Abstract

A hybrid vehicle ownership model, which comprises three sub-models (private passenger vehicle population model, public traffic vehicle population model, and other vehicle population model), was established to simulate the growth of China’s vehicle population.

The passenger vehicle population model links the vehicle population and residents’ income distribution to forecast the growth of the private passenger vehicle population. The public traffic vehicle population model links the vehicle population, human population, and urbanization rate to forecast the growth of the vehicle population of urban public buses and taxis. The other vehicle population model links vehicle population growth and GDP growth to forecast the population of all other vehicles, including passenger vehicles for public affairs, other buses, and trucks. Passenger and freight traffic volume were projected based on the forecast results for the vehicle population.

The vehicle population and traffic volume were projected under two scenarios of reference scenario and comprehensive policy scenario. The reference scenarios and comprehensive policy scenarios employed in this section are the same as those in Chap. 12 for the vehicle energy development scenario. Chapter 12 presents the scenario definitions in detail, and the present section describes only the content related to vehicle population and vehicle traffic volume.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

3.1 History and Current Status

Vehicle population and traffic volume are affected by many different factors, such as economic development, population, geography, technological progress, and policies. China’s economy has achieved rapid growth, with its gross domestic product (GDP) having increased from RMB 454.6 billion in 1980 to RMB 39,798.3 billion in 2010—an average annual growth rate of 19.1 %. By 2010, GDP per capita had reached RMB 29,900, with the annual average disposable income of urban residents and net income of rural residents having reached RMB 19,100 and RMB 5,900, respectively. The growth in GDP and personal income has been the economic basis for the rise in China’s vehicle population and traffic volume. To promote the development of China’s automotive industry, the government established its Automotive Industry Policies in 1994, which defined the automotive industry as one of the key industries in China’s national economy for stimulating the development of other industries. In 2004, to address the current situation in the domestic and overseas automotive industry after China entered the World Trade Organization, the State Council implemented its Policies on Automotive Industry Development. These policies set numerous objectives relating to upgrading the industrial structure, increasing international competitiveness, meeting growing consumer demand, and promoting positive development of the industry. In 2009, in response to the international financial crisis, the State Council promulgated its Automotive Industry Revitalization Planning, which played an important role in stabilizing automobile consumption, accelerating structural adjustments, improving independent innovative capability, and promoting upgrading of the industry.

Propelled by these factors, China’s vehicle population rose rapidly. As shown in Fig. 3.1, China’s vehicle production rose from 0.51 million in 1990 to 18.26 million in 2010, with an average annual growth rate of 15.9 %. With the spread of household vehicles, both the production and sales of passenger vehicles achieved the fastest growth, amounting to 13.9 and 13.76 million, respectively, in 2010, and passenger vehicles that year accounted for 76 % of the total production and sales. With increasing demand for mass passenger and cargo transportation, the production and sales of buses and trucks also achieved rapid growth. By 2010, the production and sales of buses amounted to 0.447 and 0.443 million, respectively, while those of trucks were 3.92 and 3.86 million. China Association of Automotive Manufactures (2011).

Vehicle imports and exports in China have also increased constantly. As shown in Fig. 3.2, vehicle imports rose from 0.4 million in 1998 to 0.81 million in 2010; vehicle exports rose from 14,000 to 567,000 over the same period. China’s vehicle exports exceeded imports in 2005. However, owing to the impact of the global financial crisis, vehicle exports experienced a fall in 2009 and 2010.

In the present study, the number of newly registered vehicles was estimated based on historical production, import, and export figures. As seen in Fig. 3.3, the number of newly registered vehicles rose from 2.16 million in 2000 to 18.57 million in 2010. Among those, the number of newly registered passenger vehicles increased from 1.23 million in 2000 to 14.44 million in 2010; the number of newly registered buses and trucks grew from 0.17 to 0.41 million and from 0.76 to 3.71 million, respectively, over the same period.

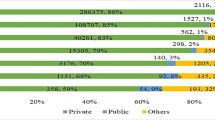

The vehicle population has increased with the growth in the number of newly registered vehicles. In our research, the total vehicle population was estimated based on the number of newly registered vehicles, and the results (from 2000 to 2010) are presented in Fig. 3.4. The total vehicle population at the end of 2010 amounted to 79.97 million (excluding low-speed vehicles; the same category of vehicles is excluded in the figures below)—an increase of 27 % from 2009. China’s vehicle ownership in 2010 was 59.6 vehicles per 1,000 persons, which was approximately equivalent to the United States level in 1918 and the Japanese level in 1965. In 2010, the number of passenger vehicles was 59.57 million (accounting for 74.5 % of the total population), buses 2.78 million (3.5 %), and trucks 17.62 million (22 %). Compared with developed countries, the number of passenger vehicles in China accounts for a lower percentage of the total vehicle population since the penetration rate of sedans is not yet that high in Chinese families.

China’s vehicle population is expanding and it has great growth potential. Many institutions and individual scholars have conducted projections of China’s vehicle population. In terms of domestic research, according to the Research on China’s Energy Development Strategy and Policy led by the National Development and Reform Commission in 2004, China’s vehicle population is expected to reach 110 million by 2020 (National Development and Reform Commission 2004). According to another estimate using income distribution figures for the year 2006, China’s vehicle population will reach 228 million by 2030 (Shen Zhongyuan 2006). The 2050 China Energy and CO2 Emissions Report published in 2009 projected that China’s vehicle population will reach 363–397 million by 2030 and 558–605 million by 2050 (China Energy and Carbon Emission Research Group 2009). In terms of global research, Wang et al. of the Argonne National Laboratory using the Gompertz model in 2006 forecast that China’s vehicle population would reach 247–287 million by 2030 and 486–662 million by 2050. In 2007, the International Energy Agency (IEA) in World Energy Outlook 2007 forecast that China’s vehicle population would reach 270–410 million by 2030. In 2007, Dargay et al. (2007) using the improved Gompertz model forecast that China’s vehicle population would reach 390 million by 2030. Wang et al. (2011) of the University of California (UC), Davis, summarized the above results and concluded that all these studies generally underestimated the growth rate of China’s vehicle population. Based on a comparison with the increasing vehicle population of the developed countries at a similar stage, estimated that China’s vehicle population would reach 332–419 million by 2022 (Sidebar 3.1).

