Abstract

This paper investigates risk shifting in commercial banks in the emerging market of Vietnam, where banks fund domestic asset portfolios almost exclusively from deposits and with limited issuance of securities. We investigate the relationship between these banks’ income diversification strategies and their overall level of risk during the recent period of deregulation and global financial crisis. Our results show that those commercial banks that have shifted to non-interest income activities in fact face higher levels of risk. This finding is at odds with theories that argue that diversification is a strategy for risk reduction and has broader implications for domestic system stability. The analysis provides a framework for evaluating these issues in other emerging markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

This paper investigates the process of risk shifting in the banking sector in Vietnam, a key emerging market. Driven by the increased competitive pressures from both international and domestic rivals, technological improvement and regulatory reform, traditional bank intermediation activities in Vietnam have been supplemented by investment in risky assets comprising both listed and unlisted stocks. One justification for this strategy is that broadening the income generating activities of a bank leads to a risk reduction due to diversification, while also increasing asset return. Simply stated, through diversification, a bank lowers its overall probability of default and this relationship is especially important for larger banks (e.g. Shim 2013; Köhler 2015; Tsai et al, 2015) and those with a domestic focus, such as public sector banks in emerging markets (e.g. Pennathur et al, 2012; Nguyen et al, 2012; Garcia-Herrero and Vazquez, 2013; Meslier et al, 2014). There is, however, one important caveat, as noted by Beale et al (2011), all banks diversifying risks in the same way can lead to an increase in the probability of multiple bank failure. Thus, from a broader system-wide perspective, the diversification strategy of banks1 acting alone and collectively can have beneficial, as well as harmful, implications for overall market stability.

In this study, we show that income diversification in Vietnam adds to risk, due to the manner of the diversification strategies pursued. This finding is consistent with a number of recent studies that highlight the complex nature of the risks involved (e.g. Demirgüç-Kunt and Huizinga, 2010; Gulamhussen et al, 2014) as well as the importance of the level of financial market development (e.g. Vithessonthi, 2014; Vithessonthi and Kumarasinghe, 2016). In this sense, this work provides another perspective to the already extensive empirical analysis of the impact the level of financial market development has on a host of macroeconomic variables such as growth (e.g.; Nyasha and Odhiambo, 2015; Phiri, 2015; Sehrawat and Giri, 2015; Ahmed, 2016; Luintel et al, 2016), income inequality (e.g. Seven and Coskun, 2016), investment behaviour (e.g. Acquaah, 2015; Pradhana et al, 2015; Wang and Zhou, 2015; Castro et al, 2015; Ciarlone and Miceli, 2016) amongst many other studies.

The Vietnamese experience therefore provides insights into bank behaviour when financial intermediaries are subject to limited prudential supervision, and when obtaining alternate sources of funding is constrained by undeveloped financial markets. The analysis also provides a framework for evaluating these issues in other emerging markets and adds to an empirical literature that investigates this phenomenon, while highlighting the idiosyncratic features of emerging markets that may compromise the benefits of diversification (e.g. Sanya and Wolfe, 2011; Nguyen, 2012; Gimet and Lagoarde-Segot, 2012).

In recent years, international banking in the face of declining interest margins and increased competition from the non-bank domestic, as well as foreign bank sector, has been subject to three main trends: first, banks worldwide, both those with a domestic as well as an international focus, have shifted from funding assets with deposits, to a mix of deposits and securities. However, doing so requires the domestic market to be of a sufficient level of financial market developments that banks are able to access corporate bond, or short-dated securities, markets. In addition, many banks have also changed the nature of their assets, from making loans to investing and trading in risky as well as those government securities traditionally required for primary dealers.2 Finally, many banks have shifted their activities from traditional intermediation activities to those that provide fees and commissions. This is especially the case for markets undergoing deregulation and increased levels of competition (e.g. Anzoategui et al, 2012).

The comprehensive study by Demirgüç-Kunt and Huizinga (2010) across 101 countries leading up to the financial crisis of 2008 demonstrates that the expansion into non-interest generating activities increases the rate of return on assets, offers some low level diversification benefits but adds to risk, since much of the funding is in the form of non-deposits. De Jonghe (2010) argued that non-interest generating activities contribute to system instability since these activities lead to higher levels of bank “tail” risk (or sensitivity to extreme events), which increase during periods of extreme economic conditions, like the Global Financial Crisis. These factors negatively weigh on a bank’s share price, especially conglomerates, which consequently trade at a discount. Nonetheless, Elsas et al (2010) argue that such a conclusion may well be a function of how diversification is measured. Thus, in this paper, a number of different approaches to measuring bank diversification are applied.

