Abstract

When attempting to identify empirical regularities in consumption patterns, their tremendous diversity across countries represents both a major opportunity and challenge. For example, consumers in rich countries devote less than 20% of their budget to food, while this rises to more than 50% in the poorest countries. This paper uses a major new database released in Selvanathan and Selvanathan (Selvanathan EA, Selvanathan S (2003) International Consumption Comparisons: OECD versus LDC. World Scientific, Singapore) to explore several related issues, including the extent to which the consumption basket is diversified and how this changes with income, whether a simple utility-maximising model is capable of explaining the diversity of consumption patterns internationally, the measurement of the extent to which tastes differ across countries, and how the world can be partitioned into groups of countries with minimal within-group heterogeneity of tastes on the basis of the revealed preference of consumers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Why do consumers in the poorest countries in the world devote more than one-half of their budgets to expenditure on food, while in rich countries food absorbs only 20% or less? This behaviour is usually explained in terms of Engel’s law, whereby the income elasticity of demand for food is less than unity. As this law has been confirmed time and time again (Houthakker 1987) and is one of the most pervasive and useful in all of economics, having a status similar to, say, the quantity theory of money, it might be profitable to investigate whether there are other patterns in consumption that may have a similar validity and be equally useful. With this idea in mind, in this paper we use a major, new body of international consumption data recently published in a book by Selvanathan and Selvanathan (2003) to analyse cross-country patterns and empirical regularities in consumption.Footnote 1 We also investigate the extent to which a simple utility-maximising model is capable of explaining the tremendous diversity of cross-country consumption patterns, the extent to which tastes can be said to differ internationally, and explore possible ways of grouping countries on the basis of the “similarity” of consumption.

Whenever cross-country comparisons of economic data are made, almost inevitably there is the troublesome problem of how to convert from one currency unit to another. For example, a direct comparison of incomes in the USA and India requires that incomes in both countries be expressed in terms of a common currency. There are several approaches to this problem, all of which have their own weaknesses. The problem associated with using prevailing exchange rates is the Balassa (1964), Samuelson (1964) productivity bias hypothesis, which has the effect of making rich countries look even richer and the poor poorer. This occurs because international productivity differences in the production of traded goods cause nontraded goods to be relatively more expensive in rich countries and cheaper in poor countries. As nontraded goods prices are not fully reflected in prevailing exchange rates, the result is an artificial amplification of world income inequality. A second approach is to use purchasing power parities (PPP).Footnote 2 While PPP values have much more appeal than prevailing exchange rates, they still do not enjoy universal acceptance due to problems associated with the choice of the base period, disagreement regarding the length of time needed for PPP to hold, what price indexes should be used in calculating the parities, disputation about the direction of causality, and so on. Paraphrasing Friedman (1956) and Laidler (1991), it could therefore be said that “PPP is always and everywhere controversial.” A distinguishing feature of this paper is the emphasis on dimensionless concepts such as budget shares and changes in the logarithms of prices and quantities, which are independent of currency units. The approach we employ, which has been previously used by Clements and Chen (1996) and Chen (1999), has the major benefit of avoiding many of the problems associated with exchange-rate conversions of incomes, expenditures and consumption.Footnote 3

The plan of the paper is as follows. In the next section we provide an overview of the data from Selvanathan and Selvanathan (2003), as well as a summary of the data in the form of price and volume indexes. The theory and measurement of the diversity of the consumption basket is dealt with in Section 3. Then, in Section 4, we discuss issues related to the income and price sensitivity of consumption. We use in Section 5 cross-country demand equations to explain consumption patterns in 45 countries, and provide an analysis of the quality of these predictions. Section 6 considers disparities of tastes internationally, and analyses how optimal groups of countries can be constructed on this basis. Section 7 contains concluding comments.

Consumption in 45 countries

Selvanathan and Selvanathan (2003) present detailed consumption data for a large number of countries, both developed and developing. They use these data to compute indexes of price and quantities, estimate income and price elasticities of demand for the broad aggregates such as food, clothing, housing, etc., carry out extensive hypotheses testing, as well as much other interesting analysis. In this section and the one after the next, we draw extensively on the Selvanathans’ work to present a summary of their data and their elasticities. Unless otherwise noted, the source for all the subsequent data and estimates is Selvanathan and Selvanathan (2003).Footnote 4 Table 1 presents in columns 1–4 the names of the 45 countries to be subsequently used, the underlying sample period and per capita income. Countries are listed in terms of decreasing per capita GDP and as can be seen, the USA is the richest and Zimbabwe is the poorest with an income of about 6% that of the USA. We will return to columns 5 and 6 of the table.

