Abstract

Interested by the volatility behavior, different models have been developed for option pricing. Starting from constant volatility model which did not succeed on capturing the effects of volatility smiles and skews; stochastic volatility models appear as a response to the weakness of the constant volatility models. Constant elasticity of volatility, Heston, Hull and White, Schöbel–Zhu, Schöbel–Zhu–Hull–White and many others are examples of models where the volatility is itself a random process. Along the chapter we deal with this class of models and we present the techniques of pricing European options. Comparing single factor stochastic volatility models to constant factor volatility models it seems evident that the stochastic volatility models represent nicely the movement of the asset price and its relations with changes in the risk. However, these models fail to explain the large independent fluctuations in the volatility levels and slope. Christoffersen et al. (Manag Sci 22(12):1914–1932, 2009, [4]) proposed a model with two-factor stochastic volatilities where the correlation between the underlying asset price and the volatilities varies randomly. In the last section of this chapter we introduce a variation of Chiarella and Ziveyi model, which is a subclass of the model presented in [4] and we use the first order asymptotic expansion methods to determine the price of European options.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

18.1 Introduction

Let \((\varOmega ,\mathfrak {F},\mathbb {P})\) be a probability space with risk-neutral probability measure \(\mathbb {P}\). Let \(\{\,\mathfrak {F}_t:0\le t\le T\,\}\) be the filtration generated by a standard d-dimensional Brownian motion \(\mathbf {W}_t\).

Let \(\mathbf {X}=(X_1,\dots ,X_m)^{\top }\) be the vector of stochastic variables. Assume, that under \(\mathbb {P}\) the stochastic variables satisfy the following stochastic differential equation:

where \(\mathbf {\mu }:[0,T]\times \mathbb {R}^m\rightarrow \mathbb {R}^m\) is the drift, and where \(\varSigma :[0,T]\times \mathbb {R}^m\rightarrow \mathbb {R}^{m\times d}\) is the diffusion. Let \(r(t,\mathbf {X}_t)\) be the instantaneous risk-free interest rate, and let \(g(\mathbf {x})\) be the payoff of a financial instrument with maturity T.

By risk-neutral valuation, the price \(V(t,\mathbf {x})\) of the instrument is

In [1] it is proved that the price \(V(t,\mathbf {x})\) satisfies the partial differential equation

subject to the terminal value condition \(V(T,\mathbf {x})=g(\mathbf {x}).\) The seminal Black–Scholes European option pricing model has the assumption that underlying stock price returns follow a lognormal diffusion process.

Different from the Black–Scholes, for a given stochastic process like the stock price \(S_{t}\), if its variance \(\sigma _{t}\) is itself randomly distributed, then (18.1) can be written for \(m=d=2\) as

where \(\sigma _{t}\) satisfies

and where \(W_t^1\) and \(W_t^2\) are standard one-dimensional Brownian motions defined on \((\varOmega ,\mathfrak {F},\mathbb {P})\) with the covariance satisfying \(d(W_t^{i},W_t^{j}) =\rho _{ij}dt\) for some constant \(\rho _{ij} \in [-1, 1]\) and \(\sigma _{t}\) is known as the stochastic volatility or the instantaneous volatility or the spot volatility. \(a (\sigma _{t}, t)\) and \(b(\sigma _{t}, t)\) are smooth functions that correspond respectively to the drift and diffusion of the spot volatility. To model derivatives like European option s more accurately, it is better to assume that the volatility of the underlying price is a stochastic process rather than a constant as it has been assumed for models based on Black–Scholes formula. The reason is that the latter cannot explain long-observed features of the implied volatility surface, volatility smile and skew, which indicate that the implied volatility does not tend to vary with respect to strike price K and horizon date T.

Definition 18.1

Under any martingale measure \(\mathbb {P}\) and the interest rate at time t given by \(r_t\); a model with the form

is said to be a stochastic volatility model .

The sections of this chapter present different procedures to price European option s with underlying asset prices governed by Constant Elasticity of Variance, Stochastic \(\alpha \beta \rho \), Detemple–Tian, Grzelak–Oosterlee–Van Veeren, Jourdain–Sbai, Ilhan–Sircar and Chiarella-Ziveyi models.

