Abstract

The paper is based on the acknowledgement that properties of markets stemming from features of demand are too frequently overlooked in the economic literature, particularly among evolutionary scholars. The overall goal is to show that “demand matters” to understand properly observed properties of markets not only because of its exogenous (i.e. non-economic) features, but also because of aspects of consumers’ behavior that fully deserve to be considered in the domain of economics. The paper presents a general model of the consumer based on a bounded rational decision algorithm. The model is shown to be compatible with available evidence on consumers’ behavior and adaptable for theoretical as well as empirical applications. The description of the proposed model’s components provides the opportunity to discuss a number of issues the importance of which for the analysis of markets of markets becomes evident taking a demand-oriented perspective. Among these, we propose a formal definition of preferences meant as decision criteria used by consumers and distinct from the actual decisions made by consumers at each purchasing occasion. We also highlight the potential role of firms’ marketing in shaping consumers’ preferences, suggesting an endogenous channel of influence on consumers’ preferences which is possibly highly relevant in certain markets. We use the model to show that the proposed model can easily replicate a generic market demand function, with the advantage of more robust foundations and greater flexibility in respect of standard consumer theory. We also show that limiting to consider distributional properties of markets, neglecting the type of demand, may lead to serious errors of interpretation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The major methodological change brought about by evolutionary economics in respect of the mainstream approach (Nelson and Winter 1982) is the shift from assuming exogenously the properties of agents’ behavior, (e.g. optimizing) to describing what agents actually do (e.g. apply routines), so that agents’ properties become an endogenous result. The obvious reason for this change is the increasingly evident inadequacy of standard assumptions of perfect rationality and equilibrium to account for many, relevant phenomena. In particular, these assumptions prevent the very representation and study of innovation and technical change, where un-resolvable uncertainty and heterogeneity are the necessary ingredients of a minimally realistic representation of observed events. It is therefore not surprising that evolutionary economics’ main successes stem from the dynamic analysis of markets for innovative products, concerning phenomena that are simply negated by the standard assumptions.

Although market configurations obviously depend on the interplay between supply and demand, most evolutionary scholars focus their attention on the supply side of markets, relying on an extremely sketchy representation of markets’ internal functioning, and specifically of demand. This is curious, since the most diffused defense of the perfect rationality hypothesis is the ’as if’ hypothesis made popular by Milton Friedman. Ironically, this justification for the rationality assumption is an extremist version of the evolutionary concept of selection: no matter what people actually do, only the best will survive the competitive test, and therefore economists can focus on the only (supposedly optima) surviving behavior, making irrelevant the point as to whether optimality depends on design or luck.

However convincing, this argument can be sustained only when agents are subject to a competitive pressure operating the selective process required to remove sub-optimality. Conversely, there is no justification, not even in principle, supporting the claim of perfect rationality for consumers, since sub-optimal consumers can hardly be supposed to be driven out of a market. In short, perfect rationality applied to consumers is an even weaker assumption than is the case for competitive producers.

Notwithstanding the importance of consumer behavior in shaping markets’ properties and their development patterns, most of the evolutionary economics literature maintained a rather primitive representation of consumers, in many cases even implicitly adopting the perspective of perfect rationality and representativity of agents. Some contributions have already highlighted the relevance of a demand for an evolutionary agenda (Nelson 1994; Metcalfe 2001). Among the works on demand can be included authors who highlight the relevance of demand-side issues for the emergence of new wants (Witt 2001) and for sustainability of variety as the engine of growth (Saviotti 2001). Concerning the analysis at the industrial level, a few works have explicitly considered the role of consumers. A recent work focuses on the importance of variety of preferences and of “experimental” users for the success of innovations (Malerba et al. 2007). Consumers’ properties and demand distributions are also attracting the attention of those concerned with evolutionary analysis (Windrum et al. 2009). Other contributions discuss indirectly demand issues by studying the formation of market segments (Windrum and Birchenhall 1998; Klepper and Thompson 2006). However, little attention has been paid to advancing a generalized model for the actual behavior of consumers (see, for an interesting exception, Aversi et al. 1999). Consequently, there is also a shortage of proposals for a generalized evolutionary model of demand, a task that is increasingly called for (Nelson and Consoli 2010), and to which the present work aims to contribute.

The goal of this paper is to propose a model for consumer compatible with the evolutionary perspective, and to highlight the relevance of economic factors (as opposed to exogenous aspects) affecting demand behavior in shaping observed states. We develop our proposal starting from the definition of a few basic requirements that a consumer model compatible with the evolutionary economic tenets should satisfy.

The first requirement concerns the possibility of the model to deal with heterogeneous products defined over a multidimensional characteristic space. Overcoming the simplifying assumption of homogeneous products is not (only) a problem of realism, but it is also a necessity to study product-embodied innovations, a highly relevant form of technological innovation, particularly for an evolutionary theory keen of its Schumpeterian roots.

The second requirement is the adherence to the assumption of bounded rationality. This requirement stems from the consideration that consumers are generally poorly informed about the technological details of available choices, and have little motivation in investing time and attention for a decision that is likely to be relatively infrequent and of relatively little importance for their overall life. Consequently, the model should be able to tune both the difficulty in assessing available alternatives and the efforts devoted by the consumer to the task, as mandated by the bounded rational paradigm.

The third requirement is that the model should be sufficiently flexible and simple to allow for the analysis of the generative mechanisms of results. A consumer may potentially behave in many, different ways, depending on his expertise, interest, frequency of purchase, etc. We not only wish the model to be able to provide purchasing decisions that reflect different consumption profiles, but also to allow an explanation as to how the ex-ante consumer conditions (e.g. behavioral parameters) lead to the resulting choices. A consumer may opt for a product for several reasons, and lacking the possibility to understand the motivation of a given choice prevents us from using the model for analytical purposes.

A fourth requirement concerns the possibility, at least potentially, to observe and to estimate the core features of the model. This requirement is obviously directed to a possible application of the model beyond purely theoretical uses. However, there is more than mere interest in empirical applications. The possibility to establish reliable connections between theoretical and empirical representations works also in the opposite direction, giving the possibility to generalize specific observations and, therefore, to enrich the theory using empirical evidence (Saviotti 2003).

The rest of the paper provides a description of the proposed model and some examples of its application to represent market demand. The core of the model has its roots in the experimental psychological literature concerning subjects making decisions under uncertainty. The original proposal seems particularly suited to represent consumers in that it has very loose requirements concerning the information available to the decision maker. In particular, the vector of characteristics defining the alternative choices needs not be made of cardinal quantities, but only requires the possibility to establish a weak ordering of available options in respect of a single dimension. The original model for decision making under uncertainty, devised to account for experimental evidence, is here adapted to deal with the general case of consumers’ discrete choice for multi-characteristic products. As a by-product of the consumer model, we also reach a formal definition for preferences, properly considered as general criteria for consumers’ decisions and distinct from any actual decision. The proposed definition of preferences would therefore allow us to transfer consumption profiles across different markets, making our model compatible with the standard classification of consumers’ classes usually adopted by professionals in, e.g., market research.

