Abstract

The environmental protection tax (EPT) reform is a major strategic measure to further implement green development and is the most important environmental economic policy in China. Using data from 3339 companies listed on the A-shares in China's Shanghai and Shenzhen from 2006 to 2021, this paper evaluates the policy impact of the EPT on corporate carbon emissions and its internal mechanism from the perspective of green innovation by the DID method. The results show that EPT reform effectively promotes corporate carbon emission reduction, and the conclusion remains valid after robustness tests such as the DDD and DML method. The EPT reform mainly promotes carbon emission reduction in companies with high executive compensation levels and high environmental information disclosure, and mature companies. Furthermore, the EPT reform promotes enterprises to reduce carbon emissions by forcing them to adopt strategic and endpoint green innovation, and this "forcing" effect is mainly reflected in internal incentives and external pressure.

Graphical Abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Green innovation effectively mitigates environmental pollution and safeguards the ecological environment through the deployment of clean technologies. Concurrently, it fosters new drivers of economic growth and supports sustainable development through technological transformation and advancement. This approach facilitates a “win–win” scenario for both economic efficiency and environmental protection (Wang et al. 2019).The rapid economic growth of China since the reform and opening up, coupled with the extensive economic development model, has severely harmed the ecological environment(Zhu et al. 2019; Xie et al. 2023). Figure 1 shows that from December 2019 to July 2023, the proportion of China's daily carbon emissions in the world is significantly higher than that of the USA, and China's average daily carbon emissions accounted for 17 percentage points higher than that of the USA from January 1 to July 31, 2023. The pollutant discharge fee in China was formally established in September 1979. The formal introduction of the EPT on January 1, 2018, marking that the pollutant discharge fee system that has operated for nearly 40 years will become history (Shang et al. 2022). Although the pollutant discharge fee and the EPT are both market-based environmental regulatory tools, they exhibit significant differences in aspects of enforcement rigor and standardization. The pollutant discharge fee's flaws, such as lax law enforcement, excessive administrative intervention, and lack of enforcement, will be fundamentally remedied with the conversion of the pollutant discharge fee to the EPT (Liu et al. 2022b). This viewpoint has gained widespread recognition in the academic community. However, the question of whether the EPT contributes to fostering green innovation, and subsequently aids in the reduction of corporate carbon emissions, remains a pressing issue that requires further investigation. The EPT is mainly levied on enterprises (Long et al. 2022), the implementation of the EPT is comparable to an exogenous "quasi-natural experiment" in the field of economics (Liu et al. 2022c), offering a unique chance to precisely and successfully identify the impact of the EPT reform on carbon emission reduction and providing sufficient evidence for the test of this problem.

Source: https://www.carbonmonitor.org.cn

Proportion of daily carbon emissions in China and the USA from January 1, 2019, to July 31, 2023.

Academics have analyzed the impact of China's EPT policy on green technology (Liu and Xiao 2022; Wang et al. 2023; Du et al. 2023), environmental protection effect (Han and Li 2020; Li et al. 2021). More recently, a few studies have also linked the relationship of technological innovation between the EPT reform and carbon emissions. For instance, Lin et al. (2023) found that the EPT caused a general decline in pollution emissions in various regions of China, and the technological innovation of enterprises, universities, and other types of subjects played an intermediary role; Gao et al. (2022) believed that green innovation is the main transmission mechanism of the EPT enhancing the synergy between pollution reduction and carbon emission reduction. Green innovation can help solve the contradiction between economic growth and environmental protection and promote sustainable development (Hamid and Wang 2023). The EPT is an effective means to encourage enterprises to carry out green innovation. However, the majority of the literature has only discussed the impact of the EPT on corporate green innovation or carbon emission reduction, with less exploration into the types and heterogeneity of green innovation. Due to differences in the quality and direction of enterprise green innovation, this paper uses differences-in-differences (DID) to analyze the possible differentiated policy effects of the EPT reform on enterprise carbon emission reduction at the micro-level, enrich the theoretical study of the factors influencing corporate carbon emissions reduction, and offer significant insights for the government to improve the environmental regulation policy and for the enterprises to enhance the capacity of green innovation in practice.

This study offers three potential contributions. First, the EPT is a major measure of China's tax reform, which is of great significance to building an environmentally friendly society (Kong et al. 2023), and is an important forcing mechanism to promote the low-carbon transformation of enterprises. The existing literature mainly focuses on the impact of the EPT reform on green innovation, while the impact of environmental regulation policies on green innovation ability is the key to the success of carbon emission reduction of enterprises. Based on enterprise-level green patent data, this paper analyzes the impact of the EPT reform on corporate green innovation behavior and carbon emission reduction from multiple dimensions, enriching the research on the micro-effects of the EPT. Second, in the expandability analysis section, this study employs a cutting-edge approach, namely the Double/Debiased Machine Learning (DML), for robust causal inference. This choice is made to circumvent challenges posed by the "curse of dimensionality," and model specification biases inherent in traditional econometric models. The DML methodology aims to mitigate the interference of confounding factors on corporate carbon emissions, allowing for a more precise assessment of the impact of the EPT on corporate carbon emissions. Finally, this paper examines the "forcing" effect of the EPT reform on green innovation and carbon emission reduction of enterprises in great detail. It finds that the EPT promotes carbon emission reduction of enterprises primarily by stimulating green innovation of strategic and endpoint green innovation activities, and conducts a heterogeneous investigation from the aspects of enterprise internal incentives and external pressure, which is of great significance for the government to improve the EPT system and promote the low-carbon development of enterprises at this stage.

Institutional background

The origin of the EPT is the Piku tax proposed by Piku, the founder of welfare economics, who believed that there is a negative externality in the production of a commodity, whose private cost is lower than the social cost. Therefore, the government should regulate it by levying a tax to make the allocation of resources, to reach the Pareto optimal state (Hu et al. 2023). The EPT is based on the polluter pays principle, and through the levy of the EPT, the external cost of polluting the environment will be transformed into the internal cost of the enterprises (Xu et al. 2023c). The EPT reform has realized the transformation from the pollutant discharge fee to the EPT, and there are substantial differences between the two (Jiang et al. 2020). Firstly, the tax standard is different. The EPT generally adopts the principle of tax burden neutrality (Shang et al. 2022), while also encouraging local authorities to raise collection standards. In addition to the existing lower limit set by current pollution charge regulations, an upper limit has been established, which is capped at no more than ten times the minimum standard. The existing pollutant discharge fee often leads to a phenomenon where companies perceive pollution discharge as legal once fees are paid, stemming from the fact that the charges levied for pollution are significantly lower than the costs of pollution control, rendering environmental regulatory policies ineffective. The EPT elevates the standard for tax amounts, consequently raising the cost of pollution for enterprises. When these pollution costs reach a sufficiently high level, it prompts companies to alter their environmental management practices to reduce emissions. Secondly, the local retention is different. The revenue from the pollutant discharge fee is divided between the central government and local governments on a 1:9 basis. After introducing the EPT, it will be fully utilized as local revenue, and the central government will no longer participate in the division. This is conducive to enhancing the local government's policy implementation and environmental protection motivation, and weakening the incentive for local governments to collude with enterprises. Finally, the main body of the levy is different. The pollutant discharge fee is collected by the environmental protection authorities. The EPT is collected by the tax authorities, and the environmental protection department plays the role of assisting in the collection of the tax. This helps to earmark the collected taxes for specific purposes and to improve the transparency and standardization of the EPT collection.

