Abstract

This paper evaluates the optimal pricing for two Internet service providers and two network providers; all are competing on price, which is based on quality. To find the optimal prices of service and network providers and to determine optimal scenarios, a two-stage competition is modeled. In the first stage, network providers compete on market prices by setting the quality in four scenarios. At this stage, we found the equilibrium prices in the market. In the second stage, by obtaining market prices, service providers compete on network prices. Finally, the equilibrium solutions are compared with each other by considering the intensity of market competition in price and quality. It is shown that equilibrium never occurs in the case when the smaller service provider has a higher Internet quality than the other (scenario 2) and the more significant service provider offers a higher Internet quality (scenario 4). Besides, when both Internet service providers offer low-quality Internet (scenario 1) and high-quality Internet (scenario 3), the companies make the most profit. By increasing and decreasing the competition in quality, equilibrium would still exist for the first scenario, and the third scenario, respectively. The intensity of market competition in price behaves oppositely as quality.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Life without Internet is unimaginable. Each year, the number of Internet devices is increasing, and the network is spreading around the globe and even expanding into space. Practically all businesses have an Internet connection. In the early years, the Internet was used to transfer data between users. For instance, Email was the primary use of the Internet, and a delay was not an urgent matter, similar to the time when people used the postal service. Nowadays, by increasing Internet services like cloud services, music streaming, video conferences to music, delay and quality would be significant. If there is a request for an online service, and the service has a bad quality or interrupts frequently, we may not be able to continue to communicate. We might even prefer to disconnect and try our chances at another time. The importance of Internet quality and the lack of attention to this issue in supply chain economics (see, for example, Jahantigh and Malmir [9]), prompt us to design a two-tier supply chain by considering two service providers and two network providers, competing on their prices in a competitive market. Also, the growing focus on developing integrated networks and smart decision models (see, for example, Ghassemi et al. [6]) directs to new opportunities and more competitions for network and internet providers.

In the literature, equilibrium models for Internet networks have considered price as the only factor affecting demand. For example, Irmeilyana et al. [8] analyzed an Internet pricing scheme under a multi-service network by generalizing their model into multi-services. Their non-linear optimization model maximizes both profits of the Internet service provider and customer satisfaction based on the number of links, the base price, and quality premium. Their results showed that Internet service providers could increase their profit while maintaining a fixed based price. He and Walrand [7] proposed a model for pricing in a network with several service providers. Their findings proved that a non-cooperative game can be unfair and prevent future network upgrades, while income-sharing policies are more efficient and encourage service providers to collaborate without deception. Musacchio et al. [12] developed a bilateral market model where service providers and network providers share their income and jointly invest in network infrastructure. This model defined the demand of the users as a function of investment by the product of service providers and network providers, which causes an exponential decrease of the demand as price increases. Nagurney et al. [13] presented a Cournot–Nash competition model for a service-oriented Internet by considering service differentiation. In their model, each service provider aims to maximize its profits to set the volume and quality of their services. However, they did not consider the maximum profit for network providers. They used the variational inequality theory to formulate the Nash equilibrium.

One of the main articles that specifically studied Internet pricing is Lv and Rouskas [10] that focused on modeling Internet service providers and pricing of multi-level network services. They presented both the model and the algorithm with computational results and considered networks that provided a variety of services and price structures in a model. Their economic model raised the issue of the choice of service levels in three perspectives; (1) the interests of users, (2) the benefits of the service providers, and (3) both at the same time. Then, they provided an approximate and efficient solution to their non-linear problem concerning a set of service levels close to the optimal answer. They also used game theory techniques to find the optimal price for each level of service to balance the conflicting goals of users and service providers. In the end, they provided a theoretical framework for reasoning the pricing of multi-level Internet services.

Interestingly, Tripathi and Barua [14] presented a model in which clients are given assurances by service providers to be able to connect to the Internet under any circumstances. In their model, if clients did not get the services they requested, the service provider pays penalties to the clients. Besides, they considered the case where Internet clients can connect dynamically to several Internet service providers. They also assumed a Poisson arrival process with the rate of arrival dependent on the price being charged. Based on their model, clients can request extra bandwidth for a period, but after that, they would be on idle for another period in which both times have an exponential distribution. After the idle period is over, the client can either depart or request extra bandwidth again. They assumed that the service provider tries to maximize its income by charging appropriate prices and presented solutions that maximize the income of the service provider. Finally, they compared the solution by using simulation.

