Abstract

The trade literature has long discussed the existence of some benefits attributed to exporting (learning-by-exporting), among others, the improvement in survival chances. This paper examines whether exporting SMEs enjoy better survival prospects than non-exporting SMEs. We investigate the determinants of survival of exporting and non-exporting SMEs and explore whether the exporting behaviour plays a significant role in explaining their probability of exit. For this purpose, we estimate discrete time proportional hazard models that account for unobserved individual heterogeneity. The dataset is a sample of Spanish manufacturing SMEs drawn from the Encuesta sobre Estrategias Empresariales (ESEE) for 1990–2002. After controlling for firm, industry and economy characteristics, we find evidence supporting the existence of a sizeable “surviving-by-exporting” effect. That is, exporting SMEs face a significantly lower probability of failure than non-exporters.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

This paper investigates the determinants of small and medium sized firm survival, and in particular, whether the survival of exporters and non-exporters is different. Previous studies on the survival of manufacturing firms (Esteve et al. 2004; Esteve and Máñez 2006) have found a negative correlation between exporting and failure. Furthermore, recent models of heterogeneous firms and international trade (Bernard et al. 2003; Melitz 2003) predict that exporters are less likely to fail than non-exporters, and Bernard and Jensen (2002) find a lower probability of death for exporting plants. However, to our knowledge, no work has scrutinized in depth the exact role of exporting on the survival of small firms.

A common finding by the trade literature is the superiority, at any point in time, of exporters (either plants or firms) over non-exporters in any performance dimension (efficiency, size, survival prospects,…).Footnote 1 Two alternative but not exclusive hypotheses related to the direction of causality have been posed: first, good firms become exporters (self-selection); and secondly, exporting improves firm performance (learning-by-exporting). On the one hand, the evidence so far is broadly consistent with the hypothesis of self-selection of the more efficient firms into export markets.Footnote 2 The argument is that the decision to export is an entry decision that involves entry costs, at least partially sunk, into foreign (uncertain) markets that the less efficient firms cannot overcome.

On the other hand, the evidence on the positive effects attributed to exporting (learning-by-exporting) is less compelling.Footnote 3 On theoretical grounds, these gains arise from the growth in sales, higher risk diversification, knowledge flows from international buyers (about technological expertise of buyers, consumer tastes, and the available products) and from competitors (about international best practices), which enhances efficiency, product quality and survival chances.Footnote 4

For one reason or another, that is, whether good firms self-select into export markets or whether exporting boosts performance, exporters are expected to be more efficient. Furthermore, according to the learning-by-exporting hypothesis exporters relative efficiency increases over time. Hence, as predicted by the industry dynamics literature (Jovanovic 1982; Ericson and Pakes 1995, among others), more efficient firms are expected to survive longer, and thus exporters are expected to survive longer than non-exporters.

This paper compares the survival patterns of exporting and non-exporting SMEs. The primary goal is to provide a satisfactory answer to the following question: do exporting SMEs and non-exporting SMEs experience different failure rates? If the answer is yes, a second step is to assess the impact of the exporting strategy on SMEs survival chances, once other characteristics associated with the survival of firms, which may make exporters different from non-exporters, are controlled for. That is, this paper aims to evaluate whether there is anything in explaining the whole difference in survival prospects that must be attributed to exporting. If after controlling for heterogeneity among firms by including other firm, industry and economy characteristics, which account for relevant features that may affect survival, exporting extends the survival prospects of SMEs, we would have found evidence of a “surviving-by-exporting” effect for SMEs.

To perform the analysis, we use data on SMEs drawn from the Encuesta sobre Estrategias Empresariales (ESEE, hereafter) for the period 1990–2002. This survey data is representative of Spanish manufacturing firms classified by industrial sectors and size categories.Footnote 5 We build a panel of firms, identify their exit dates, and use the exhaustive information at the firm level provided by the dataset. The empirical work is carried out using survival methods controlling for the interval-censored nature of the data, and the existence of unobserved individual heterogeneity (such as unobserved firms organizational capabilities, network contacts, access to specific assets, etc.). Ignoring unobserved individual heterogeneity may lead to strongly inconsistent estimates of the included covariates.

The data in this paper differ from those in most previous empirical papers analysing firm failure, that have focused on the exit probabilities of a/few cohort/s of new firms or establishments with a short follow-up period. Thus, the robustness of their empirical results critically rests on how representative the particular cohort examined is. In this line, Audretsch (1991) suggests that the determinants of new-entrants’ survival crucially depend on the length of the period in which survival is measured. In addition, Wagner (1994) points out the convenience of analyzing several cohorts since the particular year of birth of a cohort may be important in explaining its life experience. On the contrary, in this paper we examine the effect of export behaviour on survival using a representative sample of all existing SMEs, including young and mature ones, and investigate their hazard rates taking into account their different age. Thus, the time dimension in our analysis is the calendar year, rather than the age of new firms.

This research topic is of great value for academics, entrepreneurs and policy makers. First, if exporting enhances firms survival prospects, researchers investigating the existence of learning-by-exporting should account for this when carrying out their work. Secondly, reliable answers to the two main questions tackled in this paper (that are, (i) do exporting SMEs face lower failure rates than non-exporting ones? and (ii) what does cause SMEs failure rate?) may help entrepreneurs to more accurately estimate their chances of success, especially if they wish to compete in international markets. Likewise, investors, lenders and suppliers could more properly estimate the risks of their investments. Thirdly, this topic has important policy implications. Export-led growth policies assume the existence of a direct and strong relationship between openness and productivity improvements due to the positive effect of competition on entrepreneurial capacity. This effect is supposed either not to exist in the home market or to be unattainable by means of inward-oriented policies. This paper permits to assess the accuracy of these statements: the higher the survival chances of exporters and the greater the difference in survival chances between exporters and non-exporters, the more relevant the benefits of export-oriented policies.

To anticipate the results, we find evidence of a significant “surviving-by-exporting” effect among SMEs. This result arises after controlling for SMEs characteristics (among them, firm productivity as well as innovative outcomes that account for some benefits attributed to exporting), industry and economy characteristics, and controlling for the presence of unobserved heterogeneity.

The rest of the paper is organized as follows. Section 2 reviews the literature on the determinants of firm survival and discusses the expected results of the explanatory variables. In Sect. 3, the dataset is described, the statistical methods used to study firm lifetimes are briefly outlined, and some descriptive statistics are presented. In Sect. 4, we present and discuss the main results, and Sect. 5 concludes.