Theoretical basis and hypotheses

The EPT reform and corporate carbon emission

Compared with the "green paradox" effect, academics are more inclined to believe that environmental regulation contributes to carbon emission reduction (Xu et al. 2023b; Liu et al. 2022a; Pei et al. 2019; Lin and Zhang 2023). The government levies carbon and energy taxes on fossil energy producers and users to increase production and environmental costs, thereby reducing the demand for fossil energy and achieving carbon emission reduction. Environmental regulation can not only directly reduce carbon emissions through the demand side of fossil energy but also indirectly promote carbon emission reduction through transmission mechanisms such as green innovation (Nazir et al. 2023). Specifically, this involves using mechanisms such as the implementation of the EPT to regulate economic activities, thereby compelling enterprises toward green innovation. This strategy aims to reduce the demand for fossil fuels and encourage enterprises to shift to clean and renewable energy sources, indirectly lowering carbon emissions. A representative viewpoint of this indirect suppression is the Porter Hypothesis, which posits that environmental regulation can stimulate corporate innovation activities. This, in turn, drives progress in production technology and upgrades in environmental protection technologies, consequently filling the compliance costs for enterprises and reducing carbon emissions. Guo et al. (2022) found that environmental tax reform could significantly reduce urban air pollution, and that green technological innovation was an important path of environmental tax reform affecting air quality. Environmental regulation refers to the collective set of policies and measures established by the government with the purpose of environmental protection and governance. The primary tools of environmental regulation encompass three categories: command-and-control environmental regulation, such as the environmental impact assessment system and the "three simultaneous" system; market-based environmental regulation, including the EPT and pollutant discharge permits; and voluntary environmental regulation, exemplified by environmental certification and environmental audits. Environment regulations imbued with administrative characteristics may interfere with market signals, and voluntary environmental regulation is often ineffective. Only the EPT with a market-based, rational tax rate possesses the potential for an "environmental dividend." Hence, hypothesis 1 is proposed as follows.

Hypothesis 1 (H1)

The EPT reform helps promote corporate carbon emission reduction.

Forcing effect and crowding-out effect

There has been much debate concerning the impact of environmental regulation on green innovation. From the perspective of "compliance cost effect," the neoclassical economic theory argued the EPT would increase the environmental cost of enterprises. If enterprises are forced to raise prices, product competitiveness will decline. However, if they do not increase prices, the enterprise cannot guarantee the cash flow of the enterprise, and the research and development (R&D) of new technologies will be affected. In other words, the constraints of environmental regulations force enterprises to invest additional costs, showing the crowding-out effect on green innovation R&D funds, which is not conducive to green innovation. From the perspective of "innovation compensation effect," Porter's Hypothesis suggests that reasonably designed environmental regulations can promote the green innovation of enterprises and have a forcing effect on their green innovation activities, which can offset the negative impacts due to compliance with environmental regulations, thus stimulating green innovation (Luo et al. 2022; Chen et al. 2022). The positive effect of environmental regulation on corporate green innovation is mainly reflected in enterprise products process and production process. The former means that environmental regulation will promote enterprises to provide better quality and more environmentally friendly products; the latter refers to the reduction of enterprise energy consumption and the improvement of enterprise production efficiency. The improvement of enterprise product quality and the optimization of the production process can make up for the increase in enterprise production costs brought about by the EPT.

As a market-based environmental regulatory tool (Shao et al. 2020), the forcing effect of the EPT on corporate green innovation is reflected in the external pressure from stakeholders and the internal incentives of enterprise managers. From the perspective of external pressure, the EPT is based on the principle of "who pollutes, who governs." Its essence is to internalize the negative externality cost of environmental pollution. The valuation of enterprises by external stakeholders varies depending on whether enterprises undertake environmental responsibility. In the context of asymmetric environmental information, a key indicator of a company's commitment to environmental responsibility is its disclosure of environmental information. Consequently, firms that proactively disclose such information are likely to command a higher premium in the capital market (Chen et al. 2018a). Furthermore, the act of disclosing environmental information not only enhances the company's image as a socially responsible entity but also contributes to the enhancement of its corporate value. Therefore, environmental information disclosure pressure from stakeholders will force enterprise managers to weigh the consequences of polluting the environment and influence the way they respond to environmental regulations. Meanwhile, green innovation can help enhance external stakeholders' confidence in corporate sustainable development and reduce investment uncertainty triggered by environmental pressure. Therefore, to meet the realistic green demands of external stakeholders, corporate managers will choose to promote green innovation activities. From the view of internal incentives, environmental regulation means such as the EPT will impose additional burdens on enterprises. However, it will prompt managers to actively reflect on corporate shortcomings in green development (Grossman and Helpman 2018), correctly weigh the costs and benefits of environmental protection, and enhance the awareness of environmental protection of production. Green innovation activities not only meet the requirements of environmental regulation but also help to shape the new advantages of enterprise green development and open new markets. Meanwhile, shareholders will also actively incentivize by means such as remuneration. As a result, managers have the incentive to eliminate outdated production capacity, and research and develop green products. This approach leads to a win–win situation, achieving both energy conservation and emission reduction, as well as enhancing core competitiveness. Hence, hypothesis 2 is proposed as follows.

Hypothesis 2

The EPT reform "forces" enterprises to engage in green innovation rather than "crowding" them out, and the "forcing" effect is mainly manifested in enterprises with high internal incentives and high external environmental information disclosure.

