Abstract

We investigate how the relationship between capital accumulation and pollution is affected by the source of pollution: production or consumption. We are interested in polluting waste that cannot be naturally absorbed, but for which recycling efforts aim to avoid massive pollution accumulation with harmful consequences in the long run. Based on both environmental and social welfare perspectives, we determine how the interaction between growth and polluting waste accumulation is affected by the source of pollution, i.e., either consumption or production, and by the fact that recycling may or may not act as an income generator, i.e., either capital-improving or capital-neutral recycling efforts. Several new results are extracted regarding optimal recycling policy and the shape of the relationship between production and pollution. Beside the latter concern, we show both analytically and numerically that the optimal control of waste through recycling allows to reaching larger (resp., lower) consumption and capital stock levels under consumption-based waste compared to production-based waste while the latter permits to reach lower stocks of waste through lower recycling efforts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Because it is considered as a credible model of sustainable development, potentially enabling efficient production at minimal rates of use of resources and driving polluting waste and emissions down, the circular economy is at the heart of numerous ongoing research projects in operation research and ecological economics. In the related operation research and management domain also referred to as closed-loop supply chain (see Battini et al. 2017, for an overview), the emphasis is the design of reverse logistics with the aim of capturing values of products consumed or used by businesses, with the ultimate goal to reduce the environmental damage. A more recent trend is the development of circular business models, and even circular business model innovation, as recently highlighted in Geissdoerfer et al. (2020). Last but not least, the range of applications of the circular economy or closed-loop supply chains is quite wide: it ranges from the agriculture (Barros et al. 2020) to the manufacturing (Acerbi and Taisch 2020) sectors through much smaller scale problems such like waste management case studies (Hrabec et al. 2020) or sustainable inventory models (see Suhandi and Chen 2023, in the case of the pharmaceutical industry).

Needless to say, a key tool in the circular economy is recycling. This work examines the role of recycling in a circular economy with multiple sources of waste. The multiplicity of waste sources complicates enormously the optimal design of the corresponding recycling strategy. Within the literature surveyed above, comparatively fewer papers deal with this issue. A few related applied papers incidentally address this issue (see for example, Nakamura 1999, in the ecological economics literature, and Sheu 2007, in operations research) but the theoretical literature is almost silent on it. Boucekkine and El Ouardighi (2016) did build up a circular economy macro-model with two different sources of waste, consumption versus production, but they have not studied the distinct economic implications of each source of waste and the inherent policy implications. However, broadly speaking, polluting waste can emanate either from a single source, for example, solely from manufacturing activities (e.g., mineral wastes such as cement or glass wastes) or consumption activities (e.g., cellulose acetate-based materials such as cigarette butts, soda cans or polythene), or from hybrid sources, i.e., both manufacturing and consumption activities. Plastics are the best illustration of multisource waste. Incidentally, they have become indeed a global pollution issue since the formation of sprawling garbage patches in the Pacific (Eriksen et al. 2013) and Atlantic (Law et al. 2010) oceans. Most recent data show that a plastic smog estimated to be over 170 trillion plastic particles afloat in the world’s oceans (Eriksen et al. 2023).

The debate of the safest and most efficient treatment of the global issue posed by plastics waste is indeed vivid (see Verma et al. 2016, for an early view of the options, including burning in open spaces or in incineration plants). Significant progress has been recently made in the design of pyrolysis systems based in bio-refineries to convert waste such as plastic and biomass waste into energy. For instance, from used tires, the patented recycling technology, Pyrum thermolysis,Footnote 1 makes it possible to extract 50% oil, 38% coke and 12% gas, which can be used to ensure energy self-sufficiency. The potential market for the Pyrum technology is considerable since 17 million tons of used tires are generated each year worldwide. In addition to its environmental neutrality, this technology is highly profitable with a return on investment reaching 25%. Further income generation from recycling is key in our theory, as it will be clear below.

We are indeed particularly interested in polluting waste for which natural absorption takes an extremely long time, i.e., several centuries, (e.g., iron, aluminum, mineral residues) or that is non-biodegradable (e.g., plastic, computer hardware). In both cases, no natural abatement that prevents solid waste accumulation can be reasonably assumed. In this setup, recycling efforts are required to avoid massive accumulation with harmful long-term consequences. We therefore focus on the design of recycling efforts in our analysis of the optimal trade-off between economic performance and polluting waste. Depending on whether the polluting waste emanates from a stock of productive capital or from consumption flows, the long-term effects on the stocks of productive capital and polluting waste, and therefore their recycling policy implications, might differ significantly. In this paper, we investigate how the trade-off between capital growth and pollution accumulation is affected by the source of pollution—productive capital or consumption—and identify which source of pollution should be mitigated first to enhance environmental, economic and welfare performances.

A second aspect is crucial in our theory: while recycling is not without cost and requires an effort (whatever the waste source) which should be accounted for in the social welfare arithmetics, it has potentially a double social benefit. One is obvious and works through the reduction of the stock of waste. The second is more hypothetic: recycling may also generate income. In our paper, we distinguish between two cases: one where recycling efforts benefit capital accumulation, i.e., capital-improving recycling (CIR) efforts, and one where no additional revenue is drawn from recycling efforts, i.e., capital-neutral recycling (CNR) efforts. Capital-neutral recycling reflects a depreciation of the qualitative properties of recycled volume (e.g., Martin 1982), while CIR is an effective recycling process. An example of CIR can be found in the European plastics industry, where 60 million tons of plastics diverted from landfills are equivalent to over 66 billion euros (Plastics Europe, 2015). More generally, CIR has received strong support in the literature (e.g., Doonan et al. 2005; Pati et al. 2006; Jacobs et al. 2010; Simpson 2012). Two comments are worth doing at this stage. Of course, net income from recycling may be optimized, several operations research papers are devoted to this question (see for example, Derigs and Friederichs 2009). In ecological economics, the distinction between the original consumption good and the recycled consumption good is precisely done to model the extra income (or welfare) arising from recycling (since the seminal work of Lusky 1976). Here we consider a reduced form specification and assume that the net income generated from recycling may or may not benefit to capital accumulation, the unique engine of production growth in our stylized circular economy model. Second, and related to the first point, we do not integrate the fact that recycling may enlarge the set of consumption goods and the aggregate level of consumption. Again, this is due to our focus on the much less obvious recycling-capital accumulation mechanism and its long-term implications.

With all these elements accounted for, we will tackle three distinct sets of original questions:

-

How do consumption and production-based polluting waste respectively affect the short and long-term performance of the economy as measured by consumption, capital stock, recycling effort or the stock of waste? What is the role played by income generation through recycling in the latter outcomes?

-

How do consumption and production-based polluting waste respectively affect the interaction between capital and polluting waste accumulation from both environmental and social welfare perspectives?

-

How do CIR efforts influence the interaction between capital and polluting waste accumulation from both environmental and social welfare perspectives?

Incidentally, we will be also able to explore a fourth question, touching to the debate on the so-called Environmental Kuznets Curve (EKC) literature, as we will be able to compute the optimal shapes of the relationship between pollution and income (or production) for a large variety of scenarios. The EKC conjectures that pollution is an inverse U-shaped function of economic development indicators such as income or capital stock: nations undergo a phase of expansion of both capital (or income) and pollution followed by decreasing pollution and further expansion of capital. Beyond a certain turning point, capital growth coincides with a cleaner environment (see for example, Stokey 1998). Both the theoretical (see for example, Boucekkine et al. 2013) and the empirical literature (see de Bruyn and Opschoor 1997, and Sengupta 1997) are inconclusive regarding the occurrence of the EKC. We will examine the original mechanisms of our recycling model, which includes multiple sources of pollution and income generation schemes, and their respective contributions to our understanding of the relationship between pollution and revenue throughout the development process. To our knowledge, the EKC literature has not yet explored the impact of recycling activities on the latter shapes.Footnote 2

We will build on the circular economy aggregate model developed by Boucekkine and El Ouardighi (2016), and expand upon it to explore more deeply the four sets of problems described above. The current study differ from the former in several respects. First of all, our model is fully linear-quadratic while in the 2016 paper the utility function is logarithmic in line with related growth theory papers (e.g., Stokey 1999). More importantly, and beside differences in few technical assumptions like the latter, which allow to push the theoretical analysis clearly further and at a lower algebraic cost in the current paper, we keep the distinction between consumption-based versus production-based waste and the simple reduced form specification of recycling net income generation. It is worth pointing out that Boucekkine and El Ouardighi’s paper is not at all concerned with the exploration of the distinctive dynamical and long-term implications of consumption-based versus production-based waste recycling, which are in contrast the focus of the current work. Indeed, they have only explored the local stability properties of the steady state equilibrium in the presence of both sources of waste.

