Abstract

We revisit the distributional implications of macroeconomic activity in the USA by estimating the effects of the unemployment and inflation rates on the quintile Lorenz ordinates. We have access to 16 years of additional data (1995–2010) that were not available for the earlier studies, covering the deepest recession since the Great Depression. These additional data do not substantively change the results regarding the effects of unemployment and inflation on income inequality (both increase it). Adding controls for other important macroeconomic variables that have increased substantially in recent decades (public transfers, government budget deficits, and openness to trade) also has little effect on the findings regarding unemployment and inflation. Changes in budget deficits are uniformly equalizing, and public transfers increase the share of the bottom 20% across different specifications. Greater openness to international trade increases inequality in some specifications but has little effect when we also include controls for public transfers and budget deficits.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The most recent studies of the effects of macroeconomic activity on income inequality in the USA date from the 1990s and use time series data through 1994, at most. Since then the US economy endured its largest contraction since the Great Depression, federal government budget deficits rose dramatically, and international openness increased substantially. During the same years, income inequality increased sharply, with the growth of the top-income shares being particularly pronounced. The links between income inequality and macroeconomic activity have received renewed attention since the Great Recession. Rajan (2010), for example, argues that the rise of income inequality and the political responses to it set the stage for the financial crisis that triggered the Great Recession (2007–2008). In the spirit of this renewed interest in the connections between inequality and macroeconomic activity, we examine whether extending the time series by adding the additional years from 1985 to 2010 alters the effects of the unemployment and inflation rates on income inequality in the USA reported in the earlier studies.

Exploration of the connections among macroeconomic variables and the shape of the income distribution began as early as the 1960s, with different researchers offering alternative frameworks for the analysis. The most influential of these early studies was Blinder and Esaki (1978), which regressed income shares by quintile for US families on the unemployment and inflation rates using data for 1947–1974. Blank and Blinder (1985), Jäntti (1994), Bishop et al. (1994), and Mocan (1999) revisited the issue by extending the time series, using more advanced estimation procedures, and in some cases expanding the analysis to include other macro-policies such as government budget deficits and openness to international trade, which had both taken on greater salience since the earlier studies. Compared to the most recent study, we have 16 years of additional data that were not available at that time and greater variation in some of the key variables, both of which offer advantages in estimation.Footnote 1

Our purpose is twofold. First, we estimate the effects of unemployment and inflation on income inequality using a data set updated to 2010. Second, we consider the effects of including additional macroeconomic controls on these estimates. In the next section, we explain the model and the estimation methods and give a brief description of our data sample. Section III presents the estimation results and compares our findings to those based on a shorter US time series and those from other studies. Section IV summarizes our conclusions.

2 The model, estimation method, and data

The studies by Blinder and Esaki (1978), Blank and Blinder (1985), Jäntti (1994), and Mocan (1999) measure inequality using income shares by quintile, but this measure has no clear foundation for inequality rankings in welfare theory.Footnote 2 Our study follows Bishop et al. (1994) by replacing the income shares with Lorenz ordinates,Footnote 3 which allow us to use the Lorenz dominance theorem of Atkinson (1970) to compare the income distribution transformations due to changes in macroeconomic variables. Damjanovic (2005, 234) distills the theorem succinctly,

Atkinson demonstrated that if the Lorenz curve (which shows the proportion of total income received by the poorest t % of the population) for one distribution lies below the Lorenz curve associated with another, then inequality in the first case is higher for a wide range of inequality measures.

Our estimation method also differs from the early US studies. Blinder and Esaki (1978) adopted ordinary least squares (OLS) because they found no evidence of autocorrelation in the residuals and did not believe that either heteroscedasticity or reverse causation from income distribution to inflation or unemployment was present. Blank and Blinder (1985) included a correction for first-order autocorrelation. Jäntti (1994) chose a feasible generalized least squares estimation method and joint cross-equation tests. Bishop et al. (1994) selected the Engle and Granger (1987) two-step procedure to deal with the issue of cointegration and seemingly unrelated regression to improve efficiency. Likewise, Mocan (1999) contended that as key macroeconomic variables in the US data are integrated of order one, I(1), a cointegrated model is the appropriate framework for analysis. This method is also used in the most recent study along these lines that we can find outside the USA (Khattak et al. 2014).

