Abstract

This paper analyzes the effects of banking diversification and focus strategies on the profitability and risk of Chinese banks in the post-crisis years (2008–2019). For this purpose, semiparametric estimates are used. The main results indicate that Chinese banks do not gain much benefit in terms of profitability and risk from following income or asset diversification strategies, although the former are more beneficial than the latter. These results have important implications for the design of specific diversification strategies for different types of banks. Results suggest that state-owned banks could benefit from a greater degree of diversification to obtain more profits and simultaneously decrease their risk levels, while national shareholding commercial banks and city commercial banks should evaluate these strategies with more caution as the benefits from them are less obvious.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the past few decades, the banking industry landscape has been radically reshaped by the emergence of new products, evolving demands for banking services, technological changes and new market developments (Beck et al. 2016). However, this reshaping has intensified more recently, since as early as the beginning of the 1970 s banking firms have gradually been providing a more diversified bundle of products and services—i.e., a combination of traditional and nontraditional activities (DeYoung and Torna 2013). Prior to the financial crisis, the financial innovation and liberalization trends in many banking markets, particularly in developed countries, encouraged banks to pursue operational diversification (Kim et al. 2020). In this sense, Stiroh (2012) points out that, particularly after the financial crisis, larger-scale diversification with greater scope was expected to reduce risk and insulate firms from macroeconomic or financial market shocks.

In more recent years, certain tendencies in the industry have meant bank diversification is growing in importance and attracting even more attention. Due to the general fall in interest rates across the world today (Ulate 2020), banks’ net interest income and bank margins have been declining significantly, which in turn has pushed banks to diversify their products and services to generate more income. According to the KPMG report on mainland China banking (KPMG 2017), the declining interest rate makes banks adjust their strategies to increase non-interest income, and results in tougher competitive conditions. As Kamani (2019) indicates, financial deregulation and increasing competitive pressures on earnings have urged banking firms to focus more tightly on nontraditional activities (DeYoung and Torna 2013), such as commission-paying services and off-balance sheet activities (Lozano-Vivas and Pasiouras 2014) and, as a result, banking systems have been restructured and are now characterized by the emergence of universal banks with size and activity diversification. These trends have accelerated recently, due to the newly emerging, and potentially disruptive, financial technologies, which have been expanding rapidly in financial markets across the world, while their potential effects are still far from clear (Navaretti et al. 2017; Beck 2020; Boot et al. 2021). Therefore, questions related to whether banking firms benefit from either specialization (focus) or diversification are relevant from multiple points of view—for scholars, policy-makers, regulators and practitioners alike. Against this backdrop, we examine the impact of diversification on bank profitability/risk over the over the period 2008–2019.

Although the likely costs and benefits associated with banking firms’ diversification strategies has been a long-standing debate in the financial literature, up to now, no consensus has been reached as to what these are (Moudud-Ul-Huq et al. 2018). One stream in the banking literature suggests that as banks increase their leverage levels, they should diversify across products, markets and sectors to reduce their risks (Stiroh 2004a). In this regard, Baele et al. (2007) find a strong positive relationship between bank diversification and franchise value, and an opposite link between diversification and bank-specific risk. In contrast, proponents of specialization argue that bank diversification could result in increasing instability (Santomero and Eckles 2000), insolvency risk (Park 2000) and systematic risk (De Jonghe 2010). However, the links could be more intricate since, as Kim et al. (2020) point out, the relationship between diversification and bank stability is U-shaped, with diversification increasing bank financial stability, but excessive diversification having negative effects.

This paper focuses on the case of China and its banking sector which, in the specific issue of bank focus and diversification, is relevant for multiple reasons. First, the existing analyses on this issue mainly deal with US and European financial institutions (see, for instance Lepetit et al. 2004; DeYoung and Rice 2004b; Stiroh 2004a; Stiroh and Rumble 2006; Mercieca et al. 2007; Chiorazzo et al. 2008; Goddard et al. 2008; Lepetit et al. 2008; Stiroh 2012; Saghi-Zedek 2016, among others), while there is much less empirical evidence documenting on banking diversification in emerging markets. Second, as the largest emerging and transition economy, China has a changing environment in which banks have increasing flexibility to decide which business strategy to follow: specialization or diversification—in their different variants. Considering the country’s huge impact on the global economy, it is meaningful to explore the relationship between diversification strategies and bank profitability/risk there. Third, China’s financial technologies have been growing rapidly and the country has emerged as a leading FinTech center (EY 2016). Diversification may have more marked effects on bank profitability/risk in this context.

The empirical analysis is conducted on the entire sample, as well as three sub-samples of state-owned banks, national shareholding commercial banks and city commercial banks, to explore the effect more specifically. The results suggest that there is a nonlinear relationship between diversification and bank profitability/risk in China over the sample period. Overall, Chinese banks benefit more from income diversification than from asset diversification. The analysis and comparison of three different types of banks suggests that state-owned banks have a higher tolerance for income diversification and reap more benefits than shareholding national commercial banks and city commercial banks. Low-level asset diversification is suggested as an optimal strategy for all types of banks in China. The results provide interesting clues for banks to design specific diversification strategies.

In light of these findings, our study contributes to the existing literature from three perspectives. First, it fills the gap in the literature on the links between bank diversification and profitability/risk by presenting and discussing evidence for a major emerging country: China. In contrast to the few previous contributions on China, we examine the effect of diversification for three types of Chinese banks—state-owned banks, national shareholding commercial banks and city commercial banks. Second, most previous studies have only considered one indicator to measure bank diversification of income or assets, disregarding the possibility of evaluating bank diversification from both income and asset perspectives, and using several diversification indicators. Instead, we include four different diversification measures in the models and, following Laeven and Levine (2007), Edirisuriya et al. (2015) and Moudud-Ul-Huq et al. (2018), we differentiate between income and asset diversification to comprehensively analyze the effect of bank diversification on profitability/risk. Third, we use semiparametric partial linear regression (PLR) with fixed effects for the first time in investigating the diversification effect on bank profitability/risk. Some previous literature (Berger et al. 2010; Gambacorta et al. 2014) suggests there may be a nonlinear relationship between diversification and bank profitability/risk. In addition, as Baltagi and Li (2002) indicate, PLR with fixed effects performs better for an unclear relationship between two variables than the fixed effects model, and partially avoids the curse of dimensionality problems inherent to fully nonparametric models. Hence, considering our sample size, PLR with fixed effects might be a more appropriate technique than both parametric and fully nonparametric alternatives.

The remainder of this article is structured as follows. Section 2 reviews the literature on the effect of diversification on bank profitability/risk. We then provide a brief overview of the Chinese banking industry in Sect. 3. Section 4 explains the research design, including data, variables and methodology. Section 5 reports the empirical results and Sect. 6 concludes.

2 Related literature and development of hypotheses

Specialization and diversification are two different business strategy options. Firms decide either to specialize or diversify depending on their specific internal and external conditions. According to Goddard et al. (2008), the three main motivations for diversification are market power (diversified firms indulging in various forms of anti-competitive behavior), agency (when managers might wish to pursue growth through diversification) and resources (specific assets, distinctive capabilities or core competences of the firm that can be exploited in new markets). In this regard, some general research studies (Berger and Ofek 1995; Graham et al. 2002) have found that diversified firms perform worse than focused firms. In contrast, it has also been argued that firms respond differently to various economic conditions and that, in some cases, there is a premium when trading diversified financial institutions rather than a discount (Khanna and Yafeh 2007).

