Abstract

Starting from the discourse on the impact of private and governmental venture capital investments, we examine the effects of different types of venture capital on firms’ sales, employment and investment. Our results show that both private and governmental venture capital investments boost firm sales with a delay of 2–3 years. The results suggest that VC impacts sales primarily through efficiency gains and to some extent, investments in physical capital investments, whereas no employment effects can be traced. Finally, we find indications of governmental VC investors being more prone to make follow-up investments in stagnating, non-growing firms than private investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last decades, venture capital (VC) has emerged as an important model of financing for innovative, high-potential start-up firms. Research shows that venture capital-backed firms have contributed significantly to aggregate job creation (Puri and Zarutskie 2012), productivity growth (Chen et al. 2013) and innovation (Kortum and Lerner 2000; Cumming and Johan 2016).

The recognition that venture capital can foster high-potential entrepreneurship has led governments to implement policies to promote the development of VC. One result of these efforts is the formation and spread of government-sponsored venture capital firms (GVCs) that work to directly increase the supply of VC. Specifically, GVCs are VC companies that are either partly financed (what is known as “hybrid” GVC) or entirely owned and run by the government (“direct” GVC). In recent years, about one-third of new VC raised in Europe was provided by governments (Invest Europe 2016).

The increased presence of GVCs has triggered a growing literature that aims to evaluate GVC performance against private venture capital investors (PVC). This literature has tended to find that firms backed by GVC do not develop as strongly as those backed by PVC, or mixed VC (MVC, private and governmental co-investments) as measured by several metrics including exits, patents, growth and productivity (see, e.g., Puri and Zarutskie 2012; Croce et al. 2013; Grilli and Murtinu 2014). This discrepancy can be a reflection of either GVCs selecting less promising ventures, possibly because they tend to invest in sectors or stages where private funds are scarcer (dubbed the screening hypothesis) or because GVCs are providing less (or different) valued added to their portfolio companies (dubbed the value-added hypothesis) (see, e.g., Chemmanur et al. 2011; Croce et al. 2013; Engel and Keilbach 2007; Baum and Silverman 2004). In both cases, however, the discrepancy should be seen in light of the diverging objectives that characterize GVCs and PVCs.

Most private VCs are primarily focused on maximizing profit, whereas GVCs may have other goals in mind, such as promoting employment and entrepreneurial and innovative activity. This gives us reason to believe that GVCs may tend to invest in different types of firms, and/or influence them differently, compared to PVCs.

While the previous literature has documented the empirical effects of GVC and PVC on various firm-level metrics separately, surprisingly little is still known about the pathways by which the two types of VC can affect firm outcomes. To address this gap, we consider a comprehensive model of firm sales that includes both capital investment and employment (the hiring and separation of employees). Beyond a direct effect on sales from VC, we investigate the existence of indirect effects that work through investments in capital and/or employment. Hence, by looking at both inputs and output in the same framework, we hope to broaden the view of how GVC and PVC affect the targeted firms in terms of their added value.

To examine these questions, we rely on a comprehensive dataset of VC investments that cover a large share of PVC investments and virtually all investments made by the six largest GVC investors in Sweden between 2007 and 2014. These data are merged with detailed firm-level data from Statistics Sweden with information on inputs, output and the financial situation of the recipient firms. The results of this study can be summarized as follows: (i) firms that receive any form of VC increase their sales 2–3 years after the VC injection, where (ii) the increased sales is driven by increased investments and efficiency gains, while there are no signs of any employment effects within 4 years after the VC injection. Comparing investments from PVCs and GVCs, we find (iii) no indications that the effects are significantly different from each other. However, we find some indications that GVCs are more prone than PVCs to make follow-on investments in stagnating, non-growing companies.

The rest of the paper is structured in the following way: Section 2 presents a theoretical background along with the motivation for this study. The data material on VC is described in Sect. 3, followed by the empirical model and identification strategy, which is described in Sect. 4. Sections 5 and 6 present the results, whereas the final section concludes the paper with a discussion about the policy conclusions.

2 Theoretical background

The VC model is widely recognized as successful, offering financial capital and other forms of support to young and innovative firms (Gompers and Lerner 2001; Colombo and Grilli 2010; Chemmanur et al. 2011; Puri and Zarutskie 2012; Croce et al. 2013). Typically, these firms have little (if any) cash flow or collateral to pledge for credit, and with a high risk of failure, coupled with principal–agent problems, i.e., asymmetric information and moral hazard (Lerner 2002; Akerlof 1970; Kaplan and Strömberg 2001), traditional forms of financing such as bank loans can be hard for them to obtain (Hall and Mairesse 2008; Berger and Udell 1998; Carpenter and Petersen 2002).

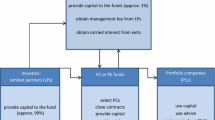

Conversely, VC investors are especially well equipped to resolve the principal–agent problem through a regimen of screening, contracting and monitoring (Kaplan and Strömberg 2001). Screening refers to an evaluation of the entrepreneur before an investment is made. Contracting provides incentives for the entrepreneur to maximize performance, such as an agreement to match the VC’s investment with his or her own funds. Monitoring refers to supervising the entrepreneur after investing, which often involves taking a seat on the board and overseeing the financial performance.Footnote 1 The fact that VC investors buy an equity share in the start-up means that they will benefit from future success when they sell their stake (“exit” their investment), allowing them to provide capital to ventures deemed too risky by lenders.

The attractiveness of VC to entrepreneurs, however, does not solely derive from access to financial capital, but also from the non-financial resources which they provide, including management advice, assistance in recruiting key personnel, and access to valuable business networks (see, e.g., Hellman and Puri 2002; Chemmanur et al. 2011). For all these reasons, VC helps fill a void in start-up financing, alleviating the financing constraints that many start-ups would otherwise face (Gompers and Lerner 2001; Bertoni et al. 2015), making VC an essential component of a vibrant start-up ecosystem.

Providing an active VC market has become an important objective for policy makers (OECD 2006).Footnote 2 Initiatives are currently being undertaken by the EU and by governments around Europe encouraged by the Europe 2020 agenda to make “an efficient European venture capital market a reality” (European Commission 2010, p. 22), including the recent announcement of a €1.6B EU-sponsored venture capital fund. These efforts have led to a situation where currently about one-third of all European VC comes from government-controlled bodies (Invest Europe 2016).

Although PVCs can bridge some of the funding gap, there are several possible reasons for why the supply of VC may be insufficient from a societal point of view, which creates a rationale for governments to intervene. In underdeveloped VC markets, GVCs can play a crucial role in catalyzing the development of an active start-up ecosystem, as in the case of the Israeli Yozma fund (Avnimelech and Teubal 2006; Lerner 2010).

In more developed VC markets, GVCs primary function is to help providing a continuous financing ladder throughout a start-up’s lifecycle (OECD 2006). In case of an “early-stage VC gap,” the potential for entrepreneurship can be held back because of a shortage of venture capital in the earliest start-up phases (OECD 2006). This gap is assumed to occur because it is hard to turn a profit from early-stage investments. No matter how promising a venture seems, the risk of failure is high. Each investment is associated with fixed costs for the VC, which has limited resources for screening and monitoring investments. VC firms often manage large funds, but consist of just a few managers that prefer to invest large sums to justify the fixed costs associated with each investment. In addition, the time horizon until exit (typically when the start-up is taken public (IPO) or acquired by another company (M&A)) for early-stage VC investments is longer, further pushing down the (annualized) return. It is therefore arguably in the early seed and start-up phases where private alternatives are most likely to be scarce and where the motivation for GVC intervention is the strongest (Lerner 2002; Colombo et al. 2016; Svensson 2011; OECD 2006).