2 The determinants of SMEs survival

In this section we examine the determinants of SMEs failure and raise some hypotheses about their expected effects. In particular, we devote special attention to compare the failure rates of exporting and non-exporting SMEs.

There exists certain consensus in the trade literature that exporters are better than non-exporters. Two alternative but not exclusive hypotheses have been proposed to explain the origin of this (cross-section) superior performance of exporters relative to that of non-exporters: either good firms become exporters (self-selection hypothesis) or firms become more efficient after becoming exporters (learning-by-exporting hypothesis). Independently of the origin of this superior performance, exporters are expected to have better survival chances than non-exporters with identical observed characteristics. A primary goal of the paper is to assess whether, after controlling for firm, industry characteristics and the economic environment, there still exist significant differences in survival that can only be attributed to export behaviour.

The discussion of the factors, others than exporting behaviour, that are likely to affect the survival of SMEs follows an eclectic approach, in that the hypotheses to be tested later are derived from the related literature, namely Industrial Organization, Resource-Based View of the Firm, and Organizational Ecology.

The determinants of firm failure can be summarized into three broad categories. First, firm-based risk that is unique (and internal) to the enterprise and presumably within its control. Secondly, industry-based risk that comprises the risk associated with the industry in which an enterprise is operating. Thirdly, economy-based risk (or economic environment), that is the risk associated with the economy in which an enterprise is located. We discuss each one of these groups in turn.

2.1 Firm-based risk

The lack of appropriate management skills or management incompetence is the most common cause of business failure. This risk is proxied by a set of firm characteristics.

2.1.1 Management skills or managerial competence

According to the Resource-Based View of the Firm literature, the ability of the firms to develop distinct capabilities, which cannot be imitated by competitors, significantly enhances their competitive advantage and improves their survival prospects (Wernerfelt 1984; Barney 1991). The generation of these firm-specific assets mainly depends on the firms’ R&D and advertising strategies given that these determine their ability to innovate and market their products. Firms that engage in advertising and are successful innovators are more likely to develop these firm-specific assets that improve their competitive advantage. Further, these activities may have considerable spillovers to the whole firm (Klette 1996), and transform the firms’ capabilities and competences in other areas. Hence, these firms are more likely to adapt to the changing competitive environment and suffer a lower failure rate.

Furthermore, the IO literature (for instance, Jovanovic 1982; Ericson and Pakes 1995) has pointed out to differences in efficiency (including the firms’ ability to adapt to the changing competitive environment) as the main factor explaining differences in firms’ fates. These differences have been usually proxied by age and size. However, Geroski (1995) argues that these variables capture this relationship rather loosely. Thus, firms’ advertising and R&D strategies may help to better capture the firms’ relative competitive position and its evolution over time. Firms that obtain innovations and carry out advertising improve their competences, which makes them fitter to survive. Furthermore, advertising outlays can be considered, as in Sutton (1991), as endogenous sunk costs improving the firms’ perceived quality image enhancing the consumers’ willingness to pay for their products. Then, it would increase firms’ expected lifetime. For Comanor and Wilson (1967), advertising has an anticompetitive effect as it raises barriers to entry, which softens the toughness of competition and makes exit less likely.

A number of studies have pointed out that sustained competitive advantage of firms not only relies on physical technology, but also, and very intensively, on knowledge assets (Parker 2004). The former can be imitated or traded, whereas human capital cannot (Teece 1998). Thus, Autor et al. (1998) point out that the ability of firms to use advanced technologies, which allows them to reach the technological frontier, greatly depends on the presence of a well educated workforce. As Grant (1996) argues, although knowledge is tacit and is embodied in firms’ routines and processes, it only exists in individuals. According to this author, formal education is an important mechanism to acquire knowledge and to develop the ability to produce new knowledge. Moreover, Altonji and Spletzer (1991) find a positive correlation between a firm’s investments in firm-specific human capital and the endowment of general human capital of the employees. Thus, the percentage of graduated workers over the total workforce of a firm (labour quality variable) can be also used to proxy for the managerial competence of the SMEs.

Apart from labour quality, we further introduce other variables to account for managerial competence. These variables are whether the firm carries out advertising activities (advertising variable),Footnote 6 and three dummy variables that account for the innovative outcomes of the firms: process innovation, product innovation, and registered patents. These three variables take value one if, in a given year, the firm declares to obtain (register) the corresponding innovation output, and zero otherwise.

To control for innovative outcomes in this context is important given the likely positive correlation between exporting and innovative outcomes. Salomon and Shaver (2005) find evidence of learning-by-exporting but not related to productivity. Instead, they argue that exporters can often access diverse knowledge inputs (through export intermediaries or directly from customers) not available in the domestic market which may foster innovation. The latter could be better measured through innovative outcomes, such as process and product innovation and number of registered patents.

2.1.2 Other firm characteristics

(a) Age. One of Geroski’s stylized facts (Geroski 1995) is that firms’ survival chances are positively related to their age and size.

The most common argument in the IO industry dynamics literature is to consider that heterogeneous entrepreneurs or firms make entry decisions incurring in sunk costs and being uncertain about their true efficiency (for instance, Jovanovic 1982 and Ericson and Pakes 1995). Entrepreneurs start a new firm based on their expected post-entry performance. Yet, they only discover their true ability (in terms of managerial competence and viability in the market) once their business are established. As time goes by, firms go through a legitimating process by learning about their abilities to be in business. Those entrepreneurs who discover that their ability exceeds their expectations stay in and expand the scale of their businesses, whereas those discovering that their post-entry performance is below their expectations will reduce their scale and/or exit from the industry. Efficient firms grow and survive and inefficient firms decline and fail. Hence, the age of a business could be considered a reasonable proxy for management experience (Parker 2004). The learning process is expected to extend over several years, leading to expect much higher exit rates for a particular cohort of new firms in the first few years after entry than for older cohorts in the same market at the same time period. Thus, exit rates are expected to decrease as firms grow older (Dunne et al. 1989; Mata and Portugal 1994).

Organizational ecologists put forward the existence of several possible relationships between age and survival. They are named as liability of “newness”, “adolescence” and “senescence”. However, the so-called liability of “newness” constitutes their preferred explanation of the age effects on survival. It refers to the time organizations need to settle down in the market, carry their specific investments, develop specific knowledge and appropriate routines, build up trust within them and with other organizations, etc. The liability of “newness” arises from some factors associated to firm novelty. First, novelty to the market, related to the degree to which potential customers are uncertain about the new firm. Besides, new entrepreneurs have usually only a limited idea of how much marketing is needed. In addition, new firms may both have to face higher marketing costs than established firms and be less certain about their effect. Secondly, novelty in production that is related to the extent in which the production technology used by the new firm is similar to the technologies in which the production team has experience and knowledge. A newly created business needs to build up a new production team and some conflicts may emerge regarding the organizational roles. Thirdly, novelty to management as a result of the lack of business skills, industry specific information, and start-up experience of the entrepreneurs.

