Abstract

In this paper, we consider a problem of dynamic spectrum access in a heterogeneous network with spectrum database-assisted where spectrum operators (SOs) provide licensed spectrum and shared spectrum to secondary users (SUs) for maximizing their revenue. SUs can select a shared spectrum to transmit data with low price, but the quality of service (QoS) could be influenced by activities of primary users (PUs). SUs can also select licensed spectrum with high price for satisfactory QoS. We use the Stackelberg game to analyze the economic behavior of SUs and the optimal revenue of operators, respectively. Furthermore, we propose a price compensation scheme (PCS) to enhance the utility of SUs when PUs appear. Numerical results verify that the high activities of PUs can motivate SUs to purchase licensed spectrum and maximize revenue of spectrum operators. The proposed scheme could also enhance the utility of SUs several times than no compensation when channel condition is getting worse.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

With the concept of cognitive radio emerging, it is likely that the scarce spectrum resource could be utilized efficiently. With the development of research work, scientists find the existence of spectrum holes and propose a novel approach to access idle spectrum, Dynamic Spectrum Access [1]. In a typical dynamic spectrum access network, SUs are allowed to opportunistically exploit the unoccupied spectrum resource and utilize the idle channel to transmit data but not to cause harmful interference to PUs. However, the main challenge is how to exploit the idle spectrum efficiently with little consumption for SUs.

The most former researches are focused on spectrum sensing and channel estimation. However, a recent study shows that sensing is not an efficient approach since it has to pay high cost for the unsatisfied sensing performance. As an alternative, the Federal Communications Commission suggests to use geo-location database to obtain spectrum information [2]. With the assist of database, unlicensed device could get spectrum information instead of sensing wireless radio environment. In [3], Luo et al. investigate the white space ecosystem, and study the equilibrium behavior of secondary network operators. Since spectrum availability is determined by PUs’ activities and changeful radio environment, Liu et al. [4] propose a joint local sensing and database scheme to confirm specific condition of channel and guarantee reliability for exploiting spectrum holes. Considering the stochastic and heterogeneous nature of SUs’ demands, Jiang et al. [5] solve the revenue maximization of SOs with joint pricing of spectrum resources and admission control. The secondary market is a promising approach to provide different spectrum for variety of QoS demands [6]. In [7], the authors study the interaction between single primary spectrum owner and multiple unlicensed SUs, and design an optimal contract to maximize their profit, respectively. With the assist of spectrum database, SOs could design mechanism to provide shared spectrum for unlicensed users (such as SUs) with suitable price to satisfy their demands. However, consider the changeful wireless environment; it is not realistic that there is enough available spectrum resource to lease. Thus, operators would like to lease licensed spectrum from licensed users (such as PUs) with high price.

However, few papers have considered the activities of PUs in a dynamic access network with database-assisted. In that case, we use the Stackelberg game to investigate the interaction between SOs and SUs in a heterogeneous network where PUs would appear with stochastic probability. Furthermore, we study SUs’ economic behavior with primary activities, and propose a price compensation scheme which could alleviate the loss of SUs when channel condition is getting worse.

The rest of this paper is organized as follows. In Sect. 2, we discuss the system model. And the problem analysis is given in Sect. 3. Section 4 provides the simulation results. Finally, Sect. 5 concludes the paper.

2 System Model

We consider a heterogeneous dynamic spectrum access network with database-assisted where SOs could provide two types of spectrum, the licensed spectrum and shared spectrum, for SUs. The licensed spectrum is owned by PULs who would like to lease portion of spectrum to SOs in exchange for additional reward, and the channel quality could be guaranteed. The shared spectrum owned by PUSs who do not lease spectrum could be used by everyone if PUSs do not occupy the channel, but the channel quality could not be guaranteed for PUSs’ activities. The spectrum database real-timely updates shared spectrum information from wireless environment and provides it to SOs. The SOs make corresponding licensed price according to the shared channel-occupied probability obtained from the database to attract more SUs for maximizing their revenue.

