Abstract

We study the relation between income distribution and growth, mediated by structural changes on the demand and supply sides. Using the results from a multi-sector growth model, we compare two growth regimes that differ in three aspects: labour relations, competition and consumption patterns. Regime one, similar to Fordism, is assumed to be relatively less unequal, more competitive and to have more homogeneous consumers than regime two, which is similar to post-Fordism. We analyse the parameters that define the two regimes to study the role of the economy’s exogenous institutional features and endogenous structural features on output growth, income distribution, and their relation. We find that regime one exhibits significantly lower inequality, higher output and productivity and lower unemployment compared to regime two, and that both institutional and structural features explain these differences. Most prominent amongst the first group are wage differences, accompanied by capital income and the distribution of bonuses to top managers. The concentration of production magnifies the effect of wage differences on income distribution and output growth, suggesting the relevance of competition norms. Amongst structural determinants, firm organisation and the structure of demand are particularly relevant. The way that final demand is distributed across sectors influences competition and overall market concentration; demand from the least wealthy classes is especially important. We show also the tight linking between institutional and structural determinants. Based on this linking, we conclude by discussing a number of policy implications that emerge from our model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

An increasing number of studies suggest that growth regimes changed in most of the OECD economies around the 1980s (Freeman and Soete 1997; Fagerberg and Verspagen 1999; Petit 1999; Boyer 2010). We discuss some of the regularities that suggest a change in the growth regime across a range of countries.

Atkinson (2015), Atkinson and Morelli (2014), and Piketty (2014), amongst many others, point to the rising income inequality since the 1980s, following several decades of decline. Whilst there are important differences in levels of inequality amongst countries with different welfare states, the pattern is similar across the OECD countries.

Also common to many of the OECD countries are the changes related to increased inequality. Inequality seems to be driven by an increased share of wealth concentrated in the 10% and 1% of the population with the highest incomes (Alvaredo and Atkinson 2013; Atkinson et al. 2011; Atkinson and Morelli 2014). From the 1970s, increased inequality was preceded by and, currently, is accompanied by a regular decline in labour shares (over GDP) (Karabarbounis and Neiman 2013; Summers 2013). Relatedly, at the end of the 1970s, wages and productivity growth, which used to be matched, started to diverge and the gap between them has increased constantly (Lazonick 2014).

Similar to what happened during other episodes of structural change, process innovation in the manufacturing sector has increasingly been labour saving: automation is replacing more routinised tasks and increasing productivity (Brynjolfsson and McAfee 2014; Karabarbounis and Neiman 2013). Labour economists have provided convincing evidence that this has been followed by an increase in the number of both low paid jobs and high paid jobs (Acemoglu and Autor 2011), and has significantly reduced the number of middle class jobs. Also, Manning (2004), Autor and Dorn (2013), and Mazzolari and Ragusa (2013) suggest that these labour market changes are not independent of changes to the composition of consumption and consumer preferences.

A large component of the increasing difference between the top 10% and the rest of the working population is the increased compensations being paid to the top classes of workers in the form of wages, bonuses, profit shares (Atkinson et al. 2011) and stock options (Frydman and Jenter 2010). Some of these differences are explained by the routinisation of tasks, and some by the financialisation of economies and firms (Lazonick 2014; Lazonick and Mazzucato 2013; Stockhammer 2012). A trend common to both these aspects is the increasing firm’s size. It has been shown that average firm size increases with national per capita income (Poschke 2015) and market concentration (The Economist 2016), and is correlated to wage dispersion (Mueller et al. 2015) and CEOs’ pay rises (Frydman and Jenter 2010). OECD (2017) suggests that recent innovations have increased market concentration and that the innovation rents have been redistributed to shareholders and managers. Autor et al. (2017) suggest that the fall in labour shares is related to increased market concentration and larger firm size, which are, to some extent, due to changes in consumer behaviour and innovation, and to lower rates of creative destruction. http://www.economist.com/news/finance-and-economics/21646266-growing-size-firms-may-help-explain-rising-inequality-bigger suggests that “part of what is perceived as a global trend towards greater disparity in wages may actually be the result of the biggest firms employing a greater share of workers”.

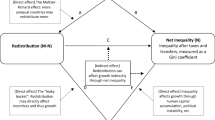

In this paper, we study the relation between income distribution and growth mediated by structural changes on the demand and supply sides. We study how the relation changes for distinct growth regimes (Boyer 1988; Petit 1999; Coriat and Dosi 2000), characterised by endogenous differences in: (i) labour relations – compensation, profit shares and the elasticity of wages to productivity and inflation; (ii) competition norms – entry barriers and market selection; and (iii) income related consumption norms – consumption shares and consumer preferences. We focus only on the structural determinants of income inequality; we do not consider potential redistributive policies.

We define two regimes. Regime one, characterised by relatively more equal labour relations, more competition and lower selection, and smaller differences in consumption behaviour; and regime two, which is relatively more unequal, with relatively more protection for incumbents, but higher levels of market selection and larger differences in consumption behaviour. Although we do not aim to replicate a specific historical period, regime one can be considered akin to a Fordist regime and regime two to a post-Fordist regime. We compare the two regimes using the results from a multi-sector model that associates the different regimes to different structural change dynamics. Employing parametric analysis, we study which of the three aspects in our model that define the regimes is the most relevant for explaining the relation between income distribution and growth.

We find that a Fordist regime (one) exhibits significantly lower inequality, higher output and lower unemployment than a Post-Fordist regime (two). We distinguish between the institutional and structural determinants of these differences, although we suggest that the two types of determinants are strongly related. Institutional determinants are used to differentiate the two regimes with respect to labour relations, competition norms and consumption norms. We find that, keeping all other features of the regimes fixed, wage differences are the most important for increasing inequality and limiting output growth. Returns on capital and bonuses to managers magnify the effect of wage differences by increasing the wealth of high wage earners with respect to low wage earners. The role of the minimum wage is substantially weaker. The concentration of production also magnifies the negative effect of labour relations on income distribution and output growth, suggesting the relevance of competition norms. However, in our model, we find two opposite effects. On the one hand concentration through entry barriers increases inequality and reduces output growth. On the other hand, concentration via market selection reduces inequality, but has no effect on output. Finally, consumption norms have no significant effect on either income distribution or output.

Instead, structural determinants are emerging properties in our model. First, in the absence of redistributive policies, an increase in average firm size has a direct effect on increasing income inequality. Changes to the structure of production amplify the effect of institutional differences in wage-setting. Second, the structure of demand plays a crucial role. Sectors that attract the largest share of consumption from the low income classes tend to be significantly less concentrated in our model than sectors that sell mainly luxury goods. The structure of demand also influences competition: sectors that constitute the largest expenditure shares of the low income classes face fiercer competition and more selective consumers with respect to price and, therefore, tend to exhibit low mark-up. This implies lower profits and dividends for the wealthier classes’ income. Third, demand is important for explaining the differences in output between the two regimes. Even if regime two were to catch up in productivity, the structure of demand means that the more uneven distribution curtails output growth.

Modelling and defining growth regimes The interaction between labour compensation, competition and consumption patterns has been discussed in the context of regulation theory with reference to different varieties of capitalism (Boyer (1988), Petit (1999), and Coriat and Dosi (2000)).

We propose a model that includes these three aspects which we understand as follows.