New organizations need time to develop their new organizational capabilities (Stinchcombe 1965; Nelson and Winter 1982; Carroll and Hannan 2000). Until firms settle, they are less likely to be able to cope with severe environmental challenges than better and longer established organizations. Some empirical studies support this result (Freeman et al. 1983, among others).

Therefore, according to both IO and the Organizational Ecologists’ liability of “newness” we expect failure rates to monotonically decline with firm age.

Other studies have found a different relationship between age and the probability of exit. The liability of “adolescence” predicts that failure rates have an inverted U-shaped relationship with age (Bruderl and Schussler 1990; Fichman and Levinthal 1991). The liability of “adolescence” suggests that new organizations can survive for a time with little risk of failure by drawing on initial resources (e.g., venture capital funding, bank loans). Hence, failure rates are low immediately after starting a business, then increase to a maximum with the exhaustion of the initial resources, and decline afterwards given that only the fittest firms remain in the market. Based on this argument, we expect an inverted U shape relationship between age and the probability of exit.

According to the liability of “newness” and “adolescence” the early years of a firm’s life are the most risky, predicting that failure rates eventually decline with age. They differ in whether exit rates peak at founding or some years later. Other authors have found that beyond a certain age, the probability of exit may increase with age. According to the liability of “senescence” (Baum 1989; Hannan 1998) older firms are highly inertial and tend to become increasingly ill-suited to cope with changing competitive environment. Consequently, beyond a certain age (the start of the senescence) failure rates are expected to increase. Thus, on the basis of the liability of “senescence”, beyond a certain age, it is expected that the risk of firm exit increases with age.

The variable age is calculated as the difference between current year (t) and the constituent year reported by the firm.

(b) Size. The literature on firm survival has found a positive relationship between size and survival. Some studies related size at time of entry with survival chances, whereas others have focused on current size instead. There are some arguments supporting the use of current size. On the one hand, Levinthal (1997) argues that a firm’s ability to adapt to changing competitive environment is a crucial determinant of survival, which could be proxied by current size. On the other hand, Mata et al. (1995) point out that current size is a better predictor of survival than initial size because the former contains information on the reaction of a firm to its market success over time. Irrespectively of the use of start-up or current size, a number of factors suggest the existence of a positive relationship between size and survival.

First, larger firms are more likely to take advantage of economies of scale than their smaller counterparts, and thus face a lower risk of exit (Audretsch and Mahmood 1994). Secondly, larger firms are usually more diversified than smaller ones. Diversification reduces the risk of exit because adverse conditions in one market can be offset by better conditions in other markets (Holmes and Schmitz 1990; Parker 2004). Thirdly, the learning literature (Jovanovic 1982; Ericson and Pakes 1995) has taken firms’ size and age to represent the efficiency differences among firms that arise from differences in experience, managerial abilities, production technology and firm organization. Fourthly, larger firms may have an advantage in raising funds, may face better tax conditions and may be in a better position to recruit qualified workers, than smaller firms. Size is measured in this paper by the number of firm employees.

(c) Labour productivity. A firm’s productivity crucially determines its relative efficiency and therefore its probability of surviving, as pointed out by the learning literature. Jovanovic (1982), Ericson and Pakes (1995), Olley and Pakes (1996) and Melitz (2003) predict that the probability of survival is smaller for low-productive firms. The variable labour productivity is measured by the ratio of firm output (in real terms) to the number of its employees.

(d) Legal structure. With regard to the effects of legal structure upon the survival of firms, Harhoff et al. (1998) argue that limited liability corporations are more likely to go bankrupt but less likely to be voluntarily liquidated than unlimited ones. The argument is that whereas the owners of limited liability corporations are not responsible for the debts of the firms, the owners of other firms are accountable for possible losses with their personal wealth. Our dataset does not allow distinguishing between exit by liquidation and exit by bankruptcy. Nevertheless, given that voluntary exit usually takes place before a firm goes bankrupt, the argument rose by Harhoff et al. (1998) still holds in our case. In this line, Mata and Portugal (2002) find that unlimited liability firms are more likely to exit than limited liability ones. To account for the firm legal structure, we use a dummy variable (legal structure) that takes value one if the firm operates under limited liability, and zero otherwise.

(e) Foreign capital participation. The evidence on the effect of foreign capital participation on survival is mixed. On the one hand, a positive correlation is expected if foreign capital participation is a signal of unobserved quality of the participated firm. On the other hand, an argument to expect a negative relationship is that firms doing business abroad may face harsher survival conditions related to the difficulty both of coordinating different business units and of adapting to local market competitive conditions (Hymer 1976). Furthermore, Braconier and Ekholm (2000) obtain that multinational firms have higher elasticity of labor demand, given their greater flexibility to shift production among locations according to local economic conditions. Recently, Mata and Portugal (2002) find that domestic new firms face higher failure rates when other determinants of exit are not taken into account. Bernard and Sjöholm (2003) obtain that foreign owned plants are more likely to shut down when other factors are not controlled for. However in the latter two studies, the effect of this variable on survival vanishes when the effects of other explanatory variables are accounted for. To control for foreign capital participation we use the dummy variable foreign that takes value one if the firm’s capital is participated by foreign capital, and zero otherwise.

2.2 Industry-based risk

2.2.1 Industry growth

Firms’ life conditions are expected to be more pleasant in growing industries than in industries with stagnant or declining demand. New firms and growing incumbents do not need to steal customers away from rivals and competition is softer. The empirical evidence supports a positive relationship between industry growth and survival (Audretsch and Mahmood 1994; Mata and Portugal 1994). Industry growth is measured by the production growth rate of the industry in which a firm operates. It has been calculated for the 20 industries of the NACE-93 classification.Footnote 7

2.2.2 Industry classification (Pavitt’s classification)

Further, we consider the influence of the type of industry in which the firm operates according to Pavitt’s (1984) classification. Pavitt (1984) grouped industries into four groups according to different characteristics of the firms: innovation behaviour (product and process innovation, sources of knowledge, appropriability regimes and the like), production organisation (e.g. degree of vertical integration) and competitive factors. These four groups are traditional industries, scale economies industries, specialized industries and R&D intensive industries.Footnote 8 Technological interdependencies among these four categories are very complex.

