Abstract

In an evolutionary delegation game, we investigate the effects on market outputs of different levels of information about the way managers are compensated. When managers are informed about their opponents, the long–run configuration of the industry depends on market conditions. When managers are informed only of the current composition of the population, only profit maximizing firms survive, no matter what market condition prevails. However, if we further lower the level of information –by hiding the current composition of the industry– then we show how managers’ beliefs affect the long run equilibrium.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Starting from the seminal papers by Vickers (1985), Fershtman and Judd (1987) and Sklivas (1987), the well-established literature on delegation of control to managers, still taking the viewpoint of owners being profit-maximizers, indicates that this goal can be achieved in a strategic environment by appropriately tweaking managers’ objective functions. In this regard, Vickers (1985), page 144, writes:

But even if it were true that the only survivors of the economic struggle were the firms that made the greatest profits, it would not follow that they were profit-maximisers in the sense of having profit-maximisation as their objective, or behaving as such. [...] In short, if strategic interactions imply that the direct pursuit of profit does not lead to maximum profits, then forces of natural selection might see the demise of the profit-maximiser rather than his ultimate survival.

When control is delegated to managers, firms’ decisions take place in two stages (see Vickers 1985): at the first stage, an owner hires a manager and sets an objective function; at the second stage, the manager decides a strategic variable (e.g. quantities, prices, quality etc.) to optimize the objective. Usually, the manager’s payoff is expressed in terms of an absolute measure of the firm’s performance (e.g. a linear combination of profits and revenues; see Sklivas (1987), Fershtman and Judd (1987)) or a relative one (e.g. the firm’s market share; see Miller and Pazgal (2002), Jansen et al. (2007)). The main message here is that the owner, by distorting his own objective function (profit), could gain at the expense of rivals. Thus, hiring a manager ensures that the owner’s commitment to a different objective is credible. The specific incentive contract serves as a commitment device to that purpose. In the duopoly case under Cournot or Bertrand competition, Sklivas (1987) shows that when owners strategically choose the contract to offer to their managers, both competitors end up delegating control to managers. Typically, under quantity competition, delegation entails output expansion by putting more weight on revenues than profits. As a result, all firms are worse off than in the usual Cournot-Nash equilibrium, i.e. a typical prisoner’s dilemma outcome arises; dual results occur with price competition. When the number of firms is large, Sklivas (1987) concludes that the optimal contract to managers tends to reward only profits instead of a combination of profits and revenues, i.e. perfect competition is retrieved. In any case, these clear-cut results rely heavily on the assumption of firms’ complete information.

In a dynamic context, the validity of the ‘profit-maximization’ paradigm has been studied by means of evolutionary game-theoretic models. As a matter of fact, the possibility that evolving objectives do not tend towards profit maximization is referred to as the “Vickers’ conjecture” in Rhode and Stegeman (2001). One of the first contributions in this area is Schaffer (1989), who shows that, whenever firms have market power, profit-maximizers are not necessarily the best survivors.Footnote 1 Similarly, Heifetz et al. (2007) argue that payoff maximization cannot be justified from an evolutionary standpoint in almost every decision involving strategic interaction. In fact, they show that, under any payoff-monotone selection dynamics, the population of agents will not converge to payoff maximizing behavior because of the strategic effects of distorting players’ actual payoffs. Rhode and Stegeman (2001) study a differentiated duopoly where the weight on sales in firms’ objective functions follows a Darwinian process; in addition, they argue that it is perfectly reasonable to assume weights on sales that are not strategically chosen by owners because of the difficulty of assessing them. They show that the long run outcome is not a Nash equilibrium and the evolution of objectives distorts behavior towards revenue maximization.

In this paper, we analyze several versions of an evolutionary oligopoly with control delegation, where we progressively lower the amount of information as to the manner in which managers are compensated. When the assumption of complete information is relaxed and a one-shot delegation game is repeated over time, in fact, several additional issues must be taken into account. First, owners might offer an incentive to managers that is based on profits, as under quantity competition, owners are better off when in the industry the managers’ contracts are proportional to profits only; second, without knowing the rivals’ incentive contracts, designing an ’optimal’ contract for managers is not an obvious task, as shown in Rhode and Stegeman (2001); in addition, a reward scheme that is optimal for the owner could be rejected by the manager if not sufficiently appealing (see remarks in Footnote 2). Within this framework, we will address the following main research questions:

-

Can behavioral heterogeneity arise endogenously as a consequence of repetition of the delegation game between ex-ante identical players?

-

What is the most likely long-run distribution of incentive contracts in the industry? Under which conditions is the “Vickers’ conjecture” confirmed?

-

What are the factors that mainly influence the long–run distribution of different incentive schemes?

-

What happens when managers do not have information about the types of agents they play against? What is the effect of a misperception of the underlying probability on the long–run distribution of the incentive contracts?

To answer the questions above, we take a standard setup and consider an oligopoly where N quantity-setting firms decide, independently and simultaneously, whether the incentive to offer to managers is based on profits only (“P-firms”) or on a linear combination of profits and revenues (“R-firms”). For R-firms, the weight put on revenues in the manager’s objective function is assumed to be exogenously given.Footnote 2 After this choice is made, managers fix production quantities of the goods, which are horizontally differentiated, following (Häckner 2000). In this setup, all firms are homogeneous, having the same cost structure and sharing the same information set.

With respect to information available, we develop separately the cases in which managers can perfectly observe the incentive contracts of their opponents (informed managers) and the case of imperfect information, where the opponents’ types are not observable (uninformed managers). In both cases, owners only have information about the distribution of types and never more. We formulate the model in terms of Darwinian dynamics: at each time period, N firms are randomly extracted from a large population and matched to play the one-shot oligopoly game previously described. When deciding compensation for the manager, each owner evaluates current profits accrued by the different schemes (P and R). The more successful scheme is more likely to be adopted by firms in the future. Evolutionary selection based on realized profits in the market stage describes how the fractions of P-firms and R-firms evolve over time.Footnote 3 In our setup, evolutionary selection operates on the first stage of the game and models owners’ behaviors; second stage decisions are made by managers on the basis of the (Cournot-)Nash quantities prescribed by their incentive contracts (P or R), which are decided by owners in the first stage. Under perfect information (or perfect ‘observability’) on the types, managers set the quantity as a function of the types they are called to play against; under imperfect information (or imperfect ‘observability’), managers set the one quantity that maximizes their expected utility given their belief as to the distribution of types. It is worth stressing that, although R-firms act to maximize an index of (absolute) market performance, the evolutionary fitness of playing R is based on realized profits only. This is in accordance with Vickers’ remark (see above) and coherent with the indirect evolutionary approach, postulating that individual behavior is driven by subjective utility maximization, whereas evolutionary success depends on objective accrued payoff (see Alger and Weibull, (2013), for details).Footnote 4

With informed managers and substitute goods we find that, depending on the relationship between costs, demand and incentive contract of R–firms, the game is either dominance solvable, with all firms deciding to be of type P or of type R, or of an anti-coordination type. In the latter case, there exists a mixed equilibrium state in which both strategies P and R are always played by firms with positive probability, i.e. behavioral heterogeneity arises endogenously among firms. Stated differently, the industry evolves either towards a monomorphic state of firms or towards a polymorphic state where both types of firms coexist.

With uninformed managers (and substitute goods), things are pretty different. In fact, when managers observe the true probability distribution and act consequently, then only profit maximizers survive in the long-run. This result is not surprising and is fully in accordance with the general analysis provided in Ok and Vega-Redondo (2001). However, it could well be that managers do not observe the true probability. We model this probability distortion by borrowing a useful weighting function proposed within the Prospect Theory framework in Abdellaoui et al. (2010) to model pessimistic and optimistic behavior. We show that such a distortion, and in particular a systematic underestimation of the true frequency of P-firms, can lead to different long-run states of the system, as, for instance, the coexistence of P and R-firms. In other words, if imperfect information is likely to lead to the survival of P-firms only, managers’ behaviors might indeed steer the system towards the coexistence of both types of firms in the industry. The results in this setup are quite strong. Perhaps surprisingly, our results are unaffected by the way the weight on revenues is chosen, but crucially depend on managers beliefs and, consequently, on manager behavior. That is, while strategic delegation is usually seen as a device used by shareholders to behave more aggressively, the gains from delegation do not depend on the weight put on revenues, but only on the behavior of managers.