In emerging markets, where domestic capital markets are underdeveloped, maintaining interest margins by funding assets through the issuance of cheaper securities may not always be possible. As a result, banks may be encouraged to maintain interest margins by making riskier investments. Vietnam is one such example. Here, in the face of increased competition from foreign banks and an aggressive non-bank sector, local banks have increased the risk of their asset portfolios, but not through the purchases of debt-like securities, but through the purchases of common stock. In effect, their balance sheets are directly exposed to market risks (and indirectly through the link between default and market risks that also affects solvency) as well as traditional liquidity and interest rate risks. Since Vietnamese bank deposits are guaranteed, there is also an implicit bailout by government in the event of bank failure. Collectively, these actions highlight the impact of risk shifting and the problems that regulators face in addressing these issues.

Foreign banks were able to open branches and incorporated entities in Vietnam from 2006, when Vietnam became a full member of the World Trade Organisation (WTO). Consequently, local Vietnamese banks were forced to compete with those large international institutions, which are able to fund local assets using internationally sourced funds, often at lower cost than their domestic competitors. While Vietnamese banks could also access foreign markets for funding, the cost of obtaining credit ratings, information and related access costs act as impediments to international market access for both debt and equity (e.g. Acquaah, 2015; Andreasen and Valenzuela, 2016). Some recent studies also highlight the extent that organizational and national culture may impede or hinder the decision to access international markets (e.g. Dewandaru et al, 2014; Guyot et al, 2014; Cai and Zhu, 2015). Importantly, these foreign institutions are not reliant on traditional bank deposits as a source of funds, which insulates them from domestic credit conditions. Goetz et al (2016) also show that foreign banks benefit from geographic expansion that lowers risk by reducing exposure to idiosyncratic local risks.

As a result of financial deregulation and liberalization worldwide, the pressure arising from increased competition, concentration and restructuring forces the banking system to constantly change and improve traditional banking operations (Lepetit et al, 2008; Mirzaei and Moore, 2014; Saeed and Sameer, 2015). Even though competition in banking is important for the efficient production of financial products and services (Claessens and Laeven 2004), banks may use more sophisticated financial activities to maintain stable incomes. Despite these competitive pressures, the relation between bank risk taking and competition may not be so clear-cut since the competition may be directed to specific market segments or time periods. For example, Liu et al (2012) found that competition did not increase bank risk-taking behaviour in the banks in Indonesia, Malaysia, Philippines and Vietnam in the period 1998–2008. These results were robust to different model specifications, estimation approaches and variable construction.

Competitive pressures may be more profound in emerging countries where existing domestic commercial banks are not only competing with growing domestic non-bank financial intermediaries, but also foreign banks. While foreign banks entered the Vietnamese markets in 2006, the full impact of their entry on domestic competition was not identified in the Liu et al's (2012) study. One of the common strategies that commercial banks have adopted to face the heightened pressure of competition, consolidation and reform is to diversify their sources of income in order to maintain revenue stability. As a compensation for the decline in interest margins induced by higher competition, commercial banks are often forced to charge a higher fee on services (if they can do so). Thus, the share of non-interest income in the profits of commercial banks has likely increased.

A recent paper by Elsas et al (2010) amongst others, documents that commercial banks tend to increase diversification by moving into fee-based businesses. Further, this work states that banks with strong fee-based incomes then expand into trading activities and underwriting. This finding raises the question of the extent that diversification is beneficial in terms of risk reduction. While this paper focuses on investigating the relationship between bank diversification and risk using a sample of Vietnamese commercial banks, we use a number of indicators to measure bank risk. We also use a number of disaggregated bank diversification measures in order to achieve a more robust result.

Thus, to sum-up, there are three main motivations for this investigation of the impact of diversification on Vietnamese banks. First, this paper arises from the increased interest in bank income diversification by bankers, policy makers and academics more generally in an international context. However, the question of whether a bank should follow a diversification strategy is also an important issue in emerging markets where commercial banks are small relative to those internationally and where the institutions are often weak. Increased competition tends to pressure banks to adopt diversification strategies to obtain higher revenues (e.g. Saghi-Zedek, 2016; Doumpos et al, 2016). This paper adds to many earlier papers that focused on how portfolio diversification affects the risk return profile of the bank (e.g. Boyd et al, 1980; Kwan 1998; DeYoung and Roland 2001; Baele et al, 2007), and on incentive approaches (e.g. Rajan 1991; John et al, 1994; Puri 1996; Boyd et al, 1998).