- Labour compensation, the wage-labour nexus.:

-

We distinguish three features of the wage labour nexus. First, we model firms as hierarchical organisations (Caliendo et al. 2015), in which workers are distributed in different tiers with different tasks and wages. At the bottom of the pyramid are clerks and blue-collars, at the top are the CEOs; in between, there are several intermediate supervisors and managers. The number of managerial tiers depends on the organisation of labour and on the size of the firm (endogenous in our model). Small firms have fewer tiers than large firms, cœteris paribus. Firm size depends on consumer selection, the level of consumer demand, labour productivity and the entry of new competitors. Wages are differentiated across tiers, determining income differences between consumer classes. Together, the number of tiers and the wage differences determine the distribution of wages in the population. The larger the wage multiplier, the larger the difference between tiers. Second, workers in managerial positions receive a part of the firm profits as bonuses or profit shares, as a part of their compensation, proportional to their base wage. The larger the rate of profits distributed as bonuses, the larger the differences between working classes. Third, the minimum wage is a function of unemployment, average productivity and inflation. We peg changes in the minimum wage to changes in productivity and prices. The larger the elasticity of the minimum wage to productivity and inflation, the higher the distribution of value to workers, and the higher their purchasing power (level of demand).

- Competition norms.:

-

In our model, competition and market concentration depend on consumer selection, firm differentiation with respect to price and quality, and entry barriers. Consumer selection and firm heterogeneity are endogenous in the model. Selection depends on changes in the structure of the consumer classes, and on their preferences; firm heterogeneity depends on how firms’ respond to price competition (investing in newer and more efficient capital goods and changing the mark-up) and non-price competition (increasing the quality of their products). We distinguish two aspects of the norms of competition. First, the lower the entry barriers, the higher the probability that new firms enter one of the consumer goods sectors and compete. Second, the more selective consumers’ preferences with respect to quality and price, the stronger is firm selection and the lower the number of surviving firms.

- Consumption norms.:

-

We model two aspects of changes in consumption behaviour. First, consumers in different income/working classes consume a different share of goods from each final good sector in the economy. We assume that less wealthy classes consume mainly basic goods and smaller shares of luxury goods. The opposite is true for the asymptotically wealthiest class. The faster the change in consumption shares between consecutive classes, the more heterogeneous is the demand between income classes at the extremes of the distribution. Second, we model preferences as selectivity with respect to price and quality. We assume that consumers in the lower income classes (compared to higher income consumers) will tend to be more selective over price and less selective over quality. These preferences change from one class to the next: the larger the change, the larger will be the differences between classes.

In our model, the three dimensions of the growth regimes are related endogenously. Firm size, which determines the organisational tiers and wage differences, depends on the level of demand and on market concentration. The level of demand depends on the elasticity of the minimum wage to changes in prices. Market concentration depends on the competition norms and the concentration of demand. In turn, consumer demand depends on the distribution of consumers amongst classes, and the income of each class which depends, in turn, on the organisational tiers and the wage differences. In other words, consumption norms are partly endogenous to the wage-labour nexus; competition norms are partly endogenous to the consumption norms; and the wage-labour nexus is partly endogenous to both the norms of competition and consumption.

We distinguish two growth regimes. Regime one is characterised by smaller differences in compensation across hierarchical tiers, a lower share of profits distributed to managers as bonuses, and a higher elasticity of the minimum wage to changes in prices and productivity. In other words, regime one assumes a lower personal and functional income inequality. In regime one, market barriers are lower and consumers are less selective with respect to both prices and quality. Finally, consumption patterns change at a slower pace and the preferences of middle income classes are closer to those of the lower income classes than to the higher income classes. Such a regime is relatively closer to what the regulation school defines as a Fordist regime.

Regime two is characterised by larger differences in compensation across hierarchical tiers, a larger share of profits distributed to managers, and lower elasticity of wages with respect to changes in prices and productivity. Regime two assumes a higher personal and functional income inequality. In regime two, market barriers are higher and consumers are more selective with respect to both price and quality. Finally, consumption patterns change at a faster pace and the preferences of the middle income classes are more similar to the preferences of the wealthier rather than the less well-off classes. Regime two is relatively closer to what the regulation school defines as a post-Fordist regime.

Relevant literature

To our knowledge, most models that replicate different growth regimes focus on long run growth and shifts in growth patterns (e.g. the unified growth theory) (Galor 2007), due, for instance, to households’ reproduction and education strategies (Galor and Weil 2000; Boucekkine et al. 2002), firm growth (Desmet and Parente 2012), or changes to technology and demand (Ciarli et al. 2012). A number of empirical studies investigate structural breaks in growth patterns, focusing particularly on developing countries (Kar et al. 2013; Lamperti and Mattei 2016; Pritchett 2000). Jones and Olken (2008) characterise the transition between regimes and find that different countries follow a common pattern of growth accelerations and declines.

Napoletano et al. (2012) is one of the few papers that attempts to model growth regimes based on insights from the regulation school. The authors focus mainly on the relation between income distribution and firms’ investment (in new process technologies) behaviours. Taking an evolutionary approach, and focusing on how micro-behaviour affects macroeconomic outcomes, Napoletano et al. (2012) investigate “how different growth regimes emerge out of micro-interactions between heterogeneous agents” [p. 237]. They discuss two regimes. In one, employment is a consequence of increased demand through investment, spurred by profit, inducing productivity enhancing innovation. In the other, investment is led not by profit, but by expected demand, and productivity gains are shared between capital goods and labour. As a result, an increase in productivity leads to increased demand via both consumption and investment.

Our paper is similar in spirit. We model how different ways of organising microeconomic interactions can lead to different macroeconomic outcomes. We add to Napoletano et al. (2012) work by more explicitly modelling labour relations, forms of competition and consumption norms, and how differences amongst those three dimensions can be described as different regimes or different forms of capitalism. To our knowledge, ours is also the first paper to investigate how structural changes are related to different growth regimes, and how they mediate the relation between growth and income distribution under different regimes.

Focusing on the relation between structural changes and growth regimes, this paper makes a substantial contribution to the burgeoning literature on agent-based macroeconomics,Footnote 1 and to evolutionary economic growth modelsFootnote 2. The paper is also close to papers that study the interaction between Schumpeterian and Keynesian dynamics using agent-based micro-foundations (Dosi et al. 2010; Dosi et al. 2015; Dosi et al. 2013). It is related to the few multi-sector models proposed in this tradition (Saviotti and Pyka 2008a, 2008b), and to papers that study skills and labour in relation to income growth and distribution (Caiani et al. 2016; Dawid et al. 2008; Deissenberg et al. 2008), and inequality more broadly (Cardaci and Saraceno 2015; Dosi et al. 2016; Russo et al. 2016). The present paper extends the work by (Ciarli et al. 2010).Footnote 3 The model proposed in this paper differs substantially from the models in Ciarli et al. (2010) and Lorentz et al. (2016) by introducing multiple consumer good sectors, industrial dynamics, and the financial connections linking households savings to investment, and focusing on medium term growth rather than the conditions for take-off in the long term.

The rest of the paper is structured as follows. Section 2 describes the aspects of the model most relevant to the three dimensions of the growth regimes: the wage-labour nexus, the forms of consumption and the forms of competition. The remaining features of the model are presented in Appendix A. Section 3 discusses the model results: the model properties and validation, comparison between the two growth regimes, and an assessment of the main institutional and structural aspects that differentiate the regimes. Section 4 concludes by summarising the core results and discussing some implications for policy.

2 The model

The model provides the micro-foundations for a number of related structural changes: firm organisation, earnings structure, sector shares, product technology, process technology, consumer classes, consumption shares and consumer preferences. The model reflects the principles of cumulative causation driving economic growth along the lines of Kaldor (1972): expansion of effective demand (final demand and induced investments) is a key factor in economic growth, mediated by changes in technology and other structural aspects. We model four sectors: consumer good producers (differentiated into 10 sectors), capital good producers, a financial sector, and a household sector. The interplay between demand and supply does not lead to market clearing (Colander et al. 2008; Dosi et al. 2010). In the final good sectors, supply is constrained by firms’ production capacity (time required to build capital goods) and labour capacity (hiring). The expansion of all markets is primarily demand-driven, but the model is circular: demand depends on households’ available income and preferences which change with the firm organisation in all sectors. A system of stocks and backlogs operates as a buffering mechanism to cope with short term differences between supply and demand. Figure 1 plots real and financial flows amongst the four sectors.

