Abstract

In firms, maintaining the quality of the product with carbon emission reduction is a big concern. To ensure the good quality of the product, so many retailers segregate perfect items from imperfect ones and made an attempt to reduce carbon emissions through green technologies. In the proposed model, the discount price of imperfect items is examined and the retailer’s joint decisions have been analyzed on reclamation of inventory and investment in reducing carbon emission under three environmental regulations such as carbon cap, carbon tax, and carbon cap-and-trade. These regulations and understanding of the customer for greener products invigorate retailers to invest in green technology. The total cost is minimized with respect to the optimal order quantity and annual investment on carbon emission reduction. Numerical examples and sensitive analysis are represented to understand the sturdiness of the model.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Economic order quantity is the quantity that is used to minimize total costs. Ford W. Haris and R.H. Wilson developed this model in 1913. Bouchery and Dallery [1] consider sustainability in the classical inventory model. Arslan and Turkay [2] have contributed to the Economic order quantity model by including sustainability considerations which embrace environmental and social criteria with standard economic consideration. Wang et al. [3] developed an EOQ model with renewal reward theory to derive the expected total profit per unit time. Lee et al. [4] developed a model for sustainable economic order quantity with stochastic lead time and multi-model transportation options. Sheikh et al. [5] developed two EOQ models with and without shortages and considered purchasing and holding costs constant.

Carbon emission is increasing day by day and many firms are working to reduce carbon emissions. The government has also taken many steps to reduce emissions such as carbon tax, cap, and offset. Therefore, Wang and Hua [6] investigate management of carbon footprints in firms under carbon emission trading mechanism. Benjaafar et al. [7] developed a model to investigate how far carbon reduction requirements can be addressed by operational adjustments as a supplement to costly investments in carbon-reducing. Chen, Benjaafar, and Elomri [8] provide a model a condition in which emission can be reduced by modifying order quantity. Toptal et al. [9] extend an EOQ model to show that in addition to carbon regulations such as carbon cap, tax, and cap-and-trade to reduce emission, emission reduction investment further reduces the emission while reducing costs. Mittal et al. [10] provide an economic production model to elaborate on human errors’ effect on emission cost, transportation cost, and expected total profit of the retailer. Daryanto et al. [11] introduced an Economic order quantity model which includes the effect of defective rates, different sources of carbon emission, different demand rates, selling price and holding cost for defective products, and shortages backorder.

Since there are perfect quality items as well as defective items, therefore, in 2000, Salameh and Jaber [12] proposed EPQ/EOQ model in which a production/inventory situation where items, received/produced, are of imperfect quality and extends the standard EOQ/EPQ model for imperfect items. Chang [13] introduces a model with the complete screening process and imperfect quality items are sold as a single batch with discount before receiving the next shipment. Jaggi and Mittal [14] developed a model for spoilable items in which there is constant deterioration and the demand rate is time dependent under inflation and money value. Jaggi and Khanna [15] developed a model to formulate an inventory policy for a retailer dealing with imperfect quality items of deteriorating nature under inflation and permissible delay in payments. Jaggi and Mittal [16] developed a model for deteriorating items with imperfect quality and also an assumption has been made that the screening rate is more than demand. Jaber et al. [17] reviewed the model of Salameh and Jaber (2000) and elongate it by making an assumption that shipment is coming from a distant supplier and thus it is not feasible to imperfect items with an additional order to the same supplier. Mittal et al. [18] discussed about the method for redesigning the ordering policy by incorporating the cross-selling effect and also compared ordering policy for imperfect items developed by applying rules derived from apriori algorithm. Mittal, Jaggi, Khanna, Reshu, and Yadav [19,20,21] developed models for imperfect items under different conditions and Jayaswal et al. [22] discussed a fiscal construction feature model for imperfect quality items with trade credit policy analyzed under the effects of learning.

Many researchers have worked on reducing carbon emissions including imperfect items. Nobil et al. [23] proposed a model to calculate the optimal reorder point for the inventory model in Salameh and Jaber(2000) by which the appropriate timing of an order can be determined. Sarkar et al. [24] developed a three-echelon sustainable supply chain model with a single-supplier, single manufacturer, and multiple retailers. Also, control the carbon emission and reduce the imperfect items to maintain the sustainability. Daryanto et al. [25] considered the EOQ model with carbon emissions from transportation and warehouse operations. Furthermore, include imperfect items and complete backordering is assumed.

