Abstract

Preference homogeneity is important for both economic modelling and firm decisions. While homogeneity may be a stretched assumption and has been rejected in the existing literature, it is more useful to examine whether preferences are converging or diverging. The European Union (EU), and especially the euro area (EA) with the use of a single currency for 19 countries, are very suitable for the testing of this hypothesis. To this end, we employ 12 categories of consumption expenditure data for the 27 countries which comprise the EU to examine whether consumption patterns are converging. The results are supportive of the convergence hypothesis for the EU as a whole. However, convergence is found to be much greater in the EA countries compared to the extra-EA ones. Disaggregate results by expenditure category suggest that the hypothesis of divergence can be rejected in all, with the convergence rate being category specific. Overall, it appears that consumption patterns in the euro area appear to be converging to a common standard, at a rate approximately 50% faster than for the rest of the European Union.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Are tastes and preferences similar across countries? Theoretical evidence on the stability of tastes was first claimed by Stigler and Becker (1977), albeit empirical results have rejected the hypothesis that preferences are similar across nations (Selvanathan and Selvanathan 1993; Carruth et al. 1999).Footnote 1 The empirical rejection of the similarity hypothesis is probably not that surprising, as the suggestion that similar preferences exist in a set of countries or even within regions of the same country could be too strong to be confirmed. Consequently, what should be examined, in the context of Levitt (1983), who suggests that globalisation homogenises the preference structure, is whether tastes are converging or diverging. In a world where communication technology changes the way both developing and developed countries live, the hypothesis of converging preferences is both intuitively and empirically more appealing, given the homogenisation of the composition of consumption baskets around the world (Friedman 1989).

The convergence or divergence of preferences matters especially in the design of economic models (Neary 2003), as well as a proxy to the globalisation process (Rodrik 1997; Stiglitz 2002).Footnote 2 The implications of preference convergence are quite important in the case of the European Union. Since labour is allowed to move freely and no barriers to trade exist, can national characteristics and tastes be important enough to consider the EU a fragmented market? Furthermore, the euro area presents even more interest on this aspect: as Mongelli (2002) and Kenen (1997) have suggested, countries with similar preferences could benefit from a currency union. To this end, a policy-relevant question would ask whether the introduction of the euro, which has further eased transactions between nations, has made preferences more homogeneous in the common currency area.

While the above have significant implications both for firms and for policymakers, the number of empirical papers dealing with convergence of preferences is very small and focuses only in a subset of consumption categories. In particular, studies have usually examined convergence with respect to specific categories such as wine and beer (Aizenman and Brooks 2008; Fedoseeva 2017), food consumption (Elsner and Hartmann 1998; Gracia and Albisu 2001; Waheeduzzaman 2011), electricity (Mohammadi and Ram 2012; Meng et al. 2013), the automobile market (Goldberg and Verboven 2005), or forestry products (Buongiorno 2009). To our knowledge, only Kónya and Ohashi (2007) have, until now, examined for overall consumption pattern convergence in an international setup.

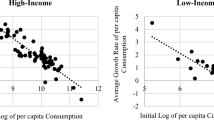

Specifically, Kónya and Ohashi (2007) employ prices and quantities of eight broadly defined household consumption goods for 24 OECD countries. Their results indicate that consumption shares are converging across the industrialised countries and furthermore find evidence that openness is related to the cross-country consumption pattern. In addition, faster convergence is recorded among the members of the European Union, followed by the OECD and the G7. Their findings indicate that the half-life of a shock in the EU is more than a year shorter than those of the OECD and the G7. This indicates that the EU’s consumer market has been more quickly integrated with the removal of both tariff and non-tariff trade barriers.

Despite the interesting conclusions reached by the authors, there has been no other documented study on this topic thus far. As such, a safe conclusion on the hypothesis that consumption patterns are converging cannot be reached. Importantly, since Konya and Ohashi’s data end in 2002, we are unaware of whether the expansion of the EU in the following years or the physical introduction of the common currency has affected consumption pattern convergence. To account for both issues, this paper utilises 12 categories of consumption expenditure data for the 27 countries which comprise the EU (EU-27) and examines whether consumption patterns are converging.Footnote 3 The results are supportive of the convergence hypothesis for the EU as a whole. However, a closer look reveals a much larger divergence in the extra-EA countries (half-life of a shock lasts nearly 8 months) compared to the case of the euro area (half-life of a shock lasts approximately 5.5 months).

