Abstract

Green investment is crucial to achieving the green transformation goal. Under increasingly strict environmental protection laws and regulations, whether it can induce the “Porter Hypothesis” effect and stimulate the green investment of enterprises is still controversial. This paper takes the China’s new environmental protection law (NEPL) as a quasi-natural experiment, uses the green investment data of listed companies in China’s heavy pollution industry, and applies the method of propensity score matching and difference-in-difference (PSM-DID) to verify whether the implementation of the law conforms to the “strong Porter Hypothesis.” The results show that as a strict command-and-control environmental regulation tool, the implementation of NEPL has significantly promoted corporate’s green investments in heavily polluting industries. The implementation of the NEPL guides to more standardized environmental disclosure regulation, stricter environmental enforcement, and severer financial constraints, and thus propel corporate’s green investment. In addition, heterogeneity analysis indicates that the effect of NEPL is more significant in those samples of enterprises located in the regions with higher industrial concentration degree or with higher level of government environmental governance, enterprises of small and medium type, and enterprises with better financial performance and higher degree of equity incentive. To achieve the carbon peaking and carbon neutrality goals, this paper provides evidence to test whether “Porter Hypothesis” is established in transition economies from the view of environmental investment and provides reference for how developing country can further enrich their environmental regulation system and optimize enterprise’s environmental protection strategies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the rapid development of industrial economy, various environmental problems have emerged. According to a report released by Greenpeace and CREA in 2018,Footnote 1 the cost of air pollution accounts for 6.6% of China’s GDP. Therefore, how to fulfill emission reduction goal through green technological innovation way has attracted wide attention. However, green investment presents a strong public goods attribute. Moreover, enterprises’ green investment has a long cycle, high cost and slow effect, which may lead to lack of enthusiasm and willingness to carry out green investment activities. In developing countries, whether the increasingly strict environmental regulation measures raise the cost of enterprises and thus reduce green investment, or strengthen green investment incentives by benefiting from technology spillovers, the current theoretical research is extremely scarce. Faced with severe environmental problems, China’s old “environmental protection law” (OEPL) enacted in 1989 cannot effectively curb environmental pollution. Thus, China began to implement a stricter environmental regulation legal system called the “new environmental protection law” (NEPL) in 2015. Since the introduction of the NEPL, remarkable achievements have been made in cracking down on environmental violations. More administrative punishment cases for environmental violations in China are detected, which highlights the Chinese government’s determination to reduce environmental pollution. The NEPL, known as one of the China’s “most stringent” environmental law in history (Cai & Xu, 2022; Liu et al., 2018), has put significant pressure on those heavily polluting enterprises (Chen et al., 2020).

Corporate activity is an essential factor leading to environmental pollution. However, enterprises are also a vital force in promoting the green investment. In 2014, the industrial emissions of sulfur dioxide, nitrogen oxides, and powder dust from enterprises accounted for 88.15, 67.60, and 83.65% of China’s total emissions. Enterprises have brought severe environmental pollution problems to society despite their contributions. To deal with the tough environmental governance, government funds alone cannot meet the need for green investment. In 2015–2020, China needed at least 3–4 trillion yuan of green investment each year, and 85% will come from social capital investment.Footnote 2 China’s 13th FYP development plan for the industrial sector (2016–2020) emphasizes the importance of policymakers and financing entities in green investment activities. As critical financing entities, enterprises must assume responsibility for green investment. According to Porter’s hypothesis, strict environmental regulation will encourage enterprises to introduce clean technology, improve environmental performance and carry out innovation activities. The resulting economic benefits are enough to cover compliance costs and ultimately achieve the win–win goal of environmental governance and profitability (Wagner, 2003). Nonetheless, due to the negative externalities, individuals or enterprises that engage in economic activity will not take the initiative in green investment (Pigou, 1933; Ren et al., 2022). Besides, the cost brought by green investment will probably crowd out productive investment and reduce productivity (Clarkson et al., 2004; Weche, 2019). Therefore, rigorous means of environmental regulation is regarded as a key means to stimulate green investment.

However, does environmental regulation necessarily increase green investment? Opinions vary on this issue. The first view is that environmental regulation can significantly increase corporate investment. In the study of public concern and China’s green investment, Liao et al. (2018) found that stricter environmental regulation is a channel for increasing the corporate’s green investment. Similarly, Du et al. (2019) found that environmental regulation can significantly increase corporate’s green investment through China’s provincial panel data. Nevertheless, provinces with stronger environmental regulations tend to be economically developed, so economic factors are also crucial for green investment. In addition, many scholars have also found a positive relationship between them (Gu et al., 2021; Liang et al., 2022). However, environmental regulation may not necessarily increase green investment. The second view holds that environmental regulation has no significant impact on corporate’s green investment and even inhibits it under certain conditions. By analyzing the data of Iceland, Siedschlag and Yan (2021) found that environmental regulation failed to increase corporate’s green investment. The third view is that the relationship between environmental regulation and green investment display as a U-shaped. Only when the environmental pressure reaches a certain degree, it is possible to stimulate enterprises to carry out green investments (Chang et al., 2021). Besides, some hold that the impact of environmental regulation on corporate’s green investment cannot be generalized, and it should be analyzed according to the specific type of regulation. Command-control regulation usually presents a U-shaped relationship with the green investment, while market-based and public-participation regulation demonstrate a positive relationship (Huang & Lei, 2021). There are many related literatures in this category, and different types of regulation often affect the green investment to varying degrees (Zhou & Zhao, 2022).

Although the above views are different, most literatures show that environmental regulation can significantly impact corporate’s green investment. What fails to reach a consensus is the direction of impact, and to what extent does it affect? Moreover, how does it affect? The divergence of existing research may be mainly due to different proxy variables of environmental regulation. Most studies use pollution emissions as the proxy variable (Antweiler et al., 2001). At the same time, in some studies, compliance costs or emission reduction costs are used as proxy variables (Gray et al., 2014). Some use principal component analysis (PCA) to construct indicators (Liao et al., 2018) and the number of issued regulations and environmental petitions according to different regulations (Huang & Lei, 2021). The introduction of the NEPL creates a quasi-natural laboratory environment to identify the causal relationship between environmental regulation and corporate green investment. We use listed companies in the Shenzhen Stock Exchange (SZSE) and the Shanghai Stock Exchange (SHSE) as research samples to empirically test the impact of the NEPL on corporate’s green investment, mechanism, and heterogeneity under different conditions.

In this paper, we put forward several research questions as follow: (1) Does the introduction of the NEPL promote corporate’s green investment? (2) What mechanism does environmental regulation affect corporate’s green investment? We examine the impact from the perspective of environmental disclosure, environmental enforcement and financial constraints. (3) Is there heterogeneity in the impact of the NEPL on corporate’s green investment, and how does this heterogeneity manifest?

To answer the above research questions, this study contributes to the literature in four ways. (1) Most existing literature focuses on the provincial and urban levels. This paper analyzes green investment at the enterprise level, which enriches the research at the micro-level. (2) Using the NEPL as a quasi-natural laboratory environment and DID method can avoid endogenous problems to a certain extent. At the same time, as a systematic environmental bill, the NEPL contains command-control, market-based, and public-participation regulations. This makes the research not limited to a single regulation, so it has more practical significance. (3) Most existing studies directly discuss the impact of environmental regulation on green investment, lacking specific mechanism analysis. This paper analyzes the impact mechanism from the perspectives of corporate environmental disclosure, environmental enforcement, and financing constraints. Also, we perform a heterogeneity analysis on regional environment and enterprise characteristics. Therefore, the research results may be more comprehensive. It can help enterprises understand the internal mechanism of environmental regulation more profoundly, make reasonable business decisions, and urge the government to optimize the supporting measures for the NEPL. (4) Taking a decree issued by the world’s largest developing country as a research object deepens the research on developing countries and provides a reference for other developing countries in environmental protection field.