2 Problem Definition

In this paper, investment on the reduction of carbon emission by retailers and decision of reclamation of inventory is taken according to the government regulations on carbon emissions. The standard EOQ model has been used under different conditions and includes imperfect items. Carbon emission is increased due to ordering, inventory holding, and manufacturing. In this study, three emission policies have been considered that is carbon cap, carbon tax, and cap-and-trade. Under the cap policy, a retailer’s emission per year cannot exceed the carbon emission cap. Under tax policy, there will be a tax \(p_e\) units for unit carbon emission. Under the cap-and-trade policy, for \(c_{p_e}\) units, retailer deals a unit carbon emission.

2.1 Notations and Assumptions

-

1.

Demand rate is considered constant throughout the model and shortages are not allowed.

-

2.

Lead time is constant and known, and instantaneous replenishment is considered.

-

3.

Each inventory containing defective items with percentage i with probability density function P(i) is known.

-

4.

Imperfect items have been sold as a single batch with a discount on price.

-

5.

Maximum reduction in carbon emission attainable due to investment decisions is less than minimum emission attainable due to ordering decisions per year. That is,

$$\begin{aligned}\sqrt{4\hat{A}\hat{h}MD} +\hat{k}D > \frac{\alpha ^2}{4\beta }\end{aligned}$$where \(M = \frac{(1-i)^2}{2}+\frac{iD}{x} \), \(\alpha \) gives the efficiency of green technology in emission reduction, and \(\beta \) is a decreasing return parameter(For G monetary units, carbon emission may be decreased in an amount of (\(\alpha G - \beta G^2\)).

-

6.

In cap policy, there are values of the investment that can reduce carbon emission per year below carbon capacity. Therefore, we can write

$$\begin{aligned}\sqrt{4\hat{A}\hat{h}MD} +\hat{k}D - \frac{\alpha ^2}{4\beta } < C\end{aligned}$$where C is the carbon cap.

Q | Order quantity (per cycle) |

k | Unit variable cost ($ per unit) |

A | Fixed cost per ($ per unit) |

i | Percentage of defective items in Q |

P(i) | Probability density function of i |

x | Screening rate, \(x > D\) |

d | Unit screening cost($ per unit) |

T | Cycle length |

h | Holding cost ($ per unit) |

\( {\hat{A}}\) | Emission associated with ordering (per unit) |

\( {\hat{h}}\) | Emission associated with inventory holding (per unit) |

\( {\hat{k}}\) | Emission associated with production/purchasing (per unit) |

D | Demand per year |

G | Amount invested on carbon emission reduction per year |

3 Carbon Cap

In this study under the carbon cap policy, retailer’s carbon emissions per year should not exceed carbon cap C. Thus, the retailer has to find a feasible solution for order quantity and investment to reduce emissions. Therefore, this problem can be shown as follows:

Minimize

Total cost per unit time \(= TCU(Q,G) = \frac{AD}{Q} + (k + d)D + h \left[ \frac{(1-i)^2}{2}\right. \left. + \frac{iD}{x} \right] Q+ G\)

Subject to

Total emission per unit time \( = TEU(Q,G) = \frac{\hat{A}D}{Q} + \hat{k} D + \hat{h} \left[ \frac{(1-i)^2}{2} + \frac{iD}{x} \right] Q -\alpha G+\beta G^2 \le C\).

If we consider \(G = 0\), then the optimal solution for this problem lies between the global interval \(Q_1\), \(Q_2\) when \(TE = C\),

where \(\hat{C} = C-\hat{k}D\) and \(M = \bigg [\frac{(1-i)^2}{2} + \frac{iD}{x} \bigg ]\). The feasible solution exists if \( C \ge 2\sqrt{\hat{A}\hat{h}MD} +\hat{k}D\).

Under cap policy, two cases can be considered such as

(1) \(C \ge 2\sqrt{\hat{A}\hat{h}MD} +\hat{k}D\).

(2) \(2\sqrt{\hat{A}\hat{h}MD} +\hat{k}D - \frac{\alpha ^2}{4\beta }< C < 2\sqrt{\hat{A}\hat{h}}MD +\hat{k}D\). The next theorem will provide the optimal order quantity and investment decisions with different cases. \((Q^*,G^*)\) will represent the feasible solution.