In most papers in the literature, numerical analysis has been used, while parametric analysis gives the reader an overview of the importance of the subject. In some other articles, the demand function is modeled only by considering the price factor. However, it is essential to consider the quality of service on the Internet. In this paper, we analyzed these models in the market competition and considered the demand function dependent on price and quality. We also described the Internet quality in four scenarios based on the real market observations; (1) both Internet service providers offer low-quality Internet, (2) the smaller service provider has a higher Internet quality than the other, (3) both service providers offer high-quality Internet, and (4) more significant service provider offers a higher Internet quality.

In this study, we measure the increase of quality on the profits of service and network providers. Undoubtedly, by increasing quality, the demand will be increased, but the question is how much does that affect the price? The purpose of this study is to maximize the profits of service providers and network providers and determine the market and network prices by considering the quality of service in different scenarios.

In the next section, we introduced the model with all the variables and parameters. Then, we obtained the optimal solutions for all the before-mentioned scenarios and analyzed the main results of the model, and the behavior of the profit functions based on quality. Following, we investigated the Nash equilibrium between service providers and network providers in the market, and then explained the obtained market Nash equilibrium by considering the intensity of competition based on price and quality and different bandwidth price. In the end, we provided a conclusion and some of the possible future research directions.

2 Model setting

We consider a two-tier supply chain consisting of a supplier (in this case Telecommunication Infrastructure Company (TIC) as a government entity that is responsible for telecommunication networks infrastructure), two service providers, two network providers, and the demand market. The downstream network providers, denoted by N1 and N2, transport and sell the Internet in the same demand market. Service providers who are denoted by S1 and S2, in this case, are supposed to distribute the Internet to network providers.

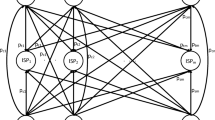

In this model, it is assumed that service providers produce content and use network providers to transfer their data to the demand market (users). Network providers compete among consumers on the market price, while service providers compete among users by setting the quality of the service and the network price (the price of data transmission through network providers). In the simplest case (when there is a competition), we assume that there are two service providers and two network providers. Service providers for the delivery of service volumes to users, contract with network providers. Consumers respond to the quality of service, and the market price determines by network providers. The task of the network providers is to transfer the Internet from the service providers to the users. Figure 1 illustrates a supply chain with two network providers and two service providers, the primary source of which is the Telecommunication Infrastructure Company.

In this model, we first assume that network providers compete in the market based on a Bertrand game to maximize their profits, which provide us the market price. Then, in the next step, given the optimal value of the market price, the maximum price of service providers is obtained by determining the network price. We assumed that the volume of service is a function of the quality and price. Quality plays an essential role in improving the productivity of companies. Since the the market price affects the demand function [5], in the next step, given the optimal value of the market price, the maximum price of service providers is obtained by determining the network price. We assumed that the volume of service is a function of the quality and price. Making decisions based on quality is interesting for companies that compete to gain more customers (see, for example, Malmir et al. [11] and Almasi and Malmir [1]). For two companies competing on price and quality, the linear model that we use for the demand is as follow (see, Banker et al. [3]):

The linear model for the two companies that compete based on price and quality is assumed to be as

where \(v_{\text{i}}\) is the demand function for company i, \(p_{i}\) is the price for firm i, and \(q_{i}\) is the quality of service for firm i. In this model, \(\alpha\) is the demand potential parameter for firm two, while for the first one, the demand potential is normalized to 1. Without loss of generality, we assume that \(\alpha \ge 1\) [4]. The parameter \(\gamma\) is the demand responsiveness to the price and satisfies \(0 \le \gamma \le 1\). The parameter \(\mu\) is the demand responsiveness to the quality and satisfies \(0 \le \mu \le 1\). In the case when γ is equal to zero, the demand for products is independent of other firm’s products, and there is no competition in the market. When γ increases, the market will become more competitive. Thus, γ reflects the intensity of competition between the firms based on price. Similarly, μ is the intensity of competition between firms based on quality. Besides, when \(\alpha > 1\), it shows that the service volume or demand of the second company has more power than the first company’s demand in the market. In other words, by assuming the same prices for each company for the Internet, the second company will satisfy a more significant share of the market. The objective of both service providers and network providers is to maximize their profits.