When surveying the Swedish GVC market, Svensson (2011) finds, to the contrary, that GVCs mostly invested in later stages.Footnote 3 The same conclusion was reached by the Swedish National Audit Office (Riksrevisionen 2014), who also pointed to several inefficiencies in the Swedish system with multiple GVCs having different profiles and an unclear division of labor between them.Footnote 4,Footnote 5

On the down side, GVCs have been criticized for being inefficient, inept at picking good investment targets and/or providing them with value added, or in the worst case, corrupt (Lerner 2009). If GVC competes with PVC investors for the most attractive investment opportunities, then GVC could “crowd out” PVC investors, thus harming the private VC sector. This risk is greatest if GVCs offer entrepreneurs higher share prices and otherwise more lenient investment terms than PVC investors are willing to do.

Drawing on different aspects of the theoretical discussion, a series of studies have sought to evaluate the effects of PVC and GVC investment on targeted firms. These firms are typically categorized into three groups: those backed by GVC only, those backed by PVC only, and those backed by both PVC and GVC, so-called mixed venture capital (MVC). For VC-backed firms, in general, it is found that they tend to perform better than other entrepreneurial firms (Puri and Zarutskie 2012; Croce et al. 2013). Much of the research (e.g., Chemmanur et al. 2011; Croce et al. 2013; Engel and Keilbach 2007; Baum and Silverman 2004) has focused on the question of whether the association between VC investment and success is a consequence of VCs selecting the most promising ventures (dubbed the “screening” hypothesis), or if VCs deserve credit for making their portfolio firms more successful (the “value-added” hypothesis). In this paper, we revisit both hypotheses.

When it comes to GVC-backed firms, previous research has almost universally arrived at the conclusion that these firms tend to perform worse than those financed by PVC or MVC (Colombo et al. 2016).Footnote 6

Why would GVC-backed perform less strongly than PVC- or MVC-backed firms? As pointed out above, GVC programs are typically based on the idea that GVC should make investments that private investors are not willing to make, yet that are desirable from a societal point of view. Many GVCs, including the Swedish ones studied in this paper, have as a goal to break even on their investments. This allows them to take greater risks and invest in ventures with smaller potential return compared to profit-seeking private investors. As argued by Lerner (2010) and Brander et al. (2010), if a GVC is consistently making a substantial profit on its investments, then its existence is no longer justified, because PVC could be expected to make those same investments. For this reason alone, GVC-backed firms are expected to on average deliver less impressive performances than those backed by PVC, and such an outcome may in fact be socially desirable. Furthermore, selection effects can play a role in the relationship between GVC investment and firm performance. It is likely that out of the firms that initially get GVC, the most successful ones are in later stages able to attract PVC investments (Guerini and Quas 2016), leading to a re-selection of the best GVC-backed firms into the MVC category. As argued by Brander et al. (2015), the reverse is also possible: GVC investors “jumping on the bandwagon” of a PVC-backed firm that is doing well.

It has also been argued that firms backed by GVC perform worse because GVCs tend to be less effective than PVCs at helping their portfolio firms succeed by providing them with value-adding services like management advice. This could be because the most capable VC managers are drawn to the higher levels of compensation in the private sector. It could also be because GVC managers face weaker incentives to work hard to screen and monitor their portfolio firms as effectively as possible (Alperovych et al. 2015). Inefficient, underperforming GVC organizations could persist where PVC funds would more quickly lose support from its financiers (known as limited partners, LPs).

When it comes to MVC, recent research has found that the impact of VC investment on firms could differ in more nuanced ways. For instance, Brander et al. (2015) find that MVC-backed firms in Europe, North America and Asia perform slightly better (as measured by exits), even compared to PVC-backed firms, when the lead investor was private. The authors theorized that in those cases GVC increased the company’s access to capital, while at the same time the value-adding capabilities of PVC were harnessed.

GVCs and PVCs may also have different objectives with their investments. Compared to PVCs, GVCs may be less focused on maximizing efficiency and profit and more interested in job creation and innovation. This could lead GVCs to support ventures that do not promise a large return but nevertheless create jobs (Buzzachi et al. 2013). This job-creating conclusion was also supported by the Parliamentary Audit Office (1996) who reported that Swedish GVC investments were used to sustain employment in otherwise non-competitive firms.Footnote 7

Many of the above explanations can at least in part be derived from systematic differences in the objective functions of GVCs and PVCs. While the previous literature has attempted to gauge the difference in performance among the funded companies along several metrics, there still exist question marks around the resource-allocating mechanisms that are driving the different outcomes.

In this paper, we contribute a key aspect to the value-added hypothesis that has more or less been overlooked in the previous literature. Departing from an examination of the screening hypothesis, we present a systematic study of different mechanisms through which different types of VC may impact firm sales. For this purpose, we use a comprehensive framework that accounts for both direct (efficiency) and indirect (capital and employment) effects of VC on sales. The approach boils down to a system of three equations allowing us to track how firms may respond differently to GVC and PVC, and furthermore, how their investment choice in turn may translate into increased sales.

3 Data and description

Data used here stem from two sources. Data on private equity investments is provided by the Swedish Venture Capital Association (SVCA). On behalf of its European parent organization, Invest Europe (formerly EVCA), SVCA asks its members (which includes both private and GVCs) to submit information about all their investments; each observation in the dataset represents one transaction from an investor to a receiving company. The SVCA database includes all forms of private equity investment, including buyouts and growth capital. In this paper, we focus on private equity invested in the early stages, i.e., venture capital. Following Invest Europe’s classification of investment stages, VC investment was defined to include the categories “seed,” “start-up” and “later-stage venture,” but not “growth capital” (see definitions below in Table 1). GVC is defined as the six VC firms wholly funded and operated by the government that we observe in our sample, and does not include quasi-GVCs.Footnote 8 The data do not include private equity investments made by private individuals, so-called business angels (sometimes referred to as “informal venture capital”).

Data on firms’ input and output are provided by Statistics Sweden (SCB) and cover all Swedish firms. Firm-level data complement VC data with information on production, sales, employment, value added, investments, physical capital, profits, industry affiliation, educational attainment of the labor force, geographic location, etc., spanning the period 2007–2014. All datasets are merged using unique individual firm-year ID codes.

Figure 1 presents the total amounts of GVC and PVC invested in Sweden from 2007 to 2014. As shown in the figure, there was a sustained decline in PVC investments in Sweden starting from the global financial crisis in 2008 until 2013. During the same period, the amount of GVC investment increased substantially. In the sectoral dimension (not shown), ICT is the single biggest sector for VC, followed by life sciences; together, these sectors account for 72% of invested VC. Energy and environment and business and industrial products and services account for just below 10% each. The remaining 10% is divided between consumer goods, services and retail; financial services and agriculture, chemicals and materials.

The set of GVC investors consists of six GVCs that are wholly funded and operated by the government (what’s known as “direct GVC”): Almi Invest, Industrifonden, Inlandsinnovation, Fouriertransform, Innovationsbron and Saminvest Mitt AB. Looking at the six GVC firms, there are some differences in their aim and scope. For example, while Industrifonden focuses on high-tech firms with growth potential, Inlandsinnovation focuses on firms located in the north of Sweden, Almi Invest goes for governmental–private co-investments in early-stage ventures and Fouriertransform was created to support the struggling auto industry in the wake of the financial crisis. Its mandate was later expanded to include other manufacturing industries.

Our data include 699 companies receiving VC. As shown in Table 2, a majority of these companies (55%) were financed either partially or entirely by GVC.Footnote 9 Looking at the size of PVC and GVC investments, the broad pattern is that companies backed by GVC tend to receive less VC per company than companies backed by PVC (or MVC) while companies backed by GVC and PVC tend to receive slightly more VC than companies backed by PVC only.

Table 3 provides descriptive statistics of VC investments in the three investment stages: seed, start-up and later stage. As shown in the table, the average size of the VC investment roughly doubles at each stage. Table 3 reveals that even though GVC (according to theory) should focus on the earliest stages of financing, total PVC and GVC investments are distributed in a similar manner with regard to investment stage. For both PVC and GVC, approximately 2% of investments went to seed funding, with private investors allocating a slightly higher seed share (2.2% GVC seed vs. 2.7% PVC seed). Looking at the number of investments (tranches), a similar picture emerges, with 7.7% of the private tranches and a slightly lower share of GVC tranches, 7.5%, allocated to seed funding. Looking at subsequent stages (start-up and later stage), the same picture remains indicating a similar stage-by-stage allocation of VC across different types of VC firms. There is therefore no evidence that the GVCs were more specialized in funding the earliest investment stages compared to private investors. Considering that one of the primary justifications for GVCs is the assumption of a PVC funding gap in the earliest stages, this finding is noteworthy.