The household sector is populated by workers/consumers. These are split into different income classes with distinct earnings, savings, rents, preferences and consumption shares. The income in each class reflects the hierarchical organisation of labour within the firms in both the final and capital good sectors. Formally, we denote classes of households/workers by the index i ∈ {0,1,…,Λ(t)}. A household is assigned to a specific class on the basis of the hierarchical position occupied by a worker. Λ(t) corresponds to the highest tier in the largest firm in the economy, determined endogenously on the basis of the number of its employees. We assume that the labour market is perfectly elastic, which removes any population growth constraint. We compute employment using the endogenous vacancy ratio (Beveridge curve), and compute the minimum wage via a wage curve.

Firms producing consumer goods populate one of the N final good sectors denoted n ∈ [1;N], each of which serves one of the N consumer needs. Therefore, the output shares of the final good sectors depend on the structure of household expenditure. Each firm active in the nth sector is indexed by f ∈ {1,…,F(t)}. The fth firm of the nth final good sector is denoted by (n,f). Industry dynamics (entry and exit of firms) determines the number of firms F(t) in each consumer good sector. A firm competes with other firms in the same consumer good sector over the quality (qf,n) and price (pf,n) of the produced good. Good quality depends on the firm’s investment in product innovation. Good price depends on an endogenously determined mark-up and on the productivity of the capital stock available, which determines the number of employees required to produce a given level of output. Firm sales depend on the consumption shares across the N sectors of the households in the different classes, and on their relative price and quality with respect to those of competitors. In order to produce, a firm f builds and adapts its production capacity to meet expected demand, inducing investment in capital goods which are supplied by firms in the capital good sector.

Firms in the capital good sector produce capital goods with a given level of embodied productivity. The embodied productivity improves as a result of firm innovation. For simplicity, we assume that all capital goods can be used in any consumer good sector. Capital good producers’ sales correspond to firms’ investment in the consumer good sectors. Each firm in the capital good sector is indexed g ∈ {1,…,G(t)}. For simplicity, we assume no industry dynamics in the capital good sector, that is, there is a constant set of capital good producers.

In all sectors and all firms, labour is organised in hierarchical tiers (Simon 1957; Lydall 1959; Rosen 1982; Tåg 2013; Caliendo et al. 2015). As we move up the hierarchy, the number of employees reduces according to a pyramidal structure, and compensation increases exponentially. Based on the recent literature on firm organisation, we assume that workers in the same tier do similar tasks and earn similar wages. With respect to the empirical evidence, we add one assumption, which is crucial to make the connection with the demand side: as noted above, workers in a given tier are homogeneous in terms of both occupation and compensation and, also, in terms of income class and, therefore, consumption shares and preferences. This channel between occupation and consumption has already received some attention (Mazzolari and Ragusa 2013) and would benefit greatly from further research.

The financial sector is a centralised mediating institution between households – supplying liquidity through savings, and firms in need of liquidity to fund their investments in new capital goods or to cover their losses. In return, the financial sector collects profits from firms and redistributes them to households in the form of dividends. We adopt a simplified representation in which households’ savings are necessarily invested in the purchase of a unique financial instrument which we define as a ”token”. The number of tokens in circulation, represent the assets of the households and the liabilities of the financial sector, whose asset comprises the debts contracted by firms. Firms’ profits return to the financial sector, which redistributes them to the households in proportion to their number of tokens. The number and price of the tokens owned by a household class depends on the cumulated level of past savings. The total value of the financial sector is given by the liquidity collected through savings and not lent to firms, and the debt cumulated by active firms in order to purchase capital goods or to cover losses. This value, divided by the total number of tokens in circulation, determines the current price of a token and is used to determine the number of new tokens bought with households’ savings.

The model makes a number of simplifying assumptions. We abstract from redistributive or any other fiscal policy and focus on the structural determinants of inequality. We focus only on incremental innovations, which, in the medium run, are more relevant to growth than are radical innovations (Garcia-Macia et al. 2015). For simplicity, we do not consider the role of skills and how they might be related to the hierarchical tiers and wages. We also simplify the labour market by assuming an infinite supply of labour and modelling unemployment at the macro-level. Again, for simplicity, we do not consider growth regime related dimensions such as the substantial differences in the international division of labour, macroeconomic policies, financial markets and trade. All these limitations offer excellent opportunities for future work.

We describe how we model each of the three dimensions of the growth regimes in Sections 2.1 (wage-labour nexus), 2.2 (norms of consumption) and 2.3 (norms of competition). The remaining model components, related indirectly to the regimes, are presented in Appendix A.

2.1 The wage-labour nexus

In our model, we distinguish three main aspects of the wage labour nexus: the wage differences amongst occupations in a firm hierarchy, that is, the compensation paid to workers and different levels of executives – including bonuses; the distribution of profits as dividends on the financial market resulting from the functional distribution of earning within the firms and the saving behaviour of households; and the elasticity of the minimum wage with respect to changes in productivity and prices, shaping the distribution of productivity gains between wages and profits, and workers’ purchasing power.

2.1.1 The wage structure

Each worker/consumer in class i has a disposable income Di(t) composed of wages Wi(t), bonuses (from profits) Ψi(t), and dividends on firm profits Ei(t):

The total wage of a class i is the sum of the wages paid by all firms in the consumer good and capital good sectors, to the employees in the corresponding organisational tier (by assumption each class corresponds to a tier of workers/executives):

where wi,n,f(t) is the wage paid to workers in the i’s tier by firm f in the consumer good sector n at time t; Li,n,f(t) is the amount of labour employed by firm f in tier i at time t; wi,g(t) is the wage rate paid to workers in the i tier by firm g in the capital good sector at time t; Li,g(t) is the amount of labour employed by firm g in tier i at time t.

Li,n,f(t), the total number of workers in a tier i employed by a firm f in a final good sector n at time t, is a function of the firm’s planned level of output \(\phantom {\dot {i}\!}Q^{d}_{n,f}(t)\). Given \(\phantom {\dot {i}\!}Q^{d}_{n,f}(t)\), firms hire a number of shop floor workers L1f(t) depending on their productivity An,f(t − 1) and on a share υ of extra labour capacity to face unexpected increases in final demand:

where 𝜖 is a measure of labour market rigidities allowing firms to reach the desired level of workers only asymptotically over time, and \(\phantom {\dot {i}\!}\frac {1}{\bar {B}}\) is a constant capital stock intensity. 𝜖 is set to a value that generates unfilled vacancies corresponding to the empirical evidence.

Similarly, the number of workers employed by firm g in tier i at time t in the capital good sector is a function of the planned output (\(\phantom {\dot {i}\!}{K^{d}_{g}}(t)\)) and of a share υg of extra labour capacity:

Firms in all sectors also hire ‘executives’. For every ν shop-floor workers, the firm hires one executive in the second tier. For every ν second tier executives, one third level executives is hired, and so on. Following (Simon 1957), the number of workers in each tier i, for any firm k ∈ {f,g}, given L1,f(t) is:Footnote 4

where Λk(t) is the total number of tiers required to manage firm k at time t.Footnote 5 We assume a fully elastic labour supply and, in Section 2.1.3, derive unemployment and the minimum wage.