The system model is described in Fig. 1. We formulate their interaction with a three-stage Stackelberg game to investigate their optimal profit, respectively. In a duration T, PULs charge operators with price \( \rho_{0} \) first, then operators determine their leasing bandwidth B in stage one, but the maximum leasing bandwidth of PULs provided is \( B^{\hbox{max} } \). Operators announce the licensed spectrum price \( \rho_{l} \) and shared spectrum price \( \rho_{s} \) to SUs in stage two. Simultaneously, operators send the channel-occupied probability obtained from database to SUs. According to the shared spectrum information and the two types of price, SU i determines the licensed spectrum fraction \( \theta_{i} \in \left[ {0,\theta } \right] \) of the total bandwidth in stage three. It is obvious that the licensed bandwidth is finite, and SUs are willing to select shared spectrum if the price of licensed spectrum is too high. In that case, SOs have to make an optimal price strategy to motivate more SUs to purchase licensed spectrum for maximizing revenue.

In this paper, we assume that there is one spectrum operator, and N number of SUs, \( {\mathcal{N}} = \left\{ {1,2, \ldots N} \right\} \). The spectrum efficiency is denoted by \( \eta \) (Mbps/MHz), the traffic demand of SU i is D i and \( \theta = \hbox{min} \left\{ {\frac{\eta \,B}{D},1} \right\} \) [8]. \( D = \sum\nolimits_{i = 1}^{N} {D_{i} } \) is sum of all SUs’ demands. Considering the activities of PUSs in shared spectrum, we use \( \varphi \) to denote channel-occupied probability.

3 Problem Formulation and Analysis

To investigate the optimal profit of SO and SUs, we formulate their interaction as a three-stage Stackelberg game as shown in Fig. 2. In this section, we will describe the price compensation scheme first and then analyze their optimal profit and PUs’ impact on SUs’ economic behavior with backward induction method.

3.1 The Price Compensation Scheme

It is worth noting that the utility function of SU i is increasing with D i and more SUs would like to select licensed spectrum with the \( \theta_{i} \) increasing because the worse QoS on shared spectrum could not satisfy users’ traffic demands.

The utility function of SU i could be defined as follows [8]:

The first term is the profit of SU i and the second term is the corresponding cost. Considering the QoS influenced by primary activities at shared spectrum, it is not reasonable that the shared spectrum price is \( \rho_{s} \). So, the operator should adjust the price to \( \left( {1 - \varphi } \right)\rho_{s} \) as a compensation for alleviating the loss of SUs. It is obvious that the shared spectrum price is decreasing with channel-occupied probability and the detail analysis is presented in Sect. 4.

3.2 The Optimal Fraction in Stage Three

In stage three, SUs need to make the decision of how much to purchase. If a user SU i purchase spectrum from operator, then its utility function \( u_{i} \) is given in (1). The optimal fraction of licensed spectrum that maximizes the profit of SU i is

Then we will characterize the optimization problem as follows:

Lemma 1

The (P1) is a convex optimization problem with \( \left\{ {\theta_{i} } \right\} \).

Proof

It is clear that the Hessian matrix of function of \( u_{i} \) is negative, and constraints of (P1) are affine functions, so the (P1) is a convex problem [9].

Using the Lagrangian method, the Lagrangian function of \( u_{i} \) is

with the KKT conditions [9], we could get the optimal fraction

because of the \( \theta_{i} \in \left[ {0,\theta } \right] \), after algebra steps, we have

3.3 The Optimal Price in Stage Two

In stage two, the operator will make the optimal price strategies to maximize its revenue according to the demands in stage three. From the analysis in stage three, the utility function of SO could be presented as

when \( \rho_{l} \ge \rho^{H} \), the revenue of PULs is zero, this situation should be ignored.

When \( \rho^{L} \le \rho_{l} < \rho^{H} \), we have the optimization problem as:

(P2.1) is a convex problem as (P1). Using the same method, let the Lagrange multiplier equal to 0, the optimal licensed price is

when \( \rho_{l} < \rho^{L} \), the optimization problem is

Similarly, the optimal solution of problem (P2.2) is

It is obvious that \( \rho_{s} \left( {1 - \varphi } \right) + \beta \varphi \,e^{\beta - 1} > \rho_{s} \left( {1 - \varphi } \right) + \beta \varphi \,e^{{\left( {1 - \theta } \right)\beta }} \), so the fraction \( \theta > \frac{1}{\beta } \).From the analysis above, we substitute (9) and (11) into (5). When \( \theta \le \frac{1}{\beta } \),

when \( \theta > \frac{1}{\beta } \),

3.4 The Optimal Leasing Bandwidth in Stage One

In stage one, operator will determine its leasing bandwidth B, but the maximum leasing bandwidth that PULs could provide is \( B^{\hbox{max} } \). It means that operator could not increase the leasing bandwidth infinitely. According the analysis in stage two, the utility function of SO could be presented as