Among firms receiving VC, it is common that firms receive more than one tranche, or transaction from a VC investor. In a given year, 60% of all firms that receive VC receive one tranche only. That is, given that a firm has received VC in a given year, 40% of those firms receive more than one injection. The maximum number of tranches received by a single firm in 1 year is ten, and over the period of observation, the maximum number of tranches received by a single firm is 47. This reflects the fact that it is common practice in the VC industry for VCs to pay out their investments in pieces (“tranches”) as the entrepreneur attains predetermined goals. Furthermore, many companies receive capital from multiple VCs.

Turning to the size of the firms that receive VC, the median firm had three employees when receiving the first VC injection and 16% of the companies had one employee only. We may also note that no firm with more than 221 employees received VC.Footnote 10

In Table 4, we tabulate some key characteristics of firms receiving VC and the entire population of Swedish firms.

VC-backed companies also employ on average more high-skilled workers and pay higher wages. While the average total debt is roughly the same, the median debt is more than four times higher for VC-backed companies. These and other differences may well be explained by VC companies selecting the most promising and growth-oriented firms. VCs engage in screening activities where the target firm’s profitability, growth and survival potential are analyzed. Hence, VC investors do not choose investment objects randomly, resulting in a selection problem. This selection problem plays a crucial role when searching for well-defined control groups in order to identify the effects of different types of VC. According to the screening hypothesis, there may also be substantial differences in the screening activities among PVCs and GVCs. Any divergence in outcomes between PVC- and GVC-backed firms could in part be caused by such screening differences, as opposed to being driven exclusively by the value-adding impact exerted by the VCs on their portfolio companies.

4 Matching and empirical model

4.1 Matching

To investigate the extent of the selection problem between PVC, GVC and mixed GVC–PVC (MVC), we can compare the respective recipient firms 1 year before they received their initial VC investment (t − 1). Table 5 tests whether the groups of firms backed by different types of VC differed from one another with regard to key firm variables that could be relevant to the VCs investment decision.

Table 5 reveals some significant differences between the three groups of firms. In particular, PVC invested in significantly larger firms as compared to GVC investors, where size is captured by measures such as sales, capital assets and the number of employees. This could explain why PVC-backed firms tend to receive larger investments compared to GVC. (There were no statistically significant differences in size between PVC- and MVC-backed firms.) It is also shown that MVC-backed firms had the highest share of workers with tertiary education, followed by PVC-backed firms, which in turn employed significantly more highly educated workers than GVC-backed firms. However, GVC-backed firms were on average significantly more profitable than both PVC- or MVC-backed firms. Finally, GVC tended to invest in firms that had significantly lower wages compared to firms targeted by PVC or MVC.

To examine the “value added” of different types of VC, we must remedy the selection problem. For this purpose, we use statistical matching and turn to the question of how to create a control group of similar non-VC-backed firms.Footnote 11 For this purpose, we use Coarsened Exact Matching (CEM). The main benefit of using CEM over, for example, propensity score matching (PSM) is that CEM does not require the estimation of a propensity score, which, if misspecified, can result in large imbalances (King and Nielsen 2016). CEM instead automatically balances the covariate vectors between the treated VC firms and the control firms, up to a predetermined level of coarsening (see Iacus et al. 2011, 2012). In specifying the matching model, we need to account for the fact that different outcome variables may require different matching variables. Here we distinguish between two models. One where sales is the outcome and one where either of the factor inputs, capital stock and employment, is the outcome. Moreover, as seen in Table 5, selection under PVC can differ from GVC, suggesting that we need to ensure that the recipient firms of PVC and GVC both are matched with appropriate firms. Therefore, we have modified the CEM algorithm such that we can determine which unique control firm is matched with each of the treated VC firms, resulting in a matching with balance results that is robust to arbitrary subsets of the treated firms. For example, when we estimate the impact of PVC, we compare the PVC-backed firms to the subset of the overall control group which was matched with the PVC-backed firms.

For each of the treated firms, the population from which matches are drawn consists of the complete population of firms. The matching is then applied 1 year before the initial treatment (t − 1), with t being the first year a firm receives VC. Our matching model for the capital and employment equations is based on the following variables: sales, growth in sales, equity/debt, profit/employee, share of high-skilled workers, and industry classification according to NACE rev. 2 division (2-digit code). For the sales equations, we match on employment, capital stock, the share of high-skilled workers, profit/employee and industry classification according to NACE rev. 2 section.

In the case of the sales equations, it turned out to be difficult to find a sufficient number of matches with this particular combination of variables when using automatic coarsening. To make the share of matched firms was similar (around 93%) for both the sales and the factor demand equations, we coarsened the industry classification to sections instead of division and manually coarsen the bins for employment and profitability.

The matching results are presented in Table 6. The first two columns report the imbalance between the treated and the matched control groups, which is compared to the imbalance between the treated group and the unmatched full population of non-treated firms from which the controls were drawn (shown within parentheses). To measure imbalance, we use the L1 metric suggested by Iacus et al. (2012), which provides a number between zero and one describing the degree to which two covariates differ in their respective distributions. An L1 measure of zero corresponds to perfect overlap and thus zero imbalance, and an L1 measure of one corresponds to no overlap between the distributions.

As noted by Iacus et al. (2011, 2012), the exact value of the imbalance test is subordinate to the change in imbalance achieved by matching. Columns 1–2 in Table 6 show that matching reduces the imbalance between treated and controls for all variables in both equations, suggesting that our strategy was successful in identifying appropriate control groups. The bottom row shows the corresponding overall imbalance result for all matching variables taken together. Columns (3) and (4) provide further evidence of the quality of the match for the sales equation control group, showing that the control group is closely matched with the treated group with regard to mean and median values of the matching variables. In addition, Fig. 2 illustrates the distributions of the matching variables for the treated and CEM-matched control group of firms.Footnote 12 Eyeballing Fig. 2 suggests that the distributions among the control group closely follow the VC-treated firms.Footnote 13

4.2 Empirical model

The econometric analysis investigates the impact of VC on sales (output), employment and physical capital, and departs from the following set of basic difference-in-difference equations:

The equations will be modified in the analysis to consider impact lags and fixed effects that are suitable to different estimators. The first equation in (1) describes the model for the logarithm of firm sales yit (small letters correspond henceforth to the natural logarithm) in firm i at year t. It is a function of both the number of employees lit and the physical capital stock kit. Following Liu and Yoon (2000), Griliches and Mairesse (1997) and Frankel and Romer (1999), we distinguish between secondary, short tertiary and longer tertiary education. Their respective shares of lit are here captured by the vector \(\varvec{H}_{it}\). To gauge the direct effect of VC on sales, we include three sets of dummy variables. First, the variable \(T_{i}\) that takes the value of 1 for all years if the firm receives at least one investment and 0 for all years if the firm belongs to the matched control group. Next, \(\varvec{VC}_{it}\) refers to a set of dummy variables that takes the value of 1 for both the treated and control firms the years following a VC investment and zero for all other (pretreatment) years. Lastly, the average treatment effect is here captured by the interaction term \(\varvec{VC}_{it} T_{i}\), which only takes the value of 1 for post-treatment years for the companies that receive a treatment.

As shown in Eq. (1), sales are a function of capital and labor (\(k_{it}\), \(l_{it}\)). Since these variables also can be affected by a VC injection, Eq. (1) is complemented by Eqs. (2) and (3) that describe the respective model for each. To reach a suitable parametric model, we draw on the labor demand literature that describes kit and lit in terms of factor prices, namely wages (wit) and the interest rate (Rit) together with output yit.Footnote 14 To capture any residual imbalance from matching, all models are also fitted with a set of pretreatment control variables, denoted by X, that include debtit, equityit and profitit, which were defined in the previous section.

