-RO maximizes the expected profit over an offline generated demand sample distributed uniformly out of \(U_{ellip}\), with \(N=100\) trajectories of dimension T. Table 2 shows the corresponding data as Table 1 for the \(U_{ellip}\) uncertainty set. Clearly, the average performance of the AARC and MCL-RO methods is very similar.

For uncertainty level \(p=14~\%\) the MCL-RO worst profit associated with the uncertainty set \(U_{ellip}\) is invalid with respect to all cost sets considered.

The simulations results show that the AARC method has very similar average profit to the MCL-RO method, implying that in practice there is no price to be paid here to achieve robust solutions. Furthermore, these methods differ in their model’s size such that the number of constraints of the PAARC method is \(O\left( T^2 \right) \), whereas the corresponding number for the MCL-RO method is \(O(T^2 +NT)\). Moreover, the AARC guarantees a worst-case profit, whereas in general the MCL-RO method does not. Therefore, according to our simulation results the AARC method exhibits superior performance suggesting that there might actually be a price to be paid for non-robustness.

6 Prediction of a profitable interval within the planning horizon

Production planning problems have two distinct stages: planning and execution (operation). The latter refers to decisions made during the planning horizon, whereas the former refers to the point in time just before the first period. Consequently, in the planning stage the information available are forecasts of the product life-cycle length, which determines the planning horizon length T, and an uncertainty set associated with the demand values in each of the future periods.

In the planning stage, the decision maker can allocate the limited resources at his disposal among different potential investments plans. The decision to embark on a specific production plan depends on its profitability compared to the best alternative investment. The AARC method provides such guaranteed periodical profits, as long as the uncertainties (demands) reside in his chosen uncertainty set. We note that an online policy does not provide such vital information.

We introduce a new strategy to assess the profitability of a production plan that supply an appropriate robust policy. The profitable horizon length is obtained by jointly optimizing the production trajectory and the length of the profitable planning horizon.

The following model (Eqs. (21)–(35)) optimizes simultaneously the profitable horizon length \(T^*\) of a product compared with an alternative investment, having periodic profit \(\varDelta _t \ \forall t=1,\ldots ,T\), along with a corresponding production plan. This is done by using a binary decision variable \(z_t\) with

Furthermore, constraint (29) below implies that the T-vector z will consist of a sequence of ones followed by a sequence of zeros. Thus, the profitable horizon length \(T^*\) is \(T^* = \max \left\{ t \ : \ z_t=1 \right\} \).

The objective function (21) consists of the cumulative following terms: income from sales, production and inventory costs, as well as the one time end of horizon effect. All of these terms accounts only for the profitable horizon as will be explained next.

By the definition of the binary decision variable \(z_t\), the cumulative income from sales \(\sum _{t=1}^{T} m_{t} d_{t} z_{t}\) is taken into account in the objective function only at the profitable horizon.

The cumulative production cost \(\sum _{t=1}^{T} c_t q_t\left( \alpha , d \right) \) refers only to the profitable horizon due to constraints (27) and (28). Defining M as a big number it holds that \(q_t\left( \alpha , d \right) \) will be zero when the production is non-profitable. The cumulative inventory cost \(\sum _{t=1}^{T} y_t\left( \beta , d \right) \) is incurred only at the profitable horizon due to constraints (25) and (26), and takes the appropriate values due to constraints (23) and (24).

Recall that by definition, the end of horizon effect at the last period T is included in both the holding \(\bar{h}\) (4) and shortage \(\bar{p}\) (3) costs. Namely, if the inventory at the end of period T is positive a unit salvage value \(s < m_T\) is gained, whereas a negative inventory stands for undelivered goods that should be fined at a unit price \(m_T\). In order to account for the end of horizon effect when the profitable horizon length is shorter than the original horizon one \(T^* < T\) a one time income \(c_{T^*}^{end}\left( \gamma , d \right) \) is incurred due to constraints (32) and (33), and takes the correct values due to constraints (34) and (35). Note that since the decision variables \(c_{t}^{end}\left( \gamma , d \right) \quad \forall t=1,\ldots ,T\) depend on the demand, they are also treated as adjustable variables satisfying the following LDR

Also note that constraint (22) requires that the cumulative profit of the product is higher than the corresponding alternative investment.