Now we offer the benefits of Internet service providers in terms of service quality. To maintain a certain level of user service quality, Internet service providers must pay for network management and some improvements. Let us assume that \(u\left( {v,q} \right)\) is the amount of bandwidth consumed by users, which is a function the demand v and the quality of service q. It is assumed that \(u\left( {v,q} \right)\) is a positive, convex, and increasing function. This is a reasonable assumption because higher demand or higher service quality requires extra bandwidth. Here we define the quality as the expected delay, which is computed by the Kleinrock function, that is a function associated with the delay of an M/M/1 queuing system with the discipline of the first-in-first-out (FIFO). Instead of minimizing the delay, the maximization of the reciprocal of the square root of the delay is considered. It can be seen in Eq. (4) that, by reducing delay times (d), the quality of service of companies increases (see, Altman et al. [2]).

where \(u\left( {v,q} \right)\) is equal to the total network bandwidth and is a function of demand or volume of service and quality, that is:

As a result, when demand for higher quality increases, more bandwidth would also be consumed, and therefore, the cost of service providers can be defined as:

where r is the price of a unit of bandwidth, v is equal to demand or volume of service, and qi is the quality of service for firm i. Therefore, we can derive the service provider’s benefit function from the difference between income and expenditure as follow:

where w is the price that the network providers pay for access to the service and transfer it to users at the demand market. Also, the profit function of the network providers is as follow:

where it defines the difference between profits from the sale of the Internet to users at the demand market and the cost of paying service providers to access the Internet, and also pi represents the market price for the firms.

In this research, by considering a supply chain with two service providers and two network providers, and using a linear demand function depending on price and quality, first, we will find the equilibrium prices in the market for network providers. Moreover, at the second stage, we will derive the equilibrium prices of the network for service providers. Then, we compared the profit functions based on bandwidth price (r) and sensitivity coefficients of the price (γ) and quality (\(\mu\)) in different scenarios. Finally, among different scenarios, the formed equilibrium between them by varying the parameters.

3 Analysis

In order to see the impact of service quality on consumer behavior, we consider quality as an input variable. First, service providers determine their service quality and then compete with others on the market price at the same time. To solve this problem, we consider four scenarios.

In the first scenario, both Internet service providers offer the same level of the low-quality Internet, in the second scenario, the smaller service provider has a higher Internet quality than the other, in the third scenario, both service providers offer the same level of high-quality Internet, and in the last scenario, more significant service provider offers high-quality Internet, and the smaller service provider offers low-quality Internet. In order to show the quality difference between service providers in this research, we represent a higher quality Internet with \(q\) and lower quality with \(mq\), where \(0 < m < 1\). We discuss four scenarios separately. The result will be shown in the next section.

In the first scenario, both service providers with low-quality Internet compete in the market. So, \(q_{1} = q_{2} = mq\); therefore, to solve and find Nash equilibrium, we can use a backward induction method to obtain the variables. We formed a two-stage competition in which in the first stage, we assume the network prices are given and try to determine the market price by simultaneously maximizing the profits of the network providers. In the next stage, service providers compete in the market to determine their network price based on maximizing their profits. By obtaining the optimal market prices, we can use them in the demand functions and determine the network prices. If we place \(q_{1} = q_{2} = mq\) in Eqs. (2) and (3) and then maximize Eq. (8) based on market prices, we can derive the optimal market prices as follows:

where the optimal equilibrium prices are derived based on \(w_{1}\) and \(w_{2}\). Now, by plugging in the optimal equilibrium prices in Eqs. (2) and (3), at this stage, we maximize the profits of service providers based on \(w_{1}\) and \(w_{2}\). To derive optimal network prices, we maximize Eq. (7) based on network prices as follows:

By obtaining \(w_{1}\) and \(w_{2}\) in terms of parameters and plugging into Eq. (9) and (10), the prices in the market can be obtained according to the parameterazation and by having the optimal value \(w_{1}\) and \(w_{2}\) and \(p_{1}\) and \(p_{2}\), all variables including service volume or demand in the market, profit functions of network providers and service providers can also be derived. Here all the optimal values of variables for scenario 1 have been calculated by Wolfram Mathematica version 9.

