Abstract

This study aims to construct a sound theory of consumption convergence and empirically test its viability. To do this, we employ a Solovian framework in which the Keynesian exogenous savings-consumption allocation rule plays a crucial role. We demonstrate that consumption convergence performance is determined by both the average propensity to save (the indirect effect) and the average propensity to consume (the direct effect). In the empirical section, we use a system GMM estimator to test our consumption convergence equation on a panel data set of 177 countries and four income groups from 1970 to 2019. Our empirical findings indicate (i) absolute consumption convergence within high- and low-income country groups; (ii) strong evidence of conditional consumption convergence within high-, upper-middle-, and lower-middle-income groups; (iii) a robust and significant effect of the average propensity to save on the convergence process in high-, upper-middle-, and lower-middle-income groups; and (iv) a more robust and significant effect of the average propensity to consume in upper-middle- and lower-middle-income countries. In summary, we find that as income rises, the indirect impact plays a larger role in explaining consumption convergence, whereas the direct effect plays a smaller role. The policy implication of this conclusion is that policy makers in upper-middle- and lower-middle-income countries should restore the balance in the tradeoff between current and future consumption in favor of savings, as the former will harm consumption convergence within each middle-income group.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The income convergence argument has largely become the empirical cornerstone of neoclassical growth theory. The ongoing research on income convergence is looking for the drivers of income differences across countries. There is an obvious reason for this. According to the data on income per capita in constant 2015 U.S. dollars, the gap between high-income and other income groups has widened rather than narrowed through the period 1970–2019. The average per capita income during these 50 years was 29,492 dollars in high-income countries, 3854 dollars in upper-middle-income countries, 1245 dollars in lower-middle-income countries, and just 713 dollars in low-income countries (World Bank 2023a). In addition, low-income countries only received 1% of the worldwide per capita income in 2019, compared to 78% for high-income countries. In this context, research on convergence offers a useful tool for better understanding the factors that influence convergence and divergence patterns in living standards within income groups and for producing policy recommendations that could eventually help countries close their income gaps .

The aim of this work is to broaden the theoretical and empirical framework of income convergence by studying convergence in consumption expenditures. We are aware of the strong positive correlation between income and consumption. Thus, finding evidence of consumption convergence may be considered similar to finding evidence of income convergence. However, this is not true for two reasons. First, consumption spending reflects welfare, whereas income is supposed to represent living standards (Deaton 1992, 2003; Attanasio and Pistaferri 2016). Second, consumption is less prone to variations in trend than income (Hall 1978; Campbell and Deaton 1989). Therefore, even if there is a significant positive relationship between consumption and income, studying consumption convergence is different from analyzing income convergence. Accordingly, the primary goal of this work is to develop a theoretically supported consumption convergence equation and then examine whether, over a 50-year period, countries’ per capita consumption expenditures have converged globally and within four income categories.

A short summary of our study is as follows: Following the standard Solovian setup, we develop a consumption convergence equation conditional on the average propensity to save and the average propensity to consume, among others. We interpret the former as the indirect determinant of consumption convergence, as a higher savings rate stimulates consumption through elevated capital accumulation, and the latter as the direct determinant of consumption convergence, as it straightly stimulates consumption behavior. In the empirical part, over the period 1970–2019, we test the existence of both absolute and conditional convergence in per capita consumption expenditures globally for a panel of 177 countries and for four income groups. In each empirical test, we employ a dynamic panel data estimator, the system GMM, due to its superior features for convergence empirics. System GMM enables us to overcome some major issues faced by traditional cross-sectional and pooled panel estimators, including unobserved heterogeneity bias, the endogeneity of regressors, correlated individual effects, and potential measurement errors. Compared to other dynamic panel data estimators, it also provides a unique tool to obtain more efficient and robust estimates by allowing the inclusion of more instruments and improving precision, even when the panel is short (Blundell and Bond 2000). Some of the results of our study are as follows: First, there is absolute consumption convergence within high- and low-income country groups. Second, there is strong evidence of conditional consumption convergence within high-, upper-middle-, and lower-middle-income groups, shortly the three income groups from now on. Third, the average propensity to save is significant in explaining consumption convergence in the three income groups. Fourth, the average propensity to consume plays a more significant and apparent role in explaining convergence patterns in the upper-middle- and lower-middle-income groups. Lastly, when considering openness to trade as a control variable, the implied rates of convergence display varied patterns for each income group without a discernible trend.

The study contributes to the literature in five ways. First, we develop a novel consumption convergence equation via exploiting the well-established Solovian framework. The innovation in our approach is the use of the Keynesian savings-consumption allocation to derive the consumption convergence equation in the traditional Solovian framework. A limited number of studies in the literature empirically address this issue, but, to our best knowledge, none present a consumption convergence equation supported by a theory. Disappointingly, due to the lack of a theoretically supported convergence equation, they empirically mimic one-to-one the standard income convergence equation, ignoring the role of the direct effect in consumption convergence. Consequently, our study provides a testable, solid equation for studies on consumption convergence and fills an important gap in the growth literature. Secondly, this study uses aggregate per capita consumption expenditure to test convergence, unlike the majority of related studies, which instead employ a subset of consumer product categories. Third, we employ a more efficient and robust dynamic panel estimator, the system GMM, to overcome the shortcomings of the previous approaches. Fourth, compared to other studies, our empirical analyses cover a large global scale, a total of 177 countries, and four income groups to test consumption convergence patterns. Finally, our sample covers an extended period of 50 years.

The organization of the paper is as follows: The next section presents a brief literature review of the studies on consumption convergence. Section 3 develops a theory-backed consumption convergence equation. Section 4 explains the methodology, describes the data, and reports the empirical findings. Section 5 concludes the study and makes a policy suggestion.

2 Literature review

Following Solow (1956) and Swan (1956), a large number of growth studies have aimed to test the \(\beta\)-convergence hypothesis in per capita incomes across countries and revealed that the income convergence hypothesis is valid among structurally similar countries or regions (Sala-i-Martin 1990, 1996; Barro 1991; Mankiw et al. 1992; Barro and Sala-i-Martin 1991, 1992a, 1992b, 1995; Evans and Karras 1996, among others). Although income convergence was tested in a vast number of studies, there were far fewer empirical studies on consumption convergence in the related literature. Furthermore, only a minority of these have attempted to examine patterns of aggregate consumption expenditures. More importantly, none of these studies have provided a theoretical background. For instance, Carruth et al. (1999) analyzed convergence in aggregate per capita consumption expenditures for 15 EU countries over the period 1955–1992 by employing a generalized least squares (GLS) estimator. Their results showed no evidence of convergence across the EU countries. Dholakia and Talukdar (2004), using annual data from 22 major emerging economies and the U.S., investigated the convergence patterns in aggregate per capita consumption levels for the period 1993–1997. Taking the difference in aggregate consumption levels between the U.S. and other sample countries as the dependent variable, their findings showed that consumption expenditures in the emerging economies converge to those of the U.S. More recently, Das et al. (2016) investigated whether the levels of households’ consumption expenditures in 23 middle- and low-income countries are converging to those in 17 high-income countries for the period 1980–2013. In their study, they analyzed both absolute and conditional \(\beta\)-convergence, \(\sigma\)-convergence, and \(\gamma\)- convergence. The results of the study revealed that, if all 40 countries are included in the analysis, there is no evidence of absolute \(\beta\)- and \(\sigma\)-convergence across the sample countries, but there is significant conditional \(\beta\)- and \(\gamma\)- convergence. However, by income groups, their findings showed that all groups of countries are converging in an absolute sense.

