Abstract

The rollout of smart meters has enabled the provision of dynamic pricing to residential customers. However, doubts remain whether households can respond to time-varying price signals and that is preventing the full-scale rollout of dynamic pricing and the attainment of economic efficiency. Experiments are being conducted to test price responsiveness. We analyze data from a pilot in Michigan which featured two dynamic pricing rates and an enabling technology. Unlike most other pilots, it also included a group of “information only” customers who were provided information on time-varying prices but billed on standard rates. Similarly, unlike most other pilots, it also included two control groups, one of whom knew they were in the pilot and one of whom did not. This was designed to test for the presence of a Hawthorne effect. Consistent with the large body of experimental literature, we find that customers, including low-income participants, do respond to dynamic pricing. We also find that the response to critical peak pricing rates is similar to the response to peak time rebates, consistent with the finding of one prior experiment but inconsistent with the finding of two prior experiments. We also find that the “information only” customers respond to the provision of pricing information but at a substantially lower rate than the customers on dynamic pricing. We find that the response to enabling technology is muted. We do not find any evidence to suggest that a Hawthorne effect existed in this experiment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Electricity cannot be stored economically in large quantities, and has to be consumed instantly on demand. The load duration curve for most utility systems is very peaky, with some 8–10 % of annual peak load being concentrated in the top 1 % of the hours of the year. These two factors, taken in conjunction with the time variation in marginal energy and capacity costs that characterizes different generation technologies, mean that the optimal way for pricing electricity is to institute time-varying rates.Footnote 1 Not only would this increase economic efficiency, it would also eliminate inter-customer cross-subsidies that are embedded in flat rates (Faruqui 2010).

A prerequisite for dynamic pricing is the presence of advanced metering infrastructure (AMI) or smart meters. Smart meters are expensive and their costs cannot typically be covered by savings in operational benefits alone. Examples of these benefits include avoided meter reading costs and faster outage detection and service restoration. Additional benefits can be derived if the customers are offered dynamic pricing, and they modify their load profiles by curtailing usage during expensive hours and shifting some of that usage to inexpensive off-peak hours. However, despite a decade of experimentation in North America, Australia, and Europe, doubts remain about the price responsiveness of residential customers (Faruqui and Sergici 2009; Rowlands and Furst 2011).

The first comprehensive pilot with dynamic pricing was carried out in California. Known as the Statewide Pricing Pilot, it ran during the years 2003 through 2005. It tested critical peak pricing (CPP) and time-of-use (TOU) pricing rates with and without enabling technologies. It found that customers were price responsive and that their responsiveness increased with enabling technology (Faruqui and George 2005). It did not test peak time rebates (PTR).

Baltimore Gas and Electric (BGE) in Maryland initiated a pilot in the year 2008 which ran through 2011, becoming the longest-running pilot thus far. It yielded a number of significant findings. For example, customers responded to price signals, CPP rates and PTRs produced a similar response, and enabling technologies boosted response (Faruqui and Sergici 2011). Connecticut Light and Power’s experiment in the summer of 2009 also found evidence of price responsiveness and showed that enabling technology boosted price responsiveness. However, it differed from the BGE pilot in that it found that CPP rates elicited higher responsiveness than PTRs (Faruqui et al. 2012). This conclusion was reinforced in the experiment carried out by Pepco in Washington, DC which found that CPP rates elicited substantially higher responsiveness than PTRs (Wolak 2011).

This paper investigates these and other hypotheses by using data from a dynamic pricing pilot that was carried out in Michigan in the summer of 2010 by Consumers Energy (CE). It was called the Personal Power Plan (PPP). Although other dynamic pricing pilots had published their findings prior to the execution of the PPP, they had been carried out in different geographies, and there was a concern that differences in climatic, economic, and sociodemographic conditions would impair the transferability of findings.

Unlike most other pilots, the PPP recruited a group of customers that were subject to time-varying rates as well as a group of customers that were only provided price information but billed on their standard rates. The price-information only (PIO) customers enabled CE to test the effectiveness of information in changing customer behavior without actually changing the prices.

The pilot included 921 residential customers and ran from July 2010 through September 2010. Around 600 customers were placed on various treatments, of which two involved dynamic pricing rates—CPP and PTR, both of which were layered atop a TOU rate, and the PIO treatment. The PTR tested in this pilot differed from the typical PTR rate tested in other pilots. Under a typical PTR rate, participants continue to pay the standard rate on the non-event days, whereas in the PPP, the PTR customers paid the TOU rates on the non-event days. The CPP and PIO treatments were also tested with and without an intelligent communicating thermostat (ICT) to observe the role of the enabling technology in boosting customer responsiveness.