The other parts are arranged as follows. Section 2 contains institutional background and hypotheses, Sect. 3 presents the research design, Sect. 4 consists of empirical analysis and robustness tests, Sect. 5 discusses mechanism, Sect. 6 provides the heterogeneity analysis, and Sect. 7 concludes.

2 Policy background and research hypothesis

2.1 Policy background

Since the late 1970s, with the rapid development of China’s economy, the contradiction between environment and development has become increasingly prominent. Environmental pollution has gradually become a major issue in China’s growth. The Chinese government also began to promote environmental protection work by formulating different rules and regulations. For example, China first promulgated the “Environmental Protection Law of the People’s Republic of China (Trial)” in 1979 and formally implemented the “Environmental Protection Law” in 1989. Subsequently, more than 50 administrative regulations were introduced, such as “Detailed Rules for the Implementation of the Water Pollution Prevention and Control Law” and “Regulation on the Administration of Collection and Use of Pollutant Discharge Fees,” which reflect the Chinese government’s determination to regulate environmental pollution. By 2005, China promulgated more than 800 national environmental protection standards.Footnote 3 However, as the fundamental environmental protection law, the OEPL in 1989 was promulgated for more than 20 years in the 2010s. The politics, economy, culture, technology, and ecological environment of China have considerably changed. The OEPL law is difficult to meet the new requirements in the new stage (Liu et al., 2021a, 2021b). In reality, the means and intensity of environmental enforcement proposed by the OEPL may no longer be effective for environmental protection. Besides, most provisions in the OEPL have been covered by supplementary laws on pollution control and resource protection. The actual role of the OEPL needs to be re-evaluated. Besides, the enhancement of people’s living standards environmental and legal awareness also placed a greater demand for environmental protection. In 2006, the OECD released a review of China’s own environment. It is believed that China is likely to lurk policy defects in environmental protection, which led to low efficiency. Thus, the OECD recommended that China should revise and implement more modern environmental protection laws (Liu et al., 2021a, 2021b).

Based on this background, China began to consider the enactment of the NEPL. The drafting of the NEPL can be traced back to 2008, when the Ministry of Environmental Protection of China organized relevant departments and experts to assess the implementation of the OEPL and conduct a series of surveys for the NEPL. After six years of collecting opinions, drafting, revising, and four deliberations, it was not until April 24, 2014, that the NEPL was finally adopted. The lengthy process reflects the importance that the Chinese government attaches to the NEPL (Liu et al., 2018).

Compared with the OEPL, the NEPL embodies three points of progress. First, the NEPL further strengthens the government’s environmental responsibility and establishes a stricter accountability system. In the OEPL, the responsible subject of environmental supervision is defined as “environmental regulators,” which leads to a vague boundary of regulators. It resulted in the mutual prevarication of responsibilities between different agencies. In the NEPL, the responsible subject is clearly defined as “local governments, environmental departments, and other environmental supervision departments.” At the same time, the NEPL has formed a multi-agent, comprehensive environmental supervision system. The NEPL stipulates that local governments assume the primary responsibility for environmental protection and has formed four levels of supervision system: public supervision (Articles 53, 56, 57, 58), the supervision of the National People’s Congress (Article 27), administrative supervision (Articles 26, 44, 67) and judicial supervision (Article 69). The multi-level supervision system dramatically enhances the enforcement of the NEPL.

Second, the NEPL expands the environmental disclosure by governments and heavily polluting enterprises. For government, the NEPL stipulates that the people’s governments at or above the county level shall report, on an annual basis, the environmental conditions and the completion of environmental protection targets to the people’s congress at the same level or its standing committee (Article 27). It strengthens the administrative duties of governments at all levels and the supervisory role of the people’s congress on the government’s environmental protection work. For enterprises, “Key pollutant-discharging units shall truthfully disclose emission status, the construction and operation of pollution prevention and control facilities, so as to be subject to social supervision (Article 55)” put forward strict requirements for environmental disclosure of heavily polluting enterprises.

Third, the NEPL increased the penalties for pollution behavior. The NEPL proposes a “daily penalty” for continued pollution. If polluting enterprises refuse to rectify pollution, regulators may impose a continuous daily penalty according to the original sum. Given these characteristics, after the introduction of the NEPL, the risk and cost of environmental violation have rocketed. For example, in 2018, China’s environmental administrative penalty reached 15.28 billion yuan, an increase of 32% year on year, 4.7 times higher than before the implementation of the NEPL, which has cracked down on environmental pollution.

2.2 Research hypothesis

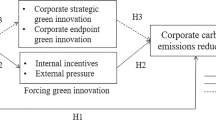

Existing studies have found that environmental regulation can internalize the externality of corporate pollution and transform its environmental strategy from passive treatment to active prevention. Hence, it effectively solves market failure in environmental problems (Crafts, 2006). The factor endowment hypothesis believes that when the return brought by environmental regulation exceeds the compliance cost, the willingness of enterprises to green investment will be significantly reduced (Leiter et al., 2011). However, the impact of China’s environmental regulation on enterprises’ green investment still has a positive trend (Liao and Shi, 2018). Figure 1 shows the theoretical framework. This paper studies the influence mechanism of the NEPL on corporate green investment from the perspectives of environmental disclosure, environmental enforcement, and financing constraints. The specific analysis is as follows.

2.2.1 Environmental disclosure

Legitimacy theory holds that enterprises will disclose environmental information to maintain a legitimate image in front of stakeholders and reduce litigation risks (Dowling & Pfeffer, 1975). If corporate environmental disclosure lacks external pressure, especially pressure from the government, corporate executives will pay more attention to economic benefits than environmental responsibility (Meng et al., 2015). In China, the OEPL has not yet contained relevant provisions on corporate environmental disclosure. Although the government has issued some management documents requiring corporate environmental disclosure since the 21st century, it lacks a fundamental environmental law, making it easy for enterprises to avoid disclosure. At the same time, corporate environmental disclosure is chaotic. In terms of form, some enterprises may disclose in the annual report, and others may in the social responsibility report, which makes it difficult for outsiders to gain clear access to corporate environmental disclosure environmental performance and increases the obstacles to public supervision (Li et al., 2018). Besides, as for content, most enterprises selectively disclose environmental information, and forgeries prevail (Fugui et al., 2008). Some enterprises focus on disclosing information that makes little sense, such as environmental strategies and emission reduction targets, but do not mention the actual emission status and energy efficiency. The NEPL clarifies the environmental information enterprises should disclose, including “major pollutants, the ways of emission, the emission concentration and total volume, the standard- exceeding emission status, as well as the construction and operation of pollution prevention and control facilities.” Therefore, the increasing legitimacy requirement gives enterprises an impulse to environmental disclosure.

How does environmental disclosure affect corporate green investment? Stakeholder theory holds that enterprises can gain the support of stakeholders by disclosing environmental information and making them aware of their environmental performance (Moser & Martin, 2012). After the introduction of the NEPL, more and more investors, consumers, and other stakeholders have gradually realized the importance of corporate green behavior (Chen et al., 2020). In order to meet the preferences of stakeholders, enterprises need to think about green investment seriously.

In the case of corporate profits, with the general enhancement of environmental awareness, Chinese consumers’ demand for green products is also increasing. The corporate environmental disclosure can deepen the green image in front of consumers, promoting demand, expanding revenue, and enabling them to have more funds for green investment inputs (Xiang et al., 2020). Thus, we propose the first Hypothesis 1:

Hypothesis 1

The introduction of the NEPL improves corporate environmental disclosure, thereby facilitating green investment.