To gauge the direct effect of VC on sales, we begin by estimating each model separately. To control for unobservable characteristics \(v_{\left( j \right)i}\) that may affect the outcome (given by \(j = y,k,l\)) but are specific to the firm, such as organizational structure, management and possibly their growth ambition we use a firm fixed effect estimator. Any temporal disturbance that may affect all firms equally, such as the business cycle or the aggregate supply, and demand for credit are captured by including a set of year dummies (\(\varvec{D}_{t}\)), which gives the following error structure \(\varepsilon_{\left( j \right)it} = v_{\left( j \right)i} + \varvec{D}_{t}\varvec{\delta}_{\left( j \right)} + e_{\left( j \right)it}\), where \(e_{\left( j \right)it}\) is assumed to be stochastic and normally distributed.

When estimating the separate equations for \(k_{it}\) and \(l_{it}\), the models in (2) and (3) are also fitted with a distributed lag, which considers the cost of adjusting the level of employees and capital (Cahuc and Zylberberg 2004; Hijzen and Swaim 2008). Thus, while the sales equation captures the average growth effect from VC, the separate labor and capital equations estimate the effect on the average rate of growth. The inclusion of a lagged dependent variable, however, imposes an endogeneity problem. To manage it, we apply the dynamic panel data estimator proposed by Han et al. (2014).Footnote 15

While a separate analysis of, for example, sales or employment is typical in the previous literature, it does not account for the interdependent structure between sales, capital and employment, nor the possibility that the error terms may be contemporaneously correlated. Moreover, VC may also affect yit indirectly, through mediation via kit and lit (Fig. 3). To test the hypotheses of an indirect effect of VC on sales, we turn to structural equation modeling (SEM), which provides a comprehensive framework and a rich set of analytical tools for analyzing different types of equation systems (see, e.g., Acock 2013; Kline 2010; Matsueda 2012).

We consider the simplified version of factor demand in which we assume no adjustment costs and replace firm fixed effects with two-digit industry dummies. In SEM, equations for \(y_{it}\), \(k_{it}\), and \(l_{it}\) are stacked and estimated simultaneously, which allows for contemporaneous correlation between the idiosyncratic error terms \(\varepsilon_{yit}\), \(\varepsilon_{kit}\) and \(\varepsilon_{lit}\). Since the models are linear in the explanatory variables, the resulting estimates correspond to those from a seemingly unrelated regressions (SUR) model.Footnote 16 The primary advantage of using SEM, however, is that it incorporates the type of mediation models that allow us to specifically test the significance of any indirect effects. To give a simple example, consider the case with only one mediating variable, say \(l_{it}\). Suppose that the error terms are statistically independent, then the indirect effect of VC on \(y_{it}\) via \(l_{it}\) is given by \(\beta_{2}\varvec{\beta}_{TE\left( l \right)}\). The total effect of VC on \(y_{it}\) is then given by \(\varvec{\beta}_{TE\left( y \right)} + \beta_{2}\varvec{\beta}_{TE\left( l \right)}\). Naturally, the errors are likely to be correlated, and if ignored could otherwise result in biased estimates.

However, the identifying assumptions for the indirect effect hinge on the assumption of sequential ignorability (see e.g. Imai et al. 2010). In matching, the standard assumption is that potential outcomes are ignorable, i.e., that sales are statistically intendent of the assignment of treatment, conditional on the matching covariates. In mediation analysis, sequential ignorability further requires (i) ignorability of the mediating variables and (ii) that given a treatment status (treated or control) and conditional on the matching covariates, the potential outcome is independent of the mediating variables. As with the standard ignorability assumption, sequential ignorability is impossible to test. However, Imai et al. (2010) have devised a way by which it is possible to gauge the sensitivity of the estimated indirect effect with respect to the violation of (ii). Since sequential ignorability requires the error terms of the model to be independent (i.e., not contemporaneously correlated), Imai et al. (2010) show how to compute the indirect effect as if they were independent and then to examine for what level of correlation this effect would disappear. If the estimated effect can be shown to be valid for a range of different correlations, then it is more likely that the model is robust to the assumption of sequential ignorability.

Since we have two potential mediating variables, we would ideally have presented a test that could examine their joint sensitivity. Lacking such a test in the fairly recent literature, however, we choose to apply the logic of Hicks and Tingley (2011) to examine the sensitivity of \(k_{it}\), and \(l_{it}\), one at a time.

5 Results

We begin the analysis by examining the direct effect of VC on sales, capital and employment separately. Starting with the impact of VC on sales, we begin by using a treatment on the treated analysis, followed by a matched difference-in-difference (DiD) regression. In the matched regressions, we triangulate the analysis of how VC impacts firms by first using a common pool of CEM-matched non-VC-backed firms. This gives us an idea of how firms, receiving different types of VC evolve, relative to a common reference point. There may, however, be systematic differences across firms receiving different types of VC, as discussed in Sect. 4. Hence, in order to be able to make inference of the impact of a specific type of VC, we in the next step apply VC-specific control groups. As a final step, we compare the growth performance of PVC-backed firms against GVC- and MVC-backed firms and therefore apply the two latter groups of firms as reference groups against PVC-backed firms.

In the second part of the analysis, we allow VC to impact sales, not only directly but also through employment and investment effects. This approach is performed by stacking Eqs. (1–3) into a structural equation model (SEM) that is estimated simultaneously. In each of the steps, we present separate results for firms that receive PVC only, GVC only, and firms that receive mixed VC (MVC). Finally, we follow the dynamic impact of VC on sales year-by-year from the time it “arrives” \(\left( {t = 0} \right)\) and at the following \(t = 1, \ldots ,4\) years.

5.1 The effect of venture capital on firm sales

We begin the analysis with a firm fixed effect analysis where we restrict the sample to firms that received VC investment at some time during the period. The analysis therefore traces trend breaks in firm sales after VC investment. As seen in Table 7, without using any comparison group it is difficult to find evidence of VC affecting firm sales up to 4 years after the VC injection. The only significant estimate is found for the manufacturing sector 1 year after receiving VC.Footnote 17

Moving on to the control variables, labor generally appears with positive and significant estimates with a labor share coefficient of approximately 0.4–0.7. For capital, however, the estimates are relatively small (in the range of 0.03–0.07) and insignificant, except for PVC where the capital coefficient of 0.17 is significant and larger than for other types of firms. This observation suggests that PVC-backed firms differ in their capital structure from GVC- and MVC-backed firms. Hence, in the subsequent impact analysis, this difference in capital structures will be controlled for.

The within-firm skill composition is captured by three skill-intensity variables measuring the share of employees in each group, taking the share of low-skilled labor (primary education) as a reference. The general impression throughout the analysis is that in most estimations, the skill composition is uncorrelated with firm sales.

VC is one of many sources of funding for investments. The firm’s financial position is an important factor behind both the need of VC and VC investors’ willingness to invest in a firm. Considering the central role played by access to capital, it is crucial to control for indicators of financial strength such as equity, debt and profits. The results in Table 7 suggest that there is little evidence of a systematic relation between sales and equity per employee, whereas the estimated elasticity of debt with respect to sales is smaller than one, suggesting that in relation to sales, the relative size of total debt decreases with firm size, i.e., a relatively low debt ratio among larger firms. Finally, we find that profitable firms have relatively large sales.

The analysis in Table 7 involved identifying trend breaks. One limitation of this analysis is that the identification of the treatment only compares the “before and after” and does not account for any selection effects. To overcome this limitation, we in Table 8 introduce CEM-matched “twin” firms that did not receive VC as comparison group.

