Abstract

Carbon emission reduction (CER) is urgent and necessary across various industries. While considerable attention has been paid to carbon emissions during manufacturing processes, less focus has been given to the end-of-life stage when a product is scrapped. The scrapping of end-of-life products significantly impacts CER, especially for rapidly upgraded products such as computers, communication devices, and consumer electronics. To better understand the effects of carbon emissions from end-of-life products, we study a closed-loop supply chain (CLSC) with a trade-in program and a carbon tax applied to the carbon emissions (CE) during a product’s production and scrapping stages. We employ a Stackelberg game to investigate the equilibrium decisions of a manufacturer, a retailer, and a regulator, in the presence of environmentally-conscious consumers. We examine the interaction between the CE in the scrapping stage and the trade-in program. The trade-in program can reduce the price sensitivity of environmentally-conscious consumers. Additionally, the trade-in program will decrease both the manufacturer’s and the retailer’s prices. Furthermore, we determine the optimal carbon tax imposed by the regulator, which is specific to the product’s characteristics and environmental conditions. In addition, we compare our CLSC with a centralized system and a system with third-party collection in terms of social welfare under a given carbon tax.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With global climate changes, people are particularly concerned about one of the major contributors: carbon dioxide. Carbon emissions have become a significant problem faced by many industries. Both scholars and managers have recognized the importance of manufacturing processes in the role of carbon emission reduction (CER). Accordingly, many regulations, such as cap-and-trade and carbon tax, have been implemented in related industries. Furthermore, the trade-in business, viewed as a method to promote newer generations of products (Mahmoudzadeh, 2020), often aligns with remanufacturing and recycling in closed-loop supply chains (CLSC) as part of firms’ low-carbon strategies (Guide & Van Wassenhove, 2009).

The carbon emission reduction (CER) in the scrap stage of products makes a significant difference, especially in e-waste, such as computers, communication, and consumer electronics (3C products), and household appliances. According to Forti el al. (2020), approximately 53.6 million tonnes (Mt) of e-waste was generated in 2019, an increase of 21 percent in five years. They estimate that the amount of e-waste generated will exceed 74 Mt by 2030. They also report that 98 Mt of carbon dioxide equivalents are released into the atmosphere due to the improper recycling of discarded refrigerators and air-conditioners. On the other hand, the recycling of iron, aluminium, and copper helps save 15 Mt of carbon dioxide equivalent emissions. Guide and Van Wassenhove (2009) recognize two kinds of used products: end-of-use products and end-of-life products. They define the former as when a functional product is replaced due to a technological upgrade, such as mobile phones. Many consumers upgrade their mobile phones to a new version every 1–2 years. The old version will be remanufactured or resold. In contrast, Guide and Van Wassenhove (2009) define the latter as when the product becomes technically obsolete or no longer holds any utility for the current user, such as most household appliances. Consumers typically use these products until they are out of use. A similar classification is given by Souza (2008). Our work focuses on the trade-in of end-of-life products.

In an effort to enhance the economic viability of the remanufacturing process, a significant body of research has been dedicated to the management of product returns, operational challenges in remanufacturing, and the market expansion for remanufactured products (Guide & Van Wassenhove, 2009). While the issue of carbon emissions in remanufacturing has garnered considerable attention, there has been a relative dearth of studies on CER resulting from the recycling of end-of-life products. This gap in the literature motivates our specific focus on the trade-in of such products.

The practice of manufacturers’ trade-in programs is widespread. Take Gree, an air-conditioner brand, as an example. When a consumer trades in a used product through Gree’s official channel, they pay a fixed processing fee and receive a coupon that can be redeemed when purchasing a new product. Several other examples are discussed by Dou and Choi (2021).

This paper considers a CLSC, consisting of a manufacturer and an online retailer, catering to environmentally-conscious consumers. There are two specific features of the supply chain we consider. First, the manufacturer is responsible for their carbon emissions from product manufacturing and the end-of-life products in their scrap stage, under a given carbon tax regulation. Second, an environmentally-conscious consumer perceives greater utility when buying a new product with a used product recycled using the manufacturer’s professional technology.

Carbon taxes can be implemented in a straightforward manner: the government imposes a price that companies must pay for each ton of greenhouse gas emissions they emit (Benjaafar et al., 2013), a principle we adhere to in this work. It is important to note that in practice, regulations surrounding carbon taxes can vary significantly across different countries. There are many factors to consider, such as reducing companies’ costs by offsetting carbon taxes with reductions in other taxes, using carbon tax revenue to compensate stakeholders, and implementing the tax incrementally (Geroe, 2019).

In our CLSC with a trade-in program, a consumer faces two decisions: purchase and trade-in. The purchase decision involves determining whether to buy a unit of the product. The trade-in decision concerns whether to utilize the trade-in program and, if so, with whom to trade in a unit of the used product. In practice, there are three trade-in modes: (1) trade-in with the manufacturer, where the manufacturer personally collects the used product from the consumer; (2) trade-in with the online retailer, where the online retailer collects the used product through her online platform and then resells it to the manufacturer; (3) a third party handles the collection of the used product. In this research, we consider the first two modes and discuss the third one in our extension.

In the trade-in mode with the online retailer, a consumer trades in their product online and receives a subsidy from the retailer. In this mode, the consumer subsidy can be applied to most of the products sold by the e-tailer. However, the consumer must make an extra effort to deliver or ship the used product to the online retailer, thus incurring a hassle cost. After collecting the used product, the online retailer can resell it to the manufacturer at a predetermined price.

A major difference between current and previous trade-in programs is that consumers can now trade in almost all of their electronic waste, without limitations on the brand or category of the product they need to buy. Customers receive coupons that can be used universally. This diminished exclusivity of today’s trade-in programs reduces the hassle cost for consumers and increases the utility for those who are environmentally conscious. The new practice of the trade-in program, coupled with the consideration of carbon emissions during the product’s scrap stage, alters consumers’ purchasing behavior. It prompts members of the CLSC, primarily the manufacturer, to reconsider the strategic impacts of the trade-in program. Our aim is to develop a quantitative model to understand the interaction effects between the manufacturer’s trade-in strategy and consumers’ purchasing behavior, with explicit consideration of the carbon emissions during the product’s scrap stage.

Specifically, we investigate how carbon emissions in the product’s scrap stage and the trade-in program jointly affect the behavior of environmentally-conscious consumers, the pricing strategy of CLSC members, and the value of regular carbon taxes. The carbon emissions from end-of-life products are included in the manufacturer’s total carbon emissions and are subject to taxation. We seek to answer the following three questions:

-

(1)

How do the carbon emissions from end-of-life products affect consumers’ purchasing decisions, the pricing strategies of manufacturers and online retailers, as well as the value of regular carbon taxes?

-

(2)

What impact does the trade-in program have on the CLSC system and carbon emissions?

-

(3)

How does the level of the manufacturer’s recycling technology affect the value of the carbon tax and the manufacturer’s trade-in strategy?

To address the aforementioned questions, we construct a one-period Stackelberg game model. This model allows us to derive the decisions of the CLSC members. Concurrently, we employ an economic utility model to characterize the consumers’ choices. Our primary focus is on the influence of end-of-life products, potentially incorporated through a trade-in program, on carbon emissions and consumers’ purchasing decisions. We determine the equilibrium decisions of the CLSC members under carbon tax regulation. Furthermore, we conduct a comparative analysis of our dual-channel CLSC with two alternative systems: a centralized system and a system with third-party collection. This comparison is based on the total social welfare under a specified carbon tax.

Our main findings are as follows. First, in the presence of environmentally-conscious consumers, a trade-in program in a CLSC that considers carbon emissions during the product’s end-of-life stage not only boosts the sales of new products but also diminishes the price sensitivity of consumers. Second, the effectiveness of the trade-in program on CLSC members increases with the carbon tax rate, especially when considering carbon emissions during the product’s end-of-life stage. Third, a decentralized CLSC implementing an end-of-life product’s trade-in program can yield higher social welfare than a centralized system. Fourth, when examining the various objectives of the CER regulator, we discovered that the regulator should not merely set the carbon tax to optimize environmental performance. Instead, it should take into account the product’s characteristics, the prevailing environmental conditions, and the overall social welfare.

The remainder of the paper is structured as follows. Section 2 reviews prior research. The model description and the equilibrium results are presented in Sects. 3 and 4, respectively. Section 5 analyzes two benchmark scenarios: one without a trade-in program and one that does not consider carbon emissions during the product’s end-of-life stage. This section compares these scenarios with the equilibrium results from Sect. 4, providing managerial insights and policy recommendations. Section 6 further explores two distinct systems: a centralized system and a CLSC with a third party responsible for collecting end-of-life products. Finally, Sect. 7 concludes our work and offers suggestions for future research.

2 Literature review

We examine the pricing decisions of members within a CLSC that implements a trade-in program for end-of-life products. Additionally, we study a regulator’s decision regarding carbon tax. The literature pertinent to our research primarily focuses on supply chain management, taking into account carbon emission reduction. We summarize the works closely related to our study in Table 1.