2.2.2 Environmental enforcement

The NEPL also strengthens environmental enforcement from the perspective of regulators and enterprises. It forms a multi-level supervision system for regulators, including public, administrative, people’s congresses, and judicial supervision. For the nine kinds of malfeasance, such as “cover-up of environment-related illegalities” “fail to make decisions on suspension of production or closure despite being so required pursuant to the law,” the primary persons in charge of the relevant departments shall take the blame and resign from office (Article 68). The accountability for law enforcement officers further strengthens environmental enforcement. For enterprises, those who violate the law and constitute a criminal offense shall be investigated for criminal liabilities (Article 69). The criminal liability increases the deterrent effect of the NEPL and shows China’s zero tolerance for pollution (Zhang et al., 2016). Due to stricter environmental enforcement, the risk of corporate pollution being investigated and punished has increased. Once the illegal act is investigated and punished, enterprises are first faced with the “daily penalty” without the upper limit, which will cause substantial economic losses to enterprises (Cai & Ye, 2020; Fang et al., 2021). Secondly, corporate reputation will be damaged. Studies have found that a good corporate reputation can improve corporate financial performance by expanding market demand, motivating employees, and attracting investment (Bahta et al., 2021; Lai et al., 2010). Thus, the corporate long-term financial performance will suffer from reputation damage. In addition, polluting enterprises will shut down or even close according to the severity of the situation. At the same time, the person directly responsible for pollution will be sentenced to fixed-term imprisonment. Under the sharp increase in illegal costs, enterprises must increase green investment in advance to avoid the consequences of environmental violations. Accordingly, this paper proposes Hypothesis 2:

Hypothesis 2

The NEPL increases environmental enforcement, which further promotes corporate green investment.

2.2.3 Financial constraints

The main financing channels of Chinese enterprises are equity financing and debt financing. Due to the Chinese government’s strict control on equity financing, it is difficult for enterprises to obtain funds through equity financing in the short term. Debt financing is the primary way to get finance (Liu et al., 2018). However, even considering debt financing, when the government promulgates new environmental policies, especially laws, investors expect that environmental regulations may inhibit the development of heavily polluting enterprises, thereby reducing investment (Geng et al., 2021; Guo et al., 2020). In debt financing, bank credit is the primary source. Banks’ credit departments often need to assess the risk of corporate environmental violation according to environmental performance (Thompson & Cowton, 2004) and reduce the risk by scaling down credit, raising interest rates on loans, or adding restrictive clauses. The risk of bank lending to heavily polluting enterprises is usually divided into direct risk, indirect risk, and reputation risk (Thompson, 1998a, 1998b).

Direct risk often refers to when land is used as collateral for loans, and its real value may decline due to pollution. Besides, the most common is the indirect risk (Thompson & Cowton, 2004). When enterprises are subject to new environmental regulations, some of their products may be eliminated from the market, deteriorating the financial situation. The financial crunch makes enterprises struggle to pay off debts on time and even go bankrupt, affecting banks’ operations (Boomhower, 2019). As banks indirectly support pollution through financing, they may be backlashed by the public, which will tarnish the bank’s reputation (Thompson & Cowton, 2004). Therefore, banks will limit the credit of heavily polluting enterprises and increase financing constraints to reduce possible credit risk. Enterprises that rely on credit for continuous operation are invulnerable to financial constraints. When financing constraints increase due to environmental policies, enterprises can only exit the market or ease it by improving environmental performance. In this case, financing constraints can strongly stimulate enterprises to improve environmental performance. Thus, this paper infers that financing constraint is crucial channel for the NEPL to promote corporate’s green investment, and we propose Hypothesis 3:

Hypothesis 3

The NEPL increases corporate financial constraints, forcing firms to promote green investment and improve environmental performance.

3 Research design

3.1 Samples and data sources

We selected Chinese A-shares listed companies in the Shenzhen Stock Exchange (SZSE) and the Shanghai Stock Exchange (SHSE) as the study samples, among which heavily polluting enterprises are regarded as the treatment group and others as the control group. The sample interval is set from 2010 to 2019. The reason why heavily polluting enterprises are selected as the treatment group is that they are the main source of pollution (Tian et al., 2019). Meanwhile, they are also the primary object of environmental enforcement, making them more vulnerable to the impact of the NEPL. According to “the Guidance for Environmental Information Disclosure of Listed Companies “ issued by the Ministry of Ecology and Environment in 2010 and “the Guidelines for Classification of Listed Companies” by the China Securities Regulatory Commission in 2012, we divide the heavily polluting industries into 23 categories.Footnote 4

Additionally, we exclude SP/*SP/TP enterprises, financial enterprises, and enterprises with more debt than assets. These companies have abnormal financial and operating conditions and are not representative. At the same time, to reduce the influence of outliers, we winsorized the continuous variables at the 1% level and finally gained 4345 effective observations. Corporate green investment data is collected manually from annual reports and corporate social responsibility reports. Other financial data are from the China Stock Market and Accounting Research (CSMAR) database.

3.2 Definitions of variables

3.2.1 Explained variables: green investment

Green investment refers to the capital expenditure related to environmental protection (Eyraud et al., 2013). According to the study of Cheng et al. (2022), we incorporate assets and expenses into the category of green investment. Among them, the assets mainly include sewage treatment equipment, the environmental transformation of production equipment, research and development in environmental protection, which are contained in the” construction in progress” item. Expenses, including Sewage charges, certification fees for the environmental management system, green fees, and so on, are included in the “general and administrative expenses” item. To avoid the impact of size, we use the ratio of corporate green investment to ending assets as the proxy for a corporate’s green investment.

3.2.2 Explaining variables

Since the NEPL was formally implemented on January 1, 2015, if the sample’s year is in 2015 or after, post = 1. Otherwise, post = 0. As mentioned above, we divide the treatment and control groups according to the heavily polluting and non-heavily polluting industries. If the enterprise belongs to the heavily polluting industry, treat = 1. Otherwise, treat = 0. The coefficient of treat × post represents the net effect of the NEPL on heavily polluting enterprises.

3.2.3 Control variables

Control variables consist of financial features, corporate characteristics, and regional environment. Among them, financial features include debt to asset ratio (Lev), Tobin Q value (Tobin_Q), cash holdings (Cash), fixed asset to equity ratio (FA_ratio), growth rate of operating income (Growth), and capital intensity (Intensify). Moreover, firm characteristics include Maturity (Age), Ownership (SOE), Number of independent directors (Indep), and ownership concentration (Top1). Besides, considering that the local economy and fiscal policy are likely to impact corporate’s business decisions, provincial GDP (GDP) and fiscal expenditure (Fin) are added as control variables at the external environment level. Table 1 displays their definitions.

3.2.4 Variables used in mechanism analyses

We use corporate environmental disclosure, environmental enforcement, and financing constraints in mechanism analysis. The environmental disclosure is measured by whether the enterprise discloses the environmental report (EnvReport). If the enterprise reveals it, EnvReport equals 1. Otherwise, it equals 0. Frequent disclosure means that the law enforcement department has increasingly strict requirements for disclosure after the introduction of the NEPL. The intensity of environmental enforcement is measured by whether the enterprise is prosecuted for environmental violations (EnvViolation). EnvViolation equals 1 if the enterprise is prosecuted for environmental violations. Otherwise, it equals 0. The more prosecuted enterprises, the stronger the intensity of environmental enforcement. In terms of the measurement of financing constraints, Hadlock and Pierce (2010) found that only two of the five indicators that make up the KZ index are related to financing constraints and questioned this proxy variable. Thus, this paper draws on the practice of Li et al. (2020) and uses the SA index (FC_SA) as the proxy for financing constraints. The above data are also obtained from the CSMAR database.