The pilot also involved two control groups. The first group, consisting of 228 customers, was randomly selected from the same AMI population. These customers were unaware of the pilot program and represented what the treatment customers would behave like absent the pilot treatments. The second group, composed of 92 customers, was also randomly selected and told that the utility would observe their everyday usage patterns this summer beginning in June until the end of September. These customers were included in the design to determine whether there was a “Hawthorne bias” in effect, which refers to human objects of an experiment changing their behaviors because of the knowledge that they are being studied.

The other difference of the PPP pilot from many of the other pilots is that the pilot participants had an inclining block rate (IBR) structure in the pretreatment period. The rates of the CPP and PTR participants were replaced with the dynamic rates after the initiation of the pilot. The PIO customers stayed with their IBRs throughout the pilot period.

CE called six critical event days during the course of the pilot period. Hourly usage was used for customers in both groups during the pilot to determine if the treatment group used less during the more expensive periods. In addition, to assess for any preexisting difference in the groups, hourly usage was also recorded during a pre-pilot phase. Econometrically, a difference-in-differences estimation procedure was applied to an unbalanced panel for estimating the treatment effects.

The PPP was designed to test six major hypotheses: (1) Do customers respond to dynamic pricing? (2) Do customers exhibit similar price responsiveness to the PTR tariff as they do to the CPP tariff? (3) Do PIO customers respond to price information? (4) Does enabling technology boost price responsiveness? (5) Are low-income customers price responsive? (6) Is there an observable Hawthorne effect?

Section “PPP experimental design” of this paper describes the experimental design of the PPP. Section “Data and methodology” summarizes the analytical methods and data used in the estimation of the load impacts. Section “Results” reports on the empirical findings and Section “Conclusions” concludes the paper.

PPP experimental design

Rate design

CE’s standard residential rates had an IBR structure in the summer months (between June and September) that amounts to $0.11/kWh for the first 600 kWh and $0.17/kWh thereafter. In the winter months (between October and May), the residential customers paid a standard flat rate of $0.11/kWh. These rates are computed on an all-in basis, which reflect the sum total of transmission, distribution, generation, and other customer charges. During the PPP period, the control group customers faced the IBR structure as the pilot ran in the summer months. The treatment customers faced one of the three following rate designs:

Critical peak pricing

The hours between 2 pm and 6 pm on non-holiday weekdays were designated as the peak period and were priced at $0.18/kWh. On the six critical peak days that were called on a day-ahead basis, the peak hours would become the critical peak hours and be priced at $0.69/kWh. The hours between 7 am and 2 pm and between 6 pm and 11 pm on non-holiday weekdays were designated as the mid-peak period and were priced at $0.11/kWh. On non-critical weekdays and weekends, the treatment customers faced an off-peak price of $0.09/kWh. In order to maintain revenue neutrality, the off-peak price was lower than the standard tariff.

Peak time rebate

The participants had the opportunity to receive a $0.50 rebate for every kilowatt hour of load reduction if they reduce their consumption below their baseline usage during the peak hours of the critical peak event days. On non-event days, the participants faced a TOU rate. The hours between 2 pm and 6 pm were priced at $0.26/kWh. The hours between 7 am and 2 pm and between 6 pm and 11 pm were priced at $0.11/kWh. The treatment customers faced an off-peak price of $0.09/kWh.

Price information only

Similar to the control group customers, the PIO participants faced an IBR structure in the summer months and a flat rate in the winter months. However, these customers were notified of the critical peak events and were encouraged to reduce their energy consumption during event windows. They were also given access to personalized web portals that contain information on their consumption patterns as well as energy-savings tips and actions.

Technology

The PPP also tested the effectiveness of an ICT in facilitating the demand response when offered in conjunction with dynamic rates and standard rates. In order to distinguish the impacts of the enabling technology from that of the prices and information alone, CPP and PIO treatments were tested with and without the technology options. The PTR treatment customers were not tested with the technology.

The ICT tested in the PPP pilot was a programmable thermostat that could also receive wireless signals from the utility. On event days, CE sent a wireless signal to the thermostats to increase the set-back temperatures (the temperature at which the thermostat kicks in) to pre-programmed levels. For instance, if the thermostat is programmed to have a set-back temperature of 79°, a wireless signal sent from the utility automatically raised the temperature to 79°. CE followed an approach that involved pre-programming the thermostats to customers’ preferred levels at the time of installation. In most previous pilots, the customers were not given such option, and the utility increased the settings of their thermostats either to a certain level (e.g., 80°), or by a given increment (e.g., by 4°).