2.3 Economy-based risk

The risk of business failure is also related to the state of the economy in which an enterprise operates (Parker 2004). In this paper, this factor is accounted for using year dummies (that allow recovering the baseline function – see methodology section), which control for the risk that is common to all surviving firms in a particular calendar year.

3 Data and methodology

3.1 Data

For this study we use yearly data from a survey of Spanish manufacturing firms sponsored by the Ministry of Industry (ESEE).Footnote 9 This survey started in 1990 and it is representative of Spanish manufacturing firms classified by industry and size categories and provides exhaustive information at the firm level. The sample analysed in this paper corresponds to the period 1990–2002 and comprises 14660 observations on 2411 SMEs. Of them, 363 failed to survive during the sample period. The dataset is an unbalanced panel given that there are entry and exit of firms. Table 1 displays the evolution of the sample of firms used in the analysis.

Although the EU considers SMEs those firms with less than 250 employees,Footnote 10 in our analysis SMEs are taken to be those firms with 200 or less employees in the first year that are included in the ESEE survey. The reason of this discrepancy is the different sampling procedure used in the ESEE for firms between 10 and 200 employees, and firms with more than 200 employees. Whereas firms with 10–200 employees were randomly sampled by industry and size strata, holding around a 5% of the population in 1990, all firms with more than 200 employees were requested to participate. As a consequence of this sampling procedure, including firms between 200 and 250 workers could bias the results of our analysis.

We compute a firm as exiting in period t when this is the last year it is in business (or independently active). Given the way in which we measure exit and the nature of the ESEE, information in 2002 is only used to identify those firms exiting in 2001. The definition of failure in this study is constrained by the nature of the ESEE survey. Thus, firm failure refers to discontinuance of ownership. That is, it comprises bankruptcy, voluntary closure, shifts to non-manufacturing activity, as well as being acquired. Acquisition includes firms either acquired by or merged with another firm in the sample (the exiting firm being the smaller one). Following Klepper and Simons (2000), when two firms merge we do not compute it as two firms exiting and one “de novo” entering, but consider the bigger firm in the merger as a continuing firm and the smaller firm as an exiting one.Footnote 11 For the active firms in 2002 and those leaving the survey (for reasons other than failure) all we know is that they were still active in 2002 or in their last year in the survey, respectively.

3.2 Methodology

The empirical work is carried out using survival methods, which are appropriate to analyse the determinants of firm exit,Footnote 12 given the features of our dataset. First, these methods take into account the evolution of the exit risk and its determinants over time since they control for both the occurrence and the timing of exit. Secondly, survival methods are appropriate in the presence of right censoring,Footnote 13 when we only know that the firm has survived at least up to a given period t. In our dataset there are two sources of right-censoring: on the one hand, there are firms that leave the risk set (i.e. the pool of firms that may fail at any time) for reasons other than failure (abandon the survey); on the other hand, there are firms that by the end of the observation window had not ended their spell (i.e. they are still in operation). Thirdly, these methods can easily accommodate time-varying covariates. The consideration of time varying covariates is a desirable feature since the ability of a firm to survive varies over time as the competitive environment changes (Mata et al. 1995).

Our analysis is based on calendar time, so that the focus lies on the determinants of the hazard or exit risk. Therefore, initially, the risk of exit is equal for all firms alive in a particular year, i.e., the macroeconomic conditions are important and controlled by the baseline hazard. Thus, firm age is to be included as an explanatory variable.

In order to examine the determinants of the probability of exit of the firms we use two different methodologies. First, we examine the influence of explanatory variables individually by carrying out non-parametric log-rank tests of the null hypothesis of equality of survival functions across the r-groups in which firms are classified according to the r-values of each of these covariates. These tests are extensions of non-parametric rank tests used to compare two or more distributions for censored data. Under the null hypothesis there is no difference in the survival rates for each of the r-groups at any of the failure times and this statistic distributes as a χ2 with r−1 degrees of freedom. At any failure time, the contribution to the t-statistic is obtained as a weighted standardized sum of the difference between the actual and expected number of exits for each of the r-groups. Given that we aim to disentangle the effects of exporting on survival, we calculate the above tests for exporting and for non-exporting SMEs separately.

Secondly, we undertake a multivariate analysis in order to evaluate the effect of each explanatory variable on the hazard rate controlling for the effect of other covariates. The implemented survival models are discrete time proportional hazard models in which duration (time) is treated as a discrete variable, not because it is intrinsically discrete but because the data is available on a yearly basis (interval-censored data). The estimation method allows for a fully non-parametric estimation of the baseline hazard and controlling for unobserved heterogeneity.

With interval censored data one knows whether a firm exits in a given year of the survey. Time intervals in our data set are of one year. Thus, the interval boundaries are the positive integers j = 1, 2, 3, 4,…, and the interval j is (j−1, j]. One firm duration spell can either be complete (c i = 1) or right censored (c i = 0). A censored spell i with length j intervals contributes to the likelihood function with the discrete time survivor function (the probability of survival until the end of interval j):

where \( T_{i} = \min {\left\{ {T^{*}_{i} ,C^{*}_{i} } \right\}} \), and \( T^{*}_{i} \) is some latent failure time and \( C^{*}_{i} \) some latent censoring time for spell i, and \( h_{{ik}} = \Pr {\left( {k - 1 < T_{i} \le k\left| {T_{i} > k - 1} \right.} \right)} \) is the discrete hazard (the probability of ending the spell in interval k conditional to the probability of survival up to the beginning of this interval). A complete spell i in the j interval contributes to the likelihood with the discrete time density function (the probability of ending the spell within the j interval):

Using (1) and (2), the log likelihood function for the sample of spells is:

Allison (1984) and Jenkins (1995, 2004) show that (3) can be rewritten as the log likelihood function of a binary dependent variable y ik with value one if spell i ends in year k, and zero otherwise:

This allows discrete time hazard models to be estimated by binary dependent variable methods and time-varying covariates to be incorporated.

Following Prentice and Gloeckler (1978), we assume that h ik is distributed as a complementary log–log (cloglog) to obtain the discrete time representation of an underlying continuous time proportional hazard:Footnote 14

where γ j is the interval baseline hazard (we use a non-parametric specification), and x ij are covariates which may be time-varying (although constant within intervals).

