Abstract

Access to new technologies is a key factor of competitive advantage for many supply chains. In this paper, we explore the impact of technology investment on supply chain coordination. To be specific, we analytically investigate the optimal pricing and technology investment decisions in a system consisting of two complementary suppliers and one manufacturer. On one hand, the suppliers are required to invest in new technologies in order to participate in the supply chain negotiations. On the other hand, the manufacturer acts as the Stackelberg leader, who offers a wholesale price (WS) contract to the suppliers. We compare both the decentralized and centralized settings, and show that if the supply chain members decide to cooperate and coordinate the system, they could increase the overall expected profit by at least 1/3 compared to the non-cooperative scenario. We then find that the cost-revenue sharing (CR) contract is capable of coordinating the two-supplier one-manufacturer supply chain. Interestingly, the CR contract also offers a win-win profit scenario to all parties of the negotiation.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Supply chain management

- Technology investment

- Cost and revenue sharing contract

- Coordination

- Win-win condition

1 Introduction

In this globalized economy, the fierce competence in the market, added to the increasingly exigences from customers demanding products with more added value and lower prices, obligate organizations to be always at the vanguard to maintain their positioning in the market. One critical ingredient for maintaining the competitive advantage is the acquisition and implementation of new technologies for achieving product enhancement. This is specially the case for high-tech industries in sectors like aerospace, pharmaceutic and telecommunication, to name but a few. But investment in new technologies is a challenging decision due to its complexity for implementation and the cost involved. Therefore, it is of utmost importance to understand the effect of new technologies on the performance of the acquiring company and on its supply chain.

Although the existence of an ample number of empirical studies that describe the relation between \(\mathcal {S}\mathcal {C}\) performance and new technologies investment, analytical research on this matter is quite scarce. In this paper, our aim is to model and analyze the impact of new technologies investment on the \(\mathcal {S}\mathcal {C}\) members performance and to demonstrate how it can lead to the coordination of the \(\mathcal {S}\mathcal {C}\). Furthermore, we step further from the simple models previously investigated and propose the study of more complex scenarios closer to real industry environments.

2 Literature Review

2.1 Impact of Technology Investment in the Supply Chain

Knowledge stands a step further from information as the accumulation of learning, expertise and know-how useful for the problem solving process but that at the same time poses more difficulties when being managed and shared [1]. It highlighted in [2] that the \(\mathcal {S}\mathcal {C}\) knowledge consists of four basic components, one of them been the technological component. This latter is the subject of our research. Global competition makes the investment in new technologies crucial for the success of any firm [3]. Due to the increasingly technological complexity and shortened life-cycle of products, organizations are compelled to continually invest in new technologies to maintain their positioning in the market [4]. Technology is seen as a key element for competitive advantage [5] that can lead companies to access wider markets, sales increment, cost reduction, brand enhancement, to name but a few [3, 6]. And its benefits are not limited only to the owner of the technology but they can be translated into the performance improvement of the \(\mathcal {S}\mathcal {C}\) as a whole [7]. On the other hand, management of new technologies can result challenging because of its complexity and high cost [4, 8], specially for high-tech industries [2]. Firms can access new technologies either through its internal development in their R&D departments [9], or thanks to its acquisition from external sources [10]. Nowadays, an increasingly number of companies are relying less on their internal resources, and opting to acquire high-tech components from suppliers who invest on innovation [11]. Examples of new technologies in the \(\mathcal {S}\mathcal {C}\) can be quite diverse. It can refer to any one or the combination of tangible aspects like materials, tools, equipment, machinery; or intangible elements like skills, applied knowledge, methods, intellectual property, among others [5, 6, 12]. An example of analytical research regarding the impact of new technologies on \(\mathcal {S}\mathcal {C}\) performance can be found in the work of [13]. They study how the investment in new sustainable green technologies can contribute to the carbon emission reduction in a \(\mathcal {S}\mathcal {C}\). Furthermore, they use contract coordination to determine the necessary conditions to maximize the \(\mathcal {S}\mathcal {C}\) profit. The authors conceptualize and model the development process of new products between two firms with different R&D capabilities and study how revenue, technological innovation and investment sharing can benefit the overall performance of the \(\mathcal {S}\mathcal {C}\) system in [4]. In their research the authors establish the conditions at which any of the sharing mechanisms proposed would be of interest for the firms.

