Abstract

The carbon emission trading policy (CETP) is a market-based environmental instrument to reduce carbon emissions and address climate change. It can further have an impact on companies’ green innovation (GI). In this regard, we innovatively propose the internal and external theoretical mechanisms of the impact of CETP on the GI of companies and use the financial data and patent data of Chinese listed companies from a micro perspective to empirically verify them. The findings demonstrate that the CETP has an inducing effect on the GI of companies, which is particularly evident in nonstate-owned companies, large companies, and the cleaning industry. The impact of CETP on companies GI is mainly achieved through internal incentive mechanisms, while the role of external influence mechanisms is not obvious. In terms of internal incentives, cost compliance effects and innovation compensation effects are the main channels for promoting GI. In terms of external effects, the carbon market’s efficacy has not contributed to boosting GI for companies; the coordination effect of carbon policy and government intervention on companies’ GI is also limited. Our research provides a theoretical basis for effectively encouraging the GI of companies to achieve carbon neutral and carbon peak goals.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Achieving a comprehensive green transformation of China’s economy and shifting from a traditional to a green development approach require large-scale and systematic technological innovation. Innovation is considered to be an important means of addressing global climate change to reduce long-term emissions reduction costs (Metz et al. 2007), particularly GI. Research shows that R&D investment is conducive to improving carbon emission efficiency (Fang et al. 2022a). The CETP, which releases price signals for companies to reduce carbon emissions (Hu et al. 2020a), can improve the efficiency of resource allocation by employing economic incentives and thus can drive companies’ innovation (Hu et al. 2020b). It not only promotes breakthroughs in cutting-edge technological innovation and the transformation of high-emission industries into green and low-carbon development but also provides an institutional basis for the achievement of carbon peaking and carbon neutrality goals and the design and construction of a national carbon market.

The carbon emission trading system (CETS) was first implemented by the European Union (EU), and EU-CETS accounts for approximately 90% of the global CO2 trading volume (Keohane et al. 2017). China’s CETS is the second largest in the world, covering steel, power, chemical, construction, paper, and nonferrous metal industries (Xu et al. 2016; Li et al. 2016; Liu et al. 2015a, b). In 2011, two provinces and five cities, including Beijing, Tianjin, Shanghai, Chongqing, Guangdong, Hubei, and Shenzhen, prioritized the establishment of a pilot CETS. In 2017, China established a national CETS that would be officially put into operation in 2021. However, with problems such as lagging legislation and weak market mechanisms, China’s CETS started late compared to Western countries (Zhao et al. 2016), but some studies have pointed out that the compliance rate and emission reduction effect of carbon markets in regions such as Beijing have not been affected (Zhou et al. 2019). Will China’s CETP induce GI? Does the Porter hypothesis (PH) hold in China, the largest developing country? What is the path of the effect of CETP on firms’ GI behavior? Does the policy work mainly through intrinsic incentives or external influences?

Given this, our study may have four contributions. First, this paper innovatively proposes a theoretical framework to examine the mechanism of CETP influencing companies’ GI from the perspective of internal incentives and external influences. This enables us to better comprehend the primary pathways via which CETP affects GI. Second, in terms of external impacts, we examine them from the perspective of carbon market mechanisms and government interventions to fully understand the effectiveness of the current carbon market in China and the impact of carbon policy and other government policies on GI. Third, the effects of CETP are empirically explored at the micro level, and emission control companies are used as the experimental group, which makes our results more accurate than at the macro level. Overall, our study can provide implications for the top-level design and concrete practice for this stage of China’s carbon market and in terms of how to encourage GI in the long term.

In this regard, we use a panel dataset of listed companies in China from 2011 to 2019 to test the influence of CETP on companies’ GI. We further examine whether the CETP influences GI intrinsically or externally. The remaining parts of this paper are as follows: Section 2 provides a review of the literature and proposes the research hypothesis for this paper. Section 3 describes the research methodology, including the setting of the econometric model and the selection of variables. Section 4 contains an analysis of the empirical results and a series of robustness tests. Section 5 includes an analysis of heterogeneity as well as tests of the mechanism. Section 6 contains the conclusions and policy recommendations.

Literature review and research hypothesis

Literature review

PH provides a theoretical basis for environmental regulation (ER) and technological innovation, suggesting that appropriate ER can bring about an “innovation compensation” effect, which can partially or fully compensate for the additional costs incurred by ER, effectively stimulating innovation (Poter 1995; Poter and Van der Linde 1995). The “weak” and “strong” types of PH were initially separated by Jaffe and Palmer (1997). That is, the former primarily suggests that a well-designed ER can encourage particular types of technical innovation. The latter, on the other hand, assesses the influence of environmental restrictions on corporate performance, which is mostly evaluated by productivity. As a result, the causal relationship between ER and firms’ innovation has been a major topic of discussion.

Research to test the presence of the PH in foreign institutional contexts has not been conclusive. Some scholars have tested the potential mechanisms by which ER affects firms’ innovation based on national and industry data (Lee et al. 2011; Ford et al. 2014; Rubashkina et al. 2015), supporting the PH. Conversely, some scholars have argued that the PH does not hold. For example, Kneller and Manderson (2012) did not find a significant support for PH in their study using data on UK manufacturing. Bel and Joseph (2018) used data for 27 European countries from 2005 to 2012 and found not only that the PH was not supported but also that ER had a dampening effect on technological innovation, as also found by Ramanathan et al. (2010).

Studies that have investigated the causal relationship between ER and corporate innovation based on the Chinese institutional context have come to different conclusions. The presence of the PH has been verified by empirical data (Xie et al. 2017; Wang et al. 2019; Zhao and Sun 2020; Ma et al. 2021), and it has been found that environmental policies can upgrade industrial structures (Zhu et al. 2019), transmitting “signal-predictions” to induce more companies to innovate in R&D (Lv and Bai 2021) and thus achieve sustainable economic and environmental dividends (Dong et al. 2019). Market-based ER produced significant productivity-enhancing effects in all types of industrial enterprises, with more pronounced effects in state-owned enterprises, low-productivity enterprises, and enterprises with high pollution intensity (Peng et al. 2021).

In contrast, other scholars have found that the PH does not hold in China. Zhang et al. (2022) found that the introduction of CETP in China inhibits GI at this stage by crowding out firms’ R&D investments. Similar findings were also obtained by Chen et al. (2021), whose study verified that the CETP reduces firms’ green technology innovation. A study by Lyu et al. (2020) further showed that CETP inhibits firms’ short-term low-carbon technology innovation. He et al. (2020) suggested that the PH is not applicable to China’s manufacturing industry but that a good circumstance of the property rights can mitigate the negative effects of ER on firms’ financial performance by inducing innovation. In addition, it has been argued that different instruments of ER can have heterogeneous technological effects. Yao et al. (2021) examined the effects of carbon trading schemes in different pilot regions and found that the CETP in Beijing, Shanghai, and Guangzhou promoted low-carbon technological innovation, while Hubei successfully enhanced its GI due to the uniqueness of its market and the strength of its scheme design.

In summary, there are no uniform conclusions on the topic of ER and innovation. First, there may be differences in models, methods, and data sample selection, with most of the literature focusing on macro levels, such as industries as well as provinces and cities, and less research at the micro level. Second, when using the difference in difference (DID) model, the identification of the experimental group is also an important factor affecting the estimation results. The literature mostly uses provinces, cities, or industries as the identification criteria, and it may include nonemission-controlled companies in the experimental group, resulting in biased estimation results. Third, researchers have not fully explored the mechanism of policy influence on companies’ innovation, and few studies consider the moderating effect of carbon market mechanisms in policy.

