Abstract

This paper investigates the survival of newly created small and medium enterprises in Brazilian manufacturing. It takes as a reference newly created firms in 1996 that are followed until 2005. The econometric analysis relies on a time-varying version of Cox’s proportional hazards model. The evidence mostly corroborates previous findings for developed countries. Salient results include the positive role played by firm size, industry size and industry growth on survival and the negative influence exerted by the minimum efficient scale and the suboptimal scale.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The potential role of smaller firms in employment creation is one of the most noticeable sources of motivation for the recurring interest in that segment, which has prompted the investigation of the factors that affect the survival of small and medium enterprises (SMEs). The empirical literature has focused on developed countries and has triggered controversies associated with size measurement and estimation issues (see e.g., Davis et al. 1996; Davidsson et al. 1998). The evidence seems to indicate, as expected, that the net job creation effect is likely to be stronger in service industries. Nevertheless, more recent studies also provide appealing evidence of particularly high net job creation by small firms in the manufacturing industry, as suggested by Hijzen et al. (2010) and Neumark et al. (2011). It is worth mentioning that in addition to the job creation aspect, a well-known stylized fact refers to the large mortality of smaller firms a few years after start-up (see Bartelsman et al. 2005).

This paper seeks to answer questions about firm survival that deserve further consideration in the literature: What are the determinants of survival for a start-up firm? Can survival probability be enhanced if the start-up size is increased? How is firm survival different in a large emerging market such as Brazil? Do regional disparities matter? Additionally, we consider looking into unobserved heterogeneity among firms, a generally ignored econometric topic in the discussion of survival. This process could yield results that are dissimilar to the current literature because this heterogeneity can underestimate duration dependence.

This subject is not only of interest for researchers. Entrepreneurs want to discern their survival prospects when entering a business and might be interested in recognizing the factors that can increase their chances of success (Mata and Portugal 2002). Policy makers also want to know what public policies can be most effective in fostering business and employment; government officials could use taxpayer money more productively if they could more efficiently target the firms with better chances.

Moreover, newly created firms (which often enter on a smaller scale) can provide important renewal incentives to their particular industry in terms of technological and organizational innovations that favor productivity improvements.

This paper considers the survival of newly created SMEs in the Brazilian manufacturing industry. There are two main contributions of the present study:

-

(a)

The literature and the available evidence on SMEs have focused primarily on developed countries. Exceptions include the descriptive study by Najberg et al. (2000), which shows an important employment effect of smaller firms in Brazil over the period 1995–1997, and the assessment of the hazards of small firms in southern Africa, as studied by McPherson (1995). The study of firm survival in a large emerging economy such as Brazil, which is characterized by the co-existence of modern and traditional sectors, may be of interest. In fact, the macroeconomic stabilization after 1994 greatly reduced economic uncertainty, and the lessening of institutional obstacles for firm creation since the 2000s appears to show a more favorable business environment. Moreover, simplified tax procedures were implemented for small businesses in the recent past.Footnote 1 Thus, in the period under consideration, different economic uncertainties that had been recurring in the Brazilian economy appear to have been mitigated. Therefore, the study of the determinants of newly created firm survival becomes more appealing in a less noisy economic environment.

-

(b)

Most of the previous studies on survival make use of a cross section of entrants’ data and derive the survival pattern using fixed covariates. Exceptions include panel data studies, such as those of Esteve-Pérez et al. (2004, 2008), which focus on the survival of exporting SMEs in Spain, explicitly control for unobserved heterogeneity (which might reflect, for example, unobserved firms’ organizational capabilities, network contacts, and access to specific assets) and suggest important policy aspects because it is crucial to clearly understand the determinants of firm survival in that segment.Footnote 2 Nevertheless, the interest on firm survival is not restricted to the specific segment of exporting firms, and thus a study focusing on SMEs in general, in the context of an emerging economy such as Brazil can be appealing.

The remainder of the paper is organized as follows. In Sect. 2.1, we introduce a brief review of the relevant literature. Section 2.2 will address the methodological aspects of our exercise, including the relevant econometric issues involved. Section 3 contains the promised application to Brazilian data, and Sect. 4 will offer final comments.

2 Firm survival: theoretical aspects

2.1 A brief review of the literature

Industrial dynamics seems to be characterized by fairly robust stylized facts that hold for different countries (see Geroski 1995, for a representative survey on entry patterns). Cabral (2007) highlights stylized facts on industrial dynamics in the context of small firms and thus is more tailored to motivate the present study. A first salient pattern refers to the existence of simultaneous entry and exit in each industry, indicating that idiosyncratic (firm-specific) shocks are likely to play an important role beyond the more aggregated (for example, sectoral) variables indicated in the related theoretical literature.

Second, a typical entrant is smaller than the industry average, and it grows faster than the industry average. A third stylized fact is that survival rates tend to increase with firm size and firm age. The aforementioned survey describes the Portuguese case as representative of generally robust stylized facts that would prevail for different industries and countries.

Table 1 provides a summary of the related studies for firm survival (or hazards) that may aid the motivation and interpretation of the empirical model adopted in the present paper.