In his review of theory and applications of cointegration over the past 30 years, the leading figure in the field (Johansen 2014) advocates the Engle-Granger method for estimating cointegrated models of nonstationary I(1) variables. Before applying the Engle-Granger two-step procedure, we must test the variables for stationarity. The tests, reported below, indicate that all our variables are integrated of order I(1) such that their first differences are stationary.

In the first stage, we use OLS to estimate the equation

where Ljt is the jth quintile Lorenz ordinate in year t, Xit is the ith explanatory variable in year t, and εjt is a random error term. The estimated coefficients, \(\hat{a}_{j0} \ldots \hat{a}_{jk}\), from Eq. (1) reveal information about the long-run equilibrium relationship between the Lorenz ordinates and the explanatory variables. The random error term, εjt, measures the degree of divergence of the dependent variable, Ljt, from the equilibrium, and the associated residuals will be included in a second-stage regression. The cointegration tests—reported in section III—reveal that there are two or more cointegrating vectors in most cases.

Therefore, we can specify a meaningful short-run adjustment equation using the first differences of all variables and an error-correction term, obtained from the first stage, to capture the deviation from equilibrium in the previous period. The second-stage equation takes the form

where ΔLjt is the first-order-difference of the jth quintile Lorenz ordinate in year t, ΔXit is the first-order difference of ith explanatory variable between t and t − 1, ejt−1 is the residual from the jth regression in Eq. (1) with a one period lag, and ujt is a random disturbance.

The estimated coefficients \(\hat{b}_{ji}\) and \(\hat{b}_{jk}\) provide information on how changes in the explanatory variables alter the Lorenz ordinates. The coefficient bjk+1 reveals how deviations from long-run equilibrium—triggered by changes in the explanatory variables—are eliminated. When \(e_{jt - 1} > 0\), we expect the Lorenz ordinate to fall back toward its equilibrium value. Thus, we expect \(b_{jk + 1} < 0\). Moreover, \(\left| {b_{jk + 1} } \right|\) indicates the speed of convergence to equilibrium; the closer to unity, the faster is the convergence. For \(\left| {b_{jk + 1} } \right| < 1\), Lj converges monotonically.

Unemployment and inflation play the dominant roles in all earlier studies, but we also want to consider the additional explanatory variables used in those studies. For the five studies based on US data (Blinder and Esaki 1978; Blank and Blinder 1985; Jäntti 1994; Bishop et al. 1994; and Mocan 1999), unemployment and inflation are the only explanatory variables common to all. Bishop et al. (1994) include 8 more variables (public transfers, the budget deficit, import duties, service industry, female participation, female head, family size, median age). Though we believe that all of these variables could affect the shape of the income distribution, the scarcity of degrees of freedom (only 48 observations for the estimation) raises the prospect of overfitting the data. Studies using panel data (Gustafsson and Johansson 1999), with observations across time and countries, have more degrees of freedom and could include more of these explanatory variables.

We also reviewed similar studies using time series data from other countries: Buse (1982), Weil (1984), Nolan (1989), Blejer and Guerrero (1990), Björklund (1991), Achdut (1996), Dimelis and Livada (1999), and Khattak et al. (2014). Here also unemployment and inflation are the usual explanatory variables, but Buse (1982) adds the aggregate participation rate, Blejer and Guerrero (1990) add 4 other variables (productivity, government spending, and the real exchange and interest rates), and Achdut (1996) includes transfers. Hence, even when additional variables are included, there is no consistency across studies.

To balance concerns about limited degrees of freedom in time series data and about the omission of variables that might influence the dependent variable (quintile Lorenz ordinates), Xit in Eq. (1) includes the unemployment rate, inflation rate, budget deficit [ratio of the deficit, including both federal and local governments, to nominal gross domestic product (GDP)], public transfers (ratio of government, federal and local, transfer payments (to persons) to nominal GDP), and openness (ratio of the country’s total trade (the sum of exports plus imports) to GDP). The inclusion of public transfers captures a well-known trend that could influence income inequality for obvious reasons.