In this context, the advantage offered by combining lending and non-interest income activities allows for diversification benefits and risk reduction. In addition, most of these early papers employ data from developed countries, like the US and European countries, while the impacts on emerging countries, such as Vietnam, often remain neglected in the literature. This study adds to this literature and benefits from a number of recent studies that investigate efficiencies in Vietnamese and banks in other emerging nations in the recent years (e.g. Nguyen et al, 2016; Stewart et al, 2016; amongst others).

Second, in the specific context of the Vietnamese banking system, commercial banks hold pivotal roles in supplying credit to the financial markets of Vietnam where firm financing sources are mainly from bank credit. The opening of the banking market to foreign banks has increased competitive pressure within the banking system in Vietnam. Furthermore, the gradual shift to a stricter international regulatory standard has also created additional pressures for the local bank system.

Third, there is the question of whether the observed shift into non-interest income activities is different in emerging markets given the uniqueness of the institutional arrangements (Mercieca et al, 2007). Diversifying sources of income may also mean that commercial banks enter new lines of business, where they have neither expertise nor experience. This issue remains a contentious topic in emerging markets given the absence of diversification benefits often reported in many small and less developed banking systems (e.g. Mercieca et al, 2007).

Therefore, in this paper, we explore the impact of bank diversification strategies by investigating whether diversification affects bank risks in the Vietnamese banking system. The results add to an expanding international literature, including the recent work by Saghi-Zedek (2016) and Doumpos et al (2016) that questions the traditional view that diversification reduces risk and offers higher returns to banks, even those in emerging markets. The remainder of the paper is structured as follows: section ‘Literature Review’ reviews the literature on this topic; section ‘Model and Data’ describes the model, data collection and methodology, while section ‘Results and Discussion of Results’ reports the results and discusses the empirical results. Finally, section five concludes the paper.

Literature Review

A detailed review of the bank diversification literature is provided by Nguyen et al (2016), Saghi-Zedek (2016) and Doumpos et al (2016) amongst others. Therefore, only a brief survey is provided in this paper. The topic of bank income diversification from the joint perspective of the benefits from reduced risk and higher return has attracted considerable discussion in the current banking literature. This analysis is consistent with a large body of literature in corporate finance that addresses the question of the respective benefits of focus (or concentration), or diversification, in the business activities of firms (Rossi et al, 2009). With respect to the banking literature, many papers suggest that the diversification of income sources is associated with a reduction in bank risks.

The simple reasoning behind this view is that holding a diversified portfolio lowers bank risk as long as the income sources are uncorrelated. Another reason is that the operating revenues on the bank’s income statement will be more stable because each line of income is subject to a different cyclical impact. In emerging markets, with limited financial infrastructure, concentrated and possibly uncompetitive banking systems, large banks are able to exploit their greater market power in lending and deposit markets to earn more from non-traditional activities (Nguyen et al, 2015). Froot et al (1993) and Froot and Stein (1998) argue that diversification is also a hedge against insolvency risk and reduces the effect of costly financial distress. The competitive pressures due to competition amongst banks across a wider range of market segments lead to an increase in innovation and efficiency, and an increase in bank profits (Carlson 2004; Landskroner et al, 2005; Acharya et al, 2006), although it can also lead to excessive risk taking and ultimately bankruptcy.

Another strand of this research suggests that adopting income diversification strategies improves bank and ultimately system stability (e.g. Landskroner et al, 2005; Baele et al, 2007; Sanya and Wolfe 2011). The benefits of shifting to sources of non-interest income were reported in a number of early papers. For example, Boyd et al (1980) state that diversifying into non-traditional banking activities offers a potential risk reduction. This finding was supported by later studies including Kwast (1989), Saunders and Walter (1994) and Gallo et al (1996). However, most of these papers suggest that these non-activities must be at a relatively low level to obtain positive income and risk benefits. More recently, _ENREF_27Slijkerman et al (2013) employs a sample of European banks and insurance firms to investigate the impact of diversification on systematic risk, and finds that downside risks can be lowered through financial conglomeration.

The sources of risks are explained by DeYoung and Roland (2001), including the increased volatility of non-interest revenues, higher fixed costs of banks engaging in new lines of operations, and less regulatory capital provision for non-credit activities. Other explanations for the increase in risk include the lack of managerial skills, lack of information in the new product market, and greater agency problems due to a more complex organization and product structure (e.g. Acharya et al, 2006; Baele et al, 2007). In emerging markets, there is also the likely impact of poor corporate governance and possibly corruption that may encourage the risk-taking activities of banks (e.g. Miletkov and Wintoki, 2012; Fan, Gillan and Yu, 2013; Minghua et al, 2015; Battaglia and Gallo, 2015).

