Abstract

The power supply network, Smart Grid, is one of the most critical infrastructures which help to realize the vision of Smart Cities. Smart Grids can provide a reliable and quality power supply with high efficiency. However, the demand for electricity fluctuates throughout the day, and this variable demand creates power instability leading to an unreliable power supply. The inherent difficulties can be addressed to a certain extent with demand-side management (DSM) that can play a vital role in managing the demand in Smart Grids and Microgrids, by implementing dynamic pricing using Smart Meters. This chapter reviews relevant challenges and recent developments in the area of dynamic electricity pricing by investigating the following pricing mechanisms : Time-of-Use Pricing , Real-Time Pricing , Critical Peak Pricing , Day-Ahead Pricing , Cost Reflective Pricing , Seasonal Pricing , and Peak Time Rebate Pricing . We also discuss four real-world case studies of different pricing mechanisms adopted in various parts of the world. This chapter concludes with suggestions for future research opportunities in this field.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Smart Grids

- Renewable energy sources

- Energy measurement

- Energy management

- Demand-side management

- Energy conservation

- Load management

- Energy efficiency

- Energy storage

- Distributed energy resources

- Appliance scheduling

1 Introduction

The increasing demand for electricity and limited fossil fuels has given rise to Demand Response (DR)-based electricity markets via Smart Grids . By means of DR, customers can manage or control their demand according to the pricing signals received from the utility company. Alternative sources of electrical energy generation such as wind, solar, geothermal, biogas, etc., are contributing to meet the growing demand. However, these sources are less reliable, which is a major issue [1,2,3]. Hence, electricity generation is not enough to meet the energy demand, which creates a gap between demand and supply. One way to address this challenge is to increase the generation capacity of existing power plants, but this requires a great deal of capital investment and also affects the environment. The other option is to optimize the existing capacity to reduce the gap, thereby fulfilling the demands of all users.

With advancements in technology, improvement in the quality of life, rapid economic growth and industrialization, the demand for electricity has increased significantly. According to the World Energy Council report [4], the consumption of electrical energy will increase to 20% in 2030, up from 18% in 2014. The increasing demand can be met by either increasing production or demand-side management (DSM). There are various issues which need to be managed effectively in order to reduce the gap between demand and supply. One of these issues is the peak-to-average load ratio. DR is an important tool for reducing the peak-to-average load ratio. DR can be realized via the DSM technique [5, 6] that can improve the power grid reliability by dynamically changing electricity consumption or rescheduling it with the implementation of dynamic tariffs [7]. Hence, DSM plays a vital role in realizing the grand vision of interconnected smart cities and Smart Grids .

In the literature, peak load management (or reducing the peak-to-average load ratio) is the most sought-after objective in demand response programs. The demand for electrical energy during peak periods can be met by establishing new generating stations, energy storage, or by demand response. However, setting up a new conventional power generating station just to meet the peak demand is not a practical solution because it is expensive and will be used only during peak demand periods. Further, it is not environmentally friendly as it produces harmful greenhouse gases. Alternative power generating sources such as wind, solar, etc., can be used to meet the power demand during peak periods, but they are not reliable as their generation can vary according to environmental conditions, weather, geographical location, etc. Hence, DR becomes an important method of reducing the peak-to-average load ratio and it can be achieved by means of dynamic pricing.

Dynamic pricing of electricity is one of the most valuable tools for DSM as customers have the opportunity to participate in day-to-day operations of the electricity grid by shifting their load during off-peak periods in response to the dynamic tariff of electrical energy like Time-of-Use [8, 9] and other incentive-based pricing strategies such as Real-Time Pricing , Critical Peak Pricing , Day-Ahead Pricing , Seasonal Pricing [10], Cost Reflective Pricing [11], and Peak Time Rebate [12, 13]. In the traditional grid, it was difficult to apply various dynamic pricing strategies as it was not possible to track the consumption of electrical energy at different periods; however, with the adoption of smart meters in Smart Grids , it can now be easily and reliably achieved.

Several studies in the literature have examined DSM [14, 15], but none of them have comprehensively considered the challenges associated with different pricing strategies. This chapter examines various challenges and reviews the recent developments in the area of dynamic electricity pricing. The following pricing mechanisms are investigated in detail—Time-of-Use Pricing , Real-Time Pricing , Critical Peak Pricing , Day-Ahead Pricing , Cost Reflective Pricing , Seasonal Pricing , and Peak Time Rebate Pricing . Further, we also include four real-world case studies of dynamic pricing mechanisms adopted in various parts of the world. This chapter concludes with suggestions for future research directions in this field.

2 History of Power Grids

The earliest electrical network was simple and localized consisting of few generating units and a distribution network. Thomas Edison designed the first electrical network in New York City on Pearl Street in 1882. It had a 100-V generator with a few hundred lamps in the neighborhood [16]. At that time, the demand for electricity was increasing rapidly and to fulfill this demand, new generation capacity was necessary, along with long-distance transmission and distribution capability. To meet this demand, investment in new infrastructure began which led to the larger and more complex electrical networks that we see today. Managing this complexity became a new challenge and the concept of grid evolved to address this issue. The grid comprised three entities namely: electricity generation , electricity transmission , and electricity distribution .

The power industries which began as regulated industries had the following characteristics: monopolistic franchise, obligation to serve, regulation oversight, least cost operation, regulated rates, and assumed returns [17]. In such a regulated market structure, the generation, transmission, and distribution of electricity were all controlled by a single entity [18].

During the 90s, the power industries faced significantly high demand that led to increased operational efficiency brought about by companies changing their inefficient systems and irrational tariff policies [19]. This resulted in the deregulation of the power industry which led to the establishment of the following entities: GenCo (generating company), TransCo (transmission company), DisCo (distribution company), ResCo (retail energy service company), and ISO (independent system operators) [20]. Deregulation of the power industry opened up the power sector and introduced competition in the electrical industry. One of the major outcomes of deregulation was increased reliability and secure operation of the power grid [21].

Increased competition, as a result of deregulation, resulted in unprecedented demands for electrical power, which required optimal utilization of the available resources. Hence, power companies began implementing SCADA systems (Supervisory Control and Data Acquisition) which provided some control but still lacked real-time control of the distribution network [22].

In a traditional hierarchical grid, the power plants are positioned at the top of the hierarchy and the consumers toward the bottom, and the flow of information is unidirectional. This system has several drawbacks such as: (1) voltage and frequency instability due to dynamic nature of the load, (2) difficulties in demand-side management, (3) integration of distributed generation is not possible [23], (4) electricity consumption occurs at the same time as generation, and (5) storage of electricity is expensive, so unused electricity is wasted.

To address these challenges, a real-time infrastructure is required to monitor and control the system. To obtain a complete and efficient control of the overall system, additional feedback is required from the consumer side, which makes the real-time monitoring of the distribution network very important. Advancement in information and computing technology makes it possible for the utility to receive these real-time inputs to the grid [24]. This is a realization of Smart Grid. A future grid or Smart Grid is a grid that is integrated with information and communication technology (ICT) with advanced dynamic control [25]. Smart Grids are described in the following section.

3 Traditional Grids to Smart Grids

In 1997, Vu et al. [24] introduced the term Smart Grid for the first time. They referred to a Self-Managing and Reliable Transmission Grid as Smart Grid. However, it was not until the 2003 North East blackout in the USA that it became popular. Massoud Amin in 2004 also referred to the term Smart Grid [26].

