Abstract

In this chapter, we discuss previous studies and summarize the properties of a mixed oligopoly. With our overview of a mixed oligopoly model, we attempt to understand the fundamental characteristics of government intervention within an oligopoly. We consider the partial privatization problem in relation to the Stackelberg leader solution. The second-best outcome can be achieved by partial privatization. We also show that full privatization is not optimal if private firms can enter the oligopolistic market. In a free-entry equilibrium, the government can control excessive entry by imposing an entry tax.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

JEL Classification

Keywords

1 Introduction

“When we talk about public and private firms, we think of firms which pursue different objectives, the pudding of a private firm is not baked with any social welfare ingredient, whereas social welfare should ultimately be the very raison d’etre of a public firm ” (De Fraja and Delbono 1989).

Thus, they explored mixed oligopolies and found that social welfare is higher in a pure private oligopoly than when public firms attempt to maximize social welfare. That result suggests that the privatization of public firms is beneficial if there are more private firms in the market. De Fraja and Delbono (1989, 1990) compared a pure private oligopoly and a mixed oligopoly where the public firm is fully owned by the government. These two situations represent two extremes: whether the public firm is fully privatized or not. Furthermore, the government can control firms through the partial ownership of the public firm or by purchasing a share of the private firm.

Matsumura (1998) went further and explicitly considered the possibility of partial privatization in which the public firm is jointly owned by private and public shareholders to optimize social welfare. Matsumura and Kanda (2005) extended the partial privatization model developed by Fershtman (1990) and then illustrated that partial privatization ensures short-run optimal conditions but that full nationalization becomes optimal in a long-run free-entry equilibrium . The differences between these short-run and long-run results occur because of the excessive entry of private firms. Mankiw and Winston (1986) and Suzumura and Kiyono (1987) pointed out that the number of firms exceeds the optimal level in a free-entry equilibrium and that a decrease in private firms improves social welfare, known as the excess entry theorem. Matsumura and Kanda (2005) consequently suggested that a fully nationalized firm can be used as an instrument to restrict entry into the market. Previous studies have largely focused on government interventions in oligopolistic markets and what form public firms should take. As a result, a mixed oligopoly is supported when the number of private firms is small and public firms can restrict the entry of private firms .

In this chapter, we discuss previous research and summarize the properties of a mixed oligopoly . In our overview of a mixed oligopoly model, we attempt to understand the fundamental characteristics of government intervention in an oligopoly. The chapter is structured as follows. In Sect. 1.2, we present the basic model of a mixed oligopoly and its main properties. In Sect. 1.3, we investigate the properties of partial privatization that replicate the Stackelberg leader solution from a short-run perspective. In Sect. 1.4, we derive the optimal form of a public firm in a long-run, free-entry equilibrium . We also show that full nationalization does not ensure a second-best solution. In Sect. 1.5, we consider entry tax as a policy tool, and then the second-best solution is ensured if the government can use privatization and entry tax . Finally, Sect. 1.6 provides a summary and offers a brief outline of the following chapters.

2 Basic Mixed Oligopoly Model

To illustrate a mixed oligopoly , we use a simple oligopoly model in which there exist n private symmetric firms and one public firm . Each private firm, \( i=1,\cdots, n \), behaves as a Nash competitor to produce its output, q i , with the given public firm output, q 0, and the number of firms, n. The profit of the private firms is as follows:

where p represents the price and relates to the total output, Q, via the inverse demand function, \( p=p(Q) \), and c(q i ) is the cost function. For simplicity, we assume that public and private firms have the same cost functions, even though De Fraja (1993) addressed the cost difference between public and private firms. By maximizing (1.1), the first-order condition can be obtained as \( p+{p}^{\prime }{q}_i-{c}^{\prime}\left({q}_i\right)=0 \). We also impose \( {p}^{\prime }+{q}_i{p}^{{\prime\prime} }<0 \) and \( {p}^{\prime }-{c}^{{\prime\prime} }<0 \). These assumptions ensure the stability of the Nash equilibrium among private firms. Because we assume all private firms are identical, the output level of each private firm, \( q={q}_i \), can be obtained as \( q=q\left({q}_0,n\right) \), with

where \( k=\frac{p^{\prime }-{c}^{{\prime\prime} }}{p^{\prime }+{p}^{{\prime\prime} }q} \). In this model, the market is the same as a pure private oligopoly, with the exception of q 0. Social welfare can be written as follows:

where \( G(Q)={\displaystyle \underset{0}{\overset{Q}{\int }}}p(s)ds \) and \( {\pi}_0=p{q}_0-c\left({q}_0\right) \) are the profit of the public firm .