These arguments are further supported by the findings of Stiroh (2004) when investigating a sample of large US banks, and the examination by Lepetit et al (2008) of European banks. Further, Stiroh and Rumble (2006) explain that the increased exposure to the new and possibly volatile earnings activities from diversification may very well outweigh the benefits. In addition, Grassa (2012) and Elyasiani and Wang (2012) acknowledge that while the proportion of non-traditional revenues of commercial banks are on the rise, the risks associated with these activities are higher. Van Oordt (2014) also shows that diversification through securitization creates instability for both banks and banking system, although this conclusion may well be a function of the sample period, which covered the GFC period.

While there a small number of papers investigating the banking system in Vietnam, the focus of these papers is typically the changes in efficiency over time. These studies include Vu and Nahm (2013), Nguyen and Simioni (2015), Nguyen et al (2016) and Stewart et al (2016). The key contribution of this study is that a large set of risk and insolvency measures, based on accounting data, at the individual bank level, are examined. Secondly, to assess risk implications, non-interest generating activities are considered in terms of both trading activities, and commission and fee activities. Third, a regression analysis is undertaken, which allows the effects of bank size and different regulatory episodes to be considered. A number of studies, including Hou et al (2015), show that the scale economies of banks have implications for off-balance sheet operations, as well as on-balance sheet operations, and that these scale economies are more often available to non-state-owned banks, which may be more innovative and risk taking.

Model and Data

In order to examine the risks associated with the level of diversification, we employ the following model, which is similar to Lepetit et al (2008) for our analysis:

where RISKit is the risk measures for bank i in year t. Two risk measures are calculated as follows:

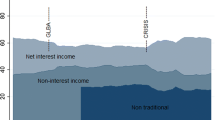

In these two ratios, the higher the value, the lower the levels of bank risk. In the above model, the term DIVit measures the degree of income diversification. A number of indicators are used to measure the structure of income to proxy for income diversification. Initially, we consider the ratio of net non-interest income to net operating income (NNII) as a measure of income diversification. Net non-interest income is calculated as the difference between non-interest income and non-interest expenses, while net operating income is the sum of net interest income and net non-interest income.

We further disaggregate the diversification measure into two components of non-interest income. The first is commission and fee income (COM), and the second is trading income (TRADE). The first is defined as the ratio of net commission and fee income to net operating income, while the second is defined as the ratio of net trading income to net operating income.

We use a set of control variables to account for bank size that is the log of total assets (TA), the ratio of operation expenses to total assets (EXPENSE), and bank capital asset ratio (CAR).

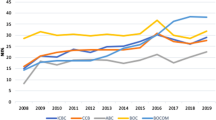

We use a sample consisting of an unbalanced panel of annual report data from 2006 to 2014 for a set of 35 commercial banks in Vietnam. The data used in the analysis include the largest commercial banks in Vietnam and were hand collected from the annual reports of each bank. The descriptive statistics of the sample are presented in Table 1.

The table reports the mean, median and maximum and minimum values for each of the eight variables: RAROA is the risk of the return on assets (Eq. 2), which had an average value of 1.64; RAROE is the risk of the return on equity (Eq. 3), which had an average value of 1.70; NNII is the ratio of non-interest income to net operating income, which had an average value of 2.51; COM is commission and fee income to non-interest income, which had an average value of 0.82, and TRADE is trading income to net operating income, which had an average value of 0.45. The control variables are SIZE, which had an average value of 17.32, measured as the log of total assets, the ratio of operating expenses to total assets (EXPENSE), which had an average value of 0.015, and the bank capital ratio CAR, which had an average ratio of 0.134. The sample period is from 2006 to 2014 (9 years) and overall there were 299 observations.

Results and Discussion of Results

Table 2 presents the correlation matrix of the various variables used in the paper. At first glance, results from this table show that all three diversification measures (NNII, COM and TRADE) are negatively correlated with the two risk indicators (RAROA and RORAE). However, the correlations, while negative are very low. Therefore, although this initial finding suggests that income diversification is associated with higher risk in the Vietnamese bank system, further statistical analysis in a regression framework is required to address potential instability and serial-correlation problems. For example, the highest correlations were in fact between the three different measures of diversification, while size was negatively correlated with CAR and EXPENSE, while CAR and EXPENSE were significantly positively correlated. Interestingly, SIZE was also positively correlated with RAROE but negatively with RAROA.