To motivate the inspection of the contents of Table 1, it is worth detailing some key works. Mata and Portugal (1994) examine the Portuguese case with data from 1981 to 1988 following a cohort of firms that had started operating in 1983. The first part of their results is based on survival rates (and the use of the Kaplan–Meier estimator), which show that survival increases monotonically with firm size. Second, assuming a baseline function for the hazard function, they are able to show that among survivors, the tendency is to grow rather than to shrink and that post-entry mobility seems to decrease with size; that is, the proportion of firms that are initially within a given size class and that remain in the same size class after a given number of years increases with firm size. They note that this result is consistent with previous interpretations (among others) that post-entry performance embodies a process of learning, an interpretation also shared by Audretsch and Mahmood (1995).

Using Cox’s proportional hazard model, Mata and Portugal are also able to show that the average size of the entrants has a positive effect on survival and that substantial hazard rates are associated with industries characterized by high entry rates. These results are elaborately obtained without taking into account firms’ start-up size, and when this variable is taken into account explicitly, they find that the risk of failure decreases as firm size increases.

In a similar vein, Audretsch et al. (2000) note that firms can decrease their risk of failure through size enlargement and that the gap between the minimum efficient scale and start-up size tends to worsen survival prospects. The authors also find that being a branch of an existing firm decreases the risk of failure, whereas high industry profit margins hinder survival (an indication of incumbents’ power to deter entry). With these comments in mind, the contents of Table 1 are self-explanatory. However, in the summary, we have omitted two relevant facts that merit close attention. After reviewing the American experience of entry, Bartelsman et al. (2005) consider harmonized firm-level data for 10 OECD countries and identify salient patterns. It is possible to detect differences in the average firm size across countries that accrue from both sectoral specialization and within-sector variations in size. The latter component can reflect scale economies, a minimum efficient scale and entry barriers, among other factors. The authors attempted to disentangle sectoral specialization and within-sector effects by means of two approaches: fixed-effect estimation and a shift-share analysis.

The most salient descriptive evidence reveals that relatively similar patterns of industry dynamics in terms of entry and exit appear to prevail across those countries. In particular, in the majority of the cases, approximately 20 % of firms enter and exit most markets every year, whereas approximately 20–40 % of entering firms fail within their first 2 years of life. Although the referenced study is not an econometric study as the present paper is, its primarily descriptive results provide useful benchmarks.

Altogether, the empirical evidence from the aforementioned works is in line with the general stylized facts mentioned by Cabral (2007). Critical aspects refer to the high mortality in that size class and the importance of firm size for survival and post-entry performance. Thus, scale effects appear crucial, as indicated by the empirical literature, but have also encountered theoretical foundations in models of industry dynamics. In fact, models that consider simultaneous entry and exit within an industry and emphasize idiosyncratic (firm-specific) factors ascribe a significant role to firm success. Jovanovic (1982) considers a model of noisy selection in which new firms passively learn about their true efficiency after entering the market upon the realization of a productivity shock. An implication of that model is that smaller firms grow faster and are more likely to fail than large firms. Hopenhayn (1992) also emphasizes firm-specific shocks but attempts to provide a simpler framework that also addresses questions related to the process of job and firm reallocation. The stationary equilibrium of the model is characterized by larger firms that live longer on average and that will tend to remain larger before they exit.Footnote 3 Therefore, firm size appears to be a relevant explanatory factor for firm success not only empirically but also from a theoretical perspective.

The stylized fact that new firms are likely to enter on a smaller scale may in part reflect the strategic choices emphasized by Mata and Portugal (2002), which can be outlined as follows. A smaller scale may not only reflect financial constraints but also indicate the deliberately cautious behavior by the entrant to avoid an aggressive reaction by the incumbent, as suggested by Scherer and Ross (1990). Moreover, the uncertainty of the entrants’ efficiency level, as highlighted by Jovanovic (1982), can be gradually dissipated, and the possibility of minimizing eventual losses by operating on a smaller scale may indicate the willingness to avoid substantial sunk costs in the case of failure. Altogether, the empirical evidence mentioned in Table 1 indicates that firm size plays a significant role in the chance of survival. Nevertheless, it is not trivial to disentangle selection and learning effects in the empirical analysis.

2.2 Econometric issues

Survival models have become widespread in empirical works [see Johnson and Johnson (1980), Lancaster (1982), Van der Berg (2001), Wooldridge (2002) and Greene (2003) for conceptual overviews]. The topic is typically addressed by means of the closely related concept of a hazard function that allows us to capture the probability of (a firm’s) exiting the initial state within a short interval, that is, an instantaneous exit given that it has survived up to the starting time of the interval. The building block that underlies hazard models is the notion of a random variable T, which reflects the duration of a state (in the present case, the survival of newly created firms in the manufacturing industry) and is assumed to have a probability density function f(t) and a cumulative distribution function F(t), which readily gives rise to the survival function given by:

Similarly, we can define the hazard rate as:

The hazard rate indicates the chances of survival for an additional infinitesimal interval conditional on having survived at least until period t, and the last equation reflects the use of the conditional probability expression and the definition of a derivative. A related and influential econometric model is given by Cox’s proportional hazards model (Cox 1972) and assumes the following parameterization \(\hbox {for }\lambda (t)\):

where \(\lambda _{0}(t)\) stands for the baseline hazard function, Z is a vector of explanatory variables (covariates), and \(\beta \) is a vector of parameters. An interesting feature of the model that motivates its name is that the effect of a covariate operates in a multiplicative fashion on \(\lambda _{0}(t)\) such that a unit change in a covariate leads to a proportional effect on the hazard rate. The simpler implementation of the model considers covariates that are not time varying; in many cases, only cross-sectional data are available, and thus, explanatory variables are provided for the initial period. In contrast, when data are available for different periods, one should explore the role of covariates of different years in explaining the survival of the firms under investigation. Mata and Portugal (1994), for example, had to rely on covariates based on the first year of the data given the cross-sectional character of the data. In contrast, we will investigate the hazard pattern (or the related survival pattern) with a dataset that has information on covariates for subsequent years following the initial sample period, and thus, the analysis will be more general by considering time-varying covariates.