Research hypothesis

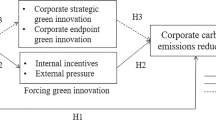

Green technological innovation is the fundamental way to achieve energy savings and emission reduction (Sun et al. 2017; Ooba et al. 2015). A reasonable ER can, according to PH, encourage companies to engage in GI activities. Therefore, we analyze the impact of CETP on GI in terms of both intrinsic incentives and external influences. Figure 1 shows the theoretical framework of this paper.

The impact of CETP on corporate GI: intrinsic incentives

The first is the cost compliance effect. The CETP’s strategy of imposing absolute control on corporate pollution emissions raises the pollution treatment and institutional compliance costs of a company (Clarkson et al. 2004); thus, investments in R&D are decreasing (Matthews and Denison 1981; Gray 1987; Gray and Shadbegian 2003). Under this constraint, if companies retain their previous production technologies and methods, they may adopt the following strategies. First, they may reduce their current production levels to cope with the carbon emission quotas issued by the government, which will inevitably cause a decrease in their operating income and a loss of profits. Second, companies may maintain their present production levels, while CO2 emissions in excess of allowances are acquired on the carbon emission trading market, which will raise their production and operating expenses. It can be shown that regardless of which strategy is chosen, companies will experience cost pressure. However, as interest-driven subjects, companies are motivated to increase their innovation investment, improve their original production process, and participate in GI activities to alleviate the cost pressure (Lanoie et al. 2008).

The second is the innovation compensation effect. A reasonable environmental policy can encourage the “innovation offsets” effect, optimize resource allocation, and raise technology levels, reducing or eliminating the compliance cost effect (Brunnermeier and Cohen 2003; Popp 2006; Del Río González 2009; Ambec et al. 2013). First, unlike traditional command-based ERs, CETP is the market-based environmental instrument. The surplus carbon emission rights obtained by enterprises after reducing CO2 emissions can be sold in the secondary market, allowing companies to gain additional revenue and provide financial research support. Second, when the marginal cost of reducing emissions is greater than that of GI, companies will choose to invest in R&D, and the long-term benefits of innovation can achieve a win–win situation for both the economic and environmental benefits of the company. The use of GI can not only significantly improve energy efficiency but also increase productivity and market competitiveness (Barney 1991). It can be seen that CETP can generate “compensatory benefits” that exceed the cost incurred by ER and thus promote GI.

Based on the above analysis, we propose the following hypothesis:

H1a: the cost compliance effect will enhance the force effect of CETP on corporate GI.

H1b: the innovation compensation effect will enhance the incentive effect of CETP on corporate GI.

The impact of CETP on corporate GI: external influences

According to the efficient market theory, market prices can accurately reflect all available information (Fama 1970). The CETP’s creative influence is dependent on the performance of the carbon market; a more effective market may be more conducive to corporate innovation (Jaff and Palmer 1997). Because various parties are involved in the operation of the carbon market, the effectiveness of the market is assessed at multiple levels. As a proxy for the efficiency of the carbon market, we use the carbon price, carbon market activity, and market liquidity.

The first is the price-signaling mechanism of the carbon market. The price formed at market equilibrium can timely and sensitively reflect changes in the supply and demand of carbon emission rights and the cost of emission reduction. By optimizing the allocation of carbon emission trading rights, the price signal adjusts resource flow and allocation efficiency. Stable price signals can effectively mitigate the risks of high cost (Baranzini et al. 2017), long cycle time, and uncertain return on investment in GI, enhancing managers’ confidence in investment and encouraging companies to make technical upgrades. Simultaneously, a reasonable carbon price will send precise signals to companies to adjust factor inputs, increasing their motivation to investigate low-carbon products and use low-carbon processes and equipment (Chen et al. 2021), as well as assisting them in making long-term investment decisions on emission reduction. When companies expect the price of emissions trading to rise, according to Laffont and Tirole (1996), they will invest in pollution control technologies and boost green technology innovation.

The second is the trading activity and liquidity of the carbon market. The effectiveness of implementing market-based environmental policies depends on good market mechanisms (Kathuria 2006). Lower liquidity and inefficient markets can encounter competitiveness and welfare loss (Lanzi et al. 2012). The more active and liquid the carbon market is in terms of trading, the more stable the regulatory role of the market mechanism will be. Stable market information minimizes the risk of disclosing corporate environmental information, as companies’ expected cash flow and cost-shifting incentives rise, quickening the flow of factors to creative companies and encouraging them to promote low-carbon technology innovation. Poor trading activity and liquidity in the carbon market, on the other hand, means that the market is more unpredictable and that the carbon price cannot offer a clear market price signal, which will stifle GI and deter companies from innovating.

Furthermore, carbon market liquidity is the endogenous condition that decides whether the carbon market is effective and whether the uncertainty is reduced (Kalaitzoglou and Ibrahim 2015). When liquidity is low, the opportunity for companies to achieve emission reduction advantages from GI is reduced, and the risk of innovation benefits being uncertain will limit the incentive effect of CETP on company innovation. Companies can ease their emissions quota limitations through GI while obtaining emission reduction benefits through carbon trading when the carbon market is more liquid, all of which strengthens the importance of CETP in promoting corporate GI.

It has been shown that the synergy of market mechanisms and administrative intervention to achieve carbon emission reduction is a major feature of the current carbon market in China. In comparison to developed countries such as European countries and the United States, China’s CETS is still in its early stages of development, with a market mechanism that is not fully formed and has low operational efficiency. China’s carbon market, according to Liu et al. (2015a, b), has a functional market deficiency. When the compliance time approaches, most carbon trading pilots have less price volatility, greater transaction size, and market liquidity but do not reach a weakly efficient market for the majority of the term (Zhang et al. 2020a, b, c). Therefore, the synergy between government intervention and CETP may affect corporate low-carbon technology innovation when carbon market mechanisms are not fully and effectively implemented.

In addition, local governments under pressure to cut emissions will press emission control companies to cut pollutant emissions by tightening environmental controls and penalties. Although pollution treatment costs will increase the financial burden on companies, high pollution control costs may crowd out GI. Imperative environmental policies, on the other hand, may send a signal of green transformation to companies, prompting executives to reflect on the shortcomings of green development (Grossman and Helpman 2018), reducing reliance on traditional production methods and providing incentives for technology innovation. Therefore, the influence of command-based ER on green technology innovation by firms remains unknown.

Some studies have found that government subsidies, as an important tool for government intervention, have a positive impact on innovation (Acemoglu et al. 2012). Environmental subsidies provide a source of funds for companies’ GI and relieve the problems of financial constraints and insufficient incentives for innovation. They decrease the cost of corporate GI through the resource compensation effect (Montmartin and Herrera 2015), which reduces the risk of long investment cycles and uncertain returns of GI and increases corporate managers’ tolerance for the prior risk of GI, thereby promoting corporate GI.

Based on the above analysis, we propose the following hypotheses:

H2a: carbon market effectiveness can promote the incentive effect of CETP on corporate GI.

H2b: the synergistic effect of government intervention and CETP can influence corporate GI, but the effect is uncertain.

Methods and data

Sample selection and data source

In the middle of 2013, China’s carbon trading pilots started to trade one after another. The starting dates of carbon emission trading in each province and city as well as the inclusion criteria are detailed in Table 1. We can see that the starting dates of carbon trading pilots are mostly concentrated from the last half of 2013 to 2014, as shown in Table 1. Because of the lag in the CETP effect, we chose 2014 as the policy impact point to precisely assess the effect of implementing CETP in the pilot. Due to the limitations of data availability, we selected the financial data and patent data of listed companies from 2011 to 2019 as a research sample, a total of 3,262 listed companies, with an observation of 21,988.