Theorem 1

Let

and

Then under carbon cap the feasible solution is

If \(C \ge 2\sqrt{\hat{A}\hat{h}MD} +\hat{k}D\), then

and if \(2\sqrt{\hat{A}\hat{h}MD} +\hat{k}D - \frac{\alpha ^2}{4\beta }< C < 2\sqrt{\hat{A}\hat{h}}MD +\hat{k}D\), then

where \(Q_5 = Q^{em} \) and \(G_5 = \frac{\alpha - \sqrt{\alpha ^2 - 4\beta (-\hat{C}+2\sqrt{\hat{A}\hat{h}MD}}}{2\beta }\). Also, \(Q^\alpha = \sqrt{\frac{(A\alpha +\hat{A})D}{h\alpha +\hat{h})M}}\).

Remark 1

When \(\frac{A}{h}=\frac{\hat{A}}{\hat{h}}\) then \(Q^c = Q^{em}\). Also, when \(C \ge 2\sqrt{\hat{A}\hat{h}MD} +\hat{k}D\) then \(G^* = 0\) and \(C < 2\sqrt{\hat{A}\hat{h}MD} +\hat{k}D\) then \(G^* > 0\). The next corollary represents the minimum emission due to the retailer’s optimal solution in the above theorem.

Corollary 1

Under carbon cap, the minimum emission due to retailer’s feasible solution is

when \(Q_2 \le Q^c \le Q_1\) and otherwise \(E_m(Q^*,G^*) = C\). Now, there will be a lemma which shows the influence of using investment on emission reduction to reduce retailer’s carbon emission with a certain cap C. Thus, there will be two considerations such as \(E_m(Q^*(0),0) - E_m(Q^*,G^*)\) and \(TC^*(Q^*(0),0)- TC^*(Q^*,G^*)\), where \(Q^*(0)\) is the retailer’s optimal order quantity under cap policy and the investment amount is zero.

Lemma 1

Investment amount to reduce emissions does not affect the carbon emission level under the certain cap per year, nevertheless it can reduce the total cost per year for the retailer. Therefore, we have \(E_m(Q^*(0),0) - E_m(Q^*,G^*) = 0\) and \(TC^*(Q^*(0),0)- TC^*(Q^*,G^*) \ge 0\)

In the next lemma, there will be a comparison of emissions per year with and without the carbon cap. Additionally, the effect of total cost per year with and without carbon cap.

Lemma 2

Carbon emission reduces after applying the carbon cap policy but total cost per year is not less than when there is no cap policy. Therefore, \( TC^*(Q^*,G^*) \ge TC(Q^c,0)\) and \( E_m(Q^*,G^*) \le E(Q^{em},0)\).

Lemma 3

If we consider two investment options, first with \(\alpha _1\) and \(\beta _1\) and second with \(\alpha _2\) and \(\beta _2\), then solution that exists using the first investment will give the same emission level per year without costs.

4 Carbon Tax

In this section, the penalty of \(p_e\) unit tax will be paid by the retailer per unit carbon emission. Therefore, the total cost and emission will be as follows:

and

With \(Q \ge 0\) and \(G \ge 0\).

In the next theorem, the total cost has been minimized under the carbon tax policy.

Theorem 2

The feasible solution under carbon tax is given by

It can be seen that \(Q^{**}\) and \(G^{**}\) are increasing when \(\frac{A}{h} > \frac{\hat{A}}{\hat{h}} \)and decreasing when \(\frac{A}{h} < \frac{\hat{A}}{\hat{h}}\). Also, when \(\frac{A}{h} =\frac{\hat{A}}{\hat{h}}\) there is no effect on \(Q^{**}\).

5 Carbon Cap-and-Trade

In this section, there is a restriction of carbon cap C, and if total emission exceeds carbon cap C, then there is no penalty but the firm can buy carbon permits equal to its demand of carbon emission at the market price of \(c_{p_e}\) units per unit carbon emitted. Also, if the emission by the retailer is less than the carbon cap, then they can sell the carbon capacity at the same price \(c_{p_e}\). Then the problem can be stated as follows:

and

with \(Q\ge 0\), \(G\ge 0\), where X denotes the amount of carbon that the retailer trades per year. In the next theorem, a feasible solution will be found out for the above-formulated problem.