The analysis concentrates on a hazard model, but it can readily provide interpretations in terms of survival if one reverses the interpretation of the signs of the relevant coefficients.

Thus, in contrast to the majority of previous empirical works, we will consider time-varying covariates and benefit from the panel structure of the data by considering the random effect estimator advanced by Meyer (1990). In fact, the model with frailty accommodates unobserved heterogeneity that provides a greater generality to the empirical analysis. A frailty model is essentially a random effects model in which an unobserved random proportionality factor modifies the hazard function of an individual or of related individuals (Hougaard 1995; Wienke 2003).Footnote 4

This latent component has important implications, as acknowledged, for example, by Jenkins (2005): (i) The non-frailty model will overestimate the degree of negative duration dependence in the (true) baseline hazard and underestimate the degree of positive duration dependence; (ii) the proportionate effect of a given covariate on the hazard rate is no longer constant and independent of the survival time; and (iii) the presence of unobserved heterogeneity attenuates the proportionate response of the hazard to the variation in each covariate at any survival time. Thus, the basic elements of this more general framework are outlined next.Footnote 5

It can be seen that the probability that a spell lasts until \(t+1\) given that it lasted until t can be expressed in terms of the hazard:

\(\hbox {where }\gamma (t)=\ln (\int \limits _{t}^{t+1} {\lambda _{0}} (u)\hbox {d}u).\)

The next step is to properly factor the likelihood function in terms of observations that are or are not subject to censoring in the last year of the sample period. To conceive his estimator, Meyer (1990) builds on Prentice and Gloeckler (1978) and Heckman and Singer (1984). Unobserved heterogeneity is assumed to take a multiplicative form in the hazard function such that:

with \(\uptheta _\mathrm{I}\) denoting a random variable that is independent of \(z_{i}(t)\). Thus, this specification has expression (3) as a particular case. Assuming a parameterization in terms of a gamma function with a mean of one (by normalization) and a variance of \(\upsigma ^{2}\), the author justifies a log-likelihood function, as given below:

where \(k_i = \hbox {min}(\hbox {int}\, (T_{i}) , C_{i})\) with \(C_{i}\) standing for the censoring time; moreover, \(\updelta _{\mathrm{I}} = 1\) if \(T_{i} \le C_{i}\) and 0 otherwise. The parameters \(\upgamma \) and \(\upbeta \) can be consistently estimated in Stata 11.0 SE with the proposed method that is implemented in the next section, i.e., the routine pgmhaz8 developed by Stephen P. Jenkins.

3 Empirical analysis

3.1 Dataset

The main data source is provided by the Relação Anual de Informações Sociais [RAIS, Ministry of Labor and Employment, Brazil], which collects annual information on formal establishments in Brazil and is a rich source for survival studies. In fact, Mata and Portugal (1994) considered it an analogous source for the case of Portugal. We were granted special access to the identified microdata over the period 1995–2005 that provide information on the total employment on December 31 of each year. It is important to stress that the referenced survey has a census character and that non-responses lead to heavy fines. The initial 8 digits of the numerical identifier (cadastro acional de pessoa jurídica-CNPJ) indicate the firm, and the remaining digits pertain to a particular plant. In the present study, the focus is on newly created (SMEs) in the manufacturing industry, and those are identified by verifying firms with numerical identifiers that appeared as active in 1996 but were not listed in 1995. The referenced firms were considered newly created firms and were followed until 2005; therefore, the analysis focuses on the 1996–2005 time span. The possibility of mergers and acquisitions is not likely for SMEs. Nevertheless, we had access to partial information from an antitrust authority [Secretaria de Direito Econômico, Ministry of Justice-Brazil]. However, the information refers only to larger firms and has no relevance in our sample. In fact, the formal evaluation of mergers and acquisitions (M&A) by the competition authority takes place only if they imply an expected significant increase in industrial concentration. Otherwise, the authority does not rule over such processes. In our sample period, there were no newly created firms involved in larger-scale M&A processes evaluated by the competition authority. Although one cannot completely rule out the possibility that newly created SMEs are involved in some undetected M&A process, those are much less likely than in the service sectors, where one often observes acquisitions of small IT starts-ups by larger firms (even if they are not subjected to a formal analysis by the competition authority).

