Abstract

By tracking more than 3000 manufacturing firms established in 1999 in China over a span of 10 years, we examined whether the status of firm survival differs in China from the so-called stylized fact that has been established in studies for other countries. We also analyzed the unique effects of ownership and productivity on firm survival in a transitional economy. The empirical evidence suggests that although the state-owned firms are still under the protection from the Chinese government, productivity influences firm survival, the effects of government protection and market selection shift over time and in various growth rate sectors, and productivity exerts a different influence on exit This paper again confirms again that some evidence independent of various institutions and policies establishes the “natural law” of industrial dynamics, and “good” economy transition can make room for market selection.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Firm survival has been discussed for more than 30 years in the field of industrial organization, and much research concerns the entry and exit of firms (Geroski 1995). When some important stylized facts and rules are applied, the econometric methods used in this field have become more sophisticated (Manjon-Antolin and Arauzo-Carod 2008), and the results have become more consistent (Audretsch et al. 2000). However, several important issues remain unresolved by the literature.

In particular, previous studies in the literature remain ambiguous whether the extant findings concerning firm survival are dependent upon the institutions specific to a particular country. Since most research on survival pertains to either developed countries or developing countries with established market economies, the results are consistent across samples, areas, and periods. However, virtually nothing is known about firm survival in the context of a non-market economy or in the institutional context of a communist political system. The purpose of this paper is to provide the first study analyzing firm survival in the context of a non-market economy—China.

In transitional countries, such as those in East Asia as well as Central and Eastern Europe, the factors, patterns and path of development are evolving from a planned economy to a market economy, and have complex dual characteristics. In the period of economic transition, private ownership, public ownership, and market economy coexist. This is contradictory to the traditional context of a market economy, which is based on private ownership. In the case of this kind of coexistence, ownership has different meanings and implications. There are state-owned (or state-controlled), private-owned (including stock company), and foreign-owned variations. Ownership in a market economy usually refers to the single-establishment and multi-establishment firms, or the domestic and foreign firms. This is the major difference in research analyzing the role of ownership and survival issues in transitional economies. In a market economy, only inputs and outputs of private production are discussed, but in a transitional economy the influence of political factors cannot be ignored. The relationship between public resources and private goods should also be taken into consideration. Using private-owned firms as reference, we want to discover the special characteristics of state-owned and foreign-owned firms. We also focus on whether market selection works under government control in China and, if so, how efficient those firms are in both the short-term and long-term. It should be considered that if the influence of market selection becomes stronger, then the transitional process will be successful to some extent. At the same time, certain firm and industry characteristics, such as size, innovation, exports, industry growth and so on, could exert different influences in a transitional economy.

This paper offers two important contributions to the literature. The first is to analyze if those factors that have been found in a plethora of studies influencing firm survival in the context of a market economy still hold under a very different institutional context of communism. The second contribution of this paper is to explicitly link the relationship between government ownership of firms to survival, which enables us to identify how government ownership of firms influences the likelihood of firm survival.

The organization of the paper is as follows. Section 2 briefly reviews the literature on ownership, productivity and firm survival. Section 3 describes the data and method we employed. Section 4 presents the findings of the paper and provides discussion. Section 5 concludes.

2 Ownership, productivity and firm survival

2.1 Confusion on ownership and survival

A large and extensive literature has emerged analyzing the factors influencing firm survival (Caves 1998; Geroski 1995). These studies have generated relatively consistent results. In particular, firm survival has been found to be highly influenced by firm size and age. Studies have also linked firm survival to its type of ownership.

There are three distinct aspects of ownership which have been linked to firm survival in the literature. The first distinguishes between single-establishment firms and multiple-establishment firms. The second aspect involves the nationality of the firm owner and distinguishes foreign-owned firms from domestic-owned firms. The third aspect involves different models of allocation of ownership (Audretsch and Lehmann 2005), or different ownership control structure (Steensma and Lyles 2000).