An AARC solution determine the LDR’s coefficients, which are feasible for every realization of the demand within the uncertainty set \(U_{box}\) and achieve a guaranteed total profit value. This guaranteed value, calculated via (18) for the AARC method, is essentially a lower bound on the profit. Comparing its corresponding cumulative profit with the best available investment determines the points in time when the product first becomes profitable and unprofitable. The same can be easily done for the PAARC method.

Figure 2 shows (for cost set C2) the cumulative profit of the optimal PAARC solution for uncertainty levels \(\rho =14~\%\) and \(\rho =20~\%\), and that of an alternative investment yielding an expected profit of \(\varDelta _t=6 \ \forall t=1,\ldots ,T\). By comparing the cumulative profit of the PAARC method and the alternative investment, it is seen that when \(\rho =14~\%\) the product plan is profitable from period 3 onwards. For \(\rho =20~\%\) the the product plan is profitable from period 5 until period 11.

We note that a profitable horizon length can also be obtained by exhaustive search over the T different feasible candidates. It can be done by comparing the AARC objective value, i.e., the product’s cumulative profit of at most T linear programs to the corresponding cumulative alternative investment’s profit starting the comparison of the cumulative profits from \(t=T\) towards \(t=1\) and stop when the alternative investment’s profit is higher.

7 A problem with fixed cost

In this section we formulate the multi-period production planning problem under demand uncertainty with an additional fixed production cost such as machine set up costs, maintenance costs, order handling costs etc. The deterministic formulation of this problem is a mixed integer linear programming (MILP) including T binary decision variables \(z_t\) for each period in the planning horizon \(t=1,\ldots ,T\), where \(z_t\) indicates whether there is a production in period t. The deterministic formulation is given by:

where \(F_{\text {fixed}}(q,y,z,d)\) is the objective function in problem (8) given by (9), minus the term \(\sum _{t=1}^T b_t z_t\), where \(b_t\) is the fixed production cost for period t. This type of MILP can be solved by standard solvers.

In order to formulate the AARC version of this problem (36), we use “partial adjustability”, that is, the binary variables given by \(z_t\)’s are treated as non-adjustable while the production quantities \(q_t\)’s are treated as adjustable. This AARC formulation associated with \(U_{box}\) is obtained by substituting the LDRs (10) and (11) in problem (36) as we did in (12). The problem solved by the AARC method is then

where the t-th component of \(y(\beta ,d)\) and \(q(\alpha ,d)\) are given by (11) and (10), respectively.

The following proposition is used to show that, despite the partial adjustability, \(z_t\) is essentially adjustable, since \(q_t\) is adjustable for all \(t=1,\ldots ,T\) due to their coupling constraints.

Proposition 1

Let \(q_t(\alpha ,d) = \alpha _t^0 + \sum \nolimits _{r = 1}^{t - 1} {\alpha _t^r d_r }\) be the production quantity at period t, and let \(U_{box}\) be a non-degenerated uncertainty set. Then \(q_t(\alpha ,d) =0\) \(\forall d\in U_{box}\) if and only if \(\alpha _t^j=0 \qquad \forall j=0,\ldots ,t-1\) for non-degenerated uncertainty set \(U_{box}\).

Proof

Recall that the uncertainty set is defined to be \(U_{box}=\{d\in \mathbb {R}^n|\underline{d}\le d\le \bar{d}\}\) with \(\underline{d}<\bar{d}\), and let v, w two vectors in \(U_{box}\) such that \(v_j=w_j \qquad \forall j\ne \tau \) and \(v_{\tau }\ne w_{\tau }\). Then in particular:

Subtracting (39) from (38) we get:

which implies that \(\alpha _t^{\tau }=0\). This holds for every choice of \(\tau \in \{1,\ldots ,t-1\}\), and thus \(\alpha _t^j=0 \quad \forall j=1,\ldots ,t-1\), which further implies that \(\alpha _t^0\) is zero as well. \(\square \)

At every period \(t=1,\ldots ,T\) if it is not worthwhile to produce for any \(d\in U_{box}\) by Proposition 1 it holds that \(\alpha _t^j=0\) \(\forall j=0,\ldots ,t-1\). This allows \(z_t\), by constraint (iv), to take one of the values zero or one. Nonetheless, the objective function is linear and decreasing in \(z_t\) and thus \(z_t\) will take the minimal value, that is, zero. if there exists at least on \(\alpha _t^j\) then \(z_t\) will take the value 1.