However, Berger et al. (2010) suggest there are big differences between the banking industry and other industries. For instance, AlKhouri and Arouri (2019) point out that, unlike diversification in non-financial firms, diversification from economies of scope in the banking sector creates value for shareholders. This means that the results of research in the specialization versus diversification literature on general corporate finance may not apply to banking firms. Banking firms are also faced with a choice between specialization and diversification in their growth and development. Bank specialization implies that banks focus their business activities on one or a few lines—for instance specific services, customers and geographic areas—in order to take advantage of their expertise, and have a dominant position in such areas. In contrast, diversification strategies go beyond a single business line and, instead, expand several business areas, and categories of products and services. Diversified banks also take greater advantage of being multi-input companies with heterogeneous resources (physical capital, human resources, funding), which enables them to expand their business scale and market shares in several directions, reducing operating risks and, possibly, raising profits. In this line, Mester (1992) points out that more traditional banks have been engaging in a wider range of nontraditional activities. They also diversify revenue resources by performing new operations or by adding new assets to their asset portfolios (Meslier et al. 2014).

Elsas et al. (2010) suggest there is a potential nonlinear relationship between bank diversification and profitability/risk, considering the multiple countervailing effect. Li and Li (2014) report that Chinese commercial banks are facing problems of declining capital adequacy ratio, fluctuating intermediary business income, and increasing correlation between interest income and non-interest income, which are caused by low-level product innovation and banks’ cross-selling strategies. This might give rise to a nonlinear effect of diversification on Chinese bank profitability/risk. In this line, Berger et al. (2010) point out that bank performance (in terms of profitability) and bank risk should be studied jointly to provide a more comprehensive understanding of the intricate effects of banks’ diversification strategies.

One set of studies shows the benefits of bank diversification through reducing costs, raising profits and increasing stability (see, for instance Boyd and Prescott 1986; Hughes et al. 1999; Cerasi and Daltung 2000; Stein 2002; Elsas et al. 2010, among others). According to Boyd and Prescott (1986), under intermediation theories, diversification gives banks credibility as screeners or monitors of borrowers with lower costs. Cerasi and Daltung (2000) provide an additional explanation for why it is beneficial to diversify products and services, namely, that bank diversification could increase the incentives of bank owners to monitor lenders. According to Stein (2002), diversification has positive effects on banks through economies of scope. From the risk perspective, Hughes et al. (1999) examine how consolidation affects the risk of insolvency and point out that the risk of bank insolvency declines through diversifying the coverage of industries, categories of loans and maturity, and geographic area.

However, Morgan and Samolyk (2003) suggest that, depending on preferences, diversification could lead to an increase in risk. Berger and Ofek (1996), Servaes (1996) and Denis et al. (1997) indicate that it is beneficial for banks to concentrate on specialized products with management’s expertise and to leave investors themselves to diversify. According to Lang and Stulz (1994), Berger and Ofek (1995), Boyd et al. (1998) and Park (2000), diversification in the banking industry is linked to an increasing risk of insolvency owing to the conflicts of interest between managers and shareholders, as well as between managers and debt holders. Santomero and Eckles (2000) also argue that since a bad outcome in any single activity may affect the whole business line and its core franchise, bank diversification could result in increased instability of a firm. Other implications for risk have been pointed out by De Jonghe (2010), who finds that revenue diversification will increase the systematic risk of banking firms, implying that the stock prices of diversified banks are more sensitive to market fluctuations than those of focused banks. In Taiwan, Tsai et al. (2015) conclude that bank diversification does not have advantages during a recession. Liang et al. (2020) find that higher diversification leads to more systemic risk and less bank standalone risk. Therefore, the evidence suggests that there is no consensus as to the positive or negative effect of specialization and diversification on different aspects of banks’ activities and risk.

Similar mixed results have been reported for specific studies focusing on the US and European countries. In the case of the US banking industry, business strategies based either on specialization or diversification were influenced by the development of information technology, deregulation and the new financial processes (DeYoung and Rice 2004b). Before the 1990 s, most banking firms in the USA were offering similar traditional services. However, after the 1990 s, banks started to diversify in terms of products, geographic scope, size, funding sources and targeted customers. Some studies (Stiroh 2004a; Stiroh and Rumble 2006; Stiroh 2012) investigate the link between diversification and bank performance with a focus on the US market, finding that the risk-return trade-off of US banking firms worsened through a shift from traditional activities toward non-interest income-generating activities. Having more non-interest activities might be linked to higher profitability, but also to higher risk. Schreiber (2024) argues that the impact of bank revenue diversification on profitability, equity capital and credit risk is changing across size groups. Large and small banks in particular are more sensitive to revenue diversification than medium-sized banks.

In the case of Europe, some studies, such as Lepetit et al. (2004) and Saghi-Zedek (2016), have also explored European commercial banks’ diversification strategies. Some authors focus on specific contexts: Chiorazzo et al. (2008), for instance, explore diversification strategies of Italian banks during the period 1993–2003, evaluating the relationship between profitability and non-income revenues. They find that risk-adjusted returns increase through income diversification, which does not align with the findings of Mercieca et al. (2007). These authors test whether the shift toward non-interest income activities improves the performance of small European banks for the period 1997–2003, detecting no direct diversification benefits for small credit institutions within or across business lines. Lepetit et al. (2008) study the relationship between bank risk and diversification in the changing European banking structure for the period 1996–2002 and conclude that, compared to the focused banks mainly providing loans, the expansion of non-interest income activities has negative effects on the insolvency and operating risk of banks. As for small banks, a higher risk is driven by changing commission and fee activities but is never linked to trading activities. Williams (2016) examines the impact of non-interest income on bank risk in Australia between the second quarter of 2002 and the final quarter of 2014; his results suggest that bank income diversification is generally associated with increasing risk, although the results for before and after the financial crisis of 2007–2009 indicate that this crisis has altered the relationship between bank income diversification and risk and needs further investigation.

However, only a few studies empirically explore bank diversification in developing countries, whose financial systems might sometimes be relatively incomplete, and their market structures different—at least in comparison with developed countries. Sanya and Wolfe (2011) and Meslier et al. (2014) examine the banking industry in several emerging economies, finding evidence that revenue diversification could enhance risk-adjusted returns, and lower the insolvency risk of banks. Maghyereh and Yamani (2022) examine the influence of income diversification on systemic risk in six Gulf Cooperation Council (GCC) countries: they find that diversification decreases systemic risk, an effect that is stronger in Islamic banks. Wang and Lin ’s (2021) study of emerging economies in the Asia Pacific finds that the more income-diversified banks are linked to less risk. In the specific case of China, on which we focus, Berger et al. (2010) investigate the effect of specialization versus diversification on bank performance, finding diseconomies of diversification in the deposit, loan, asset, and geographic characteristics of selected banks. This implies that more diversified banks are ultimately more profit- and cost-inefficient, as they have lower profits and higher costs. Also for China, Liang et al. (2020) examine the merit of bank diversification, finding that income source diversity positively affects profitability but negatively affects operating efficiency and market valuation.

Furthermore, most of the literature examines the relationship between diversification and bank profitability/risk from a single perspective (income or assets), while only a few studies differentiate between income and asset diversification and evaluate them simultaneously. For instance, Laeven and Levine (2007) conduct research covering 43 countries to explore the effects of income and asset diversification, finding that both strategies generate significant negative excess values. Baele et al. (2007) examine 255 banks from 17 European countries, showing that income diversification has a positive effect on long-term firm value, while asset diversification has no significant effect. Edirisuriya et al.’s (2015) study of bank diversification in South Asia reveals that income diversification raises market-to-book valuations and solvency of banks, but only to a certain point; in turn, asset diversification, which moves away from traditional loan assets, does not itself improve bank market performance.

In summary, therefore, although focus versus diversification for the banking industry is a well-established academic field, no consensus has yet been reached. Most empirical studies analyze the developed markets, particularly the USA and Europe, whereas comparatively little attention has been paid to other relevant contexts, such as the Chinese banking industry. In addition, the literature generally considers the effects of only one facet of diversification (either income or assets) on bank performance, without taking into account that the implications can differ remarkably.

Based on the discussion above, we test the following hypotheses:

Hypothesis 1

There is a nonlinear relationship between bank diversification and profitability/risk.