Regarding single-firm and multiple-firm enterprises, some studies have focused on cost and argued that single-firms could accept lower revenue because they have a lower opportunity cost, compared to multiple-firms (Caves and Porter 1976). Others studies, focusing on concentration and decentralization of authority (Reynolds 1998), argued that ownership concentration and less delegation lead to lower levels of R&D spending and performance (Kastl et al. 2013). Still others, from the point of resources, found that belonging to a multi-unit firm prolongs survival time of individual establishments, as they have characteristics such as being “larger, older, more productive, employ more capital and more skilled workers, and are more likely to export” (Audretsch and Mahmood 1994; Bernard and Jensen 2007). These studies also found that business skills are passed on from parent-firms to newly established-firms, and that the multiple-firms can share and reduce financial risk (Shiferaw 2009).

The second aspect regarding ownership distinguishes foreign-owned from domestic-owned businesses. Though most research has found that foreign-owned firms exhibit better performance than do their domestic-owned counterparts, there are different views on the links between foreign ownership and survival. Recent studies find that foreign-owned firms have a significant advantage in survival since they are less rooted in the local economy (Bernard and Jensen 2007), and have better access to resources such as capital, brands, and knowledge from the parent company (Kronborg and Thomsen 2008). However, the foreign-owned firms’ advantage decreased over time as they entered the host countries, due to the increasing competition among foreign subsidiaries and domestic firms (Nachum 2003). Those studies which did not find significant differences in survival between foreign and domestic firms argue that not ownership, but rather firm and industry characteristics such as size, growth strategies, capital intensity, productivity and economies of scale, etc. are the main components that influence firm survival (Mata and Portugal 2002; Taymaz and Özler 2007). Other factors include entry patterns, startup size, sector type, salary level, labor force quality and so on (Mata and Portugal 2004).

Thus, there remains at least some ambiguity concerning the link between ownership and firm survival. Most studies, however, do conclude that ownership matters for firm survival.

2.2 Ownership in a transitional economy

In this paper we focus on ownership and firm survival not in the context of a market economy, which has been the case in virtually all of the previous studies, but rather in the context of an economy transitioning from a planned system to a market-based one. Thus, the context analyzed in this paper reflects that of a transitional economy. Ownership has a different meaning in a transitional economy than in an established market economy (Steensma and Lyles 2000). Whether or not a firm is owned by the state, or government (fully or partly) has a considerable influence on firm strategy and operations. The preferential treatment given by government to those firms it owns may influence, or even distort, the process of industrial dynamics.

The designation of “Local government as industrial firms” (Walder 1995), in China leads to a deference caused by ownership that is conducive to a preferential access to resources and skews decision-making in favor of the government-owned enterprise. Regarding preferential access to resources for state-owned firms, Kornai (1979) explained how political power influenced state-owed firms’ behavior by what he termed as the soft budget constraint (SBC). Kornai (1992) argued that, in a transitional economy, the government has a focus and priority on output rather than financial performance, which leads to a “resource-constrained economy”. A market economy, despite shortages of material inputs, but not demand, constrains production. Governments often soften their own budget constraints, and take budget deficits as legitimate costs. Surpluses produced by profitable firms would be used to compensate for losses generated by the unprofitable ones. In fact, compared to private-owned sectors, state-owned firms can easily obtain financing support as well as easier access to land, entry into new markets and innovation subsidies.

In China, state-owned firms are in the process of gradual marketization. In the early 1990s, the government reorganized many firms solely funded by the state in shipbuilding and electric power, among other industries, into state-owned holding companies. The government reduced or eliminated the connection between firms, government and military institutions, ended administrative subordination and ranks of firms, and separated the functions of administration, supervision and operation on state-owned capital. Though China devoted itself to “the separation of government and enterprise” for many years, there is still a portion of state-owned firms that have yet to achieve the goal of privatization from government ownership. Such government owned enterprises lack proper corporate governance structures, and may incur a “single big holder” of state-owned capital or are controlled by administration institutions. In these cases, the state-owned firms can be subjected to the regime’s policy and preference, as SBC. On the other hand, the firms may exhibit low performance due to a deviation of operation orientation, where managers seek career enhancements rather than promoting firm performance, which hinders the decision-making process. Similarly, the once cherished privileges granted to foreign-owned firms in China are being phased out. At the beginning of 1980s, China opened for inward foreign direct investment (FDI), in order to facilitate the foreign ownership of firms. As the market replaces government planning step by step, preferential treatment is gradually disappearing. Thus, the status of government ownership in China also means that the firm is invariably involved in the process of marketization.