As we compare the average performance of the PAARC and the MCL-RO methods when considering the settings without fixed cost, we also consider the MCL-RO with fixed costs here given by:

7.1 Simulations results

We used the same simulation sets with \(k=100\) demand vectors, as described in the Appendix, to compare the PAARC and the MCL-RO solution corresponding average profits. Table 3 shows the average (over the simulations) profit of the PAARC and MCL-RO solutions, as well as the corresponding standard deviation.

Table 3 also includes the predicted worst possible profit. Such worst profit associated with the uncertainty set \(U_{box}\) and \(T=12\) can be obtained by solving \(\min _{d \in U_{box}} \mathcal {F}\left( q^{method}(d), d \right) \) via enumeration of its reasonable sized \(2^T\) vertices. Recall that it requires only \(\bar{\alpha }\), or \(\gamma \) for the PAARC or MCL-RO methods, respectively. The Table shows that these worst profits are very similar, yet the models’ size differ in favor of the PAARC method.

In general, the performance of the PAARC and MCL-RO methods is very similar, as seen for the model without fixed costs in Sect. 5.1, and hence also strengthen the empirical results shown in Table 1. Since the results for the cost sets C1 and C3 are showing the same trend we omitted them here.

References

Arrow K, Harris T, Marschak J (1951) Optimal inventory policy. Econometrica 19(3):250–272

Barthe F, Gamboa F, Lozada-chang L, Rouault A (2010) Generalized dirichlet distributions on the ball and moments. Alea 7:319–340

Ben-Tal A, Nemirovski A (2002) Robust optimization—methodology and applications. Math Progr 92(3):453–480

Ben-Tal A, Goryashko A, Guslitzer E, Nemirovski A (2004) Adjustable robust solutions of uncertain linear programs. Math Progr 99(2):351–376

Ben-Tal A, Golany B, Nemirovski A, Vial J (2005) Retailer-supplier flexible commitments contracts: a robust optimization approach. MSOM 7(3):248–271

Bertsimas D, Sim M (2004) The price of robustness. Oper Res 52(1):35–53

Bertsimas D, Thiele A (2006) A robust optimization approach to inventory theory. Oper Res 54(1):150–168

Bertsimas D, Iancu DA, Parrilo PA (2010) Optimality of affine policies in multistage robust optimization. Math Oper Res 35(2):363–394

Bertsimas D, Brown DB, Caramanis C (2011) Theory and applications of robust optimization. SIAM Rev 53(3):464–501

Bes C, Sethi SP (1988) Concepts of forecast and decision horizons: applications to dynamic stochastic optimization problems. Math Oper Res 13(2):295–310

Chan LM, Shen ZM, Simchi-Levi D, Swann JL (2004) Coordination of pricing and inventory decisions: a survey and classification. In: Simchi-Levi D, Wu SD, Shen M (eds) Handbook of quantitative supply chain analysis. Springer, US, pp 335–392

Dvoretzky A, Kiefer J, Wolfowitz J (1952) The inventory problem: I. Case of known distributions of demand. Econometrica 20(2):187–222

Gallego G, Moon I (1993) The distribution free newsboy problem: review and extensions. J Oper Res Soc 44(8):825–834

Gallego G, Ryan J, Simchi-Levi D (2001) Minimax analysis for finite-horizon inventory models. IIE Trans 33(10):861–874

Goh J, Hall NG (2013) Total cost control in project management via satisficing. Manag Sci 59(6):1354–1372

Iancu DA, Trichakis N (2014) Pareto efficiency in robust optimization. Manag Sci 60(1):130–147

Kasugai H, Kasegai T (1960) Characteristics of dynamic maximin ordering policy. J Oper Res Soc Jpn 3(1):11–26

Levi R, Roundy R, Shmoys D (2007) Provably near-optimal sampling-based policies for stochastic inventory control models. Math Oper Res 32(4):821–839