The first batch of publicly traded companies included in the pilot scope is chosen as the experimental group in this study for the following reasons: directly selecting pilot areas or industries as experimental groups is an inept strategy that could easily result in noncontrolled companies being included in the treatment group, lowering the accuracy of the experimental sample. Using companies as the treatment group, on the other hand, avoids this issue and allows for a more precise assessment of CETP’s impact on GI. The control group in this paper is nonregulated listed companies across the country that are not involved in carbon trading. The list of emissions-controlled companies is obtained from the websites of the China Statistical Bureau, the China Development and Reform Commission, and the website of China Carbon Emission Trading. Chongqing was excluded from the list of pilot companies due to its absence in the first batch of listed companies.Footnote 1 Ultimately, we collected a list of 585 emissions-controlled companies.

We obtained the data from the China Stock Market Accounting Research, Wind database, National Bureau of Statistics of China, China Statistical Yearbook, China Urban Statistical Yearbook, China Environmental Statistical Yearbook, website of Peaking University Law (PKULAW),Footnote 2China Government Reports, and China Corporate Annual Report. We also processed the sample as follows: (1) we excluded financial and insurance companies; (2) we filtered out companies that were ST or PT during the year, resulting in 13,096 observations; and (3) considering that the sample range is 2011–2019, the Fujian carbon trading market was officially launched in December 2016, in order to avoid interfering with the estimation results and ensuring the balance of the research samples, the samples in Fujian Province were deleted (He 2022).

Model construction

DID model

The CETP provides a quasi-natural experimental situation for this study to avoid endogeneity to some extent. We can effectively assess the net effect of CETP by comparing the treatment and control groups before and after the policy implementation by applying a DID method to remove the nontime-dependent effects and other unobservable factors. The baseline DID model constructed in this paper is as follows:

where i and t represent the company and year, respectively. lnpatent represents the number of green patent applications. did is the multiplication of the treatment group and CETP implementation time, defined as 1 if the company is included in the carbon trading pilot scope and the year is after the CETP (2014–2019); otherwise, it is 0. X represents a set of control variables. ε represents the random error term.

Moderating effect model of CETP and GI

To test the previous research hypotheses 1a and 1b, we construct the following models:

where cost represents the cost of the company and RD represents the investment of the company in research and development. Other variables are defined in the same way as in Eq. (1).

To test the previous research hypotheses 2a and 2b, we construct the following models:

where market represents the effectiveness of the carbon market, measured by carbon price, carbon market’s activity, and liquidity. In Eq. (5), gov represents government intervention, measured by command-based ERs and environmental subsidies. The rest of the variables are consistent with Eq. (1).

Variable selection and statistical description of the variables

Dependent variable

Due to the intangibility of technological innovation, quantitative analysis is more challenging, and there is no unified definition or benchmark for alternative technological innovation indicators. Three different types of indicators, including R&D spending, total factor productivity, and patents, can be used to quantify the innovation of green technologies. The inputs, outputs, and performance of innovations are represented by these metrics, respectively (Li and Tao 2012; Albino et al. 2014; Lee and Min 2015). Most companies’ R&D data cannot be divided into various green categories due to data restrictions. By treating emissions or pollution as “bad outputs”, green productivity metrics can assess whether technological innovation tends to be environmentally friendly. Finding specialized green components and breaking into particular technical domains are still challenging. Consequently, green patents are a relatively consistent indicator of GI (Berrone et al. 2013).

Patents are a natural indicator of green technology innovation (Chen et al. 2021). Because environmental patents are more accessible and have larger coverage than R&D and total factor productivity, we use them to gauge GI at the companies’ level in China. Patents, particularly those related to the environment, are frequently used to quantify GI due to their quantitative and practical character (Leyva-de 2019; Shen et al. 2020; Xu and Fei 2019; Soltmann et al. 2015).

We use lnpatent as the dependent variable that denotes GI, represented by the number of green patent applications by companies. The number of green patents granted might, in theory, can be a reliable indicator of how inventive green technologies are. However, it normally takes 1–2 years to approve a patent application. Because patent application data are more consistent than grant data and patent application year is a better indicator of the companies’ actual innovation time, this research analyzes the number of green patent applications to estimate the green innovation of the company.

Explanatory variable

The interaction term did reflect the net effect of CETP implementations.

Control variables

Because there are many factors that influence corporate GI, control variables such as companies’ size, financial leverage, companies’ growth, Tobin’s Q, companies’ profitability, cash flow, companies’ years of listing, book-to-market ratio, and the largest shareholder’s shareholding ratio were chosen based on existing studies (Bai et al. 2019; Qi et al. 2021) to avoid biased estimation results caused by omitted variables.

First, the scale of the companies (lnsize), company size has always been one of the important factors influencing the ability of technological innovation, and large companies are able to invest relatively large amounts in R&D (Przychodzen and Przycchodzen 2018), and their GI levels may be higher. Therefore, we use the natural logarithm of the company’s total assets to measure the size of the company.

Second, leverage (leverage), if a company’s financial leverage is low, the input and output of innovation will be promoted, and the risk of innovation will be reduced. In this study, the financial ratio is measured by the ratio of liabilities to total assets.

The third is companies’ growth (growth). Companies with greater growth rates may be going through a period of company expansion or may have only recently joined the market. These companies may focus most of their efforts on their core businesses and make insufficient investments in the development of new green technologies. As a result, companies with higher growth indexes may have lower levels of green innovation.

Fourth, the Tobin Q value (TobinQ). Zhang et al. (2020a) found that if a company’s Tobin’s Q value is higher, the higher the level of R&D investment of the company and the greater its innovation output. Therefore, we selectTobin’s Q value of the listed companies in the sample as the control variable.

Fifth, profitability (ROA), Zhang et al. (2020b) found that the profitability of companies may affect innovation investment; that is, the stronger the profitability of the company is, the more R&D investment there is, the greater the innovation output. Therefore, we chose the return on assets as the control variable to measure the profitability of a company.

Sixth, corporate cash flow (Cashflow), the higher the cash flow index of a company, the stronger its ability to operate and turn around, and the more it is likely to spend on GI.

Seventh, time to market (lnlist_age), it is generally assumed that young companies will be more motivated to innovate than established ones (Brown and Petersen 2019). Here, we use the natural logarithm of a company’s listing age to measure corporate maturity.

Eighth, book-to-market ratio (BM_Rario), this indicator contains information about the company’s future growth potential (Fama and French 1999) and is also an important factor influencing the level of GI.

Ninth, shareholding ratio of the first largest shareholder (Top1), to a certain extent, the background and shareholding ratio of major shareholders determine a company’s attitude toward innovation and its support for R&D. As a result, we control the shareholding of the largest shareholder.

Moderating variables

The index of Cost is expressed as the logarithm of companies’ operating costs. RD is measured by the ratio of corporate R&D investment to operating revenue. market is measured by carbon price, carbon market activity and carbon market liquidity. (1) Carbon price is expressed by the average annual transaction price of each trading market; (2) activity is expressed by the ratio of the number of trading days to the total number of days in the pilot areas; and (3) the illiquidity ratio of carbon market transactions. The Martin index is frequently used to assess market liquidity, but it is more useful when assessing the liquidity of a single market (Fu and Zhang 2017), and when assessing the liquidity of different carbon markets, it will ignore the differences in market size. This makes it difficult to make horizontal comparisons. In addition, the Chinese carbon market has a low transaction volume, a variety of pricing strategies, and a late start date. To account for these factors as well as the representativeness and accessibility of the data, we adopt Florackis’ (2011) method by substituting the turnover rate for transaction volume, and we deform the Martin index appropriately to measure the carbon market’s illiquidity:

where s denotes each carbon trading market, t denotes the trading day, p denotes the average price of the trading day, V denotes the total number of trading days, V0 denotes the total amount of quota circulation in each carbon market, and \({\mathrm{V}}_{\mathrm{st}}\mathrm{/}{\mathrm{V}}_{\mathrm{s,0}}\) represents the quota turnover rate of the carbon market. A higher value of illiquidity indicates a less liquid carbon market.