2.3 Productivity

Industrial dynamics theory emphasizes that the market selection mechanism results in the turnover of firms, as competition increases pressure on inefficient firms to exit, and promotes the resource reallocation from inefficient firms to more efficient ones (Jovanovic 1982; Hopenhayn 1992). In addition, many studies have found evidence supporting the idea that higher productivity reduces the likelihood of firm failure and exit.

A growing body of literature has reached somewhat different findings for the context of developing countries. In particular, Tybout (2000) finds that in less-developed countries, markets tolerate inefficient firms, because the government is biased in favor of large size and incumbent firms. Many small firms are thus unable or unwilling to grow to a scale of sufficient size to exhaust scale economies. The empirical evidence shows that the productivity dispersion of firms in developing countries is not significantly different from industrialized countries. This results in only small productivity differences among firms (Liu 1993; Tybout 1996) regardless of entry or exit, so there is a weak linkage between productivity and survival in some developing countries. While Aw et al. (2001) find different results, based on the research for Taiwan, there is a positive and significant relationship between productivity and survival. The more productive firms survived, and less productive firms exited. The research for countries in Africa and India suggest that the productivity effect is statistically significant only for a small group of firms (Shiferaw 2009).

The extant literature, including the studies discussed above, is undertaken for countries where there is little government intervention and bias introduced in the market. In the absence of government regulations and intervention, the market works in a more efficient manner, and the likelihood of a productive firm having to exit would be expected to decrease correspondingly. At the same time, the turnover caused by the productivity differential becomes an important source of industry-level productivity growth in developing countries. Therefore, to some extent, the relationship between productivity and survival can be an index for measuring the maturity of the market.

3 Data and method

3.1 Data and exit measurement

We used a longitudinal data set from Chinese Manufacturing Enterprises Database, which was compiled by National Bureau of Statistics of China. The Chinese Manufacturing Enterprises Database includes all the industrial firms whose main business income is greater than RMB5,000,000 (nearly $800,000 USD). Data are available for every year between 1995 and 2009, but there were structural changes in the sampling procedure in both 1999 and 2004. To avoid the influence of structural change we set the interval between 1999 and 2009 as our research period. The amount of firms increases from 162,033 (1999) to 351,797 (2009). 46,000 firms continuously exist during this period. Containing more than 60 indicators about firm’s characteristics, operating status, and financial data, this database has been applied in many research fields: firms’ behavior and performance, finance, international trade, FDI, R&D, industrial cluster, etc.

In order to analyze firm survival in China and the relationship between ownership and firm survival, we tracked 3882 start-up firms in 1999 for 10 years. Since Chinese Manufacturing Enterprises Database includes the indicators of start-year and start-month, it is easy to screen the firm which entered in 1999. The firm is considered to have exited when it appeared in the year t, but not in the year t + 1, t + 2, …, 2009. To identify what happened to the exited firms, we selected 41 firmsFootnote 1 out of 3882 randomly, and tracked them one by one through the inquiry system of State Administration for Industry and Commerce of China, combined with corporations’ annual reports, firms’ website and other related information. We found that 10 (24.4 %) firms survived over 10 years, 9 (22 %) firms were withdrawn or had business licenses revoked by the Administration for Industry and Commerce,Footnote 2 and 22 (53.7 %) firms cancelled their own business licenses.Footnote 3 According to this procedure, a firm exit could happen in the following situations: (1) bankruptcy or firm decision to stop operations (2) forced to close by the government due to legal reasons, (3) merger or acquisition. In addition to the real exit, there also exists the possibility of a “fake exit”. There are two main causes of such “fake exits”: one is that a firm changed its corporation information, in which case we lost the firm after the change as we tracked a firm by corporation name and code. To solve this problem, we tracked the phone number and address of some exiting firms, but this kind of “fake exit” is still hard to avoid. The other situations are outliers and missing values in the database.