Theorem 3

The optimal solution to minimize the total cost under cap-and-trade policy is given by

Also, \(X^* = C- TEU_{c_{p_e}}(Q^{***},G^{***})\), where \(X^*\) is the retailer’s optimal amount of carbon traded per year.

It can be seen that \(Q^{***}\) and \(G^{***}\) are increasing when \(\frac{A}{h} > \frac{\hat{A}}{\hat{h}}\) and decreasing when \(\frac{A}{h} < \frac{\hat{A}}{\hat{h}}\). Also, when \(\frac{A}{h} =\frac{\hat{A}}{\hat{h}}\), there is no effect on \(Q^{***}\).

6 Numerical Analysis

In this section, there will be a comparison of values between two cases, i.e., \(\frac{A}{h} > \frac{\hat{A}}{\hat{h}}\) and \(\frac{A}{h} < \frac{\hat{A}}{\hat{h}}\). We will consider two sets of examples:

(1) \(A= 100\), \(h=3\), \(\hat{A} = 4\) and \(\hat{h} = 3\).

(2) \(A= 10\), \(h=4\), \(\hat{A} = 100\) and \(\hat{h} = 8\),

where \(D= 500\), \(k = 6\), \(\hat{k} = 2\), \(d = 0.5\), and \(i= 0.02\) will remain same throughout. Also, since it is known that percentage defective random variable i is uniformly distributed and can have any value within the range \([\gamma , \delta ]\) where \(\gamma = 0\) and \(\delta = 0.04\).

Probability density function for i is

\(P(i) = {\left\{ \begin{array}{ll} 25, &{} 0\le i \le 0.04\\ 0, &{} \text {otherwise}. \end{array}\right. }\)

Now, from the first case, we have \(Q^c =186.3\), \(Q^{em} = 37.26\), \(Q^\alpha = 167.463\), \(TC(Q^c,0) = 3786.77\), and \(TE(Q^c,0) = 1279.12\), and from the case 2, \(Q^c =51.02\), \(Q^e = 114.085\), \(Q^\alpha = 77.935\), \(TC(Q^c,0) = 3446\), and \(TE(Q^c,0) = 2176.01\)

6.1 Numerical Analysis for Cap Policy

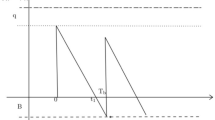

In Fig. 1, there are two figures (a) and (b) showing the changes in values of \(TC(Q^*,G^*)\) with respect to cap C for both sets of examples. In both of the cases, \(TC(Q^*,G^*)\) strictly decreases with respect to the increasing values of C.

Whenever the value of carbon cap C increases, the emission reduction investment G decreases, and therefore, the \(TC(Q^*,G^*)\) decreases. But from the table, it can be seen that the total cost before the investment is less than or equal to the total cost after the investment. Because in the first case, i.e., \(\frac{A}{h} > \frac{\hat{A}}{\hat{h}}\) when \(C= 1270\) and in the second case that is \(\frac{A}{h} < \frac{\hat{A}}{\hat{h}}\) when \(C = 2110\), \(TC(Q^c,0) < TC(Q^*,G^*)\) = \(TC(Q^*,0)\), and \(TE(Q^c,0) > TE(Q^*,G^*)\) = \(TE(Q^*,0)\). Therefore, in this policy, total emission is decreasing and the total cost is increasing.