Additional care was taken in ruling out the possible acquisition of SMEs by some large firms. Given the absence of detailed information on that aspect, we excluded the handful of firms that exhibited noticeable outliers in terms of growth by a factor \({>}5\) upon the initial size of \({<}250\) employees.Footnote 6 Finally, the possibility of wrongful identification of newly created firms did not seem to be a problem. In fact, a conversation with an official from the Revenue Services-Ministry of Finance who manages the issuing of the numerical identifier code (CNPJ) indicated that a non-response would imply the cancellation of the firm’s record. Thus, taking 1995 as reference, a firm that did not file the report in 1996 could at most re-appear (and induce a mistake) in 1997. Therefore, we considered a 2-year window for defining newly created firms, but in fact, there were only 19 such cases, which were deleted.

We define SMEs as firms with fewer than 250 employees. Thus, we consider the new firms in 1996 that belong to that size class and follow those firms up to the last year of the sample in 2005. This procedure led to a total initial number of 31529 new firms in 1996, of which 7948 were still active in the last sample year of 2005. In addition to the survival information, some covariates were constructed upon the same data source, but alternative data sources were also used. It is worth mentioning that the majority of survival studies in developed countries considered covariates that were not time-varying and thus relied on covariates referring to the initial year of the sample. In the present paper, a more general model is adopted. The following variables are considered in the empirical model and are analogous to those considered by Mata and Portugal (1994).Footnote 7 Industry variables are considered in terms of four-digit sectors [classification CNAE4-Instituto Brasileiro de Geografia e Estatística-IBGE]:Footnote 8

Initial (start-up) size: the logarithm of the initial firm size (total number of employees). Firm size is reported in different studies to have an important role in facilitating survival, possibly related to scale efficiency aspects. Therefore, it is expected to exert a positive effect on firm survival. This is the only explanatory variable of the study defined at the firm level; the remaining covariates are of a sectoral nature.Footnote 9 To acknowledge possible endogeneity in firm size, which was not addressed in previous related studies, we focus on the initial firm size. The methodological treatment of endogenous covariates in time-varying proportional hazard models is incipient. Goodliffe (2003) suggests dropping the time-varying portion of the supposedly endogenous variable by using the initial value of the covariate and provides a Monte Carlo study that favors that estimation strategy. In the present paper, we adopt this procedure, and as we will see, the results are robust in comparison with the time-varying covariate for firm size.

Growth: annual industry growth (in terms of the log difference in successive years for total employment in the sector). A more dynamic industry is likely to favor the survival of newly established firms, unlike more mature and stable industries, which would be less likely to accommodate new entrants. Thus, one would expect a positive effect of that variable on firm survival.

Entry rate: measured as the proportion of new firms in a given year relative to the total stock of the previous year. This variable is likely to reflect the competitive pressures that accrue from new competitors, and one would expect it to have a negative effect on firm survival if a minimum and non-negligible scale is required in a given sector. There are different empirical studies on industry dynamics at the sectoral level, but the majority of those do not report detailed descriptive figures that allow for making comparisons with respect to the Brazilian case. Resende et al. (2015) do consider the same survey data source and sample period of the present paper to explore dynamic entry and exit linkages in the manufacturing industry (with additional control in terms of industrial structure variables). The descriptive statistics, computed on a yearly basis over the period 1996–2005, reveal significant heterogeneity across four-digit industries and non-negligible temporal heterogeneities in the patterns of entry rates. Nyström (2007) undertook a similar empirical work in the context of the Swedish manufacturing industry over the period 1990–2000.Footnote 10 The mean entry rate for Brazil is typically above 15 % but below 20 %, whereas in Sweden, for a similar level of aggregation, the mean entry rate is typically above 10 % and below 14 %. However, the degrees of heterogeneity across industries are much larger in the Brazilian case than in Sweden. Moreover, it is interesting to note that the positive skewedness of the distribution of entry rates is more noticeable in the former case. Dunne et al. (1988) also provide useful descriptive statistics on entry rate for US manufacturing. The mean entry rates at the four-digit level and even for selected 2-digit industries are typically above 30 %. Although one needs to exercise care in making comparisons in the absence of additional descriptive statistics and differences at the aggregation level, there is some suggestive evidence that indicates that entry may not be particularly easy in the Brazilian case. Additional comparative comments across countries will be possible in studying the survival of newly created firms, as discussed later in the text.

Industry size: the logarithm of the number of firms in the industry. As the industry size increases, the accommodation of new entrants becomes more likely. Apart from the dynamic potential of an industry, which is captured by Growth, it aims to indicate the static potential for the accommodation of new entrants and capture the aggregate importance of firm size.Footnote 11

Minimum efficient scale (MES): The proxy was the median size of the firms in each four-digit industry. Despite not being an ideal measure, it has been suggested on different occasions (Sutton 1991). As the MES increases, the survival of smaller firms becomes more difficult.

Suboptimal scale: the proportion of employment in firms below the MES; thus, it is an inverse proxy for entry barriers and should have a positive relationship with survival.

Concentration: The Herfindahl concentration index based on sales (net operational revenues) as provided by a specially requested tabulation from the Pesquisa Industrial Annual [PIA-IBGE]. This measure improves on that constructed by Mata and Portugal op. cit., which considered concentration in terms of employment. If the industry is dominated by few firms, it will be more difficult for smaller firms to compete and survive. Thus, this measure highlights the relevance of the relative size in the industry that can support market dominance. The Herfindahl index is known for its superior properties relative to concentration ratios that do not consider possible changes that might occur outside the group of larger firms. Moreover, one can theoretically motivate the index in a Cournot oligopoly setting, where a structure–performance link could be established (see Cowling and Waterson 1976). It can be shown that (see Resende and Boff 2002):

where \(s_{i}\) stands for the market share of the i-th firm, and the particular function of those market shares assigns a larger weight for relatively larger firms. The last equation indicates that the concentration index depends not only on the number of firms in the industry but also on the variability of market shares, as indicated by the squared coefficient of variation of those shares.