The optimal values for the three other scenarios can be obtained similar to the first scenario. For the second scenario, we have the case where \(q_{1} = q\) and \(q_{2} = mq\), which means firm one has a high-quality and firm two has a low-quality Internet in the market. For the third scenario, we use \(q_{1} = q_{2} = q\), which means both firms compete in the market with high-quality Internet and for the last scenario, we replace \({\text{q}}_{1} = mq\) and \({\text{q}}_{2} = q\) in demand functions, and we do the same steps as in the first scenario.

Now, we examine the behavior of each player’s profit functions separately in different scenarios. First, we show the behavior of the profit functions of the network providers based on quality, and then the behavior of the profit functions of service providers based on quality in four different scenarios.

Figure 2 shows the behavior of network provider 1, the network provider with a less share in the market. The y-axis and the x-axis demonstrate the profit of the network provider and quality of Internet, respectively. We set the sensitivity coefficients of the price at γ = 0.1 and γ = 0.5 and quality at \(\mu\) = 0.1, \(\mu\) = 0.5, and \(\mu\) = 0.8 when α = 5; r = 1.5; m = 0.5.

When the market has low sensitivity to the price and quality, i.e., μ = 0.1 and γ = 0.1, the profit of network provider 1 increases with a higher degree of quality for scenario 2 and scenario 3, however, for scenario 1 and scenario 4, which means that the internet has a low-quality, profits will increase with a lesser slope. For the case when μ = 0.5 and γ = 0.1, the market is more sensitive to the price than the quality, and we can see a decrease in the behavior of the profit in scenario 3 and 4. Also, when the Internet quality increases, the second scenario gains more profit than all the others. When the market behavior is very sensitive to the quality, i.e., μ = 0.8 and γ = 0.1, the profit of the first network provider for scenario 2 and scenario 4 has an interesting behavior, since scenario 4 has the highest profit when q is up to about 0.48 but then scenario 2 will have a higher profit.

By increasing the market competition based on price (γ is not small), in the case when μ = 0.1 and γ = 0.5, the third scenario is the most profitable. It can be observed that by increasing the value of μ, the second and third scenario change their position and the first scenario will be more profitable than the fourth scenario (compare the case when μ = 0.1 and γ = 0.5 with μ = 0.5 and γ = 0.5). There is no significant change in the profit functions when μ = 0.8 and γ = 0.5, and we can explore the same trend.

Now, we analyze the behavior of network provider 2 based on quality, the network provider with a significant share in the market. Figure 3 shows the behavior of network provider 2 based on the quality by using the same initializations as for the first network provider.

When market behavior is less sensitive to price and quality, i.e., μ = 0.1 and γ = 0.1, the profits in scenario 3 and scenario 4 are higher than scenario 1 and scenario 2. Except for the case when μ = 0.1, when γ increases to 0.5, scenario 3 would have the highest profit and then scenario 4, scenario 2, and scenario 1 would have the second, third and the least profit, respectively. We can interpret this as the market has more sensitivity to quality than the price, which is not a critical factor in changing the equilibrium of the scenarios. The price is sensitive to the market only when μ is very small; that is, the market is not sensitive to the quality. It can be seen that there are no significant changes, and we can make similar arguments for all other cases.