The wage paid to the workers reflects the hierarchical structure of the firm’s labour force. The wage of the shop-floor worker w1,k(t) is a ω multiplier of the minimum wage wmin(t − 1). The wage of the immediate next tier of executives is a multiple of b of w1,k(t); the wage of the immediate next tier of executives is a multiple of b of w2,k(t); and so on. b determines the skewness in the wage distribution in line with Simon (1957) and Lydall (1959):

2.1.2 Profit shares and financial returns

The total amount of bonuses of a class i > 1 is the sum of the share of profits redistributed by firms to the corresponding tier:

where ψi,n,f(t) and ψi,n,f(t) are the respective bonuses distributed by the firm f in the consumer sector n and by the firm g in the capital good sector, to the tier of workers i > 1 at time t.

Firms in the final good and capital good sectors (k ∈ {f,g}) distribute a ratio π of their profits πk(t) as wage premia to executives:Footnote 6

These are assumed to be distributed proportional to the executive’s wage (i ∈{2;..;Λk(t)}).Footnote 7 The share ψi,k(t) of redistributed profits to the executives of each tier i is computed as

The savings used by firms in the form of loans are repaid to consumers in the form of dividends. The returns on savings of a class i is a share of the sum of the dividends distributed by all the firms (R(t)) proportional to the share of the tokens owned by the class in the previous period (Ui(t − 1)):

where R(t) corresponds to the sum of firms’ profits in the final good sectors and the capital good sectors net of wage bonuses and R&D expenses. The saving behaviour of each consumer class is described formally in Section A.2.1.

As a consequence of the saving behaviour, the wealthier the class, the higher the proportion of income saved and used to purchase financial tokens. Cœteris paribus, the share of per capita income from dividends increases by income class, proportional to wage differences.

2.1.3 Minimum wage dynamics

The third component of the wage-labour nexus, the minimum wage, is a function of unemployment, average productivity and inflation. We peg changes in the minimum wage to changes in productivity and prices. The larger the elasticity of the minimum wage to productivity and inflation, the higher the distribution of value to workers, and the higher the purchasing power.

The minimum wage wm(t) is the lowest wage that firms can offer to shop-floor workers. Following evidence on the wage curve (Blanchflower and Oswald 2006; Nijkamp and Poot 2005), the minimum wage changes proportional to changes in the rate of unemployment u(t) for a given level of productivity and price index. Following empirical evidence on wage negotiations (Boeri 2012), we assume that the wage curve shifts upwards for given changes in consumer prices (△P(t))Footnote 8 or productivity (△A(t)).Footnote 9

We assume that negotiations to increase the minimum wage take place whenever consumer prices (P(t)) or productivity (A(t)) increases, respectively, by a factor of at least ΩP or ΩA relative to the last negotiations (t = τw). Hence, for a stable unemployment rate, the minimum wage grows proportional to labour productivity and/or prices. More formally:

where 𝜖U is the elasticity with respect to changes in the rate of unemployment, 𝜖P(t) and 𝜖A(t) are the respective elasticities for changes in the consumer price and in labour productivity. 𝜖P(t) and 𝜖A(t) vary depending on the growth of P(t) and A(t) as follows:

If the increase in either P(t) or A(t), from one time period to the next, is small, the minimum wage depends only on the level of unemployment. If either P(t) or A(t) increases by ΩP or ΩA since t = τw, the minimum wage increases by an amount proportional to the increase in P(t) or A(t), irrespective of unemployment. If both P(t) and A(t) increase by ΩP or ΩA from t = τw, the minimum wage increases by an amount proportional to half the increase in P(t) and half the increase in A(t).

We estimate the level of unemployment (u(t)) using the well-established Beveridge Curve, explained in Appendix A.1.1.

How do we distinguish the two growth regimes with respect to the wage-labour nexus? regime one is characterised by smaller differences in compensation across organisational tiers (lower b), a lower share of profits redistributed to executives (lower π) and a higher elasticity of the minimum wage to an increase in productivity and/or prices (higher 𝜖P(t) and 𝜖A(t)). The reverse applies to regime two. These differences are summarised in Table 1. Note that, in our model, there is no government and, therefore, no redistribution of wealth between classes. In other words, the distribution of income in our model is assumed to depend only on the economic structure (which depends also on institutions).

2.2 Norms of consumption

We distinguish two aspects of consumer behaviour that are endogenous to the wage-labour nexus: the pace at which, as new and wealthier income classes emerge, they change the distribution of their purchases from basic to luxury goods – across the N sectors; and the pace at which, as new and wealthier income classes emerge, their preferences – with respect to price and quality – differ with respect to the immediately less wealthy class.

2.2.1 Expenditure shares

The disposable income Di(t) (Eq. 1) is spent on goods from all N sectors or saved in the central financial institution. In line with the evidence on consumption smoothing, we assume that the level of expenditure is a convex combination of the non-saved share of the current level of income Di(t) and of the past level of expenditure (Xi(t − 1)):

where γ ∈ [0;1] is the rate of consumption smoothing and si ∈ [0;1] is the given class’s’ i saving rate.Footnote 10.

Consumers from a class i allocate a share cn,i of expenditure to each final good sector. Then, the sector consumption level for each consumer class is computed as:

Following the literature on the distribution of expenditures shares and the evidence on Engel curves (Barigozzi and Moneta 2016; Moneta and Chai 2013), we assume that expenditure shares (cn,i) vary with income. Less wealthy classes tend to consume more basic goods, and more wealthy classes tend to consume more luxury goods. Let us consider the asymptotic distribution of consumption shares for the very wealthiest class: \(\phantom {\dot {i}\!}\bar {c}_{n}\). As we move from the first class towards the asymptotic class, we model the change in expenditure shares logistically:

where η is the speed of convergence to \(\phantom {\dot {i}\!}\bar {c}_{n}\), that is, the pace at which wealthier classes change consumption shares towards more luxury goods.Footnote 11

2.2.2 Consumer preferences

We model bounded rational consumption behaviour, inspired by the literature on experimental psychology (Gigerenzer 1997; Gigerenzer and Selten 2001) and implemented in Valente (2012).

Consumers do not have full information on the quality and price of goods.Footnote 12 They make a goods selection based on a perceived value of quality and price drawn from a normally distributed random function centred on the true values and with variance ι.

For each sector, n consumers first select a subset of firms with probability proportional to their visibility \(\phantom {\dot {i}\!}\hat {\upsilon }_{f}(t)\).Footnote 13 Next, consumers rank the available alternatives according to the perceived levels of price and quality. Consumers then select a subset of goods with a quality above and a price below a selectivity threshold: respectively λq,i and λp,i. The selectivity thresholds defines the maximum distance between the price and the quality of a good produced by firm {f,n} and the minimum price and maximum quality available in the same sector and period. Therefore, preferences are defined in terms of the selectivity with respect to the best option. We assume that higher income classes are less selective with respect to deviations from the lowest prices (they are prepared to buy more expensive goods) and are more selective with respect to deviations from the highest quality (they are not prepared to purchase goods of lower quality). Conversely, we assume that lower income classes are more selective with respect to price and less selective with respect to quality. More formally, the selectivity parameter with respect to price λp,i decreases with income class, and the selectivity parameter with respect to quality λq,i increases with income class:

where λmin and λmax are the asymptotic values of selectivity as well as the selectivity of the least wealthy class (λmin = λq,1, λmax = λp,1); and ηλ is the speed at which preferences change with income classes. The smaller the difference between λmin and λmax, and the lower ηλ, the smaller will be the differences between classes in terms of preferences. For a large ηλ, households have a greater ambition to “keep up with the Joneses”.