Sidebar 3.1: China’s Vehicle Population Research Approaches

Wang et al. of UC Davis selected seven countries that at one time were at a similar economic level and increasing stage of vehicle population as China; the countries were Japan, the United States, Germany, Italy, Korea, Spain, and Brazil. The study defined the year when the vehicle population of those countries reached China’s current level in 2008 (37–38 vehicles per 1,000 persons). Wang et al. then investigated the growth rate of those countries’ vehicle population over 15 years from the base year of 2008, and they took the average growth rate as the growth rate of China’s vehicle population rate from year 2008 to 2024. This method is simple and practical and made no assumptions regarding GDP or the growth in per capita income. The projected result was much higher than that of other studies and is closer to the current condition regarding current vehicle production and sales.

Wang et al. of Argonne National Laboratory adopted the Gompertz model (a kind of growth model) as the vehicle population growth model, and the input of the model was per capita GDP with three model parameters. Three scenarios were designed using a parameter representing the saturation level of the vehicle population: high, middle, and low saturation, corresponding to 600, 500, and 400 vehicles per 1,000 persons, respectively. The other two parameters were regressed based on per capita GDP and vehicle ownership from 1978 to 2004. Dargay et al. made a projection using a similar method. This approach is sensitive to the assumption of vehicle ownership saturation level, selection of historical data, and assumption of future GDP growth rate. The higher the vehicle ownership saturation level is set, the more recent are the historical data employed, the faster is the assumed future GDP growth, and the higher the result. Thus, studies using the same approach may obtain quite different projection results.

Shen Zhongyuan of the Institute of Energy Economics of Japan built a vehicle population forecast model for China based on a distribution curve for residents’ income. The vehicle population was estimated according to the integral of two results derived from a logarithmic normal distribution curve as the income distribution curve and from a logistic curve as the vehicle diffusion curve. With this approach, a parametric regression can be made with the income distribution and vehicle diffusion curves in accordance with the historical data. This study employed residents’ income distribution as the forecast basis. The advantage with this approach is that the influence of income level and income difference on vehicle diffusion rate can be modeled. However, this also requires the assumption of other parameters, such as future average income of urban and rural residents, and Gini coefficient.

Source | Forecast method | Key assumption | Results (106) |

|---|---|---|---|

Wang et al. (2011) | Used growth rate of vehicle ownership of developed countries at a similar stage to estimate vehicle ownership | Selection of similar countries | 2022: 332–419 |

Huo et al. (2007) | Took growth curve as the vehicle population growth model, estimated the model parameters based on historical data | GDP growth rate, saturation of vehicle ownership | 2020: 125–134 |

2050: 486–662 | |||

Shen Zhongyuan (2006) | Estimated vehicle ownership according to income distribution and vehicle diffusion curves | Growth of residents’ income, change in Gini coefficient | 2030: 228 |

3.2 Vehicle Ownership and Traffic-Volume Projection Model

3.2.1 Model Structure

3.2.1.1 Vehicle Classification and Model Function

Different types of vehicles vary remarkably in vehicle population growth pattern, vehicle-use characteristics, fuel economy, and other aspects. To build a corresponding analytical model, it is necessary to classify the vehicles into different categories. Currently, China Association of Automobile Manufacturers is responsible for issuing statistics concerning China’s vehicle production and sales; China Customs issues data relating to vehicle imports and exports; the Ministry of Public Security Traffic Management issues figures relating to vehicle registration; statistics relating to commercial vehicles are surveyed and issued by the Ministry of Transport. The manner of vehicle classification adopted in those statistics is quite different. A vehicle-type-based classification can provide basic details regarding the fleet characteristics of vehicles. However, for the same vehicle type, different uses would affect the fleet characteristics. With passenger vehicles, for example, both the vehicle use and ownership growth patterns are quite different for private passenger vehicles, government and business passenger vehicles, and taxis. Therefore, it is necessary to classify vehicles in two ways—vehicle type and utility. In this study, we classified vehicles into 11 categories based on vehicle type and utility. Table 3.1 presents the vehicle classification and description employed in the present study. Passenger vehicles are classified into private passenger vehicles, government and business passenger vehicles, and taxis; buses are classified into urban transit buses, non-transit operating buses, nonoperating buses based on their utility, and large buses, medium-sized buses, and light buses based on their length; trucks are classified into semitrailers, heavy-duty trucks, medium-duty trucks, light-duty trucks, and mini-trucks.

The vehicle traffic-volume projection model comprises three sub-models: vehicle population projection model, passenger vehicle traffic-volume projection model, and commercial vehicle traffic-volume projection model. The model’s input parameters include:

-

1.

GDP growth, residents’ income distribution, and other economic quantities

-

2.

Population growth, increase in urbanization rate, and other population and geographic quantities

-

3.

Vehicle population control, traffic-demand management, and other public policy quantities

The model has the following major functions:

-

1.

Simulating the relationship between vehicle population and macroeconomic factors, population, geographic factors, and public policy factors

-

2.

Projecting China’s future vehicle population and traffic volume

-

3.

Making a sensitivity analysis of the factors that may affect vehicle population and traffic volume

3.2.1.2 Passenger Vehicle Traffic-Volume Model

Figure 3.5 shows the structure of the passenger vehicle traffic-volume forecast model. China’s historical passenger vehicle registration figures are obtained from statistical yearbooks; the vehicle population is classified according to private passenger vehicles, government and business passenger vehicles, and urban taxis. Then, the total registration number and vehicle-age distribution of China’s passenger vehicles are obtained based on the passenger vehicle survival pattern model. From the vehicle population forecast model, a forecast is made of the future number of total passenger vehicle registrations based on the historical number of total passenger vehicle registrations; a calculation is then made of future new vehicle registrations based on the vehicle survival function. The traffic volume of passenger vehicles is obtained by considering the annual mileage of passenger vehicles. Finally, the fuel consumption and greenhouse gas (GHG) emissions of passenger vehicle are obtained following assumptions regarding fuel economy and GHG emission factors of new vehicles, as described in Chap. 11 of this book. The structure and content of part of the integration and optimization models appear in Figs. 3.5 and 3.6.