Examining convergence by category of consumption share indicates that there exists no category in which consumption patterns are diverging, while six out of 12 categories record a shock half-life of less than 7 months. Overall, it appears that national tastes, perceptions and mentalities regarding consumption spending in the euro area are converging relatively fast to a common standard. This also holds for the rest of the European Union, albeit to a lesser extent. To this end, the results indicate that there is still some way to go before pan-European preference convergence can be claimed.

2 A preliminary look

Before statistically examining the deviation of consumption shares, it would be useful to have a preliminary look at the data for each country. Table 1 presents the average consumption share in each country for each expenditure category and the respective EU average, while the parentheses show the standard deviation of the shares. Table 2 presents the definitions of each expenditure category.

Overall, the largest consumption share refers to the category of housing, electricity, gas and other fuels (category 4), with food and non-alcoholic beverages (category 1) and transport (category 7) following. Naturally, there are deviations between the countries: for example, the Balkan (Romania, Bulgaria, Greece) and Baltic countries (Estonia, Latvia, Lithuania) appear to devote a much larger share of their consumption on food than other countries. In contrast, Luxemburg’s share of food consumption is less than one-third the size of the Romanian one.

Category 4 is more homogeneous across countries, even though Malta appears to spend less than half the share of Bulgaria’s on housing, electricity, gas and other fuels. Spain, Cyprus and Malta are the ones which spend the most in the category of restaurants and hotels category, perhaps also due to the large tourism inflows in the countries. On the other end of the spectrum, Poland and Lithuania spend less than 3% of total consumption on restaurants and hotels.

Education (category 10) is the category in which the least amount of spending takes place, with an average value of 1.1% in the EU-27. This can perhaps be attributed to the existence of national universities which reduce the cost of education for citizens. For example, in Sweden, only 0.2% of consumption is spent on education, while Ireland and Cyprus devote 2.3% of consumption on education. Greece comes second at 2.1%. Portugal and Greece are the leaders in health expenditure (category 6), where 4.7% and 4.5%, respectively, are on average spent each year.

The above simple overview of the descriptive statistics highlights that differences in spending between countries exist and can be large at times. Nevertheless, these shares are not very revealing as they stand: perhaps the same amount of euros is spent on education in Cyprus and Sweden but as the latter has a larger overall consumption the resulting share is smaller. Further to this, differences in prices may also account for a large share of the above deviations. In addition, as already discussed in Introduction, the lack of identical tastes is to be expected. What matters is not whether there are differences but whether these are converging or diverging over time. The following section provides details into the empirical strategy employed to statistically examine this proposal.

3 Estimation framework

To be able to draw conclusions on the convergence of consumption patterns across the EU, a test of the null hypothesis of a random walk is required. To this end, we examine the differences in consumption shares in other countries relative to the EU-27 average. More precisely, the basic regression specification is:

with \( w_{i,c,t} \) denoting the log difference in the expenditure share of product \( j \in \left\{ {1, \ldots ,12} \right\} \) in country \( i \in \left\{ {1, \ldots ,27} \right\} \) relative to the benchmark at year t.Footnote 4 For example, in our case \( w_{i,c,t} \) would denote the log deviation of country i from the EU-27 cross-country sample average (\( w_{i,E,t} \)) in year t. \( \Delta \) signifies the first-difference operator, that is, \( \Delta w_{i,c,t} = w_{i,c,t} - w_{i,c,t - 1} \), or in other words the change in deviation, and \( c_{i,c} \) is a vector of constants. As is obvious from Eq. (1), the specification is identical to a standard Dickey–Fuller test with a drift. Usually, the DF test includes lags of the first difference of the consumption shares, \( \Delta w_{i,c,t} \) to account for possible serial correlation in the error. In this case, the optimal lag length was found to be one on the basis of the Akaike information criterion, and thus, the basic specification remains as in Eq. (1). As elaborated in Busetti et al. (2006), countries i and j are converging if the differential is stationary. In addition, following Busetti et al. (2006), given that we are testing for absolute convergence, we estimate a driftless model. Hence, the \( c_{i,c} \) term is removed in all subsequent equations.