From a mathematical point of view, the study of stochastic stability is carried out through a deterministic approximation of the system (see, in particular, Dawid (2007) on this point). Given the multi-stage structure of each repetition of the game, it is natural to model it in discrete time by means of a ’monotone selection’ map for the fraction of firms of the two types. By the properties of this map, when the game is dominance solvable, the population of firms evolves towards a monomorphic state where all agents select a pure strategy Nash equilibrium, regardless of firms’ behavioral parameters, such as the intensity of choice. It is well known that when the game is Hawk-Dove (i.e. anti-coordination), the equilibrium of the evolutionary model is stable only if firms’ propensity to switch strategies is sufficiently small (see Hommes et al. (2011) and, in particular, Dawid (2007) for this point). In general, such an equilibrium may lose stability because of overshooting for sufficiently high intensity of choice and even lead to complex dynamics (see Kopel et al. (2014)). Given the focus of the paper, we leave a more detailed discussion on the dynamics of the model to future research.

The paper is structured as follows. Section 2 introduces the general model and the evolutionary setup. The cases of perfect and imperfect information are detailed in Sections 3 and 4, respectively. Section 5 concludes and provides some directions for future research on the topic.

2 The model

This section describes the general framework underlying our analysis. The choice of the incentive delegation contract is modeled as a population game, with a sufficiently large number of ex-ante identical firms. Each firm consists of one owner and one manager. Two types of firms are present in the population: one type compensates managers on the basis of accrued profits only (P-firms), while the other type compensates on the basis of a linear combination of profits and revenues (R-firms).

At each time t = 0, 1, 2, ..., exactly N firms are randomly drawn from the population to play a one-shot Cournot game. Given the different types of firms, at each random drawing, a P-firm can be matched up with either 0, 1 up to N − 1 P-firms with the remaining firms deciding to compensate managers according to a combination of profits and revenues. Then firms’ managers decide quantities to produce, which, in turn, determine average profits to the various owners. The magnitude of these profits can be observed by owners, who can switch for future playing of the game from a strategy to the other (from P to R and vice-versa) according to a revision protocol if they assess that the alternative strategy improves their profit. After each round of the game, which for each firm consists of a sequential choice of manager’s compensation scheme and quantities to produce, a new sampling of firms is extracted from the population and the whole random matching procedure continues.

2.1 The underlying game

We borrow the underlying setup from the classical literature on control delegation. The market consists of N firms each delegating its output decision to a manager. Let K ( 0 ≤ K ≤ N) be the number of P–firms. Consequently, N − K is the number of R–firms. The products offered by oligopolists are horizontally differentiated. For sake of simplicity, we assume a symmetric degree of differentiation among goods, as described in Häckner (2000). Thus, the inverse demand for P-firm i and R-firm j are given, respectively, by

where \(X_{P}={\sum }_{i=1}^{K}x_{P,i}\) (total quantity produced by all P-firms), X P, i = X P −x P, i (total quantity produced by all P-firms but i), \(X_{R}={\sum }_{j=1}^{N-K}x_{R,j}\) (total quantity produced by all R-firms) and X R, j = X R −x R, j (total quantity produced by all R-firms but j).

The parameter A > 0 is the choke price, which is equal for all firms (no vertical product differentiation); the parameter γ ∈ [−1,1] measures the degree of (symmetric) horizontal products differentiation. When γ = 0, all firms act as monopolistic in their own markets. The case of homogeneous goods can be recovered by setting γ = 1. Obviously, γ ∈ (0, 1] ( γ ∈ [−1, 0)) means that goods are substitutes (complements). Finally, each firm faces the same (constant) marginal cost of production c, with 0 < c < A.

The simplicity of this market structure is chosen purposely. The setup described above is well known, and over time has become the benchmark structure in the literature. This allows us to highlight directly the role of information and beliefs, which is the primary objective of the paper.

The game consists of two stages. In the first stage, owners choose simultaneously the type of salary of their managers. P–firm i compensates its manager based only on accrued profits

while R–firm j pays its managers with a linear combination of profits and revenues:

where 1−α, with α ∈ [0, 1), measures the weight put on revenues in the managers’ incentive contract.Footnote 5 , Footnote 6

Although a manager in R-firm j wants to maximize the linear combination of profits and revenues W R(x R, j ) in Eq. 3, R-firm’s j owner is still only interested in market profits, that is he wants to maximize his profit πR(x R, j ) = x R, j (p R, j (x R, j )−c). Differently, an owner and a manager of a P-firm have the same objective function, which is given by accrued profits (2).Footnote 7

However, owners do not observe the type of their opponents but only assess expected profits, upon which they base their decisions. More precisely, let r be the probability that a firm is of type P, and let π h (K) be the profit of a type h firm ( h = P,R) when the number of P–firms is K, obtained at the second stage of the game. Then, owners evaluate expected profits of being of type P, or R, which are given, respectively, by

To complete the description of the decision problem, we need to define the information structure available to managers, who then play a Cournot game with horizontal differentiation. The key ingredient in our setup is indeed the varying degree of information. We will analyze two distinct cases, based on the information structure available to managers at the second stage. Here, and throughout the rest of the paper, we will call informed the manager who knows the exact number of P–firms playing the game. In this case, managers are Nash players who observe the market conditions and choose quantities in order to maximize their salary. Thus, manager’s payoff does depend on K, and the equilibrium they select is Nash. The uninformed manager, instead, does not know the exact K, but makes predictions on the fraction of P–firms that he faces as opponent. In this case, his objective function is actually an expected utility based on the prediction he makes, and the equilibrium he selects is Bayes-Nash.

2.2 The revision protocol

If the game is repeated a sufficiently high number of times, then average profits are well approximated by expected profits Eqs. 4 and 5. Here r denotes the (current) fraction of P-firms in the population. It is useful to define the “switching” function as the difference in expected profits Eqs. 4 and 5:

A root of the equation G(r ∗)=0 gives a particular probability value r ∗ such that the expected profits by playing the two strategies are equal; if the system is in this state, owners do not have an interest to switch to the alternative strategy since the two strategies yield the same expected payoff. On the other hand, if G(r) > 0 [ < 0], then for the given probability value r, strategy P [R] outperforms strategy R [P]; therefore, it is reasonable to assume that some firms currently playing R [P] will switch to P [R] in the next period. This, in turns, increases [decreases] the overall probability r in the next period according to the paradigm of evolutionary game theory.

From a mathematical point of view, the evolutionary pressure in discrete time determined by payoffs differences of the two incentive schemes can be modeled through monotone selection dynamics (see Cressman (2003) for details, which take the form of a unidimensional map

where r(t) is the probability extracting a P-firm from the population at time t.Footnote 8 The interval [0, 1] is assumed forward invariant for f, i.e. f([0, 1]) ⊂ [0, 1] for all t > 0. With respect to F(r, G(r)), which specifies the growth rate of strategy P, we assume that it satisfies the following assumptions:

-

1.

F(.) is continuously differentiable with \(\frac {\partial F}{\partial G}>0\) [monotone selection]Footnote 9

-

2.

F(0,G(0)) = F(1,G(1))=0 [invariance of pure strategy states];

-

3.

G(r ∗)=0 at r ∗ ∈ (0,1) if and only if F(r ∗,0)=0 [coincidence between isoprofit points and fixed points of Eq. 7];

-

4.

at r ∗ ∈ (0, 1) such that G(r ∗)=0, it is \(\frac {\partial F\left ( r^{\ast },0\right ) }{\partial r}=0\) [inheritance by \(\frac {dF}{dr}\) of the sign of G ′(.) at any inner equilibrium].

Assumption 1. is common to most evolutionary models in discrete time. Assumptions 2. and 3. are introduced for convenience, so that the map (7) encompasses many evolutionary models in discrete time, such as exponential replicator (see Hofbauer and Weibull 1996), evolutionary selection with inertia (see Dawid 1999), imitation through word of mouth (see Bischi et al. 2003), etc. In particular, Assumption 2. ensures that the “corner” points r 0 = 0 and r 1 = 1, characterized by all firms playing a pure strategy (R or P), are fixed points of Eq. 7, i.e. absent behaviors remain absent. Although mutations are not introduced in Eq. 7, their influence can be indirectly taken care of by addressing the dynamic stability of equilibria (see Weibull 1995, for a discussion on this point). Assumption 3. is introduced so that points where both strategies yield the same profits to owners are rest points of the dynamical adjustment of r. Assumption 4. is a technical requirement that guarantees, together with Assumption 1., that an equilibrium with G ′(r ∗) > 0 can not be stable, whereas G ′(r ∗)<0 is a necessary condition for the stability of r ∗. The details of this statement are the object of the following lemma.

Lemma 1

Consider map ( 7 ) with switching function G(r) defined in Eq. 6 . Let r ∗ ∈(0,1) be an inner fixed point of Eq. 7 and \({\Theta }=-\frac {2}{r^{\ast }\frac {\partial F\left ( r^{\ast },0\right ) }{\partial G}}\)

-

r ∗ is locally asymptotically stable for

$$ \frac{dG(r^{\ast})}{dr}\in({\Theta},0) $$(8)

-

r ∗ is unstable for \(\frac {dG(r^{\ast })}{dr}\in (-\infty ,{\Theta }) \cup \left ( 0,+\infty \right ) \).