Modernization of the existing power grid is referred to as Smart Grid. Smart Grids are built on top of the existing grid infrastructure by effectively utilizing information technology, internet of things (IoT) and smart algorithms for efficiently managing components like sensors, relay, energy management system (EMS), SVC (Static Var Compansator), Supervisory Control and Data Acquisition (SCADA ), etc.

As mentioned earlier, the traditional grids have the following characteristics: (1) they are unidirectional, meaning that power flows only from one end to the other; (2) the generation happens centrally, (3) consumers are required to pay fixed tariffs, and (4) consumers rely on a traditional electricity meter, which shows only the total amount of energy consumed, but does not provide a breakdown of when the consumption occurred. Smart Grids address these limitations by means of three innovations:

-

Smart Grids modernize existing power systems through an advanced control system, for example installing advanced sensors like PMU (phasor measurement unit) to monitor network parameters in real time, facilitate remote monitoring of the entire network, and use self-healing designs [27]

-

Smart Grids enable end users to monitor and control their daily consumption and the associated costs, thereby giving some degree of autonomy in energy management [12]

-

Smart Grids enable the integration of distributed energy resources (DER) in the existing grid effectively, thereby increasing the overall generation capacity and reliability of the whole power system [27].

The basic idea behind the Smart Grid is a two-way digital communication and advanced sensor network which creates an adaptive feedback loop [22]. In a traditional grid, the flow of information is unidirectional; whereas in the Smart Grid, it is bidirectional between the utilities and smart meters, which is termed “Advanced Metering Infrastructure (AMI)” [28]. With the help of smart meters, utilities can inform the end consumer about tariffs, thereby empowering the latter to have control of their overall consumption. Whereas from the utility perspective, analyzing the data gathered from smart meters helps to better manage the demand. However, this should be done in a trustworthy environment to protect consumer privacy [23]. Consumers’ privacy, cybersecurity, and the price of smart meters are just some of the issues which need to be addressed in order to make Smart Grid more resilient and reliable [29].

Smart Grids have evolved over time. The first generation of Smart Grid used computational intelligence such as fuzzy logic and neural networks in the power system, adopting a neural network approach for security assessment and the development of automated meters [30]. The second generation of Smart Grid focused on global control of the grid, stability of the system, self-healing, and dynamic pricing [30]. The third generation focused on optimal power flow which ensured global optimization of the grid by applying various optimization techniques such as approximate dynamic programming, dynamic stochastic optimization [30]. The fourth generation of Smart Grid is concerned with sustainable development, better demand response management with renewable energy source integration in the grid, including more storage in the grid using plug-in hybrid vehicles (PHEV) integration, battery storage, and mobile/distributed generation using PHEVs [27].

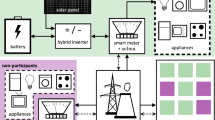

The future of smart distribution grid is the Microgrid , which is regarded as a small-scale energy zone with small-scale energy resources such as photovoltaic cells (PV), fuel cells, wind turbines, and battery storage [31]. The operation of a Microgrid can be either standalone or connected to the grid [32]. However, there are various challenges to implementing Microgrid in reality; some are technical (such as power quality, reliability, overall network efficiency, and interconnection of network [33]) and others are nontechnical (such as demand response management, prosumer management, education about the technology, and consumer privacy [29]). Microgrids play an important role in shaping the future energy grids with renewable sources that can meet the local demand as well as supply extra power to other Microgrids. Besides, Microgrid networks provide a more reliable power supply to the consumer in a smart city.

4 Smart Grids and the Vision of Smart Cities

The World Urbanization Prospects report published in 2014 stated that an additional 2.5 billion people will become part of the urban population by 2050, 90% of whom will be in Africa and Asia. It further states that the world’s urban population will rise to 66% by 2050 [34], which will put a significant load on cities’ existing infrastructure, thereby impacting on future sustainable development [35, 36]. The infrastructure of cities will need to be modified in order to sustain the pressure of an ever-increasing population. Cities need to be remodeled into smart cities where people can enjoy modern facilities with ease.

In a smart city, the basic civic infrastructure needs to be managed more effectively and in a streamlined manner. This includes the management of water, energy, transport, and health services. The underlying objective is to ensure that cities of the future do not compromise the environment as a result of socioeconomic progress. Information and communication technology is the backbone of the cities of the future.

The energy demands of a smart city are high because most modern utilities such as induction cooktops, air conditioners, air purifiers, heaters, etc., run on electricity. Infrastructures including public communication networks and healthcare services also depend on electricity. Hence, the energy infrastructure is one of the most important and critical urban infrastructures to support the realization of a sustainable smart city. Therefore, the Smart Grid is appropriate for the power infrastructure of smart cities.

A Smart Grid allows a smart city to exploit local power generation to meet the immediate needs of the city and manage the load in such a manner that the critical load required for hospitals, fire stations, police, and the like will not be affected during an outage and, if affected, the self-healing nature of the Smart Grid will restore the supply very quickly. Smart Grids also enable smart cities to manage the total load and local renewable energy source more efficiently. They help smart cities to achieve ambitious environmental goals. The smart metering infrastructure of Smart Grids enables smart cities to meet power demands and harness more local energy with net metering very easily and effectively. Hence, Smart Grids are one of the fundamental infrastructures necessary to realize a dream of smart cities.

As already mentioned, smart cities need huge amounts of electrical energy, and therefore require demand-side management. By means of dynamic pricing methods, the Smart Grid facilitates demand-side management. Several dynamic pricing methods are proposed in the literature, which will be discussed in the next section.

5 Dynamic Pricing Mechanisms

Many experimental and empirical studies have been conducted to discover the effect of peak load pricing to reduce peak load [37]. But only a handful of program types have been developed and only a few utilities really use demand response (DR) as a day-to-day tool in grid and energy management due to engineering complexity, capital investment, etc. [38].

DR programs are designed to flatten the load profile of the consumer either by reducing consumption during peak hours or by shifting the load to off-peak times. Demand response can be either dispatchable or non-dispatchable [14]. Dispatchable DR programs allow the utility to control the user load during peak times, whereas non-dispatchable DR programs provide incentives or time-varying pricing schemes to reduce the load. Time-varying pricing or dynamic pricing is a simple and effective mechanism for demand response.

Dynamic pricing is a time-varying electricity pricing mechanism designed to provide an economic incentive for consumers to participate in demand management via “demand participation” or “demand response”. It is used as an economic tool that manages demand by informing the consumer about the electricity price in the near future. Customers can use this information to modify their load and participate in demand response [29]. One of the most important aspects of demand response is the two-way communication between the utility and the consumer, which is made possible by the Smart Grid infrastructure.

Customers can actively participate in the operation of the grid. They can participate in the DR programs, consider the information they receive about the electricity price, and make wise decisions regarding their daily electricity consumption [8]. A non-dispatchable demand response program using dynamic pricing method can be easily implemented in the Smart Grid network.

The various dynamic pricing schemes which are available for demand response are Time-of-Use (TOU), Real-Time Pricing (RTP), Critical Peak Pricing (CPP), Day-Ahead Pricing [14, 29, 39]. These are now discussed in the subsequent sections.

5.1 Time-of-Use (TOU) Method

The TOU pricing scheme is based on the variation in the cost of electricity depending upon the time of use. For instance, during peak time usage, tariffs are higher, and are lower during off-peak times. However, with a flat rate tariff, a set rate is charged for the use of electricity regardless of the time of day. With TOU pricing, a different rate is fixed for different time slots over a day. Ideally, TOU should shift the load from peak time to off-peak time. The TOU time-varying scheme is generally preferred by the retail market because of its simple structure [8]. However, despite its simple structure, utilities face several challenges when implementing it in a real system. These challenges are discussed below.