3.3 Model specification

The DID method is a practical method for policy evaluation. It can effectively alleviate the impact of endogeneity, omitted variables, and other issues, creating more accurate estimates. In recent years, it has been widely used in research on environmental policies (Cheng et al., 2022; Tang et al., 2020a, 2020b). The introduction of the NEPL is an exogenous shock to enterprises, which meets the basic assumption of the DID method. Therefore, this paper analyzes the impact of the NEPL on corporate green investment by constructing a DID model.

where i and t represent the enterprise and year, respectively. GI represents corporate green investment. treat represents whether it is a heavily polluting enterprise and post represents whether the sample is under the year of policy shock; X denotes a series of control variables. We introduce the industry fixed effect \(\gamma\) and year fixed effect \(\mu\) to further ease the omitted variables’ impact. \(\varepsilon\) denotes the random disturbance. The paper focuses on the coefficient \({\beta }_{1}\). If \({\beta }_{1}\) is significantly positive, the NEPL can significantly promote the green investment of heavily polluting enterprises.

4 Empirical analysis

4.1 Descriptive statistics

Table 2 displays the descriptive statistics of the main variables. The results show that the average green investment is 0.0014, and the standard deviation is 0.0030. According to the mean and standard deviation, the coefficient of variation is 2.0714, indicating a great difference in green investment among different enterprises. The average treat is 0.5089, which means that 50.89% of enterprises belonging to the treatment group and 49.11% to the control group. Thus, the treatment group and the control group are evenly divided.

4.2 Parallel trend test

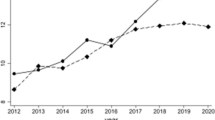

A crucial premise of the DID method for policy evaluation is the parallel trend assumption (Bertrand et al., 2004). That is, the treatment group and the control group should have a similar trend before the introduction of the NEPL. Only when the parallel trend assumption is established can the net effect of the treatment group be obtained before and after the policy shock. Thus, to exclude the possibility that the results of this paper were caused by other events before the introduction of the NEPL, we examine the trend of green investment between the treatment group and the control group before the introduction of the NEPL. Specifically, this paper refers to the practice (Beck et al., 2010), constructing the following regression model.

where yeark represents the time dummy variable. Since 2015 is taken as the base period, yeark includes the years 2010–2014 and 2016–2019. Other variables are defined the same as Model (1).

Table 3 shows the results of the parallel trend test. It can be found that the coefficient before the introduction of the NEPL is not significant, which indicates that there is no significant difference in green investment between heavily polluting enterprises and others before the introduction of the NEPL and meet the parallel trend assumption.

4.3 Results and analysis of baseline regression

The baseline regression results are presented in Table 4, where Column (1) is the estimation results without adding control variables. Column (2) adds control variables at the enterprise level; all control variables are introduced in Column (3). The results show that the coefficient of treat × post is always significantly positive at a 5% level, indicating that the NEPL significantly promotes the green investment of heavily polluting enterprises. Specifically, the coefficient of treat × post is 0.0004 in Column (3). The result indicates that after adding all control variables, industry, and year fixed effects, the NEPL increases the green investment of heavily polluting enterprises by an average of 0.0004%. It is consistent with the existing literature’s conclusions on the impact of environmental regulation on corporate green investment from the perspective of environmental taxes (Cheng et al., 2022; Liang et al., 2022). There is also an inverted U-shaped relationship between command-control environmental regulation and corporate green investment in some research (Huang & Lei, 2021). But the new environmental protection law is a complex system which contains command-control environmental, market-based and public-participation regulations. The focus of this paper is the overall impact of environmental law on corporate green investment. The positive effects of other regulations may be cover up the U-shaped characteristics of market-based regulation, making the final effect completely positive.

4.4 Robustness tests

4.4.1 Placebo tests

Referring to the study of C. Tang et al. (2020a, 2020b), two methods were used for the placebo test. The first is to change the point at which the policy came into effect. The dummy variable False_post is introduced, assuming that the points for the implementation of the NEPL are 2012, 2013, and 2014, respectively. Taking samples between 2010–2014, 2011–2015, and 2012–2016, we explore whether there are significant differences between the treatment group and the control group before and after the policy. The results are shown in Columns (1), (2), and (3) of Table 5. No matter how to change the point when the NEPL came into effect, the coefficient treat × False_post is not significant, which implies that our results are not caused by random factors.

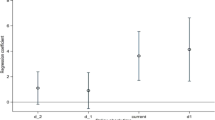

The second way is to generate treatment groups randomly. We randomly selected the treatment group from all samples, and the other samples were used as the control group. Specifically, we introduce the dummy variable False_treat. The robustness of baseline results is judged by the coefficient of False_treat × post and the average distribution of t value. To ensure the effectiveness of the placebo test, we repeated 500 random samplings. Figure 2 shows the distribution of the coefficient of False_treat × post and t value. The t value is in a normal distribution with an average of 0. Only a few of t values are greater than the benchmark results. Simultaneously, only once the virtual coefficient falls into the right side of the actual coefficient 0.0004. Therefore, the placebo results are not significant in the economic and statistical sense, indicating that our results are relatively robust.

4.4.2 Add Cluster at city level

In baseline regression, in order to correct for heteroscedasticity at the enterprise level, this paper adds robust standard errors at the enterprise level. However, considering the possible correlation between different enterprises in the same province, heteroscedasticity may also occur at the provincial level. Thus, this paper simultaneously adds the standard errors clustered over enterprises and provinces. The results are shown in Column (4) of Table 5. The coefficient of treat × post is still significantly positive at 5%, which further demonstrates the robustness of our findings.

4.4.3 PSM-DID

An essential premise of the DID method is to ensure that the treatment and control groups are randomly grouped, which gives every sample an equal opportunity to receive treatment. However, due to the differences in corporate characteristics and financial performance, the chance of receiving treatment varies, which may cause sample selection bias. Thus, we use the propensity score matching (PSM) method before using the DID method to avoid sample selection bias. Specifically, the logit model is used to estimate the probability of each sample being selected for the treatment group. We then use radius matching (± 0.05) to match the control group for the treatment group. The matching results are shown in Fig. 3. Before matching, there are significant differences in some control variables between the treatment group and the control group, especially FA_ratio. After the matching process, the bias across covariates is reduced to less than 10%. Subsequently, this paper applies the DID method again to identify the impact of the NEPL on the green investment of heavily polluting enterprises. The results are shown in Column 5 of Table 5. The positive impact of the NEPL on the green investment of heavily polluting enterprises is still significant at 5%, implying that our baseline results are robust.

4.4.4 Controlling industry-specific time trends

Since the time trend of corporate’s green investment in various industries exhibits differences, the corporate’s green investment may be affected by some industrial features that are difficult to observe. Different time trends in the treatment and control groups may lead to biased estimates. According to the study of Liu and Qiu (2016), we introduce industry-year interactions to control for industry-specific trends. Column (6) of Table 5 presents the results. The coefficient of treat × post is still significantly positive at 5% after controlling the industry-specific time trend.

4.4.5 Add province-fixed effect

Given the large differences in the geographical distribution of heavily polluting enterprises, the implementation strength of the NEPL may vary. Simultaneous, there is a risk of omitting important variables that do not change over time at the provincial level, resulting in biased or inconsistent estimates. In order to solve this problem, this paper further adds the provincial fixed effect base on retaining the industry and year fixed effect. Column 7 of Table 5 displays the result. The NEPL positively promotes the green investment of heavily polluting enterprises at 5%.

4.4.6 Dealing with reverse causality

In the baseline regression, the corporate’s green investment may affect the growth of operating income, cash flow, and the like. In order to deal with the reverse causality between green investment and control variables, based on model (1), we use all control variables lagged one period to regress again. Column (1) of Table 6 presents the results, which demonstrate that the core conclusions of this paper have not changed.

4.4.7 Preventing the interference of other policies

-

1.