The examples presented have the double purpose of investigating the potential applications of the model and to support the claim that “demand matters”. In the first two examples, we show that the proposed model for consumers can be used to generate well-behaved aggregate market demand functions. Not only can the resulting demand be shown to easily provide standard results for homogeneous as well as heterogeneous (multi-characteristic) products, but it can also provide clear indications on what type of feature lead to a given sales distribution.

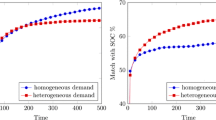

The second example tackles directly the issue of the relevance of demand in assessing a given market configuration, represented, for example, by sales distribution. We use two simulation experiments concerning the birth and expansion of an hypothetical market, suitably constructed in order to investigate demand contributions to the eventual configuration. The two experiments have in common all parameters and initial values, apart from two parameters concerning the purchasing behavior of consumers. The two experiments are shown to provide results appearing as almost identical, if evaluated in the usual terms of supply side features and distributional statistics, i.e. neglecting demand’s contribution. However, we can show not only that the two results are actually radically different, but also the (demand-based) motivations for both the different static (ranking of firms by dimension) and dynamic (expected outcome of any change) properties of the market. From this exercise we conclude that, ignoring demand, an observer would be erroneously led to either mistake the two cases as identical, or, in the best case, to assess the differences to un-explained exogenous aspects, missing the opportunity to analyze properly the events taking place in the market.

2 An evolutionary model of the consumer

The appeal of assuming perfectly rational agents in economics is largely motivated by the possibility that, assuming the result of agents’ behavior, we can neglect their actual activities, focusing only on the environmental conditions defining optimality. Besides the usual criticisms (Nelson and Winter 1982), the assumption of perfect rationality for consumers raises further reasons for skepticism. Firstly, while the optimization target for firms has a real-world counter-part, however questionable may be its use in this context,Footnote 1 consumers’ assumed optimization target (utility) is a pure economists’ invention the empirical estimation of which is, at best, highly unreliable. Actually, abundant evidence reports frequent violations of optimization behavior of whatever utility function is used (Kahneman et al. 1982). Nor can any “as if” argument be invoked, since inefficient consumers are not subject to selection. Second, in respect of producers, consumers are likely to be less committed to, and less expert of, the products and services they purchase. In fact, in most cases (and the most economically relevant) the role of a purchase in the buyer’s overall life and income is negligible, and therefore consumers can hardly be expected to devote huge amounts of time and attention on relatively unimportant activities. Of course, people do not like to waste money or buy lemons, as long as they can prevent it. Their capacity to do so will vary, resulting in a larger or smaller probability to identify the best products available. We need, in other terms, to develop a model describing consumers’ behavior, since the results of their action can hardly be predicted without knowledge of their decision procedure.

In the following, we present a model of boundedly rational agents representing the behavior of consumers that, besides being compatible with evidence on actual behavior, is also sufficiently general and simple to be adopted in theoretical applications. The goal is to define a highly general and flexible model to represent a wide range of consumers. We will describe the elements of the model in terms of their contribution to an explanation of consumer behavior. We will also provide one of the possible formal implementations for the elements with the dual purpose of clarifying the working of the model and of building the model in the following section. However, we will clearly distinguish the necessary properties of the model’s components from the implementation used to represent these properties. For example, we will implement products as defined over a set of real-valued variables, though the model only requires variables endowed with weak ordering. The format for the implementation is chosen for both clarity of exposition and for the development of the simulation exercises discussed in the following section.

In the rest of this section, we present the model by starting with the representation for the objects of trade in a market. The next paragraphs discuss how consumers can be represented to gather information, giving the modeller the opportunity to tune different levels of evaluation skills and product categories. We then present the decision making procedure proposed to represent consumer behavior, adapting a proposal for decision making under uncertainty originally proposed by experimental psychologists. Making explicit the decisional procedure naturally leads to a formal definition of preferences respecting the etymologically original meaning of the term as general decision criteria; this definition allows to correct the frequent use of the term as catch-all justification for whatever decisions are observed. Finally, we discuss how preferences may be influenced, besides many exogenous factors, also by activities internal to the markets, suggesting one route of possible endogenization of preferences into a broader market framework.

2.1 Product Space Representation

We consider consumers in a given market as having the task to fulfill a specific need by means of purchasing one among several alternative products or services,Footnote 2 as in discrete choice theory (Anderson et al. 1992).

We can generally assume that the set of products offered in a market can be represented as vectors over a set of dimensions, or characteristics (see, e.g., (Lancaster 1966; Saviotti and Metcalfe 1984; Gallouj and Weinstein 1997)).

In Table 1, the generic value \(v_{X}^{i}\) is the measure of product X in respect of characteristic i. This value must be interpreted as a measure of the quality for the “service” that the product provides in respect of a specific use.Footnote 3 In this representation, we require that there exist a weak ordering on the instances for each characteristic. That is, it is possible to assess one product X as inferior, superior or equivalent to another product Y in respect of a specific characteristic, or dimension.Footnote 4

Given our aim to devise a generalized model for consumers, we will adopt the assumption that the supply side of markets is exogenously fixed, in order to concentrate on the demand side contribution to relevant market features. Obviously, this assumption is a methodological expedient with no claim of realism, meant to investigate demand-only phenomena, and corresponds to the frequently adopted assumption of exogenous and constant demand in most of the literature on industrial economics. Before continuing, however, a few considerations on the supply side representation are worth mentioning.

First, at this stage, we skip the issue of how the set of products potentially relevant to consumers is selected because it involves not only aspects of the supply, but also features specific of consumers (e.g. income, skills, etc.). We will describe later how consumers are assumed to have minimal requirements over each characteristic that, in effect, determine the initial option set for each individual consumer. Sophisticated applications of the model may include a searching phase during which consumers collect information on available products; in any case, this is an issue that can be treated within consumers’ behavior and needs not to be discussed as a feature of the supply side of markets, at least when assuming, as we do, that the supply side is exogenously fixed.

A second consideration concerns the unit of measure of the characteristic values \(v_{X}^{i}\). As we will see below, the proposed consumer model does not require these measures to be defined as real numbers. The procedure used to implement consumers’ decisions only requires the possibility to identify one or more products as the best in respect of one dimension. The requirement for an ordinal measure of products’ characteristic is much weaker than that of a cardinal measure, consequently boosting the generality and applicability of the model. In the following, however, we will continue to indicate characteristic levels with real-valued variables for simplicity of notation and of implementation, even though the model decision algorithm only makes use of their ordinal character.

