Abstract

International energy investors are interested in investing new markets where there is a possibility of constructing a portfolio composed of fossil and renewable energies. Capital allocation decision is to be made considering the sociopolitical effects caused. Hence the market is analyzed in terms of production possibilities, price volatility, and social acceptance. The portfolio with maximum possible revenue is to be created with the least environmental effect and the smallest technological risks. This study offers a weighted goal programming (WGP) model, where the weights are calculated using Analytical Network Planning (ANP). Case study is realized in Turkey, because the Turkish electricity market is experiencing significant structural changes and a rapid transformation process. Liberalization and constantly increasing electricity demand in the country have drawn a lot of interest. The same model can be applied in any country by changing the energy resources and country-based criteria.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Analytic Hierarchy Process

- Electricity Market

- Electricity Price

- Renewable Energy Technology

- Capital Allocation

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

9.1 Introduction

Strategic planning for the medium- to long-term expansion of the electricity generating capacity of a specific country has been an important issue in the past, when electricity markets were regulated. The major concerns in regulated markets were mainly the dependence from imported fuels, stability and reliability of the transmission grid, as well as quality and security of supply [1].

The electricity sectors of many countries have faced numerous changes in their structure and their business environment during the last years. First of all, the electricity markets have gone through a deregulation process, which has introduced competition in a formerly state-regulated economic sector. Therefore, the planning for new power plant additions and existing plant replacements has shifted its focus from strategic fuel selection to economic considerations, such as the minimization of the production cost. This shift has also amplified the effects of uncertainty in fuel prices, since now its effects are even more crucial for an investment decision [2, 3].

Enactment of Kyoto Protocol is another factor that has a significant effect on investment decisions, since electricity generation based on conventional sources lead to additional costs in the developed countries. Although developing countries currently have no restrictions on greenhouse gas emissions, future uncertainties on the scope of the agreements and volatility of greenhouse gas allowances make decision-makers of developing countries to take into consideration this factor as well.

The scope of this work is to incorporate all above-mentioned criteria in a mathematical model to help investors factor in different goals while establishing an optimum electricity generating portfolio. The remainder of this paper is organized as follows: in Sect. 9.2, a literature review is presented. In Sect. 9.3, an overview of methodology is given while in Sects. 9.4 and 9.5, details of mathematical model are provided through a case study. Section 9.6 contains the results of the implementation. Finally, in Sect. 9.7 a detailed analysis is presented with suggestions for further studies.

9.2 Literature

The issue of the optimum electricity generating portfolio has long troubled researchers. Ref. [4] is among the first to introduce the portfolio analysis in the power sector. More recent research [5–7] has extended the analysis to various power expansion mixes. Mean-variance portfolio techniques have been applied in various instances [8, 9], presenting also various risk measures [10].

Along with mean-variance approach, large linear programming models have been used extensively over several decades to address Electricity Supply Industry (ESI) modeling [11–13]. Modeling with single objective functions has been a powerful tool in optimizing power station expansion under specific environmental constraints, as well as for examining the economic feasibility of new options in the energy market. This type of analysis, done in partial equilibrium frameworks, has provided policy makers with the “perfect market” response to future scenarios that are valid for both regulated, centrally planned power markets, as well as for efficient fully deregulated markets. Although this type of modeling has enjoyed some success for integrated resource planning in the past, resource planning today has become a far more complex task [12]. What such an approach fails to deliver is explicit consideration of trade-offs between different objectives and the need to address uncertainty in the modeling process [14]. Multiple-objective programming models are developed to handle this problem and analyze the trade-offs between different objectives [14, 15].

9.3 Methodology

9.3.1 General Approach

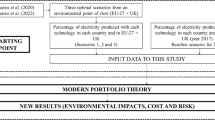

A methodology is proposed for decision-making about establishing electricity generating portfolio when taking into account different technologies, profitability of portfolio, fuel price volatility, social acceptance, greenhouse gas emissions, and capital expenditures. A Weighted Goal Programming (WGP) model has been developed and weights of the goals calculated through Analytical Network Process (ANP). Profitability calculations are done based on Levelized Cost of Electricity (LCOE). The techniques embedded in the methodology are briefly explained in this section of the paper.

