Abstract

Unequal outcomes resulting from urbanization can pose a significant challenge to sustainable development. Vehicles are an important urbanization dimension as a critical component of urban infrastructure by providing mobility and accessibility to social services. China’s vehicle ownership (referred to as in-use vehicle stocks) has been growing quickly since 2000, but its per capita stocks are still much lower than that in developed economies. This raises the question of whether and when China’s vehicle stocks will reach a peak level close to that in the developed countries. By analyzing vehicle stocks in 283 Chinese cities during 2001–2018, we have the following findings: (1) vehicle stocks are predominantly distributed in northern and eastern coastal cities and provincial capital cities; (2) inequality in vehicle ownership rates between cities shows a declining trend at both national and region scales; (3) the growth of vehicle ownership rates follows an S-shape curve and most cities are still at the early stage of motorization; (4) China is likely to have a lower saturation level of vehicle ownership rate. These results could help to accurately forecast future vehicle demand in China, estimate the resulting environmental impacts, and explore strategies to achieve carbon neutrality in transportation.

Similar content being viewed by others

Introduction

Urbanization has the potential to advance global sustainable development, but this will require addressing multiple sustainability challenges, especially the issue of inequality (Seto et al. 2017; United Nations Department of Economic, 2020). High levels of inequality can have negative impacts on economic productivity, social capital, and the distribution of environmental burdens, as well as exacerbate the impacts of economic, social, and environmental shocks. Current academic and policy discussions often focus on addressing urban inequality (Boyce, 1994; Diffenbaugh and Burke, 2019; Hamann et al. 2018). However, much of this research has been limited to examining economic (income and wealth) inequalities, which may not provide a comprehensive understanding of inequality and its relationship to urbanization. Therefore, there is a need for more research that explores a broader range of inequality indicators and their links to urbanization, to inform more effective policies and interventions to promote sustainable development.

Urbanization in China has been one of the most significant social and economic phenomena of the past few decades. Since the 1980s, China has experienced rapid urbanization, with the urban population growing from 191 million in 1980 to over 914 million in 2021 (National Bureau of Statistics of China, 2023a). China’s rapid urbanization has substantially boosted the accumulation of manufactured capital, which includes all physical assets created and perpetually renewed by society (Weisz et al. 2015). Transportation equipment is a significant part of the manufactured capital. China’s vehicle ownership, also referred to as in-use vehicle stocks in this study, has borne witness to the progression of urbanization. China’s vehicle sales market surpassed that of the United States in 2009, making it the largest vehicle sales market globally (Zhang et al. 2017). By the end of 2020, vehicle stocks in China were up to 273 million units, making it the country with the largest number of vehicles worldwide (National Bureau of Statistics of China, 2021). The substantial expansion of vehicle stocks in recent years has had significant impacts on energy consumption and carbon emissions in China (Bu et al. 2021). Gaining a comprehensive understanding of the historical growth patterns of vehicle ownership can help us forecast the future development trends of vehicle stocks, estimate the deployment potential of new energy vehicles, and assess environmental impacts, such as energy use (Hofmann et al. 2016; Huo et al. 2007), carbon emissions (Chen et al. 2022; Gan et al. 2019; Pauliuk et al. 2012), and critical metals demand (Hao et al. 2019; Li et al. 2021; Xun et al. 2020).

Considering China’s unbalance in regional economic development and urbanization process (Lu et al. 2019), a similar disparity can also be expected from vehicle ownership. Most current city-level studies focus on the relationship between different socioeconomic determinants with vehicle ownership. For instance, Li et al. (2010) analyzed the impacts of urban form and socioeconomic indicators on car ownership across 36 Chinese megacities in 2006. The results showed that city affluence, city scale, and road supply factors have significant positive effects on car ownership. Cao and Huang (2013) explored the relationship between private vehicle ownership and indicators such as per capita GDP (Gross Domestic Product), built-up area, population density, and per capita area of roadway network. They found that the most important determinants of car ownership are GDP per capita and income per capita. Similarly, Wu et al. (2016) examined the determinants of private vehicle ownership in China’s 32 provincial capital cities during 2001–2011. They found that the economic variables could significantly affect the growth of private vehicles. Yang et al. (2017) quantified the explanatory value of different urban characteristics on private vehicle ownership. Based on fixed effects models, their results demonstrated that vehicle ownership is determined by both socioeconomic indicators (such as income per capita) and urban physical environment factors (such as built-up area, road area per capita, and population density). Current city-level studies have important policy implications for managing vehicle ownership (the summary of these studies can be found in Table S1 of the Supporting Information).

Socioeconomic metabolism, a key concept in industrial ecology, encompasses the self-replicating and evolving biophysical structures that underpin human society, including the transformation, distribution, and flow of biophysical materials controlled by humans to satisfy their needs (Fischer‐Kowalski, 2008; Pauliuk et al. 2015). Central to this concept are the “in-use stocks”, which are tangible manufactured assets actively utilized within an economy, such as vehicles, buildings, roads, and household appliances (Pauliuk and Hertwich, 2015; Pauliuk and Müller, 2014). In-use stocks play a pivotal role in socioeconomic metabolism by driving anthropogenic material cycles and linking these cycles to the manufactured capital and services that society demands (Chen and Graedel, 2015). They constitute the biophysical foundation of human society, as they represent the manufactured products that are currently in active use (Pauliuk and Hertwich, 2015).

The importance of in-use stocks is particularly evident in the transportation sector, where vehicle stocks provide essential services for daily work and life. Assessing in-use vehicle stocks is critical for estimating the stocks and flows of materials associated with vehicles, thereby enabling a better understanding of the environmental implications of emission mitigation and sustainable development strategies (Pauliuk and Müller, 2014). Furthermore, examining the spatiotemporal trends of vehicle ownership rates offers insight into the dynamics of regional or urban inequality throughout the urbanization process, highlighting the significance of in-use stocks in reflecting socioeconomic patterns and informing policy decisions.

In summary, existing city-level studies predominantly investigate determinants of vehicle stocks from a statistical perspective. These studies could provide insights for policymakers to manage private vehicle ownership. However, such studies frequently overlook the temporal evolution and spatial disparities in vehicle ownership. This oversight presents a significant gap, as the characterization of growth features, including the magnitude and velocity of vehicle stock accumulation, as well as regional variances, is critical for informed projections of future demand. Against this background, our study conducts a comprehensive and long-term series (2001–2018) of research on vehicle ownership in 283 Chinese prefecture-level cities. This approach lays a robust empirical groundwork, crucial for enhancing the precision of future vehicle stock forecasts, assessing potential environmental ramifications, and informing strategies for sustainable urbanization.

Materials and Methods

Data collection

Data on country-level vehicle ownership and population are derived from United Nations Statistical Yearbook (United Nations Department of Economic-Social Affairs, n.d.), World Bank Open Data (World Bank, 2023), European ACEA Report - Vehicles in use, Europe (European Automobile Manufacturers’ Association, 2023), World vehicles in use (International Organization of Motor Vehicle Manufacturers, 2020), and national statistical offices of each country (National Bureau of Statistics of China, 2023b; Statistics Bureau of Japan, 2023; U.S. Department of Transportation-Federal Highway Administration, 2022; UK Department for Transport, 2023). Vehicles in China include three categories: passenger vehicles (large, medium, small, and mini types), trucks (heavy, medium, light, and mini types), and low-speed vehicles. Details of the vehicle classification criteria can be found in Hao et al. (2011).