-

Challenges

The TOU pricing method is one of the most important economic methods employed in DR (demand response) programs. This pricing scheme is a static time-varying pricing scheme, which is easier and cheaper to implement by the utility. It looks like a very simple strategy for DR but there are various difficulties which are associated with it and need to be addressed before implementing it in the retail energy market. The main difficulty faced by utilities is the existing traditional meter, which is unable to capture energy consumption data at specific times. So, it is difficult to implement this scheme in a system that still has traditional meters. If these were replaced with smart energy meters, utilities could easily apply the TOU tariff [40]. However, these replacements are costly for the utility, and customers have concerns regarding privacy. Another challenge faced by utilities is the design of TOU pricing, which includes a subset of challenges such as designing TOU with uncertainties in generation and demand, designing under different market structures or designing with localized generation integrated into the grid. Different market structures need different TOU designs [8]. In other words, a specific market structure requires a specific design. For instance, in some places, the need for a heating system is considered when designing a TOU scheme, whereas in other places, a heating system is not required due to the different climatic condition. Another challenge is the establishment of an optimal pricing strategy, which will maximize the utilities’ profits as well as offer monetary and social benefits to consumers. Another subset of TOU design challenges, which is found in Smart Grids , is the presence of several distributed energy resources (DER). These energy sources play a vital role in shaping the future source of clean energy. So, when designing a TOU tariff scheme, these sources should be considered in order to make the TOU pricing more effective. A summary of the aforementioned challenges is presented in Table 4.1. Recently, several researchers have proposed various means of overcoming these challenges. These recent developments are covered in the following section.

-

Recent Developments

As discussed in the previous section, there are various challenges, which impede the smooth implementation of TOU pricing. Researchers around the world have proposed various methods for overcoming these challenges.

The design of a TOU scheme plays a vital role in the success of TOU pricing in the retail market. Ferreira et al. [8] designed a TOU tariff using stochastic optimization, considering uncertainty in price fluctuations of electricity demand, with quadratic constraints. The proposed approach showed increment in social welfare and improvement in load factor. Celebi and Fuller [41] examined TOU pricing under different marketing structures and proposed a multifirm, multi-period equilibrium model to forecast future TOU rates. In designing their model, the researchers used the variational inequality (VI) problem approach. The advantage of this approach, compared with the complementarity approach, is the type of variable required for the solution. The VI approach requires only primal variables, whereas the complementarity problem approach requires both primal and dual variables. Their findings showed that the customer benefits from TOU pricing compared to the flat rate under a different market structure. Yang et al. [42] used the game theoretic approach to find the optimal TOU pricing. They proposed multi-stage game models between utility companies and consumers, whereby the utilities seek to maximize their profit and the consumers seek cost reductions and an uninterrupted power supply. They studied the responses of consumers to the TOU pricing scheme. Their studies showed that in the residential sector, the consumers shift their load from peak time to off-peak times. Commercial customers were not very responsive during office hours; that is, their consumption did not decrease significantly. Of the three sectors—residential, commercial, and industrial—the industrial customers were more flexible in changing their load according to the TOU rate. Ali et al. [43] proposed a price-based demand response scheme with a two-part tariff based on time-of-use (TOU) pricing within a Microgrid . They formulated the load scheduling problem in a Microgrid as a combinatorial optimization problem. In this two-part tariff, one part concerns the TOU pricing and the other part penalizes customers if they exceeded the specified maximum demand limit. This is more effective in reducing the total demand. The TOU pricing strategy also assists utilities with the management of profit and risk.

After designing a TOU, the effectiveness of TOU pricing needs to be determined with different scenarios. Jia-hai [44] designed a multi-agent simulation system to analyze the effectiveness of the TOU pricing on the behavior of large customers and the change on system load simultaneously. They found that, if the price difference between the flat rate and the TOU rate was less than 15%, then customers did not shift their load; however, if the price difference was between 15 and 45%, then the customers were likely to change their load linearly with the price difference, and if the difference is more than 45%, then again customers were unresponsive to price. Consumers responded to the price fluctuation by decreasing their load if there was a significant difference in cost. However, this simulation model was limited to a small number of large customers. Pallonetto et al. [45] developed a rule-based algorithm for a TOU tariff for a residential building with the following objectives: (1) minimize energy consumption, (2) minimize carbon emissions, and (3) maximize monetary benefit to the consumer in a Smart Grid with a renewable energy source. They studied two different cases: thermal energy storage and zonal temperature control. Their analysis showed an annual reduction of consumer electricity consumption by up to 15.9%, carbon emission reduction by 27%, and a greater utilization of power generated by a renewable energy source at grid scale. The TOU pricing scheme can help to reduce harmful greenhouse gases, thereby protecting the environment. Optimal utilization of a renewable energy source can be achieved through the TOU scheme.

In the Smart Grid, the presence of DER has an effect on TOU pricing and, therefore, on demand response because of the bidirectional flow of energy and net metering system. Leger et al. [46] formulated a DR algorithm with photovoltaic generation for the Smart Grid based on net energy flow shown in a smart meter. This DR approach is interesting because it requires minimal sensors, does not require the forecasting of solar resources, and requires minimum input from the user side which leads to the automated implementation of demand response using TOU pricing. Johnson et al. [47] analyzed the performance of bifacial PV (photovoltaic) array energy output during summer. They analyzed the power output from a PV array by orienting it in different directions. Then the total energy cost was analyzed according to two different rates: TOU and flat rate tariff. They performed an experiment during summer by keeping the PV array facing west, and determined whether or not customers could benefit from the reorientation of the PV array. With the TOU pricing scheme, the cost of energy is high during the afternoon in summer. If the reorientation of PV panels can generate more power during this period, then consumers can benefit financially as they use less energy from the grid. However, the findings indicated that the reorientation of the array did not result in any significant cost savings.

The acceptance of the TOU by residential consumers depends upon how it will affect them. Torriti [48] studied the impact of TOU in the residential sector. He studied the peak shifting in residential areas in Northern Italy. His study showed that a significant level of load shifting takes place for morning peaks, but issues regarding evening peaks were not resolved. His studies also indicated that the average consumption of energy per user increased after the implementation of TOU pricing. Average consumption increased but payments made by consumers decreased due to the lower tariff during off-peak periods when more energy was used. Dehnavi and Abdi [49] suggested a DR program that combined dynamic economic dispatch with TOU pricing. In economic load dispatch, the generation unit is scheduled optimally to reduce the fuel cost subjected to constraints. They integrated both the problem of economic load dispatch and the design of TOU pricing into a single optimization problem and used the meta-heuristic imperialist competitive algorithm to find the optimal solution. Their study showed that there was a reduction in fuel cost after the application of TOU pricing; moreover, network reliability was improved, and customers’ electricity bills were reduced.

Torriti [50] used a stochastic model to analyze the TOU dataset of Trento in Northern Italy. His analysis showed that there is an unstable relationship between the consumption of energy and TOU pricing, and that future consumption can be predicted by weather conditions and active occupancy. This study had significant implications for the TOU pricing scheme in Italy as it was based on nonvoluntary participation, thereby demonstrating the consequence of large-scale implementation of the TOU tariff. The new tariff scheme needs to be communicated effectively to end users so that they can actively participate in demand response. The new tariff scheme needs to be communicated via a number of channels including the new tariff being printed on the bill, mobile phones, television advertisements, radio, and newspapers.