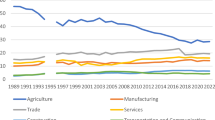

Regional dummies for the five macro-regions in Brazil (North, Northeast, Midwest, Southeast and South) that are interacted with the share of industrial value added [available from IBGE]. In fact, there are marked differences in the industrial development across regions, and one should highlight, for example, the greater importance of the Southeast region, where the state of São Paulo is often referred to as the locomotive of Brazil, comprising more than 30 % of Brazilian GDP.

Regional dummies for the 5 macro-regions in Brazil [North, Midwest, Northeast, Southeast and South]. The consideration of regional dummy variables by themselves—and not only as interacted variables—indicates that regional unobserved heterogeneities could be relevant for firm survival. For example, the data on the level of technological effort (for example, in terms of R&D) are not available on a yearly basis; 22 industry dummies at the two-digit level were considered.

The summary statistics of the covariates (before logarithmic transformations in some cases) are presented in Table 2 and indicate a significant heterogeneity in the sample.

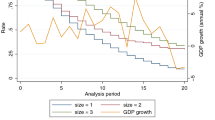

As a preliminary descriptive motivation, Fig. 1 presents the Kaplan–Meier survival function, which shows a non-negligible mortality; after only three years, one typically observes that SMEs have a 3-year survival of rate of approximately 50 % . The survival function presents an aggregate depiction of survival, which, of course, does not highlight the possible sectoral differences that will be later addressed in the econometric analysis.

Mata and Portugal (1994) provide aggregate descriptive information on survival rates after the number of years since creation in the Portuguese case. Specifically, their evidence indicates survival rates of 0.7763 (after 1 year), 0.6819 (after 2 years), 0.5895 (after 3 years) and 0.5204 (after 4 s). Analogous figures from the present study for the Brazilian case are 0.7474, 0.5993, 0.4993 and 0.4222, respectively. Thus, the aggregate patterns for Brazil reveal relatively smaller survival rates after a given elapsed period since creation.

3.2 Empirical results

The results from the econometric estimation are presented in Table 3.Footnote 12

The results are encouraging from a statistical point of view with highly significant individual coefficients. Moreover, the coefficients are economically meaningful with signs that are mostly consistent with prior expectations. A crucial assumption of the econometric model is the proportional hazard rate hypothesis, which holds that covariates must exhibit proportional effects over time; it is often questioned in the context of medical survival studies that aim at assessing the effect of a particular treatment because the age of patients implies different survival patterns. In the context of firms, and given the relatively short time interval of our analysis, one would, in principle, be less concerned about non-proportional effects. Nevertheless, we considered a preliminary run of the model with time-interacted variables, and the evidence based on the significance of the related coefficients at the 5 % level indicated that proportionality was tenable only for the entry and growth variables. Thus, the other variables were interacted with time in our final results reported in Table 3 to handle non-proportional effects. It is worth mentioning that the reported likelihood ratio test strongly favors the model with frailty.Footnote 13

To facilitate interpretation, we will reason in terms of survival and therefore invert the interpretation. In the case of the interacted variables, one considers the effects of the referred variables that also depend on time. Because we are focusing on newly created firms, in the case of the firm-level variable (initial firm size), one faces an effect that also depends on the age of the firm.

The initial firm size positively affects the chances of SMEs’ survival. The possible underlying factors relate to scale efficiency. Although one is considering firms with an initial size of up to 250 employees, it appears that the decreasing range of the long-run average cost curve may eventually be relatively steep. The importance of start-up size for firm survival had been highlighted by Mata et al. (1995), and the considered specification with interaction with age indicates that the importance of the start-up size becomes more salient as the age of the firm increases.

Industry growth positively increases the chances of SMEs’ survival, indicating that more dynamic industries are likely to provide a more favorable environment, although the significance is slightly marginal with a significance level above 5 %.

Entry appeared to exert no effect on survival given the non-significant coefficient.

The remaining covariates were interacted with time, and thus, one observes reinforcements with time of the effects indicated below.

Industry size negatively affects the chance of survival, indicating that SMEs are not more easily accommodated in that case. This result is counterintuitive and deserves further investigation.

The minimum efficient scale negatively affects the chance of survival, as expected;

Concentration negatively affects the chance of survival for SMEs. This result is intuitive because the industrial concentration refers to the totality of the industry and thus captures the dominance effects of larger established firms. The survival of newly created SMEs could, in principle, be more difficult in highly concentrated industries.

The suboptimal scale has a counterintuitive sign for the coefficient. However, one can question whether the adopted (inverse) proxy for barriers to entry is only able to capture a limited aspect of such obstacles.

Three out of five of the regional interacted dummies kept significant coefficients, indicating that disparity in the regional manufacturing industry development can be relevant. This result also highlights a main feature of the present study, which investigated a large and heterogeneous economy in contrast with previous studies of more homogenous developed economies.