Since \( \theta = \hbox{min} \left\{ {\frac{\eta \,B}{D},1} \right\} \), the utility function can be derived as follows:

When \( B \le \frac{D}{\eta \beta } \), we have optimization problem as:

The (P3) is a convex optimization problem for the same character as (P1), we could get the Lagrangian function as

Giving the KKT conditions as follows:

if \( \lambda = 0 \), substituting it to (18), we have

with the Lambert W Function [10],

if \( \lambda \ne 0 \),

Thus, the optimal leasing bandwidth is

when \( B > \frac{D}{\eta \beta } \), from (15), utility function \( \varphi \,De^{\beta - 1} + D\rho_{s} \left( {1 - \varphi } \right) - \rho_{0} B \) increases with \( B \), the \( B^{ * } = \frac{D}{\eta \beta } \).

Considering \( W(\frac{{\rho_{0} }}{{\eta \beta \varphi \,e^{\beta - 1} }}) \in \left[ {0{\kern 1pt} ,1} \right] \), we obtain the optimal leasing bandwidth as

4 Simulations

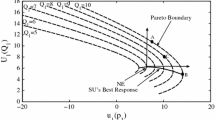

In this section, we analyze the numerical results to illustrate the performance of the system. In the simulation, we will find that profit of SUs and SO could achieve equilibrium solution. And the activities of primary users will impact secondary users’ interest on licensed spectrum.

In this network, there are four SUs groups, the total traffic demands are \( D_{1} = 80,D_{2} = 80,D_{3} = 100,D_{4} = 150 \). When they access shared spectrum, the channel-occupied probability are \( \varphi_{1} = 0.3,\varphi_{2} = 0.4,\varphi_{3} = 0.5,\varphi_{4} = 0.5 \), respectively. The other parameters set as follows: \( \alpha = 22,\beta = 3 \), the licensed spectrum unit price determined by PULs \( \rho_{0} = 1 \).

Figure 3 shows the variation of licensed spectrum fraction \( \theta \) under the heterogeneous network model. When channel condition of shared spectrum is getting worse, more users prefer licensed spectrum for high QoS. It denotes that the \( \theta \) will increase with \( \varphi \). Meanwhile, with \( \theta \) increasing, the demands for licensed spectrum from PULs increases, it is obvious in curve D 1 and D 2. That is to say, operator will lease more spectrum from PULs to satisfy SUs’ increasing licensed spectrum requirements. Furthermore, comparing with the two curve \( D_{3} = 100 \) and \( D_{4} = 150 \), we can find that the more SUs’ traffic demands is required, the more licensed spectrum could be provided.

In Fig. 4 with the \( B^{\hbox{max} } \) increasing, operator will reduce the licensed price \( \rho_{l} \) to attract more users to select licensed spectrum for maximizing operator’s revenue. If the channel condition is better, the \( \rho_{l} \) is lower. Because the shared spectrum could satisfy SUs’ demands, the operator has to adjust \( \rho_{l} \) much lower to draw attention to SUs for achieving more revenue. It is worth noting that the price decreases faster in D 3 compared with D 4; the reason is that, operator adjusts the licensed price according to SUs demands of licensed spectrum. For example, the traffic demands on licensed spectrum are 50 in D 3 and 75 in D 4, respectively. Group D 4 must purchase more licensed spectrum to satisfy communication demands so that operator decreases the price slower.

From Fig. 5 the four curve denote when operator reduces the price \( \rho_{l} \), he will achieve more revenue. The reason is due to when shared spectrum is getting worse and the licensed price is decreasing, the licensed spectrum becomes the most favorable choice. Simultaneously, operator will lease more licensed spectrum from PULs.

From Fig. 6 the leasing licensed bandwidth B increases for the increasing traffic demands and worse shared spectrum (because of PUSs’ activities). When SUs achieve their QoS demands, operator will not lease more licensed spectrum, for no user would like to purchase it. Thus, the leasing licensed bandwidth B will reach the equilibrium solution, meanwhile the revenue of operator could not increase in Fig. 5.

