Abstract

With a rapid growth of research in multi-objective transportation problem, rough and bi-rough sets are two new mathematical ideas for formulating real-world-based problems involving uncertain data. In this study, we have investigated a two-stage multi-objective transportation problem by considering credit period policy under rough and bi-rough environments. In this regard, three conflicting objective functions have been optimized simultaneously under the same restrictions. In first objective function, we have presented the minimization of transportation cost of a production house. In second objective function, total transportation cost of retailers has been minimized. But, in last one, we have maximized total profit of distributors. Besides, due to existence of different types of uncertainties in our real-life problems, in the proposed model, independent parameters (including, actual transportation cost, requirement of the retailers, and cost per unit distance) have been considered as rough in nature and dependent parameters such as demanded transportation cost and demand of the distributors have been considered as bi-rough in nature. Moreover, to convert the uncertain model into an equivalent deterministic form, a rough and bi-rough programming approach has been derived along with the expected value approach. Finally, by using these ideas, the mathematical model of our considered transportation problem has been illustrated. After that, the proposed model has been solved by applying NSGA-II algorithm (elitist non-dominated sorting genetic algorithm) with some simulated numerical data. Some sensitivity analysis associated with our proposed model has also been discussed to show the effectiveness of the model.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The economy of a country is accelerated with the progress of a business, trade, and factory. Again, the enrichment in these depends on a transportation system. That is why, the transportation system is the backbone of a country’s economy. So, the research on transportation system is very essential component in the growth of economy in a country. In 1941, Hitchcock first presented a transportation problem (Hitchcock 1941) in mathematical way. The main objective of such problem is to make a perfect decision on the transported amount along each path so that the total transportation cost is minimum. After that, many researchers like Koopmans (1949), Charnes and Cooper (1954), Kantorovich (1960), Balinski (1961), Yang and Liu (2007), Yang and Feng (2007), Ojha et al. (2009, 2013), Xie and Jia (2012), Raj and Rajendran (2012), Chen et al. (2017a), Roy et al. (2019), Sangaiah et al. (2019) and others worked on transportation problem.

Now, it is observed that in above-described researches, the items have been transported directly from a production house to retailers, but in real business world, the items are shipped from a production house to retailers through some distributors. So, there should be some stages of transportation which is known as multi-stage transportation problem. Till now, very few studies on multi-stage transportation problem have been done. For example, Das et al. (2016), Gen et al. (2006), as well as Raj and Rajendran (2012) formulated some multi-stage transportation problems to minimize the transportation cost only. Also, Pramanik et al. (2015) studied a two-stage transportation problem to maximize the profit of a transportation system. From these studies, it is seen that all research works on multi-stage transportation problem had been done with a single-objective nature considering either transportation cost or profit of the system only. But, it is not desirable because in reality there may exist more than one objective associated with a transportation problem which are needed to be optimized simultaneously. Because of this, in recent times, a multi-objective transportation problem is an interesting area in the transportation research. The concept of a multi-objective transportation problem had been invented by Lee and Moore (1973). After that, Yang and Feng (2007), Ojha et al. (2009), Chen et al. (2017b), Sifaoui and Aïder (2019), and Majumder et al. (2019b) worked on transportation problem to optimize several goals such as profit, transportation time, fuel consumption, breakability of a transportation system. But, from the literary lessons on transportation research our observation is that till now no one has considered a multi-stage transportation problem with multi-objective nature which motivates us to consider a transportation model to transport the goods from a production house to some retailers through some distributors with three objective functions.

Again, it is noted that the fixed charge, which means some constant prices other than the variable cost, is an important factor in a transportation problem. The examples of some fixed charges in transportation problem are toll tax, permit fee, tax for crossing state border, etc. Many researchers like Yang and Liu (2007), Yang and Feng (2007), Raj and Rajendran (2012), Pramanik et al. (2015), Ojha et al. (2010a), Xie and Jia (2012), Hashmi et al. (2019), Shen and Zhu (2020) formulated some transportation problems considering fixed charges depending on route only because of the consideration of a homogenous type of vehicles in the system. But, in reality, it is seen that a production house may have different types of vehicles for transportation. When different types of vehicles are used in a system, then the fixed charge not only depends on a route but also type of vehicles. Till now, there is no work on transportation problem considering fixed charges on both the vehicle type and associated path in a system. That is why, we have motivated to consider a restricted fixed charge depending on both the paths and vehicle types in the proposed model.

Now, in a business system the credit period has a vital role to influence the partners in that system. It is very well known in inventory management. There is many applications of credit period policy in an inventory system such as Banu and Mondal (2018), Panja and Mondal (2019), Das et al. (2014). Now, since in a multi-stage transportation system, there are some distributors and retailers, so to influence the retailers, distributors may offer a credit period. But, there is no research paper on transportation problem in which the credit period policy has been considered. For this reason, the proposed model has been developed under a credit period policy.

To deal with reality, almost every system in the real world has been developed depending on some uncertainties. The reasons behind these uncertainties are lack of information, fluctuating of the markets, inexperienced expert prediction, etc. Therefore, it is a natural fact to have uncertainties and vagueness in a transportation problem. The uncertainty is described by different ways such as stochastic theory, fuzzy set theory (Zadeh 1965), uncertainty theory (Liu 2007), rough set theory (Pawlak 1982). In stochastic environment, input data are imprecise in the stochastic sense and described by random variables with a known probability distribution function. Ojha et al. (2010b), Khalilpourazari and Khalilpourazary (2018), Roghanian and Pazhoheshfar (2014), and many others had worked on transportation problem by considering the nature of system’s parameters as stochastic. When there is a large variance in the parametric values in a system, we should deal with this by uncertainty theory. In uncertainty theory, the uncertainty is measured by a belief degree. A lot of works on transportation problem like Zhang et al. (2016), Sifaoui and Aïder (2019), Dalman (2019), Majumder et al. (2019a), Chen et al. (2017c, 2017d), Zhao and Pan (2020), Kara et al. (2019), as well as Shen and Zhu (2020) had been done using uncertainty theory. In fuzzy set theory, the uncertainty is described by membership function whose range is [0, 1]. Many researches such as Ojha et al. (2013, 2014), Das et al. (2016), Samanta and Mondal (2015); Samanta et al. (2018), Chakraborty and Chakraborty (2010), Baykasoglu and Subulan (2019), Mahmoodirad et al. (2019), Tirkolaee et al. (2020) had been done on transportation problem under different types of fuzzy environments. Moreover, in rough set theory, the uncertainty is measured by the approximation of a set into two crisp sets which are known as lower approximation set and upper approximation set. Here, the lower approximation set contains the surely belonging elements, while the upper approximation set contains the possible belonging elements. Now, the boundary region is obtained by separating the elements of lower approximation set from the elements of upper approximation set. If this boundary set is empty, then the considered set is crisp; otherwise, it is known as rough set. It is noted that, in rough set theory, lower approximation and upper approximation sets are crisp in nature so the boundaries of these two sets must be fixed. When the uncertainty in a problem is handled using rough set theory, then it is known that the problem is under rough environment. Till now, very few researchers (Kundu et al. 2013, 2017; Das et al. 2017) had worked on transportation problem under rough environment.

On the other hand, if boundaries of lower approximation and upper approximation sets are not fixed, i.e., they are again rough set, then the considered set is known as bi-rough set. So, it is an extension of rough set theory. Here, the uncertainty is considered in two directions, i.e., in interior points and boundary points in the set. In this way, in bi-rough set theory, a two-dimensional concept of rough set theory has been imposed. When the uncertainty in a problem is handled using bi-rough set theory, then it is known that the problem is under bi-rough environment. At our best knowledge, till now, no one has studied a transportation problem in bi-rough environment. In Tables 1 and 2, some comparative studies of recent works with the present work on transportation problem have been illustrated under different uncertain frame work.

In this research, we have worked out on a multi-objective transportation problem in rough and bi-rough environments under a credit period policy depending on the requirements of the retailers to transport the items from a production house to some retailers through some distributors by minimizing the transportation cost of the production house and retailers as well as by maximizing total profit of the distributors. For using different types of vehicles in the first stage of the model, a restricted fixed charge is considered depending on both the types of vehicles and associated paths. Also, a credit period is offered by the distributers to those retailers whose requirements are more than a threshold value in the second stage. To convert the uncertain model into an equivalent deterministic form, two different approaches, namely, an expected value approach together with a rough and bi-rough programming approach, have been proposed. For the optimal solutions, we have used one of the best evolutionary algorithm NSGA-II (elitist non-dominated sorting genetic algorithm). Finally, a numerical example has been considered to verify the feasibility of the proposed model.

The main contributions of this study are as follows:

-

This is the first work to analyze a transportation problem to investigate the benefit of the distributors along with a production house and retailers simultaneously.

-

For the first time ever, a restricted fixed charge has been allowed depending on both the varieties of vehicles and associated paths in a transportation problem.

-

A credit period policy has been considered to influence the retailers depending on their requirements which is a new concept in transportation problem.

-

To make the transportation system more realistic, the model has been constructed under rough and bi-rough environments, which no one has ever done before.

-

To convert the uncertain model into deterministic form, two different approaches such as expected value approach as well as rough and bi-rough programming approach have been proposed.