In addition, the database only contains firms whose main business income is beyond RMB5,000,000 (nearly $800,000 USD), which means it has attained a minimum size standard. However, more than 90 % firms in China are small or medium-sized, and they account for more than 60 % of GNP. Most businesses are founded and start at a size below this minimum size standard. We are able to track only those firms that reach the minimum size, so this biases the results towards a higher survival rate. Audretsch et al. (2000) and Jacobson (1985) have discussed problems and biases associated with this kind of under-reporting. However, the database reports the startup-year of each firm, so we can avoid confusing the situations in which a firm exists for the first time (if it just started in a select year) or it started up earlier, but reached the minimum size in a specific year.

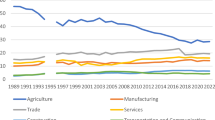

Table 1 shows the general startup and survival status in each manufacturing industrial sector from 1999 over the subsequent 10 years. Other than the tobacco industrial sector, the ten-year survival rates vary considerably across sectors, ranging from 10 % (educational and sports supplies) to 57 % (Petroleum). The mean survival rate for all of the sectors combined, is 17 %, which means that 10 years after startup, only 649 firms existed out of 3882 startups.

Since this paper links the survival rate to ownership status, we divided the firms into three types: state-owned, foreign-owned, and domestic non-state-owned. State-owned firms include both traditional means state-owned firms and corporation limited where the government holds a controlling number of shares. Foreign-owned refers to joint venture,Footnote 4 and domestic non-state-owned includes all the other types except the two above. It contains several types as private firms, collective firms, and corporation limited. Table 2 shows the firm survival rate by ownership. Because nearly 400 firms change or did not report their ownership status, 3488 firms were tracked by ownership out of the 3882 startups.

3.2 Measurement of firm and industry characteristics

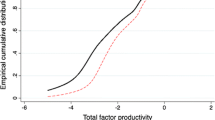

The main question we address in this paper focuses on the power of government and market and their influence on firm survival in China. Based on discussion of the previous section, the government treated firms differently according to their ownership status. However, the survival rate after comparison in six aspects, including subsidy, tax rate, depreciation rate, financing and loan rate, entry barrier or restriction, and medium and small business policy, there are no significant differences among various ownerships. Applying the theory of SBC, we can get some trace on finance support, and it can show the tendency and degree of government support and control on state-owned firms (Kornai 1979; Anderson et al. 2000; Zhang et al. 2003) in transitional economies. We used the value of long-term liability divided by main business income to measure it. We have discussed ownership above; as there are three types of ownership, we set two dummy variables to measure it. To measure firm productivity, we used data envelopment analysis (DEA) through inputs and outputs of every single firm to measure the all factors productivity (AAP) (Katayama et al. 2009). The analysis index we chose were total industrial output (current value), employee (average amount), total fixed asset, main business income, and main business cost.

For control variables, there are size (Audretsch and Mahmood 1995; Agarwal and Audretsch 2001), innovation (Audretsch and Mahmood 1991; Audretsch 1995), export (Esteve et al. 2004; Esteve and Manez 2008), industry growth (Audretsch and Mahmood 1991; Mata and Portugal 2002; Strotmann 2007) and stage of business cycle (Agarwal and Gort 2002; Shiferaw 2009). These terms are defined as following: size refers to the logarithm of annual average employee number of each firm; innovation refers to the portion of new product output value in total industrial output value of each firm; export is set as a dummy variable, measured by the export value in a firm, it is 0 if the export value is 0, otherwise it is 1; industry growth is measured by the ratio of industry total industrial output between the previous and current years. To define the stage of business cycle, we combined four related indexes as Ex-factory Price Indices of Industry Products (EPI),Footnote 5 Manufacturing Purchasing Manager’s Index (PMI),Footnote 6 Gross Industrial Output Index,Footnote 7 and Manufacturing Composite Index.Footnote 8 We then found that the period of 1999–2002 and 2009 can be described as depressions, and the period of 2003–2008 as a period of prosperity. We then applied a dummy variable to measure these two kinds of periods.

3.3 Models

To investigate what influences firm survival, researchers have applied different models to estimate the probability of exit and linked it to firm and industry characteristics. The Semi-parametric method (Cox 1972) provides a consistent estimation of β without deriving a specific distribution was mostly used to estimate firm survival (Audretsch and Mahmood 1995). It not only considers the probability of the risk event (exit) happening, but also takes the duration of the event into account (Mayer and Alexander 1990). Meanwhile, it can also handle the right-censoring problem. In survival research, the interception of data emerges from those firms which have not taken the action of exit until at the end of observation.