Numerical representation for carbon cap

\(\frac{A}{h} > \frac{\hat{A}}{\hat{h}}\) | ||||||

|---|---|---|---|---|---|---|

C | \(Q^*\) | \(G^*\) | \(TC(Q^*,G^*)\) | \(TE(Q^*,G^*)\) | \(TC(Q^*,0)\) | \(TE(Q^*,0)\) |

1070 | 162.361 | 50.4026 | 3842.26 | 1070 | – | – |

1170 | 165.6 | 21.2959 | 3811.79 | 1169.99 | 3878.22 | 1170 |

1270 | 179.696 | 0 | 3787.12 | 1270 | 3787.12 | 1270 |

1370 | 186.3 | 0 | 3786.77 | 1279.12 | 3786.77 | 1279.12 |

\(\frac{A}{h} < \frac{\hat{A}}{\hat{h}}\) | ||||||

|---|---|---|---|---|---|---|

C | \(Q^*\) | \(G^*\) | \(TC(Q^*,G^*)\) | \(TE(Q^*,G^*)\) | \(TC(Q^*,0)\) | \(TE(Q^*,0)\) |

1710 | 83.531 | 61.9684 | 3532.27 | 3532.27 | – | – |

1910 | 78.4863 | 7.27361 | 3471.74 | 1910 | 3474.1 | 1910 |

2110 | 55.8343 | 0 | 3446.8 | 2110 | 3446.8 | 2110 |

2310 | 2110 | 0 | 3446 | 2176.01 | 3446 | 2176.01 |

7 Conclusions

In the proposed model, the discount price of imperfect items is examined and retailer’s joint decisions have been analyzed on reclamation of inventory and investment on reducing carbon emissions under three environmental regulations such as carbon cap, carbon tax, and carbon cap-and-trade. This model provides that under cap policy carbon emission will either remain the same or increases when investment and imperfect items are included but in the carbon tax and cap-and-trade policy, emission level decreases. This paper imparts an idea that how a retailer should choose the reclamation of inventory and the effect of government regulations on reducing emissions and costs.

References

Bouchery, Y., Ghaffari, A., Jemai, Z., Dallery, Y.M.S.: Including sustainability criteria into inventory models. Eur. J. Oper. Res. 222, 229–240 (2012)

Arslan, M.C., Turkay, M.: EOQ revisited with sustainability considerations. Found. Comput. Decis. Sci. 38, 223–249 (2013)

Wang, W.-T., Wee, H.-M., Cheng, Y.-L., Wen, C.L., Cárdenas-Barrón, L.E.: EOQ model for imperfect quality items with partial backorders and screening constraint. Eur. J. Ind. Eng. 9, 744–773 (2015)

Lee, S.-K., Yoo, S.H., Cheong, T.: Sustainable EOQ under lead-time uncertainty and multi-modal transport. Sustainability 9, 476 (2017)

Shaikh, A.A., Al-Amin, K.M., Panda, G.C., Konstantaras, I.: Price discount facility in an EOQ model for deteriorating items with stock-dependent demand and partial backlogging. Int. Trans. Oper. Res. 26, 1365–1395 (2019)

Hua, G., Cheng, T.C.E., Wang, S.: Managing carbon footprints in inventory management. Int. J . Prod. Econ. 132, 178–185 (2011)

Benjaafar, S., Li, Y., Daskin, M.: Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 10, 99–116 (2012)

Chen, X., Benjaafar, S., Elomri, A.: The carbon-constrained EOQ. Oper. Res. Lett. 41, 172–179 (2013)

Toptal, A., Özlü, H., Konur, D.: Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 52, 243–269 (2014)

Gilotra, M., Pareek, S., Mittal, M., Dhaka, V.: Effect of carbon emission and human errors on a two-echelon supply chain under permissible delay in payments. Int. J. Math. Eng. Manag. Sci. 5, 225–236 (2020)

Daryanto, Y., Christata, B.: Optimal order quantity considering carbon emission costs, defective items, and partial backorder. Uncertain Supply Chain Manag. 9, 307–316 (2021)

Salameh, M.K., Jaber, M.Y.: Economic production quantity model for items with imperfect quality. Int. J. Prod. Econ. 64, 59–64 (2000)

Chang, H.-C.: An application of fuzzy sets theory to the EOQ model with imperfect quality items. Comput. Oper. Res. 31, 2079–2092 (2004)

Jaggi, C.K., Mittal, M.: An EOQ model for deteriorating items with time-dependent demand under inflationary conditions. Adv. Model. Optim. 5 (2003)

Jaggi, C.K., Khanna, A., Mittal, M.: Credit financing for deteriorating imperfect-quality items under inflationary conditions. Int. J. Services Oper. Inf. 6, 292–309 (2011)

Jaggi, C.K., Mittal, M.: Economic order quantity model for deteriorating items with imperfect quality. Investigación Operacional, 32, 107–113 (2011)