18.2 The Constant Elasticity of Variance (CEV) Model

The lognormality assumption from the Black–Scholes formula does not hold accurately. The pricing of European option s has been studied recently for alternative diffusion models.

In 1976 Cox and Ross [5] focused their attention on the constant elasticity of variance diffusion class, and gave the following Constant Elasticity of Variance (CEV) Model

They considered the drift \(\mu \) to be constant and the real constant parameters are \(\sigma \ge 0\) and \(\beta \ge 0\). The parameter \(\beta \) is the main feature of this model and it is known as the elasticity factor. The relationship between volatility and price described by the CEV model is controlled by \(\beta \). The payoff function is defined by \(g(s)=\alpha s^{\beta }\) for positive constant \(\alpha \) and real positive s.

Remark 18.1

Equation (18.3) becomes the Bachelier model for \(\beta = 0\), and for \(\beta = 1\) it becomes the Black–Scholes model.

Remark 18.2

Some say that the CEV model is not a stochastic volatility model, but a local volatility model based on the fact that it does not incorporate its own stochastic process for volatility and thus they remove it among the other stochastic volatility model s.

The CEV model is used for modelling equities and commodities when attempting to capture the stochastic volatility and the leverage effect. In commodities markets, volatility rises when prices rise. This is known as the inverse leverage effect and for this case \(\beta > 1\). Whereas in equity markets the volatility of a given stock increases when its price falls which is known as the leverage effect with \(\beta < 1\).

Now, for cases where \(0< \beta < 1\), the infinitesimal conditional variance of the logarithmic rate of return of the stock equals \(\sigma ^{2}_{t}=\alpha ^{2} S^{2(\beta -1)}_{t}\), and thus it changes inversely with the price. Under this condition the following equations hold:

Equation (18.3) corresponds to the classical Girsanov example in the theory of stochastic differential equations which is presented in [15, 16]; assuming that \(\mu = 0\) then it has a unique solution for any \(\beta \ge \frac{1}{2}\) and this uniqueness fails to hold for values in the interval \((0, \frac{1}{2})\).

The CEV model is complete when assuming that the filtration \(\mathscr {F}\) is generated by the driving Brownian motion \(W^{1}_t\). From this completeness, any European contingent claim that is \(\mathscr {F}_{T}\)-measurable and \(\mathbb {P}\)-integrable, with time t discounting factor \(B_t\), possesses a unique arbitrage price given by the risk-neutral valuation formula

By the Feynman–Kac theorem , the option price \(v(S_{t}, t)\), with \(v(S_T, T) = h(s)\) and \(h(S_t)\) the inverse of \(g(S_t)\), can be given as the solution of the following partial differential equation

18.2.1 European Option Pricing Formulae Under the CEV Model

Many authors have examined option pricing equations related to the CEV model among others and mentioned that the transition probability density function for the stock price governed by the CEV model can be explicitly expressed in term of the modified Bessel functions. From this, the integration of the payoff function with respect to the transition density can be used to find the arbitrage price of any European contingent claim.

The European option pricing formula can be derived and let us have a look on a computational convenient representation of Schroder presented in [18] for the call price in the CEV model:

where \(\gamma =\frac{1}{2(1-\beta )}\) and \(g(p,x)= \frac{x^{p-1}e^{-x}}{\Gamma (p)}\) is the density function of the Gamma distribution. For the forward price of a stock \(F_{t}=\frac{S_{t}}{B(t, T)}\) we have:

is the scaled expiry of an option.

18.2.2 Implied Volatility Smile in the CEV Model

The presence of parameter \(\beta \) in the CEV model is a big advantage over the classical Black-Scholes model because it is possible to make a better fit to observed market prices options with an appropriate choice of \(\alpha \) and \(\beta \). Making \(\beta \ne 1\) and \(\alpha \ne 0\), the CEV model yields prices of European option s corresponding to smiles in the Black-Scholes implied volatility surface. Which means that, for a fixed maturity T, the implied volatility of a call option is a decreasing function of the strike K.