In Table 1, concerning the operational decisions of supply chain members, we enumerate decisions related to pricing and production quantity. Pricing may pertain to wholesale and retail prices for either new or remanufactured products. Similarly, the quantity decision may apply to either new or remanufactured products. It is important to note that, in some cases, the decision regarding pricing is equivalent to that of quantity, as quantity is influenced by market demand as a function of price. We present pricing or quantity decisions exactly as they appear in the original works. The closed-loop feature is applicable only when the return or trade-in of used products is explicitly modeled. Some works explore remanufacturing operations but do not explicitly consider the return or trade-in of used products and are not classified under the closed-loop feature. Concerning the channel structure, we specifically address the return channel, not the selling channel. A multi-channel setup implies that consumers can return a used product to different supply chain members. For conciseness, we only consider the carbon tax as the carbon reduction policy. Other viable policies, such as the remanufacturing subsidy policy (Cao et al., 2020) and the zero-emission vehicle (ZEV) credit regulation (Huang & Zhu, 2021), exist. Lastly, the decision to reduce carbon emissions is also made by supply chain members and is categorized under carbon emission reduction for specificity.

Operations in a supply chain with carbon emission reduction are extensively studied, focusing primarily on decisions related to pricing and production quantity. Among the sixteen closely related works listed in Table 1, twelve delve into pricing decisions, while three explore decisions regarding production quantity. Additionally, four papers examine decisions concerning carbon emission reduction efforts. For instance, Wang et al. (2021) address consumers’ environmental consciousness and discuss a manufacturer’s pricing and carbon emission reduction decisions in a supply chain. They demonstrate that the retailer’s altruistic preference leads to a sacrifice in her profit for the benefit of the manufacturer, carbon emission reduction, and the overall supply chain. In our study, we investigate pricing decisions for both manufacturers and retailers. It is important to note that, although we do not explicitly consider decisions over production quantity, the pricing decisions under our study directly influence consumer demand and sales volume.

In a CLSC, the channel for consumers to return or trade in their used products can be through a retailer, a third party, or directly to the manufacturer. It is a standard setting to consider a single return channel. Zhang and Zhang (2018) analyze the impact of trade-in remanufacturing on customer purchasing behavior and the effectiveness of government policies. They highlight the importance of considering customer preferences and product quality in the related decisions. Zhang and Zhang (2021) study a CLSC system with two suppliers, one manufacturer, one risk-averse retailer, and one fair-caring third party in the presence of supply disruption. They analyze how the manufacturer’s decisions and other factors affect the system’s stability and propose methods to stabilize it. Zhang and Zhang (2022) study a CLSC under carbon tax regulation and show that the retailer’s fairness concern level is negatively related to the optimal wholesale price and positively related to the optimal retail price of a new product.

Multiple return channels are also widely studied. Savaskan et al. (2004) study a supply chain with a manufacturer and a retailer, with three collecting structures: manufacturer, retailer, and third party collection. They find that the retailer is the manufacturer’s most effective undertaker of product collection activity, and simple coordination mechanisms can coordinate the collection effort of the retailer and the supply chain profit. Shi et al. (2020) study a supply chain system with the manufacturer having a manufacturing division and a remanufacturing division. They find that indirect selling can bring higher manufacturer profit and consumer demand, and direct selling of remanufactured products and indirect selling of new products can better induce a remanufacturable product design. Yu et al. (2023) investigate coalition formation of members of a CLSC under differentiated carbon tax regulations. They show coalition formation can enhance supply chain performance, and carbon tax regulation can incentivize firms to cooperate and reduce emissions. In this work, we consider a CLSC where the consumers have two channels to trade in used products: through the manufacturer or the online retailer. We also extend our study to the system with third party collection.

From Table 1, most researchers study carbon emission in the production stage and investigate carbon emission related to end-of-use, instead of end-of-life, products. For example, Luo et al. (2022) evaluate the impact of carbon tax policy on manufacturing and remanufacturing decisions in two scenarios, with or without carbon reduction investment. They show that the carbon tax policy can induce the manufacturer’s low carbon production, such as investing in carbon reduction technology or remanufacturing. We note that limited research investigates the inner mechanism of how carbon emission in the product’s scrap stage affects supply chain members and the regulator’s decisions. It is important to examine the return and trade-in of end-of-life products. As found by Li et al. (2011), a better understanding of the product characteristics can help improve the return flow forecast and make a better trade-in policy. Our paper explicitly considers an end-of-life product’s carbon emission in its scrap stage in a dual channel CLSC with a trade-in program. Compared to the end-of-use products, end-of-life products’ collections apparently have less benefit to their manufacturers. However, the interaction between carbon emission in the product’s scrap stage and the trade-in program makes the problem complex, especially in the presence of environmentally-conscious consumers. We discuss the effects of a trade-in program on the decisions of CLSC members and a regulator.

The CER policy is another important feature of the works in Table 1. Owning to the serious environmental problem caused by greenhouse gas, CER policy plays an important role in the benefit of our society. Benjaafar et al. (2013) extend classic lot-sizing models with single and multiple firms to investigate how different carbon emission regulations can be integrated into procurement, production, and inventory management decisions. Their research highlights the trade-offs between cost, carbon footprint, and service level, suggesting that finding an optimal balance is essential for effective supply chain management. Bai et al. (2018) analyze a make-to-order supply chain with two products under cap-and-trade regulation. They consider decision variables such as production quantity, emission reduction investment, and carbon trading and discuss how environmental regulations influence supply chain strategies and performance. Gan et al. (2019) investigate pricing and revenue-sharing decisions for remanufacturing products in a CLSC under carbon cap-and-trade regulation. They find that pricing decisions for remanufactured products are influenced by carbon trading price, product demand elasticity, and production cost, and a revenue-sharing contract can effectively coordinate the supply chain. Huang and Zhu (2021) consider competition among manufacturers with ZEV productions. They find that the ZEV credit regulation can incentivize automakers to produce and sell more electric vehicles, and the effectiveness of the ZEV credit regulation depends on credit requirements, market competition, and consumer preferences. Sun and Yang (2021) examine the competition between two manufacturers facing cap-and-trade or carbon tax policy. They show that the cap-and-trade policy is more sensitive to consumer environmental awareness than the carbon tax policy, and fierce carbon emission reduction competition may hurt the supply chain and the environment. Lyu et al. (2022) examine the implementation of green marketing by a retailer and the collaboration between the two manufacturers in a decentralized CLSC under a carbon tax. They find that green marketing can increase profits for all CLSC members and improve trade-in rates. Further, Bai et al. (2018), Sun and Yang (2021), Wang et al. (2021), and Luo et al. (2022) consider investment decisions for emission reduction. Our work considers carbon tax charged to carbon emission in the manufacturer’s production and scrap stages.

3 Model setup

3.1 Model description

We consider a CLSC that consists of a manufacturer and an online retailer. The manufacturer produces products such as computers, communication, and consumer electronic products, collectively referred to as 3C products. These 3C products are characterized by their short usage duration and significant carbon emissions during the scrapping stage. The manufacturer distributes these 3C products to consumers via the online retailer. When a consumer plans to purchase a 3C product, they may exhibit trade-in behavior driven by environmental considerations. This trade-in program can help reduce carbon emissions as the manufacturer can professionally scrap used products, thereby reducing carbon emissions during the product’s scrapping stage. An environmentally-conscious consumer can gain economic utility from a subsidy and transaction utility from carbon reduction. We assume that end-of-life products have little value for remanufacturing. Therefore, there will be no subsequent periods in which remanufactured products are sold to consumers. Consequently, we adopt a single-period static model. The framework of the system is depicted in Fig. 1.

Specifically, the manufacturer sells a product to the online retailer at a wholesale price of w. Then, the online retailer distributes the product at a retail price of p to the consumers. The manufacturer will incur carbon emission in the amount of e for a unit of the product in the production stage. In the product’s scrap stage, without any recycling measures, the carbon emission amount is \(e'\). The manufacturer can reduce the carbon emission to \(\beta e'\) through technologies to recycle or reuse a used product in the scrap stage. The value of \(\beta \) is a parameter that represents the manufacturer’s recycling or reusing technology in carbon reduction. We assume that if a consumer purchases a new product without a trade-in, then the carbon emission of the used product discarded by the consumer is \(e'\). If the consumer buys a new product with a trade-in, the carbon emission of the consumer’s used product is \(\beta e'\). Note that the larger the \(\beta \) is, the lower the level of the manufacturer’s recycling technology.

There is a regulator who decides the carbon tax level. The regulator formulates and implements a carbon tax mechanism considering the whole life cycle of products, including the scrap stage. With the carbon tax regulation, the manufacturer pays t per unit of carbon emission for his product, not only in the production stage but also in the scrap stage. Note that there are carbon emissions during the product’s sales. However, a retailer often sells many products and does not relate her carbon missions to a specific product. For that reason, we do not model carbon emissions for the retailer in this work.

The main notations throughout the paper are summarized in Table 2.

Considering a typical practice, we make the following reasonable assumptions of certain parameters, as follows:

-

(i)

\(h_m\ge \delta \), to avoid the case that all consumers who purchase a new product will trade-in.

-

(ii)

\(r\ge \delta \), to ensure the online retailer can profit positively from the used product’s trade-in.