Let p i and q i be the price and per capita quantity consumed of good i, so that p i q i is expenditure on that good. If there are n goods, then \(M = {\sum\nolimits_{i = 1}^n {p_{i} q_{i} } }\) is total expenditure, and w i =p i q i /M is the proportion of this total expenditure devoted to good i. This w i is known as the budget share of good i. Table 2 presents the budget shares in the 45 countries for n=8 goods. These w i are averages over each year included in the relevant sample period indicated in column 2 of Table 1. Several interesting features emerge from Table 2. First, food is the dominant good as it has the largest single budget share in all countries except three. The three exceptions to this rule are the USA, Canada and New Zealand, where the budget share of housing exceeds that of food. Averaging over all countries, the food budget share is 32%, and in some of the poorest countries food absorbs more than one-half of the consumer’s budget.Footnote 5 Second, there is a distinct tendency for the food budget share to rise as we go down column 2 of Table 2, i.e., as GDP per capita falls. This tendency is in agreement with Engel’s law. The feature is also illustrated in Fig. 1, where the food budget share is plotted against GDP per capita. The figure shows that as the budget shares for Sri Lanka and Zimbabwe are a considerable distance away from the regression line, these shares are much different to those expected on the basis of income. Third, on average for this group of countries, housing has the second largest budget share, although there is considerable variability in this share. Fourth, the housing share tends to fall with GDP per capita. This can be clearly seen from the third last and second last entries in column 4 of Table 2 where the 45 countries are divided into two groups, (1) countries 1–25, whose per capita incomes are at least 50% of that of the USA (which we shall refer to as the “rich countries”); and (2) countries 26–45, whose per capita incomes are below 50% that of the USA (the “poor” countries). For the first group, the average housing share is 17.2%, while it is 12.5% for the second.

Let \({\text{D}}p_{{it}} = \log {\text{ }}p_{{it}} - \log {\text{ }}p_{{i,t - 1}} \) and \({\text{D}}q_{{it}} = \log q_{{it}} - \log q_{{i,t - 1}} \) be the log-change in the ith price and quantity consumed of good i from year t−1 to t; when multiplied by 100, these log-changes are approximately annual percentage changes. If we write Dp i and Dq i for the averages of these log-changes, one way to summarise the change in the price of the consumption basket as a whole and its associated volume is via Divisia indexes:

In words, the Divisia price index DP is a budget-share weighted average of the eight individual price log-changes; and similarly for the corresponding volume index DQ. These indexes are independent of currency units, expressed in terms of percent p.a. (when multiplied by 100) and directly comparable across countries. These indexes are given in columns 5 and 6 of Table 1, from which we see that the high-inflation countries tend to be among the poorer. That is, mean inflation for the rich countries is about 7.9% p.a., while for the poor countries it is 13.1% p.a. For the 45 countries as a whole, the average rate of inflation over the period considered is about 10.3% p.a. Regarding the value of the volume index, the country with the highest growth in per capita consumption is Taiwan (6.3% p.a.), followed by Korea (5.9%); the slowest growth occurred in Zimbabwe where the volume of per capita consumption fell by 4.4% p.a. As a group, the Asian NICs distinguish themselves as rapid growers.

Diversity of the consumption basket

In this section we use information theoretic concepts to measure the extent to which consumption patterns are diversified over goods, and how this changes with income. This material is mainly based on Theil (1967, Chap. 4) and Theil and Finke (1983).

A very poor consumer will devote much of the budget to necessities and little to luxuries. But as income increases, the budget shares of necessities fall while those of luxuries rise, so that there is more diversity, or less specialisation, in the consumption basket. A natural measure of the diversity of consumption patterns is the entropy of the n budget shares w 1,..., w n:

This H takes a minimum of 0 when consumption is specialised in one good, so that w i =1 for some i and all other shares vanish. When each w i equals 1/n, then H takes its maximum value of log n. When the budget shares are more equal, total expenditure is more widely spread over goods, so there is more diversity in the consumption basket. In this sense then, there is no contradiction in identifying more equality in the budget shares with greater diversity.

As indicted by the old saying “variety is the spice of life,” diversity is something that valued by most consumers.Footnote 6 Thus as the entropy 3.1 is increasing in diversity, we would expect H to rise with GDP per capita. We pursue this matter by applying Eq. 3.1 to the n=8 budget shares of Table 2, and the results are contained in column 2 of Table 3. As can be seen, there is a tendency for the entropy to decline as we go down the column, that is, as GDP per capita falls: For the USA, H=2.01 which is only slightly below the maximum of log 8≈2.08. The lowest value of the entropy is for Sri Lanka, where H=1.33. Recall that Fig. 1 seems to suggest that Zimbabwe and Sri Lanka could be outlying countries with respect to food consumption. This is also reflected in their entropy values of column 2 of Table 3—the value of H for Zimbabwe is higher than those of its near neighbours, as its food budget share is lower, while H for Sri Lanka is lower for the opposite reason.

Next, we divide the n goods into G<n groups, to be denoted by S 1,...,S G , such that each good belongs to only one group. Let the budget share for group g be \(W_{g} {\text{ = }}{\sum\nolimits_{i \in {\mathbf{S}}_{g} } {w_{i} } }\). We can then express the entropy 3.1 as

where

Eq. 3.3 is the within-group entropy, which deals with the conditional, or within group, budget shares w i /W g . As the conditional share \({w_{i} } \mathord{\left/ {\vphantom {{w_{i} } {W_{g} }}} \right. \kern-\nulldelimiterspace} {W_{g} }{\text{ = }}{p_{i} q_{i} } \mathord{\left/ {\vphantom {{p_{i} q_{i} } {{\sum\nolimits_{j \in {\mathbf{S}}_{g} } {p_{j} } }q_{j} }}} \right. \kern-\nulldelimiterspace} {{\sum\nolimits_{j \in {\mathbf{S}}_{g} } {p_{j} } }q_{j} }\), it measures expenditure on good i as a faction of total expenditure on the group to which the good belongs. The measure H g increases as the conditional shares become more equal; that is, with greater diversity of the within-group basket. The first term on the right-hand side of Eq. 3.2 is the between-group entropy. Accordingly, Eq. 3.2 states that the entropy of the entire basket can be decomposed into the sum of the between-group entropy and a weighted average of the G within-group entropies, the weights being the relevant group budget shares.

