Abstract

By using the valence theory and trust transfer theory, this study builds a mobile payment adoption model where consumers shift the payment from tourism websites to mobile apps. The study uses structural equation model based on 323 questionnaires data to test the impact of the trust in on-line payment on initial trust in mobile payment as well as the impacts of consumers trust, and its positive and negative utilities on consumers’ behaviour intention to adopt mobile payment. The findings of the empirical study indicate that: (1) users’ trust in on-line payment via tourism website significantly impacts the initial trust in mobile payment; (2) perceived usefulness and perceived ease-of-use and consumers’ innovativeness positively and significantly impact the users’ intention to adopt mobile payment; (3) initial trust in mobile payment by increasing perceived usefulness has significant impacts on users’ intention to adopt mobile payment, both directly and indirectly.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

To meet the increasing travel demand of customers, tourism portals such as Taobao Trip and Qunar.com have been investing heavily on mobile payment and wireless clients, where consumers are able to search travel products and make payments via mobile phones. Qunar.com has installed the complete functions of mobile payment on IOS and Android—the mainstream smart systems, supporting payment from ten banks such as China CITIC Bank; the built-in Ali-pay on Taobao Trip Client also allows users to purchase tickets on a real-time basis. While previously mobile phones could only be used to make basic searches on travel products and information, today’s successful emergence of mobile payment is critical to and is the precondition for the development of mobile business for tourism.

Nowadays, large travel portals are keen on adventuring into the new mobile business for travelling. Study shows that the consumers’ adoption of mobile payment is vital to its development. Davis (1989) said that when a new technology has eliminated all barriers of usage, the users’ intention to adopt the technology becomes the vital factor for its success. What exactly are the factors to influence customers’ intention to use mobile payment? What is the relation between on-line payment and mobile payment? The answers to these questions are of great significance to promote the adoption of the new technology and its success. This study will discuss mobile payment for tourism e-business from these two perspectives.

2 Theories and Hypotheses

2.1 Hypotheses Based on Valence Theory

Peter and Tarpey (1975) have proposed valence theory based on perceived risks and perceived benefits. The theory hypothesis is that consumers’ purchase of products will have positive and negative utility and they will make a decision that maximizes their net utility. Valence theory has been applied to the E-business scenario in some literatures, and has been verified. Valence theory is also consistent with the theories of Lewin (1943) and Bilkey (1953, 1955), which provides the theoretical framework of this study.

Positive Utility. In the primitive valence theory, only one variable, perceived benefits, is measured in user’s perception. However, we have to stress the important position of TAM in the study of mobile payment. As early as 1989, Davis (1989) has put forward the Technology Acceptance Model (TAM), which later on has gradually become one of the most extensively applied models in the study of IT adoption. In the model, Davis (1989) raised the two major decisive factors to consumers’ attitude towards the use of technologies: Perceived Usefulness (PU) and perceived Ease of Use (PEOU). PU refers to the extent to which a user believes his or her working performance increases by using a certain system; PEOU refers to the degree of difficulty for a user to use some system. Since its formation more than 20 years ago, many scholars have studied and extended the TAM, and the TAM has gained rather consistent support for its ability to explain the theory.

A user’s PU and PEOU bear direct impact on his or her behaviour intention (BI) to adopt mobile payment in tourism E-business. On this basis, the study raises the following hypotheses:

- H1:

-

PU has significant and positive impact on users’ intention to adopt mobile payment in tourism E-business.

- H2:

-

PEOU has significant and positive impact on users’ intention to adopt mobile payment in tourism E-business.

Moreover, since mobile payment is relatively in tourism, the extent to which consumers accept and use an innovative product, or the consumers’ innovativeness (CCR) will make a dent on their attitudes towards accepting new technologies, and many researches also indicate that CCR positively influence their intention to use mobile payment (Rogers and Shocmaker 2002). Since mobile payment in this market has yet to be popularized, many consumers have never been exposed to or used it, therefore, the more innovative the consumers, the more likely that they will accept mobile payment. Based on the above analysis, the study raises the following hypothesis:

- H3:

-

CCR has significant and positive impact on their intention to use mobile payment in tourism E-business.