On the one hand, it is important for banks to adopt an appropriate level of diversification if they are to achieve sustainable growth (Jiang and Han 2018). A higher level of diversification across various financial products, as well as geographic diversification, does not per se imply better performance. On the other hand, by considering three different categories of Chinese commercial banks, namely state-owned banks, national shareholding commercial banks and city commercial banks, we can examine whether diversification affects them differently.

Hypothesis 2

Diversification has positive effects on bank profitability.

Diversification benefits from economies of scope. Both internal or cost economies of scope in joint production and marketing, and external or revenue economies of scope in consumption expand the non-interest income of commercial banks (Klein and Saidenberg 2000). Under the former, banks offer a wide range of products and services by implementing cross-selling strategies or developing new products. The latter can be defined as comprehensive banking, so that banks raise their profitability via mergers or holding other financial institutions to develop various businesses.

Hypothesis 3

Diversification may have dual effects on bank risks.

Different operating strategies, serving markets and FinTech opportunities are elements of diversification effects that differ enormously across banks (Stiroh 2004b). For banks in the mature stage of their business cycle, such as the Big Five banks in China, diversification strategies can help to diversify risk, whereas for relatively small banks—e.g., city commercial banks—high diversification levels might contribute to diversify resources rather than risk, ultimately resulting in a negative effect on banks. Lepetit et al. (2008) indicate that small banks’ shift to nontraditional activities increases bank risk.

3 A brief overview of Chinese banking industry

Prior to the 1990 s, Chinese banks were limited to granting loans only to designated sectors or customers, which resulted in fewer opportunities to diversify their product mixes. For instance, the Big Four state-owned banks at that time in China (i.e., Bank of China, Industrial and Commercial Bank of China, Agricultural Bank of China and China Construction Bank), were required by policy makers to provide the majority of their loans to foreign trade and exchange, manufacturing and commercial lending, agriculture, and construction.

These strict restrictions started to be loosened in the mid-1990 s, specifically with the enacting of the 1995 Commercial Banking Law of China. It officially classified the state-owned banks as commercial banks, and allowed them to diversify into market-based commercial businesses (Berger et al. 2009). In this respect, Yuan (2006) points out that, within commercial business, Chinese banks relied heavily on net interest income activities, with fee-based activities accounting for only 10% of their total revenues—on average. This reflected a mature lending business and, simultaneously, a more immature cash management and treasury business. At the same time, although some new foreign banks were entering the market, the operational and geographical restrictions for foreign banks were not eased until China joined the WTO in December 2001.

In recent years, the Chinese banking industry has greater freedom in terms of takeovers and M &As, operation, and geographical scope. Not only have several new regulations been enacted, but also some existing laws (for instance the Commercial Banking Law of China) have been modified to align with the WTO agreement (Berger et al. 2009). Geographic expansion restrictions on foreign banks in China were relaxed, allowing higher levels of geographical diversification for domestic banks as well. Compared to other commercial banks and city commercial banks, the Big FiveFootnote 1 are the largest beneficiaries of geographical diversification, as they have branches in almost every corner of urban and rural China. Moreover, some Chinese banks have expanded into foreign markets, although under certain strict restrictions, considering the potential risks of the big difference between the Chinese banks and banks in developed countries. Therefore, in the current context of higher flexibility and deregulatory trends in the Chinese banking industry, banks have more options to choose between specialized and diversified business strategies under the WTO agreement.

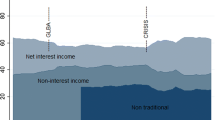

As mentioned in the introduction, interest rates have been declining steadily over the last few years in most banking industries across the world. In the specific case of China, the People’s Bank of China (PBOC) reduced interest rates five times in 2015, which resulted in a declining net interest income for Chinese banks (KPMG 2017). Figure 1 shows the share of non-interest income (defined as non-interest income to operating revenue) for five Chinese state-owned banks from 2007 to 2018. It can be seen that, although the scale of non-interest income for the Big Five experienced some fluctuations, the trend was one of overall growth over that period. This has been reflected in the steady development of nontraditional activities in the Chinese banking industry. In this regard, Li and Zhang (2013) show how Chinese banks have been shifting from traditional activities toward a more diversified income structure. Table 1 reports income structure in terms of interest income and non-interest income for Chinese banks, along with the activities corresponding to each income category.

Related to this, Navaretti et al. (2017) indicate that the emergence of FinTech contributes to intensifying competition in the Chinese banking industry and financial system in general. Banks attract an increasing number of clients by offering financial services—for instance third-party payments—with lower costs and, in general, higher efficiency levels. As in any leading FinTech context, the Chinese banking industry faces major challenges, especially in its traditional activity of issuing loans and attract deposits. In response, and related to the aims of our paper, traditional Chinese banks must provide their customers with a more diversified and innovative product mix to meet the new demands, in order to remain competitive.

4 Research design

4.1 Sample description

The initial sample of 27 Chinese listed banks was reduced as values of certain variables, such as capital adequacy ratio and non-performing loans, were missing for eight banks. After eliminating the banks with missing values and outliers, the final sample consisted of 19 Chinese banks listed on the Shanghai and Shenzhen Stock Exchange for the years 2008 to 2019, broken down as follows: 5 state-owned banks (Bank of China, Industrial and Commercial Bank of China, Agricultural Bank of China, China Construction Bank, and Bank of Communications); 7 national shareholding commercial banks (China CITIC Bank, China Merchants Bank, China Minsheng Bank, Hua Xia Bank, Industrial Bank, Ping An Bank and Shanghai Pudong Development Bank), which are known as the “second-type” Chinese domestic banks; and 7 city commercial banks (Bank of Beijing, Bank of Changsha, Bank of Jiangsu, Bank of Nanjing, Bank of Ningbo, Bank of Zhengzhou and Jiangsu Zhangjiagang Rural Commercial Bank). These banks account on average for 61% of the total assets of total Chinese banking. Table 2 lists all variables in the models and their definitions. The data for specific banks are based on the yearly financial data reported in the balance sheet, profit and loss statement, and profitability report. They are mainly collected from the Wind database (the biggest financial database in China). Some missing and/or questionable values were taken and/or double-checked from other official sources, such as each bank’s official annual report. Macroeconomic data (M2 and GDP growth rates) are taken from the World Bank.Footnote 2 Panel data are used to assess the potential effects of diversification on traditional commercial banks.

Table 3 reports the mean for profitability (ROA), non-performing loans (NPL), size (SIZE), capital adequacy ratio (CAR), loan-to-deposits ratio (LDR), equity ratio (ER), M2 growth rate (gM2), and GDP growth rate (gGDP), as well as the four diversification measures selected by year during the period 2008–2019. It is worth highlighting the decreasing trend in profitability (measured by ROA) throughout the analyzed period, as well as the increase of the four proxy variables for diversification (NII, \(HHI_{a}\), Entropy and NIBATA).

Table 4 reports summary statistics for the sample, including mean, standard deviation, minimum, maximum, and median for all the variables. This information is reported for the full sample as well as the sub-samples of state-owned banks, national shareholding commercial banks and city commercial banks, for the 2008–2019 period. The table shows a large gap between maximum and minimum ROA (2.20% and 0.17%, respectively) for the full sample, indicating large profitability differences across banks. More specifically, the average profitability for state-owned banks is about 1.36%, which is higher than the average for the full sample (\(ROA=\)1.26%). For their part, both national shareholding commercial banks and city commercial banks have lower average ROA (1.20% and 1.23%, respectively) than the full sample. In the case of risk, state-owned banks in the sample have higher values for non-performing loans (NPL, about 1.50%) than the full sample (whose average \(NPL=\)1.26%). In contrast, lower risk can be found for national shareholding commercial banks and city commercial banks, with lower values for non-performing loans (NPL, on average, 1.20% and 1.15%, respectively). In addition, the maximum NPL value for the sub-sample of state-owned banks is 4.32%, implying potential excessive default risk for some state-owned banks.