Another unique feature of the CE’s enabling technology deployment was the ease of overrides by the customers. The customers could simply go to the control panel of their thermostats and cancel the temperature set by CE or adjust it to some other level. In many other pilots, the overrides were more difficult and most of the time involved calling the utility to cancel the utility’s control of the thermostat. A combination of time-varying rates, information treatments, and an enabling technology yielded five different treatment cells in the pilot.

Sample design

CE had deployed 3,800 AMI meters in the city of Jackson, Michigan which represented the participant population for this pilot.Footnote 2 Pilot customers were randomly selected and then recruited from this sample through direct mailing and follow-up calls. The final sample design included approximately 600 program participants. Of the 600 customers who were subject to pricing or information-only treatments during this period, 115 customers were classified as low income because they earned less than $25,000 a year. Of this total, 97 were on pricing treatments and 18 were on the information-only treatment.

In the recruitment process, CE first mailed information to the customers to notify them about the PPP and inviting them to join the pilot. Customers who received the mailings and wished to participate in the program could contact CE’s hot line by email or telephone. CE also used outbound calls to contact customers who did not respond. Detailed information was provided to invitees in the mailing including the type of rate design and/or enabling technology. The letter only detailed the specific rate (e.g., CPP or PTR) that was being offered to the invitees and none of the other rates. Participating customers were offered an appreciation payment of $150 (for CPP, PTR, and PIO treatments) or $175 (for CPP_TECH and PIO_TECH) if they stayed in the pilot throughout the pilot period. CE sequentially recruited treatment customers for five different treatment groups.

This was one of the few dynamic pricing pilots that tested for the presence of the Hawthorne effect, according to which, people who are not on any experimental treatment change their behavior merely because they are aware of the experiment.Footnote 3 This would suggest that the observed treatment effects, which are the difference in usage between the treatment and control group customers, would be understated since the control group customers would also change their behavior merely by being included in the experiment.

CE randomly selected two control groups to carry out the test. The GCON group, consisting of 228 customers, was randomly selected from the AMI population and was unaware of the pilot program. The RCON group, consisting of 92 customers, was also randomly selected but was made aware of the pilot program.Footnote 4 The RCON customers were told that CE would observe their everyday usage patterns during the summer season, beginning in June and running through the end of September. If the Hawthorne effect existed, then the treatment effect measured relative to the RCON group would differ from that measured relative to the GCON group. One might presume that the RCON measurement would yield a smaller treatment effect than the GCON measurement since customers in the RCON group would lower their peak usage because they were being observed. Table 1 shows the distribution of the treatment and the control customers into different pilot cells as of September 2010.

Customer communication

CE called six critical peak days between the months of June and September. The participants were notified of the critical peak days on a day-ahead basis through one or more of the following options: telephone messages, e-mail communication, and text messages.

Data and methodology

Data

CE metered the hourly usage of the treatment and control group customers both before and during the pilot period. The data from May to September yielded a residential data set of 921 customers. Price series used into the estimation procedure were first converted to all-in prices in order to reflect the sum total of transmission, distribution, generation, and other customer charges. Four types of rates structures were used in the PPP dataset:

Standard all-in rates

Retaining the IBR structure could lead to problems with identification of the demand curves and needed special attention. We addressed the problem by estimating the average CE customer usage of 931 kWh/month and converting the IBR to a flat all-in rate of $0.13/kWh. The rates were then matched to the control group customers in the pretreatment as well as the treatment periods in the data manipulation stage. They were also matched to the treatment customers in the pretreatment period since the pilot rates were not yet in effect.

CPP all-in rates

The CPP rates were converted into all-in rates and matched to the CPP customers while carefully checking that off-peak, peak, mid-peak, and critical peak prices corresponded to the hours defined in the CPP program.

PTR all-in rates

The PTR rates were converted into all-in rates and matched to the PTR customers with the corresponding off-peak, peak, mid-peak, and critical peak prices. We summed up the rebate component with the peak rate to obtain the all-in PTR rate. We contend that an additional kilowatt hour of consumption means foregoing the rebate amount and, therefore, constitutes an opportunity cost for the customer.

PIO all-in rates

The standard all-in rates were matched to the PIO customers in the pretreatment as well as the treatment periods.

We also used two hourly weather variables, dry bulb temperature and dew point temperature, to create a temperature–humidity index (THI) variable, which will be described later.

