Abstract

The aim of this short analysis is to answer whether shale gas can be a sustainable solution to Turkey’s long-term energy needs. Turkey, with no significant hydrocarbon reserves of her own, is vulnerable to the risks and challenges associated with energy import dependency. Having a fast-growing natural gas demand has caused Turkey to undertake many gas import contracts. In 2013, 98 % of the natural gas consumption is imported. Globally increasing natural gas prices and volatile Turkish Lira/US Dollar exchange rate have a series of ramifications, including a substantial burden on national budget and balance of payments. It is crucial for Turkey to reduce the share of imports in energy and to develop domestic resources in order to avoid exposure to relevant risks. In short, Turkey needs gas supply security. However, conventional natural gas reserves of Turkey are far from meeting its needs. Shale gas, in this frame, emerges as a buoyant potential for secure future gas deliveries. Given the example of unconventional gas frenzy in the USA, Turkey is now discussed as a long-term candidate for shale gas production. This possibility triggers high hopes, as well as unsupported expectations. Shale gas production has a long list of requirements: distinct geological formations, concordant conditions in surrounding area, advanced exploration and production technology, and capital-intense investments. Even if these conditions are fulfilled, environmental challenges of this production method are yet to be addressed and tackled diligently. Turkey is still on exploration phase of shale gas experience. It will take Turkey at least another decade to meet the requirements for tangible results and to name the shale gas as an answer to its energy hunger.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Rapid industrialization in twentieth century had one crucial element: uninterrupted access to energy. While pioneers of industry and technology were thriving for secure and affordable energy supplies, uneven distribution of energy sourcesFootnote 1 around the globe created a trade scheme, from producers toward customer, who are not necessarily located in proximity.

As shown in Fig. 8.1, the Middle East is the forerunner in crude oil production, whereas the majority of the crude oil is consumed in North America, Europe, and industrialized Asia-Pacific countries. In case of natural gas, the Middle East is replaced by Eurasian region. Former Soviet Republics hold the lion’s share of the current natural gas production in the world, while the majority of the gas is transported to Europe through large-capacity pipelines.

Comparison of oil-producing and oil-consuming regions (BP Statistical Energy Review 2013)

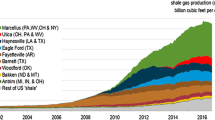

In the last decade, North America has shifted its position from an importer, toward a self-sufficient point) and potentially an exporter. This radical change has its roots in the very own properties of the American oil and gas industry. Yet many countries around the globe have the ambition to create their own shale gas revolution. Turkey is one of the most assertive countries on the list. Understanding whether and how Turkey can make this dream come true needs a careful analysis of available assets and coercive measures which the shale gas business ground rules dictate.

In this study, an outlook on Turkey’s energy market is presented with focus on natural gas market. Turkey’s shale gas ambition stems from the country’s shortage of conventional gas resources. Therefore, a close look on the gas supply and demand balance would set the tone for understanding Turkish enthusiasm on shale gas. In the next section, a brief chapter on shale gas is presented in order to introduce hallmarks of the exploration and production techniques, which have borned the term “unconventional.” In the following section, a list of peculiarities of shale gas production is provided, with their corresponding challenges for Turkey under each headline. After having laid the fundamentals of shale gas development in Turkey, the conclusion section intends to answer the question whether Turkey holds a strong case with regard to being next shale revolution in near future.

2 Energy of Turkey

Turkey has a fast-growing population and has gone through a robust industrialization since the establishment of the Republic. Economic growth, urbanization, and population increase have boosted the need for hydrocarbon sources (Aydın 2010). Increase in energy need has become even higher in the last two decades. As seen in the Fig. 8.2, displaying primary energy consumption has been in steady increase since 1990. Annual energy demand is expected to increase by 5.9 % every year until 2025 (Lise and Van Montfort 2007).

Primary energy consumption of Turkey between 1990 and 2011, in thousand tons petroleum equivalent (World Energy Council—Turkish National Committee 2013)

Turkey’s indigenous energy production, however, is far from meeting this increasing need. According to the historical data provided by the Ministry of Energy and Natural Resources for the same time period, Turkey’s primary energy production corresponds only to one-third of the consumption. Although majority of the energy need is met by crude oil and natural gas, none of these two sources has sufficient exposure in Turkey. In 2011, only 9.5 % of the crude oil demand is answered by domestic sources. In natural gas, share of indigenous production in domestic gas demand is only 2 % (TPAO 2011) (Fig. 8.3).

