Abstract

The escalating energy demand across the globe has intensified the electricity production. Owing to the unavailability of the reliable techniques for electricity storage for a long duration, it is consumed immediately after its production. Therefore, electricity markets can’t be handled like the conventional stock markets. Power companies are facing immense price and delivery risks owing to the increasing competition in the electricity markets. As a result, risk management is the fundamental concern to be addressed in order to achieve the optimum profit targets. Consequently, the power generation organizations need to allocate their generation in bilateral contracts and spot market. For this purpose, an optimal theory of portfolio selection is proposed in this study for electricity generation by forming a reliable prototype and applying the proposed scheme to obtain the suitable outcomes. The Paris Accord on environmental safety from carbon dioxide and NOx gases is especially considered during the modeling of the proposed technique. The credibility of the proposed scheme is validated by using the real-time market data from the PJM market. Various risk-return tradeoffs are implemented, and their corresponding solutions are acquired for portfolio optimization as corroborated by the results. The suggested technique is found reliable and adequate for the carbon tax paying suppliers around the world for allocating their respective generation based on the demand of the consumers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Greenhouse gases (GHG) have affected the climate and several researchers have contributed in addressing this issue. However, instead of many researches, mankind remained unable to find the appropriate solution of these problems. However, researchers are considering GHG as hot topic for research across the globe over since 2010 [1,2,3,4]. United Nations Framework Convention on Climate Change (UNFCCC) is the first treaty to target the reduction of carbon emissions since 1994. Nevertheless, after 1994 UNFCCC, Kyoto Protocol requested different countries to fulfil their commitments to constrict the emission of GHG [5].

A historic milestone for the energy sector has been laid in the Paris accord to constrain the escalating temperature “well below C” and creeping towards C. A much faster and widespread transformation of the energy sector is essential to challenge the current climate conditions and energy policy agenda. According to the analysts, CO2 (carbon dioxide) and other NOx gases are major reasons of this escalating temperature. In order to achieve the aforementioned goals, carbon capture and storage (CCS) is emerging as an advanced technology [6, 7]. Hazardous emissions from the industrial processes and fossil fuels used in the power sector can be reduced by implementing the CCS technology.

Two market-based instruments namely tradable permits and carbon tax are commonly considered by policy makers to regulate pollution. As pre-determined by authorities, tax is always fixed, whereas, uncertain permit price depends on the varying prices of natural gas and electricity [8]. While the aforesaid problems were under discussion to be solved through an appropriate solution and to be implemented around the world. The advancement in technology is leading to change the economic perspective of the electricity sector. Lately, relative fuel costs of coal and gas, moderate costs of renewable energy technology and growth in electricity demand are the major factors to be incorporated into the electricity sector. These changes affect the emission prediction of CO2 independent of the presence or absence of price on carbon emissions [9].

Keeping in view the Paris agreement and its framework, many countries have legislated new laws to enforce the implementation of a carbon tax or energy tax on power generators to control the carbon emission. Figure 1 depicts the world’s largest carbon emitting countries and carbon tax has already been implemented in the USA, UK, India, China, Canada, South Korea, Japan, South Africa etc., [10,11,12,13]. As a result, many countries from each continent are playing their respective part in controlling the carbon emissions and trying to constrain the globally rising temperature. Due to this carbon tax implementation, power generators are forced to introduce carbon treatment methods in their plants and produce cleaner energy using the same fossil fuels. According to scenarios developed by International Energy Agency (IEA), it is estimated that there might be 10% reduction in CO2 emission from power plants till 2050, by using carbon capturing techniques to stabilize global warming (IEA 2010) [14,15,16].

Till date, the most reliable technology for reducing the substantial emissions from the use of fossil fuels in power generation and industrial applications is CCS. Hence, carbon capturing cost is the part of electricity generation cost now but it’s not cheap at all and generation companies need to pay the carbon tax and it has its impact on different electricity markets around the globe.

2 Literature Review

Efficient and competitive electricity markets are being created worldwide with widespread deregulation and restructuring of electric power industries and vertically integrated electricity units [17]. Independent companies take advance trading decisions in the electricity market. High market uncertainty is being created due to several unpredictable factors, which affect the prices during real time conditions [18]. This new environment of the electricity market is quite volatile and efforts are made to manage price volatility. For maximizing profit, generation companies should pay attention to make appropriate plans for distributing and allocating their generation capacities in different markets to meet the challenges in competitive environment.