There are other stylized circular economy macro-models in the ecological economics literature, and our setting entails some essential departures with respect to this literature. We have already explained above the crucial difference with respect to the seminal model of Lusky, the central role of capital accumulation in our model. We also depart from other multisectoral models in the literature (like those of Martin 1982, or Fodha and Magris 2015) in that we use a simple one sector-one good circular economy, rich enough to replicate the multiple trade-offs one can find in the latter more complex frames. However, what makes definitively the originality of our paper is that it is the first one that studies theoretically the distinctive implications of recycling in the short and long run depending on the source of the waste. We do that as explained above by considering different interaction channels between capital accumulation and recycling, in particular through contrasting the CIR vs the CNR configurations.

We show that under consumption-based waste the central planner reaches larger consumption and capital stock levels than under production-based waste. The main rationale behind this result is that when waste is generated through production, the negative environmental externality limits both capital accumulation and consumption. This brake on capital accumulation is inactive under consumption-based waste.

The paper is structured as follows. Section 2 develops the central planner model where polluting waste is a by-product of either consumption or production. In Sect. 3, we derive the qualitative properties of the model under both consumption and production-based waste. Section 4 compares and contrasts the results, and Sect. 5 concludes the paper.

2 Model

Following standard assumptions, we consider a society that continuously exploits productive capital, denoted by \(K\left( t \right) \ge 0\), where \(t\) stands for time, to linearly generate a flow of revenue, \(aK\left( t \right)\), where \(a > 0\) is the constant marginal revenue generated by the productive capital stock. The revenue generated allows a certain consumption level, denoted by \(c\left( t \right) \ge 0\).

Polluting waste, denoted by \(w\left( t \right) \ge 0\), is caused by either the production or the consumption process (Boucekkine and El Ouardighi 2016). In the case where polluting waste emanates from the exploitation of productive capital (production-based waste), we assume that \(w\left( t \right) = \kappa aK\left( t \right) \ge 0\), where \(\kappa > 0\) is the marginal wasting impact of production. In the case where polluting waste emanates from consumption (consumption-based waste), we assume that \(w\left( t \right) = \beta c\left( t \right)\), where \(\beta > 0\) is the marginal wasting impact of consumption.

To reduce the stock of polluting waste, denoted by \(W\left( t \right) \ge 0\), the economy may, in all cases, invest in recycling efforts \(v\left( t \right) \ge 0\) over time. We assume that the waste-generating processes and recycling operations are mutually independent so that the recycling efforts are non-proportional to the waste emissions. This assumption allows for unbounded recycling efforts, i.e., \(v\left( t \right)\frac{ < }{ > }w\left( t \right)\), to account for the possibility of reduction of past waste emissions. Due to the generally long time span of natural absorption of the waste, we assume that there is no natural abatement of pollution waste. In economic terms, this implies that the social planner cannot benefit from any natural amenities.

Finally, a fixed proportion of recycled waste is supposed to possibly generate additional revenues, \(\varphi v\left( t \right)\), and therefore to positively influence capital growth, \(\varphi \ge 0\) being the marginal revenue from recycling. However, if \(\varphi = 0\), recycling has a neutral impact on capital growth due to an ineffective recycling process. For simplicity, we also assume zero capital depreciation. Indeed, as one can see just below, adding a nonzero depreciation of capital, \(\delta\), will essentially lead to replace the productivity parameter, \(a\), by \(a - \delta\) in the law of capital accumulation just below. In realistic case, \(a \gg \delta\). So, this assumption is totally innocuous.

Based on the previous assumptions, the endogenous capital growth process is given as:

where a positive difference between the total revenues from capital and recycled waste, and current consumption results in investment in productive capital, while a negative difference leads to disinvestment. The initial capital endowment is \(K_{0} \ge 0\).

It is noteworthy that the modeling of income generation through recycling is exclusively aimed to capture the link between recycling and capital growth. It turns out that the unique engine of growth in this model is capital accumulation because the production function is linear in the capital stock. Whether recycling may be capital reducing is not an issue here for two reasons. First, as explained in the introduction, we are referring to primary recycling activities where part of the waste is channeled into a recycling sector. This sector may generate profits, notably through cost reduction (Doonan et al. 2005; Pati et al. 2006; Jacobs et al. 2010; Simpson 2012); we assume that these profits go to investment in order to capture the link between revenue growth and recycling, and we model the size of this growth effect linearly through the term \(\varphi v\left( t \right)\), \(\varphi\) measuring the marginal contribution, that is, the marginal effectiveness, of recycling on economic growth. It could be the case, of course, that part of the waste (in particular production waste) comes from capital goods in the workplace. For example, some of these goods may be scrapped for environmental reasons: typically, the oldest capital goods are the most polluting (see Boucekkine et al. 2014, for an explicit modeling of the latter environmental nexus). In such a case, the loss in value due the scrapping has to be considered in addition to recycling profits in the law of motion of capital. We do assume here that the net effect is positive. Note that this is the most acceptable assumption as the scrapped goods are the oldest, the dirtiest and also the least productive goods. Last but not least, the model works even though we relax the positivity of parameter \(\varphi\), we only stick to the most acceptable case.

The general law of motion of polluting waste is given by:

Notice that we do not introduce natural depreciation of waste: this is because, as outlined strongly in the introduction, we are particularly interested in the waste for which natural absorption takes an extremely long time, or that is non-biodegradable, implying a self-degradation rate close to zero. A similar assumption can be found in El Ouardighi et al. (2016) and El Ouardighi et al. (2021), though over finite time horizon.

We now define the objective function. We assume that the social utility is the difference between the utility drawn from current consumption and the costs incurred from the waste stock and the recycling efforts, respectively. The instantaneous utility from current consumption is a linear quadratic function, that is, \(c\left( t \right)\left( {\theta - c\left( t \right)/2} \right)\), where \(\theta > 0\) is the utility-maximizing consumption level. The justification of this choice, notably with respect to Boucekkine and El Ouardighi (2016), is detailed in the introduction.

Further, the waste stock entails negative externalities such as environmental destruction and biomass extinction (Barnes 2002), and related health consequences. These negative externalities are internalized by the central planner and valued as an increasing convex function of the waste stock, that is, \(eW\left( t \right)^{2} /2\), where \(e > 0\) is a disutility coefficient associated with the waste stock.

Lastly, regardless of whether they are related to consumption or production-based waste, recycling efforts generally involve separation and transformation efforts. The disutility engendered by these efforts is expressed as an increasing quadratic function denoted by \(fv\left( t \right)^{2} /2\), with \(f > 0\). In order to gain more insights and without loss of generality regarding the qualitative properties of the model, \(f\) is normalized to \(1\), so that \(e\), the disutility coefficient of waste, could be interpreted relative to 1, as the disutility coefficient of recycling.

If \(r > 0\) denotes the discounting rate, we assume that the social planner is sufficiently patient that the net marginal revenue generated by the productive capital stock is strictly positive (i.e., \(a - r > 0\)) to allow sustained capital accumulation.

Assuming an infinite planning horizon, the social planner’s optimal control problem is:

subject to:

under the control constraints \(c\left( t \right) \ge 0\) and \(v\left( t \right) \ge 0\), and the state constraints \(K\left( t \right) \ge 0\) and \(W\left( t \right) \ge 0\).

3 Analytical properties of the optimal paths

We successively determine the optimal consumption and recycling policies related to consumption and production-based waste generation, and characterize the nature of convergence to the steady state, if any. For each source of waste generation, we assess the long-run effects of recycling effort on capital growth. It might look odd that steady states could co-exist with an AK production function, which usually serves as the reduced form of endogenous (balanced) growth. Nonetheless, as demonstrated already by Stokey (1998), the internalization of the pollution externality by the central planner eventually leads to not let capital grow indefinitely, thus choosing convergence to an optimal steady state despite the AK production technology. This is also true here (with recycling “replacing” abatement in the Stokey frame). Clearly, replacing the AK production function with a Cobb–Douglas one, beside complicating a lot the algebra, will not change the concept of admissible long-term equilibria as decreasing returns inherent in Cobb–Douglas production functions disable the emergence of balanced growth paths asymptotically.