After examining the behavior of the network providers, let us now consider the behavior of the profit functions of service providers for different scenarios. Figure 4 shows the behavior of service provider 1 based on quality, the network provider with a less share in the market, for different scenarios by using the same initializations as for the network providers. In all six graphs in Fig. 4, the behavior of the profit functions is equal in almost all scenarios when q is small. As q increases, when μ = 0.1 and γ = 0.1, the amount of profit is the highest in the fourth scenario, and then scenario 1, scenario 2, and scenario 3 have the second, third, and least profit, respectively. For μ = 0.5 and μ = 0.8 with γ = 0.1, we can observe similar behavior in the profit functions, with the profit of the order of scenario 1, scenario 4, scenario 2, and scenario 3. For μ = 0.5 and μ = 0.8 with γ = 0.5, again we can see a similar behavior and there is no significant alteration between different scenarios except the case when μ = 0.8 and q is large (more than 0.7) in which we can explore that scenario 1 has the highest profit, and then scenario 4, scenario 2, and scenario 3.

By comparing Figs. 4 and 5, for the case when γ = 0.1, we can observe that the profits for service provider 2 is always higher than service provider 1 when the quality is not an essential factor in the market (q = 0), and providers compete on the price for all four scenarios. As a result, service provider 1 would have higher profits.

When γ = 0.5, we can see that in scenario 1 we do not have a significant change in the profits for different values of \(\mu\). Besides, for scenario 2, scenario 3, and scenario 4, the profit function has a descending trend.

Next, to investigate the equilibrium in the market we defined a simply 2 by 2 game theory model as shown in Table 1. In a game, “equilibrium” is a state that none of the players are willing to change. The Nash equilibrium represents a situation in which a particular player cannot achieve a better state with a unilateral move (assuming the strategy is stable for other players). To find the Nash equilibrium, we must compute each payoff of the states or scenarios of the game. First, we assume each opponent’s scenario is given, and then we find the best response to those scenarios for all players.

According to these conditions and the Nash equilibrium definition, the first scenario is an equilibrium, if:

The second scenario is an equilibrium, if:

The third scenario is an equilibrium, if:

The fourth scenario is an equilibrium, if:

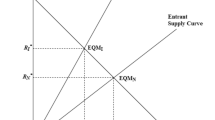

To find the Nash equilibrium, we need to solve the equations in (19–26). Also, yo analyze the equilibrium, we are going to show graphical representations as shown in Figs. 6, 7, 8 and 9 by considering \(\alpha = 5\), \(m = 0.8\), and for different \(\gamma\) and \(\mu\).

In Fig. 6, we demonstrated the equilibrium in the market by considering the intensity of competition based on only price for a variety of \(\mu\). It can be seen that when μ = 0.8, the equilibrium is formed in the first scenario. In this case, when the competition on quality is high in the market, the demand will be reduced. As a result, the equilibrium is formed in a scenario that has a lower quality. For service providers, to profit under this condition, it is better to choose the Internet at a lower quality level. In this case, each profit has the highest value compared to other scenarios. When μ = 0.5, at a low γ level, the market equilibrium is in the first scenario, but if we increase γ, the equilibrium changes, and transfers into the third scenario. That means, if the market reacts to the price more than the quality, it is better for both service providers to compete on the high level of quality. In other words, any service providers that can produce high-quality Internet would win the game. Otherwise, the first scenario is a better solution. With μ = 0.1, it can be seen that the response space is more likely to occur in the third scenario. Moreover, in this case, only when γ is small, the equilibrium changes and moves to the first scenario.

Next, we try to find the equilibrium by considering the intensity of competition based on quality shown in Fig. 7.

Based on Fig. 7, when γ = 0.1 with a small amount of μ, the equilibrium is formed in scenario 3. As μ increases, the equilibrium will move to scenario 1. That means if the market is very sensitive to the price, there is an equilibrium between scenario 1 and scenario 3. If the market is sensitive to quality (\(\mu\) is large), then scenario 1 is a better solution. Otherwise, scenario 3 will be selected. It is worth noting that, when μ = 0.08 and q = 0.1, there is a point in which scenario 4 forms an equilibrium which is unlikely to happen. For γ = 0.5 and γ = 0.8, when μ is greater than or equal to 0.4 and 0.6, respectively, the equilibrium would form in scenario 1. Now, we are going to vary the bandwidth price (r) and see how the equilibrium would change based on quality and price as shown in Figs. 8 and 9.