The benchmark choice in \( \Delta w_{i,c,t} \) is easier than in other studies in which no prior information holds (e.g. Parsley and Wei 1996). As already suggested, the aim of this paper is to investigate whether there is a deviation in the consumption patterns of EU countries. Consequently, the natural choice of a benchmark is the cross-country sample average of the expenditure share of each product, which gives equal weighting to all countries. A similar approach was employed in Kónya and Ohashi (2007), where a theoretical cross-country average was assumed as the benchmark. While some may argue in favour of using a single country as the benchmark, we believe that a cross-country average better captures the essence of the investigation at hand, as the aim of the study is to examine whether countries converge or diverge from their mean and not pin-point the (expected, as discussed in Introduction) differences from one country to a specific counterpart.Footnote 5

It should be mentioned that instead of expenditure shares, one could focus on nominal (or real) expenditure. However, nominal expenditure is vulnerable to price changes and is furthermore unlikely to be stationary. Real expenditure on the other hand is trending because of economic growth, also making it non-stationary. Consumption shares allow to alleviate the non-stationarity issue since consumption in category i would change at the rate of economic growth, along with its denominator. Any remaining non-stationarity would be related to changing preferences which, if not aligned with similar changes in other countries, would suggest the divergence of consumption patterns.

In the estimation, Eq. (1) is modified to include product and country (two-way) fixed effects, which aim at capturing differences in product quality or variety across countries.Footnote 6 As such, Eq. (1) now becomes:

The empirical distribution of the unit root t-statistic for the convergence equation with the individual fixed effects and serial correlation in the error structure can be found in Levin et al. (2002). This specification allows us to better capture the extent of the deviation from the EU average, after accounting for country/product idiosyncrasies. Statistically, our choice is also supported by the fact that the fixed effects F-test for joint insignificance rejects the null at the 1% level. Later, the assumption of a common \( \beta \) across country/product pairs is relaxed, and the model is estimated for each expenditure category.

Conditional on our finding that the \( w_{i,j,t} \) process is not a unit root, the magnitude of a negative \( \beta \) denotes its rate of convergence. To obtain a more intuitive understanding of the rate of convergence, we estimate the half-life index, which is suggestive of the number of periods it takes to eliminate 50% of a shock on the variable. Using the estimate, \( \hat{\beta } \), we calculate the half-life of the shock such that \( HL = \ln \left( {0.5} \right)/{ \ln }\left( {|\hat{\beta }|} \right) \), where \( |\hat{\beta }| \) is the absolute value of \( \hat{\beta } \).

Continuing with the proper specification of Eq. (1), it may be the case that other variables are also important in determining the consumption deviation. In particular, and even though this study does not seek to elaborate as to why preferences converge, the phenomena surveyed by Stigler and Becker (1977), such as advertising and fashions, could perhaps play a role in the preference structure. However, as the authors also note, these phenomena do not affect tastes directly, but do so via their impact on prices and incomes. Controlling for these variables would allow us to estimate more precisely whether preferences are converging. To this end, and similar to Kónya and Ohashi (2007), we also employ the log difference in the price of product j in country i relative to the benchmark at year t (\( p_{i,c,t} ) \), and the log difference in country i’s real income relative to the benchmark (\( m_{i,t} ) \). Consequently, Eq. (2) becomes,

where FE refers to the product/country fixed effects as in Eq. (2). The last two terms (price difference and income difference) allow for substitution effects and income effects, respectively, with the underlying assumption being that both effects are contained within a country and do not spill across borders. Consistent with Engel’s law, we expect to find that income is negatively correlated with the food expenditure category and positively correlated with luxury goods.

Further to the specification of Kónya and Ohashi (2007), additional variables which could play a role in the defining the differences in consumption shares are also included. Specifically, we employ openness, a common metric of the country’s exposure to international trade as well as a proxy for the globalisation process, by calculating a world openness variable. Finally, a dummy for the post-2008 recession period is also introduced to examine whether the recession had an impact on the convergence process. The ensuing equation is then specified as

in which \( \varphi_{t} \) is openness, \( G_{t} \) is the globalisation variable and \( R_{t} \) is the recession dummy. Estimation results can be found in the section which follows.

4 Convergence in consumption shares

The results from the estimation on the convergence of consumption shares in the EU, based on Eqs. (1) to (4), can be found in Table 3. Specifically, columns (1) and (2) show the results when including and when excluding the country/product fixed effects, respectively. The results indicate that avoiding the use of fixed effects severely impacts our results as it underestimates both the deviation and the speed of convergence. Furthermore, the use of panel fixed effects is also statistically justified since they are significant at the 1% level. Consequently, in the panels which follow we report only the estimations in which fixed effects are included.