In this paper, vehicle ownership is defined as the number of vehicles registered for use with the local traffic administration bureau. This registration indicates that the vehicles are in the use stage, and thus, the term vehicle ownership is synonymous with the number of in-use vehicle stocks within our analysis. Given the regulatory framework in China, which mandates that vehicles must be registered shortly after purchase, we posit that the number of registered vehicles is a reasonable approximation of the vehicle stocks for the purposes of this study. It is important to note that when we refer to “vehicle stocks” within this paper, we are specifically discussing in-use vehicle stocks, unless indicated otherwise. This means that our analysis does not consider vehicles that are not actively in use, also known as hibernating stocks. Due to the scope of the data available to us, our analysis encompasses the total number of registered in-use vehicles, incorporating both privately owned vehicles and those used for commercial purposes.

At the city level, due to the data paucity, we have derived vehicle ownership, population, GDP, and urbanization rate of 283 prefecture-level cities (including 4 municipalities like Beijing, Shanghai, Tianjin, and Chongqing) between 2000 and 2018 (Fig. 1). Data on vehicle ownership, population, GDP, and urbanization rate are collected from the national, provincial, and city-level bureau of statistics. GDP is the real GDP at 2000 constant price. Population is the resident population. Urbanization rate is the proportion of urban population to the total population. Urban population refers to the population living in the urban areas of prefecture-level cities. Overall, our city-level data accounts for 93% of the national population, 96% of national vehicle ownership, and 97% of national GDP in 2018. The details of city-level data are listed in Table 1.

In China, the prefecture-level cities serve as administrative units, which rank below that of provinces–the highest non-national level administrative unit. Prefecture-level cities typically include several districts and counties, which are classified as urban and rural according to their economic development level and demographic character (Liu et al. 2019; Zund and Bettencourt, 2019). Although this definition does not precisely correspond to the concept of a functional urban area as it is understood in the West, it is nonetheless a practical and standardized unit for analysis, particularly given that the most detailed and official Chinese statistical data are frequently compiled on this administrative level (Bettencourt et al. 2007; Li et al. 2023; Zund and Bettencourt, 2019). This underscores the distinct urban categorization between China and Western regions and the necessity for methodological adjustments in research to accommodate the specificities of Chinese data availability.

As Fig. 1 shows, China has been divided into 8 regions (North Coast region, Northeast region, East Coast region, Middle Yellow River region, South Coast region, Northwest region, Southwest region, and Middle Yangtze River region). Cities in the same region generally have similar economic development patterns and geographical features (Yang et al. 2022a). During the urbanization process, urban agglomerations have the largest economic development potential and the largest attractiveness to the floating population. To promote economic development, the central government approved the development of seven urban agglomerations in 2018 (Wang et al. 2023). Typically, Beijing-Tianjin-Hebei, Yangtze River Delta, Pearl River Delta, and Chengdu–Chongqing urban agglomerations have experienced rapid aggregation of the population in the central cities and rapid industrial development over the past few decades (Li et al. 2022). Therefore, vehicle ownership in these four major urban agglomerations is further analyzed.

Inequality analysis

We employed the Theil index and its decomposition formula to measure the inequality in vehicle ownership rates in Chinese cities according to previous studies (Clarke-Sather et al. 2011; Xu, 2020). The Theil index indicates the degree of regional inequality in vehicle ownership rate. The growth of the Theil index represents an increase in vehicle ownership rate inequality. At the national level, the Theil index of vehicle ownership rate can be expressed as Eq. (1).

N is the number of cities, vj is the proportion of the number of vehicles in the city j to the total vehicle number, and pj is the proportion of the population of the city j to the total population. Equation (1) could be also expressed as Eq. (2).

Ni is the number of cities in region i, Vij is the number of vehicles in city j in region i, Vi is the number of vehicles in region i, and V is the number of vehicles in all cities. Pij is the population of city j in Region I, and P is the population of all cities.

The disparity between cities in the region i (Ti) could be expressed as Eq. (3). In the equation, Pi is the population of region i.

The Theil index can be further divided into disparity within regions (TWR) and disparity between regions (TBR) as Eq. (4) shows.

In this equation, \({T}_{{WR}}={\sum }_{i=1}^{8}(\frac{{V}_{i}}{V}){T}_{i}\) and \({T}_{{BR}}={\sum }_{i=1}^{8}(\frac{{V}_{i}}{V}){\mathrm{ln}}(\frac{{V}_{i}/V}{{P}_{i}/P})\).

Vehicle ownership rate growth pattern identification

In this study, we use the level, speed, and acceleration of vehicle ownership rates to characterize the evolution pattern of the vehicle ownership rate in China. The level is the vehicle ownership rate in a city in a certain year. The speed is the change in vehicle ownership rate between two consecutive years. The acceleration is the change in speed between two consecutive years. The ARIMA (Autoregressive Integrated Moving Average) method (Cao et al. 2017; Fishman et al. 2016) is used to identify the growth patterns of vehicle ownership rates. Accordingly, the growth patterns of vehicle ownership rates in different cities can be classified into 4 types:

Type-A: The acceleration is stationary around zero, and thus the speed of stock growth is stationary and the level of the stock shows a linear growth trend.

Type-B: The acceleration is stationary with a positive value, so the speed of stock accumulation increases linearly, and the level of stock approximates parabolic shape growth.

Type-C: The acceleration has an increasing trend throughout time, which results in the speed and level of stock accumulation increasing rapidly.

Type-D: The acceleration exhibits a decreasing trend (from positive to negative), which makes the speed entering a period of increasing, stable, and decreasing.

Correlation analysis

To understand what causes the disparities in vehicle ownership rate, we conduct a correlation analysis. In this paper, Pearson correlation analysis is used to measure the relationship between the vehicle ownership rate and GDP per capita, as well as urbanization rate (Buehler and Pucher, 2011; Ivanova et al. 2018; Law et al. 2015). Pearson correlation analysis is often used to quantify the relationship between two variables. The value of the Pearson correlation coefficient ranges from −1 to 1. A correlation coefficient of 1 means that the two variables are perfectly related in a positive manner. If the correlation coefficient is −1, the two variables are perfectly related in a negative manner. A correlation coefficient of 0 indicates that there is no linear relationship between two variables (Gogtay and Thatte, 2017). The calculation of correlation coefficients is based on R. The relationship between vehicle ownership rate and GDP per capita, as well as the relationship between vehicle ownership rate and urbanization rate, are quantified respectively. The results of correlation analysis could provide insights to identify cities that are likely to experience a rapid growth in vehicle ownership rate in the future.

Results

A rapid increase in vehicle ownership

Widespread urbanization in China has led to a rapid boost in the size of the vehicle stocks. Since 2000, China’s vehicle stocks have increased with an annual average growth rate of 15% and soared to 273 million units in 2020, thus China surpassed the United States to become the world’s largest vehicle holder for the first time (Fig. 2a). However, on the per capita basis, China’s vehicle ownership is still significantly lower than that of developed countries. Specifically, in 2020, the vehicle ownership rate (vehicle ownership/capita) in China was only 0.19, whereas, in developed countries such as the U.S., it was as high as 0.83, and even South Korea had reached 0.47 (Fig. 2b). Comparatively, China is still at the initial stage of motorization, which means a steady growth in vehicle stocks is foreseeable in the future.

a Vehicle stocks in different countries, b Vehicle ownership rates in different countries, c Vehicle stocks in different regions of China, d Annual growth rate of vehicle stocks in different regions of China, e The proportion of vehicle stocks in four urban agglomerations in the country, f Vehicle ownership rates in four urban agglomerations.