Given the dominance of food in the consumer’s basket, it is natural to consider G=2 groups of goods, “food” and “nonfood.” The food group contains just one more elementary good, viz., food, while the remaining seven elementary goods comprise the group nonfood. Thus, as w 1 is the budget share for elementary food, and 1−w 1 is the budget share for the remaining seven goods, we have in the notation of the previous paragraph W 1=w 1 and W 2=1−w 1. The first term on the right-hand side of decomposition 3.2 then becomes

while the second term becomes

In words, the entropy within the food group is zero as this group contains only one elementary good. Collecting terms, application of Eq. 3.2 to the G=2 case yields

The first two terms on the right-hand side of Eq. 3.4 represents the between-group entropy for the food/nonfood partitioning of the budget. Column 3 of Table 3 contains this measure and as can be seen, this tends to increase as we go down the column and hit poorer and poorer countries. For rich countries, the food budget share w 1 is modest, so that the share for nonfood, 1−w 1, is large. At this two-group level, it could be said that the budget for the rich is concentrated in nonfood and that there is not much diversity in the basket. As income falls, w 1 rises and 1−w 1 declines, making for more diversity. This explains why the between-group entropy increases as income falls. Column 4 of Table 3 gives the weighted-average within-group entropy for nonfood, the last term on the right of Eq. 3.4. This tends to decline with income, implying that the nonfood part of the basket is more diversified for the rich and less diversified for the poor. This decline in the entropy as income falls supports the presence of at least one more necessity, in addition to food, in the consumption basket. Finally, column 5 of Table 3 gives the percentage share of the total accounted for by the between-group entropy. At high incomes this term accounts for something of the order of 30% of the total; but as income falls, total entropy falls, while the between-group term rises, causing its percentage share to increase substantially.Footnote 7

The income and price responsiveness of consumption

The ith equation of the CBS preference independence model (Keller and van Driel 1985) is

where \(\overline{w} _{i} = {{\left( {w_{{it}} + w_{{i,t - 1}} } \right)}} \mathord{\left/ {\vphantom {{{\left( {w_{{it}} + w_{{i,t - 1}} } \right)}} 2}} \right. \kern-\nulldelimiterspace} 2\) in the arithmetic average of the ith budget share over the years t and t−1; \({\text{D}}q_{{it}} {\text{ = }}\log q_{{it}} {\text{ - }}\log q_{{i,t - 1}} \) is the log-change in the quantity demanded of good i; \({\text{DQ}}_{t} {\text{ = }}{\sum\nolimits_{i{\text{ = 1}}}^n {\overline{w} _{{it}} {\text{D}}q_{{it}} } }\) is the Divisia volume index, with n the number of goods; \({\text{D}}p_{{it}} {\text{ = }}\log p_{{it}} {\text{ - }}\log p_{{i,t - 1}} \) is the log-change in the price of good i; \({\text{DP}}^{\prime }_{t} = {\sum\nolimits_{i = 1}^n {{\left( {\overline{w} _{{it}} + \beta _{i} } \right)}{\text{D}}p_{{it}} } }\) is the Frisch price index; and α i *, β i and ϕ are the parameters. The parameter ϕ is the income flexibility (the reciprocal of the income elasticity of the marginal utility of income). Eq. 4.1 implies that the autonomous trend in consumption of good i is \({\alpha ^{*}_{i} } \mathord{\left/ {\vphantom {{\alpha ^{*}_{i} } {\overline{w} _{{it}} }}} \right. \kern-\nulldelimiterspace} {\overline{w} _{{it}} }\), the ith income elasticity is \(\eta _{{it}} {\text{ = }}{{\text{1 + }}\beta _{i} } \mathord{\left/ {\vphantom {{{\text{1 + }}\beta _{i} } {\overline{w} _{{it}} }}} \right. \kern-\nulldelimiterspace} {\overline{w} _{{it}} }\), and the (i, j)th Slutsky price elasticity is \(\eta _{{ijt}} = \phi \eta _{{it}} {\left( {\delta _{{ij}} - \overline{w} _{{jt}} \eta _{{jt}} } \right)}\), where δ ij is the Kronecker delta (δ ij =1 if i=j, 0 otherwise).

Selvanathan and Selvanathan (2003) use time-series data to estimate Eq. 4.1 for i=1,...,n for each of the 45 countries separately to yield 45 sets of estimates of α i *, β i and ϕ. In the vast majority of cases the number of goods, n, is either 9 or 8. As set out in detail in Clements et al. (2004), we apply some straightforward aggregation/disaggregation procedures to yield n=8 in all countries. Table 4 gives the trend terms evaluated at sample means. From the last row of this table, we see that on average there is a trend out of food, clothing and durables, into the other goods. Table 5 presents the income elasticities at means. As expected, in all case the food income elasticity is not greater than unity, which supports Engel’s law. The housing income elasticities tend to be surprisingly low, but these values have to be considered in conjunction with the positive trend terms for this good; that is, the low-income elasticities tend to be offset by the high positive trend terms. A similar argument also applies to medical care. Selvanathan and Selvanathan (2003) also provide an estimate of the income flexibility ϕ for each country, but they conclude that these values are unrelated to income. While this finding contradicts Frisch’s (1959) famous conjecture, it is consistent with much of the previous literature.Footnote 8 The finding that the income flexibility is independent of income is not surprising given that this elasticity involves a third-order derivative of the utility function; economic data are usually silent regarding the value of such high-order effects (Clements and Theil 1996). In what follows, for ϕ we use the value −0.41, which is the mean of the 45 estimates reported by Selvanathan and Selvanathan (2003).