Incorporating unobserved heterogeneity, the cloglog model in (6) becomes

where u i ≡ ln (ν i ), and ν i originally enters the underlying continuous hazard function multiplicatively, \( h{\left( {t,x_{{it}} } \right)} = h_{0} {\left( t \right)}\exp ^{{\beta _{0} + x_{{it}} \beta }} \nu _{i} \). Usually ν is assumed to be Gamma distributed with unit mean and variance σ 2 to be estimated from the data (Meyer 1990).Footnote 15

The lack of control for unobserved individual heterogeneity may cause some problems. First, the degree of negative (positive) duration dependence in the hazard is over-estimated (under-estimated). This is the result of a selection process. For instance, with negative duration dependence, high ν-value individuals finish the spell more rapidly. Then, as time goes by, a higher proportion of individuals with low values of ν remain alive, which implies a lower hazard. Secondly, positive (negative) β parameters are under-estimated (over-estimated). Finally, the estimated coefficients can no longer be interpreted as the proportionate response of the hazard to a change in a given covariate.

3.3 Data description

Table 2 reports descriptive statistics of our sample on SMEs export activity, for the period 1990–2001. The proportion of exporting firms steadily increased from 30.65 to 50.57%, signalling a trend of incorporation of SMEs to the export market. However, export intensity (export to sales ratio) remained quite stable during the sample period, with the minimum at 20.35% (for the year 1992) and the maximum at 24.45% (for the year 1999).

Table 3 reports the average value of the continuous variables and the percentage of ones for the dummy variables used as determinants of SMEs survival, both for the overall sample an for exporters and non-exporters. As our main interest lies on the effects of export strategies on SMEs survival, tests on the comparison between exporters and non-exporters are also reported. Exporting SMEs are significantly larger, older, more productive, and hire more qualified workers than its non-exporting counterparts. Further, the proportion of exporting SMEs that obtain innovations (either process or product innovations, or patents) and carry out advertising activities is significantly higher than that of non-exporting SMEs. As for the legal structure, exporting SMEs are more likely to operate under limited liability and to be participated by foreign capital. Both exporting and non-exporting firms mostly operate in Traditional and Scale economies industries (72.88 and 83.05% of the exporting and non-exporting SMEs, respectively) with a smaller number of firms operating in Specialized and R&D intensive industries. However, it should be noted that whereas the percentage of non-exporting SMEs operating in Traditional and Scale economies industries is significantly higher for non-exporting SMEs, the opposite happens for Specialized and R&D intensive industries.

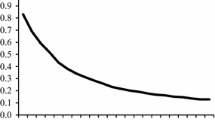

Finally, panel a of Fig. 1 shows, both for exporting and for non-exporting SMEs, a non-parametric estimation of the hazard rate, that is without controlling for the effect of other explanatory variables. This figure illustrates the evolution of the overall risk of exit over time, showing the relationship between risk of failure and the macroeconomic business cycle. We plot in panel b of Fig. 1 the evolution of the GDP growth rate to proxy for the business cycle. The comparison in panel a of Fig. 1 of the hazard rates that correspond to exporting and non-exporting SMEs provides a number of interesting insights. First, it is evident that the differences between exporting and non-exporting SMEs hold true along the time span of our sample. At any year exporters experience a lower risk of exit than non-exporters. Secondly, comparison of panels a and b of Fig. 1 reveals that the evolution of the hazard rates partially resembles the evolution of the business cycle as: (i) the hazard rates peak with the early nineties crisis (1992–1993); (ii) then they level off as the Spanish economy recovers from 1994 to 1997; and, (iii) eventually, they increase with the deceleration of the Spanish economy along 2001. However, the increase in hazard rates observed for 1998 and 1999 does not match the evolution of the Spanish business cycle.

4 Results

We devote the first part of this section to briefly analyze the results of the univariate tests described in Sect. 3. They aim at obtaining a first picture of the individual effect of each one of the variables considered on the probability of exit. The second part of this section carries out a thorough description of the results obtained in the multivariate regression analysis and relates them with the hypotheses on firm survival stated in Sect. 2.

Since our main goal is to analyse the influence of exporting in SMEs survival, we first carry out a log-rank test analysing whether exporting or not has an impact on the probability of survival of SMEs, then we undertake log-rank tests for each one of the other explanatory variables controlling for the export status of the SMEs.

As for the influence of exporting, the value of the log rank test (27.08 with p-value = 0.000) suggests that exporting SMEs enjoy better survival prospects than non-exporting ones. Although the result has been obtained without taking into account the effect of other variables that may also explain survival prospects, this could be interpreted as a first piece of evidence of a “surviving-by-exporting” effect.

Table 4 shows the results for the log-rank tests of equality of hazard functions across groups of firms classified by explanatory variables.Footnote 16 The results suggest the existence of remarkable differences in the survival prospects between groups of firms for most of the variables. Thus, workforce qualification, firm size, labour productivity, whether or not the firm obtains process innovations, carries out advertising activities and the type of industry in which the firm operates are found to affect the probability of survival of exporting and non exporting SMEs. However, these variables influence the probability of survival of exporters and non-exporters in a different manner.

Further, some variables only influence the survival probability of exporting SMEs but not that of non-exporting SMEs, and viceversa. Thus, whereas age only influences the survival probability of non-exporting SMEs, other variables such as industry growth, firm legal form and whether or not the firm obtains product innovations or registers patents only affect the survival probability of exporters.

Among exporting SMEs, the fittest to survive are the largest, more productive, with a high proportion of qualified workforce, operating under limited liability, performing advertising, obtaining product and process innovations, registering patents and operating in R&D intensive industries. As for non-exporting SMEs, those that endure better survival prospects are large firms, with intermediate productivity, workforce qualification and age, and obtaining process innovations, performing advertising and operating in scale economies industries.

Table 5 reports the results of estimating several specifications of the discrete time proportional hazard model (complementary log–log model, cloglog) in order to investigate the determinants of firm survival. In all the estimations we treat the shape of the baseline hazard function non-parametrically.

The first column displays the estimates of the unconditional impact of being an exporter upon de probability of exit, i.e., the effect of being an exporter without controlling for other firm characteristics, which may also affect survival. This estimate shows that being an exporter has a strong and significant effect on the probability of SMEs survival, as exporting SMEs experience a 46% lower hazard rate than that of non-exporting ones. This finding is consistent with the hypothesis of a “learning-by-exporting” effect that improves SMEs survival chances.