Budget deficits are included to capture changes in fiscal policy (expansionary or contractionary) and to control for their rapid expansion beginning in the Reagan administration. Corresponding to this period of rising budget deficits was a period of low and stable inflation. It appears that policy emphasis changed from expansionary monetary policy to expansionary fiscal policy (budget deficits due to tax cuts), though monetary policy was much more expansionary in the last years of our sample (the Great Recession).

We can draw upon prior studies of the impact of fiscal consolidations (reductions in government spending, or increases in taxes, or both) on income inequality to justify including budget deficits in Eq. (1). Using a panel of 18 industrialized countries, including the USA, from 1978 to 2009, Angello and Sousa (2014, 702) report that “income inequality significantly rises during periods of fiscal consolidation,” even after inclusion of other controls. Furthermore, they find that spending cuts worsen the income distribution while tax increases have the opposite effect. For the purposes of our study, which revisits earlier studies after including additional data covering a major financial crisis, it is also relevant that both effects are amplified when the fiscal consolidation happens after financial turmoil. Woo et al. (2013), using panel data on 17 OECD (Organization for Economic Co-operation and Development) countries, including the USA, find that fiscal consolidations worsen income inequality and that the effects of spending cuts tend to be more significant than those from tax increases. Consistent with the latter finding, Wolff and Zacharias (2007) determine that net government expenditures in the USA are progressive (the ratio of net expenditures (received) to income declines as one moves up the income deciles), while the opposite holds in the case of taxes, except for the top decile in some cases.

The effect of international openness on jobs and income inequality is a source of considerable controversy in the USA. For many years, models of international trade assumed fully flexible wages and full employment, but new models have emerged that allow for search and structural unemployment. These developments have inspired empirical studies that explore the relationship between trade and unemployment, with clear implications for income inequality. Using both cross-sectional (1990s average values) and longitudinal (from 1985 to 2004) analysis, Dutt et al. (2009) find a robust negative relationship between trade openness and unemployment in the cross-sectional analysis and a negative relationship in years 2 and 3 in the panel analysis—though unemployment increases in year 1 (when liberalization occurs). Felbermayr et al. (2011) also use both cross-sectional (85 countries) and panel (20 OECD countries) analysis and find that greater trade openness is usually associated with a lower rate of structural unemployment—never a higher rate—in the long run. This result holds under different models, specifications, and data sources, but it does not preclude an increase in frictional unemployment in the short run. They also find evidence that the impact of openness is transmitted through total factor productivity, which boosts the demand for labor and thus, influences the distribution of income.

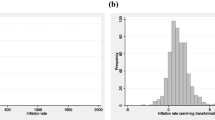

For the estimation, we use time series data from 1950 through 2010, the first and last years for which all of our variables are available. For comparisons with earlier studies, we also estimate a model with only unemployment and inflation and using a restricted sample (1950–1989). The samples in Bishop et al. (1994) and Jäntti (1994) begin in 1947 and 1948, respectively, and go to 1989. Table 1 shows summary statistics for the explanatory variables. The unemployment rate is lowest in 1953 and reaches its peak after the Great Recession (2009). Inflation, which we measure by annual changes in the Consumer Price Index in the urban areas (CPI-U), reaches its peak in 1980 and its lowest point during the Great Recession deflation. As a percentage of GDP, public transfers grow to their highest level in the last year of the full sample (2010). The largest budget deficits (federal through local), measured as a percentage of GDP, also occur during the Great Recession. The degree of openness to world markets (defined as exports plus imports, expressed as a percentage of GDP) also reaches its peak at the end of the sample. See “Appendix A” for the definitions of and the sources for our variables.

3 Estimation results

3.1 Stationarity, cointegration, and first-stage estimates

We first check our variables for stationarity and cointegration. Following Hayes et al. (1990), who report that the quintile income shares in the USA follow a random walk for 1948–1984, we test for unit roots in the dependent variables (Lorenz ordinates) and the explanatory variables (unemployment and inflation rates, public transfers, government budget deficit, and the openness index). After the pretests, we perform a cointegration test to determine whether there is a long-run equilibrium relation tying the dynamics of the variables together.