Demand model

We took several steps to our modeling approach: (1) We specified electricity demand models that represent the electricity consumption behavior of the CE customers. (2) We used panel data econometrics to estimate and parameterize the models. (3) We simulated the impact of the treatments that were deployed in the pilot as well as intermediate treatments that could be deployed in the post-pilot phase.

We employed a model that has been widely used in empirical work on dynamic pricing, the constant elasticity of substitution (CES) model, to estimate customer demand curves for electricity by time period and derive the peak to off-peak substitution and daily price elasticities. The CES model allowed us to estimate the demand response impacts of each PPP pricing option and also to predict the impact of prices other than those used in the pilot. We also relied on the analysis of variance and covariance (ANCOVA) model in order to estimate the impacts of the information-only treatments as they did not face time-varying rates.

The CES model consists of two equations. The first equation models the ratio of the natural logarithm of peak to off-peak quantities as a function of the ratio of the natural logarithm of peak to off-peak prices and other terms.Footnote 5 The second equation models the average daily electricity consumption as a function of the daily price of electricity. The two equations constitute a system for predicting electricity consumption by time period where the first equation predicts the changes in the load shape caused by changing peak to off-peak price ratios, and the second equation predicts the changes in the level of daily electricity consumption caused by changing the average daily electricity price.

Econometric estimation

We used a “fixed-effects” estimation procedure to model the CES demand system. Fixed effects estimation uses a data transformation method that removes any unobserved time-invariant effect that has a potential impact on the dependent variable. By estimating a fixed effects model, we effectively controlled for all customer specific characteristics that don’t vary over time and isolate their impact on the dependent variable. However, there are also several observed variables that may affect the level of the dependent variable, and these need to be included in the model. We discuss these variables and the econometric specifications of the substitution and the daily demand equations below.

Substitution equation

The equation captures the ability of customers to substitute relatively inexpensive off-peak consumption for relative expensive peak consumption. The decision to substitute between peak and off-peak periods is mainly affected by the relative prices between these two periods. However, the relative weather conditions between the periods should also be included in the analysis because weather has a strong influence on load. Keeping everything else constant, the average peak load is greater than the average off-peak load on a hot summer day because the average peak temperature is higher than the average off-peak temperature, which leads to more cooling during the peak period. In the Midwest region, humidity amplifies the effect of temperature. In order to capture the impact of temperature and humidity on the electricity load, we created a variable called the THI (sometimes called the discomfort index). The variable is a weighted average of the dry bulb temperature (air temperature shielded from moisture) and the dew point temperature (a measure of relative humidity) and is computed as follows:

The substitution equation takes the following functional form:

where:

- \( \ln \left( {\frac{{\mathrm{Peak}\_\mathrm{kWh}}}{{\mathrm{OffPeak}\_\mathrm{kWh}}}} \right)it \) :

-

Natural logarithm of the ratio of peak to off-peak load for a given day

- THI_DIFF t :

-

The difference between average peak and average off-peak THI.

- THI_DIFF t × D_Month k :

-

Interaction of THI_DIFF variable with monthly dummies.

- \( \ln {{\left( {\frac{{\mathrm{Peak}\_\mathrm{Price}}}{{\mathrm{OffPeak}\_\mathrm{Price}}}} \right)}_{it }}\times \mathrm{THI}\_\mathrm{DIF}{{\mathrm{F}}_t} \) :

-

Interaction of \( \ln \left( {\frac{{\mathrm{Peak}\_\mathrm{kWh}}}{{\mathrm{OffPeak}\_\mathrm{kWh}}}} \right)it \) and THI_DIFF

- \( \ln {{\left( {\frac{{\mathrm{Peak}\_\mathrm{Price}}}{{\mathrm{OffPeak}\_\mathrm{Price}}}} \right)}_{it }}\times \mathrm{THI}\_\mathrm{DIFF}\times \mathrm{TEC}{{\mathrm{H}}_i} \) :

-

Interaction of \( \ln \left( {\frac{{\mathrm{Peak}\_\mathrm{kWh}}}{{\mathrm{OffPeak}\_\mathrm{kWh}}}} \right)it \), THI_DIFF and TECH.

- TECH:

-

Equal to 1 if the customer has an ICT.