As for the control variables, state-owned banks have a higher average for the capital adequacy ratio (CAR, 13.64%) compared to national shareholding commercial banks and city commercial banks, implying higher risk aversion for state-owned banks. Meanwhile, there is a large difference between minimum and maximum for the loan-to-deposits ratio (LDR), which refers to the banks’ asset structure, when considering the full sample, but this difference is small within each sub-sample. This suggests that there is convergence of business models and revenue structure within types of banks, but not among different types of banks—i.e., among-group differences widen whereas within-group differences diminish (Correa and Goldberg 2020). In addition, national shareholding commercial banks have a relative lower average for the equity ratio (\(ER =\) 6.09%) compared with the other two bank types.

Regarding the explanatory variables for income diversification—considering the non-interest income ratio (NII), the adjusted Herfindahl-Hirschman index (\(HHI_{a}\)) and the Shannon entropy—there are large differences in the range for the full sample. This might suggest various income diversification strategies for different banks. Meanwhile, state-owned and national shareholding commercial banks have higher average income diversification levels than the full sample average. As for asset-based indicators, sample city commercial banks have higher average non-interest-bearing assets to total assets (\(NIBATA=\) 0.59), not only than the entire sample average (\(NIBATA =\) 0.53), but also compared to both state-owned banks and national shareholding commercial banks with average non-interest bearing assets to total assets of 0.49 and 0.50, respectively. This might suggest that state-owned and national shareholding banks are more income-diversified, while city commercial banks have more asset-diversified portfolios.

Table 5 reports the correlation matrix of the main variables of the study. The correlation between ROA and the proxy variables for diversification is negative, while it is positive between these variables and NPL.

4.2 Model specification and methodology

According to the modern portfolio theory, profitability and risk are two important indicators in explaining performance. Some studies (see, for instance Berger et al. 2010; Li and Li 2014) explore the relationship between bank performance and diversification by using bank profitability and risk jointly to indicate bank performance. Therefore, we follow these studies to consider profitability and risk as dependent variables.

The following models for profitability and risk are estimated to test our hypotheses:

where i indicates the cross-section dimension (i.e., bank), t denotes the time dimension, \(\alpha _{i}\) denotes the fixed effect, SIZE is bank size, LDR is loan-deposit ratio, CAR is capital adequacy ratio, ER is equity ratio, gM2 is M2 growth rate, gGDP is GDP growth rate, DIV is the diversification indicator, and \(\mu _{it}\) is the error term. Considering the potential endogeneity issue, DIV uses the one-year lagged value.

Both return on assets (ROA) and return on equity (ROE) are relevant to obtain a clear picture of corporate performance in banking. Considering the effect of banks’ high leverage ratio on their ROE, which might lead to potentially contaminated results (Saghi-Zedek 2016), we use ROA to measure bank profitability. We eliminate the impact of tax policies on banks by computing ROA as income before taxes as a share of total assets (rather than net income to total assets).

Risk is another dependent variable. The Basel Committee on Banking Supervision (BSBC) categorizes bank risks into operational risk, credit risk, liquidity risk and market risk. Credit risk is the main risk in most banks (Quang and Gan 2019). Hence, the non-performing loan ratio (NPL), which reflects the credit risk of banks (Jiang and Han 2018), is used to measure the risk of each bank; we define it as the ratio of non-performing loans to total loans.

4.2.1 Different measures of bank diversification

According to the literature, and as indicated in previous paragraphs, there are two categories of diversification measures for banks, namely, income-based and asset-based indicators. The former measures diversification across different revenue sources, whereas the latter measures it across various types of assets (see, for instance Laeven and Levine 2007; Baele et al. 2007; Armstrong et al. 2014; Edirisuriya et al. 2015; Moudud-Ul-Huq et al. 2018).

Income-based indicators The income-based diversification indicators mainly include the following three measures:

-

Non-interest income ratio (NII): this is our first income-based diversification indicator, which we define as:

$$\begin{aligned} NII= \frac{\text {Non-interest Income}}{\text {Total Operating Income}} \end{aligned}$$(3)or, alternatively,

$$\begin{aligned} NII= 1-\frac{\text {Net Interest Income} - \text {Other Operating Income}}{\text {Total Operating Income}} \end{aligned}$$(4)It takes values between 0 and 1, with values closer to 1 indicating higher degrees of diversification.

Interest income mainly derives from banks’ traditional activities of providing loans and deposit services. Therefore, the amount of non-interest income could intuitively indicate a bank’s diversification level. DeYoung and Rice (2004a), Stiroh (2006), Stiroh and Rumble (2006), Laeven and Levine (2007), Armstrong et al. (2014) and Yanlei (2018) use this indicator to reflect banks’ income portfolio diversification.

-

Revenue Herfindahl-Hirschman Index: the revenue Herfindahl-Hirschman Index (HHI) is the second income-based approach to indicate the degree of diversification. It is calculated as:

$$\begin{aligned} HHI=\sum _{i=1}^{n} P_{i}^2 \end{aligned}$$(5)where n indicates the number of all bank businesses, and \(P_{i}\) denotes the share of one specific income source of total revenue.

The index is commonly used in the study of bank diversification, and measures the revenue diversification level by calculating the share corresponding to each specific line of bank business. Considering the limited information available on the types of income generated by different business activities, a broad revenue HHI is usually used to indicate diversification (Baele et al. 2007). It categorizes bank income as net interest income and non-interest income. The lower the HHI index, the greater the diversification level in terms of a bank’s revenues.

In some studies (see, for instance Acharya et al. 2006; Stiroh and Rumble 2006; Elsas et al. 2010), the adjusted HHI is preferred for measuring income diversification:

$$\begin{aligned} HHI_{a}=1-\sum _{i=1}^{n} P_{i}^2 \end{aligned}$$(6)where n indicates the number of all bank business, and \(P_{i}\) denotes the proportion of one specific income source in total revenue.

The conception of this measure is to subtract the sum of squared revenue shares from the unity, so that \(HHI_{a}\) increases when revenue diversification is higher. When a bank has several products and services, with a highly diversified revenue composition, the sum of squared revenue shares is small and the \(HHI_{a}\) is high. In contrast, when \(HHI_{a}\) declines, the bank becomes more focused, with a lower degree of income diversification. In addition, \(HHI_{a}\) takes values between 0 and 0.5, where 0 indicates an extremely specialized level (only one source of revenues), and 0.5 indicates a fully diversified bank from a revenue perspective.

-

Entropy Index: the Entropy Index is widely applied in finance and economics. It was originally developed in the field of physics and was first introduced in economics in the 1960 s (Gulko 1999), particularly in studies designed to evaluate inequalities. In the 1990 s, significant contributions applying the entropy index in finance were made by Stutzer (1996) and Avellaneda (1998). In this line, Tabak et al. (2011) pointed out that the Shannon entropy is an effective approach to measure diversification, an approach also adopted by Li and Li (2014) and Ceptureanu et al. (2017). This entropy can be defined as:

$$\begin{aligned} \text {Entropy}_i=\sum _{i=1}^{n} P_{i} \times \text {log}{ \Big ( \frac{1}{P_{i}} \Big )}= -\sum _{i=1}^{n} P_{i}\ln {P_{i}} \end{aligned}$$(7)where n indicates the number of all bank business, \(P_{i}\) denotes the share of one specific revenue source in total revenue. The higher the diversification, the higher the entropy index.

Asset-based indicators The loan-to-asset ratio (LAR), defined as total loans to total assets, and/or the ratio of non-interest bearing assets to total assets (NIBATA) is the most commonly used asset-based diversification indicator (see, for instance Baele et al. 2007; Edirisuriya et al. 2015; Moudud-Ul-Huq et al. 2018). The equations of both ratios are:

-

Loan-to-asset-ratio:

$$\begin{aligned} LAR = \frac{\text {Total Loans}}{\text {Total Assets}} \end{aligned}$$(8) -

Non-interest bearing assets to total assets:

$$\begin{aligned} NIBATA = \frac{ \text { Non-interest Bearing Assets}}{\text {Total Assets}} = \frac{ \text {Total Assets} - \text {Loans}}{\text {Total Assets}} \end{aligned}$$(9)Lower values of loan-to-asset ratio (LAR) or higher values of non-interest bearing assets to total assets (NIBATA) reflect higher diversification from a bank’s assets perspective.