Using the full data sample (1950–2010), we perform an augmented Dicky–Fuller (1979) test (ADF) for unit roots and a Kwiatkowski, Phillips, Schmidt, and Shin (1992) test (KPSS) for stationarity. We investigate two possible data-generating mechanisms: one with an intercept and another with an intercept and time trend. Table 2A and 2B reports the test results. For the ADF test, the null and alternative hypotheses are formulated as ρ = 1 (the series has a unit root) and ρ < 1 (the series is stationary), respectively. For the KPSS test, the null and alternative are reversed: The series is stationary (null) and the series is nonstationary (alternative).

In Table 2A.1, the estimated coefficients (\(\hat{\rho }\)) for the autoregressive terms are close to unity and the ADF test statistics are above the 5% critical values. Therefore, we cannot reject the null hypothesis that the Lorenz ordinates all have unit roots. In Table 2A.2, the KPSS test statistics are all above the 5% critical values, so we can reject the null hypothesis that the Lorenz ordinates are stationary.

In Table 2B.1, where we test the explanatory variables for unit roots, the estimated coefficients (\(\hat{\rho }\)) are close to one and the ADF test statistics are above the critical values. The KPSS test statistics in Table 2B.2, where we test the explanatory variables for stationarity, are all above one or more of the critical values, so we can reject the null hypothesis that the explanatory variables are stationary.

Given the evidence that our dependent and explanatory variables are all unit root processes, we test whether they are cointegrated. We use the trace test of Johansen (1988) to identify a cointegration vector. The results given in Table 3 allow us to reject the null hypothesis that the number of cointegration vectors is less than or equal to one at the 5% significance level. Therefore, there are at least two cointegrating vectors for the income distribution and the explanatory variables, implying a long-run equilibrium relationship among the variables as well as a causality relationship in the sense of Granger (1969). Our findings are consistent with those in Bishop et al. (1994) for the period 1947–1989 and in Mocan (1999) for 1948–1994. Therefore, we conclude that the explanatory variables interact with one another in a general equilibrium sense, while systematically causing changes in the income distribution across time.

Table 7 in “Appendix B” reports the first-stage estimates for Eq. (1), where the Lorenz ordinates are the dependent variables and all variables are expressed in levels. From earlier findings in Table 2A and B, all the variables are likely I(1). Furthermore, the Durbin–Watson statistics in Table 7 are consistent with the residuals being stationary. By the Granger representation theorem (Engle and Granger 1987), the variables are cointegrated, reinforcing the finding from the Johansen test in Table 3 and implying that there exists a valid error-correction representation of the data.

3.2 Second-stage estimates

We turn next to the second-stage estimates from (error-correction) Eq. (2), where the dependent variables (ΔLjt) are first differences in the quintile Lorenz ordinates. We begin with a parsimonious model, including only changes in unemployment and inflation, which most nearly reflects the models used in early US studies. Next, we offer a more complete model that adds three other macro-policy variables (public transfers, government budget deficits, and an international openness index), also in first differences. As these variables are all I(1) in levels, their first differences are I(0), as is the residual term from the first-stage equation. Later, we will consider models with different combinations of the additional variables.

Table 4 reports the parameter estimates and their p values for the parsimonious model, which includes only the unemployment (U) and inflation (I) rates, for shorter and longer sample periods. The coefficients for the lagged error-correction are negative and significant in four of the five equations, suggesting that the Lorenz ordinates converge monotonically to a long-run equilibrium. The Breusch–Godfrey tests find no statistical evidence that the error terms are autocorrelated in Eq. (2).

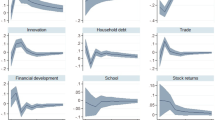

Examining Table 4a, we observe that the signs and coefficient estimates of the unemployment and inflation rates are similar across the two periods. In both periods, increases in the unemployment rate and the CPI generate crossing Lorenz curves. The Lorenz curve shifts away from the line of equality at the bottom of the income distribution, but shifts toward the line of equality above the 80th percentile, as shown in Fig. 1. Hence, neither effect creates Lorenz dominance. Yet, given that the crossing occurs above the 80th percentile and that the downward shifts in the Lorenz ordinates in the bottom four quintiles are at least as large as the upward shift in the Lorenz ordinate at the 95th percentile, the area between the curves below the crossing must be large—more than four times longer and also thicker—relative to the area between the curves above the crossing. Therefore, we can use the notion of “almost Lorenz dominance” proposed by Zheng (2018) to say that increases in the unemployment and inflation rates worsen income inequality for a wide range of inequality measures. From the results reported in Tables 4a and b, we can also conclude that the inclusion of 16 additional years of data, by itself, has little effect on the estimates in the parsimonious model.