Tables 3 and 4 report the regression results where the two risk indicators, RAROA and RAROE, are the dependent variables, respectively. In each table, the left panel shows the results of the OLS estimation and the right panel shows the fixed-effects estimation. The use of a number of estimation techniques for panel data allows us to enhance the robustness of the results. Accordingly, we highlight some important findings as follows.

Overall, the key empirical result is that the coefficients for the various diversification measures are negative and significant in all regressions. Furthermore, the results are consistent for both the OLS and fixed-effects estimates. More importantly, the results are robust for different measures of diversification, including fee income and trading diversification indicators. These findings suggest that banks with a higher diversification of income are associated with more risks. Our results are in line with the previous finding of Stiroh and Rumble (2006), who use a sample of financial holding companies in the US. However, our finding is different from studies such as Sawada (2013), who states that banks diversifying into fee income reduce bank risk. The simple conclusion is that Vietnamese banks should focus on their traditional intermediation activities, given that diversification adds to the level of individual bank risk and may add to systemic risk.

The results in Tables 3 and 4 also offer some other interesting insights. First, these tables report that the estimated coefficients for the bank size variables (SIZE) are not significant in either of the regression estimations, both OLS and fixed effects. This suggests that bank size does not have any consistent and significant effect on bank risk in Vietnam when controlling for other factors. In this study what appears more important for bank risk are the more traditional measures of asset quality, the extent of asset-liability maturity mismatch (liquidity and interest rate risks) and the quality of management.

Secondly, the results show that banks with higher expenses are associated with higher risks since the coefficients for expenses are negative and significant in all regressions. Improved management of expenses improves efficiency and hence reduces risk (Athanasoglou et al, 2008). This important finding suggests that by becoming more efficient Vietnamese, commercial banks can significantly reduce their level of risk.

Finally, the results from these two tables also reveal that the coefficients for all the capital ratio variables are positive and significant in all regressions. This result suggests that a higher capital ratio reduces risk in the Vietnamese banking system. While not surprising, this finding does reinforce the importance of maintaining an adequate capital ratio for commercial banks in Vietnam and other emerging nations. This result demonstrates that maintaining a strict capital requirement has a sound theoretical basis and practical importance. Furthermore, our result supports the view that bank capital adequacy is an important element of prudential analysis and a higher capital requirement will result in a more stable financial system. More importantly, maintaining a higher level of equity will act as a buffer to prevent banks from falling back on government to mitigate their losses and discourage banks from taking irresponsible risks.

Conclusion

The objective of this paper is to assess the risk implications of revenue diversification in the context of the Vietnamese banking industry. This study complements previous studies of both developed and emerging countries and provides insights into these issues when banking markets are not subject to the same degree of regulatory oversight as occurs in major developed markets, or when the financial markets themselves are less developed. In Vietnam’s case, the recent entry of foreign banks and ongoing deregulation has increased competition in the domestic banking sector. Further, we provide an updated analysis of the recent financial activities of Vietnamese commercial banks, which have moved away from traditional intermediation towards non-interest income activities.

The results of this empirical investigation indicate that the shift to non-interest sources of income has been accompanied by a significant increase in Vietnamese bank risk. Our results are in line with the previous findings of Stiroh and Rumble (2006) and Demirgüç-Kunt and Huizinga (2010) amongst others that suggest that following a diversification strategy might in fact be riskier than traditional intermediation activities. Our finding of a negative relationship between income diversification and the level of bank risk has two important implications for the Vietnamese banking system: first, the non-interest income strategy may not be viable in the long-term suggesting regulators should remain vigilant; and second, there are long-term systemic risk implications implied by income diversification away from traditional intermediation in Vietnam and possibly in other emerging markets that also require monitoring and possibly regulation. The impact and policy implications remain the subject for further study and analysis.

Notes

-

1

Kohler (2015) also discusses the specific business model being pursued by a bank.

-

2

However, in some countries, banks have been able to access international capital markets for these purposes. Recent data from the Bank for International Settlements confirm these trends, while the Global Financial Crisis has highlighted the risks from overreliance on short-term international funding.

References

Acharya, V.V., Hasan, I., and Saunders, A. (2006) Should banks be diversified? Evidence from individual bank loan portfolios. The Journal of Business 79(3): 1355–1412.

Acquaah, M. (2015) Determinants of corporate listings on stock markets in Sub-Saharan Africa: Evidence from Ghana. Emerging Markets Review 22: 154–175.