We choose command-based ER (regulation) and environmental subsidies (subsidies) to measure government intervention. We quantify ER using the number of environmental penalty cases from PKULAW, the three wasteFootnote 3 ER index, and the proportion of the industrial pollution control investment in the industrial added value (Pearce and Palmer 2010). The number of environmental subsidies is acquired from the annual reports of companies. The formula for calculating the three waste ER indexes is as follows:

where \({\mathrm{PR}}_{\mathrm{dj}}^{\mathrm{s}}\) is the standardized value of each index, d represents the area, j represents wastewater, waste gas, and solid waste (j = 1,2,3), and \({\mathrm{PR}}_{\mathrm{dj}}\) represents the original value of each individual index.

where \(\omega_{dj}\) is the adjustment factor, i.e., weight; \({\mathrm{E}}_{\mathrm{dj}}\) is the emission of pollutant j in area d; \(\sum {\mathrm{E}}_{\mathrm{dj}}\) corresponds to the national emission of the same pollutant; \({\mathrm{Y}}_{\mathrm{d}}\) is the industrial value added in region d; and \(\sum {\mathrm{Y}}_{\mathrm{d}}\) is the national industrial value added.

Using the standardized values and average weights of the single indicators, we calculate the environmental regulation index for each region:

The specific descriptions of the above variables and the calculation methods are shown in Table 2.

Table 3 shows the statistical description of the main variables. Among them, the mean values of lnpatent in the control and treatment groups are 0.29 and 0.63, respectively, and the level of GI in the control group is significantly lower than that in the treatment group, indicating that the noncontrolled companies are less motivated to innovate than the controlled companies. Furthermore, the standard deviation of lnpatent in the treatment group is 1.14, which indicates that there are large differences in the innovation levels of companies in different treatment groups. The mean value of the control variables is similar between the two groups, so it will not be repeated here.

Empirical results and robustness test

DID results

According to model (1), the DID results of the impact of CETP on companies’ GI are presented in Table 4. To exclude the effect of the choice of control variables, we do not include control variables in the regression of column (1). The coefficient of the key explanatory variable is 0.328 and is significant at the 1% level, implying that the rise in GI in emission-controlled companies is on average 32.8% higher than in nonemission-controlled companies after CETP implementation. To avoid the interference of other missing variables on the estimation results, column (2) controls for year fixed effects only, column (3) controls for year and industry fixed effects, and column (4) controls for year and province fixed effects. The estimated coefficients of did in the three columns are 0.202, 0.206, and 0.157, respectively, and the first two are significant at the 10% level, indicating that the treated companies’ GI level after the implementation of CETP is significantly greater than that of the control groups. Column (5) adds the control variables as well as the three levels of fixed effects. The coefficient of did is 0.176, and it is significant at the 10% level, which is not significantly different from the magnitude of the coefficients in the previous regressions. In general, the estimation results in Table 4 indicate that the implementation of the CETP helps promote the level of companies’ GI.

Let us take the estimation result of column (5) as an example. Among the control variables, the coefficients of cash flow (Cashflow) are not significant, showing that the cash flow of the company is not the factor affecting GI. The coefficients of companies’ scale (lnsize), financial leverage (leverage), Tobin’s Q value (TobinQ), and profitability (ROA) are significantly positive, which implies that they can promote companies’ GI. However, the coefficients of companies’ growth (growth), number of years the company has been listed (lnlist_age), book-to-market ratio (BM_rario), and shareholding ratio (Top1) are significantly negative. This means that companies with stronger growth and longer listing times have lower willingness to GI. Companies with large book value and a high shareholding ratio of the first shareholder are also not conducive to the improvement of the GI level.

Robustness test

Parallel trend assumption

The main purpose of the parallel trend test is to verify whether there is a significant difference between the experimental group and the control group before the policy is implemented; that is, the characteristics of the experimental group are similar to those of the experimental group before it can be used as a control group. In this study, if the number of green patent applications in the experimental group and the control group have different time trends prior to the implementation of the carbon trading pilot policy, i.e., the coefficients of the two groups are significantly different, it indicates that the two groups’ GI had been impacted by other policies or factors that do not meet the criteria for the carbon trading pilot policy. It can only be demonstrated that the regression findings of the DID model are reliable if they pass the parallel trend test.

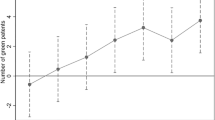

Figure 2 shows the time trends for treated and untreated companies. Before CETP implementation, there is no significant difference in the coefficients between the experimental group and the control group (2011–2013). The coefficients of the experimental group and the control group start to considerably diverge in the years after the policy’s introduction (2014), and the discrepancy became most pronounced in 2016, demonstrating that the policy has a time lag impact. In the third year after the implementation of the policy, the effect gradually disappeared. It may be tentatively stated that the trends of green patent applications in the two groups before policy implementation are essentially the same, while the CETP is responsible for the differences in trends of green patent applications after policy implementation. However, this conclusion is not robust and needs to be further verified.

Furthermore, we use the “event study method” to test the parallel trend hypothesis. Specifically, we add five dummy variables into Eq. (1) and establish the following model, and we delete the interaction term for the year before the policy implementation to avoid multicollinearity:

The estimate results of Eq. (10) are reported in Table 5. From column (1), we can see that none of the interaction terms before the implementation of the CETP are significant, while the coefficients of the interaction terms are significantly positive after the implementation of the CETP in 2014, indicating that the parallel trend hypothesis is satisfied. In addition, the coefficient of Treat*T2018 is not significant, while the coefficient of Treat*T2019 is even negative, which indicates that in the long run, the promotion effect of green innovation in carbon policy is disappearing, and there is even a trend of negative impact.

PSM-DID results

Direct policy evaluation using the DID method can lead to inaccurate results. First, it is not random whether a company is included in a controlled group. According to the policy plan of each pilot, the formulation of the list of key emission control companies will refer to certain industries and emission standards, and companies above a certain emission level will be included in the list, which may cause sample selection bias. Second, the difference between the GI level of controlled and noncontrolled companies may be caused by other unobservable factors that change over time, which may cause endogenous bias in missing variables. To alleviate the above problems, we used propensity score matching (PSM) to eliminate the selectivity problem of the sample and then used the DID model to estimate the impact of carbon emission trading on the level of GI of companies.

First, we select control variables as covariates to estimate propensity score values, followed by matching according to propensity scores. As shown in Fig. 3, the covariate bias after matching was significantly lower between the treatment and control groups, both less than 10%, indicating better matching quality. Furthermore, we show the kernel density distribution of propensity score values before and after matching, where the density curves of propensity scores overlap less before matching, while after matching, the density curves of propensity scores are close to overlap, see Figs. 4 and 5.

We next performed DID regressions on the matched samples, and column (1) of Table 6 shows the results of the regressions on the samples involved in matching. We choose samples that meet the common support hypothesis for estimation to confirm the DID results’ robustness. The PSM-DID estimation result shows that the estimated did coefficient is significantly positive, indicating that the CETP helps companies achieve GI.

Tobit results

According to the statistical analysis of the variables in Table 1, the dependent variable in this study is the total number of green patent applications in the current year, and its minimum value is 0. Although all observational data are obtained in this study, some listed companies did not carry out green innovation activities, and the value of green patents was 0. These dependent variables are compressed at one point, i.e., the left merge point is 0. Therefore, as a robustness check, the maximum likelihood estimate proposed by Tobit is used for bilateral consolidation estimation, and we re-estimate the basic results using the Tobit method. The results estimated by the Tobit method are shown in column (2) of Table 6, and the estimated coefficient of did is 0.544 at the 1% significance level, which again verifies the robustness of the previous DID regression results.