Jaber, M.Y., Zanoni, S., Zavanella, L.E.: Economic order quantity models for imperfect items with buy and repair options. Int. J. Prod. Econ. 155, 126–131 (2014)

Mittal, M., Pareek, S., Agarwal, R.: EOQ estimation for imperfect quality items using association rule mining with clustering. Dec. Sci. Lett. 4, 497–508 (2015)

Yadav, R., Pareek, S., Mittal, M.: Supply chain models with imperfect quality items when end demand is sensitive to price and marketing expenditure. RAIRO-Oper. Res. 52, 725–742 (2018)

Mittal, M., Khanna, A., Jaggi, C.K.: Retailer’s ordering policy for deteriorating imperfect quality items when demand and price are time-dependent under inflationary conditions and permissible delay in payments. Int. J. Procure. Manag. 10, 461–494 (2017)

Agarwal, R., Mittal, M.: Inventory classification using multi-level association rule mining. Int. J. Dec. Support Syst. Technol. (IJDSST) 11, 1–12 (2019)

Jayaswal, M., Sangal, I.S.H.A., Mittal, M., Malik, S.: Effects of learning on retailer ordering policy for imperfect quality items with trade credit financing. Uncertain Supply Chain Manag. 7, 49–62 (2019)

Nobil, A.H., Sedigh, A.H.A. Cárdenas-Barrón, L.E.: Reorder point for the EOQ inventory model with imperfect quality items. Ain Shams Eng. J. 11, 1339–1343 (2020)

Sarkar, B., Sarkar, M., Ganguly, B., Cárdenas-Barrón, L.E.: Combined effects of carbon emission and production quality improvement for fixed lifetime products in a sustainable supply chain management. Int. J. Prod. Econ. 231, 107867 (2021)

Mashud, A.H.M., Pervin, M., Mishra, U., Daryanto, Y., Tseng, M.-L., Lim, M.K.: A sustainable inventory model with controllable carbon emissions in green-warehouse farms. J. Clean. Prod. 298, 126777 (2021)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

8 Appendix

8 Appendix

8.1 Proof of Theorem-1

In carbon cap policy, KKT(Karush-Kuhn-Tucker) conditions have been used to find the optimal solution for emission constraint. A feasible solution exists when there are constraints such that

and

By using KKT conditions, there is global optimality when optimality conditions have been used. Therefore,

where \(M =\bigg ( \frac{(1-i)^2}{2} + \frac{iD}{x} \bigg )\) and multipliers \(\lambda _1\), \(\mu _1\), and \(\mu _2\) may be greater than or equal to zero. There could be eight possible cases but the feasible solution can be attained using the following three.

Case 1. \( \lambda _1 = 0\), \(\mu _1 = 0\), \(\mu _2 > 0\)

If \( \lambda _1 = 0\), \(\mu _1 = 0\), then Eq.(3) becomes

Therefore, \(Q = \sqrt{\frac{AD}{hM}} = Q^c\) and since \(\mu _2G=0\) and \(\mu _2 > 0\) then \(G = 0\).

Where \(Q^c\) is the optimal solution for imperfect items.

To get the optimal solution order quantity must satisfy the

Using this equation, there will be a global interval \([Q_1,Q_2]\), where

For a solution to be feasible \(\hat{C}^2 - 4\hat{F}D\hat{h}M \ge 0\) and hence \(C \ge \hat{k}D +\sqrt{4\hat{A}D\hat{h}M}.\) Thus, if \(C \ge \hat{k}D +\sqrt{4\hat{A}D\hat{h}M}\) and \(Q_1 \le Q^c \le Q_2\), then \(Q^* = Q^c\) and \(G = 0\).

Case 2. \(\lambda _1 > 0\), \(\mu _1 = 0\), \(\mu _2 > 0\)

From Eqs. (3) and (4), we have

and

Since \(\mu _2 > 0 \) then \(G = 0\). Therefore, from Eq. (8),

Also, \(\lambda _1 > 0 \) then from Eq. (5), we have

\( Q_1\) and \(Q_2\) satisfy the above equality. Thus, they must have \(C \ge \hat{k}D +\sqrt{4\hat{A}D\hat{h}M}\) to get the feasible solution. Further, let us consider two cases as follows:

Case 2.1. \(C = \hat{k}D +\sqrt{4\hat{A}D\hat{h}M}\)

In this case, \(Q_1 = Q_2 = \sqrt{\frac{\hat{A}D}{\hat{h}M}} = Q^{em} \) and also, since \(\lambda _1 >0\) and \(\mu _2 > = 0\) then \(\lambda _1 < \frac{1}{\alpha }\). Equation (7) exists for any positive value of \(\lambda _1\) and \(\frac{A}{h} = \frac{\hat{A}}{\hat{h}}\). Thus, if \(\frac{A}{h} = \frac{\hat{A}}{\hat{h}}\) then \(Q^* = Q^c\) and \(G^* = 0\).