Third, even though we are concerned with consumer behaviors and, consequently, we will assume supply aspects as exogenously fixed, it is worth briefly discussing the nature the products’ qualities. There are two possible characteristic spaces to represent products: the space of technical characteristics, defining the content of a product, and the space of users’ characteristics, defining the services provided by the product to users (see, e.g., Gallouj and Weinstein 1997). The mapping from one space to the other resembles the genotype-phenotype mapping in living organisms, dealing with how technological or organizational (genotypic) complexity may affect (phenotypic) performance. In our case, dealing with consumers’ decisions, the relevant space is that of “phenotypic” descriptions, that is, how a given product fulfills users’ needs. Thus, for the purpose of this paper, we define “supply” as the set of alternative products that consumers consider as a potential purchase for a specific use, and their “quality” values must be measured in respect of that use. This set may not coincide with the definition of supply based on the technological content of products, a definition adopted by common industrial classification systems. For example, the market for “urban transportation” may include small cars, bikes, public transport, etc., but exclude sport and luxurious cars (category: status goods, competing with, e.g., diamonds and yachts), inter-city trains (category: middle-range transportation, competing with domestic air companies), etc.Footnote 5 In conclusion, the set of products in the list of potential purchases should be understood as including all products that are perceived as potential alternatives by consumers for a specific need, whether or not these products are actually classified within the same industry.

A fourth consideration concerns possible (and, indeed, likely) functional relations among characteristic values. We can reasonably expect that characteristic variables across products show strong functional relations such as, for example, higher prices associated with higher quality products or more extra features. The relation between characteristic values can be classified into two groups: technological and strategic relations. The first reflects the technological constraints imposing, for example, that a more robust product is generally heavier.Footnote 6 The strategic relations concern sellers’ decisions such as, for example, higher prices for more costly productions or for more recent versions of a product. We will not need to discuss the origins, constraints and possible consequences of the values for product characteristics, since the results we are concerned with depend on consumers’ behaviors only, and therefore would hold for any product characteristic values (see Valente 2000 for an integration of demand and supply actions).

A final property of the multi-characteristic representation of products is that innovation can be expressed not only in terms of improved values on one or more characteristic, but also in variations of the very numbers of characteristics, such as product embodied innovations and adoption of universal standards. In the first case, the features of a product may be expressed as increments of the dimensions defining the products (obviously, old products lacking a novel feature appear as dominated by new products having that feature). The second case can be expressed as the reduction of the space when all products score identically on a set of dimensions. Our model for consumers is potentially compatible with any of these events,Footnote 7 though, for obvious reasons, in this work we will not explore further this issue.

The definition of products by their characteristic values must be considered as an “objective” representation of available products, as, for example, may be agreed upon by experts of the technology. However, the generic user is unlikely to be able to assess properly at least some of the characteristic values, and can be expected to interpret erroneously the information available. In the following, we discuss how consumers elaborate the objective data from the supply side into subjective information used for their purchasing decisions.

2.2 Consumers’ information

The importance of information in influencing consumers’ behavior has long been acknowledged (Nelson 1970). Proposing a consumer model we need to make explicit how consumers may be affected by different types of information.

The proposed model includes three ways to elaborate information which is eventually fed into the decision procedure. Each of these constitutes possible ways to differentiate consumers, and consequently their purchasing behavior, even using the same decision process. Though we will describe in detail the decision procedure in the following paragraph, it is necessary to specify the nature of the elementary unit of information on which the decisions are made, in order to appreciate how the data elaboration by consumers generates the necessary information.

Consumers are assumed to base their decisions on the comparison of available products in respect of a single characteristic. In particular, the basic unit of information required by the proposed decisional algorithm is the identity of the best product, or products, in respect of one single dimension.

We assume that such information is potentially available, accessible to observers with perfect knowledge of the products, but not necessarily to consumers. We assume that the actual decision procedure takes place only after consumers have performed three preceding steps, during which they elaborate the available (objective) data into personal, private information. The first type of data elaboration consists in mere perception, possibly distorting data in respect of the “true” ones. The perceived information is then used in two further steps: assessment of equivalently optimal products and identification of affordable products.

2.2.1 Products’ values perception

In order to extend the generality of the model, we consider the possibility of consumers to differentiate in respect of their skills in assessing products and, therefore, making mistakes in assessing which product is the best in respect of one characteristic. There may be several motivations: buyers may not be experts in the technology embedded in the products they buy; some of the qualities may be difficult to assess at purchase time, becoming evident only after using the product; a consumer may not consider it worth an extensive research to find the exact quality values, preferring to rely on generic, and imprecise, information; sellers may be reluctant to make public detailed information concerning their products. For any of these or other reasons, it is possible that a dominated product (in respect of one characteristic) appears as superior to the actually dominant product.

To implement these mistakes, which we call perception errors, it is sufficient to define the probability that every available product is judged as the best in respect of each characteristic. Data on these probabilities may be collected with surveys for empirical works or imposed exogenously in theoretical models as assumptions concerning the composition of demand. In the following, we present a specific implementation with a compact and pretty general formalization, which makes more evident the nature of the perception errors and allows us to discuss briefly their origins and effects.

As stated above, the basic information required by the adopted decision procedure consists in the identification of the best product(s) in respect of one single characteristic among a set of products. However, for obvious reasons of clarity and without loss of generality, we will consider the most simple case of comparison between two products only, under the assumption that this elementary case can be scaled up to include the generalized case with sets containing more than two products.

We can expect that an erroneous evaluation is less likely the wider is the difference between inferior and superior products and the higher are the skills of the consumer in assessing that particular characteristic. Given the adopted representation of products, we assume that consumers will not consider directly the true values \(v_{X}^i\) as the value of characteristic i for product X but:

where Norm(μ, σ) indicates a draw from a normally distributed random function, and Δ, the variance of the random variable, is a proxy for the consumer’s “ignorance” of the product’s quality. When comparing two products, a consumer draws two values from the two random distributions centered on their respective true values. Δ is the parameter affecting the distribution of perceived values around the true ones. This implementation ensures that the probability of correct identification of the best product ranges from 100 % (no mistakes) to 50 % (pure random) depending directly on the distance between the two quality levels and inversely on the level of the perception error.

As an example, consider a product, X, the “objective” value of which in respect of a characteristic is v X = 100. Varying Δ we can determine how frequently product X is correctly identified as superior to another product Y with lower quality v Y < v X . Figure 1 reports the probability that a consumer perceives correctly the ranking between the two products, \(\hat{ v_{Y}} < \hat{ v_{X}}\), in respect of different values for v Y and of the error parameter Δ. The figure shows that the probability of perceived values correctly reflecting the actual ranking decreases for smaller quality differences and for increasing levels of Δ.

Obviously, the setting of Δ should depend on the nature of the characteristic it affects, besides the skill of the consumer to whom it refers. For example, characteristics such as prices generally allows for no mistakes in assessment, resulting in Δ = 0. Furthermore, Δ can be defined as a variable changing in time reflecting a learning process leading to decreasing chances of making evaluation errors while the consumer increases the knowledge of the product. Any of these options depend on the overall scope of application of the model, and we will not discuss further this aspect, except to note that it permits us to represent a rather wide range of different categories of consumers.

2.2.2 Tolerance on quality differences

Not every quality difference is equally relevant for consumers. We can expect, for example, that consumers caring for the price of products will undoubtedly opt for any product costing half the price of that of competitors; but they are likely not to consider similarly relevant a price difference of, say, 0.1 %. The model should then define how frequently two products are considered as equivalent in respect of one characteristic, even when their perceived values differ.