Based on Fig. 8, only scenario 1 and scenario 3 form an equilibrium except for the case when γ = 0.1 where scenario 2 and scenario 4 form an equilibrium as a point in r = 1.4 and r = 1.8, respectively. Also, it can be seen that when r is increasing from 1 to 1.8, scenario 1, would have a less chance to be an equilibrium because the equilibrium region is decreasing. Besides, when γ = 0.5 and γ = 0.8, there is no significant difference for different r.

In Fig. 9, only scenario 1 and scenario 3 are forming an equilibrium. When μ = 0.8, in any circumstances for r, scenario 1 forms an equilibrium. In addition, when μ = 0.5, scenario 3 forms an equilibrium only if γ ≥ 0.65. And, when μ = 0.1, scenario 3 forms an equilibrium only if γ ≥ 0.18.

Finally, we want to show the equilibrium by considering the intensity of competition based on price (γ) and quality (μ). As shown in Fig. 10, equilibrium always occurs in scenario 1 and scenario 3. When γ > μ, equilibrium is formed in scenario 3, that is, both service providers offer high-quality Internet. Initially, the market is more sensitive to the price than the quality of the Internet which made the equilibrium to form in scenario 3, that is, service providers are gaining more profit by providing a high-quality Internet. Besides, if the players change their strategy (scenario), they would have less profit. In this case, market equilibrium will be formed in scenario 3, and demand for the high-quality Internet will increase. As demand starts growing, the sensitivity of the market based on price would increase. In this case, the rival company tries to improve the quality of its Internet in comparison with the other competitor. By increasing the quality of the Internet, its price will also increase. As a result of this price increase, the demand for the Internet would drop, and then service providers need to reduce their Internet quality. In this case, the equilibrium moves from scenario 3 to scenario 1.

As a real-world scenario, in one of the countries in Asia in 1990, the Internet was under the government’s control and used only for military and educational purposes. In 2005, the Internet became accessible publicly, and the government continued providing Internet under a private sector. Before 2005, since the government was fully controlling the Internet, there was no competition regarding price and quality. In 2008, another private sector started to work in this industry. This new company provided a high-speed Internet in comparison with the older one, which, based on our case, is called scenario 2. Since then, the market became more sensitive to the quality because people could only satisfy with a high-quality Internet in which the new private sector was providing. The older company would not have been able to profit with low priced service and also the low-quality Internet. Therefore, they decided to increase the quality of the Internet, at least as much as the other company, which is precisely the case in scenario 3. After that, the older company introduced a higher quality Internet in order to outreach the new company (scenario 4). Both companies started to lose profit, which maps in our model that the equilibrium would not be formed in scenario 4, and the providers would not benefit in that scenario. The older company raised exceedingly the Internet quality, which led to a high price of the Internet. However, after that, the market got more sensitive to price than the quality. Also, to compensate for the loss, the older company decreased the Internet quality at the same level as the new company, which is the case in scenario 1, i.e., both companies have a low-quality Internet. Also, today, with the growing number of service providers and various types of services, in addition to price and quality, the demand depends on a variety of factors such as Internet bonus plans, discounts, and broader bandwidth.

4 Conclusions

This research attempts to optimize pricing by analyzing the relationship between service providers and network providers. We consider the quality of service based on four scenarios, and their respective market and network prices. The optimal prices are derived by maximizinig the expected profit functions. We studied the optimal scenarios of two competing service and network providers in the market, in which demand is dependent on the price and quality.

The results illustrated that the equilibrium never occurs in scenario 2 and scenario 4. Moreover, in general, scenario 1 and scenario 3 make the most profit for companies. We obtained the equilibrium by several critical factors, including the difference in market potential (α), the intensity of competition in the market based on price (γ), the intensity of market competition based on quality (μ), bandwidth price (r), and the difference in quality between companies (m). Besides, we analyzed the market equilibrium in a supply chain with two service and two network providers who compete on price and quality. We obtained the equilibrium prices based on a two-stage competition model. In the first stage, network providers competed on market prices, and then in the second stage, service providers competed on network prices. Then, the behaviors of the four-player profit functions were compared to the quality of the Internet by considering the intensity of market competition based on price and quality. We investigated the equilibrium based on 4 defined scenarios. The results showed that by increasing the intensity of market competition based on quality, the equilibrium is formed in scenario 1, and by decreasing the intensity of market competition based on quality, the equilibrium moves to scenario 3. Another factor that affected the equilibrium is the bandwidth price. We showed that by increasing the bandwidth price, the profit would decrease. The intensity of market competition based on price also affects the equilibrium, which, by increasing it, the equilibrium moves from scenario 1 to scenario 3.