Nahmias S (1982) Perishable inventory theory: a review. Oper Res 30(4):680–708

Rink D, Swan J (1979) Product life cycle research: a literature review. J Bus Res 7(3):219–242

Ruiter FD, Ben-Tal A, Brekelmans R, Hertog DD (2014) Adjustable robust optimizations with decision rules based on inexact revealed data. Discussion paper 2014–003, Tilburg University, Center for Economic Research

Scarf HE (1958) A min–max solution of an inventory problem. In: Arrow KJ (ed) Studies in the mathematical theory of inventory and production. Stanford University Press, California, pp 201–209

Scarf HE (1960) The optimality of (s, s) policies in the dynamic inventory problem. In: Arrow KJ, Karlin S, Suppes P (eds) Mathematical methods in the social sciences. Stanford University Press, California, pp 196–202

Scarf HE (1963) A survey of analytic techniques in inventory theory. In: Scarf HE, Gilford DM, Shelly MW (eds) Multistage inventory models and techniques. Stanford University Press, California, pp 185–225

See CT, Sim M (2010) Robust approximation to multiperiod inventory management. Oper Res 58(3):583–594

Shapiro A, Dentcheva D, Ruszczynski A (2009) Lectures on stochastic programming: modeling and theory. SIAM, Philadelphia

Veinott A (1966) On the optimality of (s, s) inventory policies: new conditions and a new proof. SIAM J Appl Math 14(5):1067–1083

Zipkin P (2000) Foundations of inventory management. McGraw-Hill, Boston

Acknowledgments

The authors thank the editors and two anonymous referees for their insightful comments and suggestions on this paper. Their input led to significant improvement in the authors’ work. We are grateful to the editors for suggesting the comparison to the MCL-RO method. The first author is grateful to Boris Bachelis for his kindness and patience in introducing her to the RO software. She also expresses her gratitude for Shimrit Shtern on many fruitful discussions and support.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Demand simulations

In order to examine the performance of the different methods under demand uncertainty we used demand simulations from the uncertainty set. For several uncertainty levels \(\rho \), \(l=3\) sets of k=100 demand vectors were generated, each vector consisting of T=12 entries to represent a twelve month planning horizon. Each set corresponds to a different distribution, with parameters, that were chosen to explore the effect of symmetric as well as non-symmetric demand distributions.

1.1.1 \(U_{box}\)

The entries were generated from a linearly transformed Beta distribution with specific shape parameters supported by the uncertainty set for the demand as shown in Table 4. The distributions’ parameters were chosen to explore the effect of symmetric as well as non-symmetric demand distributions.

1.1.2 \(U_{ellip}\)

The demand vectors were generated according to the Generalized Dirichlet distributions (Barthe et al. 2010) on the ball. It is a generalization of the beta distribution to a multivariate distribution. We used the same shape parameter as described in Table 4.

1.2 Cost parameters

The cost parameters are all set relatively to the production cost \(c_t\), which was set to 1 for all t. The life-cycle pattern of the demand affects the structure of the selling price vector m. At first, the price is high and it is decreasing according to the life-cycle pattern’s sequential stages. In addition, we assumed that the penalty on shortage p satisfies \(p_t=0.5m_t\) for all t. Accordingly, the salvage value was set to \(s=m_T=0.8\). These aforementioned cost parameters are identical for all the different sets: C1, C2, and C3. These sets differ in the holding cost vector h. The set C2 has a constant h, which is again set relatively to the production cost vector c. Whereas in sets C1 and C3 we examine the trade-off between the holding and penalty costs by changing the holding cost vector h according to a specific ratio \(\frac{h_t}{p_t}\),which was set to 0.1 and 1.5, respectively. Table 5 shows the cost parameters in use. Note, that the initial inventory level \(I_0\) was set to zero.

Rights and permissions

About this article

Cite this article

Melamed, M., Ben-Tal, A. & Golany, B. On the average performance of the adjustable RO and its use as an offline tool for multi-period production planning under uncertainty. Comput Manag Sci 13, 293–315 (2016). https://doi.org/10.1007/s10287-016-0250-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-016-0250-9