The second column goes a step further and investigates the influence that SMEs export intensity has on their probability of survival. With the aim of capturing possible non-linear effects of export intensity on duration, we introduce this variable in our model as a set of four dummy variables, being the omitted category in our regression the one corresponding to non-exporting SMEs. The other three dummies correspond to low, intermediate and high export intensity (first, second and third terciles of the positive part of the export intensity distribution, respectively). The estimated hazard rates suggest that independently of the export intensity level, exporting improves SMEs survival probabilities (the three hazard rates are significant and rank between 0.471 and 0.577). However, higher export intensity does not ensure a longer life, as pair-wise comparisons of the hazard rates indicate that there is not any significant difference among the hazard rates for the different export intensity groups.Footnote 17 This suggests that the relevant relationship between survival and exports is whether or not the SMEs export and not their exporting intensity level. Therefore, in the estimates of columns 3 and 4, we measure the possible effect of exporting on the probability of exit by means of an export participation dummy variable. In any case, the estimates strongly suggest the possible existence of a “surviving-by-exporting” effect among SMEs.

In columns (3) and (4), we report the estimates when controlling for heterogeneity among SMEs by including in our model the firm, industry and economy variables discussed in the previous section, which account for important characteristics that are expected to affect the risk of exit. The only difference between estimations of columns (3) and (4) is the inclusion in the latter of an unobserved heterogeneity component for which a gamma distribution is assumed. However, the estimates in columns (3) and (4) are quite similar as we do not find evidence of unobserved heterogeneity (that is, we cannot reject the null hypothesis that the unobserved heterogeneity variance component (σ 2) is equal to zero). Therefore, our comments focus on the estimates reported in column (3).Footnote 18

As for the variables capturing management skills or managerial competence of the firm, we find the following results. The quality of the human capital of SMEs is clearly important for their survival prospects. SMEs with a high proportion of qualified workers experience better survival prospects. Our estimates indicate that a SME with a 10% higher proportion of graduated workers has a 0.04% lower probability of exit. Whereas declaring to implement process innovations improves SMEs survival chances (the hazard rate for process innovators is a 35% lower), neither declaring to implement product innovations nor to register patents has a significant effect on the chances of survival of SMEs. The positive effect of process innovations on survival is in line with Cosh et al. (1999) who found that in Britain process innovations significantly decreased the probability of small-firm failure. Further, SMEs actively involved in advertising activities enjoy longer survival prospects (the hazard rate of advertisers is about 31% lower than that of non-advertisers).

In relation to the other firms characteristics, we find that larger firms experience lower risk of failure. In particular, our results indicate that if a firm has 10 workers more than another, being equal in all the other variables, it has a 0.34% lower probability of failure. The age of the firm does not seem to have any effect on the risk of failure. Initially, this result may be seen as contradictory with the findings by the survival literature (both IO and liability of “newness”). The usual argument in the literature is that younger firms fail more often than older ones due to the lack of experience and/or the uncertainty about their true ability to survive. However, as Geroski (1995) pointed out, other characteristics such as R&D and advertising strategies, labour quality, etc., may account for this effect more accurately. Once we control for other factors, SMEs legal structure (limited liability versus others) does not appear to be significantly related to SMEs survival. This result is in contrast with the findings of Mata and Portugal (2002) that, using a sample of Portuguese firms, found that limited liability corporations were significantly less likely to exit the market than those firms with other legal structure.

Finally, our results indicate that those SMEs with foreign capital participation bear a notorious higher risk of exit (the hazard rate for firms whose capital is participated by foreign capital is more than 100% higher as compared to that borne by non-participated firms). The scarce empirical evidence on the impact of foreign ownership on survival is mixed.Footnote 19 However, our result is consistent with Görg and Strobl (2003), who found increased probabilities of exit for Irish majority foreign-owned plants, and with Bernard and Sjöholm (2003) who obtained, for a sample of Indonesian firms, that after controlling for plant size and productivity, foreign-owned plants are far more likely to close down than domestically-owned ones.

As for the industry-based risk variables, we find that, once we control for other industry variables, industry growth does not seem to have any effect on the probability of failure. However, the type of industrial sector where the firm operates affects the risk of failure. The joint consideration of the results of the estimation and pair-wise tests lead to the following classification: the higher risk of exit corresponds to firms operating in traditional industries, firms operating in specialized and R&D intensive industries experience an intermediate risk of exit, and the lowest risk of exit corresponds to SMEs in scale economies sectors. This result is in contrast with previous work (Audrestch 1995; Segarra and Callejón 2002) who have obtained that in highly innovative industries the probability of exit is higher.

Finally, we focus our attention on the main variable of interest in our analysis: the effect of exporting on the probability of survival. After considering a number of firm, industry and economy characteristics, the positive effect of exporting on SMEs survival does not vanish. Although the effect of exporting slightly shrinks with the introduction of control variables (see Table 5), it is still quite robust, as the risk of failure of exporting SMEs is still 33% lower than that of non-exporting SMEs. This result confirms the existence of a “surviving-by-exporting” effect among SMEs that goes beyond the possible influence of the traditional “learning-by-exporting” effect, which suggests that exporting may improve exporters’ performance in such dimensions (Bernard and Jensen 1999) as productivity improvements, the likelihood of introducing process and product innovations (Salomon and Shaver 2005). Given that, among other control variables, both productivity and process and product innovations have been considered in this analysis, our results suggest that exporting by itself extends SMEs survival prospects. In addition, we have exploited further our results by estimating the predicted discrete hazard contributions that correspond to a representative SME that exports and to one that does not export. These predicted hazard contribution shown in Fig. 2 reinforce our evidence in favour of a “surviving-by-exporting” effect. After setting the values of all other variables to those of a representative SME, the hazard rate of the exporters is always substantially below that of non-exporters, i.e. exporting improve SMEs survival probabilities.

5 Concluding remarks

The primary goal of this paper is to investigate whether exporting and non-exporting SMEs experience different failure rates. If so, a second step is to assess the impact of the exporting strategy on SMEs survival chances, after controlling for other sources of heterogeneity among firms by including other firm, industry and economy characteristics, which account for relevant features that may affect the risk of exit.

We compare survival patterns of exporting and non-exporting SMEs using a representative sample of Spanish manufacturing firms drawn from the ESEE for the period 1990–2002. The preliminary evidence suggests that exporting SMEs face a sizeable and significant lower probability of failure than non-exporting SMEs. After considering a number of firm, industry and economy characteristics, the positive effect of exporting on SMEs survival slightly shrinks but remains remarkably large and significant. Thus, our results strongly support the existence of a “surviving-by-exporting” effect among SMEs. Interestingly, this effect remains significant even after controlling for variables capturing some of the benefits commonly attributed to exporting (learning-by-exporting), such as firm productivity and innovative outcomes.