3.1 Consumption-based waste generation

In this case, we assume that \(\kappa = 0\) and \(\beta > 0\) in the law of motion of polluting waste (3). Skipping the time index for convenience, the current-value Hamiltonian is:

where \(\lambda \equiv \lambda \left( t \right)\) and \(\mu \equiv \mu \left( t \right)\) are costate variables, that, if the state constraints are not binding, evolve according to:

under the transversality conditions: \(\mathop {\lim }\limits_{t \to \infty } e^{ - rt} \lambda \left( t \right) = 0\) and \(\mathop {\lim }\limits_{t \to \infty } e^{ - rt} \mu \left( t \right) = 0\).

Although (5) and (6) are given for an interior solution in terms of state variables, we will also discuss important cases where the states can become negative. In such cases, non-negativity will be imposed, \(K\left( t \right) \ge 0\) and \(W\left( t \right) \ge 0\), and the costate equations may include jumps (when the constraints are binding), which we denote by \(d\eta \left( t \right)\). Whenever jumps are possible in both states, \(\eta \left( t \right)\) will have subscript 1 to identify a jump due to \(K = 0\) and subscript 2 due to \(W = 0\). Formally, the jumps are characterized by non-negativity \(d\eta_{1} \left( t \right) \ge 0\), \(d\eta_{2} \left( t \right) \ge 0\) and complementary slackness, \(\int_{0}^{\infty } K d\eta _{1} = 0\) and \(\int_{0}^{\infty } W d\eta _{2} = 0\).

Assuming interior solutions, necessary conditions for optimality are:

From (5), we get \(\lambda \left( t \right) = Ge^{{\left( {r - a} \right)t}}\), where \(G\) is a constant of integration. Given that \(a - r > 0\), this solution satisfies the transversality condition regardless of whether \(G\) is different from zero or not. In all cases, \(\lambda\) is zero at the steady state. This implies that, in the long run, the capital stock is disregarded and that the controls depend only on the implicit value of the waste stock.

Lemma 1

For \(\kappa = 0\) and \(> 0\), the necessary conditions are sufficient for optimality.

Proof

See “Appendix A1”.

The sufficient conditions used are true only for interior solutions (Seierstadt and Sydsaeter 1987, p. 187).

Lemma 2

Let the state constraint \(W\left( t \right) \ge 0\) be non-binding. Then, it always holds that \(\mu < 0\). Further, let the state constraint \(K\left( t \right) \ge 0\) be non-binding, then \(\lambda > 0\) if \(\lambda \left( 0 \right) > 0\) and \(\lambda < 0\) when \(\lambda \left( 0 \right) < 0\). In addition, we have: \(\mathop {\lim }\limits_{t \to + \infty } \lambda = 0\).

Proof

See “Appendix A2”.

Conversely, under binding state constraints (Hartl et al. 1995), both costates \(\lambda\) and \(\mu\) can exhibit negative jumps which, in this case, are given by the differentiable function:

We summarize the possible binding cases as follows.

Lemma 3

If \(W\left(0\right)>0\) and \(K\left(0\right)>0\), neither state constraint \(K\ge 0\) exclusively nor state constraint \(W\ge 0\) exclusively will become binding over the planning horizon. Further, \(K=0\) and \(W=0\) can never be maintained simultaneously over an interval of time with positive controls \(v>0\) and \(c>0\). If \(W\left( 0 \right) = 0\) and \(K\left( 0 \right) > 0\), then it is optimal to maintain only this state at a zero level, \(W = 0\) and \(\dot{W} = 0\), over a finite interval of time. Similarly, if \(W\left( 0 \right) > 0\) and \(K\left( 0 \right) = 0\), then it is optimal to maintain only this state at a zero level, \(K = 0\) and \(\dot{K} = 0\), over a finite interval of time.

Proof

See “Appendix A3”.

We now turn to the analysis of an interior solution. Plugging the value of \(c\) and \(v\) from (7) and (8) in (2) and (3) for interior solutions, respectively, the equations:

along with (5) and (6), form the canonical system in the state-costate space.

Proposition 1

Under consumption-based waste generation, if \(\beta \varphi < 1\), the steady state is unique, given by:

where the superscript ‘\(S\)’ stands for steady state.

Proof

See “Appendix A4”.

The steady state in (12) exists in spite of the condition for sustained long-term growth \(a > r\). This is due to two ingredients of the model. First, the central planner accounts for the existence of a negative environmental externality. This result was first identified by Stokey (1998). Second, preferences are linear-quadratic: even without the environmental externality, that is only keeping the consumption term in instantaneous utility, the economy would not grow indefinitely. The parametric condition \(\beta \varphi < 1\) is worth commenting. Notice if this condition fails to hold, stationary capital becomes negative. This comes from the accumulation Eqs. (2) and (3) in the steady state which jointly imply:

It can be shown that if \(\beta \varphi < 1\) is violated, the unique equilibrium compatible with the non-negativity constraints is the trivial equilibrium where all variables are nil. As explained before, we disregard this type of equilibrium, which is an artefact of the linear-quadratic preferences. Moreover the larger \(\varphi\) or \(\beta\), the lower the capital stock. This looks at first glance odd at least in what concerns the impact of parameter \(\varphi\). Indeed, if this parameter increases ceteris paribus, recycling generates income and both \(v\) and \(K\) should trivially go up in first reaction. However, as income and production are raised, consumption will also increase by a mere income effect, which tends to curb capital accumulation. The overall effect on capital either in the short or long run is therefore ambiguous. This ambiguity shows up clearly in the long run (\(aK^{S} = c^{S} - \varphi v^{S}\)). In our analytical case, the overall effect is negative and capital goes down when \(\varphi\) increases. The same kind of reasoning can be applied to interpret the impact of a rising \(\varphi\) on stationary waste, recycling or consumption. Concerning the stock of waste, by its law of motion, a larger consumption would in principle, as above, increase the recycling effort, therefore driving it down. But again as above, the resulting second-round income effect would push consumption up, resulting in more waste. It appears that the two effects offset each other.

One can draw some more comparative statics from the expressions of the steady state variables’ values given here above. Interestingly enough, an increase in \(\beta\) unambiguously decreases long-term consumption but its effect on both recycling and total waste depends on the position of \(\beta\)with respect to \(1\). In the normal case where \(\beta < 1\) (that is, one marginal unit of consumption generates less than one unit of waste), a further increase in \(\beta\) raises the long-term recycling effort but also the stock of waste. While stationary consumption decreases when \(\beta\) rises, the flow of waste \(\beta c^{S}\) does increase in the long-run.

As to the parameters of the utility function, one notes that a greater consumption utility coefficient (\(\theta\)) increases all the steady state values. This is due to the linear-quadratic specification of preferences. Qualitatively, an increase in \(\theta\) boosts the marginal utility of consumption, which increases the consumption and the stock of waste. This in turn stimulates recycling. The total impact on capital depends on income generation through recycling and consumption rise. In our case, it is positive. Finally, a greater waste disutility coefficient (\(e\)) lowers the steady-state waste stock and does not affect the steady state capital stock. Note that if the waste disutility coefficient is lower than the recycling disutility coefficient, i.e., \(e < 1\), the steady-state waste stock increases. Regarding the discounting rate (\(r\)), it has no influence on the steady-state capital stock but has a positive effect on the steady-state waste stock. This property is mainly due to the linear-quadratic preferences: abstracting away from waste and recycling, the AK model with quadratic preferences will deliver long-term consumption and capital levels which only depend on productivity \(a\) and the bliss point \(\theta\). Adding waste and recycling does not modify this property. However, as the discounting rate increases, leading to a larger preference for the present, consumption will increase along the transition, inducing an increment in the stock of waste in the long-run.

We now investigate the structure of the associated stable manifolds.

Proposition 2

Under consumption-based waste generation, the steady state exhibits a local two-dimensional stable manifold. The convergence from a close neighborhood to the steady state is monotonic.

Proof

See “Appendix A5”.

Therefore, for a sufficiently patient social planner, a saddle-point exists. In addition, the control paths can be characterized as follows.

Lemma 4

Under consumption-based waste generation, an interior optimal solution satisfies the system:

Proof

See “Appendix A6”.