In our research, we set the time interval between firm startup and exit as the “survival time”. Using the Cox hazard model, we tested how the multi-factors impact on this “survival time”. Cox hazard model takes the form as:

Take the logarithm to the function (1):

In the function (2), t represents the time; X represents the different kinds of factors. In this paper, the factors which influence survival includes firm and industry characteristics as ownership (\(OWN_{state}\),\(OWN_{foreign}\)), soft budget constraint (\(SBC\)), productivity (\(PRD\)), firm size (\(SIZ\)), innovation (\(INV\)), export (\(EXP\)), industry growth (\(IGR\)) and stage of business cycle (\(BNC\)). Thus, we build the Cox hazard model of the entrepreneurial intentions translating into behavior as following:

In order to analyze the covariate effects of ownership and time on SBC and productivity, we also applied some covariates in the model as \(OWN_{state} \_SBC\), \(OWN_{state} \_PRD\), \(Y2000\_SBC\), \(Y2008\_SBC\), \(Y2000\_PRD\), \(Y2008\_PRD\). Using dataset selected, we explore how the firm and industry characteristics influence firm survival by Cox regression.

4 Results

4.1 Are there any differences in survival by ownership and by sectors?

To understand if there are significant differences of survival rate between various types of ownership and sectors, we used t test and ANOVA. Between state-owned and non-state-owned firms, the equal variances of survival are assumed significant. Then, from the revised results we found that significant differences exist (shown in Tables 3, 4), which means ownership is an important variable which influences the survival status.

Regarding non-state-owned firms, we compared both foreign-owned and domestic non-state-owned firms (shown in Tables 5, 6). The results of t-test show that there is no significant difference between these two types of ownership, though they have different 10-years survival rate as 27 and 16 %, respectively.

Among 34 two-digit level industrial sectors, we still can find significant difference in survival time (shown in Table 7). That means it is necessary to analyze the influence factors by each sector.

In general, either by ownership or by industrial sector, we find significant difference in survival time, state-owned firms and firms in some sectors. As electrical equipment and communication equipment have unique survival characteristics, we did some advanced analysis on these groups of firms.

4.2 SBC or productivity?

The Cox model is estimated for different firm and industry characteristics and industrial sectors.Footnote 9 This enables us to understand the effects of ownership, SBC, productivity, and other factors on firm survival.

After estimating the model for each control variables which represent firm and industry characteristics separately, we can find the effects of ownership and productivity on firm survival. Table 8 reports the Cox proportional hazard rate model estimating result. Model (1) presents the basic effect of independent variables on ownership, SBC, and productivity. Model (2) controls the firm characteristics as firm size, innovation and export. Model (3) controls the firm and industry characteristics together. The result indicates that the hazard of exit tends to be lower in foreign-owned firms, compared to state-owned and domestic non-state-owned firms. Foreign-owned firms have intrinsic advantage in their survival, but there is no significant difference between state-owned firms and domestic non-state-owned ones. The results in both the basic and extended model indicate that productivity decreases the probability of exit, and firms with a high level of efficiency would survive longer. SBC shows positive effects on exit risk after controlling firm and industry characteristics, which means SBC (always considered as an advantage of state-owned firms as they receive government protection) doesn’t improve firm survival; on the contrary, it increases the risk of exit.

As for the control variables, the negative and statistically significant coefficients of firm size, innovation and export show these factors decrease the risk of exit, and this result is consistent with the former research. Despite differences in significance of the negative coefficients on productivity, size, innovation and export, we find that a competitive market works in China. Successful firms with high efficiency, large size, and high levels of innovation and ability to export can survive longer, while others were swept out. While the variable of industrial growth and industry cycle is negative and statistically significant, that means when the specific industry is in the period of prosperity, the risk of firm exit decreases correspondingly, but active economic activities result in greater turnover rate.