How do we distinguish the two growth regimes with respect to the norms of consumption? Regime one is characterised by a relatively lower consumption of luxury goods cœeteris paribus, that is, irrespective of class income. In other words, firms tend to concentrate in fewer sectors, and the demand for niche goods is relatively low. Accordingly, regime one is characterised also by a slower pace of change in consumption preferences as new classes emerge and consumers tend, on average, to be more selective about price than quality. These differences are summarised in Table 2.

2.3 Competition and market concentration

We consider two aspects of the competition norms distinguishing economic regimes. The first is defined exogenously as barriers to the entry of new firms. The second, firm selection, is endogenous to consumer behaviour.

2.3.1 Industrial dynamics

The number of firms F(t) active in each sector at time t is a result of the interplay between a stochastic entry and an endogenous exit mechanism based on firm performance.

Firms in the final good sectors exit when their estimated return on capital falls below a given threshold ξ. A firm’s f return on capital is computed as the ratio between the moving average of firm’s profit (\(\hat {{\Pi }}_{f}(t)\))Footnote 14 and the value of its assets, that is, the previous equipment purchases \(\phantom {\dot {i}\!}\hat {K}_{f}(t)\):

For simplicity, the value of a firm’s assets used to compute its RoKf(t) is assessed as the cumulated loans received from the financial sector since birth, to either purchase new capital goods \(\phantom {\dot {i}\!}{J^{k}_{f}}(j)\) or cover losses (\(\phantom {\dot {i}\!}{J^{l}_{f}}(j)\)):

where j is the time period in which the loan was received. The model assumes that the money borrowed from the financial sector is never repaid because households, through the intermediation of the financial sector, effectively become firm shareholders. Firm’s profits not invested in R&D or used to pay bonuses are returned to the financial sector to be distributed to consumers as dividends.

At each time step, a new firm enters in each final good sector with a probability 𝜗. New firms are assumed to produce a good of the same quality as the best quality produced in the sector. They are given a loan equal to 10% of the sum of the net worth of all firms in the sector to purchase a capital good of the latest vintage. Each firm is assumed to have a level of visibility, which conditions the probability of being selected by consumers. We assume that new firms have low visibility (0.1),Footnote 15 and, therefore, initially serve a niche demand.

2.3.2 Firm’s selection: price and quality

Firms compete on price and quality. Which is the most effective strategy depends on the composition of the demand, which, in our model, depends on the distribution of earnings, bonuses and dividends (the wage-labour nexus), and on the changes in consumption shares and preferences (consumption norms).

Firms in the final good sector charge a mark-up mf(t) on unitary production costs:

As firms grow, they invest in new, more productive (on average) capital vintages,Footnote 16 which reduces the labour costs, and hire new labour, which increases the labour costs due to the increased number and levels of executives.Footnote 17

The mark-up increases when demand exceeds the firm’s production capacity, and reduces when inventories exceed its desired ratio. Formally, the mark-up mechanisms is modelled as:

where \(\phantom {\dot {i}\!}\bar {m}\) is the minimum mark-up; μ is a coefficient of variation that determines how much the mark-up can adjust in the short term; \(\phantom {\dot {i}\!}{Y^{e}_{f}}(t)\) represents the expected sales of the firm; Qf(t) is its current production level; and If(t) is its current inventories.

Changes in a firm’s good quality (qn,f(t)) result from product innovation. In each period, final good firms spend a fixed share ρ of the moving average of expected sales in R&D: \(\phantom {\dot {i}\!}RD_{f}(t)=\rho \bar {Y}^{e}_{f}(t)\). As a result a firm has a proportional number of innovation trials, which increases at a decreasing rate to conform to both Schumpeter Mark I and Schumpeter Mark II innovative behaviour (Malerba and Orsenigo 1995) – cœteris paribus a new firm has a higher probability of benefiting from an innovation, but larger firms innovate more: RTf(t) = log(1 + RDf(t)).

The probability of success for a given trial is assumed to be fixed, χ, and uniformly distributed across trials/firms. For a successful trialFootnote 18, the quality of the new product is normally distributed:

where σq is fixed. The new product replaces the current one if its quality is higher:

How do we distinguish the two growth regimes with respect to the norms of competition? On the one hand, regime one is characterised by a relatively higher probability of entry, therefore, more opportunities and lower barriers, cœteris paribus. On the other hand, in regime one the least wealthy consumers’ selectivity with respect to price is lower. That is, for each sector, the most selective consumers with respect to price (the least wealthy class), purchase goods from a relatively larger set of firms with different prices, and the difference with respect the most wealthy class (with a very low selectivity with respect to price) is smaller. These differences are summarised in Table 3.

3 Simulation results

We investigate computationally the results of the model with respect to aggregate output and income distribution, and their relation, for two growth regimes, which differ with respect to labour relations, competition and consumption. For each parametrisation, we run the model several times and analyse the resulting average and across-runs standard deviations.Footnote 19

Before studying the two regimes, we discuss the properties of the model and its robustness with respect to several stylised facts. We employ a “benchmark” parameterisation of the model relying on empirically calibrated values for all parameters for which we could find empirical evidence.Footnote 20 Table 17 in Appendix C provides full detail of the parameter initialisations. The “benchmark” parameter values are also the average of the values in the two regimes. The model was implemented and studied in the open source software http://www.labsimdev.org/Joomla_1-3/.

3.1 Model Properties and Empirical Validation

Our model is able to study the evolution of an economy through different phases of economic development, including long term stagnation and economic take off.Footnote 21 Because our interest in this paper is in studying regimes characterising modern capitalistic systems, we run the model until a modern economy emerges, after take-off – an emergent property of the model related to several structural changes (Ciarli et al. 2010; 2012). As part of the economy takes-off, firms grow in size and adopt complex organisational structures; new consumer classes emerge and purchase relatively larger ratios of luxury goods; the consumption baskets of lower income classes change as an outcome of imitation; productivity growth accompanies population growth; sectors become more concentrated; and inequality increases.

We initialise the model from this stage using the parameter values observed for modern economies (Table 17). We let the model run for 250 time periods to eliminate the noise of the initial adjustment, and analyse the model for the following 1,000 time periods.Footnote 22 The level of detail of the agents’ micro behaviour in our model suggests that each time period is equivalent to approximately a week/fortnight.

The model exhibits endogenous exponential output growth, accompanied by growing consumption, investment (Fig. 2a) and aggregate labour productivity (Fig. 2b). The main aggregate drivers of the endogenous growth are demand- and productivity-enhancing technological change (discussed extensively below).

Main macro series 2a and productivity (2b): Notes. Panel 2a exhibits the time series for aggregate output, investment and consumption. All series are in logs. Output and consumption are in real values (deflated with a price index). Investment is proxied by the physical production of capital goods. Panel 2b exhibits the series for aggregate labour productivity computed as total output over the total number of workers

Technological change in the capital good sector increases the productivity of capital vintages purchased by incumbents and new firms, which has two main effects: replacing labour, which reduces demand in the short term; reducing relative prices and increasing relative wages, which increases demand and output in the medium term.

The model reproduces a large number of empirical regularities at the macro, meso and microeconomic levels. These are summarised in Table 4 and discussed in Appendix D.

3.2 Growth regimes, income distribution and economic growth

Inspired by analysis of regulation theory (Coriat and Dosi 2000), we distinguish two different regimes with respect to the following three dimensions:Footnote 23 the wage labour nexus; competition and market concentration; and consumption norms.

With respect to the first dimension (wage labour nexus), the two regimes differ in the variation in wages along the firm’s hierarchical organisation (b in Eq. 6), the size of bonuses and wage premia distributed to managers according to their hierarchical position (π in Eq. 8), and the purchasing power of the least wealthy class, as a result of changes in the minimum wage with respect to productivity (𝜖A in Eq. 11) and prices (𝜖P in Eq. 11).