TOU pricing is the first demand response price incentive program to be implemented in various countries worldwide. Numerous researchers have proposed several techniques such as quadratic programming, stochastic optimization, combinatorial optimization, MILP, etc., to address the problems faced by utilities when implementing TOU pricing. A summary of recent developments is presented in Table 4.1.

5.2 Real-Time Pricing (RTP) Method

RTP is a dynamic pricing scheme which follows the spot price of electricity in the wholesale market. The wholesale market is a power market, where the electricity is sold for re-sale purpose and a uniform biding strategy is used to set the spot price (real time) of electricity. Based on the spot price in the wholesale market, the hourly rate of RTP for retail consumers is fixed by the utility [51]. In this pricing method, the price signal is released a day ahead or an hour ahead. It has been one of the most researched topics in dynamic pricing in recent times as the smart metering infrastructure has been rolled out in several countries around the world [3, 52,53,54]. It has also attracted numerous researchers globally who have attempted to find effective and efficient methods for the practical implementation of RTP schemes.

RTP is different from TOU (time of use) in several ways. TOU is a predefined tariff block pricing strategy; that is, the cost of energy varies from time to time during a whole day, and this variation is announced by the retailer before the billing cycle. However, with RTP, the tariff is announced by the retailer a day or an hour before. The fixed tariff structure of TOU over a long period makes it static in nature, but the RTP changes after an hour or a day which makes it a dynamic scheme. Due to the static nature of TOU, it is not very effective in addressing the peak load problems [39]. On the other hand, the RTP is dynamic in nature and it can adjust the tariff within a short period of time. Hence, it is more effective in dealing with peak load reduction. Since the RTP is linked to the wholesale price, it is able to reflect fluctuations in the wholesale market price, which cannot be done by the TOU. Evidently then, the RTP has several advantages over the TOU pricing, but there are also various challenges, which make difficult to implement it in reality. The challenges associated with RTP are discussed below.

-

Challenges

There are several issues related to RTP implementation and its impact on the consumers and the utility, which should be carefully considered before it is implemented. One of the most important of these is the design of the RTP scheme itself. RTP schemes should be designed in such a way that they offer a win–win situation for both consumer and utility. Demand profile and consumer satisfaction are important factors which need to be considered when designing an RTP tariff structure, because consumers have to change their consumption behavior according to the pricing signal they receive from the utility company on a daily or hourly basis. The utility company needs to communicate the tariff to the end consumer in real time via different communication media. There are several technologies available that can facilitate this communication including an in-home display unit, smart meters, e-mail, SMS, energy orbs (globes that light up green, yellow or red) which show a different colored light to indicate peak, medium peak, off-peak hours, etc. However, it is likely that the consumer will not be available to make a decision when a price signal arrives (e.g., consumer is away from a computer/mobile device or in a meeting for instance). This scenario has two adverse impacts: first, the consumer may have to pay more if the pricing signal is high and second, the utility company cannot reduce the peak demand even with RTP implementation. This can be a challenging task for both the consumers and the utility. Hence, consumers may be reluctant to shift to RTP schemes. There is also a possibility that they may change utility providers if they find that RTP is inconvenient. Hence, RTP schemes need to be designed so that they not only benefit the consumer, but also motivate them to be part of a new paradigm. One such approach is to implement automated load management systems that can be programmed to react to RTP signals in real time according to customer preferences in order to derive the maximum benefit from RTP and to address some of the other issues. However, designing an effective automated load controller is a challenge in itself because each household appliance needs to communicate with the controller for effective control. Other than design challenges, the economic impact on the consumer and the utility needs to be thoroughly analyzed, and the RTP’s social impact on the consumer needs to be determined. Other than the aforementioned issues, several other critical challenges need to be overcome such as the implementation of RTP without demand-side management, and price forecasting that includes models for short-term and long-term forecasting, i.e., daily versus hourly forecasting. Variation in pricing poses another problem: understanding how consumers respond to pricing structures, and whether they accept or ignore the pricing signals. If the customers ignore the pricing signals (i.e., they consume power even if the price signal is considered high by the utility company), what can be done to manage peak demand? In this situation, real-time smart meter data can be analyzed to design real-time and adaptable pricing structures to ensure the effective management of peak demand. Alternatively, penalty schemes can be explored as a mechanism to manage peak demand. Consumer privacy is an issue related to smart meters because the energy use pattern and smart meter data can be hacked and may be used by an unauthorized person for unlawful activities. All these issues need to be addressed in order to effectively implement the RTP. A summary of the various challenges associated with RTP is presented in Table 4.2.

-

Recent Developments

The design of an RTP scheme is important for both the consumer and the utility. Much research has been conducted in recent times to make it more realistic to implement RTP schemes on a large scale by addressing some of the abovementioned challenges. Numerous researchers have proposed several techniques to address these problems using various methods such as convex optimization, least-square support vector machines, genetic algorithm, stochastic optimization, etc., and these are briefly articulated below.

Real-time price forecasting: Real-time price (RTP) forecasting is a challenging task as there are so many variables that need to be considered when designing a RTP forecasting model. For example, a statistical model for forecasting real-time retail prices would require inputs such as hourly or daily wholesale market prices, weather conditions, local generation availability, renewable generation capacity, customer demand profile, etc. Furthermore, such models can be tailored for short-term or long-term forecasting. Oldewurtel et al. [55] applied least-square support vector machines (LS-SVM) for regression to compute short-term tariff forecasts for the wholesale market based on past spot price and grid load levels. This price forecast data have been used to design an RTP for retail customers, which reflects the wholesale price. Their studies showed that within the proposed tariff regime, the peak electricity demand of buildings can be significantly reduced.

Determine price based on consumer responsiveness to price: Kim and Giannakis [53] designed a strategy to determine RTP pricing based on consumer responsiveness to price, using an online convex optimization framework to find the real-time pricing structure with two feedback structures: (1) partial information (i.e., load data) that is known to the utility and (2) full information (i.e., aggregate load and price fluctuations) that is known to the utility.

Reducing the peak-to-average ratio: Reducing the peak to average ratio is an important factor that needs to be considered when designing an RTP scheme. Qian et al. [56] proposed a two-stage optimization technique to design an RTP scheme for the Smart Grid to reduce the peak-to-average ratio. On the one hand, users react to price to maximize their financial benefit; on the other hand, utilities try to formulate an RTP with forecasted user reaction to maximize their profits. The researchers’ simulation result showed that the proposed algorithm can effectively reduce the energy usages peak.

Real-time data analysis for price determination: Vivekananthan et al. [57] proposed a new real-time pricing scheme which was based on price components with instantaneous data analysis and after the data has been analyzed in real time, the information about price and the appropriate load adjustment is sent through a smart meter to an in-home unit display. With this information, consumers can easily identify their critical load for possible adjustment.

Impact on price due to uncertainty: In practice, users’ responsiveness to price is uncertain particularly when they have been equipped with an automated energy consumption scheduling (ECS) device. Samadi et al. [58] designed two real-time pricing algorithms based on finite-difference and simultaneous perturbation methods using an iterative stochastic optimization approach which includes the load uncertainty at the consumer end. In the presence of large consumers, these algorithms converge much faster because they do not involve direct user interaction. This study showed that the proposed algorithm can reduce the peak-to-average ratio.

