Abstract

In this paper, we propose and analyze a two-stage oligopoly game in which firms first simultaneously choose production technologies and in the second stage simultaneously choose production quantities. After characterizing the Nash equilibrium of the game, we cast our static model in a dynamic setting exploring the stability properties of the market equilibrium in two different cases: (i) exogenously distributed technologies and Cournot adjustments and (ii) endogenously distributed technologies in an infinite population game with Cournot–Nash equilibrium outputs. The main aim of the paper is that of extending the results about Cournot oligopoly stability in an evolutionary setting of heterogeneous decreasing returns-to-scale technologies. We show how the interplay between production decisions and R&D decisions can generate endogenous market fluctuations leading to complex dynamic phenomena.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Corporate control is usually a complex, dynamic and multidimensional problem. Companies typically adopt a segmented management structure with specialized departments handling production, sales, marketing, HR, R&D, finance, etc. The fact that these departments intensively communicate with each-other indicates that managers clearly know that decisions taken on one dimension interfere with the actions performed by their colleagues in another department. Abstracting away from all fronts of decision-making other than production and R&D, this paper formally studies the impact of these decisions on market dynamics and equilibria. We introduce a model where firms may take boundedly rational decisions on either production or innovation and show how these decisions and their interaction in a dynamic environment relate to market equilibrium stability and emerging endogenous fluctuations of innovation policy.

Our approach allows us to identify two potential sources of non-convergence to an equilibrium outcome, leading to market instability. The first one is operational in nature and is driven through adaptive quantity-setting by firms that are endowed with imperfect expectations of what their competitors will do. Given its source, we will call this phenomenon ‘production instability’ throughout the paper. The second type of instability in our model stems from adaptive choices of firms over two alternative production technologies. This choice, we show, can generate ‘technological instability’. Our analysis reveals that these two types of decisions can together generate bounded endogenous market fluctuations.

Our first line of inquiry, relating to production instability, follows from the seminal paper of Theocharis (1960). He showed the Cournot–Nash equilibrium in a quantity-setting oligopoly to be dynamically unstable when more than three firms compete by supplying, in each period, naive best-response quantities to the output produced by competitors one period before. The importance of this result was reflected by the quick emergence of works extending, qualifying and containing it, Fisher (1961), McManus and Quandt (1961) and Hahn (1962). With the development of chaos and bifurcation theory and the wide acknowledgment of their relevance for economic theory due to Grandmont (1985) and Brock and Hommes (1997), Theocharis’ inquiries were revisited in works celebrating endogenous cycle formation and chaotic dynamics in oligopoly markets, see Agliari et al. (2000), Droste et al. (2002), Bischi and Lamantia (2004, 2012), Hommes et al. (2018), Kopel et al. (2014) and Bischi et al. (2015). A frequent feature in these models is the introduction of behavioral heterogeneity—be it in terms of expectations, Droste et al. (2002), Hommes et al. (2018) or of the objectives of the firm, Kopel et al. (2014), De Giovanni and Lamantia (2016), Kopel and Lamantia (2018) and Radi (2017). Our model also focuses on firm heterogeneity, but here it is of a technological nature.

As such, our analysis of technological instability also relates our inquiry to Nelson and Winter (1982). In their seminal work, bounded rationality and firms’ technological heterogeneity—both central to our analysis—are key features of industrial dynamics and economic growth. Heterogeneity and dynamic adaptation, they argue from an evolutionary perspective that is Schumpeterian in both scope and method, are essential to understanding innovation and technological progress. Their approach inspired a rich literature of Agent-Based simulation models. Some of its highlights are surveyed in Dawid (2006).

Also inspired by Nelson and Winter (1982), Hommes and Zeppini (2014) and Diks et al. (2013) analyzed models where firms choose between alternative R&D strategies: innovation and imitation. Much like their analysis the work presented here employs a simpler formulation of the technological dimension, one that allows for a more general analysis of the model combining the classical tools of game theory and dynamic system analysis with bifurcation theory and numerical simulation. Despite differences in the naming of the two competing technologies,Footnote 1 our market setup closely resembles the one used in Hommes and Zeppini (2014) and Diks et al. (2013). The model analyzed here is different, as we consider a setting where firms strategically compete in an oligopoly market whereas Hommes and Zeppini (2014) assume an infinite firm population with no individual market power. Moreover, differently from Hommes and Zeppini (2014), we do not assume that, given technology choice, the market is always in equilibrium. Our work is also related to Ding et al. (2014, 2015), where firms learn how to invest based on realizations of profit margins while, as in Hommes and Zeppini (2014), the market clears for Nash quantities every period. The effect of consumers’ demands on firms’ technology selection is instead analyzed in Lamantia and Radi (2015). They propose an oligopoly model of technology adoption in the exploitation of natural resources, where the use of each technology has a different impact on the natural growth of the resource and where consumers’ willingness to pay depends on firms’ technology adoption. Finally, a related setup with forward-looking firms is analyzed in Lamantia and Radi (2018), which assumes nonlinear demand and constant return-to-scale technology, whereas our analysis is based on linear demand and decreasing return-to-scale technology.

This paper is organized as follows. In Sect. 2 we begin by deriving some preliminary results for a market setup where firms choose production technology and are engaged in static Cournot competition. We characterize the Nash equilibrium of the model and show that, depending on model parameters—in particular, the cost of using the innovative technology—we can either obtain an equilibrium with all firms employing the same technology—innovative or standard—or a mixed equilibrium where fractions of the firm population use different technologies. This is summed up in Theorem 1. Casting our static model in a suite of dynamic settings, we then move on to investigate the stability properties of the market equilibrium when firms make boundedly rational decisions. We consider two separate cases: (i) technology distribution is exogenous and production is determined by Cournot adjustment (i.e. best-response dynamics with naive expectations)—Sect. 3; (ii) output is at the Cournot–Nash equilibrium but firms switch technologies based on average profitability—Sect. 4. Section 5 concludes providing suggestions for further extensions to put in the research agenda.