The remaining parts of this paper have been organized as follows: In Sect. 2, we have discussed the basic concepts of rough and bi-rough set theory. The main theme of this study, i.e., the problem definition, is presented in Sect. 3. Section 4 describes the mathematical formulation of this study with assumptions and notations. The process of converting into deterministic form is addressed in Sect. 5. In Sect. 6, the solution methodologies have been introduced. In Sect. 7, some numerical experiments and sensitivity analysis are illustrated. Finally, a conclusion for this work is drawn in Sect. 8.

2 The concept of rough and bi-rough set theory

In this section, firstly, the definitions of rough and bi-rough sets have been defined in interval form which are used to represent the uncertainty in this paper; then, some arithmetic operations and properties have been discussed for the purpose of this study.

Definition of rough set in interval form A set with uncertainty is said to be a rough set in interval form if it is approximated into two crisp sets in interval form, namely upper approximation set and lower approximation set, and it is defined as \(\hat{A}=([a_{1},~b_{1}],~[c_{1},~ d_{1}])\) where \(a_{1}\), \(b_{1}\), \(c_{1}\), and \(d_{1}\) are real numbers with the condition \(c_{1}\le a_{1}\le b_{1}\le d_{1}\). Here, \([a_{1},~b_{1}]\) is the lower approximation set, while \([c_{1},~d_{1}]\) is the upper approximation set.

Definition of bi-rough set in interval form A set with uncertainty is said to be a bi-rough set in interval form if it is approximated into two interval rough sets, namely upper approximation set and lower approximation set, and it is defined as \(\hat{\hat{\varsigma }}_{1}=([\hat{A}-k_{1},~\hat{A}+l_{1}], ~[\hat{A}-m_{1},~\hat{A}+n_{1}])\) where \(\hat{A}\) is the rough set associated with the bi-rough set \(\hat{\hat{\varsigma }}_{1}\) and \(k_{1}\), \(l_{1}\), \(m_{1}\), and \(n_{1}\) are all real numbers with conditions \(k_{1}\le m_{1}\) and \(l_{1}\le n_{1}\).

2.1 Arithmetic operations on rough set

To illustrate the arithmetic operations on rough set, we have considered two rough sets \(\hat{A}\) and \(\hat{B}\) where \(\hat{A}=([a_{1},~b_{1}],~[c_{1},~d_{1}])\) and \(\hat{B}=([a_{2},~b_{2}],~[c_{2},~d_{2}])\) and \(a_{1}\), \(b_{1}\), \(c_{1}\), \(d_{1}\), \(a_{2}\), \(b_{2}\), \(c_{2}\), and \(d_{2}\) are real numbers with the conditions \(c_{1}\le a_{1}\le b_{1}\le d_{1}\) as well as \(c_{2}\le a_{2}\le b_{2} \le d_{2}\).

-

Addition The addition of two rough sets (Liu 2004) \(\hat{A}\) and \(\hat{B}\) has been defined as:

$$\begin{aligned}&\hat{A}+\hat{B}=([a_{1}+a_{2},~b_{1}+b_{2}],~[c_{1}+c_{2},~d_{1}+d_{2}]). \end{aligned}$$ -

Scalar multiplication Here, we have discussed about scalar (both positive and negative) multiplication (Liu 2004) with a rough set \(\hat{A}\) as:

$$\begin{aligned} \varpi .\hat{A} = \left\{ \begin{array}{ll} ([\varpi .a_{1},~\varpi .b_{1}],~[\varpi .c_{1},~\varpi .d_{1}]), &{}\quad \text{ if } \quad \varpi \ge 0 \\ ([\varpi .b_{1},~\varpi .a_{1}],~[\varpi .d_{1},~\varpi .c_{1}]), &{}\quad \text{ if } \quad \varpi <0 \\ \end{array}\right. \end{aligned}$$where \(\varpi \) is a real number.

Lemma 1

If \(\hat{A}=([a_{1},~b_{1}],~[c_{1},~d_{1}])\) and \(\hat{B}=([a_{2},~b_{2}],[c_{2},~d_{2}])\) are two rough sets, then

where \(a_{1}\), \(b_{1}\), \(c_{1}\), \(d_{1}\), \(a_{2}\), \(b_{2}\), \(c_{2}\), and \(d_{2}\) are all real numbers with the conditions \(c_{1}\le a_{1}\le b_{1}\le d_{1}\) and \(c_{2}\le a_{2}\le b_{2} \le d_{2}\).

Proof

It is given that

Now, it has to prove that \(c_{1}-d_{2} \le a_{1}-b_{2} \le b_{1}-a_{2}\le d_{1}-c_{2}\). Since \(c_{1}\le a_{1}\) and \(b_{2}\le d_{2}\) exist, so we have \(c_{1}+b_{2}\le a_{1}+d_{2}\) i.e., \(c_{1}-d_{2}\le a_{1}-b_{2}\). In similar way, it can be proved that \(a_{1}-b_{2} \le b_{1}-a_{2}\) and \(b_{1}-a_{2}\le d_{1}-c_{2}\). Combining these three inequalities, we have \(c_{1}-d_{2} \le a_{1}-b_{2} \le b_{1}-a_{2}\le d_{1}-c_{2}\). Again, following the above procedure, we get

Now, this is necessary to examine the existence of the inequality \(c_{2}-d_{1} \le a_{2}-b_{1} \le b_{2}-a_{1}\le d_{2}-c_{1}\). Since \(c_{2}\le a_{2}\) and \(b_{1}\le d_{1}\) both are given so using these we have \(c_{2}-d_{1} \le a_{2}-b_{1}\), and in similar way, the other inequalities \(a_{2}-b_{1} \le b_{2}-a_{1}\) and \(b_{2}-a_{1}\le d_{2}-c_{1}\) have been also proved. Finally, using these, it is obtained that \(c_{2}-d_{1} \le a_{2}-b_{1} \le b_{2}-a_{1}\le d_{2}-c_{1}\). Hence, this is the complete proof of subtraction of two rough sets. \(\square \)

Lemma 2

If \(\hat{A}=([a_{1}, ~b_{1}],~ [c_{1}, ~d_{1}])\) be a rough set and \(\varpi \) be real number, then

where \(a_{1}\), \(b_{1}\), \(c_{1}\), and \(d_{1}\) are all real numbers with condition \(c_{1}\le a_{1}\le b_{1}\le d_{1}\).

Proof

A real number \(\varpi \) can be written in rough form as \(([\varpi ,~ \varpi ], ~[\varpi , ~\varpi ])\).

Since \(c_{1}\le a_{1}\le b_{1}\le d_{1}\) satisfy and \(\varpi \) be any real number, so we have \(c_{1}+\varpi \le a_{1}+\varpi \le b_{1}+\varpi \le d_{1}+\varpi \). Hence, this is the complete proof of scalar addition with rough set. \(\square \)

Lemma 3

If \(\hat{A}=([a_{1}, ~b_{1}], ~[c_{1},~ d_{1}])\) be a rough set and \(\varpi \) be real number, then

where \(a_{1}\), \(b_{1}\), \(c_{1}\), and \(d_{1}\) are all real numbers with condition \(c_{1}\le a_{1}\le b_{1}\le d_{1}\).

Proof

This lemma can be proved easily like Lemma 2. \(\square \)

2.2 Arithmetic operations on bi-rough set

In this subsection, some arithmetic operations on bi-rough set have been also deduced.

Lemma 4

\(\hat{\hat{\varsigma }}_{1}=([\hat{A}-k_{1}, ~\hat{A}+l_{1}], ~[\hat{A}-m_{1}, ~\hat{A}+n_{1}])\) and \(\hat{\hat{\varsigma }}_{2}=([\hat{B}-k_{2},~ \hat{B}+l_{2}],~ [\hat{B}-m_{2}, ~\hat{B}+n_{2}])\) are two bi-rough sets in interval form, where \(\hat{A}\) and \(\hat{B}\) are the rough sets associated with the bi-rough sets \(\hat{\hat{\varsigma }}_{1}\) and \(\hat{\hat{\varsigma }}_{2}\), respectively. \(k_{1}\), \(k_{2}\), \(l_{1}\), \(l_{2}\), \(m_{1}\), \(m_{2}\), \(n_{1}\), and \(n_{2}\) are all real numbers with conditions \(k_{1}\le m_{1}\), \(l_{1}\le n_{1}\), \(k_{2}\le m_{2}\), and \(l_{2}\le n_{2}\) then

Proof

Using the concept of addition of rough sets, it has been proved that

Now, it is essential to show \((k_{1}+k_{2})\le (m_{1}+m_{2})\) and \((l_{1}+l_{2})\le (n_{1}+n_{2})\). Since \(k_{1}\le m_{1}\) and \(k_{2}\le m_{2}\) both are given, so we have \((k_{1}+k_{2})\le (m_{1}+m_{2})\) again \(l_{1}\le n_{1}\) and \(l_{2}\le n_{2}\) both imply \((l_{1}+l_{2})\le (n_{1}+n_{2})\). This is the complete proof of the addition of two bi-rough sets. \(\square \)

Lemma 5

\(\hat{\hat{\varsigma }}_{1}=([\hat{A}-k_{1},~ \hat{A}+l_{1}], ~[\hat{A}-m_{1}, ~\hat{A}+n_{1}])\) be a bi-rough set where \(\hat{A}\) is a rough set associated with the bi-rough set \(\hat{\hat{\varsigma }}_{1}\). \(k_{1}\), \(l_{1}\), \(m_{1}\), and \(n_{1}\) are all real numbers with conditions \(k_{1}\le m_{1}\) and \(l_{1}\le n_{1}\) then for any real number \(\varpi \),

Proof

For \(\varpi \ge 0\), using the concept of scalar multiplication on rough set, we have

Since \(k_{1}\le m_{1}\) and \(l_{1}\le n_{1}\) hold and \(\varpi \) be a non-negative real number, so it has been easily proved that \(\varpi .k_{1}\le \varpi .m_{1}\) and \(\varpi .l_{1}\le \varpi .n_{1}\).