With respect to the second dimension, the two regimes differ in the entry barriers to new firms in all sectors (𝜗 in Section 2.3.1) and the selectivity of consumers in the first class (least wealthy) with respect to price (λp,1 in Eq. 17) and quality (λq,1 in Eq. 17).

With respect to the third dimension, the two regimes differ in the speed at which consumption shares change between income classes (η in Eq. 15) and in terms of whether middle income class consumer preferences are closer to those of the wealthiest consumers – more (less) selective on quality (price), or to the least wealthy consumers (ηλ in Eq. 17) – less (more) selective on quality (price).

We define Regime one to resemble what regulation theory qualifies as Fordist, with relatively lower differences in wages and profit shares, and relatively higher wage elasticity with respect to productivity and inflation; lower entry barriers and weaker competition; and relatively less differentiated consumption patterns, but relatively more similar preferences between the middle and the top classes. We define Regime two to resemble what regulation theory qualifies as Post-Fordist: larger differences in wages, higher profit shares and lower minimum wage elasticity with respect to productivity and inflation; higher entry barriers and stronger competition; and relatively more differentiated consumption patterns, but relatively more similar preferences between the low and the middle classes. Table 5 reports the initial conditions of the two different regimes, with reference to the model parameters.

We employ the model to study how the two regimes differ in terms of output and income distribution, and to what extent the differences are related to the different dimensions of structural change. Table 6 reports the mean values over 25 independent runs with different pseudo random seeds for each regime – and the t-statistics and p-values for the mean difference test between the two regimes, for a selected number of macroeconomic indices: output, income distribution, employment, productivity, and different indices for the structure of production, consumption, and earnings. Each value is the average over 2,000 steps.

The two regimes differ significantly with respect to output level, unemployment rate and inequality (measured using the Atkinson index).Footnote 24 Regime one experiences higher output, lower inequality and to some extent also lower unemployment.

To investigate the extent of the relation between economic growth and inequality, we estimate the correlation between the Atkinson index and real output using a least absolute deviations (LAD) estimator for the average values computed over each simulation run. Table 7 shows that, although in both regimes, inequality is positively related to real output,Footnote 25 the relation is significantly stronger in regime two. In a regime with larger wage differences, lower distribution of productivity gains to wages, lower competition, and more skewed consumption patterns, productivity gains are more unevenly distributed amongst workers.

3.2.1 Institutional components of income distribution and economic growth

The differences in the distributive outcomes can be traced to four related institutional components in our model. First, higher inequality in regime two is a direct consequence of the difference in the wage multiplier between tiers of workers (b), which is lower in regime one (Table 5). The wage-income ratioFootnote 26 measures the share of wage earnings in the household’s total income. For both regimes, wages correspond to the largest component of income (Table 6). As a consequence, the wage settings account for a large part of the income inequality differences between the two regimes.

The second component of the difference in inequality is the minimum wage. Whilst regime two has a higher average level of household income, the minimum wage is significantly lower (Table 6). The higher average household income in regime two is accompanied by a lower wage of the first tiers of workers, the least wealthy households.

The third component of the difference in inequality is due to dividends (the functional distribution of income). The share of dividends in total household income, measured by the dividends-income ratioFootnote 27, in regime two is significantly higher than in regime one (Table 6). Moreover, firms in regime two make a significantly higher level of (total) profits than the firms in the regime one (Table 6). Since higher tiers of workers have a higher saving rate, the profits redistributed to the corresponding wealthier classes as dividends also are higher in regime two. However, the dominating weight of wages in total income limits the actual contribution of dividends to inequality.

Fourth, the differences in the industrial structure between regimes magnify the differences in the structure of earnings. As measured by the inverse Herfindhal index in sales,Footnote 28 the final good sector is significantly less concentrated in regime one than in regime two (Table 6). Market concentration tends to increase income inequality:Footnote 29 larger firms require more organisational tiers and, therefore, there are higher wage differences between the bottom and the top tiers; they also make higher profits, redistributed through premia and dividends to the wealthiest income classes. The lower market concentration in regime one is driven by two distinct mechanisms. The first is a direct consequence of the regime setting: a higher probability of firm entry and less selective consumers in regime one, by assumption (Table 5), imply a higher level of competition. The second and more interesting mechanism is an emerging property of the model: the most concentrated sectors are those producing luxury goods, representing the main consumption shares of the top income classes, whereas basic good sectors, which represent the highest shares of consumption of the least wealthy classes (e.g. food, housing, and power), are significantly less concentrated (more on this below).

We study the relative influence of these four components by comparing the Atkinson index for different combinations of parameters ranging between the values of the two regimes, cœteris paribus.Footnote 30 Tables 8 to 10 report the results of the t-tests for mean values of the Atkinson index across 2000 simulation steps for 20 replications.

Table 8 reports the combined effect of the wage multiplier and the elasticity of the minimum wage to productivity and consumer price on inequality with respect to the benchmark case (b = 1.6, εA = εP = 1). In our model, as expected, increasing the tier-multiplier for wages (increasing b) significantly increases the wage inequality amongst workers. However, the elasticity of the minimum wage (𝜖A and 𝜖P), on its own, does not have a significant effect on inequality in our model, even when combined with a higher wage multiplier.

Table 9 reports the combined effect of the inequality of the wage multiplier and the share of profits redistributed as premia, with respect to the benchmark case (b = 1.6 and π = 0.15). Both parameters mechanically affect the individual and functional income distribution: increasing the share of profits (higher π) redistributed as premia significantly increases the level of inequality, magnifying the effect of a higher wage multiplier on the inequality. Because, in our model, the distribution of premia is proportional to the wage, higher wage differences imply higher premia differences, reinforcing income inequality.

We focus next on the effect of the parameters defining the nature of competition and, therefore, concentration: the joint effect of consumer’s selectivity – which tends to reduce the number of firms fit to compete, and the probability of firm entry. Table 10 shows the effect of competition on inequality with respect to the intermediate case (\(\vartheta = 0.08, \lambda _{p,1} = \bar {0.825}, \lambda _{q,1} = \bar {0.175}\)). Cœteris paribus, increased competition in all sectors (higher 𝜗) reduces market concentration.Footnote 31 In turn, an equal reduction in market concentration across all sectors tends to decrease the relative sizes of firms: the same output is produced by a larger number of smaller firms. As a result, there are fewer managers with large salaries, profits distributed as dividends are low, and savings and capital gains are also lower.

Selection has the opposite effect. The increased concentration due to higher consumer selectivity (higher λp,1) reduces income inequality. This is due to two main emergent properties in our model.

First, the most concentrated sectors are those in which the least wealthy classes have the lowest consumption shares.Footnote 32 This, in turn, is due to two main features of our model. On the one hand, a price strategy is more flexible than an innovation strategy: firms can change their prices and follow consumer price preferences more quickly than they can innovate and improve the quality of their good. That is, firms can more easily escape selective pressure from the large number of consumers that prefer less expensive goods, but struggle to excel in quality and capture demand from consumers that prefer high quality goods. On the other hand, mass consumption exerts strong pressure even on large firms, which, in the short run, will accumulate large backlogs – as they wait for the new capital goods – and steer consumer demand towards competitors even though their prices may be higher.Footnote 33 That is, the time required to build capital creates more competition amongst consumer good firms.

Second, increased price selectivity induces small changes in employment shares out-migrating from sectors that constitute the highest shares of less wealthy consumers. Despite being the least concentrated, these are the sectors with the largest incumbents, cumulated revenues and profits. Then, changes in employment shares have a small, but significant negative effect on the inequality observed in Table 10, despite the overall increase in concentration due to stronger market selection.