This general case is solvable numerically. For \(\beta = 1\), we get:

whose constants of integration can be found explicitly. Letting \(\varphi < 1\), then for \(G > 0\) (\(G < 0\)), the sum \(c\left( t \right) + v\left( t \right)\) increases (decreases) monotonically and concavely (convexly) to converge to \(\theta\) when \(t \to \infty\). Furthermore, the closer \(\varphi\) to one the smaller the change in \(c\left( t \right) + v\left( t \right)\), i.e., the weaker the short turm effect of \(\varphi\) on the evolution of \(c\left( t \right) + v\left( t \right)\). Note, the difference \(c\left( t \right) - v\left( t \right)\) decreases to zero when \(t \to \infty\) and \(\varphi\) has no effect on it at all.

Remark

The system (10)-(11)-(5)-(6) has a two-dimensional stable manifold. Any combination on this manifold results in a path of state and costate variables which ends in the steady state for variables \(W\), \(c\) or \(v\). However, in this case \(K\) can potentially grow indefinitely and asymptotically at rate \(a\). As a result, a second type of paths, which may be optimal, can emerge. Along these paths, the system converges to an asymptotic balanced growth path (in the sense that all variables grow asymptotically at constant rates, equal to zero for variables \(c\), \(v\) and \(W\)). In our comparison of the consumption vs production-based waste generation cases, we shall disregard these alternative paths for a souple of reasons: economic irrelevance and mathematical non-robustness. Indeed, they are economically irrelevant because they lead to a major violation of Kaldor stylized facts: the ratio \(c/Y = c/aK\) tends to zero. Obviously, this property cannot arise generally in a model with CRRA preferences: for example, it cannot happen in the non-circular economy model à la Stokey (1998), already quoted above. The spurious nature of these alternative paths can be captured even more directly, without moving to CRRA preferences or any other fundamental adjustment: it’s enough to add a condition ensuring the Kaldor fact holds at large, for example by constraining the limit of \(c/Y\) to be larger than or equal to given a strictly positive constant at large (which could be arbitrarily small).

3.2 Production-based waste generation

In this case, we assume that \(\kappa > 0\) and \(\beta = 0\) in the law of motion of polluting waste (3). Skipping the time index for convenience, the current-value Hamiltonian is:

where \(\lambda \equiv \lambda \left( t \right)\) and \(\mu \equiv \mu \left( t \right)\) are costate variables, that, if the state constraints are not binding, evolve according to:

under the transversality conditions: \(\mathop {\lim }\limits_{t \to \infty } e^{ - rt} \lambda \left( t \right) = 0\) and \(\mathop {\lim }\limits_{t \to \infty } e^{ - rt} \mu \left( t \right) = 0\).

Assuming interior solutions, necessary conditions for optimality are:

From (18), the greater the implicit price of the capital stock, the lower the consumption rate. In (19), the greater the implicit price of the capital stock and the implicit cost of the waste stock, the greater the recycling effort. These results are intuitive.

Comparing necessary conditions (18)–(19) and (7)–(8) and their related costate equations, it is obvious that under consumption-based waste, the consumption is instantaneously diminished by the implicit cost of waste engendered by the marginal consumption-based waste, while under production-based waste, it is intertemporally diminished by the implicit cost of waste engendered by the marginal waste due to the marginal revenue of capital.

Lemma 5

The necessary conditions are sufficient for optimality.

Proof

See “Appendix A7”.

Here also, the sufficient conditions used are true only for interior solutions.

Lemma 6

Let the state constraint \(W \ge 0\) be non-binding. Then, it always holds that \(\mu < 0\).

Proof

See “Appendix A8”.

Lemma 7

It is not optimal to have \(W = 0\) and \(K = 0\) along an interval of time.

Proof

See “Appendix A9”.

The above lemma shows that, unlike with consumption-based waste generation, it is not optimal to maintain both states \(K\) and \(W\) at zero over any time interval.

Plugging the value of \(c\) and \(v\) from (18) and (19) in (2) and (3’), respectively, the equations:

along with (16) and (17), form the canonical system in the state-costate space.

Proposition 3

Under production-based waste generation, for \(r < a\), the steady state is unique, given by:

Proof

See “Appendix A10”.

As it transpires from the expressions of the steady state values given above, the model with capital-based or equivalently production-based waste involves more complex relationships because capital accumulation is not only the main engine of income in this economy, it is also the generator of waste, which cause the negative environmental externality and fosters recycling. Henceforth the corresponding comparative statics are more complicated. From (22), we observe that the marginal wasting coefficient of production (\(\alpha\)) decreases as expected the long-run capital stock, waste stock and consumption flow. More interesting comparative statics are with respect to parameter, which are common to the consumption-based waste and production-based waste models. Let us consider parameter \(\varphi\) for example. Greater marginal revenue from recycling (\(\varphi\)) increases the long-run consumption, which in turn decreases the long-run capital stock. As a consequence, the long-run waste stock and recycling effort are both reduced. When \(\varphi\) goes up, consumption seems to play a long-term stabilizing role on the stock of waste. This is not the case in the model with consumption-based waste where the recycling effort, while increasing with \(\varphi\) in the short-run, ends up independent of this parameter in the long- run.

The second common parameter example is the discounting rate (\(r\)): it has a negative impact on the long-run capital stock, consumption rate and recycling effort but a positive effect on the long-run waste stock. Recall that in the consumption-based waste case, it only affects (positively as in the current case) the stock of waste. In the model with production-based waste, the stationary capital ends up decreasing with the discount rate, as in the traditional Ramsey model.

We now move to the stability analysis and investigate the structure of the stable manifolds.

Proposition 4

Under production-based waste generation, the steady state exhibits a (local) two-dimensional stable manifold. The convergence to the steady state is either monotonic or oscillatory.

Proof

See “Appendix A11”.

We now highlight an interesting property of the optimal growth model with production-based waste. We show hereafter that under certain conditions, it may give rise to an oscillatory convergence to the steady state, which is not granted in the case of consumption-based waste (Proposition 2). According to Proposition 4, convergence to the saddle-point is either monotonic or oscillatory, depending on the magnitude of the wasting impact of the revenue-generation process and the marginal impact of the recycling effort on capital accumulation. Therefore, oscillating convergence to the steady state can be caused either by highly wasteful production, which reflects the use of dirty technology (Stokey 1998), or by highly CIR, which mirrors the absence of any depreciation of scrap recovery (Martin 1982), that is, a highly effective recycling process.

3.3 A preliminary comparison result

In the next section, we shall go a step further and determine the main differences between consumption and production-based polluting waste, on the one hand, and CNR and CIR efforts, on the other hand, on capital growth and polluting waste accumulation in terms of both the steady state and the transient path, using both analytical and numerical results. Before, and based on our analytical results for consumption and production-based polluting waste, we make an important comparison.

Lemma 8

For \(\varphi = 0\) and equal marginal wasting impact of production and consumption, it holds that:

Proof

See “Appendix A12”.

Therefore, for CNR efforts, i.e., \(\varphi = 0\), and equivalent marginal wasting impact in the case of either consumption- or production-based waste, i.e., \(\kappa = \beta > 0\) for either \(\kappa = 0\) and \(\beta > 0\) or \(\kappa > 0\) and \(\beta = 0\), the steady-state consumption level is greater if the polluting waste is a by-product of consumption rather than of production. Because \(c_{{\left| {\kappa = 0,\beta > 0} \right.}}^{S} < \theta\) and \(c_{{\left| {\kappa > 0,\beta = 0} \right.}}^{S} < \theta\), the steady-state consumption is lower than the utility-maximizing consumption level under both production and consumption-based waste. For similar conditions, it follows that the steady-state capital stock is greater under consumption-based waste than under production-based waste. The two latter properties are important and thus deserve a careful interpretation. Why could it be that under consumption-based waste the central planner reaches larger consumption and capital stock levels than under production-based waste? When only consumption generates waste, two effects are at work: on one hand, consumption is directly driven down (with respect to the case \(\beta = 0\)) as it decreases utility via waste; but on the other hand, a drop in consumption increases savings and capital accumulation, which in turn pushes consumption up (income effect). When waste is generated through production, there is an explicit brake on capital accumulation induced by the environmental negative externality, which limits both capital accumulation and consumption. It turns out that this mechanism (brake on capital accumulation) is inactive under consumption-based waste. As a result, both the long-term consumption and capital stock are higher in the latter case.