Column (3) illustrates the effects of including additional variables, namely prices and income in the estimation framework, as indicated in Eq. (3). Perhaps surprisingly, both price and income are statistically insignificant. This is attributed to the fact that prices and income are significant in only specific categories of expenditure, something which will become more clear in Sect. 5. The estimation of Eq. (4), with further variables included in the estimation, can be found in columns (4) to (6). Overall, results indicate that the inclusion of more variables is statistically unwarranted and thus appears to be very little change in both the deviation and the speed of convergence in panels following the inclusion of price deviations.

The implied half-life of a shock increases substantially from 0.40 periods (years) to 0.56 after the incorporation of the price and income differentials, and remains relatively stable afterwards. The estimates for half-life appear to be smaller than the ones reported by Kónya and Ohashi (2007). The main causes of difference can be mainly attributed to data availability (Konya and Ohashi only have data until 2002) and to the fact that the EU cross-country sample average could be a more representative benchmark for these countries than the OECD cross-country average employed in their study. Naturally, an additional explanation lies in the fact that consumption patterns may have converged more in the EU after the physical introduction of the common currency in 2002, something which coincides with the predictions of Mongelli (2002) and Kenen (1997).

To further examine the validity of this hypothesis and elaborate on the differences between country groups within the EU, Table 4 presents an alternative estimation of Eq. (4). Column (1) re-estimates Eq. (4) including only the euro area countries. The results suggest that the divergence is significantly lower in the case of the euro area than for the whole of the EU. This finding is also confirmed by the fact that the non-euro area estimation in column (4) suggests a higher half-life for shocks (0.67 compared to 0.46 in the euro area).

The two middle columns in Table 4 show the results from the estimation when differentiating between the original members of the euro area (i.e. the initial set of countries which adopted the euro) in column (2), and those which joined afterwards (column 3).Footnote 7 The results suggest that there is little difference between the two, with the post-1999 euro area members registering a slightly smaller deviation. However, since the probability that the two coefficients are equal at the 95% level cannot be ruled out, the difference can most likely be attributed to the smaller sample size.

Overall, Table 4 underlines the fact that euro area countries are more homogenous than non-EA countries. In the latter case, the deviation is 50% greater, suggesting that preferences are converging by a slower rate. Thus, the findings suggest that it is possible for the physical introduction of the euro to have increased homogeneity between consumption patterns and consequently pushed preferences to converge.

5 Relaxing the common coefficient assumption

The specifications in Tables 3 and 4 have, until now, forced the convergence coefficient to have the same value across all products. However, it would be useful to examine the effects of allowing the coefficient to vary across products in order to examine the extent at which convergence evolves at the product/expenditure class. To this end, Table 5 presents an evaluation of Eq. (4) by expenditure category. Definitions of each category of expenditure can be found in Table 2.

At first glance, what strikes out is that the highest divergence is in the categories of food and non-alcoholic beverages (1), alcoholic beverages, tobacco and narcotics (2) and communications (8). The communications category also stands out as no other variable appears to be significant in the estimation. In contrast, in the first two categories, income is statistically significant and with a negative sign, abiding Engel’s law and is in accordance with the findings of Falkinger and Zweimüller (1996). Furthermore, prices also appear to be statistically significant determinants of convergence in the first two categories.

Excluding these categories, the results range from approximately − 0.26 to − 0.36, far from the unit root case. Columns (9) and (11), which reflect the categories of recreation and culture, and restaurants and hotels, respectively, appear to have the lowest divergence. The half-life of a shock in the two categories is just 0.51 years.Footnote 8 This can most likely be justified through the fact that costs are similar in most countries, with openness (expectedly) playing a role in the case of restaurants and hotels. Other than the three categories discussed above, other relatively high values can be observed in columns (3) and (7), reflecting the consumption share of clothing and transport.

Overall, half of the 12 categories record convergence rates less than − 0.31, with the respective half-life of the shocks lasting approximately seven months. The categories which record convergence coefficients higher than − 0.31 are those in which country-specific differences in preferences are more likely. For example, in the case of education (column 10), only income and openness are significant determinants of the consumption share, signifying the role of higher costs (hence requiring higher income) and perhaps suggesting the positive role of an inflow of foreign students. An additional reason may lie in differences regarding the number of people in tertiary education in each country.