Again, if \(\varpi < 0\), in similar way, it has been shown that

So, this is the complete proof of scalar multiplication. \(\square \)

Lemma 6

\(\hat{\hat{\varsigma }}_{1}=([\hat{A}-k_{1}, ~\hat{A}+l_{1}], ~[\hat{A}-m_{1},~ \hat{A}+n_{1}])\) and \(\hat{\hat{\varsigma }}_{2}=([\hat{B}-k_{2},~ \hat{B}+l_{2}], ~[\hat{B}-m_{2}, ~\hat{B}+n_{2}])\) are two bi-rough sets in interval form where \(\hat{A}\) and \(\hat{B}\) are the rough sets associated with the bi-rough sets \(\hat{\hat{\varsigma }}_{1}\) and \(\hat{\hat{\varsigma }}_{2}\), respectively. \(k_{1}\), \(k_{2}\), \(l_{1}\), \(l_{2}\), \(m_{1}\), \(m_{2}\), \(n_{1}\), and \(n_{2}\) are all real numbers with conditions \(k_{1}\le m_{1}\), \(l_{1}\le n_{1}\), \(k_{2}\le m_{2}\), and \(l_{2}\le n_{2}\) then

Proof

Using Lemma 4 and 5, it has been proved that

Now, It is essential to verify \((k_{1}+l_{2})\le (m_{1}+n_{2})\) and \((l_{1}+k_{2})\le (m_{2}+n_{1})\). Since \(k_{1}\le m_{1}\) and \(l_{2}\le n_{2}\) both are true so we have \((k_{1}+l_{2})\le (m_{1}+n_{2})\). Again, we have \((l_{1}+k_{2})\le (m_{2}+n_{1})\) from the given inequalities \(l_{1}\le n_{1}\) and \(k_{2}\le m_{2}\). This is the complete proof of subtraction on bi-rough sets. \(\square \)

2.3 Trust measure

In rough set theory, the uncertainty is measured by the trust (Liu 2004; Kundu et al. 2017). Trust is a measurable function from a rough space (\(\Omega \), \(\Gamma \), \(\Delta \), \(\pi \)) to [0, 1] where \(\Omega \) be a non-empty set, \(\Gamma \) be a \(\sigma \)-algebra of the subsets of \(\Omega \), \(\Delta \) be an element of \(\Gamma \), and \(\pi \) be non-negative real-valued function, is denoted by “Tr.” Let \(S\in \Gamma \), then the trust of the event S is defined as:

where

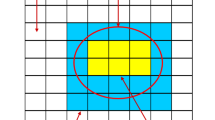

For example, let \(\hat{A}=([a_{1}, ~b_{1}], ~[c_{1}, ~d_{1}])\) (where \(a_{1}\), \(b_{1}\), \(c_{1}\), and \(d_{1}\) are all real numbers with \(c_{1}\le a_{1}\le b_{1}\le d_{1}\)) be a rough set. Then trust measure of the event \((\hat{A}\le r)\) (where r is a real number) is defined as follows:

Similarly, the trust of the event \((\hat{A}\ge r)\) has been described as

In Figs. 1 and 2, the graphical representation of trust measure of the events \(\hat{A}\le r\) and \(\hat{A}\ge r\) has been depicted, respectively.

The \(\alpha \)-optimistic value of a rough set \(\hat{A}\) has been prescribed as

Similarly, the \(\alpha \)-pessimistic value of \(\hat{A}\) has been prescribed as

2.4 Chance measure

The uncertainty of a bi-rough set has been identified by the chance measure (Liu 2004) and is denoted by “Ch.” Let \(\hat{\hat{\varsigma }}_{1}=([\hat{A}-k_{1},~ \hat{A}+l_{1}], ~[\hat{A}-m_{1}, ~\hat{A}+n_{1}])\) be a bi-rough set where \(\hat{A}\) is a rough set associated with the bi-rough set \(\hat{\hat{\varsigma }}_{1}\) and \(k_{1}\), \(l_{1}\), \(m_{1}\), and \(n_{1}\) are all real numbers with conditions \(k_{1}\le m_{1}\) and \(l_{1}\le n_{1}\), and B be a borel set, then the chance measure of the bi-rough event \((\hat{\hat{\varsigma }} \in B)\) is a function from (0, 1] to [0, 1] and is defined as

If

then we have

-

Let \(\hat{\hat{\varsigma }}_{1}\) be a bi-rough set and \(\beta \), \(\gamma \ \in \) (0, 1], then its \((\beta ,~\gamma )\) optimistic value and the pessimistic value can be expressed by the respective following equations

$$\begin{aligned}&\hat{\hat{\varsigma }}_{1_{\mathrm{sup}}}(\beta ,~\gamma ) =\hbox {sup}\{r : \hbox {Ch}\{\hat{\hat{\varsigma }}_{1} \ge r\}(\beta ) \ge \gamma \}\\&\hat{\hat{\varsigma }}_{1_{\mathrm{inf}}}(\beta ,~\gamma ) =\hbox {inf}\{r : \hbox {Ch}\{\hat{\hat{\varsigma }}_{1} \le r\}(\beta ) \ge \gamma \}. \end{aligned}$$

2.5 Expected value of rough set

The expected value (Liu 2004) of a rough set \(\hat{A} =([a_{1}, b_{1}], [c_{1}, d_{1}])\) has been defined as

2.6 Expected value of bi-rough set

Expected value (Liu 2004) of a bi-rough set \(\hat{\hat{\varsigma }}_{1}\) has been evaluated by the following expression:

where \(\hat{\mu }\) is a rough set and it is deduced by taking the expected value on the bi-rough set \(\hat{\hat{\varsigma }}_{1}\). Then, the deterministic form has been obtained by taking the expected value on the rough set \(\hat{\mu }\) again and this is described as

For example, if \(\hat{\hat{\varsigma _{1}}}=([\hat{A}-k_{1}, ~\hat{A}+l_{1}], ~[\hat{A}-m_{1},~\hat{A}+n_{1}])\) be a bi-rough set (where \(\hat{A}=([a_{1},~ b_{1}], ~[c_{1},~ d_{1}])\) is associate rough set), then the expected value is

3 Problem definition

In real life, instead of transporting directly from a production house to different retailers, every usable goods have been delivered to retailers from a production house through some mediators or distributors. Here, we have described such a realistic transportation model to transport the products from a production house to retailers with the help of some distributors. The described model is a two-stage transportation model where the first stage is between a production house and some distributors and the next between distributors and retailers. Here, production house supplies their own products to different distributors according to their demands by using different types of vehicles which are available to them and distributors deliver those products to different retailers by themselves using similar kind of vehicles. For this purpose, distributors make some money as commission from the production house for their work and they demand a certain cost to send every single item to different retailers, which is more than the actual unit transportation cost. In order to influence the retailers, the distributors use a credit period policy depending on the requirements of the retailers. According to this policy, if any retailer’s requirement is higher than a threshold requirement then that particular retailer would get the benefit of credit period from any distributor. Here, a restricted fixed charge has been considered depending on both the vehicle types and associated routes in the first stage. Based on the above descriptions, we have developed a two-stage multi-objective transportation model that is very useful for reducing the transportation costs of production house and retailers as well as to increase the distributor’s income at the same time. So, the main objective is to determine by the production house which type of how many vehicles have to use to transport the items to different distributors according to their demands and distributors have to decide how much items have been transported from them to different retailers so that the production house and the retailers can reduce their transportation cost and the distributors can increase their profit simultaneously. Therefore, the production house and the distributors play the role of decision makers in the respective stages. To deal with reality, the model has been constructed under an uncertain environment, namely rough and bi-rough. In Fig. 3, the whole transportation system has been illustrated.

3.1 Why has the model been constructed under rough and bi-rough environments?

In this study, the proposed model has been structured in rough and bi-rough environments to consider the uncertainty in the real world.

-

Although, in the literature, there are many uncertain problems which are solved using the concept of the fuzzy set theory, nevertheless, why are we thinking about rough and bi-rough environments to formulate the model?

-

Why have we chosen two different types of parameters’ uncertain nature in the same model?

To answer the above questions, firstly, we have discussed a comparative study of the fuzzy set and rough set by considering some realistic transportation-related examples to clear the conflicting concept between fuzzy and rough sets.

Fuzzy and rough sets are the generalizations of crisp set for modeling uncertainty and vagueness. Initially, the idea of fuzzy set was invented by Zadeh (1965). Here, the uncertainty is measured by a membership function which is a function from a set of objects to the interval [0, 1]. The objects with membership value 0 do not belong to the set, while the objects with membership value 1 imply surely belonged. For partially belonged, the membership value lies in (0, 1).