Proof 1

See Appendix A. □

3 The delegation game with informed managers

This section analyzes the basic delegation game with partial information. Here, we assume that owners correctly assess current expected profits of P and R-firms and that managers observe their opponents’ types and play Cournot-Nash quantities. In the next Section, we address a variant of the model in which managers form their beliefs on the probability distribution of P-firms.

As usual, the game is analyzed by backward induction. In the second stage, after observing the number of P-firms and R-firms, managers play the corresponding Cournot-Nash equilibrium. In the first stage, owners decide the incentive scheme by comparing the profits realized through the different delegation schemes (P or R). An evolutionary mechanism driven by accrued profits regulates how owners switch between the different incentive schemes.

Let us begin by analyzing the second stage, where managers choose the quantity to produce to maximize their own incentive. The next Proposition contains the details on Nash equilibrium quantities in the semi-symmetric setting.Footnote 10

Proposition 2

In the considered N-firm oligopoly where K owners compensate their managers according to profits ( 2 ) and N−K owners compensate their managers according to the linear combination of profits and revenues ( 3 ), the (semi-)symmetric Nash equilibrium quantities are given by

Proof 2

The proof easily follows from managers’ first order conditions (FOCs), which are also sufficient in this game to maximize managers’ compensations Eqs. 2 and 3, by employing the assumption of symmetry among firms of the same type, namely that in Eq. 1 it is X P, i = (K − 1)x P, i and X R, j = (N − K − 1)x R, j . QED

Notice that \(\hat {x}_{R}(K)>\hat {x}_{P}(K)\).Footnote 11 This relationship has an immediate interpretation in the delegation model by recalling that managers in R-firms expand production to increase revenues, which, in turn, raise their compensation.

When goods are substitutes, quantities (9) are positive when

In particular, quantities of P-firms are positive when \(c<\bar {c}\), while quantities of R-firms are always positive. Conversely, with complement goods, quantities (9) are positive when N > 3 and \(\gamma >-\frac {2}{N-1}\).

In the following, we denote by π P (K) the profit of a P-firm when in the market K other P-firms are present and quantities are chosen according to Eq. 9; similarly, π R (K) is the profit of a R-firm with K other P-firms with quantities at the corresponding Nash equilibrium. Through π P (K) and π R (K) we define the switching function G(r) in Eq. 6. In the particular case under analysis, G(r) is linear in r, with slope:Footnote 12 \(z=\frac {c(\alpha -1)\left ( -A(N-1)(\gamma -2)\gamma ^{2}+c\left ( -(2+(N-2)\gamma )^{2}+\alpha \left ( 4+\gamma \left ( -8+4N+6\gamma +(N-6)N\gamma +(N-1)\gamma ^{2}\right ) \right ) \right ) \right ) } {(\gamma -2)^{2}(2+(N-1)\gamma )^{2}}\)

Thus, at most one fixed point r ∗ ∈ (0,1) for Eq. 7 exists, which is obtained by solving the equation G(r ∗)=0:

If stable under evolutionary selection (7), this inner fixed point guarantees the coexistence of both types of agents. Depending on firms’ marginal cost, either a pure strategy equilibrium is a dominating strategy (P or R), so that all firms will play that equilibrium in the long run, or a mixed-state exists where both strategies are played with positive probability (when goods are substitutes). The strategy profile in which P is played with probability r ∗ (and R with probability 1−r ∗) corresponds to a mixed-strategies Nash equilibrium for the N-person game. In particular for this game, we consider as equilibrium concept the Evolutionary Stable Strategy (ESS), which is the most common Nash equilibrium refinement in evolutionary games (see Weibull (1995)). The details are contained in the following proposition. □

Proposition 3

Consider the Monotone Selection Dynamics ( 7 ) with G(r) in Eq. 6 and \(\frac {dG}{dr}\) in ( 11 ). There exist real numbers \(c_{1}=\frac {A(N-1)(2-\gamma )\gamma ^{2} }{h_{1}}\) and \(c_{2}=\frac {c_{1}h_{1}}{h_{2}}\) such that: Footnote 13

-

When goods are substitutes, i.e. when 0 < γ ≤ 1,

-

if c 2 < c < A then strategy P dominates strategy R. Map (7) admits two fixed points: r 0 = 0, which is unstable, and r 1 = 1, which is locally asymptotically stable. P is the only ESS of the game;

-

if 0 < c < c 1 then strategy R dominates strategy P. Map (7) admits two fixed points: r 0 = 0, which is locally asymptotically stable, and r 1 = 1, which is unstable. R is the only ESS of the game;

-

if c 1 < c < c 2 , then neither P dominates R nor R dominates P. Map (7) admits three fixed points: r 0 = 0 and r 1 = 1, which are unstable, and r ∗ ∈ (0, 1) in Eq. 12 , which is the only possible locally asymptotically stable fixed point when condition ( 8 ) is verified and loses stability through a flip bifurcation at \(\frac {dG(r^{\ast })}{dr}={\Theta }\) . Playing P with probability r ∗ and R with probability (1−r ∗) is the only possible ESS of the game;

-

at c = c 1 a transcritical bifurcation occurs, at which fixed points r ∗ and r 0 = 0 coincide and exchange their stability properties; analogously, at c = c 2 a transcritical bifurcation occurs, at which fixed points r ∗ and r 1 = 1 coincide and exchange their stability properties.

-

-

When goods are complements, i.e. when −1 ≤ γ < 0,

-

if c 1 < c < A then strategy P dominates strategy R. Map (7) admits two fixed points: r 0 = 0, which is unstable, and r 1 = 1, which is locally asymptotically stable. P is the only ESS of the game;

-

if 0 < c < c 2 then strategy R dominates strategy P. Map (7) admits two fixed points: r 0 = 0, which is locally asymptotically stable, and r 1 = 1, which is unstable. R is the only ESS of the game;

-

if c 2 < c < c 1 , then P dominates R for any r ∈ (r ∗ , 1] and R dominates P for any r ∈ [0, r ∗ ). Map (7) admits three fixed points: r 0 = 0 and r 1 = 1, which are both locally asymptotically stable, and r ∗ ∈ (0, 1) in Eq. 12 , which is unstable and delimits the basin of attraction of the other two stable fixed points. Playing P and playing R are both ESSs of the game;

-

at c = c 2 a transcritical bifurcation occurs, at which fixed points r ∗ and r 1 = 1 coincide and exchange their stability properties; analogously, at c = c 1 a transcritical bifurcation occurs, at which fixed points r ∗ and r 0 = 0 coincide and exchange their stability properties.

-

Proof

The proposition follows from Lemma 1, by considering that with substitute goods it is \(\frac {dG}{dr}<0\) whereas with complement goods, it is \(\frac {dG}{dr}>0\) (see Eq. 11). QED □

Remark

The relationship between a switching function such as Eq. 6 and an ESS of the underlying game is analyzed in Broom and rychtář (2013).

According to Proposition 3, any locally asymptotically stable fixed point of the monotone selection dynamics (7) is also a Nash equilibrium of the underlying game. Moreover, when goods are substitutes and r ∗ ∈ (0, 1), then playing P with probability r ∗ always constitutes a Nash equilibrium of the delegation game in mixed strategies, although the dynamics (7) might fail to converge to r ∗ because of overshooting.

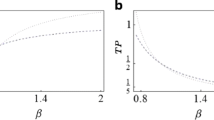

The bifurcation diagram of Fig. 1 visually summarizes the previous proposition: r 0 = 0 and r 1 = 1 are always fixed points of the model, but their stability properties change with the value of the marginal cost c. When c is sufficiently close to maximum selling price A, then strategy P dominates strategy R so that r 1 = 1 is stable (solid line) and r 0 = 0 is unstable (dashed line); by contrast, when c is sufficiently close to zero, then R dominates P so that r 0 = 0 is stable (solid line) and r 1 = 1 is unstable (dashed line). The inner fixed point r ∗ always exists for intermediate levels of marginal costs. Notice that this holds both when goods are substitutes and when they are complements. However, the sign of the product differentiation parameter plays a key role for the stability of the inner fixed point r ∗ and the resulting dynamic properties of the model: when products are substitutes ( 0 < γ ≤ 1), r ∗, when it exists, is stable and the two boundary fixed points ( r 0 = 0 and r 1 = 1) are unstable (see Fig. 1, left panel); by contrast, when products are complements ( −1 ≤ γ < 0), r ∗, when it exists, is unstable and the two boundary fixed points ( r 0 = 0 and r 1 = 1) are stable (see Fig. 1, right panel). Thus, when marginal costs are intermediate, with substitute goods we expect coexistence of both types of firms in the long-run (see solid curve r ∗ of Fig. 1, left panel), whereas when products are complements, we expect only one strategy to prevail in the long-run, be it P or R, and the prevalence of one strategy over the other depends on the initial distribution of the share r (see dashed curve r ∗ of Fig. 1, right panel). The arrows in Fig. 1 show qualitatively the direction of the motion of the share of P-firms r for different values of the parameter c, according to Proposition 3.