Natural gas supply to Turkey; imports and indigenous production (Energy Market Regulatory Authority EMRA 2013)

Natural gas use in Turkey has started in 1976, with the discovery of Hamitabat gas reserve in Thrace area. Although the only customer happened to be the local industry for a decade, robust population increase and air pollution in big cities triggered natural gas consumption in larger sense. To meet the increasing demand, Turkey has signed its first natural gas import contract with the Soviet Union in 1984.

Deliveries started in 1986, after a pipeline had been constructed for the gas to flow via Bulgaria and the Thrace region of Turkey. In the following decades, natural gas demand has shown a steep increase, particularly in 2000s, due to expansion of the natural gas transmission network and investments made in gas-fired power plants (Fig. 8.4).

Turkey’s annual natural gas consumption between 2005 and 2013 (Energy Market Regulatory Authority EMRA 2013)

However, Turkey has very limited reserves of her own to answer the increasing gas demand. According to Turkish Petroleum Corporation (TPAO)’s data, Turkey has produced 0.53 bcm natural gas in 2013, while Turkey’s natural gas consumption has reached 44.1 bcm in the same year. In order to fill the gap in supplies, Turkey has signed gas import deals for further volumes, with the Soviet Union (later Russian Federation) and other suppliers (Table 8.1).

Turkey’s dependence on imports of natural gas raises concerns for a list of reasons. The first and the most important one is the supply security. In case of a disruption in gas deliveries, Turkish energy balance is not able to cover the lack of natural gas. Since Turkey does not have a substantial storage capacity, it is crucial to guarantee uninterrupted flow of gas from contracted suppliers. Lacking of gas storage capacity in Turkish natural gas infrastructure, Turkey is vulnerable to any externalities in natural gas imports (Deloitte 2012).

Second important aspect of import dependency on energy resources is the effect of the payments on national budget. Typically, long-term gas sales and purchase agreements use USD as payment currency. Importing natural gas in USD and selling to domestic market in Turkish Lira leaves Turkish energy authorities with no choice, but to take the exchange rate risk.

Thirdly, Turkish energy market has been heavily subsidized by the Turkish State. BOTAS, State Natural Gas Corporation, has not made any domestic price increases in two years (as of September 2014), despite the increasing import cost of natural gas. In 2012, Turkish economy had a current account deficit of USD 84 billion and energy imports constituted 62.3 % of this deficit.

Combining the need for supply security and easing off the burden on economy, Turkish energy authorities welcomed the possibility of shale gas development in Turkey. Given Turkey’s very limited natural gas production with conventional methods, “shale gas boom” in the USA has promoted high expectations on the possibility of implementing the same experience in Turkey.

3 Shale Gas

The term “shale gas” presents a new technique of extracting the natural gas trapped in a certain formation of rocks, which is not possible to exploit with conventional methods. Due to the new production method, the gas produced is also referred to as “unconventional gas.” This new exploration and production method requires a more advanced technology than the conventional ways of production. Unconventional gas production entails high-pressure water spraying with chemicals into the cracks in the rock formation to produce a “fracture.” Fracturing or hydraulic fracking method allows the producer to access the natural gas trapped in the formation, which would be impossible to access otherwise. The cost is also higher compared to the conventional method.

Unconventional natural gas production has been developed and successfully implemented in the USA in the last decade. Once a large natural gas importer, the USA rapidly turned itself into a self-sustaining gas producer, with anticipation of being an exporter in coming years. Many gas importer countries around the world have taken the USA as example and have developed an expectation for duplicating the same experience in their respective gas markets to eliminate the challenges of being gas importer (Geny 2010). Turkey is one of the countries where wishful thinking and reality collide and not necessarily coincide.

Accessing shale gas has a list of requirements and environmental risks, which are widely criticized in countries where production has already started. Majority of these challenges are directly applicable in Turkey. Since Turkey is still in the exploratory phase in shale gas development, it is in best interest of Turkey to consider these issues early in the process and take necessary measures to tackle these challenges.