Eliminate other policy interference

The amendment to the Environmental Protection Law of the People’s Republic of China (hereinafter referred to as the new Environmental Protection Law), which came into effect on 1 January 2015, will help the market form a reasonable expectation of environmental protection, prompt companies to form stable expectations for the harshness and long-term nature of environmental governance, and accelerate the green transformation of companies. In this regard, this paper controls the interaction term (did_f) between the polluting industries affected by the new environmental protection law and the implementation time of the policy (2015). The regression results are shown in column (3) of Table 6, which proves that the conclusions of this paper are still valid after excluding the interference of the new Environmental Protection Law.

Placebo test

The core idea of the placebo test is to estimate the imaginary processing group or the fictitious policy time, if the regression result of the estimation under different fictitious methods is still significant, then it means that the original estimate is likely to be biased, and the change of the dependent variable is likely to be affected by other policy changes or random factors. If it is suspected that the changes in the processing group and the control group are affected by other policies, then the time of policy implementation is of little use, and the processing group should be placebo tested. Therefore, a more general approach is to make up a processing group, that is, to select a known group that is not affected by the policy as a processing group for regression. The purpose of our placebo test in the article is to rule out the impact of other possible policies on GI of companies, confirming that it is indeed the CETP that affects the number of patent applications of companies.

This section performs a placebo test on the DID results. We randomly assign a sample of companies involved in the carbon trading pilot to see if the randomized did coefficient kernel density plots are close to 0 and if they diverge significantly from the genuine value. The randomization process of the placebo test was repeated 500 times. The kernel density distribution of the did coefficients in the sample estimates is shown in Fig. 6, and the P value kernel density distribution is shown in Fig. 7. The coefficients are clustered toward the 0 value, which is a long way from the actual coefficient (black solid line in Fig. 6). The scatter distribution of the P value is also concentrated at 0 and distant from the true value, with most of the scatter points above the dashed line, indicating that the coefficients are not significant at the 10% level. From this, we can infer that the effect of CETP on GI is not affected by other unobservable factors.

Change the fixed effect

Furthermore, we also control the fixed effect of annual interaction items with industry and annual interaction items with provinces (cities). Among them, the annual interaction with the industry is used to control the influence of unobservable factors that change year by year at the industry level on the GI of companies. For example, the impact of year-on-year demand shocks at the industry level on whether companies engage in green innovation activities. The interaction between the fixed effect of the province and the fixed effect of the year to control the influence of unobservable factors at the provincial level over time on the green innovation of companies. For example, the impact of year-on-year economic fluctuations at the provincial level on the probability of whether a company is engaged in green innovation. The core explanatory variable coefficients thus identified are more accurate than if this set of fixed effects is not controlled (Wang 2013). From Table 7, we can see that the estimated coefficient of did is still significantly positive, implying that the CETP can promote GI.

Further discussion

Heterogeneity analysis

To test the heterogeneous impact of the CETP on the GI, we further categorize companies based on ownership, size, and whether they are in clean industries. The results are reported in Table 8, where it is seen that the CETP effectively promotes GI among nonstate companies, large-scale companies, and clean industries.

The coefficient of did in column (2) is significantly 0.311 at the 5% level, while the coefficient in column (1) is not significant, which indicates that CETP promotes the GI of nonstate-owned companies. Most state-owned companies are traditional industries, such as electricity, chemicals, and transportation. They pursue R&D and production strategies that are high in pollution and emissions; therefore, they might experience significant path dependence in R&D and innovation. Because of the invisible link between state-owned companies and governments, the regulatory effect of environmental policies on state-owned companies may be weaker, and the degree of inducing green technology innovation is also more limited. In contrast, nonstate-owned companies that are predominantly private companies must quickly change the direction of R&D in accordance with policy requirements due to more intense market competition and the pressure of environmental policies to increase productivity and offset the environmental costs brought on by regulations. As a result, nonstate-owned companies typically exhibit greater flexibility and a passion for innovation. For example, Wang and Zou (2018) show that wind power industry-related policies have a significant promotion effect on the core technology of private companies in the wind power industry but only have a certain impact on the noncore technology innovation of state-owned companies.

In column (3), the core explanatory variable of the did coefficient is negative but not significant, while in column (4), it is significantly positive. The CETP mainly promotes the GI of large-scale companies, while the impact of the CETP on the GI of small-scale companies is negative. Large-scale companies have a greater motivation to perform their own R&D with stable finance and abundant funds (Gupeng and Xiangdong 2012) than small-scale companies since they often have better capitalization. At the same time, GI will provide comparable “subsidy” benefits for production, encouraging large-scale companies to develop. Small-scale companies, on the other hand, will face significant pressure if they continue to engage in GI operations due to periodic capital expenditures (Chen et al. 2021). Therefore, with CETP, small-scale companies tend to reduce GI.

Furthermore, we distinguish between polluting industries and clean industries.Footnote 4 The coefficient of did in column (5) is significant at – 0.259, indicating that the CETP decreases polluting sectors’ GI by 25.9% on average. The coefficient of did in column (6) is significantly positive, which means that the CETP increases the cleaning sectors’ GI. Companies in clean industries have lower environmental technology adjustment costs than those in polluting industries because of variations in factor input structure, tolerance for environmental regulation, and cost of technology innovation. Additionally, companies in clean industries are more likely to stray from the path of technology dependence and thus have a higher incentive to innovate than companies in polluting industries.

Intrinsic motivation

Table 9 presents the key results to investigate the intrinsic mechanism of CETP to foster GI. The coefficient of did*cost is significantly 0.145 at the 10% level, indicating that the higher the cost pressure faced by companies is, the stronger the pushback effect of CETP on GI, which verifies H1a. The imposing absolute control on corporate pollution emissions raises the pollution treatment and institutional compliance costs of the company, which will crowd out green innovation. However, as interest-driven subjects, companies have the power to carry out GI under the pressure of high cost. Companies that engaged in GI can not only fulfill the carbon quota tasks distributed by the government but also produce cleaner products, creating a competitive advantage in the industry. Therefore, companies are motivated to improve their original production process and participate in GI activities.

The estimated results of the innovation compensation effect are reported in column (2), where the estimated coefficient of did*RD is 0.070 and significant. This indicates that the greater the intensity of companies’ R&D expenditures, the stronger the incentive effect of CETP on GI, which validates H1b. Companies typically choose to directly invest funds to control the level of pollution discharge or implement green technology innovation to achieve the purpose of pollution reduction in the face of market incentive regulation to achieve the unity of profit maximization and environmental protection. The implementation of the CETP may put pressure on costs for companies in the short term, but over time, the CETP will compel companies to invest more in product R&D and upgrade their production facilities. The resulting innovation compensation effect can make up for the cost pressure and promote the improvement of the GI level of companies.

External influence

To test the previous H2a and H2b, we estimate the previous Eqs. (4) and (5), and the results are presented in Tables 10 and 11.