Note also that due to \(\beta \left[ {\left( {a - r} \right) + \kappa^{2} a} \right] > \left( {1 + \beta^{2} } \right)\kappa \left( {a - r} \right)\) when \(\kappa = \beta\), the steady-state values of the waste stock and the recycling efforts are lower under production-based waste than under consumption-based waste. This comes as a natural consequence of the abovementioned properties for equal marginal waste generation coefficients (\(\kappa = \beta\)): as both consumption and capital stock are lower under production-based waste, the resulting stock of waste, and thus the optimal recycling effort (under \(\varphi = 0\)), are lower.

It is impossible to come out with complete analytical comparison results for any \(\kappa\), \(\beta\) and \(\varphi\). However, numerical experiments are conducted hereafter to complement this analytical section.

4 Numerical analysis

We now get back to the main research questions stated in the introduction and answer them. We shall in particular investigate how consumption versus production-based polluting waste affect the interaction between capital growth and waste accumulation (thus the emergence of an EKC path), and the role of the CIR versus the CNR assumption in the mechanisms involved. To this end, we use numerical experiments.

4.1 Numerical strategy and calibration

To compute the solution paths, we use a dynamic programming approach (see "Appendix A13"). The model is calibrated as depicted in Table 1 just below:

The values in Table 1 reflect a situation where the marginal revenue from the capital stock (\(a=0.1\)) is greater than the discounting rate (\(r=0.05\)). The range of values selected for \(\kappa\), \(\beta\) and \(\varphi\) aims to contrast some important configurations, that is, production-based versus consumption-based waste (i.e., \(\kappa = 0.5\) vs.\(\beta = 0.5\)), on the one hand, and CIR versus CNR efforts (i.e., \(\varphi = 0.1\) vs. \(\varphi = 0\)) on the other hand. In addition, two special cases inducing oscillatory convergence to the steady state are considered, that is, highly wasteful production processes (i.e., \(\alpha = 4\)) and highly CIR (i.e., \(\varphi = 10\)). Finally, we assume equivalent parameter values for the disutility coefficient of waste and the disutility coefficient of recycling (i.e., \(e = 1\)) so that the tradeoff between waste and recycling does not stem from arbitrary decisions concerning parameter values. To assess the sensitivity of the solutions to the initial conditions, we assume in the cases with monotonic convergence two initial values for each state variable, that is, low and high (i.e., lower and higher than the steady-state value), with \(K_{0} = \left( {6,10} \right)\) and \(W_{0} = \left( {0,0.3} \right)\).

The steady state values are reported in Table 2. All things being equal, the long-run capital stock and consumption are greater under consumption-based than production-based waste. Despite greater recycling efforts, the long-run waste is greater under consumption-based than production-based waste. On the other hand, the steady-state capital stock is greater under capital-neutral than CIR while the steady-state waste stock is similar under consumption-based waste and greater under production-based waste.

Claim 1

Although CIR limits capital growth more than CNR does, it promotes a slightly cleaner environment only under production-based waste (Table 2).

To unburden the presentation and ease the comparison between the different mechanisms involved, we shall study the induced optimal paths and welfare outcomes first under consumption-based waste, then under production-based waste.

4.2 Optimal time paths and implied welfare under consumption-based waste

4.2.1 Transient dynamics

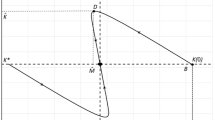

Figure 1 illustrates the paths converging to the steady state from various initial conditions under consumption-based waste for CIR (1.a) and CNR (1.b) efforts. The transient paths are drawn for initially low versus high capital and waste stocks, that is, \(\left( {K_{0} ,W_{0} } \right) = \left\{ {\left( {6,0} \right),\left( {10,0} \right),\left( {6,0.3} \right),\left( {10,0.3} \right)} \right\}\).

The optimal path is composed of two arcs corresponding to sequential sets of actions, that is:

-

From both initially high (low) state values, the optimal policy consists in first decreasing (increasing) the waste stock rapidly and the capital stock slowly, and then decreasing (increasing) both the capital and waste stocks at a similar pace until the steady state is reached.

-

From initially high (low) capital stock and high (low) waste stock, the optimal policy is first to decrease (increase) the waste stock rapidly and the capital stock slowly, and then to decrease (increase) the capital and waste stocks at a similar pace toward the steady state.

The second arc, which arises beyond the turning point and characterizes the longest portion of the planning horizon, depicts a mutual complementarity between the capital stock and the waste stock. That is, under consumption-based waste, capital and pollution most often either increase or decrease together. This result lets us identify initial conditions for which the first arc, located before the turning point, would exhibit (transient) mutual substitutability between the capital and waste stocks, i.e., an EKC-like arc.

We find that such initial conditions exist (Fig. 2): for both CIR and CNR, capital growth allows a cleaner environment from initially intermediate capital stock (i.e., near its steady-state value) and very large waste stock, e.g.,\(\left( {K_{0} ,W_{0} } \right) = \left( {8,2} \right)\), but only for limited time interval. The substitutability arc between the two stocks is more marked for CIR than for CNR, as in the subsequent complementarity arc, which allows greater contraction of the capital stock but with much smaller decrease of the stock of waste.

Claim 2

An EKC-like arc exists for consumption-based waste, during which capital accumulation allows for a cleaner environment for both capital-improving and capital-neutral recycling, but with ephemeral and reversible capital growth (Fig. 2).

The optimal consumption and recycling effort policies’ time paths corresponding to the various paths in Fig. 1 are shown in Fig. 3. The patterns of optimal consumption and recycling efforts obtained for the various initial conditions are summarized in Table 3. The initial recycling efforts are at their highest level for both initially high stocks of capital and waste, while consumption is clearly lower than for initially high capital stock and low waste stock. The reason is that more recycling and less consumption are initially needed to quickly reduce the initial waste stock. Note however that the initial capital stock has a stronger influence than the initial waste stock on both consumption level and recycling efforts.

An interesting feature nevertheless associated with a high initial waste stock is a non-monotonic behavior, i.e., undershooting of recycling efforts linked to initially low capital stock and overshooting of consumption due to initially high capital stock. This behavior is particularly marked in the case of initially low capital stock and high waste stock for which consumption and recycling efforts are first briefly mutual substitutes and then become mutual complements.

In the specific case of initially intermediate capital stock and very large waste stock, e.g., \(\left( {K_{0} ,W_{0} } \right) = \left( {8,2} \right)\), which allows for an EKC-like path, the optimal policy also exhibits overshooting, predominantly with substitutability between the control variables, i.e., consumption should be initially low and increasing while recycling efforts should be initially high and decreasing over time, as suggested in Fig. 4. Finally, in all cases, when recycling does not add to capital growth, consumption is lower than in the converse case, which thus makes recycling efforts less necessary.

4.2.2 Welfare implications

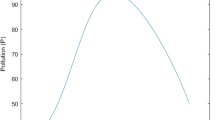

In Fig. 5, the welfare function is computed as a function of the length of the time horizon to emphasize the magnitude of its transient evolution. Due to the effect of discounting, the instantaneous welfare tends to zero as the length of the time horizon tends to infinity.

Apparently, lower initial waste stock results in higher welfare. Compared with CIR, CNR is welfare-improving in the case of higher initial capital stock because lower consumption under CNR than CIR entails less disutility from pollution waste and recycling efforts. In contrast, welfare is similar between CIR and CNR in the case of low initial capital stock due to the initially low and increasing consumption path induced.

Claim 3

Social welfare is greater with both poorer and cleaner rather than both wealthier and dirtier initial conditions (Fig. 5).

Welfare is also very similar between CIR and CNR for very high initial waste stock, as in the case of the EKC-like path for which consumption is also initially low and increasing (Fig. 6). In all cases, a greater initial waste stock is more harmful to the transient welfare.

4.3 Optimal time paths and implied welfare under production-based waste

4.3.1 Transient dynamics

We now turn to the case of production-based waste. The phase-portrait diagrams in Fig. 7 show the paths converging to the steady state from for initially low versus large capital and waste stocks, that is, \(\left( {K_{0} ,W_{0} } \right) = \left\{ {\left( {6,0} \right),\left( {10,0} \right),\left( {6,0.3} \right),\left( {10,0.3} \right)} \right\}\) for CIR and CNR (resp., 7.a and 7.b).

