Abstract

The paper we consider traffic optimization problem for a model with multi-sided dynamic pricing in the telecommunications market with incomplete competition and taking into account congested networks. The model consists in the use of mathematical modeling methods, game theory and queueing theory. It is assumed that telecommunication companies agree on the rules of incoming and outgoing traffic charging in pairs, and this charging is built as a function of the tariffs that companies offer their subscribers for service. Companies are limited the agreement on mutual rules of reciprocal proportional charging for access traffic at first, which subsequently determine the tariffs for the network users. The reciprocity of the rules means that companies are subject to the same rules for the entire time interval during which the agreement is in force. Taking into account imperfect competition in the telecommunications market and using traffic and profit optimization method for each company the equilibrium tariffs and the volume of services are found with subject to congestion in multi-service networks. Numerical calculation is performed to illustrate the results.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

- Queueing theory

- Game theory

- Optimization methods

- Probability theory

- Industrial market theory

- Economic and mathematical modeling

1 Introduction

Methods of mathematical modeling in the economy of telecommunications are developed actively. Jean Tirole considers the impact of telecommunication technologies on competition in services and goods markets [10,11,12,13,14].

Doganoglu and Tauman [6] presented a model of two competing local telecommunications networks which are mandated to interconnect. After negotiating the access charges, the companies engage in price competition. Given the prices, each consumer selects a network and determines the consumption of phone calls. Using a discrete/continuous consumer choice model, it was shown that a pure strategy equilibrium exists quite generally and satisfies desirable properties.

Dessein [4] considered network competition in nonlinear pricing, assuming linear pricing, and had shown that telecommunications networks may use a high access charge as an instrument of collusion. He showed that this conclusion is difficult to maintain when operators compete in nonlinear pricing: as long as subscription demand is inelastic, profits can remain independent of the access charge, even when customers are heterogeneous and networks engage in second-degree price discrimination. When demand for subscriptions is elastic, networks may increase profits by agreeing on an access charge below marginal cost (relative to cost-based access pricing) and welfare is typically increased by setting the access charge above marginal cost.

Wouter Dessein argued that the telecommunications industry is a fragmented of a market, characterized by a tremendous amount of customer heterogeneity [5]. He showed how such customer heterogeneity dramatically affects nonlinear pricing strategies. If there are unbalanced calling patterns between different customer types, networks make larger profits on the least attractive customers, the nature of the calling pattern substantially affects how networks discriminate implicitly between different customer types. Different customer types often perceive the substitutability of competing networks differently.

Hahn [7] considered two-way access pricing in a telecommunications market where consumers are heterogeneous in their demand for calls and firms are allowed to use non-linear tariffs. He investigated how the presence of access charges affects the tariffs offered by firms in symmetric equilibrium and showed that under certain conditions each firm’s profit is independent of the level of (reciprocal) access charge and, therefore, collusion using access charges is not sustainable. This result suggests that efficient call-allocations can be achieved under a minimal regulatory intervention, i.e. recommending firms set access charges equal to call-termination cost.

Chuna Se-Hak considered optimal access charges for the provision of telecommunication network, mobile commerce, and cloud services [17]. Using theoretical analysis, Chuna Se-Hak investigated, when a regulator can set rational access pricing, considering the characteristics of access demand. Chuna Se-Hak demonstrated that optimal access prices depend on whether the final products or services are strategic independence or strategic substitutes. The results have implications for policy makers setting optimal access charges that maximize social welfare.

Lee, Jeong, Seo [15] considered optimal pricing and capacity partitioning for tiered access service in virtual networks. They showed that many Internet service providers offer some forms of tiered access service to meet diverse demands of users and to improve the efficiency of network resources. They found the optimal pricing and capacity partitioning by addressing the revenue maximization problem in the tiered service.

Mark Armstrong examined the use of nonlinear pricing as a method of price discrimination, both with monopoly and oligopoly supply [1].

Ushchev, Zenou [19] developed a product-differentiated model where the product space is a network defined as a set of varieties (nodes) linked by their degrees of substitutability (edges). They located consumers into this network, so that the location of each consumer (node) corresponds to her “ideal” variety. It was shown that there exists a unique Bertrand–Nash equilibrium where prices are determined by both the firms’ sign-alternating Bonacich centralities and the average willingness to pay across consumers. They also investigated how local product differentiation and the spatial discount factor affect the equilibrium prices. They showed that these effects non-trivially depend on the network structure. It was found that, in a star-shaped network, the central firm does not always enjoy higher monopoly power than the peripheral firms.