The vehicle stocks are unevenly distributed across different regions in China (Fig. 2c). At the regional level, the North Coast region has the largest vehicle stocks. In 2018, the North Coast region had more than 45.8 million vehicles, followed by the East Coast region (37.3 million), the Middle Yellow River region (30.9 million), and the Middle Yangtze River region (29.0 million). The Northwest region had the lowest vehicle stocks of 6.9 million units. The annual growth rates of vehicle stocks in different regions varied widely, but they both showed a decreasing trend around 2009 (Fig. 2d). In 2018, the Middle Yangtze River region had the largest vehicle stock growth rate at 15.1%. In comparison, the Northwest region’s growth rate was 8.4%. The growth rate of the whole country decreased to 11.3% by 2018.

At the city level, there is a huge diversity in the vehicle ownership. Four major urban agglomerations, (i.e., Yangtze River Delta, Beijing-Tianjin-Hebei, Pearl River Delta, and Chengdu-Chongqing urban agglomerations), where rapid urbanization is taking place, had about 40% of the national vehicle stocks (Fig. 2e). In 2018, the Yangtze River Delta had the largest vehicle stocks of 37.6 million, while the Chengdu-Chongqing agglomeration had the smallest stocks of only 14.0 million. During 2001–2018, vehicle ownership rates in the Yangtze River Delta, Beijing-Tianjin-Hebei, and Pearl River Delta urban agglomerations were higher than the national level, while the gap between Chengdu-Chongqing urban agglomeration and the national level was expanding (Fig. 2f). In 2018, the Beijing-Tianjin-Hebei had the highest vehicle ownership rate, followed by the Yangtze River Delta, the Pearl River Delta, and Chengdu-Chongqing urban agglomeration. In 2018, the top 5 cities with the highest vehicle stocks were Beijing, Chengdu, Chongqing, Shanghai, and Suzhou (Fig. S1). Beijing had the highest vehicle stocks of 5.7 million units in 2018, while Ezhou (in Hubei province) had the lowest stocks of 68.1 thousand units. Vehicle stocks in all cities have been increasing from 2001 to 2018 (Fig. S2). However, an obvious slowdown in the increase of vehicle stocks can be observed in megacities like Beijing, Guangzhou, Tianjin, Hangzhou, and Shenzhen due to the strict regulations on registration of new car plates issued by local governments.

Spatial inequalities in vehicle ownership rates

From the per capita perspective, the vehicle ownership rates have experienced a substantial expansion and are widely, but unevenly distributed across mainland China. The rapid spatial expansion in vehicle ownership rates reflects remarkable economic progress and growing service demand from societies. It shows clearly on the map that there is a big gap between the eastern and western regions (Fig. 3a–c). Besides, coastal cities and provincial capitals have more vehicles than other cities on a per capita basis (Figs. 3c and S3). For example, in 2001, Beijing had the highest vehicle ownership rate, followed by Karamay, Urumqi, and Zhuhai. By 2010, the rapid urbanization and industrialization in coastal regions (such as Shenzhen, Dongying, and Ningbo) and provincial capitals in the mainland (such as Taiyuan, Lhasa, and Zhengzhou) stimulated urban motorization, which resulted in the explosive growth of vehicle stocks in these cities. In 2018, we found the highest level of vehicle ownership rate in Hohhot (in Inner Mongolia Autonomous Region) with 0.343, followed by Jinhua (in Zhejiang province) with 0.336, Dongying (in Shandong province) with 0.320, and Urumqi (in Xinjiang Autonomous Region) with 0.319. We also found that cities in the Yangtze River Delta, Beijing-Tianjin-Hebei, and Pearl River Delta urban agglomerations generally had higher levels of vehicle ownership rates. Comparatively, the values of cities in Chengdu-Chongqing urban agglomerations were lower except for Chengdu. Figure 3d shows the development trend of vehicle ownership rates in different regions. In 2018, the East Coast region had the highest vehicle ownership rate, while the Mid-Yangtze River region had the lowest vehicle ownership rate. The gap between the two regions reached 0.095.

a Vehicle ownership per capita in 2001, b Vehicle ownership per capita in 2010, c Vehicle ownership per capita in 2018, d Vehicle ownership rates in different regions, e Dynamic changes in total inequality (T), inequality within regions (TWR), and inequality between regions (TBR), f Dynamic changes in inner-regional inequality.

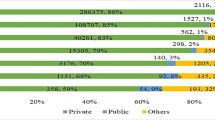

The inequalities in vehicle ownership rates showed a decreasing trend at both national and regional levels. At the national level, the Theil index increased from 0.28 in 2001 to 0.29 in 2003 but has since been on a downward trajectory (Fig. 3e). A similar trend is observed in intra-regional disparity (TWR). During 2001–2018, the inter-regional disparity (TBR) was substantially lower than TWR, indicating that differences between regions were much lower than those within regions. Furthermore, TBR experienced an uptick from 2001 to 2004 before entering a period of decline.

At the regional level, the Theil index of eight regions also displayed a decreasing trend in terms of vehicles per capita (Fig. 3f). In 2018, the North Coast region exhibited the lowest Theil index, signifying the most balanced distribution of vehicle ownership on a per capita basis. This region was closely followed by the Northeast and East Coast regions. In contrast, the Southwest, Northwest, and the Middle Yangtze River regions demonstrated greater disparities between cities. Many cities in these regions were still in the early stages of motorization. Their capital cities, however, possessed significantly more vehicles than their counterparts. Consequently, these regions experienced notably high disparities in the spatial distribution of vehicles.

Saturation occurs in vehicle ownership rates

Four distinct evolutionary stages of the vehicle ownership rate can be identified, which generally follows a logistic growth curve, often described as an S-shape curve (Fig. 4). Based on the various stages of motorization, cities can be categorized into four types:

-

Type-A: Cities in this category are at the initial stage of motorization. There are 56 Type-A cities and most of them are primarily located in the central and western regions of China. The average vehicle ownership rate in these cities was 0.10 in 2018.

-

Type-B: Representing the take-off stage of motorization, Type-B encompasses the majority of Chinese cities. In 2018, the average vehicle ownership rate in Type-B cities was 0.15.

-

Type-C: Cities in this category are in the accelerating stage of motorization. This type includes 22 cities, most of which are provincial capital cities or developed cities in coastal regions. The average vehicle ownership rate in these cities was 0.26 in 2018.

-

Type-D: Cities in this category have entered the slow-down stage, and most of them are located in eastern China. The average vehicle ownership rate in Type-D cities was 0.25 in 2018. As mentioned above, cities such as Beijing, Shenzhen, Guangzhou, and Tianjin have implemented strict purchase restriction regulations for vehicle plates (Table S2). Therefore, it is plausible that the saturation point of these cities could be very low. Their vehicle ownership rates range from around 0.15 to 0.30 (Fig. S4). Additionally, Type-D cities like Xiamen, Karamay, and Zhuhai also manifest a slow-down trend in vehicle ownership rates, despite the absence of vehicle purchase restriction policies (Fig. S3).