Fifteen out of the 22 industry dummies had significant coefficients at the 5 % level.Footnote 14

Altogether, the results are mostly consistent with the previous evidence for developed countries, as reported in Table 1. The previous empirical literature on firm survival has not necessarily addressed SMEs, but it is nonetheless worth highlighting more salient similarities.

A strong result in the literature comprises the positive role of firm size in survival and thus underscores the role of scale effects. This type of effect was also obtained in the studies by Mata and Portugal (1994), Harhoff et al. (1998), McCloughan and Stone (1998), Fotopoulos and Louri (2000), Audretsch et al. (2000) and Esteve-Pérez et al. (2004). It is worth mentioning that our study, based on the SME segment, indicates the relevance of the size effect even for smaller class sizes.

The positive effect of industry growth on survival encountered in the present paper is consistent with some previous studies, including Mata and Portugal (1994), McCloughan and Stone (1998) and Segarra and Callejón (2002).

Finally, the negative effect of industrial concentration on firm survival had previously limited evidence. An analogous result was found by McCloughan and Stone (1998).

Altogether, the results for newly created SMEs in Brazil do display some similarities with other firm survival studies for developed countries, as indicated above, but also highlight the role of covariates that were not often considered in the literature, such as the minimum efficient scale and barriers to entry. Moreover, regional heterogeneity appeared to be important for firm survival in that large and heterogeneous economy.

It is also worth noting that the use of variables that interacted with time often resulted in significant effects and can suggest possible learning effects. However, the clear separation of selection and learning effects on firm survival is not straightforward. Nevertheless, Cabral and Mata (2003) considered the evolution of the firm size distribution in Portugal with the same data source used by Mata and Portugal (1994). The evidence indicates distributions with high positive skewedness even when the distributions are considered by age cohort and the change in the shape of the distributions overtime is not significantly affected by newly created firms. A salient conclusion is that selection, along the lines of Jovanovic (1982), “... explains a very small part of the evolution of the firm size distribution”. This evidence is informative in attributing the change in the shape of the firm size distribution in connection to the prevalence of learning processes.Footnote 15

Finally, an additional result regarding the estimation of the duration dependence of the hazard rate can be reported. Following the procedure suggested by Jenkins (2005), we included a time parameter on a separate regression with the same covariates to account for the duration dependence. This parameter was found to be positive (0.776) when controlling for unobserved heterogeneity, which indicates that the hazard increases monotonically. It should be noted that the estimate for this parameter yielded a negative coefficient when frailty was not considered. As stated before, the non-frailty model tends to over-estimate the degree of negative duration dependence in the hazard. We believe this result shows that it is advisable to control for this feature of the data because previous studies have used non-frailty models and have found negative duration dependence.

Although the results on duration dependence are in contrast with some of the literature, as for example Mata and Portugal (1994), some remarks are in order:

-

(i)

There are studies with evidence on positive duration dependence to some extent as for example Audretsch and Mahmood (1994) and Wagner (1994). Indeed, inverse U-shaped hazard functions were obtained in those studies, respectively, for the USA and Germany;

-

(ii)

It is possible to conceive peculiar hazard dynamics for smaller firms as suggested by Lopez-Garcia and Puente (2006). The focus of the present study on SMEs could favor the detection of positive duration dependence;

-

(iii)

As previously noted, the consideration of unobserved heterogeneity in terms of an econometric model with frailty in the present paper was crucial for the results. In fact, in traditional models there is a propensity to over-estimate the degree of negative duration dependence and that was indeed the case when a random effects specification was disregarded.

4 Final comments

The paper aimed at investigating the determinants of SMEs’ survival in the context of the Brazilian manufacturing industry. For that purpose, a discrete time hazard model with time-varying covariates was considered. The results were encouraging from a statistical and economic point of view. The prominent results that were in line with previous evidence for developed countries include the positive roles played by firm size, industry size and industry growth in survival and the negative influence exerted by the minimum efficient scale, the industrial concentration scale and the suboptimal scale. Likewise, we found that regional inequalities account for a relevant source of variation in survival rates.

Nevertheless, a cautionary remark is warranted. Despite the more favorable economic environment and the expressive creation of new SMEs, one nonetheless observes high mortality rates within the early years. The mortality rates were aggregated, but the stylized fact is general to different sectors, though subjected to possibly heterogeneous patterns.

More recently, an important switch in government policy toward SMEs was indicated by the large increase in the amount of loans below market rates, which exhibited a substantial growth between 1999 and 2011. In the latter year, the amount of loans reached more than US $24 billion, showing that this new policy strategy might support more sustainable start-up sizes for SMEs, though we do not have information on the age of firms that have benefited.Footnote 16

A last relevant remark refers to the substantial mortality of SMEs. In a study applied to the segment of franchising, Façanha et al. (2013) identified a crucial role for training on survival. Fortunately, it appears that BNDES has also provided substantial funding for industrial technical training (for the institution SENAI) even though the actual effects of those policies have yet to be assessed. Eventual coordination with the traditional institutions that offer specialized courses to SMEs (SEBRAE) might be revealed as desirable.

A valuable avenue for future research includes descriptive survival analysis at the industry level by means of survival functions to pinpoint important industry patterns. An explicit reassessment of hazard models can be valuable as more recent data become available, and further research can inspect explicit controls for policies targeted at SMEs.