Quality and direction of green innovation

Following the implementation of the EPT, enterprises in regions with increased tax burdens are experiencing heightened environmental regulatory pressures. Studying the quality of green innovation under the stress of environmental regulation is of significant importance for enterprises aiming to reduce carbon emissions. According to the quality of innovation, the green innovation behavior of enterprises is divided into substantial green innovation and strategic green innovation. The substantial green innovation refers to the green innovation behavior with the purpose of promoting product upgrading and creating unique competitive advantages, which belongs to high technological green innovation; the strategic green innovation, through the unilateral pursuit of the speed of green innovation to cope with the environmental regulation and cater to the innovation strategy of government policy (Li et al. 2020), belongs to low technological green innovation. Compared to strategic innovation, substantive green innovation, while high in value and potentially capable of yielding considerable long-term benefits, is associated with greater risks and a longer duration for development (Liao et al. 2023; Kiss and Barr 2017). Additionally, green innovation is characterized by its spillover effect, meaning it can be easily imitated without incurring costs (Arf et al. 2018; Nie et al. 2023). Consequently, due to practical constraints, companies tend to prioritize quantity and engage in strategic green innovation activities. These activities serve to signal green innovation, comply with government regulations, and address the pressures arising from environmental regulation (Li et al. 2023). Therefore, the EPT reform has incentivized corporate strategic green innovation behaviors.

Examining the different directions of green innovation activities has important academic value and policy significance for understanding the carbon reduction effect and mechanism of the EPT. The World Intellectual Property Organization (WIPO) launched the Green List of the International Patent Classification in 2010, which classifies green patents into seven categories: alternative energy, nuclear power generation, agriculture and forestry management, energy conservation, administrative and regulatory design, waste management, and transportation, in accordance with the United Nations Framework Convention on Climate Change (Qi et al. 2018). Hence, green innovation can be categorized, based on the direction of the innovation activities, into source and endpoint innovation. Source green innovation involves innovation activities aimed at reducing the generation of taxable pollutants from the source. This is achieved through the development of green products and upgrading emission reduction technologies, exemplified by innovations in alternative energy and nuclear power generation. On the other hand, endpoint green innovation involves innovation activities that focus on purchasing environmental protection equipment and enhancing pollution control measures. These activities aim to reduce the emission of final pollutants at the end of the production process, exemplified by innovations in waste management. In the long run, source green innovation is the key to reduce environmental pollution and realize green low carbon. However, due to the high requirements of source innovation for enterprises, especially the difficulty of innovation activities related to alternative energy sources and environmentally friendly energy sources. So enterprises prefer to carry out waste management innovation activities to reduce pollutant emissions at the end of production, which is related to the path dependence of corporate green innovation in China's traditional energy pattern (Liu and Xiao 2022). Hence, hypothesis 3 is proposed as follows.

Hypothesis 3: The EPT stimulates corporate strategic green innovation and endpoint green innovation, thereby promoting corporate carbon emissions reduction.

Methodology and data

Model setting

After the implementation of the EPT policy, 12 provincesFootnote 1 raised the tax burden standard, while the other regions took the original pollutant discharge fee levy standard as the EPT standard. In this paper, the enterprises are grouped according to whether they have raised the EPT standard before and after the policy. The enterprises with shifting tax burden are considered as the control group, and the enterprises with a significantly higher tax burden are regarded as the treatment group. This paper uses the DID method to construct the following model to effectively identify the impact of the EPT reform on corporate carbon emissions.

Ln carbonit represents the carbon emissions of enterprise i in year t; post stands for the dummy variable before and after the EPT policy, which takes the value of 1 in the current year 2018 and thereafter, and 0 otherwise; treat is a dummy variable indicating whether the tax burden has increased or not, treat takes 1 if the tax rate in the region where the firm is located has increased, and 0 otherwise. The coefficient of the interactive term treat*post is the policy effect that this paper focuses on, it is the impact of the EPT reform on corporate carbon emissions. X represents all identifiable control variables including firm age, roa, tobinQ, top1, HHI, and book-to-market ratio. \(\gamma t\) and \(\mu i\) are year fixed effect and individual fixed effect, \(\omega_{it}\) is the random interference term.

Variables selection

Dependent variable: lncarbon

This paper employs the natural logarithm of the total carbon emissions of listed companies, incremented by one, as the dependent variable. According to the Greenhouse Gas Accounting System, corporate carbon emissions consist of both direct and indirect emissions. The former refers to the greenhouse gases produced by a company through energy consumption in its production processes, while the latter encompasses emissions resulting from electricity and heat consumption, as well as other scattered carbon emissions (not originating from emission sources owned or controlled by the company, which are not considered in this study). Thus, this paper measures corporate carbon emissions from both direct emissions and indirect emissions generated through electricity and heat consumption. The measurement of carbon emissions is conducted based on social responsibility reports, sustainable development reports, and environmental reports of listed companies. For those companies that directly disclose annual direct or indirect carbon emissions or total carbon emissions, the data disclosed in their reports are directly utilized. In cases where annual carbon emissions are not directly disclosed but different types of fossil energy consumption, electricity consumption, and heat consumption are reported, the direct and indirect carbon emissions are separately calculated according to the Guidelines for Corporate Greenhouse Gas Emission Accounting and Reporting released by the National Development and Reform Commission of the People's Republic of China. The results are then summed to obtain the total carbon emissions (Wang et al. 2022).

Independent variable: treat*post

As can be seen from the above, firms in the 12 provinces are selected as the treatment group (treat = 1), and firms in other regions are the control group (treat = 0). post is a time dummy variable for whether or not the EPT policy has been implemented, with post = 0 prior to 2018; and post = 1 in 2018 and beyond.

Control variables

In order to mitigate the endogeneity bias caused by omitted variables, referring to Li et al.(2023) and Wang et al.(2022), this paper selects firm-level economic characteristics as control variables: firm age (current year—firm opening year + 1), roa (net profit at the end of the period/total assets at the end of the period), tobinQ (market value of the firm/capital replacement cost), top1 (number of shares held by the first largest shareholder at the end of the period/total number of shares at the end of the period), book-to-market ratio (shareholders' equity/market capitalization), and HHI (book value of ownership interests in a single company/book value of ownership interests in the industry to which it belongs).

Data sources and explanation

This paper selects 3339 listed companies in China's Shanghai and Shenzhen A-shares from 2006 to 2021 as the research object. The sample data are processed as follows: Companies with abnormal trading status (ST, * ST, PT) during the sample period are excluded, and companies with serious missing values are excluded. Moreover, tail trimming of 1% from both upper and lower ends is applied to all continuous variables to alleviate the impact of extreme values. The data sources of this paper are as follows: Corporate green innovation data come from CNRDS (Chinese Research Data Services); carbon emission data of listed companies mainly come from social responsibility reports, sustainable development reports, and environmental reports; and other corporate characteristics data mainly come from China Stock Market & Accounting Research Database (CSMAR). The descriptive statistics of the main variables are shown in Table 1.

Whether the experimental group and the control group had parallel trends prior to policy implementation.