Ahmed, A.D. (2016) Integration of financial markets, financial development and growth: Is Africa different? Journal of International Financial Markets Institutions and Money 42: 43–59.

Andreasen, E., and Valenzuela, P. (2016) Financial openness, domestic financial development and credit ratings. Finance Research Letters 16: 11–18.

Anzoategui, D., Pería, M.S.M., and Melecky, M. (2012) Bank competition in Russia: An examination at different levels of aggregation. Emerging Markets Review 13(1): 42–57.

Athanasoglou, P.P., Brissimis, S.N., and Delis, M.D. (2008) Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of international financial Markets, Institutions and Money 18(2): 121–136.

Baele, L., De Jonghe, O., and Vennet, R.V. (2007a) Does the stock market value bank diversification? Journal of Banking & Finance 31(7): 1999–2023.

Baele, L., Jonghe, O.D., and Vennet, R.V. (2007b) Does the stock market value bank diversification? Journal of Banking & Finance 31: 1999–2023.

Battaglia, F., and Gallo, A. (2015) Risk governance and Asian bank performance: An empirical investigation over the financial crisis. Emerging Markets Review 25: 53–68.

Beale, N., Rand, D.G., Battey, H., Croxson, K., May, R.M., and Nowak, M.A. (2011) Individual versus systemic risk and the Regulator’s Dilemma. Proceedings of the National Academy of Sciences of the United States of America 108(31): 12647–12652.

Boyd, J., Chang, C., and Smith, D. (1998) Moral hazard under commercial and universal banking. Journal of Money, Credit and Banking 30(3): 426–468.

Boyd, J., Hanweck, G. and Pithyachariyakul, P. (1980) Bank holding company diversification. In: Proceedings from a conference on bank structure and competition, may. Federal Reserve Bank of Chicago: (pp. 105–120).

Cai, K., and Zhu, H. (2015) Cultural distance and foreign IPO underpricing variations. Journal of Multinational Financial Management 29: 99–114.

Carlson, M. (2004) Are branch banks better survivors? Evidence from the depression era Economic Inquiry 42(1): 111–126.

Castro, F., Kalatzis, A.E.G., and Martins-Filho, C. (2015) Financing in an emerging economy: Does financial development or financial structure matter? Emerging Markets Review 23: 96–123.

Ciarlone, A., and Miceli, V. (2016) Escaping financial crises? Macro evidence from sovereign wealth funds’ investment behaviour. Emerging Markets Review 27: 169–196.

Claessens, S., and Laeven, L. (2004) What drives bank competition? Some international evidence. Journal of Money, Credit and Banking 36: 563–583.

De Jonghe, O. (2010) Back to the basics in banking? A micro-analysis of banking system stability. Journal of Financial Intermediation 19(3): 387–417.

Demirgüç-Kunt, A., and Huizinga, H. (2010) Bank activity and funding strategies: The impact on risk and returns. Journal of Financial Economics 98(3): 626–650.

Dewandaru, G., Rizvi, S.A.R., Bacha, O.I., and Masih, M. (2014) What factors explain stock market retardation in Islamic Countries. Emerging Markets Review 19: 106–127.

DeYoung, R., and Roland, K. (2001) Product mix and earnings volatility at commercial banks: Evidence from a degree of total leverage model. Journal of Financial Intermediation 10: 54–84.

Doumpos, M., Gaganis, C. and Pasiouras, F. (2016) Bank diversification and overall financial strength: International evidence. Financial Markets, Institutions & Instruments 25: 169–213.

Elsas, R., Hackethal, A., and Holzhäuser, M. (2010) The anatomy of bank diversification. Journal of Banking & Finance 34(6): 1274–1287.

Elyasiani, E., and Wang, Y. (2012) Bank holding company diversification and production efficiency. Applied Financial Economics 22(17): 1409–1428.

Fan, J.P.H., Gillan, S.L., and Yu, X. (2013) Property rights, R&D spillovers, and corporate accounting transparency in China. Emerging Markets Review 15: 34–56.

Froot, K.A., Scharfstein, D.S., and Stein, J.C. (1993) Risk management: Coordinating corporate investment and financing policies. The Journal of Finance 48(5): 1629–1658.

Froot, K.A., and Stein, J.C. (1998) Risk management, capital budgeting, and capital structure policy for financial institutions: An integrated approach. Journal of Financial Economics 47(1): 55–82.