There are still many open topics that exist in this area. An interesting and challenging topic is considering more players and using a non-linear demand function which reflects a more realistic scenario. For instance, a combination of price and quality with advertisement or rebate is a demanding research that requires a strong motivation. With the emergence of new wireless applications and services in the context of communication networks, the motivation to apply game theory models are considerably increasing. One of these emerging wireless applications is wireless intelligent transportation system that could be modeled by using game theory applications.

References

Almasi, F., & Malmir, B. (2015). Analyzing and estimating the project success with a hybrid method based on fuzzy theory and decision making analysis. In 2015 International conference on industrial engineering and operations management (IEOM) (pp. 1–9). IEEE.

Altman, E., Rojas, J., Wong, S., Hanawal, M. K., & Xu, Y. (2011). Net neutrality and quality of service. In International conference on game theory for networks (pp. 137–152).

Banker, R. D., Khosla, I., & Sinha, K. K. (1998). Quality and competition. Management Science,44(9), 1179–1192.

Bolandifar, E., Kouvelis, P., & Zhang, F. (2016). Delegation vs. control in supply chain procurement under competition. Production and Operations Management,25(9), 1528–1541.

Esmaeili, M., Abad, P. L., & Aryanezhad, M. B. (2009). Seller-buyer relationship when end demand is sensitive to price and promotion. Asia-Pacific Journal of Operational Research,26(05), 605–621.

Ghassemi, A., Hu, M., & Zhou, Z. (2017). Robust planning decision model for an integrated water system. Journal of Water Resources Planning and Management,143(5), 05017002.

He, L., & Walrand, J. (2003). Pricing internet services with multiple providers. Proceedings of the Annual Allerton Conference on Communication Control and Computing,41(1), 140–149.

Irmeilyana, I., Puspita, F. M., & Husniah, I. (2016). Optimization of wireless internet pricing scheme in serving multi QoS network using various attributes. TELKOMNIKA (Telecommunication Computing Electronics and Control),14(1), 273–279.

Jahantigh, F. F., & Malmir, B. (2015). Development of a supply chain model for healthcare industry. In 2015 International conference on industrial engineering and operations management (IEOM) (pp. 1–5). IEEE.

Lv, Q., & Rouskas, G. N. (2010). An economic model for pricing tiered network services. Annals of Telecommunications-annales des Télécommunications,65(3–4), 147–161.

Malmir, B., Dehghani, S., Jahantigh, F. F., & Najjartabar, M. (2016, June). A new model for supply chain quality management of hospital medical equipment through game theory. In Proceedings of the 6th international conference on information systems, logistics and supply chain, ILS 2016.

Musacchio, J., Schwartz, G., & Walrand, J. (2011). 18 Network economics: neutrality, competition, and service differentiation. Next-Generation Internet: Architectures and Protocols, 1, 378.

Nagurney, A., Li, D., Wolf, T., & Saberi, S. (2013). A network economic game theory model of a service-oriented internet with choices and quality competition. NETNOMICS: Economic Research and Electronic Networking,14(1–2), 1–25.

Tripathi, R., & Barua, G. (2016). Dynamic internet pricing with service level agreements for multihomed clients. NETNOMICS: Economic Research and Electronic Networking,17(2), 121–156.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mohamadi, M., Bahrini, A. A Nash–Stackelberg equilibrium model for internet and network service providers in the demand market—a scenario-based approach. Wireless Netw 26, 449–461 (2020). https://doi.org/10.1007/s11276-019-02155-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11276-019-02155-8