Cramton, Doyle [2] described an open access market for capacity. Thet assumed that open access means that in real-time, network capacity cannot be withheld–capacity is priced dynamically by the marginal demand during congestion. They offered the open access market as a means for managing growing spectrum demand and as an alternative to naked spectrum sharing.

In a network formation framework, where payoffs reflect an agent’s ability to access information from direct and indirect contacts. Mohlmeier, Rusinowska, Tanimura [9] integrated negative externalities due to connectivity associated with two types of effects: competition for the access to information, and rivalrous use of information.

Samouylov, Sevastianov, Kulyabov, Gaidamaka, Gudkova and other researchers built various multiservice models of networks, queuing systems and considered their dynamics [3, 8, 16].

This article a mathematical model of pricing for telecommunications services with overloads in networks is built. It is generalized the model that it was built earlier [18, 20].

It is assumed that telecommunications companies agree in pairs on the rules of charging for access traffic to the network other, and it is considered as a function of the tariffs that companies offer their consumers (subscribers) for services. Thus, these companies have contracts at the first step by agreements on reciprocal proportional access charge rules (RPACR), which subsequently allow them to determine the subscription rates. The ambiguity of the rules means that companies are subject to one and the same rules for the entire time interval during, which the agreement is valid.

RPACR may be seen as analogous to the regulatory policy of the state of the telecommunications industry. If telecommunication services, provided by different companies, are close substitutes, the use of RPACR by companies it leads to competitive prices in industry. However, if it is assumed that competing companies follow the policy of services differentiation, then it is required intervention of the state to preclude the use by companies of monopoly power.

It is also assumed that the utility function of subscribers consists of deterministic and stochastic parts. The deterministic part allows to find a linear function of subscribers demand for telecommunications services, which has a constant price elasticity. It allows to avoid unlimited growth of consumption of telecommunication services by subscribers at aspiration the corresponding tariffs to zero and ensures the existence of a saturation point, i.e., for example, there is time limits that the subscriber uses for using telecommunication services. The Weibull distribution is used for the stochastic component of the utility function, which is convenient for further analysis. It is possible to find equilibrium tariffs and equilibrium demand for telecommunication services. This equilibrium is equilibrium in pure strategies and always exists, and the subscription rates are calculated explicitly. Numerical calculation is performed to illustrate the results.

2 Model of Telecommunications Industry

2.1 Multiservice Network Model

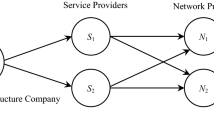

Let consider a network NW (\(NW=\bigcup \limits _{i=1}^{n} NW_i\)) consisting of n equivalent multiservice network (numbered in a certain order multiservice network \(SR=\bigcup \limits _{s=1}^{m} SR_s \)) belonging to different telecommunication companies \(T_i\) (\(i=\overline{1,n}\)), and it is assumed that in between all the networking companies are switching nodes.

Let \(t\in \left\{ 1,2,\ldots ,T_{\max }\right\} \) be time intervals (for example, the time period equals a week, a month or a year) equal to the length of time periods during which companies \(T_i\) independently decide on pricing for their services, and \(t_{\max }\) is the maximum planning horizon.

Let’s assume that the network NW consists of a set of nodes \(J^t =\bigcup \limits _{i=1}^{s_j} J_{i}^t \) and a set of channels \(L^t =\bigcup \limits _{i=1}^{s_l} L_{i}^t\), and \(NW=J^t \cup l^t\).

In the time period t each network \(NW_i\) of the company \(T_i\) (\(i=\overline{1,n}\)) is represented the set of nodes \(J_{ij}^t\) \((j=1,\ldots ,s^J_i)\) and channel set \(L_{ij}^t\) \((j=1,\ldots , s^L_i )\), numbered in a certain way, where \(J_{i}^t= \bigcup \limits _{j=1}^{s^J_i} J_{ij}^t\), \(L_{i}^t =\bigcup \limits _{k=1}^{s^L_i} L_{ik}^t \) and \(NW_i = J_{i}^t \cup L_{i}^t\), and the total number of nodes is \(S^{J}_{NW}(t)=\sum \limits _{i=1}^{n} s^J_i\), and the total number of channels is \(S^{L}_{NW}(t)= \sum \limits _{i=1}^{n} s^L_i\) for network NW.