As shown in Fig. 2, the carbon emissions of the experimental and control groups showed a similar trend before 2018, and both of them basically maintained the same trend in the time period of 2006–2017, showing that there is no obvious difference between the treatment and control groups before the EPT policy. In addition, there is a significant difference in lncarbon between the treatment and control groups from 2020, indicating that the impact of the EPT policy on corporate carbon emissions in 2018 lags about two years. Figure 2 shows just an intuitive feeling, and there will be followed by more specific empirical methods to judge.

Results and discussion

Baseline regression

This section estimates the effect of the EPT reform on corporate carbon emissions reduction to test H1. The regression results are shown in Table 2. Column (1) is the result of OLS estimation, and columns (2), (3), and (4) are the results of FE estimation. Column (2) controls the year fixed effect; column (3) controls both year and individual fixed effect; and column (4) controls year, individual, and industry fixed effect. The empirical conclusions of the basic results remain consistent, showing that the EPT reform has a significant negative impact on corporate carbon emissions.

Identify hypothesis testing

Parallel trend testing

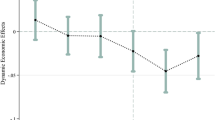

The assumption that the experimental group and the control group meet the parallel trend is an important prerequisite for using the DID method. It means that before the implementation of the EPT policy, the carbon emissions of listed companies maintain a relatively stable trend of change. Although Fig. 2 preliminarily shows that the trend of corporate carbon emissions in the experimental group and the control group before the policy is basically parallel, it is necessary to adopt a more rigorous and specific test method. According to Li et al. (2016), the event study approach is used to empirically test the dynamic effects of the EPT reform. The treat*post in model (1) is replaced with dummy variables indicating the number of years before and after the EPT reform, while the dependent variable remains unchanged. The following dynamic model is constructed:

In Eq. (2), n is the year of the company away from the implementation of the EPT reform in 2018. n is greater than 0 indicating n years after the implementation of the EPT reform, and n is less than 0 indicating n years before the implementation of the EPT reform. F0 denotes a dummy variable for the year in which the EPT reform was implemented. Because of the long period in the sample before the introduction of the EPT reform, this paper sets the pre-policy year 5 and above as the base group (Zhang et al. 2019; Fajgelbaum et al. 2020). Figure 3 reports the estimated parameters {\(\beta - 5\), \(\beta - 4\), \(\beta - 3\), …, \(\beta 1\), \(\beta 2\), \(\beta 3\)}. The regression results show that the coefficient estimates of the five years before the policy are basically insignificant. And the regression coefficients are all around zero, indicating that before the implementation of the EPT reform, the trend of corporate carbon emissions in the treatment group and the control group is similar, which satisfies the assumption of the parallel trend (Xu et al. 2023a). The coefficient estimates for the year of policy implementation and the following three years are all significantly positive at the 10% level. From the dynamic effect of the parallel trend test, the impact of the EPT reform on corporate carbon emissions is significantly negative.

Placebo testing

In order to exclude the effects of unobserved factors on carbon emission reduction, this paper conducts a placebo testing by randomly assigning pilot areas (Cai et al. 2016). Based on Eq. (1), the expression for the estimated treat*post coefficient is as follows:

In Eq. (3), if the unbiased estimation of \(\beta_{1}\) is to be realized, the δ = 0. However, there is no way to know whether it is 0 or not, and it is also impossible to directly test whether the estimation result will be affected by other random factors. If based on the relevant economic theory, the use of computer simulation to make treat*post does not have an impact on the dependent variable, and \(\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\beta }_{1}\) can also be estimated equal to 0. Then it can be inverted that \(\delta\) = 0. This paper has carried out 1000 times random sampling, and regressed according to Eq. (1). Figure 4 shows that the estimated coefficients are all centrally distributed around 0, so δ should be equal to 0, indicating that the baseline estimates in this paper are unlikely to be driven by unobserved factors.

Other robustness tests

The replacement of the explanatory variable

In order to enhance the persuasiveness of the findings, this paper uses two other methods to measure corporate carbon emissions and test them again. The explanatory variable in column (1) of Table 3 is lnfossil, which is the natural logarithm of the fossil fuel combustion emissions of listed companies. The explanatory variable in column (2) is carbon intensity, which is equal to the ratio of total carbon emissions of listed companies to their total profits. It can be seen that the empirical results of this paper are not influenced by the method of measuring the dependent variable, which means the conclusion that the EPT can help enterprises reduce carbon emissions is robust.

PSM-DID

Initially, a categorized assessment using the logit model and kernel matching method is employed for resampling the treatment group with replacement. Subsequently, a balance test is conducted on the matched samples. Column (3) of Table 3 shows the regression results of PSM-DID, which indicates that the matching method is valid, the regression coefficients are significantly negative, and the baseline regression results are robust.

Excluding the effects of other policies

Prior to the EPT reform, China implemented other environmental regulatory measures, such as the implementation of the Environmental Protection Law of the People's Republic of China (2015) (new EPL). This may confound the DID results with other policy effects. Therefore, in the baseline regression, a cross term between the dummy variable for that policy and the time linear trend is included, to control for the impact of the relevant policy on the estimations. Column (4) of Table 3 shows that the estimated coefficient of treat*post is significantly positive at the 1% level, and the test results are consistent with those above. The effect of the new EPL policy was largely ruled out.

DDD

Environmental regulation mainly targets high-pollution industries, and low-pollution industries are affected very little. This paper introduces third difference (industry pollution degree) on the basis of the DID model to refine the causal effect of the EPT reform on corporate carbon emissions (Deschênes et al. 2017). Specifically, the time dimension is used as the first difference to compare the effects before and after the EPT reform; the regional dimension is used as the second difference to compare the impact of the difference of environmental regulation intensity between regions with significantly higher tax burdens and constant tax burdens; and the degree of pollution in the industry is used as the third difference to further exclude the influences that are unobservable and outside of the policy. According to the Management List of Industry Classification for Environmental Verification of Listed Companies (Environmental Affairs Office Letter [2008] No. 373), the research object is classified into two categories of high-pollution industry and low-pollution industry. The high-pollution industries primarily include 16 industries.Footnote 2 Based on this, the paper constructs the DDD model following the approach of Chen et al. (2018b).

Ln carbonit represents the natural logarithm of the carbon emissions of enterprise i in industry j in the year t. When the sample enterprise belongs to high-pollution industry, the value is 1, and when it belongs to low-pollution industry, the value is 0. \(\gamma tj\), \(\mu ij\), \(\eta it\) are three sets of two-dimensional fixed effects. treat*post*poll is the explanatory variable, its coefficient is estimated by DDD, which examines the impact of corporate carbon emissions between regions with significantly higher tax burdens and constant tax burdens, and between high-polluting industry and low-polluting industry before and after the EPT reform. Column (5) of Table 3 reports the average treated effect of the DDD estimation. The coefficient on treat*post*poll is significantly negative, generally consistent with the DID results, suggesting that the EPT reform reduces corporate carbon emissions.