Next, we turn to the model with three additional macroeconomic variables: public transfers, budget deficits, and openness in Table 5. This model implies convergence to long-run equilibrium and indicates that the residuals are stationary, like the parsimonious model. Relative to that model (Tables 4a and b), the R2 increases modestly. We summarize our findings from this model as well as from models that add each control separately in Table 6.

In Table 6, the numbers 1 through 5 represent the five Lorenz ordinates. Omitted numbers indicate lack of statistical significance for a parameter at that specific Lorenz ordinate. Numbers without brackets indicate positive parameter signs for the listed set of Lorenz ordinates; numbers in brackets indicate negative parameter signs for the listed set of Lorenz ordinates. If no Lorenz ordinate is significantly affected by a particular variable, a dash appears in Table 6. Note also that evaluating Lorenz curves based on quintiles requires simultaneous inference methods, which we describe in “Appendix C.”

The first column in Table 6 is labeled “U and I only” and summarizes the results from Table 4b (based on the 1950–2010 time series.) The next three columns add controls for public transfers, government budget deficits, and openness separately. The last column summarizes the results in Table 5, which includes all three controls. We begin by checking the robustness of our earlier results when we include additional control variables. While the additional controls (added either separately or together) can change the statistical significance at any given Lorenz ordinate, the major finding that increases in both unemployment and inflation are disequalizing is robust. If we compare the “all controls” model in Table 5 with the parsimonious model in Table 4b, we find that the inclusion of the three additional controls expands the disequalizing effects of both unemployment and inflation through the bottom 80% (L4) of the income distribution.

The finding that increases in the unemployment rate have little or no negative impact on the top-5 income share is interesting, but not surprising. Atkinson et al. (2011) find that a surge in top wage incomes over the previous 30 years led to wage incomes comprising a larger share of top incomes, and one would expect highly skilled workers to be less vulnerable to income losses when unemployment rises. Furthermore, high-income earners have access to expertise on how to hedge against inflation, so their share of income does not diminish as the inflation rate increases.

Next, we examine the effects of the three additional macroeconomic policy controls (public transfers, government budget deficits, and openness to international trade). We expect public transfers to be equalizing and openness to trade to be disequalizing. We include budget deficits along with inflation to capture the changes in public policy after 1980, a period of stable prices and soaring budget deficits. The effect of budget deficits on inequality is not apparent a priori—it depends on the outcome of a complex federal budgeting process. Still, budget deficits allow policy makers with differing priorities to avoid making hard choices, such as budget cuts that would exacerbate the trend toward rising inequality.

We find that increases in public transfers have an equalizing effect, but only on the bottom 20% (L1) of families. Rising budget deficits are unambiguously equalizing, both when included alone and when they are included together with the other controls. Finally, increases in international openness are unambiguously disequalizing when included separately, but their impact diminishes when combined with the other controls.

3.3 Comparisons to earlier findings

The most influential early US research on these issues was motivated by an interest in comparing the effects of unemployment and inflation on the distribution of incomes. Blinder and Esaki (1978, 607–608) arrived at a clear verdict:

[T]he one unequivocal message seems to be that the incidence of unemployment is quite regressive. … While the findings on inflation are less firm, … the effects of inflation on the income distribution simply are much less important than those of unemployment.

Several years later, Blank and Blinder (1985, 11) reach a similar conclusion:

High unemployment has significant and systematically regressive effects on the distribution of income: the poorer the group, the worse it fares when unemployment rises. … For inflation, few significant effects were found.

The difficulties in comparing our findings to those from other studies arise from two sources: (1) Most of the earlier studies use a different dependent variable (quintile income shares directly or relative to the bottom quintile in some studies and the Gini, Theil, or Atkinson income inequality index in others) and (2) the list of explanatory variables differs across studies. Even in those that focus on the two most common explanatory variables, the unemployment and inflation rates, some distinguish between cyclical and structural unemployment or opt for unemployment rates for primary-age males, while others distinguish between anticipated and unanticipated inflation.