9.3.2 Weighted Goal Programming

Goal Programming is a multiobjective programming technique. The ethos of GP lies in the Simonan [16] concept of satisfying of objectives. Simon conjectures that in today’s complex organizations the decision-makers do not try to maximize a well-defined utility function. In fact the conflicts of interest and the incompleteness of available information make it almost impossible to build a reliable mathematical representation of the decision-makers’ preferences. On the contrary, within this kind of decision environment the decision-makers try and achieve a set of goals (or targets) as closely as possible. Although Goal Programming was not originally conceived within a satisfying philosophy it still provides a good framework in which to implement this kind of philosophy [17].

Goal Programming models can be classified into two major subsets. In the first type, the unwanted deviations are assigned weights according to their relative importance to the decision-maker and minimized as an Archimedean sum. This is known as WGP. The algebraic formulation of a WGP is given as:

where f i (x) is a linear function(objective) and b i the target value for that objective. n i and p i represent the negative and positive deviations from this target value. u i and v i are the respective positive weights attached to these deviations in the achievement function z. These weights take the value zero if the minimization of the corresponding deviation variable is unimportant to the decision-maker. C s is an optional set of hard constraints as found in linear programming (LP) [17].

9.3.3 Analytical Network Process

The ANP was first introduced by Saaty to provide a framework for dealing with decision-making problems. Since the introduction, it has been applied to a large variety of decision-making and forecasting problems. The ANP is a general form of the well-known decision theory, Analytic Hierarchy Process (AHP). Similar to the AHP, the ANP is based on deriving ratio-scale measurement to be used to allocate resources according to their ratio-scale priorities. Whereas AHP models assume an unidirectional hierarchical relationship among decision levels, ANP does not require this strictly hierarchical structure and allows for more complex interrelationships among the decision levels. ANP generalizes the pairwise comparison process, so that decision models can be built as complex networks of decision objectives, criteria, stakeholders, alternatives, scenarios, and other environmental factors that all influence one another’s priorities. The key concept of the ANP is that influence does not necessarily have to flow only downwards, as is the case with the hierarchy in the AHP. Influence can flow between any two factors in the network causing nonlinear results of priorities of alternative choices. The ANP can be described as a system of N components (which may be part of a cluster of components) that form a network, where every component (C n ) can interact with or have an influence on itself or some or all of the other components of the system. The network, N, equals {C a,C b,C c,…, C n } and {{C a, C a},{C a, C b},{C a, C c},…,{C n , C n }} represents the set of pairwise linkage within or between components of the network. This multicriteria decision-making model derives priorities or weights for each of the “n” criteria or components, C n , of the model based on their judged relative importance to the overall goal. The derivation of the ANP priority weights, which use pairwise assessment based on statistical or judgmental relevance, is quite different from more traditional methods [18].

9.3.4 Levelized Cost of Generating Electricity

The notion of levelized costs of electricity (LCOE) is a handy tool for comparing the unit costs of different technologies over their economic life. It would correspond to the cost of an investor assuming the certainty of production costs and the stability of electricity prices. In other words, the discount rate used in LCOE calculations reflects the return on capital for an investor in the absence of specific market or technology risks. Given that such specific market and technology risks frequently exist, a gap between the LCOE and true financial costs of an investor operating in real electricity markets with their specific uncertainties is usually verified. For the same reason, LCOE is also closer to the real cost of investment in electricity production in regulated monopoly electricity markets with loan guarantees and regulated prices rather than to the real costs of investments in competitive markets with variable prices.