Due to advancement in the markets and reducing the relative risks, Independent Power Plants (IPPs) are forced to diversify their generation and sales portfolios with various renewable and conventional alternatives. This approach is well known and quite familiar for the researchers, as this situation can be observed from the perspective of classical portfolio theory. With the addition of new securities in the market, the portfolio risk quickly drops and converges to market risk, as mentioned in classical portfolio theory. Classical portfolio theory’s application cannot only be seen through studies applied on the stock markets but can also be proven through mathematical equations and calculations [19, 20]. However, this theory isn’t enough to be applied in many securities because it isn’t a systematic approach to diminish risk (variance) [21]. The best way is to avert investing in high correlation factor containing securities. The competitive electricity markets usually consist of energy market, i.e., real time, hour-ahead and day-ahead and contractual instruments based on trading protocols [22].

Power producers and end retailers are trying to use the bilateral contracts, options and futures to minimize spot markets risks [23, 24]. Considering risk-return trade-off in a prospective market, strategic decision making to allocate energy among multiple contracts and risk preference is known as portfolio optimization. However, in a competitive market, every power producer’s main goal is to maximize its profit and minimize the associated risks, and it needs the clear determination of these risks as well as necessary actions should be taken in order to achieve the said factors. Likelihood of suffering from damage or harm: threat or danger is called risk. Uncertainty cause risk. But uncertainty and risk are two different factors: something which can controlled is called risk while something which is beyond anyone’s control can be said as uncertainty. The process of achieving the desired profit/return through a particular strategy by considering risks is called risk management [25].

There are various risk management techniques which have been applied to different electricity markets. Risk control and risk assessment are mainly two fundamental components of risk management [22]. Value at risk (VAR) is the way generally adopted for risk assessment, which tends to finding out the risk exposure of portfolios. This is a financial value any portfolio is going to lose less than assigned amount over a certain period of time with a definite likelihood. Portfolio optimization and hedging are mainly termed as risk control techniques. Forward contracts, options, future contracts etc., are the instruments which can be commonly used for risk control. An agreement used to sell/buy a specific agreed amount of commodity at a designated time and at a specific price is called as a forward contract. A contract, where there exists no compulsion of physical delivery, handled as a reliable future agreement and traded on exchange basis is called a future contract. A contract which offers a right but not a compulsion to holder for selling/buying a product at a specified price and designated time is termed as an option. To offset the market risks, hedging uses these financial instruments with payoff patterns [25].

Determining the weights of portfolio and optimization of portfolio pertaining to risk aversion degree of investor is the main step at this point. Considering the correlation between different trading options and portfolio optimization is an important mechanism for risk hedging in electricity market. Portfolio optimization is used by GenCos to secure themselves from different uncertain conditions including physical and financial trading of wholesale markets [26,27,28]. These uncertainties include transmission congestion charges uncertainty, fuel price uncertainty and pool price uncertainty etc. In future market trading, contract pricing is constantly a vital issue for futures market partakers. For evaluating the future contracts of electricity, extensively used traditional methods of common commodity markets cannot be applied directly owing to unique characteristics of the electricity market [29, 30].

To solve portfolio optimization issues, there are few more methods available apart from a numerical method like Monte Carlo simulation. These methods are Decision Analysis and Modern Portfolio Theory (MPT) [17, 31, 32]. There are many techniques applied for portfolio optimization in stock and electricity markets including MPT. MPT uses a process to search the most efficient portfolios. Now here efficient portfolio means a portfolio that provides minimum risk for a specific level of return or maximum profit for a given level of risk. Some publications also discussed the problem of asset allocation in electricity market [33,34,35]. Spot market risks and constraints of hydro-power plants were critically considered during asset allocation to bilateral and spot markets via down-side and semi-variance moment [31].