2.2 Supply Chain Coordination

The field of \(\mathcal {S}\mathcal {C}\) management has widely examined the \(\mathcal {S}\mathcal {C}\) coordination. The reader is referred to [14] for a detailed review on this topic. \(\mathcal {S}\mathcal {C}\) contracts is one of the main mechanisms studied in the literature for achieving coordination. Among these contracts, the cost sharing contract and the cost and revenue sharing contract are well-known and extensively adopted in many organizations. A \(\mathcal {S}\mathcal {C}\) formed by one retailer and two competing suppliers is studied and how collaborative quality improvement can be of benefit for all the parties is analyzed in [15]. The authors propose different coordination mechanisms to incentive the retailer and suppliers to share the cost on quality investment. Their results show that with the cost-sharing contract the \(\mathcal {S}\mathcal {C}\) can attain higher quality improvement levels and higher profits compared to the wholesale price contract. The benefit of cost sharing contracts over a supplier-manufacturer \(\mathcal {S}\mathcal {C}\) negotiation committed towards green initiatives is explored in [16]. Utilizing a game theoretic approach, the authors identify how the proposed contract can influence the product greening levels and profits of the \(\mathcal {S}\mathcal {C}\) participants. They further prove that implementation of the cost sharing contract results in higher profits for both parties and for the \(\mathcal {S}\mathcal {C}\) as a whole. The cost and revenue sharing contract is another contract extensively adopted in industry. examine A sustainable \(\mathcal {S}\mathcal {C}\) formed by one manufacturer and one retailer with deteriorating items and under carbon cap-and-trade regulation is examined in [13]. The authors propose two coordination mechanisms in their research, the revenue and promotional cost-sharing contract and the two-part tariff contract. They demonstrate that both contracts are capable to reach coordination and they determine the win-win conditions for the \(\mathcal {S}\mathcal {C}\) members. Moreover, the authors prove that the two-part tariff contract is more robust compared to the revenue and promotional cost-sharing contract. A revenue and cost sharing contract as a mechanism to enhance the remanufacturer-retailer \(\mathcal {S}\mathcal {C}\) is analyzed in [17]. In this study the author investigates the scenario when the retailer is the Stackelberg leader of the negotiation, and the one when the leader is the remanufacturer. Results from the numerical example show that in both cases the proposed contract can achieve a higher expected profit for the two parties.