3.2.1.3 Commercial Vehicle Traffic-Volume Model

The commercial vehicle traffic-volume model is shown in Fig. 3.6. The number of China’s historical commercial vehicle new registrations is obtained from statistical yearbooks; the number of China's current total commercial vehicle registrations and vehicle-age distribution are calculated according to the survival function of commercial vehicles. Unlike with the passenger vehicle model, the commercial vehicle model first estimates the historical commercial vehicle traffic volume according to a single vehicle’s annual mileage and passenger (cargo) capacity before forecasting the future growth of traffic volume. Then, the future number of total commercial vehicle registrations is calculated based on the estimated traffic-volume demand. Finally, the fuel consumption and GHG emissions of commercial vehicles are calculated in accordance with assumptions regarding the fuel economy and GHG emission factors of new vehicles.

3.2.1.4 Basic Assumptions of the Model

Table 3.2 presents the basic macro assumptions adopted in this study, including total GDP, population, and urbanization rate.

3.2.2 Vehicle Population Forecast Model

The vehicle population forecast model comprises three sub-models: private passenger vehicle population model, public traffic vehicle population model, and other vehicle population model. Among these, the passenger vehicle population model links the vehicle population and residents’ income distribution to forecast the growth of the private passenger vehicle population. The public traffic vehicle population model links the vehicle population, human population, and urbanization rate to forecast the growth of the vehicle population of urban public buses and taxis. The other vehicle population model links vehicle population growth and GDP growth to forecast the population of all other vehicles, including passenger vehicles for public affairs, other buses, and trucks.

3.2.2.1 Private Passenger Vehicle Population Model

3.2.2.1.1 Model

For private passenger vehicles, the main driving factor of population growth is increasing residents’ income level. This study investigates the relationship between China’s household income and vehicle ownership according to the available historical data; it then analyzes the inherent laws and assumes vehicle ownership under the condition of increasing household income; and it forecasts the private passenger vehicle population through Eq. 3.1 according to residents’ income distribution:

where \( \mathrm{UP}{{\mathrm{V}}_i} \) signifies the urban private passenger vehicle population in year i, \( \mathrm{U}{{\mathrm{P}}_i} \) the urban population in year i, \( \mathrm{ULN}{{\mathrm{D}}_i}(x) \) the value of the urban household income distribution density function in year i corresponding to x, and \( \mathrm{UPV}{{\mathrm{O}}_i}(x) \) the average household’s vehicle population rate when the household income in year i equals x. It should be noted that Eq. 3.1 is for the urban private passenger vehicle population; the rural private passenger vehicle population is estimated by a similar method.

To estimate the private passenger vehicle population using Eq. 3.1, it is necessary to obtain the household income distribution function. Related domestic and foreign studies have adopted many functions for the household income distribution function; of these, the logarithmic normal distribution has been the most widely used, and it is expressed in Eq. 3.2. In this study, we employ the logarithmic normal distribution as the urban household disposable income distribution function.

The relationship between the two parameters μ and σ in Eq. 3.2 and average household income α and Gini coefficient G calculated using the household income distribution can be expressed by Eqs. 3.3 and 3.4 (Aitchison and Brown 1963).

3.2.2.1.2 Data and Scenario Assumption

The China Statistical Yearbook contains statistics for China’s urban and rural resident household income and vehicle population level. Figure 3.7 presents passenger vehicle ownership under different household income levels obtained from the yearbook. It is evident that vehicle ownership rises with increasing income level, and there is a significantly linear relationship between vehicle ownership and household income when annual household income exceeds RMB 50,000. Additionally, with the same household income level, private vehicle ownership in more recent years is higher than in earlier years. There may be three reasons for this. First, the price of vehicles has decreased annually (Huo and Wang 2011). Since 2003, the price of vehicles in China, especially of household passenger vehicles, has been falling, which means that even with the same income level, households have more recently had greater ability to purchase vehicles. The second reason is the demonstration effect of vehicle purchase. Since China’s vehicle ownership level is at present still very low, there is a strong demonstration effect for families with cars compared with families without cars. The final reason is higher income expectations. Since income levels in China have quickly increased over recent years, people have relatively high expectations regarding their future incomes, and this also stimulates vehicle purchases. It is also possible to see that the difference between the various years has decreased; for example, the curve for 2009 is not so different from that for 2008. This indicates that the results of falling vehicle prices, the demonstration effect, and residents’ income expectations are constantly diminishing. Thus, in our opinion, before vehicle ownership reaches the level of one vehicle per household, there will be a linear increase from the historical curve as household income changes. As the level of one vehicle per household approaches, vehicle ownership will decrease with increasing household income, and it will reach a state of saturation after the level of two vehicles per household is attained.

Following the above assumptions, Fig. 3.8 presents the vehicle population rate with higher average household disposable income. From this, it is evident that in 2010, when the average household disposable income reached RMB 276,000, the ownership level would have reached one vehicle per household; when the average household disposable income reaches RMB 1,520,000, the population level would rise to two vehicles per household, and thereafter it would not rise with increasing average household income level. In view of the fact that vehicle ownership under the same household income rises annually owing to the fall in vehicle prices, we assume that vehicle ownership after 2010 will be higher than in 2010 with same household income level.

The average urban household disposable income and Gini coefficient were calculated based on the statistics of urban residents’ income given in the China Statistical Yearbook; it was assumed that the annual growth rate in China’s average household disposable income every 10 years from the year 2010 to 2050 would be 8, 6.8, 4.7, and 3.4 % (in 2010 prices) and that the Gini coefficient would be reduced by 5 % every 10 years. Calculating the characteristic parameters of the logarithmic normal distribution in Eqs. 3.3 and 3.4, we obtain the future distribution of urban household disposable income in China as shown in Fig. 3.9.