Compared with developed countries (Fig. 1b), Chinese cities enter the slow-down stage at a lower level of vehicle ownership rates. Thus, the saturation level of vehicle ownership rate in China is probably lower than that in developed countries. However, considering that most of the Chinese cities are still in the initial stage and take-off stage, the vehicle ownership rates in these cities are expected to continue growing, leading to a larger vehicle stock in the future.

Vehicle ownership rate is positively related to both GDP per capita and urbanization rate. The correlation analysis results show that the correlation coefficient between vehicle ownership rate and GDP per capita is 0.80. Generally, Type-C and Type-D cities have high GDP per capita, which translates to higher vehicle ownership rates (Fig. 5a). Comparatively, most Type-A and Type-B cities possess a GDP per capita of around 30000 CNY/cap, with lower vehicle ownership rates.

a GDP per capita vs vehicle ownership rate, b Urbanization rate vs vehicle ownership rate. The classification of city type here is the same as Fig. 4.

While cities may share similar GDP per capita, vehicle ownership rates can still show significant disparities, indicating that factors beyond economic output influence vehicle ownership. The correlation coefficient of 0.63 between vehicle ownership and urbanization rates reinforces this, as it suggests a trend that more urbanized cities generally have higher vehicle ownership rates.

As Fig. 5b shows, the urbanization rates for most Type-A and Type-B cities fall below 60%, whereas the rate for most Type-D cities exceeds 70%. Notably, even with high GDP per capita and urbanization rates, megacities such as Shenzhen, Shanghai, and Guangzhou exhibit lower vehicle ownership rates, which can be attributed to vehicle purchase restrictions. For instance, Shanghai, which implemented purchase restrictions in 1994, controls the number of license plates issued annually, resulting in a sluggish growth of vehicle ownership from 2001 to 2018 (Fig. S4). Consequently, Shanghai is categorized as a Type-B city. Our analysis underscores the complex relationship between a city’s motorization level and its development trajectory. Currently, most of the population is still living in underdeveloped cities. With the development of the economy and urbanization, vehicle ownership rates in these cities will keep growing in the near future.

Discussion

Spatial diversity highlights the inequality feature of urbanization

There is a large inequality in vehicle ownership rates between coastal cities and inland cities (Fig. 3a–c). Meanwhile, the inequality index shows a declining trend over 17 years at both national and regional levels (Fig. 3d–e). Vehicle ownership rates in coastal cities and provincial capital cities are generally much higher than in other cities. As Fig. 5 shows, the inequality in vehicle ownership rates could be partly attributed to the imbalance in GDP per capita and urbanization rates among cities (Dargay et al. 2007). The disparity in economic and urbanization development is generally considered to be due to historical and geographical factors. Since China’s reform and opening up, the coastal areas have benefited a lot from financial and policy incentives and developed rapidly (Xie and Zhou, 2014). Therefore, cities in the East Coast region and the North Coast region have a high level of vehicle ownership rates and the inner-regional inequality in these regions is relatively low.

To achieve balanced development and alleviate poverty, the central government implemented the “Develop-the-west strategy” in the 10th Five-Year Plan and the “Central-China-rising strategy” in the 11th Five-Year Plan (Song et al. 2020). These strategies have promoted the construction of infrastructure and the development of industrialization in the central and western regions. For instance, according to the “National Highway Network Planning” released by the central government, over half of the proposed new highways are slated for construction in the central and western regions of China (Hao et al. 2011). These strategic infrastructure projects have significantly stimulated economic growth and increased urbanization rates.

As mentioned above, GDP per capita and urbanization rate are positively correlated with the vehicle ownership rate. The decrease of inter and inner-regional inequality in vehicle ownership rates reconfirms the effect of balanced regional development strategies in China. However, the gap between cities still exists (Figs. 3c and 5), which means more policies are needed to realize coordinated development. It is also clear that cities with similar per capita GDP and urbanization rates may not necessarily have the same vehicle ownership rates, which means the disparities in vehicle ownership rates are affected by other development indicators. However, these data are currently not available at the prefectural level.

A wide disparity existed in total vehicle stocks at both regional and city scales. Regionally, vehicle stocks are mainly distributed in the North Coast region and the East Coast region. Comparatively, vehicle in-use stocks in the Northeast region and the Northwest region are much lower (Fig. 2c). At the city level, coastal cities (such as Guangzhou, Shenzhen, and Suzhou), municipalities (such as Shanghai, Beijing, and Chongqing), and inland provincial capital cities (such as Zhengzhou, and Taiyuan) have higher vehicle stocks than other cities (Fig. S1). During China’s rapid urbanization, there has been a significant migration flow from smaller cities to larger metropolitan areas, which is driven by the pursuit of enhanced employment prospects, superior healthcare services, and improved educational facilities (Li and Lu, 2021). This trend of population concentration in large cities has led to a marked increase in vehicle stocks, especially in more developed cities such as municipalities, provincial capitals, and coastal cities. Understanding the spatiotemporal distribution of total vehicle stocks is not only crucial for providing data support for strategic site selection and capacity planning of regional facilities managing end-of-life vehicles but also for projecting future trends in vehicle energy consumption and emissions output.

A lower saturation level implies more intensive development in China

Based on city-level data, we discover that the growth of vehicle ownership rate follows a logistic pattern (S-shape curve). It is worth noting that this result could not be observed on a national or provincial scale (Gan et al. 2019; Huo and Wang, 2012). Based on the S-shaped curve, cities can be classified into four stages of motorization. This classification can help to better estimate the growth trend of vehicle ownership rates and vehicle stocks in China. For example, we speculate that the cities in the central region will drive the vehicle stock accumulation in China, as they have a large population and most of them are in the take-off stage of motorization (Figs. 4 and S5). Fueled by economic development and the urbanization process, the vehicle stocks in these cities are expected to rapidly increase soon.

Based on our analysis of Type-D cities, China is likely to have a lower saturation level of vehicle ownership rate. The urban population density of Chinese cities is higher than that of Western cities (Chen et al. 2008; Xu et al. 2019). As evidenced by cities like Beijing, Guangzhou, and Tianjin, the high population density often leads to a scarcity of land resources needed for vehicles, such as roadway infrastructure and parking space (Gan et al. 2019). The rapid increase in vehicle stocks in large cities has led to serious traffic congestion and air pollution (Liu et al. 2020; Liu et al. 2019; Zheng et al. 2014). To solve these problems, various vehicle purchase restriction policies have been introduced by local governments (Table S2). Meanwhile, China has been dedicating itself to developing public transportation, including city buses, subways, and intercity high-speed railways (Mao et al. 2021). It has been proved that the fast and convenient public transportation system can significantly reduce the demand for vehicles (Dargay et al. 2007; Kowald et al. 2016; Ma et al. 2018; Yang et al. 2022b).