3 Base Models

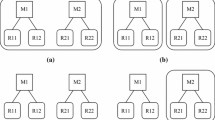

3.1 Supply Chain Model

We consider in this paper a supply chain \((\mathcal {S}\mathcal {C})\) consisting of two complementary suppliers (\(\mathcal {S}_i\), where i=1,2) who sell a component (i) to one original equipment manufacturer (OEM) that uses them to assembly the final product to be sold in the market. It is assumed that both suppliers need to acquire certain level of technology 0 < α i < 1 in order to participate in the \(\mathcal {S}\mathcal {C}\) negotiation. This technology could be required by the suppliers for meeting manufacturing regulations [13], enhance quality level [4, 15], to name but a few. The new technology cost is denoted by η i and it is considered to be a one-off investment [18]. For analytical simplicity, we assume that the investment on technology does not affect the cost structure of the system. Similar assumptions can be found in the work of [15] and [18]. After receiving the costumer’s order, the \(\mathcal {O}\mathcal {E}\mathcal {M}\) sends it to the \(\mathcal {S}_i\) that follow a make-to-order (MTO) manufacturing policy. The unit production cost and unit wholesale price for component (i) are c i and w i respectively. The unit retail price of the final product is p. In addition, it is established that p > w 1 + w 2 and w i > c i. These inequalities assure the non-negative profit for the parties. It is further considered that the market demand D(p, α 1, α 2, ξ) is stochastic, price dependent [15, 16], and technology dependent [4]. It is formulated as D(p, α 1, α 2, ξ) = d − θp + β 1α 1 + β 2α 2 + ξ, where d > 0 is the base demand, θ > 0, β 1 > 0 and β 2 > 0 are the demand sensitivity coefficient to p, to α 1 and to α 2 respectively, and ξ is the demand uncertainty with \(\mathbb {E}[\xi ]=0\) and \( \operatorname {\mathrm {Var}}[\xi ]=\sigma ^2\). Similar to the work of [18], we consider that all information is symmetric between the members, and that the market can accurately perceive the technology enhancement in the final product. Finally, for the negotiation the \(\mathcal {O}\mathcal {E}\mathcal {M}\) acts as the leader while \(\mathcal {S}_i\) are the followers.

3.2 Profit Objective Functions

With the base supply chain model established, we now proceed to formulate the profit functions for each participant of the \(\mathcal {S}\mathcal {C}\). First, Eqs. 1 and 2 present the profit and expected profit functions for the \(\mathcal {O}\mathcal {E}\mathcal {M}\):

Similarly, Eqs. 3 and 4 show the profit and expected profit functions for \(\mathcal {S}_i\), (i=1,2), respectively:

Finally, Eq. 5 presents the expected profit function for the \(\mathcal {S}\mathcal {C}\):

4 Equilibrium Analysis

4.1 Optimal Decisions for the Decentralized Supply Chain

In this section we derive the optimal pricing and technology-acquisition decisions of the WS contract by exploring the equilibrium of the negotiation game. Because \(\mathcal {S}_i\ (i=1,2)\) are the followers, we first find the optimal values for wholesale price and level of technology.

Proposition 4.1

The \(\mathbb {E}_\xi [\varPi _{\mathcal {O}\mathcal {E}\mathcal {M}}^{WS}(p)]\) is a strictly concave function of p and the optimal retail price p WS∗ can be expressed as:

Proposition 4.1 demonstrates the concavity of \(\mathbb {E}_\xi [\varPi _{\mathcal {O}\mathcal {E}\mathcal {M}}^{WS}(p)]\) and therefore the existence of an unique optimal retail price p WS∗.

Proposition 4.2

The \(\mathbb {E}_\xi [\varPi _{\mathcal {S}_i}^{WS}(w_i,\alpha _i)]\) is a strictly concave function of w i and α i and the optimal wholesale price \(w_i^{WS*}\) and technology level \(\alpha _i^{WS*}\) can be expressed as:

4.2 Optimal Decisions for the Centralized Supply Chain

As a benchmark, we now assume that both \(\mathcal {S}_i\ (i=1,2)\) and the \(\mathcal {O}\mathcal {E}\mathcal {M}\) belong to the same centrally coordinated system. Under this assumption, the profit and expected value of profit for the \(\mathcal {S}\mathcal {C}\) can be expressed as:

We proceed now to derive the optimal pricing and technology-acquisition decisions for the \(\mathcal {S}\mathcal {C}\) in the centralized scenario.

Proposition 4.3

The \(\mathbb {E}_\xi [\varPi _{\mathcal {S}\mathcal {C}}(p,\alpha _1,\alpha _2)]\) is a strictly concave function of p and α i and the optimal retail price p ∗ and technology level \(\alpha _i^*\) can be expressed as:

Proposition 4.3 implies that in the centralized \(\mathcal {S}\mathcal {C}\), the optimal retail price p ∗ and technology level \(\alpha ^*_i\) in the Stackelberg equilibrium uniquely exist.