Apart from lower steady state values of the state variables and slightly weaker complementarity relationship between the two stocks, the patterns do not seem to differ much from those of consumption-based waste. However, for a high initial capital endowment, the contraction of capital is clearly greater for consumption-based waste than for production-based waste, with a similar steady state stock of waste.

Claim 4

Consumption-based waste is less capital-destructive than production-based waste, notably under capital-neutral recycling (Figs. 1, 7).

However, the initial conditions under which mutual substitutability exists between the stocks of capital and waste, i.e., EKC-like path, are different from those related to consumption-based waste (Fig. 8). That is, a lower initial capital stock and larger waste stock than for consumption-based waste, i.e., \(\left( {K_{0} ,W_{0} } \right) = \left( {7,3} \right)\), are now required for capital growth to allow a transiently cleaner environment but over a smaller interval. However, the arc of substitutability between the stocks of capital and waste does not exist for CNR even for much higher initial waste stock. Thus, complementarity always prevails under production-based waste with CNR, which leads to less severe contraction of capital but also less effective depollution than under CIR.

Claim 5

An EKC-like arc exists for production-based waste, but over a smaller interval and under more restrictive conditions than for consumption-based waste, that is, lower initial wealth and larger waste stock and only for capital-improving recycling (Fig. 8).

The optimal consumption and recycling effort policies related to the different paths in Fig. 7 are shown in Fig. 9. Here again, higher consumption results from higher initial capital stock. Consumption is also positively affected by the initial waste stock, albeit to a lesser extent. This is in contrast with the consumption-based waste case because consumption here is a non-costly, welfare-improving mean to reduce the waste stock via a capital decrease. Another important difference from the case of consumption-based waste is that recycling is positively influenced by the waste stock. A third important difference from the case of consumption-based waste lies with the fact that while consumption is lower under CNR than CIR efforts, the recycling efforts are now very similar.

Claim 6

In contrast with the case of consumption-based waste, consumption is much greater under CIR than CNR for production-based waste (Fig. 9 vs Fig. 3).

In the specific case of the EKC-like state path, the optimal policy is characterized by complementarity between the control variables, i.e., both consumption and recycling efforts should be initially high and decreasing over time, as suggested in Fig. 10. When recycling is CN, consumption is significantly lower than in the converse case, whereas the magnitude of recycling efforts remains unaffected.

Claim 7

The optimal policy related to an EKC-like path for production-based waste exhibits complementarity between the control variables rather than substitutability as observed for consumption-based waste (Fig. 10).

4.3.2 Welfare implications

Figure 11 reports the social welfare associated with production-based waste, where higher welfare results from lower initial waste stock and to some extent from higher initial capital stock. Despite higher consumption, initial conditions with both higher capital and waste stocks lead to lower welfare due to greater disutility resulting from higher recycling efforts. Again, the differences in welfare between lower and higher initial capital stock are more marked under CIR than CNR efforts, due to the greater reduction in consumption in the latter case between CIR and CNR for initially higher than lower capital stock. Finally, social welfare under CNR is similar to that under CIR from initially high capital but lower than that from initially low capital, mainly because slightly greater recycling efforts under CNR than CIR entail smaller disutility.

Comparing Figs. 5 and 11, respectively, we observe that, for CIR, the welfare is greater under production-based waste than under consumption-based waste from initially high capital stock and similar welfare of production-based waste and consumption-based waste from low capital stock. In contrast, for CNR, the welfare is still greater under production-based waste than under consumption-based waste for initially high capital stock, but lower for initially low capital stock.

Claim 8

In the case of production-based waste, poorer but cleaner initial conditions provide greater social welfare than wealthier but dirtier initial conditions (Fig. 11).

In the case of the EKC-like state path, the transient welfare is negative with quite low values (Fig. 12), due to the initially high disutility generated by both high waste stock and recycling efforts. Afterwards, welfare becomes positive with a slightly greater value under CIR than under CNR because of a greater consumption level.

Overall, production-based waste is more welfare-improving than consumption-based waste if the initial capital endowment is high. The reason is that although consumption-based waste exhibits a higher long-run consumption level for a high initial capital endowment, it has lower consumption in the short run and tends to incur more disutility from polluting waste and recycling efforts than does production-based waste over the whole time horizon. For a low initial capital endowment, production-based waste is still associated with greater transient consumption than consumption-based waste is, but the transient differences in terms of disutility from polluting waste and recycling efforts are now lower.

4.3.3 The case of oscillatory dynamics

We now study two special cases related to production-based waste, for which the convergence to the steady state is oscillatory, due either to the wasting impact of the revenue generation process or to the marginal impact of the recycling effort on capital growth (see Proposition 4).

We first consider the case of highly wasteful production (\(\alpha = 4\)). In this case, we observe that any path starting with capital stock greater than its steady-state value first undergoes a phase of contraction of capital along with expansion of the waste stock and then a phase of contraction of the two stocks (Fig. 13). Beyond the turning point, the capital decline results in a cleaner environment. Therefore, the dirtiest production technologies result in a total reversal of the EKC. Under an ineffective recycling process, i.e., CNR, the total reversal of the EKC is even more severe in terms of capital contraction.

Claim 9

Highly wasteful production is heavily capital-destructive (Fig. 13).

In the context of total reversal of the EKC, the optimal policy is also characterized by complementarity between the control variables (Fig. 14). When recycling does not add to capital, consumption is lower than in the converse case only if the initial stock of capital is sufficiently high. Under the latter condition, however, recycling efforts are greater under CNR than in the converse case. The rationale behind this result is that consumption under CIR is a substitute for recycling to reduce waste.

In Fig. 15, a higher welfare results from lower initial capital stock and to a lesser extent from lower initial waste stock. Again, despite higher consumption, initial conditions involving both higher stocks of capital and waste lead to lower welfare due to greater disutility resulting from higher recycling efforts. In contrast with the previous cases, welfare is now lower under CNR than under CIR. The reason is that recycling efforts result in smaller disutility under CIR due to greater consumption used to reduce waste.

Claim 10

For highly wasteful production, social welfare is greater from poorer rather than wealthier initial conditions (Fig. 15).

We finally analyze the case of highly CIR (\(\varphi = 10\)). Here, two main phases are observed, that is, a phase of contraction of capital along with expansion of the waste stock and then a phase of expansion of capital along with contraction of the waste stock (Fig. 16). Beyond the turning point, capital growth allows a cleaner environment. Therefore, a highly effective recycling process leads to a partial reversal of the EKC.

Claim 11

Highly capital-improving recycling is partly capital destructive (Fig. 16).

In the case of partial reversal of the EKC, the optimal policy is also based on complementarity between the control variables (Fig. 17). Consumption and recycling are both positively affected by the initial capital stock and are affected to a lesser extent by the initial waste stock.

In Fig. 18, higher welfare is derived from lower initial capital stock and to a lesser extent from lower initial waste stock. The ranking in terms of decreasing welfare is consistent with that of consumption, which in turn is allowed by the highly effective recycling efforts.

Claim 12

For highly effective production-based recycling, social welfare is greater with either both poorer and dirtier or both wealthier and cleaner initial conditions rather than both wealthier and dirtier initial conditions (Fig. 15).

5 Conclusion

This paper seeks to determine which source of polluting waste among the stock of productive capital and consumption flows is the most detrimental in terms of welfare and environmental sustainability. We consider a capital accumulation model where either production or consumption is a source of polluting waste. Although the accumulation of the polluting waste cannot be naturally abated, it can be reduced by recycling efforts. To account for their effectiveness, recycling efforts may or may not benefit capital accumulation. The economic tradeoff, which involves instantaneous utility from consumption and instantaneous disutility due to polluting waste and recycling over infinite time horizon, allows us to identify the optimal recycling policy depending on the source of pollution and also to disclose the conditions of emergence of an Environmental Kuznets Curve path.

Our mathematical analysis shows that consumption and production as sources of polluting waste have quite different consequences on the interaction between capital and pollution accumulation. The main differences can be summarized as follows:

-

Convergence from a close neighborhood to the unique interior, locally stable steady state is monotonic under consumption-based waste, but it can also be oscillatory under production-based waste due either to very dirty technology of production or to highly effective recycling.

-

To compare the long-term consequences of the optimal control of consumption versus production-based waste via recycling, we examine the implications of the benchmark case where one additional unit of consumption yields the same additional waste as a supplementary unit of production and recycling does not generate additional income. In this framework, larger consumption and capital stock stationary values are reached under consumption-based waste than under production-based waste. This is because in the latter there is an explicit brake on capital accumulation induced by the environmental negative externality, which limits both capital accumulation and therefore consumption. Such a mechanism does not exist under consumption-based waste.