Although the growth of vehicle ownership could promote economic development and provide convenient travel services to residents, it also brings a series of environmental and social problems. For instance, China’s oil demand has experienced substantial growth over the past four decades due to the rapid increase in vehicle stocks. The consumption of oil fuels has contributed to energy security and greenhouse gas emissions. In 2018, it is estimated that carbon emissions from China’s transportation sector accounted for 9.2% of the total, which means transportation became one of China’s three main carbon emissions sectors (Qiu et al. 2022; Yu et al. 2021). Besides, air pollutants such as NOx (nitrogen oxides), PM2.5 (particulate matter with a diameter of no more than 2.5 μm), and O3 (ozone) emitted by fuel vehicles can damage human health and increase premature deaths (Fu et al. 2024).

The rapid growth of vehicle ownership has also led to a corresponding increase in end-of-life vehicles. Improper disposal of end-of-life vehicles can have catastrophic effects on the environment and public health. For example, toxic materials in discarded batteries (such as lithium, cobalt, lead, and electrolyte additives) might have harmful impacts on the natural environment and human health during transportation and mechanical disassembly stages (Bauer et al. 2022; Ren et al. 2023). On the other hand, traffic congestion has emerged as a severe issue in numerous Chinese cities, resulting in increased travel durations and escalated costs for both commuters and freight companies. The situation is compounded during traffic jams when vehicles emit exhaust gas at higher rates, which significantly worsens air pollution (Rahman et al. 2021). Given China’s vast population, maintaining a lower saturation point for vehicle ownership rate could yield considerable environmental and societal advantages by mitigating the negative impacts associated with the country’s motorization phase.

Vehicle purchase restriction policies could dampen vehicle ownership growth, but governments must also address residents’ increasing travel needs. In China’s large cities, car-sharing, ride-hailing, and taxis are playing an important role in urban passenger transport and becoming important supplements to the public transportation system (Hui et al. 2019; Tang et al. 2019). The insights gained from this study suggest that cities in the early stages of urbanization and industrialization, both in China and other developing nations, have the opportunity to pursue more sustainable transportation strategies as they progress through motorization. Implementing proactive planning and policy decisions from the outset can guide these cities towards a lower reliance on private vehicles, thereby supporting the attainment of Sustainable Development Goals within the transportation sector (Pauliuk et al. 2012; Winkler et al. 2023). For example, developing compact cities will promote the construction and operation of the public transportation system, thus the need and demand for private vehicles could be reduced (Bibri et al. 2020; Fu et al. 2024).

The database can serve as the foundation for analyzing energy consumption and material cycles

The projection of vehicle stocks could offer valuable information on urban mining (Zeng et al. 2020; Zhang et al. 2022), material demand (Aguilar Lopez et al. 2023; Billy and Müller, 2023; Xu et al. 2020), and energy consumption (Bu et al. 2021; Zheng et al. 2015) to governments and related industries. Currently, most studies on vehicle ownership projection in China focus on national and provincial scales. For example, Hao et al. (2011) estimated that China’s vehicle stock will reach 607 million by 2050. Lu et al. (2023) assessed China’s road transport decarbonization pathways and critical battery mineral demand. Their results showed that China’s vehicle stock will reach 520 million by 2050, and it will gradually decline to 500 million by 2060. Peng et al. (2018) estimated the future energy demand and carbon dioxide emissions of China’s road transport at a provincial level. The results showed that vehicle stock in China will keep increasing to 543 million by 2050. Zhang et al. (2023) analyzed the impact of nickel recycling from batteries on nickel demand during vehicle electrification in China from 2010–2050. According to their estimation, China’s vehicle stock is likely to reach 680 million in 2050. The estimates of vehicle stock in China from existing studies are quite different because the results are sensitive to historical data and assumed saturation levels of vehicle ownership rate (Hao et al. 2011). A saturation level in the range of 0.20–0.80 vehicles per capita was normally used for China (Gan et al. 2019). We speculate that a saturation level of 0.30–0.50 vehicles per capita is reasonable according to our city-level results.

According to previous studies (Zeng et al. 2016; Zhao et al. 2019; Zheng et al. 2015), city-level vehicle stocks could also be forecasted using the same methods in national and provincial level studies, which are based on historical data (vehicle ownership rate and GDP per capita) and future projections (based on GDP and population). Given the fact that China’s population and economic activity are unevenly distributed, estimation based on city-level data could refine the accuracy of the country’s vehicle stocks forecasts. Additionally, material flows of critical resources used in vehicles, including lithium, cobalt, iron, aluminum, copper, plastic, and rubber, and the greenhouse gas emissions from vehicles could be analyzed combined with the penetration scenarios of new energy vehicles. China has been the world’s largest consumer of electric vehicles for many years (Lu et al. 2022). However, in this paper, there is no specific analysis of electric vehicles due to the limitation of data availability. Further research could be conducted as more detailed data is added to our city-level database.

Our results unavoidably bear uncertainties. First, although our research covers the vast majority of prefecture-level cities in China, it still ignores some prefecture-level cities that are relatively underdeveloped. Consequently, the in-use vehicle stocks in some regions are underestimated and vehicle ownership rates in these regions are likely to be overestimated, especially in the Northwest region and Southwest region. Second, statistical uncertainties in data collection and organization might affect the results of this study. For example, the population and GDP of several cities sometimes show a fluctuating trend because of wrong data or misleading data. Besides, data from sample surveys organized by local governments are generally much noisier than national census data. However, national population censuses and economic censuses are organized every 10 years and every 5 years, respectively. Third, discrepancies can arise between the number of registered vehicles and the actual vehicle stocks; this is due to the inclusion of end-of-life vehicles that have yet to be deregistered and the exclusion of newly sold vehicles that have not been registered. For a more accurate reflection of the situation, there is a clear need for access to more current, authoritative, and detailed data sets to enhance the credibility of the study’s results.

Conclusions

Based on data from 283 Chinese prefecture-level cities, spatiotemporal patterns of vehicle ownership in mainland China are analyzed. At the regional level, most of the vehicle stocks are accumulated in the North Coast region and the East Coast region. At the city level, coastal cities and provincial capital cities generally hold more vehicles than other cities. The inequality in vehicle ownership rates across cities shows a declining trend at both national and regional scales. Overall, the growth of vehicle ownership rates follows an S-shape curve and is closely related to a city’s affluence and the urbanization rate. However, vehicle plate restriction policies could significantly affect the development trend of vehicle ownership rates. Vehicle ownership rates in megacities like Beijing, Guangzhou, and Shenzhen showed a saturation trend at a relatively low level because of the vehicle plate restriction policies. Besides, the saturation level of vehicle ownership rate in China is likely to be lower than that in developed countries. Considering the fact that most Chinese cities are still at the initial and take-off stages of motorization, we suggest promoting the development of intercity and inner-city public transport systems, which could meet the increasing travel demand of urban residents with fewer vehicle stocks. Furthermore, understanding the growth pattern of vehicle ownership can help us better forecast future demand for vehicles in China, estimate the resulting energy consumption and material cycles, and deploy different strategies to achieve sustainable transportation.