Predicting consumption

Eq. 4.1 explains consumption of good i in terms of an autonomous trend, the change in real income and changes in the prices. To what extent does this provide an acceptable explanation of consumption? Selvanathan and Selvanathan (2003) analyse this question with time-series data on a country-by-country basis. By contrast, we shall examine the question from a cross-country perspective for all 45 countries simultaneously. Eq. 4.1 can be rearranged to yield the following differential demand equation (with the time subscripts and the bars on the budget shares suppressed and with n=8):

with \(\alpha _{i} {\text{ = }}{\alpha ^{*}_{i} } \mathord{\left/ {\vphantom {{\alpha ^{*}_{i} } {w_{i} }}} \right. \kern-\nulldelimiterspace} {w_{i} }\), η i =1+β i /w i , and

It follows from the consumer’s budget constraint that the coefficients of Eq. 5.1 for i=1,..., 8 satisfy

We use the right-hand side of Eq. 5.1 to provide predicted consumption, which we then compare to the corresponding actual value. To evaluate Eq. 5.1 we use the trend term from Table 4, the income elasticity from Table 5 and obtain the price elasticities from Eq. 5.2 with ϕ=−0.41 and the budget shares from Table 2. Regarding the variables on the right of Eq. 5.1, the Divisia volume index is from column 6 of Table 1 and the price log-changes are from Selvanathan and Selvanathan (2003). This yields a predicted value for the log-change in the consumption of good i, \({\text{D}}\widehat{q}_{i} \). To recap, the prediction procedure can be summarised in the following five steps: (1) The Selvanathans estimate model 4.1 for i=1,..., n goods for 45 countries; this model is estimated for each country separately, so there are 45 sets of estimated parameters. (2) We use the autonomous trends and income elasticities implied by these parameters for n=8. The trends and income elasticities, which are contained in Tables 4 and 5, vary over countries. (3) We employ Eq. 5.2 for i,j=1,..., 8 to compute the own-and cross-price elasticities with ϕ=−0.41, the mean of the Selvanathans’ 45 estimates, and the mean budget shares given in Table 2. It is to be noted that expression 5.2 is implied by model 4.1. (4) The trends, income elasticities and price elasticities are combined with the observed income and price changes according to Eq. 5.1 for i=1,..., 8. These income and price changes refer to the averages over the sample period for each country. (5) This combination then yields the predicted change in consumption over the period of each of the goods for each of the 45 countries.

The actual log-change Dq i is available in Selvanathan and Selvanathan (2003), so the prediction error is \(e_{i} {\text{ = D}}q_{i} {\text{ - D}}\widehat{q}_{i} \). It follows from Eq. 5.3 that \({\sum\nolimits_{i{\text{ = 1}}}^{\text{8}} {w_{i} e_{i} {\text{ = 0}}} }\). In words, a budget-share weighted-average of the errors is zero, which reflects that the system comprising Eq. 5.1 for i=1,..., 8 is an allocation model. Given that the weighted first-order moment of the prediction errors is zero, it is natural to measure their dispersion by the corresponding weighted second-order moment, \({\sum\nolimits_{i{\text{ = 1}}}^{\text{8}} {w_{i} e^{2}_{i} } }\). This weighted mean-squared error (MSE) is a measure of the quality of predictions, with higher values indicating poorer performance. A commodity decomposition of the MSE is \(w_{i} e^{2}_{i} /{\sum\nolimits_j {w_{j} e^{2}_{j} } }\), i=1,...,8, and these shares are given in percentage form in columns 2–9 of Table 6, together with the square root of the MSE (RMSE) in column 10. Averaging over all countries, we find that transport represents the largest contributor to the MSE, which is then followed by other. Looking at the RMSEs of column 10, we see that although for some poor countries (such as Israel, Greece, and South Africa) the quality of the predictions is much better than that for some rich countries, on average the predictions for the rich are considerably better. The second and third last entries of column 10 show that the average RMSE for the poor countries is more than double that of the rich.

The RMSEs in Table 6 tell us about the quality of the predictions from the demand Eq. 5.1 for i=1,...,8. These demand equations are implemented with country-specific coefficients for the trend terms α i , income elasticities η i and price elasticities η ij . To analyse the importance of these determinants, we start by setting all the coefficients in Eq. 5.1 equal to zero, and then compute the associated MSE. In this case, the MSE equals \({\sum\nolimits_{i{\text{ = 1}}}^{\text{8}} {w_{i} {\text{D}}q^{2}_{i} } }\), where Dq i is the actual log-change, so that the MSE is equivalent to a (weighted average of the) total sum of squares. The square root for this measure for all 45 countries is given in column 2 of Table 7. Column 3 of this table gives the RMSEs when the eight income elasticities are specified as unity and the other coefficients zero. Column 4 reveals that in all cases the RMSEs fall when setting η i =1, although in a handful of countries the fall is minimal (Venezuela, Hungary, Fiji, Iran and Jamaica). Averaging over the 45 countries, the RMSE falls from 2.99 to 1.47% when consumption is allowed to be proportional to income. Next, column 5 gives the RMSEs corresponding to all the coefficients taking their previous country-specific values, so that this column coincides with column 10 of Table 6. We give in column 6 of Table 7 the changes in the RMSEs in going from column 2, where all coefficients are zero, to column 5, where the country-specific coefficients are used. Several comments can be made regarding the results of column 6. First, the RMSEs fall in all cases except two—Venezuela and Hungary. This could possibly be taken as evidence against the assumption of preference independence for these countries, or it could be related to data problems. Whatever the cause, it seems sensible to treat these countries as outliers and disregard them in the subsequent analysis. Accordingly, the means given in the last two entries in columns 5 and 6 exclude these two countries.