The proposed implementation includes a parameter representing the tolerance for quality differences. The margin of tolerance indicates that, if the difference between the (perceived) values of two products is smaller than a given threshold, then the two products are considered equivalent, as if they had identical values. In general, comparing two product X and Y on one characteristic, the model considers these products as equivalent if:

where τ is a coefficient in the [0,1] range. When τ = 0, even minimal differences are considered relevant to assess the superiority of one product; conversely, a high value of τ indicates that even large quality differences are considered as irrelevant, and therefore two products will be assessed as equivalent (on that characteristic) even for substantially different values. As noted for the error parameter, the tolerance level may be differentiated for different characteristics, e.g. representing a consumer as accepting no compromises on safety standards, always opting for the (perceived) best options, but being generously tolerant in respect of, say, style differences.

The combined effect of perception errors and tolerance relieves the sensitivity of the results to the choices of units of measures and to possible arbitrary evaluations in case of empirical applications of the model. As already suggested, the proposed model may actually dispense altogether with any quantitative measure of characteristics qualities. The only requirement is to set the probabilities that a product is considered as superior, inferior or equivalent to any other in respect of each characteristic. Such information is much more reliable and easier to collect than numerical evaluations for product characteristics, many of which have a qualitative nature. This is a great advantage in respect of statistical techniques the application of which strictly requires real-valued measures (such as hedonic pricing) which are known to be extremely sensitive to the numerical assessment of qualitative aspects (Hulten 2003). For our purposes, however, we will continue to use numerical values for simplicity of presentation and of interpretation.

2.2.3 Minimal requirements

A consumer can discard a product either because it is not affordable (or judged as wanting in some aspect other than price), or because a competing product appears as more attractive. Though the eventual result is identical (the consumer not buying the product), we need to distinguish the two cases to assess properly the economic conditions of the market. For example, in the second case, the removal of some competitor may lead the consumer to choose the product, but that will not happen in the first case.

In our model, we distinguish the two cases, considering the first as part of a selection process producing a set (possibly empty) of viable products, and the second as a step in the decision process eventually leading to the choice of the product to purchase. This paragraph describes how to implement the selection phase, the discarding of potentially available products because of their failing in some respect such as, most typically but not exclusively, an excessive price.

We consider consumers as endowed with a set of the minimal requirements (one for each characteristic) that a product must satisfy in order to be considered as potentially viable for purchase. Formally, consumer j is associated to a vector \(\vec{m}_{j}=\{m_{j}^{1}, m_{j}^{2}, ..., m_{j}^{m}\}\), containing as many elements as the number of characteristics defining the product. The potential set for the consumer is defined by all products X such that \(\hat{v}_{X}^{i} > m_{j}^{i}\) for all characteristics i.

Choosing appropriately the level of minimal requirement allows us to represent the rejection of options because they violate in some respect the minimal conditions for the product to be of any use. The most obvious and foremost of these cases is the elimination of attractive products because they would violate the consumer’s budget constraint—standard (i.e. not wealthy) consumers will discard beforehand attractive options because of their excessive price. An identical effect can be assumed in principle for any other characteristic of the product, so that we need not distinguish the price from any other characteristics, since, from the viewpoint of consumers, a single insufficient aspect of a product justifies its rejection.

The use of minimum requirements allows us also to remove a potential source of problems in the application of the model: which products’ should be included in the initial option set? For many product categories, the boundaries of classes of products are not well defined, so that the choice of which products should be considered as potential alternatives may be problematic. Making use of minimum requirements removes this problem because consumers would consider all products that fulfill a clear set of requirements, on prices as well as on any other aspect, without the need of a preliminary definition of a given product category. Note that, in effect, we define product categories based on how product features fulfill consumers needs, possibly adopting different technologies.

2.3 Boundedly rational decision strategy

The most challenging issue concerning a consumer model is the decision mechanism for the purchase decisions of consumers among the set of product deemed as potential alternatives. Experimental economics and the bias literature (Tversky and Kahneman 1981; Kahneman et al. 1982) has highlighted a large number of systematic departures from perfect rationality, and even suggested classes of decision mechanisms from evidence routinely observed in experiments. The relevance of these results for the economic theory of consumers has already been noted (Devetag 1999). However, few constructive proposals aiming at representing a general decision mechanism have been advanced. One of these, called Take-The-Best (TTB), concerns classes of decisions compatible with the consumer’s problem, as we stated in our setting: the choice of one item out of a set of possible alternatives defined over a multi-dimensional space (Gigerenzer and Goldstein 1996; Gigerenzer 2000; Gigerenzer and Selten 2000). We describe below the (very simple) decision algorithm proposed as the decision mechanism by consumers acting upon the information elaborated as described above. We will then discuss the implications derived by using this decision procedure for consumers and, in the following section, showing the results provided by a simulated demand made of the aggregation of many consumers.

The proponents of the TTB convincingly sustain that the algorithm is both empirically supported by observations of actual people’s behavior and very efficient under uncertainty and poor information, conditions frequently occurring in real-world decisions. The decision algorithm is meant to individuate one option among many defined over a set of characteristics. The procedure consists in cyclically repeating the following steps until the exit condition on step 3 is satisfied:

-

1.

Consider initially all options that may potentially be chosen.

-

2.

Choose one characteristic among the m available.

-

3.

If one single option scores highest in respect of that characteristic, this is the choice.

-

4.

Otherwise, if more than one option scores similarly in respect of the adopted characteristic, remove the options with values lower than the maximum, and restart from step 2.

In essence, the TTB consists in considering initially all options as potential choices. Subsequently, the decision maker performs a sequence of rounds during each of which a filtering is applied using as criterion the condition that only the options scoring highest in respect of one characteristic remain as potential choices, while dominated options (in respect of that characteristic) are discarded. If, after a round of filtering, more than one candidate score equivalently to the optimum, then a new filtering round is performed, adopting another, as yet un-used, characteristic as criterion. The procedure terminates when a filtering round identifies one single option scoring optimally in respect of the currently adopted characteristic.Footnote 8

The authors proposing this strategy argue convincingly that it is an algorithm respecting the principles of bounded rationality (Simon 1982), which seems quite adapted to represent the generality of consumers’ behavior. In fact, most of the purchasing decisions, and by far the ones of larger economic impact in modern markets, are made by people buying items the costs and importance of which are very limited in respect of their overall life and income. Therefore, they have relatively little interest in investing time and attention just to be sure of making the optimal choice, and would rather risk the costs of choosing a dominated alternative, possibly a little more expensive in price or of slightly lower quality, but by far easier to be decided upon. Concerning the realism of TTB, there is a huge amount of literature suggesting that, when people face the choice between different alternatives “[...] they resolve the conflict by selecting the alternative that is superior on the more important dimension, which seems to provide a compelling reason for choice” (Shafir et al. 1993, p. 15). TTB can then be considered a “reason-based” decision procedure, where the decision maker uses as compelling reason the superiority of a product in respect of one dimension.