The industry*year interaction fixed effect

In order to avoid biasing the estimation results by omitting industry dynamics and to control for time-varying industry characteristic variables as much as possible. This paper estimates the model again by controlling for the industry*year interaction fixed effect. As shown in column (6) of Table 3, the estimated results are still consistent with the regression results of the benchmark model, further verifying the robustness of the basic conclusions of this paper.

Expandability analysis

According to the study of Chernozhukov et al. (2018), the paper uses a more advanced DML model to the policy effect assessment of the EPT. On the one hand, DML is a causal inference method based on nonparametric models, without pre-setting functions, overcoming the preset limitations of traditional econometric regression models, and breaking the "dimensional curse" by controlling high-dimensional covariates. On the other hand, the instrumental variable function of DML and the orthogonal method can ensure the estimation effectiveness, solve the problem of regular bias, and then obtain the approximate unbiased estimator of the processing effect, which enhances the reliability and robustness of the research conclusions. A partially linear regression (PLR) model is constructed based on DML to estimate the processing effect, the specific formula is as follows:

Among them, \(\theta_{0}\) is the disposal coefficient that should be focused on here;\(X_{it}\) is a set of high-dimensional control variables; g (\(X_{it}\)) and m (\(X_{it}\)) need to estimate their concrete forms through DML; \(U_{it}\) and \(V_{it}\) represent error terms whose conditional mean is 0.

The DML method in column (1) and column (2) of Table 4 is least absolute shrinkage and selection operator (lasso) regression and neural network (nnet) regression, and the samples are divided into five groups, respectively. The regression results also show that the EPT policy can promote the carbon emission reduction of enterprises, which further supports the conclusions of this study.

The impact of the EPT reform on corporate carbon emissions: a heterogeneity test.

Test based on the perspective of internal incentives

In this paper, the top 3 executives’ compensations are selected to measure internal incentives, because corporate managers are the formulators and advocators of green innovation strategies. Their green cognition are crucial, and a company that engages in low-carbon development depends largely on whether or not the managers are effectively incentivized (Brav et al. 2018). In this study, the median total compensation of the top three executives among all listed companies within the sample scope is used as the dividing criterion. Specifically, if the compensation level of the top three executives of a company in a given year exceeds the median of the sample, then “top3” is assigned a value of 1; otherwise, it is assigned a value of 0. Column (1) and (2) of Table 5 show that the estimated coefficient of treat*post passes the 1% significance test for firms with greater internal incentives, while there is no significant relationship for firms with lesser internal incentives.

Test based on the perspective of external stress

Disclosure of environmental information enhances the transparency of corporate environmental data, affecting how external stakeholders perceive the company. This increased scrutiny intensifies the external pressure on managers, thereby reducing opportunities for opportunistic behaviors aimed at evading environmental regulation. In this study, a dummy variable, “corporate environmental information disclosure” (eid), is used as a measure of this external pressure. This paper adopts the dummy variable, corporate environmental information disclosure eid, as a measure of external pressure. The environmental disclosure scoring indicator system contains two types of information, namely monetized informationFootnote 3 and non-monetized information.Footnote 4 Specifically divided into 25 disclosure items, the scores of these items are summed and then do natural logarithmic processing to get the quality of environmental information disclosure (Kong et al. 2021). If corporate environmental disclosure score for the current year is greater than the median of the sample, then eid is equal to 1, otherwise eid is equal to 0. Columns (3) and (4) of Table 5 show that the EPT reform has a significant effect on carbon emission reduction in enterprises with more environmental information disclosure, while it is not significant in enterprises with less environmental information disclosure. This result suggests that the EPT reform can promote carbon emission reduction in enterprises with high pressure of external environmental information disclosure.

Test based on the perspective of enterprise life cycle

The life cycle theory points out that due to the different stages of enterprises, there will be big differences in scale, profitability, growth, investment and financing strategies, willingness to innovation, and so on. Therefore, enterprises in different life cycles will adopt different technological innovation behaviors and show different carbon emission reduction capacity. The impact of the EPT reform on the corporate carbon emissions will also be various according to the different life cycle stages of enterprises. There are many methods of enterprise life cycle division in the existing literature, among which, the cash flow pattern method is more objective and operable. In this paper, the cash flow pattern method is used to categorize the lifecycle of a company. This is achieved by reflecting the characteristics of different life stages through the combination of net cash flows from operating, investing, and financing activities. The company's lifecycle is divided into three stages: growth, maturity, and recession (Vorst and Yohn 2018). Details are shown in Table 6.

Table 7 shows the results of grouping according to the life cycle of enterprises. In the maturity period of enterprises in column (2), the estimated coefficient of treat*post is significantly negative at the 1% level, while there is no significant relationship in the growth and recession period of enterprises, indicating that the effect of the EPT reform on promoting carbon emission reduction is mainly reflected in the mature stage of enterprises. This is because in the maturity period enterprises begin to realize stable profitability, internal financing constraints can be eased, and enterprises are also more likely to get a larger amount of exogenous financing at a lower cost. At this time, enterprises have a stronger willingness and ability to innovate, and R&D investment and innovations are more than the growth and recession period. Therefore, the EPT reform has a relatively larger role in promoting corporate carbon emission reduction in the maturity period (Liu et al. 2020).

Examination of the influencing mechanism based on corporate green innovation.