To deal with these difficulties, we return to the parsimonious model (U and I only) and focus on the shorter time series (1950–1989), which ends in the same year as a pair of prior studies (Jäntti 1994; Bishop et al. 1994), the latter of which uses the same dependent variable as we use (Lorenz ordinates). Notice here that the income quintile share and Lorenz ordinate are the same for the bottom quintile and that Lorenz (and in our case, almost Lorenz) dominance implies a smaller Gini inequality index for the dominating distribution.

When we focus on the two common explanatory variables across prior studies, the unemployment and inflation rates, and their effects on the bottom quintile (or in some of the studies for other countries, the Gini ratio), our study reinforces the finding of all US studies that a higher unemployment rate reduces the income share and Lorenz ordinate of the bottom quintile of the distribution. The unemployment rate has mixed effects in other countries, so we can make no meaningful comparison. Prior studies using US data also report mixed results for the effects of a higher inflation rate on the income share of the bottom quintile. The studies most similar to ours (Bishop et al. 1994; Mocan 1999) report that a higher inflation rate raises the income share in the bottom quintile, but we find the opposite—whether we use a shorter or longer time series. This result does not seem to depend on the number of explanatory variables, as we find that a higher CPI harms the lowest quintile, even with additional controls in the model. In studies based on data from other countries, the coefficient of the inflation rate varies in sign and significance, so again no meaningful comparison with our findings is possible.

How do our findings compare to those obtained by the most influential early studies using US data? They strongly support one of the conclusions reported by both Blinder and Esaki (1978) and Blank and Blinder (1985): Unemployment is a regressive tax. But we do not find support for the claim that inflation has less damaging distributional effects. With different estimation methods, an explanatory variable with a more direct connection to income inequality, a longer time series, and more control variables, we find that the effects of unemployment and inflation on the shape of the income distribution are similar in both direction and magnitude.

4 Conclusion

We re-examine the influence of the inflation and unemployment rates on the size distribution of income among US families using 16 years of additional data (1995–2010) not available in previous studies, including the deepest recession since World War II. We also investigate the effects of changes in government budget deficits, international openness, and public transfers, all of which reached their highest levels in the years added to the sample.

We find that including these additional data does not substantively change the results regarding the effects of unemployment and inflation (both disequalizing) on income inequality when only unemployment and inflation are included in the model. We also explore the effects of including additional macroeconomic policy controls: public transfers (strongly equalizing), more openness to international trade (moderately disequalizing), and government budget deficits (equalizing, except at the top of the distribution). Adding the additional controls also has little influence on the way unemployment and inflation affect the distribution of incomes. Of the three controls considered, public transfers are equalizing only at the bottom of the income distribution, budget deficits are unambiguously equalizing (and thus, perhaps politically difficult to address), and the effect of openness dissipates when combined with public transfers and budget deficits.

Notes

Dimelis and Livada (1999) also analyze the time series for the USA, along with three EU countries, but their methodology is very different from the other studies.

The link between income inequality and welfare theory was established by Atkinson (1970) and involves the cumulated income shares (Lorenz ordinates), not the income shares separately.

The Current Population Reports provide for the USA as a whole the Lorenz curves for family incomes, at the following points, bottom 20%, bottom 40%, bottom 60%, bottom 80%, and bottom 95%. Appendix A provides detailed data definitions.

Student maximum modulus (SMM) tables can be obtained from Stoline and Ury (1979). For deciles the 5% critical value is 2.80, and for quintiles, 2.50.

References

Achdut L (1996) Income inequality, income composition and macroeconomic trends: Israel, 1979–93. Economica 63:S1–S27

Anderson G (1996) Nonparametric tests of stochastic dominance in income distributions. Econometrica 64:1183–1193

Angello L, Sousa RM (2014) How does fiscal consolidation impact on income inequality? Rev Income Wealth 60:702–726

Atkinson A (1970) On the measurement of inequality. J Econ Theory 2:244–263

Atkinson AB, Piketty T, Saez E (2011) Top incomes in the long run of history. J Econ Lit 49:3–71

Barrett GF, Donald SG (2003) Consistent tests for stochastic dominance. Econometrica 71:71–104

Beach CM, Davidson R (1983) Distribution-free statistical inference with Lorenz curves and income shares. Rev Econ Stud 50:723–735