Negative Utility. The perceived risk (PR) is a major barrier for consumers to use mobile payment. In this study, PR is defined as the uncertainties of potential negative consequences when users are making mobile payment. Existing researches find out that users’ PR will influence their decisions on mobile payment. Generally speaking, compared with the conventional on-line payment, it is more difficult for users to accept mobile payment. For travel products such as air tickets, most people purchase them on their own computers in advance, and only a few do so when they are travelling on the road, because mobile phone’s exposure to public areas inevitably entails some risks, and the connections may not be stable. Therefore, PR exerts big influence on the adoption of mobile payment. This study raises the following hypothesis:

- H4:

-

PR has significant and negative impact on consumers’ intention to use mobile payment in tourism E-business.

The primitive valence theory only measures PR when evaluating the perceived negative utility of users, however, when users make mobile payment, they need to pay for extra cost, including mobile phones, communication and transactions. Many researches verify that perceived cost (PC) serves as a main factor to impede the adoption of mobile payment (Shin 2009; Luarn and Lin 2005). On this basis, this study raises the following hypothesis:

- H5:

-

PC has significant and negative impact on consumers’ intention to use mobile payment in tourism E-business.

2.2 Hypotheses Based on the Trust Theory

The trust theory emerged at the early 20th century, and it was widely applied in psychology and then gradually extended to management and marketing. Scholars have their own definitions of trust. This study studies trust in the context of E-business, about which there are a lot of literatures. The definition of trust in the E-business context emphasizes the importance of transaction environment. Kini and Choobineh (1998) believe that trust refers to “the ability to believe in the environment, reliability and safety under risky circumstances”, a definition from the risk perspective.

Due to the inherent nature of mobile payment, consumers are exposed to various risks. Under these uncertainties, trust has become the way to solve these risks. In face of uncertainties and uncontrollable consequences, trust has become the key factor. Trust may mitigate the risks in mobile payment via two means: firstly, under the condition that consumers have to bear risks due to their inability to control the consequences completely, the trust is relevant; when trust increases, consumers’ PR is lower than the one that lacks trust. Therefore, trust has impacted the consumers’ intention of adoption indirectly by reducing risks. Secondly, some scholars who study trust argue that there is a direct relation between trust and the intention to use mobile payment (Kim et al. 2009). Therefore, trust will directly and indirectly influence the intention of adoption. On this basis, the study arrives at the following hypothesis:

- H6a:

-

The initial trust in mobile payment (TOM) in tourism E-business has significant and positive impact on consumers’ intention of adoption.

- H6b:

-

The TOM in tourism E-business has significant and negative impact on the PR.

In addition, some researches show that the increased trust will elevate the users’ PU; therefore, this study makes the following hypothesis:

- H6c:

-

The TOM in tourism E-business has significant and positive impact on the PU.

2.3 Hypotheses Based on Trust Transfer

Mobile tourism is a transition from on-line to off-line environment. This transition will also transfer the users’ trust from on line to off line, hence the need to study the concept of trust transfer. Trust transfer generally means that people’s trust in one field will influence their trust in other fields (Lee et al. 2007). Kim et al. (2009) divides trust transfer process into intra-channel transfer and inter-channel transfer. Intra-channel transfer means that trust may transfer from one trustable entity to another unknown entity, and such transfer occur under the same scenario, where users’ long-term use of a product or service will gradually accumulate trust, and such trust will influence other products within the same channel; the inter-channel trust transfer generally includes three types of transfers, namely on line to on line, off line to off line, and mobile to mobile. In conventional literatures of corporate marketing, there exists researches on trust transfer from off line to off line; however, there are only a few about trust transfer from on line to on line. Inter-channel trust transfer refers to the transfer of trust from one environment to another, including two types of transfer: off line to on line, and on line to mobile. Many scholars have studied the trust transfer in E-business. Kuan and Bock (2007) has studied the trust transfer to click retailers and found out that the users’ trust in the brick retailers significantly and positively influence their trust in the click retailers. The study by Lu et al. (2011) indicates that users’ trust in on-line payment (TOI) has significant and positive influence on the TOM. Based on the statement above, this study puts forward the following hypothesis from the perspective of trust transfer:

-

H7 The TOI through travel websites has significant and positive influence on the TOM.

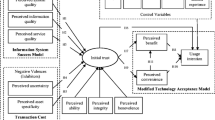

On the basis of the valence theory, and supported by the trust theory and trust transfer theory, this study builds the model of consumers’ adoption in tourism E-business, as shown in Fig. 1.

3 Scale Development and Data Collection

3.1 Scale Development

This research collects data by sending out questionnaires and then summarizes the factors that influence the consumers’ intention to adopt mobile payment in tourism E-business. Therefore, the design of the questionnaires is the key to the empirical study. This study develops the scales based on the fundamental principles and procedure of questionnaire design. In an effort to collect the complete information of users, the questionnaire is composed of two parts: main body and basic information. The main body designs questions by adopting the Likert Scale, and the options are on a scale of 1–5, from totally disagree to totally agree. This part measures the users’ perception on influencing factors. The other part of the questionnaire is the users’ basic information, including gender, age and education, which intend to check the demographic features when the questionnaires are returned so that the questionnaires can have a wide coverage. The basic information also includes how users utilize the mobile payment in tourism E-business, which can show the differences of users with varied demographic features in using mobile payment. The design of the scale in the main body is as shown in Table 1.

To ensure validity of the questionnaire, a pre-survey was conducted within a narrow scope of users when the draft design was completed, and the returned data was subject to validity and reliability tests, as a result, the unqualified variables were kicked out or improved to enhance the validity of the questionnaire, which can better measure the views of users in mobile payment in tourism E-business.

3.2 Data Collection

The questionnaires were distributed on line, and responses were received from 26 provinces and cities such as Jiangsu, Shanghai, Beijing, Shandong, Hong Kong, as well as from abroad. The survey has received 352 responses. After removing those incomplete and unclear samples, 323 samples remained. The description of the samples is as indicated in Table 2. Among the interviewees, 166 of them are males, and 157 females, 288 of them have made on-line payment on computers, making up 89.16 % of the total interviewees, and 201 people have used mobile payment, accounting for 62.33 %. Statistics demonstrates that on-line payment is moving towards mobile payment, and more and more people are purchasing travel products by making mobile payment. Wireless travel market enjoys remarkable potential for development.

Cross analysis finds that as the education background improves, the proportion of users who have made mobile payment to buy travel products also increases. Among users with bachelor’s degree and master’s degree, 64.32 and 62.86 % of them respectively have used mobile payment, yet only 36.36 % of the users with high school degree or below have done so. Moreover, among the group of people aged between 25 and 34, 67.01 % of them have used mobile payment, while the figure stands at 50 % for users of other age group. As the income rises, the proportion of users who have used mobile payment also expands. To sum up, education background and income are proportional to utilization of mobile payment, and young people tend to take a larger share.