-

Diversity measures: an alternative asset-based indicator was proposed by Laeven and Levine (2007), and is used in the study of Armstrong et al. (2014). It is defined as:

$$\begin{aligned} DIV_{A}= 1- \Bigl | \frac{\text {Net loans} - \text {Other Earning Assets}}{\text {Total Earning Assets}} \Bigr | \end{aligned}$$(10)If the value is equal to 0, the bank is fully specialized, or focused; if the value is equal to 1, it means that the bank’s assets are fully diversified. However, this variable relies on the assumption that the optimal diversification mix is constituted by an equal division between non-lending and lending activities (Baele et al. 2007).

In this study, we follow previous approaches to examine the effects of diversification on bank performance from both income and asset perspectives. In order to obtain more robust results, we will consider more than one diversification measure, from both perspectives, rather than confining the results to just one measure from each. This dual approach will provide us with a richer and more precise evaluation of the links between diversification and bank performance.

The income diversification measures are defined as:

-

(1)

The ratio of non-interest income to total operating income (NII).

-

(2)

The adjusted-HHI, which is calculated as:

$$\begin{aligned} HHI_{a}=1-(P_{1}^2+P_{2}^2) \end{aligned}$$(11)where \(P_{1}\) indicates the share of net interest income, and \(P_2\) denotes the share of non-interest income.

-

(3)

The Shannon entropy (Entropy)

As for the asset-based indicator, following Edirisuriya et al. (2015) and Moudud-Ul-Huq et al. (2018), the ratio of non-interest bearing assets to total assets (NIBATA) is applied to examine bank diversification in assets.

According to Benitez et al. (2016), endogeneity in the nonparametric part will generate incorrect results. Thus, the one-year lagged value of DIV is taken into account in the model.

4.2.2 Control variables

Newey et al. (1999) and Ahamada and Flachaire (2010) point out that more control variables in the model could ensure exogeneity of the nonparametric part. Therefore, we will consider bank-specific and macroeconomic determinants as control variables in the models, for the reason explained below. In turn \(\alpha _{i}\) indicates the fixed effect which might include factors (related to organizational and governance structure, for instance) and tax policy.

From the microperspective, the literature suggests controlling for the effect of bank size, asset structure, capital structure and capital adequacy on bank performance (see, for instance Chen et al. 2013; Li and Li 2014):

According to Stiroh (2004a), Stiroh and Rumble (2006), Behr et al. (2007) and Chiorazzo et al. (2008), bank size affects bank returns and risk. Specifically, following Smirlock (1985), Akhavein et al. (1997), Demirgüç-Kunt and Huizinga (1999) and Goddard et al. (2004), size is closely and positively related to bank profitability. Regarding the links between bank size and risk, several authors (Saunders et al. 1990; Chen et al. 1998; Megginson 2005) have found negative links. Berger et al. (1987) also found scale inefficiencies play a role, especially for large banks. Therefore, bank size is included as a control variable in the models.

Asset structure refers to the distribution of various categories of the firm’s assets, which can to some extent affect its performance. Loans, as the largest asset type of most banks, is used in some diversification studies (DeYoung and Roland 2001; Stiroh and Rumble 2006) to explore the degree to which banks are dependent on traditional business. The loan-deposit ratio is included to examine the effects of asset structure on performance.

As firms with a high leverage ratio, the effect of bank capital structure on bank performance cannot be overlooked, especially for banks in developing countries. Sufian (2009) indicates that strong capital structure not only better ensures safety for depositors during macroeconomic fluctuation periods, but also strengthens banks’ capacity to cope with financial crises. The variable of shareholder equity ratio is included in the models to examine the effect of bank capitalization. In turn, capital adequacy reflects the inner strength of a bank, especially against risk (Sangmi and Nazir 2010), and is considered in the model as an important indicator of bank performance.

At the macro level, there is a close relationship between bank risk and macroeconomic factors—for instance, monetary policy and GDP growth (Buch et al. 2010). The GDP is expected to affect the supply and demand of banking services (Sufian et al. 2012). Armstrong et al. (2014) include gGDP as a control variable in their model to explore the effect of financial institutions’ diversification on valuation. M2 growth rate is another macroeconomic indicator included in the models, which reflects money supply. Mamatzakis and Remoundos (2003) report significant effects of money supply on bank profitability.

4.2.3 Semiparametric partial linear regression

In order to empirically validate or refute our hypotheses, we specify a semiparametric partial linear regression (PLR) with fixed effects that models the relationship between diversification and bank profitability or risk. Our specification adopts the following general form:

where \(i=1,\ldots , N, t=1,\ldots ,T\), \(X_{it}\) refers to the control variables, \(fin_{it}\) indicates the nonparametric component, \(\alpha _{i}\) indicates the fixed effect, \(\mu _{it}\) is the error term.

Semiparametric partial linear regression, based on smoothing splines, was first used by Engle et al. (1986) to explore the relation between weather and electricity sales, but has been successfully extended to many other research areas.Footnote 3 As a hybrid between parametric and nonparametric regression, PLR accommodates data linear transformations easily and therefore provides a convenient framework to accurately capture the nonlinear relationship between dependent and independent variables. Yatchew (1998) points out that limited economic theories could imply difficulties in finding specific functional forms when exploring the relationship between dependent and independent variables, so more flexible forms might be more appropriate. Therefore, compared to linear regression models such as OLS, PLR can be a better option for intricate relationships between dependent and independent variables than fully parametric alternatives.

Another flexible alternative is provided by nonparametric regression (Li and Racine 2007), which shares some of the underpinnings of semiparametric partial linear regression, with the advantage of being even more flexible. However, it requires large data sets to obtain a meaningful model structure and estimates, and can also be affected by the curse of dimensionality (Härdle et al. 2012). In sum, despite being more flexible, nonparametric regression is not free from disadvantages and we therefore adopt a semiparametric specification.

Although semiparametric partial linear regression is well established in the academic field, less attention has been paid to consistent estimation of PLR with fixed effects. It builds up asymptotic normality for the finite dimensional parameter of interest in the model and consistency for the nonparametric object by taking the first difference to eliminate the fixed effects and using the series method (Su and Ullah 2006). PLR with fixed effects overcomes some drawbacks caused by the kernel approach of PLR, for instance related to the curse of dimensionality, although it is also subject to some problems such as non-estimated slope parameter (Baltagi and Li 2002). To date, these methods have only been used remotely for analyzing diversification vs. specialization (see Tortosa-Ausina 2003).

With respect to more widely used methods, which are generally parametric (including panel data models with fixed effects and random effects, FE2SLS, first-differenced GMM-IV estimators, system GMM-IV estimators, or dynamic panel data models), the semiparametric approach employed here offers several advantages, several of which have been mentioned above. Among them, we should highlight their relative greater flexibility for modeling complex relationships without imposing stringent functional form assumptions, higher robustness to misspecification (making them suitable for situations where the true data-generating process may deviate from the assumed model), reduced bias by allowing for more flexible modeling (especially in scenarios where parametric assumptions may not hold, and higher efficiency when the true model is unknown or complex (Henderson and Parmeter 2015). They therefore offer a blend of parametric and nonparametric components, providing flexibility and efficiency in model estimation.Footnote 4

5 Results

5.1 Semiparametric linear regression (PLR) with fixed effects: full sample

In using the partially linear panel date model with fixed effects for the entire sample, we consider the bank-specific and macroeconomic control variables as the linear and parametric components, whereas diversification indicators are the nonlinear and nonparametric components. In addition, in order to better compare the different models, we conduct ordinary least squares (OLS) regressions and fixed effects (FE) regressions for the entire sample of banks, including the control variables. We chose the Herfindahl-Hirschman index (\(HHI_{a}\)) diversification indicator in both OLS and FE models. Table 6 presents the regression results, in which Model (1) and Model (2) reflect the OLS regressions and the FE regressions, respectively; Models (3)–(6) indicate the PLR regression results of models with non-interest income ratio (NII), revenue Herfindahl-Hirschman index (\(HHI_{a}\)), Entropy (Entropy)and non-interest bearing assets to total assets (NIBATA), respectively.