Bifurcation diagram representing stable (solid) and unstable (dashed) fixed points of r according to Proposition 3 for c ranging in the interval (0,A) and parameters A = 1; N = 10; α = 0.5. Left panel: typical asymptotic dynamics with substitute goods ( γ = 1). Right panel: typical asymptotic dynamics with complement goods ( γ = −1)

The economic intuition that explains how the level of marginal costs favors one strategy over the other can be easily provided. In fact, when c = 0, strategies R and P coincide, since profits are equal to revenues. Moreover, for any level of 0 ≤ α < 1, it is always \(\frac {\partial G}{\partial c}_{|c=0}<0\), so that when marginal costs are small, their increments reduce more the profits of P-firms than the profits of R-firms. On the other hand, when c→A, then it is G(r) > 0.Footnote 14 Thus in general, low marginal costs favor strategy R against P, whereas the opposite occurs as marginal costs approach the choke price. For intermediate levels of marginal costs, the inner fixed point r ∗ in Eq. 12 belongs to the interval (0,1). Moreover, from

it follows that r ∗ increases (decreases) in c when goods are substitutes (complements) (see Fig. 1, left panel; for complements, see Fig. 1, right panel). This can be explained by noticing that, in Eq. 13, the sign of ∂ G/∂ r is the opposite of the sign of γ (see Proposition 3) and \(\frac {\partial G}{\partial c}_{|r=r^{\ast }}>0\): higher marginal costs increase the likelihood that R-firms have profits lower than P-firms as their managers set productions as if costs were indeed lower (see Eq. 3). Also, the influence of the weight α on r ∗ only depends on the sign of γ, the parameter of product differentiation. From

r ∗ decreases (increases) in α when products are substitutes (complements). In terms of manager’s compensation, higher α puts more weight on profits than revenues for R-firms and increase the possibility of lower profits for P-firms. Notice that, in Eq. 14, it is \(\frac {\partial G}{\partial \alpha }_{|r=r^{\ast }}<0\) and, again, the sign of \(\frac {\partial G}{\partial r}\) is the opposite of the sign of γ, thus explaining the change in sign of \(\frac {\partial r^{\ast }}{\partial \alpha }\) with the sign of γ. Finally, it is also interesting to observe that both \(\frac {\partial c_{1}}{\partial \alpha }>0\) and \(\frac {\partial c_{2}}{\partial \alpha }>0\), that is, by putting more weight on profits than revenues in R-firms’ incentive contracts, both the thresholds in marginal costs separating the different cases of Proposition 3 increase.

From the point of view of the dynamics, most properties of the evolutionary model do not depend on the particular form of the monotone selection dynamics considered but only on the underlying oligopoly model. For instance, take a map that satisfies the assumptions stated above for Eq. 7 such as the exponential replicator dynamics with inertia, which can be written as follows (see Hofbauer and Weibull (1996), Kopel et al. (2014))

The parameter 𝜃 ≥ 0 models agents’ intensity of choice, i.e. the propensity to switch to the more rewarding behavior as a consequence of payoffs differences; the parameter δ ∈ [0, 1] represents the fraction of agents per unit of time who stick to their current strategy (see Hommes (2009) for details on the point).Footnote 15 By applying Proposition 3, we have that, when it exists, with substitute goods the inner steady state r ∗ is stable for 𝜃 < 𝜃 ∗ and loses stability through a flip bifurcation at 𝜃 = 𝜃 ∗, where

Some further comments on the proposition are in order. Clearly, when no inner fixed point of Eq. 7 exists, the game is dominance solvable. On the other hand, when an inner fixed point exists, one has to distinguish between the cases of substitute and complement goods. In fact, with substitute goods, the long run evolution of the system leads towards the mixed state (anti-coordination game). In this case, starting from an initial condition with not all firms of the same type (P or R), e.g. because of a mutation in firms’ behaviors, evolutionary selection will push the system towards the point in which the probability of extracting a P-firm is the r ∗ in Eq. 12. However, convergence to the inner fixed point (12) is achieved as long as firms are not too “impatient” to switch to the more profitable strategy, as measured by \(\frac {\partial F\left ( r^{\ast },0\right ) }{\partial G}\). For instance, for the exponential replicator dynamics, this means that firms’ intensity of choice is below the threshold level (16). Otherwise, when too many of them switch to the (currently outperforming) strategy at each unit of time, the system oscillates around the fixed point r ∗ without converging to it. The flip bifurcation occurring at \(\frac {dG}{dr}={\Theta }\) in Eq. 8 or at 𝜃 = 𝜃 ∗ in Eq. 16 for the exponential replicator dynamics with inertia, represents a typical example of overshooting (or overreaction) in the evolutionary switching process, which is common in these models with an inner equilibrium where the slope of the switching function is negative as it is in Eq. 11 (see Kopel et al. (2014) for similar examples).

On the other hand, when goods are complements, the inner steady state always repels nearby trajectories so that, in the long run, only P-firms or R-firms operate according to the initial share of P-firm (coordination game). In this case, the convergence to a fixed point where all firms adopt the dominant strategy is monotonic and a higher intensity of choice only accelerates the process of convergence to a boundary fixed point, be it with all P or all R firms. Thus, when the game admits two stable steady states both on the border, the inner fixed point behaves as the basin boundary of the two steady states: all firms will eventually belong to a given type provided that the initial share of firms of that particular type is sufficiently high.

Figure 2 shows the various cases considered in Proposition 3 applied to the particular evolutionary model (15) (exponential replicator). Notice that the dynamic behaviors in the first column as well as those in the last column of Fig. 2 are qualitatively equivalent, as trajectories converge to the same (boundary) steady states, although the sign of the product differentiation parameter γ is different. However, the cases in the central column of Fig. 2 are qualitatively different: with substitute goods (first row, second column of Fig. 2) r ∗ is locally asymptotically stable (if, as in this example, 𝜃 = 1 < 𝜃 ∗ ≈ 7.706, see Eq. 16) whereas with complement goods (second row, second column of Fig. 2) r ∗ is always unstable.

Map (15) in the various cases of Proposition 3, with parameters A = 10; α = 0.5; N = 10; δ = 0; 𝜃 = 1 and two initial conditions r 1(0)=0.2 (blue) and r 2(0)=0.8 (red). First row depicts a typical case with substitute goods ( γ = 1): 0 < c = 1.2 < c 1 (left), where all inner trajectories converge to r 0 = 0; c 1 < c = 2.5 < c 2 (center), where all inner trajectories converge to r ∗; c 2 < c = 6 < A (right), where all inner trajectories converge to r 1 = 1; second row depicts a typical case with complement goods ( γ = −1): 0 < c = 1 < c 2 (left), where all inner trajectories converge to r 0 = 0; c 2 < c = 5 < c 1 (center), where trajectories starting below (above) r ∗ converge to r 0 ( r 1); c 1 < c = 8.5 < A (right), where all inner trajectories converge to r 1 = 1. (For interpretation of the references to color in this figure legend, the reader is referred to the web version of the article)

With respect to the condition (10) ensuring the non-negativity of Cournot equilibrium quantities, for a large region in the parameter space it is \(\overline {c}>c_{2}\) so that the previous proposition holds and second stage quantities are well defined. Moreover, with homogeneous goods ( γ = 1) and pure-revenue maximization ( α = 0), an inner fixed point r ∗ with coexistence of P-firms and R-firms occurs whenever \(c\in \left ( \frac {A(N-1)}{N^{2}},\frac {A(N-1)}{2N-1}\right ) \), which is the behavioral heterogeneity condition specified in Chirco et al. (2013), Proposition 1. In that paper, this interval is obtained by analyzing the deviation-proof equilibria in the static context of cartel stability.

In the next paragraph, we describe how the model changes when managers are uninformed on their opponents’ types and form beliefs on the distribution of types in the population.

4 The delegation game with uninformed managers

As pointed out in Fershtman and Kalai (1997), page 763, “in most situations, however, the delegation contract, or even its existence, is unobservable”. As a matter of fact, specific corporate codes must be and have been imposed in real organizations (see Aguilera and Cuervo-Cazurra, 2004) to disclose managerial compensation. These codes of ’good’ governance are employed to prevent managers’ opportunistic behavior and protect shareholders’ interests.Footnote 16

In this Section, we address a variant of the previous model in which neither managers nor owners observe the opponents’ types, i.e. we reformulate the model without disclosure clauses. Since the results when goods are complements are analogous to those with substitute goods, in this part of the paper we restrict our attention to the case of substitute goods for expositional purposes.