Remove the interference of the overcapacity industry. Overcapacity has been standing in the way of China’s economic development. It is severe in heavily polluting industries with excessive energy consumption. According to the “guidance on resolving the contradiction of severe overcapacity” formulated by the State Council in 2012, industries such as steel, cement, electrolytic aluminum, flat glass, and ships are defined as overcapacity sectors. The regulators will focus on solving the overcapacity problems in these sectors. Thus, some heavily polluting enterprises belonging to overcapacity sectors are not only subject to environmental regulation brought by the NEPL but also facing regulatory requirements for cutting overcapacity, which may affect their financial conditions. We eliminate the enterprises belonging to overcapacity sectors and regress again based on model (1). As shown in Column (2) of Table 6, the coefficient of treat × post was significantly positive at 5%, consistent with the baseline regression.

-

2.

Exclude the impact of “the inspection on ecological and environmental protection.” Since the introduction of the NEPL, the supervision and management of environmental protection across the country have become increasingly stringent. According to the “scheme of environmental supervision (trial),” in July 2015, the central government has dispatched an inspection team to multiple provinces since 2016. The inspection team focuses on local governments’ inaction and misbehavior in environmental protection, forcing local law enforcement officers to exercise their responsibilities more strictly. This increases the risk of environmental violations and compels enterprises to promote green investment. We exclude the pilot provincesFootnote 5 and cities where the inspection team was stationed in 2016 and regress again based on model (1). As shown in Column (3) of Table 5, the coefficient of treat × post is significantly positive at 5%. Thus, our core conclusion remained unchanged.

-

3.

Exclude the impact of environmental taxation. “The Environmental Protection Tax Law of the People’s Republic of China” was formally implemented on January 1, 2018, which has stipulated heavy polluted enterprises to pay corresponding environmental taxes based on emissions. The new law forces enterprises to increase green investment in advance to reduce emissions. According to research by Jin et al. (2020), we add the interactive term of Envtax and Envpost based on model (1) to control the impact of environmental tax policy. Envtax and Envpost represent the provincesFootnote 6 and period of policy implementation, respectively. Column 4 of Table 6 presents the regression results. The promotion effect of the NEPL on the green investment of highly polluting enterprises still exists.

In addition, this paper further controls the influence of the above three policies simultaneously. The results are shown in Column 5 of Table 6. The coefficient of treat × post is still significantly positive at 5% and even increases, proving the robustness of our core conclusion.

4.4.8 Re-identify heavily polluting industries

Hithink RoyalFlush is one of China’s largest and most popular financial information providers. For robustness, we draw on the classification criteria of Hithink RoyalFlush to reclassify heavily polluting and non-heavily polluting industries.Footnote 7 Based on the new classification, we retest the conclusion of baseline regression. Column 6 of Table 6 displays the results. After using the new classification, the promotion effect of the NEPL on corporate green investment is still significantly positive at 5%.

5 Mechanism analyses

According to the theoretical analysis in Sect. 2, the introduction of the NEPL may promote corporate’s green investment by improving environmental disclosure, strengthening environmental enforcement, and increasing financing constraints. Thus, this paper examines possible mechanisms from these three aspects. Since the mediation model has endogeneity problems in the mechanism analysis (Wang et al., 2021), this paper focuses on the impact of the NEPL on mechanism variables.

This paper uses “whether the enterprise discloses environmental reports” to measure corporate environmental disclosure (Env_report). According to the “Guidelines for Drafting on Corporate Environmental Report” issued by the Ministry of Ecology and Environment in 2011, the corporate’s environmental report consists of environmental performance, strategy, accounting, petition, management, green procurement, which comprehensively reflects the corporate’s environmental work. Thus, we use the disclosure of the environmental report to measure corporate’s environmental disclosure. The definitions of proxies of environmental enforcement and financial constraints are presented in Sect. 3. We will test the mechanisms by replacing the explained variable with different mechanism variables in the following.

Table 7 reports the test results of the mechanisms. From Column (1), the coefficient of treat × post on corporate environmental disclosure (Env_report) is significantly positive at 1%. The positive coefficient shows that the NEPL has improved corporate environmental disclosure, which indicates environmental disclosure is a channel between the NEPL and corporate green investment. Thus, hypothesis H1 is verified. Li et al (2018) examines corporate carbon disclosure from legitimacy pressure from government, competitors and customers, which also proves that environmental legitimacy pressure is positively associated with corporate carbon disclosure. Column (2) and Column (3) convey that the coefficients of treat × post are significantly positive at 1 and 5% on environmental enforcement (EnvViolation) and financial constraints (FC_SA), respectively. The results reflect that the introduction of the NEPL has strengthened the regulators’ law enforcement, punished more and more environmental violations, and increased corporate financing constraints. Based on the above analysis, the introduction of the NEPL can promote green investment in heavily polluting enterprises by improving strengthening environmental enforcement and increasing financing constraints, which proves H2 and H3.

6 The heterogeneity analysis

According to existing literature, the impact of the NEPL on corporate profitability and green innovation will change with the financial features and regional environmental factors (Cai & Xu, 2022; Fang et al., 2021; Liu et al., 2021a, 2021b). In this paper, the samples also exist differences in the regional environment and resource endowment. Thus is the impact of the NEPL on green investment also different? Thus, we analyze the heterogeneity of the NEPL from the perspectives of the regional environment and corporate characteristics.

6.1 Market concentration

The structure–conduct–performance model holds that there is a positive correlation between market concentration and monopolistic behaviors. When market concentration degree is low, corporate’s behaviors are more competitive. With the increase in market concentration, market monopoly gradually replaces market competition. Monopolies can manipulate market prices with their vast market force to achieve better financial performance and make excess profits (Sung, 2014). Simultaneously, monopolies are more likely to gain bargaining power through market force when facing more stringent government regulation. On the contrary, enterprises with lower market concentration degree are likely to face more fierce market competition and bear more pressure from the government, which is greatly affected by the external environment. After the introduction of the NEPL, the enterprises with higher market concentration degree have excess profits to compensate for the compliance costs. However, compliance costs will bite the operating results of enterprises with low market concentration. Meanwhile, they are more vulnerable to litigation risks brought by environmental violations. Thus, enterprises with lower market concentration degree tend to actively promote green investment to avoid compliance costs and litigation risks. We conclude that the NEPL will play a more significant role in a less concentrated market through the above analysis. Specifically, we use the Herfindahl–Hirschman index (HHI) as the proxy of market concentration. Based on the model (1), the treat × post × HHI is added to construct a difference-in-difference-in-differences (DDD) model to test the heterogeneity of market concentration.

This paper focuses on the coefficient of treat × post × HHI, and the regression results are shown in Column (1) of Table 8. The coefficient of treat × post × HHI is significantly negative at 5%, indicating that the promotion effect of the NEPL on green investment is more significant for enterprises with low market concentration. Therefore, it can be considered that market concentration is one of the heterogeneous factors that affect the role of the NEPL. Zhou and Zhao (2022) also found that market competition positively moderated the relationship between environmental regulation and corporate green investment, which is consistent with our findings.