As shown in Table 6 (profitability), SIZE has a significant and negative effect on profitability (ROA) for the semiparametric models, consistent with previous findings in the literature (e.g., Berger et al. 1987). The positive coefficient of SIZE in Model (1) might be caused by missing fixed effects. Loan-to-deposit ratio (LDR) is significantly and negatively related to bank profitability (ROA) for the Models (3), (4), (5) and (6), which is in line with Huang and Pan ’s (2016) findings. ER is significantly and positively related to profitability (ROA), with a 1% significance level for all cases. This result aligns with the findings of positive relationship between bank capitalization and profitability from García-Herrero et al. (2009); Sufian (2009); Tan and Floros (2012), among others.

Table 6 also reports results for risk models, for which the M2 growth (gM2) variable and GDP growth (gGDP) are statistically significant. The negative coefficient found for gM2 suggests that tighter monetary policies might have contributed to straining risk-related issues for our sample of listed banks in China during the period analyzed.

Figure 2 shows the nonparametric sections of the models for the full sample of banks, for the 2008–2019 period. Results are robust to the different diversification indicators used. The nonparametric estimation is conducted using B-splines, which is frequently used to model a nonlinear predictive relationship between X and Y, and greatly contributes to explaining the results (Newson 2012). The dashed area in all the subfigures reports 95% confidence intervals. In addition, Petersen (2009) suggests using clustered standard errors when a fixed firm effect exists in both the independent variable and the residual, otherwise the OLS standard errors underestimate the true standard errors. Therefore, the standard error is clustered in this study to ensure unbiased estimates. The subfigures in Fig. 2 show there is a convoluted nonlinear relationship between diversification and bank performance that any linear model would fit with more difficulties.

The three upper panels (rows) in Fig. 2 show the effect of the different measures of bank income diversification (NII, \(HHI_{a}\) and Entropy). As indicated in Sect. 4, diversification is expected to affect bank profitability positively. However, a joint analysis of Fig. 2a, c and e would suggest that, after controlling for bank-specific and macroeconomic factors, when a bank’s income is highly diversified, profitability declines. This finding coincides with results reported in Berger et al. (2010), who indicate that diversified Chinese banks are associated with lower profitability (ROA), on average, and higher costs. The increasing management costs generated by implementing a high level of income diversification strategy might be the potential reason for the declining profitability. However, our result differs from Li and Zhang ’s (2013) findings that raising non-interest income leads to diversification benefits in the Chinese banking industry.

Regarding the risk perspective, Fig. 2b, d and f shows that a high level of income diversification contributes to an overall increase in bank risk. Meanwhile, for less diversified banks (i.e., \(<0.1\)), the diversification strategy is beneficial in that it reduces risk. This result is in line with the relationship between diversification and bank risk found by Li and Zhang (2013), namely that increasing reliance on non-interest income may lead to higher risks for Chinese banks.

The lower panel in Fig. 2 presents the relationship between diversification and bank performance from the asset perspective. In general, asset diversification has a non-significant effect on both profitability and risk (panels 2g and h, respectively). Only when diversification is sufficiently low (i.e., under 0.45) do both profitability and risk increase; or when diversification is extremely high (i.e., above 0.65), profitability declines slightly. This differs from the situation of traditional banks in some other Asian countries (i.e., Indonesia, Malaysia, and Pakistan) reported by Chen et al. (2018). They find that asset diversification has negative effects on the profitability of traditional banks in those countries, but could lead to an increase of cost efficiency.

Two additional alternative analyses have been carried out. First, the returns calculated based on stock prices are used as profitability measure instead of ROA,Footnote 5 The total stock prices return (Return on stock prices) is calculated as the difference between the stock price of each period minus the stock price of the previous period plus dividends, all divided by the stock price of the previous period. Second, we used the Z-score of ROA as a risk measure (Z-score), instead of the non-performing loans ratio (NPL). A Z-score measures the number of standard deviations a data point is from the mean of a dataset. It is calculated by subtracting the mean from the individual data point and then dividing by the standard deviation. The results are shown in Table 7. Regarding profitability estimates, only M2 growth (gM2) and GDP growth (gGDP) have a statistically significant coefficient. Regarding risk estimates, the proxy variable for bank size (SIZE) shows a statistically significant and negative coefficient for the semiparametric models, as well as the LDR variable and GDP growth. On the other hand, the ER variable shows a positive and significant effect on risk for all cases.

5.2 Semiparametric partial linear regression (PLR) with fixed effects for sub-samples

The full sample is divided into three sub-samples of state-owned banks, national shareholding commercial banks and city commercial banks in order to better explore and compare the effect of income and asset diversification on the different types of banks in China.

Tables 8–10 present the regression results of the linear and parametric part for all bank types during the period 2008–2019. Models (1)–(4) here indicate semiparametric models with diversification indicators NII, \(HHI_{a}\), Entropy and NIBATA, respectively. Table 8 shows that only M2 growth (gM2) has significant and negative effects on risk for state-owned banks.

Regarding national shareholding commercial banks (Table 9), SIZE, loan-deposit ratio (LDR) and GDP growth (gGDP) have significant effects on profitability—although LDR is only significant for Models (2), (3) and (4). The negative effect of the loan-to-deposits ratio on profitability may indicate that an overreliance on traditional activities reduces profitability for national shareholding commercial banks. In the risk model, both LDR and gM2 have significant effects on non-performing loans (NPL); LDR affects NPL positively (although it is only significant for Models (2), (3) and (4)), whereas gM2 affects NPL negatively. As shown in the panel of city commercial banks (Table 10), which are considered as the “third type” of banks in China, both LDR and ER have a significant coefficient. LDR has a negative effect on profitability while ER has a positive effect. In the risk model, both LDR and gM2 have significant effects on non-performing loans (NPL); LDR affects NPL positively (although, again, it is only significant for Models (2), (3) and (4)), while gM2 affects NPL negatively.

The relationship between bank performance and diversification for state-owned banks, national shareholding commercial banks and city commercial banks is also illustrated in Figs. 4, 5 and 6. In the case of state-owned banks (Fig. 4), we find that the relationships between profitability and non-performing loans and the different income diversification indicators considered are similar to each other, which provides some robustness to the results. There is an inverted U-shaped relationship between income diversification and bank profitability, implying that diversification raises bank profitability until the diversification level reaches the average, while excessive diversification level reduces bank profitability. The relationship between income diversification and risk is U-shaped, indicating that risk declines in the income diversification level to a certain point, and then changes inversely, possibly suggesting that a middle-level income diversification strategy benefits Chinese state-owned banks by increasing profitability and reducing risk. This partially aligns with findings reported by Li and Li (2014); these authors argue that income diversification of large banks in China could increase profitability and spread risk.

Figure 4 presents the relationship from an asset perspective. As shown in Fig. 4.g, diversifying assets in the 0.45–0.55 range has no significant effect on profitability. However, when diversification is lower than 0.45, profitability increases, whereas for values higher than 0.55, it declines. Figure 4.h shows that risk declines for asset diversification levels under 0.55, and surges above this threshold, suggesting that less diversified asset portfolios might be beneficial for state-owned banks. Therefore, the comparison of results for the income and asset perspectives suggests that it is more beneficial for banks to engage in income rather than in asset diversification strategies—a finding in line with Moudud-Ul-Huq et al. (2018).