-

(iii)

\(p\ge w\ge r\), to ensure that the retail and the manufacturer gain positive profits.

-

(iv)

\(\delta \ge s\), i.e., the used product’s salvage value is smaller than the trade-in subsidy, to avoid the case that the manufacturer can always achieve a positive profit from the trade-in program.

3.2 CLSC members’ decisions

We consider a group of rational consumers who are heterogeneous in their transaction valuation v of the product. We assume the consumers are environmentally-conscious, with a consciousness parameter \(\gamma \) on their valuation in terms of the product. Specifically, the environmental consciousness of a consumer is associated with the product’s carbon emission level \(\epsilon \) in the product’s scrap stage, where \(\epsilon =e'\) without trade-in and \(\epsilon =\beta e'\) with a trade-in. Specifically, a consumer’s utility of buying a new product with a fundamental valuation of v is

where H is the hassle cost of the trade-in transaction, and d is the subsidy received from trading in a used product. Note that \(H=0\) without trade-in, \(H=h_m\) when trading in with the manufacturer, and \(H=h_r=\theta /c\) when trading in with the online retailer. Also, we have \(d=0\) without a trade-in and \(d=\delta \) with a trade-in.

A consumer’s utility consists of two parts: economic and transaction utilities. The economic utility, \(d-p\), refers to the exact payoff in money. From (1), the economic utility is negative because the subsidy for trading in a used product is lower than the new product’s price. The transaction utility \(\frac{v}{\gamma +\epsilon }-H\) is associated with consumers’ valuation of the new product v and their environmental consciousness. A greater carbon emission leads to a consumer’s lower transaction utility. The manufacturer can reduce carbon emissions by handling professional technology in end-of-life product recycling. Thus, environmentally-conscious consumers can improve their transaction utility by trade-in.

The parameter H is the hassle cost of the trade-in transaction. When a consumer purchases the product with the manufacturer trade-in, the hassle cost is \(H=h_m\). When a consumer purchases a new product with the online retailer trade-in, the consumer needs to specify the characteristics of the used product, such as the used duration and appearance, step by step. We assume the consumers are heterogeneous in the online trade-in transactions, with a random cost modeled by \(\theta \). The consumer incurs a transaction cost of \(H=h_r=\theta /c\), where c is the consumer’s hassle cost coefficient of operating the online trade-in process.

We assume a consumer’s product valuation and online transaction cost follow uniform distributions \(v\sim [0, V]\) and \(\theta \sim [0,\Theta ]\), respectively. The larger the value of v is, the more the consumer is willing to buy the product. The larger the value of \(\theta \) is, the larger the hassle cost when the consumer handles the trade-in process online. Note that the values of V and \(\Theta \) jointly define the market size, i.e., the maximum possible demand, as \(V\Theta \).

Suppose a consumer decides to buy the product. In that case, he has three choices: purchasing without a trade-in, purchasing with the manufacturer trade-in, and purchasing with the online retailer trade-in. If the consumer buys a new product directly without a trade-in, then the carbon emission of the used product in the scrap stage is \(e'\). If the consumer purchases a new product with a trade-in, the carbon emission of the used product in the scrap stage is \(\beta e'\). The consumer receives a subsidy \(\delta \) with hassle cost \(h_m\) or \(h_r\), depending on where to trade in. Then, the consumer utility under the three different purchasing choices are:

-

(i)

When a consumer buys a new product without a trade-in, the utility is \(u_1=\frac{v}{\gamma +e'}-p\);

-

(ii)

when a consumer buys a new product with the manufacturer trade-in, the utility is \(u_2=\frac{v}{\gamma +\beta e'}-p+\delta -h_m\);

-

(iii)

when a consumer buys a new product with the online retailer trade-in, the utility is \(u_3=\frac{v}{\gamma +\beta e'}-p+\delta -h_r\).

The online retailer pays a unit wholesale price of w to buy the product from the manufacturer and fills the demand with a retail price of p. The manufacturer pays a subsidy of r to the online retailer for each unit of the product collected, and the salvage value of a recycled product is s. Besides, the manufacturer and the online retailer provide trade-in service to consumers with the same unit subsidy \(\delta \). The dual channel trade-in is reasonable. For example, Gree, a national household appliance brand in China, adopts a unified subsidy standard for scrapped appliances through online and offline collecting channels.

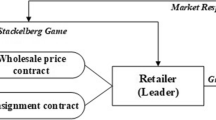

The CLSC members make decisions following a Stackelberg game. First, the carbon regulator announces the carbon tax t. Second, the manufacturer decides the wholesale price w. Third, the online retailer decides the retail price p. The sequence of the events is shown in Fig. 2.

The manufacturer and the retailer make their decisions to maximize their profit. The manufacturer’s profit function is:

where \(d_s=d_1+d_2+d_3\) and \(d_t=d_2+d_3\) represent the total demand and the trade-in demand, respectively. The value \(E=ed_s+\beta e'd_t+e'(d_s-d_t)\) denotes the total CE of the entire stage of the product. In the profit function, the first part \(wd_s\) is the wholesale revenue of the new product, the second part \((s-\delta )d_2+(s-r)d_3\) is the salvage of the used product, and the last part tE is the cost associated with the carbon emission.

The online retailer’s profit function is:

where the first term \((p-w)d_s\) is the retailer’s retailing revenue, the second term \((r-\delta )d_3\) is the payoff from the manufacturer for used products’ collection, and the last term \(c_r\) is the fixed cost of the trade-in program.

The carbon regulator may have different objectives. We consider the following two objective functions of the regulator:

-

(i)

If the regular focuses on reducing carbon emission, the objective function is: \(R=ted_s+t\beta e'd_t+te'(d_s-d_t)-ED\), where ED is the environmental damage caused by carbon emission and will be explained in detail later.

-

(ii)

If the regular emphasizes social welfare, the objective function is \(SW=\pi _m+\pi _r+R+CS\), where CS is the consumer surplus and will be explicitly introduced later.

4 Supply chain members’ decisions and stationary equilibrium

In this section, we backtrack the sequence of events. First, we discuss consumers’ choices and derive the demand function. Next, we study the pricing decisions of the manufacturer and the online retailer. Finally, we examine the carbon regulator’s decision regarding the carbon tax.

4.1 Consumers’ choices and demand functions

We assume that consumers are rational and make their choices to maximize their utility. We can obtain the consumers’ decisions by comparing the utility functions in the following lemma. In the following lemma, we classify the used product’s trade-in subsidy ratio over manufacturer trade-in hassle cost as high and low. This classification is not affected by consumers’ trade-in costs with the online retailer. The trade-in cost with the online retailer can be either higher or lower than that with the manufacturer.

Lemma 1

Given the manufacturer and the retailer’s pricing decisions, the consumers’ choices will be:

-

(i)

When the used product’s trade-in subsidy ratio is high, i.e., \(\frac{\gamma +\beta e'}{\gamma +e'}<\frac{\delta }{h_m}\le 1\), we have:

$$\begin{aligned} \left\{ \begin{array}{ll} d_1=&{}0,\\ d_2=&{}(\Theta -ch_m)[V-(\gamma +\beta e')(p+h_m-\delta )],\\ d_3=&{}\frac{ch_m(2V-2(\gamma +\beta e')(p-\delta )-(\gamma +\beta e')h_m)}{2}, \end{array} \right. \end{aligned}$$and the total demand of the new product is \(d_s=d_1+d_2+d_3=\theta [V-\beta e'(p+h_m-\delta )]+\frac{\beta e'ch_m^2}{2}\).

-

(ii)

When the used products’ trade-in subsidy ratio is low, i.e., \(0<\frac{\delta }{h_m}\le \frac{\gamma +\beta e'}{\gamma +e'}\), we have:

$$\begin{aligned} d_1= & {} \left\{ \begin{array}{lll} \frac{1}{2}[2\Theta -ch_m-c(\frac{p(1-\beta )e'}{\gamma +\beta e'}+\delta )][\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}-p(\gamma +e')],&{}~\text{ if }&{}~\delta<p\le \frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'},\\ 0,&{}~\text{ if }&{}~p>\frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'} \end{array} \right. \\ d_2= & {} \left\{ \begin{array}{lll} (\Theta -ch_m)[V-\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}],&{}~\text{ if }&{}~\delta<p\le \frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'},\\ (\Theta -ch_m)[V-(\gamma +\beta e')(p+h_m-\delta )],&{}~\text{ if }&{}~p>\frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'}, \end{array} \right. \\ d_3= & {} \left\{ \begin{array}{lll} &{}ch_m[V-\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}]+\frac{c(\frac{(1-\beta )e'p}{\gamma +\beta e'}+\delta )((1-\beta )e'p+\delta )}{2},\\ &{}+\frac{1}{2}[ch_m+c(\frac{p(1-\beta )e'}{\gamma +\beta e'}+\delta )][\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}-p(\gamma +e')],&{}~\text{ if }~\delta <p\le \frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'},\\ \\ &{}\frac{ch_m[2V-2(\gamma +\beta e')(p-\delta )-(\gamma +\beta e')h_m]}{2},&{}~\text{ if }~p>\frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'}, \end{array} \right. \end{aligned}$$and the total demand of the new product is

$$\begin{aligned} d_s=\left\{ \begin{array}{lll} \Theta [V-(\gamma +e')p]+\frac{c(\frac{(1-\beta )e'p}{\gamma +\beta e'}+\delta )((1-\beta )e'p+\delta )}{2},&{}~\text{ if }&{}~\delta <p\le \frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'},\\ \Theta [V-(p+h_m-\delta )(\gamma +\beta e')]+\frac{ch_m(h_m-\delta )(\gamma +\beta e')^2}{2(1-\beta e')},&{}~\text{ if }&{}~p>\frac{(\gamma +\beta e')(h_m-\delta )}{(1-\beta )e'}. \end{array} \right. \end{aligned}$$