The majority of the studies on consumption convergence have concentrated only on a subset of consumer product categories. As they are only slightly relevant to our study, we will only provide a brief overview of them. Smith et al. (1999), Wan (2005), Aizenman and Brooks (2008), and Holmes and Anderson (2017) investigated consumption convergence in alcohol products; Kramper (2000) in durables; Blandford (1984), Herrmann and Röder (1995), Gil et al. (1995), and Elsner and Hartmann (1998) in food consumption; Dholakia and Talukdar (2004) in soft drinks; Buongiorno (2009) in the consumption of forest products; and De Mooij (2003), Kónya and Ohashi (2007), Waheeduzzaman (2011), Nowak and Kochkova (2011), Michail (2020), and Ozturk et al. (2021) in a mix of multiple product categories.Footnote 1 All these studies used a small set of cross-sectional data to test the convergence patterns in consumption expenditures for a single product or product categories. Furthermore, instead of using aggregate measures, these studies generally used the sub-categories of consumer products to measure consumption expenditures, which in turn makes it difficult to assess the findings from a macro perspective. Moreover, the empirical approaches of these studies generally relied on cross-sectional and pooled panel methodologies, except for a few that used descriptive methods or unit root testing procedures. However, while cross-sectional approaches ignore the differences in the initial level of technology and assume that other regressors are constant for the entire sample period, pooled panel approaches suffer from heterogeneity and dynamic panel bias. Therefore, this study investigates whether aggregate per capita consumption expenditures converge across the globe and within four income groups over a 50-year period, deviating from previous consumption convergence research by employing a dynamic panel data estimator to test the convergence equation derived through exploiting the Solow growth model. Unlike the above studies, this study provides a testable, theory-backed equation of consumption convergence that considers not only the role of the average propensity to save but also to consume.

3 The model

Consider a closed Solovian economy in which the production function is defined as follows:

where \({Y}_{t}\) is the total output, \({K}_{t}\) is the physical capital, \({L}_{t}\) is the total labor force augmented by the technology \({A}_{t}\), \(\alpha\) is the output elasticity of the physical capital, and \(t\) represents time.Footnote 2 We assume that the output \({Y}_{t}\) is produced by the inputs \({K}_{t}\) and \({L}_{t}\) in Cobb–Douglas form. The Cobb–Douglas form guarantees that all factors of production are essential and that the real profit is zero. The total labor force \({L}_{t}\) and the technological progress \({A}_{t}\) are defined as \({L}_{t}={L}_{0}{e}^{nt}\) and \({A}_{t}={A}_{0}{e}^{xt}\), where \({L}_{0}\) and \({A}_{0}\) are the initial values and \(n\) and \(x\) are the exogenous growth rates of the labor force and technology, respectively.

Under the assumption of a closed economy without government, macroeconomic equilibrium implies that total output \({Y}_{t}\) is equal to aggregate expenditure, \({AE}_{t}={C}_{t}+{I}_{t}\), where \({C}_{t}\) and \({I}_{t}\) represent consumption expenditure and gross investment, respectively. As \({Y}_{t}\) is allocated between consumption expenditure \({C}_{t}\) and savings \({S}_{t}\), macroeconomic equilibrium implies a savings-investment identity, \({S}_{t}={I}_{t}\). Assume that, in accordance with the standard Solovian framework, savings are a fixed proportion of income, \({S}_{t}=s{Y}_{t}\), where \(0<s<1\) is a constant. Additionally, assume that gross investment is equal to net investment plus depreciation, \({I}_{t}={\dot{K}}_{t}+\delta {K}_{t}\), where \({\dot{K}}_{t}\) is the net investment, \(\delta\) is the depreciation rate, and a dot on top of a variable denotes the time derivative of the variable. The savings-investment identity can then be written as \(s{Y}_{t}={\dot{K}}_{t}+\delta {K}_{t}\). Therefore, \({\dot{K}}_{t}=s{K}_{t}^{\alpha }{\left({A}_{t}{L}_{t}\right)}^{1-\alpha }-\delta {K}_{t}\) is the fundamental equation of growth. Dividing both sides by \({A}_{t}{L}_{t}\) leads to \(\frac{{\dot{K}}_{t}}{{A}_{t}{L}_{t}}=s{\left(\frac{{K}_{t}}{{A}_{t}{L}_{t}}\right)}^{\alpha }-\delta \left(\frac{{K}_{t}}{{A}_{t}{L}_{t}}\right)\). Let us now define \({\widetilde{k}}_{t}=\frac{{K}_{t}}{{A}_{t}{L}_{t}}\), which implies \(\frac{{\dot{K}}_{t}}{{A}_{t}{L}_{t}}={\dot{\widetilde{k}}}_{t}+\left(n+x\right){\widetilde{k}}_{t}\). Hence, the capital accumulation function in terms of per effective capita is \({\dot{\widetilde{k}}}_{t}=s{\widetilde{k}}_{t}^{\alpha }-\left(n+\delta +x\right){\widetilde{k}}_{t}\), or \(\frac{{\dot{\widetilde{k}}}_{t}}{{\widetilde{k}}_{t}}=s{\widetilde{k}}_{t}^{\alpha -1}-\left(n+\delta +x\right)\) in growth form, where \(\frac{{\dot{\widetilde{k}}}_{t}}{{\widetilde{k}}_{t}}\) is the growth rate of capital per effective capita. We note that the production function in terms of per effective capita is \({\widetilde{y}}_{t}={\widetilde{k}}_{t}^{\alpha }\), where \({\widetilde{y}}_{t}=\frac{{Y}_{t}}{{A}_{t}{L}_{t}}\). It is well known that the capital accumulation function in terms of per effective capita does not lead to long-run growth and approaches the equilibrium value \({\widetilde{k}}^{*}={\left(\frac{s}{n+\delta +x}\right)}^{\frac{1}{1-\alpha }}\) at infinity, which immediately implies \({\widetilde{y}}^{*}={\left(\frac{s}{n+\delta +x}\right)}^{\frac{\alpha }{1-\alpha }}\).