Case 2.2. \( C > \hat{k}D +\sqrt{4\hat{A}D\hat{h}M}\)

In this case, \(Q_1 \ne Q_2\). Then either \(Q = Q_1\) or \(Q = Q_2\) to get the feasible solution. Since \(\lambda _1 > 0 \), \(G = 0\) then from Eq. (7), it obtained

then to get optimality, we must have

From the above inequality, there are two possibilities that is either \(AD - hMQ^2 > 0\) and \(-\hat{A}D +\hat{h}MQ^2 > 0 \) or \(AD - hMQ^2 < 0\) and \(-\hat{A}D +\hat{h}MQ^2 < 0\).

Thus, let us prove first that both the numerator and denominator are less than zero.

Since, we already know that for optimality \( C > \hat{k}D +\sqrt{4\hat{F}D\hat{h}M}\). It can be rewritten as

Therefore, according to Eq. (11), we must have \(AD - hMQ_1^2 < 0\) and \(0< \frac{AD - hMQ_1^2}{-\hat{A}D +\hat{h}MQ_1^2} < \frac{1}{\alpha }\). By solving these two equations together, the result can be formulated as \(Q_2 > \sqrt{\frac{AD}{hM}} = Q^c\) and \( Q_2 < \sqrt{\frac{(A+\alpha \hat{A})D}{(h+\hat{h})M}} = Q^\alpha \), then \(Q^* = Q_2\) and \(G^* = 0\).

In a similar manner, we can show that \(AD - hMQ_1^2 > 0\), \(-\hat{A}D +\hat{h}MQ_1^2 > 0 \) and \(\frac{AD - hMQ^1}{-\hat{A}D +\hat{h}MQ^1} < \frac{1}{\alpha }\). After formulating the above results, the result can be shown as \(Q_1 < \sqrt{\frac{AD}{hM}} = Q^c\) and \( Q_1 > \sqrt{\frac{(A+\alpha \hat{A})D}{(h+\hat{h})M} } = Q^\alpha \), then \(Q^* = Q_1\) and \(G^* = 0\).

Case 3. \(\lambda _1 > 0 , \mu _1 = 0, \mu _2 = 0\)

Since \(\mu _1 = 0\) and \(\mu _2 = 0\) then Eqs. (3) and (4) can be written as

Now, for \(\lambda _1 > 0\), we rewrite Eq. (5) as

By evaluating the above equation, we obtain

Here, \(Q_3\) , \(Q_4\) exist only if \(\hat{C} +\alpha G- \beta G^2 - 4\hat{A}\hat{h}MD \ge 0\). Let us consider two cases as follows.

Case 3.1. \(\hat{C} +\alpha G- \beta G^2 = 4\hat{A}\hat{h}MD \)

From this equality, \(Q_3(G) = Q_4(G) = \sqrt{\frac{\hat{A}D}{\hat{h}M}} = Q^{em}\), where \(Q^{em}\) is the optimal solution for emission. We should have from Eq. (13)

When \(Q = Q^{em}\) then Eq. (12) holds for any positive value of \(\lambda _1\) as long as \(\frac{\hat{A}}{\hat{h}}= \frac{A}{h} \). Now, we have \(\hat{C} +\alpha G- \beta G^2 = 4\hat{A}\hat{h}MD \) then there will be two roots from this equation but the condition, i.e., \(0<G< \frac{\alpha }{2\beta }\) only holds at one value which is given by

We can consider this value as \(G_5\). Thus, if \(2\sqrt{\hat{h}\hat{A}MD}+ \hat{k}D- \frac{\alpha ^2}{4\beta }< C < 2\sqrt{\hat{h}\hat{A}MD}+ \hat{k}D \) and \(\frac{\hat{A}}{\hat{h}}= \frac{A}{h} \), then \(Q^* = Q^{em} \) and \(G^*= G_5\).