3.2.2.2 Public Traffic Vehicle Population Model

3.2.2.2.1 Model

The public bus and taxi population is affected by such factors as human population, area, and a city’s economic development level; it is also closely related to a city’s transport planning. This study investigated the current public bus population of cities at prefecture level or above in China (National Bureau of Statistics of the People’s Republic of China 2010); we analyzed the inherent relationship between the public bus population and the city’s human population; we then made a forecast of China's future public bus population based on the conclusions concerning China’s future population and urbanization rate. The urban taxi and bus population is forecast using Eq. 3.5:

where \( \mathrm{UPT}{{\mathrm{V}}_i} \) signifies the urban public bus or taxi population in year i, \( \mathrm{U}{{\mathrm{P}}_{i,n }} \) the population of the city of category n in year i (1,000 persons), and \( \mathrm{V}{{\mathrm{D}}_{i,n }} \) the public bus or taxi density of the city of category n in year i (vehicles/1,000 persons).

3.2.2.2.2 Data and Scenario Assumption

Figure 3.10 shows the relationship between the population of selected cities at prefecture level and the number of taxis. From this, it is evident that the taxi population generally rises with increasing population; however, in cities with a lower human population, the taxi population is somewhat low. There may be two reasons for this. First, the urban taxi population is highly subject to related transport planning by local governments, and different local policies may result in large differences in the taxi population; thus, the urban taxi population is to a large extent affected by local factors. Second, motorcycle taxis are widely used in many cities as an alternative to regular taxis; thus, the taxi population does not necessarily reflect the size of a city.

From Fig. 3.10, it is evident that China’s cities can be divided into eight levels according to the residential population; a calculation of each level of taxi density is presented in Fig. 3.11. There, it can be seen that the taxi density is relatively high in a small city with a population of under one million residents; with increasing population, the taxi density first falls before rising. The main reason for a small city with a population of under one million people having a relatively high taxi population density is that these cities lack the large-scale public transport systems, such as subway and public buses, and the private passenger vehicle population is relatively low; thus, there is mostly a dependency on taxis for middle- and long-distance travel. Moreover, from a comparison of the data between 2003 and 2007, it can be seen that the taxi density in the same city does not change greatly with time under the same population scale. There may be two reasons for this. First, taxis are a relatively mature type of public transport. Second, since the energy consumption per traffic unit with urban taxis is higher than with buses, local governments implement policies to control the total taxi population.

Next, we analyzed urban public buses using the same method. Figure 3.12 shows the relationship between the human population and the number of public buses in China’s cities at prefecture level in 2007. From Fig. 3.12, it can be seen that the bus population generally rises with an increase in the number of city residents; however, there is divergence in the data distribution in the case of cities with smaller populations. The main reason for this is that the number of public buses is closely dependent on a city’s public bus system planning and thus is very much subject to local variation.

The results of our analysis are shown in Fig. 3.13 based on the data presented in Fig. 3.12 using the same method as that used for taxis. From this, it is evident that, unlike taxis, the number of transit buses in cities with over two million residents shows a dramatic leap; this indicates that the demand for public transport systems rises quickly with increasing city size. At the same time, when comparing data for 2003 and 2007, it can be seen that the public bus density for 2007 is significantly higher than for 2003 with the same urban population size. This indicates that China’s rapid development greatly supports the development of the public bus system and that the density of China’s public buses will increase further.

Our analysis indicates the relationship between the density of urban taxis and public buses and urban population size. Based on this, our research concludes that China’s urban taxi and public bus densities will continue to rise in the future.

As evident in Fig. 3.14, according to our analysis, there is no large potential for growth in the urban taxi density with a constant urban population size, so we conclude that taxis have a low growth rate. However, with public buses, we take the highest public bus density among the population-based city groups to be the average public bus density for 2050 since this city group reflects the largest development potential for public buses. Therefore, we can conclude that all cities with different population sizes have large growth potential for public buses.

Figure 3.15 shows China’s future population distribution in cities with different sizes; it assumes the rates for China’s future population growth and urbanization presented in Sect. 3.2. Based on the above assumptions, we can forecast China’s urban taxi and public bus population using Eq. 3.5 .

3.2.2.3 Other Vehicle Population Model

3.2.2.3.1 Model

For categories of vehicles other than private passenger vehicles, public buses, and taxis, we investigated the relationship between the population of passenger vehicles for public affairs, coaches (excluding public buses), and trucks and GDP growth. We propose an index of vehicle population growth elasticity; we then forecast the population of other categories of vehicles based on judging the vehicle population growth elasticity and future macroeconomic trends. In this sub-model, we forecast the population of passenger vehicles for public affairs, coaches, and trucks using Eq. 3.6:

where \( \mathrm{EU}{{\mathrm{V}}_{i,k }} \) signifies the population of the vehicles of category k in year i, \( \mathrm{GD}{{\mathrm{P}}_i} \) the GDP in year i, and \( {E_{i,k }} \) the elasticity coefficient of growth of vehicles of category k to GDP growth in year i.

3.2.2.3.2 Data and Scenario Setting

Figure 3.16 shows the relationship between the population of categories of vehicles and China’s total GDP for 2003–2008. From this, we can see that the population of all categories of vehicles increases as total GDP rises with different growth rates. Among these vehicles, passenger vehicles for public affairs present the fastest growth rate, followed by light and mini-passenger vehicles; other categories of vehicles have a relatively slow growth rate.

To forecast China’s future vehicle population using Eq. 3.6, we shall assume vehicle population growth elasticity.

In this study, we assume growth elasticity by considering the history of vehicle population growth in developed countries. Figure 3.17 shows the relationship between coach population growth and GDP growth in developed countries. It is evident in this figure that the coach population growth rate falls with a decreasing GDP growth: it is less than 5 % when the GDP growth rate is reduced to less than 6 %, and it may fluctuate within a certain range. The average growth rate of the coach population from 2005 to 2009 has been 7 %, and from the experience of developed countries, it may show a further increase with decreasing GDP growth rate.