Considering the case when a stock price is governed by (18.3), the forward price of a stock

under the martingale measure \(\mathbb {P}\), satisfies

As presented in [16] the implied volatility \(\hat{\sigma }_{0}(T, K)\) predicted by (18.6) is

\(\hat{\sigma }_{0}(T,K)\) is the Black implied volatility, \(F_{a}=\frac{(F_{0}+K)}{2}\) and \(\alpha _{a}=(\frac{1}{T}\int ^{T}_{0}\alpha ^{2}(u)du)^{1/2}\).

18.3 The Stochastic \(\alpha \beta \rho \) (SABR) Model

The SABR model can be seen as a natural extension of the CEV model. When in [11] Hagan et al. examined the issue of dynamics of the implied volatility smile, they argued that any model based on the local volatility function incorrectly predicts the future behaviour of the smile, i.e. when the price of the underlying decreases, local volatility models predict that the smile shifts to higher prices. Similarly, an increase of the price results in a shift of the smile to lower prices. It was observed that the market behaviour of the smile is precisely the opposite. Thus, the local volatility model has an inherent flaw of predicting the wrong dynamics of the Black–Scholes implied volatility. Consequently, hedging strategies based on such a model may be worse than the hedging strategies evaluated for the naive model with constant volatility that is, the Black–Scholes models.

A challenging issue is to identify a class of models that has the following essential features: a model should be easily and effectively calibrated and it should correctly capture the dynamics of the implied volatility smile.

A particular model proposed and analyzed in [11] is specified as follows: under the martingale measure \(\mathbb {P}\), the forward asset price \(S_{t}\) is assumed to obey the equation

which is the SABR model, where \(\alpha _{0}=0\), \(\frac{1}{2} \le \beta \le 1\), \(\alpha _{t\ne 0}> 0\) and \(\nu _t \) is the instantaneous variance of the variance process. \(W^{1}_t\) and \(W_t^2\) are two correlated Brownian motions with respect to a filtration \(\mathfrak {F}\) with constant correlation \(-1< \rho < 1\). Thus, (18.8) can be written as

18.3.1 European Option Pricing Formulae Under the SABR Model

Let us now assume that the overall volatility \(\alpha _{t}\) and the volatility of volatility \(\nu _t\) are very small. At date t, \(S(t)=s\), \(\alpha (0)=\alpha \) we can write the value of an European call option by

where \(t_{ex.}\) is the exercise time. As presented in [19] the option price becomes

where \(q=\frac{x^{2}}{2\tau }.\)

18.3.2 Implied Volatility Smile in the SABR Model

After deriving the European call option pricing formula under the SABR model, we can derive the approximate implied normal volatility and the implied Black volatility in order to utilize the pricing formula more conveniently.

At-the-money option, it is proven in [16] that the Black implied volatility formula under the SABR is as follows:

where \(\hat{\beta }=1-\beta \).

18.4 The Detemple–Tian Model (DTM)

Different from most of the models we present in this chapter, the DTM is considering volatility to be constant but it assumes that the interest rate changes randomly. The underlying asset price \(S_{t}\) and the interest rate \(r_{t}\) follow the system of stochastic differential equations bellow:

where \(\delta , a, \sigma _{1},\sigma _{2}\) are constants, \(\delta \) is the dividend rate, \(\sigma _{1}\) is the asset price volatility, the speed of mean reversion of the interest rate is a and \(\sigma _{2}\) its volatility. \(\theta (t)\) is deterministic function of time and \(W_{1}\), \(W_{2}\) are correlated Brownian motions with correlation coefficient \(\rho \).

Detemple and Tian in [6] use the model to compute the American option price and show that the exercise region is depending on the interest rate and dividend yield. Also the results were used to derive recursively an integral equation for the exercise region.