Energy management controller: The energy consumption pattern of residential area varies considerably. For future smart cities, each home must be equipped with an energy management controller.

Load Management : Load management is one of the crucial aspects of the RTP pricing scheme as it fluctuates hourly or daily. Hence, there is a need for load management which has to be done with the help of a smart control device because manual load management in the RTP scheme is very difficult. A smart meter makes it easier to communicate with the load end and therefore the load management in houses is easier in smart cities.

Load Management Strategy: In [59], a load management strategy is proposed under a Smart Grid paradigm. This strategy is based on RTP pricing and the use of different household appliances and electric vehicles in a typical smart house. With the help of a smart meter, the consumer can manage the load which can include the charging of electric vehicles, washing machine use, etc. Under the RTP scheme, the proposed model enabled users to reduce their electricity bill by 8–22% for a typical summer day. Hence, load management enables consumers to reduce their electricity bill and helps the utility with its demand response.

Types of loads and Automatic Load Management : Tsui and Chan [60] categorizedvarious types of loads in a smart home like schedule load (which need to be switched on and off at a particular time to save energy), battery-assisted load, and model-based load. The authors formulated a versatile convex programming for demand-response optimization of automatic load management of various types of loads in a smart home. From the perspective of the utility, the consumers’ response is important while designing the tariff structure.

Combined Load Management for Community-based RTP: In [52], the author proposed a new architecture for the smart home community. To reduce the peak-to-average power ratio, RTP has been used between the home community and the utility. In this RTP scheme, the charge for electricity at the end of a day is calculated according to the combined loads of the entire community. Combined load scheduling for the community is required in this scheme.

RTP for Profit Maximization for Utility: Meng and Zeng [61] proposed a decision-making scheme for a retailer and its customers based on the Stackelberg game. They modeled a one-leader, N-follower Stackelberg game between the electricity retailer and its customers. The author designed an efficient energy management system to maximize the consumer benefit. Whereas for the utility side, they designed an optimal RTP rate that took into consideration the responses from customers in order to maximize the benefits for the utility. Their findings indicated that the retailer benefitted from the proposed RTP pricing algorithm.

Energy control: In [62], the author formulated a non-cooperative game for the consumers and searched for a unique equilibrium in demand response which is aligned with the Nash equilibrium. The Nash equilibrium is a set of strategies where no consumer has an incentive to change its strategy unilaterally given the strategies of the other consumers. To find the Nash equilibrium of this game, the authors proposed an energy control algorithm which could be used to control the energy consumption of the consumers. Their study indicated that there is a reduction in the peak load, the daily load and the peak-to-average ratio with RTP feedback.

Energy storage device: In the RTP pricing scheme, an energy storage device enables consumers to maximize their savings by optimally utilizing the storage device. The storage device needs to be charged and discharged in such a manner so that it will reduce the consumers’ bills. In [63], the author developed a new optimization model to find the best storage size and control process for the charging and discharging. However, the maintenance and replacement cost of the storage facility is not viable within the current RTP pricing structure where there is not much difference between maximum and minimum prices each day.

RTP without DSM: Campillo et al. [64] studied the impact of RTP on customers. Customers without a demand-side management facility were considered in this study. The authors determined the theoretical impact by analyzing the data for the previous 7 years from 2000 to 2007 obtained from a smart metering infrastructure, and compared these data with data for two different pricing strategies: RTP and fixed pricing. They studied data for 400 households, which they divided equally into two consumer groups: one used district heating and other used electricity to run ground-source heating. Their studies showed that customers who had not changed their consumption pattern benefitted after shifting from a flat rate tariff to an RTP tariff.

Load Curtailment and Load Shift: Althaher and Mutale [65] investigated the impact and benefit to residential consumers who used the automatic demand response system under real-time pricing. Although the authors proposed a scheme for load curtailment and load shift, more work needs to be done to make the real-time pricing more user-friendly. The other concern regarding this scheme is that it requires a great deal of data in order to accurately forecast the RTP price, thereby raising the issue of customer privacy which must be protected in every manner possible.

As the electrical industry moves towards sustainability, the integration in the grid of a renewable energy source becomes increasingly important. A renewable energy sources such as solar–photovoltaic cells, wind energy farm other distributed generation (DG) source is an important source of energy for smart cities. These sources of power generation are not as reliable as the conventional sources because their availability depends on natural environmental factors such as weather, wind speed etc. Therefore, the demand response system plays vital role in bridging the gap between demand and supply. In [66], the author proposed a stochastic unit commitment model for the integration of wind power into grid. The given optimization technique is used to realize higher wind power generation under various possible wind condition. This technique could also deal with the wind power uncertainty economically. The proposed stochastic optimal model with RTP could be helpful to integrate large-scale wind power.

The previous discussion showed that there have been many developments in the field of RTP pricing. Researchers explore various aspect of the RTP like profit maximization for consumer and for utility, optimal energy storage utilization, optimal DG utilization with RTP, consumer privacy, etc. Consumer privacy is one of the concerns which need to be explored more for effective implementation of RTP in real market. Structure of RTP is complex, hence special emphasis is needed to be put on consumers education. A brief summary of recent developments is presented in Table 4.2.

5.3 Critical Peak Pricing

Critical peak pricing (CPP) is another pricing strategy employed for demand response which is slightly different from TOU and RTP. CPP increases electricity prices to punitive levels at peak hours on critical days announced beforehand [67].

As mentioned earlier, the TOU has a predefined block for the pricing mechanism; that is, the pricing for the different intervals of time is fixed for a certain duration (like a month) that makes TOU static in nature, whereas the real-time pricing changes after an hour or a day which makes the RTP a dynamic pricing scheme. But in certain cases, TOU pricing scheme is not sufficient to reduce the peak because consumers can shift their load to create a peak at another time, and the energy consumption may increase [48].

Critical peak pricing (CPP) incorporates some of the characteristics of both RTP and TOU and solves the problem faced by the utilities to implement the TOU and RTP pricing schemes. The CPP based on the TOU pricing scheme has a simple structure and can also reduce the peak demand by identifying a peak event and increasing the electricity cost for the duration. Although it is less dynamic, it can handle peak demand effectively. The various challenges facing the implementation of CPP in the retail market are discussed below.

-

Challenges

CPP programs are based on the TOU structure but include critical events which can be called by the utility at a very short notice. However, CPP programs are limited to calling peak events no more than 50 or 100 times [39]. CPP can be seen as a modified version of TOU because the peak event called is based on a system constraint, not on consumer demand behavior. Some of the features of RTP are available in the CPP scheme. For example, the retail price CPP can vary with the wholesale market price during peak periods. In RTP, the information related to the electricity price can be declared an hour before, whereas with CPP, it must be declared a day before the peak event [68]. Therefore, there are more constraints in CPP than in RTP. Although the CPP structure is simple, there are challenges associated with this scheme which need to be overcome before it is fully implemented. One of the challenges is the price during peak times which needs to be adjusted so that consumers will reduce their consumption and utilities can manage the demand as well as make a profit [69]. If the prices are very high, then customers will be reluctant to shift to this new tariff; if the prices are low, then customers will not respond to price and therefore the demand will not decrease during peak time. Hence, the design of optimal pricing for peak times is one of the critical challenges, in addition to the rate and frequency of calling the peak event. Other challenges are related to the magnitude and characteristics of demand responses of consumers to the CPP from various sections of society such as high-end users, low-end users, etc. [70]. With the automatic demand controller, the household load can effectively deal with the peak pricing, although automatic controllers are not so common. Therefore, consumers need to control their load manually which is not possible in some instances. Informing consumers about a peak event is done via different communication channels. However, sometimes consumers do not receive the information or may receive it after a delay, which means that they cannot react to the peak price and ultimately are financially disadvantaged. Therefore, the utility should ensure that the information reaches the consumer on time. Another challenge is consumer education, since the consumers’ need to know how to control the appliance manually in order to reduce the peak demand. These challenges are summarized in Table 4.3.