Let us now derive the consumption-convergence equation. We first note that the log-differentiation of the production function is \(\frac{{\dot{\widetilde{y}}}_{t}}{{\widetilde{y}}_{t}}=\alpha \left(\frac{ {\dot{\widetilde{k}}}_{t}}{{\widetilde{k}}_{t}}\right)\), where \(\frac{{\dot{\widetilde{y}}}_{t}}{{\widetilde{y}}_{t}}\) is the growth rate of output per effective capita. Using \({\widetilde{y}}_{t}={\widetilde{k}}_{t}^{\alpha }\) to eliminate \({\widetilde{k}}_{t}\) and \(\frac{{\dot{\widetilde{k}}}_{t}}{{\widetilde{k}}_{t}}=\frac{1}{\alpha }\frac{{\dot{\widetilde{y}}}_{t}}{{\widetilde{y}}_{t}}\) to eliminate \(\frac{{\dot{\widetilde{k}}}_{t}}{{\widetilde{k}}_{t}}\) in the accumulation function in growth form, one obtains \(\frac{{\dot{\widetilde{y}}}_{t}}{{\widetilde{y}}_{t}}=\alpha \left[s{\widetilde{y}}_{t}^{\frac{\alpha -1}{\alpha }}-\left(n+\delta +x\right)\right]\). As the exogenous consumption-savings tradeoff implies \({C}_{t}=\left(1-s\right){Y}_{t}\) in aggregates or \({\widetilde{c}}_{t}=\left(1-s\right){\widetilde{y}}_{t}\) in terms of per effective capita, where \({\widetilde{c}}_{t}=\frac{{C}_{t}}{{A}_{t}{L}_{t}}\), the dynamic equation can also be expressed asFootnote 3:

Let us now rewrite Eq. (2) in its log form as \(\frac{dLn\left[{\widetilde{c}}_{t}\right]}{dt}=\alpha \left[s{\left(1-s\right)}^{\frac{1-\alpha }{\alpha }}{e}^{\left(\frac{\alpha -1}{\alpha }\right)Ln\left[{\widetilde{c}}_{t}\right]}-(n+\delta +x)\right]\equiv \phi \left(Ln\left[{\widetilde{c}}_{t}\right]\right)\). The first-order Taylor series approximation of this equation is \(\frac{dLn\left[{\widetilde{c}}_{t}\right]}{dt}\approx \phi \left(Ln\left[{\widetilde{c}}^{*}\right]\right)+{\phi }{\prime}\left(Ln\left[{\widetilde{c}}^{*}\right]\right)\left[Ln\left[{\widetilde{c}}_{t}\right]-Ln\left[{\widetilde{c}}^{*}\right]\right]\), where \({\widetilde{c}}^{*}=\left(1-s\right){\widetilde{y}}^{*}\). It is straightforward to show that \(\phi \left(Ln\left[{\widetilde{c}}^{*}\right]\right)=0\) and \({\phi }{\prime}\left(Ln\left[{\widetilde{c}}^{*}\right]\right)=-(1-\alpha )\left(n+\delta +x\right)\). Hence, the first-order Taylor approximation of Eq. (2) is \(\frac{dLn\left[{\widetilde{c}}_{t}\right]}{dt}\approx -v\left[Ln\left[{\widetilde{c}}_{t}\right]-Ln\left[{\widetilde{c}}^{*}\right]\right]\), where \(v=\left(1-\alpha \right)(n+\delta +x)\). The convergence rate is \(\frac{d({\dot{\widetilde{c}}}_{t}/{\widetilde{c}}_{t})}{dln({\widetilde{c}}_{t}/{\widetilde{c}}^{*})}\cong -v\), which shows the rate at which an economy’s consumption per effective capita approaches its steady-state value. Given \(v\), an economy farther (closer) to its steady-state level will have a higher (lower) growth rate. We observe that, given the effective depreciation rate, the higher the production elasticity of capital, the lower the convergence rate. The differential can be solved straightforwardly. To this end, let us first define \({z}_{t}=Ln\left[{\widetilde{c}}_{t}\right]\) and \(b=\nu Ln\left[{\widetilde{c}}^{*}\right]\), which allows us to express the above equation as \({\dot{z}}_{t}=-\nu {z}_{t}+b\). After applying the integrating factor method, \(Ln\left[{\widetilde{c}}_{t}\right]=Ln\left[{\widetilde{c}}^{*}\right]+{e}^{-\nu t}con\) is obtained, where \(con\) represents an arbitrary constant. Finally, following Islam (1995), assume that \({t}_{1}\) and \({t}_{2}\) are two points in time such that \({t}_{2}>{t}_{1}\) and \(\tau ={t}_{2}-{t}_{1}\). Subsequently, one can obtain the following consumption-convergence equation:

Replacing the value for \(Ln\left[{\widetilde{c}}^{*}\right]\) and transforming Eq. (3) into per capita terms gives

In Eq. (4), \({c}_{t}\) is the real per capita consumption. Hence, the left-hand side of Eq. (4) is the growth rate of per capita consumption, and the determinants of conditional consumption convergence are on the right-hand side of the equation. We call the coefficient of \(Ln\left[s\right]\) the indirect effect and the coefficient of \(Ln\left[1-s\right]\) the direct effect. We call the former the indirect effect because it stimulates consumption convergence by increasing production through capital accumulation, and we call the latter the direct effect because it fosters consumption convergence directly. The introduction of the direct effect is the novelty of the consumption convergence equation in our study.

4 Methodology, data, and findings

The following dynamic panel specification is used to empirically test the consumption convergence equation given in Eq. (4)Footnote 4:

In Eq. (5), the dependent variable is the log of real per capita consumption at each time period \(\tau\).Footnote 5\({\beta }_{1}={e}^{-\nu \tau }\) is the coefficient of the log of the previous period’s per capita consumption and is theoretically expected to be \({0<\beta }_{1}<1\) in line with the convergence idea.Footnote 6\({\beta }_{2}=\frac{\alpha }{1-\alpha }\left(1-{e}^{-v\tau }\right)\) is the coefficient of the average propensity to save, \(aps\), the indirect determinant of consumption convergence, as its effect is observed only after accumulated capital increases consumption through increased production. We expect that \(aps\) has a positive effect on consumption convergence, i.e., \({\beta }_{2}>0\). \({\beta }_{3}=-\frac{\alpha }{1-\alpha }\left(1-{e}^{-v\tau }\right)\) shows the effect of the effective depreciation rate on consumption, which is the population growth rate augmented by the country- and year-specific depreciation rates plus the rate of technological progress and is expected to be negative. \({\beta }_{4}=\left(1-{e}^{-v\tau }\right)\) is the coefficient of the average propensity to consume, \(apc\), which we consider the direct determinant of consumption convergence as it straightly affects consumption. We expect that \({\beta }_{4}>0\). \({Z}_{i, t}\) represents the vector of control variables, which includes trade openness in our case and is expected to have a positive effect on per capita real consumption expenditures. Furthermore, \({\mu }_{i}=\left(1-{e}^{-v\tau }\right) ln\left({A}_{0}\right)\) corresponds to the unobserved effects on total factor productivity due to country-specific omitted factors, and \({\phi }_{t}= x\left({t}_{2}-{e}^{-v\tau }{t}_{1}\right)\) captures the impact of a potentially wide set of macroeconomic shocks occurring in period \(t\) on consumption that are common to all countries in the sample, i.e., country- and time-specific fixed effects, respectively. Lastly, \({\varepsilon }_{i, t}\) denotes the idiosyncratic shocks, \(i\) indicates the cross-sectional units, each \(\tau\) corresponds to a 3-year period, and \(t\) denotes non-overlapping time points.