Interestingly, health (column 6) which could be affected by the existence of national policies as well as the predominance of private health insurances, appears not to be affected by any other determinants (similar to the communications category before). The same rationale would also hold for columns (1), (2) and (3) which reflect differences in food, drinks and clothing. As suggested earlier, these categories record the largest divergence something which could likely attributable to the variety of national tastes regarding the consumption of food and alcohol, as well as clothing perceptions.

Finally, it should be mentioned that while income and prices were not statistically significant in the aggregate (Tables 3, 4), they are now significant in many categories. The reason behind the non-significance likely lies in aggregation bias. In particular, the variables record (expectedly) both positive and negative signs in the disaggregate level, which zeroes out the aggregate result. As such, the importance of relaxing the common coefficient of convergence is further underlined.

6 Conclusions

The convergence of preferences matters for many economic agents, such as firms wishing to enter new markets, and currency area participants. It also greatly affects the way economists construct models, with assumptions of equal preferences being the norm, especially in classical models of international trade. Furthermore, convergence of patterns matters culturally, as divergent national tastes, preferences, and standards across countries are barriers to overall economic integration.

The findings of the preceding sections have shown that tastes, measured by consumption patterns, are converging in the European Union, with the half-life of shocks expected to last approximately 0.56 years (Table 1). Distinguishing between euro area and non-euro area countries shows that convergence is about 50% higher in the euro area countries compared to other (non-EA) European Union members. This, while perhaps not all due to it, underlines the fact that the introduction of the common currency has increased homogeneity in the region. A different view (in line with earlier studies on the subject) is that in order to join the euro area, a country would have to be relatively homogenous with the existing group. Whichever of the reasons may hold, the results indicate that while consumption patterns are not diverging, categories have different degrees of convergence. Overall, it appears that national tastes, perceptions and mentalities regarding consumption spending in the euro area are converging to a common standard, with the process of convergence estimated to be slower for the rest of the European Union.

Notes

See Colacicco (2015) for a recent survey of general oligopolistic equilibrium models, in which firms view the world market as a fully integrated one.

Even though Croatia joined the EU in 2013, data for the country were not available at the time this study was conducted.

A detailed description of data and sources can be found in Appendix accompanying this paper.

The weighted EU average, constructed as a consumption-weighted average of the categories, was also employed in the estimation and, while not presented here, reached qualitatively similar results. The weights are calculated on the basis of a country’s consumption in each category, with the aggregate calculated as the sum. However, this is prone to over-representing large counties (e.g. Germany, France, Italy) and hence not fully representative of the overall average preference structure. Results are available upon request.

These product/country (i.e. two-way) fixed effects aim at capturing potential differences in the quality (or variety) of goods across countries. In general, product/country fixed effects would capture effects which are constant through time, such as the quality (or variety) of goods in share country i is consistently different than in country j. This has no impact on the measurement of taste convergence, given that, by definition, if tastes are either converging or diverging they cannot be stable (i.e. fixed) through time or countries.

Names of countries in the latter/former distinction can be found in Appendix.

It should be remembered that the results by category include both the euro area and the non-euro area countries, and thus, we should not expect them to be lower than the overall euro area estimates.

References

Aizenman J, Brooks E (2008) Globalization and taste convergence: the cases of wine and beer. Rev Int Econ 16(2):217–233

Buongiorno J (2009) International trends in forest products consumption: is there convergence? Int For Rev 11(4):490–500

Busetti F, Forni L, Harvey A, Venditti F (2006) Inflation convergence and divergence within the European Monetary Union. ECB working paper, No. 574, January

Carruth A, Gibson H, Tsakalotos E (1999) Are aggregate consumption relationships similar across the European Union? Reg Stud 33(1):17–26

Clements KW, Selvanathan S (1994) Understanding consumption patterns. Empir Econ 19(1):69–110

Clements KW, Wu Y, Zhang J (2006) Comparing international consumption patterns. Empir Econ 31(1):1–30

Colacicco R (2015) Ten years of general oligopolistic equilibrium: a survey. J Econ Surv 29(5):965–992

Elsner K, Hartmann M (1998) Convergence of food consumption patterns between Eastern and Western Europe (No. 13). Discussion Paper, Institute of Agricultural Development in Central and Eastern Europe

Falkinger J, Zweimüller J (1996) The cross-country Engel curve for product diversification. Struct Change Econ D 7(1):79–97

Fedoseeva S (2017) In vino veritas? An alternative story of European convergence. Beverages 3(4):58