4.3 Comparison of the Decentralized and Centralized Supply Chain Models

A review of both the decentralized and centralized \(\mathcal {S}\mathcal {C}\) models lead us to the following interesting observations:

Proposition 4.4

The comparison of both models show that:

-

(a)

The decentralized model can not coordinate the supply chain.

-

(b)

If the supply chain members decide to cooperate and reach coordination, they can increase the expected optimal profit of the supply chain at least 1∕3 compared to the decentralized scenario.

Proposition 4.4.(b) presents a clear incentive for all members to collaborate in the expectation to reach the \(\mathcal {S}\mathcal {C}\) coordination. Next section shows a contract designed to coordinate the \(\mathcal {S}\mathcal {C}\). This contract is tested to verify: (1) its ability to coordinate and reach the maximum expected profit for the \(\mathcal {S}\mathcal {C}\), and (2) the existence of win-win conditions that will lead to an increment of the profit for all members of the \(\mathcal {S}\mathcal {C}\).

5 Coordination: Technology-Cost and Revenue Sharing Contract

5.1 Model and Optimal Decisions

For the CR contract it is now assumed that the \(\mathcal {O}\mathcal {E}\mathcal {M}\) is willing to share a fraction of the technology cost paid by \(\mathcal {S}_i\), i.e. \(\frac {\eta _i(1-\phi _i)}{2}\), while on the other hand \(\mathcal {S}_i\) agree to share a fraction of its revenue with the \(\mathcal {O}\mathcal {E}\mathcal {M}\), i.e. w i(1 − ϕ i). Equations 13 and 14 present the profit and expected value of the profit for the \(\mathcal {O}\mathcal {E}\mathcal {M}\), respectively:

Similarly, Eqs. 15 and 16 show the profit and expected profit functions for \(\mathcal {S}_i\), (i=1,2), respectively:

In order to derive the optimal pricing and technology-acquisition decisions of the CR contract, we proceed to find the optimal values for wholesale price and level of technology.

Proposition 5.1

For \(\mathcal {S}_i\), (i = 1, 2), with a given retail price p, its optimal wholesale price \(w^{CR^{\ast }}_i\), and optimal level of technology acquired \(\alpha ^{CR^{\ast }}_i\)can be expressed as:

5.2 Comparison of the CR Contract and Centralized Supply Chain Model

In order to test if the CR contract of the decentralized model can reach coordination, we set \(\alpha ^{CR^{\ast }}_i |{ }_{p}=\alpha ^*_i\) and then from these results determine if \(p^{CR^{\ast }}=p^*\).

Proposition 5.2

We reach to the following observations:

-

(a)

The CR contract coordinates the supply chain.

-

(b)

\(p^{CR^{\ast }}=p^*\)and \(\alpha ^{CR^{\ast }}_i=\alpha ^*_i\).

This means that the CR contract can successfully coordinate the \(\mathcal {S}\mathcal {C}\). Furthermore, it is proved that \(p^{CR^{\ast }}=p^*\) and \(\alpha ^{CR^{\ast }}_i=\alpha ^*_i\), meaning that the 3 decision variables of the CR contract can coordinate simultaneously. Now, it is analyzed the win-win conditions of this contract. Comparing the optimal expected profit functions of the OEM and \(\mathcal {S}_i\) for both the WS and CR contract lead us to the next interesting finding:

Proposition 5.3

There exist a feasible solution for ϕ i that offers a win-win condition for the \(\mathcal {O}\mathcal {E}\mathcal {M}\) and the \(\mathcal {S}_i\) in the CR contract.

6 Conclusions

This paper studies the technology investment strategy in a two echelon supply chain consisting of two complementary suppliers and one manufacturer. By comparing a non-collaborative scenario with wholesale price (WS) contract and a collaborative scenario with cost-revenue sharing (CR) contract, we analyze whether a collaborative technology enhancement initiative is beneficial to all supply chain parties. We demonstrate that if the supply chain members decide to cooperate and coordinate the system, they could increase the overall expected profit by at least 1/3 compared to the non-cooperative scenario. We then find that the CR contract is capable of coordinating the two-supplier one-manufacturer supply chain. Interestingly, the CR contract offers also a win-win profit scenario to all parties of the negotiation.