Because the outputs of the private firms are the function of q 0 and n, social welfare changes with the output of the public firm and the number of public firms:

Next, we obtain the second-best solution with respect to q 0 and n by setting the above equations to zero. In the short run, n is fixed. The second-best condition shows that because an increase in the output of the public firm decreases the outputs of the private firms and \( p-{c}^{\prime }(q)=-{p}^{\prime }q>0 \), the optimal output of the public firm must be smaller than the output of the marginal pricing (MP) level. It also suggests that the public firm is more profitable if the number of private firms is large enough. This point will be discussed in the latter part of this section in our comparison of a mixed oligopoly and a pure private oligopoly. In addition, an increase in the number of private firms may improve social welfare if the private firms are sufficiently profitable . However, the entry of a private firm may harm social welfare if the profit of the private firm were small where the number of firms is large enough.

We now analyze the behavior of the public firm . We assume that the purpose of the public firm is determined by the government and the government cannot directly control the output of the public firm . In this case, the firm is fully nationalized and the output level is set to maximize social welfare as given private outputs. The optimization problem of the public firm is as follows:

The first-order condition is

In this case, the public firm behaves as a Nash competitor, and the output level is equal to the MP level. The public firm is a more aggressive producer than the private firms. Using comparative statics, we see that the total output with a fully nationalized firm exceeds the second-best level, and social welfare within a mixed oligopoly is lower than the second-best level because the marginal cost is equal to the market price.

If the public firm is fully privatized, it maximizes its own profit instead of social welfare. This case is the same as a pure private oligopoly. We can compare pure and mixed oligopolies regarding social welfare. From (1.3), a fully mixed oligopoly is superior to a pure private oligopoly where the number of private firms is small. De Fraja and Delbono (1989), however, demonstrated that social welfare in a mixed oligopoly may not be higher than in a pure private oligopoly. We can interpret their result from (1.3), where the MP level harms social welfare. Furthermore, total social welfare may improve if the number of private firms is large enough and if the private firm is still profitable. Thus, the second-best solution is not realized if the public firm behaves as a Nash competitor and is fully nationalized. Although the effect of full privatization on social welfare is ambiguous, it may be superior to a mixed oligopoly if the private firms are highly incubated.

3 Partial Privatization

In this section, we assume that the government can partially own a private firm or it can sell some of its equity in a public firm . Such a firm is regarded as a partially privatized firm, and its objective typically combines both public and private interests. To simplify, we assume that the partial public firm considers both social welfare and its own profit and that the weight on both objectives depends on the level of government ownership. This type of firm faces the following optimization problem:

The first-order condition is

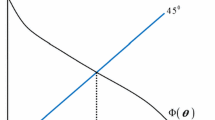

where θ is the government’s shareholding ratio of the public firm or the privatization ratio. If the firm is fully privatized, θ is equal to unity, and it is zero when the firm is fully nationalized. Given θ, the output reaches an intermediate level (between pure private and fully nationalized levels) if the firm is partially owned by the government.

We know that a mixed oligopoly is beneficial when the number of private firms is small. However, can partial privatization replicate the second-best solution? The answer is yes. Using (1.3) and (1.6),

We call this condition the optimal privatization ratio, which achieves the second-best level of output. The properties of this ratio depend on the number of private firms. We have discussed the above short-run results via a comparison of previous research and have identified several properties of a mixed oligopoly .

We now consider government intervention in a mixed oligopoly . In this section, full nationalization and full privatization do not ensure a second-best solution under a fixed number of private firms. If the government indirectly controls the output of the public firm via partial ownership, the output level is delivered to the optimal level. However, partial privatization is only justified with a fixed number of private firms. De Fraja and Delbono (1989) focused on optimal privatization and showed that a mixed oligopoly is not superior to a Stackelberg leader solution where the government directly sets the output and acts as the leader. We too find similar results for optimal partial privatization . In addition, an increase in the number of private firms promotes the total output if the output of the public firm is fixed. In such a case, the output of the public firm must decrease to ensure a second-best solution. The government then enforces the privatization of the firm because entry restrictions must be loosened.

In this section, we showed the existence of the optimal privatization ratio and its implications related to previous studies. We now consider the long-run situation in which new firms enter the market and explain the limitations of the privatization policy.

4 Free-Entry Equilibrium and the Privatization Problem

We now turn to the long-run situation of a mixed oligopoly . From a long-run perspective, new firms may enter the market until the profit becomes zero. In this case, the zero profit condition determines the number of private firms regardless of whether the public firm is fully nationalized or privatized. However, because the degree of privatization affects the output of the public firm , the number of private firms also depends on the privatization policy. Regarding the long-run equilibrium, the number of private firms can be written as a function of the output of the public firm using a zero profit condition:

where * denotes the long-run equilibrium variables.