The idea of rough set was initially introduced by Pawlak (1982). In rough set, the uncertainty is measured by the approximation into two crisp sets, namely lower approximation and upper approximation sets. The lower approximation set contains surely belonging elements, while the upper approximation set contains possible belonging elements. The boundary region is obtained by separating the elements of lower approximation set from the elements of upper approximation set. If this boundary region is empty, then the considered set is crisp otherwise rough.

Moreover, bi-rough is an extended concept of rough set theory to deal with more uncertainty. The boundaries of a bi-rough set are rough in nature, while the boundaries of the rough data are deterministic. Now, a comparative study of crisp, fuzzy, rough, and bi-rough sets has been done by considering the following examples linguistically.

-

Example 3.1 The unit transportation cost along a particular road is Rs. 25.

-

Example 3.2 The unit transportation cost along a particular road is around Rs. 25.

-

Example 3.3 The unit transportation cost along a particular road in general lies between Rs. 23 and Rs. 27. If for some reason it is less than 23, it would be never less than Rs. 20, and if it is more than 27, it would be never greater than Rs. 30.

In example 3.1, it is mentioned that the unit transportation cost along a particular road is exactly Rs. 25. So, this is a fixed value which is never changed for the sake of the environment. That is why, this is a deterministic or crisp case. But, the unit transportation cost is fixed depending on the several factors of transportation, such as fuel consumption, driver cost, labor cost, traffic, nature of the road, which are always fluctuated depending on market situation. So, it is not true that the expense for per unit transportation along a particular road is always Rs. 25.

In example 3.2, we have described that the unit transportation cost along a particular road is around Rs. 25, i.e., the cost is more or less than 25 which is not a fixed value during a business period. In this way, there exists some uncertainty and vagueness in the transportation cost. This type of uncertainty may be handled using fuzzy set theory defining a membership function whose value may be considered as 1 in some interval containing 25 and the membership value in the other region is less than 1.

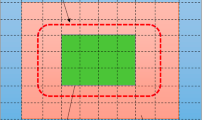

In example 3.3, the described transportation cost is with full of uncertainty and vagueness. From the description, we have seen that the transportation cost surely belongs to the interval (Kundu et al. 2013; Liu 2007) and possibly belongs to the interval (Kara et al. 2019; Majumder et al. 2019b). For this example, we can not define the exact membership value for each point in both intervals. One way is to express this uncertainty by the approximation of these two intervals which is the fundamental concept of rough set. Here, the interval (Kundu et al. 2013; Liu 2007) is the lower approximation set, while the interval (Kara et al. 2019; Majumder et al. 2019b) is the upper approximation set and completely has been written in rough set form as Kundu et al. (2013), Liu (2007), Kara et al. (2019), Majumder et al. (2019b). The nature of the above-described rough data is depicted in Fig. 4.

A realistic example of a bi-rough set is illustrated in following example 3.4.

-

Example 3.4 The demanded unit transportation cost along a particular destination is fixed from the experience of the previous trips as \(\hat{\psi }=([30, 35], [25, 40])\) which is a rough data. Moreover, the assigning of the demanded transportation cost is the distributer’s own policy, that is why, there is another dimensional uncertainty from the distributers’ point of views. And, distributers may say in general cost changes from \(-2\) to \(+2\), also the change of minimum cost is \(-3\) and the change of maximum cost is \(+3\). These uncertain data are expressed by a bi-rough form as \(\hat{\hat{\varsigma }}\)=([\(\hat{\psi }\)-2, \(\hat{\psi }\)+2], [\(\hat{\psi }\)-3, \(\hat{\psi }\)+3]). In Fig. 5, the above-described bi-rough set has been described more precisely.

If these types of uncertainties (described in examples 3.3 and 3.4) present in a system, then it must have to develop under rough and bi-rough environments.

But the question is, is it reasonable to have all the parameters of a transportation model bi-rough in nature when the model has been developed in bi-rough environment? By studying the nature of rough and bi-rough set theory, we conclude that it is not always true. In a transportation model, there are some dependent parameters whose values would be fixed depending on some other parameters which are independent in the system. So, if the independent parameters are rough, then the dependent parameters which are fixed depending on these must be bi-rough in nature. Due to the existence of more and another dimensional uncertainty, we cannot say the nature of these dependent parameters as rough. That is why, when a model has been formulated in bi-rough environment, there must be exist some parameters rough in nature. So, the model is constructed under rough and bi-rough environments and independent parameters like actual transportation cost in both the stages and requirements of the retailers of the model are considered as rough in nature, while the dependent parameters like demanded unit transportation cost and demands of the distributors which are fixed depending on the above-discussed independent parameters are considered as bi-rough.

4 Mathematical model formulation

In this section, we have derived the mathematical model of the proposed study.

-

Notations The following notations are linked in Table 3 to develop the model.

-

Assumptions The following assumptions have been listed to construct the present study:

-

(i)

In reality, it is observed that in a business system goods are transported from a production house to different distributors; then, distributors deliver these goods to various retailers in an area. For this reason, here, a two-stage transportation problem has been assumed to deliver the homogenous goods from a production house to some retailers with the help of some distributors as mediator.

-

(ii)

Generally, the production house may have different types of vehicles with various capacities, but distributors have vehicles of the same kind because they deliver the items in a local area. Again, distances of distribution centers from the production house are different and much more; hence, there must exist some additional cost except transportation cost such as toll tax, permit fee, state border crossing tax. Henceforth, a fixed charge (Ojha et al. 2010a; Shen and Zhu 2020; Zhang et al. 2016; Majumder et al. 2019a) should be included in the total transportation cost of the production house. This fixed cost may be different for different types of vehicles and associated routes. Due to this fact, we have considered a restricted fixed charge for the first stage of the model depending on both the vehicle types and associated paths. Again, since distributors are liable to distribute the products among local retailers, this type of additional cost is not considered in the second stage.

-

(iii)

The storage costs have not considered at the distribution centers because after receiving the goods, distributors send these to different retailers as soon as possible.

-

(iv)

A credit period means a time duration between receiving the products and payment of their dues. In reality, retailers can not make payment to distributors immediately after taking the goods. They always want to make payment their dues after some time. Moreover, retailers would like to get the goods from that distributor who offers this facility. So, to increase the transportation business, distributors always want to influence more retailers. Here, a credit period (Panja and Mondal 2020) has been considered depending on the requirement of the retailers, i.e., if a retailer’s requirement is more than a threshold value, distributors are obliged to give a certain amount of credit period to that particular retailer. This is described mathematically as:

$$\begin{aligned} \tau _{k} = \left\{ \begin{array}{ll} 0, &{} \quad \text{ if } \quad \sum \limits _{j=1}^{N}x_{jk} < \xi \\ T, &{} \quad \text{ if } \quad \sum \limits _{j=1}^{N}x_{jk} \ge \xi \\ \end{array}\right. ,\quad k=1,2,\ldots ,R\nonumber \\ \end{aligned}$$(1)where \(\xi \) is the threshold requirements of the retailers to be fixed by the distributors to get the benefit of credit period policy and \(x_{jk}\) be the transported amount from jth distributor to kth retailer.

-

(v)

We know that the real world is full of uncertainty. So, to tackle with the uncertainty associated with the transportation parameters, we have considered that the actual transportation cost in both the stages and requirements of the retailers is all rough, while the demanded unit transportation costs and the demands of the distributors are all bi-rough in nature. The fact of nature of uncertainties of parameters is discussed in Sect. 3.1.

-

(vi)

In the first stage of the transportation system, the decision maker is a production house who decides which type of how many vehicles have been sent out to different distributors. Since a fixed amount of items has to be sent out to different distributors according to their demands, the distances of production house from different distributors are very important. In this regard, we have assumed distance as a parameter in the first stage of transportation, but in the second stage the items are transported depending on unit transportation cost according to distributors’ decision.

-

(vii)

Since the considered transportation problem is a joint transportation system with three partners such as production house, distributors, and retailers according to the first assumption, so each of them has a specific objective and they would always want to optimize their own objectives. For this reason, several conflicting objectives of different partners are to be optimized simultaneously under the same conditions. Here, three objectives such as minimization of transportation cost of a production house, minimization of total transportation cost of retailers, and maximization the total profit of distributors are considered.