In columns 1–3 in Table 8, we match PVC, GVC and MVC to a common control group of firms that did not receive VC and in columns 4–6 we repeat the regressions in columns 1–3 now using VC-specific control groups.Footnote 18

Starting with firms receiving PVC only, the results in column 1 suggest a positive impact of PVC on sales taking place 1 year after the VC injection and that this effect increases in size during the following years, peaking 3 years after the VC injection. Apart from no initial drop in sales, this behavior is consistent with VC giving rise to a (time-consuming) re-shuffling of firm resources, suggesting that the impact of VC on sales comes with a delay, i.e., the so-called J-curve hypothesis discussed by Meyer and Mathonet (2011).

Moving on to column 2 and firms receiving GVC only, we find less significant results as compared to PVC-treated firms but a similar pattern. For GVC firms, we note a slight nonsignificant dip in sales at the time of the VC investment followed by a positive trend generating a positive and significant effect 2 years after receiving GVC.

Approximately 20% of the firms in our sample receive both GVC and PVC. According to Brander et al. (2015), Bertoni and Tykvova (2015) and Grilli and Murtinu (2014), firms that receive both GVC and PVC tend to perform about as well as firms receiving PVC only, and better than firms receiving GVC only. This could be attributable to the advantages of being backed by a more diverse group of investors (Colombo et al. 2016) and/or receiving a greater amount of VC (Brander et al. 2015). The results in column 3 of Table 8 suggest a longer delay in growth for MVC firms than for PVC- and GVC-backed firms. Hence, for MVC-backed firms we have no positive and significant effects until 4 years after receiving VC.

Turning to columns 4–6 with VC-specific control groups, the perhaps most striking observation is the modest impact this has on the results, implicitly suggesting that firms that receive different types of VC as a group are rather similar to each other. There are some observations to be made, however. Perhaps most notably, we find that when using a PVC-specific control group, the estimated coefficients become slightly smaller and less significant (with a positive and significant VC effect appearing in (t + 3) only). For GVC on the other hand, using a GVC-specific control group the estimated coefficients become slightly larger, but the estimated impact of VC is still only significant at (t + 2). For MVC, finally, in line with PVC, we note slightly smaller and nonsignificant point estimates.

Broadly speaking, these results suggest that both PVC- and MVC-backed firms “benefit” from being compared to the common control group and that GVC-backed firms are “unfavorably” matched when using a common pool of non-VC-backed firms.

To complement the results in Table 8, Fig. 4 plots the estimates of VC effects over time. While it is not possible say that one type of VC significantly outperforms another type of VC, we can note that firms receiving PVC or GVC appear to have a quicker take-off compared to MVC-backed firms. However, after 2–3 years, they all (PVC-, GVC- and MVC-backed firms) tend to converge.

Sales development. Firms receiving VC versus control firms not receiving VC. VC-specific control groups. Note: Figure is based on results in Table 8 columns 4–6

To assess whether the observed differences are significant between the respective types of VC, we in Table 9 present an analysis where PVC-backed firms are taken as the treatment group using GVC- and MVC-backed firms as control groups. By this approach, we are given a direct measure of whether PVC-backed firms outperform or are outperformed by GVC- and MVC-backed firms. In column 1 in Table 9, we compare PVC-backed firms with GVC-backed firms, and in column 2 PVC-backed firms are compared with MVC-backed firms. Although we are not able to account for possible differences in the covariate distribution before treatment, it complements the previous results in providing a direct test of the differential effects on firm sales for different VC types.

Results in Table 9 suggest that the possible differences in treatment effects across various types of VC, as illustrated in Fig. 3, are generally not significant. Specifically, we note that when comparing the treatment effects of various types of VC over the full post-treatment period, there is no evidence of significant differences. However, due to differences in the dynamic patterns, we in Table 9 note that in (t + 3), PVC significantly outperforms GVC. Though there might be a slight edge for PVC, the overall pattern is a lack of results suggesting significant differences in how PVC, GVC and MVC impact firm sales.

5.2 Effects of VC on the capital stock

In Table 10, we analyze the impact of the different types of VC on investment and the capital stock. Following Hall et al. (2001), we in columns 1–3 apply a dynamic model specification.Footnote 19 Specifically the regressions in columns 1–3 in Table 10 are performed using the Han–Philips Fixed Effects Dynamic Panel Data estimator, whereas the model in columns 4–6 is estimated without dynamic adjustment using the fixed effect estimator.Footnote 20

The dynamic model results in Table 10 (columns 1–3) suggest that only PVC-backed firms demonstrate a significant boost to capital investment following VC investment and that this effect only occurs 1 year after the VC injection. No effects can be observed for either GVC or MVC. In columns 4–6, we estimate the capital equation without a dynamic lag using the fixed effect (FE) estimator. Under the fixed effect model, the result for PVC disappears, whereas for both GVC- and MVC-backed firms there is some evidence of a positive and significant effect. Specifically, we find that GVC-backed firms increase investments at the year of the VC injection (at t) and at the last year of the studied period (at t + 4), whereas MVC-backed firms increase their capital investments 2–3 years after receiving VC.

5.3 The impact of VC on Employment

From a policy perspective, increased employment is a desired effect of GVC investments, whereas it is reasonable to assume that private investors are more concerned with the return on the investment. Following the setup for the analysis of capital, we in Table 11, columns 1–3, estimate a series of dynamic models, followed up by fixed effect estimates in columns 4–6.Footnote 21 The results from the employment regressions in Table 11 can be summarized as there being no significant effects of VC on employment within 4 years after receiving the first investment.Footnote 22

Examining the insignificant estimates, the results suggest that VC does not primarily boost firm employment. One possible interpretation of these results is that VC-backed firms are in the early stages of R&D and have reached scalability in their production (Puri and Zarutskie 2012). Combined, these observations suggest that VC can be considered a trigger for increased efficiency rather than employment, a finding that is consistent with previous studies finding that VC increases efficiency in targeted firms (Chemmanur et al. 2011; Croce et al. 2013; Alperovych et al. 2015). For private investors, the lack of a positive employment effect from private VC is unproblematic. The primary goal of private investors is maximizing return on the investment, something that can be achieved without employment growth. For GVC, however, employment is often a desired outcome, which can cause a conflict of interest when public investors want to achieve both increased competitiveness and employment, or when they co-invest with PVC.Footnote 23 Lastly, our findings of negligible employment growth and delayed sales growth effects are consistent with those of Grilli and Murtinu (2014), although they do not find significant sales growth among GVC-backed firms.

Yet, these results are based on individual estimations of Eqs. (1) to (3). In the next section, we turn to structural equation modeling, where we combine the equations into a system that is estimated simultaneously. This allows us to account for possible cross-equation correlations and to bundle the direct and indirect effects in order to examine the total effect of VC on firm sales.

5.4 Indirect and direct effects estimated by structural equations

VC may impact sales not only directly but also indirectly through investment and employment. To address this issue, we estimate a structural equation model (SEM).Footnote 24 To be precise, we consider Eqs. (1) to (3) together to specify a SEM model (illustrated in Fig. 3) where VC is not restricted to the direct effect on sales (the efficiency effect), but also can impact sales through increased investments in capital and labor. (The term mediation model is sometimes used for this type of model, see Acock 2013.) The results are presented in Table 12.

Using VC-specific control groups, we find little evidence of a significant direct treatment effect of either PVC or GVC.Footnote 25 However, when allowing for employment and investment effects to add to the total effect of VC we observe positive and significant overall effects of PVC 1–3 years following the VC investment. Hence, bundling efficiency-, employment- and investment effects together, the impact of VC on firm sales becomes stronger and more significant.Footnote 26

For GVC firms, the results are similar as for PVC with increased significance when accounting for indirect effects, though the dynamic patterns differ somewhat. Specifically, we find that the total effect on sales from GVC is significant at year (t + 0) and (t + 3)–(t + 4). Hence, again the results suggest that bundling efficiency-, employment- and investment effects together boosts the impact of VC on firm sales.