Case 3.2. \(\hat{C} +\alpha G- \beta G^2> 4\hat{A}\hat{h}MD\)

In this case, \(Q_3(G) \ne Q_4(G)\). Now, from Eq. (12),\( \lambda _1 = \frac{AD - hMQ^2}{-\hat{A}D +\hat{h}MQ^2}\), and for \(Q_3(G) > 0 \) and \(Q_4(G)\) to be optimal, they must satisfy this inequality. Therefore, it is possible to show that \(-\hat{A}D +\hat{h}MQ_3^2(G) > 0 \). Moreover, from this result, \(Q_3(G) > Q^{em}\). Similarly, for \(\lambda _1 > 0\), we must have \(-AD +hMQ_3^2(G) > 0 \) and therefore \(Q_3(G) < Q^c\).

Now, use the value of \(\lambda _1\) in Eq. (13), to find the value of G in the form of \(Q_3(G)\), then\( (Q_3, G_3)\) is the feasible solution, that is,

Since, \(G \ge 0 \) then \((AD +hMQ_3^2(G)) \alpha - (-\hat{A}D +\hat{h}MQ_3^2(G)) \ge 0 \) and therefore \(Q \le Q^\alpha \). Now, there are three inequalities such as \(Q \le Q^\alpha \), \(Q_3(G) < Q^c\), and \(Q_3(G) > Q^{em}\). From \(Q^{em}< Q_3(G) < Q^c\), \(\frac{A}{h} > \frac{\hat{A}}{\hat{h}}\) and therefore, \(Q^\alpha < Q^c\). Final result can be expressed as if \(2\sqrt{\hat{h}\hat{A}MD}+ \hat{k}D- \frac{\alpha ^2}{4\beta }< C < 2\sqrt{\hat{h}\hat{A}MD}+ \hat{k}D \) and \(Q^{em}< Q_3(G) < Q^\alpha \), the optimal solution is \( (Q_3, G_3)\).

Similarly, \( (Q_4, G_4)\) can be obtained. Here,

Therefore, it can be concluded that if \(2\sqrt{\hat{h}\hat{A}MD}+ \hat{k}D- \frac{\alpha ^2}{4\beta }< C < 2\sqrt{\hat{h}\hat{A}MD}+ \hat{k}D \) and \(Q^\alpha< Q_4(G) < Q^{em}\), then the optimal solution is \( (Q_4, G_4)\).

8.2 proof of Theorem-2

Objective function is

Putting the value of TEU(Q, G) in the above equation, therefore

To find the feasible solution for a total cost per year, solve the Hessian matrix, which gives

must be greater than zero.

and

Therefore,

Then the optimal solution is \(Q^{**} = \sqrt{\frac{(A+p_e \hat{A})D}{h+p_e \hat{h})M}}\) and \(G^{**} = \frac{\alpha p_e -1}{2p_e\beta }\).

8.3 Proof of theorem-3

Objective function is

and

Putting the value of X from the above equation in the objective function, thus

With the similar approach in 8.2, \(TCU_{c_{p_e}}(Q,G)\) is convex in Q and G. Therefore, \(Q^{***} = \sqrt{\frac{(A+c_{p_e} \hat{A})D}{(h+c_{p_e} \hat{h})M}}\) and \(G^{***} = \frac{\alpha c_{p_e} -1}{2c_{p_e}\beta }\). Thus, \((Q^{***},G^{***})\) is the feasible solution.

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Raiya, G., Mittal, M. (2023). Joint Decisions on Imperfect Production Process and Carbon Emission Reduction Under Carbon Regulations. In: Sharma, R.K., Pareschi, L., Atangana, A., Sahoo, B., Kukreja, V.K. (eds) Frontiers in Industrial and Applied Mathematics. FIAM 2021. Springer Proceedings in Mathematics & Statistics, vol 410. Springer, Singapore. https://doi.org/10.1007/978-981-19-7272-0_29

Download citation

DOI: https://doi.org/10.1007/978-981-19-7272-0_29

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-7271-3

Online ISBN: 978-981-19-7272-0

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)