If we define

and

for the European call, the options price is given by the following formula

where

P(t, T) the pure discount bond price is given by

and

18.5 Grzelak–Oosterlee–Van Veeren (GOVV) Model

The particular case of (18.1) when the drift and the diffusion are defined for \(m=d=3\) is known as GOVV model presented by Grzelak et al. in [10]. They considered that the price of an asset at time t is \(S_t\) and is governed by an stochastic differential equation with stochastic interest rate \(r_t\) and stochastic volatility \(\sigma _t\) of mean reversion type. The model evolves according to the following system:

where p is constant, \(\lambda \) and k are the speed of mean reversion processes, \(\eta \) is the volatility of the interest rate, \(\gamma \) is the volatility of volatility. \(\theta _t\) is the long run mean of the interest rate and \(\overline{\sigma }\) is the long run mean of the volatility. \(Z_t^1,~Z_t^2,Z_t^3 \) are independent Brownian motions with correlation factors given by

Considering

and using the notation

the GOVV model (18.16) can be written as

If on the above model we consider that the interest rate is constant, the correlation factors \(\rho _{2j}\) and \(\rho _{i2}\) are equal to zero we generate:

-

Heston Model, if \(p=\frac{1}{2}\). The underlying asset price and volatilities are governed by the following system

$$\begin{aligned} dS_t = r+S_t dt + \sqrt{\sigma _t} S_t dW_t^1, \\\nonumber d\sigma _t= k^{H}(\overline{\sigma }^{H} -\sigma _t)dt + \gamma ^{H} \sqrt{\sigma _t} \left( \rho _{13} dW_t^1+\sqrt{1-\rho ^2_{13}}dW_t^3\right) , \end{aligned}$$(18.18)where the superscript H stands for Heston, to indicate long run volatility mean, speed of mean return and volatility of volatility.

-

Schöbel–Zhu–Heston model, if \(p=1\). The underlying asset price and volatility are governed by the following system

$$\begin{aligned} dS_t = r_tS_t dt + \sigma _t S_t dW_t^1, \\\nonumber d\sigma _t= k^{H}(\overline{\sigma }^{H} -\sigma _t)dt +\gamma ^{H} \left( \rho _{13} dW_t^1+\sqrt{1-\rho ^2_{13}}dW_t^3\right) . \end{aligned}$$(18.19) -

Schöbel–Zhu model; which is a transformation of Schöbel–Zhu–Heston model that is obtained considering the variance of instantaneous stock \(\sigma _t=\sqrt{v_t}\), when the speed of mean reversion of the volatility process is given by 2k and the long run mean is represented by \(-\left( \sigma _ t \overline{\sigma } +\frac{\gamma ^2}{2k}\right) \) i.e.

$$\begin{aligned} dv_t = 2\sqrt{v_t} \left( k^{H}(\overline{\sigma }^{H} -\sigma _t)dt + \gamma ^{H} \left( \rho _{13} dW_t^1+\sqrt{1-\rho ^2 _{13}}dW_t^3\right) \right) ; \end{aligned}$$therefore the governing equations of the asset price and its volatility will be

$$\begin{aligned} dS_t = r_tS_t dt + v_tS_t dW_t^1,\qquad \\ \nonumber dv_t= 2k(v_t+\sigma _t \overline{\sigma } +\frac{\gamma ^2}{2k})dt + 2\gamma \sqrt{v_t} \left( \rho _{13} dW_t^1+\sqrt{1-\rho ^2_{13}}dW_t^3\right) . \end{aligned}$$(18.20) -

Black–Scholes model, if \(p=0.\)

18.5.1 Pricing European Options for the GOVV Type Models

Assuming that the characteristic function of the logarithm of the underlying asset price is known; to price an European option one can choose to apply the fast Fourier transforms in a Carr–Madan technique presented in [2] or use the Fourier–Cosine explained in [8]. If from one hand Carr–Madan is a forward method and with easy computations; it requires to use a damping parameter which is only experimentally determined for some very specific classes of models. The fact that there is no any scientifically method to determine the damping parameters brings a huge limitation for the cases when dealing with models with unknown damping parameter. In the next section the pricing methodology is developed using the Fourier–Cosine method.