- \( \ln {{\left( {\frac{{\mathrm{Peak}\_\mathrm{Price}}}{{\mathrm{OffPeak}\_\mathrm{Price}}}} \right)}_{it }}\times \mathrm{THI}\_\mathrm{DIFF}\times \mathrm{PT}{{\mathrm{R}}_i} \) :

-

Interaction of \( \ln \left( {\frac{{\mathrm{Peak}\_\mathrm{kWh}}}{{\mathrm{OffPeak}\_\mathrm{kWh}}}} \right)it \), THI_DIFF and PTR

- PTR:

-

Equal to 1 for a PTR customer, 0 otherwise.

- D_TreatPeriod t :

-

Dummy variable is equal to 1 when the period is July 2010 through September 1, 2010.

- D_TreatCustomer i :

-

is equal to 1 for the treatment customers.

- D_TreatPeriod t × TreatCustomer i :

-

Interaction of D_TreatPeriod t with D_TreatCustomer i

- D_WEEKEND t :

-

Dummy variable that is equal to 1 on weekends.

- v i :

-

Time invariant fixed effects for customers.

- u it :

-

Normally distributed error term.

The substitution equation was estimated using data on both the treatment and the control customers before and during the pilot period. Such database allows one to isolate the true impact of the experiment by controlling for any potential biases due to either differences between control and treatment customers in the pretreatment period or any changes in the consumption behavior of the treatment customers between the pretreatment and the treatment periods that are not related to the treatment per se (Faruqui et al. 2009). These potential confounding factors are controlled for by introducing dummy variables pertaining to the customer type and the analysis period. We estimated the substitution equation for the full sample using the GCON and RCON control groups, as well as for the low-income customer sample using the GCON control group.

This equation determined the substitution elasticity of the pilot customers. The substitution elasticity indicates the percent change in the ratio of peak to off-peak consumption due to a 1 % change in the ratio of peak to off-peak prices. A priori, we hypothesize that the substitution elasticity will increase in absolute terms with weather. To capture this behavior, we interacted the price ratio and the weather term in the model. We also introduced the interaction terms between the price ratios and dummy variables for the enabling technology to capture the incremental impact of the technology on the price responsiveness of the customers.

Since the PIO customers did not face time-varying rates, we estimated a separate model which we discuss in the ANCOVA equation section. The estimation results for the substitution equations are provided in Table 2.

Daily demand equation

The daily demand equation captures the change in the average daily consumption due to the changes in the average daily price. Similar to the substitution equation, the daily equation also relies on the pretreatment and the treatment period data on both treatment and control group customers. We estimated the daily demand equation for the full sample using the GCON and RCON control groups, as well as for the low-income customer sample using the GCON control group.

We use the following specification for the CPP and the PTR customers:

where:

- ln(kWh) it :

-

Natural logarithm of the daily average of the hourly load.

- ln(THI) it :

-

Natural logarithm of the daily average of the hourly THI.

- ln (THI) t × D_Month k :

-

Interaction of ln(THI) variable with monthly dummies.

- ln (Price) it × ln (THI) t :

-

Interaction of ln(price) with ln(THI).

- ln (Price) it × ln (THI) × TECH t :

-

Interaction of ln(price) with ln(THI) and TECH.

- ET:

-

is equal to 1 if the customer has an ICT.

- ln (Price) it × ln (THI) × PTR t :

-

Interaction of ln(price) with ln(THI) and PTR

- PTR:

-

Equal to 1 for a PTR customer.

- D_TreatPeriod t :

-

Dummy variable is equal to 1 when the period is July 2010 through September 1, 2010.

- D_TreatCustomer i :

-

Equal to 1 for the treatment customers.

- D_TreatPeriod t × TreatCustomer i :

-

Interaction of with D_TreatPeriod t with D_TreatCustomer i

- D_WEEKEND t :

-

Dummy variable that is equal to 1 on weekends.

- v t :

-

Time invariant fixed effects for customers.

- u it :

-

Normally distributed error term.

The daily equation determined the daily price elasticity of the CE customers. Similar to the substitution elasticities, the daily price elasticities were interacted with the weather term. The estimation results for the daily demand equation are presented in Table 3.