A second point to make about the results of column 6 of Table 7 is that in addition to the above two cases, for four countries the RMSEs increase when moving from column 3, where η i=1, to column 5. These countries are Cyprus, Portugal, Mexico and India. While a case can be made that these countries should also be treated as outliers, in what follows we shall leave them in as their “problems” are not nearly as severe as those of the previous group of countries. Third, averaging over all countries, the RMSE falls from 2.99 to 0.64%, or by almost 80%, when using the demand model, as can be seen from the last entries of columns 2 and 5 of Table 7. For the rich and poor groups of countries, the model accounts for 86 and 69% of the total variation, respectively. Fourth, the last row of the Table 7 provides the basis for the rough rule of thumb that for all countries, allowing consumption to be proportional to income accounts for about one-half of the total variation in consumption patterns, while using the coefficients of the demand model explains a further one-half of the remaining one-half. This rule of thumb thus involves an explanation of about 1/2+1/2×1/2=3/4 of the total variation in consumption. As discussed above, the actual reduction in the average RMSE is almost 80% (from 2.99 to 0.64), which shows that the rule of thumb is not too inaccurate. Taken as a whole, these findings seem to indicate that a substantial part of international consumption patterns can be explained by a simple demand model. In other words, once the influences of differences in incomes and prices are controlled for, only a limited amount of residual variation in cross-country consumption patterns remains.

Disparities in tastes and groups of countries

In the previous section we used country-specific coefficients in the demand equations so that tastes were allowed to differ across countries. In making comparisons of consumption patterns between countries as different as the USA and Zimbabwe, where GDP per capita differs by a factor of almost 20, this may seem a natural way of proceeding. But on the other hand, if we were to use a strict model of Homo economicus, we would probably argue that the only determinants of cross-country disparities in consumption patterns are observable differences in real incomes and relative prices—not tastes. According to this view, ascribing differences in behaviour to differing tastes is a “fudge factor” as it is vacuous with no behaviour—no matter how unconventional—ruled out. A somewhat less stringent attitude is to regard models as only approximations to reality (at best), and accept the inevitability of omitted factors and that the world is likely to be more complex than any simple model.

Even if we agreed that allowing for cross-country differences in tastes is the appropriate way to proceed, identical tastes are still of interest as a base case as a comparison of the RMSEs associated with identical and different tastes is a way to quantify the role of tastes in explaining cross-country consumption. To implement identical tastes, we average over the 43 remaining countries the autonomous trends, income and price elasticities, and then renormalise so that the coefficients satisfy the aggregation constrains 5.3.Footnote 9 We then use these coefficients for each country to compute the RMSEs and column 3 of Table 8 contains the results. For comparison, column 2 of this table reproduces column 5 of Table 7, the RMSEs associated with different tastes, as measured by the country-specific coefficients. The last entry of column 4 of Table 8 shows that the hypothesis of identical tastes increases the RMSE by about 0.35 percentage points on average for all countries; and surprisingly in 11 countries the RMSE decreases with identical tastes. While this 0.35 percentage-point increase in the average RMSE may seem modest, it still involves a rise from 0.64% to 0.97%, an increase of more than one half.

Rather than postulating identical tastes in all countries, it would seem natural to consider groups of countries with the same tastes. We consider the rich and poor countries as two groups and apply the same approach as before.Footnote 10 Columns 5 and 6 of Table 8 contain the results. As can be seen from the last entry of column 6, the average increase in the RMSE is now 0.31 percentage points, whereas when all countries belong to the same group the rise was 0.35 percentage points, as discussed in the previous paragraph.

The division of the 43 countries into rich and poor groups is based on a comparison of their per capita GDP with that of the USA. A country whose per capita GDP is at least 50% that of the USA is declared to be “rich,” while all other countries are “poor.” As the basis for dividing up the world in this manner is admittedly rather arbitrary, it is useful to explore alternatives which have firmer analytical foundations. Even if we confine our attention to the problem of classifying the 43 countries into just two groups, there is a total of 43×42/2=903 possibilities. Obviously, putting some additional structure on the problem is desirable in the interests of manageability. To do this, we shall keep countries ranked by income and consider the following 42 alternative groupings:

Grouping | First group | Second group |

|---|---|---|

1 | Richest country | Remaining 42 countries |

2 | Top 2 richest countries | Remaining 41 countries |

⫶ | ⫶ | ⫶ |

42 | Top 42 richest countries | Remaining 1 country |

In essence, this approach lists the 43 countries in order of decreasing per capita GDP and uses a “dividing line” between the two groups that starts at the top of the list and then successively moves downward.