Despite these shortcomings, LCOE remains the most transparent consensus measure of generating costs and remains a widely used tool for comparing the costs of different power generation technologies in modeling and policy discussions. The calculation of the LCOE is based on the equivalence of the present value of the sum of discounted revenues and the present value of the sum of discounted costs. The LCOE is, in fact, equal to the present value of the sum of discounted costs divided by total production adjusted for its economic time value [19]. The formulation given below represents LCOE calculation:

In this study, LCOE is only used for profitability calculations. Though it is an important factor affecting the results that can be get from our model, the decision-making process doesn’t merely rely on the usage of this tool. The above-mentioned shortcomings of LCOE are compensated through incorporating environmental, fuel volatility, and social acceptance related goals in the model.

9.4 Case Study

9.4.1 Turkish Electricity Sector Status

Turkish electricity sector is chosen for the implementation of mathematical model developed because the Turkish electricity market has been considerably restructured in recent years. In order to open it further for private sector participation, the formerly vertically integrated companies have been unbundled, leaving only the transmission grid as a natural monopoly. During the last two decades, the Turkish electricity market has been rapidly growing, with an average annual growth rate of more than 6 % [20]. Rapidly growing demand and deregulation draw interests of international and local investors. Before and after entering the market, capital allocation and electricity generating portfolio construction is one of the most important challenges that all players face, since there are lots of criteria that need to be taken into consideration and inherent uncertainties related to the market.

All data fed into the model is provided in this section of the study. The same model can be applied in any country by changing the energy resources, country-based criteria, and relevant data.

9.4.2 Levelized Cost of Electricity for Turkey

In 2010, International Energy Agency (IEA) and Organisation for Economic Co-operation and Development (OECD) published a detailed report on levelized costs of electricity on country and source basis. The study contains data on electricity generating costs for almost 200 power plants in 17 OECD member countries and 4 non-OECD countries.

The levelized costs and the relative competitiveness of different power generation technologies in each country are highly sensitive to the discount rate and slightly less, but still significantly sensitive, to the projected prices for CO2, natural gas, and coal. For renewable energy technologies, country- and site-specific load factors also play an important role [19]. In the report, there is no data provided for the electricity generating costs in Turkey. Since carbon prices for nonmember countries are zero as in Turkey and there are lots of similarities in terms of economy, gross domestic product per capita, and economic growth rate between Turkey and non-OECD countries (China, Russia, Brazil, South Africa) analyzed in report, LCOE for Turkey is assumed to be the arithmetic average costs of non-OECD countries. In many studies, China, Russia, Brazil, South Africa, and Turkey are classified in the same group as emerging countries and upper middle income economies [21, 22]. The above-mentioned facts about Turkey and non-OECD countries justify the assumption made for the LCOE calculations. Table 9.1 presents the results of LCOE analysis for Turkey.

9.4.3 Renewable Energy Policies and Wholesale Electricity Prices in Turkey

Turkey aims to utilize its energy potential, including from renewable sources in a cost-effective manner. In its efforts to promote renewable energy, the government has focused on electricity. The renewable energy-related legislation has been intensified. The cornerstone of Turkey’s legislation on electricity from renewable sources is the Law on the Utilization of Renewable Energy Resources for the Purpose of Generating Electricity, enacted in May 2005, and its subsequent amendments. Also relevant are the 2001 Electricity Market Law, 2007 Energy Efficiency Law, and 2007 Law on Geothermal Resources and Natural Mineral Waters. Together laws include the following instruments:

-

Feed-in tariffs and purchase obligation

-

Connection priority

-

Reduced license fees

-

Exemptions from license obligation for small-scale generators

-

Reduced fees for project preparation and land acquisition [23, 24].

The electricity generated from a fossil fuel source can either be sold through day-ahead market or to retail and wholesale electricity companies. In line with Electricity Market Law, day-ahead electricity prices are decided to be taken as the basis for the average electricity wholesale prices [25]. Source-by-source electricity prices, which are fed in the model as well, are presented in Table 9.2.