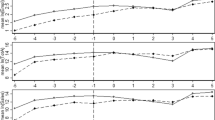

Before drawing any far-reaching conclusions concerning the indirect effect, we in Fig. 5 present some tests of the validity of the SEM approach. Specifically, we lump all types of VC together and estimate two models with a simplified dynamics where the dummies for (t, t + 1, …, t + 4) are grouped into a single-treatment variable. Hence, the treatment dummy now signals the average effect of VC over all observed treatment and post-treatment years. With that in mind, we estimate two system equations, the first with the sales and employment regressions and the other using the sales and capital regressions models. Following Hicks and Tingley (2011), we analyze whether it is reasonable to assume that the underlying assumption of sequential ignorability (SI), required for the interpretation of the indirect effects to be interpreted in the form of causal mediation effect, is fulfilled. Technically we synthetically allow the cross-equation correlation to vary from − 0.95 to 0.95. Although sequential ignorability cannot be tested outright, it is possible to calculate the indirect effect as if the cross-equation correlation of the error terms was zero—a necessary requirement for SI—and to examine the implied indirect effects sensitivity to deviations of the cross-equation correlation from zero. The sensitivity analysis is presented in Fig. 5 for capital and labor individually.

Mediation effect of capital and labor on firm sales. Note: Top row, capital and sales equations. Bottom row, employment and sales equations. Based on model specifications in Table 12. The analysis includes all types of VC firms. VC treatment applies to the treatment year and all available post-VC-treatment years. Cross-equation correlation variation [− 0.95:0.95]

As seen in the figure, the indirect effect is insignificant for capital for correlations larger than around -0.5, suggesting that the observed significant mediation effect of capital may not satisfy the SI assumption. Hence, for capital, a careful interpretation of the indirect effects is recommended. Turning to the mediation effect through employment, we see from the lower graph in Fig. 5 that the implied effect when cross-sectional correlations are zero is positive and significant. For a correlation less than 0.1 (including 0), the mediation effect is significant, which would provide some support for a causal interpretation of the mediation effect over employment.

6 Robustness

6.1 The impact of VC by stage

Small, young and innovation-driven firms can find it difficult to raise capital in early stages; therefore, GVCs are often motivated as a bridge filling the financing gap in the seed and start-up stages encountered by such firms. If GVC is biased toward seed- and early-stage financing, it might be inappropriate to directly compare the performance of PVC with GVC. We therefore proceed and estimate the effects of GVC and PVC by investment stage. The stages analyzed are: (i) seed, (ii) start-up, and (iii) later-stage investments. Over time, some firms will receive seed capital and subsequently receive VC for later stages. Hence, firms are allowed to move upward from their starting point.

Table 13 displays results by investment stage for different types of VC. The results reflect the treatment effect over the treatment year and all observed post-treatment years. Before turning to the results, we want to flag for the fact that splitting up the treatment effect into three types of VC and three types of investment stages reduces the number of treated firms per group, which may lead to increased standard errors and generally less significant estimates. With this caveat in mind, the results in Table 13 indicate that the positive result for PVC-backed firms is driven by VC investments in the start-up stage, whereas none of the stages show any significant results for GVC- or MVC-backed firms.Footnote 27

6.2 By VC spells

Investing equity capital in a firm is associated with a high level of engagement from the investor. If the firm fails, the investment is lost. Therefore, it can be rational for an investor to follow up an initial investment, if the firm needs it. Approximately one-third (31%) of the firms in our data receive one tranche of VC only, the mean number of tranches received is 3.8 and the maximum number of tranches received by a single firm over the period 2007–2013 is 47. Repeated investments can be considered an indicator of quality; the firm succeeds in attracting multiple VC investments. On the other hand, repeated VC injections can also signal problems raising internal capital and the investor’s protection of investments sunk in the firm. Thus, the question of whether multiple tranches signal firm growth or financing problems is to some extent an empirical question. In addition to the signal value of repeated tranches, the impact of the later tranches can interact with lagged effects from earlier tranches.

To analyze whether the impact of VC changes over time, we analyze the impact of VC by separating the analysis by yearly VC spells in Table 14. The effect of each subsequent VC spell is depicted in Fig. 6. The results suggest an increased impact on sales from each subsequent spell of PVC. The increased effect can be partially attributable to remaining post-treatment effects from previous VC injections, but also be a signal of growth. In other words, a plausible interpretation is that PVCs make additional investments conditional on firm performance—if they do not see growth within 2–3 years of the initial investment, they are likely to withdraw their support. This finding is in line with that of Puri and Zarutskie (2012). For GVC on the other hand, we cannot detect an increasing effect on sales from each subsequent VC spell. To some extent, these results are in line with Buzzachi et al. (2013), who found that European VC firms with a higher level of government funding tend to support start-ups for a longer time after the initial investment, even when the return on the investment is mediocre. This difference in investor behavior likely reflects the differing objectives and natures of PVC and GVC. GVCs’ focus on societal goods such as innovation and entrepreneurial spillovers, job creation and regional development, as well as lower profit targets (typically to break even), could make them more lenient toward portfolio firms that are struggling or taking a longer time to mature, where profit maximizing PVC investors are more ruthless.

The impact of VC on sales per yearly VC spell. Note: Based on estimates from Table 14

7 Concluding remarks

In the last few years, there has been a debate among policymakers and academics concerning the design of GVC policies. A popular idea is that GVCs should take the form of “hybrid” governmental–private partnerships, where government provides some or all of the investment funds, while private sector investors are allowed to manage the investments (Lerner 2010), as opposed to GVCs that are funded and operated solely by the government (“direct” GVC).

Most academics seem to agree that GVC can contribute to stimulating innovation and entrepreneurship in at least some situations, assuming of course that the policy is well designed and implemented, and that it is regarded as a complement to other policies which promote entrepreneurship (Lerner 2010). The expansion of GVCs in many countries indicates broad political support for the idea. Given the growing role of GVCs, one might presume that they have a proven record of accomplishments and that their role is motivated by a well-identified market failure. With this as a background, a relevant question is how GVC invests and impacts firms in relation to PVC and MVC.

We use comprehensive data on Swedish VC investments to investigate this question. We begin by testing the screening hypothesis that different types of VC invest in different types of firms, which could help explain differences in outcomes. We do find some notable differences; for example, PVC tends to invest in larger but less profitable firms, compared to GVC. The main focus of our analysis considers the value-added hypothesis that VC influences the development of the firms which it invests in. We use a comprehensive empirical framework that accounts for both direct (efficiency) and indirect (capital and employment) effects of VC on sales. To account for the screening differences between firms that receive PVC, GVC and MVC, we use statistical matching that assigns a separate control group to each type of VC.

The results of the main analysis can be summarized as follows: Firms receiving any form of VC typically experience increased sales 2–3 years after the VC investment. However, there are several considerations to keep in mind. First, whether or not we find significant effects of VC on sales depends on the group of comparison. When using a common pool of non-VC-backed firms, PVC tends to generate more positive and significant effects than both GVC and MVC. When assigning VC-specific control groups of non-VC-backed firms, PVC- and MVC-backed firms show weaker growth results, whereas GVC-backed firms benefit from having its own group of comparison. Hence, PVC- and MVC-backed firms “benefit” from being compared to the common control group, and GVC-backed firms are “unfavorably” matched when using a common pool of non-VC-backed firms. This indicates a stronger growth effect among PVC- and MVC-backed firms as compared to GVC-backed firms. However, a direct comparison between PVC- versus GVC- and PVC- versus MVC-backed firms suggest that the differences in growth effects are too small to be classified as significant. Hence, the overall impression is a rather similar response to VC, regardless of what type of VC a firm has received.

VC may impact sales not only directly but also indirectly through investment and employment. When studying the impact of VC on employment and investment in capital, we found no evidence of any employment effects, whereas there were some indications of significant investment effects. While the absent employment effect may not be so surprising for PVC-backed firms, many GVC-backed firms have increased employment as a desired policy outcome. The zero employment effect may be due to the possibility that GVCs tend to invest in ventures that may involve more risk or have lower growth potential, but nevertheless provide jobs. Two examples are the GVCs Inlandsinnovation and Fouriertransform who have played a more supportive role for the GVC-backed firms, rather than say picking the fastest growing firms or the most promising. The former focused on regional development in northern Sweden, and the latter focused on supporting the manufacturing industry, especially the struggling auto industry in the wake of the global financial crisis. It is also possible that employment effects arise in the longer term, beyond our 4-year post-investment time horizon. Another reason for the absent employment effects could be the relatively strict employment protections in Sweden, which could make firms more reluctant to expand by hiring new employees in early stages.