The mechanism test of the EPT influencing corporate carbon emissions reduction

The quality of innovative activities: substantive or strategic green innovation

In accordance with the three classifications of patents by the China National Intellectual Property Administration (CNIPA), namely invention patents, utility model patents, and design patents (Hu et al. 2020). According to the provisions of the Patent Law of the People's Republic of China, invention patents, in comparison with the existing technology, are required to possess prominent substantive features and significant advancements. Moreover, they undergo a substantive examination during the authorization process, thereby entailing a higher level of application difficulty and technological value. In this context, invention patents are commonly employed as a metric for gauging a company's genuine innovation prowess, indicative of substantive or breakthrough innovations. Concurrently, utility model patents, unburdened by stringent conditions during the authorization process, are frequently utilized to measure strategic innovations catering to investors and regulatory compliance, encompassing both strategic and incremental innovations (Jiang and Bai 2022). Based on this, enterprise green innovation is divided into substantive green innovation and strategic green innovation from the perspective of the quality of innovation activities. Green invention patent is regarded as substantive green innovation because it is a kind of intellectual property rights with high technical value, which can reflect the independent innovation ability of enterprises to a certain extent. Green utility model patent is regarded as strategic green innovation because it reflects the "quantitative change" of corporate innovation, and it is an innovative strategy to cope with environmental regulation (Du et al 2022; Lian et al. 2022). It is found that after the implementation of the EPT reform, the estimated coefficient of treat*post*strategic is negative and passes the 5% significance level test as shown in column (1) of Table 8, while column (2) shows that the regression coefficient of treat*post*substantial is negative but not significant. Due to the relatively low cost of implementing strategic innovative behaviors, profit-maximizing firms will over-pursuing an increase in the number of green innovations in the short term despite the pressure of environmental regulations. It is a more realistic choice to engage in less difficult strategic innovative activities. The results of Zhang et al. (2023) also indicated that strategic green innovations seemed to be more sensitive to real environmental regulation. Dai et al. (2015) thought that incremental green innovation could help improve environmental performance, but radical innovation played a more important role in the transition to a sustainable future. Cui et al. (2022) pointed out that cleaner production audit projects had greater impact on radical environmental innovation than progressive environmental innovation.

The direction of innovative activities: source green innovation or endpoint green innovation

Green innovation is crucial in harmonizing environmental regulation with sustainable corporate development. Examining the direction of corporate green innovation under the pressure of environmental regulation is of significant importance for achieving carbon emission reduction in enterprises. Based on WIPO's green innovation division standard, this paper identifies and calculates the annual data of listed companies' green innovation, and further distinguishes between source green innovation and endpoint green innovation. Source green innovation involves refining production processes at their source to fundamentally reduce the generation of pollutants, representing a fundamental means for enterprises to achieve sustainable development. Endpoint green innovation entails the improvement or installation of emission treatment equipment to decrease the final emission quantity of pollutants (Wang and Chu 2023). Then this paper uses the proportion of source green innovation patents and the proportion of endpoint green innovation patents in corporate green innovation as proxy variables (Liu and Xiao 2022) to measure the corporate green innovation direction. As shown in column (3) of Table 8, the estimated coefficient of treat*post*endpoint is significantly negative at the 10% level, while column (4) shows that the regression coefficients of treat*post*source does not pass the test of the significance level. This suggests that after the EPT reform, the endpoint innovation of firms in the region where the tax standard is raised is significantly higher, but not in source innovation. The EPT reform mainly incentivizes firms to carry out innovation activities in the category of waste management. This may be due to the fact that when the intensity of environmental regulation increases, enterprises find their scope for initiating green innovation activities at the source to be somewhat limited. They tend to favor green innovation activities at the endpoint stage to reduce the emissions of taxable pollutants. This suggests that under China's traditional energy-dominated development pattern, corporate green innovation activities exhibit a pronounced path dependency. These findings corroborate the research of Zou et al. (2019) and Zhang et al. (2018), affirming that endpoint management, defined as the treatment of waste materials in the production process by enterprises, can significantly enhance their environmental performance; endpoint management facilitates enterprises in meeting regulatory thresholds more readily, representing a strategy adopted by enterprises to maintain compliance in their operations. Therefore, hypothesis 3 is verified.

The heterogeneity test of the EPT influencing corporate carbon emissions reduction

The above results verify the influencing mechanism of the EPT reform on carbon emissions through corporate green innovation. According to the empirical results in the previous section, the forcing effect of the EPT reform is mainly manifested in enterprises with high level of internal compensation and high environmental information disclosure. Therefore, following the EPT reform, such enterprises are likely to have a relatively greater potential for enhancing green innovation. This study categorizes the research samples based on internal salary incentives and external pressure for environmental information disclosure. The empirical test results are presented in Tables 9 and 10.

The results in columns (1) and (2) of Table 9 and columns (1) and (2) of Table 10 show that the EPT reform effectively promotes strategic green innovation and endpoint green innovation of enterprises with high remuneration levels, and then driven carbon reduction. Wu et al. (2023) supported this conclusion, arguing that as a market incentive type of environmental regulation, the impact of environmental regulation on enterprise green innovations was mainly through internal incentives. According to the results in columns (3) and (4) of Table 9 and columns (3) and (4) of Table 10, the EPT policy significantly promotes strategic green innovation and endpoint green innovation in firms with high environmental information disclosure, and thus promotes the reduction of carbon emissions. This is consistent with the findings of some scholars: Jiang et al. (2022) found that environmental information disclosure had a significant positive effect on the innovation of high-polluting firms; Song et al. (2022) argued that environmental regulation forced corporate green technological progress through external pressure. In summary, this further supports the mechanism of the EPT reform's role in influencing corporate carbon emissions through the channel of green innovation. H2 is basically verified.

Conclusions and policy implications

This paper takes 3339 listed companies in China's Shanghai and Shenzhen A-shares as research samples from 2006 to 2021, adopts the DID method to investigate the micro-mechanisms and differential effects of the EPT on carbon emission reduction, and draws the following conclusions: Firstly, the EPT policy significantly reduces the carbon emissions of enterprises, and this conclusion still holds after the robustness tests of the DDD and DML method; secondly, the heterogeneity analysis reveals that the forcing effect of the EPT reform on carbon emission reduction is more obvious in enterprises with the high level of executive compensation and high environmental information disclosure, and mature enterprise; finally, the mechanism test shows that the EPT reform mainly promotes carbon emission reduction by stimulating strategic green innovation and endpoint green innovation activities, and this forcing effect is mainly manifested in internal incentives and external pressure.

This study proposes the following policy recommendations. First, the government should improve the design of EPT system. By learning from the more developed EPT regimes of Europe and America, there is a need to establish a green tax system that is based on the EPT and coordinates multiple types of taxes. This would expedite the greening of the tax structure, optimize the overall EPT system, and promote a long-term mechanism for tax revenue dedicated to ecological and environmental protection. In parallel, enhancing other EPT categories and tax policies would collaboratively compel corporate green innovation. Second, governments need to improve the quality of green innovation. In formulating policies to encourage green innovation in enterprises, the government should discriminate based on the difficulty and value of these green innovation activities. This involves, on the one hand, intensifying support for high-technology R&D projects in their initial stages to promote substantial green innovation within corporations. On the other hand, there should be reasonable guidance and moderate support for enterprises engaged in lower-technology level innovation. During later stages of subsidy provision, a selection process for the outcomes of corporate green innovations should be implemented, with elevated standards to enhance the overall quality of green innovation. Third, enterprises should strengthen innovation in source control. Enterprises need to undergo a transformation in their approach—from passive compliance to active management, and from endpoint management to source control. This shift necessitates improvements in production techniques or processes, the development of environmentally friendly technologies and green products, the strengthening of upfront prevention and clean production practices, the active engagement in green innovation, and realization of a green, low-carbon transition.