9.4.4 Gaseous Pollutants Emissions

During the last 20 years, half of all increases in energy-related CO2 emissions were from electricity generation [27]. In fact, no power source is entirely impact free. All energy sources require energy and give rise to some degree of pollution from manufacture of the technology. The environmental impacts can depend greatly on how energy is produced and used, the fuel mix, the structure of the energy systems, and related energy regulatory actions and pricing structures.

Measured gaseous pollutants emissions for various fuel types such as CO2, CH4, NOx, and SO2 are presented in Table 9.3. The figures shown in Table 9.3 are based on the life cycle assessment technique and indicate gaseous emissions emitted during the whole process.

9.4.5 Social Acceptance

Citizens’ preferences for different energy sources have come to play an increasingly central role in decisions about energy investments to be undertaken in the regions or the countries they live in even sometimes in their neighboring countries [31]. The public resistance that escalated dramatically after the recent Fukushima accident, for instance, means that governments in a number of developed countries are no longer free to easily opt for nuclear energy. Germany is one such case where strong public pressure in favor of a nuclear phase-out, backed by the political pressure of the antinuclear Green Party, has forced the current government to reverse traditional German national policies on nuclear energy [32, 33]. The impact of citizens’ preferences on energy policies extends, albeit to a lesser degree, to developing countries as well. Strong local resistance in India, for example, led to the withdrawal of the World Bank from funding the Sardar Sarovar Dam project [34].

Given the above-mentioned concerns related to energy investments and the importance of the issue, social acceptance is taken into consideration while constructing our model too. A study based on data from a face-to-face survey of 2,422 residents randomly drawn from urban Turkey is used for the social acceptance calculations in this study. Table 9.4 shows the results reached through the survey.

9.4.6 Fuel Price Volatility

High volatility in price returns often appears in deregulated energy markets. The market participants such as energy producers and distributors always face such high volatility risks from energy markets. Lots of volatility models both in continuous and discrete time were developed in financial markets, and they are directly applied to the volatility models in energy markets without any adjustment for the energy characteristics [36]. Both continuous and discrete time models can be found in abundance in the literature. In our model, a linear programming approach has been embraced for the minimization of fuel price volatility in the portfolio. The characteristics of each energy source are defined through a volatility matrix and weights used in the model are given in Table 9.5.

9.5 Mathematical Model

Nine different electricity generation methods have been included in the analysis, almost all of them with different fuel source. For each one of them, the best available technology has been selected. Goals that should be taken into consideration are defined in order to reach the optimum electricity generating portfolio. After defining the goals, weights attained to each goal are calculated and factored in the model.

9.5.1 Goals

In order to determine the electricity generating portfolio capable of meeting the multiple-objectives market participant defined, the model will be developed with the following goals:

-

Goal 1: Maximize profit

-

Goal 2: Minimize carbon emissions

-

Goal 3: Minimize fuel volatility in portfolio

-

Goal 4: Maximize social acceptance or minimize social opposition

Mathematical expression of each goals is given as follows:

9.5.2 Constraints

Hard constraints that no tolerance is given for deviations are commonly encountered in decision-making problems. Two constraints are decided as utmost important factors to be considered from an investor’s point of view and incorporated in the model.

Constraint 1: Installed capacity limitations for each energy source

Constraint 2: Installed capacity limitation of portfolio

Turkey’s technical potential in renewable energy sources is high; however, once the feasibility and various technical constraints related to developing renewable energy projects are taken into consideration, the economic potential of renewable investments seems limited [38]. As for the fossil fuel sources, the country possesses rich lignite deposit with generally low in calorific values. In addition, there are also hard coal and asphaltite basins that most of them are currently in use. The aforementioned facts about the energy sources of country force decision-makers to apply constraints while making capital allocation. On the other hand, portfolio diversification is another factor making capacity limitations significant in terms of source-based risk aversion while constructing a portfolio.

In general, private investors have a maximum capacity horizon in a certain market. Therefore, constraint 2 is applied to the model to simulate the capacity cap.