In order to evaluate the full effect of VC on sales, we bundle the direct (efficiency) effect with the indirect mediation effects of employment and investment in a structural equation model, by which the total effect of VC on sales can be analyzed. In bundling the efficiency-, employment- and investment effects together, the impact of VC on firm sales becomes stronger and more significant for PVC and GVC.Footnote 28 In particular, we observe positive and significant total effects of PVC 1–3 years following the VC investment, when allowing for employment and investment effects to add to the total effect of VC.Footnote 29

Investing capital in a firm is associated with a high level of engagement and risk for the VC investor. If the firm fails, the investment is lost. Therefore, VC investors often spread their investment into a series of tranches, allowing them to follow, and to some extent gain control over the object of investment. Many of the firms in our data receive multiple tranches of VC spread over several years. When we follow the effect of each subsequent investment spell, the results suggest an increased impact on sales from each subsequent spell of PVC, whereas for GVC we cannot detect an increasing effect on sales from each subsequent VC spell. These results are in line with Buzzachi et al. (2013), who found that European VC firms with a higher level of public funding tend to support start-ups for a longer time after the initial investment, even when the return on the investment is mediocre. PVC investors, in contrast, usually only make further investments if the firm demonstrates growth.

Finally, we found that when we separate firms with respect to investment stage, positive growth effects of VC were most likely to occur for PVC-backed firms receiving early-stage VC. This result is consistent with an edge to PVC, as compared to GVC and MVC, and the difficulty of evaluating newborn firms and gaining a return on seed-stage investment, as well as the generally slower growth pattern of larger and older firms receiving later-stage VC.

Though we are not primarily searching for policy recommendations, the overall impression is that the growth effects of GVC and MVC did not differ dramatically from that of PVC in the Swedish case. If anything, our results indicate that GVC investors are more prone to continue to make follow-on investments in non-growing firms than are private VC investors, and also that it might be optimistic to view VC as an efficient tool for increasing employment, at least in the short term. What VC investment primarily seems to give rise to within a few years of the investment is increased efficiency and potentially investment in capital effects.

Notes

In addition to VC, other forms of start-up financing can also play a role, such as subsidized loans, grants, incubators, and crowdfunding, as well as policies/conditions which stimulate the demand for VC (as emphasized by, for example, Callagher et al. 2015).

In the European context, it is believed that the lower level of R&D spending (2% of GDP) compared to the USA (2.6% of GDP) may partially reflect the relatively small European VC market (European Commission 2010; p. 22). To close the European–US VC gap, the European Commission implemented the Risk Capital Action Plan in 1998 (European Commission 1998) to stimulate stock market openness, increase the flexibility of labor markets and provide a set of tax incentives.

In case of a “later-stage VC gap,” GVCs can also play an important role if PVCs avoid start-ups that need VC and have the potential to become sustainable businesses, but that do not offer the high growth potential demanded by PVCs.

An early analysis of the Swedish GVC market was undertaken by the Parliamentary Audit Office (1996). It found that most GVC investments had been failures and that the GVCs lacked knowledge and skills in board work and management. GVC policies have recently been reformed, with the aim to direct more focus on the early investment stages and increase coordination with private investors (SOU 2015:64; Prop., 2015/16:110).

This conclusion has been reached in studies using several different metrics of firm performance, including exits (Brander et al. 2010, 2015; Cumming et al. 2014; Tykvova and Walz 2007), patents (Bertoni and Tykvova 2015), productivity (Alperovych et al. 2015) and growth as measured by employment or sales (Grilli and Murtinu 2014).

Other research on GVC has investigated whether GVCs behave differently as investors compared to other types of GVC, for example, with regard to the types of firms which they invest in Bertoni et al. (2011). Another vein of research has focused on the macroeconomic impact of GVC on the VC market, in particular addressing the question of whether GVC investment “crowds out” private VCs (Leleux and Surlemont 2003; Brander et al. 2015; Cumming and Macintosh 2006; Cozzarin et al. 2015).

These include publicly owned pension funds such as the 6th AP Fund and VCs that are independently run but funded partially with public funds, such as the VC Stockholm Innovation and Growth (what is known as a “hybrid” governmental–private VC).

Almi Invest makes nearly all of its investments together with private investors and business angels. Further, Tillväxtanalys (2016) states that 35 percent of Almi’s co-investments are made with business angels, which are not observed in our data. For this reason, the share of “GVC only” companies is likely to be overestimated somewhat.

Typically, larger firms are more prone to become targets of leveraged buyouts or growth capital.

Corresponding results for the employment and capital equations are excluded here because of space constraints but can be found in “Appendix”.

One advantage of CEM compared to PSM is that CEM not only considers the first moment but also higher moments.

The expression for kit and lit is typically derived from cost minimization. It gives the optimal amount of kit and lit required to produce a given output. To avoid circularity in the model, we do not use sales in the demand equations, but rather log(value added) to proxy for firm size.

It relies on (long) differencing and is not burdened by the problem of (weak) moment conditions, and has good short panel properties.

Although standard deviations estimated in SEM and SUR models are asymptotically identical, they differ in finite samples. There is no reason to expect that one is better than the other, however.

We may note that the insignificant results implicitly suggest that the impact of different types of VC may not differ dramatically.

As indicated by the matching results in Table 6, firm capital intensity is included as one of the matching variables.

See Han et al. (2014).

The only exception from the nonsignificant patterns is for MVC; using the FE estimator, 3 years after receiving VC we note a negative and significant employment effect.

Full set of estimations are available on request.

The SEM models do not allow for firm-level fixed effects; in order to compensate for this to some extent, we apply industry fixed effects at the 2-digit level throughout all SEM models.

For MVC, we in the SEM estimations in Table 12 were not able to achieve model convergence for the period-by-period analysis.

We may note that the insignificance of MVC to some extent may be attributed to relatively few observations in this group; approximately 20% of the firms receive MVC.

For MVC, we in the SEM estimations in Table 11 were not able to make get convergence for the period-by-period analysis.

The SEM models do not allow for firm-level fixed effects, in order to some extent compensate for this we apply industry fixed effects at the 2-digit level throughout all SEM models.

References

Acock AC (2013) Discovering structural equation modeling using stata, Revised edn. Stata Press, College Station, p 3

Akerlof G (1970) The market for “Lemons”: Qualitative uncertainty and market mechanisms. Q J Econ 84:488–500

Alperovych J, Hübner GMBJ, Lobet F (2015) How does governmental versus private venture capital backing affect a firm’s efficiency? Evidence from Belgium. J Bus Ventur 30:508–525

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Avnimelech G, Teubal M (2006) Creating venture capital industries that co-evolve with high tech: insights from an extended industry life cycle perspective of the Israeli experience. Res Policy 35(10):1477–1498

Baum JAC, Silverman B (2004) Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. J Bus Ventur 19(3):411–436

Berger A, Udell G (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Bank Finance 22:613–673

Bertoni F, Tykvova T (2015) Does governmental venture capital spur invention and innovation? Evidence from young European biotech companies. Res Policy 44(4):925–935

Bertoni F, Colombo M, Grilli L (2011) Venture capital investor type and the growth mode of new technology-based firms. Res Policy 40(3):527–552

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:11–143

Brander JA, Egan E, Hellmann TF (2010) Government sponsored versus private venture capital: Canadian evidence. NBER Working Paper

Brander J, Du Q, Hellmann T (2015) The effects of government-sponsored venture capital: international Evidence. Rev Finance 19(2):571–618

Buzzachi L, Scellato G, Ughetto E (2013) The investment strategies of publicly sponsored venture capital funds. J Bank Finance 37(3):707–716