Notes

As indicated by the private entity for support of SMEs in Brazil [Serviço Brasileiro de Apoio às Micro e Pequenas Empresas-SEBRAE]. In particular, for 2009, the average time for legally establishing a new firm was approximately 20 days, in contrast with an average of 152 days in the more distant past. Moreover, evidence appears to indicate that the simplified taxation favored firm formality (see Fajnzylber et al. (2011)).

The motivation for firm-specific shocks indicated by that model does not discard, of course, the relevance of observable control to be considered in the econometric analysis at the sectoral level. In fact, the market structure, as approximated by the Herfindahl concentration index, is a salient example because those dynamic theoretical models focus on unobserved firm-level factors in a more competitive environment.

For an overview of the biases accruing from ignoring frailty in the analysis of proportional hazards models, see Henderson and Oman (1999).

A similar criterion was considered by Kosová and Lafontaine (2010) in the context of US franchising.

As later explained in Sect. 3.2, to manage the limitations of the proportional hazard assumption, we consider some covariates that interact with time.

The variables characterize a discrete time hazard model with time-varying covariates.

For this variable, we consider firms with at least one employee because those listed with 0 employees were managed by an unspecified number of owners, whereas for explanatory factors such as entry rate, one considered the totality of firms in the sector. Once more, it is reassuring that the empirical results remain essentially similar irrespective of those filters.

A shortcoming of that work is that the data set merges heterogeneous sub-samples that refer to plants and firms.

Mata and Portugal (1994) also considered a covariate pertaining to entrants’ size (in terms of the logarithm of the employment in new firms in the industry). The variable aimed to capture the size effect of new firms taken as a group and therefore highlights the role of entrants’ scale in affecting the survival of newly created SMEs. In the present application, the large correlation (0.895) with industry size motivated its exclusion of entrants’ size, though the results are nonetheless robust.

Given the logarithmic specification of the firm size variable, the model considers firms with at least 1 employee, so as to avoid the cases of firms that are managed by the owner (those with 0 employees).

In our chosen specification, the estimated parameter was larger than the parameter without the gamma frailty, which confirms the fact already mentioned result that not accounting for unobserved heterogeneity causes an underestimation of the increase in the hazard rate along with duration, and it mitigates the effects of the covariates on the hazard rate.

The related results are not reported for conciseness but can be provided upon request.

It would be beyond the scope of the paper to implement similar diagnoses of firm size distributions in Brazil. Moreover, the consideration of the totality of firms (not only newly created firms) would require proxies for ages that are not readily available.

The definition adopted by BNDES for firm size is different from the one used in this paper, but the new importance attributed to SMEs is evident.

References

Audretsch DB, Houweling P, Thurik AR (2000) Firm survival in the Netherlands. Rev Ind Organ 16:1–11

Audretsch DB, Mahmood TA (1994) The rate of hazard confronting new firms and plants in US manufacturing. Rev Ind Organ 9:41–56

Audretsch DB, Mahmood TA (1995) New firm survival: new results using a hazard function. Rev Econ Stat 77:97–103

Bartelsman E, Scarpetta S, Schivardi F (2005) Comparative analysis of firm demographics and survival: evidence from micro-level sources in OECD countries. Ind Corp Change 14:365–391

Cabral LM (2007) Small firms in Portugal: a selective survey of stylized facts, economic analysis, and policy implications. Portuguese Econ J 6:65–88

Cabral LM, Mata J (2003) On the evolution of the firm size distribution: facts and theory. Am Econ Rev 93:1075–1090

Cantner U, Dressler K, Kruger JJ (2006) Firm survival in the German Automobile Industry. Empirica 33:49–60

Clayton DG (1978) A model for association in bivariate life tables and its application in epidemiological studies of familial tendency in chronic disease incidence. Biometrika 65:141–151

Cox DR (1972) Regression models and life tables. J R Stat Soc B 34:187–202

Cowling K, Waterson M (1976) Price-cost margins and market structure. Economica 43:267–274

Davidsson P, Lindmark L, Olofsson C (1998) The extent of overestimation of small firm job creation: an empirical examination of the regression bias. Small Bus Econ 11:87–100

Davis SJ, Haltiwanger J, Schuh S (1996) Small business and job creation: dissecting the myth and reassessing the facts. Small Bus Econ 8:297–315

Dunne T, Roberts MJ, Samuelson L (1988) Patterns of firm entry and exit in U.S. manufacturing industries. RAND J Econ 19:495–515

Esteve-Pérez S, Sanchis-Llopis A, Sanchis-Llopis JA (2004) The determinants of survival of Spanish manufacturing firms. Rev Ind Organ 25:251–273

Esteve-Pérez S, Máñez-Castillejo JA, Sanchis-Llopis JA (2008) Does a “survival-by-exporting” effect for SMEs exist? Empirica 35:81–104

Façanha LO, Resende M, Cardoso V, Schröder BH (2013) Survival of new firms in the Brazilian franchising segment: an empirical study. Serv Ind J 33:1089–1102

Fajnzylber P, Maloney WF, Montes-Rojas GV (2011) Does formality improve micro-firm performance? Evidence from the Brazilian SIMPLES program. J Devel Econ 94:262–276

Fotopoulos G, Louri H (2000) Location and survival of new entry. Small Bus Econ 14:311–321