9.5.3 Weights

ANP technique is used for defining the weights of the goals in the model. Hierarchical structure of the model is comprised of four subnetworks representing the goals of the model and subnetworks are composed of aforementioned criteria for choosing eight different alternatives.

Pairwise comparisons of the alternatives for criteria in each subnetworks are performed through questionnaires in order to take the judgments of 7 experts. The fundamental scale for pairwise comparison is given in Table 9.6. By taking into account the 1–9 Saaty scale, Tables 9.1, 9.2, 9.3, 9.4, 9.5 are used to construct the pairwise comparison matrix of the alternatives for criteria of all subnetworks. Super8 Decisions software was used for the analysis. Weights calculated through pairwise comparison is presented in Table 9.7.

9.6 Results and Discussions

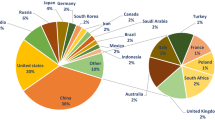

The WGP is run in LINGO to apply Eqs. 9.4, 9.5, 9.6, 9.7. A hypothetical 2000 MW portfolio is constructed and the results are presented in Fig. 9.1. Although the most important criterion for an investor was chosen to be profitability factor by our ANP model, renewable energy sources hold the majority of the portfolio with 63.2 %. Contrary to general belief in the industry, renewable energy sources prove their competitiveness once appropriate incentive framework is provided.

Biomass, hydro and geothermal energy sources seem to get maximum possible capital allocation within constraints applied in the model. Current power generation mix of the country verifies that the importance and benefits of hydroelectricity is well understood by the investors. Since hydroelectricity is a well-developed technology that has a longer history comparing to other renewable power sources, the status of this source in the mix is not surprising. However, it seems that biomass and geothermal energy sources were unable to attract investors’ attention as it was indicated by the results of the model. Geothermal energy has lots of advantages in terms of profitability, carbon emissions, and public acceptance; the main obstacles in the way of project development are high upfront investment and irrevocable capital expenditures at site development stage. Different kind of incentive mechanisms can be developed to overcome aforementioned challenges through modifications in the regulatory framework.

The share of biomass in the electricity generation of Turkey is less than even 1 %. The results of our model show that an investor should exploit from all available potential that can be got from this energy source. The reason behind the lack of usage of various types of biomass is technical, supply, and quality problems. Given the fact that the problems related to developing biomass energy projects can be easily handled, a significant increase in the share of this source is expected in the near future.

The developed model proposes no capital allocation to off-shore wind and solar power technologies. This is not an anticipated result, since the electricity sale prices for these technologies are considerably lower than their levelized costs. Feed-in tariffs for these technologies should be revised, if private investment is expected.

Interestingly, the share of on-shore wind power plants in the portfolio is low unlike the recent developments on wind energy in the country. Especially in the last 5 years, there has been an unprecedented increase in the wind energy investments due to the popularity of renewable energy in the world; however, the results generated by the model show that investment climate for wind is not better than many energy sources analyzed in this study. The electricity prices defined for wind energy in the feed-in tariff is very close to the levelized cost of this technology, therefore the investors should analyze on-shore wind energy consciously in a more quantitative way.

Fossil fuel power stations’ share in the portfolio is about 37 %. Although coal-fired power plants are very competitive in terms of profitability, its high carbon emissions and low social acceptance drop its share lower in the portfolio. Usage of recently developed clean firing technologies can make coal-fired power station investments attractive from investor’s point of view. The increase in the investment costs once clean firing technologies used should be subsidized to offset the economic losses of investors.

Almost 50 % of Turkey’s electricity generation comes from natural gas-fired power stations. There has been a long debate about the installation of natural gas-fired power plants in the country due to the security of supply and rise in the natural gas prices. Our model suggests to allocate maximum share possible for the natural gas-fired power plants in the portfolio. Despite the aforementioned shortcomings of natural gas for policy makers, natural gas-fired power stations are still important alternatives from an investor’s point of view.

9.7 Conclusions and Suggestions

This paper has developed a multiple criteria decision-making model to construct an electricity generating portfolio. Weights of the model are calculated according to the different perspectives by means of the ANP.