References

Rowley J (2007) The wisdom hierarchy: representations of the dikw hierarchy. J Inf Sci 33(2):163–180

Battistella C, Toni AFD, Pillon R (2016) Inter-organizational technology/knowledge transfer: a framework from critical literature review. J Technol Transf 41(5):1195–1234

Kumar S, Luthra S, Haleem A (2015) Benchmarking supply chains by analyzing technology transfer critical barriers using ahp approach. BIJ 22(4):538–558

Bhaskaran SR, Krishnan V (2009) Effort, revenue, and cost sharing mechanisms for collaborative new product development. Manag Sci 55(7):1152–1169

Reisman A (2005) Transfer of technologies: a cross-disciplinary taxonomy. Omega 33(3):189–202

da Silva VL, Kovaleski JL, Pagani RN (2019) Technology transfer in the supply chain oriented to industry 4.0: a literature review. Tech Anal Strat Manag 31(5):546–562

Kang P, Jiang W (2011) The evaluation study on knowledge transfer effect of supply chain companies. In: International conference on advances in education and management, pp 440–447

Gunsel A (2015) Research on effectiveness of technology transfer from a knowledge based perspective. Procedia Soc Behav Sci 207:777–785

Tatikonda MV, Stock GN (2003) Product technology transfer in the upstream supply chain. J Prod Innov Manag 20(6):444–467

Brunswicker S, Vanhaverbeke W (2015) Open innovation in small and medium-sized enterprises (smes): External knowledge sourcing strategies and internal organizational facilitators. J Small Bus Manag 53(4):1241–1263

Wang J, Shin H (2015) The impact of contracts and competition on upstream innovation in a supply chain. Prod Oper Manag 24(1):134–146

Liu S, Fang Z, Shi H, Guo B (2016) Theory of science and technology transfer and applications. Auerbach Publications

Bai Q, Chen M, Xu L (2017) Revenue and promotional cost-sharing contract versus two-part tariff contract in coordinating sustainable supply chain systems with deteriorating items. Int J Prod Econ 187:85–101

Chan HK, Chan FT (2010) A review of coordination studies in the context of supply chain dynamics. Int J Prod Res 48(10):2793–2819

Chakraborty T, Chauhan SS, Ouhimmou M (2019) Cost-sharing mechanism for product quality improvement in a supply chain under competition. Int J Prod Econ 208:566–587

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Inaba T (2018) Revenue and cost sharing mechanism for effective remanufacturing supply chain. In: 2018 IEEE international conference on industrial engineering and engineering management (IEEM), pp 923–927

Yang H, Chen W (2018) Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus cost-sharing. Omega 78:179–191

Acknowledgements

The authors are grateful for the partial financial support from the Natural Sciences and Engineering Research Council of Canada (NSERC); the National Natural Science Foundation of China under grant 71771138, the Special Foundation for Taishan Scholars of Shandong Province, China under grant tsqn201812061, the Science and Technology Research Program for Higher Education of Shandong Province, China under grant 2019KJI006; and the Secretary of Higher Education, Science, Technology and Innovation of Ecuador (Senescyt).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Gallegos, C.A.R., Bai, Q., Chen, M. (2020). Coordination via Revenue and Technology-Cost Sharing in a Two-Supplier and One-Manufacturer Supply Chain System. In: Li, X., Xu, X. (eds) Proceedings of the Seventh International Forum on Decision Sciences. Uncertainty and Operations Research. Springer, Singapore. https://doi.org/10.1007/978-981-15-5720-0_5

Download citation

DOI: https://doi.org/10.1007/978-981-15-5720-0_5

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-15-5719-4

Online ISBN: 978-981-15-5720-0

eBook Packages: Business and ManagementBusiness and Management (R0)