Figure 3.18 shows the relationship between truck population growth and GDP growth in developed countries. It is evident that the truck population growth rate follows the same pattern as that for coaches. The average growth rate of the truck population from 2005 to 2009 has been 12 %; from the experience of developed countries, China’s future truck population will show a further increase with slower GDP growth rate. Generally speaking, China is currently in a period with the biggest population growth elasticity for both coaches and trucks. In the future, with a changing economic structure and saturated demand for passenger and cargo transportation, the population growth elasticity of both coaches and trucks will gradually reduce.

3.2.3 Vehicle Traffic-Volume Forecast Model

Vehicle traffic volume is mainly propelled by growing social demand for passenger and cargo transportation. This factor is reflected in the forecast for the vehicle population; accordingly, this study will make a forecast of the vehicle traffic volume using the forecast results for the vehicle population. Equation 3.7 is used to calculate China’s vehicle traffic volume:

where \( \mathrm{RT}{{\mathrm{S}}_i} \) signifies the vehicle traffic volume (passenger or cargo transportation) in year i (the passenger transportation’s traffic volume unit is in person kilometers, while the cargo transportation’s is in ton kilometers), \( \mathrm{V}{{\mathrm{P}}_{i,k }} \) the population of vehicles of category k in year i, \( \mathrm{KP}{{\mathrm{V}}_{i,k }} \) the mileage of each vehicle of category k in year i, and \( \mathrm{L}{{\mathrm{C}}_{i,k }} \) the average passenger capacity of each vehicle of category k in year i.

3.2.3.1 Annual Vehicle Mileage

Surveys relating to the mileage achieved by various categories of vehicles are mainly conducted by the related national departments and research institutions; the survey results may vary depending on the survey region and target groups. Table 3.3 summarizes the estimations of China’s annual vehicle mileage made by the main domestic research institutions. The Vehicle Emission Control Center of the State Environmental Protection Administration conducted a vehicle mileage survey on 20 Chinese cities in 2007. In that survey, the number of light buses exceeded 650,000 vehicles, and the survey showed that the annual average mileage for light buses in 2007 in China was 26,900 km. According to related studies, the annual mileage of urban sedans in China before 2005 was 24,000–27,000 km; among those vehicles, the annual mileage of taxis was 90,000–115,000 km and that of other categories of vehicles was 16,000–18,000 km. According to the national road transportation census in 2008 carried out by the Ministry of Transport, the annual mileage of heavy trucks was 65,000 km and that of light trucks was 25,000 km. These results may be higher than the average annual mileage of all trucks since the survey targets were all commuter vehicles. Compared with developed countries, China’s annual mileage for private passenger vehicles is relatively high, and this may gradually reduce with the country’s rapidly developing public traffic systems. The annual mileage for urban taxis mainly depends on daily working hours and average speeds; the annual mileage for urban buses and long-distance coaches largely depends on driving routes; the annual mileage of passenger vehicles for public affairs and trucks mainly depends on the purposes for which they are used, but the annual mileage for these vehicles does not in general change significantly. The present study intends to forecast the change in the future mileage of private passenger vehicles.

3.2.3.2 Forecast of Private Passenger Vehicle Mileage

Since there is a high population of private passenger vehicles and they have larger growth potential than other vehicles, the mileage of this category of vehicle is an important factor in terms of vehicle energy demand. The annual mileage of private passenger vehicles can be divided into short-distance and long-distance mileage according to purpose. The main purpose of urban short-distance travel is daily travel (such as commuting to work) and weekend suburban travel; this mileage is mainly affected by the development of public transport. Mileage in long-distance travel relates to intercity travel, and it is mainly affected by the development of long-distance coaches and high-speed railways. Driven by such economic factors as increasing oil prices and such policy factors as fuel taxes, the cost of using private passenger vehicles has increased with decreasing competitive power. In addition, China’s urban public transport and intercity high-speed railways will undergo rapid development and achieve speed and comfort levels comparable with those of private passenger vehicles; thus, public transport should take over some of the mileage from the latter category. It can be anticipated that the annual mileage of China’s private passenger vehicles will gradually undergo a reduction. The present study adopts a model based on residents’ travel to forecast the annual mileage for private passenger vehicles. The annual mileage for urban or rural private passenger vehicles can be expressed by Eq. 3.8:

where \( \mathrm{KPV} \) signifies the annual mileage of each private passenger vehicle, \( \mathrm{UTF} \) the urban travel frequency of car owners, \( \mathrm{UTD} \) the average distance traveled by car owners, \( \mathrm{US} \) the percentage of traveling by car owners in private passenger vehicles, \( \mathrm{ITF} \) the intercity travel frequency of car owners, \( \mathrm{ITD} \) the average intercity travel distance of car owners, and \( \mathrm{IS} \) the percentage of intercity traveling by car owners in private passenger vehicles.

According to the survey results on travel by the residents of some cities, the average number of trips made by urban residents on a travel day was two to three, while the equivalent figure for rural residents was 0.5. Considering that the average travel time for car owners is usually higher than that for non-car owners, the present study assumes the daily number of trips made by car-owning urban residents on a travel day to be four, while for rural car owners it is two. The average urban travel distance depends on several factors, such as city structure and size. We have made assumptions on the average travel distances in China’s large, medium-sized, and small cities and in rural areas for the year 2010 based on survey results on travel by the residents of some cities. We also assume that the average urban travel distance will increase with greater city size. Since the current public transport systems in China are unable to compete with private passenger vehicles in terms of speed and comfort, most car owners travel in their vehicles. However, with the development of high-quality public systems, such as subways, these can be expected to provide alternatives for the urban use of private passenger vehicles.