Let \(H_{ij}^t\) be a capacity (bits/sec) of j-node (\(j=\overline{1,J_{s^J_i}}\)), and \(S_{ik}^t\) a throughput (bits/sec) k-link (\(k=\overline{1,L_{s^L_i}}\)) \(T_i\) of network \(NW_i\) company \(T_i\) in the time period t.

Two-point connections can be established to transmit information flows between the network nodes of network NW. Each connection is characterized by a route, i.e. a set of network links NW, through which connections are established.

Let \(s=\{1,\ldots ,m\}\) be a set of services that offer companies for potential consumers (subscribers) during the period \(t\in \left\{ 1,2,\ldots ,T_{\max }\right\} \). Let b \((b\in \left( 1,2,\ldots , B^t\right) )\) be a set of consumers, who want to use the telecommunications services in the market.

2.2 Individual Consumer Demand and Network Traffic

Let’s assume that the individual consumer demand function for the service \(s= \{1,\ldots , m\}\) has the form:

\(D_{bs}^t (p_{s}^t )\) is a linear function of the price \(p_{s}^t\), and \(r_{bs}^t >0 \) and \( s_{bs}^t >0\) is positive coefficients, which are determined from the market research services SR in the period t.

A consumer b generates the traffic loading or the load using the service s in the period t. Let \(Y_{bs}^t\) be an individual traffic volume of a consumer b, and let \(Y_{bs}^t =\bar{\lambda }_{bs}^t h_{bs}^t\) be the average value of \(Y_{bs}^t\), where the parameter \(\bar{\lambda }_{bs}^t\) is the average intensity of the flow of requests and the parameter \(h_{bs}^t\) is the average duration of service in the period t.

We assume that the average load is generated by the consumer b when using the service s in the period t, linearly depends on the corresponding demand function for this service s

where \(\theta _s \) is the proportionality factor for the s service It links the consumer demand for telecommunication services and the amount of traffic generated by this consumer in the network.

The total network traffic volume that it creates by a consumer in the period t during using the service s, is the sum of consumers network traffic volumes

where \(\bar{a}_{s}^t\), \(\bar{B}_{s}^t\) are parameters of the function \(Y_{s}^t\).

The total consumers demand for the service s during the time t is the sum of all demand functions for the service s of all:

where the parameters \(a_{s}^t\geqslant 0\) and \(b_{s}^t\geqslant 0\) are determined from market research of services in the period t.

We can get a link between the network traffic volume \(Y_{s}^t (p_{s}^t )\) and the demand function \(D_{bs}^t (p_{s}^t )\) of the service s during the period t:

where \(Y_{s}^t (p_{s}^t )\) is linear price functions and \(A_{s}^t = \theta _s a_{s}^t\), \(B_{s}^t = \theta _s b_{s}^t \) are coefficients.

We can get the network traffic volume that is associated with the consumer b (\(b=\overline{1, B^t} \))

where \(\bar{A}_{b}^t \geqslant 0\), \(\bar{B}_{b}^t\geqslant 0\) is parameters load functions \(Y_{b}^t\) associated with the consumer b, and a parameter \(\bar{p}^{t}\) is a tariff for services SR (service package) during the time period t.

A consumer’s b (\(b=\overline{1, B^t} \)) demand for SR-services in the considered the time period t has the form:

Aggregating the network traffic volume \(Y_{s}^t (p_{s}^t )\) from (5) for all services \(s= \{1,\ldots , m\}\), we can get the total network traffic volume Y(t) for the period t in the form:

where \(\bar{A}^t \geqslant 0\) and \(\bar{B}^t \geqslant 0\) are aggregated parameters of function Y(t), and where function of aggregated demand for services SR (service package) has the form:

where the parameters \(\bar{a}^t \geqslant 0\) and \(\bar{b}^t \geqslant 0\) are aggregated parameters of the demand function D(t).