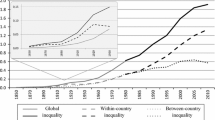

For all countries in a given group, we use the same set of trends and demand elasticities, and then evaluate the RMSE for each member of the group, as before. Accordingly, tastes are specified to be identical for countries within the same group, but they differ for countries in different groups. Finally, we judge the “quality” of a given grouping by averaging over the 43 countries the RMSEs so obtained. For the trends and demand elasticities for a group we use the averages over its members of the country-specific coefficients and then renormalise. Figure 2 plots the average RMSEs for each of the 42 possible groups and as can be seen, this criterion is minimised when the first 23 countries are included in one group, and the remaining 20 countries are in the other. As this grouping of countries minimises the heterogeneity of tastes within each of the two groups, in this sense it is the “optimal way” to divide up the world. The interesting result is that this optimal grouping is very close to the previous arbitrary grouping, whereby countries 1–25 were in the first group and the remaining 18 in the second. This result can be seen from column 7 of Table 8 which contains the individual country RMSEs associated with the optimal grouping. In the vast majority of cases, these RMSEs are close to the corresponding entries in column 5, the RMSEs associated with the previous arbitrary grouping.

A final way of grouping countries is as follows. For country c, let Dq c be a vector of log-change of quantities consumed; x c be a vector of income and price changes; and θ c be a vector of parameters comprising autonomous tends, income and price elasticities. We can then write the system of demand equations as Dq c=f(x c, θ c). When θ c is country-specific, tastes differ internationally; when θ c=θ, a vector of constants, tastes are identical; and when

the world is then divided into two groups of countries. These three cases have been considered above. An alternative approach, which is a mixture of the second and third cases, is when the parameter vector θ takes the same value for all countries, and is defined as a weighted average of that for the rich, θ r, and the poor, θ p:

where the scalar λ is the weight accorded to the rich, with 0≤λ≤1. Note that Eq. 6.1 treats all commodities symmetrically as the weight λ is neither commodity nor elasticity specific. For a related approach, see Clements and Ye (2003).

For a fixed value of the weight λ, we can define θ* from Eq. 6.1, use it in the demand system for each country, compute the RMSE (weighted by commodity, as before), and then average over all countries. This procedure can be repeated for various values of λ to determine the one that minimizes the average RMSE.Footnote 11 This yields λ=0.55, a value that has democratic attractions as rich and poor countries are treated approximately equally. The associated RMSEs for the individual countries are given in column 9 of Table 8. The values in this column are quite close to those of column 3, where tastes are specified as being identical. The reason for this result is as follows. The parameter vector associated with identical tastes is an average over the 43 countries of the individual-country vectors, \(\overline{\theta } = {\left( {1/43} \right)}{\sum\nolimits_{c = 1}^{43} {\theta ^{c} } }\), while those for the rich and the poor are also the corresponding averages, \(\theta ^{{\text{r}}} = {\left( {1/n_{{\text{r}}} } \right)}{\sum\nolimits_{c \in {\mathbf{S}}_{{\text{r}}} } {\theta ^{{\text{c}}} } }\), \(\theta ^{{\text{r}}} = {\left( {1/n_{{\text{p}}} } \right)}{\sum\nolimits_{c \in {\mathbf{S}}_{{\text{p}}} } {\theta ^{{\text{c}}} } }\), where n g is the number of countries contained in group g (g=r, p). It then follows that

where γ=n r/(n r+n p) is the share of the rich in the total number of countries. In our application, n r=25, n p=18, and n r+n p=43, so that γ=25/43≈0.58, which is quite close to the optimal value of λ, viz. 0.55. As Eq. 6.2 has the same from as Eq. 6.1 and as γ≈λ, it follows that \(\overline{\theta } \approx \theta {\text{*}}\), so that identical tastes approximate the linear combination of the rich and the poor.Footnote 12

Concluding comments

This paper has analysed similarities and differences in consumption patterns across countries. Using a large international database recently published by Selvanathan and Selvanathan (2003), we showed that consumption baskets have a distinct tendency to become more diversified as income rises, indicating a positive income elasticity of the demand for variety. But when we confine attention to just food and nonfood, the reverse happens as due to the operation of Engel’s law, consumers in rich countries have a distinct concentration on nonfood items, so that at this level the basket becomes more specialised. Using income and price elasticities from the Selvanathans, we demonstrated that a surprisingly large share of the overall variability of international consumption patterns can be explained by simple demand equations without having to resort to the old favorite “special case” arguments that have only post hoc justifications. In light of the large variability of cross-country consumption patterns, whereby food, for example, occupies more than one half of the overall budget in the poorest countries and only about 15% in the richest, this is quite a spectacular result.

Other key findings of the paper include:

-

Consumption in rich countries can be explained considerably better than that in poor. Conceivably, this could be due to inferior quality data produced by poor countries, although we cannot rule out other explanations such as for some reason or other, our modeling of the utility-maximising consumer is simply deficient for those countries. These alternatives could be usefully explored further in subsequent research.

-

As a rough rule of thumb, allowing consumption to be proportional to income explains about one-half of the total variation in consumption patterns, while using a conventional demand model explains a further one half of the remaining one-half. Accordingly, a respectable 1/2+1/2×1/2=3/4 of the total is accounted for.