Evolutionary games with incomplete information have been studied, for instance, in Ok and Vega-Redondo (2001) and Dekel et al. (2007), where players use their (limited) knowledge about the true distribution of the population when making their choices. Here, managers are assumed to form a belief as to the probability distribution of each type and set quantities to maximize their expected utility, given their incentive contract. Owners offer incentive contracts to managers according to realized profits accrued by each strategy (P or R), exactly as in the previous case. The aim of this Section is to study how managers’ beliefs change the long-run composition of the population.

This assumption is motivated by the large theoretical and experimental literature originated by Kahneman and Tversky (1979). Since managers do not know exactly the type of their opponent, the way they perceive the risk involved in playing the game induces them to distort the true probability. Alternatively, one may think of this assumption as follows. Managers do not observe the state of the population r, but do observe a noisy signal. Being unable to process the signal perfectly, managers form a belief based on their best forecast given the signal and use it to make their choice (see, for instance, Samuelson and Swinkels (2006)).

At a given time, managers have belief w ∈ [0,1] that a P-firm is extracted from the population. For the reasons explained below, it is useful to distinguish w from r, which is the underlying distribution of P-firms. The expected managers’ payoffs of the two types are (see Appendix B for details)Footnote 17

From managers’ FOCs on expected payoffs and by symmetry, the following quantities in the market stage are played by a P and a R-firm, respectively:

which depend (linearly) on managers’ belief w about the fraction of P-firms in the population. Notice that, similar to the case of informed managers, x P (w) < x R (w) for all parameters values.

Quantities by P-firms are positive when \(c<\bar {\bar {c}}\), with

and also quantities by R-firms are positive in this case.Footnote 18

Now consider a large number of sampling delegation games from the population of firms, so that realized profits are well approximated by expected profits. Thus, on the one hand, quantities (17) are decided by managers given their beliefs w as to the distribution of P-firms; on the other hand, expected profits are determined through the true probability distribution r. Therefore, expected profits for the two strategies depend on the current frequency of P-firms r and on the current managers’ beliefs w. Similar to the previous Section, firms’ expected profits can be written as

An important quantity is again the difference in expected profits of a P-firm and a R-firm (the ”switching” function, see Eq. 6), which assumes the simple form

We can immediately observe that, when managers’ beliefs are correct ( w = r), it holds that G(r, r) > 0. This means that expected profits for P-firms are always above those for R-firms. Thus, any evolutionary dynamics that select undominated strategies make it so that only P-firms survive in the long run. In other words, P is the only ESS of the game. The economic intuition for this stems from the fact that incentive contracts are not observable and so players can not condition their strategy on them. In the case of one-sided delegation, the problem is studied in Koçkesen and Ok (2004). This is also in accordance to Ok and Vega-Redondo (2001), where it is shown that, under incomplete information, individualistic preferences (profit maximization) dominate non-individualistic ones in cases such as the one proposed here, where the size of groups in the matching process is small with respect to the population size.

In the following, we are interested in assessing how a distortion in the managers’ belief systems can change such a clear-cut outcome. In particular, managers could be unable to observe the correct frequency of P-firms (lack of observability). Simple inspection of Eq. 18 reveals the following:

Proposition 4

Consider the Monotone Selection Dynamics (7) with G(r) given in Eq. 18 where w ∈ [0, 1] is a (given) constant and suppose γ > 0. If γ(N − 1) < 1, then strategy P always dominates strategy R.

Proposition 4 can be read as a necessary condition (i.e., γ(N − 1) ≥ 1) for the existence of mixed equilibria of Eq. 7 in terms of degree of product differentiation and number of agents. We may interpret the number γ(N − 1) as a measure of market competition, opportunely corrected by the product differentiation factor. Under incomplete information, there is room for survival of R-firms only if the market is sufficiently competitive. For instance, while strategy P always dominates strategy R in duopolies with imperfect substitutes goods, managers’ beliefs about the true probabilities start to play a crucial role as soon as market conditions change (to some extent consumers change their views about the goods, from slightly imperfect substitutes to homogenous). Notice finally that Proposition 4 does not apply when products are perfect substitutes ( γ = 1).

Consider now the probability deformation. Following the methodology developed within Prospect Theory, we assume that the true underlying probability r is subjected to a nonlinear transformation and study how the long-run behavior of the model is changed when:

-

managers systematically overestimate or underestimate the true probability r;

-

managers overweight small probabilities of playing with a given type and underweight high probabilities of playing with that type.

We again assume that evolutionary selection of strategies P and R is modeled through Monotone Selection dynamics of the form (7) [or Eq. 15 for a specific example], where the “switching” function is now defined in Eq. 18. As before, r(t) is the probability at time t to extract a P-firm from the population. Managers’ beliefs w(t) are connected to the true probability distribution r(t) through the following probability weighting function, which has been recently proposed in Abdellaoui et al. (2010) to model optimistic, neutral, pessimistic and mixed probability attitudes:

with parameters δ ∈ [0,1] and ν ∈ [0, + ∞). The usefulness of this transformation can be understood by noticing that, by varying the two parameters δ and ν, the following cases arise:

-

underestimation. For δ = 0 and ν ∈ (0,1) [or equivalently for δ = 1 and ν ∈ (1, + ∞)], managers systematically underestimate the fraction of P-firms;

-

overestimation. For δ = 0 and ν ∈ (1, + ∞) [or equivalently for δ = 1 and ν ∈ (0, 1)], managers systematically overestimate the fraction of P-firms;

-

first-over-then-underestimation. For δ ∈ (0,1) and ν ∈ (0,1), managers overestimate the fraction of P-firms when this is low (i.e. less than δ) and underestimate it otherwise;

-

first-under-then-overestimation. For δ ∈ (0,1) and ν ∈ (1, + ∞), managers underestimate the fraction of P-firms if this is low (i.e. less than δ) and overestimate it otherwise;

-

correct estimation. For ν = 1, managers observe the true distribution, i.e. w(r) = r.

In the case ν = 1, in which probabilities and beliefs coincide, we already have seen that P is a dominant strategy. Recall from Proposition 3 that when P dominates R, map (7) admits only two fixed points: r 0 = 0 (unstable) and r 1 = 1 (locally asymptotically stable). The next proposition characterizes the long-run dynamics of the map (7) when managers’ belief distortions occur through the probability transformation (19).

Proposition 5

Consider the Monotone Selection Dynamics (7) where G(r) = G(w(r), r) is given in Eq. 18 and w = w(r) in Eq. 19 . Suppose also that γ > 0, ν ≠ 1 and γ(N − 1) ≥ 1. The following cases occur:

-

1.

(Overestimation) If managers overestimate the true probability, that is, if either δ=0 and ν>1 or δ=1 and 0<ν<1, then strategy P always dominates strategy R.

-

2.

(Underestimation or first-under-then-overestimation) Suppose ν>1 and 0<δ≤1. Let \(\bar {r}_{2}=\nu ^{\frac {1}{1-\nu } }\delta \) , and consider the function \(l(\nu ,\delta )=\nu ^{\frac {\nu }{1-\nu }}\delta -\delta \nu ^{\frac {1} {1-\nu }}\):

-

(a)

If \(l(\nu ,\delta ) > -\frac {1}{\gamma (N-1)}\) , then strategy P dominates strategy R.

-

(b)

At \(l(\nu ,\delta ) = -\frac {1}{\gamma (N-1)}\) a fold bifurcation occurs: a new fixed point arises at \(r=\bar {r}_{2}\) . The slope of the switching function is negative for \(r<\bar {r}_{2}\) and positive for \(r>\bar {r}_{2}\) . When \(r\neq \bar {r}_{2}\) , strategy P strictly dominates R.

-

(c)

If \(l(\nu ,\delta ) < -\frac {1}{\gamma (N-1)}\) , then there exist two distinct fixed points \(r_{1}^{*}\) and \(r_{2}^{*} \) of Eq. 7 with coexistence of P and R-firms, with \(0<r_{1}^{*} <\bar {r}_{2}<r_{2}^{*}<\delta \) ; the smallest one is the only possible locally asymptotically stable equilibrium for ( 7 ), provided that condition ( 8 ) applies, whereas the largest one is always asymptotically unstable.

-

(a)

-

3.

(Underestimation or first-over-then-underestimation) Suppose 0 < ν < 1 and 0 ≤ δ < 1. Let \(\bar {r}_{3}=1-\nu ^{\frac {1} {1-\nu }}(1-\delta )\) , and consider the function \(h(\nu , \delta )=(1-\delta )\nu ^{\frac {1}{1-\nu }} -(1-\delta )\nu ^{\frac {\nu }{1-\nu }}\):

-

(a)

If \(h(\nu ,\delta )> -\frac {1}{\gamma (N-1)}\) , then strategy P dominates strategy R.