According to Lemma 1, we note that both a high subsidy ratio \(\frac{\delta }{h_m}\) and a high recycling level \(\beta \) can reduce the impact of the retail price on consumers’ purchasing behavior. We also can find that a high trade-in subsidy ratio or a high recycling level (\(\frac{\gamma +\beta e'}{\gamma +e'}<\frac{\delta }{h_m}<1\)), or a low retail price (\(0<p\le \frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\)), can incentivize the consumers’ trade-in behavior. The result is consistent with our cognition and easy to understand. On the one hand, when the trade-in subsidy ratio is high, the consumers’ economic utility is high. The trade-in program’s high economic utility can help offset the retail price they pay for the new product. A low retail price also leads to a high economic utility, and the consumers will be more willing to pay the hassle cost of trading in their used products. On the other hand, when the manufacturer has a high recycling level, the carbon emission reduction in the products’ scrap stage is large. Compared to buying a new product without a trade-in, consumers can gain a higher transaction utility because of the carbon emission reduction achieved through recycling associated with the trade-in program. Therefore, a high subsidy, a high recycling level of the manufacturer, or a low retail price of the new product can lead to a high transaction utility.

4.2 Stationary equilibrium of CLSC members

From Lemma 1, we see that the demand function differs in the trade-in subsidy ratio \(\frac{\delta }{h_m}\), which leads to the CLSC members’ objective functions being different. Thus, we will discuss the manufacturer and the online retailer’s equilibrium decisions with the conditions of \(0<\frac{\delta }{h_m}\le \frac{\gamma +\beta e'}{\gamma +e'}\) and \(\frac{\gamma +\beta e'}{\gamma +e'}<\frac{\delta }{h_m}<1\) separately.

4.2.1 The high trade-in subsidy ratio case

When the trade-in program’s subsidy ratio is high, i.e., \(\frac{\gamma +\beta e'}{\gamma +e'}<\frac{\delta }{h_m}<1\), purchasing a new product with the trade-in program can bring consumers a larger utility than without the trade-in program, i.e., \(d_s=d_t\). Thus, the profit functions of the manufacturer and the online retailer are:

and

When the trade-in program’s subsidy ratio is high, the online retailer’s profit function is shown in Eq. (5). Using backward induction, we first derive the online retailer’s reaction function with respect to the manufacturer’s wholesale price w, as in the following Lemma.

Lemma 2

Given the manufacturer’s wholesale price w, the online retailer’s optimal reaction function of p with respect to w is:

and the total demand is \(d_s=\frac{\Theta [V-(\gamma +\beta e')(w+h_m-\delta )]}{2}-\frac{\Theta (\gamma +\beta e')ch_m(h_m+2\delta -2r)}{4}+\frac{ch_m^2(\gamma +\beta e')}{2}\).

From Lemma 2, given the manufacturer’s wholesale price, the retailer’s retail price is independent of the carbon tax. However, the carbon emissions will affect the retail price. From the formulation of p(w), we see that larger carbon emission leads to a lower retail price. This is because the carbon emissions affect environmentally-conscious consumers’ transaction utility. Carbon reduction can increase consumers’ transaction utility, and the retailer can charge a higher retail price. On the contrary, more carbon emissions cause the retailer to lower the retail price to increase consumers’ utility and boost sales.

4.2.2 The low trade-in subsidy ratio case

When the trade-in program’s subsidy ratio is low, i.e., \(0<\frac{\delta }{h_m}\le \frac{\gamma +\beta e'}{\gamma +e'}\), consumers’ choices are related to retail price p, and the profit functions of the manufacturer and the online retailer are piece-wise functions:

and

Substituting the demand function in Lemma 1 into the online retailer’s profit function, we have:

where \(A_1=-[\frac{c(1-\beta )^2e'^2w}{2(\gamma +\beta e')}+\frac{ce'(1-\beta )(r-3\delta )}{2}+\Theta (\gamma +e')]<0\), \(B_1=\Theta V+\Theta (\gamma +e')w-c\delta e'(1-\beta )w-c\delta (\gamma +\beta e')(r-\frac{3\delta }{2})>0\), \(C_1=-w(\Theta V+\frac{(\gamma +\beta e')c\delta ^2}{2})+(r-\delta )(ch_mV+\frac{(\gamma +\beta e')c\delta ^2}{2}-\frac{(\gamma +e')(\gamma +\beta e')c(h_m-\delta )^2}{2(1-\beta )e'})-c<0\), \(A_2=-\Theta (\gamma +\beta e')<0\), \(B_2=\Theta V+(w+\delta -h_m)\Theta (\gamma +\beta e')-ch_m(\gamma +\beta e')(r-\delta -\frac{h_m}{2})>0\), and \(C_2=-w[\Theta V+\frac{(\gamma +\beta e')ch_m^2}{2}-\Theta (\gamma +\beta e')(h_m-\delta )]+(r-\delta )(ch_mV+(\gamma +\beta e')ch_m\delta -\frac{(\gamma +\beta e')ch_m^2}{2})-c_r<0\).

We can see that the online retailer’s profit function is continuous. To find the equilibrium decision, a similar calculation as in the high trade-in subsidy ratio will be carried. The online retailer’s reaction function is shown in the following lemma.

Lemma 3

When the used product’s subsidy ratio is low, i.e., \(0<\frac{\delta }{h_m}\le \frac{\gamma +\beta e'}{\gamma +e'}\), the optimal reaction function of the online retailer is

From Lemmas 2 and 3, we see that whether the trade-in subsidy ratio is high or low, the online retailer’s optimal reaction functions concerning the wholesale price w are the same, i.e., \(p(w)=\frac{V}{2(\gamma +\beta e')}+\frac{w+\delta -h_m}{2}+\frac{ch_m(h_m+2\delta -2r)}{4\Theta }\). Under condition \(p<\frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\), the optimal retail price is reasonably low. As in our analysis of Lemma 1, a low retail price can generate a high economic utility and can induce consumers to purchase a new product and, at the same time, trade in a used product. Therefore, though a low retail price leads to a small profit margin in terms of the new product’s sales, it can benefit the online retailer by expanding the sales of the new product and the trade-ins of used products. Note that a low retail price also benefits the consumers with a high economic utility.

Substituting the reaction function p(w) into the manufacturer’s profit function, as in Eq. (4), and differentiating the function with respect to w, we obtain the manufacturer’s optimal wholesale price decision, as shown in the following lemma.

Lemma 4

Given the regulator’s carbon price t, the manufacturer’s optimal wholesale price is:

From Lemma 4, we have that \(\partial w^*/ \partial t=\beta e'/2\). From Lemmas 2 and 3, we have \(\partial p^*(w)/ \partial w = 1/2\). That means if \(\beta e' > 1\), only a partial carbon tax transfers to the customers. However, if \(\beta e' \le 1\), the extra payment made by customers is even more than the carbon tax the manufacturer pays. This is because we consider environmentally-conscious consumers, whose transaction utility increases with carbon reduction, and hence are willing to pay more when the carbon emission is low.

Following the above results, we can find the equilibrium decisions of the manufacturer and the online retailer with a giving carbon tax when the used products’ subsidy ratio is low, i.e., \(0<\frac{\delta }{h_m}\le \frac{\gamma +\beta e'}{\gamma +e'}\), as in the following proposition.

Proposition 1

Given a carbon tax t, the CLSC members’ equilibrium decisions are:

and the other corresponding results are shown in Table 3.

We have two observations regarding Proposition 1. First, the optimal retail price is reasonably high, so consumers can only obtain positive utility using the trade-in program. That is to say, the online retailer will set a retail price high enough and subsidize consumers to trade in their used products. Second, a rational and environmentally-conscious consumer will buy the new product and trade in his used product. By trading in a used product, a consumer receives a subsidy to compensate for the negative economic utility and improve the transaction utility by reducing carbon emissions.

4.3 Carbon tax regulation

Given carbon emission amount E, the cost function of environmental damage can be expressed in a quadratic form (Richard, 1995; Weber & Neuhoff, 2009). For calculation convenience, we assume the cost function as follows:

where \(\alpha \) denotes the slope of the marginal environmental damage curve. Consequently, the cost of environmental damage in our CLSC is

and the regulator’s objective function from his own perspective is:

where A is the current environmental condition. Note that parameter A represents the current environmental condition that depends on pollution emissions, including carbon emissions. In the long run, the carbon tax impacts the environmental condition. However, at an operational level, the impact of a carbon tax on the overall environmental condition can be ignored. Hence, we assume A is a constant.