External mechanism of carbon market effectiveness

The results of Table 10 show that among the indicators used to assess the effectiveness of the carbon market. From the results of column (1), we can see that although the interaction between corporate GI and carbon prices is positive, it is not statistically significant. This shows that carbon prices have not fully exploited their price-signaling mechanism, preventing emission control entities from developing realistic expectations for the carbon market, which would have an impact on GI. The interaction term coefficient between did and carbon prices is – 0.271 at a significant level of 5%, indicating that the current carbon price in China has weakened the positive relationship between CETP and GI of companies. Studies have shown that the effectiveness of China’s carbon market is not high (Chang et al 2018a, b; Wen et al 2020), carbon prices exhibit nonlinearity and instability, leverage, asymmetry, and regional heterogeneity (Han et al. 2019; Liu and Jin 2020; Zhou and Li 2019). These characteristics prevent companies from forming positive expectations for the carbon market through price-signaling mechanisms. By observing the carbon price statistics of the sample, we find that the minimum and maximum values are $0/ton and $78.75/ton. Due to the high price volatility of carbon, companies will increasingly choose to buy carbon quotas in order to satisfy performance goals and minimize risks. This will displace green investment and R&D and lower the degree of green innovation among companies. Carbon prices thereby reduce the benefit of carbon policy in fostering companies’ green innovation. In addition, compared to the international carbon market, China’s carbon pilot price is too low,Footnote 5 resulting in the cost of carbon emission allowances for high polluting companies being lower than the cost of green technology innovation. As a result, high polluting companies are more willing to use their R&D funds to purchase carbon emission allowances (Tang et al. 2015), which leads to a crowding-out effect on R&D investments and reduces companies’ green technology innovation. Thus, carbon prices weaken the positive relationship between carbon policy and companies’ green innovation.

From the regression results in column (2), we conclude that in the case of a significantly positive CETP coefficient, the regression coefficient of carbon market illiquidity is not significant, and the interaction coefficient between carbon market illiquidity and did is not significant. This result shows that the liquidity of the carbon market has no moderating effect on the relationship between CETP and corporate GI. From column (3), we find that carbon market activity has a negative impact on corporate GI, with a coefficient of – 0.146, which is significant at the 10% level. Although the interaction coefficient between did and carbon market activity is negative, it is not significant, indicating that carbon market activity has not had a significant effect on CETP and corporate GI. Although the interaction coefficient between did and carbon market activity is negative, it is not significant, indicating that carbon market activity has not had a significant effect on CETP and corporate GI. In comparison to developed nations, China’s carbon market is still in its early stages of development. This lack of liquidity will cause extreme price fluctuations, low trading volume, and infrequent trades, which will make the market less active (Liu et al. 2015a, b; Zhao et al. 2017) and unable to encourage GI. It will negatively affect the relationship between carbon policy and green innovation (Chang et al. 2018a, b).

External mechanism of government intervention

Table 11 reports the effects of the synergistic effects of government intervention on companies’ GI. The traditional command-and-control environmental policies (regulation), measured by the number of environmental penalty cases, the three-waste environmental regulation index, and the ratio of the investment in industrial pollution control, do not significantly promote GI. Moreover, the interaction term coefficients between the regulation and did are also not significant. Traditional environmental regulation, usually manifested as command-and-control supervision, plays an important role in controlling and reducing pollution. Companies, however, often try to avoid environmental regulations in an effort to reduce costs. When this is challenging, companies will invest more in pollution prevention and emissions management. As a result, companies are forced to cut back on spending for other parts of business management or the production of products, and innovation generally suffers as a result (Walley and Whitehead 1994). Therefore, traditional environmental regulation may lead to inefficiency, hinder corporate innovation, and fail to positively moderate the relationship between CETP and corporate GI.

However, the environmental subsidies in column (4) positively moderate the role of CETP in inducing GI, with a coefficient of 0.088. The environmental protection subsidy has the nature of earmarking; according to government regulations, the environmental protection subsidy must be used for energy conservation and environmental protection investment. This is consistent with the conclusions of existing studies (Montmartin and Herrera 2015). GI requires a large amount of long-term investment of resources, and insufficient resource constraints and incentives are the primary problems that plague companies in GI (Manso 2011). The government subsidy offers a source of funding for companies GI, alleviates the lack of funding needed for GI, lowers the cost of GI, aids in easing the concern of managers about the unpredictability of innovation activities, and increases the prior tolerance of the company for the risks of GI (Stiglitz, 2015). Therefore, under the role of environmental subsidies, the positive impact of CETP on GI has been enhanced.

Conclusions and suggestions

As a significant instrument for energy conservation and emission reduction, CETP affects the cost of production for economic agents through market mechanisms, boosting GI and advancing the transition to a green economy. Using sample data of listed companies from 2011 to 2019 and the number of green patent applications, this research investigates whether the CETP can induce GI and its influence mechanism. The findings show that (1) on average, the implementation of the CETP can significantly promote corporate GI, and this finding still holds after conducting a series of robustness tests, including a parallel trend test, PSM-DID regression, Tobit regression, eliminate other policy interference, placebo test, and controlling for different levels of fixed effects. (2) The PH of the CETP is mainly realized by nonstate companies, large-scale companies and clean industries. (3) CETP mainly promotes corporate innovation through internal incentives, while the role of external influence on corporate innovation is not obvious. (4) In terms of internal incentives, the cost compliance effect and the innovation compensation effect enhance the promotion of GI by carbon trading. (5) In terms of external influences, the role of the carbon market mechanism is relatively limited. Specifically, the carbon price has not yet effectively played a signaling mechanism to induce companies to participate in GI activities, and carbon market liquidity and activity have not significantly boosted the policy’s innovation effect. In addition, environmental subsidies in the government intervention mechanism can induce GI through the resource compensation effect, while the synergistic effect of command-based ER and CETP on companies’ GI is not remarkable.

The findings of this paper have certain policy implications for developing and promoting the construction of a national carbon market in China and stimulating corporate GI. First, we should continue to improve the top-level design of China’s carbon market and provide long-term stable market expectation signals to companies. The research presented in this paper suggests that the current ineffective carbon price transmission mechanism and weak carbon market activity do not allow companies to build accurate expectations of the carbon market, failing to successfully encourage corporate innovation. Research on the cost of carbon reduction to the whole society and key industries should be strengthened. The adjustment of industrial structure and energy consumption structure is the key for China to achieve the goal of carbon emission peak (Fang et al. 2022b). The formation of a reasonable carbon price should be guided by a flexible market mechanism to give full play to the role of carbon market price signals. The introduction of the carbon financial derivatives trading mechanism will encourage the carbon price to accurately reflect risk and maximize the economic burden of the carbon price and, at the same time, encourage the diversification of carbon trading subjects to enhance market activity and form a stable positive cycle, inducing companies to adopt green innovation.

Second, to foster companies’ innovation, the line between the market and the government should be drawn scientifically and logically. This study demonstrates that corporate innovation has not yet been impacted by the synergy between command-based ERs and market-based ERs; therefore, it is particularly important to correctly position the degree and mode of government intervention in the market. Additionally, environmental subsidies have successfully encouraged GI by easing companies’ financial limitations and lowering innovation risks. As a result, it is important to continue utilizing environmental subsidies’ resource compensation impact to encourage GI behavior.

Third, based on the results of the carbon emission trading pilot project, we should support the development of a national carbon market to encourage GI actions among companies and meet the targets for carbon peaking and carbon neutrality on time. Through active policy adjustment, we should improve the relevant institutional systems, scientifically formulate quota methods, strengthen transaction supervision. At the same time, we should appropriately strengthen the government’s environmental protection intervention, such as the implementation of environmental taxes (Fang et al. 2022c), continuously increase the willingness of companies to engage in green R&D, and promote the green innovation of companies.

Availability of data and materials

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Change history

14 April 2023

A Correction to this paper has been published: https://doi.org/10.1007/s11356-023-27037-7

Notes

Chongqing may have some companies that would otherwise be in the experimental group sample due to the missing list of pilot companies; however, according to the analysis report of China Carbon Market 2015, Chongqing has a low compliance rate and a serious surplus of quotas and is less motivated to trade carbon, so the exclusion of Chongqing as a pilot has little impact on the estimation results of this paper.

Three waste means wastewater, solid waste, and waste gas from industry.