Although this study strives for perfection in exploration, it still has some shortcomings. Firstly, the research focuses exclusively on green innovation, leaving room for future studies to investigate the effects of the EPT on corporate carbon emissions in conjunction with green innovation spillover effects. Secondly, the analysis is confined to China as a whole; future research could be more region specific, examining the impact of the EPT on corporate carbon emissions across different areas. Additionally, considering the availability of data, there is a need to broaden the selection of control variables. Due to space constraints, the heterogeneity analysis in this study is limited to corporate characteristics, with industry heterogeneity (such as competition levels, technological attributes, and manufacturing properties) not being analyzed. These aspects present opportunities for further refinement in subsequent research.

Data availability

Data will be made available on request.

Notes

Including Hebei, Henan, Jiangsu, Shandong, Hunan, Sichuan, Chongqing, Guizhou, Hainan, Guangxi, Shanxi, and Beijing.

Including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, chemical industry, petrochemical, building materials, papermaking, brewing, pharmaceutical, fermentation, textile, tanning, and mining.

Including environmental liability disclosure, environmental performance and governance disclosure; if the quantitative and qualitative combination of disclosure = 2, qualitative disclosure = 1, no disclosure = 0.

Including environmental management disclosure, environmental certification disclosure and environmental information disclosure; if disclosure = 2, no disclosure = 0.

References

Arf WB, Hikkerova L, Sahut JM (2018) External knowledge sources, green innovation and performance. Technol Forecast Soc Chang 129:210–220

Brav A, Jiang W, Ma S, Tian X (2018) How does hedge fund activism reshape corporate innovation? J Financ Econ 130(2):237–264

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85

Chen YC, Hung M, Wang Y (2018a) The effect of mandatory CSR disclosure on firm profitability and social externalities: evidence from China. J Account Econ 65(1):169–190

Chen Z, Kahn ME, Liu Y, Wang Z (2018b) The Consequences of spatially differentiated water pollution regulation in China. J Environ Econ Manag 88:468–485

Chen Y, Yao Z, Zhong K (2022) Do environmental regulations of carbon emissions and air pollution foster green technology innovation: evidence from China's prefecture-level cities. J Clean Prod, 350.

Chernozhukov V, Chetverikov D, Demirer M, Duflo E, Hansen C, Newey W, Robins J (2018) Double/debiased machine learning for treatment and structural parameters. Economet J 21(1):C1–C68

Cui J, Dai J, Wang Z, Zhao X (2022) Does environmental regulation induce green innovation? A panel study of Chinese listed firms. Technol Forecast Soc 176:121492

Dai J, Cantor DE, Montabon FL (2015) How environmental management competitive pressure affects a focal firm's environmental innovation activities: a green supply chain perspective. J Bus Logist 36(3):242–259

Deschenes O, Greenstone M, Shapiro JS (2017) Defensive investments and the demand for air quality: evidence from the NOx budget program. Am Econ Rev 107(10):2958–2989

Du L, Lin W, Du J, Jin M, Fan M (2022) Can vertical environmental regulation induce enterprise green innovation? A new perspective from automatic air quality monitoring station in China. J Environ Manag 317:115349

Du G, Zhou C, Ma Y (2023) Impact mechanism of environmental protection tax policy on enterprises’ green technology innovation with quantity and quality from the micro-enterprise perspective. Environ Sci Pollut R, 1–19.

Fajgelbaum PD, Goldberg PK, Kennedy PJ, Khandelwal AK (2020) The return to protectionism. Q J Econ 135(1):1–55

Gao X, Liu N, Hua Y (2023) Environmental protection tax law on the synergy of pollution reduction and carbon reduction in China: evidence from a panel data of 107 cities. Sustain Prod Consump 33:425–437

Grossman GM, Helpman E (2018) Growth, trade, and inequality. Econometrica 86(1):37–83

Guo B, Wang Y, Feng Y, Liang C, Tang L, Yao X, Hu F (2022) The effects of environmental tax reform on urban air pollution: a quasi-natural experiment based on the environmental protection tax law. Front Public Health 10:967524

Hamid S, Wang K (2023) Are emerging BRICST economies greening? An empirical analysis from green innovation efficiency perspective. Clean Technol Envir, 1–18.

Han F, Li J (2020) Assessing impacts and determinants of China’s environmental protection tax on improving air quality at the provincial level based on Bayesian statistics. J Environ Manage 271:111017

Hu J, Pan X, Huang Q (2020) Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol Forecast Soc 158:120122

Hu S, Wang A, Du K (2023) Environmental tax reform and greenwashing: evidence from Chinese listed companies. Energ Econ, 106873.

Jiang L, Bai Y (2022) Strategic or substantive innovation?–The impact of institutional investors’ site visits on green innovation evidence from China. Technol Soc 68:101904

Jiang Z, Wang Z, Zeng Y (2020) Can voluntary environmental regulation promote corporate technological innovation? Bus Strateg Environ 29(2):390–406

Jiang C, Zhang F, Wu C (2021) Environmental information disclosure, political connections and innovation in high-polluting enterprises. Sci Total Environ 764:144248

Kiss AN, Barr PS (2017) New product development strategy implementation duration and new venture performance: a contingency-based perspective. J Manage 43(4):1185–1210

Kong D, Wei Y, Ji M (2021) A study on the impact of environmental protection fee to tax on corporate green information disclosure. China Secur Market Herald 08:2–14

Kong L, Wang S, Xu K (2023) The impact of environmental protection tax reform on total factor energy efficiency. Clean Technol Envir, 1–16.

Li P, Lu Y, Wang J (2016) Does flattening government improve economic performance? Evidence from China. J Dev Econ 123:18–37

Li J, Ren H, Zhang C, Li Q, Duan K (2020) Substantive innovation or strategic innovation? Research on multiplayer stochastic evolutionary game model and simulation. Complexity 2020:1–15

Li P, Lin Z, Du H, Feng T, Zuo J (2021) Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J Environ Manage 295:113112

Li X, Guo F, Xu Q, Wang S, Huang H (2023) Strategic or substantive innovation? The effect of government environmental punishment on enterprise green technology innovation. Sustain Dev 31:3365–3386

Lian G, Xu A, Zhu Y (2022) Substantive green innovation or symbolic green innovation? The impact of ER on enterprise green innovation based on the dual moderating effects. J Innov Knowl 7(3):100203

Liao Z, Chen J, Weng C, Zhu C (2023) The effects of external supervision on firm-level environmental innovation in China: are they substantive or strategic? Econ Anal Policy 80:267–277

Lin B, Zhang A (2023) Can government environmental regulation promote low-carbon development in heavy polluting industries? Evidence from China’s new environmental protection law. Environ Impact Asses 99:106991