-

The assumption that tastes are identical across countries seems to be too rigid, even for the broad aggregates such as food, clothing, housing, etc. Such an assumption substantially increases the degree to which consumption is unexplained and should be relaxed in future work on cross-country demand systems.

-

Dividing countries up into two groups, “the rich,” which have per capita GDPs of at least 50% that of the USA, and “the poor,” comprising all other countries, has some attractions. This partitioning of the world closely approximates an “optimal” structure, which minimizes the heterogeneity of tastes between countries belonging to the same group.

Notes

Apart from Selvanathan and Selvanathan (2003), other studies on international comparisons of consumption patterns include Clark (1940, 1957), Chen (1999), Clements and Chen (1996), Clements and Ye (2003), Clements and Selvanathan (1994), Houthakker (1957), Kravis et al. (1982), Lluch and Powell (1975), Lluch et al (1977), S. Selvanathan (1993), Theil (1987), (1996), Theil et al. (1989) and Theil and Suhm (1981).

PPP rates are either produced by the International Comparisons Project (see, e.g., Summers and Heston 1991) or by some other body such as the famous Big Mac Index published by The Economist magazine (see Ong 2003). A related approach is to use a measure of the “equilibrium exchange rate,” computed from either econometrically estimated trade/current account equations, or a computable general equilibrium model (see, e.g., Clark and MacDonald 1998; Driver and Westaway 2001; MacDonald 2000; Montiel and Hinkle 1999; Williamson 1994, and Wren-Lewis and Driver 1998). A recent innovation in this area is by Lan (2003) who relates the equilibrium exchange rate to the steady-state value associated with a simple time-series model of the deviations from PPP. More recently, Chua (2003) compares cross-country incomes on the basis of food consumption patterns.

Of course, it could be argued that the budget shares themselves reflect international differences in the price of traded goods relative to nontraded. In view of the degree to which the food budget share (the largest share in most instances) is related to income per capita across countries (Chua 2003; Theil 1987; Theil et al 1989), it seems that this problem is relatively minor when compared to the problems of using prevailing exchange rates when making international comparisons. Nevertheless, it should be acknowledged that no measure is perfect and this qualification should be kept in mind.

For a detailed description of the data, see Clements et al. (2004).

A referee has pointed out that the cross-country average of the food budget share of 32% is somewhat higher than that reported in Theil et al. (1989) using the dataset developed by Kravis et al. (1982). While the countries and time periods involved are not identical, it seems that a major reason for the difference is that the commodity “food” in this study includes beverages and tobacco (Selvanathan and Selvanathan 2003, pages 72 and 127), while in Theil et al. food excludes beverages and tobacco.

Another way of making the same point is in the two-good case where q i *=M/p i is the maximum quantity the consumer can purchase of i (i=1, 2) with income M. Suppose the consumer is indifferent between the two specialised baskets (q 1* , 0) and (0, q 2*), so that u(q 1*, 0)=u(0, q 2*), where u(.,.) is the utility function. For any positive fraction λ, we can define the diversified basket (λq 1*,(1−λ)q 2*), which is feasible as p 1 λq 1*+p 2(1−λ)q 2*=M. Convexity of indifference curves implies that the diversified basket is always preferred to specialisation, that is, u(λq 1*, (1−λ)q 2*)>u(q 1*,0)=u(0, q 2*). See Dixit and Stiglitz (1977).

The previously mentioned “problems” associated with food consumption in Zimbabwe and Sri Lanka are also manifest in columns 4 and 5 of Table 3. As the food budget share, w 1, for Zimbabwe is lower than that expected on the basis of its GDP, (1−w 1)=W 2 is higher, causing W 2 H 2 to also be higher, as indicated by the entry in row 45 of column 4 of Table 3. This in turn leads to the corresponding entry of column 5 to be lower. A similar argument, but in reverse, applies to Sri Lanka.

For a survey, see Clements and Selvanathan (1994, Sec. 9).

Here and subsequently, when we refer to prices elasticities averaged over countries, it is understood to mean the elasticities obtained from Eq. 5.2 for i, j=1,..., 8 evaluated with ϕ=−0.41 and the relevant cross-country averages of the income elasticities and budget shares.

We follow the previous approach of defining countries 1–25 as “rich” and the remaining 18 as “poor.”

This problem has a unique minimum as the average RMSE is quadratic in λ with positive second derivative.

It is worth mentioning that Theil and Moss (2003) consider the related problem of how a country qualifies for admission to the Group of Seven. This does not seem to be on the basis of population nor GDP per capita alone; e.g., the world’s most populous country, China, is not a member, while some rich countries, in GDP per capita terms, such as Norway, Switzerland and Australia, are also excluded. Accordingly, Theil and Moss postulate that eligibility for membership (E) is “produced” with inputs population (P) and GDP per capita (G) with constant returns to scale Cobb–Douglas technology, \(E{\text{ = }}P^{\delta } G^{{{\text{1 - }}\delta }} \), where δ is a parameter lying between zero and one. Theil and Moss seem to favour the value δ≈.2 and note that δ≈.5, whereby population and GDP are equally weighted, is too high as this amounts to eligibility being \(E{\text{ = }}{\sqrt {P{\text{ $ \times $ }}G} }\), which is increasing in total GDP, P×G.