We note that the related literature typically assumes that the regular aims to maximize social welfare instead of solely the environmental performance measure (Esenduran et al., 2015). Social welfare is the sum of three components: the total supply chain profit, the environmental performance measure, and the consumer surplus. In our model, the social welfare is

where \(\textit{CS}\) is the consumer surplus, defined as follows:

Calculating the integral function, the consumer surplus function is

Substituting the manufacturer and the online retailer’s price into the regulator’s objective functions to maximize, we can find the optimal carbon taxes, as in the following lemma.

Lemma 5

-

(i)

From the aspect of the regular’s performance, i.e., to maximize R, the optimal unit carbon tax is \(T_r=\frac{(N+4)M}{2\Theta (\gamma +\beta e')(N+8)}\);

-

(ii)

from the aspect of social welfare, i.e., to minimize SW, the optimal unit carbon tax is \(T_s=\frac{(N-3)M}{2\Theta (\gamma +\beta e')(N+1)}\);

-

(iii)

from the aspect of the CLSC, i.e., to maximize \(\pi _m+\pi _r\), the optimal unit carbon tax is \(T_c=\frac{(N-2)M}{2\Theta (\gamma +\beta e')(N+2)}\),

where \(N=\alpha \Theta (\gamma +\beta e')(\beta e'+e)^2\).

5 Equilibrium analysis

To investigate the impact of the trade-in program on carbon tax, and the importance of considering carbon emissions during the product’s scrap stage, we propose two benchmark scenarios. The results of these scenarios are compared with the equilibrium results presented in Sect. 4. We use the subscripts “s1” and “s2” to denote Scenario 1 and Scenario 2, respectively. Scenario 1 represents a CLSC without a trade-in program, while Scenario 2 represents a CLSC that does not consider carbon emissions during the product’s scrap stage.

Scenario 1: CLSC without trade-in

Scenario 1 is a CLSC without a trade-in program, where consumers’ surplus is \(u_b=\frac{v}{\gamma +e'}-p\), and the demand is \(\Theta [V-(\gamma +e')p]\).

Proposition 2

The equilibrium decisions in Scenario 1 are as follows:

Correspondingly, the demand is \(d_s=\frac{\Theta V}{\alpha \Theta (\gamma +e')(e+e')^2+8}\), the profits of the manufacturer and the online retailer are \(\pi _m=\frac{(V-t_{s1}^*(e+e')^2)\Theta }{8(\gamma +e')}\) and \(\pi _r=\frac{(V-t_{s1}^*(e+e')^2)\Theta }{16(\gamma +e')}\), respectively, and the total carbon emission is \(E_{s1}=\frac{4\Theta V(e+e')}{\alpha \Theta (\gamma +e')(e+e')^2+8}\).

Scenario 2: CLSC without considering carbon emission in the product’s scrap stage

Scenario 2 is a CLSC with a trade-in program where carbon emission in the product’s scrap stage is not considered. The consumer utility functions of different consumer choices are: \(u_{t1}=\frac{v}{\gamma }-p\), \(u_{t2}=\frac{v}{\gamma }-p-h_m+\delta \), and \(u_{t3}=\frac{v}{\gamma }-p-h_r+\delta \). Comparing the consumer surplus functions, we can derive the demand function \(d_{t1}=(\Theta -c\delta )(V-\gamma p)\), \(d_{t2}=0\), \(d_{t3}=\frac{c\delta (2V-2\gamma p+\gamma \delta )}{2}\), and the corresponding total demand is \(d_s=\Theta (V-\gamma p)+\frac{\gamma c\delta ^2}{2}\).

Following the demand function, if we do not consider CE in the scrap stage, the consumers who trade in their used products have relatively low online trade-in costs. They always trade in with the online retailer because the hassle cost associated with the manufacturer trade-in is higher. Solving the Stackelberg game between the manufacturer and the online retailer, we can obtain their equilibrium decisions in the following proposition.

Proposition 3

In Scenario 2, without considering the carbon emission in the product’s scrap stage, the equilibrium decisions of the CLSC members are:

Correspondingly, the total demand is \(d_s=\frac{3\Theta V}{16}+\frac{\gamma c\delta (31\delta -6\,s)}{32\Theta }-\frac{\gamma c\delta ^2(e+\beta e')}{8[\Theta (e+e')-c\delta (1-\beta )e']}\), and the profits of the manufacturer and the online retailer are \(\pi _m\) and \(\pi _r\), respectively.

5.1 Impacts of trade-in and CER in scrap stage

In this section, we analyze the coordination and the impacts of addressing carbon emissions in the product’s scrap stage and the trade-in program in the CLSC. First, we have the following result.

Proposition 4

Given a retail price of p, the demand with the trade-in program and the consideration of carbon emissions in the product’s scrap stage is the smallest, i.e.,

-

(i)

\(d_s^{s1}(p)<d_s(p)\),

-

(ii)

\(d_s^{s2}(p)>d_s(p)\).

Proposition 4 shows that the trade-in program and considering carbon emissions in the scrap stage affect market demand. Specifically, comparing the demand under the dual channel CLSC and Scenario 1, we have \(d_s^{s1}(p)<d_s(p)\). That is to say, the trade-in program helps the online retailer gain a larger market share. Regarding Scenario 2, we have \(d_s^{s2}(p)>d_s(p)\), which means consumers’ consideration of carbon emissions in the scrap stage will lower the demand. Though environmentally-conscious consumers incur costs to handle the used product’s trade-in, the trade-in subsidy can help increase their economic utility. The trade-in program can also help reduce carbon emissions, and consumers can achieve a higher transaction utility. Therefore, more consumers will buy the product with trade-ins. On the other hand, carbon emissions in the product’s scrap stage can not be ignored. The demand without considering carbon emissions in the product’s scrap stage is higher than that when considering that. Without considering carbon emissions in the product’s scrap stage, the online retailer will overestimate the demand and make decisions resulting in a lower profit.

Proposition 5

With carbon tax charged over carbon emissions in the product’s scrap stage, the trade-in program reduces the price elasticity of demand.

It is well-known that trade-in programs promote new-generation products (Mahmoudzadeh, 2020). With carbon tax charged over carbon emissions in the product’s scrap stage, Proposition 5 shows that a trade-in program can decrease consumers’ price sensitivity. The price elasticity of the demand is a measurement of the change in consumption of a product concerning a change in its price.

Comparing our dual channel CLSC and Scenarios 1 and 2, we summarize our results in Table 4, and present our main results in Proposition 6.

Proposition 6

Comparing the equilibrium results in the dual channel CLSC and Scenarios 1 and 2, we summarize the effects of carbon tax on the manufacturer’s wholesale price as follows.

-

(i)

-

(a)

If \(0<t\le \frac{V}{(\gamma +\beta e')(\gamma +e')}+\frac{ch_m(4r+h_m-4\delta )}{2\Theta (1-\beta )e'}-\frac{h_m+s-2\delta }{(1-\beta )e'}\), then \(w_{s1}^*<w^*\le w_{s2}^*\);

-

(b)

if \(\frac{V}{(\gamma +\beta e')(\gamma +e')}+\frac{ch_m(4r+h_m-4\delta )}{2\Theta (1-\beta )e'}-\frac{h_m+s-2\delta }{(1-\beta )e'}<t\le \frac{V}{\gamma (\gamma +\beta e')}-\frac{ch_m(4r+h_m-4\delta )}{2\Theta \beta e'}-\frac{2\Theta \delta -c\delta (2s+\delta )}{2\Theta \beta e'}+\frac{h_m+s}{\beta e'}\), then \(w^*<w_{s1}^*\), and \(w^*<w_{s2}^*\);

-

(c)

if \(t>\frac{V}{\gamma (\gamma +\beta e')}-\frac{ch_m(4r+h_m-4\delta )}{2\Theta \beta e'}-\frac{2\Theta \delta -c\delta (2s+\delta )}{2\Theta \beta e'}+\frac{h_m+s}{\beta e'}\), then \(w_{s2}^*<w^*\le w_{s1}^*\).

The effects of carbon tax on the online retailer’s retail price are summarized as follows.

-

(a)

-

(ii)

-

(a)

If \(t<\frac{3V}{(\gamma +e')(\gamma +\beta e')}+\frac{3ch_m^2}{2\Theta (1-\beta )e'}-\frac{3h_m+s-4\delta }{(1-\beta )e'}\), then \(p_{s1}^*<p^*<p_{s2}^*\);

-

(b)

if \(\frac{3V}{(\gamma +e')(\gamma +\beta e')}+\frac{3ch_m^2}{2\Theta (1-\beta )e'}-\frac{3h_m+s-4\delta }{(1-\beta )e'}<t\le \frac{3V}{\gamma (\gamma +\beta e')}-\frac{3ch_m^2-c\delta (5\delta -2s-4r)}{2\Theta \beta e'}+\frac{3h_m+s-4\delta }{\beta e'}\), then \(p^*<p_{s1}^*\) and \(p^*<p_{s2}^*\);

-

(c)

if \(t>\frac{3V}{\gamma (\gamma +\beta e')}-\frac{3ch_m^2-c\delta (5\delta -2s-4r)}{2\Theta \beta e'}+\frac{3h_m+s-4\delta }{\beta e'}\), then \(p_{s2}^*<p^*<p_{s1}^*\).