6.2 The level of government environmental governance

Due to the particularity of green investment, it is difficult to bring economic benefits to enterprises in a short term, so enterprises often lack adequate motivation for green investment. Government involvement is considered as an effective way to deal with market failure in environmental governance (Porter & Linde, 1995). Joo et al. (2018) hold that the government can improve corporate’s environmental performance by providing information support and environmental subsidies for enterprises, enhancing environmental education, and helping enterprises carry out environmental certification. Government environmental information disclosure is conducive to clarifying those key polluters, corporate environmental violations, environmental inspections and petitions, which may help ENGOs and other forces from the public level gain access to environmental information and public supervision. As an informal regulation, public supervision widens the channels for monitoring heavily polluting enterprises and further increases the difficulty and cost of regulation capture (Zhang et al., 2022). Moreover, government investment in pollution control can demonstrate the determination of environmental governance and reduce the impact of policy uncertainty on corporate’s environmental decision-making. After the introduction of the NEPL, the government investment in pollution control has deterred pollution by strengthening pollution monitoring and law enforcement. Meanwhile, it has aroused corporate enthusiasm for green investment through environmental subsidies and green procurement. This paper measures the level of government environmental governance from government environmental information disclosure and pollution control investment. Specifically, the Pollution Information Transparency Index (PITI) and the regional pollution control investment (Env_Treatinv) are used as proxies for grouped regression according to the median of the sample. The data are all from the CSMAR database.

Table 8 displays the results. The coefficient of treat × post on the group with a poorer level of government environmental governance is positive but not significant, while the coefficient of treat × post on the group with a higher level of government environmental governance is significantly positive at 10%, which is more statistically and economically significant than the coefficient on the other group. To test the inter-group differences in coefficients, we use the chow test. The result shows that inter-group differences in coefficients are significant at 1 and 10%, respectively, which meets the chow test. Based on the results of grouped regression and chow test, it can be found that a higher level of government environmental governance is conducive to promoting corporate’s green investment.

6.3 Enterprises’ size

Due to the scale effect, large-scale enterprises are well-funded and are not sensitive to the compliance costs brought by the NEPL. Simultaneously, they are often an essential source of local tax revenue. Under the growth mode of obsessing over GDP in the past, large-scale enterprises with higher revenues play an essential role in the assessment system of officials. Local governments are closely related to enterprises, especially large-scale enterprises with considerable profits (Dong et al., 2016; Li, 2022). Therefore, large-scale enterprises have stronger bargaining power than the SMEs when facing increasingly stringent environmental regulations and tend to evade environmental governance. In order to test whether the impact of the NEPL on green investment varies from enterprise size, this paper divides enterprises into different scale groups according to operating income. We regard the enterprises whose operating income is higher than the median as large-scale enterprises and others as small- and medium-sized enterprises. Regression is performed on the two groups based on the model (1). Columns (1) and (2) of Table 9 display the results.

The inter-group differences in coefficients under the chow test are significantly significant at 1%. While the coefficient of treat × post on large enterprises is positive but not significant, the coefficient on SMEs is significant at 5%, which shows that the NEPL has a more significant role in promoting green investment of SMEs. Cheng et al. (2022) pointed out the phenomenon of the green tax forcing firms that heavily pollute to significantly improve their green investment levels is more salient for large firms.

6.4 Financial performance

Companies with better financial performance are more likely to spontaneously improve environmental performance (Blanco et al., 2009). Environmental activities such as pollution control will increase the burden on enterprises, and better financial performance can offset the impact of environmental costs on regular business operations. Simultaneously, improving environmental performance will make enterprises favored by consumers (Xiang et al., 2020) and solidify their legitimacy (Li et al., 2018). Driven by the desire to maintain their competitive edge, enterprises with better financial performance will invest more resources in environmental protection (de Burgos-Jiménez et al., 2013). Thus, this study believes that the promotion effect of the NEPL on green investment may be more significant for enterprises with better financial performance. We refer to the practice of Iwata and Okada (2011) and use ROA as the proxy of financial performance to test the idea. Enterprises with ROA higher than the median are divided into groups with better financial performance, and the others are in groups with poorer financial performance. Similarly, we perform regression on the two groups based on model (1).

The results are shown in columns (3) and (4) of Table 9. The inter-group differences in coefficients under the chow test are significantly significant at 1%. In the group with poorer financial performance, the coefficient of treat × post is positive but not significant. While in the group with better financial performance, the coefficient is significantly positive at 5%, indicating that the NEPL has more promoted green investment in enterprises with better financial performance.

6.5 Equity incentives

Because corporate’s investment decisions on environmental protection are mainly made by executives, their attitudes and behaviors determine the formulation and implementation of corporate environmental strategy. In the short term, executive pay is often derived from the corporate profits they create. However, green investment will crowd out productive investment, which may diminish corporate productivity and profits in the short term. Therefore, the executive pay will take a knock, which may force executives to give up green investments (Patricia et al., 1991). Executives motivated by equity incentives will pay more attention to long-term profitability and corporate image (Jensen & Meckling, 1976). In the long run, green investment can bring lasting market competitiveness, increasing enterprise value. For executives with equity incentives, their holdings will also appreciate. Therefore, after the implementation of the NEPL, the higher the degree of equity incentives, the more significant the increase in corporate green investment. According to this idea, this paper uses the number of shares held by executives (Share) to proxy the degree of equity incentive. Similarly, with the median number of shares held by executives in the samples, the enterprises are divided into two groups for regression.

Columns (5) and (6) of Table 9 show the results. When the test of inter-group differences in coefficients is passed, the coefficient of treat × post on enterprises with a lower degree of equity incentive is positive but not significant. At the same time, the coefficient of treat × post on enterprises with a higher degree of equity incentives is significantly positive at 5%, showing that the NEPL has a more substantial promotion effect on enterprises with a higher degree of equity incentives.

7 Conclusions and policy implications

Under the background of increasing emphasis on ESG and sustainable development, this paper takes the introduction of China’s new environmental protection law as an event shock and uses the data of Chinese listed companies and DID method to test the impact of environmental regulation on corporate green investment. Further, we try to study the mechanism and heterogeneity of the NEPL, drawing the following conclusions. Firstly, after baseline regression and a series of robustness tests, this paper finds that the introduction of the NEPL has significantly promoted the green investment of heavily polluting enterprises. Secondly, further mechanism analysis shows that the new NEPL promotes corporate’s green investment through improving environmental disclosure, strengthening environmental enforcement, and increasing financing constraints. Thirdly, in terms of regional heterogeneity, the NEPL reveals a more significant role in promoting green investment in regions with high market concentration than in regions with low market concentration. Simultaneously, the NEPL shows a more significant impact in regions with a higher level of government environmental governance. Fourthly, when analyzing the firm heterogeneity from enterprise size, financial performance, and equity incentives, this paper discovers that the effect of the NEPL is more potent for small- and medium-sized enterprises (SMEs), enterprises with better financial performance and with higher degree of equity incentive.

According to the above conclusions, this paper puts forward the following policy recommendations. (1) We should strengthen environmental supervision and introduce diversified supervision tools. In view of the incentive effect of environmental regulation on green investment of enterprises, regional regulatory agencies need to strictly implement environmental regulatory requirements and improve the efficiency of environmental protection law enforcement and the level of rule of law. Because NEPL is essentially a diversified regulatory tool, its emphasis on pollution charges, fines and public participation makes it have the characteristics of dual supervision based on market and public participation, which greatly strengthens its deterrent effect on pollution enterprises. Therefore, when strengthening environmental protection supervision, we should also pay attention to giving full play to the role of market incentives and public participation in diversified supervision methods in limiting enterprise pollution emissions, and force enterprises to increase green investment based on cost pressure and environmental benefits. (2) In view of the differences in policy effects, we should avoid one size fits all policies and adopt precise policies. While strengthening environmental supervision, we can consider introducing supporting policies to stimulate enterprises’ green investment intentions, so as to fully mobilize enterprises’ enthusiasm for environmental governance. For example, the government provides environmental protection technology support, environmental management experience and skills training, special environmental technology subsidies, environmental protection investment tax incentives, etc., to reduce the cost of environmental protection investment and strengthen their green investment motivation. In addition, from the perspective of social reputation, enterprises that actively increase green investment should be publicized in various ways to improve their social image by promoting “intangible assets.” (3) Eliminate the evaluation system that plagues local GDP, and gradually incorporate environmental governance into the evaluation system of local officials. Blindly linking the promotion of officials to regional GDP can easily lead to collusion between local governments and enterprises, and reduce the effect of environmental supervision. At the same time, more effective measures should be taken to strengthen the central supervision of local environmental governance, prevent collusion in environmental governance, and ultimately investigate the pollution responsibility of officials. For example, the Central Ecological and Environmental Protection Patrol System should be thoroughly implemented, urging local authorities to attach importance to environmental protection, take the initiative to assume regulatory responsibility, and force enterprises to invest in environmental protection. (4) Equity incentives for senior executives should be increased. The executives’ attitude toward green investment determines the efficiency of green investment. Through equity incentive, executives’ self-interest and long-term corporate interests are tied together, which is conducive to encouraging them to attach importance to green investment.