For intercity travel, we can make approximate estimates based on the use of commuter coaches. According to the China Statistical Yearbook, the country’s road passenger capacity by commuter coaches in 2009 was 27.8 billion person trips—about 20 trips per person—and the average distance traveled was 49 km. This figure mainly reflects the passenger transport conditions of intercity commuter coaches, and most of these passengers are people without cars. The present study assumes that residents with and without cars have the same intercity travel characteristics; the intercity travel frequency of Chinese people with cars in 2010 was 20 trips per year with an average distance traveled of 50 km. Table 3.4 shows the assumptions of the present study in detail.

The change in the percentage of people traveling by private passenger vehicles is the main reason for the change in the mileage of such vehicles. In this study, we provide reference scenarios and comprehensive substitution policy scenarios to reflect the different percentages of residents’ traveling by private passenger vehicles. Under the reference scenario, 98 % of travel by urban residents with cars in 2010 was by private passenger vehicles, and the equivalent figure for intercity travel was 90 %. By 2050, the proportion of residents with cars in large, medium-sized, and small cities traveling by private passenger vehicles will be reduced to 60, 60, and 80 %, respectively; the percentage of their intercity travel in such vehicles will be reduced to 50 %. Under the comprehensive substitution policy scenario, the percentage of intercity travel in private passenger vehicles by residents with cars is reduced at a rate 1.5-fold faster than under the reference scenario. The annual mileage of private passenger vehicles in large, medium-sized, and small cities and rural areas can be calculated using Eq. 3.8, and then the weighted average value of the annual mileage of private passenger vehicles can be determined based on the vehicle population.

3.2.3.3 Average Passenger (Cargo) Capacity of Vehicles

According to Eq. 3.7, the vehicle traffic volume is the product of the vehicle population, the average mileage of each vehicle, and the average passenger (cargo) capacity of each vehicle. Based on China’s historical vehicle traffic volume concluded from the China Statistical Yearbook, the average passenger (cargo) capacity of each vehicle can be deduced using Eq. 3.7. Since the passenger (cargo) capacity of each vehicle changes slowly, and the change in the average passenger (cargo) capacity of each vehicle and that of the vehicle population are linked to each other in terms of the use of commuter coaches, we assume there is no change.

3.3 Scenario Analysis

3.3.1 Scenario Definition

The reference scenarios and comprehensive policy scenarios employed in this section are the same as those in Chap. 12 for the vehicle energy development scenario. Chapter 12 presents the scenario definitions in detail, and the present section describes only the content related to vehicle population and vehicle traffic volume.

Reference scenarios form the basis for the comprehensive policy scenarios. Under the reference scenario, the vehicle population, increase, and mileage depend on the macroeconomic conditions and population and geographic factors; they include GDP growth rate, growth and structural change in the population, and urbanization rate. These factors vary with changes in macroeconomic conditions, population, and geographic factors without regard to restrictions of resources, the environment, security, fairness, and vehicle-use management policy.

Comprehensive policy scenarios are the target of reference scenarios. Under comprehensive policy scenarios, private passenger vehicles are subject to development of public transport and intercity transport systems; thus, the traffic volume of such vehicles becomes significantly reduced. With the rapid development of China’s high-speed railway network, the original low-speed railways will be used mainly for cargo transport. Railway cargo transport will compete with long-distance truck transport by virtue of the low transport costs and high reliability. Thus, the development of the railway cargo transport system will lead to a reduction in the cargo service volume of trucks.

3.3.2 Vehicle Population

Figure 3.19 shows the projected changes in China’s vehicle population.

The period from 2010 to 2020 is the one that displays the fastest growth in China’s vehicle population; China’s vehicle population may reach 270 million vehicles by 2020 at an average annual growth rate of 13 %. Among these, passenger vehicle will show the fastest growth rate: the figure will reach 240 million vehicles by 2020, accounting for 89.1 % of the total vehicle population. The population of coaches and trucks will amount to 3.28 and 26.27 million vehicles, respectively, by 2020, accounting for 1.2 and 9.7 % of the total population. The vehicle population growth rate will slow down over the period 2020–2030, and the total vehicle population will reach 440 million vehicles by 2030 at an average annual growth rate of 5 %. The passenger vehicle population will amount to 400 million vehicles by 2030, representing an increase to 91 % of the total vehicle population. The population of coaches and trucks will become 4.03 and 36.74 million vehicles, respectively, accounting for 0.9 and 8.3 % of the total population. The vehicle population growth rate will further diminish over the period 2030–2050. By 2050, the total vehicle population may attain 588 million vehicles—an approximately 7.4-fold increase over the figure for 2010; this would comprise 550 million passenger vehicles, 4.1 million coaches, and 36.8 million trucks.

According to the assumptions of this study relating to vehicle population forecasts and population growth, as shown in Fig. 3.20 (Davis et al. 2010), the vehicle population per 1,000 persons in China by the years 2020, 2030, and 2050 will amount to 189, 300, and 403 vehicles, respectively—equivalent to the levels for the United States in 1926, 1949, and 1959. Therefore, we can conclude that China’s vehicle population rate will contain to maintain a large gap relative to that of developed countries owing to limitations of resources, the environment, and other factors in addition to the large population base.

Figure 3.21 shows a comparison of forecast results for China’s vehicle population as determined in domestic and foreign studies. From that figure, it is evident that the forecast value predicted by the present study for 2020 is lower than that of UC Davis, though it is higher than the value found by other studies. The various studies are significantly different in their forecast values for 2030; among them, the present study reported the highest value. This study’s forecast for 2050 is equivalent to that of the US Argonne National Laboratory and the 2050 China Energy and Carbon Emission Research Group. Since each investigation has its own particular forecast method and basic data, we need to compare the forecast results according to the methods employed and the basic assumptions. Generally speaking, the forecast results of earlier studies are lower because of their relatively conservative estimates with regard to China’s vehicle output and sales volume and population growth rate. Using more up-to-date data, later studies are better able to reflect the high-speed growth of China’s vehicle population in recent years, and they thus derive higher forecast values.