ANCOVA equation

As the PIO customers were not subject to time-varying rates, it is not possible to estimate the demand impacts for these customers using the substitution and daily equations. Instead, we modeled the changes in the peak electricity consumption of these customers on the event days using an ANCOVA approach. This approach is based on identifying the event days and comparing the changes in the peak usage, caused by the event notification, to the peak usage of non-event days. The estimation equation takes the following functional form:

where:

- ln(kWh) it :

-

Logarithm of the hourly peak load for a given day

- THI t :

-

THI = 0.55 × dry bulb temperature + 0.20 × Dewpoint + 17.5

- THI × D_Month k :

-

Interaction of the hourly peak THI with monthly dummies

- D_TreatPeriod t :

-

Dummy variable is equal to 1 when the period is July 2010 through September 2010

- TreatCustomer:

-

Dummy variable is equal to 1 for a treatment customer

- D_TreatPeriod t × TreatCustomer i :

-

Interaction of D_TreatPeriod with TreatCustomer

- D_Event_Day t × THI it :

-

Interaction of D_Event_Day and THI for RPIO customers

- D_Event_Day t × THI it × D_TECH:

-

Interaction of D_Event_Day × THI and dummy variable for RPIO_TECH customers

- D_WEEKEND t :

-

Dummy variable that is equal to 1 on weekends

- v t :

-

Time invariant fixed effects for customers

- u t :

-

Normally distributed error term

The initial specifications of the PPP demand model also implied that the peak consumption of the PIO customers increased with the hotter weather. Therefore, we included an interaction term between the event day and the THI variables in the model to capture this relationship. We also introduced an interaction term between the event day variable and the enabling technology to capture the incremental impact of technology above and beyond the information-only treatment and relied on the fixed effects estimation procedure to estimate the model. The estimation results for the ANCOVA equation are presented in Table 4.

Results

CPP and PTR elasticities

Once we had estimated the parameters of the substitution and the daily equations, we calculated the substitution and the daily price elasticities. As the CE price elasticities are weather dependent, the impact of the weather on the substitution elasticity and the daily elasticity is captured through the THI_DIFF variable and the ln (THI) variable, respectively. In order to quantify the load impacts from the pilot, we determined the “average CPP event day weather” to be used in the calculation of the price elasticities. We identified the average CPP event day weather by finding the average values of the THI_DIFF and the THI variables for the six event days.

Substitution elasticity

The substitution elasticities can be derived from the following equations:

These equations make it possible to determine a substitution elasticity conditional on a specific weather condition and the existence of an enabling technology.

Daily elasticity

The daily price elasticities from the estimated model can be derived using the following equations:

It is also possible to estimate a daily price elasticity conditional on a specific weather condition using this equation.

PIO impacts

We modeled the changes in the peak electricity consumption of these customers on the event days using the ANCOVA approach. After estimating the parameters of the ANCOVA equation, we calculated the impacts based on the “average CPP event day weather.” We identified the average CPP event day weather by finding the average values of the peak THI variable for the six event days.

ANCOVA impacts

The PIO impacts from the estimated model can be derived using the following equations:

These equations make it possible to estimate the peak impacts conditional on a specific weather condition and the existing of an enabling technology.

Empirical findings

Table 5 reports the estimated substitution and daily price elasticities for the CPP and the PTR customers.

The key findings are noted below:

-

1.

We found that the elasticities of substitution are statistically significant and in line with other pilots, confirming that residential customers are price responsive.

-

2.

Unlike the substitution elasticities, the daily price elasticities were statistically insignificant except for the CPP customers with the enabling technology. The CPP + TECH daily elasticity was estimated as −0.089, more than twice as high as the value observed in the 2008 BGE experiment.

-

3.

CE customers showed the same price responsiveness to the equivalently designed PTR and CPP rates. This finding complements the result of the BGE pilot in Maryland which, during its first year of operation in 2008, tested both the CPP and the PTR rates. However, it contradicts the results of the PowerCents DC pilot carried out by Pepco in the District of Columbia which ran during the summers of 2008–2009 and the finding of the dynamic pricing pilot run by Connecticut Light & Power Company (Faruqui et al. 2012; Wolak 2011).

-

4.

The CPP and the PTR substitution elasticities were estimated as −0.107. This is higher than the average substitution elasticity of −0.076 reported in the California SPP and of −0.096 reported in the BGE pilot.Footnote 6

-

5.

We found that the substitution elasticities did not differ for customers with and without the enabling technology. This finding contradicts the result of the BGE pilot in Maryland and the Connecticut Light & Power pilot in Connecticut and may be due to the ease with which customers were able to override the utility’s control of their thermostat.

-

6.

As mentioned earlier, CE recruited two control groups GCON and RCON to test the existence of a Hawthorne effect. As shown in Table 2, we found no statistical difference between the substitution elasticities using the GCON group which were unaware of the pilot program and the RCON group who were told that the utility would observe their everyday usage patterns. However, the daily price elasticity for the CPP with enabling technology customers was higher when estimated using the RCON group, compared to the original model (estimated using the GCON group). Finally, the load reduction impact estimated from the ANCOVA model using the RCON group is slightly lower compared to that using the GCON group; however, the difference between these two coefficients is not statistically significant. Based on these findings, we conclude that there is no definitive evidence to support the existence of a Hawthorne effect in the PPP pilot.