The 17 polluting industries are chemical raw materials and chemical products manufacturing, the ferrous metal smelting and rolling processing industry, nonferrous metal smelting and rolling processing industry, paper and paper products industry, pharmaceutical manufacturing, chemical fiber manufacturing, the oil and gas extraction industry, nonmetallic mineral products industry, nonferrous metal ore mining, construction decoration and other construction industry, textile clothing, the apparel industry, rubber and plastic products industry, coal mining and washing industry, petroleum processing, the coking and nuclear fuel processing industry, metal products industry, ferrous metal ore mining industry, and textile industry.

According to the Southern Metropolis Daily, compared to the international carbon market, China’s carbon pilot prices are generally low. As of April 29, 2021, the Chinese carbon pilot price was between $5.53 and 42.02/ton, while the EUA carbon quota spot settlement price was $380/ton on the same day, which is 9–68 times higher than the Chinese carbon pilot price.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Albino V, Ardito L, Dangelico RM, Petruzzelli AM (2014) Understanding the development trends of low-carbon energy technologies: a patent analysis. Appl Energy 135:836–854

Ambec S, Cohen MA, Elgie S, Lanoie P (2013) The porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness. Rev Env Econ Policy 7(1):2–22

Bai Y, Song S, Jiao J, Yang R (2019) The impacts of government R&D subsidies on green innovation: evidence from Chinese energy-intensive firms. J Clean Prod 233:819–829

Baranzini A, Van den Bergh JC, Carattini S, Howarth RB, Padilla E, Roca J (2017) Carbon pricing in climate policy: seven reasons, complementary instruments, and political economy considerations. Wires Clim Change 8(4):e462

Barney J (1991) Firm resources and sustained competitive advantage. J Manage 17(1):99–120

Bel G, Joseph S (2018) Policy stringency under the European Union Emission trading system and its impact on technological change in the energy sector. Energy Policy 117:434–444

Berrone P, Fosfuri A, Gelabert L, Gomez-Mejia LR (2013) Necessity as the mother of green inventions: institutional pressures and environmental innovations. Strateg Manage J 34(8):891–909

Brown JR, Petersen F (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J Finance 64(1):151–185

Brunnermeier SB, Cohen MA (2003) Determinants of environmental innovation in US manufacturing industries. J Environ Econ Manage 45(2):278–293

Chang K, Lu S, Song X (2018b) The impacts of liquidity dynamics on emissions allowances price: different evidence from China’s emissions trading pilots. J Clean Prod 183:786–796

Chang K, Ge F, Zhang C, Wang W (2018a). The dynamic linkage effect between energy and emissions allowances price for regional emissions trading scheme pilots in China. Renew Sust Energ Rev: 415–425

Chen Z, Zhang X, Chen F (2021) Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol Forecast Soc Change 168:120744

Clarkson PM, Li Y, Richardson GD (2004) The market valuation of environmental capital expenditures by pulp and paper companies. The Accounting Rev 79(2):329–353

Dong F, Dai Y, Zhang S, Zhang X, Long R (2019) Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci Total Environ 653:565–577

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Finance 25(2):383–417

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33(1):3–56

Fang G, Gao Z, Tian L, Fu M (2022a) What drives urban carbon emission efficiency? -spatial analysis based on nighttime light data. Appl Energy 312:118772

Fang G, Wang L, Gao Z, Chen J, Tian L (2022b). How to advance China’s carbon emission peak? - a comparative analysis of energy transition in China and the USA. Environ Sci Pollut Res: 1–15

Fang G, Yang K, Tian L, Ma Y (2022c). Can environmental tax promote renewable energy consumption? - an empirical study from the typical countries along the Belt and Road. Energy: 125193

Feng C, Shi B, Kang R (2017) Does environmental policy reduce enterprise innovation?—evidence from China. Sustainability 9(6):872

Florackis C, Gregoriou A, Kostakis A (2011) Trading frequency and asset pricing on the London Stock Exchange: evidence from a new price impact ratio. J Bank Financ 35(12):3335–3350

Ford JA, Steen J, Verreynne ML (2014) How environmental regulations affect innovation in the Australian oil and gas industry: going beyond the Porter Hypothesis. J Clean Prod 84:204–213

Fu J, Zhang Y, Xie Z (2017) Does the mechanism design influence carbon market’s liquidity? -a research based on China’s pilot regions. Finance Trade Econ 38(8):129–143 (in Chinese)

Gray WB (1987) The cost of regulation: OSHA, EPA and the productivity slowdown. Am Econ Rev 77(5):998–1006

Gray WB, Shadbegian RJ (2003) Plant vintage, technology, and environmental regulation. J Environ Econ Manage 46(3):384–402

Grossman GM, Helpman E (2018) Growth, trade, and inequality. Econometrica 86(1):37–83

Gupeng Z, Xiangdong C (2012) The value of invention patents in China: country origin and technology field differences. China Econ Rev 23(2):357–370

Han M, Ding L, Zhao X, Kang W (2019). Forecasting carbon prices in the Shenzhen market, China: the role of mixed-frequency factors. Energy: 69–76

He W, Tan L, Liu ZJ, Zhang H (2020) Property rights protection, environmental regulation and corporate financial performance: revisiting the Porter hypothesis. J Clean Prod 264:121615

Hu J, Pan X, Huang Q (2020a) Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol Forecast Soc Chang 158:120122

Hu Y, Ren S, Wang Y, Chen X (2020b) Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energ Econ 85:104590

Jaffe AB, Palmer K (1997) Environmental regulation and innovation: a panel data study. Rev Econ Stat 79:610–619

Kalaitzoglou IA, Ibrahim BM (2015) Liquidity and resolution of uncertainty in the European carbon futures market. Int Rev Financ Anal 37:89–102

Kathuria V (2006) Controlling water pollution in developing and transition countries—lessons from three successful cases. J Environ Manage 78(4):405–426

Keohane N, Petsonk A, Hanafi A (2017) Toward a club of carbon markets. Clim Change 144:81–95

Kneller R, Manderson E (2012) Environmental regulations and innovation activity in UK manufacturing industries. Resour Energy Econ 34:211–235

Laffont JJ, Tirole J (1996) Pollution permits and environmental innovation. J Public Econ 62:127–140

Lanoie P, Patry M, Lajeunesse R (2008) Environmental regulation and productivity: testing the Porter hypothesis. J Prod Anal 30(2):121–128

Lanzi E, Chateau J, Dellink R (2012) Alternative approaches for levelling carbon prices in a world with fragmented carbon markets. Energy Econ 34:S240–S250

Lee KH, Min B (2015) Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J Clean Prod 108:534–542

Lee J, Veloso FM, Hounshell DA (2011) Linking induced technological change, and environmental regulation: evidence from patenting in the US auto industry. Resour Policy 40:1240–1252

Leyva-de la Hiz DI (2019) Environmental innovations and policy network styles: the influence of pluralism and corporativism. J Clean Prod 232:839–847

Li L, Tao F (2012) Selection of optimal environmental regulation intensity for Chinese manufacturing industry-based on the green TFP perspective. China Ind Econ 5(5):70–82

Li B, Gasser T, Ciais P, Piao S, Tao S, Balkanski Y, Zhou F (2016) The contribution of China’s emissions to global climate forcing. Nature 7594:357–361

Liu L, Chen C, Zhao Y, Zhao E (2015a) China׳ s carbon-emissions trading: overview, challenges and future. Renew Sust Energ Rev 49:254–266

Liu Z, Guan D, Wei W, Davis SJ, Ciais P, Bai J, He K (2015b) Reduced carbon emission estimates from fossil fuel combustion and cement production in China. Nature 7565:335–338

Liu X, Jin Z (2020). An analysis of the interactions between electricity, fossil fuel and carbon market prices in Guangdong, China. Energy Sustain Dev: 82–94