-

(a)

Proposition 6 shows that the wholesale price w and the retail price p are the lowest in Scenario 1 when the carbon tax level is relatively low and are the lowest in Scenario 2 when the carbon tax level is relatively high. Scenario 1 has no trade-in program, and consumers receive no subsidy. Thus, the online retailer must lower the retail price to improve consumers’ willingness to buy. In this case, with the relatively low carbon tax, the manufacturer can afford a low wholesale price and still make a profit. In Scenario 2, the carbon emission in the used product’s scrap stage is ignored, and the manufacturer’s perceived carbon emission cost is lower than in the other two cases. Under a relatively high carbon tax, the manufacturer can still lower the wholesale price to help the online retailer reduce the retail price to attract more consumers. However, when the carbon tax is at a medium level, though the carbon emission in the used product’s scrap stage increases the manufacturer’s cost, the trade-in program can not only reduce the carbon emission but also improve environmentally-conscious consumers’ transaction utility and hence willingness to buy the new product and trade-in a used one. Therefore, when the carbon tax is at a medium level, the dual channel CLSC has the lowest wholesale and retail prices.

5.2 Impacts of carbon tax on CLSC

We depict Fig. 3 to demonstrate the effects of the carbon tax on the CLSC members’ values. First, according to the profit comparison in Fig. 3a, the trade-in program will benefit both the manufacturer and the online retailer. Further, the manufacturer’s profit is higher than the online retailer, with or without the trade-in program. Essentially, this is because the manufacturer is the leader in the system with the first-mover advantage and makes decisions for his profit maximization.

Figure 3b shows that as the carbon tax increases, the social welfare and the regulator’s value increase first and then decrease. Moreover, the optimal carbon tax that maximizes social welfare is smaller than that maximizes the regulator’s value. The manufacturer and the online retailer’s profits decrease with the carbon tax. Figure 3b shows the conflict of the optimal carbon tax decisions between the CER regulator’s value and the social welfare. Specifically, we can see that when the regulator adjusts the carbon tax from \(t_r\) to \(t_w\), the regulator’s performance measure decreases from R1 to R2, but both the social welfare and the CLSC members’ profits increase.

Proposition 7

Comparing the carbon emission in Scenario 1 and in our model with different carbon taxes, we have

-

(i)

If \(\frac{M}{\Theta V}>8\), then \(E_{s1}<E_r<E_c<E_s\);

-

(ii)

if \(\frac{M}{\Theta V}\le \frac{8(N+1)}{N+8}\),then \(E_{s1}>E_s>E_c>E_r\);

-

(iii)

if \(\frac{8(N+2)}{N+8}<\frac{M}{\Theta V}<8\), then \(E_r<E_{s1}<E_c<E_s\);

-

(iv)

if \(\frac{8(N+1)}{N+8}<\frac{M}{\Theta V}<\frac{8(N+2)}{N+8}\), then \(E_s>E_{s1}>E_c>E_r\).

Proposition 7 shows that when the consumer’s valuation of the product is very high and the salvage value is relatively low, i.e., \(\frac{M}{\Theta V}>8\), the trade-in program increases the carbon emission. The reason is that with the high valuation of the product, the trade-in program will significantly increase the product demand and hence the carbon emission.

Figure 4 shows how the carbon tax level affects the total supply chain profit, the social welfare, and the regular’s value. Figure 4 shows that from the perspective of the regular, the carbon tax level should be set at \(t_r\). However, this will sacrifice the social welfare and the supply chain profit to a certain degree. Instead, when the tax level is set at \(t_w\), the social welfare is the highest, and the supply chain profit is reasonably high, at the cost of the regulator’s performance measure.

6 Centralized system and third party collection

This section extends our previous models to incorporate two new system structures: a centralized system and a CLSC with a third party conducting collection. We compare the equilibrium results of these new structures with those from our previous models. The structures of these two new systems are depicted in Fig. 5.

In the centralized system, a center decision maker decides the new product’s retail price p. Similar to the model descriptions in Sect. 3.1, consumers are heterogeneous in their valuation and make their choices to maximize their utility. In the CLSC, with a third party conducting the collection, the manufacturer wholesales the new product to the online retailer at a wholesale price of w. The online retailer sells the new product to consumers at p. The third party collects used products with a subsidy \(\delta \). After the third party collects the used products, the manufacturer will obtain the used products from the third party with a unit subsidy of r. As in Sect. 3.1, consumers are heterogeneous in their product valuation v and will pay a per unit hassle cost \(h_m\) if the third party collects their used products.

6.1 Centralized system

We consider a central decision maker who sells the new product and collects used products, as shown in Fig. 5a. The central decision maker decides the retail price p according to carbon tax based on the profit maximization principle.

A consumer has two choices: purchasing the new product only and purchasing the new product and simultaneously trading in a used product. If a consumer purchases the new product only, the utility is \(u_1=\frac{v}{\gamma +e'}-p\). If a consumer purchases a new product and trades in a used product simultaneously, the utility is \(u_c=\frac{v}{\gamma +\beta e'}-p+\delta -h_m\). Then, we can find the zero points of \(u_1\) and \(u_c\) are \(v_1=p(\gamma +e')\) and \(v_c=(p+h_m-\delta )(\gamma +\beta e')\), respectively. The indifference point is \(v_0=\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}\). Similarly, the consumers’ demands are:

and

Consequently, the center decision maker’s profit function is

Proposition 8

-

i)

In the centralized system, the optimal retail price is \(p^*=\frac{V}{2(\gamma +\beta e')}+\frac{te+t\beta e'+2\delta -h_m-s}{2}\), and the corresponding total demand is \(d_s=d_2=\Theta (\gamma +\beta e')[\frac{V}{2(\gamma +\beta e')}+\frac{T+s-h_m}{2}]\). Consequently, the system’s maximum profit is \(\pi _c^*=[\frac{V}{2(\gamma +\beta e')}-\frac{T+h_m-s}{2}]^2\Theta (\gamma +\beta e')+\Theta (\gamma +\beta e')(s+\delta )[\frac{V}{2(\gamma +\beta e')}-\frac{T+h_m-s}{2}]\).

-

ii)

The social welfare under retail price \(p^*\) is

$$\begin{aligned} SW&=\Theta (\gamma +\beta e')\left( 1-\frac{\alpha \Theta (e+\beta e')^2}{2}\right) \left[ \frac{V}{2(\gamma +\beta e')}-\frac{T+h_m-s}{2}\right] ^2\\&\quad +\Theta (\gamma +\beta e')(T+s+\delta )\left[ \frac{V}{2(\gamma +\beta e')}-\frac{T+h_m-s}{2}\right] +A.\\ \end{aligned}$$ -

iii)

The carbon tax achieving the maximum social welfare is \(T^*=\frac{\alpha \Theta (e+\beta e')[V-(h_m-s)(\gamma +\beta e')]}{(\gamma +\beta e')(2+\alpha \Theta (e+\beta e')^2)}-\frac{2(s+\delta )}{2+\alpha \Theta (e+\beta e')^2}\).

6.2 Third party collection

Consider a third party that conducts the collection of used products. As shown in Fig. 5b, the manufacturer manufactures the product and wholesales it to the online retailer at a unit price of w. Then, the online retailer sells the products to consumers at a retail price of p. Besides, a third party collects used products with unit subsidy \(\delta \) to consumers. Then, it returns the products to the manufacturer with a unit subsidy of r. Similar to that in Sect. 3.1, if a consumer buys a new product without the trade-in program, the utility is \(u_1=\frac{v}{\gamma +e'}-p\). If the consumer buys a new product and trades in a used product through a third party, the utility is \(u_t=\frac{v}{\gamma +\beta e'}-p+\delta -h_m\). Similar to the discussions in Sect. 4, denote \(v_1\) as the zero point for \(u_1\) and \(v_t\) for \(u_t\), and denote \(v_0\) as the indifference point in terms of \(u_1\) and \(u_t\). Comparing the utilities \(u_1\) and \(u_t\), we have \(v_1=p(\gamma +e')\), \(v_t=(p+h_m-\delta )(\gamma +\beta e')\), and \(v_0=\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}\). The demand functions are similar to those in the centralized system. Accordingly, the CLSC members’ profit functions are

and

The event sequence is similar to that shown in Fig. 1. The manufacturer determines the wholesale price w taking consideration the carbon tax t. Then the retailer decides the retail price of the new product p as a follower. We have the following proposition to characterize the system members’ decisions in equilibrium.