-

7.

The results showed that the substitution elasticities for low-income groups were not statistically distinguishable from non-low-income participants. Enabling technologies did not yield additional impacts across income groups. The substitution elasticities for the CPP and PTR treatments were also indistinguishable among income groups.

-

8.

The daily elasticities of CPP treatments were insignificant across income groups. The CPP and PTR treatments are statistically different among non-low-income participants.

Simulating the demand response impacts

Once we had estimated the equations for the CPP, the PTR, and the PIO customers, we were then able to estimate the demand response impacts for the rates tested in the PPP. We obtained the impacts of the PIO customers directly from the ANCOVA equation, while we determined the impacts of the CPP and the PTR rates through the Pricing Impact Simulation Model (PRISM) software. The PRISM software emerged from the California Statewide Pricing Pilot (Faruqui and George 2005). Originally developed for California, PRISM has been adapted to conditions in other parts of North America after making adjustments for weather, customer price responsiveness (price elasticities), rate, and load shape characteristics. We calibrated the PRISM model to the estimated elasticities, the typical CE residential load profiles, and all-in rates the control and the PPP customers paid during the pilot period and created the CE-PRISM model. Using the CE-PRISM model, we calculated the demand response impacts for the rates that were tested in the PPP program. CE-PRISM also allows calculating the impacts from other values of the rates tested in the PPP.

The CE-PRISM model generates several metrics including percent change in peak and off-peak consumption on critical and non-critical days and percent change in total monthly consumption.

Customer impacts

Table 6 presents the customer impacts.

The following findings emerged from the experiment:

-

1.

The CPP customers reduced their critical peak period usage by 15.2 %.

-

2.

The CPP customers with the enabling technology reduced their critical peak period usage by 19.4 %, but this effect is not coming from their having a higher substitution elasticity; instead, it is coming from their having a higher daily price elasticity.

-

3.

The PTR customers reduced their critical peak period usage by 15.9 %.

-

4.

The PIO customers reduced their critical peak period usage by 5.8 %.

-

5.

The PIO customers with the enabling technology did not yield additional impacts above and beyond that of the information only treatment.

-

6.

The total monthly consumption remained unchanged for both the CPP and the PTR programs as the daily elasticity was statistically insignificant. Such findings implied that the CPP and the PTR rates only induced customers to shift their loads from peak to off-peak periods, and did not lead to any statistically detectable load building or load conservation impacts.

-

7.

The total monthly consumption for the CPP customer with enabling technology increased by 0.8 % as the daily elasticity was statistically significant. During the pilot period, the average daily price reached $0.23/kWh on critical event days, whereas it decreased to $0.10/kWh on the non-critical days. Since the number of event days was far less than the number of non-event days in a given month, the load building effect overweighed the load conservation effect, and average monthly usage increased. It is also plausible that changing the hardware may have changed the schedules and/or energy usage and led to increased energy consumption.

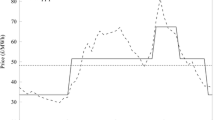

Figure 1 lays out the peak reductions for CE residential customers relative to other pilots (Faruqui and Palmer 2012). It takes data from a variety of dynamic pricing pilots that have been conducted during the past decade over three continents. Most of the pilots had multiple treatments, and the figure shows the results of each treatment. On the vertical axis, we plot the reduction in peak demand and associate it with the peak to off-peak price ratio which is plotted on the horizontal axis. The results are grouped by treatment type: price-only shown in red, price with technology shown in blue, and price with super technology shown in green. Simple regression curves are fit to each of the three clusters yielding three “arcs of price responsiveness.” The three CE impacts, with circles drawn around them, are broadly consistent with the findings of the other experiments.

Conclusions

In CE’s dynamic pricing experiment, we found conclusive evidence of price responsiveness, as seen in other dynamic pricing pilots. We also found that equivalently designed PTR and CPP rates had equivalent impacts on peak demand. This finding complements the result found in the BGE pilot in Maryland during its first summer of operation in 2008, but contradicts the findings of the dynamic pricing pilots carried out in the District of Columbia in 2008–2009 and in Connecticut in 2009. This remains a fertile topic for future work. We also found that “information only” customers responded to the provision of pricing information but at a lesser rate than customers who were actually on dynamic pricing.

In this experiment, enabling technologies only affected the daily price elasticity and had no effect on the substitution elasticity. This tended to yield a lower impact for enabling technologies than seen in other pilots.

Within the subset of the PPP customers who responded to the income question, we found that the elasticities of substitution for low-income customers with known income data were essentially the same as those for the average customer. Finally, we did not find any definitive evidence to support the existence of a Hawthorne effect in the pilot.

Notes

For a survey, see Crew et al. (1995). A case for dynamic (as opposed to static) time-varying rates was provided by Vickrey (1971). Chao (1983) introduced uncertainty into the analysis. Littlechild (2003) made a case for passing through wholesale costs to retail customers. Borenstein (2005) compared the efficiency gains of dynamic and static time-varying rates.

Jackson is a small town in south central Michigan about 40 miles west of Ann Arbor with a population of some 30,000. http://www.cityofjackson.org/

“The Hawthorne effect has been an enduring legacy of the celebrated studies of workplace behavior conducted in the 1920s and 1930s at Western Electric's Hawthorne Plant.” Jones (1992).

An alternative approach to form the RCON group is to recruit them similarly to the treatment group, then to deny them the treatment impact. However, by having two different control groups with only one of them having the knowledge of the pilot, we believe we would get very similar results.

Given that the price differential between the mid-peak rate and the off-peak rate was insignificant, we treated the mid-peak period as an off-peak period and used a two-period rate structure.

References

Borenstein, S. (2005). The long-run efficiency of real-time pricing. The Energy Journal, 26(3), 93–116.

Chao, H.-P. (1983). Peak-load pricing and capacity planning with demand and supply uncertainty. Bell Journal of Economics, 14(1), 170–190.

Crew, M. A., Fernando, C. S., & Kleindorfer, P. R. (1995). The theory of peak load pricing: a survey. Journal of Regulatory Economics, 8, 215–248.

Faruqui, A. (2010). The ethics of dynamic pricing. The Electricity Journal, 23(6), 13–27.

Faruqui, A., & George, S. S. (2005). Quantifying customer response to dynamic pricing. The Electricity Journal, 18(4), 53–63.

Faruqui, A., & Palmer, J. (2012). The discovery of price responsiveness—a survey of experiments involving dynamic pricing of electricity. EDI Quarterly, 4(1), 15–18.

Faruqui, Ahmad, Sanem Sergici and Lamine Akaba. (2012). “Dynamic pricing in a moderate climate: the evidence from Connecticut” http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2028178. Accesssed June 2012.

Faruqui, A., & Sergici, S. (2009). Household response to dynamic pricing of electricity—a survey of 15 experiments. Journal of Regulatory Economics, 38(2), 193–225.

Faruqui, A., & Sergici, S. (2011). Dynamic pricing of electricity in the mid-Atlantic region: econometric results from the Baltimore gas and electric company experiment. Journal of Regulatory Economics, 40(1), 82–109.

Faruqui, A., Hledik, R., & Sergici, S. (2009). Piloting the smart grid. The Electricity Journal, 22(7), 55–69.

Jones, S. R. G. (1992). Was there a Hawthorne effect? The American Journal of Sociology, 98(3), 451–468.

Littlechild, S. C. (2003). Wholesale spot price pass-through. Journal of Regulatory Economics, 23(1), 61–91.

Rowlands, I. H., & Furst, I. M. (2011). The cost impacts of a mandatory move to time-of-use pricing on residential customers: an Ontario (Canada) case-study. Energy Efficiency, 4(4), 571–585.

Vickrey, W. S. (1971). Responsive pricing of public utility services. Bell Journal of Economics, 2(1), 337–346.

Wolak, Frank A. (2011). “Do residential customers respond to hourly prices: evidence from a dynamic pricing experiment.” American Economic Review: Papers and Proceedings, http://www.stanford.edu/group/fwolak/cgibin/sites/default/files/files/hourly_pricing_aer_paper.pdf. Accesssed June 2012.

Acknowledgments

We would like to thank staff at Consumers Energy for their helpful suggestions and comments on earlier drafts of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Ahmad Faruqui is a Principal, Sanem Sergici is a Senior Associate (Sanem.Sergici@brattle.com) and Lamine Akaba is a Senior Research Analyst (Lamine.Akaba@brattle.com) with The Brattle Group.

Rights and permissions

About this article

Cite this article

Faruqui, A., Sergici, S. & Akaba, L. Dynamic pricing of electricity for residential customers: the evidence from Michigan. Energy Efficiency 6, 571–584 (2013). https://doi.org/10.1007/s12053-013-9192-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-013-9192-z