2.3 Reciprocal Proportional Access Charge Rules and Multi-sided Pricing

We can assume that for each company \(T_i\) (\(i=\overline{1,n}\)) has a function of consumer demand for services SR (service package) during the time period t. Let \(D_{sii}\) \((i\in \{ 1, \ldots , n \})\) be a demand function of services \(SR=\bigcup \limits _{s=1}^{m} SR_s \) provided by the company \(T_i\) using its \(NW_i\) network resource only, and let \(D_{sij}^{t}\) \((i,j \in \{ 1, \ldots , n \} , \, i \ne j )\) be a demand function of services provided together with a network \(NW_i\) of a company \(T_i\) and a network \(NW_j\) of a company \(T_j\) \(( i,j \in \{ 1, \ldots , n \},\, i \ne j )\). Thus, there is a question of access of one company to resources of a network of other company.

We assume that the companies \(T_i\) and \(T_j\) to \(( i,j \in \{ 1, \ldots , n \} , \, i \ne j )\) agree on the charges \(\hat{a} _{ij}^{t} \) and \(\hat{a} _{ji}^{t} \), where \(\hat{a} _{ij}^{t} \) is a charge, which company \(T_i\) pays the company \(T_j\) of \(( i,j \in \{ 1, \ldots , n \}, \, i \ne j )\) for the use of its network resources in connection with the service of \( s \in \{ 1, \ldots , m \} \) (traffic from the network \(NW_i\) to the network \(NW_j\) or outgoing traffic for the company \(T_i\) and incoming traffic the company \(T_j\)), and \(\hat{a} _{ji}^{t} \) is a corresponding charge at which the company \(T_j\) pays the company \(T_i\) \(( i,j \in \{ 1, \ldots , n \}, \,i \ne j )\) for the using of network resources in connection with the provision of a similar service \( s \in \{ 1, \ldots , m \} \) (traffic from the network \(NW_j\) to the network \(NW_i\) or outgoing traffic for the company \(T_j\) and incoming traffic the company \(T_i\)) during the time period t.

Suppose that any two companies \(T_i\) and \(T_j\) \((i,j \in \{ 1, \ldots , n \} , \, i \ne j )\) charges \(\hat{a} _{ij}^{t}\) and \(\hat{a}_{ji}^{t}\) depend on tariffs \(\bar{p}_{i}^t\) and \(\bar{p}_{j}^t\), and \(\hat{a}_{ij}^{t} = a_{i}^{t} (\bar{p}_{i}^t,\, \bar{p}_{j}^t) \) for any \(( i,j \in \{ 1, \ldots , n \}, \, i \ne j )\) and \( s \in \{ 1, \ldots , m \} \) at any time \(t\in \left\{ 1,2,\ldots ,T_{\max }\right\} \).

We assume that there is the proportional dependence between \(\hat{a}_{ij}^{t} \) and \(\bar{p}_{i}^t\), then \(\hat{a}_{ij}^{t} = {a}_{i}^{t} \bar{p}_{i}^t, \) where the proportionality factor is \(0\leqslant a_{i}^{t} \leqslant 1\) for \( i \in \{ 1, \ldots , n \} \) and \( s \in \{ 1, \ldots , m \} \).

3 Multiservice Demand Function

Suppose that each consumer can use telecommunication multiservice network of companies \(T_i\) \(( i \in \{ 1, \ldots , n \} ) \) at any time period t. Let’s assume that each consumer has individual tastes and preferences in relation to these services SR. We assume that the consumer b \((b \in \{ 1, \ldots , B^t \})\), which is ready to choose one service from the set \( s \in \{1, \ldots , m \} \) of the company \(T_i\) \( (i \in \{1, \ldots , n \})\), has the following utility function:

where the random parameter \(\epsilon _{ibs}^t\) characterizes individual tastes and preferences of the consumer. Let’s consider that \(\epsilon _{ibs}^t\) has a Weibull distribution. The value of \(\eta _s\) gives the characteristic measures of the dispersion of tastes and preferences of the consumers, that is \(\eta _s\) allows us to estimate the substitutability telecommunication services \( s \in \{1, \ldots , m\} \) that provide companies \(T_i\) and \(T_j\) \(( i, j \in \{1, \ldots , n\},\, i \ne j )\). The services \( s \in \{1, \ldots , m\} \) of companies become total substitutes with \(\eta _s \rightarrow 0\), and it is total complementary with \(\eta _s \rightarrow \infty \).