Proposition 9

-

i)

In the system with third party collection, the equilibrium pricing decisions of the manufacturer and the online retailer are \(w^*=\frac{V}{2(\gamma +\beta e')}-\frac{h_m+s-\delta -r-T}{2}\) and \(p^*=\frac{3V}{4(\gamma +\beta e')}-\frac{3h_m-3\delta +s-r-T}{4}\). The corresponding total demand is \(d_s=\Theta (\gamma +\beta e')[\frac{V}{4(\gamma +\beta e')}+\frac{h_m-\delta +s-r-T}{4}]\). The profits of the manufacturer and the retailer are \(\pi _m=2\Theta (\gamma +\beta e')[\frac{V^2}{16(\gamma +\beta e')^2}-\frac{(T+h_m+r-s-\delta )^2}{16}]\) and \(\pi _r=\Theta (\gamma +\beta e')[\frac{V}{4(\gamma +\beta e')}+\frac{T+h_m+r-s-\delta }{4}][\frac{V}{4(\gamma +\beta e')}-\frac{h_m-\delta -s-3r-3T}{4}]\), respectively.

-

ii)

The optimal carbon tax \(T^*\) that maximizes the social welfare is \(T^*=\)\(\frac{[\alpha \Theta ^2(e+\beta e')^2(\gamma +\beta e')+5\Theta ]V}{\alpha \Theta ^2(e+\beta e')^2(\gamma +\beta e')^2+17\Theta (\gamma +\beta e')}-\frac{\alpha \Theta ^2(e+\beta e')^2(\gamma +\beta e')^2(h_m+r-s-\delta )+\Theta (\gamma +\beta e')(9h_m+13r-9\,s-9\delta )}{\alpha \Theta ^2(e+\beta e')^2(\gamma +\beta e')^2+17\Theta (\gamma +\beta e')}\).

Next, we briefly compare the dual channel CLSC, the centralized system, and the system with third party collection. For conciseness, we consider a given carbon tax T and see how social welfare is affected by system structure. We list the pricing decisions and demands for a given carbon tax in Table 5, as characterized in Proposition 8, and 9. Generally, the social welfare under the centralized system structure is lower than that under the dual channel CLSC. Further, we find that when the carbon tax is relatively low, the system with third party collection generates higher social welfare than that under the dual channel CLSC. When the carbon tax is relatively high, the dual channel CLSC generates higher social welfare than the system with third party collection.

Next, we illustrate the social welfare in the three systems in Fig. 6. In Fig. 6, the solid black, dash blue, and dash-dot curves represent the social welfare under the dual channel CLSC, the system with third party collection, and the centralized system. When the carbon tax level is relatively low, the dash-dot red curve is under the other two curves. That is to say when we consider the end-of-life products’ carbon emissions, a decentralized system can benefit the social welfare more than a centralized system. This is because a centralized system aims to obtain the highest possible economic payoff, which may not be the best for social welfare. The sale volume under the centralized system is the highest. So, carbon emission is the largest, with a more severe environmental impact. On the other hand, under a decentralized system, due to the gaming between the system members, consumers with a low product valuation do not purchase a new product, and overall carbon emission is relatively low.

7 Concluding remarks

We examine how a trade-in program for end-of-life products and the carbon emissions during a product’s scrap stage influence a CLSC system catering to environmentally-conscious consumers. From the perspective of CLSC members, we identify a novel function of the trade-in program: it can be utilized to decrease the price sensitivity of environmentally-conscious consumers. This is in addition to the established understanding that a trade-in program can boost the sales of new products. Furthermore, consumers’ price sensitivity diminishes when carbon emissions during the product’s scrap stage are taken into account. Secondly, when the carbon tax is at a moderate level, the dual-channel CLSC offers the lowest wholesale and retail prices. The trade-in program enables firms to recover the salvage value of used products. Given the presence of consumers’ environmental awareness, the trade-in program can decrease the carbon emissions of used products and increase consumers’ valuation of the product. As a result, firms can achieve higher profits with the trade-in program. Conversely, the trade-in program assists the manufacturer in collecting used products and reusing or recycling them, thereby reducing carbon emissions and saving on carbon tax. Therefore, the trade-in program can decrease the manufacturer’s carbon tax and enhance their profit.

From the perspective of CER, a trade-in program can help decrease carbon emissions, particularly when consumers’ valuation of the product is at a moderate level. However, when consumers highly value the product, the trade-in program may encourage them to frequently purchase newer editions, thereby increasing carbon emissions generated during the product’s production and recycling stages. For instance, electronics enthusiasts may update products like cell phones and small home appliances more often if a convenient trade-in program is available, leading to increased carbon emissions. For such products, the primary effect of a trade-in program is to stimulate new product sales. Conversely, for products with low consumer valuation, the inconvenience of a trade-in can outweigh the subsidy received. Consumers might discard their used products instead of using an available trade-in program. In this scenario, the CER impact of a trade-in program is less pronounced. We further explore the effects of the carbon tax from various perspectives, including environmental performance measures, social welfare, and supply chain profit.

Lastly, we broaden our discussion to include both a centralized system and a CLSC with third-party collection. In both scenarios, the trade-in program for end-of-life products incentivizes consumers to return their used products when purchasing new ones. Furthermore, under a carbon-neutral framework, it is more advantageous to adopt a decentralized system for the trade-in of end-of-life products. This approach not only reduces carbon emissions but also contributes to environmental protection and social welfare.

There are several ways for expanding this work. Firstly, we have only considered a linear form of carbon tax for carbon regulation. Other forms of tax regulation, such as cap-and-trade, deserve comprehensive investigation within a similar CLSC framework. Secondly, we have examined the scenario where the manufacturer recycles the used product at a certain cost. It would be worthwhile to explore the scenario where the manufacturer employs a third party for recycling. Thirdly, we have adopted a basic model of consumers’ environmental consciousness, assuming a uniform level of environmental concern among consumers. It would be interesting to extend this model to account for heterogeneity in consumers’ environmental concerns.

References

Bai, Q., Xu, J., & Zhang, Y. (2018). Emission reduction decision and coordination of a make-to-order supply chain with two products under cap-and-trade regulation. Computers & Industrial Engineering, 119, 131–145.

Benjaafar, S., Li, Y., & Daskin, M. (2013). Carbon footprint and the management of supply chains: Insights from simple models. IEEE Transactions on Automation Science & Engineering, 10(1), 99–116.

Cao, K., He, P., & Liu, Z. (2020). Production and pricing decisions in a dual-channel supply chain under remanufacturing subsidy policy and carbon tax policy. Journal of the Operational Research Society, 71(8), 1199–1215.

Dou, G., & Choi, T. M. (2021). Does implementing trade-in and green technology together benefit the environment? European Journal of Operational Research, 295(2), 517–533.

Esenduran, G., Hall, N. G., & Liu, Z. (2015). Environmental regulation in project-based industries. Naval Research Logistics, 62(3), 228–247.

Forti, V., Baldá, C.P., Kuehr, R. & Bel, G. (2020). The global e-waste monitor 2020: quantities, flows and the circular economy potential. https://ewastemonitor.info/gem-2020/. Last accessed August 29, 2023.

Gan, W., Peng, L., Li, D., Han, L., & Zhang, C. (2019). A coordinated revenue-sharing based pricing decision model for remanufactured products in carbon cap and trade regulated closed-loop supply chain. IEEE Access, 7, 142879–142893.

Geroe, S. (2019). Addressing climate change through a low-cost, high-impact carbon tax. Journal of Environment & Development, 28(1), 3–27.

Guide, V. D. R., & Van Wassenhove, L. N. (2009). The evolution of closed-loop supply chain research. Operations Research, 57(1), 10–18.

Huang, W., & Zhu, H. (2021). Performance evaluation and improvement for ZEV credit regulation in a competitive environment. Omega, 102, 102294.

Li, K. J., Fong, D. K. H., & Xu, S. H. (2011). Managing trade-in programs based on product characteristics and customer heterogeneity in business-to-business markets. Manufacturing & Service Operations Management, 13(1), 108–123.

Luo, R., Zhou, L., Song, Y., & Fan, T. (2022). Evaluating the impact of carbon tax policy on manufacturing and remanufacturing decisions in a closed-loop supply chain. International Journal of Production Economics, 245, 108408.

Lyu, S., Chen, Y., & Wang, L. (2022). Optimal decisions in a multi-party closed-loop supply chain considering green marketing and carbon tax policy. International Journal of Environmental Research and Public Health, 19(15), 9244.

Mahmoudzadeh, M. (2020). On the non-equivalence of trade-ins and upgrades in the presence of framing effect: Experimental evidence and implications for theory. Production and Operations Management, 29(2), 330–352.

Richard, S. (1995). The damage costs of climate change toward more comprehensive calculations. Environmental and Resource Economics, 5(4), 353–374.

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252.

Shi, T., Chhajed, D., Wan, Z., & Liu, Y. (2020). Distribution channel choice and divisional conflict in remanufacturing operations. Production and Operations Management, 29(7), 1702–1719.

Souza, G. C. (2014). Closed-loop supply chains with remanufacturing. In INFORMS TutORials in Operations Research, 14, 130–153.

Sun, H., & Yang, J. (2021). Optimal decisions for competitive manufacturers under carbon tax and cap-and-trade policies. Computers & Industrial Engineering, 156(2), 107244.

Wang, Y., Yu, Z., Jin, M., & Mao, J. (2021). Decisions and coordination of retailer-led low-carbon supply chain under altruistic preference. European Journal of Operational Research, 293(1), 910–925.