An analytic approach is specified on mean–variance portfolio theory in [17] for energy allocation between bilateral contracts and spot market. The fuel market’s influence on energy allocation is observed and a method is presented to determine the risk-penalty factor of the profit approach. In this method, optimal generation source allocation problem is resolved at a particular time instance. A forward contract is usually signed for a time span for energy trading. Standard portfolio optimization approach has been employed in majority of works for electricity portfolio optimization, i.e., mean–variance (MV) formulation [21] and it is considered as first step of managing portfolios. This model is said to be bi-criteria optimization problem because it is based on trade-off between risk and return and it’s a rational portfolio choice. Although, an assumption is always made in standard MV model that each asset’s return follows a normal distribution, all assets returns can be represented only by mean and variance of distributions. However, substantial studies in this sector [36, 37] stated that higher moments shouldn’t be neglected unless there is a reason that returns of the assets are distributed symmetrically around the mean. Moreover, the significance of skewness in portfolio management was pointed out in these studies. However, on the other hand, statistically significant levels of positive skewness were exhibited by spot price as well as return series due to high volatility in competitive electricity markets, as shown in empirical studies [38, 39]. Financial option theory concepts have been used for generation asset valuation [40, 41].

A fuzzy set method for addressing the economic performance of contracts in the electricity market is described in [42]. To solve the ideal asset allocation problem, the dynamic programming method is illustrated in [43, 44] and is applied with all the unit operating constraints fulfilled.

A comprehensive study about mean-risk portfolio analysis of demand-response and supply resources is provided in [45]. However, this model doesn’t address specifically address the problems of carbon tax payers.

In this paper, an analysis based on the theoretical background of the suggested techniques in various credible articles is critically considered to present the proposed portfolio selection technique. The basic aim of this paper is to describe the reliability of the proposed portfolio optimization approach in the electricity market to manage the supplier’s assets according to his corresponding risk aversion degree. The proposed portfolio selection technique is valid specifically for the carbon tax paying audience. The real-time data from the PJM market is employed to validate the authenticity of the proposed scheme. Several risk-return compromises are considered and their respective solutions are derived as depicted through the results. This paper is organized as follows: Agenda for the portfolio selection technique, the assumptions of asset allocation and their characteristics are discussed in Sect. 3. Mathematical models constructed in Sect. 4. A real market (PJM) data based on case study is described and the results are validated and discussed in Sect. 5. Finally, the conclusions are derived in Sect. 6.

3 Methodology

In this section, the structure of portfolio selection model is described comprehensively. The minimization of risk and receiving the maximum profit are the core objectives of every investor. Generally, it is hard to attain these two objectives simultaneously on the practical ground. This process can be considered as utility maximization. Equation (1) expresses one of the most significant utility functions usually employed by financial theorists; this formula is also employed by the Association of Investment Management and Research [48]. Therefore, various trade-off solutions are introduced between risk and profit. Financial theoreticians usually employ a utility function, as formulated in Eq. (1).

where signifies the profit of portfolio, denotes the risk of portfolio, and indicates the risk aversion degree of the investor. Suppose kinds of assets are available for an investor then utility function can be maximized by deciding the share of each asset, which is a portfolio selection problem. So, this problem can be formulated as:

The utility function is hard to be expressed explicitly. Integrating all the available shares of each asset gives rise to unity. Where the value of. is either zero or unity, whereas, kinds of assets would be. An optimum method has been established by considering the portfolio selection theory to tackle this problem, which is demarcated in five steps as demonstrated in Fig. 2.

3.1 Estimation of Holding Period’s Profit Characteristics

The criteria to decide the share of a specific asset in an investor’s portfolio is based on the profit of the asset in a future holding-period. Due to its statistical characteristics, asset profit is generally defined as a random variable in the financial field. For example, the profit rate of the asset \(g\) is \(r_{g}\), expectation \(E(r_{g} )\) and standard deviation \(\sigma_{g}\) can be used to measure the characteristics of \(r_{g}\), covariance \(\text{cov} (r_{g} ,r_{h} )\) or correlation coefficient can help to measure profit characteristics.