Bishop JA, Formby JP, Thistle PD (1989) Statistical inference, income distributions, and social welfare. In: Slottje DJ (ed) Research on economic inequality, vol 1. JAI Press, Greenwich, pp 49–82

Bishop JA, Formby JP, Thistle PD (1992) Convergence of the south and non-south income distributions, 1969–1979. Am Econ Rev 82:262–272

Bishop JA, Formby JP, Sakano R (1994) Evaluating changes in the distribution of income in the United States. J Income Distrib 4:79–105

Björklund A (1991) Unemployment and income distribution: time-series evidence from Sweden. Scand J Econ 93:457–465

Blank RM, Blinder AS (1985) Macroeconomics, income distribution, and poverty. NBER Working Paper No. 1567

Blejer MI, Guerrero I (1990) The impact of macroeconomic policies on income distribution: an empirical study of the Philippines. Rev Econ Stat 72:414–423

Blinder AS, Esaki HY (1978) Macroeconomic activity and income distribution in the postwar United States. Rev Econ Stat 60:604–609

Buse A (1982) The cyclical behaviour of the size distribution of income in Canada: 1947–78. Can J Econ 15:189–204

Damjanovic T (2005) Lorenz dominance for transformed income distributions. Math Soc Sci 50:234–237

Davidson R, Duclos J-Y (2000) Statistical inference for stochastic dominance and for the measurement of poverty and inequality. Econometrica 68:1435–1464

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dimelis S, Livada A (1999) Inequality and business cycles in the U.S. and European Union countries. Int Adv Econ Res 5:321–338

Dutt P, Mitra D, Ranjan P (2009) International trade and unemployment: theory and cross-national evidence. J Int Econ 78:32–44

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 39:251–276

Felbermayr G, Prat J, Schmerer H-J (2011) Trade and unemployment: What do the data say? Eur Econ Rev 55:741–758

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Gustafsson B, Johansson M (1999) In search of smoking guns: What makes income inequality vary over time in different countries? Am Soc Rev 64:585–605

Hayes KJ, Slottje DJ, Porter-Hudak S, Scully G (1990) Is the size distribution of income a random walk? J Econom 43:213–226

Jäntti M (1994) A more efficient estimate of the effects of macroeconomic activity on the distribution of income. Rev Econ Stat 76:372–378

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S (2014) Time series: cointegration, CREATES (Center for Research in the Econometric Analysis of Time Series) Research Paper 2014-38

Khattak D, Muhammad A, Iqbal K (2014) Determining the relationship between income inequality, economic growth & inflation. J Soc Econ Res Acad Soc Sci 1:104–114

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. J Econom 54:159–178

Mocan HN (1999) Structural unemployment, cyclical unemployment, and income inequality. Rev Econ Stat 81:122–134

Nolan B (1989) Macroeconomic conditions and the size distribution of income: evidence from the United Kingdom. J Post Keynes Econ 11:196–221

Rajan RG (2010) Fault lines: how hidden fractures still threaten the world economy. Princeton University Press, Princeton

Stoline MR, Ury HK (1979) Tables of the studentized maximum modulus distribution and an application to multiple comparisons among means. Technometrics 21:87–93

Tse YK, Zhang X (2004) A Monte Carlo investigation of some tests for stochastic dominance. J Stat Comput Simul 74:361–378

Weil G (1984) Cyclical and secular influences on the size distribution of personal income in the UK: some econometric tests. Appl Econ 16:749–756

Wolff EN, Zacharias A (2007) The distributional consequences of government spending and taxation in the U.S., 1989 and 2000. Rev Inc Wealth 53:692–715

Woo J, Bova E, Kinda T, Zhang YS (2013) Distributional consequences of fiscal consolidation and the role of fiscal policy: What do the data say? International Monetary Fund (IMF) working paper WP/13/195

Xu K (1997) Asymptotically distribution-free statistical test for the generalized Lorenz curve. J Income Distrib 7:45–62

Xu K, Osberg L (1998) A distribution-free test for deprivation dominance. Econom Rev 17:415–429

Zheng B (2018) Almost Lorenz dominance. Soc Choice Welf 51:51–63

Acknowledgements

The authors thank Philip Rothman, Robert Kunst, and two anonymous referees for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix A: Definition and measurement of variables