Geroski PA (1995) What do we know about entry? Int J Ind Organ 13:421–440

Girma S, Görg H, Strobl E (2007) The effects of government grants on plant survival: a micro-econometric analysis. Int J Ind Organ 25:701–720

Girma S, Görg H, Strobl E (2007) The effects of government grants on plant survival: a micro-econometric analysis. Int J Ind Organ 25:701–720

Greene WH (2003) Econometric analysis, 5th edn. Prentice Hall, Upper Saddle River

Harhoff D, Stahl K, Woywode M (1998) Legal form, growth and exit of West German firms-empirical results for manufacturing, construction, trade and service industries. J Ind Econ 46:453–488

Heckman JJ, Singer B (1984) A method for minimizing the distributional assumptions in econometric models for duration data. Econometrica 52:271–320

Henderson R, Oman P (1999) Effect of frailty on marginal regression estimates in survival analysis. J R Stat Soc B 61:367–379

Hijzen A, Upward R, Wright PW (2010) Job creation, job destruction and the role of small firms: firm-level evidence for the UK. Oxford Bull Econ Stat 72:621–647

Hopenhayn HA (1992) Entry, exit, and firm dynamics in long run equilibrium. Econometrica 60:1127–1150

Hougaard P (1995) Frailty models for survival data. Lifetime Data Anal 1:255–273

Hougaard P (1995) Frailty models for survival data. Lifetime Data Anal 1:255–273

Johnson RE, Johnson N (1980) Survival models and data analysis. Wiley, New York

Jovanovic B (1982) Selection and the evolution of industry. Econometrica 50:649–670

Kosová R, Lafontaine F (2010) Survival and growth in retail and service industries: evidence from franchised chains. J Ind Econ 58:542–578

Lancaster T (1982) The econometric analysis of transition data. Cambridge University Press, Cambridge

Lopez-Garcia P, Puente S (2006) Business demography in Spain: determinants of firm survival. Documentos de Trabajo No. 0608, Banco de España

Mata J, Portugal P (1994) Life duration of new firms. J Ind Econ 42:227–245

Mata J, Portugal P (2002) The survival of new domestic and foreign-owned firms. Strategic Manage J 23:323–343

Mata J, Portugal P, Guimarães P (1995) The survival of new plants: start-up conditions and post-entry evolution. Int J Ind Organ 13:459–481

McCloughan P, Stone I (1998) Life duration of foreign multinational subsidiaries: evidence from UK northern manufacturing industry 1970–93. Int J Ind Organ 16:719–748

McPherson MA (1995) The hazards of small firms in Southern Africa. J Devel Stud 32:31–54

Meyer BD (1990) Unemployment insurance and unemployment spells. Econometrica 58:757–782

Neumark D, Wall B, Zhang J (2011) Do small businesses create more jobs? New evidence for the United States from the National Establishment Time Series. Rev Econ Stat 93:16–29

Neumark D, Wall B, Zhang J (2011) Do small businesses create more jobs? New evidence for the United States from the National Establishment Time Series. Rev Econ Stat 93:16–29

Nyström K (2007) Interdependencies in the dynamics of firm entry and exit. J Ind Compet Trade 7:113–130

Prentice R, Gloeckler L (1978) Regression analysis of grouped survival data with application to breast cancer data. Biometrics 34:57–67

Resende M, Boff H (2002) Concentração industrial. In: Kupfer D, Hasenclever L (eds) Economia industrial. Elsevier, Rio de Janeiro, pp 73–90

Resende M, Ribeiro EP, Zeidan R (2015) Dynamic Entry and exit linkages in the Brazilian manufacturing industry: an econometric investigation. Int J Econ Bus 22:1–14. doi:10.1080/13571516.2015.1009684

Santarelli E, Vivarelli M (2002) Is subsidizing entry an optimal policy? Ind Corp Change 11:39–52

Scherer F, Ross D (1990) Industrial market structure and economic performance, 3rd edn. Houghton-MI, Boston

Segarra A, Callejón M (2002) New firms’ survival and market turbulence: new evidence from Spain. Rev Ind Organ 20:1–14

Sutton J (1991) Sunk costs and market structure. MIT Press, Cambridge

Van der Berg GJ (2001) Duration models: specification, identification and multiple durations. In: Heckman JJ, Leamer E (eds) Handbook of econometrics, vol 5. North-Holland, Amsterdam, pp 3381–3460

Vaupel JW, Manton KG, Stallard E (1979) The impact of heterogeneity in Individual frailty on the dynamics of mortality. Demography 16:439–454

Wagner J (1994) The post-entry performance of new small firms in German manufacturing industries. J Ind Econ 42:141–154

Wienke A (2003), Frailty models, Max Planck Institute for Demographic Research WP 2003-032

Wooldridge JM (2002) Econometric analysis of cross section and panel data. MIT Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors acknowledge the comments from two anonymous referees on different versions of the paper, but the usual caveats apply. Marcelo Resende is grateful to the financial support from CNPq.

Rights and permissions

About this article

Cite this article

Resende, M., Cardoso, V. & Façanha, L.O. Determinants of survival of newly created SMEs in the Brazilian manufacturing industry: an econometric study. Empir Econ 50, 1255–1274 (2016). https://doi.org/10.1007/s00181-015-0981-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-0981-4