18.5.1.1 Pricing Method

Let us present first a theorem that will give us the approximation of the probability density function in a bounded domain.

Theorem 18.1

For a given bounded domain \(D=[a_1,~a_2]\) and a Fourier expansion with N terms, the probability density function \(p_Y(y|S_t)\) can be approximated by

for \(w_0=\frac{1}{2},~w_n=1,~\forall n\in \mathbb {R}\) and \(\mathfrak {R}\) denoting the real part.

The proof of the theorem is presented in [8].

For the European option s, the general risk neutral pricing formula shows that the contingent claim \(C(t,~S_t)\) written at time t on an asset that value is \(S_t\) can be obtained by calculating the expected value under risk neutral measure \(\mathbb {P}\) of the discounted payoff function \(H(t, S_t)\) at maturity T, given that the information \(\mathfrak {F}_t\) is known, i.e.

If the probability density function \(p_Y(y| S_t)\) is known, the above expectation is given by

where

and

Assuming that \(p_Y(y|S_t)\) decays fast, it is possible to restrict the integrations to a closed and bounded domain. Therefore, the contingent claim will be approximated to

where \(\mathbb {D}= [a_1, a_2]\) and \(|\mathbb {D}|=a_2-a_1 >0.\)

If we set

in order to obtain obvious boundary conditions at maturity, the discounted characteristic function is given by

which is the transformation of the probability density function \(p_Y(y|S_t)\) according to Fourier. Moreover, when considering the domain \(\mathbb {D}\) instead of \(\mathbb {R}\) the characteristic function is approximated to

where the probability density function is determined with the use of the Theorem 18.1. The contingent claim can then be obtained by

where

and \(\zeta _n^{\mathbb {D}} =\frac{2K}{|\mathbb {D}|} \left( \alpha _n - \beta _n\right) .\) \(\alpha _n\) and \(\beta _n\) are defined by

for

and

18.5.1.2 Schöbel–Zhu–Hull–White (SZHW) Model

On a probability space \((\varOmega , \mathfrak {F}_t, \mathbb {P})\), when the vector state \(\mathbf {X}_t=[S_t, r_t,\sigma _t]\) is Markovian relative to filtration \(\mathfrak {F}_t\) with asset price and volatility defined as in (18.16), when \(p=1\) we obtain the so called SZHW model, if interest rate process is given by

From the Hull–White decomposition explained in [10], the interest rate process can be expressed by

where

and

Introducing the notation \(\sigma _t=\sqrt{v_t}\), \(\log S_t=x_t = \widetilde{x}_t+\varphi _t\) for \(\phi _t = \int \limits _0^t m_s ds \); the SZHW model is described in an expanded vector space with the new stochastic process \(v_t\), i.e.

It is shown in [7] that the characteristic function has the following form:

where

for

where

and

Making \(\mathbf {U}=[u,~0,~0,~0]\) the boundary conditions at maturity will be

This implies that, for the \(\log S_T\), the discounted characteristic function is

for

and

18.6 Jourdain–Sbai Model (JSM)

Another particular case of (18.16) can be obtained by considering constant interest rate. In this particular model, let us denote volatility by Y

with

for independent correlated Brownian motions \(W_t^1\) and \(W_t^2\). Under these conditions, the underlying asset price is governed the following model:

In [14] the above model was treated considering a particular case of Ornstein–Uhlenbeck process and introducing higher order discretization schemes. JSM considers function f to be positive and strictly monotonic allowing that the effective correlation between the asset price and the volatility remain with the same signal (positive). It also considers that function b and c are also smooth functions. This generalizes a group of model, for example Quadratic Gaussian, Stein & Stein, Scotts, Hull and White, Cox and Ross and Detemple–Tian model. When considering the log-price of the asset return, model (18.23) is transformed to

The goal is to use the second equation of (18.24) into the first equation and make it free of the stochastic integral involving the common Brownian motion \(W_t^2\). Assuming that the volatility of volatility is positive, the drift function of the volatility and the underlying asset volatility are first order differentiable functions with continuous derivatives, then one can define a primitive

and using Ito’s formula, the differential of the primitive is

which transforms (18.24) into

where

For simplicity, functions \(c(Y_t)\), \(b(Y_y)\) are denoted by c and b respectively. Bellow we present the discretization of the SDE satisfied by \(Y_t\) constructing a scheme which converges to order 2. The details can be found in [14].