1.1 Dependent variable

Lx: Lorenz ordinate, where Lx is the cumulative share of family income. Incomes are ranked from lowest to highest and the ordinates are measured in percentage terms. We consider five Lorenz ordinates L1 = .2, L2 = .4, L3 = .6, L4 = .8, L5 = .95, where L5 is the combined share of family income of the bottom 95% of families. (Source: computed from the Current Population Reports, Series P-60)

1.2 Explanatory variables

Unemployment

Unemployment rate of all workers, measured in percentage terms. [Source: Federal Reserve Economic Data (FRED)]

Inflation

Inflation rate computed as a first difference of the Consumer Price Index for urban areas. (Source: FRED)

Budget deficit

Ratio of government deficit, including both federal and local governments, to nominal GDP, measured in percentage terms. (Source: FRED)

Public transfers

Ratio of government (federal and local) transfer payments (to persons) to nominal GDP, measured in percentage terms. (Source: FRED)

Openness

Ratio of the country’s total trade (the sum of exports plus imports) to GDP. (Source: FRED)

Appendix B: Stage 1 cointegration estimates

See Table 7.

Appendix C: inference tests for Lorenz dominance

To test for Lorenz dominance, we follow Bishop et al. (1989, 1992), who propose a multiple comparison procedure. The multiple comparison procedure employs a union-intersection test. This procedure uses a fixed set of K quantiles (in our case quintiles) and their corresponding test statistics, T. In addition to the overall null hypothesis (H0) of pro-poor equality, there are two possible alternatives: pro-poor dominance (HA1) and crossing (HA2).

The overall null hypothesis is the logical intersection of the K sub-hypotheses, and the alternative hypotheses are the logical union of the K sub-hypotheses. To control for the probability of rejecting the overall null, we use the student maximum modulus, MK.Footnote 4 These test statistics for each of the sub-hypotheses are:

where the variance of L1 is given by Beach and Davidson (1983), or:

Therefore, we

-

1.

Reject H0 if |TGLi| > MK for i = 1, … K

-

2.

Accept HA1 if |TGLi| > MK for some i and |TGLi| <= MK for all other i,

-

3.

Accept HA2 if TGLi > MK for some i and − TGLi > MK for some other i.

Under (1), if each of the sub-hypotheses is not rejected, then the joint null hypothesis is not rejected, and we conclude that the explanatory variable is neither pro-equality nor anti-equality. On the other hand, if any of the sub-hypotheses are rejected, then the following are the possible outcomes:

-

Under (2): Weak Equality Dominance: If for some quantiles GLI > GL1 and for others GLI = GL1, then we conclude that the effect of the explanatory variable is weakly pro-equality. If GLI > GL1 for all i, then we have strong pro-equality.

-

Under (3): If for some quantiles GLI > GL1 and for others GLI < GL1, then no unambiguous ranking is possible for all z (a ‘crossing’ has occurred).

A number of alternative tests for stochastic dominance have been suggested (e.g., Anderson 1996; Xu 1997; Xu and Osberg 1998; Davidson and Duclos 2000; Barrett and Donald 2003, among others). Barrett and Donald (2003) note that Davidson and Duclos (2000) propose two types of test, the first being a Wald test. To implement this test, Barrett and Donald (2003, 83) note that “one must compute the solutions to a large number of quadratic programming problems in order to estimate the weights that appear in the Chi squared mixture limiting distribution.” Davidson and Duclos (2000, 1455) recognize the complexity of this test. The second test proposed by Davidson and Duclos has the Bishop, Formby, and Thistle (BFT) test structure. When Tse and Zhang (2004) provide size and power estimates of the Davidson and Duclos test, which they call “the DD test,” it has the BFT test structure with the variance–covariance structure from Davidson and Duclos (2000, 364). Tse and Zhang (2004) provide a review of these tests and extensive simulation results. We note that given the complex alternative hypothesis, no single test can completely rank Lorenz curves.

Rights and permissions

About this article

Cite this article

Bishop, J.A., Liu, H., Zeager, L.A. et al. Revisiting macroeconomic activity and income distribution in the USA. Empir Econ 59, 1107–1125 (2020). https://doi.org/10.1007/s00181-019-01729-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01729-x