3.2 Ideal Risky Portfolio

Among all the investable available assets to the investor, suppose non-fixed profit assets are \(n\), these are also called as risky assets. In a risky asset portfolio, variables \(x_{1} ,x_{2} , \ldots x_{n}\) are defined as the weights of risky assets. In \(E - \sigma\) coordinates, a series of segments connecting a riskless asset point and a set of executable risk asset portfolios (risk portfolio opportunity sets) is called a capital allocation line (CAL), as described in [19]. This phenomenon is comprehensively illustrated through Fig. 3, where the optimal portfolio, optimal risky portfolio are on a particular CAL that has a maximum slope, \(L_{p} = [E(r_{p} ) - r_{n} ]/\sigma_{p}\). Where \(r_{n}\) is rate of profit for no risk asset, whereas, \(E(r_{p} )\) and \(\sigma_{p}\) are defined as following:

Therefore, the basic goal for finding the ideal risky portfolio has been changed to the optimization problem of maximizing \(L_{p}\), which is expressed as following:

The above defined optimization problem is solved and the ideal risky portfolio is determined.

3.3 Ideal Risky Asset Portfolio Profit Characteristics

The profit characteristics \(E(r_{p} )^{\prime}\) and \((\sigma_{p}^{2} )^{\prime}\) of ideal risky asset portfolio can be easily expressed after obtaining the ideal risky asset portfolio \(x_{1}^{\prime } ,x_{2}^{\prime } , \ldots ,x_{n}^{\prime }\) as in Eq. (7):

3.4 Shared Determination Between No Risk Asset and Risky Portfolio

Risk portfolio share \(v^{*}\) and share of risk-free asset (\(1 - v^{*}\)) can be found by solving the equations:

where \(p_{o}\) denotes the portfolio profit.

When the inequality limitation is inactive, the perfect answer has a rational form that can be read from the first-order ideal condition.

Equation (10) shows that risky portfolio’s share is linear to the inverse of risk aversion degree. Overall portfolio’s risk and profit are \(r_{n} + v^{\prime} \cdot [E(r_{p} )^{\prime} - r_{n} ]\) and \(y^{{{\prime }2}} (\sigma_{p}^{2} )^{{\prime }}\), respectively.

3.5 Each Asset Share Calculation in Portfolio

The no risk asset share and each risky asset share \(i\) are stated in Eqs. (11) and (12) respectively:

4 Asset Allocation Problem

In this study, the fundamental focus is on three types of assets, i.e., day-ahead energy, risk-free contracts and risky contracts. Furthermore, it is also discussed that why portfolio selection model has been proposed, while other alternatives like real option models were already available. In the determination of diverse portfolios for extreme risk avoiding investors, actual option-based approaches are displayed as a result. For easily understanding the proposed methods, two suppositions are formulated, based on these assumptions, this method can be observed as an optimum solution for extremely risk-averse investor. First supposition is to maintain the hedging process that investors always have adequate cash and the other supposition is to consider market as a complete market. These two suppositions are hard to realize in most of the electricity markets. For electricity products, it’s very rare that there is a financial market which works for electricity markets. A perfect hedging is absent, due to lack of correlation, as the connection between future price and real price is not adequate. Due to large exchange quantities, it’s really hard to realize the second supposition in electricity markets as some suppliers are unable to sustain the perfect hedging position. Furthermore, there are few investors recognized as aggressive investors, instead of using the money for hedging they like to capitalize in great risk and high-profit assets. This usually produces the higher profit, even though at the price of higher risk, but overall it increases the utility. The overall representation of the solution for tackling the asset allocation model is depicted in Fig. 4.

4.1 Asset Allocation Model

A model for supplier’s asset allocation has been derived in this section as mentioned in Fig. 4 based on the assumptions and discussions in the last section.

4.1.1 Model of Supplier

Suppose that during a trading interval, the cost function of supplier consists of two components, i.e., variable cost \((\beta \cdot E + \gamma \cdot E^{2} )\) and fixed cost \(\alpha\), where during the trading interval, the scheduled energy produced is denoted by \(E\), therefore, the relation between variable cost and fixed cost is defined below:

By considering the role of carbon emission and carbon tax in the supplier model, the above expression becomes as follows

where \(C_{T}\) denotes the carbon tax for scheduled energy produced and it’s assumed to be fixed [46].

\(D\) is risk aversion degree of the supplier based on it’s personal records. Due to diverse aptitudes of bearing risk, different values of \(D\) have been chosen by different suppliers. If \(D > 0\), the supplier is risk-hesitant; if \(D = 0\), it represents that supplier is risk-neutral; and if \(D < 0\), the supplier is risk-loving. Most of the markets have risk-averters as predominant.