Let each consumer b \((b \in \{ 1, \ldots , B^t \})\) makes a choice the company \(T_i\) and rejects the company \(T_j\) \(( i,j \in \{ 1, \ldots , t \} , \, i \ne j )\) at the period t then there is inequality

Thus, the probability \(P_{ibs}^t \) that the consumer b gives preference to the company \(T_i\) and reject the company \(T_j\) \(( i,j \in \{ 1, \ldots , n \} , \, i \ne j ) \) equals to

Since the values \(\epsilon _{ibs} \) are independent and have a Weibull distribution we have that

where \(\tau _s = 2 / \eta _s \). Similarly for the company \(T_j\) we have that same

Thus, each consumer chooses one service s in the company \(T_i\) with probability \( p_{ibs}\) and in the company \(T_j\) with probability \( p_{jbs}\).

We can generalize this approach for the case when the consumer chooses one company \(T_i\) from the set of companies \(\{ T_1, \ldots , T_n \} \) to obtain the service s, and we can get the probability in case the consumer gives preference to the company \(T_i\):

The probability that the consumer chooses one company \(T_i\) from a set of companies \(\{ T_1, \ldots , T_n \} \) to receive service package SR have the form:

The expected value of consumers \(b_{i}(t)\) who chooses a company \(T_i\) is determined by the probability \(P_{ib}^t\), which can be considered as the market share \(m_{i}^t \) of a company \(T_i\) has form

The demand of consumers for services \( s \in \{ 1, \ldots , m \} \) of the company \(T_i\) \(( i \in \{ 1, \ldots , n \}) \) has the form:

Demand function of the consumers \(D_{sii}^{t}\) who have plan to use the service SR of a company \(T_i\), which may be implemented within network \(NW_i\), and demand function of the consumer \(D_{ij}^{t}\) who has plan to use the service SR implemented with resources of the networks \(NW_i\) and \(NW_j\), have the form:

where the aggregated s-service demand \(D_{is}^t\) has form:

and the total network traffic volume demand \(D_{i}^t\) for company \(T_i\) has form:

where

and the total network traffic volume for a company \(T_i\) has form:

where \(\theta \) is an “average” linking parameter for function \(Y_{i}^t\) and \(D_{i}^t.\)

4 Revenue, ARPU, Profit

Revenue function \(TR_i^t\) companies \(T_i\) (\(i \in \left\{ 1,\ldots , n \right\} \)) at the period t (\(t=1,2,\ldots , T_{\max }\)) has the form:

where \( \delta _{ij}^t \in \left[ 0,1\right] \) is a parameter to be defined during negotiations between companies \(T_i\) and \(T_j\). We assume that the cost of an access service to the competitor’s network is a value proportional to the cost of servicing by this company of its consumers.

Average revenue per user (ARPU) \(ARPU_i^t\) companies \(T_i\) (\(i \in \left\{ 1,\ldots , n \right\} \)) at the period t (\(t=1,2,\ldots , T_{\max }\)) has the form:

Profit function \(\varPi _i^t\) of companies \(T_i\) (\(i\in \left\{ 1,\ldots , n \right\} \)) at the period t (\(t=1,2,\ldots , T_{\max }\)) has the form:

where \(TC^t\) is a total costs function and \(F^t\) is a fix cost.

5 Congested Traffic Networks with RPACR

5.1 Traffic Optimization Problem in Congested Networks with RPACR

We can formulate an optimization problem for each company \(T_i\) \((i\in \left\{ 1,\ldots ,n \right\} )\) at any time \(t\in \left\{ 1,2,\ldots , T_{\max }\right\} \):

where \(\bar{Y}_i^t\) is the maximum peak of the total network traffic volume for a company \(T_i\).

The following theorem holds true.