-

(b)

At \(h(\nu ,\delta )= -\frac {1}{\gamma (N-1)}\) a fold bifurcation occurs: a new fixed point is created at \(r=\bar {r}_{3}\) . The slope of the switching function is negative for \(r<\bar {r}_{3} \) and positive for \(r>\bar {r}_{3}\) . When \(r\neq \bar {r}_{3} \) , strategy P strictly dominates R.

-

(c)

If \(h(\nu ,\delta )< -\frac {1}{\gamma (N-1)}\) , then there exist two distinct fixed points \(r_{3}^{*}\) and \(r_{4}^{*} \) of ( 7 ) with coexistence of P and R-firms, with \(\delta <r_{3}^{*}<\bar {r}_{3}<r_{4}^{*}<1\) ; the smallest one is the only possible locally asymptotically stable equilibrium for ( 7 ), provided that condition ( 8 ) holds, whereas the largest one is always unstable.

-

(a)

Proof 4

See Appendix A. □

Corollary 6 (Underestimation)

If γ(N − 1) > 1 and managers underestimate the true probability (in Eq. 19 either δ = 0 and 0 < ν < 1 or δ = 1 and ν > 1) then there always exists a locally asymptotically stable fixed point r with coexistence of P and R firms provided that the probability deformation is sufficiently high (either \(\nu \in (0,\bar {\nu })\) with \(\bar {\nu }<1\) when δ = 0 or \(\nu \in (\bar {\nu }, +\infty )\) with \(\bar {\nu }>1\) when δ = 1).

Proof 5

The proof easily follows by applying Proposition 5, case 2 with δ = 1 or case 3 with δ = 0. Condition γ(N − 1) > 1 guarantees that the minimum value of the function g(r), defined in the proof of Proposition 5, is negative. Therefore, two roots of equation g(r) = 0 are in the (0,1) interval, as g(0) = g(1) = 1 and g(.) is continuous. □

The rationale of Proposition 5 can be explained as follows. Provided that parameters are not in the region studied in Proposition 4, then manager beliefs play a crucial role in the long–run outcome. Suppose, for instance, ν > 1, so that managers underestimate r when r ≤ δ and overestimate r in the complementary region (first-under-then-overestimation).

Then, the gain function (18) can have 0,1, or 2 roots in the (0,1) interval. This case is depicted in the left panel of Fig. 3 (the right panel displays the case ν ∈ (0, 1)). The region of P-dominance indeed identifies the set of belief parameters for which the gain function is always positive. In that region, map (7) admits only the two boundary equilibria: r 0 = 0, which is unstable, and r 1 = 1, which is locally asymptotically stable. The pink region instead identifies the set of belief parameters for which the gain function (18) admits in the (0,1) interval two roots, \(r_{1}^{*}\) and \(r_{2}^{*}\), which are also steady states of the map (7). In this situation, r 0 = 0 is unstable while \(r = r_{1}^{*}\) and r 1 = 1 are both locally asymptotically stable, each with its own basin of attraction. The unstable fixed point \(r_{2}^{*}\) acts, indeed, as the boundary of the basin of the two attractors \(r_{1}^{*}\) and r 1 = 1: if the system starts at \(r(0)>r_{2}^{*}\), then the long run outcome will be P-dominance; otherwise the system will finally end up with a polymorphic industry where the fraction of P-firms is \(r_{1}^{*}\). The transition from a configuration with two pure strategy equilibria where P strictly dominates R (and with r 0 = 0 unstable and r 1 = 1 locally asymptotically stable for Eq. 7) to a situation with multiple stable equilibria occurs when points (ν, δ) cross the bifurcation curves \(l(\nu ,\delta ) = \frac {-1}{\gamma (N-1)}\) (when ν > 1) or \(h(\nu ,\delta )= \frac {-1}{\gamma (N-1)}\) (when 0 < ν < 1). These bifurcation curves are clearly visible in Fig. 3 as the boundary of the set of P-dominance.

Region of dominance of Profit maximization in the belief space (ν, δ) when N = 5 and γ = 0.9 is depicted in blue. Pink region displays couple of belief parameters such that the gain function has multiple roots in the (0,1) interval, which corresponds to steady states of the monotone selection dynamics. Left panel displays the case ν > 1. Right panel displays the case 0 < ν < 1. (For interpretation of the references to color in this figure legend, the reader is referred to the web version of the article)

Thus, while overestimation of the distribution of P-firms leads to a clear cut situation (P dominates R), its underestimation may lead to mixed configurations with coexistence of both types of firms. When the level of underestimation is particularly high, then an interval in r exists such that strategy R strictly dominates strategy P. These results have an immediate economic interpretation. Recall that, when managers have a correct estimation of the underlying probability ( w = r), P always dominates R because players do not condition their strategies on unobservable incentive contracts. In other words, when w = r the incentive contract does not work as a strategic commitment device. Clearly, overestimation of r works even less to this purpose: a level of w such that w > r makes it even less plausible that firms adopt non-profit-maximizing behavior. However, in the case of underestimation of the true probability r, the commitment effect is, in some sense, induced by the misperception of the probability, thus giving room to the survival of non-profit-maximizing firms. The same reasoning applies to the cases of first-over-then-underestimation and first-under-then-overestimation. In fact, also in these cases, Proposition 5 establishes that mixed configurations with coexistence of both types of firms are possible only in regions of r where the probability deformation underestimates the true probability of r.

5 Conclusions

The evolutionary stability properties of preferences alternative to mere profit maximization is clearly linked to the amount of information available to agents. When agents know each other’s preferences, the threat to behave differently is credible and agents with alternative preferences have strong arguments to invade the population and survive in the long-run. On the other hand, lack of such information makes the commitment to a different behavior no longer credible, and it is usually believed that, in those cases, only profit maximizers survive (see Dekel et al. 2007; Ok and Vega-Redondo 2001, for prominent research in this direction). However, the recent study in Alger and Weibull (2013) shows that this is valid only as long as the matching process in a large population is uniform. More general assortative matching processes lead to alternative preferences (in their case moralistic preferences) to be evolutionary stable and profit maximizers to vanish in the long–run.

In the context of industrial organization, strategic delegation is usually regarded as a device that makes the commitment to a more aggressive behavior credible. Shareholders, by hiring a manager to decide the firm’s strategy, make sure that the threat will be indeed pursued. However, often the way managers are paid is private information. This is not only highlighted by prominent researchers in the field (see for instance (Fershtman and Kalai 1997)), but has also been witnessed by the impressive amount of empirical research on the determinants of CEOs compensation.

In an otherwise standard Cournot oligopoly, we investigate the effects of varying degree of information available to agents about how managers are paid. First, we hide such information to the first–stage–players (the owners) only, and uncover it at the second stage. Here the second stage Nash equilibrium chosen by informed managers displays all the features of a classic delegation game, with R–firms producing more than P–firms. However, since the information is not available to actors of the first stage, we find that, depending on market parameters, the game can be either dominance solvable with only one type of firm surviving, or mixed equilibrium states exist. As long as owners are not too impatient to change their preferences, such states are stable and coexistence of both types prevails with substitute goods. By contrast, when goods are complements, mixed states are unstable and behavioral heterogeneity in the population will vanish in the long–run.

Then we hide the information also at the second stage. This setup belongs to the family of games studied in Ok and Vega-Redondo (2001) and the conclusion is just an example of their results. However, the situation changes completely when we allow managers to violate the basic principles of Von Neumann–Morgenstern Expected Utility Theory and make their choices according to Prospect Theory (PT). By changing the way managers select the second stage Nash equilibrium, we find that the conclusion that profit maximizers are the ultimate survivors seems to be hazardous. Under private information and risk attitudes in accordance with Prospect Theory, the question of which preference is the ultimate survival in the long–run has no unique reply, but depends on the prevailing risk attitude in the population, the number of agents extracted to play the one–shot game, and the parameter of product differentiation. The clear–cut situation of P-firms dominance arises when managers systematically overestimate the true probability. Otherwise, provided a necessary condition implied by Proposition 4, we show that different combinations of risk attitudes lead to situations where both kinds of preferences can prevail. In this case, the underestimation of true probability strengthens the commitment effect of adopting non-profit-maximizing behavior. As a consequence, for certain combinations of parameters, a stable population state with preference heterogeneity exists, a fact that is new to us in a setting of private information.

The shift from Von Neumann–like risk attitudes to PT–like risk attitudes is crucial for our results in Section 4. Our view on this change in the players way of selecting the equilibrium is that the true fraction of P–firms may be unknown to players, thus forcing them to make their best forecast through the belief. In this respect, the evolutionary game may be seen as a game where information is completely absent. On the other hand, even if players know the true fraction of P–firms in the population, laboratory experiments clearly show that human beings may distort their risk attitude in a way that is not consistent with utility theory (see, for instance, the seminal paper on Prospect Theory by Kahneman and Tversky 1979).