-

(i)

-

Formulation Here, total number of distribution centers is N with demand of jth distributor \(\hat{\hat{w}}_{j}\) (\(\hbox {j}=1\), 2,..., N) and there are total R retailers with requirement \(\hat{s}_{k}\) (k=1, 2,..., R) for kth retailer. \(\hat{\hat{c}}_{jk}\) be the demanded unit transportation cost, while \(\hat{c}^{a}_{jk}\) be the actual unit transportation cost along the j-k path (i.e., from jth distributor to kth retailer) and \(p^{d}_{j}\) be the commission given by the production house to jth distributor for the distribution per unit item. At production house, there are total M types of vehicles (\(\hbox {i}=1, 2,\ldots , M\)) and the numbers of ith-type vehicle are \(p_{i}\) with capacity \(q_{i}\). \(f_{ij}\) be the restricted fixed charge associated with ith-type vehicle along jth distributor. Here, \(\tau _{k}\) be the offered credit period for the kth retailer and r be the banking interest. If \(x_{jk}\) be the transported amount from jth distributor to kth retailer and \(v_{ij}\) be the number of ith-type vehicles have been used to transport the products to jth distributor from the production house, then model has been formulated as:

$$\begin{aligned}&\text{ minimize }~~ \bar{F}_{1}=\sum \limits _{i=1}^{M} \sum \limits _{j=1}^{N}\hat{c^{v}_{i}}.d_{j}.v_{ij} +\sum \limits _{i=1}^{M}\sum \limits _{j=1}^{N}f_{ij}.v_{ij} \end{aligned}$$(2)$$\begin{aligned}&\text{ minimize }~~\bar{F}_{2}=\sum \limits _{j=1}^{N} \sum \limits _{k=1}^{R}\hat{\hat{c_{jk}}}.x_{jk} -\sum \limits _{k=1}^{R}\bigg [\sum \limits _{j=1}^{N}x_{jk}. \hat{\hat{c_{jk}}}\bigg ]. \tau _{k}.r \nonumber \\\end{aligned}$$(3)$$\begin{aligned}&\text{ maximize }~~\bar{F}_{3}\nonumber \\&\quad =\sum \limits _{j=1}^{N}p^{d}_{j}.w_{j}+\sum \limits _{j=1}^{N} \sum \limits _{k=1}^{R}\hat{\hat{c_{jk}}}.x_{jk}\nonumber \\&\qquad -\sum \limits _{j=1}^{N}\sum \limits _{k=1}^{R}\hat{c^{a}_{jk}}.x_{jk} -\sum \limits _{k=1}^{R}\bigg [\sum \limits _{j=1}^{N}x_{jk}.\hat{\hat{c_{jk}}}\bigg ]. \tau _{k}.r \end{aligned}$$(4)subject to

$$\begin{aligned}&\sum \limits _{i=1}^{M}q_{i}.v_{ij} \ge \hat{\hat{w}}_{j},~j=1,~2,\ldots ,~N \end{aligned}$$(5)$$\begin{aligned}&\sum \limits _{k=1}^{R}x_{jk} \le \hat{\hat{w}}_{j},~j=1,~2,\ldots ,~N \end{aligned}$$(6)$$\begin{aligned}&\sum \limits _{j=1}^{N}x_{jk} \ge \hat{s}_{k},~k=1,~2,\ldots ,~R \end{aligned}$$(7)$$\begin{aligned}&\sum \limits _{j=1}^{N}v_{ij} \le p_{i},~i=1,~2,\ldots ,~M \end{aligned}$$(8)$$\begin{aligned}&\sum \limits _{i=1}^{M}\sum \limits _{j=1}^{N}q_{i}.v_{ij} \ge \sum \limits _{j=1}^{N}\sum \limits _{k=1}^{R}x_{jk} \end{aligned}$$(9)$$\begin{aligned}&\sum \limits _{i=1}^{M}q_{i}.v_{ij}\ge \sum \limits _{k=1}^{R} x_{jk},~j=1,~2,\ldots ,~N \end{aligned}$$(10)$$\begin{aligned}&\tau _{k} = \left\{ \begin{array}{ll} 0, &{} \quad \text{ if } \quad \sum \limits _{j=1}^{N}x_{jk} < \xi \\ T, &{} \quad \text{ if } \quad \sum \limits _{j=1}^{N}x_{jk} \ge \xi \\ \end{array} \right. ,~k=1,~2,\ldots ,~R \end{aligned}$$(11)$$\begin{aligned}&x_{jk}\ge 0,~j=1,~2,\ldots ,~N;~ k=1,~2,\ldots ,~R \end{aligned}$$(12)$$\begin{aligned}&v_{ij}\ge 0, ~i=1,~2,\ldots ,~M;~j=1,~2,\ldots ,~N \end{aligned}$$(13)$$\begin{aligned}&\sum \limits _{j=1}^{N}\hat{\hat{w}}_{j} \ge \sum \limits _{k=1}^{R}\hat{s_{k}}. \end{aligned}$$(14)By objective functions (2) and (3), transportation cost of the production house and retailers are minimized, respectively, while objective function (4) maximizes the total profit of the distributors. Constraint (5) indicates that the total transported amount to a particular distributor is more than or equal to the demand of that particular distributor for the first stage. Constraints (6) and (7) are the demand and requirement constraints of the distributors and retailers, respectively, in the second stage. Constraint (8) is a restriction on the total numbers of different types of vehicles. The overall flow is balanced by constraint (9), while the flow at a particular distribution center is conserved by constraint (10). Constraint (11) is a restriction on the offered credit period. Finally, the feasibility of the problem has been maintained by constraints (12)–(14).

5 De-rough and de-bi-rough of the model

De-rough and de-bi-rough are a procedure to convert the uncertain model with rough and bi-rough parameters into an equivalent deterministic model.

It is noted that, after creating a transportation problem in varieties of uncertain environments, it has to be tackled properly. There are two mechanisms for dealing with uncertainty, the first one is without converting into deterministic form (Baykasoglu and Subulan 2019), and in second one, different types of uncertain programming have been formulated to convert into deterministic form. Expected value approach and chance constraint programming approach (Roy et al. 2019; Zhang et al. 2016; Kundu et al. 2017) are common uncertain programming approach in different uncertain environments. Moreover, the other popular uncertain programming approaches are Robust optimization (Sangaiah et al. 2019; Kara et al. 2019), stochastic optimal control (Khalilpourazari and Khalilpourazary 2018), etc. Here, the expected value approach and rough and bi-rough programming approach (an extension of chance constraint programming approach) have been utilized for the purpose of de-rough and de-bi-rough of the model.

-

Expected value approach

In expected value approach (Chen et al. 2017a; Cheng et al. 2017; Kundu et al. 2017), all uncertain objective functions (2)–(4) and uncertain constraints (5)–(7) and (14) have been converted into the deterministic form using the expected values of both rough and bi-rough parameters using Sects. 2.5 and 2.6.

-

Rough and bi-rough programming approach

In rough and bi-rough programming approach, uncertain objective functions (2)–(4) have been transformed into the deterministic form using expected values (Sects. 2.5 and 2.6) of associated rough and bi-rough parameters. Then the uncertain constraints with rough parameters are transformed into the deterministic form with the help of trust measure (Sect. 2.3), while the uncertain constraints with bi-rough parameters have been converted into deterministic form by chance measure (Sect. 2.4).

It is noted that to remove the uncertainty, expected value approach and chance constraint programming approach both have been used. Now, the difference between these two methods is that the uncertainty of a parameter in a constraint has been removed taking only expected value of that parameter, and on the other hand, to remove the uncertainty of a parameter in a constraint, the chance of satisfaction of that constraint above some confidence level has been taken first, and then trust measure for rough and chance measure for bi-rough parameter has been used to remove the uncertainty of that parameter in constraint.

5.1 Crisp form of the model using expected value approach

Here, the transportation cost for per unit distance in the first stage \(\hat{c}^{v}_{i}=([c^{v}_{i1},~c^{v}_{i2}],~[c^{v}_{i3}, ~c^{v}_{i4}])\), actual unit transportation cost \(\hat{c}^{a}_{jk}=([c^{a}_{jk1},~c^{a}_{jk2},~[c^{a}_{jk3}, ~c^{a}_{jk4}])\) in the second stage, and requirements of the retailers \(\hat{s}_{k}=([s^{1}_{k},~s^{2}_{k}],~[s^{3}_{k}, ~s^{4}_{k}])\) are all rough. Moreover, the demanded unit transportation cost \(\hat{\hat{c}}_{jk}=([\hat{c}_{jk} -a^{1}_{jk},~\hat{c}_{jk}+a^{2}_{jk}],~[\hat{c}_{jk} -a^{3}_{jk},~\hat{c}_{jk}+a^{4}_{jk}])\) where \(\hat{c}_{jk}=([c^{1}_{jk},~c^{2}_{jk}],~[c^{3}_{jk}, ~c^{4}_{jk}])\) and demands of the distributors \(\hat{\hat{w}}_{j}=([\hat{w}_{j}-b^{1}_{j},~\hat{w}_{j} -b^{2}_{j}],~[\hat{w}_{j}-b^{3}_{j},~\hat{w}_{j}-b^{4}_{j}])\), \(\hat{w}_{j}=([w^{1}_{j},~w^{2}_{j}],~[w^{3}_{j},~w^{4}_{j}])\) are bi-rough. Using the framework of earlier described expected value approach, the proposed uncertain model (2)–(14) has been converted into the equivalent crisp form as:

subject to

where \(F_{1}\), \(F_{2}\), and \(F_{3}\) are the deterministic form of \(\bar{F}_{1}\), \(\bar{F}_{2}\), and \(\bar{F}_{3}\), respectively. Now, the above model can be rewritten into the following deterministic form as:

subject to

5.2 Crisp form of the model using rough and bi-rough programming approach

Using rough and bi-rough programming approach, the proposed uncertain model has been converted into the following form:

subject to

So, the above model has been rewritten into the following deterministic form as

subject to

where \(W_{j}\) and \(W'_{j}\) are the deterministic value of \(\hat{\hat{w}}_{j}\) corresponding to constraints (31) and (32), respectively, and \(S_{k}\) be the deterministic value of \(\hat{s}_{k}\) corresponding to constraint (33).