\(D\) can be assessed by using survey analysis. According to a text book on investment science [47], some scholars in American investment markets estimated that the value of \(D\) lies between 2 and 4. Due to unavailability of confident data, subsequent opinions are monitored in this work, described as following:

\(D\) should not be the reason for exceptionally high projected risk.

\(D\) should not be the reason for exceptionally low projected profit.

Profit and risk both shouldn’t be too sensitive to \(D\), otherwise there will be a noteworthy deviation of profit or risk can occur due to trivial change of approach towards risk, which can result in an unstable financial situation for the company.

Certainly, first two principles are the fundamental goals of Business Risk Management and Business Profit Management, respectively. The range for \(D\) has been chosen between 2.89 and 6.1 based on the above principles. Sensitivities of risk and profit, the risk level and the expected profit rate are appropriate within this range. (Figure 8 shows the profit curve).

4.1.2 Return Model of No Risk Contracts

In the electricity market, the total cost of electricity production is calculated from the cost functions of the various generators and their capacity to produce electricity. In this paper, (total income-total cost)/total cost is defined as profit in conclusion period. This classification is called as a conclusion period profit (CPP) to differentiate it from other profit classifications.

Suppose conclusion period trading intervals are Z. If \(M_{z}^{de}\) and \(m_{z}^{de}\) are discussed production and discussed value, respectively for \(Z{th}\) conclusion period trading interval then the formula for conclusion period return or risk-free contracts can be expressed:

\(CPP_{NRC}\) is constant because \(M_{z}^{de}\) and \(m_{z}^{de}\) both are given. A supplier usually opts a contract with highest \(CPP_{NRC}\).

4.1.3 Return Model of Day-Ahead Market

Keeping in view all the previous definitions, conclusion period profit of a day-ahead market can be expressed as:

Day-ahead market price is denoted by \(m_{z}^{DA}\) at the \(Zth\) trading interval, its expected distribution depends on price forecasting because it’s a random variable. Generation scheduled is denoted by \(M_{z}\) in \(Zth\) trading interval.

So, the expected and variance return of \(CPP_{DA}\) can be expressed as:

The estimation of \(E(m_{z}^{DA} )\) and \(\sigma^{2} (m_{z}^{DA} )\) in Eqs. (17) and (18) is a problem of spot-price prediction, it is itself a research topic and out of scope for this paper. In this paper, a historic data-based technique is employed for predicting the price. The spot price model in the \(Zth\) trading interval comprises of historical data in months and hours. There is an important supposition in using the mean–variance model in asset allocation. Each asset’s profit follows a normal distribution is that supposition so that asset profits can be represented by expected variance and expected mean. Therefore, it’s important to know that \(CPP_{DA}\) follows the normal distribution or not before applying Eqs. (17) and (18) to describe \(CPP_{DA}\). Lilliefors distribution test and Jarque–Bera distribution test are performed for this purpose.

Distribution of \(CPP_{DA}\) can be considered as normal distribution according to the test results, although not every \(m_{z}^{DA}\) in consideration period follows a normal distribution. For these tests, PJM data has been taken as an example. A GenCo’s historical data from 2013 to 2016 has been assumed and consideration period was April 2017 in this paper. In PJM day-ahead market, the trading interval is 1 h, so there are \(24 \times 30 = 720\) trading intervals in consideration period. Therefore, the sample consists of adjusted historical day-ahead prices in similar hours and months for every trading interval. Hence, 58.3% of the \(m_{z}^{DA}\)’s got rejected in Lilliefors’ test owing to normal distribution lying at 5% significance. After that Jarque–Bera test has also been performed and it implies the approximately same results. Lilliefors test statistics (LTS) is the amount of approximation error to a normal distribution, the lower the value, better the approximation of sample to a normal distribution. So \(CPP_{DA}\) has been accepted by both Lilliefors and Jarque–Bera tests.

4.1.4 Return Model of Risky Contracts

One typical risky contract form has been considered between the supplier and system operator named as an interruptible contract. There should be \(m\) models formulated for \(m\) assets, if there are \(m\) kinds of risky contracts in the market, then a set of risky portfolio opportunities would be formed to combine them with day-ahead assets.