4.1 Methodology

The system GMM approach, a dynamic panel data methodology developed by Arellano and Bover (1995) and Blundell and Bond (1998), is employed in this study to estimate the consumption convergence equation given in Eq. (5). The system GMM estimator, which produces more reliable estimates compared to other panel data estimators, is highly recommended in empirical growth models due to its superior finite sample properties (Blundell and Bond 1998; Bond et al. 2001; Roodman 2009b). For instance, OLS and Within-Group (WG) estimators produce biased and inconsistent estimates in a dynamic panel data framework.Footnote 7 The omission of unobserved heterogeneity causes OLS estimates to be upwardly biased due to a positive correlation between the lagged dependent variable and the error term containing unobserved individual-specific effects (Hsiao 1986). On the other hand, the WG estimator produces a downwardly biased estimate of the coefficient on the lagged dependent variable due to a dynamic panel bias originating from the correlation between the lagged dependent variable and the error term in the elimination process of unobserved heterogeneity when the time dimension is fixed (Nickell 1981). Furthermore, the estimator also results in an endogeneity bias in cases where the panel is short, particularly because of the inclusion of the lagged dependent variable among other potential sources of endogeneity.

Several dynamic panel estimators have been developed prior to system GMM to overcome the deficiencies of the previous approaches. However, although these estimators offer a partial solution to the problem of endogeneity, they all suffer from a finite sample bias and low precision in cases where the individual series are highly persistent, the instruments are weak, and the time dimension is fixed (Blundell and Bond 2000; Blundell et al. 2001; Mátyás and Sevestre 2008). For instance, the coefficient of the lagged dependent variable estimated by the difference GMM tends to be downward biased towards the WG estimator when the instruments are weak and the number of observations in the time dimension is small (Blundell and Bond 1998; Bond et al. 2001; Bond 2002). In this sense, the system GMM estimator is more efficient than the difference GMM estimator since it (i) allows the inclusion of more instruments by assuming that the first differences of the instruments are uncorrelated with the fixed effects (Roodman 2009a), (ii) uses extra moment conditions suggested by Ahn and Schmidt (1995, 1997), which dramatically improve the precision of the standard first difference estimators, and hence (iii) reduces the finite-sample bias and improves the precision, even for short panels and highly persistent series (Blundell and Bond 2000; Bond et al. 2001).

Accordingly, this study employs the system GMM approach, which has become more prevalent in convergence studies in recent decades (Levine et al. 2000; Bond et al. 2001; Hoeffler 2002; Ding and Knight 2009, 2011, among others). It is designed for micro panels and allows the regression equation to include (i) independent variables that are not strictly exogenous and (ii) individual fixed effects by assuming no correlation between the first-differenced instrumental variables and the fixed effects (Blundell and Bond 1998). It further provides consistent and efficient parameter estimates in the presence of heteroscedasticity and autocorrelation within individuals (Roodman 2009a). The consistency of the system GMM depends on the validity of the following four key conditions: First, there should be no second-order serial correlation (\(AR(2)\)), although first-order autocorrelation (\(AR(1)\)) may be expected due to the inclusion of the lagged dependent variable. To check for this condition, the Arellano and Bond (1991) test is applied to the disturbances in differences to detect the first- and second-order autocorrelation under the null hypothesis of no autocorrelation. Second, the instruments should not be correlated with the error term. Hence, the validity of the instrument set is tested by using the Hansen (1982) \(J\)-test of over-identifying restrictions under the null hypothesis that the error terms are uncorrelated with the instruments.Footnote 8 Third, the additional moment restrictions proposed by Blundell and Bond (1998) must be valid. Therefore, the difference-in-Hansen test is used to test the validity of these additional moment conditions. Lastly, as a rule of thumb, the number of instruments must be less than or equal to the number of groups to avoid overfitting endogenous variables (Roodman 2009b).

4.2 Data

This study employs a panel data set of 177 countries, the global sample, over a 50-year period (= 17 time points) between 1970 and 2019. The sample is further divided into four income groups (high, upper-middle, lower-middle, and low) according to the World Bank’s classification for 2019 (World Bank 2023b).Footnote 9 Consequently, Eq. (5) is estimated both for the global sample, which includes all 177 countries, and also for the four income groups.Footnote 10 The real per capita consumption (\({c}_{i, t}\)) is calculated by dividing the real consumption (in millions, 2017 US dollars) by the total population (in millions). The percentage share of gross capital formation at current purchasing power parities (PPPs) is used as a proxy for the average propensity to save (\({aps}_{i,t}\)). The effective depreciation rate, \({n}_{i,t}+{\delta }_{i,t}+x\), is obtained as the sum of the population growth rate (\({n}_{i,t}\)) calculated from the data on total population (in millions) plus country- and year-specific average depreciation rates of the capital stock (\({\delta }_{i,t}\)) and the rate of technological progress, which is assumed to be 0.02 following Mankiw et al. (1992). Two different measures are used for the average propensity to consume: the percentage share of real consumption in real income (\({apc}_{i,t}^{1}\)) and the percentage share of household consumption at current PPPs (\({apc}_{i,t}^{2}\)). The \({apc}_{i,t}^{1}\) data is produced by calculating the percentage share of real consumption (\({c}_{i,t}\)) in real GDP (\({rgdp}_{i, t})\), measured at constant 2017 US dollars. Both measures are alternately included in the empirical analyses and are expected to have a positive impact on the log of real per capita consumption. Trade openness (\({open}_{i, t}\)) is also included in the analyses as a control variable and is calculated as the sum of the percentage shares of merchandise exports and imports at current PPPs over real GDP. Our motivation to include openness as a control variable is the globalization trend in the last 50 years, which may affect consumption patterns by increasing product variety, lowering prices, enhancing efficiency and productivity, and inducing technology transfer. All data were obtained from the Penn World Table (PWT) database, version 10.01, compiled by Feenstra et al. (2015).Footnote 11 Table 1 below reports the descriptive statistics of the annual data on sample variables.Footnote 12

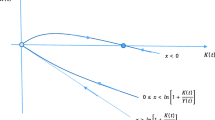

Figure 1 below provides scatter plots of the average growth rate of per capita consumption between 1970 and 2019 against the log of per capita consumption in 1970 for high- and low-income country groups, the two extreme income groups, for the matter of illustration. In the figure, the average growth rate of per capita consumption for the 1970–2019 period is shown on the vertical axis and the log of per capita consumption in 1970 on the horizontal axis. Accordingly, for both high- and low-income country groups, the average growth rate of per capita consumption over the period 1970–2019 is negatively related to the log of per capita consumption in 1970, indicating that absolute \(\beta\)-convergence in per capita consumption expenditures exists for both income groups.