18.6.1 The Weak Scheme of Second Order

In the system (18.25), the integration of both sides of the first integral when time goes from 0 to t, gives

which is not dependent on the Brownian motion \(W_t^2\). The challenge now is to solve one integral with respect to time and another integral with respect to a Brownian motion \(W_t^1\). This is done using numerical techniques (i.e. numerical integration). The weak scheme is defined as:

where

for

The notation \(e^{tV (x)}\) means the solution of an ordinary differential equation of order one in the form \(\zeta ' (t) = V(\zeta (t))\) at time t and starting from x.

On the other hand if \(Z_t= X_t -\rho F(Y_t)\) the system on our scheme will be

Applying Feynman–Kac theorem the differential operator associated with (18.26) will be

with

In the case of plain vanilla, the option price is given in [17] by

where \(\alpha \) is the payoff function depending on the underlying asset and the strike price. \(BS_{\alpha , T} (s,v)\) is the price of a European option with payoff function \(\alpha \) which matures at T, initial stock price s, volatility \(\sqrt{v}\), constant interest rate r, given by Black - Scholes formula. For the case of call or put option, \(BS_{\alpha , T}\) is given in a closed formula and the option price can be approximated by

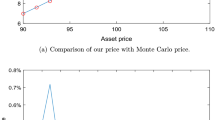

where M is the total number of Monte Carlo samples and the index i refers to independent draws.

18.7 Ilhan–Sircar Model (ISM)

Barrier options are contingent claims that are activated or deactivated if the underlying asset price hits the barrier during the life time of the option. These options are qualified as:

-

up in - the underlying asset price in the beginning is lower than the barrier level and the option will be activated only if before the maturity the asset price hits the barrier;

-

up out - the underlying asset price in the beginning is lower than the barrier level and the option starts activated. If the asset price hits the barrier before the maturity the option is deactivated;

-

down in - the underlying asset price in the beginning is greater than the barrier level and the option will be activated only if before the maturity the asset price hits the barrier;

-

down out - the underlying asset price in the beginning is greater than the barrier level and the option starts activated. If the asset price hits the barrier before the maturity the option is deactivated.

The activation or deactivation of an barrier option is for its life, meaning that if the option hits the barrier and is activated or deactivate doesn’t matter if afterwards it returns to the barrier. For the execution or not is only considered the position the option took at the first time it hits the barrier level.

In a model presented by Ilhan and Sircar in [13] the stock price process and the volatility driving process are solutions of the following stochastic differential equations:

where \(\rho \) is the instantaneous correlation between shocks to S and Y and the symbol \(\rho '\) denote \(\sqrt{1-\rho ^2}\). Assuming that \(a(t,Y_t)\) and \(\sigma (t,Y_t)\) are bounded above and bellow away from zero and smooth with bounded derivatives, and also that \(b(t,Y_t)\) is smooth with bounded derivatives. The utility indifference price of the contingent claim D at time \(t=0\) of an investor who has initial wealth z, is the solution \(\tilde{h}(z,D)\) to the following equation:

Let \(h(z,D)=e^{rT}\tilde{h}(z,D)\) be the T-forward value of indifference price. According to

the indifference price does not depend on the initial wealth. Therefore, we omit the dependence on z in the notation.

According to [13] under some regularity conditions, the optimal static hedging position exists, is unique, and satisfies the following equation:

It remains to find \(\tilde{h}(B^{\alpha })\).