The mathematical model developed is implemented to Turkish electricity market as a case study for demonstration purposes, but it is applicable to any market by changing the energy resources and country-based criteria.

One of the major limitations of this model is that all data fed into the model represents today’s investment climate. It is widely known that the construction and production costs of all renewable energy technologies are decreasing. It would also be useful to compare future cost projections of renewable energy with cost projections for fossil fuels. However, predicting the price of oil and natural gas has proven even more difficult in the past few years than predicting the cost of renewable energy. Similarly, as technologies mature, they may improve on other critical performance dimensions [39]. Prices of fossil fuels are country specific and for renewable energy technologies, country- and site-specific load factors play an important role, a more precise LCOE calculation can be done in the future for the country used in the case study. Moreover, model can be further developed through incorporation of uncertainties in carbon prices, country risks, exchange risks, security of supply risk, supply and demand projections of relevant market.

The model gives decision-makers a tool to use in making strategic decisions on matters related to energy investments. Clearly, private investors do not have to abide strictly by the results given by this, or any other model, but the present model provides quantitative results that can help improve the decision-making process.

References

T. McGovern, C. Hicks, Deregulation and restructuring of the global electricity supply industry and its impact upon power plant suppliers. Int. J. Prod. Econ. 89, 321–337 (2004)

A. Rentizelas, G. Tziralis, K. Kirytopoulos, Incorporating uncertainty in optimal investment decisions. World Rev. Entrep. Manag. Sustain. Dev. 3(3/4), 273–283 (2007)

G. Kumbaroglu, R. Madlener, M. Demirel, A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ. 30, 1882–1908 (2008)

D. Bar-Lev, S. Katz, A portfolio approach to fossil fuel procurement in the electric utility industry. J. Finance 31, 933–947 (1976)

S. Awerbuch, M. Berger, Energy Security and Diversity in the EU: A Mean-variance Portfolio Approach (International Energy Agency, Paris, 2003)

S. Awerbuch, Portfolio-based electricity generation planning: policy implications for renewables and energy security. Mitig. Adapt. Strat. Glob. Change 11, 693–710 (2006)

M. Bazilian, F. Roques, Analytic Methods for Energy Diversity and Security. Applications of Mean Variance Portfolio Theory (A Tribute to Shimon Awerbuch, London, 2008)

I. Fortin, S. Fuss, J. Hlouskova, N. Khabarov, M. Obersteiner, J. Szolgayova, An integrated CVaR and real options approach to investments in the energy sector. J. Energy Markets. 1, 61–85 (2008)

F.A. Roques, D.M. Newberry, W.J. Nuttall, Fuel mix diversification incentivesin liberalized electricity markets: a mean-variance portfolio theory approach. Energy Econ. 30, 1831–1849 (2008)

A.A. Rentizales, Investment planning in electricity production under CO2 price uncertainty. Int. J. Prod. Econ. 140 (2), 622–629 (2012)

C. Cormio, M. Dicorato, A. Minoia, M. Trovato, A regional energy planning methodology including renewable energy sources and environmental constraints. Renew Sust. Energy 7, 99–130 (2003)

B.F. Hobbs, Optimization methods for electric utility resource planning. Eur. J. Oper. Res. 83, 1–20 (1995)

B.F. Hobbs, P.M. Meier, Energy Decisions and the Environment—A Guide to the Use of Multicriteria Methods (Kluwer Academic, Boston, 2000)

G. Heinricha, M. Howellsb, L. Bassona, J. Petrie, Electricity supply industry modelling for multiple objectives underdemand growth uncertainty. Energy 32, 2210–2229 (2006)

E. Svensson, T. Berntsson, A.B. Strömberg, M. Patriksson, An optimisation methodology for identifying robust process integration investments under uncertainty. Energy Policy 37, 680–685 (2009)

H.A. Simon, Models of Man (Wiley, New York, 1955)