Comparing the relative effect of each parameter on income inequality with respect to the differences between the two regimes (Table 6), we find that the first component, the wage multiplier (inflated by the third component of dividends, which are proportional to wages), represents the lion’s share. A distribution of larger bonuses further increases the relevance of wage differences.

The role of market competition, on its own, is ambiguous and depends on whether it is due to lower barriers to entry (which reduce inequality) or weaker consumer selection (which, in our model, increases inequality).

Finally, the second component, changes in the minimum wage, on its own, does not seem to play a significant role.

The higher inequality in regime two is accompanied by a significantly lower level of real output and labour productivity and a significantly higher unemployment rate. Tables 11 to 13 report the results of the t-test for mean values of the output across 2,000 simulation steps for 20 replications, for the parameters defining the two regimes.

With the exception of a few parameterisations, increasing the wage multiplier (higher b) significantly limits output growth (Table 11). Similarly, increasing the share of profits redistributed as premia (higher π) also has a negative effect on output. Both parameters seem to hinder growth since they increase inequality.

Reducing the elasticity of minimum wages to prices and productivity (lower 𝜖A and 𝜖P) has a negative effect on output only below a certain threshold, which in our model is 0.75 (Table 12). This negative effect is independent of changes in the income distribution. This is a purely demand driven effect: increases in prices and productivity that are not reflected in an increase in the level of all wages tend to depress demand.

The competition parameters also have a different effect on output with respect to the income distribution (Table 13). On the one hand, alongside income inequality, a higher probability of entry (higher 𝜗) also increases output significantly. On the other hand, stronger market selection (higher λp,1), although it reduces inequality, does not have a significant impact on real output.

Comparing the relative effect of each parameter on real output with respect to the overall difference between the two regimes (Table 6), we find that wage differences may account for a large part, but not all of the difference in output. The elasticity of the minimum age accounts for a small fraction of the difference between regimes, even when combined with differences in the wage coefficient. cœteris paribus, entry barriers – and especially lower entry barriers – also account for a large share of the differences between the regimes – selection has almost no effect.

3.2.2 Structural change, income distribution and economic growth

We argue in this section that some of the differences in output and income distribution resulting from the two different institutional settings are rooted in the structure of production and consumption.

First, in our model an increase in demand and output can be satisfied by new entrants or by increased growth of incumbents. As firms grow, higher hierarchical tiers are required. These higher tiers of workers correspond to higher income classes. Thus, the sheer emergence of large firms explains part of the rising inequality. As discussed, the modes of competition that distinguish our two regimes, work to fine tune the extent of output growth concentration.

Whilst supply side concentration has a direct impact on income distribution, more concentrated demand also helps to explain the differences between the two regimes.

As already noted, the aggregate level of concentration hides major differences between sectors. However, concentration is significantly negatively related to the expenditure shares of the least wealthy income classes: the higher the demand from low income classes, the lower the concentration. However, the consumption shares of the income classes above the first one, change between the two regimes as the rate of change in expenditure shares increases from regime one to regime two. As demand shifts more rapidly to luxury goods, employment should grow relatively more in sectors that tend to be more concentrated, increasing the overall concentration of production. This effect may be counterbalanced by changes in preferences that reduce price selectivity and increase quality selectivity, which, on average, reduce the competitive pressure on firms.

Third, the structure of demand influences competition. Sectors serving high shares of less wealthy consumers, experience significantly higher demand from consumers that are very selective with respect to price. Given the pyramidal structure of firms and society, these classes represent the large majority of consumers.Footnote 34 As a result, sectors representing high shares of less wealthy consumers’ expenditures are significantly more competitive, and firms tend to charge a lower mark-up, than in less competitive sectors. Profits are also remarkably lower. Therefore, a faster increase in the expenditure shares of luxury goods, as in regime two, should imply higher inequality (and lower output growth).

We test how differences in the modes of consumption affect output, cœteris paribus. Table 14 reports the difference in output for different rates of change in expenditure shares (η) and consumer preferences (ηλ) ranging between the values of the two regimes – and the results of the t-test for mean values of output across 2,000 simulation steps for 20 replications. Moving from lower to higher heterogeneity in expenditure shares or preferences, on its own, has no significant effect on real output (although the direction of the change is as expected).

We run the same analysis for inequality outcomes (Table 15) and, again, find no significant effect of the heterogeneity of consumption shares or consumer preferences.

The results highlight that, in our model, the tier/class structure is more relevant than the corresponding expenditure shares. This is relatively straightforward. As already noted, the first two classes of consumers constitute 88% of total population and 72% of total consumption.Footnote 35η and ηλ modify the expenditure shares and preferences of income classes above the first one, as we move towards wealthier classes. The contribution of these richer classes to shaping the level of firms’ employment and profits is limited.

Finally, the relation between output and productivity points to another fundamental mechanism in the model, which links the structure of production and demand to aggregate output. Table 16 shows the correlation between labour productivity and real output, estimated using a LAD estimator for the average values across the 2,000 periods. Whilst, in both cases, labour productivity is positively and significantly correlated to output, the relation is stronger for regime one than for regime two.

However, as Table 6 suggests, higher output and productivity in regime one are due also to higher demand. Despite the lower output, regime two experiences a small, but significantly higher capital-labour ratio. This implies that for the same level of output, regime two may show a larger labour productivity, related to the higher concentration of production. However, the uneven distribution of productivity gains, due to institutional and structural differences, leads to an overall significantly lower output and productivity.

4 Discussion and concluding remarks

In the last four decades, most OECD countries have experienced a sharp increase in income inequality, due mainly to the rise in top incomes. During the same period, economies’ income growth has stagnated following the 2008 crisis. The observed changes in income distribution and growth are related to a number of changes in the structure of the economy such as decreasing labour shares, de-linked productivity and wages dynamics, increased mechanisation, increased rents, changes in consumer preferences and shares of goods consumed, and increased concentration of production in fewer firms. These structural changes have been accompanied by institutional changes that have increased the within-firm differences in wages and the appropriation of innovation-induced rents.

In this paper, we proposed a model to study the relation between income inequality and economic growth due to exogenous institutional features and endogenous structural features of the economy. We studied the effect of these features on the relation between income growth and distribution by comparing the results from two different growth regimes.

The two regimes differ with respect to (i) labour relations – differences in compensation within firms, profit shares and wage elasticity with respect to productivity; (ii) norms of competition – entry barriers and market selection; and (iii) income related consumption norms – consumption shares and consumer preferences. Regime one (Fordist) was characterised by relatively more equal labour relations, more competition and lower selection, and smaller difference in consumption behaviour across consumer classes. Regime two (post-Fordist) was characterised as more unequal, with relatively more protection for incumbents and higher market selection, and larger differences in consumption behaviour across consumer classes.

We find that a Fordist regime (one) exhibits significantly lower inequality, higher output and lower unemployment than a Post-Fordist regime (two). We distinguish between the institutional and structural determinants of these differences, although we suggest that both types are strongly related.

Institutional determinants are used to differentiate the two regimes with respect to labour relations, and competition and consumption norms. We find that, keeping all other features of the regimes fixed, wage differences are the most important for increasing inequality and limiting output growth. The financial market magnifies this effect by increasing the wealth of high wage earners with respect to low wage earners. Accruing to these differences and their negative effect on income distribution and output growth, is the share of profits distributed as bonuses. Instead, according to our results, the role of the minimum wage is substantially weaker. A lower elasticity with respect to price and productivity has a significant effect on output, but only below a low threshold.

The concentration of production also magnifies the negative effect of labour relations on income distribution and output growth, suggesting the relevance of competition norms. However, in our model we find two opposite effects. On the one hand, concentration based on entry barriers increases inequality and reduces output growth. On the other hand, concentration via market selection reduces inequality, but has no effect on output.