Our previous discussions on the perception of product values, tolerance levels and minimal requirements add further sophistication to the original TTB proposal, providing a flexible representation for consumers in both abstract and empirical applications. In the next section, we will support this view using the model in a few exercises meant to explore the relevance of demand in explaining market configurations. Before doing so, however, we need to counter a possible criticism to the use of TTB as a general model for consumer behavior. In the following, we will maintain that this apparent weakness of the proposed algorithm leads to a theoretically and empirically relevant definition: the nature of consumer preferences and the identification of one of their sources.

2.4 Consumer preferences

The results provided by applying the TTB algorithm to a given set of products are obviously influenced by the order in which characteristics are used to filter the set of available products. This indeterminacy may appear as a weakness of TTB as a model for consumer, since, for any given set of alternative options available to consumers, TTB does not provide a unique result; conversely, it generally returns different results depending on the order of the characteristics adopted. However, a more careful consideration shows that this very feature leads to a formal result with relevant consequences both in theoretical as well as applied uses: a definition of consumer preferences. The proposed definition not only formalizes a central concept for the theory of consumer, but, due to its intuitive and empirically robust nature, it also allows us to investigate the manner in which consumers construct their preferences. Here, we first provide a formal definition of preferences, and then discuss two factors affecting preferences that, we sustain, are empirically relevant but rarely considered in economics: marketing and social information.

2.4.1 Definition of preferences

The concept of preferences technically should refer to the criteria used by consumers to choose a product, a separate concept in respect of other elements concerning consumers: (i) the decision procedure used by the consumer, which exploits preferences but is not itself an expression of preferences; and (ii) the actual decisions made by consumers, which are the final results of information, preferences and the decision procedure. However, in the economic literature, preferences are mostly “appealed to” in order to (avoid to) explain, ex-post, how consumers reached a specific decision. Even the “lexicographic preferences” literature (which, apparently, closely resembles the TTB model) defines the ranking of bundles of features or goods, ignoring how this ranking is produced. Consequently, preferences-as-criteria and preferences-as-decisions are confused in a tautological concept by which decision criteria and the resulting decisions cannot be distinguished from one another.

Besides surrendering the possibility to explain observed behavior, mixing criteria and actual decisions also prevents the possibility to make predictions about hypothetical decisions by agents with known preferences when offered a different set of alternatives. Identifying the criteria adopted by consumers for their decisions, conversely, would greatly extend the possibilities of economic analysis and its applications because we can predict the results produced by relatively stable preferences applied onto different and potentially fast changing sets of alternative options.

From a theoretical perspective, considering preferences as decision criteria would add a further layer of explanation between exogenous features and observed behaviors of consumers, motivating the latter on the base of the criteria adopted. Another possibility is to predict likely outcomes in respect of given changes, by simply applying the same criteria to hypothetical markets including new, or changed, products. For example, a firm may evaluate the effects in the current market conditions of a potential price discount or a quality improvement, choosing the most profitable alternative. These and other highly interesting analyses depend on the possibility to define preferences as criteria distinct from the actual decisions to which those criteria (and many other factors) lead.

The structure of TTB naturally provides a definition of decision criteria that, in the case of consumer decisions, can be proposed as representing preferences:

Consumer preferences are the ordered set of a product’s characteristics ranked according to their descending relevance in the consumer purchasing decision.

Note that the nature of general decision criteria is guaranteed by the lack of reference to specific products or characteristic values. Given the proposed decision procedure, TTB, preferences consist in an ordered list of product characteristics.

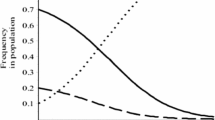

As an example of preferences, suppose that there were only two characteristics defining a given type of product: quality and price. The proposed definition implies that there are two possible types of preferences: quality-first or price-first. The “quality oriented” buyers will prefer the cheapest products among those scoring highest in quality, while “price oriented” buyers will buy the highest quality products among the cheapest ones. In the general case of many dimensions, the number of preferences is given by the number of all possible permutations of the characteristics.Footnote 9

The proposed decisional algorithm and the resulting definition of preferences leads to an interesting conjecture. Suppose that a given product can be defined over a number of characteristics, some of which are decidedly of higher importance than others. For example, a consumer evaluating cars may consider of primary importance (i.e. among the top position in the preferences) characteristics such as price, reliability, safety, fuel consumption, etc. Other characteristics may also be relevant, but in lower positions in the preferences: satellite navigator, fashionable colors, sophisticated sound systems, etc. We may expect that, since consumers give a determinant importance to the first group of variables, firms should also devote most of their efforts in improving these aspects. However, the proposed definition suggests that something different may occur.

Suppose that a mature and widely diffused technology ensures that all competing products score similarly in respect of the most relevant characteristics. We will then observe that firms will try to differentiate and to compete on secondary aspects only because no differentiation actually exists in respect of the primary aspects. A casual observation of how car producers tend to promote their offerings seems to support the conjecture. For example, we will hardly find a commercial reassuringly claiming that “our car’s brakes never fail”, while they seem focused on (apparently) far less relevant aspects. Thus, when technological advancement and diffusion reduces drastically differences on core aspects, these become an irrelevant aspect for distinction, and therefore competition focuses on minor, fringe aspects.

Our proposal allows many applications and directions for further investigation. For example, our definition of preferences provides detailed indications on how to collect such information, that is, the relative importance of a product’s characteristics for consumers. Indeed, such information is routinely collected and used by market research companies for techniques such as the conjoint analysis (Green and Srinivasan 1978). Considering that preferences can be observed would allow us to deepen our understanding of demand by explaining at least one step from exogenous factors to observed behaviors of consumers. In the experiments at the end of this work, we will explain patterns of sales in a simulated market on the basis of features of consumer behavior that are potentially observable. Further examples are the possibility to predict the expected level of sales across a range of competing product on the basis of observed preferences, or to predict changes in sales levels as a consequence of changes in preferences.

Having provided a clear and formal definition for consumer preferences, it is possible to exploit this proposal in order to investigate the origin preferences. In the next two sections, we will describe one of the mechanisms contributing to shape consumer preferences. The purpose of these notes is not to provide a full account of preference generation. We agree with most economists that preferences, even meant as decision criteria, originate from a wide variety of sources, such as psychological conditions, life styles, culture, etc. Consequently, preferences can be expected to differ, even substantially, for different classes of products and classes of consumers, with a large number of exogenous conditions, not pertaining to economics, motivating these differences. However, the existence of exogenous factors does not imply the lack economic, potentially endogenous, contributions to the shape of consumer preferences. In the following, we will present two of the potential sources of influence on preferences that should be of interest to economists: one originated by producers and the other from other fellow consumers.

2.4.2 Marketing induced preferences

Most economists consider consumer preferences as exogenous, referring to psychological, social and other determinants of behavior as falling outside the realm of economics (Bowles 1998). Unfortunately, this reasonable assumption is frequently (mis-)used as a justification to avoid the economic analysis of consumers altogether: any consumer decisions are, ex-ante, potentially observable, and we can only justify ex-post the observed results as due to exogenous preferences. Economic analysis, therefore, cannot but register consumer decisions as expressed in their actual purchases, and declare itself unable to explain further demand events.