Models (4), (5), (6) are designed to reveal whether state-ownership can decide the relationship between SBC or productivity and survival. The result of Model (5) indicates that the effect of SBC varies significantly between the group of state-owned and non-state-owned firms. “Softer” budget constraints indeed protect state-owned firms, helping them to survive longer, and according to the result in Model (3), it plays an opposite role in non-state-owned firms. The result in Model (6) shows there is no difference in the productivity effect between state-owned and non-state-owned firms, and that higher productivity will lead to higher survival rate in any type of ownership.

4.3 Do effects shift over time?

As China is in its process of transition from a planned economy to a market economy, we would expect market power to be stronger in select efficient firms over time. During this period, the effect of productivity on survival will increase, while the effect of SBC, the advantage of state-owned firms, will weaken. The empirical results confirm the effect changes over time, as shown in Table 9. In addition to the variables considered in Model (1) showing the main effect, we set the middle year of 2004 as a benchmark, and included 2 time dummy variables as Y2000 and Y2008, to observe the regression results of cross dummies as \(Y2000\_SBC\), \(Y2008\_SBC\), \(Y2000\_PRD\) and \(Y2008\_PRD\), so we can test the changes of effect in 2000 and 2008 compared to those of 2004.

Models (2) and (3) show that both SBC and productivity have significant effects in trends over time. Productivity gains significance over time, while SBC loses significance. Specifically, compared to 2004, the positive effect of SBC on exit hazard in 2000 is lower (according to the minus coefficient of \(Y2000\_SBC\) in Model (2), while in 2008 is higher (according to the plus coefficient of \(Y2008\_SBC\) in Model (3). For survival rate, that means the protection degree comes from SBC being reduced gradually from year 2000 to year 2008. Furthermore, in 2004–2008 it heavily reduced (according to the absolute value of coefficient of \(Y2008\_SBC\) is vastly larger than \(Y2000\_SBC\)). In the same way, we can see that the effect of productivity on survival increased in the period of 2000–2008, especially from 2004 to 2008. This result confirms the fact that, in the marketization process in China, the interference of government recedes while market selection power enhances step by step.

4.4 Does sector matter?

As mentioned above, there are significant differences in hazards of exit across the various industrial sectors. To determine if ownership and other firm and industrial characteristics exert different effects on firm survival in various sectors, we estimate the above model for each cohort of two-digit sectors (except tobacco). There is a large disparity in the effects of ownership, SBC, productivity, and other variables across sectors (results are not reported here but are available upon request).

In order to do further analysis about sector differences, we applied hierarchical linear model (HLM) to test the effect of sectorial industry growth on the relationship between SBC and productivity on firm survival. The second hierarchical model is as below,

\(Y_{1}\), \(Y_{2}\) are the coefficients of SBC and productivity in above Cox proportional hazard rate regression for each cohort of two-digit sectors. The linear regression result is in Table 10.

Model (1)-SBC shows that SBC influences firm survival regardless of industry growth, while Model (2)-PRD shows that different industry growth rate works on the relationship between productivity and firm survival. The significant and positive B value in Model (2)-PRD indicates that the higher the sectorial industry growth rate, the lower the NEGATIVE relationship between productivity and firm exit hazard. That means, in high growth sectors, productivity does not exert so large influence on exit as in low growth sectors. With the industry expanding rapidly, low efficiency firms also have opportunities. However, in sectors of lower growth rate, low efficiency firms tend to be weeded out more easily.

5 Conclusions

“A fundamental issue in industrial organization is whether empirical evidence that is so compelling as to constitute stylized facts under one set of institutional conditions in one set of countries, hold in other countries with different institutions” (Audretsch et al. 2000). Focusing on the research in the transitional economy of China allows us to further understand how the firm survival is influenced by different institutes and policies that have not been considered in the previous research. The results of this paper provide compelling evidence suggesting that the institutional context plays a big role in influencing industry dynamics. In particular, the soft budget constraints of those firms which are owned by the government are associated with higher rates of survival. This might suggest that the disciplinary impact of market forces on such government-owned enterprises tends to be weak.

In addition, the effects of government protection and market selection shift over time. In the period between 2000 and 2008, government impact represented by the soft budget became weaker while the selection mechanism of productivity became more important. This trend is even more striking in the second half of the period analyzed, suggesting that China has made considerable progress in transitioning to a market economy. The market is playing a greater role in the selection process than the government over time. Finally, in various growth rate sectors, productivity exerts different influences on exit.