M. Tamiza, D. Jonesa, C. Romero, Goal programming for decision making: an overview of the current state-of-the-art. Eur. J. Oper. Res. 111, 569–581 (1998)

M.P. Niemira, T.L. Saaty, An analytical network process model for financial crisis forecasting. Int. J. Forecast. 20, 573–587 (2004)

IEA, OECD, Projected Costs of Generating Electricity (IEA, OECD, Paris, 2010)

TEIAS: Electricity Generation - Transmission Statistics of Turkey, http://www.teias.gov.tr/istatistik2009/index.htm

C. Kearney, Emerging markets research: trends, issues and future directions. Emerg. Mark. Rev. 13, 159–183 (2012)

World Bank: Country classification http://data.worldbank.org/about/country-classifications/country-and-lending-groups#Upper_middle_income

M. Tukenmez, E. Demireli, Renewable energy policy in Turkey with the new legal regulations. Renew. Energy 39, 1–9 (2012)

Law on Utilization of Renewable Energy Sources for the Purpose of Generating Electrical Energy, http://www.mevzuat.adalet.gov.tr/html/1477.html

Electricity Market Law, http://www.mevzuat.adalet.gov.tr/html/1130.html

TEIAS, Day-ahead Market Prices, http://www.teias.gov.tr/

S.M. Rashad, F.H. Hammad, Nuclear power and the environment: comparative assessment of environmental and health impacts of electricity-generating systems. Appl. Energy 65, 211–229 (2000)

TAEA, Sustainable Development and Nuclear Energy (Turkish Atomic Energy Authority, Ankara, 2000)

A. Strupczewski, Accident risks in nuclear-power plants. Appl. Energy 75(1–2), 79–86 (2003)

EURELECTRIC, Efficiency in Electricity Generation (Union of the Electricity Industry-EURELECTRIC, Brussels, 2003)

N.F. Pidgeon, I. Lorenzoni, W. Poortinga, Climate change or nuclear power—No thanks! A quantitative study of public perceptions and risk framing in Britain. Glob. Environ. Chang. 18, 69–85 (2008)

D. Adam, Parochial energy policy. Nat. Clim. Change (Commentary) 1, 230–232 (2011)

M. Poumadere, R. Bertoldo, J. Samadi, Public perceptions and governance of controversial technologies to tackle climate change: nuclear power, carbon capture and storage, wind, and geoengineering. WIREs Clim. Change 2, 712–727 (2011)

R. Dwivedi, Displacement, risks and resistance: local perceptions and actions in the Sardar Sarowar. Dev. Change 30, 43–78 (1999)

P.E. Akyazı, F. Adaman, B. Ozkaynak, U. Zenginobuz, Citizens’ preferences on nuclear and renewable energy sources: evidence from Turkey. Energy Policy 47, 309–320 (2012)

T. Kanamura, A supply and demand based volatility model for energy prices. Energy Econ. 31, 736–747 (2009)

E. Regnier, Oil and energy price volatility. Energy Econ. 29, 405–427 (2007)

MENR, Ministry of Energy and Natural Resources, www.etbk.gov.tr

T.U. Daim, G. Kayakutlu, K. Cowan, Developing Oregon’s renewable energy portfolio using fuzzy goal programming model. Comput. Ind. Eng. 59, 786–793 (2010)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Kilic, U., Kayakutlu, G. (2015). Portfolio Optimization in the Electricity Market-Investor’s Perspective. In: Daim, T., Kim, J., Iskin, I., Abu Taha, R., van Blommestein, K. (eds) Policies and Programs for Sustainable Energy Innovations. Innovation, Technology, and Knowledge Management. Springer, Cham. https://doi.org/10.1007/978-3-319-16033-7_9

Download citation

DOI: https://doi.org/10.1007/978-3-319-16033-7_9

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-16032-0

Online ISBN: 978-3-319-16033-7

eBook Packages: Business and EconomicsBusiness and Management (R0)