While it is undeniable that consumer preferences are largely determined by non-economic factors, the assumption that these are the only sources of influence on preferences sits uncomfortably with empirical evidence from both experimental and cognitive psychology, on the one hand, and from the observation of real markets, on the other hand.

Concerning experimental evidence, preferences seem to be “[...] actually constructed—not merely revealed—during their elicitation.” (Shafir et al. 1993, p. 34). The contextual generation and application of preferences weakens the argument of preference exogeneity, particularly when the presentation of available options can be influenced by actors interested in pushing decision makers to opt for a particular option. Indeed, it has long been known that it is possible to influence people’s decisions by manipulating the presentation of alternative choices, the so-called framing effect (Tversky and Kahneman 1981; Kahneman et al. 1982). This further reinforces the conjecture that an interested party would be able to steer people’s decisions towards a specific option and away from others by influencing decision makers’ preferences. Concerning consumption, competing firms are obviously interested in affecting consumers’ decisions, and there is plenty of evidence that they are fully aware of the possibility.

The activities of firms generally considered in economic theory are those concerning the production process (e.g. technology and costs), product qualities (R&D), and the internal organization of the firm (agency theory). However, even a casual observation of real companies shows that a very large share of their expenses (frequently the highest) is devoted to a fourth activity ignored by economic theory: marketing.Footnote 10 The relevance of the sums invested in marketing in respect of those for production, research and managing the organization is strikingly consistent across a wide range of sectors and countries. For example, it is well known that pharmaceutical companies spend more on marketing than on R&D. Also, during the dot.com bubble, start-up’s were encouraged to devote at least 50 % of their seed money to marketing initiatives. In general, most operators share the opinion that a company with good marketing and a bad product is likely to survive, at least temporarily, while bad marketing puts at serious risk any firm, no matter how good the product.

The definition of preferences as ranking of characteristics in order of importance offers the opportunity to fill the gap that economic thinking has left in explaining such common and widespread evidence. In the following, we will discuss how marketing can be considered the link between the supply side of markets (providing resources and a strategic direction) and the demand side (where preferences are affected by supplier marketing). In so doing, we can close the circle formed by consumers determining firm performance by means of their purchasing decisions, and firms influencing the very preferences affecting those consumer decisions.

A firm’s marketing is designed to press buyers to adopt a particular perspective of the product. Obviously, it is a perspective that is expected to exalt the features of the product most likely to provide a competitive advantage in respect of competitors. One of the means to pursue these goals broadly supports the definition of preferences we provided above, showing how firms, among other techniques, try to manipulate consumer preferences defined as general criteria formed by a characteristic’s relevance.

In many modern commercials, firms do not limit (and, in some cases, conspicuously underplay) their own brand name or specific product. Rather, they try to push reasonable and acceptable general principles that just happen to imply the superiority of the sponsor’s product in respect of those of competitors. For example, a commercial may largely focus on the importance of protecting the environment from pollution, presenting, say, wonderful natural landscapes under risk of an ever growing cloud of smog. Only during the last few seconds of the commercial does the producer’s brand appear, with a small text highlighting the low environmental impact of its models. A competitor may, instead, show an embarrassed family struggling to squeeze too many cases into too small a car, in order to highlight the large room available in the trunk of the advertised model.

The two examples are cases in which competitors do not directly promote their offerings by means of underlining their positive features. Rather, they remind the potential customers of the importance of some aspects, which is indirectly expected to lead consumers to choosing their products because, on those aspects, they happen to beat the competitors.

This suggestion is supported by another recurring feature of many marketing claims: every competitor, even in crowded markets, advertises its position as the market leader. Though all of these claims but one should necessarily be un-deserved, a more careful consideration reveals that they are not, after all, void of any credibility. Statements such as “leading firm in the market”, the best product “in its category”, cheapest “in its segment”, etc., seem, at first, to signify that all firms represent themselves as market leaders. But a more careful consideration of these claims shows that each of them defines the reference market in different ways, and therefore it is well possible that all of them are market leaders. In short, the real competition appears to be not directly among products, but about setting in the mind of consumers a specific perspective on the product category, perspective that implicitly defines the criteria by which a product should be assessed.

In our setting, this translates into an effort to convince buyers that some characteristics are more important then others, so urging potential consumers to develop a specific set of preferences, i.e. a given ranking of importance of characteristics. Obviously, we can expect producers to design the desired preferences so that their product gets the best chance of being chosen by consumers. This may not be easy, since a marketing strategy must take into account the strengths (and weaknesses) of the firm’s own product as compared to those of all competing products, besides the general tastes and constraints of consumers. Designing the appropriate strategy to promote indirectly the appeal of the product can be highly difficult and risky; indeed, there are a large number of examples of marketing campaigns failing to reach their goals, and even that spectacularly backfired, seriously damaging the sponsor’s competitive position.Footnote 11

For the purpose of modeling this effect, we present here a possible way to represent the marketing strategies of firms. We assume producers to have their own “ideal” ranking of characteristics, i.e. consumer preferences, that they would like to push through consumers, supposedly exalting their own product against those of competitors. Formally, the marketing strategies can be represented as a vector of values for each producer, containing a value for each characteristic.

The generic element \(k_{X}^{i}\) in Table 2 must be interpreted as the relative importance that producer X gives to characteristic i for the promotion of its product. The ranking in descending order of all the values for a producer constitutes the producer’s marketing strategy. In practice, it consists in the ranking of the characteristics that the producer would like consumer preferences to respect, supposedly because they would allow its product to emerge above those of competitors. The choice of using real-valued numbers must be considered merely as a convenient implementation for the producer’s “desired” preferences. That is, the producer assigns higher values to the characteristics it would like to be in the top positions in consumer preferences, and lower values to those aspects of its product more likely to be dominated by competing products. Ranking the characteristics according to the descending order of marketing values provides the “desired” preferences by the producer.

Concerning the producers’ decisions about their marketing strategies, we may expect that the more important is a characteristic for a producer, the higher will be its value compared to other the marketing values for other characteristics. The importance depends on the comparison between the producer’s and competitors’ products on each specific quality. In principle, a coherent producer X should set its \(k_{X}^{i}\) higher the more its product is better than those of his competitors in respect of the characteristic i. However, we can expect these strategies to be difficult to elaborate, depending on a large number of factors. As for other aspects concerning the supply side of markets, we limit ourselves here to defining the general concept (marketing strategies), their function (influence preferences) and one possible implementation (real-valued vector, the ranking in descending order of which corresponds to the desired preferences), without entering into details of how producers actually determine their decisions.Footnote 12 The next paragraph describes how the proposed implementation of the firms’ marketing strategies can be used to affect the consumer preferences as described above.

2.4.3 Social influences

By their very nature, competing firms’ marketing messages are likely to be mutually inconsistent, and their effect on consumers’ preferences will depend on the the relative trust associated to firms. In this section we describe how to represent a mechanism to determine the formation of preferences when consumers are targeted by conflicting marketing messages.