The findings from this paper provide new insights into the process of firm selection and industry dynamics in the context of a transitional economy. On the one hand, this paper does confirm the important underlying role that certain firm-specific characteristics, such as size and age play in the process of industrial dynamics. On the other hand, the paper provides compelling evidence that the institutional context in which firms and industries can have a strong influence in biasing firm and industry dynamics. An important limitation of this paper involves the implicit advantage or disadvantage of state-owned firms. As there is a special relationship between government and state-owned firms, the firms could be influenced by the protection, control and intervention of the government, the effects include both benefits and losses, but they are all implicit and difficult to measure and evaluate. We only chose the soft budget constraint to explain this kind of relationship; it is obviously not all-inclusive. Future research needs to further explore and disentangle the obtuse and varied way in which the institutional context can influence firm and industry dynamics.

Notes

We selected 100 firms at first, and succeed in tracking 41 firms with this method.

In China, under the following conditions a firm may be withdrawn or revoked its business license: false registration, operation beyond the registered scope of business, not open or closed with no reason, and failure to pass the annual inspection.

Through checking the information from firms’ annual reports, websites and other materials, we find firms cancelling their business licenses may occur through the following situations: bankruptcy, long or short period net loss, merger or acquisition.

Joint venture includes not only funds from a foreign country but also from Hong Kong, Taiwan, and Macao.

Resource: http://finance.stockstar.com/finance/macrodata/ppilist.aspx (1999–2009).

Resource: http://data.eastmoney.com/cjsj/pmi.html (2005–2009).

Resource: http://www.stats.gov.cn/tjsj/ndsj/2013/indexch.htm (1999–2009).

Resource: http://data.stats.gov.cn/ (1999–2009).

In this regression, we didn’t employ the sample data from the year of 1999–2009 (showed in previous study), but of 2000–2008, as we set 1999 as observation start point and 2009 as end point. At the same time, we eliminated part of the sample due to some index value outlier(s?) or missing(Missing what?), and the same situation occurs in next studies.

References

Agarwal, R., & Audretsch, D. B. (2001). Does entry size matter? The impact of the life cycle and technology on firm survival. Journal of Industrial Economics, 49, 21–43.

Agarwal, R., & Gort, M. (2002). Firm and product life cycle and firm survival. American Economic Review, 92, 184–190.

Anderson, J. H., Lee, Y., & Murrell, P. (2000). Competition and privatization amidst weak institutions: evidence from Mongolia. Economic Inquiry, 38(4), 527–549.

Audretsch, D. B. (1995). Innovation and industry evolution. Cambridge: The MIT Press.

Audretsch, D. B., Houweling, P., & Thurik, A. R. (2000). Firm survival in the Netherlands. Review of Industrial Organization, 16, 1–11.

Audretsch, D. B., & Lehmann, E. E. (2005). The effects of experience, ownership, and knowledge on IPO survival: Empirical evidence from Germany. Review of Accounting and Finance, 4, 13–33.

Audretsch, D. B., & Mahmood, T. (1991). The hazard rate of new establishments: a first report. Economics Letters, 36(4), 409–412.

Audretsch, D. B., & Mahmood, T. (1994). The rate of hazard confronting new firms and plants in U.S. manufacturing. Review of Industrial Organization, 9, 41–56.

Audretsch, D. B., & Mahmood, T. (1995). New firm survival: new results using a hazard function. The Review of Economics and Statistics, 97–103.

Aw, B. Y., Chen, X. M., & Roberts, M. J. (2001). Firm-level evidence on productivity differentials and turnover in Taiwanese manufacturing. Journal of Development Economics, 66, 51–86.

Bernard, A. B., & Jensen, J. B. (2007). Firm structure, multinationals, and manufacturing plant deaths. The Review of Economics and Statistics, 89, 193–204.

Caves, R. E. (1998). Industrial organization and new findings on the turnover and mobility of firms. Journal of economic literature, 1947-1982.

Caves, R. E., & Porter, M. E. (1976). Barriers to exit, essays on Industrial Organization in Honor of Joe S. Bain. Cambridge: Ballinger.