Firstly, we have obtained the value of \(S_{k}\) with confidence level \(\alpha \ \in \) (0, 1] by expression (39) as

The real number \(W_{j}\) corresponding to constraint (35) is calculated from the bi-rough parameter \(\hat{\hat{w}}_{j}=([P^{1}_{j},~P^{2}_{j}], ~[P^{3}_{j},~P^{4}_{j}])\) with confidence level \(\gamma \ \in \) (0, 1] using (40) and the real numbers \(P^{1}_{j}\), \(P^{2}_{j}\), \(P^{3}_{j}\), and \(P^{4}_{j}\) are calculated using (41)–(44) from the rough parameters \(\hat{w}_{j}-b^{1}_{j}\), \(\hat{w}_{j}-b^{2}_{j}\), \(\hat{w}_{j}-b^{3}_{j}\), and \(\hat{w}_{j}-b^{4}_{j}\), respectively, with confidence level \(\beta \ \in \) (0, 1] while \(\hat{w}_{j}=([w^{1}_{j},~w^{1}_{j}],~[w^{3}_{j},~w^{4}_{j}])\). So, the values of \(W_{j}\) have been derived by the following expressions

where

and

The real number \(W'_{j}\) corresponding to constraint (35) is calculated from the bi-rough parameter \(\hat{\hat{w}}_{j}=([Q^{1}_{j},~Q^{2}_{j}], [Q^{3}_{j},~Q^{4}_{j}])\) with confidence level \(\gamma \ \in \) (0, 1] using (45), and the real numbers \(Q^{1}_{j}\), \(Q^{2}_{j}\), \(Q^{3}_{j}\), and \(Q^{4}_{j}\) have been obtained from the rough parameters \(\hat{w}_{j}-b^{1}_{j}\), \(\hat{w}_{j}-b^{2}_{j}\), \(\hat{w}_{j}-b^{3}_{j}\), and \(\hat{w}_{j}-b^{4}_{j}\), respectively, using (46)–(49) with confidence level \(\beta \ \in \) (0, 1] while \(\hat{w}_{j}=([w^{1}_{j},~w^{1}_{j}],~ [w^{3}_{j},~w^{4}_{j}])\).

So, the values of \(W'_{j}\) have been calculated by the following expressions

where

and

6 Solution methodology

The proposed model contains three objective functions with a large number of variables. So, it is hard to find out the solutions by a classical method. From the literature, it is known that NSGA-II (Deb et al. 2000; Majumder et al. 2019a) is one of the best evolutionary algorithms to solve a complicated multi-objective optimization problem. To solve the proposed model by two approaches, the following two algorithms have been developed.

Algorithm 1

Solution algorithm in expected value approach

- Step 1::

-

Firstly obtain the expressions of \(\bar{F}_{1}\), \(\bar{F}_{2}\), \(\bar{F}_{3}\) and the constraints (5)–(14).

- Step 2::

-

Give the values of M, N, and R then input crisp parameters like \(d_{j}\), \(f_{ij}\), \(p_{i}\), \(q_{i}\), r, T, and \(\xi \) where \(i=1,~2,\ldots ,~M\) and \(j=1,~2,\ldots ,~N\).

- Step 3::

-

Input the values \(c^{v}_{i1}\), \(c^{v}_{i2}\), \(c^{v}_{i3}\), \(c^{v}_{i4}\) for the rough distance-based cost \(\hat{c}^{v}_{i}\) in the first stage and \(c^{a}_{jk1}\), \(c^{a}_{jk2}\), \(c^{a}_{jk3}\), \(c^{a}_{jk4}\) for the rough actual unit transportation cost in the second stage \(\hat{c}^{a}_{jk}\) and \(s^{1}_{k}\), \(s^{2}_{k}\), \(s^{3}_{k}\), \(s^{4}_{k}\) for the rough requirements of the retailers \(\hat{s}_{k}\) where \(i=1,~2,\ldots ,~M\), \(j=1,~2,\ldots ,~N\), and \(k=1,~2,\ldots ,~R\).

- Step 4::

-

Input \(c^{1}_{jk}\),\(c^{2}_{jk}\), \(c^{3}_{jk}\), \(c^{4}_{jk}\), \(a^{1}_{jk}\), \(a^{2}_{jk}\), \(a^{3}_{jk}\), \(a^{4}_{jk}\) for the bi-rough demanded unit transportation cost \(\hat{\hat{c}}_{jk}\) and \(w^{1}_{j}\), \(w^{2}_{j}\), \(w^{3}_{j}\), \(w^{4}_{j}\), \(b^{1}_{j}\), \(b^{2}_{j}\), \(b^{3}_{j}\), \(b^{4}_{j}\) for the bi-rough demands of the distributors \(\hat{\hat{w}}_{j}\) with \(j=1,~2,\ldots ,~N\) and \(k=1,~2,\ldots ,~R\).

- Step 5::

-

Using expected value presented in Sects. 2.5 and 2.6, evaluate the deterministic values \(E(\hat{c}^{v}_{i})\), \(E(\hat{c}^{a}_{jk})\), \(E(\hat{s}_{k})\), \(E(\hat{\hat{c}}_{jk})\), \(E(\hat{\hat{w}}_{j})\) for \(i=1,~2,\ldots ,~M\), \(j=1,~2,\ldots ,~N\), and \(k=1,~2,\ldots ,~R\).

- Step 6::

-

Using step 5, formulate the deterministic model like (23)–(30).

- Step 7::

-

Assign the values of NSGA-II parameters such as population size, number of generations, crossover probability and mutation probability.

- Step 8::

-

To get the optimum values of \(v_{ij}\) and \(x_{jk}\), optimize \(F_{1}\), \(F_{2}\), and \(F_{3}\) subject to constraints (26)–(30) with the help of NSGA-II through Dev-C++ solver software, where \(i=1,~2,\ldots ,~M\), \(j=1,~2,\ldots ,~N\), and \(k=1,~2,\ldots ,~R\).

- Step 9::

-

Using these optimum values of \(v_{ij}\) and \(x_{jk}\) in step 8, a set of pareto-optimal solutions have been summarized.

Algorithm 2

Solution algorithm in rough and bi-rough programming approach

- Step 1::

-

Follow steps 1–4 in Algorithm 1 for parametric values associated with problem.

- Step 2::

-

Using expected value, convert uncertain objective functions (2)–(4) into deterministic form (23)–(25).

- Step 3::

-

Determine the deterministic values \(W_{j}\) and \(W'_{j}\) for bi-rough constraints (5) and (6) using (40)–(44) as well as (45)–(49), respectively, and \(S_{k}\) for rough constraint (7) with the help of (39) where \(j=1,~2,\ldots ,~N\) and \(k=1,~2,\ldots ,~R\).

- Step 4::

-

Declaring the NSGA-II parameter values, optimize \(F_{1}\), \(F_{2}\) and \(F_{2}\) subject to constraints (35)–(38) to get the optimum values of \(v_{ij}\) and \(x_{jk}\) (\(i=1,~2,\ldots ,~M\), \(j=1,~2,\ldots ,~N\), and \(k=1,~2,\ldots ,~R\)) using NSGA-II through Dev-C++ solver software.

- Step 5::

-

Summarize a set of trade-off solutions using Step 4.

7 Model application with sensitivity analysis

To illustrate the proposed model numerically, we have taken into account the following problem.

A cattle feed production house at Dumdum has three types of vehicles such as Eicher pro 1049 truck, SML sartaj GS 5252 truck, and Eicher pro 1080 XPT tipper with maximum load capacities 49, 52, and 82.50 quintals, respectively, to transport the products to three distribution centers at Sonarpur, Maheshtala, and Habra, respectively. The number of vehicles of each type is 10. Per trip fixed charges for each type of vehicle along different paths are given in Table 4. The average cost for per unit distance of each type of vehicles is given in Table 5. Moreover, the distances of the distribution centers from the production house are 26.6 km, 31.1 km, and 37.9 km, respectively. The demands of the distributors are displayed in Table 6. The items distributed among four retailers at Thakurpukur, Raghabpur, Dankuni, and Bhangar with the requirements of the retailers are shown in Table 7. For the distribution of the products, distributors demand a certain amount of cost (shown in Table 9) which is more than actual transportation cost (in Table 8). To influence the retailers, distributors offer 30 days of credit period policy to those retailers whose requirements are more than 350 quintals. Moreover, yearly banking interest is 6%. So, production house has to take a perfect decision on how many vehicles of which type to be sent out to a particular distribution center so that their transportation cost is minimum and a perfect decision on transported amount by the distributors so that the total transportation cost of the retailers is minimum as well as their total profit is maximum.

Solution Here, the given parametric values are \(M=3\), \(N=3\), \(R=4\), \(d_{1}=26.6\), \(d_{2}=31.1\), \(d_{3}=37.9\), \(r=6\), \(T=30\), \(\xi =350\), \(p_{1}=10\), \(p_{2}=10\), \(p_{3}=10\), \(q_{1}=49\), \(q_{2}=52\), and \(q_{3}=82.50\) with respective units. Now, the given problem in which some parameters are rough and some are bi-rough in nature has been solved using Algorithm 1 taking the NSGA-II parametric values of probability of crossover, probability of mutation, population size, and number of generations as 0.75, 0.05, 500, and 1000, respectively. Firstly, Tables 5, 6, 7, 8, and 9 are converted into deterministic forms in the Tables 10, 11, 12, 13, and 14, respectively, using expected value. Using these deterministic values, a crisp model has been formulated. The obtained crisp model is solved by NSGA-II through Dev-C++ solver software and has summarized a set of optimal solutions which is discussed in Table 15.