In Smallwood and Conlisk (1979), the authors propose a model where buyers choose their purchases randomly with probabilities proportional to the market shares of the competing firms. The justification for this is obvious: there is no better advertising that having many users showing your product around. This method seems even better adapted to represent the relative diffusion not of products, but of preferences. Consumers pass to each other “perspectives” of the product, and the probability of choosing a given perspective is likely to depend on the number of fellow consumers who have adopted it in the past. In other terms, households are sensitive to each other’s “life styles”, as implemented and transmitted by the motivation they supply to explain a given choice. Though in different ways, other works in the literature support this interpretation. For example, Cowan et al. (1997) assume that consumers pursue two goals in deciding their purchases: the distance of your consumption pattern from the one adopted by members of lower social classes (distinction), and imitation of those used by members of higher classes (aspiration). In our case, neglecting the existence of different social classes, we can limit to consider the aspiration effect only, consisting in pursuing a consumption profile similar to that of the majority of the society.

Formally, we use the following algorithm when a consumer forms his preferences, assuming that many competing firms are engaged in (potentially conflicting) marketing activities. Assuming a consumer forms his preferences exclusively under the effect of marketing, the target is to generate consumer preferences defined as the ordered set of integers referring to the m characteristics representing the product space:

where c i indicates the characteristic ranked at the ith position in the preferences. For example, if m = 3, the possible sets of preferences is composed by all permutations of the three characteristics:

To determine the preferences for a consumer, we propose to weight the firms’ marketing strategies by their respective market shares, used as proxies for their popularity. We assume that a consumer draws randomly one characteristic per time, starting from the most relevant, c 1 and continuing with all characteristics for the descending ranking position in the preferences.

The procedure is based on the following indicators, computed for all characteristics i:

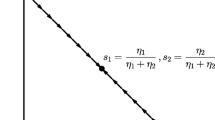

where s j represent the market shares of firm j, \(k_{j}^{i}\) is the marketing level of firm j in respect of characteristic i, n is the number of firms. The parameter δ is a coefficient flattening or steepening the differences among these indicators. A value of δ approaching 0 means that the indicators for all characteristics will tend to be equal, irrespective of marketing strategies. Conversely, higher values of δ will increase the differences between the indicators, resulting in indicators with sharply higher values for the characteristics most relevant in the marketing strategies of the most popular firms.

The indicators p i represent the importance that the supply side of the market as a whole gives to the ith characteristic, using market shares as weights to balance the marketing strategies. The more firms (weighted by their market shares) press for one characteristic, the more likely users will consider this as more relevant in their preferences.

To generate the preferences for one consumer we proceed incrementally in m steps, choosing first the most important characteristic, then the second most relevant, and continuing for all the m characteristics, concluding with the least relevant.

The first step, producing the first characteristic in the preferences, c 1, is obtained by drawing randomly one of the m characteristic with probabilities equal to:

The same indicators are used to compute the probabilities to draw the second characteristic in the preferences, c 2, after setting to 0 the probability for the characteristic already chosen, \(p_{c_1}=0\). That is:

Iteratively, the same procedure is used to assign probabilities for all the subsequent extractions, each time resulting in the choice of a characteristic to be placed in descending ranking position. The final result will be the ordered set of integers representing the characteristics of the product space. The likelihood that a given characteristic will appear higher in the ranking of a consumer’s preferences (and, therefore, that it will be highly relevant for the purchasing decisions) will be higher the higher is the marketing value for that characteristic in the strategies of the highest selling firms. The parameter δ can be considered as indicating the general trust given by the consumer to market as a whole.

The proposed generation mechanism is only one possible way to model the generation of preferences depending solely on marketing strategies and no exogenous determinants. Specific applications may require different generation mechanisms or, trivially, an exogenous setting of preferences. A similar approach may also be used to represent the change in preferences resulting by changes in marketing. For example, in Valente (2000) firms update their marketing endogenously according to the indications on which characteristic are the most sensitive among their actual and potential customers, and consumers continuously update their preferences following the changes in marketing strategies.

In this first section, we described a model for consumer based on a bounded rational algorithm for decision making under uncertainty. In the process of adapting the algorithm to the case of consumer decisions, we discussed the nature of the information (and possible biases) used by the consumer, and reached a formal definition of preferences considered as criterion for, and not merely as justification of, decision making. Finally, we suggested one source of influence on preferences, marketing, which is particularly interesting because it suggests a partial endogenization of preferences, where producers’ success depends on preferences that are partly influenced by the producers themselves.

Overall, the proposed model includes several parameters governing its behavior, which can be used to generate a wide range of different types of consumers. The following section presents a few simulation exercises showing the implications of the proposed model to represent a generic demand side for a market.

3 Micro-founded market demand

The consumer model presented in the previous section represents the generalized behavior of a potential consumer considering the purchase of one product among a number of competing alternatives defined over a multi-dimensional product space. A first goal, it should be noted, has already been reached by means of the mere specification of the model. The definition of preferences and the possible role of marketing in shaping them are noteworthy results, derived by the simple requirement of logical consistency and the observation of reality from the new perspective of the model. In this section, we want to provide an initial, necessarily partial, assessment of the model in its capacity to represent the demand side of markets. For this purpose, we will test the model generating simulation experiments and investigate the possibility that the use of the proposed model can increase our understanding of some properties of markets.

There are obviously a large number of possible experiments in which this generic model may be used, once both the model internal parameters and other external conditions, such as supply side features, are specified.Footnote 13 In this work, we don’t aim at representing specific markets, but only to support the general claim that economic aspects of demand (as opposed to its exogenous features) can be highly relevant to correctly interpret market properties, and to suggest by which means economic factors from demand affect markets. The goal is to show that deman not only matters because, trivially, it is the consumers’ tastes, culture, etc. that ultimately determine observed market conditions. It also matters because, we maintain, there are relevant properties of markets that depend on economic activities by consumers in the market, given their exogenous features. The ultimate goal is to show that neglecting demand properties risks, at best, unnecessarily limiting the scope of economic analysis. It may even result, in the worst cases, in serious mistakes leading to wrong analytical as well as empirical conclusions.

We present two applications of the model with the double goal of showing the power and flexibility of the model, and to support our claim that economic factors concerning the demand side of markets are worth as much attention as those concerning the supply side. The first two exercises are meant to show that our proposal does not imply a revolutionary modification of basic concepts such as aggregate market demand functions. We will show that our model can actually be considered a generalization of a standard demand function to a multi-dimensional product space, with the additional advantage that the underlining micro-foundations are robustly rooted in empirical evidence and depend on intuitive and easy-to-collect data. In short, the aim of this application of the model is to show that throwing away the dirty water of perfect rationality and well-behaved utility functions still allows us to keep the baby of generalized market demand functions and all the results derived from this analytical tool.