It should be noted that the UC Davis study adopted forecast results based on the average growth rate of seven countries; the study by the 2050 CEACER (China Energy and CO2 Emissions Report) group adopted forecast results using vehicle population figures from a basic scenario; the IEA study adopted forecast results using vehicle population figures from a reference scenario; the Argonne National Laboratory study adopted forecast results using a scenario with a saturated vehicle population. It should also be stated that the forecast results regarding vehicle population provided by the present study are closely related to a specific scenario assumption; thus, the forecast values will change with changes in the scenario assumption.

Figure 3.22 indicates the influence of changes in household income on the private vehicle population under the scenario assumption. From this figure, it is evident that the forecast results on the private passenger vehicle population up to the year 2020 change by ±15 % when China’s household income changes by ±20 %. With time, the change in household income will have an increasingly weaker influence on the forecast results for the private passenger vehicle population: by 2050, with a household income change within the range of ±15 %, the forecast results on private passenger vehicle population will change by only ±5 %. Since there is uncertainty with respect to the growth of China’s vehicle population, the forecast results of the present study reflect the influence of various factors on vehicle population.

3.3.3 Traffic Volume of Vehicle Passenger Transport

Figure 3.23 presents the change in China’s traffic volume of vehicle passenger transport under reference scenarios. The period from 2010 to 2020 is that with the fastest growth in the traffic volume of passenger transport. The traffic volume of vehicle passenger transport will rise to 9,914 billion person km by 2020—a rise from 4,310 billion person km in 2010; among that volume, passenger vehicles will account for 5,322 billion person km by 2020, accounting for 53.7 % of the total traffic volume. From 2020 to 2030, the growth rate in the traffic volume of passenger vehicle transport will slow down: it will reach 13,605 billion person km by 2030, of which 47.4 % of the traffic volume will be accounted for by passenger vehicles and 52.6 % by buses. From 2030 to 2050, the growth rate in the traffic volume of passenger vehicle transport will slow down further: it will reach 15,096 billion person km by 2050, of which 42.8 % of the traffic volume will be accounted for by passenger vehicles and 57.2 % by buses. The percentage of passenger vehicles in the traffic volume will show an increase from 2010 to 2050, reflecting the scenario assumption of a rapidly increasing passenger vehicle population.

Figure 3.24 shows the change in China’s traffic volume of vehicle passenger transport under comprehensive policy scenarios. Compared with the reference scenarios, the growth rate in traffic volume under comprehensive policy scenarios is relatively low. The traffic volume of passenger vehicle transport will reach 8,995; 12,224; and 14,053 billion person km by year 2020, 2030, and 2050, respectively; this is equivalent to 90.7, 89.9, and 93.1 % of the volume under the reference scenarios during the same periods. The decrease results from the traffic volume of passenger vehicles, which will reach 3,673; 5,067; and 5,425 billion person km by 2020, 2030, and 2050, respectively; this is equivalent to 80.0, 78.6, and 83.9 % of the volume under the reference scenarios during the same periods.

From a comparison of the traffic volume of passenger vehicle transport under the reference and comprehensive policy scenarios, it is evident that if vehicle population growth is to be maintained, the traffic volume—especially the traffic volume of private passenger vehicles—will have to undergo a significant reduction. The decrease in the traffic volume for passenger vehicle transport will be mainly compensated by urban mass transit, based on the subway; this will result in reduced average travel times and distances with private passenger vehicles.

3.3.4 Traffic Volume of Vehicle Cargo Transport

Figure 3.25 shows China’s traffic volume for cargo vehicle transport under reference and comprehensive policy scenarios. Under reference scenarios, the traffic volume of cargo vehicle transport shows a rapidly rising trend: it will reach 9,077 billion ton km, 14,765 billion ton km, and 19,924 billion ton km by 2020, 2030, and 2050, respectively.

Under comprehensive policy scenarios, the traffic volume of cargo vehicle transport will basically become saturated after 2040. It will amount to 87,420; 13,526; and 16,571 billion ton km by 2020, 2030, and 2050, respectively; this is equivalent to 96.3, 91.6, and 83.2 % of the same periods under reference scenarios.

From a comparison of the traffic volume for vehicle cargo transport under reference and comprehensive policy scenarios, the traffic volume of cargo vehicle transport will also undergo a large reduction. The decrease in the traffic volume of cargo vehicle transport will be mainly compensated by the traffic volume of railway cargo transport.

3.4 Conclusions

-

1.

The growth in China’s vehicle population and traffic volume is subject to various complex factors, including macroeconomic development, urbanization, population change, fluctuations in vehicle prices, and traffic policy. With a gradually rising income level of the population, increasing demand for passenger and cargo transport, and a national policy to stimulate the development of the auto industry, China’s vehicle population has undergone a rapid increase over the past 10 years. In coming decades, macroeconomic development will still be the internal motivating force for the growth of China’s vehicle population and traffic volume. However, in the meantime, the rapidly growing vehicle population and traffic volume will also put great pressure on China’s urban traffic and energy supply in addition to other aspects. Some cities, such as Beijing and Shanghai, have adopted administrative measures to control the vehicle population in an effort to relieve the pressure from urban traffic. Such measures will exert an obvious impact on the growth of China’s vehicle population. On the whole, while maintaining current macroeconomic and national policy trends, China’s vehicle population will continue its rapid increase for quite some time in the future.

-

2.

According to the forecasts of the current study, China’s vehicle population will amount to 270, 440, and 590 million vehicles by 2020, 2030, and 2050, respectively. Private passenger vehicles will be the main force for the growth of the total vehicle population: the private passenger vehicle population may reach 240, 400, and 550 million vehicles in 2020, 2030, and 2050, respectively; its proportion of the total population will increase in the future. In addition, China’s bus and truck population will also undergo a major increase. The bus population will amount to 3.28, 4.03, and 4.1 million vehicles by 2020, 2030, and 2050; the truck population will reach 26.27, 36.74, and 36.8 million vehicles by 2020, 2030, and 2050. Though China’s vehicle population will rise rapidly in the future—influenced by population, resource, environmental, and other factors—China’s vehicle population level will remain far behind that of developed countries in Europe and the United States; it will therefore be difficult for China to attain the current vehicle population level in those countries.