The property of the number of private firms is characterized by the privatization policy. The number becomes larger if privatization is accelerated. Because privatization brings about a decrease in the output of the privatized firm, a new firm can enter the market. In other words, nationalization can be interpreted as a tool to restrict entry.

The free-entry equilibrium in a pure private oligopoly results in inefficient resource allocation. This was shown by Mankiw and Winston (1986) and Suzumura and Kiyono (1987) and is known as the excess entry theorem. This theorem states that the number of firms reaches a certain level depending on the cost function and that each firm produces an output at a higher average cost. Thus, a decrease in the number of firms can lower sunk costs and decrease the average cost. Therefore, government entry restrictions may improve social welfare and restore more efficient resource allocation. If we apply the excess entry theorem to the mixed oligopoly , nationalization or partial privatization can be interpreted as an instrument of entry restriction.

Next, we consider the output and market price in a free-entry equilibrium . Matsumura and Kanda (2005) commented that private output and total output are independent of the output of the public firm . We call such properties the neutrality theorem of privatization . Using comparative statics of the long-run number of private firms, we can check the neutrality theorem as follows:

We now consider the privatization problem from a long-run perspective and investigate whether the government can maximize social welfare using the output of the public firm . The answer is no because the government only chooses the privatization ratio. We can check this using the following maximization problem:

The first-order condition is

In this case, if the government only uses the output of the public firm as a policy instrument, then such a condition can only be satisfied when the public firm is fully nationalized because a fully nationalized firm always provides the MP level of output.

However, with (1.3) and (1.4), full nationalization cannot achieve the second-best solution because the number of firms still exceeds the optimal level. Even though the public firm restricts the number of private firms, the MP level of output of the public firm is still too high. This depends on the number of policy instruments because the government has to control the output of the public firm and the number of private firms to satisfy the second-best situation. The government needs to use another policy instrument to restrict the number of private firms. In the following section, we consider how the government reaches the second-best solution and what type of policy instrument is appropriate.

5 Entry Restriction and Partial Privatization

As mentioned above, the second-best solution cannot be realized through a privatization policy because by itself it is not enough. In this section, we introduce an entry tax as an additional policy instrument and analyze the policy effects and social welfare implications.

The profit function is rewritten if the government imposes an entry tax to each firm. We also assume that the entry tax is imposed as a lump sum. The entry tax does not change the output level of the private firm in the short run. However, it affects the number of private firms in the long run.

The entry tax has some interesting effects not only regarding the number of firms but also on output levels from a long-run perspective. This enables the government to control both levels. The government now faces the following maximization problem:

The first-order conditions are

In this case, the second-best solution does not require the MP level output of the public firm . Moreover, the entry tax is a positive value as follows:

Because the public firm provides less than the MP level of output if the firm is partially privatized, the second-best condition requires partial privatization , not full nationalization. This is in contrast to when the government only uses a privatization policy. The optimal entry tax is always positive, regardless of whether the public firm is privatized or nationalized. Thus, the government now separately and fully controls the number of firms and the output of the public firm .

De Fraja and Delbono (1989) considered a similar situation, although they did not introduce partial privatization and entry tax . They stated that the government can maximize social welfare if it controls the output of the public firm and the number of private firms like a Stackelberg leader. Because the free-entry equilibrium always exceeds the optimal level, any entry restriction may improve social welfare, and full privatization results in overprovision. However, if the government cannot use the number of private firms and the output of public firms, it is difficult to bring a market solution to second-best level. Our case highlights their replication using an entry tax and partial privatization . We have also shown that a second-best solution cannot be achieved if the government adopts either an entry tax or a partial privatization policy.

Finally, we mentioned several properties of a mixed oligopoly from both short- and long-run perspectives, with reference to previous research including De Fraja and Delbono (1989) and Matsumura and Kanda (2005). The policy implications from our analysis of a mixed oligopoly are broad, taking into account market size and market composition. From a short-run view, a privatization policy is more likely to be effective, but in the long run, the government needs other policy instruments to restrict the entry of firms.

Thus, privatization is regarded as a government intervention in an oligopolistic market. Although privatization affects the market structure and restores social welfare, there are some limitations to improving social welfare via a privatization policy. For instance, the public firm alone is not a strong enough policy instrument to restrict the entry of new firms. Thus, government intervention via a public firm cannot fully restrict the number of private firms, and a further policy tool is necessary to ensure the efficient allocation of resources. We introduced an entry tax to resolve this problem. As a result, a second-best solution is found via an entry tax and a privatization policy.