Weber, T. A., & Neuhoff, K. (2009). Carbon markets and technological innovation. Journal of Environmental Economics and Management, 60(2), 115–132.

Yu, Z., Lin, Y., Wang, Y., & Goh, M. (2023). Closed-loop supply chain coalitional cooperation and coordination under differentiated carbon tax regulation. Journal of Cleaner Production, 392, 136239.

Zhang, F., & Zhang, R. (2018). Trade-in remanufacturing, customer purchasing behavior, and government policy. Manufacturing & Service Operations Management, 20(4), 601–616.

Zhang, Y., & Zhang, T. (2021). Complex dynamics in a closed-loop supply chain with risk aversion and fairness concerns under supply disruption. International Journal of Bifurcation and Chaos, 31(9), 2150132.

Zhang, Y., & Zhang, T. (2022). Dynamic analysis of a dual-channel closed-loop supply chain with fairness concerns under carbon tax regulation. Environmental Science and Pollution Research, 29(38), 57543–57565.

Acknowledgements

The authors sincerely thank the Guest Editor, Ramzi Benkraiem, and two anonymous reviewers for their constructive comments, which have substantially improved the quality of this work. The work of the second author was partly supported by the Key Program of the National Natural Science Foundation of China (No. 71831007), the General Program of the National Natural Science Foundation of China (No. 72071085), the Huazhong University of Science and Technology Double First-Class Funds for Humanities and Social Sciences (Digital Intelligence Decision Optimization Innovation Team, 2021WKFZZX008), the High-End Foreign Expert Recruitment Plan (No. G2022154004L), and the National Key R &D Program of China (No. 2023YFB3308300).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors do not have Conflict of interest to disclose for this work.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 1

According to the discussions of consumers’ utility, we have that if the consumer buy a new product without trade-in, the utility is \(u_1=\frac{v}{\gamma +e'}-p\), and if the consumer buy a new product with the manufacturer trade-in, the utility is \(u_2=\frac{v}{\gamma +\beta e'}-p+\delta -h_m\), and if the consumer buy a new product with the online retailer trade-in, the utility it \(u_3=\frac{v}{\gamma +\beta e'}-h_r-p+\delta \). Let \(v_1^0\), \(v_2^0\) are the zero point of \(u_1\) and \(u_2\), we can obtain the zero points of \(u_1\) and \(u_2\) in terms of the consumers’ valuation to the product \(v_1^0=(\gamma +e')p\) and \(v_2^0=(p+h_m-\delta )(\gamma +\beta e')\). Denote \(v_0\) as the indifferent point of \(u_1\) and \(u_2\), then \(v_0=\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}\). Denote \(\frac{\delta }{h_m}\) as the subsidy ratio of the used product in the trade-in program, the magnitude relationship between \(v_1^0\), \(v_2^0\) and \(v_0\) varies according to \(\frac{\delta }{h_m}\). Thus we will divide our discussion into three cases according to \(\frac{\delta }{h_m}\): \(0<\frac{\delta }{h_m}\le \frac{\gamma }{\gamma +e'}\), \(\frac{\gamma }{\gamma +e'}<\frac{\delta }{h_m}\le \frac{\gamma +\beta e'}{\gamma +e'}\) and \(\frac{\gamma +\beta e'}{\gamma +e'}<\frac{\delta }{h_m}\le 1\).

Case 1: When \(0<\frac{\delta }{h_m}\le \frac{\gamma }{\gamma +e'}\), then we have \(\frac{\delta (\gamma +e')}{h_me'}-\frac{\gamma }{e'}<0<\beta \) which leads to \(\delta <\frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\). Since \(p>\delta \), if \(\delta <p\le \frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\), then \(v_1^0<v_2^0<v_0\); if \(p>\frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\), then \(v_0<v_2<v_1\).

-

(i)

if \(\delta <p\le \frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\), then \(v_1^0<v_2^0<v_0\) and the sketch of consumers’ choices is shown as in Fig. 7. By comparing the utility functions \(u_1\), \(u_2\) and \(u_3\), in the rectangle on the upper right, we have \(u_2>\max \{0, u_1, u_2\}\); in the ladder-shaped upper middle, i.e., the yellow region, we have \(u_1>\max \{0, u_2, u_3\}\); in the polygon on the lower right, i.e., the gray region, we have \(u_3>\max \{0, u_1, u_2\}\). then the demand functions are \(d_1=\frac{1}{2}[2\Theta -ch_m-c(\frac{p(1-\beta )e'}{\gamma +\beta e'}+\delta )][\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}-p(\gamma +e')]\), \(d_2=(\Theta -ch_m)[V-\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}]\) and \(d_3=ch_m[V-\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}]+\frac{1}{2}[ch_m+c(\frac{p(1-\beta )e'}{\gamma +\beta e'}+\delta )][\frac{(h_m-\delta )(\gamma +e')(\gamma +\beta e')}{(1-\beta )e'}-p(\gamma +e')]\);

-

(ii)

if \(p\le \frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\), then \(v_0<v_2^0<v_1^0\) and the sketch of consumers’ choices is hown as in Fig. 8. By comparing the utility functions \(u_1\), \(u_2\) and \(u_3\), we find that at the right side of \(v=v_0\), \(u_2>u_1\) always holds. Thus, in the rectangle on the upper right, we have \(u_2>\max \{0, u_1, u_2\}\); in the ladder-shaped on the lower right, we have \(u_3>\max \{0, u_1, u_2\}\).

In such a case, the demand functions can be summarized as follows. The demand of consumers’ purchasing a new product without trade-in is

and the total demand of the new product is

Case 2: When \(\frac{\gamma }{\gamma +e'}<\frac{\delta }{h_m}\le \frac{\gamma +\beta e'}{\gamma +e'}\), we also can verify \(\delta <\frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\), then the discussion will be the same as that in Case 1. As a consequence, the results will be the same.

Case 3: When \(\frac{\gamma +\beta e'}{\gamma +e'}<\frac{\delta }{\gamma }< 1\), then we have \(\delta \frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\). Since \(p>\delta \), then \(p>\frac{(h_m-\delta )(\gamma +\beta e')}{(1-\beta )e'}\). From the above discussion, we have \(v_0<v_1^0<v_2^0\). Therefore, the skethch of \(u_1\), \(u_2\) and \(u_3\) is shown by Fig. 3a. By comparing the utility functions \(u_1\), \(u_2\) and \(u_3\), we find that at the right side of \(v=v_0\), \(u_2>u_1\) always holds. Thus, in the rectangle on the upper right, we have \(u_2>\max \{0, u_1, u_2\}\); in the ladder-shaped on the lower right, we have \(u_3>\max \{0, u_1, u_2\}\). In such a case, the demand function will be:

and the total sales of the e-retailer is \(d_s=\Theta [V-(p+h_m-\delta )(\gamma +\beta e')]+\frac{ch_m^2(\gamma +\beta e')}{2}\).

Summarizing the above discussion, Lemma 1 holds. \(\square \)

Proof of Lemma 2

The system members’ profit function is given as Eq. (5).

and

Differentiating the online retailer’s profit function, i.e., Eq. (18) with respect to p, we have:

and \(\frac{\partial ^2\pi _r}{\partial p^2}=-2\Theta \beta e'\). Then we can conclude that Eq. (18) is a concave function, and it will achieve its maximum value at the zero point of equation \(\frac{\partial \pi _r}{\partial p}=0\). Thus, solving the equation \(\frac{\partial \pi _r}{\partial p}=0\) for variable p. We have \(p(w)=\frac{w}{2}+\frac{2\Theta [V-\beta e'(h_m-\delta )]+ch_m\beta e'(h_m+2r-2\delta -2c)}{4\Theta \beta e'}\). \(\square \)

Proof of Lemma 3

When the manufacturer has a low recycling technology, the online retailer’s profit function is:

Where \(A_1=-[\frac{c(1-\beta )^2e'^2w}{2(\gamma +\beta e')}+\frac{ce'(1-\beta )(r-3\delta )}{2}+\Theta (\gamma +e')]<0\), \(B_1=\Theta V+\Theta (\gamma +e')w-c\delta e'(1-\beta )w-c\delta (\gamma +\beta e')(r-\frac{3\delta }{2})>0\), \(C_1=-w(\Theta V+\frac{(\gamma +\beta e')c\delta ^2}{2})+(r-\delta )(ch_mV+\frac{(\gamma +\beta e')c\delta ^2}{2}-\frac{(\gamma +e')(\gamma +\beta e')c(h_m-\delta )^2}{2(1-\beta )e'})-c<0\); and \(A_2=-\Theta (\gamma +\beta e')<0\), \(B_2=\Theta V+(w+\delta -h_m)\Theta (\gamma +\beta e')-ch_m(\gamma +\beta e')(r-\delta -\frac{h_m}{2})>0\), \(C_2=-w[\Theta V+\frac{(\gamma +\beta e')ch_m^2}{2}-\Theta (\gamma +\beta e')(h_m-\delta )]+(r-\delta )(ch_mV+(\gamma +\beta e')ch_m\delta -\frac{(\gamma +\beta e')ch_m^2}{2})-c<0\).