Provided that the parameters \(\theta _s > 0\), \(\bar{a}^t > 0\), \(\bar{b}^t > 0\), \(\delta _{ij}^t \in \left[ 0,1\right] \), \({w_{J}}^t_{ij} \geqslant 0\), \({w_{L}}^t_{ij}\geqslant 0\), \( F^t \geqslant 0\), \(\bar{Y}_i^t >0\) there is a unique solution of the problem (24) in the form of the equilibrium value of the tariff for the use of services SR of company \( i\in \left\{ 1,\ldots ,n\right\} \) during the period t:

Proof

Let’s write out the profit function of i company in the form of:

We can calculate the derivatives of \(\bar{p}_{i}^t\) and equals them to zero, we obtain a system of algebraic equations of the form:

and the equilibrium value of the tariff has form:

We can obtain for \(\partial ^{2} \varPi _i^t /\partial \bar{p}_{i}^{t2} \),

The theorem is proved.

We can formulate an optimization problem for each company \(T_i\) \((i\in \left\{ 1,\ldots ,n \right\} )\) at any time \(t\in \left\{ 1,2,\ldots , T_{\max }\right\} \) for the tariff value \(\bar{p}_{it}^{*}\):

which allows maximizing the profit of each company of \(T_i\) using the parameter \(\delta _{ij}^t\) with condition \(Y_i^t \le \bar{Y}_i^t\).

After substituting the corresponding equilibrium tariffs \(\bar{p}_{it}^{*}\) in the profit function, we obtain the following equation

where

and differentiating by \(\delta _{ij}^t\) and equating to zero, we have a system of algebraic equations, solving which, we obtain an equilibrium value of \(\delta _t^{ * } = 0.5\).

The equilibrium tariff \(\bar{p}_{it}^{*}\) for the services of company \(T_i\), taking into account the optimal value \( \delta _t^{ * } = 0.5\) during the period t, has the form:

The equilibrium demand function for the company \(T_i\) \((i\in \left\{ 1,\ldots ,n \right\} )\) services SR at any t can be represented as follows:

and the total network traffic volume for a company \(T_i\) with the equilibrium tariff has form:

The total equilibrium market demand function \(D^{ * }_{t}\) and the total equilibrium traffic volume \(Y_{t}^{*}\) for services SR at any t has the form:

and we can show that with a uniform distribution of customers between all companies \(T_i\) \((i\in \left\{ 1,\ldots ,n \right\} )\) the total equilibrium market demand function the total equilibrium traffic volume for services SR reaches maximum.

If the network bandwidth of companies is less than the traffic volume that subscribers generate, then companies can manage the overload by creating such tariffs that reduces the overload on the network.

5.2 Numerical Analysis of Traffic Optimization Problem in Congested Networks

Let’s consider this model in the case of the oligopoly, when two companies are present in the market of telecommunication services, using numerical analysis. Let the duration of the calculations be \(t_{max} = 36 \) then the equilibrium tariff \(\bar{p}_{it}^{*}\) for the services of company \(T_i\) (\(i=1,2\)), taking into account the optimal value \( \delta _t^{ * } = 0.5\) during this \(t=0,1,\ldots ,36\), has the form:

Let’s suppose that the market share between two companies changes in such way as it is presented (see Fig. 1).

In this case the network traffic volume dynamics for a company \(T_i\) (\(i=1,2\)) with subject to the equilibrium tariff it is presented at (Fig. 2). We an see that each company try to increase the capacity of own network. There is fluctuation of network capacity in the long term, which may be due to the periodic transition of users from one company to the other and back.

6 Conclusions

In this paper a mathematical model of the telecommunications market is constructed taking into account congested in networks. It is carried out the analysis of equilibrium tariffs for telecommunications services for this type of market with multi-sided pricing.

The applied value of the model is that the use of PACR telecommunication companies does not require detailed information market telecommunications, as the number of parameters of the model is optimized. This model proved to be effective in the analysis the dynamics of the telecommunications market, as it allows companies to respond flexibly to external changes, which allows timely to change the strategy. The proposed model can serve as a tool for analyzing the existence of collusion between companies in the telecommunications industry market with congested networks. Numerical calculation is performed to illustrate the results.