-

Recent Developments

The design of the CPP is crucial as it has more constraints compared to RTP and TOU. Park et al. [71] designed a CPP with the objective of maximizing the utility’s profits by taking into consideration the consumers’ response to dynamic pricing. The number of events, their duration, and peak rate are some of the important factors to consider when designing a CPP scheme. In the CPP pricing scheme, the optimal peak rate (OPR) is the optimal price during peak periods. As the optimal peak rate increased, the consumer response decreased. The authors used the profit index which is an additional benefit that the utility can derive from the triggering of a critical event. By using the profit index, the effects of parameters such as critical peak price, peak event, and duration of peak event on the profit of the LSE (least square error) can be analyzed. A minimum number of peak events needs to be triggered by the utility in the CPP pricing scheme in order to benefit financially, unlike the uniform pricing scheme. The length of the peak duration influences the consumer response to the CPP pricing [40]. The shorter the duration of the peak time, the better will be the response compared to the longer duration. During a peak, customers can curtail their consumption by reducing space heating and cooling systems.

Residential consumers’ average consumption of electricity is reduced significantly under the CPP pricing scheme [68]. In this study, the authors divided consumers into two different groups: one group was charged according to CPP with base TOU pricing, and the other group was charged TOU. The study was conducted using four different cost structures during the peak period, and demonstrated that in all four cases, the consumers who followed the CPP scheme consumed less. It shows the effectiveness of CPP in reducing consumption. This reduction varies depending on whether the consumers are high-end or low-end users in response to the TOU pricing scheme, the high-end users significantly reduced their energy consumption, whereas low-end users saved significantly more on their annual electricity bills [69].

In [70], Herter and Wayland analyzed the data for the summer months only (1 July–30 September 2004) from 483 households who took part in the CPP experiment, which was conducted in California. In this pilot study, the participants were divided into twelve strata, according to climate zone and building type. Findings of the analysis indicated that the CPP events were successful at reducing load during peak periods. Their analysis also showed that there were significant load increases just after the notification of an event day has been sent to consumers and also just after the event ends. This indicated that much of the load reduction during the CPP period results from load shifting by participating households.

CPP can be implemented by forming groups of consumers (zones) who will voluntarily participate in a CPP scheme and in return expect some type of incentive from the utility. This pricing scheme is known as a zonal tariff. The design of a zonal tariff scheme requires the effective coordination of the supplier and network operators [72]. The authors concluded that with this pricing scheme, a demand-side resource could be created, which would be able to offer load reduction based on dispersed customers.

Dynamic pricing may have an adverse impact on people’s lifestyles. Kii et al. [37] examined the impact of CPP on people of different ages. They conducted a survey in which the participants were given choices in terms of the appliances that they wanted to switch off during the peak hours (e.g., the air conditioner, refrigerator, etc.) but unique option among various choices is going out or staying at home during the peak time. This study will assist with the development of future smart cities. Their study indicated that the CPP may have a more negative impact on older people. Moreover, population density directly affects the demand for electricity. If the population density increases by 10%, then demand will decrease 0.047 and 0.021% for the households with residents who are able to go out and average households, respectively.

The CPP program has a simply structured variable pricing scheme, which can efficiently deal with peak loads. The findings of various case studies which have been done in different electrical markets show that CPP is more effective than TOU pricing. The recent developments in this pricing area are presented in Table 4.3.

5.4 Day-Ahead Pricing (DAP)

In the TOU pricing scheme, the tariff structure is fixed by the utility a month before or more. Therefore, consumers know the tariff in advance and can shift their load which produces a new peak [48]. With the CPP that is based on TOU, information related to a peak event must be sent to the consumer a day ahead of the event. This is because for both dynamic pricing systems, the base price is fixed at the start of the billing cycle, and in the case of CPP, the peak event is decided only one day before it occurs, with a limited number of peak events in a year. Hence, the utility has little control over the daily load. In RTP, the rate is varied hourly and therefore it is more uncertain, which makes it less attractive to the consumer [73]. The day-ahead pricing scheme in which the tariff is fixed a day ahead is beneficial for both the consumer and the utility. Seasonal Pricing Consumers and many enterprise customers prefer day-ahead, time-dependent pricing. In comparison, the day-ahead pricing is much more attractive to residential consumers because they can plan their activities in advance according to the day-ahead price [73] and schedule their appliances accordingly.

-

Challenges

The day-ahead pricing is most prominent from the consumer as well as from utility point of view compared with other dynamic pricing schemes. Consumers can schedule their activities well beforehand, and the utility can fix the tariff to benefit financially and maintain the constant load profile. It also helps the utility to reduce the cost of purchasing the electricity from the wholesale market. Day-ahead pricing is looking very promising for demand response, but there are several issues associated with it. The first and most important challenge is the designing of a forecasting model [74]. Energy price forecasting has been done by analyzing the various input parameters such as the forecasted energy demand, available supply, local weather, etc. So, the forecasting of the energy price a day ahead is a challenging task and needs a robust and effective model [75]. Another challenge for the utility is that it needs to inform consumers about the day-ahead pricing. The utility needs to send the information to consumers so that they can schedule their appliances. Since the pricing is declared a day ahead, there is a chance of peak during low price time. If consumers change their load during off-peak periods, the utility may incur a financial loss. Hence, there is the need for an optimal day-ahead price to maximize the benefit for the utility [76]. These are several challenges which need to be overcome in order to obtain the maximum advantage from day-ahead pricing. A summary of these challenges has been presented in Table 4.4.

-

Recent Developments

For day-ahead pricing, forecasting is important. Several methods are available for forecasting the day-ahead price of electricity. Joe-Wong et al. in [73] developed an algorithm to determine the day-ahead pricing in order to minimize the cost incurred by the service provider, and maximize revenue. Their algorithm also estimates the response of the consumer to DAP in a Smart Grid environment. Consumers respond to DAP by reducing their load during high price times. With the day-ahead pricing scheme, there is a significant reduction in the peak consumption and therefore there is a reduction in the peak-to-average ratio.

Another method for day-ahead price forecasting is the artificial neural network. The relationship between input data (weather condition, demand, and supply) and target parameters (reducing peak load, maximizing utility benefit) for price forecasting is nonlinear in nature. The artificial neural network is a common technique that can deal with nonlinearity. The day-ahead price forecasting using the artificial neural network with a clustering algorithm is presented in [74]. It is a robust forecasting scheme which includes the tradition generation unit, self-producer, retailer, and aggregators. The ANN (artificial neural network) model for load forecasting using only historical price values has not demonstrated reliable performance in this study, although the researchers designed a cascade ANN network to reduce errors. Their results indicated that the cascaded neural networks were the optimal model. The authors also designed a hybrid forecasting model comprising a two-stage process where the clustering tool was combined with the cascaded ANN. The efficiency of the hybrid model was no better, but it produced fewer errors than the cascade neural network.