An equilibrium amid the source and request of electric power at each occurrence of time should be maintained by the independent system operator as it cannot be stored proficiently. However, for various reasons, power demand fluctuates from time to time. There can be a need to disrupt load or decrease generation in case of severe imbalance situation by the system operator. For this purpose, system operator subscribe interruptible contracts in advance. Interruptible contract considered in this paper is as follows:

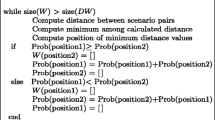

According to Eq. (19), if the spot price \(m^{DA}\) is greater than the interruptible price \(m_{I}\), the contract price \(m_{RC}\) is equal to the promised price, \(m_{a}\). Generation would be interjected and reimbursement price \(m_{C}\) would be compensated when the spot price is lesser than the interruptible price. As a result, this contract becomes a non-compensated interruptible contract if \(m_{C} = 0\). In, consideration period return of this interruptible contract has been expressed, where the probability of random event occurrence is denoted by Prob \(( \bullet )\) function.

5 Numerical Study and Results

PJM market’s data has been used for numerical study which is described in this section. According to assumption, supplier is seeking an answer for its asset allocation issue and he makes his decision on the basis of available data on PJM market website from 2013 to 2016, the period of consideration is April 2017. Suppose that supplier got two fossil fuel generators located at PJM Western Hub, 250-MW each and their generation graph in Fig. 5 shows how price per MWh decreases with increase in the output.

Cost information as well as public information available to supplier is listed in Table 1. First, statistical characteristics of the asset’s profit in consideration period are estimated based on return models and historical data in the Sect. 5 and results are listed in Table 2. The procedures mentioned in Sect. 3 are performed, Fig. 6 shows the ideal solutions for asset allocation.

On the basis of ideal portfolio selection theory, a simple example of asset allocation has been described in Sect. 4. There are several questions that may arise immediately. First, how can this portfolio work better than other portfolios if they are compared? This presented asset allocation technique really works? Second, in what manners this technique works with a change of situations like a change in attitude towards risk by the supplier. Third, statistical estimation has been used to obtain some parameters; although the method used can theoretically produce an ideal portfolio solution. What will be the result if this method has been applied by the supplier?

Additional simulations have been performed to address the above concerns and test the proposed method. First, according to supplier’s risk-aversion-degrees, ideal portfolios have been computed. The results are stated in Fig. 7.

After the supplier’s risk-aversion-degree rises according to Fig. 7, ideal portfolio executes piecewise. The ideal portfolio comprises of all three assets when risk-aversion-degree spans from 0 to 3.5. According to this phenomenon, a supplier is more apprehensive about profit than risk, while, his risk-aversion degree is particularly low. Therefore, choosing the asset having the highest return with highest risk is the ideal strategy. So very less percentage of NRC can be seen from 0 to 3.5. When the degree of risk aversion increases from 3.5 to 5, the ideal portfolio includes three assets, day ahead (DA), risky contract (RC) and no risk contract (NRC). This shows that DA decreases with an increase in RC for an instance, with a substantial increase in NRC to regulate the risk and it seems to be the most suitable strategy. The ideal portfolio comprises of these assets: no risk contract (NRC), RC and DA. It depicts that the increasing RC ratio cannot justify the risk of the portfolio once the aversion rate increases, so, the finest approach is to increase the NRC. In this range, the ratio of the two risky assets depicts a gradual slump with the escalating risk aversion degree, whereas, the no risk instrument results in repeated growth.

According to Fig. 6, if risk-aversion-degree is lesser than 3.5, portfolio mainly consists of DA and RC assets and remained unchanged, so that the risk and profit can be retained constant. Profit and risk experience a monotonic decline, as risk aversion increases and becomes greater than 3.5. Greater risk aversion portfolio has a greater ability to reduce risk. By prevailing the proportion of each asset, portfolio mitigates its risk first by increasing the assets with reasonable risk and profit (RC) and afterwards by increasing the no risk contract (NRC) during inadequacies. Figure 8 shows the risk-profit dependency, with the decreasing risk, profit also decreases monotonously. Whereas, there exists the lower return in case of moderated risk. Therefore, profit decreases as risk decreases. Certainly, this technique is based on a settlement among the portfolio’s profit and risk.