References

Aguilar Lopez F, Billy RG, Müller DB (2023) Evaluating strategies for managing resource use in lithium-ion batteries for electric vehicles using the global MATILDA model. Resour. Conserv Recycl 193:106951. https://doi.org/10.1016/j.resconrec.2023.106951

Bauer C, Burkhardt S, Dasgupta NP, Ellingsen LA-W, Gaines LL, Hao H, Hischier R, Hu L, Huang Y, Janek J, Liang C, Li H, Li J, Li Y, Lu Y-C, Luo W, Nazar LF, Olivetti EA, Peters JF, Rupp JLM, Weil M, Whitacre JF, Xu S (2022) Charging sustainable batteries. Nat. Sustain 5(3):176–178. https://doi.org/10.1038/s41893-022-00864-1

Bettencourt LMA, Lobo J, Helbing D, Kuhnert C, West GB (2007) Growth, innovation, scaling, and the pace of life in cities. P Natl Acad Sci USA 104(17):7301-7306. https://doi.org/10.1073/pnas.0610172104

Bibri SE, Krogstie J, Kärrholm M (2020) Compact city planning and development: Emerging practices and strategies for achieving the goals of sustainability. Dev. Built Environ. 4:100021. https://doi.org/10.1016/j.dibe.2020.100021

Billy RG, Müller DB (2023) Aluminium use in passenger cars poses systemic challenges for recycling and GHG emissions. Resour. Conserv Recycl 190:106827. https://doi.org/10.1016/j.resconrec.2022.106827

Boyce JK (1994) Inequality as a cause of environmental degradation. Ecol. Econ. 11(3):169–178. https://doi.org/10.1016/0921-8009(94)90198-8

Bu C, Cui X, Li R, Li J, Zhang Y, Wang C, Cai W (2021) Achieving net-zero emissions in China’s passenger transport sector through regionally tailored mitigation strategies. Appl Energy 284:116265. https://doi.org/10.1016/j.apenergy.2020.116265

Buehler R, Pucher J (2011) Cycling to work in 90 large American cities: new evidence on the role of bike paths and lanes. Transportation 39(2):409–432. https://doi.org/10.1007/s11116-011-9355-8

Cao X, Huang X (2013) City-level determinants of private car ownership in China. Asian Geogr. 30(1):37–53. https://doi.org/10.1080/10225706.2013.799507

Cao Z, Shen L, Lovik AN, Muller DB, Liu G (2017) Elaborating the history of our cementing societies: an in-use stock perspective. Environ. Sci. Technol. 51(19):11468–11475. https://doi.org/10.1021/acs.est.7b03077

Chen H, Jia B, Lau SSY (2008) Sustainable urban form for Chinese compact cities: Challenges of a rapid urbanized economy. Habitat Int 32(1):28–40. https://doi.org/10.1016/j.habitatint.2007.06.005

Chen W, Sun X, Liu L, Liu X, Zhang R, Zhang S, Xue J, Sun Q, Wang M, Li X, Yang J, Hertwich E, Ge Q, Liu G (2022) Carbon neutrality of China’s passenger car sector requires coordinated short-term behavioral changes and long-term technological solutions. One Earth 5(8):875–891. https://doi.org/10.1016/j.oneear.2022.07.005

Chen WQ, Graedel TE (2015) In-use product stocks link manufactured capital to natural capital. P Natl Acad. Sci. USA 112(20):6265–6270. https://doi.org/10.1073/pnas.1406866112

Clarke-Sather A, Qu J, Wang Q, Zeng J, Li Y (2011) Carbon inequality at the sub-national scale: A case study of provincial-level inequality in CO2 emissions in China 1997–2007. Energy Policy 39(9):5420–5428. https://doi.org/10.1016/j.enpol.2011.05.021

Dargay J, Gately D, Sommer M (2007) Vehicle ownership and income growth, worldwide: 1960-2030. Energy J. 28(4):143–170. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol28-No4-7

Diffenbaugh NS, Burke M (2019) Global warming has increased global economic inequality. Proc. Natl Acad. Sci. USA 116(20):9808–9813. https://doi.org/10.1073/pnas.1816020116

European Automobile Manufacturers’ Association (2023) ACEA Report - Vehicles in use, Europe. https://www.acea.auto/nav/?search=in+use. Accessed 09 May 2024

Fischer-Kowalski M (2008) Society’s metabolism. J. Ind. Ecol. 2(1):61–78. https://doi.org/10.1162/jiec.1998.2.1.61

Fishman T, Schandl H, Tanikawa H (2016) Stochastic analysis and forecasts of the patterns of speed, acceleration, and levels of material stock accumulation in society. Environ. Sci. Technol. 50(7):3729–3737. https://doi.org/10.1021/acs.est.5b05790

Fu X, Cheng J, Peng L, Zhou M, Tong D, Mauzerall D L (2024) Co-benefits of transport demand reductions from compact urban development in Chinese cities. Nat Sustain. https://doi.org/10.1038/s41893-024-01271-4

Gan Y, Lu Z, Cai H, Wang M, He X, Przesmitzki S (2019) Future private car stock in China: current growth pattern and effects of car sales restriction. Mitig. Adapt Strat Gl. 25(3):289–306. https://doi.org/10.1007/s11027-019-09868-3

Gogtay NJ, Thatte UM (2017) Principles of correlation analysis. J. Assoc. Physicians India 65(3):78–81

Hamann M, Berry K, Chaigneau T, Curry T, Heilmayr R, Henriksson PJG, Hentati-Sundberg J, Jina A, Lindkvist E, Lopez-Maldonado Y, Nieminen E, Piaggio M, Qiu J, Rocha JC, Schill C, Shepon A, Tilman AR, van den Bijgaart I, Wu T (2018) Inequality and the biosphere. Annu Rev. Environ. Resour. 43(1):61–83. https://doi.org/10.1146/annurev-environ-102017-025949

Hao H, Geng Y, Tate JE, Liu F, Sun X, Mu Z, Xun D, Liu Z, Zhao F (2019) Securing platinum-group metals for transport low-carbon transition. One Earth 1(1):117–125. https://doi.org/10.1016/j.oneear.2019.08.012

Hao H, Wang H, Yi R (2011) Hybrid modeling of China’s vehicle ownership and projection through 2050. Energy 36(2):1351–1361. https://doi.org/10.1016/j.energy.2010.10.055

Hofmann J, Guan D, Chalvatzis K, Huo H (2016) Assessment of electrical vehicles as a successful driver for reducing CO2 emissions in China. Appl Energy 184:995–1003. https://doi.org/10.1016/j.apenergy.2016.06.042

Hui Y, Wang Y, Sun Q, Tang L (2019) The impact of car-sharing on the willingness to postpone a car purchase: a case study in Hangzhou, China. J. Adv. Transp. 2019:9348496. https://doi.org/10.1155/2019/9348496

Huo H, Wang M (2012) Modeling future vehicle sales and stock in China. Energy Policy 43:17–29. https://doi.org/10.1016/j.enpol.2011.09.063

Huo H, Wang M, Johnson L, He D (2007) Projection of Chinese motor vehicle growth, oil demand, and CO2 emissions through 2050. Transp. Res Rec: J. Transp. Res Board 2038(1):69–77. https://doi.org/10.3141/2038-09

International Organization of Motor Vehicle Manufacturers (2020) World vehicles in use. https://www.oica.net/category/vehicles-in-use/. Accessed 9 May 2024

Ivanova D, Vita G, Wood R, Lausselet C, Dumitru A, Krause K, Macsinga I, Hertwich EG (2018) Carbon mitigation in domains of high consumer lock-in. Glob. Environ. Chang 52:117–130. https://doi.org/10.1016/j.gloenvcha.2018.06.006