2 The model

Consider a firm population producing homogeneous goods. Firms play a two-stage sequential game. In the first stage, all firms simultaneously choose one of two available production technologies. In the second stage, firms produce homogeneous goods and compete à la Cournot. Before the second stage takes place, technology decisions become public knowledge in an aggregate sense: firms know what the fractions of the firm population using each technology are. After firms simultaneously decide on an output level, q, they are matched with \(N-1\) other firms randomly drawn from the population. Then, in groups of N, firms jointly serve a group level demand function by supplying the output that they produced before the match was realized. Because matching and market clearing are realized after production decisions are made, firms do not know the exact technological composition of their oligopoly competitors at the time they make production decisions. Instead, they base their output decisions on their expectation about the technology choice of the firms composing their group. As we consider only two technological alternatives, we only need to keep track of the share of firms using one of the technologies. We denote by z the share of firms who produce with the standard technology, s, while the remaining \(1-z\) firms use the innovative technology denoted by i.Footnote 2

The cost functions associated with the two technologies are given by

for standard firms and

for innovative firms. We assume \(d_{s}>d_{i}\ge 0\), with \(d_{s}-d_{i}\) representing the marginal cost advantage of innovative firms and \(K>0\) the fixed investment required for using the innovative production technology. The amount K is paid before production and will be treated throughout our analysis as a sunk cost.

Market competition is set-up to translate the classical Cournot oligopoly game to a large population of heterogeneous firms. Each firm is randomly matched to \(N-1\) other firms in the population and their joint second-stage output clears a linear (inverse) demand:

where \(Q_{N}\) is the sum of quantities produced by the N firms that are matched together.

The game is solved by backward induction. We begin by determining the competitively optimal output decisions in stage two for any given population share. Then, by comparing the realized profits of the two technological strategies, we can establish the Nash equilibrium in terms of both output and technology. Because the analysis will further dive into model dynamics, it is convenient to restrict our attention to the quasi-symmetric equilibrium, where all firms of one type produce the same output that we denote by \(q_j,\;j\in \{s,i\}\).

Depending on the production technology used, the expected average profit of a firm who knows the population shares of standard and innovating firms, z and \(1-z\), is computed as the probability weighted sum, over all possible market compositions, of the profits realized in each particular scenario, with w standard competitors and \(N-1-w\) innovating competitors:

The only term in the above expression that depends on the summation index, w, accounts for the possible output of competitors in each possible market composition, \(\left[ wq_{s}+\left( N-1-w\right) q_{i}\right] \). Simplifying accordingly, we obtain:

where \(\bar{Q}_{N-1}\left( z\right) \) denotes the average competing output that a firm expects to face from the firms with which it will be matched, given population shares z and \(1-z\). Notice that it is:

Plugging (3) into (2) and maximizing with respect to own quantities, we obtain the reaction functions:

Solving for quantities and introducing the quantity

we find manageable expressions for the quasi-symmetric Cournot–Nash quantities as a function of Z:

Notice that \(q_{i}^{N}(z)=\frac{2+d_{s}}{2+d_{i}}q_{s}^{N}\left( z\right) >q_{s}^{N}(z)\): innovators will always produce more than standard firms.

Plugging Nash quantities back into (2), we obtain the expected average Cournot–Nash profits:

The choice of production technology in the first stage of the game will depend on the relation between the profit functions given in Eq. (7). Theorem 1, proven in the Appendix, is based on a comparison of the two profit functions in (7) depending on z and on model parameters. It allows identifying the quasi-symmetric Nash equilibria of the game in terms of output \(q_{s}\) and population-wide technology distribution, z. Because there are only two available technologies and, according to Eq. (6), the quantities produced by the two types of firms are linearly dependent, \(q_{i}^{N}\left( z\right) =\frac{2+d_{s}}{2+d_{i}}q_{s}^{N}\left( z\right) \), the Nash equilibrium of the two-stage game is fully characterized by a pair, \(\left( q_{s}^{*},z^{*}\right) \), of standard firm output and population share. While the model has four parameters, \(d_s\), \(d_i\), N and K, it is convenient to focus on the cost of innovation parameter, K.

Theorem 1

For all \(N\ge 2\), \(d_{s}>d_{i}\ge 0\), one the following three cases applies:

-

(a)

\(\left( q_{s}^{*},z^{*}\right) =\left( \frac{1}{\left( 1+d_{s}+N\right) },\;1\right) \) iff \(K>K^{1}\);

-

(b)

\(\left( q_{s}^{*},z^{*}\right) =\left( \sqrt{\frac{2(2+d_{i})K}{(d_{s}-d_{i})(2+d_{s})}},\ \frac{2+d_{s}}{d_{s}-d_{i}}-\frac{\left( 2+d_{i}\right) }{\left( N-1\right) \left( d_{s}-d_{i}\right) }\left[ \sqrt{\frac{(d_{s}-d_{i})(2+d_{s})}{2(2+d_{i})K}}-\left( 2+d_{s}\right) \right] \right) \) iff \(K^{0}\le K\le K^{1}\);

-

(c)

\(\left( q_{s}^{*},z^{*}\right) =\left( \frac{1}{\left( 1+d_{i}+N\right) },\;0\right) \) iff \(K<K^{0}\);

with \(K^{0}=\frac{\left( 2+d_{i}\right) \left( d_{s}-d_{i}\right) }{2(2+d_{s})\left( N+1+d_{i}\right) ^{2}}\) and \(K^{1}=\frac{\left( 2+d_{s}\right) \left( d_{s}-d_{i}\right) }{2(2+d_{i})\left( N+1+d_{s}\right) ^{2}}>K^0.\)

Rewriting (7) in function of z, we can compute Nash equilibrium profits for any given population shares, z.

The results of Theorem 1 can be intuitively grasped by inspecting Fig. 1a. Notice that average profits, for both types of firms will be strictly increasing and convex in z.Footnote 3 In addition, it is \(\frac{\partial \bar{\pi }_{s}^{N}(z)}{\partial z}=\frac{2+d_{i}}{2+d_{s}}\frac{\partial \bar{\pi }_{i}^{N}(z)}{\partial z}\) which means that the profit function of the innovative firms slopes steeper in z than the profit function of standard firms. This implies that if the profit functions cross for some \(z>0\) they will only do so once, assuring the uniqueness of \(z^{*}\). Changing K results only in a vertical shift of the innovative firms’ profit curve. For high innovation costs, \(K>K^{1}\), standard firms always make higher profits and the Nash equilibrium has all firms using the standard strategy. When innovation costs fall below \(K^1\), but are still in the intermediate range between the two bounds, \(K^0\) and \(K^1\), there will be a unique interior point of intersection, \(z^{*},\) where the two strategies generate equal profits. Here, any population shares with a smaller fraction of standard firms than \(z^{*}\) cannot be a Nash equilibrium since innovative firms will have an incentive to switch to the standard technology (leading to an increase in z). Likewise, we cannot have a Nash equilibrium with more than \(z^{*}\) standard firms since in such a population a standard firm would want to switch and become an innovator (resulting in a decrease in z). For \(K<K^{0}\) innovative firms make strictly higher profits than standard firms, for any z, therefore all firms will innovate in the Nash equilibrium.

a Second-stage Nash profits as a function of z for \(d_{s}=1.5,\) \(d_{i}=0.5\), \(N=4\) and different levels of K. The (first-stage) equilibrium share of standard firms is found at the intersection between \(\pi _{s}\left( z\right) \) and \(\pi _{i}\left( z\right) \). b The effects of increasing N on the equilibrium share of standard firms. \(K=0.012\), \(d_{s}=1.5,d_{i}=0.5\)

From the expressions of \(z^{*}\) and \(q_{s}^{*}\) in Theorem 1, we can also immediately derive the comparative statics of the equilibrium with respect to innovation costs: equilibrium quantities (for both types of firms) are increasing in K and so is the equilibrium share of standard firms, \(z^{*}\). Also, the interior equilibrium fraction of standard firms, \(z^{*}\), is a strictly concave function of K.

At first glance, it may seem surprising that equilibrium output for both technological strategies increases in K, particularly given that quantities are strategic substitutes in Cournot oligopoly games. Inspecting the best-response functions for quantities, Eq. (4), we notice that they are identical except for the denominator which tells us that standard firms will react less aggressively to whatever the expected output by competitors is. While own output is strategically decreasing in the expected output of the competitors, it is not clear how competitors’ output would react to changes in innovation costs, K. Intuitively, raising K would lead to a drop in the share of innovators, who always produce more than standard firms. This, in turn, would leave a gap in the supply. This gap leaves room for extra production to both the (now fewer) innovators and the standard firms, therefore, firm output increases for both types when fixed innovation costs, K, increase.

The effect of innovation costs on equilibrium firm output is best explained when we inspect the effect of K on total output at equilibrium, \(\bar{Q}_{N}^{*}\) which, regarding K, behaves exactly like the output by a firm’s competitors at equilibrium, since \(\bar{Q}_{N}^{*}=\frac{N}{N-1}\bar{Q}_{N-1}^{*}\). As both \(z^{*}\) and \(q_{s}^{*}\) are increasing in K, the effect of fixed innovation costs on the average industry quantity produced in equilibrium is a priori ambiguous: higher K indirectly entails higher production by the standard firms but also less innovative firms who, at any given parameter combination, produce more than the standard ones. According to Corollary 1, it is the latter effect that is stronger overall. Therefore, even if both types of firms would produce more when the share of innovators drops as a consequence of the innovative strategy being more expensive, overall, the population mix effect is stronger, leading to lower average total industry output when innovation costs are higher.

Corollary 1

In a mixed population equilibrium, average total industry output is given by:

and decreases in K. Average total industry profits are:

Remarkably, once first-stage decisions on technology are internalized, the equilibrium quantity produced by an individual firm—no matter its technology—will not depend on the number of oligopoly firms, N, nor will its average equilibrium profit. The equilibrium share of standard firms, \(z^{*},\) is however increasing in N.Footnote 4 This means that an increase in the intensity of competition will lead, in our model, to less innovation, a result which has a Schumpeter mark II flavor, with more intensive competition having a stifling effect on innovation.Footnote 5 Indeed, given z, second-stage profits are decreasing in N, see Eq. (7). As N increases, the part of the profit function that does not depend on fixed innovation costs decreases for both types of firms, but this decrease will be \(\frac{2+d_{s}}{2+d_{i}}\) times stronger for innovative firms. In other words, moving from N to \(N+1\) firms will lead to a flattening of the second-stage profit curves given in (8), but the flattening will be more pronounced for \(\bar{\pi }_{i}^{N}(z)\) than for \(\bar{\pi }_{s}^{N}(z)\). This means that the profit functions will cross—if at all—for a higher z as shown in Fig. 1b. So, in the first stage, more firms will choose the standard technology when the number of oligopoly firms increases.

The comparative statics of the equilibrium share of standard firms with regard to marginal production costs are not always monotonic. We can show that the share of standard firms is always decreasing in \(d_{s}\), as expected, but its relation to \(d_{i}\) depends on the relation between parameters \(d_{s},d_{i}\) and N. Specifically \(z^{*}\) will be always increasing in \(d_{i}\) when the standard technology is not excessively more inefficient than the innovative technology, or, if the efficiency gap between the two technologies is high, when the number of oligopoly firms, N, is not too large.

Theorem 1 gives a characterization of the full range of equilibria that our model can have in a static setting, with cases (a) and (c) corresponding to Nash equilibria with only one type of firm, standard or innovative, respectively. Case (b) corresponds to parameter combinations where both types of firms are present in equilibrium. In accordance with the expressions for \(K^{0}\) and \(K^{1}\), provided by Theorem 1, when N increases we observe only a downward shift of the subset of the \(\left( d_{s},d_{i},K\right) \) parameter space where the mixed equilibrium exists, while its shape remains qualitatively the same.

Having characterized the Nash equilibrium of the static game, we turn our attention to the dynamic features of the model, analyzing what happens when firms repeatedly take decisions on which technology to use or on what quantity to produce. In the next section, we first consider a version of the model where technology is exogenous (i.e. z is fixed) thus quantities produced are the only source of economic dynamics—forming naive expectations of the quantity supplied by competitors, each firm maximizes its profits with respect to the quantity they produce. Next, in Sect. 4, we endogenize technological choice and constrain the production behavior of the firms to supplying the Nash equilibrium quantities corresponding to the current shares of standard and innovative firms.

3 Non-evolutionary best-response quantity dynamics

In this section, we assume that the population shares are fixed and known to the firms before they make their production decisions. Quantity decisions follow a Cournot adjustment process where, before producing for period t, firms make a naive forecast, \(\bar{Q}_{N-1,t}\), of how much their competitors will produce. The forecast will be based on known population shares, z and \(1-z\), and past production behavior \(q_{s,t-1}\) and \(q_{i,t-1}\), Given these expectations, each firm will produce a profit maximizing quantity, \(q_{j,t},\; j\in \left\{ s,i\right\} \) that is derived as the best-response functions in (4), adapted here for a dynamic setting:

Notice that again \(q_{i,t}=q_{s,t}\frac{2+d_{s}}{2+d_{i}}\)—the relation we found in our static analysis between Nash quantities holds in this dynamic set-up as well. Thus, the dynamic model can be entirely characterized by a one-dimensional map. Specifically, the quantity dynamics expressed in \(q_{s}\) become:

So, for any fixed level of \(z\in \left[ 0,1\right] \), solving for the steady state quantity \(q_{s}^{*}\) gives:

which are equivalent to the Cournot–Nash quantities in (6). Theorem 2 describes the stability properties of this equilibrium.

Theorem 2

The steady state of the dynamic system in (10) is the Cournot–Nash equilibrium of the static game and it is globally stable if and only if:

otherwise the dynamics converge to a two cycle in which one of the periodic points is zero.

Given that the map in (10) is (piecewise-)linear, the price and quantity time-series generated by this model will either converge to the Nash equilibrium or diverge and hit the non-negativity constraint on production settling into a two cycle oscillating between 0 and \(\frac{1}{2+d_{s}}\). In a subspace of the parameter space defined by \(\left( N-1\right) \left[ \frac{z}{2+d_{s}}+\frac{1-z}{2+d_{i}}\right] =1\), there will be a bounded two-cycle with quantities oscillating between any initial value \(q_{0}\) and \(\frac{1}{2+d_{s}}-q_{0}\).

Theorem 2 also provides insight into the effects of model parameters on the stability of the system. It implies that increases in marginal costs, \(d_{s}\) and \(d_{i}\), will have a stabilizing effect on market dynamics, consistent with the findings in Fisher (1961), whereas an increase in the share of firms that use the innovative technology will (weakly) reduce the stability of the system: higher marginal costs reduce over-reaction typical of best reply dynamics leading to more stability, whereas the adoption of the most efficient technology entails lower marginal costs favouring players’ over-reaction and leading to instability. The theorem also generalizes the Theocaris result with quadratic costs a la Fisher to an evolutionary setting (see Fisher 1961).Footnote 6

Clearly, when \(d_{s}\) and \(d_{i}\) are sufficiently high, the equilibrium is stable regardless of z. Likewise, for sufficiently high N and low enough \(d_{s}\) and \(d_i\) the equilibrium will always be unstable for all z. In between these two extremes, there exists an interesting section of the parameter space where the equilibrium is stable for large z (few innovators) and unstable for low z (many innovators).

One such parameter region can be obtained by setting \(d_{s}\) and \(d_{i}\) such that the equilibrium is stable for \(z=1\) and unstable for \(z=0\). This requires \(\widehat{N}(1)=3+d_{s}>N>3+d_{i}=\widehat{N}(0)\). Obviously, if \(\widehat{N}(0)<N<\widehat{N}(1)\) there exists a \(\widehat{z}\in ]0,1[\) such that the fixed point \(\bar{q}_{s}^{*}\) is unstable for \(z\in [0,\widehat{z}[\) and stable for \(z\in ]\widehat{z},1]\). In fact,

4 Evolutionary dynamics with Nash players

In this section, we assume that agents play the Nash equilibrium strategy in terms of the quantity they supply, but switch production technologies based on their past performance. The adjustment of the share of firms employing a given technology will be governed by a replicator equation and provides the source of dynamic behavior for the model analyzed in this section. We first describe the model set-up in general terms and then analyze a sluggish replicator specification where only a fraction of firms can change strategy in each period.

4.1 General set-up

To be more precise on the structure of the problem faced by firms and the timing of decision-making, in time period t, the following steps happen in order:

-

1.

Firms pay any fixed costs associated with their newly chosen production technology (i.e. innovators pay K).

-

2.

Firms find out the current population shares, they know \(z_{t}\).

-

3.

Firms produce the Nash equilibrium quantities corresponding to the current population shares, \(q_{s}^{N}\left( z_{t}\right) \) and \(q_{i}^{N}\left( z_{t}\right) \). Firms are randomly matched in groups of N. The market clears and average profits \(\bar{\pi }_{s}^{N}\left( z_{t}\right) \) and \(\bar{\pi }_{i}^{N}\left( z_{t}\right) \) are realized.

-

4.

(A fraction of the) firms update technological strategy: each firm randomly samples another firm from the firm population, if the selected firm obtained a higher profit, the updating firm imitates its R&D strategy with a probability that increases with the profit difference. This determines the population shares in the next period, \(z_{t+1}\).

A strategy revision protocol like the one described in the fourth step of the setup above can be approximated by an aggregate replicator equation describing how, for every current population state, \(z_{t}\), average realized profits \(\bar{\pi }_{s}^{N}\left( z_{t}\right) \) and \(\bar{\pi }_{i}^{N}\left( z_{t}\right) \) will determine the population state in next period, \(z_{t+1}\), see Schlag (1998), Lahkar and Sandholm (2008) and Hofbauer and Sandholm (2009). At this stage, we generically refer to the replicator equation by \(G\left( (z_{t})\right) \), so that, formally, the dynamic system is a one-dimensional map and is fully described by the equation:Footnote 7

Each firm knows the current fraction of standard firms, \(z_{t}\), and sets the Nash equilibrium quantities corresponding to the current population shares and its own technology, expecting all competitors to do likewise. In this sense, firms have rational expectations because their expectation of competitors’ quantities is based on the actual population shares and the realized Nash quantities. An alternative interpretation would be that the quantity and technology adjustment processes take place on different time scales with technology being updated less often while quantities have sufficient time to converge to the Nash equilibrium between subsequent technology decisions.

In the following subsection, we explore the dynamic properties of the one-dimensional model described at the beginning of this section when the evolution of population shares is driven by an extension of the above replicator equation.

4.2 Dynamics with sluggish replicator dynamics

We now consider a particular form of the dynamic system in (13) with a Sluggish Replicator equation, meaning that only a share \(1-\delta \), \(\delta \in [0,1]\), of the firm population updates their production technology (asynchronous updating):

where

Dynamic system (13) with \(G_{\delta }(z_{t})\) in (14) and \(\delta =0\) is referred to as the Adjusted (Exponential) Replicator dynamics, see also Dindo and Tuinstra (2011). Parameter \(\theta >0\) models firms’ propensity in revising their decisions and is referred to as the intensity of choice.

In the analysis that follows, it will be handy to denote the difference between the average profits realized by the two types of firms setting Nash quantities by:

Theorem 3, whose proof can be deduced directly from Lemma 1 in De Giovanni and Lamantia (2016), describes the dynamic properties of the evolutionary model where firms set Nash equilibrium quantities and update their production technology based on past performance. In conjunction with Theorem 1, it allows us to identify the steady state and make a global analysis of its stability.

Theorem 3

The Nash equilibria given in Theorem 1 are steady states of the dynamic system defined by map (14). The stability of each steady state is governed by the intensity of choice parameter, \(\theta \), and the cost of innovation, K in the following way:

-

(a)

\(z_{1}=1\) is always a steady state for map (14). \(z_1\) is almost globally stable for \(K\ge K^{1}\) and unstable for \(K<K^{1}\);

-

(b)

For \(K^{0}<K<K^{1}\), \(z^{*}\in ]0,1[\) is a steady state. Steady state \(z^{*}\) is almost globally stable for \(\theta <\widehat{\theta }\) and unstable for \(\theta >\widehat{\theta }\), where:

$$\begin{aligned} \widehat{\theta }= & {} -\frac{2}{(1-z^{*})z^{*}\psi ^{\prime }(z^{*})(1-\delta )}. \end{aligned}$$ -

(c)

\(z_{0}=0\) is always a steady state for map (14). \(z_0\) is almost globally stable for \(K\le K^{0}\) and unstable for \(K>K^{0}\);

Notice that the instability threshold, \(\widehat{\theta }\), for the interior equilibrium, \(z^{*}\), as defined in Theorem 3, depends on \(z^{*}\) and therefore also depends on the value of K whenever \(K^{0}<K<K^{1}\). While \(z_{0}=0\) and \(z_{1}=1\) are always steady states of the system, they are (almost globally) stable if and only if they are also Nash equilibria of the static game, see Theorem 1.Footnote 8

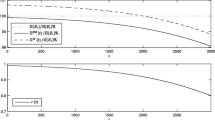

Interestingly, the stability properties of the Nash equilibrium change smoothly as we increase K, while its nature qualitatively shifts from a homogeneous to a mixed and then again to a homogenous population equilibrium. When \(K\in ]K^{0},K^{1}[\) approaches either of the interval boundaries, \(\widehat{\theta }\) tends to infinity. This feature is a direct result of the updating mechanism described by the replicator equation in (14).Footnote 9 When only few firms of either type are present in the equilibrium population, the probability that, following a perturbation, a firm of the predominant type will encounter a more profitable firm of the scarce type to imitate its strategy is smaller compared to a situation when strategies are evenly distributed at equilibrium. This means that, around an equilibrium that is closer to the boundary, there will be comparatively less switching of strategies and therefore smoother re-adjustment toward the equilibrium following a shock. The bifurcation diagrams in Fig. 4 confirm that the interior steady state, \(z^{*}\), tends to be more stable when K is close to \(K^{0}\) or \(K^{1}\) and unstable for values of K located toward the center of the interval.

Notice also that the instability threshold, \(\widehat{\theta }\), is increasing in \(\delta \). Quite intuitively, the smaller the share of firms, \(1-\delta \), that update their strategy, the less likely will be the emergence of overshooting behavior. Therefore, we find the standard Adjusted exponential replicator dynamics to be more unstable than its sluggish extension.

Numerical analysis confirms the analytical results above showing the market can be destabilized by overshooting in technology adjustment, for high \(\theta \).Footnote 10 Although all market variables—quantity, profits and strategy shares—alternate above and below the steady state, they never manage to converge to it. The economic mechanism of this result is fairly simple. When \(z_{t}\) is below its steady state value both types of firms will underproduce compared to the mixed equilibrium output. This happens because quantities are strategic substitutes in Cournot games and expected average competing output is decreasing in z. Therefore, firms will expect competitors to produce more than \(\bar{Q}_{N-1}^{*}\) when \(z_{t}<z^{*}\) and react accordingly by producing too little. This means that second-stage Nash profits in (13) will be below the steady state value for both types of firms, but more so for innovators who will not be able to compensate their fixed innovation costs by selling a sufficiently large output: as shown in Sect. 2, we will have \(\bar{\pi }_{s}^{N}\left( z_{t}\right) >\bar{\pi }_{i}^{N}\left( z_{t}\right) \). This determines a switch toward the standard strategy, but because the intensity of choice is too high, the steady state \(z^{*}\) is overshot and now the opposite is true, with \(\bar{\pi }_{s}^{N}\left( z_{t}\right) <\bar{\pi }_{i}^{N}\left( z_{t}\right) \) determining another overzealous switch toward innovation.

Interestingly, when starting close to the steady state, at first, successive fluctuations increase in amplitude. This is to be expected, since the further away we are from the steady state, the higher the profit difference, see also Fig. 1a. However, once \(z_{t}\) moves sufficiently far below the steady state, fluctuations will be dampened and population shares will return close to the steady state although still slightly overshooting \(z^{*}\). From there the scenario repeats.

The economic interpretation of this observation requires close inspection of the dynamic map in Fig. 2 and relies on the micro-level behavioral foundations of the strategy share updating equation described in Dindo and Tuinstra (2011). The details of the overshooting behavior and the return close to equilibrium are also related to the asymmetric tent-like shape of the map with a flat-sloping increasing linear component given by \(\delta z_{t}\) and the sharply locally decreasing nonlinear component, \((1-\delta )\frac{z_{t}\exp \left( \theta \bar{\pi }_{s}^{N}(z_{t})\right) }{z_{t}\exp \left( \theta \bar{\pi }_{s}^{N}(z_{t})\right) +(1-z_{t})\exp \left( \theta \bar{\pi }_{i}^{N}(z_{t})\right) }.\)

For very small but positive z, the map abruptly grows from 0 to 0.75.Footnote 11 For low enough values of \(\theta \), the generic trajectory converges to an equilibrium, see Fig. 2a. The situation depicted in Fig. 2b is different: because \(\theta \) is very high and standard profits are smaller than innovator profits, practically all firms would switch to the standard strategy except for the \(\delta \) proportion of firms who, by assumption, cannot update strategy. By the same logic, as z increases, the map also increases almost linearly with a slope of \(\delta \). When we get close to the fixed point, the profit difference becomes small enough to compensate for the high \(\theta \) and strategy switching will no longer occur for all firms that are free to update. This is where we finally notice that the map begins to curve downwards and cross the diagonal at \(z^{*}\). At the micro-level of our updating mechanism, this means that innovating firms are decreasingly likely to copy the technology of a standard firm, whenever they compare profits with such a firm, because standard profits are not much higher than their own. At the point where the map crosses the diagonal, firms will literally find no other firm with higher profit so they all keep their current technology. After this crossing happens, the map will abruptly head downwards because the profit differential increases faster as we move rightward from the mixed steady state than it does when we move leftward from the mixed steady state, see also Fig. 1a. Eventually, as we approach \(z=1\) innovators will become increasingly harder to find and imitate, because there are simply less of them in the population, so, when z is very high, most standard firms will simply compare profits with another standard firm and conclude that they are doing well enough.