In Table 15, the first column indicates the optimum transported amounts from different distribution centers to various retailers, while the second three columns indicate about the optimum results of different types of vehicles to be sent to different distributors from the production house. Moreover, the last three columns represent the optimal values of the objective functions. From Table 15, it is observed that distributors get maximum profit of amount 17,778.50 for \(x_{11}=86.00\), \(x_{12}=0.00\), \(x_{13}=147.80\), \(x_{14}=272.30\), \(x_{21}=153.40\), \(x_{22}=92.30\), \(x_{23}=164.40\), \(x_{24}=97.40\), \(x_{31}=159.10\), \(x_{32}=232.70\), \(x_{33}=83.40\), \(x_{34}=23.50\), \(v_{11}=6\), \(v_{12}=3\), \(v_{13}=1\), \(v_{21}=0\), \(v_{22}=3\), \(v_{23}=6\), \(v_{31}=4\), \(v_{32}=4\), and \(v_{33}=2\) when the production house and the retailers have the costs of amounts 93,450.80 and 39,923.50, respectively, but, in this case, these are not optimal. Again, when we see the minimum cost of retailers is 38,600.70 for \(x_{11}=129.24\), \(x_{12}=25.50\), \(x_{13}=142.00\), \(x_{14}=204.60\), \(x_{21}=155.40\), \(x_{22}=218.10\), \(x_{23}=5.30\), \(x_{24}=128.00\), \(x_{31}=120.00\), \(x_{32}=14.50\), \(x_{33}=252.30\), \(x_{34}=61.00\), \(v_{11}=3\), \(v_{12}=4\), \(v_{13}=2\), \(v_{21}=3\), \(v_{22}=2\), \(v_{23}=5\), \(v_{31}=4\), \(v_{32}=4\), and \(v_{33}=2\), then the cost of production house (93,836.00) and the total profit of distributors (16,601.00) are not optimum. Also, similar scenario has been observed for production house. So, it is concluded that when one objective function is best, then the other objective functions may not be so, i.e., Table 15 gives a set of pareto-optimal solutions from which a decision maker can choose anyone according to his/her choice.

Again, the given problem has been solved using Algorithm 2 taking the same parametric values of NSGA-II as earlier. Assigning the confidence levels \(\alpha \) and \((\beta ,~\gamma )\) as 0.75 and (0.75, 0.25), respectively, get the deterministic values \(S_{k}\), \(W_{j}\), and \(W'_{j}\) for constraints (35)–(37), respectively, in Tables 16 and 17. Using these, a deterministic model has been constructed and solved as earlier. In Table 18, a set of solutions have been listed.

From Table 18, it has been noticed that production house’s transportation cost (88,615.50) is minimum and distributors’ profit (17,101.20) is maximum for \(x_{11}=216.20\), \(x_{12}=130.30\), \(x_{13}=81.40\), \(x_{14}=76.00\), \(x_{21}=33.40\), \(x_{22}=61.40\), \(x_{23}=279.30\), \(x_{24}=133.40\), \(x_{31}=158.00\), \(x_{32}=111.00\), \(x_{33}=42.90\), \(x_{34}=185.30\), \(v_{11}=0\), \(v_{12}=4\), \(v_{13}=3\), \(v_{21}=5\), \(v_{22}=1\), \(v_{23}=4\), \(v_{31}=4\), \(v_{32}=4\), and \(v_{33}=2\) where total transportation cost of retailers is 40,853.20, but, in this case it is not optimal. Again, when we see the minimum cost of retailers (37,108.60) for \(x_{11}=19.70\), \(x_{12}=211.60\), \(x_{13}=157.40\), \(x_{14}=100.00\), \(x_{21}=210.40\), \(x_{22}=51.60\), \(x_{23}=43.80\), \(x_{24}=155.60\), \(x_{31}=103.00\), \(x_{32}=53.00\), \(x_{33}=184.60\), \(x_{34}=150.00\), \(v_{11}=2\), \(v_{12}=1\), \(v_{13}=7\), \(v_{21}=1\), \(v_{22}=6\), \(v_{23}=3\), \(v_{31}=6\), \(v_{32}=4\), and \(v_{33}=0\), then the cost of production house (95,751.00) and the total profit of distributors (14,272.90) are not optimum. So, it is concluded that when one or more objective functions are best, then other objective functions may not be so, i.e., Table 18 gives a set of trade-off solutions from which a decision maker can choose anyone according to his/her choice.

Now, some sensitivity analysis has been done to analyze the effects of different parameters on optimal solutions through Dev-C++ solver software and the graphical presentations for sensitivity analysis have been made by Microsoft Office Excel. For the sensitivity analysis of the model, Tables 19 and 20 and Fig. 6 show the different outcomes of the optimal solutions.

In rough and bi-rough programming approach, three types of confidence levels such as \(\alpha \) and (\(\beta \), \(\gamma \)) have been utilized to convert constraints (5)–(7) into the deterministic form. The values of these confidences levels always lie between 0 and 1. So it is necessary to review how the solutions would be changed for different values of that confidence levels.

From the previous discussion, a set of non-dominated solutions of the model have been obtained using Algorithms 1 and 2. So, for each different values of \(\alpha \) and (\(\beta \), \(\gamma \)), we have obtained a different set of non-dominated solutions. That is why, it is difficult to make a comparison among the solutions. To overcome this difficulty, we have picked up that solution from the non-dominated set of solutions which is best with respect to a particular objective function for each \(\alpha \) and (\(\beta \), \(\gamma \)).

So, in Table 19, we have listed a set of optimal solutions when the model is converted in deterministic form using rough and bi-rough programming approach (i.e., Algorithm 2). Here, for each \(\alpha \) and (\(\beta \), \(\gamma \)), we have picked up that particular solution from the non-dominated solutions set, which is best with respect to \(F_{3}\).

From Table 19, it is seen that, if we specify the value of \((\beta \), \(\gamma )=(0.50, 0.50)\) and increase the value of \(\alpha \), the profit of the distributors’ would also increase, but after a certain value of \(\alpha \) (i.e., \(\alpha =0.75\)), the profit decreases. At the same time, both the other objective functions \(F_{1}\) and \(F_{2}\) fluctuate slightly. Similar type of results would be obtained if we pick up the solutions from the pareto-optimal set by giving the priority the other objective functions separately for each particular values of \(\alpha \) and (\(\beta \), \(\gamma \)).

Here, the offered credit period has been fixed by the distributors depending on the requirements of the retailers. So, for what values of requirements of retailers, (i.e., the threshold requirement \(\xi \) of the retailers has been fixed by the distributors) distributors would pay the credit period (T), which is distributor’s own policy. So, it is essential to analyze the effect on optimal solutions for different values of \(\xi \). In Table 20, we have summarized a set of three optimal results for different threshold values of requirement (\(\xi \)) by giving priority the third objective function \(F_{3}\). Moreover, a graphical view is depicted in Fig. 6.

-

From Fig. 6, it has been observed that when the threshold requirements (\(\xi \)) of the retailers are fixed by the distributers as 300, then all retailers get the benefit of credit period policy since their respective requirements (405, 300, 400, and 392.5) are greater than or equal to \(\xi =300\). In this case, transportation cost of production house is 84,278.75, total transportation cost of retailers is 38,927.50, and total profit of the distributors is 16,197.90.

-

When \(\xi =400\), in the considered problem, only first and third retailers get the benefit of credit period policy because their respective requirements (405 and 400) are greater than or equal to the specified threshold requirement. In this case, the transportation cost of production house is 84,162.50, total transportation cost of retailers is 39,074.70, and total profit of distributors is 16,682.40.

-

When \(\xi =500\), no one will get the benefit of credit period policy. In this case, the transportation cost of production house is 84,327.50, total transportation cost of retailers is 39,322.80, and the total profit of the distributors is 17,056.30.

From Fig. 6, it is observed that when the value of \(\xi \) stepwise increases, total transportation cost of the retailers and the total profit of the distributers increase, while transportation cost of the production house fluctuates with small value due to the conflicting nature of the objective functions.

8 Conclusion

In this work, a two-stage multi-objective transportation problem has been addressed to deliver the products from a production house to some retailers through some distributors. Here, we have simultaneously optimized three conflicting goals which are (i) minimization of transportation cost of production house, (ii) minimization of total transportation cost of retailers, and (iii) maximization of total profit of distributors. This model has been decorated by including a restricted fixed charge in the first stage and a requirement-dependent credit period policy in the second stage. Due to the lack of exact data in the problem, different uncertainties, like rough and bi-rough nature, have been considered in the associated parameters of the model and a rough and bi-rough programming approach has been developed to remove the uncertainties. Finally, a real-life transportation-related example is chosen for numerical analysis. The results of some computational studies have been presented which are carried out as a benchmark of such type of transportation problem. It is noted that in the model there exist some limitations such as (i) it is applicable only for one production house, (ii) distributors consider only one type of vehicles, (iii) it is compatible for two-stage transportation system, and (iv) to measure the uncertainty, the concepts of rough and bi-rough sets have been used.