These results are noticeable from different perspectives. First, researchers investigating the existence of learning-by-exporting should control for this when carrying out their research. Secondly, our results make help managers and entrepreneurs to more accurately estimate their chances of success, especially if they want to compete in international markets. Thirdly, for policy makers our results mean that, based on survival performance, export promotion policies could be desirable. In addition, this research also points out other characteristics that may further enhance survival.

Notes

Two explanations for the relatively scarce evidence supporting the learning-by-exporting hypothesis are the following. First, most studies do not take into account the positive effect of exporting on survival. Secondly, Girma et al. (2004) point out that in order to evaluate the extent of the learning-by-exporting hypothesis it is necessary to compare the across-time performance of the firm following entry into export. This requires information about what would have happened to a firm had it not entered the export market, which is unobservable. Bernard and Jensen (1999) and related literature assume that all non-exporters are capable of providing this counterfactual.

The ESEE does not include firms with less than 10 employees.

We have also tried with the continuous variable advertising intensity. However, the large number of zeros (firms that do not perform advertising) leads to a non-significant effect of this variable on the risk of exit in the regression analysis. It seems that the relevant decision is whether to carry out or not advertising.

Industry growth rates are built using the Industrial Production Index provided by the Spanish National Statistics Institute.

In our database and on the basis of the 20 industries NACE-93 classification of the ESEE, we consider (i) traditional industries: textiles, leather and shoes, wood, paper, printing and printing stuff, and furniture; (ii) scale economies industries: meat industry, food and tobacco, beverages, rubber and plastic products, non-metallic miner products, metallurgy, metallic products, motors and cars, and other transport material; (iii) specialized industries: machinery and mechanic equipment, and other manufacturing goods; and, (iv) R&D intensive industries: chemical products, and electronic and electric machinery and material.

See http://www.funep.es/esee/ing/i_esee.asp for further details.

Extract of Article 2 of the Annex of Recommendation 2003/361/EC.

We should notice that the ESEE does not provide information allowing distinguishing the situation where a sampled firm acquires or mergers with (being the larger firm) other firms in the sample or outside the sample, from the situation where a non-sampled firm acquires a company within the sample. However, this is not a limitation given that the ESEE is a representative sample of the Spanish manufacturing industries.

See Kiefer (1988) for a survey on the application of these models to economic studies.

The presence of left censored observations, i.e. firms that started production some time before the beginning of the sample period, is not a problem in so far the interest lies on the study of the conditional probability of exit.

We could have used other binary discrete choice models such as a logit or a probit but then we could not interpret any longer the hazard ratios as belonging to a proportional hazards model. Interestingly, the assumption does not impose any restriction on the shape of the baseline hazard.

An up-to-date Stata program drawn up by S. Jenkins that implements the cloglog with gamma-distributed unobserved heterogeneity is available from http://www.bc.edu/RePEc/bocode/p or it can also be obtained, inside Stata, by typing ssc install pgmhaz8. An initial version of the program was presented in Jenkins (2001).

To carry out the non-parametric tests we have divided the continuous variables in three intervals: first, second and third tercile of each one of the variable distribution. In order to rank by survival probability each one of these three groups we use the incidence rate defined as the ratio between the number of events (firm failures) and the total (analysis) time at risk.

The results of these pairwise tests are as follows

Export Intensity3

Export Intensity4

Export Intensity2

0.817 (0.433)

0.833 (0.480)

Export Intensity3

–

1.019 (0.989)

We have tested the null hypothesis that the unobserved heterogeneity variance component (σ 2) is equal to zero. As Jenkins (2004) noticed, this is a “boundary” test that accounts for the fact that the null distribution is not the usual χ 2 (d.f. = 1) but is rather a 50:50 variate and a χ 2 (d.f. = 0) variate and χ 2 (d.f. = 1) (Gutierrez et al. 2001). For this reason it is called a Chibar2(01) statistic in the Stata results reported by the pgmhaz8 programme written by S. Jenkins. The Chibar2(01) is equal to 0.002 with a p-value of 0.989.

We have tried with different thresholds of foreign capital participation and results do not change. It seems that the important factor is whether or not the capital of the firm is participated by foreign investors.

References

Allison PD (1984) Event history analysis: regression for longitudinal data. Sage, Newbury Parca

Altonji J, Spletzer J (1991) Worker characteristics, job characteristics, and the receipt of on-the-job-training. Ind Labor Relat Rev 45:58–79

Audretsch DB (1991) New firm survival and the technological regime. Rev Econ Stat 73:441–450

Audretsch DB (1995) Innovation, growth and survival. Int J Ind Organ 13:441–457

Audretsch DB, Mahmood T (1994) The rate of hazard confronting new firms and plants in U.S. manufacturing. Rev Ind Organ 9:41–56

Autor D, Katz L, Krueger A (1998) Computing inequality: have computers changed the labor market? Q J Econ 113:1169–1213

Aw BY, Chen X, Roberts MJ (1997) Firm-level evidence on productivity differentials, turnover, and exports in Taiwanese manufacturing. Pennsylvania State University, Mimeo

Aw BY, Chung S, Roberts MJ (2000) Productivity and turnover in the export market: micro evidence from Taiwan and South Korea. World Bank Econ Rev 14:65–90

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17:34–56

Baum JAC (1989) Liabilities of newness, adolescence, and obsolescence: exploring age dependence in the dissolution of organizational relationships and organizations. Proc Adm Sci Assoc Can 10:1–10

Bernard AB, Jensen JB (1995) Exporters, jobs, and wages in US manufacturing: 1976–1987. Brookings papers on economic activity: microeconomics, pp 67–112

Bernard AB, Jensen JB (1999) Exceptional exporter performance: cause, effect, or both. J Int Econ 47:1–25

Bernard AB, Jensen JB (2002) The deaths of manufacturing plants. NBER Work Pap 9026

Bernard AB, Eaton J, Jensen JB, Kortum SS (2003) Plants and productivity in international trade. Am Econ Rev 93:1268–1290

Bernard AB, Sjöholm F (2003) Foreign owners and plant survival. NBER Work Pap Ser, working Paper no. 10039, Cambridge

Braconier H, Ekholm K (2000) Swedish multinational and competition from high and low wage locations. Rev Int Econ 8:448–461

Bruderl J, Schussler R (1990) Organizational mortality: the liabilities of newness and adolescence. Adm Sci Q 35:530–547

Carroll GR, Hannan MT (2000) The demography of corporations and industries. Princeton University Press, Princeton

Castellini D (2002) Export behaviour and productivity growth: evidence from Italian manufacturing firms. Weltwirtsch Archiv 138:605–628

Clerides SK, Lach S, Tybout JR (1998) Is learning by exporting important? Micro-dynamic evidence from Colombia, Mexico, and Morocco. Q J Econ 113:903–948