Finally, the norms of consumption – changes in the distribution expenditure shares and in consumer preferences – have no significant effect on either income distribution or output. This is because the most relevant consumers in our model are those who work in the first two tiers (or even the first one). That wealthy income classes have different expenditure shares and preferences has no significant effect in our model.

We found structural determinants to be emerging properties in our model. First, in the absence of any redistributive policies, an increase in average firm size has a direct effect by increasing income inequality (see also Autor et al. (2017)). Changes in the structure of production amplify the effect of institutional differences in wage setting. In our model, firm size is related to the norms of competition, but may also be related to technological features (Malerba and Orsenigo 1995) or trade strategies (Keller and Olney 2017).

Second, the structure of demand also is important. Sectors that attract the largest shares of consumption from the low income classes, in our model tend also to be significantly less concentrated than sectors that sell mainly luxury goods. On its own, a higher share of employment in less concentrated sectors reduces the overall concentration of production (with the positive effects on income distribution and output discussed above). The structure of demand also influences competition: in our model, sectors that account for the largest expenditure shares of the low income classes face fiercer competition and more selective consumers with respect to price and, therefore, tend to exhibit a low mark-up. This implies lower profits and dividends, and relatively lower income for the top classes.

Demand is critical for explaining differences in output between the two regimes. Even if regime two catches up in terms of productivity, the more unequal distribution due to the structure of demand, curtails output growth.

To conclude, in order to improve income distribution and, thus, output growth, policies should aim at breaking the vicious cycle between the institutional and the structural determinants, which, in regime two (Post-Fordist), induce a more unequal distribution of income, lower output and higher unemployment. Assuming that expenditure shares do not change as a consequence of distribution, and that firms will always have a hierarchical organisation, the most easily addressed determinants of growth and inequality are the institutional determinants.

For a given concentration of production, large differences in wages, returns to capital and bonuses may need to be capped or redistributed through progressive taxation. For given differences in wages, returns to capital and bonuses, reducing market concentration by reducing the barriers to entry (which may depend on trust, but also on technology specific factors and protection of property rights), would also be beneficial. The results from our model suggest that the first type of redistributive policies would have a bigger impact.

Our model suggests also that demand side policies that address consumer behaviour, on their own, may be less relevant. However, an important message from our model is that the structure of consumption has a substantial bearing on the economy by shaping sectoral concentration and the related compensation structure. Redistributive policies should also consider the non-trivial effects of changing consumption behaviour and market selection as demand becomes more homogeneous.

Although the results are robust for the two regimes explored in this paper, in future research we plan to test the model with respect to more extreme regimes, and explore a wider parameter space. The model could also be used to test the effect of alternative fiscal policies. The model proposed is relative rich, but in future work we aim to explore an explicit modelling of the labour market and an open economy.

Notes

See, e.g., Leijonhufvud (2006), Colander et al. (2008), LeBaron and Tesfatsion (2008), Buchanan (2009), Farmer and Foley (2009), Gatti et al. (2010), Fagiolo and Roventini (2012), Dosi et al. (2013), Lengnick (2013), Assenza et al. (2015), Dosi et al. (2015), Lorentz (2015), and Caiani et al. (2016). See also the recent review in Fagiolo and Roventini (2017), and other papers in this issue.

The index for sector n is suppressed because we represent both the final good and the capital good sectors.

Caiani et al. (2016) propose an interesting, simplified, static version of the firm hierarchical structure, introducing heterogeneous wages within each tier. For simplicity, in our model, we assume that all workers in a given level earn the same wage.

The index for sector n is suppressed because we represent both the final good and the capital good sectors.

The aim of this paper is not to explain the rise in executives’ compensation. However, the proposed wage and bonus structure mean that the model conforms to a stylised representation of the evidence on firms’ compensation structures, and on the recent increases in executive pay. There is some evidence that suggests that the rise in CEO pay is linked mainly to stock options (Frydman and Jenter 2010). However, there is other evidence suggesting that the main components of the increased incomes of the top 1% are salaries and bonuses (Atkinson et al. 2011). The crucial aspect that we highlight here, is the exponential wage increases with an organisation’s tiers, and the use of profits to amplify this difference. Dividends, which can be thought of as stock options, also augment the income of the wealthiest classes relative to the less wealthy, as discussed below. Whether they come from savings or from firm compensation is not critical in this model.

P(t) is the weighted average of the final good firms’ prices:

$$P(t)=\sum\limits_{n = 1}^N\sum\limits_{f = 1}^{F(t)}\frac{Y_{f}(t)}{{\sum}_{n = 1}^N{\sum}_{f = 1}^{F(t)}Y_{f}(t)}p_{f}(t-1) $$Aggregate productivity is the ratio between aggregate output and employment:

$$A(t)=\sum\limits_{n = 1}^N\sum\limits_{f = 1}^{F(t)}\frac{Y_{n,f}(t)}{{\sum}_{n = 1}^N{\sum}_{f = 1}^{F(t)}Y_{n,f}(t)}A_{n,f}(t-1) $$The actual savings can differ from the desired share in the case of sudden changes in income: accumulated when income increases, and used when income reduces.

See Eq. 41.

\(\hat {{\Pi }}_{f}(t)=\hat {{\Pi }_{f}(t-1)} a + (1-a) {\Pi }_{f}(t)\).

See Eq. 41.

See Appendix A.3.3.

Labour costs are computed only with respect to the shop-floor workers.

If successful, no more trials are used in that period, and the firm must wait Ξ periods before the next investment in R&D.

100 runs when investigating the model properties and empirical validation, and 25 runs when investigating the regimes.

For some of the behavioural parameters we were unable to find any evidence and were forced to rely on qualitative evidence.

The initial adjustment is due to small differences in consumer preferences, productivity and labour market adjustments, introduced to reflect parameter values that are closer to those observed in a modern system with respect to those observed in a pre-take-off economy: the first class of wage earners are less selective with respect to price; innovation efforts are more successful, and wages more closely follow changes in prices and in productivity. These changes cause an initial minor downturn in the economy as prices, firms’ market shares and concentration (exit and entry) adjust to the new system.

Regulation theory discusses two other relevant dimensions: finance and the role of the state. Both are crucial, but for the sake of clarity we leave their analysis to further research.

As noted, in our model we do not consider any redistributive mechanism. We study income distribution as an outcome of the structure of production and demand

See Eq. 62 in the Appendix

Cœteris paribus, by this we mean the benchmark configuration (Table 6).

See the effect of selectivity and entry probability on market concentration in Appendix Table 20.

Results not shown here are available from the authors.

Note that firms with high backlogs in our model also have an incentive to increase mark-up.

In the benchmark configuration the first (least wealthy) class is populated by approximately 66% of the total population and the second class by approximately 22% of the total population. Their respective shares of total consumption are approximately 47% and 25%.

In the benchmark scenario.

The Beveridge curve constant is set to 1 because the values in Börsch-Supan (1991) range between -5 and 4.

Initialised with a value generating vacancy rates corresponding to the empirical evidence.

We assume equal savings for all the consumers in a class.

The constant assumption is corroborated by numerous empirical studies, starting with Kaldor (1957). The investment decision in in new capital vintages ensures that capital stock intensity remains fixed over time.

Given that, in our model, consumption occurs at the level of the class and goods are then distributed to consumers, there is no rationing at the consumer level. We assume that, although all consumers make a demand for all goods in all periods, only consumers who have not purchased the good in previous periods will need it. In other words, backlogs is a simplifying assumption to provide firms with market signals about future demand and allow a class of consumers to consume the same good in different time periods.