Price forecasting is one of the challenging tasks. There is only a limited number of forecasting methods available for load forecasting. The price time series method used to forecast the day-ahead price is volatile and is influenced by a diverse set of parameters such as weather conditions, hydrocapacity, fossil fuel prices, etc. Therefore, a novel computational intelligence is required based on models for load forecasting. A summary of recent developments is presented in Table 4.4.

5.5 Other Pricing Incentive Schemes for DR

Apart from the dynamic pricing mechanisms for demand response discussed above, the literature includes various other pricing mechanisms used for demand response programs. Some of them are cost reflective pricing [11], season pricing [10], and peak time rebate [12, 13].

Cost Reflective Pricing : A cost reflective tariff reflects the cost of supplying electricity which includes the spot price in the wholesale market, transmission network costs and future expansion costs. In other words, the cost reflects the true cost of supplying electricity.

Seasonal Pricing : The demand for electricity varies from season to season because electrical appliance requirements differ from one season to another. Electricity generation varies seasonally due to the availability of other energy sources. For example, in summer, less electricity can be generated by a hydropower plant because of the reduced amount of water. Demand management is required to bridge the gap between demand and supply during different seasons. This can be achieved by adopting seasonal variable pricing which will vary according to the season.

Peak Time Rebate (PTR): Dynamic pricing schemes such as TOU, RTP, DAP pricing, and CPP are all based on the restructuring of electricity tariff. The peak time rebate is given to consumers who help the utility by reducing their consumption during peak times. Consumers may choose whether or not to reduce their load: if they reduce it, they receive the rebate; if not, they will pay a flat rate. In this pricing scheme, the consumers have not been forced indirectly to reduce the peak load by increasing the tariff during a certain period. This benefits the customers, but the utility has to wait for the consumers’ response.

-

Challenges

The most challenging task is to design a pricing scheme that will benefit both the consumer and the utility. Designing a cost-reflecting scheme with integrated renewable energy sources, and that considers network cost, is one of the challenges faced when implementing a cost reflecting the price. Various factors influence the customers’ response to cost-reflective tariffs, so it is necessary to find which factor has the greatest influence on consumers, and how consumers will respond if there are any changes to this factor.

A seasonal pricing scheme varies according to the season. So, the challenge here is to design an optimal seasonal pricing scheme which will effectively reduce the gap between demand and supply during a particular season. When designing the seasonal pricing, weather data needs to be considered in order to accurately forecast the seasonal price.

Peak time rebate (PTR) relies on rewarding the customers during the peak time based on their load reduction. Accordingly, any load that can be shifted to off-peak periods looks like a gain. PTR scheme heavily depends on consumer base load (CBL). So, the method to find the consumer base load is important while designing the rebate pricing scheme. Consumer response to this pricing scheme is important from the utility perspective. Hence, consumers must be informed of the benefits that they can receive. Other challenges include the ways by which consumers can receive information about the peak time and rebate they will receive if they reduce their load during peak time. The above challenges are summarized in Table 4.5.

-

Recent Development

An electrical distribution network has two essential costs: network operational cost and network development cost. The network development cost includes the cost of expanding the network. In a deregulated competitive market where coordinated generation and network planning is replaced by pricing, economic efficiency which can be achieved by sending the pricing signal to the end user, can influence their energy consumption behavior according to their location. The authors of [11] developed a cost reflective pricing scheme for a distribution network with distributed generation. In developing this pricing scheme, they took network security into consideration. They proposed a pricing framework which included the network planning cost, fixed cost, and other factors that had a simple structure. The authors created a price zone in the distribution network because creating a unique charge for each and every node in a network would be impractical. The effective technical and economic integration of DG (distributed generation) into various zones of power systems has reduced the cost reflective price.

Hung et al. in [9] studied the seasonality of electricity consumption by Taiwanese consumers. Most of the peak demand occurred during the summer months. The regulated summer rates were higher than those for the non-summer months. Their studies confirmed that in the residential sector, there was greater electricity demand in summer. They found that price fluctuations during the summer season were lower than those of non-summer months due to the consistently high temperatures. Their results suggest that energy consumption and CO2 emissions can effectively be reduced during non-summer months if the carbon tax is considered in combination with the electricity price, since in Taiwan, the electricity price is lower in the non-summer months and higher in the summer months. By combining the carbon tax with electricity price, the government of Taiwan is able to smooth the electricity expenditure of households over the course of a year.

An incentive-based demand response program is different from a price-based program. From the policy perspective, the PTR (Peak Time Rebate ) program is more appealing than other programs because it requires minimal changes to existing systems and produces a favorable result if it is designed optimally. In [12], Mohajeryami et al. studied the effect of behavioral characteristics in the design of demand response programs. Loss aversion is one of the behavioral characteristics of human beings. Its effect on the customers’ perception of the different programs was also examined by authors. They also examined the impact of two dynamic programs (PTR and RTP) on demand response. They proposed a model which can be used by utilities for profit maximization and can be used to design a more efficient dynamic pricing scheme. They have examined two PTR cases to test the proposed model. The first PTR case took loss aversion into consideration, while the second PTR case did not. The first RTP case performed better than the PTR; whereas the second PTR case performed better than the RTP. Their study showed that loss aversion had no effect on the consumers’ selection of an appropriate dynamic pricing program. As shown in this study, in DR programs, behavioral impacts have to be taken into the consideration more seriously. The findings indicated that behavioral characteristics cannot be ignored when one of two competing programs is being selected.

In [13], the authors studied the relationship between accuracy of customer baseline (CBL) calculation and efficiency of the peak time rebate (PTR) program for residential customers. The authors analyzed the economic performance of PTR for residential customers. The CBL calculation method to predict the consumer load profile on event days is an important means of calculating the efficiency of PTR. Hence, the authors analyzed the accuracy and bias metrics of CBLs and explained how these metrics translate into financial losses for utility and customers. They used exponential moving average and regression methods and their adjusted forms to calculate the CBL. This CBL was used to determine the economic performance of the PTR. Their study showed that the utility paid at least half of its revenue as a rebate just because the CBL had not been calculated accurately.

There are several pricing mechanisms that have not been extensively used for demand response. Several pilot tests have been conducted with these programs, but these are very limited in number. These programs need to be explored more for effective demand response output. In future, these programs could be combined with TOU, RTP to design more effective dynamic programs for demand response. A summary of the recent developments is presented in Table 4.5.

6 Case Studies

In the literature, various pricing schemes have been proposed by researchers across the globe. But there are doubts about the consumer response to dynamic pricing and this is one of the impediments to the full-scale rollout of dynamic pricing. The various experiments were conducted to study consumer responses to various dynamic pricing strategies, and determine their usefulness in a demand response program. Four case studies are presented here.

-

Day-Ahead Pricing Experiment: Belgium

A pilot experiment study of day-ahead pricing in the Belgium market was conducted from September 2013 to July 2014 [77]. A total of 240 residential consumers participated in this experiment, 186 of whom were equipped with smart appliances such as smart domestic hot water buffers and electric vehicles. The remaining 54 families participated in a manual dynamic pricing scheme. Analysis of consumer consumption profiles showed that there were very limited to no behavioral changes.

The experiment analysis showed a significant shift of the flexible load like washing machine, dishwasher, etc., from peak hours to off-peak hour, i.e., to the lower price periods. But this significant shift of flexible loads had an impact at the national level, whereas the physical impact on the local distribution grid was limited. Another finding was the high variation in energy consumption and load flexibility in the groups of pilot participants.