4 Data Analysis and Hypotheses Testing

4.1 Validity and Reliability Tests

This study uses SPSS 16.0 Software to test the validity and reliability of the questionnaire. The Cronbach’s Alpha coefficient of the Scale is 0.806, indicating that the questionnaire is valid. The reliability of each factor is also subject to test, and the Cronbach’s Alpha coefficient of each sub-scale is all higher than 0.8, indicating good reliability of each sub-scale. Meanwhile, this study also tests the structural validity of the questionnaire by factor analysis on data, using SPSS software. This study conducts KMO test and Bartlett’s test on data. The findings show that KMO (Kaiser–Meyer–Olkin) statistics of the data is 0.910, Chi square value of Bartlett’s test is 4,294 (degree of freedom is 276), and concomitant probability is 0.000. This means that the data is suitable for factor analysis. Then SPSS is used to do varimax rotated principal component analysis to all the indicators and conduct explorative factor analysis. Five factors were extracted whose characteristic value is bigger than 1, the accumulative explained variance is 65.145 %, and all the factor loads are bigger than 0.5, demonstrating fine validity of the questionnaire, hence no need to remove any items.

4.2 Test of Structural Equation Model

After passing the validity and reliability tests, this study has used structural equation model (SEM) to verify the hypotheses. SEM, a relatively new research methodology focused by many researchers studying tourism, has rapidly become popular among various research methodologies in tourism science. This study adopts AMOS to build the structural equation model in which data was put in and tested.

Results show that the fitness of each indicator is all within acceptable scope and the parameters of the hypotheses test results are as shown in Fig. 2. According to the hypotheses test of AMOS SEM, the result is that under the prominence condition of p = 0.05, seven out of the aforementioned nine hypotheses are accepted, shown in Table 3.

5 Conclusion

Based on the trust transfer theory and valence theory, this study takes into account the features of tourism E-business to build the consumer’s adoption model for the mobile payment, and this study also conducts empirical analysis over the model according to the data from 323 questionnaires, and the conclusions are reached as follows:

First, trust in on-line payment on tourism websites has significant and positive impact on the TOM for tourism E-business. The correlation coefficient between the two is 0.654, indicating close correlation of the two. This conclusion has once again proved the validity of trust transfer theory from the perspective of tourism E-business. As China’s mobile payment in tourism E-business is in the early stage of development, trust transfer theory serves as a great reference to the development of this market in the future. The tourism E-business should, in its effort to expand to the wireless market, take into account the correlation between users’ trust in internet and in the mobile environment. It should strengthen the trust of existing users on internet and then transfer their trust into mobile environment and develop new users.

Second, the TOM for tourism E-business has significant and positive impact on consumers’ intention of adoption, and the correlation coefficient between the two is 0.218. The TOM for tourism E-business has direct and positive impact on the intention of adoption, and has indirect impact through PU. The coefficient of the impact of TOM for tourism E-business on PU is 0.708, the coefficient of the impact of PU on the intention of adoption is 0.452, which further states the important role of TOM, and initial trust has exerted double impact on the intention of adoption. This conclusion points to the important role of initial trust in promoting the adoption by consumers. To tourism websites, they may try to strengthen users’ TOM to encourage them to ultimately use it.

Third, PU (0.452), PEOU (0.194) and CCR (0.195) have significant and positive impact on the intention of adoption. Among them, PU has the highest coefficient of the impact on intention of adoption, which effectively verifies the TAM. Companies for tourism E-business should focus on building professional and high-quality websites that provide the best user experience, enhancing and enriching the functions on the websites, diversifying the travel products, meeting the customized needs of consumers, creating pleasant-looking and convenient user interface, learning from the operating model of some established and excellent tourism website from abroad, as well as bringing in new marketing notions and innovation. As a result, the users’ travelling needs will be fully satisfied and supported, which will gradually build their trust in the websites.

Fourth, the impact of PR and PC on the intention to use mobile payment is not significant. Contrary to the views verified by previous researches, the empirical study of this study concludes that there is no significant impact of PR and PC on the mobile payment. The author believes that three major reasons have led to this conclusion: firstly, the number of smart phone users has been very large; according to “Projection over China’s development trend of mobile payment 2011–2014” by EnfoDesk, a think tank, “by the end of 2011, the number of users of mobile payment has reached 187 million”, the size of mobile payment has been expanding steadily every year, and consumers’ trust in mobile payment is also increasing accordingly. Secondly, China Mobile, China Unicom and China Telecom, the three carriers, have all released different kinds of service packages and flux packages; Wi-Fi coverage in scenic spots and cities has been constantly expanding, and the cost of flux incurred for mobile payment is lower than before. Lastly, consumers value the quality of travelling and the pleasant feeling brought about by travelling, so the cost incurred from mobile payment for travel products constitutes a primary factor of influence. Therefore, the impact of PR and PC on mobile payment is not significant, and the tourism E-business should put more of their marketing efforts on other influencing factors.