We can further see from Fig. 7 that under the proposed scheme, the SUs using worse channel will get more compensation to reduce their loss of profit. When \( \varphi = 0.9 \), the channel condition of shared spectrum is getting worse than that at \( \varphi = 0.3 \). But the utility of SUs could increase up 14.17 %, when \( \varphi = 0.9 \). However, the utility just increase up 1.92 % when \( \varphi = 0.3 \). Moreover, when shared spectrum is worse, such as \( \varphi = 0.9 \), utility of SUs increases faster than that with \( \varphi = 0.3 \) under the PCS. Meanwhile, more licensed spectrum is required. From Fig. 7, the maximum leasing bandwidth for licensed spectrum is 24 MHz when \( \varphi = 0.9 \), and it is 18 MHz when \( \varphi = 0.3 \). Obviously, PULs will achieve more profit when shared spectrum is getting worse.

5 Conclusions

In this paper, we have studied the economic behavior of SUs under the impact of PUSs’ activities on shared spectrum. We use three-stage Stackelberg game to analyze the optimal revenue of operator and users, respectively. Furthermore, we propose a price compensation scheme (PCS) to enhance the utility of SUs when channel condition of shared spectrum is getting worse. Numerical results verify that the high activities of primary users could motivate SUs to purchase more licensed spectrum, which maximizes revenue of operator and PULs, respectively. The proposed scheme could enhance the utility of users up to 14.17 % when \( \varphi = 0.9 \), that is better than the case of \( \varphi = 0.3 \).

References

Zhao Q, Sadler B (2005) A survey of dynamic spectrum access: signal processing, network, and regulatory policy. IEEE Signal Process 24(3):201–220

Ofcom, Implementing Geolocation (2010)

Luo Y, Gao L, Huang J (2013) White space ecosystem: a secondary network operator’s perspective. IEEE GLOBECOM. doi:10.1109/GLOCOM.2013.6831192

Liu Y, Yu R, Pan M, Zhan Y (2014) Adaptive channel access in spectrum database-driven cognitive radio networks. IEEE ICC. doi:10.1109/ICC.2014.6884102

Jiang C, Duan L, Huang J (2014) Joint spectrum pricing and admission control for heterogeneous secondary users. In: Modeling and optimization in mobile, Ad Hoc, and wireless networks (WiOpt), pp 497–504

Kun Z, Niyato D, Wang P, Han Z (2012) Dynamic spectrum leasing and service selection in spectrum secondary market of cognitive radio network. IEEE Trans Wirel Commun 11(3):1136–1145. doi:10.1109/TWC.2012.010312.110732

Yin J, Sun G, Wang X (2013) Spectrum trading in cognitive radio network: a two-stage market based on contract and stackelberg game. In: IEEE WCNC, pp 1679–1684. doi:10.1109/WCNC.2013.6554816

Feng X, Zhang Q, Zhang J (2013) Dynamic spectrum leasing with users-determined traffic segmentation. In: IEEE ICC, pp 6069–6100. doi:10.1109/ICC.2013.6655578

Boydnad S, Vandenberghe L (2004) Convex optimization. Cambridge University Press

Corless RM, Gonnet GH, Hare DE, Jeffrey D, Knuth DE (1996) On the Lambert W function. Adv Comput Math 5

Acknowledgments

This research was supported in part by the National Nature Science Foundation of China (Grant No. 61301161, 61471395). And the Natural Science Foundation of Jiangsu Province (Grant No. BK20141070).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Liao, Y., Chen, Y., Sun, A., Zhang, J. (2016). Stackelberg Game-Based Dynamic Spectrum Access Scheme in Heterogeneous Network. In: Liang, Q., Mu, J., Wang, W., Zhang, B. (eds) Proceedings of the 2015 International Conference on Communications, Signal Processing, and Systems. Lecture Notes in Electrical Engineering, vol 386. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-49831-6_3

Download citation

DOI: https://doi.org/10.1007/978-3-662-49831-6_3

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-49829-3

Online ISBN: 978-3-662-49831-6

eBook Packages: EngineeringEngineering (R0)