Absolute consumption convergence across high-income vs. low-income country groups: 1970–2019. Source Feenstra et al. (2015), PWT 10.01

The study further uses non-overlapping time intervals widely used in convergence analysis to remove cyclical effects. Compared to annual data, this approach allows for the reduction of serial correlation among error terms and the minimization of the effects of temporary shocks related to business cycle fluctuations (Islam 1995; Caselli et al. 1996; Hoeffler 2002). Although there is no consensus on the determination of the time intervals, shorter intervals are more likely to obtain more series variation than longer intervals (Islam 1995; Bond et al. 2001; Ding and Knight 2009). Therefore, we opt for non-overlapping 3-year time intervals to express the time dimension of our sample data. After employing 3-year span data on 50 years, we end up with 17 time points (1972, 1975, 1978, …, 2017, 2019). Hence, our final dataset includes a total of 177 countries, further divided into four income groups, and 17 time points for each country. All variables are used in their natural logarithms in the estimations.

4.3 Findings

Tables 2, 3, 4, and 5 represent the results of system GMM estimations. In each table, column (1) provides the estimation results for absolute consumption convergence. Columns (2) and (4) explore conditional consumption convergence that considers the effects of \(aps\), \({apc}^{1}\) or \({apc}^{2}\), and the effective depreciation rate.Footnote 13 Columns (3) and (5) include trade openness as a control variable. In all regressions, the dependent variable is the log of real per capita consumption, and the lagged log of real per capita consumption is treated as predetermined. In each table, in columns (2)–(5), all independent variables, including the effective depreciation rate, are treated as endogenous regressors, that is, assumed to be correlated with shocks to real per capita consumption both in the current and previous time periods, following Bond et al. (2001).

In each estimation, we employ a one-step estimator. Although it is argued that the two-step estimator is always more efficient, several studies show that it results in seriously misleading asymptotic \(t\)-ratios compared to the one-step estimator (Bond 2002, p. 147). Furthermore, the efficiency gains from using the two-step estimator are very small for the system GMM, and the one-step estimator is more reliable for finite sample inference, even in the presence of non-normality and considerable heteroskedasticity (Blundell and Bond 1998, p. 142). Therefore, our findings are based on the one-step system GMM estimator as in the studies of Bond et al. (2001), Blundell et al. (2001), and Ding and Knight (2009), among others. Additionally, since the GMM estimators assume that the disturbances are uncorrelated across individuals, time dummies are included in all regressions to prevent the most likely form of contemporaneous correlation (Roodman 2009a).

The bottom parts of Tables 2, 3, 4, and 5 provide the \(p\)-values of the test statistics to verify the consistency of the system GMM results. Accordingly, in Tables 2, 3, 4, and 5, the \(p\)-values of the Arellano-Bond test statistics for first- and second-order autocorrelation (\(AR(1)\)) and (\(AR(2)\)) show that there is no second-order serial correlation, but a first-order serial correlation is observed in each case. Secondly, the \(p\)-values of the Hansen and difference-in-Hansen test statistics show that the instruments and their subsets are all valid in each estimation. Lastly, the number of instruments is less than or equal to the number of groups in all estimations.

Our empirical findings are as follows: Column (1) of Tables 2, 3, 4, and 5 shows the findings on absolute consumption convergence. The results show that the countries in the global sample converge at an estimated rate of about 0.1%, which is relatively low but consistent with the heterogeneity of the fundamentals across the countries in the sample. For high- and low-income groups,Footnote 14 the findings show that the coefficient of lagged log of per capita consumption is less than one and significant, indicating absolute consumption convergence within high- and low-income country groups. According to the results, high-income countries absolutely converge, with an estimated convergence rate of about 3.3% per period, and low-income countries converge at about 2.6% per period. On the other hand, for upper-middle- and lower-middle-income countries, our findings do not indicate absolute consumption convergence.Footnote 15

Columns (2) and (3) of Tables 2, 3, 4, and 5 provide the results for conditional consumption convergence using the percentage share of real per capita consumption in per capita income, \({apc}^{1}\), as a measure of average propensity to consume. The findings in column (2) show that the coefficient of lagged log of per capita consumption is highly significant and less than one in each of Tables 2, 3, 4, and 5. Among income groups, the highest convergence rate is obtained for the high-income country group. This group conditionally converges with an estimated rate of about 5.7% per period, while upper-middle- and lower-middle-income countries have estimated rates of about 3.7% and 2.7% per period, respectively. According to the results, \(aps\) has a positive and significant effect on the convergence process of real per capita consumption expenditures in the global sample and in the three income groups (high-, upper-middle, and lower-middle). As expected, the estimated coefficient of \(aps\) is larger in magnitude for high-income countries compared to upper-middle- and lower-middle-income countries. The coefficient of \({apc}^{1}\) is positive and significant for both upper-middle- and lower-middle-income groups and for the global sample, but positive and insignificant for the high-income group. The coefficient of the effective depreciation rate is positive and significant for the high-income country group and insignificant for the other groups.

Column (3) of Tables 2, 3, 4, and 5 provides the results for conditional consumption convergence when trade openness is included in the regressions as a control variable. The coefficient of lagged log of per capita consumption is significant and less than one for the three income groups and for the global sample, indicating that there is conditional consumption convergence. Although the coefficient of trade openness is significant only for the global sample, its inclusion raises the implied convergence rates in both the upper-middle-income group and the global sample. For the three income groups, \(aps\) has a positive and significant effect on the convergence process of real per capita consumption expenditures. The coefficient of \({apc}^{1}\) is positive and significant for both upper-middle- and lower-middle-income groups, but it is the largest in magnitude for the latter. The coefficient of the effective depreciation rate is only significant for the high-income group and for the global sample.

Columns (4) and (5) of Tables 2, 3, 4, and 5 show the estimation results for conditional consumption convergence when \({apc}^{2}\), the percentage share of household consumption at current PPPs, is used as a proxy for \(apc\). Column (4) shows evidence of conditional consumption convergence in the three income groups and in the global sample. As in column (2), the highest convergence rate is obtained for high-income countries, and the lowest rate is obtained for the global sample. The findings indicate that high-income countries converge at an estimated rate of about 4.3% per period, while lower-middle-income countries converge at a rate of about 2.8% per period. The coefficient on \(aps\) is positive and significant for the global sample and for the three income groups. However, similar to the findings in column (2), the magnitude of the coefficient of \(aps\) is larger in high-income countries compared to upper-middle- and lower-middle-income countries. On the other hand, as in column (2), the effect of \({apc}^{2}\) is found to be positive and significant for upper-middle- and lower-middle-income countries and for the global sample but insignificant for high-income countries. The highest coefficient of \({apc}^{2}\) is obtained for the lower-middle-income country group. The coefficient of the effective depreciation rate is negative and significant for the lower-middle-income country group and insignificant for the other groups.