6 Concluding Remarks

In this section, we highlight some remaining issues and discuss the intended extension of the mixed oligopoly model. First, domestic firms sometimes compete with foreign firms. Foreign firms aim to maximize their own profit, and these profits are usually forwarded to the firms’ home countries. Because such an erosion of profits harms domestic social welfare, the domestic government has an incentive to use the public firm to prevent such erosions. In this case, Fjell and Pal (1996) considered that the public firm not only acts to restore social welfare but also behaves as a protection tool against foreign firms. This situation is known as an international mixed oligopoly . Traditionally, the import tariff has been recognized as a protection instrument in such cases. If we have such a protection tool, we need to consider whether the tariff rate and privatization are compatible. This problem is worth considering when composing relevant policy in an international economy.

Second, the public firm can be seen as an entry barrier to private firms and prevents private firms’ capital accumulation . Furthermore, a disincentive for capital accumulation may harm economic growth. To analyze this situation, we need an intertemporal model of a mixed oligopoly to investigate the causality between a mixed oligopoly and economic growth, as in Futagami et al. (2011). The capital accumulation process relates to the entry of firms in the market, as new firms always bring new capital. The number of firms can then be used as a proxy of capital accumulation . Therefore, both the entry process and privatization policies are related to economic growth.

Third, the present chapter assumed that the government maximizes social welfare or acts as a benevolent agent. In reality, private firms often approach the government to derive more favorite policies via campaign contributions to politicians. In this case, the government has its own payoff function (not maximizing social welfare), which means it is a non-benevolent agent. This political bias via campaign contributions may change the level of privatization , and thus, the market outcomes differ from a benevolent case. A question remains unanswered: which case brings about higher social welfare?

If we consider political bias in an international mixed oligopoly , the intuitive explanation becomes more complex. Domestic firms wish to increase import tariffs to reduce the presence of foreign firms. They also try to privatize public firms via campaign contributions because privatization brings a market share to private firms. This incentive with campaign contributions can also distort domestic social welfare. Thus, further investigations are required to determine the effect of political bias on social welfare.

When oligopolistic markets are considered, Cournot quantity-setting models and Bertrand price-setting models are commonly used as analytical tools. However, the price in both models is determined by the market, even though the market is a pure private or mixed oligopoly . Furthermore, sometimes a public firm competes against a private firm in a market in which the price is restricted. For example, national universities in Japan compete with private universities, and the tuition fees of both are restricted by government regulations. In the healthcare market, both public and private hospitals share patients, but the payments from national health insurance are standardized by the government. Thus, this non-price mixed oligopoly may represent different definitions of privatization and government intervention.

To encompass the various policy implications of privatization , we investigate several extensions of the mixed oligopoly model in the following chapters. Each chapter will show how privatization policy relates to the individual subject. Throughout this book, we seek to identify the significance of privatization and its related meanings.

References

De Fraja G (1993) Productive efficiency in public and private firms. J Pub Econ 50(1):15–30

De Fraja G, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxford Econ Pap 41(1):302–311

De Fraja G, Delbono F (1990) Game theoretic models of mixed oligopoly. J Econ Surv 4(1):1–17

Fershtman C (1990) The interdependence between ownership status and market structure: the case of privatization. Economica 57(227):319–328

Fjell K, Pal D (1996) A mixed oligopoly in the presence of foreign private firms. Can J Econ 29(3):737–743

Futagami K, Iwaisako T, Okamura M (2011) Welfare analysis of free entry in a dynamic general equilibrium model. Osaka University, Graduate School of Economics and Osaka School of International Public Policy (OSIPP) Discussion Papers in Economics and Business, pp 11–20

Mankiw N, Whinston M (1986) Free entry and social inefficiency. Rand J Econ 17(1):48–58

Matsumura T (1998) Partial privatization in mixed duopoly. J Pub Econ 70(3):473–483

Matsumura T, Kanda O (2005) Mixed oligopoly at free entry markets. J Econ 84(1):27–48

Suzumura K, Kiyono K (1987) Entry barriers and economic welfare. Rev Econ Stud 54(1):157–167

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer Japan

About this chapter

Cite this chapter

Shinozaki, T., Kunizaki, M. (2017). Basic Properties of a Mixed Oligopoly Model. In: Yanagihara, M., Kunizaki, M. (eds) The Theory of Mixed Oligopoly. New Frontiers in Regional Science: Asian Perspectives, vol 14. Springer, Tokyo. https://doi.org/10.1007/978-4-431-55633-6_1

Download citation

DOI: https://doi.org/10.1007/978-4-431-55633-6_1

Published:

Publisher Name: Springer, Tokyo

Print ISBN: 978-4-431-55632-9

Online ISBN: 978-4-431-55633-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)