Let \(\mathscr {L}^0_y\) be the following differential operator:

and f(t, y) be the solution to the following problem:

Denoting

for the differential operator \(\mathscr {L}^E_{x,y}\) defined as:

if \(\varPhi (t,x,y)\) is the solution to the following problem:

and \(\varphi (t,x,y)\) the solution to the following problem:

then, the indifference price at time \(t=0\) is

18.8 Two Stochastic Volatilities Model

The previous models considered an underlying asset governed by one stochastic variance. Some models considered stochastic interest rate and others assume interest rate as constant. We consider here the price evolution of an asset (for example an equity stock) that is governed by the following stochastic differential equation

where \(\mu \) is the mean return of the asset, \(V_{1,t}\) and \(V_{2,t}\) are two uncorrelated and finite variance processes described by Heston [12] that also change stochastically according to the following equations

Here \(\displaystyle \frac{1}{\varepsilon }\) and \(\delta \) are the speeds of mean reversion; \(\theta _1\) and \(\theta _2\) are the long run means; \(\sqrt{\displaystyle \frac{1}{\varepsilon }}\) and \(\sqrt{\delta }\) the instantaneous volatilities of \(V_{1,t}\) and \(V_{2,t}\) respectively and \(W_i\), for \(i=\{1,2,3,4\}\) are Wiener processes. The correlations between the asset price \(S_t\) and the variance processes \(V_{1,t}\) and \(V_{2,t}\) are given respectively by \(\rho _{13}\sqrt{\displaystyle \frac{V_{1,t}}{\varepsilon }}\) and \(\rho _{24}\sqrt{V_{2,t}\delta }\) which are chosen as in Chiarella and Ziveyi [3] to avoid the product term \(\sqrt{V_{1,t} V_{2,t}}\).

In Eq. (18.29) choosing \(\varepsilon \) and \(\delta \) to be small and to follow Feller [9] conditions, we have a fast mean reversion speed for \(V_{1,t}\) and a slow mean reversion speed for \(V_{2,t}\). Therefore in our model the underlying asset price \(S_t\) is influenced by two volatility terms that behave completely differently. For example, one may change each month whereas the other one may change twice a day.

The finiteness of the two variances gives guarantee that (18.28) has a solution under the real-world probability measure. In addition it ensures that there exists an equivalent risk neutral measure under which the same equation has a solution and the discounted stock price process under this measure is a martingale. Girsanov theorem presented in [15] allow to transform the presented environment into risk neutral probability world. Feynman–Kac theorem also presented in [15], proves that the option price of the underlying asset described above can be given as the solution of the following partial differential equation

subject to the terminal value condition \(U(T, S_t,V_{1,t},V_{2,t})=h(S_t)\). \(\lambda _1\) and \(\lambda _2\) are the market prices of risk; r and q are constant interest rate and dividend factor respectively. Consider that the solution of the partial differential equation U depends on the values of \(\varepsilon \) and \(\delta \), i.e. \(U=U^{\varepsilon , \delta }\); collecting terms with the same power of \(\frac{1}{\sqrt{\varepsilon }}\) and \(\sqrt{\delta }\) will transform the above partial differential equation into

for

Our aim is to find the price of a European option with payoff function \(h(S_t)\) at maturity T. Taking into account the Markov property and the fact that our system is considered under the risk neutral probability measure, we can apply Feynman–Kac theorem to obtain the option price as

Calculation of this expectation is very complicated because it involves many parameters that have to be clearly measured and applied. To avoid this complication, we present a perturbation method that approximates the option price by a quantity that depends on much less parameters than those imposed by Feynman–Kac theorem . From our system and also our partial differential equation, it is clear that \(U(t,s,v_1,v_2)\) depends on \(\varepsilon \) and \(\delta \). From now on, to make this dependence clear, we write \(U^{\varepsilon ;\delta }(t,s,v_1,v_2)\) instead of \(U(t,s,v_1,v_2)\). Our assumption is that if \(\varepsilon \) and \(\delta \) are small, the associated operators will diverge and be small respectively. Therefore we use the approach of singular and regular perturbations. Assume that our solution can be expressed in the following form

Applying this expansion in (18.30) we generate systems of partial differential equations that can be solved to obtain the prices of European option in the following form

where the notation \(U_{BS}\) stands for the solution to the corresponding two-dimensional Black–Scholes model.

and \(\phi (v_1,v_2)\) is the solution of

where \(\langle \cdot \rangle =\displaystyle \int \cdot ~\pi (s) ds\) denotes the averaging over the invariant distribution \(\varPi \) of the variance process \(V_{1,t}\).