There are some limits and drawbacks in this study, and the number and scope of samples should be expanded in the follow-up researches. Moreover, the existing model is based on the valence theory and touches upon TAM and the trust theory, but some other consumer behaviour theories are not taken into consideration. Therefore, other theories should be fully considered in the future research to improve the existing model.

References

Bilkey, W. J. (1953). A psychological approach to consumer behaviour analysis. Journal of Marketing, 18, 18–25.

Bilkey, W. J. (1955). Psychic tensions and purchasing behaviour. Journal of Social Psychology, 41(1955), 247–257.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340.

Kim, G., Shin, B., & Lee, H. G. (2009). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283–311.

Kini, A. & Choobineh. J. (1998). Trust in electronic commerce: Definition and theoretical considerations. In Proceedings of the 31th Hawaii International Conference on System Science (Vol. 4, pp. 51–61).

Kuan, H., & Bock, G. (2007). Trust transference in brick and click retailers: An investigation of the before-online-visit phase. Information and Management, 44(2), 175–187.

Lee, K. C., Kang, I., & McKnight, D. H. (2007). Transfer from offline trust to key online perceptions: An empirical study. IEEE Transactions on Engineering Management, 54(4), 729–741.

Lewin, K. (1943). Forces behind food habits and methods of change. Bulletin of the National Research Council, 108, 35–65.

Luarn, P. & Lin, H. H. (2005). Toward an understanding of the behavioural intention to use mobile banking. Computers in Human Behaviour, 21(6), 873–891.

Lu, Y., Yang, S., Chau, P. Y. K., & Cao, Y. (2011). Dynamics between the trust transfer process and intention to use mobile payment services: A cross-environment perspective. Information and Management, 48(8), 393–403.

Pedersen, P. (2005). Adoption of mobile internet services: An exploratory study of mobile commerce early adopters. Journal of Organizational Computing and Electronic Commerce, 15(2), 203–222.

Peter, P. J., & Tarpey, L. X. (1975). A comparative analysis of three consumer decision strategies. Journal of Consumer Research, 2(1), 29–37.

Rogers & Shocmaker (2002). Influence of mobile commerce. In Proceedings of the 35th Hawaii International Conference on System Sciences (pp. 45–62).

Shin, D. H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behaviour, 25(6), 1343–1354.

Taylor, S., & Todd, P. A. (1995). Understanding information technology usage: A test of competing models. Information Systems Research, 6, 144–176.

Acknowledgments

Funding support for this study: National Key Technology R&D Program “R&D and Demonstration for Application on one-stop Service Platform of Regional Tourism” (2012BAH18F05), University-level research finding “the Building and Application Research on the Website Assessment System for Travelling Destinations” (12YBGLX01).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer International Publishing Switzerland

About this paper

Cite this paper

Huang, J., Li, Y., Li, H. (2013). Study on Factors to Adopt Mobile Payment for Tourism E-Business: Based on Valence Theory and Trust Transfer Theory. In: Xiang, Z., Tussyadiah, I. (eds) Information and Communication Technologies in Tourism 2014. Springer, Cham. https://doi.org/10.1007/978-3-319-03973-2_54

Download citation

DOI: https://doi.org/10.1007/978-3-319-03973-2_54

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-03972-5

Online ISBN: 978-3-319-03973-2

eBook Packages: Business and EconomicsBusiness and Management (R0)