Lastly, column (5) of Tables 2, 3, 4, and 5 provides the results for conditional consumption convergence when regressions are controlled for openness to trade. The coefficient of lagged log of per capita consumption is significant and lies below one for the three income groups and for the global sample, implying conditional convergence in per capita consumption expenditures. The findings show that openness to trade has a significantly positive effect on explaining the convergence process of the global sample and the high-income group. Its inclusion raises the implied convergence rates in all sample groups but decreases this rate in the lower-middle-income group. The effects of \(aps\) are positive and significant for the three income groups and the global sample, as in column (3). In this case, the highest significant and positive contribution of \(aps\) is obtained for the high-income group. As in column (3), the effects of \({apc}^{2}\) are positive and significant for upper-middle- and lower-middle-income countries but positive and insignificant for the high-income group and for the global sample. Notably, the largest and most significant coefficient of \({apc}^{2}\) is obtained for the lower-middle-income group. Finally, the coefficient of the effective depreciation rate is negative and significant only for lower-middle-income countries and for the global sample.

It is reasonable to wonder if our conclusions would have been different if the theoretical model had been based on an open economy when evaluating the robustness of our findings. This critique is warranted because, since the late 1980s, most countries have become more open due to the trend of globalization than they were previously. For three reasons, we believe that our empirical results are at least able to capture the open-economy extension of the Solow model. First, in fact, we use the investment rate in our empirical analyses as a proxy for the savings rate. Since it is essentially irrelevant who funds investment expenditures in a domestic economy, we think the investment rate is a far more resilient variable to the openness objection. Second, we are aware of the strong empirical correlation between domestic savings and investment, at least since Feldstein and Horioka (1980). This remains valid regardless of most countries being highly open to international trade and international capital flows (please see Apergis and Tsoumas (2009) for a literature survey, Chang and Smith (2014) and Ko and Funashima (2019) for recent empirical applications). This suggests that the investment rate may serve as a good proxy for the savings rate. Third, even though the theoretical model presupposes a closed economy, our empirical analyses include openness as a control variable.

5 Concluding remarks and policy implications

This study contributes to understanding the determinants of convergence in per capita consumption expenditure. The theoretical part uses a Solovian setup relying on the Keynesian exogenous savings-consumption allocation rule to obtain the consumption convergence equation. The theoretical findings show that the growth rate of per capita consumption depends on the lagged per capita consumption, the average propensity to save, the effective depreciation rate, and the average propensity to consume in the transitional period. The empirical part provides the system GMM estimates for 177 countries as a whole and for four income groups over the period 1970–2019. Our empirical findings confirm the validity of the consumption convergence hypothesis. A short summary of our empirical findings is as follows: First, there is absolute consumption convergence within high- and low-income country groups. Second, all groups included in the analyses exhibit conditional convergence, regardless of the definition of \(apc\) or whether the control variable is included or not in the analyses. Our findings provide support for absolute and faster conditional consumption convergence among high-income countries, consistent with empirical evidence on income convergence. Third, \(aps\) has a significant and positive effect on the consumption convergence process in all estimations for all income groups. Fourth, both \(apc\) positively and significantly explain the convergence process of upper-middle- and lower-middle-income countries. However, their effects are insignificant for high-income countries. Fifth, adding trade openness raises the implied rates in the global sample and upper-middle-income countries while reducing them in lower-middle-income countries.

Savings is a major determinant of the growth of future income and consumption, while current consumption is the major determinant of current welfare. In accordance with this statement, our results lead us to expect in the future either a slower convergence or even a persistent divergence in consumption convergence within upper-middle- and lower-middle-income countries, given that \(aps\) plays a larger role in explaining consumption convergence as income rises and that both measures of \(apc\) clearly contribute to the process of consumption convergence only within upper-middle- and lower-middle-income countries. The policy implication of this conclusion is that policy makers in upper-middle- and lower-middle-income countries should restore the balance in the tradeoff between current and future consumption in favor of savings.

Certainly, the study can be extended in several directions. The current study purely focuses on testing the existence of \(\beta\)-convergence in per capita consumption expenditures for four income groups. In a future study, the stochastic and local convergence patterns of consumption expenditures can be examined to further explore the issue at hand and derive more detailed policy implications. In this sense, future research could include examining local convergence patterns by identifying sub-groups within income categories, for example, using the regression tree technique, which allows us to select endogenously the most important variables in achieving the best group identification in order to avoid the group selection bias problem. Secondly, we are aware of the fact that our existing results should be interpreted with caution as, on theoretical grounds, they are built on a closed economy model without government. Therefore, future research is also needed to examine how the patterns of consumption convergence would change if the economy was open to international trade and/or there was government in the model.

Notes

The labor force and population are assumed to be the same, just like in the standard Solow model.

We are aware that the sum of the average propensity to consume (apc) and the average propensity to save (aps) does not equal unity when the model is expanded, for example, by including public spending and/or international trade. Adding one or both to the model, however, does not only lead to a deviation of apc from \(1-aps\) but also distorts the entire setup. As an example, suppose that there is a government in the model. The macroeconomic equilibrium implies \({Y}_{t}={C}_{t}+{I}_{t}+{G}_{t}\), where \({G}_{t}\) represents government expenditure, and the saving-investment identity becomes \({S}_{t}+\left({T}_{t}-{G}_{t}\right)={I}_{t}\) , where \({S}_{t}\) is savings and \({T}_{t}\) is taxes net of transfers and interest on the government debt. Clearly, it is not anymore possible to assume that \(apc=1-aps\), as \(\frac{{S}_{t}}{{Y}_{t}}+\frac{\left({T}_{t}-{G}_{t}\right)}{{Y}_{t}}=1-\frac{{C}_{t}}{{Y}_{t}}-\frac{{G}_{t}}{{Y}_{t}}\) for an unbalanced budget. Furthermore, \({\dot{K}}_{t}={Y}_{t}-{C}_{t}-{G}_{t}-\delta {K}_{t}\), which needs a definition of \({G}_{t}\) and will lead to a significant alteration in the consumption convergence equation. As a final note, the model is not interesting when tax revenue is proportional to income, \({T}_{t}=\tau {Y}_{t}\), where \(\tau\) is the income tax rate, and budget is balanced because then \({\dot{K}}_{t}=\left(1-\tau \right)s{Y}_{t}-\delta {K}_{t}\) and there is no qualitative change in the consumption convergence equation and the implied convergence rate. As a result, we avoid these extensions in this paper.

Although the left-hand side of Eq. (4) gives the growth rate of per capita consumption, following Islam (1995), we use its alternative form given in Eq. (5) in the empirical analyses to be able to employ a dynamic panel data model, which produces more efficient results in convergence studies (Islam 1995, p. 1136).

As in Eq. (3) and Eq. (4), \({t}_{1}\) and \({t}_{2}\) are two points in time such that \({t}_{2}>{t}_{1}\) and the time difference is constant between these two points, \(\tau ={t}_{2}-{t}_{1}\). In empirical analyses, we opt for non-overlapping 3-year time intervals to express the time dimension of our sample data and, hence, \(\tau ={t}_{2}-{t}_{1}=3\) in our analyses. This is a traditional practice in convergence studies following Islam (1995), in particular for the studies that use micro panels in their empirical analyses. In this study, we also use the system GMM, a dynamic micro-panel data methodology that is highly suggested for use in Solow convergence studies due to its superior features compared to its counterparts (Bond et al. 2001).