References

Andersen, L., Piterbarg, V.: Interest Rate Modeling. Volume 1: Foundations and Vanilla Models. Atlantic Financial Press, Boston (2010)

Carr, P.P., Madan, D.B.: Option valuation using fast fourier transform. J. Comput. Financ. 2, 61–73 (1999)

Chiarella, C., Ziveyi, J.: American option pricing under two stochastic volatility processes. J. Appl. Math. Comput. 224, 283–310 (2013)

Christoffersen, P., Heston, S., Jacobs, K.: The shape and term structure of index option smirk: why multifactor stochastic volatilities models work so well. Manag. Sci. 22(12), 1914–1932 (2009)

Cox, J., Ross, S.: The valuation of options alternative stochastic processes. J. Financ. Econ. 3, 145–166 (1976)

Detemple, J., Tian, W.: The valuation of American options for a class of diffusion processes. Manag. Sci. 48(7), 917–937 (2002)

Duffie, D., Pan, J., Singleton, K.: Transform analysis and asset pricing for affine jump-diffusions. Econometrica 68, 1343–1376 (2000)

Fang, F., Oosterlee, C.W.: A Novel Option Pricing Method based on Fourier-Cosine Series Expansions. Technical Report 08-02, Delft University Technical, The Netherlands. http://ta.twi.tudelft.nl/mf/users/oosterlee/oosterlee/COS.pdf (2008)

Feller, W.: Two singular diffusion problems. Ann. Math. 54, 173–182 (1951)

Grzelak, L., Oosterlee, C.W, Van, V.: Extension of stochastic volatility models with Hull–White interest rate process. Report 08-04, Delft University of technology, The Netherlands (2008)

Managing smile risk: Hegan, P.S., Kumar, D., Lesniewski, S.S., Woodward. D.E. Wilmott Mag. 1, 84–108 (2003)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bonds and currency options. Rev. Financ. Stud. 6, 327–343 (1993)

Ilham, A., Sircar, R.: Optimal static-dynamic hedges for barrier options. Math. Financ. 16, 359–385 (2006)

Jourdain, B., Sbai, M.: Higher order discretization schemes for stochastic volatility models. AeXiv e-prrint. http://arxiv.org/abs/0908.1926v3 (2011)

Kijima, M.: Stochastic Processes with Applications to Finance, 2nd edn. Capman and Hall/CRC, New York (2013)

Musiela, M., Rutkowski, M.: Martingale Methods in Financial Modelling, 2nd edn. Springer, Berlin (2005)

Romano, M., Touzi, N.: Contingent claim and market completeness in a stochastic volatility model. Math. Financ. 7(4), 399–412 (1997)

Schroder, M.: Computing the constant elasticity of variance option princing formula. J. Financ. 44, 211–219 (1989)

Zhang, N.: Properties of the SABR model. Departement of Mathematics. Uppsala University. http://uu.diva-portal.org/smash/get/diva2:430537/FULLTEXT01.pdf (2011)

Acknowledgements

This work was partially supported by Swedish SIDA Foundation International Science Program. Betuel Canhanga and Jean-Paul Murara thanks Division of Applied Mathematics, School of Education, Culture and Communication, Mälardalen University for creating excellent research and educational environment.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this paper

Cite this paper

Canhanga, B., Malyarenko, A., Murara, JP., Silvestrov, S. (2016). Pricing European Options Under Stochastic Volatilities Models. In: Silvestrov, S., Rančić, M. (eds) Engineering Mathematics I. Springer Proceedings in Mathematics & Statistics, vol 178. Springer, Cham. https://doi.org/10.1007/978-3-319-42082-0_18

Download citation

DOI: https://doi.org/10.1007/978-3-319-42082-0_18

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-42081-3

Online ISBN: 978-3-319-42082-0

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)