Figure 5 reports results for national shareholding commercial banks. For this group, the overall picture shows that income diversification strategies have no significant effect on bank profitability. Only for relatively low levels of diversification does profitability increase slightly. Figure 5b, d and f shows a U-shaped relationship between income diversification and risk, which is slightly flatter compared to state-owned banks. Risk declines with the degree of income diversification, but only to a certain extent. Thus, it can be concluded that a relatively low level of income diversification may slightly raise bank profitability and, simultaneously, reduce risk, while a high degree of income diversification may be linked to increasing risk for this group of financial institutions. These relationships, although intricate (and consequently difficult to fit for fully parametric specifications), are robust across income diversification measures.

As for the asset diversification measures, reported in the lower panels of Fig. 5, when a bank’s diversification level is lower than 0.45, profitability rises slightly. However, above the 0.50 threshold of asset diversification, the relationship is negative. In addition, asset diversification is only beneficial for reducing risk if a bank’s asset diversification is lower than 0.45.

The relationships between diversification and bank performance for Chinese city commercial banks are shown in Fig. 6. Income diversification has a positive effect of increasing bank profitability only when banks have a very low level income diversification strategy (i.e., \(< 0.05\) for NII; \(< 0.10\) for \(HHI_{a}\); \(< 0.15\) for Entropy). However, this result is entirely driven by an outlier. Once the effect of this outlier is isolated, the impact of diversification on profitability is negative across the three income diversification measures considered (see Fig. 6a, c and e). In contrast, and as illustrated in Fig. 6b, d and f, the relationship between income diversification and risk has an almost entirely positive slope, with a negative impact existing only when risk is below a given degree of diversification (i.e., \(< 0.05\) for NII; \(< 0.10\) for \(HHI_{a}\); \(< 0.15\) for Entropy). Yet this effect is also due to the presence of an outlier. Therefore, for these banks, and once the effect of outliers is removed, low income diversification levels are beneficial in terms of both profitability and risk. This result is in line with Stiroh (2004b), whose findings indicate that higher income diversification levels are negatively related to the performance of small banks.

From the assets diversification perspective, we observe both in Fig. 6g and h that diversification has a modest effect on profitability, with no clear sign (particularly in the case of profitability), but could contribute slightly to reducing risk when its level is lower than 0.45.

The results of the empirical analysis for sub-samples suggest two main points. First, income and asset diversification have proven to be beneficial in general, but vary across different types of Chinese banks. As the first type banks, the Big Five have a much higher tolerance for diversification than the other commercial banks. This is because the Big Five enjoy significant advantages in terms of geographically diversified branches, client structure and supporting policies, which allow them to implement scale and scope economies more easily. In addition, bigger banks could discount fixed costs generated by introducing financial technologies during their diversification process. According to Berger et al. (2010), diversification discount by national shareholding commercial banks and city commercial banks might be due to inexperienced top management teams and an ineffective incentive mechanism to maximize shareholders’ wealth. Thus, the Big Five state-owned banks benefit more than the other commercial banks. The second point is that there is a threshold for the positive effects of diversification on bank profitability and risk, although the threshold values vary among the three bank types. Benefits increase in the diversification level within the specific threshold area, but decline in the excessive diversification level.

6 Conclusions

Over the last few years, a significant stream of the banking literature has been evaluating the issue of whether banks should either diversify their portfolios (and/or territories where they operate) or, in contrast, specialize and focus on fewer business lines. This is the diversification-focus issue, on which no general consensus has yet been reached: while there is substantial evidence concluding that conglomerates underperform their specialized counterparts, the number of studies reaching opposite conclusions is not negligible. This evidence supporting either of the two conflicting views on the focus-diversification issue, however, has been mostly concerned with European and US markets. In contrast, the analyses evaluating other relevant contexts, particularly emerging economies, remains comparatively underexplored, at least in relatively recent years.

Our aim in this study was to bridge this gap in the literature. Specifically, we examined the impact of diversification on bank profitability/risk in the world’s largest emerging economy, China, a context where banks did not have much choice in terms of product diversification until recently. We contribute to the literature by exploring the relationship between diversification and performance for Chinese listed banks over a critical and less examined period (2008–2019), considering semiparametric partial linear methods, which have a higher degree of flexibility than more standard approaches. We also differentiated between income and asset diversification, considering a variety of diversification measures, namely non-interest income ratio, the revenue Herfindahl-Hirschman index, Entropy and non-interest bearing assets to total assets.

Interestingly, our study provides evidence that there is a nonlinear relationship between diversification and bank profitability/risk from both income and asset aspects. Had we considered other less flexible approaches, this finding would have remained largely concealed. Overall, the benefits for Chinese banks in terms of either income or asset diversification are modest, although results vary depending on the type of bank under analysis. State-owned banks have a higher tendency to income-diversify than their national shareholding commercial and city commercial counterparts. Nonetheless, the relationship is intricate, since only by employing semiparametric partial methods do we learn that it is beneficial for state-owned banks to diversify up to a middle level, and up to a lower level for national shareholding commercial banks and city commercial banks. In addition, for equivalent income diversification levels, state-owned banks outperform (i.e., have higher profitability and lower risk) the other two types of banks, a result that is robust regardless of the perspective considered—either profitability or risk. This robustness is also found when evaluating the relationship between profitability/risk and diversification using different income diversification measures.

Results differ slightly from an asset diversification perspective. In this case, the effects are similar across types of bank, since it is beneficial to have asset portfolios with relatively low levels of diversification; again, this result was revealed because we used flexible techniques. Therefore, state-owned Chinese banks might enjoy some advantages when facing the new competitive environment. As for the other bank types, the results suggest they should take advantage of their expertise by focusing on one or a few business lines to cope with tighter competition in their markets.

Therefore, the diversification discount for Chinese banks found in previous relevant studies (notably Berger et al. 2010) is only partially confirmed in this research. Although the mechanisms are intricate, some explanations might be related to the ineffective incentive schemes for management teams to maximize shareholders’ wealth, or the lack of managerial expertise. These factors are aggravated by the mechanisms for appointing top managers in China, which are highly dependent on managers’ cooperation with local and central governments. However, according to Berger et al. (2010), this influence of different layers of government was expected to decline in the years following their study (1996–2006), which is precisely what we found when we analyzed the subsequent time period (2008–2019). We consider that our choice of a set of methodologies that more easily accommodates any possible nonlinearity present in the data also contributes to extending and refining the previous literature, since the premium or discount varies across the distribution of diversification.

This study has some practical implications. First, although the traditional banking industry might need to rethink their business models and increase investment in times of unconventional monetary policies, there is still something unique about traditional banks that makes it difficult for non-banks to challenge them (Stulz 2022). Indeed, although some large and diversified banks have management teams that might be tempted to grow and protect their fiefdoms, they have generally established effective incentive mechanisms to deal with the impact of digital technologies and competitors. Second, considering the changing effects of diversification on bank performance across types of banks, specific diversification strategies are suggested to obtain competitive advantages. State-owned banks—which are more sensitive to income diversification than national shareholding commercial banks and city commercial banks—should take advantage of emerging financial technologies to create smart banks with industry advantages. Meanwhile, national shareholding commercial banks and city commercial banks should mainly focus on traditional business lines at this stage, rather than blindly pursuing diversification. Third, there is a need to implement robust regulatory policies to preserve a stable financial environment. Such policies help to promoting the transformation from the traditional bank models to new business models, easing the sometimes imbalanced demand between loans and deposits and improving the competitiveness of traditional banks under the threat of a new environment with a myriad of new competitors, particularly FinTech and BigTech.

Notes

Bank of Communication (BOCOM) has been classified as a state-owned bank since 2006.

For instance, Tripathi (1997) analyzes firms’ profitability by using PLR.

The specific comparisons with more widely used methods referred to above are summarized as follows:

-

Compared to panel models (fixed effects and random effects), semiparametric models can handle complex and nonlinear relationships that may not be captured by panel models (Henderson and Soberon 2024; Libois and Verardi 2013; Ai and Li 2008), whereas they may require more computational resources and assumptions about the functional form of the nonparametric component.