Lin Y, Liao L, Yu C, Yang Q (2023) Re-examining the governance effect of China’s environmental protection tax. Environ Sci Pollut R 30(22):62325–62340

Liu J, Xiao Y (2022) China’s environmental protection tax and green innovation: leverage effect or crowding out effect? China Econ Res J 57(01):72–88

Liu S, Lin Z, Leng Z (2020) Do tax incentives improve the level of corporate innovation?–A test based on firm life cycle theory. China Econ Res J 55(06):105–121

Liu C, Xin L, Li J (2022a) Environmental regulation and manufacturing carbon emissions in China: a new perspective on local government competition. Environ Sci Pollut R 29(24):36351–36375

Liu G, Zhang L, Xie Z (2022c) Environmental taxes and corporate cash holdings: evidence from China. Pac-Basin Financ J 76:101888

Liu G, Yang Z, Zhang F, Zhang N (2022b) Environmental tax reform and environmental investment: a quasi-natural experiment based on China's environmental protection tax law. Energ Econ, 109.

Long F, Lin F, Ge C (2022) Impact of China’s environmental protection tax on corporate performance: empirical data from heavily polluting industries. Environ Impact Asses 97:106892

Luo Y, Mensah CN, Lu Z, Wu C (2022) Environmental regulation and green total factor productivity in China: a perspective of Porter’s and Compliance hypothesis. Ecol Indic 145:109744

Nazir R, Gillani S, Shafiq MN (2023) Realizing the direct and indirect impact of environmental regulations on pollution: a path analysis approach to explore the mediating role of green innovation in G7 economies. Environ Sci Pollut R 30(15):44795–44818

Nie C, Zhong Z, Feng Y (2023) Can digital infrastructure induce urban green innovation? New insights from China. Clean Technol Envir, 1–18.

Pei Y, Zhu Y, Liu S, Wang X, Cao J (2019) Environmental regulation and carbon emission: the mediation effect of technical efficiency. J Clean Prod 236:117599

Qi S, Lin S, Cui J (2018) Can the environmental equity trading market induce green innovation?–Evidence based on green patent data of listed companies in China. China Econ Res J 53(12):129–143

Shang S, Chen Z, Shen Z, Shabbir MS, Bokhari A, Han N, Klemes JJ (2022) The effect of cleaner and sustainable sewage fee-to-tax on business innovation. J Clean Prod,361.

Shao S, Hu Z, Cao J, Yang L, Guan D (2020) Environmental regulation and enterprise innovation: a review. Bus Strateg Environ 29(3):1465–1478

Sinn HW (2008) Public policies against global warming: a supply side approach. Int Tax Public Finan 15(4):360–394

Song M, Peng L, Shang Y, Zhao X (2022) Green technology progress and total factor productivity of resource-based enterprises: a perspective of technical compensation of environmental regulation. Technol Forecast Soc, 174.

Vorst P, Yohn TL (2018) Life cycle models and forecasting growth and profitability. Account Rev 93(6):357–381

Wang Z, Chu E (2023) Can creating information infrastructure achieve “emission reduction” and “efficiency enhancement” simultaneously? Based on the perspective of green technology innovation. Modern Finan Econs-J Tianjin Univ Finac Econ 43(10):74–89

Wang Q, Qu J, Wang B, Wang P, Yang T (2019) Green technology innovation development in China in 1990–2015. Sci Total Environ 696:134008

Wang H, Liu J, Zhang L (2022) Carbon emissions and asset pricing—Evidence from China’s listed companies. China J Econom 9(02):28–75

Wang Y, Xu S, Meng X (2023) Environmental protection tax and green innovation. Environ Sci Pollut R 30(19):56670–56686

Wang H, Wei W (2019) Coordinating technological progress and environmental regulation in CO2 mitigation: the optimal levels for OECD countries emerging economies. Energ Econ, 104510.

Wu S, Qu Y, Huang H, Xia Y (2023) Carbon emission trading policy and corporate green innovation: internal incentives or external influences. Environ Sci Pollut R 30(11):31501–31523

Xie L, Zuo S, Xie Z (2023) Environmental protection fee-to-tax and enterprise investment efficiency: evidence from China. Res Int Bus Financ 66:102057

Xu A, Wang W, Zhu Y (2023a) Does smart city pilot policy reduce CO2 emissions from industrial firms? Insights from China J Innov Knowl 8(3):100367

Xu H, Pan X, Li J, Feng S, Guo S (2023b) Comparing the impacts of carbon tax and carbon emission trading, which regulation is more effective? J Environ Manage 330:117156

Xu Y, Wen Sh, Chang-Qi T (2023c) Impact of environmental tax on pollution control: a sustainable development perspective. Econ Anal Policy 9:89–106

Zhang G, Qiu S, Zhang W (2018) Does strengthening environmental regulations affect corporate RD innovation: an empirical analysis based on the implementation of the new environmental protection law of PRC. J Guangdong Univ Fin Econ 33(06):8088–8101

Zhang G, Tong M, Li H, Chen F (2019) Evaluation of economic growth effect and policy effectiveness in pilot poverty alleviation reform zone. China Ind Econ 8:136–154

Zhang M, Yan T, Gao W, Xie W, Yu Z (2023) How does environmental regulation affect real green technology innovation and strategic green technology innovation? Sci Total Environ 872:162221

Zhu L, Hao Y, Lu ZN, Wu H, Ran Q (2019) Do economic activities cause air pollution? Evidence from China’s major cities. Sustain Cities Soc 49:101593

Zou Z, Xin P, Chao Y, Zhu X (2019) Research on the influence of executive green cognition and corporate green behavior on its green performance—based on data of Shandong Light Industry Enterprises. East China Econ Manag 33(12):35–41

Funding

This study is funded by Key Project of Jiangsu Province Social Science Applied Research Excellence Program (Grant No. 23SYA-001); Key Research Project of Jiangsu Province in the "14th Five-Year Plan" for Education Science (Grant No. B/2022/01/102); University Philosophy, Social Science Research Fund project of Jiangsu Province (Grant No. 2019SJA0857).

Author information

Authors and Affiliations

Contributions

Rongrong Wei was involved in conceptualization, methodology, software, formal analysis, investigation, and writing—original draft, review, and editing. Meiling Wang was responsible for conceptualization, supervision, and validation. Yueming Xia carried out data curation, visualization, and reviewing.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wei, R., Wang, M. & Xia, Y. Environmental protection tax and corporate carbon emissions in China: a perspective of green innovation. Clean Techn Environ Policy 26, 2625–2641 (2024). https://doi.org/10.1007/s10098-024-02754-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-024-02754-w