A questionnaire was administered before and after the experiment to determine the users’ acceptance of the dynamic pricing. Analysis shows that for complex pricing schemes that require frequent price consultation, an automated response by means of smart appliances is preferable to the manual response.

-

TOU/CPP Pilot Study: British Columbia

A pilot study was conducted in a Canadian province, British Columbia, which experiences a severe winter peak. The study was intended to determine the relative kW response of the participants who had the TOU/CPP electricity tariff [78]. Relative kW response is defined as the percentage change in the customer’s hourly kW due to exposure to time-varying pricing.

The data were collected from November 2007 to February 2008 for 1717 single-family homes, 411 of which were allocated to the control group and the rest to the treatment group. Hourly kW data collected from the control group of customers with the flat rate tariff and the treatment group of customers with the TOU/CPP rates, triggered by a 1-day advanced notice.

Remotely activated load control devices were considered in this pilot study to automatically reduce water heating and space heating load during CPP events. Analysis of this study shows that TOU pricing yields statistically significant evening peak kW reductions of 4–11%. An additional evening peak kW reduction of about 9% could be achieved via CPP. This can be further increased to 33% through remotely activated load control of space heating and water heating. The result shows that an optional TOU rate design can effectively reduce residential peak demands.

-

CPP and Peak Time Rebate (PTR) Experiment: Michigan

Consumers energy (CE) conducted a pilot experiment in Michigan known as the personal power plan (PPP) from July 2010 through September 2010 [79]. A total of 921 residential customers participated in this experiment. This PPP pilot project was conducted by dividing the customers into two groups. The first group was subject to time-varying rates, whereas the second group was subjected to their existing rate but they received information about peak times and peak pricing.

The CE created a price information only (PIO) consumer group to determine whether consumer behavior changed after information had been received. Two dynamic pricing strategies, i.e., CPP and peak time rebate (PTR) both of which were layered atop a TOU rate, were used to study consumer responses. During the pilot study, a total of 6 days were announced as critical peak days and the participants were informed about each one day ahead.

During the PPP period, the control group customers faced the inclining block rates structure in which tariff varied according to total consumption. The treatment customers were given one of the rates: CPP, PTR, or PIO. CE customers showed the same price responsiveness to the equivalently designed PTR and CPP rates. This pilot study showed that there was a reduction in critical peak period usage by the entire treatment group. There was no significant difference between the CPP (15.2%) and PTR (15.9%) treatment groups. Consumers in the PIO group also reduced their usage by 5.8%. However, the total monthly consumption remained unchanged for both the CPP and the PTR groups as the daily variations were statistically insignificant. This indicated that, although there was a reduction in peak demand for the CPP and PTR groups, this did not have any statistically detectable load building or load conservation impact.

The pilot study also involved two control groups. A randomly selected group of 228 consumers, who were unaware of the pilot program were placed in the first group. The second group comprised the remaining 92 consumers who knew that the utility would observe their daily usage patterns. This was done to study any changes in human behavior as a result of participants knowing that they are being monitored by a utility. This is known as “Hawthorne bias”. Their study showed that the consumption pattern of both groups remained unchanged. Therefore, there is no definitive evidence of a Hawthorne effect in the PPP pilot program.

-

CPP Field Experiment: Kitakyushu and Kyoto

A field experiment was conducted by the Japanese Ministry of Economy, Trade, and Industry (METI) in four cities in Japan (Yokohama, Toyota, Kyoto and Kitakyushu) to examine the effect, on residential electricity demand, of dynamic pricing and smart energy equipment.

In [80], the authors analyzed experimental data for the summer of 2012 in two cities—Kitakyushu and Kyoto. The Kitakyushu experiment had 182 participants and the Kyoto experiment had 681 participants. The participants were paid 12,000 yen (USD 105) to participate in this experiment; moreover, a smart meter and in-home display were installed in their homes for free.

Electricity consumption data were collected from the smart meters at 30-minute intervals. Of the 182 households, 112 were randomly selected for the treatment group. Consumers in the treatment group had a time-of-use price schedule on nonevent days. A CPP day was announced one day ahead, with the critical peak price shown on the home display unit.

Critical peak prices for the two cities are slightly different. This study showed that the CPP of higher marginal prices led to larger reductions in consumption, but the rate of incremental reductions diminishes with increases in price. This study also showed a slight increase in consumption during off-peak hours. Consumers increased their consumption by 4–5% during the off-peak hours in the Kitakyushu experiment, whereas in the case of Kyoto, the consumption increased by 3–4%.

In the Kyoto experiment, a warning-only treatment group of consumers was formed. In this group, consumers received day-ahead notices about the CPP event in the same way that consumers in the dynamic pricing group did. However, they were told that their price would not change. The warning-only treatment group reduced their consumption by 3% which is small compared to that of the dynamic price consumer group. However, this demonstrated that informing consumers about the peak time will help to reduce the peak demand, which is an interesting finding.

7 Future Research Directions

In this chapter, we discussed several dynamic pricing schemes such as TOU RTP, CPP, day-ahead pricing, etc. Each of these schemes has some unique characteristics and addresses some aspect of energy consumption management. Although this area has received much research attention, there are still numerous open research issues that need investigation in the future, as briefly discussed below.

-

Open Research Directions in TOU (Time of Use)

Designing the smart house controller with the TOU pricing for smart home is an important field for research. An algorithm is needed for the efficient use of a storage device and a renewable energy source in order to reduce the customer’s electricity bill. There is a need to analyze the effects of the TOU program in terms of voltage improvement and frequency control. A smart device in the home will reduce electricity costs for the consumer, but on the other hand, it will decrease the utility’s revenue. Therefore, what is needed is a TOU tariff that maximizes utility profits.

-

Open Research Directions for RTP ( Real-Time Pricing )

The establishment of an RTP tariff is a task that requires intensive effort because, of all the dynamic pricing systems, RTP is the most complex. Consumer wants and needs vary from person to person, so an RTP scheme needs to be aligned with individual consumer requirements and preferences. The responsiveness to the pricing is another method that can be used for the design of RTP pricing. Another research opportunity in RTP is use of the recurrent neural network for solving DSM (demand-side management ) optimization problems. Design of RTP with imperfect information from any side either customer or generation side needs to be explored more in future. The distributed generation systems such as rooftop PV (photovoltaic) cells will play a vital role in future DR (demand response) program, so there is need to design RTP with feed-in tariffs from rooftop PVs. Privacy constraints should be taken into account when designing and implementing an efficient RTP scheme.

-

Open Research Directions in CPP ( Critical Peak Pricing )

Various communication modes (e.g., by mail, email, telephone, social media, etc.) should be used to deliver information related to event day and critical peak time prices. The synchronizing of all communication modes is required for the efficient and effective information system. A forecasting model needs to be designed that can forecast data with minimal error. A CPP price model needs to be developed which includes the pre-established load variability from the consumer end.

-

Open Research Directions in DAP ( Day-Ahead Pricing )

A two-sided pricing mechanism needs to be developed. The first side of the mechanism enables the consumer to sell to the utility the power generated locally using renewable sources such as a photovoltaic cell, etc. The other side of price mechanism is where the utility sells the electricity to the user. A DAP forecast model needs to be developed incorporating a new computational intelligence technique that takes into account other clustering algorithms. The DAP forecast model needs to integrate renewable energy sources, but take into account the uncertainties associated with them.

-

General Open Research Directions