So, in future research, the present study can be extended by considering more than one production house through more stages. Studying of some two-stage transportation models where both the production house and distributors used different types of vehicles under various uncertain environments such as type-2 fuzzy, bi-fuzzy, rough-fuzzy, may be regarded as a future research suggestion.

References

Balinski ML (1961) Fixed cost transportation problems. Nav Res Logist Q 8(1):41–54

Banu A, Mondal SK (2018) Analyzing an inventory model with two-lebel trade credit period including the effect of customers’ credit on the demand function using q-fuzzy number. Oper Res Int J 1:1–29

Baykasoglu A, Subulan K (2019) A direct solution approach based on constrained fuzzy arithmetic and metaheuristic for fuzzy transportation problems. Soft Comput 23(5):1667–1698

Chakraborty A, Chakraborty M (2010) Cost-time minimization in a transportation problem with fuzzy parameters: a case study. J Transp Syst Eng Inf Technol 10(6):53–63

Charnes A, Cooper WW (1954) The stepping-stone method for explaining linear programming calculation in transportation problem. Manag Sci 1(1):49–69

Chen L, Peng J, Liu Z, Zhao R (2017a) Pricing and effort decisions for a supply chain with uncertain information. Int J Prod Res 55(1):264–284

Chen L, Peng J, Zhang B (2017b) Uncertain goal programming models for bicriteria solid transportation problem. Appl Soft Comput 51:49–59

Chen L, Peng J, Zhang B, Li S (2017c) Uncertain programming model for uncertain minimum weight vertex covering problem. J Intell Manuf 28(3):625–632

Chen L, Peng J, Zhang B, Rosyida I (2017d) Diversified models for portfolio selection based on uncertain semivariance. Int J Syst Sci 48(3):637–648

Cheng L, Rao C, Chen L (2017) Multidimensional knapsack problem based on uncertain measure. Sci Iran 24(5):2527–2539

Dalman H (2019) Entropy-based multi-item solid transportation problems with uncertain variables. Soft Comput 23(14):5931–5943

Das A, Bera UK, Maiti M (2016) A breakable multi-item multi stage solid transportation problem under budget with Gaussian type-2 fuzzy parameters. Appl Intell 45(3):923–951

Das A, Bera UK, Maiti M (2017) A profit maximizing solid transportation model under a rough interval approach. IEEE Trans Fuzzy Syst 25(3):485–498

Das BC, Das B, Mondal SK (2014) Optimal transportation and business cycles in an integrated production-inventory model with a discrete credit period. Transp Res E Logist Transp Rev 68:1–13

Deb K, Pratap A, Agarwal S, Meyarivan T (2000) A fast and elitist multiobjective genetic algorithm:NSGA-II. Evol Comput 6(2):182–197

Gen M, Altiparmak F, Lin L (2006) GA genetic algorithm for two-stage transportation problem using priority-based encoding. OR Spectr 28(3):337–354

Hashmi N, Jalil SA, Javaid S (2019) A model for two-stage fixed charge transportation problem with multiple objectives and fuzzy linguistic preferences. Soft Comput 23(23):12401–12415

Hitchcock FL (1941) The distribution of a product from several sources to numerous locations. J Math Phys 20(1–4):224–230

Kantorovich LV (1960) Mathematical methods of organizing and planning production. Manag Sci 6(4):366–422

Kara G, Özmen A, Weber GW (2019) Stability advances in robust portfolio optimization under parallelepiped uncertainty. Cent Eur J Oper Res 27(1):241–261

Khalilpourazari S, Khalilpourazary S (2018) A Robust Stochastic Fractal Search approach for optimization of the surface grinding process. Swarm Evol Comput 38:173–186

Koopmans TC (1949) Optimum utilization of the transportation system. Econmetrica 17:3–4

Kundu P, Kar S, Maiti M (2013) Some solid transportation models with crisp and rough costs. Int J Math Comput Phys Quant Eng 7(1):8–15

Kundu P, Kar MB, Kar S (2017) A solid transportation model with product blending and parameters as rough variables. Soft Comput 21(9):2297–2306

Lee SM, Moore LJ (1973) Optimizing transportation problems with multiple objectives. IEEE Trans 5(4):333–338

Liu B (2004) Uncertainty theory: an introduction to its axiomatic foundations. Springer, Berlin

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Mahmoodirad A, Allahviranloo T, Niroomand S (2019) A new effective solution method for fully intuitionistic fuzzy transportation problem. Soft Comput 23(12):4521–4530

Majumder S, Kar MB, Kar S, Pal T (2019a) Uncertain programming models for multi-objective shortest path problem with uncertain parameters. Soft Comput 24:1–22

Majumder S, Kundu P, Kar S, Pal T (2019b) Uncertain multi-objective multi-item fixed charge solid transportation problem with budget constraint. Soft Comput 23(10):3279–3301

Ojha A, Das B, Mondal SK, Maiti M (2009) An entropy based solid transportation problem for general fuzzy costs and time with fuzzy equality. Math Comput Model 50(1–2):166–178

Ojha A, Das B, Mondal SK, Maiti M (2010a) A solid transportation problem for an item with fixed charge, vechicle cost and price discounted varying charge using genetic algorithm. Appl Soft Comput 10(1):100–110

Ojha A, Das B, Mondal SK, Maiti M (2010b) A stochastic discounted multi-objective solied transportation problem for breakble items using analytical hierarchy process. Appl Math Model 34(8):2256–2271

Ojha A, Das B, Mondal SK, Maiti M (2013) A multi-item transportation problem with fuzzy tolerance. Appl Soft Comput 13(8):3703–3712

Ojha A, Das B, Mondal SK, Maiti M (2014) A transportation problem with fuzzy-stochastic cost. Appl Math Model 38(4):1464–1481

Panja S, Mondal SK (2019) Analyzing a four-layer green supply chain imperfect production inventory model for green products under type-2 fuzzy credit period. Comput Ind Eng 129:435–453

Panja S, Mondal SK (2020) Exploring a two-layer green supply chain game theoretic model with credit linked demand and mark-up under revenue sharing contract. J Clean Prod 250:119491. https://doi.org/10.1016/j.jclepro.2019.119491

Pawlak Z (1982) Rough sets. Int J Inf Tech Decis 11(5):341–356

Pramanik S, Jana DK, Mondal SK, Maiti M (2015) A fixed-charge transportation problem in two-stage supply chain network in Gaussian type-2 fuzzy environments. Inf Sci 325:190–214

Raj KAAD, Rajendran C (2012) A genetic algorithm for solving the fixed-charge transportation model: two-stage problem. Comput Oper Res 39(9):2016–2032

Roghanian E, Pazhoheshfar P (2014) An optimization model for reverse logistics network under stochastic environment by using genetic algorithm. J Manuf Syst 33(3):348–356

Roy SK, Midya S, Weber GW (2019) Multi-objective multi-item fixed-charge solid transportation problem under two fold uncertainty. Neural Comput Appl 31(12):8593–8613

Samanta S, Mondal SK (2015) A multi-objective solid transportation problem with discount and two-level fuzzy programming technique. Int J Oper Res 24(4):423–440

Samanta S, Das B, Mondal SK (2018) A new method for solving a fuzzy solid transportation model with fuzzy ranking. Asian J Math 2:73–83

Sangaiah AK, Tirkolaee EB, Goli A, Dehnavi-Arani S (2019) Robust optimization and mixed-integer linear programming model for LNG supply chain planning problem. Soft Comput. https://doi.org/10.1007/s00500-019-04010-6

Shen J, Zhu K (2020) An uncertain two-echelon fixed charge transportation problem. Soft Comput 24(5):3529–3541

Sifaoui T, Aïder M (2019) Uncertain interval programming model for multi-objective multi-item fixed charge solid transportation problem with budget constraint and safety measure. Soft Comput. https://doi.org/10.1007/s00500-019-04526-x

Tirkolaee EB, Mahdavi I, Esfahani MMS, Weber GW (2020) A hybrid augmented ant colony optimization for the multi-trip capacitated arc routing problem under fuzzy demands for urban solid waste management. Waste Manag Res 38(2):156–172

Xie F, Jia R (2012) Nonlinear fixed charge transportation problem by minimum cost flow-based genetic algorithm. Comput Ind Eng 63(4):763–778

Yang L, Feng Y (2007) A bicriteria solid transportation problem with fixed charge under stochastic environment. Appl Math Model 31(12):2668–2683

Yang L, Liu L (2007) Fuzzy fixed charge solid transportation problem and algorithm. Appl Soft Comput 7(3):879–889

Zadeh LA (1965) Fuzzy sets. Inf Control 8(3):338–356

Zhang B, Peng J, Li S, Chen L (2016) Fixed charge solid transportation problem in uncertain environment and its algorithm. Comput Ind Eng 102:186–197

Zhao G, Pan D (2020) A transportation planning problem with transfer costs in uncertain environment. Soft Comput 24(4):2647–2653

Acknowledgements

This work is supported by the Department of Science and Technology (DST), New Delhi, India, for research through the letter No. DST/INSPIRE/03/2016/002898 and Reg. no.-IF170721.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bera, R.K., Mondal, S.K. Credit linked two-stage multi-objective transportation problem in rough and bi-rough environments. Soft Comput 24, 18129–18154 (2020). https://doi.org/10.1007/s00500-020-05066-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-020-05066-5