Comanor WS, Wilson TA (1967) Advertising, market structure and performance. Rev Econ Stat 49:423–440

Cosh AD, Hughes A, Wood E (1999) Innovation in UK SMEs: causes and consequences fro firm failure and acquisition. In: Acs ZJ, Carlsson B (eds) Entrepreneurship, small and medium sized enterprises and the macro economy. Cambridge University Press, Cambridge

Delgado MJ, Fariñas JC, Ruano S (2002) Firms’ productivity and the export markets. J Int Econ 57:397–422

Dunne T, Roberts MJ, Samuelson L (1989) The growth and failure of US manufacturing plants. Q J Econ 104:671–698

Ericson R, Pakes A (1995) Markov perfect industry dynamics: a framework for empirical work. Rev Econ Stud 62:53–82

Esteve-Pérez S, Mañez-Castillejo JA (2006) Life duration of Spanish manufacturing firms. Mimeo

Esteve-Pérez S, Sanchis-Llopis A, Sanchis-Llopis JA (2004) The determinants of survival of Spanish manufacturing firms. Rev Ind Organ 25:251–273

Fichman M, Levinthal D (1991) Honeymoons and the liability of adolescence: a new perspective on duration dependence in social and organizational relationships. Acad Manag Rev 16:442–468

Freeman J, Carroll G, Hannan M (1983) The liability of newness–age dependence in organizational death rates. Am Sociol Rev 48:692–710

Geroski P (1995) What do we know about entry? Int J Ind Organ 13:421–440

Girma S, Greeenaway D, Kneller R (2004) Entry to export markets and productivity: a microeconomic analysis of matched firms. Rev Int Econ 12:855–866

Görg H, Strobl E (2003) Footlose Multinationals? Manchester Sch 71:1–19

Gutierrez R, Carter S, Drukker DM (2001) On boundary value likelihood-ratio tests. Stata Technical Bulletin, STB-60, pp 15–16, StataCorp, College Station TX

Grant R (1996) Toward a knowledge-based theory of the firm. Strateg Manag J 17:109–122

Hannan M (1998) Rethinking age dependence in organizational mortality: logical formalizations. Am J Sociol 104:126–164

Harhoff D, Stahl K, Woywode M (1998) Legal form, growth and exit of West German firms. J Ind Econ 46:453–488

Holmes TJ, Schmitz JA (1990) A theory of entrepreneurship and its application to the study of business transfers. J Polit Econ 98:265–294

Hymer S (1976) The international operations of national firms. MIT Press, Cambridge

Jenkins SP (1995) Easy estimation methods for discrete-time duration models. Oxf Bull Econ Stat 57:129–138

Jenkins SP (2001) Discrete time proportional hazards regression. Stat Tech Bull 39:22–32

Jenkins SP (2004) Survival analysis. Unpublished manuscript, Institute for Social and Economic Research, University of Essex, Colchester, UK. Downloadable form http://www.iser.essex.ac.uk/teaching/degree/stephenj/ec968/pdfs/ec968lno tesv5.pdf

Jovanovic B (1982) Selection and evolution of industry. Econometrica 50:649–670

Kiefer NM (1988) Economic duration data and hazard functions. J Econ Lit 6:646–670

Klepper S, Simons KL (2000) The making of an oligopoly: firm survival and technological change in the evolution of the US tire industry. J Polit Econ 108:728–760

Klette T (1996) R&D, scope economies and plant performance. R J Econ 27:502–522

Kraay A (1999) Exports and economic performance: evidence from a panel of Chinese enterprises. Rev Econ Dév 1–2:183–207

Levinthal D (1997) Adaptation on rugged landscapes. Manag Sci 43:934–950

Mata J, Portugal P (1994) Life duration of new firms. J Ind Econ 42:227–246

Mata J, Portugal P (2002) The survival of new domestic and foreign owned firms. Strat Manag J 23:323–343

Mata J, Portugal P, Guimaraes P (1995) The survival of new plants: start-up conditions and post-entry evolution. Int J Ind Organ 35:607–627

Melitz MJ (2003) The impact of trade in intra-industry reallocations and aggregate industry productivity. Econometrica 71:1695–1725

Meyer R (1990) Unemployment insurance and unemployment spells. Econometrica 58:757–782

Nelson R, Winter S (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge

Olley SG, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64:1263–1297

Parker SC (2004) The economics of self-employment and entrepreneurship. Cambridge University Press, Cambridge

Pavitt K (1984) Sectorial patterns of tecnical change: towards a taxonomy and a theory. Res Policy 13:343–373

Prentice RL, Gloecker LA (1978) Regression analysis of grouped survival data with application to breast cancer data. Biometrics 34:57–67

Salomon RM, Shaver JM (2005) Learning-by-exporting: new insights from examining firm innovation. J Econ Manag Strat 14:431–460

Segarra A, Callejón M (2002) New firms’ survival and market turbulence: new evidence from Spain. Rev Ind Organ 20:1–14

Stinchcombe F (1965) Social structure and organizations. In: March J (ed) Handbook of organizations. Rand McNally, Chicago

Sutton J (1991) Sunk costs and market structure. The MIT Press

Teece D (1998) Capturing value from knowledge assets: the new economy, markets for know-how and intangibles assets. Calif Manage Rev 40:55–79

Trofimenko N (2005) Learning by exporting: does it matter where one learns? Evidence from Colombian manufacturing plants, 1981–1991. Mimeo

Wagner J (1994) The post-entry performance of new firms in German manufacturing industries. J Ind Econ 42:141–154

Wagner J (2005) Exports and productivity: a survey of the evidence from firm level data. HWWA Discussion Paper 319

Wernerfelt B (1984) A resource-based view of the firm. Strat Manag J 18:509–533

Yasar M, Nelson C (2004) The relationship between exports and productivity at the plant level in the Turkish apparel and motor vehicle parts industries. Forthcoming in Baltagi B (ed) Contributions to economic analysis. Elsevier, Amsterdam

Acknowledgements

Financial support from the Spanish Ministry of Science and Technology (project numbers SEJ2005-05966 and SEJ2005-08783-C04-01) and from the Generalitat Valenciana (project numbers GV05/183 and GVACOMP2007-132), is gratefully acknowledged. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Esteve-Pérez, S., Máñez-Castillejo, J.A. & Sanchis-Llopis, J.A. Does a “survival-by-exporting” effect for SMEs exist?. Empirica 35, 81–104 (2008). https://doi.org/10.1007/s10663-007-9052-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-007-9052-1