Cahuc P, Zylberberg A (2004) Labor economics. MIT Press, Cambridge

Callagher LJ, Smith P, Ruscoe S (2015) Government roles in venture capital development: a review of current literature. J Entrep Public Policy 4(3):367–391

Carpenter R, Petersen B (2002) Capital market imperfections, high-tech investment, and new equity financing. Econ J 122(477):F54–F72

Chemmanur T, Krishnan K, Nandy D (2011) How does venture capital financing improve efficiency in private firms? A look beneath the surface. Rev Financ Stud 24(12):4037–4090

Chen C, Huang T, Lin C (2013) Financing decision and productivity growth for the venture capital industry. Taiwan Review of Pacific Basin Financial Markets and Policies, 06/2013, 16(2)

Colombo MG, Grilli L (2010) On growth drivers of high-tech start-ups: exploring the role of founders’ human capital and venture capital. J Bus Ventur 25(6):610–626

Colombo M, Cumming D, Vismara S (2016) Governmental venture capital for innovative young firms. J Technol Transf 41(1):10

Commission European (1998) Risk Capital: a key to job creation in the European Union. European Commission, Brussels

Commission European (2010) Europe 2020: a strategy for smart, sustainable and inclusive growth. Communication form the commission, Brussels

Cozzarin B, Cumming D, Dahaj A (2015) Government venture capital and cross border investment. Working paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2641982

Croce A, Marti J, Murtinu S (2013) The impact of venture capital on the productivity growth of European entrepreneurial firms: ‘Screening’ or ‘value added’ effect? J Bus Ventur 28(4):489–510

Cumming D, Johan S (2016) Venture’s economic impact in Australia. J Technol Transf 41(1):25

Cumming D, MacIntosh J (2006) Crowding out private equity: Canadian evidence. J Bus Ventur 21(5):569–609

Cumming D, Grilli L, Murtinu S (2014) Governmental and independent venture capital investments in Europe: a firm-level analysis. J Corporate Finance 42(10):439–459

Engel D, Keilbach M (2007) Firm-level implications of early stage venture capital investment—an empirical investigation. J Empir Finance 14(2):150–167

Frankel JA, Romer D (1999) Does trade cause growth? Am Econ Rev 89(3):379–399

Gompers P, Lerner J (2001) The venture capital revolution. J Econ Perspect 15(2):145–168

Gompers P, Lerner J (2003) Short-term America revisited? Boom and bust in the venture capital industry and the impact on innovation. Innov Policy Econ 3:1–27

Griliches Z, Mairesse J (1997) Production functions: the search for identification. Working Papers 97-30, Centre de Recherche en Economie et Statistique

Grilli L, Murtinu S (2014) Government, venture capital and the growth of European high-tech entrepreneurial firms. Res Policy 43(9):1523–1543

Guerini M, Quas A (2016) Governmental venture capital in Europe: screening and certification. J Bus Ventur 31(2):175

Hall BH, Mairesse J (2008) Evaluating the impact of technology development funds in emerging economies: evidence from Latin America. Eur J Dev Res 20(2):172–198

Hall BH, Mulkay B, Mairesse J (2001) Firm Level Investment and R&D in France and the United States: a comparison. In: Investing Today for the World of Tomorrow (eds) Deutsche Bundesbank. ISBN: 978-3-642-62523-7 (Print) 978-3-642-56601-1

Han C, Phillips PCB, Su D (2014) X-differencing and dynamic panel data estimation. Econom Theory 30(01):201–251

Hellmann T, Puri M (2002) Venture capital and the professionalization of start-up firms: empirical evidence. J Finance 57(1):959–984

Hicks R, Tingley D (2011) Causal mediation analysis. Stat J 11(4):605–619

Hijzen A, Swaim P (2008) Offshoring, labour market institutions and the elasticity of labour demand. The University of Nottingham, Research paper series, No. 2008/05

Iacus SM, King G, Porro G (2011) Multivariate matching methods that are monotonic imbalance bounding. J Am Stat Assoc 106(493):345–361

Iacus SM, King G, Porro G (2012) Causal inference without balance checking: coarsened exact matching. Polit Anal 20(1):1–24

Imai K, Keele L, Tingley D (2010) A general approach to causal mediation analysis. Psych Methods 15(4):309–334

Invest Europe (Formerly EVCA) (2016) 2015 European Private Equity Activity—statistics on fundraising, investments and divestments. http://www.investeurope.eu/media/476271/2015-European-Private-Equity-Activity.pdf

Kaplan S, Strömberg P (2001) Venture capitalists as principals: contracting, screening and monitoring. Am Econ Rev 91(2):426–430

King G, Nielsen R (2016) Why propensity scores should not be used for matching. Working paper. http://j.mp/1sexgVw

Kline RB (2010) Principles and practice of structural equation modeling, 3rd edn. Guilford Press 6, New York

Kortum S, Lerner J (2000) Assessing the contribution of venture capital to innovation. Rand J Econ 31(4):674–692

Leleux B, Surlemont B (2003) Public versus private venture capital: seeding or crowding out? A pan-European analysis. J Bus Ventur 18(1):81–104

Lerner J (2002) When bureaucrats meet entrepreneurs: the design of effective ‘public venture capital’ programmes. J Bus 112(477):F73–F84

Lerner J (2009) The boulevard of broken dreams: why public efforts to boost entrepreneurship and venture capital have failed—and what to do about it. Princeton University Press, Princeton

Lerner J (2010) The future of public efforts to boost entrepreneurship and venture capital. Small Bus Econ 35(3):255–264

Lerner J, Watson B (2008) The public venture capital challenge: the Australian case. Ventur Capital 10(1):1–20

Liu B-Y, Yoon BJ (2000) China’s economic reform and regional productivity differentials. J Econ Dev 25(2):23–41

Matsueda RL (2012) Key advances in the history of structural equation modeling. In: Hoyle R (ed) Handbook of structural equation modeling. Guilford Press 7, New York

Meyer T, Mathonet P-Y (2011) Beyond the J curve: managing a portfolio of venture capital and private equity funds. Wiley, Hoboken. ISBN 978-1-119-99502-9

OECD (2006) SME financing gap, volume 1: theory and evidence. Organisation for Economic Cooperation and Development (OECD)

Parliamentary Audit Office (1996) Riksdagens revisorers förslag angående statligt engagemang i regionala investmentbolag. 1996/97:RR2. Stockholm: Riksdagens revisorer

Proposition 2015/16:110 Staten och kapitalet—struktur för finansiering av innovation och hållbar tillväxt. Motion of the Swedish government to parliament concerning reform of GVC policies

Puri M, Zarutskie R (2012) On the life cycle dynamics of venture-capital-backed and non-venture-capital-financed firms. J Finance 67(6):2247–2293

Riksrevisionen (2014) Statens insatser för riskkapitalförsörjning—i senaste laget’, Riksrevisionen, RiR 2014:1. Report by the National Audit Office concerning GVC policy

Robinson DT, Sensoy BA (2013) Cyclicality, performance measurement, and cash flow liquidity in private equity. J Financ Econ 122(3):521–543

SOU 2015:64 En fondstruktur för innovation och tillväxt. Statens Offentliga Utredningar, Regeringskansliet. Report commissioned by the Swedish government concerning GVC policy

Svensson R (2011) Statligt venture capital i stort behov av omstrukturering. Ekonomisk Debatt 39(6):14–27

Tillväxtanalys (2016) Effekter & erfarenheter—slututvärdering av satsningen med regionala riskkapitalfonder 2009–15. Rapport 2016:03, Tillväxtanalys, Östersund

Tykvova T, Walz U (2007) How important is participation of different venture capitalists in German IPOs? Glob Finance J 17(3):350–378

Funding

Funding was provided by the Swedish Competition Agency.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Engberg, E., Tingvall, P.G. & Halvarsson, D. Direct and indirect effects of private- and government-sponsored venture capital. Empir Econ 60, 701–735 (2021). https://doi.org/10.1007/s00181-019-01770-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01770-w