References

Armstrong, M.: Nonlinear pricing. Ann. Rev. Econ. 8, 583–614 (2016)

Cramton, P., Doyle, L.: Open access wireless markets. Telecommun. Policy 41(5–6), 379–390 (2017)

Gaidamaka, Y., Sopin, E., Talanova, M.: Approach to the analysis of probability measures of cloud computing systems with dynamic scaling. In: Vishnevsky, V., Kozyrev, D. (eds.) DCCN 2015. CCIS, vol. 601, pp. 121–131. Springer, Cham (2016). https://doi.org/10.1007/978-3-319-30843-2_13

Dessein, W.: Network competition in nonlinear pricing. Rand J. Econ. 34, 593–611 (2003)

Dessein, W.: Network competition with heterogeneous customers and calling patterns. Inform. Econ. Policy 16, 323–345 (2004)

Doganoglu, T., Tauman, Y.: Network competition and access charge rules. Manch. Sch. 70, 16–35 (2002)

Hahn, J.-H.: Network competition and interconnection with heterogeneous subscribers. Int. J. Ind. Organ. 22, 611–631 (2004)

Korolkova, A.V., Eferina, E.G., Laneev, E.B., Gudkova, I.A., Sevastianov, L.A., Kulyabov, D.S.: Stochastization of one-step processes in the occupations number representation. In: Proceedings - 30th European Conference on Modelling and Simulation, ECMS 2016, pp. 698–704 (2016)

Mohlmeier, P., Rusinowska, A., Tanimura, E.: Competition for the access to and use of information in networks. Math. Soc. Sci. 92(C), 48–63 (2018)

Laffont, J.-J., Tirole, J.: Access pricing and competition. Eur. Econ. Rev. 38, 1673 (1994)

Laffont, J.-J., Rey, P., Tirole, J.: Network competition I: overview and nondiscriminatory pricing. Rand J. Econ. 29, 1–37 (1999)

Laffont, J.-J., Rey, P., Tirole, J.: Network competition II: price discrimination. Rand J. Econ. 29, 38–56 (1998)

Laffont, J.-J., Tirole, J.: Internet interconnection and the off-net-cost pricing principle. Rand J. Econ. 34, 73–95 (2003)

Laffont, J.-J., Tirole, J.: Receiver-pays principle. Rand J. Econ. 35, 85–110 (2004)

Lee, S.-H., Jeong, H.-Y., Seo, S.-W.: Optimal pricing and capacity partitioning for tiered access service in virtual networks. Comput. Netw. 57(18), 3941–3956 (2013)

Samouylov, K., Naumov, V., Sopin, E., Gudkova, I., Shorgin, S.: Sojourn time analysis for processor sharing loss system with unreliable server. In: Wittevrongel, S., Phung-Duc, T. (eds.) ASMTA 2016. LNCS, vol. 9845, pp. 284–297. Springer, Cham (2016). https://doi.org/10.1007/978-3-319-43904-4_20

Se-Hak, C.: Network capacity and access pricing for cloud services. Procedia Soc. Behav. Sci. 109, 1348–1352 (2014)

Sevastianov, L.A., Vasilyev, S.A.: Large-scale queuing systems and services pricing. In: 9th International Congress on Ultra Modern Telecommunications and Control Systems and Workshops, (ICUMT 2017), pp. 7–12 (2017)

Ushchev, P., Zenou, Y.: Price competition in product variety networks. Games Econ. Behav. 110, 226–247 (2018)

Vasilyev, S.A., Sevastianov, L.A., Urusova, D.A.: Economics and mathematical modeling of oligopoly telecommunication market. Math. Inform. Sci. Phys. 2, 59–69 (2011). Bulletin of Peoples Friendship University of Russia

Acknowledgments

The publication has been prepared with the support of the “RUDN University Program 5-100”.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Switzerland AG

About this paper

Cite this paper

Salih, H.H., Urusova, D.A., Vasilyev, S.A. (2018). Traffic Optimization and Multi-sided Pricing in Congested Networks. In: Dudin, A., Nazarov, A., Moiseev, A. (eds) Information Technologies and Mathematical Modelling. Queueing Theory and Applications. ITMM WRQ 2018 2018. Communications in Computer and Information Science, vol 912. Springer, Cham. https://doi.org/10.1007/978-3-319-97595-5_29

Download citation

DOI: https://doi.org/10.1007/978-3-319-97595-5_29

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-97594-8

Online ISBN: 978-3-319-97595-5

eBook Packages: Computer ScienceComputer Science (R0)