Note that \({\beta }_{1}>1\) implies divergence.

The Between-Group estimator also results in an upwardly biased estimate in a dynamic and short panel case (Mátyás and Sevestre 2008).

We argue that while choosing any year for country classification introduces a systematic bias, it would be the lowest in the final year of the sample period. This is because the number of countries initially classified in a lower income group and ended up in a higher income group would always be greater than the number of countries initially classified in a higher income group and ended up in a lower income group, consistent with the notion of convergence. In our sample dataset, we observed that the income classification of a total of 91 countries (out of 177) has remained unchanged; a total of 82 countries (out of 177) moved to a higher income group in 2019 compared to 1987, or the next most recent year, and a total of only 4 countries (out of 177) moved to a lower income group. Upon request, the authors may provide a more thorough examination of how economies have changed from one income category to another.

The list of sample countries (63 high-income, 47 upper-middle-income, 43 lower-middle-income, and 24 low-income) is provided in Table A1 in Appendix A.

In the study, we used PPP-based variables to control differences in price levels between countries. This enables us to make cross-country comparisons with a common currency. Furthermore, compared to market rates, using PPPs allows us to compare prices for non-traded products, which is particularly important in comparing high- and low-income countries. See Deaton and Heston (2010), Hsieh and Klenow (2007) for the strengths and weaknesses of using PPP, and Feenstra et al. (2013) for the main features and limitations of the PPP used in PWT.

We also removed outliers from the dataset using the box-and-whisker plot and the interquartile range (IQR) method.

To avoid any possible problem, we check for multicollinearity by using variance inflation factors (VIFs) as a rule of thumb. Our results show that the regression models do not suffer from a serious multicollinearity problem, as the mean VIF value is smaller than or equal to 1.97 in each case. Although the results are not provided to save space, they are available from the authors upon request.

There are 29 low-income countries, according to the income classification of the World Bank (2023b). However, we could only include 24 low-income countries in the analyses due to the lack of data. Hence, the number of low-income countries allows us to run only absolute convergence regressions for that country group since the number of instruments always becomes greater than the number of countries in conditional convergence regressions. Therefore, for the low-income country group, we are able to present only the results for absolute consumption convergence in column (6) of Table 5.

For upper-middle- and lower-middle-income countries, we applied a t-test to detect whether the coefficients of \(ln\left({c}_{i,t-1}\right)\) are significantly different from one and not just from zero. The results show that our coefficients are not statistically different from one (the test statistics are \(t=1.126\) for the upper-middle-income group and \(t=1.130\) for the lower-middle-income group).

References

Ahn SC, Schmidt P (1995) Efficient estimation of models for dynamic panel data. J Econ 68(1):5–27. https://doi.org/10.1016/0304-4076(94)01641-C

Ahn SC, Schmidt P (1997) Efficient estimation of dynamic panel data models: alternative assumptions and simplified estimation. J Econ 76(1–2):309–321. https://doi.org/10.1016/0304-4076(95)01793-3

Aizenman J, Brooks E (2008) Globalization and taste convergence: the cases of wine and beer. Rev Int Econ 16(2):217–233. https://doi.org/10.1111/j.1467-9396.2007.00659.x

Apergis N, Tsoumas C (2009) A survey of the Feldstein-Horioka puzzle: what has been done and where we stand. Res Econ 63(2):64–76. https://doi.org/10.1016/j.rie.2009.05.001

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297. https://doi.org/10.2307/2297968

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Attanasio OP, Pistaferri L (2016) Consumption inequality. J Econ Perspect 30(2):3–28. https://doi.org/10.1257/jep.30.2.3

Barro RJ (1991) Economic growth in a cross section of countries. Q J Econ 106(2):407–443. https://doi.org/10.2307/2937943

Barro RJ, Sala-i-Martin X (1991) Convergence across states and regions. Brook Pap Econ Act 22(1):107–182. https://doi.org/10.2307/2534639

Barro RJ, Sala-i-Martin X (1992a) Convergence. J Polit Econ 100(2):223–251. https://doi.org/10.1086/261816

Barro RJ, Sala-i-Martin X (1992b) Regional growth and migration: a Japan-United States comparison. J Jpn Int Econ 6(4):312–346. https://doi.org/10.1016/0889-1583(92)90002-L

Barro RJ, Sala-i-Martin X (1995) Technological diffusion, convergence, and growth. NBER working paper no. 5151. https://doi.org/10.3386/w5151

Blandford D (1984) Changes in food consumption patterns in the OECD area. Eur Rev Agric Econ 11(1):43–65. https://doi.org/10.1093/erae/11.1.43

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Economet Rev 19(3):321–340. https://doi.org/10.1080/07474930008800475

Blundell R, Bond S, Windmeijer F (2001) Estimation in dynamic panel data models: improving on the performance of the standard GMM estimator. In: Baltagi BH, Fomby TB, Hill RC (eds) Advances in econometrics, nonstationary panels, panel cointegration, and dynamic panels, vol 15. Emerald Group Publishing Limited, Bingley, pp 53–91. https://doi.org/10.1016/S0731-9053(00)15003-0

Bond SR (2002) Dynamic panel data models: a guide to micro data methods and practice. Port Econ J 1:141–162. https://doi.org/10.1007/s10258-002-0009-9

Bond S, Hoeffler A, Temple J (2001) GMM estimation of empirical growth models. Economics papers 2001-W21, Economics group, Nuffield College, University of Oxford

Buongiorno J (2009) International trends in forest products consumption: is there convergence? Int for Rev 11(4):490–500

Campbell J, Deaton A (1989) Why is consumption so smooth? Rev Econ Stud 56(3):357–373. https://doi.org/10.2307/2297552

Carruth A, Gibson H, Tsakalotos E (1999) Are aggregate consumption relationships similar across the European Union? Reg Stud 33(1):17–26. https://doi.org/10.1080/00343409950118887

Caselli F, Esquivel G, Lefort F (1996) Reopening the convergence debate: a new look at cross-country growth empirics. J Econ Growth 1(3):363–389. https://doi.org/10.1007/BF00141044

Chang Y, Smith RT (2014) Feldstein–Horioka puzzles. Eur Econ Rev 72:98–112. https://doi.org/10.1016/j.euroecorev.2014.09.001

Das RC, Das A, Martin F (2016) Convergence analysis of households’ consumption expenditure: a cross country study. In: Das R (ed) Handbook of research on global indicators of economic and political convergence. IGI Global, Hershey, pp 1–28. https://doi.org/10.4018/978-1-5225-0215-9.ch001

De Mooij M (2003) Convergence and divergence in consumer behaviour: implications for global advertising. Int J Advert 22(2):183–202. https://doi.org/10.1080/02650487.2003.11072848

Deaton A (1992) Understanding consumption. Oxford University Press, Oxford

Deaton A (2003) Household surveys, consumption, and the measurement of poverty. Econ Syst Res 15(2):135–159. https://doi.org/10.1080/0953531032000091144