Gallo, J., Apilado, V., and Kolari, J. (1996) Commercial bank mutual fund activities: Implications for bank risk and profitability. Banking and Finance 20: 1775–1791.

García-Herrero, A., and Vázquez, F. (2013) International diversification gains and home bias in banking. Journal of Banking & Finance 37(7): 2560–2571.

Gimet, C., and Lagoarde-Segot, T. (2012) Financial sector development and access to finance: Does size say it all? Emerging Markets Review 13(3): 316–337.

Goetz, M.R., Laeven, L., and Levine, R. (2016) Does the geographic expansion of banks reduce risk? Journal of Financial Economics 120(2): 346–362.

Grassa, R. (2012) Islamic banks’ income structure and risk: Evidence from gcc countries. Accounting Research Journal 25(3): 227–241.

Gulamhussen, M.A., Pinheiro, C., and Pozzolo, A.F. (2014) International diversification and risk of multinational banks: Evidence from the pre-crisis period. Journal of Financial Stability 13: 30–43.

Guyot, A., Lagoarde-Segot, T., and Neaime, S. (2014) Foreign shocks and international cost of equity destabilization: Evidence from the MENA region. Emerging Markets Review 18: 101–122.

Hou, X., Wang, Q., and Li, C. (2015) Role of off-balance sheet operations on bank scale economies: Evidence from China’s banking sector. Emerging Markets Review 22: 140–153.

John, K., John, T.A., and Saunders, A. (1994) Universal banking and firm risktaking. Journal of Banking & Finance 18(2): 307–323.

Köhler, M. (2015) Which banks are more risky? The impact of business models on bank stability. Journal of Financial Stability 16: 195–212.

Kwan, S. (1998), Securities activities by commercial banking firms’ section 20 subsidiaries: Risk, return and diversification benefits. In: Economic research, Federal Reserve Bank of San Francisco.

Kwast, M. (1989) The impact of underwriting and dealing on bank returns and risks. Journal of Banking & Finance 13: 101–125.

Landskroner, Y., Ruthenberg, D., and Zaken, D. (2005) Diversification and performance in banking: The israeli case. Journal of Financial Services Research 27(1): 27–49.

Lepetit, L., Nys, E., Rous, P., and Tarazi, A. (2008) Bank income structure and risk: An empirical analysis of european banks. Journal of Banking & Finance 32(8): 1452–1467.

Liu, H., Molyneux, P., and Nguyen, L.H. (2012) Competition and risk in south east Asian commercial banking. Applied Economics 44(28): 3627–3644.

Luintel, K.B., Khan, M., Leon-Gonzalez, R., and Li, G. (2016) Financial development, structure and growth: New data, method and results. Journal of International Financial Markets Institutions and Money 43: 95–112.

Mercieca, S., Schaeck, K., and Wolfe, S. (2007) Small european banks: Benefits from diversification? Journal of Banking & Finance 31(7): 1975–1998.

Meslier, C., Tacneng, R., and Tarazi, A. (2014) Is bank income diversification beneficial? Evidence from an emerging economy. Journal of International Financial Markets Institutions and Money 31(1): 97–126.

Miletkov, M., and Wintoki, M.B. (2012) Financial development and the evolution of property rights and legal institutions. Emerging Markets Review 13(4): 650–673.

Minghua, C., Jeon, B.N., Wang, R., and Ji, W. (2015) Corruption and bank risk-taking: Evidence from emerging economies. Emerging Markets Review 24: 122–148.

Mirzaei, A., and Moore, T. (2014) What are the driving forces of bank competition across different income groups of countries? Journal of International Financial Markets Institutions and Money 32(1): 38–71.

Nguyen, J. (2012) The relationship between net interest margin and noninterest income using a system estimation approach. Journal of Banking & Finance 36(9): 2429–2437.

Nguyen, T.P.T., Nghiem, S.H., Roca, E., and Sharma, P. (2016a) Bank reforms and efficiency in Vietnamese banks: evidence based on SFA and DEA. Applied Economics 48(30): 2822–2835.

Nguyen, M., Perera, S., and Skully, M. (2016b) Bank market power, ownership, regional presence and revenue diversification: Evidence from Africa. Emerging Markets Review 27: 36–62.

Nguyen, P.A., and Simioni, M. (2015) Productivity and efficiency of Vietnamese banking system: new evidence using Färe-Primont index analysis. Applied Economics 47(41): 4395–4407.

Nguyen, M., Skully, M., and Perera, S. (2012) Market power, revenue diversification and bank stability: Evidence from selected South Asian countries. Journal of International Financial Markets Institutions and Money 22(4): 897–912.