-

In the same analytical set-up, it is shown that lower stocks of waste are obtained with lower recycling efforts in the production-based waste case.

From extensive numerical analysis, we also gained further important insights:

-

The analytical results above are shown to be robust under a set of alternative parameterizations where the assumptions adopted in the benchmark case are successively dropped.

-

In countries with intermediate wealth and very large waste stock, an EKC-like arc exists under consumption-based waste, during which capital accumulation allows for a cleaner environment for both capital-improving and capital-neutral recycling, but with ephemeral and reversible capital growth. In contrast, under production-based waste, a lower initial wealth and larger waste stock than for consumption-based waste are required for an EKC-like arc to arise, but this happens only for capital-improving recycling and over a smaller interval.

-

Under production-based waste involving very dirty technology, a total reversal of the EKC-like arc is observed. Under capital-neutral recycling, the reversal of the EKC is even more severe in terms of capital contraction. Finally, under production-based waste with highly capital-improving recycling, a partial reversal of the EKC-like arc is obtained.

While most economic studies disregard the consequences of the differences between two pollution sources, namely production and consumption, on social welfare and environmental sustainability, our study suggests that, all things being equal, wealthy countries should focus on minimizing the wasteful impact of consumption rather than production because it is less capital-destructive, especially in the case of ineffective recycling. In contrast, national regulations should focus on minimizing the wasteful impact of production in the case of ineffective recycling in poor countries.

Our results can be further generalized by extending the model to the case of two non-cooperative countries with different levels of effectiveness of their recycling process. An important issue related to this context is how the countries’ non-cooperative strategies affect both welfare and environmental sustainability.

Notes

Indeed, the EKC literature is huge (e.g., Boucekkine et al. 2013), and there are thousands of cases studied with different ingredients (abatement, recycling, multisectoral economy, circular or not, etc.), which each features a different case for non-monotonicity with the corresponding underlying mechanisms. In our paper, we use “EKC-like” for any capital-waste trajectory that is not monotonic. Of course, our model needs not have the same associated dynamics per variable that we find in the classical case, precisely because we rely on different variables and different income generation mechanisms.

We warmly thank a Referee for raising this point.

References

Acerbi F, Taisch M (2020) A literature review on circular economy adoption in the manufacturing sector. J Clean Prod 273:123086

Barnes DKA (2002) Invasions by marine life on plastic debris. Nature 416:808–809

Barros MV, Salvador R, de Francisco AC, Piekarski CM (2020) Mapping of research lines on circular economy practices in agriculture: from waste to energy. Renew Sustain Energy Rev 131:109958

Battini D, Bogataj M, Choudhary A (2017) Introduction to the special issue on closed loop supply chain (CLSC): economics, modelling, management and control. Int J Prod Econ 183:319–321

Boucekkine R, El Ouardighi F (2016) Optimal growth with pollution waste and recycling. In: Feichtinger G (ed) Dynamic perspectives on managerial decision making. Springer

Boucekkine R, Pommeret A, Prieur F (2013) Technological vs. ecological switch and the environmental Kuznets curve. Am J Agric Econ 95(2):252–260

Boucekkine R, Hritonenko N, Yatsenko Y (2014) Optimal investment in heterogeneous capital and technology under restricted natural resource. J Optim Theory Appl 163:310–331

de Bruyn S, Opschoor J (1997) Developments in the throughput-income relationship: theoretical and empirical observations. Ecol Econ 20(3):255–268

Derigs U, Friederichs S (2009) On the application of a transportation model for revenue optimization in waste management: a case study. CEJOR 17:81–93

Dockner E (1985) Local stability in optimal control problems with two state variables. In: Feichtinger G (ed) Optimal control theory and economic analysis, vol 2. North Holland

Dockner E, Feichtinger G (1991) On the optimality of limit cycles in dynamic economic systems. J Econ 53(1):31–50

Doonan J, Lanoie P, Laplante B (2005) Determinants of environmental performance in the Canadian pulp and paper industry: an assessment from inside the industry. Ecol Econ 55(1):73–84

El Ouardighi F, Sim JE, Kim B (2016) Pollution accumulation and abatement policy in a supply chain. Eur J Oper Res 248(3):982–996

El Ouardighi F, Sim JE, Kim B (2021) Pollution accumulation and abatement policies in two supply chains under vertical and horizontal competition and strategy types. Omega 98(102108):1–19

Eriksen M, Maximenko N, Thiel M, Cummins A, Lattin G, Wilson S, Hafner J, Zellers A, Rifman S (2013) Plastic pollution in the South Pacific subtropical gyre. Mar Pollut Bull 68(1–2):71–76

Eriksen M, Cowger W, Erdle LM, Coffin S, Villarrubia-Gómez P, Moore CJ et al (2023) A growing plastic smog, now estimated to be over 170 trillion plastic particles afloat in the world’s oceans—urgent solutions required. PLoS ONE 18(3):e0281596. https://doi.org/10.1371/journal.pone.0281596

Fodha M, Magris F (2015) Recycling waste and endogenous fluctuations in an OLG model. Int J Econ Theory 11(4):405–427

Geissdoerfer M, Pieroni MPP, Pigosso DCA, Soufani K (2020) Circular business models: a review. J Clean Prod 277:123741

Grass D, Caulkins JP, Feichtinger G, Tragler G, Behrens DA (2008) Optimal control of nonlinear processes with applications in drugs, corruption, and terror. Springer

Hartl RH, Sethi SP, Vickson RG (1995) A survey of the maximum principles for optimal control problems with state constraints. SIAM Rev 37(2):181–218

Hrabec D, Kudela J, Somplak R, Nevrly V, Popela P (2020) Circular economy implementation in waste management network design problem: a case study. CEJOR 28:1441–1458

Jacobs B, Singhal V, Subramanian R (2010) An empirical investigation of environmental performance and the market value of the firm. J Oper Manag 28(5):430–441

Law K, Moret-Ferguson S, Maximenko N, Proskurowski G, Peacock E, Hafner J, Reddy CM (2010) Plastic accumulation in the North Atlantic subtropical gyre. Science 329(5996):1185–1188

Lusky R (1976) A model of recycling and pollution control. Can J Econ 9(1):91–101

Martin RE (1982) Monopoly power and the recycling of raw materials. J Ind Econ 30(4):104–419

Nakamura S (1999) An interindustry approach to analyzing economic and environmental effects of the recycling of waste. Ecol Econ 28:133–145

Pati RK, Vrat P, Kumar P (2006) Economic analysis of paper recycling vis-à-vis wood as raw material. Int J Prod Econ 103(2):489–508

PlasticsEurope (2015) Plastics—the facts 2014/2015. An analysis of European plastics production, demand and waste data. Belgium

Seierstad A, Sydsæter K (1987) Optimal control theory with economic applications. North Holland

Sengupta RP (1997) CO2 emission—income relationship: policy approach for climate control. Pac Asia J Energy 7(2):207–229

Sephton P, Mann J (2016) Compelling evidence of an environmental Kuznets curve in the United Kingdom. Environ Resour Econ 64(2):301–315

Sheu JB (2007) A coordinated reverse logistics system for regional management of multi-source hazardous wastes. Comput Oper Res 34(5):1442–1462

Simpson D (2012) Institutional pressure and waste reduction: the role of investments in waste reduction resources. Int J Prod Econ 139(1):330–339

Stokey N (1998) Are there limits to growth? Int Econ Rev 39(1):1–31

Suhandi V, Chen PS (2023) Closed-loop supply chain inventory model in the pharmaceutical industry toward a circular economy. J Clean Prod 383:135474

Verma R, Vinoda KS, Papireddy M, Gowda ANS (2016) Toxic pollutants from plastic waste—a review. Procedia Environ Sci 35:701–708

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors ensure that no conflict of interest is directly or indirectly related to this study. The authors have no financial or proprietary interests in any material discussed in this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 A1