The shape of the map in particular the softly increasing linear part followed by an abruptly decreasing nonlinear segment also explains why large downward fluctuations are followed by returns of the population shares close to equilibrium. The entire flat part of the map slopes around the steady state equilibrium and, whenever overshooting brings population shares sufficiently far below the equilibrium, it ‘catches’ the dynamics and directs population shares back close to equilibrium. It is important to mention that the return close to equilibrium is not so precise for all parameter combinations associated with instability, but it does appear to be a common feature of those parameter combinations that support chaotic fluctuations.

Comparing results for different choices of the sluggishness parameter, \(\delta ,\) also outlines a remarkable difference between the model dynamics with the Adjusted replicator (\(\delta =0\)) compared to its sluggish counterpart (\(\delta >0\)). Figures 3 and 4 show how only a small amount of sluggishness is enough to tame the system into a less complicated pattern. The small pocket of unruly dynamics generated by the Adjusted replicator equation disappears for \(\delta >0\). As we further increase \(\delta \), we can have, for sufficiently high \(\theta \), qualitatively different types of dynamics. This is illustrated by Figs. 3 and 4. For low levels of \(\delta \), an over-shooting two-cycle exists for a considerable range of values of \(K\in ]K^{0},K^{1}[\) provided the intensity of choice, \(\theta \), is sufficiently high. As \(\delta \) increases, cycles of higher order as well as chaotic dynamics become possible while, at the same time, the range of the fluctuations becomes smaller.Footnote 12 As \(\delta \) approaches 1, stability is eventually restored. This parallels the result of Diks et al. (2013) where introducing memory in the fitness function used for strategy updating in an evolutionary model of innovation and imitation quantitatively reduced system instability (lower amplitude of fluctuations) while also increasing it in a qualitative sense (creating a bifurcation route to chaos). Although our model differs in the exact specification of fitness and of the evolutionary dynamics, increasing \(\delta \) in our model has very similar effects on the shape of the dynamic map as increasing the weight of past profits has on the one-dimensional map analyzed by Diks et al. (2013, p. 812): it simply shifts weight toward the linear increasing component of a map that, as in their paper, is “a convex combination of a linear increasing and a nonlinear decreasing map”.

Evolutionary strategy switching by sluggish replicator dynamics with Nash quantity-setting: bifurcation diagrams for the share of standard firms, \(z_{t}\), over parameter K, for \(N=4\), \(d_{s}=\frac{3}{2}\), \(d_{i}=\frac{1}{2}\), \(\theta =10{,}000\), for various levels of sluggishness a \(\delta =0\); b \(\delta =0.01\); c \(\delta =0.1\); d \(\delta =0.5\); e \(\delta =0.75\); f \(\delta =0.9\)

In examining Fig. 3a, one may be surprised to notice the upper right portion of the parameter space where the system seems to converge to a stable steady state according to our numerical results. This may appear even more surprising if we take into account that this apparent convergence tends to happen for higher intensity of choice, when \(\theta \text { is above }10{,}000\). However, on closer inspection, we find that the system does not actually converge to the mixed Nash equilibrium steady state there, but instead it becomes “stuck” in the steady state with standard firms only, \(z=1\). As argued above, this state cannot be a stable steady state of the system as long as it is not the Nash equilibrium. What we actually observe in Fig. 3a is a numerical error that the standard replicator dynamics are susceptible to. When, as far as machine precision can distinguish, \(z_{t}\) becomes equal to 1 the replicator equation (14) with \(\delta =0\) becomes a trivial equality and the system can no longer change its state. It is useful to note that while the sluggish extension to the replicator equation in (14) also becomes a trivial equality for \(z_{t}=1\), the fact that a portion of the firms, \(\delta \), does not update their strategy, is enough to keep the system far enough from the border so that it does not become stuck in the same way.

5 Conclusions

Our model analyzed the role of both production decisions and R&D decisions in generating endogenous market fluctuations. For specific parameter combinations, namely when intensity of choice is high and there is a relatively large number of firms competing in oligopoly, the decision-making process may generate complex dynamic phenomena.

While Hommes et al. (2018) show that explosive best-response dynamics can become bounded when nested in an evolutionary heuristic switching model, we show that the same result can be obtained by a model with evolutionary switching between production technologies. To the extent that technological heterogeneity is a more widely accepted feature of economic reality than behavioral heuristic heterogeneity, our analysis has the potential to broadcast to a broader—or at least different—audience the relevance of Theocharis’ result on oligopoly instability.

Finally, some limitations to the model interpretation and possible extension should be addressed. To begin with, innovation enters our model in a particular way that is mostly consistent with licensing of an external technology: firms have to pay a fixed cost each period in order to use the innovative technology. This is only one of many ways in which firms might access new technology and also only one of several alternative schemes for paying for it.Footnote 13 Examining the empirical evidence, Vishwasrao (2007) shows that in the presence of sales fluctuations fixed-fee licensing is the preferred method for licensing innovation. Therefore, our way of modeling the cost for using the new technology is adequate when the cost advantage of the innovative technology is not extremely high and when quantity dynamics are unstable. The second of these circumstances, as we have shown, is consistent with our model results.

Furthermore, the model used here cannot address long-term technological change. To have such power, we would have to consider a scenario where the conditions by which innovation is brought to the market change over time as a result of market outcomes. Such a scenario is investigated by Hommes and Zeppini (2014) where repeated use of the innovative technology over time can drive the associated production cost down. They find that depending on the price-elasticity of demand and model parameters either, market breakdown (exclusion of the innovative technology) or technological progress (exclusion of the standard technology) or balanced technological change (change in the equilibrium share of innovators) can occur. It would be interesting to investigate the extent to which that result would apply in our setting.