The second exercise provides an example of the potential errors to which ignoring demand may lead. We build an artificial market in which two sets of consumers with identical exogenous features, but different purchasing (and observable) attitudes, have apparently similar distributional results. Yet, we will see that the two configurations are actually radically different in both static (relative ranking of firms dimensions, and their motivations) and, possibly more importantly, dynamic terms (what would be the effects of a given innovation, and why), allowing us to conclude that demand, indeed, does matter.

3.1 A micro-founded demand function

A market demand function reports the level of sales expected at different levels of price. According to the standard textbooks, the market demand function is built as the sum of (unobservable) individual consumer demand functions, and therefore its properties are theoretically inherited from consumers’ own demand functions. In this section, we show how the proposed model can be used to generate standard market demand functions, with the additional advantages of direct dependence on observable consumers’ features and of an extensive flexibility.

An apparent difficulty is that the proposed model does not represent an individual consumer demand function, i.e. a map price-quantity, but a generalized discrete choice problem: which product to buy among those on offer, if any. The market demand is therefore formed by the sum of all consumers who decide to buy a product, but the properties of the market demand function cannot be justified with non-existent individual consumer demand functions. How do we find, then, the market demand features when we apply the proposed model?

To show how a market demand can be generated, we start by considering the simplest of the possible cases for demand (and, generally, the only one treated in economic textbooks): the case of an homogeneous product. The demand in this case consists in the relation between all possible prices with the relative quantities purchased by the population of consumers. To build a demand function for this purpose, we neglect the choice based on different features of the products, and consider a product defined by one single characteristic: the price. Lacking the possibility to represent heterogeneous products, there is no need to apply (and even to conceive) preferences. The only aspect of the model that matters is the application of the consumers’ constraints that, in this case, consist in the maximum price for which the consumer accepts to buy a unit of the product.

If every consumer had the same threshold for the maximum price, the market demand would be a made of a single, giant step at the point of the threshold, where all consumers switch from buying the product at lower price to none at higher prices. However, the generality of markets includes differentiated consumers. We can safely assume that the number of consumers having more stringent budget constraints (lower maximum price) will be larger than the number of consumers with looser constraints. To test the model, we consider a demand composed by consumers differentiated for minimal requirements on price.

Figure 2 presents the results obtained by counting the number of consumers willing to buy a product at different prices. Consumers are grouped into classes, where the consumers in the same class are assigned the same maximum price level. These levels are arbitrarily assigned linearly increasing levels across classes. The number of consumers across the classes changes in inverse relation to the maximum price: the higher the maximum price in a class, the smaller the number of consumers. For the exercise, in the figure we assigned the number of consumers in each class proportionally to the number of households for different income classes in USA.Footnote 14

Market demand function for a homogeneous product. Demand formed by 37 classes with linearly increasing levels of maximum price in the range from 5 to 10. Number of consumers in each class proportional to US income distribution of households. Data generated counting the number of consumers willing to buy a unit of a product for each price level in the range 4.87 to 10

The motivations for the results are rather trivial: at each price level, the simulation cumulates all consumers for which the maximum price constraint allows the purchase. In essence, the demand function merely depends on the classes’ minimum price and dimension. The figure, however, shows that it is not necessary to assume consumers as endowed with well-behaved demand functions in order to obtain a market-level (well-behaved) demand. Moreover, the properties of the demand function depend on relatively easy to collect and robust data: population distribution and price constraints. This example is merely meant to show how an aggregate demand with all the properties familiar to economists can be obtained with the proposed model for consumers, but does not make use of the most prominent feature of the model, the capacity to deal with heterogeneous products. In the following example, we take a second step in the analysis by considering a multi-dimensional demand function.

3.2 A multi-dimensional demand function

A demand function cannot work for heterogeneous products, since the relation between price and quantity is biased by differences in quality. The standard approach to this problem is to force a sort of re-homogenization based on the estimation of hedonic prices, the differences of which with the actual prices are supposed to compensate for quality differences among products. The use of hedonic prices faces, however, serious difficulties from both a theoretical and empirical perspective because of the very demanding hypotheses required for their use and the notorious unreliability of their estimates. Using the proposed model to represent consumers’ decisions, we can provide a much more robust foundation to a generalized market demand.

Having shown that a price-quantity relation for homogeneous products can easily be constructed by the proposed model, we move now to consider a generalized demand function for heterogeneous products, doing away with heroic and unsupported assumptions (utility maximization), as well as with statistically challenging and unreliable operations (forced homogenization via hedonic prices).

Considering a generalized set of competing (differentiated) products defined over a multidimensional space of characteristics, we posit a demand function for these products as a map from each vector of characteristic values for each product to the level of sales for all products available. In fact, the demand for a product depends, besides on its own properties (e.g. price), both on the features of consumers (e.g. incomes, preferences, etc.) and on the properties of competing products. Consequently, a demand function for the market will be the sum over the demand functions for all products on the market which, in turn, are mutually dependent. To summarize, we can state that a market demand function for heterogeneous products should support the following properties:

-

Other things being equal, improving one product in respect of one characteristic should increase its sales.

-

Other things being equal, improving one product in respect of one characteristic should decrease the sales of other products.

-

Other things being equal, improving one product in respect of one characteristic should increase the total sales of the market.

As in the previous example, we build a simulation exercise in which the demand of a market is made of a set of independent consumers, each represented by the modified TTB model. Considering as established the capacity of the model to deal with the price changes for an homogenous product, we consider now the case for a market including heterogeneous products, where the demand function concerns not necessarily a price-quantity map, but a map from generic multi-dimensional vector of characteristics to a vector of sales, one value for each available product. To interpret better the results, we consider all consumers having the same minimal requirements, in practice limiting the analysis to a consideration of the portion of demand coming from the same income class. Results for the whole consumers, not presented here, can easily be constructed by summing up the values for each class.

To generate a demand function capable of being represented in a three dimensional space, we restrict the number of characteristics to two and consider the competition between two products only, X and Y. The two characteristics may be any aspect of products relevant for consumers, as, e.g., price and quality. To simplify the interpretation of the results, we assume both characteristics to be positive, that is, consumers prefer products with higher values on both aspects. Thus, we may interpret one dimension as “cheapness” (positive) rather than price (negative).Footnote 15

For presentation clarity, and without loss of generality, we assume product Y as constant, and evaluate the sales of the two products for different values of the two characteristics relative to product X. The constant quality levels for Y are set to \(v_{Y}^{1}=v_{Y}^{2}=10\). For product X, we explore the results for each value of the characteristics in the range \(v_{X}^{1}, v_{X}^{2} \in[5,15]\).

The demand is made of 20,000 consumers evenly divided into two classes for the two types of preferences available in this setting: < 1, 2 > and < 2, 1 >. That is, consumers in one class will select initially the product(s) with the best score in respect of the first characteristic, using the second characteristic as a tie-breaker. Consumers in the second class follow the opposite criterion.

The other parameters governing consumer behavior are set to identical values for all consumers. The error level, affecting quality perception, is set to Δ = 0.4; the tolerance level determining the range of values to be considered as equivalent to the optimum is set to τ = 0.1; the minimal quality levels below which a product is discarded are set to m 1 = m 2 = 8.