For reducing the imperceptible risks in the stock market, a strategy known as diversification is frequently employed. It is also found as an effective approach to reduce the risk for the electricity supplier, as demonstrated in earlier simulations and discussions in this section. Moreover, Fig. 7 also shows that these suppliers have ideal positions to pursue a portfolio with three assets that are comparatively riskier at the medium and higher levels. However, owing to some unique attributes of electricity market, diversification is constrained. First, in comparison with stock market, types of assets in electricity market are very limited. Secondly, asset returns are closely correlated in electricity market than in stock markets. Therefore, electricity suppliers should also invest in other markets (e.g., stock markets, future markets and options market).

6 Conclusion

Portfolio optimization plays a pivot role in supplier’s risks and potential profits. In this paper, an optimum portfolio optimization technique based on the portfolio selection scheme is suggested. Real-time data from a PJM market is employed for the numerical study to test this strategy for carbon tax paying electricity suppliers. Proposed portfolio selection theory is a significant and reliable strategy to optimize the risks and increase the profits. Moreover, various risk-return negotiations are taken into account, their relevant solutions are presented and the provided solutions through the proposed strategy are validated through the results.

References

Lee KH (2011) Integrating carbon footprint into supply chain management: the case of Hyundai Motor Company (HMC) in the automobile industry. J Clean Prod 19(11):1216–1223

Al-mulali U, Sab CNBC (2012) The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39(1):180–186

Wang K, Yu S, Zhang W (2013) China’s regional energy and environmental efficiency: a DEA window analysis based dynamic evaluation. Math Comput Model 58(5–6):1117–1127

Wang Y, Zhu Q, Geng Y (2013) Trajectory and driving factors for GHG emissions in the Chinese cement industry. J Clean Prod 53:252–260

Grubb M (2004) Kyoto and the future of international climate change responses: from here to where? Int Rev Environ Strateg 5(1):15–38

CCSA (2016) What is CCS?—the carbon capture and storage association (CCSA). CCSA, London

Gibbins J, Chalmers H (2008) Carbon capture and storage. Energy Policy 36(12):4317–4322

Chen Y, Tseng CL (2011) Inducing clean technology in the electricity sector: tradable permits or carbon tax policies? Energy J 32(3):149–174

Palmer K, Paul A, Keyes A (2018) Changing baselines, shifting margins: how predicted impacts of pricing carbon in the electricity sector have evolved over time. Energy Econ 73:371–379

W B Group (2018) State and trends of carbon pricing 2018. https://openknowledge.worldbank.org/bitstream/handle/10986/29687/9781464812927.pdf?sequence=5&isAllowed=y. Accessed 13 Apr 2018

Alton T et al (2014) Introducing carbon taxes in South Africa. Appl Energy 116:344–354

Mathur A, Morris AC (2014) Distributional effects of a carbon tax in broader US fiscal reform. Energy Policy 66:326–334

Massetti E (2011) Carbon tax scenarios for China and India: exploring politically feasible mitigation goals. Int Environ Agreem Polit Law Econ 11(3):209–227

Finkenrath M (2011) Cost and performance of carbon dioxide capture from power generation. In: IEA energy papers, pp 51–51

Finkenrath M (2012) Carbon dioxide capture from power generation—status of cost and performance. Chem Eng Technol 35(3):482–488

Gerdes K, Stevens R, Fout T, Fisher J, Hackett G, Shelton W (2014) Current and future power generation technologies: pathways to reducing the cost of carbon capture for coal-fueled power plants. Energy Procedia 63:7541–7557

Liu M, Wu FF (2006) Managing price risk in a multimarket environment. IEEE Trans Power Syst 21(4):1512–1519

Bjorgan R, Liu CC, Lawarree J (1999) Financial risk management in a competitive electricity market. IEEE Trans Power Syst 14(4):1285–1291

Gökgöz F, Atmaca ME (2012) Financial optimization in the Turkish electricity market: Markowitz’s mean-variance approach. Renew Sustain Energy Rev 16(1):357–368

Statman M (1987) How many stocks make a diversified portfolio? J Financ Quant Anal 22:353–363

Markowitz HM (1952) Portfolio selection. J Finance 7(60):77–91

Shahidehpour M, Yamin H, Li Z (2002) Market operations in electric power systems: forecasting, scheduling, and risk management. Wiley, Hoboken, p 531

Gedra TW (1994) Optional forward contracts for electric power markets. IEEE Trans Power Syst 9(4):1766–1773