When one recognizes that agents may even not know the exact distribution of each type in the population, then alternative attitudes toward risk may rationalize agents choices in selecting the second stage state dependent Nash equilibria. The novelty of this paper is the separation between risk attitudes and agents’ objective functions. Taking a particular form of risk attitudes as exogenously given, we show that this has deep implications in the long–run objective function of agents.

We remark here that many aspects of the dynamics have not been addressed in this paper, as we decided to focus on steady states analysis and configuration of the basins of attraction of the deterministic system. As a matter of fact, it is well-known that such systems can generate periodic or chaotic dynamics when the game is, for instance, of anti-coordination type (see Kopel et al. 2014) due to overshooting around the equilibrium with coexistence of the different types (see also Bischi et al. 2003; Droste et al. 2002, among others, for issues on the global analysis of similar systems). Although these points are worth being explored, they are mainly linked to the agents’ behavioral assumption (e.g. agents’ intensity of choice and inertia in the switching process) rather than to the underlying economic model. For this reason, in this paper, we decided to focus just on possible equilibrium configuration of the system, remarking that equilibria with coexistence of both P and R-firms can indeed be stable in some given sets of the parameters space.

The market structure proposed in this paper is intentionally kept at the most basic level. While one may view this choice as a drawback of the model, we emphasize that our results hold despite the simplicity of the model. In this sense, we view the simplicity of the underlying model as a way to isolate, in a well known framework, the effect of varying degree of information and of managers’ behaviors.

Some additional questions need to be explored. Our finding that preference heterogeneity may arise endogenously in the long–run also when information is private is unaffected by all market parameters but product differentiation, marginal costs, and even the fraction of revenues included in the manager salary. This suggests that future research should explore the validity of this result for a wider class of evolutionary games, including different compensation schemes (e.g. market share) and other competitive settings (e.g. price competition).

Interestingly, Proposition 5 shows that, as long as a mild necessary condition is valid, our results are not affected by the asymmetry of the fitness functions introduced by the degree of product differentiation. Nonetheless, the interaction between evolving preferences and fully asymmetric games is a topic that deserve more attention.

Finally, we view this paper as a starting point to a new way to model evolving preferences. If one identifies agent behavior as a couple of objects, one modeling the objective function and the other the risk attitudes of a given individual, then the score function (that is what we call the switching function) is bi–dimensional. For instance, we already know that a Von Neumann Profit Maximizer will survive when competing against other Von Neumann–like players. But will the Prospect Theory R–firms population resist invasion of – say– Ellsberg–like P–firms mutants?

Notes

This weight can be thought of as an average incentive for managers in a specific industrial sector and depends on a bargaining process between owners and managers, as discussed in Van Witteloostuijn et al. (2007).

A similar modeling structure has been employed in evolutionary oligopolies to investigate the effect of competition among players with different information or with different objective functions. In Droste et al. (2002), at each (discrete) time period a large population is matched in pairs to play a Cournot game. For the simple duopoly setting with two behavioral rules on current period’s quantity – a best reply rule and a (costly, since sophisticated) Nash rule – the authors show that complicated and endogenous fluctuations may arise. More recently, Hommes et al. (2011) studied an evolutionary model with N Cournot competitors where, based on past performance, firms switch between different expectation rules concerning aggregate output of their rivals. They find that the result in Theocharis (1960) about the instability of the Nash equilibrium for more than three firms is qualitatively confirmed under evolutionary competition between heterogeneous (costly and costless) expectation heuristics. Along the same line of research, evolutionary models of oligopoly competition where firms can employ different behavioral rules have been studied in Bischi et al. (2015) and Cerboni Baiardi et al. (2015). In Kopel et al. (2014), a mixed evolutionary duopoly is considered with competition between standard profit maximizers and corporate social responsible firms. In particular, conditions for coexistence in the industry of both types of firms are provided, assuming that firms are Nash players or best reply players.

As remarked in Ok and Vega-Redondo (2001), this kind of dynamics can be thought of as a combination of fast-slow dynamics: fast dynamics lead agents to play a (Bayesian-)Nash equilibrium, given the population composition; slow dynamics take place through evolutionary selection and increase the share of more successful strategies.

The weight α put on revenues in the delegation contract is itself a strategic variable. However, an endogenous choice of this weight would imply a level of rationality and information by owners that is higher than what is assumed in the paper. Also this would imply an additional stage in the underlying evolutionary game. For these reasons, as well as the reasons discussed in the introduction, we do not address this point in this paper and treat α as a parameter of the model.

Implicit in the model is that managers are risk-neutral and their contracts have a fixed and a variable component, the latter being proportional to Eqs. 2 or 3 for a P-manager or a R-manager respectively. In any case, the reservation wage for managers is zero and the fixed component is adjusted such that the salary of the managers is at least equal to the reservation wage.

The choice of evolutionary selection in discrete rather than continuous time appears more coherent with the setup of an underlying two-stage game. In any case, similar considerations can be provided with continuous time evolution.

Notice that the assumption introduced here is stronger than the usual monotonicity assumption (see Cressman 2003).

In this paper, the analysis focuses only on semi-symmetric equilibria where all players of the same type behave identically.

The switching function is thus \(G(r)=r\frac {dG}{dr}+z\) where:

13 where: h 1 =(2+(N−2)γ) 2 −α(4+4(N−2)γ+(6−6N+N 2 )γ 2 +(N−1)γ 3 ) and

When 0 < γ ≤ 1 this last inequality holds for any 0 < r < 1. When −1 ≤ γ < 0, it can be shown that it holds for any \(\bar {r}<r<1\), with an opportune \(\bar {r} \geq 0\) that depends on N.

The case δ = 0 corresponds to the case in which all agents reconsider their strategies (synchronous updating) similarly to Brock and Hommes (1997), whereas with δ = 1 the model reduces a nonevolutionary setting.

However, aligning the interests of managers and shareholders can be harmful to consumers, see Van Witteloostuijn et al. (2007) on the point.

Overlined variables denote expected quantities produced by managers. See Appendix B for precise definition.

Note that with γ > 0, it is \(\bar {\bar {c}}<A\) for all values of N, all 0 ≤ α < 1 and all 0 ≤ w < 1.

References

Abdellaoui M, L’Haridon O, Zank H (2010) Separating curvature and elevation: a parametric probability weighting function. J Risk Uncertain 41:39–65

Aguilera RV, Cuervo-Cazurra A (2004) Codes of good governance worldwide: What is the trigger? Organ Stud 25(3):417–446

Alger I, Weibull J (2013) Homo moralis - preference evolution under incomplete information and assortative matching. Econometrica 81(6):2269–2302

Bischi GI, Dawid H, Kopel M (2003) Spillover effects and the evolution of firm clusters. J Econ Behav Organ 50:47–75

Bischi GI, Lamantia F, Radi D (2015) An evolutionary Cournot model with limited market knowledge. J Econ Behav Organ 116:219–238

Brock WH, Hommes CH (1997) A rational route to randomness. Econometrica 65(5):1059–1096

Broom M, Rychtář J (2013) Game-Theoretical Models in Biology. CRC Press, Boca Raton

Cerboni Baiardi L, Lamantia F, Radi D (2015) Evolutionary competition between boundedly rational behavioral rules in oligopoly games. Chaos, Solitons Fractals 79:204–225

Chirco A, Colombo C, Scrimitore M (2013) Quantity competition, endogenous motives and behavioral heterogeneity. Theor Decis 74(1):55–74

Cressman R (2003) Evolutionary dynamics and extensive form games. The M.I.T. Press, Cambridge

Dawid H (1999) On the stability of monotone discrete selection dynamics with inertia. Math Soc Sci 39:265–280

Dawid H (2007) Evolutionary game dynamics and the analysis of agent-based imitation models: The long run, the medium run and the importance of global analysis. J Econ Dyn Control 31:2108–2133

Dekel E, Ely JC, Yilankaya O (2007) Evolution of preferences. Rev Econ Stud 74:685–704

Dixon HD, Wallis S, Moss S (2002) Axelrod meets Cournot: Oligopoly and the evolutionary metaphor. Comput Econ 20(3):139–156

Droste E, Hommes C, Tuinstra J (2002) Endogenous fluctuations under evolutionary pressure in Cournot competition. Games Econ Behav 40:232–269

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77(5):926–940

Fershtman C, Kalai E (1997) Unobserved delegation. Int Econ Rev 38 (4):763–774

Friedman M (1953) Essays in positive economics. University of Chicago Press, Chicago

Friedman M (1970) The social responsibility of business is to increase its profits. The New York Times, September 13th

Häckner J (2000) A note on price and quantity competition in differentiated oligopolies. J Econ Theory 93:233–239

Heifetz A, Shannon C, Spiegel Y (2007) What to maximize if you must. J Econ Theory 133(1):31–57

Hofbauer J, Weibull J (1996) Evolutionary selection against dominated strategies. J Econ Theory 71:558–573