Future extensions of the current setup will address the case in which both production and technology choice is dynamic: agents play the best response to the quantity they expect their competitors will supply and switch production technologies based on their past performance. In addition, we will study and compare the welfare effects of innovation policy with quantity setting competing firms in the cases of Nash players and best-response players.

Notes

Where they speak of innovation versus imitation we contrast between an innovative strategy and a standard strategy.

A terminological different (but mathematical equivalent) formulation of the current setup can be proposed following Schaeffer (1989), by assuming that there are N firms and a large (infinite) number of managers of different types (managers who adopt the innovative technology and managers who adopt the standard one) who are randomly selected to run the N firms.

The share of standard firms appears only in the denominator in (8), \((2+d_{s})(1+d_{i}+N)-(d_{s}-d_{i})(N-1)z=d_{s}+(1+d_{i}+N)+\left( \left( 1-z\right) d_{s}+zd_{i}\right) \left( N-1\right) \), which is strictly positive \(\forall \) \(0\le z\le 1\), \(N\ge 2\) and \(d_{s}<d_{i}\) and also decreasing in z as it linearly depends on the population weighted average of marginal costs.

It is clear from Theorem (1)(b) that \(z^{*}\) depends on N only through the denominator of the fraction multiplying the expression in square brackets, \(E=\left( 2+d_{s}\right) -\frac{1}{q_{s}^{*}}\). Even though this expression does not depend itself on N, we cannot immediately determine its sign. However, we notice that, through \(q_{s}^{*}\), it is monotonic in K. More precisely, as long as there is a \(z^{*}\in ]0,1[\) we have \(2+d_{s}-\frac{1}{q_{s}^{*}\left( K^{0}\right) }<E<2+d_{s}-\frac{1}{q_{s}^{*}\left( K^{1}\right) }\) which simplifies to \(\frac{2+d_{s}}{2+d_{i}}\left( 1-N\right)<E<1-N\), meaning that E is always negative. Therefore \(z^{*}\) is increasing in N. Notice also that \(E=\left( 2+d_{s}\right) -\frac{1}{q_{s}^{*}}=-\frac{1-\left( 2+d_{s}\right) q_{s}^{*}}{q_{s}^{*}}=-\frac{\bar{Q}_{N-1}^{*}}{q_{s}^{*}}\).

Schumpeter’s first conjecture, Schumpeter (1934), is that higher intensity of market competition between firms spurs innovation. This conjecture has been labeled mark I. He later stated, in Schumpeter (1942), in what is also called Schumpter’s mark II conjecture, that less acute competition gives firms the slack they need in order to divert resources to innovation.

An analogous generalization to an evolutionary setting with Cournotian and Walrasian firms has been proposed in Radi (2017).

See De Giovanni and Lamantia (2016) for the general properties that function G should have.

Here a fixed point is almost globally stable when its basin of attraction is \([0,1]\backslash L\) where L is a zero-measure subset of [0, 1].

If, for instance, we would have used the standard logit updating equation which is based on best-response behavior rather than imitation of better performing strategies and, as a consequence, the exponentiated payoffs are not weighted by population shares, then we would not have had the same result of increased stability of the mixed equilibrium close to the boundaries.

All numerical simulation results presented in this paper were powered by E&F Chaos, the user-friendly software for nonlinear dynamic analysis developed at CeNDEF, University of Amsterdam. For a didactic presentation of its capabilities, see Diks et al. (2008).

Although the graph of \(G_\delta (z)\) in Fig. 2 passes through the origin, this is not visible in the figure given the steep slope of the function there.

Kamien and Tauman (1986) examined a static model where a patent holder licenses a cost-reducing innovation to a an oligopolistic market. They find that the a fixed-fee licensing scheme is preferred by the licensor compared to a royalty scheme. On the other hand, when auctioning of the innovation is also possible, Kamien et al. (1992), find that an auction may be preferred by the licensor, in particular, when the innovation is more substantive.

References

Agliari, A., Gardini, L., Puu, T.: The dynamics of a triopoly Cournot game. Chaos Solitons Fractals 11(15), 2531–2560 (2000)

Bischi, G.I., Lamantia, F.: A competition game with knowledge accumulation and spillovers. Int. Game Theory Rev. 6(03), 323–341 (2004)

Bischi, G.I., Lamantia, F.: Routes to complexity induced by constraints in Cournot oligopoly games with linear reaction functions. Stud. Nonlinear Dyn. Econom. 16(2), 1–30 (2012)

Bischi, G., Lamantia, F., Radi, D.: An evolutionary Cournot model with limited market knowledge. J. Econ. Behav. Organ. 116, 219–238 (2015)

Brock, W.A., Hommes, C.H.: A rational route to randomness. Econometrica 65(5), 1059–1096 (1997)

Dawid, H.: Agent-based models of innovation and technological change. Handb. Comput. Econ. 2, 1235–1272 (2006)

De Giovanni, D., Lamantia, F.: Control delegation, information and beliefs in evolutionary oligopolies. J. Evolut. Econ. 26(5), 1089–1116 (2016)

Diks, C., Hommes, C., Panchenko, V., van der Weide, R.: E&f chaos: a user friendly software package for nonlinear economic dynamics. Comput. Econ. 32(1), 221–244 (2008). https://doi.org/10.1007/s10614-008-9130-x

Diks, C., Hommes, C., Zeppini, P.: More memory under evolutionary learning may lead to chaos. Phys. A Stat. Mech. Appl. 392(4), 808–812 (2013). https://doi.org/10.1016/j.physa.2012.10.045

Dindo, P., Tuinstra, J.: A class of evolutionary models for participation games with negative feedback. Comput. Econ. 37(3), 267–300 (2011)

Ding, Z., Wang, Q., Jiang, S.: Analysis on the dynamics of a Cournot investment game with bounded rationality. Econ. Model. 39, 204–212 (2014)

Ding, Z., Li, Q., Jiang, S., Wang, X.: Dynamics in a Cournot investment game with heterogeneous players. Appl. Math. Comput. 256, 939–950 (2015)

Droste, E., Hommes, C., Tuinstra, J.: Endogenous fluctuations under evolutionary pressure in Cournot competition. Games Econ. Behav. 40(2), 232–269 (2002)

Fisher, F.M.: The stability of the Cournot oligopoly solution: the effects of speeds of adjustment and increasing marginal costs. Rev. Econ. Stud. 28(2), 125–135 (1961)

Grandmont, J.M.: On endogenous competitive business cycles. Econom. J. Econom. Soc. 53, 995–1045 (1985)