Deaton A, Heston A (2010) Understanding PPPs and PPP-based national accounts. Am Econ J Macroecon 2(4):1–35. https://doi.org/10.1257/mac.2.4.1

Dholakia UM, Talukdar D (2004) How social influence affects consumption trends in emerging markets: an empirical investigation of the consumption convergence hypothesis. Psychol Mark 21(10):775–797. https://doi.org/10.1002/mar.20029

Ding S, Knight J (2009) Can the augmented solow model explain China’s remarkable economic growth? A cross-country panel data analysis. J Comp Econ 37(3):432–452. https://doi.org/10.1016/j.jce.2009.04.006

Ding S, Knight J (2011) Why has China grown so fast? the role of physical and human capital formation. Oxford Bull Econ Stat 73(2):141–174. https://doi.org/10.1111/j.1468-0084.2010.00625.x

Elsner K, Hartmann M (1998) Convergence of food consumption patterns between Eastern and Western Europe. Discussion paper no. 13, 3–43. Institute of Agricultural Development in Central and Eastern Europe (IAMO). http://nbn-resolving.de/urn:nbn:de:gbv:3:2-22737

Evans P, Karras G (1996) Convergence revisited. J Monet Econ 37(2):249–265. https://doi.org/10.1016/S0304-3932(96)90036-7

Feenstra RC, Inklaar R, Timmer MP (2015) The next generation of the Penn World Table. Am Econ Rev 105(10):3150–3182. https://doi.org/10.1257/aer.20130954

Feenstra RC, Inklaar R, Timmer MP (2013) PWT 8.0-a user guide. Groningen growth and development centre, University of Groningen

Feldstein M, Horioka C (1980) Domestic saving and international capital flows. Econ J 90(358):314–329. https://doi.org/10.2307/2231790

Gil JM, Gracia A, Pérez Y, Pérez L (1995) Food consumption and economic development in the European Union. Eur Rev Agric Econ 22(3):385–399. https://doi.org/10.1093/erae/22.3.385

Hall RE (1978) Stochastic implications of the life cycle-permanent income hypothesis: theory and evidence. J Polit Econ 86(6):971–987. https://doi.org/10.1086/260724

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50(4):1029–1054. https://doi.org/10.2307/1912775

Herrmann R, Röder C (1995) Does food consumption converge internationally? Measurement, empirical tests and determinants. Eur Rev Agric Econ 22:400–414. https://doi.org/10.1093/erae/22.3.400

Hoeffler AE (2002) The augmented solow model and the African growth debate. Oxford Bull Econ Stat 64(2):135–158. https://doi.org/10.1111/1468-0084.00016

Holmes A, Anderson K (2017) Convergence in national alcohol consumption patterns: new global indicators. J Wine Econ 12(2):117–148. https://doi.org/10.1017/jwe.2017.15

Hsiao C (1986) Analysis of panel data. Cambridge University Press, Cambridge

Hsieh CT, Klenow PJ (2007) Relative prices and relative prosperity. Am Econ Rev 97(3):562–585. https://doi.org/10.1257/aer.97.3.562

Islam N (1995) Growth empirics: a panel data approach. Q J Econ 110(4):1127–1170. https://doi.org/10.2307/2946651

Ko JH, Funashima Y (2019) On the sources of the Feldstein–Horioka puzzle across time and frequencies. Oxford Bull Econ Stat 81(4):889–910. https://doi.org/10.1111/obes.12293

Kónya I, Ohashi H (2007) International consumption patterns among high-income countries: evidence from the OECD Data. Rev Int Econ 15(4):744–757. https://doi.org/10.1111/j.1467-9396.2007.00676.x

Kramper, P (2000) From economic convergence to convergence in affluence? Income growth, household expenditure and the rise of mass consumption in Britain and West Germany, 1950–1974. Working paper no. 56/00, department of economic history, London School of Economics.

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46(1):31–77. https://doi.org/10.1016/S0304-3932(00)00017-9

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107(2):407–437. https://doi.org/10.2307/2118477

Mátyás L, Sevestre P (2008) The econometrics of panel data, fundamentals and recent developments in theory and practice, 3rd edn. Springer-Verlag, Berlin Heidelberg

Michail NA (2020) Convergence of consumption patterns in the European Union. Empir Econ 58:979–994. https://doi.org/10.1007/s00181-018-1578-5

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49(6):1417–1426. https://doi.org/10.2307/1911408

Nowak J, Kochkova O (2011) Income, culture, and household consumption expenditure patterns in the European Union: convergence or divergence? J Int Consum Mark 23(3–4):260–275. https://doi.org/10.1080/08961530.2011.578062

Ozturk A, Cavusgil ST, Ozturk OC (2021) Consumption convergence across countries: measurement, antecedents, and consequences. J Int Bus Stud 52:105–120. https://doi.org/10.1057/s41267-020-00334-w

Roodman D (2009a) How to do xtabond2: an introduction to difference and system GMM in stata. Stand Genomic Sci 9(1):86–136. https://doi.org/10.1177/1536867X0900900106

Roodman D (2009b) A note on the theme of too many instruments. Oxford Bull Econ Stat 71(1):135–158. https://doi.org/10.1111/j.1468-0084.2008.00542.x

Sala-i-Martin X (1990) On growth and states (doctorate thesis). Harvard University, Cambridge, MA

Sala-i-Martin X (1996) The classical approach to convergence analysis. Econ J 106(437):1019–1036. https://doi.org/10.2307/2235375

Sargan JD (1958) The estimation of economic relationships using instrumental variables. Econometrica 26(3):393–415. https://doi.org/10.2307/1907619

Smith D, Solgaard H, Beckmann S (1999) Changes and trends in alcohol consumption patterns in Europe. J Consum Stud Home Econ 23(4):247–260. https://doi.org/10.1046/j.1365-2737.1999.00115.x

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94. https://doi.org/10.2307/1884513

Swan TW (1956) Economic growth and capital accumulation. Econ Record 32(2):334–361. https://doi.org/10.1111/j.1475-4932.1956.tb00434.x

Waheeduzzaman AN (2011) Are emerging markets catching up with the developed markets in terms of consumption? J Glob Mark 24(2):136–151. https://doi.org/10.1080/08911762.2011.558812

Wan GH (2005) Convergence in food consumption in rural China: evidence from household survey data. Chin Econ Rev 16:90–102. https://doi.org/10.1016/j.chieco.2004.09.002

World Bank (2023a) World development indicators (WDI) 2023. https://databank.worldbank.org/source/world-development-indicators

World Bank (2023b) World bank country and lending groups 2019, Historical classification by income. https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups

Funding

No funds, grants, or other support was received.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Responsible Editor: Jesus Crespo Cuaresma.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yetkiner, H., Öztürk, G. & Taş, B. Consumption convergence: theory and evidence. Empirica 51, 619–643 (2024). https://doi.org/10.1007/s10663-024-09620-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-024-09620-4

Keywords

- Solow model

- Consumption convergence

- \(\beta\)-convergence

- Average propensity to save

- Average propensity to consume

- Dynamic panel data

- One-step GMM