Hommes C (2009) Bounded rationality and learning in complex markets. In: Handbook of economic complexity. Edward Elgar, Cheltenham

Hommes C, Ochea M, Tuinstra J (2011) On the stability of the Cournot equilibrium: an evolutionary approach. WP, http://www1.fee.uva.nl/cendef/publications/papers/HOT2011.pdf

Jansen T, van Lier A, van Witteloostuijn A (2007) A note on strategic delegation The market share case. Int J Ind Organ 25:531–539

Kahneman D, Tversky A (1979) Prospect Theory: An analysis of decision under risk. Econometrica 47(2):263–291

Koçkesen L, Ok EA (2004) Strategic delegation by unobservable incentive contracts. Rev Econ Stud 71(2):397–424

Kopel M, Lamantia F, Szidarovszky F (2014) Evolutionary competition in a mixed market with socially concerned firms. J Econ Dyn Control 48:394–409

Manasakis C, Mitrokostas E, Petrakis E (2010) Endogenous managerial incentive contracts in a differentiated duopoly, with and without commitment. Manag Decis Econ 31:531–543

Miller N, Pazgal A (2002) Relative performance as a strategic commitment mechanism. Manag Decis Econ 23(2):51–68

Ok EA, Vega-Redondo F (2001) On the evolution of individualistic preferences: an incomplete information scenario. J Econ Theory 97:231–254

Possajennikov A (2003) Imitation dynamics and Nash equilibrium in Cournot oligopoly with capacities. Inter Game Theory Rev 5(3):291–305

Rhode P, Stegeman M (2001) Non-Nash equilibria of Darwinian dynamics with applications to duopoly. Int J Ind Organ 19:415–453

Samuelson L, Swinkels J (2006) Information, evolution and utility. Theor Econ 1(1):119–142

Schaffer ME (1989) Are profit-maximizers the best survivors? J Econ Behav Organ 12:29–45

Sklivas SD (1987) The strategic choice of managerial incentives. RAND J Econ 18(3):452–458

Theocharis RD (1960) On the stability of the Cournot solution on the oligopoly problem. Rev Econ Stud 27:133–134

Vickers J (1985) Delegation and the theory of the firm. Econ J 95(S):138–147

Weibull J (1995) Evolutionary Game Theory. The M.I.T. Press, Cambridge

Van Witteloostuijn A, Jansen T, Van Lier A (2007) Bargaining over managerial contracts in delegation games: Managerial power, contract disclosure and cartel behavior. Manag Decis Econ 28:897–904

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank the participants to the 16th International Symposium on Dynamic Games and Applications, Amsterdam, July 2014. We are indebted to two anonymous Referees for their valuable advice and helpful suggestions. The usual disclaimer applies. The work of F. Lamantia has been done within the activities of the COST action IS1104 “The EU in the new complex geography of economic systems: models, tools and policy evaluation”.

Appendices

A Proofs

1.1 A.1 Proof of Lemma 1

The lemma follows from a standard local stability analysis on the map (7). In fact, a fixed point r ∗ ∈ (0, 1) is locally asymptotically stable provided that \(\left \vert \frac {dr(t+1)} {dr\left ( t\right ) }_{|r(t)=r^{\ast }}\right \vert <1\). By Assumption 4. on the Monotone Selection dynamics, r ∗ is stable whenever

which is equivalent to Eq. 8; a flip bifurcation occurs whenever \(\frac {dr(t+1)}{dr\left ( t\right ) }_{|r(t)=r^{\ast }}=-1\), i.e. at \(\frac {dG(r^{\ast })}{dr}=-\frac {2}{r^{\ast }\frac {\partial F\left ( r^{\ast },0\right ) }{\partial G}}\). It is straightforward to see from Eq. 20 that an inner steady state r ∗ with \(\frac {dG(r^{\ast })}{dr}>0\) is always unstable because of Assumption 1. QED

1.2 A.2 Proof of Proposition 4

To prove the claim, it is sufficient to show that G(w, r) in Eq. 18 is always positive if γ(N − 1) < 1. This indeed happens since |w − r| < 1.

1.3 A.3 Proof of Proposition 5

Consider the function g(r) = (w(r) − r)γ(N − 1) + 1, with w(r) defined in Eq. 19,

with 0 ≤ δ ≤ 1 and ν ∈ (0, 1)∪(1, + ∞). The roots of equation g(r) = 0 are also roots of G(w(r),r) = 0 in Eq. 18 and, by Assumption 3. on the evolutionary process, fixed points for Eq. 7.

Observe that g(0) = g(1) = 1 and that g is smooth in [0, 1], with derivative

Define:

and

Observe that:

-

h(ν, δ) = 0 for δ = 1, while for δ ∈ [0, 1), it is −1 < h(ν, δ) < 0 whenever 0 < ν < 1, and 0 < h(ν, δ) <1 for ν > 1;

-

l(ν, δ) = 0 for δ = 0, while for δ ∈ (0,1], it is −1 < l(ν, δ)<0 whenever ν > 1, and 0 < l(ν, δ)<1 for 0 < ν < 1.

Now, proceed with the statements. We prove the first statement in the case δ = 0 and ν > 1 (the case δ = 1 and 0 < ν < 1 is similar).

Suppose δ = 0. The function g reduces to g(r) = 1+(1−(1−r)ν−r)γ(N − 1). Given ν > 1, it is g ′(r) > 0 when \(r<\bar {r}_{1}\) and g ′(r)<0 when \(r>\bar {r}_{1}\). Thus g(r)≥g(0) = g(1) = 1. This proves that g(r) > 0 for each r ∈ [0, 1].

Finally we prove the second statement (the third is similar). Suppose ν > 1 and observe that \(\bar {r}_{2}=\arg \min g(r)\), since g ′(r) < 0 for \(r<\bar {r}_{2}\) and g ′(r) > 0 when \(r>\bar {r}_{2}\). The minimum value of g is thus \(g(\bar {r}_{2})=1+\gamma (N-1)l(\nu ,\delta )\). Define the following sets:

-

\({E_{1}^{l}}(\gamma ,N)=\left \{ (\nu ,\delta )\text { s.t. }0<\delta \leq 1,l(\nu ,\delta )>\frac {-1}{\gamma (N-1)}\right \} ;\)

-

\({E_{2}^{l}}(\gamma ,N)=\left \{ (\nu ,\delta )\text { s.t. }0<\delta \leq 1,l(\nu ,\delta )=\frac {-1}{\gamma (N-1)}\right \} ;\)

-

\({E_{3}^{l}}(\gamma ,N)=\left \{ (\nu ,\delta )\text { s.t. }0<\delta \leq 1,l(\nu ,\delta )<\frac {-1}{\gamma (N-1)}\right \} \) ,

which are nonempty provided that the necessary condition γ(N − 1) ≥ 1 holds; these sets define the conditions on the plane (ν, δ) for the sign of \(g(\bar {r}_{2})\):

When \((\nu ,\delta )\in {E_{1}^{l}}(\gamma ,N)\), then \(g(\bar {r}_{2})>0\) and g(r) > 0 for each r ∈ [0,1].

When \((\nu ,\delta )\in {E_{2}^{l}}(\gamma ,N)\), then \(g(\bar {r}_{2})=0\) and g(r) > 0 for each \(r\in [0,1]\setminus \{\bar {r}_{2}\}\), while \(\bar {r}_{2}\) is a fixed point.

When \((\nu ,\delta )\in {E_{3}^{l}}(\gamma ,N)\), then \(g(\bar {r}_{2})<0\) and equation g(r) = 0 has two roots \(r_{1}^{*}<\bar {r}_{2}\) and \(r_{2}^{*}>\bar {r}_{2}\).

The stability analysis of these steady states for Eq. 7 follows from the proof of Proposition 1. The couple of fixed points (possibly stable and unstable) are created through a fold bifurcation for Eq. 7 on the bifurcation curves \({E_{2}^{l}}(\gamma ,N)\) (when ν > 1) and \({E_{2}^{h}} (\gamma ,N)\) (when 0 < ν < 1) in the parameter space (ν, δ).

B Derivation of uninformed managers’ expected utility

Consider, as in the case of informed managers, the (inverse) demand system (1), which can be written, for a given number K of P-firms, as follows

where, by symmetry, it is

Given K, the objective functions of managers in the i-th P-firm and j-th R-firm are, respectively,

At a given time, managers have beliefs w ∈ [0,1] that a P-firm is extracted from the population. To obtain the expected utility u R (r, x R, j ) of a R-manager we calculate

The expected utility u P (w, x P, i ) of a P-manager is calculated analogously.

Rights and permissions

About this article

Cite this article

De Giovanni, D., Lamantia, F. Control delegation, information and beliefs in evolutionary oligopolies. J Evol Econ 26, 1089–1116 (2016). https://doi.org/10.1007/s00191-016-0472-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-016-0472-6