The Legendre-Clebsch condition of joint concavity of the Hamiltonian with respect to the control variables is satisfied, because the Hessian \(\left[ {\begin{array}{*{20}c} {H_{cc} } & {H_{cv} } \\ {H_{vc} } & {H_{vv} } \\ \end{array} } \right] = \left[ {\begin{array}{*{20}c} { - 1} & 0 \\ 0 & { - 1} \\ \end{array} } \right]\) is negative definite. This guarantees a maximum of the Hamiltonian. Plugging the expressions of \(c\) and \(v\) respectively from (7) and (8) in (4) gives the maximized Hamiltonian:

from which the Hessian \(\left[ {\begin{array}{*{20}c} {H_{KK} } & {H_{KW} } \\ {H_{WK} } & {H_{WW} } \\ \end{array} } \right] = \left[ {\begin{array}{*{20}c} 0 & 0 \\ 0 & { - e} \\ \end{array} } \right]\) is negative semi-definite. This ensures that the necessary conditions are sufficient for optimality and thus the existence of a globally optimal solution. □

1.2 A2

The proof is by contradiction. Assume a time point \(t\) such that the costate \(\mu \ge 0\) and the transversality condition holds. Then, Eq. (6) implies that \(\mu\) can grow only at a rate greater than \(r\). Therefore, the transversality condition will never be met. Such a point cannot exist, i.e., \(\mu < 0\). The result for \(\lambda\) is derived in a similar way. Because we assume that \(r < a\), starting from any \(\lambda \left( 0 \right)\), \(\lambda\) always tends to zero. □

1.3 A3

Differentiating (9), we find that \(d\beta c - dv = 0\) if:

and, with respect to \(W = 0\), we have:

Since \(r < a\), \(\dot{\eta } \ge 0\) when \(\lambda \ge 0\) and \(\mu \ge 0\), which with respect to (9) requires:

which holds only for positive \(\lambda\). Such a solution is clearly feasible, if \(c > 0\) and \(v > 0\) and implies \(\lambda\) remains positive and tends to zero while \(\mu\) grows over time and satisfies the transversality condition by a growing negative jump. Next, we verify when the controls are feasible by substituting \(\mu\) with respect to (9). Specifically, \(c \ge 0\) if:

or if:

and \(v = \varphi \lambda - \mu = \varphi \lambda - \frac{{\left( {\beta + \varphi } \right)\lambda - \beta \theta }}{{1 + \beta^{2} }} = \frac{{\varphi \left( {1 + \beta^{2} } \right)\lambda - \left( {\beta + \varphi } \right)\lambda + \beta \theta }}{{1 + \beta^{2} }}\), that is:

Let \(\varphi \left( {1 + \beta^{2} } \right) - \left( {\beta + \varphi } \right) \le 0\), then (A3.4) always holds and (A3.4) along with (A3.2) results in:

Since \(r < a\), \(\lambda\) always decreases to zero and the left-hand side will not hold, i.e., \(\beta c - v > 0\). Therefore, \(W\) increases. Letting \(1 + \beta^{2} - \beta - \varphi > 0\), then if \(\varphi \left( {1 + \beta^{2} } \right) - \left( {\beta + \varphi } \right) \le 0\) still holds, we get the same result, \(W\) increases. If \(\varphi \left( {1 + \beta^{2} } \right) - \left( {\beta + \varphi } \right) > 0\), then (A3.4) holds. Consequently, (A3.3) along with (A3.2) results in:

Again, \(W\) will eventually increase. Thus, \(W = 0\) can occur only during a finite interval. Finally, while \(W = 0\), \(K\) may decrease to zero if \(\varphi < \frac{1}{\beta }\).

Regarding the fact that \(K\left( 0 \right) = 0\) can be maintained when \(W\left( 0 \right) > 0\) only over a finite time interval, this requires a jump as given by (9). The jump is due to requiring \(\dot{K} = 0\), that is:

which, when differentiating to ensure \(dc - d\varphi v = 0\), results in:

Finally, to have \(K = 0\) and \(W = 0\) concurrently along with \(v > 0\) and \(c > 0\) over an interval of time, we need \(\dot{K} = 0\) and \(\dot{W} = 0\), i.e., \(\varphi = 1/\beta\). Assuming that \(\varphi \ne 1/\beta\), this would apparently not be possible. Let \(\beta \varphi > 1\). If both \(W = 0\) and \(K = 0\) at a point in time, then from that point on, the nil solution, i.e., no recycling and no consumption, is optimal over the entire time horizon. Note that \(\dot{K} = aK - c + \varphi v < 0\) and \(\dot{W} = \beta c - v < 0\), if \(\beta c < v < \frac{c - aK}{\varphi }\). This implies that if \(K\) is small and \(\beta < 1\), then it is possible that \(\dot{W} < 0\) and \(\dot{K} < 0\) occurs starting from some point in time so that both \(K\) and \(W\) will become equal to zero. Note that, in practice, this solution corresponds to a negative capital state. □

1.4 A4

Equating the RHS of (9)-(10)-(5)-(6) to 0 and solving by identification and substitution, we get \(\lambda^{S} = 0\) and \(\mu^{S} = - \frac{\beta \theta }{{1 + \beta^{2} }}\) and \(K^{S}\) and \(W^{S}\) as given in (11). Plugging these expressions in (7) and (8), respectively, and simplifying yields \(c^{S}\) and \(v^{S}\) in (11). From (11), it can be shown that the limiting transversality conditions are satisfied for the saddle-paths because:

This ensures the uniqueness of the globally optimal solution. □

1.5 A5

To analyze the stability of the canonical system (10)-(11)-(5)-(6), we write the Jacobian:

Given that \(\lambda\) and \(\mu\) are evaluated at their steady state value, we compute the determinant:

which has a positive value for \(r < a\). Using Dockner’s formula (Dockner 1985), we determine the sum of the principal minors of \(J\) of order 2 minus the squared discounting rate, that is:

The necessary and sufficient conditions that ensure that two eigenvalues have negative real parts and two have positive real parts, which corresponds to the case of a two-dimensional stable manifold, are \(\left| J \right| > 0\) and \({\Psi } < 0\). The sign of \({\Psi }\) is negative whenever \(r < a\), which implies that a two-dimensional stable manifold (saddle-point) exists in the case of a sufficiently patient social planner. To determine whether the optimal path is monotonic or oscillatory, we compute the expression (Dockner 1985):

A positive (negative) sign of \({\Omega }\) indicates that convergence to the saddle-point is monotonic (spiraling) near the steady state. Because \({\Omega } > 0\), the convergence to the saddle-point is monotonic near the steady state. □

1.6 A6

Differentiating (7) with respect to time, we get:

which, when differentiating again, leads to:

Substituting \(\beta \left( {r\mu + eW} \right)\) from (A6.1) and \(\dot{W}\) from the state Eq. (3), we have:

Similarly, from (8), we obtain:

which, differentiated again, gives:

Thus, accounting for \(\lambda \left( t \right) = Ge^{{\left( {r - a} \right)t}}\), we get (13)–(14). The transient path converging to a steady state can then be found with the boundary conditions:

1.7 A7

The Legendre–Clebsch condition of concavity of the Hamiltonian with respect to the control variables is satisfied, as \(\left[ {\begin{array}{*{20}c} {H_{cc} } & {H_{cv} } \\ {H_{vc} } & {H_{vv} } \\ \end{array} } \right] = \left[ {\begin{array}{*{20}c} { - 1} & 0 \\ 0 & { - 1} \\ \end{array} } \right]\) is negative definite. This guarantees a maximum of the Hamiltonian. Plugging the respective expressions of \(c\) and \(v\) in (4) gives the maximized Hamiltonian:

from which the Hessian matrix: \(\left[ {\begin{array}{*{20}c} {H_{KK} } & {H_{KW} } \\ {H_{WK} } & {H_{WW} } \\ \end{array} } \right] = \left[ {\begin{array}{*{20}c} 0 & 0 \\ 0 & { - e} \\ \end{array} } \right]\) is negative semi-definite. This ensures that the necessary conditions are also sufficient for optimality. □

1.8 A8

The proof is identical to that for Lemma 2. □

1.9 A9

Let \(W = 0\) and \(K = 0\), \(v = 0\) and \(c = 0\) due to \(\varphi \lambda - \mu \le 0\) and \(c = \theta - \lambda \le 0\), that is:

Then, both \(\lambda > 0\) and \(\mu > 0\) to meet (A9.1) and if:

then (A9.1) can be feasible. Accordingly, to maintain \(W = 0\) and \(K = 0\), we need to keep \(v = 0\) and \(c = 0\) which, with respect to (18) and (19), leads to: