Abstract

We consider spatial competition when consumers are arbitrarily distributed on a compact metric space. Retailers can choose one of finitely many locations in this space. We focus on symmetric mixed equilibria which exist for any number of retailers. We prove that the distribution of retailers tends to agree with the distribution of the consumers when the number of competitors is large enough. The results are shown to be robust to the introduction of (1) randomness in the number of retailers and (2) different ability of the retailers to attract consumers.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Consider a market with consumers and retailers. Suppose that the former ones are distributed on the unit interval and each one of them shops at the closest store whereas the latter ones decide where to locate in order to attract the largest fraction of consumers. This model is called the Pure Location Game and was initially considered by Hotelling [18] for the case of two retailers. This seminal paper has been extended and applied in different fields such as industrial organization or spatial competition (as in [8]), giving rise to an immense literature.

Among the different lessons one can draw from this model, the convergence to the median result is a highly attractive feature. Indeed, with just two players, a unique equilibrium exists. This equilibrium has two main features: (1) it is in pure strategies and (2) both parties locate at the location preferred by the median consumer. Yet, these attractive features are not robust to the introduction of some slight modifications of the model (see the review of the literature for a detailed account). For instance, if one assumes that consumers are distributed on a multidimensional space rather than on the unit interval, a pure equilibrium ceases to exist. Similarly, adding more retailers to the game might imply that a pure strategy equilibrium fails to exist. For instance, a pure equilibrium need not exist with at least four firms [26] when firms can locate over the unit interval. Nuñez and Scarsini [25] prove that, surprisingly a pure equilibrium must exist when the number of retailers is large enough as long as firms are restricted to choose from a finite set of locations. More specifically, while the consumers are distributed in a multidimensional space, the retailers can only locate in a finite subset of this space.Footnote 1 Moreover, in this pure strategy equilibrium, the distribution of retailers converges towards the distribution of consumers when the number of retailers increases. Note that [25]’s result allows the consumers to be distributed in any multidimensional space and holds independently of the finite set of locations the retailers can choose from.

The current work focuses on a similar frameworkFootnote 2 and attempts to characterize the whole set of symmetric equilibria when the number of retailers becomes large enough. To do so, we first consider a simple version of the model, where all retailers are symmetric. We examine the properties of symmetric mixed strategy equilibria (which must exist since the game is finite and symmetric). We first prove that, as the number of retailers grows large, every symmetric equilibrium must be completely mixed. In other words, in these equilibria, every feasible location is occupied with positive probability. This implies that the expected payoff from choosing each location must be equal for each retailer. A non-trivial consequence of this is that the distribution of retailers induced by the symmetric mixed equilibrium converges to the consumers’ distribution.

Once we have considered the simple model with an exogenous number of symmetric retailers, we then examine two extensions. The first extension deals with games with a random number of players and the second one introduces ex-ante asymmetries between the retailers. As far as the first extension is concerned, it is well-known that games with a large number of players can easily produce results that are not robust with respect to the number of players. In order to check this robustness, we consider also a model where the number of players is random, using Poisson games à la [23, 24]. We show that in the unique equilibrium of the Poisson game retailers match consumers when the parameter of the Poisson distribution is large enough, so retailers do not even need to know the exact number of their competitors to play their (mixed) equilibrium strategies.

Finally, we consider a richer model where the retailers are of two different types, advantaged and disadvantaged. Consumers prefer advantaged retailers, so they are ready to travel a bit more to shop at one of them rather than at a disadvantaged one. Here we model the comparative advantage of the first type of retailers by an additive constant. This is formally equivalent to the idea of valence in election models [see 2, 3, among others]. We show that, when the number of advantaged players increases, they play as if the disadvantaged retailers did not exist, and these ones get a zero payoff, no matter what they do.

1.1 Review of the Literature

We refer the reader to [13] for a recent survey of the literature on Hotelling games. Here we just mention the articles that are somehow closer to our contribution. Eaton and Lipsey [10] consider a Hotelling-type model with an arbitrary number of players, different possible structures of the space where retailers can locate, and different distributions of the customers. Lederer and Hurter [20] consider a model with two retailers where consumers are non-uniformly distributed on the plane. Aoyagi and Okabe [1] look at a bidimensional market and, through simulation, relate the existence of equilibria and their properties to the shape of the market. Tabuchi [32] considers a two-stage Hotelling duopoly model in a bidimensional market. Hörner and Jamison [17] look at a Hotelling model with a finite number of customers. Note that, with just two retailers, the literature has underlined the existence of a “curse of multidimensionality” (see [5] and [33] for a discussion). This curse implies that there exists no equilibrium in pure strategies for almost all distributions of consumers whenever the competition takes place in a setting with more than one dimension (as first identified by Plott [30]).Footnote 3 When the number of retailers becomes large, the location of the retailers at the symmetric mixed equilibrium tends to coincide with the distribution of the consumers on the space. This phenomenon where “retailers match consumers” was first observed by Osborne and Pitchik [26].Footnote 4 A similar result is present in [19] and [27] in the context of professional forecasting. The previously mentioned results just focus on the unidimensional space. As far as multidimensional spaces are concerned, [9, 11, 22], and [15] consider a Hotelling model on graphs where retailers can locate only on the vertices of the graph. Pálvölgyi [28], Fournier and Scarsini [13], and Fournier [12] consider Hotelling games on graphs with an arbitrary number of players. Heijnen and Soetevent [16] extend Hotelling’s model of price competition with quadratic transportation costs from a line to graphs. Another model of location-price competition on a graph is studied in [29]. Nuñez and Scarsini [25] prove the existence of pure strategy equilibrium when the number of locations is finite and the number of players is large enough.

Two papers on the optimization literature are related to ours. Crippa et al. [7] focuses on an one-shot optimization problem where several agents, distributed across some space, have access to different services. To use a service, each agent spends some amount of time which is due both to the travel time to the service and to the queue time waiting in the service. This article considers this problem globally and in an equilibrium-like perspective. Mallozzi and Passarelli di Napoli [21] solve a two-stage optimization problem in which a social planner divides the market region into a set of service regions, each served by a single facility, in order to minimize the total cost. More precisely, the social planner decides in the first period the location of the facilities and seeks in the second period an optimal partition of the customers in each of the locations.

The paper is organized as follows. Section 2 introduces the model. Section 3 analyzes its equilibria. Section 4 considers the case of a random number of retailers. Section 5 deals with the case of differentiated retailers. All proofs are in Appendix.

2 The Model

In this section we describe the basic location model, whose different variations will be studied in the rest of the paper. This model falls in the more general framework studied by Nuñez and Scarsini [25].

2.1 Consumers

In this model consumers are distributed according to a measure λ on a compact Borel metric space (S, d). For instance S could be a compact subset of \(\mathbb{R}^{2}\) or a compact subset of a 2-sphere, but it could also be a (properly metrized) network.

2.2 Retailers

A finite set N n : = { 1, …, n} of retailers have to decide where to set shop, knowing that consumers choose the closest retailers. Each retailer wants to maximize her market share. The action set of each retailer is a finite subset of S. This means that, unlike what happens in a typical Hotelling-type model, retailers cannot locate anywhere they want, but can choose only one of finitely many possible locations. For instance they can set shop only in one of the existing shopping malls in town.

2.3 Tessellation

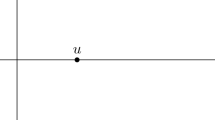

More formally, define K = { 1, …, k} and let X K : = { x 1, …, x k } ⊂ S be a finite collection of points in S. These are the points where retailers can open a store. For every J ⊂ K call X J : = { x j : j ∈ J} and consider the Voronoi tessellation V (X J ) of S induced by X J . That is, for each x j ∈ X J define the Voronoi cell of x j as follows:

The cell v J (x j ) contains all points whose distance from x j is not larger than the distance from the other points in X J . Call

the set of all Voronoi cells v J (x j ). See, for instance, Fig. 1. It is clear that for J ⊂ L ⊂ K we have v J (x j ) ⊃ v L (x j ) for every j ∈ J.

Given that λ is the distribution of consumers on the space S, we have that λ(v J (x j )) is the mass of consumers who are weakly closer to x j than to any other point in X J . These consumers will weakly prefer to shop at location x j rather than at other locations in X J since we assume that all firms offer the same good at the same price.

To simplify the notation and the results, we assume that S is a compact subset of some Euclidean space, that λ is absolutely continuous with respect to the Lebesgue measure on this space and

This assumption implies that the set of consumers that belong to r different Voronoi cells \(v_{J}(x_{j_{1}}),\ldots,v_{J}(x_{j_{r}})\) (i.e. are at the same distance of several points in X K ) is of zero measure. This allows us to simplify the payoff functions. More general situations can be considered but they would require more care in handling ties.

2.4 The Game

We will build a game where N n : = { 1, …, n} is the set of players. For i ∈ N n call a i ∈ X K the action of player i. Then \(\boldsymbol{a}:= (a_{i})_{i\in N_{n}}\) is the profile of actions and \(\boldsymbol{a}_{-i}:= (a_{h})_{h\in N_{n}\setminus \{i\}}\) is the profile of actions of all the players different from i. Hence \(\boldsymbol{a} = (a_{i},\boldsymbol{a}_{-i})\).

We say that \(\boldsymbol{a}:= (a_{1},\ldots,a_{n}) \approx X_{J}\) if for all locations x j ∈ X J there exists a player i ∈ N n such that a i = x j and for all players i ∈ N n there exists a location x j ∈ X J such that a i = x j . For each \(\boldsymbol{a}\), we let \(K(\boldsymbol{a})\) denote the subset of K such that \(\boldsymbol{a} \approx X_{K(\boldsymbol{a})}\). Therefore, for i ∈ N n , the payoff of player i is \(u_{i}: X_{K}^{n} \rightarrow \mathbb{R}\), defined as follows:

The idea behind expression (2) is as follows. Player i’s payoff is the measure of the consumers that are closer to the location that she chooses than to any other location chosen by any other player, divided by the number of retailers that choose the same action as i. As Fig. 1 shows, some locations may not be chosen by any player, this is why, for every J ⊂ K, we have to consider the Voronoi tessellation V (X J ) with \(\boldsymbol{a} \approx X_{J}\) rather than the finer tessellation V (X K ). We examine a simple example to clarify the idea.

Example 1.

Let S = [0, 1], let λ be the Lebesgue measure on [0, 1], and let X K = { 0, 1∕2, 1}. As mentioned before, for any given X J , the Voronoi cell of location x j represents the set of points in [0, 1] that are closer to x j than any other point in X J .

See Fig. 2.

Hence

Therefore the payoff for player i, if she chooses location 0 when the rest of the players’ pure actions are \(\boldsymbol{a}_{-i}\) is

where

The payoffs when she chooses either 1∕2 or 1 can be similarly computed.

Remark 1.

As mentioned before, the total demand for a location x j (i.e. share of consumers that purchase the good from a given location) depends on the location of all the retailers. The minimum value that this demand can assume is equal to λ(v K (x j )) > 0, which happens when there is at least one retailer in each location (i.e. when \(\boldsymbol{a} \approx X_{K}\)). This represents one of the main differences with respect to the classical model in which retailers can locate everywhere in the set S. In the classical model the demand for a location could be made arbitrarily small. To see why, consider the classical Downsian model in the interval [0, 1] with three players. Assume, for instance that player 1 locates in x, player 2 locates in x −ɛ and player 3 locates in x +ɛ. Then the total demand for x can be rendered arbitrary small as ɛ → 0.

Consider a game where the consumers are distributed on S according to λ, the set of players is N n , the set of actions for each player is X K and the payoff of player i is given by (2). Call this game \(\mathcal{G}_{n} =\langle S,\lambda,N_{n},X_{K},(u_{i})\rangle\). Since the set of actions coincides with the set of locations, we will use the two terms interchangeably.

With an abuse of notation, we use the same symbol \(\mathcal{G}_{n}\) for the mixed extension of the game, where, for a mixed strategy profile \(\boldsymbol{\sigma }= (\sigma _{1},\ldots,\sigma _{n})\), the expected payoff of player i is

3 Equilibria

In the rest of this section, unless otherwise stated, we consider a sequence \(\{\mathcal{G}_{n}\}\) of games, all of which have the same parameters S, λ, X K . More precisely, our focus is on the sequence of games when the number of retailers n grows.

We prove that when the number of retailers is large enough the distribution of retailers in equilibrium approaches the distribution of consumers.

3.1 Pure Equilibria

Nuñez and Scarsini [25, Theorem 3.4] prove in a more general setting that, when the number of players is large, the game \(\mathcal{G}_{n}\) admits pure equilibria and the share of players in the different locations in equilibrium is approximately proportional to the measure of the corresponding Voronoi cells. They also show that this is not the case for small n. In our setting their theorem becomes:

Theorem 1.

Consider a sequence of games \(\{\mathcal{G}_{n}\}_{n\in \mathbb{N}}\) , where \(\mathcal{G}_{n} =\langle S,\lambda,N_{n},X_{K},(u_{i})\rangle\) and all the symbols are defined as in Sect. 2. Then there exists \(\bar{n}\) such that for all \(n \geq \bar{ n}\) the game \(\mathcal{G}_{n}\) admits a pure equilibrium \(\boldsymbol{a}^{{\ast}}\) . Moreover, for all \(n \geq \bar{ n}\) , any pure equilibrium is such that

3.2 Mixed Equilibria

We consider now the mixed equilibria of the game \(\mathcal{G}_{n}\).

Theorem 2.

For every \(n \in \mathbb{N}\) the game \(\mathcal{G}_{n}\) admits a symmetric mixed equilibrium \(\boldsymbol{\gamma }^{(n)} = (\gamma ^{(n)},\ldots,\gamma ^{(n)})\) such that

with

Theorem 2 says that, as the number of players grows, there is a symmetric equilibrium where players mix according to the market share of each location. This result holds only asymptotically. For instance, consider a game \(\mathcal{G}_{n}\) with n = 2, S = [0, 1], λ the Lebesgue measure, and X K = { 0. 45, 0. 5, 0. 55}. Then the only symmetric equilibrium is the pure profile where both players choose the location 0. 5.

4 Games with a Random Number of Players

In this section we consider games where the number of players is random and we show how the results of the previous section extend to this case. In particular we focus on Poisson games [see 23, 24, among others]. In these games, the number of players follows a Poisson distribution. We call \(\mathcal{P}_{n} =\langle S,\lambda,N_{\varXi _{n}},X_{K},(u_{i})\rangle\) the game where the cardinality of the players set \(N_{\varXi _{n}}\) is a random variable Ξ n , with

that is, Ξ n has a Poisson distribution with parameter n.

Just like in game \(\mathcal{G}_{n}\), in game \(\mathcal{P}_{n}\) all players have the same utility function. So the utility function of player i depends only on i’ s action and on the number of players who have chosen x j for all j ∈ K.

Quoting [23], “population uncertainty forces us to treat players symmetrically in our game-theoretic analysis,” so each player choses action x j with probability σ(x j ). As a consequence, all equilibria are symmetric. Properties of the Poisson distribution imply that the number of players choosing action x j is independent of the number of players choosing action x ℓ for j ≠ ℓ.

Let Z(X K ) stand for the set of vectors \(y = (y(x_{i}))_{x_{i}\in X_{K}}\) such that each component y(x i ) is a nonnegative integer that describes the number of players choosing action x i . For each mixed strategy σ, the probability that that the actual play equals y for any y ∈ Z(X K ) equals:

where the product is a consequence of the independence of the different voters choosing a different action. Therefore, the expected utility of each player, when she chooses action x j and all the other players act according to the mixed strategy σ is

In the rest of this section we consider a sequence \(\{\mathcal{P}_{n}\}\) of games, all of which have the same parameters S, λ, X K .

Theorem 3.

For every \(n \in \mathbb{N}\) the game \(\mathcal{P}_{n}\) admits a symmetric mixed equilibrium γ (n) such that

The next example shows that in general the equilibria of \(\mathcal{G}_{n}\) and \(\mathcal{P}_{n}\) do not coincide.

Example 2.

Let S = [0, 1] with λ the Lebesgue measure on [0, 1] and X K = { 0. 1, 0. 5, 0. 9}. We consider the equilibria of the games \(\mathcal{G}_{3}\) (static) and \(\mathcal{P}_{3}\) (Poisson).

In the game \(\mathcal{G}_{3}\), there exists an equilibrium σ ∗ in which each retailer locates in 0. 5. Under σ ∗ the payoff for each retailer equals 1∕3 since they uniformly split the consumers in S. A deviation towards 0. 1 or 0. 9 would give a payoff of 0. 3 < 1∕3, so σ ∗ is indeed an equilibrium of \(\mathcal{G}_{3}\).

We now prove that σ ∗ is not an equilibrium in the game \(\mathcal{P}_{3}\). We have

This shows that a deviation to either 0. 1 or 0. 9 is profitable, hence σ ∗ is not an equilibrium of the game \(\mathcal{P}_{3}\).

5 Competition with Different Classes of Retailers

Up to now, we have considered a model where all retailers are equally able to attract consumers. In other words, a consumer is indifferent between purchasing the good at two different shops if they are equally distant from her location.

In many situations some retailers have a comparative advantage due, for instance, to reputation. Therefore, ceteris paribus, a consumer may prefer one retailer over another. Similar models have been studied in the political competition literature with few strategic parties [see 2, among others]. In this literature the term “valence” is used to indicate the competitive advantage of one candidate over another.

In the model that we analyze below, retailers can be of two types: advantaged (A) and disadvantaged (D). We choose this dichotomic model out of simplicity. Results are not qualitatively different when a finite number of types is allowed. More precisely, we have in mind a model with several types of firms ranked by their comparative advantage. If we assume that the number of most advantaged firms goes to infinity (as we do now with just two types), then the most advantaged firms split the consumers among them and the disadvantaged ones get a zero payoff (asymptotically) whatever they do and independently of their comparative advantage.

When choosing between two retailers of the same type, a consumer takes into account only their distance from her and she prefers the closer of the two. When choosing between a retailer of type A located in x A and a retailer of type D located in x D, a consumer located in y will prefer the retailer of type A iff

She will be indifferent between the two retailers iff

Obviously the case β = 0 corresponds to the model examined in Sect. 2.

Different ways to model advantage of one type of players over another have been considered in the literature [see 14, for a discussion].

We now formally define a game \(\mathcal{D}_{n}\) with differentiated retailers. For j ∈ { A, D}, call N n j the set of retailers of type j and define \(n^{j} =\mathop{ \mathrm{card}}\nolimits (N_{n}^{j})\). Therefore

For j ∈ { A, D} and i ∈ N n j call a i j ∈ X K the action of retailer i. Then the profile of actions is

For any profile \(\boldsymbol{a} \in X_{K}^{n}\) define

So n j A and n j D are the number of A and D players, respectively, who choose action x j .

We say that \((\boldsymbol{a}^{A},\boldsymbol{a}^{D}) \approx X_{J^{A},J^{D}}\) if for all locations \(x_{j} \in X_{J^{A}}\) there exists a player i ∈ N n A such that a i A = x j and for all players i ∈ N n A there exists a location \(x_{j} \in X_{J^{A}}\) such that a i A = x j and for all locations \(x_{j} \in X_{J^{D}}\) there exists a player i ∈ N n D such that a i D = x j and for all players i ∈ N n D there exists a location \(x_{j} \in X_{J^{D}}\) such that a i D = x j .

Fix β > 0, and, for J A, J D ⊂ K, define

For i ∈ N n , the payoff of player i is \(u_{i}: X_{K}^{n} \rightarrow \mathbb{R}\), defined as follows:

We call \(\mathcal{D}_{n}:=\langle S,\lambda,N_{n}^{A},N_{n}^{D},X_{K},\beta,(u_{i})\rangle\) a Hotelling game with differentiated players.

Note that, in any pure strategy profile of the game \(\mathcal{D}_{n}\), a D-player gets a strictly positive payoff only if she chooses a location that is not chosen by any advantaged players.

The next example shows how substantially different the equilibria of a game \(\mathcal{G}_{n}\) and of a game \(\mathcal{D}_{n}\) can be.

Example 3.

Let S = [0, 1] with λ the Lebesgue measure on [0, 1] and X K = { 0, 1}. The game \(\mathcal{G}_{2}\) admits pure equilibria. Actually any pure or mixed profile is an equilibrium and gives the same payoff 1∕2 to both players.

Consider now the game \(\mathcal{D}_{2}\) with one advantaged and one disadvantaged players. In the unique equilibrium of \(\mathcal{D}_{2}\) both players randomize with probability 1∕2 over the two possible locations.

Indeed, in \(\mathcal{D}_{2}\) there cannot be a pure equilibrium in which both players choose the same location since the disadvantaged player would get 0 and hence would strictly increase her payoff by deviating. Similarly, there cannot be a pure equilibrium in which players choose different locations, since the advantaged player would have an incentive to deviate to the location chosen by the disadvantaged player. Therefore, any equilibrium must be mixed. A simple computation proves that uniform randomization is the unique strategy profile that constitutes an equilibrium.

We now examine the equilibria in this model with differentiated candidates. Given a game \(\mathcal{D}_{n}\), an equilibrium profile \((\boldsymbol{\gamma }^{A,n},\boldsymbol{\gamma }^{D,n})\) is called (A, D)-symmetric if

Theorem 4.

For every \(n \in \mathbb{N}\) the game \(\mathcal{D}_{n}\) admits an (A,D)-symmetric equilibrium \((\boldsymbol{\gamma }^{A,n},\boldsymbol{\gamma }^{D,n})\) such that

for all x j ∈ S, for all J D ⊂ K. Moreover, in this equilibrium,

Theorem 4 shows that, as the number n A of advantaged players grows, they behave as if the disadvantaged players did not exist, so they play the same mixed strategies as in the game \(\mathcal{G}_{n^{A}}\). The disadvantaged players in turn get a zero payoff whatever they do.

Notes

- 1.

There are several real-life applications where the strategic behavior of the retailers is subject to feasibility constraints as, for instance, when zoning regulations are enforced. Land use regulation has been extensively analyzed in urban economics, mostly from an applied perspective. It is often argued that zoning can have anti-competitive effects and at the same time be beneficial since it might solve problems of externalities [see 31, for a recent work on this area].

- 2.

Throughout, we assume that competition among retailers is only in terms of location, not price. We do this for several reasons. First, there exist several markets where price is not decided by retailers: think, for instance of newsvendors, shops operating under franchising, pharmacies in many countries, etc. Second, our model without pricing can be used to study other topics, e.g., political competition, when candidates have to take position on several, possibly related, issues. Finally several of the existing models that allow competition on location and pricing are two-stage models, where competition first happens on location and subsequently on price. Our game could be seen as a model of the first stage. It is interesting to notice that the recent paper by Heijnen and Soetevent [16] deals with the second stage in a location model on a graph, assuming that the first has already been solved.

- 3.

- 4.

Formally, [26] prove that the symmetric equilibrium strategies satisfy the claim assuming that the consumers are distributed in the interval [0,1] according to any twice continuously differentiable distribution function.

References

Aoyagi, M., Okabe, A.: Spatial competition of firms in a two-dimensional bounded market. Reg. Sci. Urban Econ. 23 (2), 259–289 (1993). doi:http://dx.doi.org/10.1016/0166-0462(93)90006-Z. http://dx.doi.org/10.1016/0166-0462(93)90006-Z

Aragones, E., Palfrey, T.R.: Mixed equilibrium in a Downsian model with a favored candidate. J. Econ. Theory 103 (1), 131–161 (2002). doi:10.1006/jeth.2001.2821. http://dx.doi.org/10.1006/jeth.2001.2821

Aragonès, E., Xefteris, D.: Candidate quality in a Downsian model with a continuous policy space. Games Econ. Behav. 75 (2), 464–480 (2012). doi:10.1016/j.geb.2011.12.008. http://dx.doi.org/10.1016/j.geb.2011.12.008

Banks, J.S., Duggan, J., Le Breton, M.: Social choice and electoral competition in the general spatial model. J. Econ. Theory 126 (1), 194–234 (2006). doi:10.1016/j.jet.2004.08.001. http://dx.doi.org/10.1016/j.jet.2004.08.001

Bernheim, B.D., Slavov, S.N.: A solution concept for majority rule in dynamic settings. Rev. Econ. Stud. 76 (1), 33–62 (2009). doi:10.1111/j.1467-937X.2008.00520.x. http://dx.doi.org/10.1111/j.1467-937X.2008.00520.x

Calvert, R.L.: Robustness of the multidimensional voting model: candidate motivations, uncertainty, and convergence. Am. J. Pol. Sci. 39 (1), 69–95 (1985)

Crippa, G., Jimenez, C., Pratelli, A.: Optimum and equilibrium in a transport problem with queue penalization effect. Adv. Calc. Var. 2 (3), 207–246 (2009). doi:10.1515/ACV.2009.009. http://dx.doi.org/10.1515/ACV.2009.009

Downs, A.: An Economic Theory of Democracy. Harper and Row, New York (1957)

Dürr, C., Thang, N.K.: Nash equilibria in Voronoi games on graphs. In: European Symposium on Algorithms (2007)

Eaton, B.C., Lipsey, R.G.: The principle of minimum differentiation reconsidered: some new developments in the theory of spatial competition. Rev. Econ. Stud. 42 (1), 27–49 (1975). http://www.jstor.org/stable/2296817

Feldmann, R., Mavronicolas, M., Monien, B.: Nash equilibria for voronoi games on transitive graphs. In: Leonardi, S. (ed.) Internet and Network Economics. Lecture Notes in Computer Science, vol. 5929, pp. 280–291. Springer, Berlin, Heidelberg (2009). doi:10.1007/978-3-642-10841-9_26. http://dx.doi.org/10.1007/978-3-642-10841-9_26

Fournier, G.: General distribution of consumers in pure Hotelling games (2016). https://arxiv.org/abs/1602.04851. arXiv 1602.04851

Fournier, G., Scarsini, M.: Hotelling games on networks: existence and efficiency of equilibria (2016). http://dx.doi.org/10.2139/ssrn.2423345. sSRN 2423345

Gouret, F., Hollard, G., Rossignol, S.: An empirical analysis of valence in electoral competition. Soc. Choice. Welf. 37 (2), 309–340 (2011). doi:10.1007/s00355-010-0495-0. http://dx.doi.org/10.1007/s00355-010-0495-0

Gur, Y., Saban, D., Stier-Moses, N.E.: The competitive facility location problem in a duopoly. Mimeo (2014)

Heijnen, P., Soetevent, A.R.: Price competition on graphs. Technical Report TI 2014-131/VII. Tinbergen Institute (2014). http://ssrn.com/abstract=2504454

H&rner, J., Jamison, J.: Hotelling’s spatial model with finitely many consumers. Mimeo (2012)

Hotelling, H.: Stability in competition. Econ. J. 39 (153), 41–57 (1929). http://www.jstor.org/stable/2224214

Laster, D., Bennet, P., Geoum, I.: Rational bias in macroeconomic forecasts. Q. J. Econ. 45 (2), 145–186 (1999). doi:10.1007/s00355-010-0495-0. http://dx.doi.org/10.1007/s00355-010-0495-0

Lederer, P.J., Hurter, A.P., Jr.: Competition of firms: discriminatory pricing and location. Econometrica 54 (3), 623–640 (1986). doi:10.2307/1911311. http://dx.doi.org/10.2307/1911311

Mallozzi, L., Passarelli di Napoli, A.: Optimal transport and a bilevel location-allocation problem. J. Glob. Optim. 1–15 (2015) http://dx.doi.org/10.1007/s10898-015-0347-7

Mavronicolas, M., Monien, B., Papadopoulou, V.G., Schoppmann, F.: Voronoi games on cycle graphs. In: Mathematical Foundations of Computer Science, vol. 2008. Lecture Notes in Computer Science, vol. 5162, pp. 503–514. Springer, Berlin (2008). doi:10.1007/978-3-540-85238-4_41. http://dx.doi.org/10.1007/978-3-540-85238-4_41

Myerson, R.B.: Population uncertainty and Poisson games. Int. J. Game Theory 27 (3), 375–392 (1998). doi:10.1007/s001820050079. http://dx.doi.org/10.1007/s001820050079

Myerson, R.B.: Large Poisson games. J. Econ. Theory 94 (1), 7–45 (2000). doi:10.1006/jeth.1998.2453. http://dx.doi.org/10.1006/jeth.1998.2453

Nuñez, M., Scarsini, M.: Competing over a finite number of locations. Econ. Theory Bull. 4 (2), 125–136 (2016) http://dx.doi.org/10.1007/s40505-015-0068-6

Osborne, M.J., Pitchik, C.: The nature of equilibrium in a location model. Int. Econ. Rev. 27 (1), 223–237 (1986). doi:10.2307/2526617. http://dx.doi.org/10.2307/2526617

Ottaviani, M., Sorensen, P.N.: The strategy of professional forecasting. J. Financ. Econ. 81 (2), 441–466 (2006). doi:10.1007/s00355-010-0495-0. http://dx.doi.org/10.1007/s00355-010-0495-0

Pálv&lgyi, D.: Hotelling on graphs. Mimeo (2011)

Pinto, A.A., Almeida, J.P., Parreira, T.: Local market structure in a Hotelling town. J. Dyn. Games 3 (1), 75–100 (2016). doi:10.3934/jdg.2016004. http://dx.doi.org/10.3934/jdg.2016004

Plott, C.R.: A notion of equilibrium and its possibility under majority rule. Am. Econ. Rev. 57 (4), 787–806 (1967)

Suzuki, J.: Land use regulation as a barrier to entry: evidence from the Texas lodging industry. Int. Econ. Rev. 54 (2), 495–523 (2013). doi:10.1111/iere.12004. http://dx.doi.org/10.1007/s00355-010-0495-0

Tabuchi, T.: Two-stage two-dimensional spatial competition between two firms. Reg. Sci. Urban. Econ. 24 (2), 207–227 (1994). doi:http://dx.doi.org/10.1016/0166-0462(93)02031-W. http://dx.doi.org/10.1016/0166-0462(93)02031-W

Xefteris, D.: Multidimensional electoral competition between differentiated candidates. Mimeo, University of Cyprus (2015)

Acknowledgements

The authors thank Dimitrios Xefteris for useful discussions and the PHC Galilée G15-30 “Location models and applications in economics and political science” for financial support.

Matías Núñez was supported by the center of excellence MME-DII (ANR-11-LBX-0023-01).

Marco Scarsini was partially supported by PRIN 20103S5RN3 and MOE2013-T2-1-158. This author is a member of GNAMPA-INdAM.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix: Proofs

Appendix: Proofs

1.1 Proofs of Sect. 3

The proof of Theorem 2 requires some preliminary results.

Lemma 1.

Consider a sequence of games \(\{\mathcal{G}_{n}\}_{n\in \mathbb{N}}\). There exists \(\bar{n}\) such that for all \(n \geq \bar{ n}\), if \(\boldsymbol{\gamma }^{(n)}\) is a symmetric equilibrium of \(\mathcal{G}_{n}\), then \(\boldsymbol{\gamma }^{(n)}\) is completely mixed, i.e.,

Proof.

Assume by contradiction that for every \(n \in \mathbb{N}\) there exists some x j ∈ X K and a symmetric equilibrium \(\boldsymbol{\gamma }^{(n)}\) of \(\mathcal{G}_{n}\) such that γ (n)(x j ) = 0. Given that λ(S) < ∞, we have that for all i ∈ N n ,

If player i deviates and plays the pure action a i = x j , then she obtains a payoff

where the strict inequality holds for n large enough. This contradicts the assumption that \(\boldsymbol{\gamma }^{(n)}\) is an equilibrium. □

Lemma 2.

Let (Y 1 ,…,Y k ) be a random vector distributed according to a multinomial distribution with parameters (n − 1;γ 1 (n) ,…,γ k (n) ), with δ < γ j (n) < 1 −δ, for some 0 < δ < 1 and for all j ∈ K. Then

iff

Proof.

Given j ∈ K, consider all J ⊂ K such that j ∈ J and the family \(\mathcal{V}_{j}\) of all corresponding Voronoi tessellations V (X J ). Call \(\widetilde{V }_{j}\) the finest partition of S generated by \(\mathcal{V}_{j}\), that is, the set of all possible intersections of cells v J (x j ) ∈ V (X J ) for \(V (X_{J}) \in \mathcal{V}_{j}\). It is clear that \(v_{K}(x_{j}) \in \widetilde{ V }_{j}\).

For \(A \in \widetilde{ V }_{j}\), call \(\widetilde{V }_{j}(A)\) the class of all cells in \(\widetilde{V }_{j}\) whose intersection with A is nonempty.

Then

since \(\mathbb{P}(Y _{i} = 0) = (1 -\gamma _{i}^{(n)})^{n} = o(1/n)\) for n → ∞. Therefore

Given that ∑ j = 1 k γ(x j ) = 1, (13) holds if and only if (12) does. □

Proof (Proof of Theorem 2).

The game \(\mathcal{G}_{n}\) is finite and symmetric, so it admits a symmetric mixed Nash equilibrium \(\boldsymbol{\gamma }^{(n)} = (\gamma ^{(n)},\ldots,\gamma ^{(n)})\). Then, given Lemma 1, for all j, ℓ ∈ K,

Using (2) we obtain

where (Y 1, …, Y k ) has a multinomial distribution with parameters (n − 1; γ (n)(x 1), …, γ (n)(x k )). Notice that \(\boldsymbol{a} \approx X_{J}\) is equivalent to Y h = 0 for all h ∉ J.

Therefore (14) holds if and only if

which implies (11). Lemma 2 provides the result. □

1.2 Proofs of Sect. 4

The next two lemmata are similar to Lemmata 1 and 2, respectively.

Lemma 3.

Consider a sequence of games \(\{\mathcal{P}_{n}\}_{n\in \mathbb{N}}\) . There exists \(\bar{n}\) such that for all \(n \geq \bar{ n}\) , if \(\boldsymbol{\gamma }^{(n)}\) is a symmetric equilibrium of \(\mathcal{P}_{n}\) , then \(\boldsymbol{\gamma }^{(n)}\) is completely mixed, i.e.,

Proof.

Assume by contradiction that for every \(n \in \mathbb{N}\) there exists some x j ∈ X K and a symmetric equilibrium \(\boldsymbol{\gamma }^{(n)}\) of \(\mathcal{P}_{n}\) such that γ (n)(x j ) = 0. Given that λ(S) < ∞, we have that for each player i

where Ξ n has a Poisson distribution with parameter n. If player i deviates and plays the pure action a i = x j , then she obtains a payoff

where the strict inequality holds for n large enough. This contradicts the assumption that \(\boldsymbol{\gamma }^{(n)}\) is an equilibrium. □

Lemma 4.

Let (Ξ 1 ,…,Ξ k ) be a random vector of independent random variables where Ξ j has a Poisson distribution with parameter nγ j (n) , with δ < γ j (n) < 1 −δ, for some 0 < δ < 1 and for all j ∈ K. Then

iff

Proof.

Given j ∈ K, consider all J ⊂ K such that j ∈ J and the family \(\mathcal{V}_{j}\) of all corresponding Voronoi tessellations V (X J ). Call \(\widetilde{V }_{j}\) the finest partition of S generated by \(\mathcal{V}_{j}\), that is, the set of all possible intersections of cells v J (x j ) ∈ V (X J ) for \(V (X_{J}) \in \mathcal{V}_{j}\). It is clear that \(v_{K}(x_{j}) \in \widetilde{ V }_{j}\).

For \(A \in \widetilde{ V }_{j}\), call \(\widetilde{V }_{j}(A)\) the class of all cells in \(\widetilde{V }_{j}\) whose intersection with A is nonempty.

Then

since \(\mathbb{P}(\varXi _{i} = 0) =\mathop{ \mathrm{e}}\nolimits ^{-n} = o(1/n)\) for n → ∞. Therefore

Given that ∑ j = 1 k γ(x j ) = 1, (17) holds if and only if (16) does. □

Proof (Proof of Theorem 3).

Since the number of types and actions is finite, [23, Theorem 3] implies that the Poisson game \(\mathcal{P}_{n}\) admits a symmetric equilibrium \(\boldsymbol{\gamma }^{(n)}\). Given Lemma 3, for all j, ℓ ∈ K,

For j ∈ K call \(n_{j}(\boldsymbol{a},\xi )\) the number of players who choose x j under strategy \(\boldsymbol{a}\) when the total number of players in the game is ξ. Using (2) we obtain

where (Ξ 1, …, Ξ k ) are independent random variables such that Ξ j has a Poisson distribution with parameter n γ (n)(x j ). Notice that \(\boldsymbol{a} \approx X_{J}\) is equivalent to Ξ h = 0 for all h ∉ J.

Therefore (18) holds if and only if

which implies (15). Lemma 4 provides the result. □

1.3 Proofs of Sect. 5

Lemma 5.

Consider a sequence of games \(\{\mathcal{D}_{n}\}_{n\in \mathbb{N}}\) . There exists \(\bar{n}^{A}\) such that for all \(n^{A} \geq \bar{ n}^{A}\) , if \((\boldsymbol{\gamma }^{A,n},\boldsymbol{\gamma }^{D,n})\) is an (A,D)-symmetric equilibrium of \(\mathcal{D}_{n}\) , then γ A,n is completely mixed, i.e.,

Proof.

Assume by contradiction that for every \(n \in \mathbb{N}\) there exists some x j ∈ X K and an (A, D)-symmetric equilibrium \((\boldsymbol{\gamma }^{A,n},\boldsymbol{\gamma }^{D,n})\) of \(\mathcal{D}_{n}\), such that γ A, n(x j ) = 0. Given that λ(S) < ∞, we have that for i ∈ N n A

If player i ∈ N n A deviates and plays the pure action a i = x j , then she obtains a payoff

for n A large enough. Indeed, note that even if some D-players choose x j in γ D, n, the A player attracts all the consumers from x j . Therefore \((\boldsymbol{\gamma }^{A,n},\boldsymbol{\gamma }^{D,n})\) is not an equilibrium for n A large enough. □

Lemma 6.

Let (Y 1 ,…,Y k ) be a random vector distributed according to a multinomial distribution with parameters (n;γ 1 (n) ,…,γ k (n) ), with δ < γ j (n) < 1 −δ, for some 0 < δ < 1 and for all j ∈ K. Then

Proof.

The result is obvious, since

□

Proof (Proof of Theorem 4).

Whenever a location x j is occupied by an advantaged player, any disadvantaged player choosing x j gets a payoff equal to zero. Therefore (10) is an immediate consequence of Lemmata 5 and 6. Moreover, asymptotically, the actions of disadvantaged players do not affect the payoff of advantaged players. Therefore an application of Lemma 2 with n A replacing n provides (9). □

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Núñez, M., Scarsini, M. (2017). Large Spatial Competition. In: Mallozzi, L., D'Amato, E., Pardalos, P. (eds) Spatial Interaction Models . Springer Optimization and Its Applications, vol 118. Springer, Cham. https://doi.org/10.1007/978-3-319-52654-6_10

Download citation

DOI: https://doi.org/10.1007/978-3-319-52654-6_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-52653-9

Online ISBN: 978-3-319-52654-6

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)