There may be some limitations in this study, which provide the following directions for future research. First, due to the availability of data, we only discuss the effect of environmental regulation on heavily polluting industries at a general macro-level. The heavily polluting industries also contain specific industries and future researchers can extend the issue to a more specific industry, such as the food industry, medical industry, and chemical industry. Similarly, future researchers can conduct specific tests on different aspects of the law, such as environmental regulation on atmosphere, water and the like. Second, due to the short implementation period of the environmental protection law, the time observed in this paper is only from 2015 to 2019. It examines the short-term effect of the NEPL on corporate environmental investment. With the deepening of the policy implementation, the long-term impact of the policy is the main direction of future research. Third, corporate’s green investment is the result of multiple environmental regulations and environmental law is only a part of them. Further studies should examine a more comprehensive set of environmental regulations.

Notes

The 23 industries are as follows: Coal mining and dressing industry (B06); Oil and natural gas exploitation industry (B07); Ferrous metal ore mining and dressing industry(B08); Non-ferrous metal ore mining and dressing industry (B09); Non-metallic ore mining and dressing industry (B10); Exploitation auxiliary activities (B11); Alcohol, beverage and refined tea manufacturing (C15); Textile industry (C17); Textile garment and apparel industry (C18); Leathers, furs, feathers and related products and footwear industry (C19); Papermaking and paper product industry (C22); Industries of petroleum processing, coking, and nuclear fuel processing (C25); Manufacturing of chemical raw materials and chemical products (C26); Chemical fiber manufacturing (C28); Industry of rubber and plastic products (C29); Industry of non-metallic mineral products (C30); Industry of ferrous metal smelting and rolling processing (C31); Industry of non-ferrous metal smelting and rolling processing (C32); Metal product industry (C33); Industry of electric power and heat production and supply (D44); Gas production and supply industry (D45); Construction installation industry (E49); Architectural decoration and other construction industries (E50).

Hebei, Heilongjiang, Jiangsu, Jiangxi, Henan, Guangxi, Yunnan, Ningxia, Beijing, Shanghai, Hubei, Guangdong, Chongqing, Shaanxi and Gansu.

Beijing, Hebei, Shanxi, Shandong, Jiangsu, Henan, Hunan, Guangxi, Hainan, Sichuan, Chongqing and Guizhou.

According to the classification criteria of Hithink RoyalFlush, there are 14 heavily polluting industries: Coal mining and dressing industry (B06);Oil and natural gas exploitation industry (B07); Ferrous metal ore mining and dressing industry (B08); Agricultural and sideline food processing industry (C13); Alcohol, beverage and refined tea manufacturing (C15); Textile garment and apparel industry (C18); Leathers, furs, feathers and related products and footwear industry (C19); Papermaking and paper product industry (C22); Manufacturing of chemical raw materials and chemical products (C26); Pharmaceutical industry (C27); Industry of rubber and plastic products (C29); Industry of non-metallic mineral products (C30); Industry of non-ferrous metal smelting and rolling processing (C32); Industry of electric power and heat production and supply (D44).

References

Antweiler, W., Copeland, B. R., & Taylor, M. S. (2001). Is free trade good for the environment? The American Economic Review, 91(4), 877–908.

Bahta, D., Yun, J., Islam, M. R., & Bikanyi, K. J. (2021). How does CSR enhance the financial performance of SMEs? The mediating role of firm reputation. Economic Research-Ekonomska Istraživanja, 34(1), 1428–1451.

Beck, T., Levine, R., & Levkov, A. (2010). Big bad banks? The winners and losers from bank deregulation in the United States. The Journal of Finance, 65(5), 1637–1667.

Bertrand, M., Duflo, E., & Mullainathan, S. (2004). How much should we trust differences-in-differences estimates? The Quarterly Journal of Economics, 119(1), 249–275.

Blanco, E., Rey-Maquieira, J., & Lozano, J. (2009). The economic impacts of voluntary environmental performance of firms: a critical review. Journal of Economic Surveys, 23(3), 462–502.

Boomhower, J. (2019). Drilling like there’s no tomorrow: bankruptcy, insurance, and environmental risk. American Economic Review, 109(2), 391–426.

Cai, W., & Xu, F. (2022). The impact of the new environmental protection law on eco-innovation: Evidence from green patent data of Chinese listed companies. Environmental Science and Pollution Research, 29(7), 10047–10062.

Cai, W., & Ye, P. (2020). How does environmental regulation influence enterprises’ total factor productivity? A quasi-natural experiment based on China’s new environmental protection law. Journal of Cleaner Production, 276, 124105.

Chang, K. C., Wang, D., Lu, Y., Chang, W., Ren, G., Liu, L., & Zhou, X. (2021). Environmental regulation, promotion pressure of officials, and enterprise environmental protection investment. Frontiers in Public Health, 9, 724351.

Chen, J., Huang, J., Huang, X., Sun, S., Hao, Y., & Wu, H. (2020). How does new environmental law affect public environmental protection activities in China? Evidence from structural equation model analysis on legal cognition. Science of the Total Environment, 714, 136558.

Cheng, B., Qiu, B., Chan, K. C., & Zhang, H. (2022). Does a green tax impact a heavy-polluting firm’s green investments? Applied Economics, 54(2), 189–205.

Clarkson, C., Maharaj, V. J., Crouch, N. R., Grace, O. M., Pillay, P., Matsabisa, M. G., Bhagwandin, N., Smith, P. J., & Folb, P. I. (2004). In vitro antiplasmodial activity of medicinal plants native to or naturalised in South Africa. Journal of Ethnopharmacology, 92(2–3), 177–191.

Crafts, N. (2006). Regulation and productivity performance. Oxford Review of Economic Policy, 22(2), 186–202.

De Burgos-Jiménez, J., Vázquez-Brust, D., Plaza-Úbeda, J. A., & Dijkshoorn, J. (2013). Environmental protection and financial performance: An empirical analysis in Wales. International Journal of Operations & Production Management, 33(8), 981–1018.

Dong, Z., Wei, X., & Zhang, Y. (2016). The allocation of entrepreneurial efforts in a rent-seeking society: Evidence from China. Journal of Comparative Economics, 44(2), 353–371.

Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: social values and organizational behavior. The Pacific Sociological Review, 18(1), 122–136.

Du, K., Li, P., & Yan, Z. (2019). Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technological Forecasting and Social Change, 146, 297–303.

Eyraud, L., Clements, B., & Wane, A. (2013). Green investment: trends and determinants. Energy Policy, 60, 852–865.

Fang, Z., Kong, X., Sensoy, A., Cui, X., & Cheng, F. (2021). Government’s awareness of environmental protection and corporate green innovation: A natural experiment from the new environmental protection law in China. Economic Analysis and Policy, 70, 294–312.

Fugui, L., Bing, X., & Bing, X. (2008). Improving public access to environmental information in China. Journal of Environmental Management, 88(4), 1649–1656.