Lv M, Bai M (2021) Evaluation of China’s carbon emission trading policy from corporate innovation. Finance Res Lett 39:101565

Lyu X, Shi A, Wang X (2020) Research on the impact of carbon emission trading system on low-carbon technology innovation. Carbon Manag 11(2):183–193

Ma J, Hu Q, Shen W, Wei X (2021) Does the low-carbon city pilot policy promote green technology innovation? Based on green patent data of Chinese A-share listed companies. Int J Environ Res Public Health 18(7):3695

Manso G (2011) Motivating innovation. J. Finance 66(5):1823–1860

Matthews RC, Denison EF (1981) Accounting for slower economic growth: the United States in the 1970s. Econ J 91:1044–1046

Metz B, Davidson OR, Bosch PR, Dave R, Meyer LA (2007) Contribution of working group III to the fourth assessment report of the intergovernmental panel on climate change. Cambridge University Press, Cambridge

Montmartin B, Herrera M (2015) Internal and external effects of R&D subsidies and fiscal incentives: empirical evidence using spatial dynamic panel models. Res Policy 44(5):1065–1079

Ooba M, Hayashi K, Fujii M, Fujita T, Machimura T, Matsui T (2015) A long-term assessment of ecological-economic sustainability of woody biomass production in Japan. J Clean Prod 88:318–325

Pearce D, Palmer C (2010) Public and private spending for environmental protection: a cross-country policy analysis. Fisc Stud 22:403–456

Peng J, Xie R, Ma C, Fu Y (2021) Market-based environmental regulation and total factor productivity: evidence from Chinese enterprises. Econ Model 95:394–407

Popp D (2006) International innovation and diffusion of air pollution control technologies: the effects of NOX and SO2 regulation in the US, Japan and Germany. J Environ Econ Manage 51(1):46–71

Porter ME (1991) America’s green strategy. Sci Am 264:168

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Pers 9:97–118

Przychodzen W, Przychodzen J (2018). Sustainable innovations in the corporate sector: the empirical evidence from IBEX 35 firms. J Clean Prod 172: 3557e3566

Qi G, Jia Y, Zou H (2021) Is institutional pressure the mother of green innovation? Examining the moderating effect of absorptive capacity. J Clean Prod 278:123957

Ramanathan R, Black A, Nath P, Muyldermans L (2010) Impact of environmental regulations on innovation and performance in the UK industrial sector. Manage Decis 48(10):1493–1513

P, Del Río González (2009) The empirical analysis of the determinants for environmental technological change: a research agenda. Ecol Econ 68(3):861–878

Rubashkina Y, Galeotti M, Verdolini E (2015) Environmental regulation and competitiveness: empirical evidence on the Porter hypothesis from European manufacturing sectors. Energy Policy 83:288–300

Shen C, Li S, Wang X, Liao Z (2020) The effect of environmental policy tools on regional green innovation: evidence from China. J Clean Prod 254:120122

Soltmann C, Stucki T, Woerter M (2015) The impact of environmentally friendly innovations on value added. Environ Resour Econ 62(3):457–479

Stiglitz JE (2015) Leaders and followers: perspectives on the Nordic model and the economics of innovation. J Public Econ 127:3–16

Sun LY, Miao CL, Yang L (2017) Ecological-economic efficiency evaluation of green technology innovation in strategic emerging industries based on entropy weighted TOPSIS method. Ecol Indic 73:554–558

Tang L, Wu J, Yu L, Bao Q (2015) Carbon emissions trading scheme exploration in China: a multi-agent-based model. Energy Policy 81:152–169

Walley N, B, Whitehead, (1994) It’s not easy being green. Harv Bus Rev 72(3):46–51

Wang J (2013) The economic impact of special economic zones: evidence from Chinese municipalities. J Dev Econ 101:133–147

Wang X, Zou H (2018) Study on the effect of wind power industry policy types on the innovation performance of different ownership enterprises: evidence from China. Energy Policy 122:241–252

Wang H, Chen Z, Wu X, Nie X (2019) Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis? - empirical analysis based on the PSM-DID method. Energy Policy 129:930–938

Wen F, Zhao L, He S, Yang G (2020). Asymmetric relationship between carbon emission trading market and stock market: evidences from China. Energy Econ (91): Article 104850

Xie RH, Yuan YJ, Huang JJ (2017) Different types of environmental regulations and heterogeneous influence on “green” productivity: evidence from China. Ecol Econ 132:104–112

Xu W, Fei W (2019) No resource or no motivation? Government subsidies, green innovation and incentive strategy selection. Sci Res Manage 40(7):131

Xu WQ, Wan B, Zhu TY, Shao MP (2016) CO2 emissions from China’s iron and steel industry. J Clean Prod 139:1504–1511

Yanni He (2022) Impact and mechanism of carbon trading market on firms’ innovation strategies. China J Popul Resour Environ 32(7):37–48 (in Chinese)

Yao S, Yu X, Yan S, Wen S (2021) Heterogeneous emission trading schemes and green innovation. Energy Policy 155:112367

Zhang S, Jiang K, Wang L, Bongers G, Hu G, Li J (2020a) Do the performance and efficiency of China’s carbon emission trading market change over time? Environ Sci Pollut Res 27(26):33140–33160

Zhang YF, Li S, Luo TY, Gao J (2020b) The effect of emission trading policy on carbon emission reduction: evidence from an integrated study of pilot regions in China. J Clean Prod 265:121843

Zhang YJ, Shi W, Jiang L (2020c) Does China’s carbon emissions trading policy improve the technology innovation of relevant enterprises? Bus Strategy Environ 29(3):872–885

Zhang W, Li G, Guo F (2022) Does carbon emissions trading promote green technology innovation in China? Appl Energy 315:119012

Zhao X, Sun B (2016) The influence of Chinese environmental regulation on corporation innovation and competitiveness. J Clean Prod 112:1528–1536

Zhao XG, Jiang GW, Nie D, Chen H (2016) How to improve the market efficiency of carbon trading: a perspective of China. Renew Sust Energ 59:1229–1245

Zhao X, Wu G, L, Li A, (2017) Research on the efficiency of carbon trading market in China. Renew Sust Energ Rev 79:1–8

Zhou B, Zhang C, Song H, Wang Q (2019) How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci Total Environ 676:514–523

Zhou K, Li Y (2019). Influencing factors and fluctuation characteristics of China’s carbon emission trading price. Physica A: Statistical Mechanics and its Applications: 459–474

Zhu J, Fan Y, Deng X, Xue L (2019) Low-carbon innovation induced by emissions trading in China. Nat Commun 10(1):1–8

Funding

This research was supported by the National Social Science Foundation Project of China "Study on the Impact Mechanism and Policy Optimization of the Construction of Free Trade Areas on China's Carbon Emissions" (NSSF Projects No. 22CJY053).

Author information

Authors and Affiliations

Contributions

Conceptualization, S.W. and Y.Q.; methodology, S.W. and Y.Q.; software, S.W.; validation, S.W. and Y.Q.; formal analysis, S.W.; investigation, S.W.; resources, S.W.; data curation, Y.Q.; writing—original draft preparation, S.W.; writing—review and editing, S.W., Y.Q., H.H., and Y.X.; visualization, S.W.; supervision, Y.Q., H.H., and Y.X.; project administration, Y.Q.; funding acquisition, Y.Q. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This is not applicable.

Consent for publication

This is not applicable.

Competing interests

The authors declare no conflicts of interest.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wu, S., Qu, Y., Huang, H. et al. Carbon emission trading policy and corporate green innovation: internal incentives or external influences. Environ Sci Pollut Res 30, 31501–31523 (2023). https://doi.org/10.1007/s11356-022-24351-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-24351-4