Kowald M, Kieser B, Mathys N, Justen A (2016) Determinants of mobility resource ownership in Switzerland: changes between 2000 and 2010. Transportation 44(5):1043–1065. https://doi.org/10.1007/s11116-016-9693-7

Law TH, Hamid H, Goh CN (2015) The motorcycle to passenger car ownership ratio and economic growth: A cross-country analysis. J. Transp. Geogr. 46:122–128. https://doi.org/10.1016/j.jtrangeo.2015.06.007

Li J, Walker JL, Srinivasan S, Anderson WP (2010) Modeling private car ownership in China. Transp. Res Rec: J. Transp. Res Board 2193(1):76–84. https://doi.org/10.3141/2193-10

Li P, Lu M (2021) Urban systems: Understanding and predicting the spatial distribution of China’s population. China World Econ. 29(4):35–62. https://doi.org/10.1111/cwe.12380

Li T, Zheng X, Zhang C, Wang R, Liu J (2022) Mining spatial correlation patterns of the urban functional areas in urban agglomeration: a case Study of four typical urban agglomerations in China. Land 11(6). https://doi.org/10.3390/land11060870

Li X, Song L, Liu Q, Ouyang X, Mao T, Lu H, Liu L, Liu X, Chen W, Liu G (2023) Product, building, and infrastructure material stocks dataset for 337 Chinese cities between 1978 and 2020. Sci Data 10(1):228. https://doi.org/10.1038/s41597-023-02143-w

Li Y, Huang S, Liu Y, Ju Y (2021) Recycling potential of plastic resources from end-of-life passenger vehicles in China. Int J. Env Res Pub He 18(19):10285. https://doi.org/10.3390/ijerph181910285

Liu F, Zhao F, Liu Z, Hao H (2020) The impact of purchase restriction policy on car ownership in China’s four major cities. J. Adv. Transp. 2020:1–14. https://doi.org/10.1155/2020/7454307

Liu Q, Cao Z, Liu X, Liu L, Dai T, Han J, Duan H, Wang C, Wang H, Liu J, Cai G, Mao R, Wang G, Tan J, Li S, Liu G (2019) Product and metal stocks accumulation of China’s megacities: patterns, drivers, and implications. Environ. Sci. Technol. 53(8):4128–4139. https://doi.org/10.1021/acs.est.9b00387

Lu Q, Duan H, Shi H, Peng B, Liu Y, Wu T, Du H, Wang S (2022) Decarbonization scenarios and carbon reduction potential for China’s road transportation by 2060. npj Urban Sustain 2(1):34. https://doi.org/10.1038/s42949-022-00079-5

Lu Y, Peng T, Zhu L, Shao T, Pan X (2023) China’s road transport decarbonization pathways and critical battery mineral demand under carbon neutrality. Transp. Res Part D. Transp. Environ. 124:103927. https://doi.org/10.1016/j.trd.2023.103927

Lu Y, Zhang Y, Cao X, Wang C, Wang Y, Zhang M, Ferrier RC, Jenkins A, Yuan J, Bailey MJ (2019) Forty years of reform and opening up: China’s progress toward a sustainable path. Sci. Adv. 5(8):eaau9413. https://doi.org/10.1126/sciadv.aau9413

Ma J, Ye X, Shi C (2018) Development of multivariate ordered probit model to understand household vehicle ownership behavior in Xiaoshan district of Hangzhou, China. Sustainability 10(10):3660. https://doi.org/10.3390/su10103660

Mao R, Bao Y, Duan H, Liu G (2021) Global urban subway development, construction material stocks, and embodied carbon emissions. Humanit Soc. Sci. Commun. 8(1):1–11. https://doi.org/10.1057/s41599-021-00757-2

National Bureau of Statistics of China (2021) China Statistical Yearbook 2021. China Statistics Press, Beijing, http://www.stats.gov.cn/sj/ndsj/2021/indexch.htm

National Bureau of Statistics of China (2023a) China Statistical Yearbook 2022. China Statistics Press, Beijing, http://www.stats.gov.cn/sj/ndsj/2022/indexch.htm

National Bureau of Statistics of China (2023b) National Data. https://data.stats.gov.cn/english/easyquery.htm?cn=C01. Accessed 9 May 2024

Pauliuk S, Dhaniati NM, Muller DB (2012) Reconciling sectoral abatement strategies with global climate targets: the case of the Chinese passenger vehicle fleet. Environ. Sci. Technol. 46(1):140–147. https://doi.org/10.1021/es201799k

Pauliuk S, Hertwich EG (2015) Socioeconomic metabolism as paradigm for studying the biophysical basis of human societies. Ecol. Econ. 119:83–93. https://doi.org/10.1016/j.ecolecon.2015.08.012

Pauliuk S, Majeau‐Bettez G, Müller DB, Hertwich EG (2015) Toward a practical ontology for socioeconomic metabolism. J. Ind. Ecol. 20(6):1260–1272. https://doi.org/10.1111/jiec.12386

Pauliuk S, Müller DB (2014) The role of in-use stocks in the social metabolism and in climate change mitigation. Glob. Environ. Chang 24:132–142. https://doi.org/10.1016/j.gloenvcha.2013.11.006

Peng T, Ou X, Yuan Z, Yan X, Zhang X (2018) Development and application of China provincial road transport energy demand and GHG emissions analysis model. Appl Energy 222:313–328. https://doi.org/10.1016/j.apenergy.2018.03.139

Qiu X, Zhao J, Yu Y, Ma T (2022) Levelized costs of the energy chains of new energy vehicles targeted at carbon neutrality in China. Front. Eng. Manag. 9(3):392–408. https://doi.org/10.1007/s42524-022-0212-6

Rahman MM, Najaf P, Fields MG, Thill J-C (2021) Traffic congestion and its urban scale factors: Empirical evidence from American urban areas. Int J. Sustain Transp. 16(5):406–421. https://doi.org/10.1080/15568318.2021.1885085

Ren S, Huang Z, Bao Y, Yin G, Yang J, Shan X (2023) Matching end-of-life household vehicle generation and recycling capacity in Chinese cities: A spatio-temporal analysis for 2022–2050. Sci. Total Environ. 899:165498. https://doi.org/10.1016/j.scitotenv.2023.165498

Seto KC, Golden JS, Alberti M, Turner BL (2017) Sustainability in an urbanizing planet. P Natl Acad. Sci. USA 114(34):8935–8938. https://doi.org/10.1073/pnas.1606037114

Song L, Wang P, Hao M, Dai M, Xiang K, Li N, Chen W-Q (2020) Mapping provincial steel stocks and flows in China: 1978–2050. J. Clean. Prod. 262:121393. https://doi.org/10.1016/j.jclepro.2020.121393

Statistics Bureau of Japan (2023) Japan Statistical Yearbook. Japan. https://www.stat.go.jp/english/data/nenkan/index.html

Tang B-J, Li X-Y, Yu B, Wei Y-M (2019) How app-based ride-hailing services influence travel behavior: An empirical study from China. Int J. Sustain Transp. 14(7):554–568. https://doi.org/10.1080/15568318.2019.1584932

U.S. Department of Transportation-Federal Highway Administration (2022) Highway Statistics Series. https://www.fhwa.dot.gov/policyinformation/statistics.cfm. Accessed 9 May 2024