Geng, Y., Liu, W., Li, K., & Chen, H. (2021). Environmental regulation and corporate tax avoidance: A quasi-natural experiment based on the eleventh Five-Year Plan in China. Energy Economics, 99, 105312.

Gray, W. B., Shadbegian, R. J., Wang, C., & Meral, M. (2014). Do EPA regulations affect labor demand? Evidence from the pulp and paper industry. Journal of Environmental Economics and Management, 68(1), 188–202.

Gu, Y., Ho, K.-C., Yan, C., & Gozgor, G. (2021). Public environmental concern, CEO turnover, and green investment: Evidence from a quasi-natural experiment in China. Energy Economics, 100, 105379.

Guo, M., Kuai, Y., & Liu, X. (2020). Stock market response to environmental policies: Evidence from heavily polluting firms in China. Economic Modelling, 86, 306–316.

Hadlock, C. J., & Pierce, J. R. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Review of Financial Studies, 23(5), 1909–1940.

Huang, L., & Lei, Z. (2021). How environmental regulation affect corporate green investment: Evidence from China. Journal of Cleaner Production, 279, 123560.

Iwata, H., & Okada, K. (2011). How does environmental performance affect financial performance? Evidence from Japanese manufacturing firms. Ecological Economics, 70(9), 1691–1700.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jin, Y., Gu, J., & Zeng, H. (2020). Will changing environmental protection fees to taxes affect corporate performance? Accounting Research, (05), 117–113. (in Chinese).

Joo, H.-Y., Seo, Y.-W., & Min, H. (2018). Examining the effects of government intervention on the firm’s environmental and technological innovation capabilities and export performance. International Journal of Production Research, 56(18), 6090–6111.

Lai, C. S., Chiu, C. J., Yang, C. F., & Pai, D. C. (2010). The effects of corporate social responsibility on brand performance: The mediating effect of industrial brand equity and corporate reputation. Journal of Business Ethics, 95(3), 457–469.

Leiter, A. M., Parolini, A., & Winner, H. (2011). Environmental regulation and investment: Evidence from European industry data. Ecological Economics, 70(4), 759–770.

Li, D., Huang, M., Ren, S., Chen, X., & Ning, L. (2018). Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. Journal of Business Ethics, 150(4), 1089–1104.

Li, W., Zheng, M., Zhang, Y., & Cui, G. (2020). Green governance structure, ownership characteristics, and corporate financing constraints. Journal of Cleaner Production, 260, 121008.

Li, Z. (2022). Government-enterprise relation, financing plight and enterprise growth: empirical evidence from world bank on chinese firms. Amfiteatru Economic, 24(59), 214–235.

Liang, H., Wang, Z., & Niu, R. (2022). Does environmental regulations promote the green transformation of high polluters? Applied Economics Letters, 30(7), 1–5.

Liao, X., & Shi, X. (2018). Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy, 119, 554–562.

Liu, Q., & Qiu, L. D. (2016). Intermediate input imports and innovations: Evidence from Chinese firms’ patent filings. Journal of International Economics, 103, 166–183.

Liu, X., Wang, E., & Cai, D. (2018). Environmental regulation and corporate financing—quasi-natural experiment evidence from China. Sustainability, 10(11), 4028.

Liu, X., Xu, H., & Lu, M. (2021a). Do auditors respond to stringent environmental regulation? Evidence from China’s new environmental protection law. Economic Modelling, 96, 54–67.

Liu, Y., Wang, A., & Wu, Y. (2021b). Environmental regulation and green innovation: Evidence from China’s new environmental protection law. Journal of Cleaner Production, 297, 126698.

Meng, X. H., Zeng, S. X., Leung, A. W. T., & Tam, C. M. (2015). Relationship between top executives’ characteristics and corporate environmental responsibility: Evidence from China. Human and Ecological Risk Assessment: An International Journal, 21(2), 466–491.

Moser, D. V., & Martin, P. R. (2012). A broader perspective on corporate social responsibility research in accounting. The Accounting Review, 87(3), 797–806.

Patricia, M., Dechow, R., & Sloan, G. (1991). Executive incentives and the horizon problem: An empirical investigation. Journal of Accounting and Economics, 14(1), 1–89.

Pigou, A. C. (1933). The economics of welfare. The Economic Journal, 43(170), 329–330.

Porter, M. E., & van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives, 9(4), 97–118.

Ren, S., Hao, Y., & Wu, H. (2022). How does green investment affect environmental pollution? Evidence from China. Environmental and Resource Economics, 81(1), 25–51.

Siedschlag, I., & Yan, W. (2021). Firms’ green investments: What factors matter? Journal of Cleaner Production, 310, 127554.

Sung, N. (2014). Market concentration and competition in OECD mobile telecommunications markets. Applied Economics, 46(25), 3037–3048.

Tang, C., Zhao, L., & Zhao, Z. (2020a). Does free education help combat child labor? The effect of a free compulsory education reform in rural China. Journal of Population Economics, 33(2), 601–631.

Tang, K., Qiu, Y., & Zhou, D. (2020b). Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Science of the Total Environment, 712, 136362.

Thompson, P. (1998a). Assessing the environmental risk exposure of UK banks. International Journal of Bank Marketing, 16(3), 129–139.

Thompson, P. (1998b). Bank lending and the environment: Policies and opportunities. International Journal of Bank Marketing, 16(6), 243–252.

Thompson, P., & Cowton, C. J. (2004). Bringing the environment into bank lending: Implications for environmental reporting. The British Accounting Review, 36(2), 197–218.

Tian, M., Xu, G., & Zhang, L. (2019). Does environmental inspection led by central government undermine Chinese heavy-polluting firms’ stock value? The buffer role of political connection. Journal of Cleaner Production, 236, 117695.

Wagner, M. (2003). The Porter hypothesis revisited: a literature review of theoretical models and empirical tests. University Library of Munich, Germany: Public Economics 0407014.

Wang, A., Hu, S., & Li, J. (2021). Does economic development help achieve the goals of environmental regulation? Evidence from partially linear functional-coefficient model. Energy Economics, 103, 105618.

Weche, J. P. (2019). Does green corporate investment crowd out other business investment? Industrial and Corporate Change, 28(5), 1279–1295.

Xiang, X., Liu, C., Yang, M., & Zhao, X. (2020). Confession or justification: The effects of environmental disclosure on corporate green innovation in China. Corporate Social Responsibility and Environmental Management, 27(6), 2735–2750.

Zhang, B., Cao, C., Gu, J., & Liu, T. (2016). A new environmental protection law, many old problems? Challenges to environmental governance in China. Journal of Environmental Law, 28(2), 325–335.

Zhang, H., Xu, T., & Feng, C. (2022). Does public participation promote environmental efficiency? Evidence from a quasi-natural experiment of environmental information disclosure in China. Energy Economics, 108, 105871.

Zhou, X., & Zhao, X. (2022). Does diversified environmental regulation make FDI cleaner and more beneficial to China’s green growth? Environmental Science and Pollution Research, 29(3), 3487–3497.

Funding

This paper is supported by the following projects: Guangdong Provincial Philosophy and Social Sciences Planning Project “Digital Empowerment and Manufacturing Global Value Chain Climbing: Theoretical Logic and Guangdong Practice” (GD22YYJ16); Project of the 14th Five-Year Plan for the Development of Philosophy and Social Sciences in Guangzhou, “Research on Building a Strong City of Modern Service Industry in Guangzhou: Based on the Perspective of collaborative governance of Digital Transformation” (2022GZQN06); Guangdong Philosophy and Social Sciences Planning Project “Digital Transformation and Green Development of Guangdong Enterprises: Theoretical Logic and Empirical Evidence” (GD23GJ113); Guangdong Province Innovation Training Project “Spatial Layout of Digital Service Industry and Upgrading of China's Manufacturing Value Chain: Coordination or Disharmony”.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article