3.1 Use of Extensive Amount of Clean Water

The major element of the unconventional gas production is the hydraulic fracturing technique. Fracking involves drilling a well deep underground and then pumping water, sand, and chemicals down at high pressure to fracture the rocks and enable the gas trapped within them to flow out. The technique requires access to vast water resources in the vicinity of the wells.

Two main shale gas basins in Turkey—Thrace and Dadaslar basins—are located in areas where water resources are limited. Thrace region has gradually lost its natural agricultural character due to rapid industrialization, which led to pollution of existing water resources. At Diyarbakır province, where Dadaslar basin is located, river Euphrates has been lately become the source of all economic activity. There are five dams actively working on the river Euphrates, together with the agriculture zones supplied by these dams. If and when Dadaslar basin is proven fully recoverable, access to vast amount of water would be one of the main concerns.

3.2 Disposal of Flow-Back Fracking Fluids Containing Residual Chemicals

The water is contaminated during the process of hydraulic fracturing. After the contaminated water is taken up on the ground, measures will have to be taken to ensure that leaking is prevented. Otherwise, any possible toxic water leaks pose high risks to pollute the clean underground water sources (Howarth et al. 2011).

Toxic water can be stored and purified in isolated tanks or pools before it is safe enough to release it to nature. However, such outdoor cleansing facilities do not necessarily alleviate the risk of the mixture of toxic water with the environment and endangering the residential communities nearby.

The well integrity poses additional challenges to avoid possible damages of poisonous chemicals. Inadequate well structure can lead to gas or toxic water leakage and eventually threaten the nature and the people.

3.3 Possibility to Trigger Seismic Activities

A less visible, yet more vigilant risk of unconventional gas production is the potential seismic effect of hydraulic fracturing. Potential risks to trigger tectonic activities have been argued by some seismologists and environmental institutions, since the fracking takes place deep underground.Footnote 2, Footnote 3 In few European Union member states, this claim is taken seriously and led political authorities to cancel the licenses and to put shale gas production projects on a shelf.Footnote 4 There are conflicting views on the causal effect of fracking on triggering an earthquake. However, in countries with frequent tectonic activities, even the slightest possibility has to be ruled out before stepping forward in unconventional production.

3.4 Need for Large and Unhabituated Areas for Fracturing

One way to avoid the risks mentioned above would be to carry out unconventional gas production activities in unhabituated rural regions. This way, even if a natural hazard takes place, it would not directly threaten the human life, livestock, agriculture, or the environment. In the US experience, thanks to the size of the continent, the risk of endangering the life and environment with shale production is relatively lower.

3.5 Gas Prices and Cost of Shale Gas

The last concern for shale gas production in Turkey is the cost element. TPAO has been in cooperation with international companies to share the know-how and the financial burden of the explorations. Since the explorations are in early phase, it is very difficult to predict the future project economics. Additionally, natural gas prices are very much affected by the policies and politics of international suppliers. Therefore, there is always a risk of investing in the shale gas production in long run and not being able to present it to the regional markets with a competitive price.

4 Shale Gas in Turkey

The first and the foremost requirement for Turkey to turn itself into a gas sufficient country is the physical existence of substantial amount of recoverable shale gas. Only existing data on the magnitude of potential shale gas reserves in Turkey belong to American Energy Information Agency (EIA). According to EIA, Turkey has two promising basins with a total reserve of approximately 450 bcm of natural gas recoverable with unconventional methods.Footnote 5 In the EIA analysis, two regions, Thrace and Dadaslar basin in South East Turkey, are marked as two regions with potential. Although some unanimous experts are referred to in media for stating 13 tcm of total gas reserves in Turkey, these figures remain untested and speculative.

Other than data provided by EIA, size of shale gas reserves located in Turkey is not known. TPAO has been active in exploring the regions referred to in the EIA report and confirmed findings on potential rock formations. TPAO has engaged in cooperation with international oil companies that consider the above-mentioned two basins attractive. First agreement is signed in 2010 with Transatlantic and Valeura for exploratory studies in both Thrace region and South East Turkey in the form of a memorandum of understanding. Following this protocol, TPAO entered into another agreement with Shell for cooperation in 2011 and exploratory work started in South East Turkey, close to Diyarbakır province.