-

3.

In accordance with the rapidly growing vehicle population, China's vehicle traffic volume will also undergo rapid growth. Under reference scenarios, the traffic volume for passenger vehicle transport will reach 9,914, 13,605, and 15,096 billion person km by 2020, 2030, and 2050, respectively; under comprehensive policy scenarios, the values will amount to 8,995; 12,224; and 14,053 billion person km, respectively. Under reference scenarios, the traffic volume for cargo vehicle transport will reach 9,077; 14,765; and 19,924 billion ton km by 2020, 2030, and 2050, respectively; under comprehensive policy scenarios, the values will amount to 8,742; 13,526; and 16,571 billion ton km, respectively. Rapid growth in the vehicle traffic volume signifies rapid growth in vehicle energy demands and increasing emissions of GHGs and general contaminants. Therefore, it is necessary to reduce unit consumption and introduce low-carbon alternative fuels to cope with such challenges.

-

4.

Compared with reference scenarios, China’s vehicle population under comprehensive policy scenarios shows no change. The reason for this is that one of the basic principles of comprehensive policy scenarios is to protect rapid development of the domestic auto industry to maintain the stimulating effect of that industry on the national economy; however, under comprehensive policy scenarios, the growth of the vehicle population is supposed to be the same as under reference scenarios. However, in terms of vehicle traffic volume, the population under comprehensive policy scenarios is lower than under reference scenarios. Under reference scenarios, the traffic volume of passenger vehicles and cargo transport by 2050 will be 3.5- and 5.2-fold higher, respectively, than in 2010, and there will be a 3.3- and 4.3-fold respective increase in the traffic volume of passenger vehicles and cargo transport. The reason for the vehicle traffic volume under comprehensive policy scenarios being lower than under reference scenarios is that the demand for vehicle traffic volume is supposed to be diminished by reduced vehicle use through traffic-management measures, such as policies, regulations, and alternative modes of transport. The decreased vehicle traffic volume is transferred to other transport modes through various methods, for example, urban traveling by bus instead of by private passenger vehicles, intercity travel by rail instead of by private passenger vehicle, and long-distance cargo transport by truck being transferred to rail. By transferring the traffic volume from private passenger vehicle traffic, with relatively high energy consumption, to public transport and rail traffic, with relatively low energy consumption, it should be possible to greatly conserve energy and reduce emissions.

-

5.

From a comparison of reference and comprehensive policy scenarios, we can conclude that traffic-demand management is an important measure for reducing vehicle traffic volume, thereby reducing vehicle energy demand and carbon emissions. To ensure a normal increase in the vehicle population, the vehicle traffic volume can be radically decreased using various traffic-management measures. Such measures may include the following: limiting the use of private passenger vehicles, increasing the use of public transport, promoting the development of urban and intercity high-speed rail systems as alternatives for travel by passenger vehicles, and developing rail cargo transport, especially long-distance rail cargo transport, as an alternative to long-distance truck transport.

References

Aitchison J, Brown JAC (1963) The lognormal distribution. Cambridge University Press, Cambridge

Australian Bureau of Statistics (2009) Motor vehicle census 2009. Australian Bureau of Statistics, Canberra

China Academy of Transportation Sciences (2009) Investigation of vehicle travel of operating vehicles. Presentation on the Energy Foundation conference, Beijing

China Association of Automotive Manufactures (2011) China automotive industry yearbook 2011. China Automotive Industry Yearbook Press, Beijing

China Energy and Carbon Emission Research Group (2009) 2050 China energy and carbon emission report. Science Press, Beijing

Dargay J, Gately D, Sommer M (2007) Vehicle population and income growth, worldwide: 1960–2030. Energy J 28(4):143–170

Davis SC, Diegel SW, Boundy RG (2010) Transportation energy data book, 29th edn. Oak Ridge National Laboratory, Oak Ridge

Heston A, Summers R, Aten B (2009) Penn world table version 6.3. Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania, Philadelphia

Huo H, Wang M (2011) Modeling future vehicle sales and stock in China. Energy Policy 43(4):17–29

Huo H et al (2007) Projection of China’s motor vehicle growth, oil demand, and CO2 emissions through 2050. Transportation Res Rec 2038:69–77

International Energy Agency (2007) World energy outlook 2007. IEA, Paris

Japan Automobile Manufacturers Association (2009) Motor vehicle statistics of Japan 2009. Japan Automobile Manufacturers Association, Inc., Tokyo

Lin Xiuli et al (2009) China’s motor vehicle mileage distribution rule. Environ Sci Res 22(3):377–380

Ministry of Transport of the People’s Republic of China (2008) Compilation of national highway and waterway transportation volume special survey data. China Economic Publishing House, Beijing

National Bureau of Statistics of the People’s Republic of China (2010) China city statistics yearbook 2010. China Statistics Press, Beijing

National Bureau of Statistics of the People’s Republic of China (2011) China city statistics yearbook 2011. China Statistics Press, Beijing

National Development and Reform Commission (2004) China energy comprehensive development strategy and policy research. http://www.efchina.org/CSEPCN/FReports.do. Accessed 17 Jan 2013

North American Transportation Statistics (2010) Transportation vehicle. http://nats.sct.gob.mx. Accessed 17 Jan 2013

Shen Zhongyuan (2006) Forecasting China’s vehicle population by income distribution curve. Environ Sci Res 28(8):11–15

Wang Y, Teter J, Sperling D (2011) China’s soaring vehicle population: even greater than forecasted? Energy Policy 39(6):3296–3306

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Hewu, W., Han, H., Minggao, O. (2013). Scenario Analyses of China’s Vehicle Ownership and Vehicle Traffic Services. In: Sustainable Automotive Energy System in China. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-36847-9_3

Download citation

DOI: https://doi.org/10.1007/978-3-642-36847-9_3

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-36846-2

Online ISBN: 978-3-642-36847-9

eBook Packages: EnergyEnergy (R0)