References

Balasa B (1964) The purchasing-power parity doctrine: a reappraisal. J Polit Econ 72:584–596

Chen D-L (1999) World consumption economics. World Scientific, Singapore

Chua G (2003) Food and cross-country income comparisons. Discussion Paper No. 03–14, Economics Program, University of Western Australia, Perth

Clark C (1940) The Conditions of Economic Progress. Macmillan, London

Clark C (1957) The Conditions of Economic Progress. Macmillan, London and St. Martin’s Press, New York

Clark PB, MacDonald R (1998) Exchange Rates and Economic Fundamentals: A Methodological Comparison of BEERs and FEERs, IMF Working Paper 98/67. International Monetary Fund, Washington DC

Clements KW, Chen D-L (1996) Fundamental similarities in consumer behaviour. Appl Econ 28:747–757

Clements KW, Selvanathan S (1994) Understanding consumption patterns. Empir Econ 19:69–110

Clements KW, Theil H (1996)A cross-country analysis of consumption patterns. In: Theil H (ed)Studies in global economics. Kluwer, Dordrecht

Clements KW, Ye Q (2003) The economics of global consumption patterns. J Agric Appl Econ. (Suppl) 35:21–37

Clements KW, Wu Y, Zhang J (2004) Comparing international consumption patterns. Discussion Paper No. 04.04, Economics Program, University of Western Australia, Perth

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297–308

Driver R, Westaway PF (2001) Concepts of Equilibrium Exchange Rates. Mimeo, Bank of England

Friedman M (1956) The quantity theory of money—a restatement. In: Friedman M (ed) Studies in the Quantity Theory of Money, Chap. 1. University of Chicago, Chicago, pp. 3–21

Frisch R (1959) A complete scheme for computing all direct and cross demand elasticities in a model with many sections. Econometrica 27:177–196

Houthakker HS (1957) An international comparison of household expenditure patterns, commemorating the centenary of Engel’s law. Econometrica 25:532–551

Houthakker HS (1987). Engel’s law. In: Eatwelll J, Milgate M, Newman P (eds) The New Palgrave Dictionary of Economics. Macmillan, London. Volume 2, pp. 143–144

Keller WJ, van Driel J (1985) Differential consumer demand systems. Eur Econ Rev 27:375–390

Kravis IB, Heston AW, Summers R (1982) World product and income: international comparisons of real gross product. Johns Hopkins University, Baltimore

Laidler D (1991) The quantity theory is always and everywhere controversial: why?. Econ Rec 77:199–225

Lan Y (2003) The long-run behaviour of exchange rates. Unpublished Ph.D thesis. Economic Research Centre, Department of Economics, The University of Western Australia

Lluch C, Powell AA (1975) International comparison of expenditure patterns. Eur Econ Rev 5:275–303

Lluch C, Powell AA, Williams RA (1977) Patterns in household demand and saving. Oxford University Press, Oxford

MacDonald R (2000) Concepts to calculate equilibrium exchange rates: an overview. Discussion Paper 3/00. Economic Research Group, the Deutsche Bundesbank

Montiel PJ, Hinkle LE (1999) Exchange rate misalignment: an overview. In: Honkle LE, Montiel PJ (eds) Exchange rate misalignment: concepts and measurement for developing countries, Chap. 1. The World Bank, New York

Ong LL (2003) The Big Mac Index: applications of purchasing power parity, Macmillan, London

Samuelson PA (1964) Theoretical notes on trade problems. Rev Econ Stat 46:145–154

Selvanathan S (1993) A system-wide analysis of international consumption patterns. Kluwer, Boston, Dordrecht and London

Selvanathan EA, Selvanathan S (2003) International consumption comparisons: OECD versus LDC. World Scientific, Singapore

Summers R, Heston A (1991) The Penn world table (Mark 5): an expanded set of international comparisons. Q J Econ 106:327–368

Theil H (1967) Economics and information theory. North-Holland, Amsterdam

Theil H (1987) Evidence from international consumption comparison. In: Theil H, Clements KW (eds) Applied demand analysis: results from system-wide approaches, Chap. 1. Ballinger, Cambridge, MA pp 37–100

Theil H (1996) Studies in global economics. Kluwer, Dordrecht

Theil H, Finke R (1983) The consumer’s demand for diversity. Eur Econ Rev 23:395–400

Theil H, Moss CB (2003) Les Maîtres du Monde: The G-7’s path to prominence, 1885–1994. J Agri Appl Econ, Suppl 35:155–160

Theil H, Suhm FE (1981) International consumption comparisons: a system-wide approach. North Holland, Amsterdam

Theil H, Chung C-F, Seale JL Jr (1989) International evidence on consumption patterns. JAI, Greenwich and London

Williamson J (1994) Estimating equilibrium exchange rates. Institute for International Economics, Greenwich and London

Wren-Lewis S, Driver RL (1998) Real exchange rates for the year 2000. Institute for International Economics, Washington DC

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported in part by a grant from ACIAR. For excellent research assistance, we would like to acknowledge the help of Yihui Lan and Clare Yu; and for his support, stimulus and comments, we would like to acknowledge the help of Ray Trewin. In revising the paper, we have benefited from the comments of two anonymous referees and the research assistance of Stéphane Verani.

Rights and permissions

About this article

Cite this article

Clements, K.W., Wu, Y. & Zhang, J. Comparing international consumption patterns. Empirical Economics 31, 1–30 (2006). https://doi.org/10.1007/s00181-005-0012-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-005-0012-y