Nyasha, S., and Odhiambo, N.M. (2015) Economic growth and market-based financial systems: A review. Studies in Economics and Finance 32(2): 235–255.

Pennathur, A.K., Subrahmanyam, V., and Vishwasrao, S. (2012) Income diversification and risk: Does ownership matter? An empirical examination of Indian banks. Journal of Banking and Finance 36(8): 2203–2215.

Phiri, A. (2015) Asymmetric cointegration and causality effects between financial development and economic growth in South Africa. Studies in Economics and Finance 32(4): 464–484.

Pradhana, R.P., Arvinb, M.B., and Norman, N.R. (2015) Insurance development and the finance-growth nexus: Evidence from 34 OECD countries. Journal of Multinational Financial Management 31: 1–22.

Puri, M. (1996) Conflicts of interest, intermediation, and the pricing of underwritten securities. Mimeo, Graduate School of Business. Stanford University, Mars

Rajan, R. (1991) Conflict of interest and the separation of commercial and investment banking, Working Paper. University of Chicago

Rossi, S.P.S., Schwaiger, M.S., and Winkler, G. (2009) How loan portfolio diversification affects risk, efficiency and capitalization: A managerial behavior model for austrian banks. Journal of Banking & Finance 33(12): 2218–2226.

Saeed, A., and Sameer, M. (2015) Financial constraints, bank concentration and SMEs: evidence from Pakistan. Studies in Economics and Finance 32(4): 503–524.

Saghi-Zedek, N. (2016) Product diversification and bank performance: Does ownership structure matter? Journal of Banking & Finance 71: 154–167.

Sanya, S., and Wolfe, S. (2011) Can banks in emerging economies benefit from revenue diversification? Journal of Financial Services Research 40(1–2): 79–101.

Saunders, A., and Walter, I. (1994) Universal Banking in the United States: What Could We Gain? What Could We Lose?. Oxford : Oxford University Press.

Sawada, M. (2013) How does the stock market value bank diversification? Empirical evidence from japanese banks. Pacific-Basin Finance Journal 25: 40–61.

Sehrawat, M., and Giri, A.K. (2015) Financial development and economic growth: Empirical evidence from India. Studies in Economics and Finance 32(3): 340–356.

Seven, U., and Coskun, Y. (2016) Does financial development reduce income inequality and poverty? Evidence from emerging countries. Emerging Markets Review 26: 34–63.

Shim, J. (2013) Bank capital buffer and portfolio risk: The influence of business cycle and revenue diversification. Journal of Banking & Finance 37(3): 761–772.

Slijkerman, J.F., Schoenmaker, D., and de Vries, C.G. (2013) Systemic risk and diversification across european banks and insurers. Journal of Banking & Finance 37(3): 773–785.

Stewart, C., Matousek, R., and Nguyen, T.N. (2016) Efficiency in the Vietnamese banking system: A DEA double bootstrap approach. Research in International Business and Finance 36: 96–111.

Stiroh, K. (2004) Diversification in banking: Is non-interest income the answer? Journal of Money, Credit and Banking 36(5): 853–882.

Stiroh, K.J., and Rumble, A. (2006) The dark side of diversification: The case of us financial holding companies. Journal of Banking & Finance 30(8): 2131–2161.

Tsai, Y.-S., Lin, C.-C., and Chen, H.-Y. (2015) Optimal diversification, bank value maximization and default probability. Applied Economics 47(24): 2488–2499.

van Oordt, M.R.C. (2014) Securitization and the dark side of diversification. Journal of Financial Intermediation 23(2), 214–231.

Vithessonthi, C. (2014) The effect of financial market development on bank risk: Evidence from Southeast Asian countries. International Review of Financial Analysis 35: 249–260.

Vithessonthi, C., and Kumarasinghe, S. (2016) Financial development, international trade integration, and stock market integration: Evidence from Asia. Journal of Multinational Financial Management 35: 79–92.

Vu, H., and Nahm, D. (2013) The determinants of profit efficiency of banks in Vietnam. Journal of the Asia Pacific Economy 18(4): 615–631.

Wang, J., and Zhou, H. (2015) Competition of trading volume among markets: Evidence from stocks with multiple cross-listing destinations. Journal of Multinational Financial Management 31: 23–62.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Batten, J.A., Vo, X.V. Bank risk shifting and diversification in an emerging market. Risk Manag 18, 217–235 (2016). https://doi.org/10.1057/s41283-016-0008-2

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41283-016-0008-2