Hahn, F.H.: The stability of the Cournot oligopoly solution. Rev. Econ. Stud. 29(4), 329–331 (1962)

Hofbauer, J., Sandholm, W.H.: Stable games and their dynamics. J. Econ. Theory 144(4), 1665–1693 (2009)

Hommes, C., Zeppini, P.: Innovate or imitate? Behavioural technological change. J. Econ. Dyn. Control 48, 308–324 (2014)

Hommes, C., Ochea, M., Tuinstra, J.: Evolutionary competition between adjustment processes in Cournot oligopoly: instability and complex dynamics. Dyn. Games Appl. (2018). https://doi.org/10.1007/s13235-018-0238-x

Kamien, M.I., Tauman, Y.: Fees versus royalties and the private value of a patent. Q. J. Econ. 101, 471–491 (1986)

Kamien, M.I., Oren, S.S., Tauman, Y.: Optimal licensing of cost-reducing innovation. J. Math. Econ. 21(5), 483–508 (1992)

Kopel, M., Lamantia, F.: The persistence of social strategies under increasing competitive pressure. J. Econ. Dyn. Control 91, 71–83 (2018)

Kopel, M., Lamantia, F., Szidarovszky, F.: Evolutionary competition in a mixed market with socially concerned firms. J. Econ. Dyn. Control 48, 394–409 (2014)

Lahkar, R., Sandholm, W.H.: The projection dynamic and the geometry of population games. Games Econ. Behav. 64(2), 565–590 (2008)

Lamantia, F., Radi, D.: Exploitation of renewable resources with differentiated technologies: an evolutionary analysis. Math. Comput. Simul. 108, 155–174 (2015)

Lamantia, F., Radi, D.: Evolutionary technology adoption in an oligopoly market with forward-looking firms. Chaos Interdiscip. J. Nonlinear Sci. 28(5), 055904 (2018)

Li, T.Y., Yorke, J.A.: Period three implies chaos. Am. Math. Mon. 82(10), 985–992 (1975)

McManus, M., Quandt, R.E.: Comments on the stability of the Cournot oligopoly model. Rev. Econ. Stud. 28(2), 136–139 (1961)

Nelson, R., Winter, S.: An Evolutionary Theory of Economic Change. The Belknap Press of Harvard University Press, Cambridge (1982)

Radi, D.: Walrasian versus Cournot behavior in an oligopoly of bounded rational firms. J. Evolut. Econ. 27(5), 933–961 (2017)

Schaeffer, M.E.: Are profit-maximizers the best survivors? J. Econ. Behav. Organ. 12, 29–45 (1989)

Schlag, K.H.: Why imitate, and if so, how?: A boundedly rational approach to multi-armed bandits. J. Econ. Theory 78(1), 130–156 (1998)

Schumpeter, J.A.: The Theory of Economic Development. Harvard Economic Studies, Cambridge (1934)

Schumpeter, J.A.: Socialism, Capitalism and Democracy. Harper and Brothers, New York (1942)

Theocharis, R.D.: On the stability of the cournot solution on the oligopoly problem. Rev. Econ. Stud. 27(2), 133–134 (1960)

Vishwasrao, S.: Royalties vs. fees: how do firms pay for foreign technology? Int. J. Ind. Organ. 25(4), 741–759 (2007)

Acknowledgements

The authors would like to thank the anonymous Referees for their valuable comments, which highly helped to improve the manuscript. Fabio Lamantia and Jan Tuinstra gratefully acknowledge financial support from EU COST Action IS1104 “The EU in the new economic complex geography: models, tools and policy evaluation”. The research was supported by VŠB-TU Ostrava under the SGS Project SP2018/34.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Theorem 1

Profits are equal when \(\bar{\pi }_{s}^{N}(z)=\bar{\pi }_{i}^{N}(z)\). Solving for K and recalling (5) we obtain

which is positive \(\forall d_{s}>d_{i}\).

Expressing \(Z^{*}\) as a function of K gives:

We have thus:

Multiplying both sides by \(\left( 2+d_{s}\right) \left( 2+d_{i}\right) \) we obtain

By using (17), we can compute the equilibrium quantity for a standard firm when technologies are equally profitable as function of the model parameters (10):

We can also rewrite \(z^{*}\) as a function of \(q_{s}^{*}\):

Note that \(z^{*}\) is increasing in K, as expected; the more expensive it is to use the innovative technology, the smaller will be the equilibrium share of firms using it.

The interior point defined in part (b) of the theorem exists when the two profit function cross for some \(z\in ]0,1[\). This is equivalent to imposing \(\bar{\pi }_{s}^{N}(1)-\bar{\pi }_{i}^{N}(1)<0<\bar{\pi }_{s}^{N}(0)-\bar{\pi }_{i}^{N}(0)\), meaning that condition \(z^{*}\in ]0,1[\) is equivalent to:

which correspond to the two threshold levels for the fixed cost of investing in the new technology that are defined by the theorem.

Thus, when \(K^{0}<K<K^{1}\), for \(z\in ]0,z^{*}[\), we have \(\bar{\pi }_{s}^{N}(z)>\bar{\pi }_{i}^{N}(z)\) and for \(z\in ]z^{*},1[\) , it is \(\bar{\pi }_{s}^{N}(z)<\bar{\pi }_{i}^{N}(z)\).

Moreover condition \(\bar{\pi }_{s}^{N}(1)-\bar{\pi }_{i}^{N}(1)>0\) is equivalent to \(K>K^{1}\), standard firms are always better off than innovators because of the high cost to innovate.

The opposite holds if \(\bar{\pi }_{s}^{N}(0)-\bar{\pi }_{i}^{N}(0)<0\), i.e. for \(0<K<K^{0}\), where innovating dominates using the standard technology.

Proof of Corollary 1

By expressing equilibrium profits as a function of \(q_{s}^{*}\) as:

and substituting for \(q_{s}^{*}=\sqrt{\frac{2(2+d_{i})K}{(d_{s}-d_{i})(2+d_{s})}}\) we find equilibrium profits are linearly increasing in K for both types of firms:

This means that average total industry profits are given by:

Average industry output is given by

Rights and permissions

About this article

Cite this article

Lamantia, F., Negriu, A. & Tuinstra, J. Technology choice in an evolutionary oligopoly game. Decisions Econ Finan 41, 335–356 (2018). https://doi.org/10.1007/s10203-018-0215-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-018-0215-2