UK Department for Transport (2023) Vehicle licensing statistics data files. https://www.gov.uk/government/statistical-data-sets/vehicle-licensing-statistics-data-files#download-data-files. Accessed 9 May 2024

United Nations Department of Economic-Social Affairs United Nations Statistical Yearbook (n.d.). United Nations. https://www.un-ilibrary.org/content/periodicals/24121436?pageSize=60

United Nations Department of Economic (2020) World social report 2020: Inequality in a rapidly changing world. United Nations. https://www.un.org/development/desa/dspd/wp-content/uploads/sites/22/2020/02/World-Social-Report2020-FullReport.pdf

Wang J, Chen J, Liu X, Wang W, Min S (2023) Exploring the spatial and temporal characteristics of China’s four major urban agglomerations in the luminous remote sensing perspective. Remote Sens 15(10):2546. https://doi.org/10.3390/rs15102546

Weisz H, Suh S, Graedel TE (2015) Industrial Ecology: The role of manufactured capital in sustainability. P Natl Acad. Sci. USA 112(20):6260–6264. https://doi.org/10.1073/pnas.1506532112

Winkler L, Pearce D, Nelson J, Babacan O (2023) The effect of sustainable mobility transition policies on cumulative urban transport emissions and energy demand. Nat. Commun. 14(1):2357. https://doi.org/10.1038/s41467-023-37728-x

World Bank (2023) World Bank Open Data. https://data.worldbank.org/. Accessed 9 May 2024

Wu N, Zhao S, Zhang Q (2016) A study on the determinants of private car ownership in China: Findings from the panel data. Transp. Res: Part A: Pol. Pract. 85:186–195. https://doi.org/10.1016/j.tra.2016.01.012

Xie Y, Zhou X (2014) Income inequality in today’s China. P Natl Acad. Sci. USA 111(19):6928–6933. https://doi.org/10.1073/pnas.1403158111

Xu C (2020) Determinants of carbon inequality in China from static and dynamic perspectives. J. Clean. Prod. 277:123286. https://doi.org/10.1016/j.jclepro.2020.123286

Xu C, Dai Q, Gaines L, Hu M, Tukker A, Steubing B (2020) Future material demand for automotive lithium-based batteries. Commun. Mater. 1(1):99. https://doi.org/10.1038/s43246-020-00095-x

Xu G, Jiao L, Yuan M, Dong T, Zhang B, Du C (2019) How does urban population density decline over time? An exponential model for Chinese cities with international comparisons. Landsc. Urban Plan 183:59–67. https://doi.org/10.1016/j.landurbplan.2018.11.005

Xun D, Hao H, Sun X, Liu Z, Zhao F (2020) End-of-life recycling rates of platinum group metals in the automotive industry: Insight into regional disparities. J. Clean. Prod. 266:121942. https://doi.org/10.1016/j.jclepro.2020.121942

Yang C, Zhang L, Chen Z, Gao Y, Xu Z (2022a) Dynamic material flow analysis of aluminum from automobiles in China during 2000–2050 for standardized recycling management. J. Clean. Prod. 337:130544. https://doi.org/10.1016/j.jclepro.2022.130544

Yang H, Zhai G, Liu X, Yang L, Liu Y, Yuan Q (2022b) Determinants of city-level private car ownership: Effect of vehicle regulation policies and the relative price. Transp. Policy 115:40–48. https://doi.org/10.1016/j.tranpol.2021.10.025

Yang Z, Jia P, Liu W, Yin H (2017) Car ownership and urban development in Chinese cities: A panel data analysis. J. Transp. Geogr. 58:127–134. https://doi.org/10.1016/j.jtrangeo.2016.11.015

Yu Y, Li S, Sun H, Taghizadeh-Hesary F (2021) Energy carbon emission reduction of China’s transportation sector: An input–output approach. Econ. Anal. Pol. 69:378–393. https://doi.org/10.1016/j.eap.2020.12.014

Zeng X, Ali SH, Tian J, Li J (2020) Mapping anthropogenic mineral generation in China and its implications for a circular economy. Nat. Commun. 11(1):1544. https://doi.org/10.1038/s41467-020-15246-4

Zeng Y, Tan X, Gu B, Wang Y, Xu B (2016) Greenhouse gas emissions of motor vehicles in Chinese cities and the implication for China’s mitigation targets. Appl Energy 184:1016–1025. https://doi.org/10.1016/j.apenergy.2016.06.130

Zhang H, Liu G, Li J, Qiao D, Zhang S, Li T, Guo X, Liu M (2023) Modeling the impact of nickel recycling from batteries on nickel demand during vehicle electrification in China from 2010 to 2050. Sci. Total Environ. 859:159964. https://doi.org/10.1016/j.scitotenv.2022.159964

Zhang L, Lu Q, Yuan W, Jiang S, Wu H (2022) Characterizing end-of-life household vehicles’ generations in China: Spatial-temporal patterns and resource potentials. Resour. Conserv Recycl 177:105979. https://doi.org/10.1016/j.resconrec.2021.105979

Zhang Z, Jin W, Jiang H, Xie Q, Shen W, Han W (2017) Modeling heterogeneous vehicle ownership in China: A case study based on the Chinese national survey. Transp. Policy 54:11–20. https://doi.org/10.1016/j.tranpol.2016.10.005

Zhao F, Liu F, Liu Z, Hao H (2019) The correlated impacts of fuel consumption improvements and vehicle electrification on vehicle greenhouse gas emissions in China. J. Clean. Prod. 207:702–716. https://doi.org/10.1016/j.jclepro.2018.10.046

Zheng B, Huo H, Zhang Q, Yao ZL, Wang XT, Yang XF, Liu H, He KB (2014) High-resolution mapping of vehicle emissions in China in 2008. Atmos. Chem. Phys. 14(18):9787–9805. https://doi.org/10.5194/acp-14-9787-2014

Zheng B, Zhang Q, Borken-Kleefeld J, Huo H, Guan D, Klimont Z, Peters GP, He K (2015) How will greenhouse gas emissions from motor vehicles be constrained in China around 2030? Appl Energy 156:230–240. https://doi.org/10.1016/j.apenergy.2015.07.018

Zund D, Bettencourt LMA (2019) Growth and development in prefecture-level cities in China. PLoS One 14(9):e0221017. https://doi.org/10.1371/journal.pone.0221017

Acknowledgements

This work was supported by the National Social Science Fund of China (Grant No. 22AZD098), the National Natural Science Foundation of China (Grant No. 52170183, 52070178, and 52200214), the National Social Science Fund of China (Grant No. 21&ZD104), and the China Scholarship Council (Grant No. 202004910474).

Author information

Authors and Affiliations

Contributions

LD: writing - original draft, methodology, software, and formal analysis. LS: conceptualization, methodology, and writing - review & editing. WW: data curation and investigation. XJ: methodology and software. RH: writing - review & editing. W-QC: writing - review & editing, supervision, and funding acquisition.

Corresponding authors

Ethics declarations

Competing interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

Ethical approval was not required as the study did not involve human participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Duan, L., Song, L., Wang, W. et al. Urbanization inequality: evidence from vehicle ownership in Chinese cities. Humanit Soc Sci Commun 11, 703 (2024). https://doi.org/10.1057/s41599-024-03173-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03173-4

- Springer Nature Limited