Friedman TL (1989) The lexus and the olive tree. Farrar, Straus and Giroux, New York

Goldberg PK, Verboven F (2005) Market integration and convergence to the Law of One Price: evidence from the European car market. J Int Econ 65(1):49–73

Gracia A, Albisu LM (2001) Food consumption in the European Union: main determinants and country differences. Agribusiness 17(4):469–488

Houthakker HS (1957) An international comparison of household expenditure patterns, commemorating the centenary of Engel’s law. Econometrica 25(4):532–551

Kenen PB (1997) Preferences, domains, and sustainability. Am Econ Rev 87(2):211–213

Kónya I, Ohashi H (2007) International Consumption Patterns among High-income Countries: evidence from the OECD Data. Rev Int Econ 15(4):744–757

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econometrics 108(1):1–24

Levitt T (1983) The globalisation of markets. Harvard Business Review, May/June, pp 92–102

Meng M, Payne JE, Lee J (2013) Convergence in per capita energy use among OECD countries. Energ Econ 36:536–545

Mohammadi H, Ram R (2012) Cross-country convergence in energy and electricity consumption, 1971–2007. Energ Econ 34(6):1882–1887

Mongelli FP (2002) New views on the optimum currency area theory: what is EMU telling us? ECB, working paper no. 138

Neary JP (2003) Globalization and market structure. J Eur Econ Assoc 1(2–3):245–271

Parsley DC, Wei S-J (1996) Convergence to the law of one price without trade barriers or currency fluctuations. Q J Econ 111(4):1211–1236

Rodrik D (1997) Has globalization gone too far?. Institute for International Economics, Washington

Seale JL, Regmi A (2006) Modeling international consumption patterns. Rev Income Wealth 52(4):603–624

Selvanathan S, Selvanathan EA (1993) A cross-country analysis of consumption patterns. Appl Econ 25(9):1245–1259

Stigler GJ, Becker GS (1977) De gustibus non est disputandum. Am Econ Rev 67(2):76–90

Stiglitz JE (2002) Globalization and its discontents. Allen Lane, Penguin Press, London

Waheeduzzaman ANM (2011) Are emerging markets catching up with the developed markets in terms of consumption? J Glob Market 24(2):136–151

Author information

Authors and Affiliations

Corresponding author

Additional information

I would like to thank the Editor and two anonymous referees for their comments and suggestions. Any opinions expressed are strictly personal and may not reflect those of the institutions I am affiliated with.

Data appendix

Data appendix

The data used for the demand estimation are from Eurostat’s “Final consumption expenditure of households by consumption purpose (COICOP 3 digit)”. All available publications from 1996 to 2014 are collected. Data for 2015 are only available for a small subset of countries, and hence, they were not employed in the estimation. The data were employed as a percentage of total consumption and deviations from the cross-country sample average were used.

Data for prices are collected from the “Purchasing power parities (PPPs), price level indices and real expenditures for ESA 2010 aggregates” publication of Eurostat, with the purchasing power parity of the EU-27 set to one. Data for this publication are available from 2003 to 2014 and were exchange rate-adjusted for the non-euro area countries. Openness was defined as total trade (imports plus exports of goods and services) over gross domestic product. Both series were obtained from Eurostat.

Income is defined as the gross domestic product per capita, at 2010 chain linked volumes and normalised by its deviation from the cross-country sample average. The globalisation variable is defined as total world exports of goods and services divided by total world GDP. The recession dummy takes a value of 1 from 2008 until 2014, covering both the global financial crisis and the European sovereign debt crisis of 2009–2014. The 1999 euro area countries are Belgium, Germany, Ireland, Greece, Spain, France, Italy, Luxemburg, the Netherlands, Austria and Finland. The post-1999 euro area countries are Estonia, Cyprus, Malta, Slovenia and Slovakia, while the extra-euro area countries are Bulgaria, Czech Republic, Denmark, Latvia, Lithuania, Hungary, Poland, Romania, Sweden and the UK.

The twelve categories of consumption spending are defined under Table 4 in the text. Similar to Kónya and Ohashi (2007), we do not use government consumption or capital formation in order to be able to focus directly on the household consumption pattern.

Rights and permissions

About this article

Cite this article

Michail, N.A. Convergence of consumption patterns in the European Union. Empir Econ 58, 979–994 (2020). https://doi.org/10.1007/s00181-018-1578-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1578-5