Cox, D. R. (1972) Regression models and life-tables. Journal of the Royal Statistical Society. Series B (Methodological), 187–220.

Esteve, S., & Manez, J. (2008). The resource-based theory of the firm and firm survival. Small Business Economics, 30, 231–249.

Esteve, S., Sanchis, A., & Sanchis, J. A. (2004). The determinants of survival of Spanish manufacturing firms. Review of Industrial Organization, 25, 251–273.

Geroski, P. A. (1995). What do we know about entry? International Journal of Industrial Organization, 13, 421–440.

Hopenhayn, H. (1992). Entry, exit, and firm dynamics in long-run equilibrium. Econometrica, 60, 1127–1150.

Jacobson, L. (1985). Analysis of the accuracy of SBA's Small Business Data Base. Center for Naval Analysis, Alexandria, Va.

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica, 50, 649–670.

Kastl, J., Martimort, D., & Piccolo, S. (2013). Delegation, ownership concentration and R&D spending: Evidence from Italy. The Journal of Industrial Economics, 61, 84–107.

Katayama, H., Lu, S., & Tybout, J. R. (2009). Firm-level productivity studies: Illusions and a solution. International Journal of Industrial Organization, 27, 403–413.

Kornai, J. (1979). Resource-constrained versus demand-constrained systems. Econometrica, 47, 801–819.

Kornai, J. (1992). The Socialist System: The Political Economy of Communism: The Political Economy of Communism. Oxford University Press.

Kronborg, D., & Thomsen, S. (2008). Foreign ownership and long-term survival. Strategic Management Journal, 30, 207–219.

Liu, L. L. (1993). Entry-exit, learning, and productivity change: Evidence from Chile. Journal of Development Economics, 42, 217–242.

Manjon-Antolin, M. C., & Arauzo-Carod, J. (2008). Firm survival: Method and evidence. Empirica, 35, 1–24.

Mata, J., & Portugal, P. (2002). The survival of new domestic and foreign-owned firms. Strategic Management Journal, 23, 323–343.

Mata, J., & Portugal, P. (2004). Patterns of entry, post-entry growth and survival: A comparison between domestic and foreign owned firms. Small Business Economics, 22, 283–298.

Mayer, C., & Alexander, I. (1990). Banks and securities markets: Corporate financing in Germany and the United Kingdom. Journal of the Japanese and International Economies, 4(4), 450–475.

Nachum, L. (2003). Liability of foreignness in global competition? Financial service affiliates in the city of London. Strategic Management Journal, 24, 1187.

Reynolds, S. S. (1998). Plant closing and exit behavior in declining industry. Economica, 55, 493–503.

Shiferaw, A. (2009). Survival of private sector manufacturing establishments in Africa: The role of productivity and ownership. World Development, 37, 572–584.

Steensma, H. K., & Lyles, M. A. (2000). Explaining IJV survival in a transitional economy through social exchange and knowledge-based perspectives. Strategic Management Journal, 21, 831–851.

Strotmann, H. (2007). Entrepreneurial survival. Small business. Economics, 28, 87–104.

Taymaz, E., & Özler, Ş. (2007). Foreign ownership, competition, and survival dynamics. Review of Industrial Organization, 32, 23–42.

Tybout, J. R. (1996). Heterogeneity and productivity growth: Assessing the evidence. Industrial evolution in developing countries: Micro patterns of turnover, productivity, and market structure (pp. 43–72). New York: Oxford University Press.

Tybout, J. R. (2000). Manufacturing firms in developing countries: How well do they do, and why? Journal of Economic literature, 11–44.

Walder, A. G. (1995). Local governments as industrial firms: An organizational analysis of China’s transitional economy. American Journal of Sociology, 101, 263–301.

Zhang, W., Zhou, L., & Gu, Q. (2003). The mechanism of firm exit in economics transition: An empirical analysis for Zhongguancun Science Park of Beijing. Economic Research Journal, 106, 3–14.

Acknowledgments

The National Science Council in China funded the study under the project No. 71203023.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Audretsch, D., Guo, X., Hepfer, A. et al. Ownership, productivity and firm survival in China. Econ Polit Ind 43, 67–83 (2016). https://doi.org/10.1007/s40812-015-0021-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-015-0021-6