-

FE2SLS models (two-stage least squares with fixed effects) handle endogeneity in panel data particularly well, but assume a linear relationship, whereas semiparametric methods can better capture nonlinear relationships and provide more flexible modeling.

-

With respect to first-differenced GMM-IV estimators, semiparametric methods can provide more efficient estimates if the relationship between variables is complex or unknown. However, GMM-IV estimators may perform better in the presence of heteroskedasticity.

-

Similar to the first-differenced GMM-IV estimator, the system GMM-IV estimator may be more efficient under heteroskedasticity. However, semiparametric methods can handle more complex relationships.

-

Dynamic panel data models (panel GMM) may have some difficulties in capturing some nonlinearities and complex relationships which are better handled by semiparametric methods. However, dynamic panel data models may be more suitable for handling endogeneity and autocorrelation issues.

In sum, semiparametric methods provide flexibility in modeling complex relationships and can potentially lead to more efficient estimates. However, they may require more computational resources and assumptions about the functional form of the nonparametric component.

-

Due to missing values for the construction of the variable Returns on stock prices the sample is reduced by 44 observations, resulting in a total of 184 observations.

References

Acharya VV, Hasan I, Saunders A (2006) Should banks be diversified? Evidence from individual bank loan portfolios. J Bus 79(3):1355–1412

Ahamada I, Flachaire E (2010) Non-Parametric Econometrics. Practical Econometrics Oxford University Press, New York

Ai C, Li Q (2008) Semi-parametric and non-parametric methods in panel data models. In: The econometrics of panel data: fundamentals and recent developments in theory and practice. Springer, pp 451–478

Akhavein JD, Berger AN, Humphrey DB (1997) The effects of megamergers on efficiency and prices: evidence from a bank profit function. Rev Ind Organ 12(1):95–139

AlKhouri R, Arouri H (2019) The effect of diversification on risk and return in banking sector. Int J Manag Financ 15(1):100–128

Armstrong A, Fic T, et al (2014) Bank diversification and valuation: international evidence. Technical report, National Institute of Economic and Social Research

Avellaneda M (1998) Minimum-relative-entropy calibration of asset-pricing models. Int J Theor Appl Financ 1(04):447–472

Baele L, De Jonghe O, Vander Vennet R (2007) Does the stock market value bank diversification? J Bank Financ 31(7):1999–2023

Baltagi BH, Li D et al (2002) Series estimation of partially linear panel data models with fixed effects. Ann Econ Financ 3(1):103–116

Beck T (2020) Fintech and financial inclusion: opportunities and pitfalls. ADBI Working Paper 1165, Tokyo: Asian Development Bank Institute. Available at: https://www.adb.org/publications/fintech-financial-inclusion-opportunities-pitfalls (Accessed July,2020)

Beck T, Chen T, Lin C, Song FM (2016) Financial innovation: the bright and the dark sides. J Bank Financ 72:28–51

Behr A, Kamp A, Memmel C, Pfingsten A (2007) Diversification and the banks’ risk-return-characteristics: evidence from loan portfolios of German banks

Benitez J, Henseler J, Roldán J (2016) How to address endogeneity in partial least squares path modeling. In: 22th Americas conference on information systems

Berger PG, Ofek E (1995) Diversification’s effect on firm value. J Financ Econ 37(1):39–65

Berger PG, Ofek E (1996) Bustup takeovers of value-destroying diversified firms. J Financ 51(4):1175–1200

Berger AN, Hanweck GA, Humphrey DB (1987) Competitive viability in banking: scale, scope, and product mix economies. J Monet Econ 20(3):501–520

Berger AN, Hasan I, Zhou M (2009) Bank ownership and efficiency in China: What will happen in the world’s largest nation? J Bank Financ 33(1):113–130

Berger AN, Hasan I, Zhou M (2010) The effects of focus versus diversification on bank performance: evidence from Chinese banks. J Bank Financ 34(7):1417–1435

Boot A, Hoffmann P, Laeven L, Ratnovski L (2021) FinTech - What’s Old, What’s New? J Financ Stab 53(C):100836

Boyd JH, Prescott EC (1986) Financial intermediary-coalitions. J Econ Theory 38(2):211–232

Boyd JH, Chang C, Smith BD (1998) Moral hazard under commercial and universal banking. J Money Credit Bank 30(3):426–468

Buch CM, Eickmeier S, Prieto E (2010) Macroeconomic factors and micro-level bank risk

Ceptureanu SI, Ceptureanu EG, Marin I (2017) Assessing the role of strategic choice on organizational performance by Jacquemin-Berry Entropy Index. Entropy 19(9):448

Cerasi V, Daltung S (2000) The optimal size of a bank: costs and benefits of diversification. Eur Econ Rev 44(9):1701–1726

Chen CR, Steiner TL, Whyte AM (1998) Risk-taking behavior and management ownership in depository institutions. J Financ Res 21(1):1–16

Chen Y, Wei X, Zhang L, Shi Y (2013) Sectoral diversification and the banks’ return and risk: evidence from Chinese listed commercial banks. Proced Comput Sci 18:1737–1746

Chen N, Liang H-Y, Yu M-T (2018) Asset diversification and bank performance: evidence from three Asian countries with a dual banking system. Pac Basin Financ J 52:40–53

Chiorazzo V, Milani C, Salvini F (2008) Income diversification and bank performance: evidence from Italian banks. J Financ Serv Res 33(3):181–203

Correa R, Goldberg LS (2020) Bank complexity, governance, and risk. In: International finance discussion papers 187, board of Governors of the Federal Reserve System, New York

De Jonghe O (2010) Back to the basics in banking? A micro-analysis of banking system stability. J Financ Intermed 19(3):387–417

Demirgüç-Kunt A, Huizinga H (1999) Determinants of commercial bank interest margins and profitability: some international evidence. World Bank Econ Rev 13(2):379–408

Denis DJ, Denis DK, Sarin A (1997) Agency problems, equity ownership, and corporate diversification. J Financ 52(1):135–160

DeYoung R, Rice T (2004a) Noninterest income and financial performance at US commercial banks. Financ Rev 39(1):101–127

DeYoung R, Rice T et al (2004b) How do banks make money? A variety of business strategies. Econ Perspect Federal Reserve Bank Chicago 28(4):52

DeYoung R, Roland KP (2001) Product mix and earnings volatility at commercial banks: Evidence from a degree of total leverage model. J Financ Intermed 10(1):54–84

DeYoung R, Torna G (2013) Nontraditional banking activities and bank failures during the financial crisis. J Financ Intermed 22(3):397–421

Edirisuriya P, Gunasekarage A, Dempsey M (2015) Bank diversification, performance and stock market response: Evidence from listed public banks in South Asian countries. J Asian Econ 41:69–85

Elsas R, Hackethal A, Holzhäuser M (2010) The anatomy of bank diversification. J Bank Financ 34(6):1274–1287

Engle RF, Granger CW, Rice J, Weiss A (1986) Semiparametric estimates of the relation between weather and electricity sales. J Am Stat Assoc 81(394):310–320

EY (2016) China and UK FinTech. EY. Available at: https://www.ey.com/Publication/vwLUAssets/ey-china-and-uk-fintech/File/ey-china-and-uk-fintech.pdf. (Accessed December, 2016)

Gambacorta L, Scatigna M, Yang J (2014) Diversification and bank profitability: a nonlinear approach. Appl Econ Lett 21(6):438–441

García-Herrero A, Gavilá S, Santabárbara D (2009) What explains the low profitability of Chinese banks? J Bank Financ 33(11):2080–2092

Goddard J, Molyneux P, Wilson JO (2004) The profitability of European banks: a cross-sectional and dynamic panel analysis. Manch Sch 72(3):363–381

Goddard J, McKillop D, Wilson JO (2008) The diversification and financial performance of US credit unions. J Bank Financ 32(9):1836–1849