Menniti D, Musmanno R, Scordino N, Sorrentino N, Violi A (2007) Managing price risk while bidding in a multimarket environment. In: 2007 IEEE power engineering society general meeting. IEEE, pp 1–10

Liu M, Wu FF (2007) Portfolio optimization in electricity markets. Electric Power Syst Res 77(8):1000–1009

Siddiqi SN (2000) Project valuation and power portfolio management in a competitive market. IEEE Trans Power Syst 15:116–121

Xu J, Luh PB, White FB, Ni E, Kasiviswanathan K (2006) Power portfolio optimization in deregulated electricity markets with risk management. IEEE Trans Power Syst 21:1653–1662

Shrestha GB, Pokharel BK, Lie TT, Fleten SE (2005) Medium term power planning with bilateral contracts. IEEE Trans Power Syst 20:627–633

Collins RA (2002) The economics of electricity hedging and a proposed modification for the futures contract for electricity. IEEE Trans Power Syst 17(1):100–107

Bessembinder H, Lemmon ML (2002) Equilibrium pricing and optimal hedging in electricity forward markets. J Finance 57:1347–1382

Gökgöz F, Atmaca M (2013) Optimal asset allocation in the Turkish electricity market: down-side vs semi-variance risk approach. In: Proceedings of the World Congress on …, vol 1, pp 3–8

Vehviläinen I, Keppo J (2003) Managing electricity market price risk. Eur J Oper Res 145(1):136–147

Campo RA (2002) Probabilistic optimality in long-term energy sales. IEEE Trans Power Syst 17(2):237–242

Mo B, Gjelsvik A, Grundt A (2001) Integrated risk management of hydro power scheduling and contract management. IEEE Trans Power Syst 16(2):216–221

Liu M, Wu FF, Ni Y (2003) Market allocation between bilateral contracts and spot market without financial transmission rights. In: 2003 IEEE power engineering society general meeting (IEEE Cat No 03CH37491), vol 2. IEEE, pp 1007–1011

Lai TY (1991) Portfolio selection with skewness: a multiple-objective approach. Rev Quant Finance Account 1:293

Liu S, Wang SY, Qiu W (2003) Mean-variance-skewness model for portfolio selection with transaction costs. Int J Syst Sci 34:255–262

Eydeland A, Wolyniec K (2003) Energy and power risk management. Phys A Stat Mech Appl 285:127–134

Longstaff FA, Wang AW (2004) Electricity forward prices: a high-frequency empirical analysis. J Financ 59(4):1877–1900

Deng SJ, Johnson B, Sogomonian A (2001) Exotic electricity options and the valuation of electricity generation and transmission assets. Decis Support Syst 30:383–392

Chung-Li T, Barz G (2002) Short-term generation asset valuation: a real options approach. Oper Res 50:297–310

Schmutz A, Gnansounou E, Sarlos G (2002) Economic performance of contracts in electricity markets: a fuzzy and multiple criteria approach. IEEE Trans Power Syst 17(4):966–973

Fan W, Guan X, Zhai Q (2002) A new method for unit commitment with ramping constraints. Electric Power Syst Res 62:215–224

Zhai Q, Guan X, Cui J (2002) Unit commitment with identical units: successive subproblem solving method based on Lagrangian relaxation. IEEE Trans Power Syst 17:1250–1257

Deng SJ, Xu L (2009) Mean-risk efficient portfolio analysis of demand response and supply resources. Energy 34(10):1523–1529

Olsen DJ, Dvorkin Y, Fernandez-Blanco R, Ortega-Vazquez MA (2018) Optimal carbon taxes for emissions targets in the electricity sector. IEEE Trans Power Syst 33:1

Tütüncü RH, Koenig M (2004) Robust asset allocation. Ann Oper Res 132:157–187

Bodie Z, Kane A, Marcus AJ (2005) Investments, 6th edn. McGraw-Hill, New York

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wattoo, W.A., Kaloi, G.S., Yousif, M. et al. An Optimal Asset Allocation Strategy for Suppliers Paying Carbon Tax in the Competitive Electricity Market. J. Electr. Eng. Technol. 15, 193–203 (2020). https://doi.org/10.1007/s42835-019-00318-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42835-019-00318-3