TPAO has been historically cautious for not revealing any certain figures on the size of the basins which are worked on. International companies which TPAO works with have also been refraining from publishing figures on how much of a gas reserve they have been estimating on the reserves they engage in.

5 Conclusions

Turkey, as a net energy importer country, is in immediate need of securing its future supplies. Turkey is located between the markets and suppliers for natural gas, yet overly relying on a single supplier. Cost of importing natural gas is the second reason why Turkey would be very much interested in developing shale gas production. Cost of importing energy in 2013 was around USD 60 billion, and any alternative to reduce this bill is sincerely welcomed in Turkey.

Having observed the “game changer” feature of the shale gas boom in the USA, Turkish energy authorities have become quickly interested in shale gas developments. Together with international partners, Turkey is now engaged in two basins on Turkish soil, which are promising areas for shale gas production. With the absence of official figures on the reserve sizes, it has been easy in Turkish media to get carried away and many ambitious calculations are referred to. Beside the uncertainties around the reliability of reserve data stemming from EIA, there are other challenges which make shale gas production in Turkey risky. Given the lack of strict environmental control and distance to international environmental standards, it is more important for Turkey to start on right foot and prevent any danger to livelihood in and around the shale basins.

For the purpose of this paper, only the most immediate and universal concerns are listed. Access to water, risk of contamination, potential effect on earthquakes, and need for vast areas are the major issues which are discussed in EU member countries before Turkey and has created a strong public opinion. In addition, the environmental concerns, project economics, potential cost of production, and future gas prices create uncertainty around how attractive the shale production projects would be for international investors. Lack of specific references in the Turkish legal code on shale gas production would be another unattractive factor for international investors.

Geological, legal, and economic uncertainties, together with environmental concerns, will shape Turkey’s shale gas experience in the next decade. Without tangible steps taken on these fronts, shale gas is very unlikely to be the cure for Turkey’s energy problem. With a population of 74 million and a fast-growing economy, Turkey’s energy needs are far from being tamed anytime soon. Due to the factors listed above, domestic shale gas production is very unlikely to answer Turkey’s ever-growing energy need in coming few years.

Notes

- 1.

In this work, “energy sources” refer only to crude oil and natural gas.

- 2.

- 3.

- 4.

- 5.

References

Deloitte. (2012). Turkish Natural Gas Market- Expectations, Developments.

EMRA. (2013). Natural Gas Market Sector Report. Energy Market Regulatory Authority, EMRA.

Geny, F. (2010). Can Unconventional Gas be a game changer in Continental European Gas Markets? The Oxford Institute for Energy Studies.

Howarth, R.W., Santoro, R., & Ingraffea, A. (2011). Methane and the greenhouse-gas footprint of natural gas from shale formations. Climatic Change, 106(4), 679–690.

Lise W., & Van Monfort K. (2007). Energy consumption and GDP in turkey: is there a cointegration relationship? Energy Economics, 29(6), 1166–1178.

TPAO. (2013). Crude Oil and Natural Gas Sector Report. Turkish Petroleum Corporation (TPAO).

Turkey Energy Outlook. (2013). Presentation by Mr. Oğuz Türkyılmaz, Chairman of Energy Commission of Chamber Of Mechanical Engineers—Member of Executive Board Turkish National Committee Of WEC.

Turkey Energy Outlook. (2013). World Energy Council—Turkish National Committee.

The US Energy Information Administration. (2011). World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States.

Further Readings

Energy Outlook in Turkey and in the World. Turkish Ministry of Energy and Natural Resources, 2011.

IEA. (2012). Golden Rules for a Golden Age of Gas. World Energy Outlook Special Report on Unconventional Gas. International Energy Agency (IEA).

IEA. (2014). World Energy Outlook. International Energy Agency (IEA).

Unconventional Gas-Transforming the Global Gas Industry. IHS and International Gas Union Special Report, 2012.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this paper

Cite this paper

Kozçaz, I.Y. (2015). Shale Gas: A Solution to Turkey’s Energy Hunger?. In: Bilge, A., Toy, A., Günay, M. (eds) Energy Systems and Management. Springer Proceedings in Energy. Springer, Cham. https://doi.org/10.1007/978-3-319-16024-5_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-16024-5_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-16023-8

Online ISBN: 978-3-319-16024-5

eBook Packages: EnergyEnergy (R0)